Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Kazakhstan Kagazy Plc & Ors v Baglan Abdullayevich Zhunus & Ors [2018] EWHC 369 (Comm) (28 February 2018)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2018/369.html

Cite as: [2018] EWHC 369 (Comm)

[New search] [Printable RTF version] [Help]

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Fetter Lane, London, EC4A 1NL |

||

B e f o r e :

____________________

| (1) KAZAKHSTAN KAGAZY PLC (2) KAZAKHSTAN KAGAZY JSC (3) PRIME ESTATE ACTIVITIES KAZAKHSTAN LLP (4) PEAK AKZHAL LLP (5) (5) ASTANA-CONTRACT JSC (7) PARAGON DEVELOPMENT LLP |

Claimants |

|

| - and - |

||

| (1) BAGLAN ABDULLAYEVICH ZHUNUS (formerly BAGLAN ABDULLAYEVICH ZHUNUSSOV) (2) MAKSAT ASKARULY ARIP (3) SHYNAR DIKHANBAYEVA HARBOUR FUND III LLP |

Defendants Additional Party |

____________________

David Foxton QC and Anna Dilnot (instructed by Cleary Gottlieb Steen & Hamilton LLP) for the Defendants

Tim Akkouh (instructed by Byrne & Partners LLP) for the Additional Party

Hearing dates: 8, 9 and 12 February 2018

____________________

Crown Copyright ©

- This judgment follows on from the substantial judgment (the 'Judgment') which I handed down on 22 December 2017 ([2017] EWHC 3374 (Comm)) after the lengthy trial which took place between April and July 2017. I decided on that occasion that the Claimants were entitled to judgment against Mr Arip and Ms Dikhanbayeva as regards each of the PEAK, Astana 2 and Land Plots Claims and that what this means in financial terms would need either to be agreed or to be determined at a further hearing along with other consequential issues such as currency of judgment, interest, release of security for costs, interim payment on account of damages, costs and stay of execution. These issues and, as will appear, certain other issues were addressed at a consequentials hearing which took place over 2½ days on 8, 9 and 12 February 2018.

- This further judgment is itself substantial. This is because there are over thirty issues which I need to address and certain of them, specifically an issue concerning the 2014 Co-Operation Agreement (see the Judgment at [346], [351] and [352]), a question relating to appropriate currency and the topic of interest, involve disputes running to tens (if not hundreds) of millions of US Dollars (or KZT equivalent). There were, in addition, well over eighty authorities placed before me for the purposes of the consequentials hearing.

- Before me at the consequentials hearing, Mr Howe QC (leading Mr Miller and Mr Saoul) continued to act for the Claimants. Mr David Foxton QC had, however, since the Judgment been instructed on behalf of Mr Arip and Ms Dikhanbayeva (leading Ms Dilnot), and Mr Tim Akkouh also appeared on behalf of the Additional Party, Harbour Fund III LPP ('Harbour'). I shall come on to explain about Harbour's involvement later when dealing with what was ultimately agreed between the parties concerning the destination of monies paid in satisfaction of the judgment or by way of costs.

- Although in the lead-up to the consequentials hearing it appeared as though there might not be agreement between the quantity surveying experts (Mr Tapper and Mr Jackson), happily by the time of the hearing the relevant calculations had been agreed subject to a point concerning applicable rates. Notwithstanding this, a number of issues concerning quantum need to be considered.

- As to that (rates) point, what Mr Howe described as "a question of clarification" or "a question of principle" arises. This stems from the fact that, in reaching conclusions concerning the appropriate rates to be used in assessing the value of work which was carried out and for which credit should be given by the Claimants in arriving at the appropriate level of damages due to them from Mr Arip and Ms Dikhanbayeva, the Court rejected the approach to rates which was adopted by Mr Jackson, Mr Arip's and Ms Dikhanbayeva's expert, in favour of the approach adopted by Mr Tapper, the Claimants' expert, but in certain respects with adjustments as described in the Judgment.

- Specifically, as helpfully pointed out by Mr Foxton: the Court adopted Mr Tapper's "services/utilities" figure which was higher than Mr Jackson's (see the Judgment at [259]); the Court took the middle figure for foundations ([261]); the Court adopted Mr Tapper's figure for the warehouses on the basis that he was right to proceed on the basis that the Loging contract included some of the "add-ons" which Mr Jackson had identified but without the deduction Mr Tapper had made ([263]-[264]) and with certain "add-ons" ([265]); the Court adjusted both expert's evidence on "other buildings" ([266]); on "earthworks" the Court used Mr Tapper's estimate for transportation distance but rejected Mr Tapper's evidence on labour rates ([272]), his plant rates ([274]) and as to Akzhal-2 ([277]-[278]); the Court held that Mr Jackson's comparables were not reliable ([275]); the Court accepted Mr Jackson's evidence as to the height of the Akzhal-2 embankment ([277]) but not at Aksenger ([293]); the Court accepted Mr Jackson's evidence as to what drainage he saw at Akzhal-2 and works to the Aksai river but arrived at its own valuations ([280]-[281]); the Court accepted Mr Tapper's 17% overhead/profit rather than Mr Jackson's 15%, and also accepted Mr Jackson's 5.7% contingency ([282]); the Court did not accept Mr Jackson's evidence of the extent of earthworks at Aksenger ([290]) and adopted Mr Tapper's valuation approach but required a revision of rates ([291]); and the Court noted Mr Jackson's correction of his evidence regarding the road and drainage at Aksenger ([295-297]) and rejected his evidence on a centralised locking system ([298]) but upheld his evidence on other railway work ([300]).

- The Court's intention was that Mr Tapper would re-calculate in line with the adjustments identified and that, hopefully, Mr Jackson would then be in a position to agree the revised figures. Mr Tapper's carrying out of this exercise has, however, led to a somewhat unexpected result, in that in certain cases Mr Tapper's approach (with the adjustments required by the Court) has led to higher valuations than Mr Jackson had himself put forward at trial. As Mr Howe put it, "having turned the crank and done the calculations", this is the consequence. It is the Claimants' position that, in these circumstances, Mr Jackson's valuations ought nonetheless to be adopted. As Mr Foxton put it, the Claimants invite the Court to treat Mr Jackson's valuations as representing "some form of forensic cap on the value" which should be used for credit calculation purposes.

- In order to illustrate the point, Mr Tapper prepared revised calculations of the value of the construction work done at each of the PEAK sites and at the Astana site on two bases. Position 1 comprised the valuations arrived at without having regard to any 'Jackson cap', whilst Position 2 gave valuations which in certain respects (where Mr Tapper's adjusted valuation is higher than Mr Jackson's valuations) used Mr Jackson's valuations rather than Mr Tapper's adjusted valuations. The difference between Positions 1 and 2 is a little over US$ 3 million. In context, therefore, the dispute on this issue is not vast, although it is hardly insignificant.

- It was Mr Howe's submission that Mr Tapper's Position 2 valuations should be preferred. He submitted that it was unlikely that the Court intended that Mr Tapper's adjusted rates would lead to higher valuations than those put forward by Mr Jackson, whose approach regarding rates was rejected in the Judgment. He submitted, indeed, that it would be perverse for the result of the recalculation exercise to be even more favourable to Mr Arip and Ms Dikhanbayeva than the position which they advanced at trial in reliance on Mr Jackson's evidence. Mr Howe highlighted, in this respect, how in the Judgment at [268] I stated I was "left in the position which Mr Twigger contemplated I might find myself in, which is that the right rates lie 'somewhere in between the Jackson and Tapper rates'". Mr Howe suggested that it cannot have been the Court's intention that the ultimate outcome would be to lift any particular set of rates above those which Mr Jackson had put forward.

- I cannot agree with Mr Howe about this. As I put to him during the course of his submissions, having rejected Mr Jackson's approach, I regard it as wrong in principle to allow Mr Jackson's valuations to operate as some sort of ceiling. As Mr Foxton put it when he came on to make his submissions, I made findings as to the correct methodology to be adopted, deciding that Mr Tapper's methodology was the right one and not Mr Jackson's, and in such circumstances it cannot be right that any reliance is placed on Mr Jackson's approach, whether as a cap or otherwise, since this would entail reliance being placed on the very evidence which I have decided should not be relied upon. Mr Foxton was plainly right about this. Whether it was to be expected that Mr Tapper's recalculations would produce in some respects higher valuations than those of Mr Jackson is nothing to the point. What matters is that Mr Tapper has done the exercise which I envisaged he would perform. It is that exercise which I have previously determined is the appropriate exercise to undertake. It follows that it is the result of that exercise which should be reflected in the credits which need to be applied. To adopt any different approach would be to act other than in accordance with what the Court has previously decided.

- Furthermore, as Mr Foxton went on to explain, by reference to the updated valuation prepared by Mr Tapper, since it is not even the case that Mr Tapper's adjusted rates are in every respect higher than Mr Jackson's rates, if Mr Howe's submission were to be accepted, it would mean using different rates for the same work being done in the same place at the same time for some parts of the overall calculation and not for others. That would be neither logical nor principled, as well as inconsistent with what I have previously decided.

- It follows that my decision is that the appropriate rates to apply when performing the relevant calculations are Mr Tapper's rates as adjusted in accordance with the Judgment without regard to Mr Jackson's rates. In other words, the relevant calculations are Mr Tapper's Position 1 calculations rather than his Position 2 calculations.

- As to steel, the point here arises in the context of the Astana 2 Claim, specifically whether credit ought to be given for certain steel which was left at the Astana 2 construction site but was removed and sold by the Claimants. The relevant paragraphs in the Judgment are [330] and [331]. In the latter, in particular, having referred to certain emails which Mr Werner was asked about in cross-examination, I went on to say this:

- Mr Foxton observed, however, that there was no finding in the Judgment that, even if there were evidence before the Court as to the amount for which the steel was in fact sold (or indeed the amount of steel), no credit for it should be given. He submitted that, in view of the fact Mr Werner accepted that there were records relating to the sale, those records ought now to be disclosed pursuant to CPR 31.11 and that this should be done before the Court "proceeds to give a quantum determination on Astana 2". He contended that the Court should not proceed to decide quantum in the knowledge that there is additional credit to be given since any lack of relevant evidence on this matter is not Mr Arip's and Ms Dikhanbayeva's fault but that of the Claimants through their failure to comply with their disclosure obligations. It was because of this, Mr Foxton explained, that on 26 and 30 January 2018 Cleary Gottlieb wrote to Allen & Overy asking that the Claimants disclose the documents relating to the sale of the steel and that, subsequently on 2 February 2018, an application for specific disclosure was issued. It was Mr Foxton's submission that, in the circumstances, any determination of the quantum of the Astana 2 Claim should await the provision of such disclosure by the Claimants.

- There is absolutely no merit in this position. As Mr Howe rightly pointed out, the issue concerning the value of the steel was not left open in the Judgment but resolved at [331]. In arriving at the determination which I did, I considered the evidence which was before the Court, specifically the emails involving Mr Khabbaz to which I referred at [331], and the submissions advanced by Mr Twigger (then acting for Mr Arip and Ms Dikhanbayeva) in reliance on those emails. I decided that I was unable to place any reliance on the emails. In such circumstances, it is now simply too late for Mr Arip and Ms Dikhanbayeva to be seeking disclosure in the way that they are. If such disclosure is thought to be necessary at this stage, it should have been sought much earlier. It is to be borne in mind, in this context, that the cross-examination of Mr Werner on the topic of steel took place on Day 7 of a 13-week trial. It would have been open to Mr Arip and Ms Dikhanbayeva, therefore, to have sought disclosure at a much earlier stage indeed, more conventionally, before the trial had even started. To wait some nine months after Mr Werner was cross-examined, however, and to make an application only after judgment has been handed down, is obviously too late.

- Accordingly, my conclusion at [331] of the Judgment stands and no credit in respect of steel is to be given.

- This topic is a substantial one since it would appear, based on a schedule prepared by Mr Howe, that almost US$ 80 million (or KZT equivalent) turns on it.

- I dealt with the Claimants' claim for Penalties and Interest in the Judgment at [339] to [357]. I decided that the claim succeeded. In arriving at that decision, I addressed the parties' rival contentions in detail. These included the question of whether the Claimants had made the relevant payments or whether there are liabilities which will cause them to suffer loss in the future, and whether such payments or liabilities had been caused by the Defendants' wrongdoing. These were the issues which I identified at [342] and which I went on to address in the paragraphs which followed: at [343] to [349] and at [350] to [356] respectively.

- It is important to note that, in dealing with the Penalties and Interest issue, I did not leave anything open. As I explained in the Conclusion at the end of the Judgment, at [564(2)], the parties needed "to try and agree the relevant calculations"; in other words, I was expecting the figures to be agreed. Subject only to this, the Penalties and Interest issue had been determined. I was not expecting that it would be open to either side to seek to revisit the issue. There had been a trial, a very long one at that, the parties had adduced their evidence and made their submissions, and I had reached my conclusions, based on that evidence and those submissions, as set out in detail in the Judgment. Indeed, the Order which was drawn up (and agreed between the parties) immediately after the handing down of the Judgment provided in paragraph 1 unequivocally as follows:

- Mr Foxton drew attention to the fact that in the Re-Re-Amended Particulars of Claim, at paragraph 36(g) to be more precise, the case which was advanced was that, by reason of the Defendants' conduct, KK JSC, PEAK and Peak Akzhal had become liable to Alliance Bank for KZT 7.232 billion in penalties and KZT 2.72 billion in default interest. Mr Foxton highlighted how it was said that, insofar as KK JSC, PEAK and Peak Akzhal were able to mitigate that loss, credit would be given, the implication being that that liability or contingent liability remained and had yet to be mitigated and so that no contingency had occurred which had discharged the liability.

- Mr Foxton acknowledged that, in deciding at [352] to [357] that Mr Arip and Ms Dikhanbayeva are liable in respect of such liabilities incurred by KK JSC, PEAK and Peak Akzhal to Alliance Bank, the Court should be taken as having rejected a submission that the claims to interest and penalties had been "relinquished" pursuant to the 2014 Co-operation Agreement by the Agreement because the mutual release was stated to take effect only when the KK Group entities had performed all their relevant obligations which included an obligation to pay over the fruits of a judgment or settlement in respect of the PEAK Claim. It is worth in this regard setting out the relevant part of the key paragraph, [252], which states as follows:

- The evidence on which Mr Foxton relied was evidence contained in a witness statement made by Ms Yvonne Jefferies, a partner in Byrne & Partners LLP, Harbour's solicitors, and put before Knowles J on 19 January 2018 in an ex parte hearing at which Harbour sought (and obtained) an order varying a freezing order granted by HHJ Mackie QC in November 2013. As I say, I shall come back to Harbour later. What matters for present purposes, however, is that Mr Foxton explained that Ms Jefferies' evidence dealt with matters about which the Defendants had no awareness at the time of the trial and which, Mr Foxton suggested, "are of central importance to the issue of quantum and which therefore must be taken account of when the Court is assessing quantum". In particular, Ms Jefferies referred to how the 2014 Co-Operation Agreement not only required KK Plc, KK JSC, PEAK and Peak Akzhal to pay Alliance Bank (now Forte Bank) certain sums in the event that they were successful in these proceedings, but additionally required Alliance Bank to pay what was described as a 'Service Fee'. As to the former, Clauses 2.1 and 2.2, in particular, provide:

- Ms Jefferies went on to state that, despite various requests for payment, Alliance Bank defaulted on the last two instalments of the 'Service Fee' and that, as a result, according to Ms Jefferies at least, "under the Cooperation Agreement that Forte's entitlement to receive any payments as a result of success in the London proceedings ceased". The relevant provision in the 2014 Co-Operation Agreement for these purposes would appear to be Clause 4.8, which provides:

- Accordingly, Mr Foxton submitted, Alliance Bank having defaulted in paying the 'Service Fee' and having thereby ceased to be entitled to be paid any share of the proceeds of these proceedings, it follows that there cannot be the liabilities which the Claimants were saying at trial they were under. Specifically, Mr Foxton was highly critical of Mr McGregor, who gave evidence concerning penalties and interest at trial, for not mentioning the fact that Alliance Bank had failed to pay the 'Service Fee' or that Harbour had taken the position as against Alliance Bank that Clauses 2.1 to 2.10 of the 2014 Co-operation Agreement had ceased to have effect.

- Mr Foxton went on to submit in this context that, in further consequence of Alliance Bank's default as regards the 'Service Fee', the obligations which KK Plc, KK JSC, PEAK and Peak Akzhal were under by virtue of Clauses 2.1 and 2.2 of the 2014 Co-Operation Agreement ceased and those clauses (along with Clauses 2.3 to 2.10) no longer operated as condition precedents to the release contained in Clause 6.1, which is in these terms:

- I am quite clear that this is not a matter which it would be appropriate to determine one way or the other at what is, after all, a consequentials hearing. Were it to be determined, there would need to be proper preparation, including in all probability, as Mr Howe suggested, disclosure directed to the issue since the issue inevitably requires some further factual inquiry in order to enable the legal point to be considered in its proper context. The first of Mr Foxton's proposed courses of action is not, therefore, viable in practical terms. Even this assumes, however, that Mr Foxton were in a position to overcome Mr Howe's prior objection that it is now far too late to be permitting such arguments to be advanced, the Judgment having followed a trial on liability and quantum and having addressed each and every issue which was raised leaving only certain calculations (together with the currency issue: see [565]) to be addressed.

- I have concluded that Mr Foxton is in no position to overcome this objection. As I have explained, this is not a case where the Judgment left open any issue concerning Penalties and Interest other than the matter of calculation. It is not, therefore, a case where there can be said to be any error or misunderstanding which needs to be corrected and which it is appropriate to raise with the trial judge to allow him or her an opportunity address the point.

- Mr Foxton cited in this context Spice Girls Limited v Aprilla World Service BV 20 July 2000, 2000 WL 1212985, in which Arden J (as she then was) had this to say at [9]:

- Nor is this a case like Compagnie Noga D'Importation ET D'Expropriation SA v Abacha 2001 WL 606396, where Rix LJ (but sitting in his capacity as the trial judge) was faced with a request that he reconsider his judgment (a judgment arrived at after a trial lasting some six months) on the basis that he was said to have "got the answer wrong" (see [44]). As Rix LJ explained, the right course, in such circumstances, is to appeal. As he put it at [47]:

- As Rix LJ had earlier explained, when describing the circumstances in which it is appropriate to invite a judge to reconsider, the jurisdiction is limited to "exceptional circumstances". He stated as follows at [41]-[43]:

- Clearly, in view of these authorities, there is no justification in the present case to permit Mr Arip and Ms Dikhanbayeva to re-open the Penalties and Interest issue. There needs to be finality in litigation. This applies as much to high-value and complex litigation as it does to low-value and simple litigation. This was a trial which lasted a great deal of time and which resulted in a lengthy judgment which took a great deal of time and effort to prepare. The parties had a full opportunity to present their respective cases. It is now too late to allow the unsuccessful party another bite of the cherry, even if that bite is apparently only being taken because of new information not previously known about by that party. It seems to me that the appropriate course, in the circumstances, is for Mr Arip and Ms Dikhanbayeva to seek permission from the Court of Appeal invoking, if they can, the Ladd v Marshall jurisdiction. If successful in that and if the Court of Appeal considers it appropriate, it may be that the matter will then be remitted to me to consider the new argument which is sought to be advanced. If that is what happens, then, so be it. What is not appropriate, in my view, is to re-open an issue which has already been decided based on the evidence and submissions which were deployed at trial simply because, in the period between the handing down of the Judgment and the consequentials hearing, something has come to light which gives the losing party a further argument. I repeat that this litigation, like other cases in every court in the country, must have some finality about it. Were it otherwise, the courts system could potentially descend into chaos.

- It follows that the decision arrived at in the Judgment concerning Penalties and Interest must stand.

- It is agreed that credit amounting to US$ 3 million in respect of the settlement reached by the Claimants with Mr Zhunus needs to be given in calculating the amount due from Mr Arip and Ms Dikhanbayeva.

- I dealt with the Astana 2 Claim in the Judgment at [305] to [338]. I addressed all of the arguments which were raised on Mr Arip's and Ms Dikhanbayeva's behalf, deciding that the Astana 2 Claim was established. Notwithstanding this, in the skeleton argument for the consequentials hearing it was stated that Mr Arip and Ms Dikhanbayeva "have recently become aware" that IFK's claim against Astana-Contract and Paragon "may have been discharged as a matter of Kazakh law because the claims were not entered on the register of creditors". No detail was given in relation to this. Nothing was explained about how or when the awareness described was acquired. There was no elaboration on the Kazakh law which was said to operate. Despite this, it was suggested that "there is sufficient uncertainty as to the position that the appropriate relief is to make a declaration" entitling Astana-Contract and Paragon (or KK Plc as assignee) to an indemnity in respect of such liability as they may have to IFK "with liberty to apply".

- This is wholly unsatisfactory, and it is perhaps telling that, in his oral submissions, Mr Foxton explained that he was "not in a position to bring forward any specific material that has come to my attention". I am quite clear that it is now far too late to allow such a case to be advanced. I dealt with the Astana 2 Claim, leaving nothing over for subsequent determination (save possibly in the event that the parties could not agree on figures). It is wholly unrealistic for it now to be supposed that the Court would be amenable to a wholly new argument to be advanced by Mr Arip and Ms Dikhanbayeva and, all the more so, given the complete lack of detail put forward in support of the submission that the Court should do so.

- There is, lastly in the context of interest, a discrete issue concerning the PEAK Claim which needs to be considered. This is the suggestion made by Mr Foxton that there should be pro-rating of interest payable to Alliance Bank so as to ensure that what is recovered is properly attributable to the matters about which complaint was made in the PEAK Claim. Mr Foxton submitted that this was appropriate because it was accepted by the Claimants (and Mr Crooks, their forensic accountancy expert) that this should be done in relation to the Astana 2 Claim: see the Judgment at [345]. The Court was, accordingly, invited to express the value of the works as a percentage of the amount borrowed, and reduce any interest claim by that percentage.

- I cannot accept that this would be appropriate. The argument now advanced is entirely new and is not the type of argument which it is open to a party to raise at a consequentials hearing because it is a substantive argument. I agree with Mr Howe that, if it had any merit, it is an argument which could, and should, have been raised during the trial so that it could be the subject of factual and expert evidence. It is simply too late to put it forward at this stage.

- This, however, is not the only reason why, in my view, there is nothing in the point which is now (belatedly) raised since, in addition, as Mr Howe went on to explain, there is a material difference between the PEAK Claim, on the one hand, and the Astana 2 Claim, on the other. This is that, as is apparent from what I had to say in the Judgment at [345], the reason why there had to be an apportionment is because comparing the size of the Astana 2 Claim and the amount of the loan from DBK makes it obvious that an apportionment is required. The Astana 2 Claim, in short, represents only a small portion of the DBK loan. In contrast, the PEAK Claim exceeds the amount of the Alliance Loan, and so no apportionment is called for. That is why, despite the experts being agreed that there should be pro-rating as regards the Astana 2 Claim, it was not suggested at trial that this should be done as regards the PEAK Claim.

- I am clear, in the circumstances, that there ought not to be a percentage pro rata reduction as regards penalties and interest in relation to the PEAK Claim.

- As explained in the Judgment at [565], it was agreed that the issue concerning the appropriate currency of the judgment would be deferred to be dealt with when dealing with consequential matters. This, then, is an issue which, unlike certain others sought to be raised by Mr Foxton on Mr Arip's and Ms Dikhanbayeva's behalf, was intended to be dealt with at this juncture.

- The Claimants' position is that the judgment should also be in US Dollars as regards the PEAK Claim and the Land Plots Claim as well as the Astana 2 Claim, whereas the submission made on behalf of Mr Arip and Ms Dikhanbayeva by Mr Foxton was that the appropriate currency ought to be KZT in all cases except that he accepted that US Dollars would be appropriate for part of the Astana 2 Claim. Although it is not altogether easy to be precise about the point, Mr Howe explained that the difference between the two positions is likely to be substantial, perhaps affecting the size of the overall recovery by as much as a third.

- Mr Foxton submitted, in this context, that to adopt the Claimants' position would be to give them a windfall (and, indeed, Harbour also), in view of the fact that, in order to obtain the US Dollar amounts, the Claimants have converted KZT to US Dollars at a rate of US$1: KZT 129.126 (the average exchange rate between January 2006 and December 2009, the period over which they say they suffered loss), yet prior to 2015 the NBK devalued the KZT twice as against the US Dollar (on 4 February 2009 by 25% and on 11 February 2014 by around a further 19%) and, furthermore, Mr Thompson has confirmed that, between 1 January 2006 and 31 December 2016, the exchange rate moved from 133.38 KZT per US Dollar to 334.85 KZT per US Dollar meaning that the KZT depreciated by as much as 150% against the US Dollar over that period.

- It was Mr Foxton's submission that, the Claimants being Kazakh companies which operate their businesses, in both practical and financial terms, in Kazakhstan and in KZT, and the causes of action on which they have succeeded being Kazakh law causes of action, any losses suffered as a result of the Defendants' activities were incurred in, and are properly measured in, KZT. Mr Foxton had in mind, when making this submission, the leading authority on the issue, The Despina R [1979] AC 685. In that case, Lord Wilberforce had this to say at page 697F-H:

- Lord Wilberforce went on to consider certain objections which had been raised, beginning with the suggestion that the approach described by him would involve complicated inquiries. As to that, he stated as follows:

- Both Mr Howe and Mr Foxton referred also to The Texaco Melbourne [1994] 1 Lloyd's Rep 473, specifically to the following passage in Lord Goff's judgment at page 479:

- Mr Foxton emphasised that in The Texaco Melbourne there had been a dramatic collapse in the value of the relevant currency (Ghanaian cedis) against the US Dollar between the date of loss (there, the date of the breach of contract) and the date of the arbitral award. At first instance, it was held by Webster J that the existence of the decline in the cedi was a factor to be taken into account when deciding on the appropriate currency in which to express the award. However, the House of Lords held (in agreement with the Court of Appeal) that when deciding what was the appropriate currency for the purposes of loss, fluctuations in the relevant currency between the date of loss and the date of judgment were not to be taken into account. Accordingly, the fact that as at the date of the relevant breach the claimant's loss of 7,937,014 cedis amounted to US$2,886,187 yet as at the date of the award this had fallen to $21,165 was immaterial.

- As to the factors which pointed towards the currency of loss being cedis, these were identified by Lord Goff at page 478 as follows:

- It was Mr Foxton's submission that the position is similar in the present case since it is clear, he submitted, that the Claimants operate in Kazakhstan and that most of their assets, liabilities and sales arose in Kazakhstan. He relied, in particular, on the fact that the KK Group's financial statements for the year ended 31 December 2008 contain the following statement:

- Mr Foxton submitted that these passages demonstrate that the relevant "functional currency" used by the Claimants was KZT rather than US Dollars. Were the position otherwise, he suggested, it would have made no sense for the financial statements to speak in such terms. Mr Foxton also pointed to the IPO prospectus and the statement in this document that:

- Against this, Mr Foxton observed, the fact that the KK Group published its consolidated financial statements in US Dollars, as relied upon by Mr Howe, is nothing to the point. Mr Foxton submitted that the currency in which the loss is felt, or the operational trading currency, does not change merely because the claimant chooses to draw up end-of-year accounts in some other currency. In this context, Mr Foxton prayed in aid The Lash Atlantico [1987] 2 Lloyd's Rep. 114. In that case, Kerr LJ stated as follows at page 118:

- The reference to US Dollars in the consolidated financial statements was, Mr Foxton submitted, purely for presentational purposes since KZT was, in addition, the principal currency which, in his March 2017 report, Mr Thompson noted was used in the Claimants' accounting databases. Indeed, Mr Thompson reported that, where a transaction was recorded in a "native currency" other than KZT, it was apparently the case that the KZT equivalent was also noted on the 1C database. Mr Foxton highlighted, furthermore, how, in his own March 2017 report, Mr Crooks himself described US Dollars as being "the presentational currency selected by the KK Group to present its financial results and financial position in its statutory financial statements".

- Although I have regard to these matters and consider that Mr Foxton may well have been right to say that the Claimants' functional currency was KZT, I am not satisfied that, in and of themselves, these are matters which very much matter. I agree with Mr Howe when he submitted that what the exercise carried out by Mr Thompson has done is, in effect, to give an overview of what the Claimants' typical operating currency is, although, even then, it should not be overlooked that a not insubstantial proportion of the transactions (in a wider time period than strictly is relevant) were in US Dollars. What matters, however, as Mr Howe pointed out, is not what was generally the currency which the Claimants used but what is the currency which best expresses the losses in the specific circumstances of the present case. This requires an inquiry into the position in relation to each of the three Claims. Generality is not helpful when what is required is specificity. It is for this reason that it is similarly unhelpful to place too much store by Mr Thompson's analysis of the KK Group's borrowings, again as set out in his March 2017 report, relating to the period between 2004 and 2012, and so his conclusion that such borrowings were predominantly in KZT, with the highest level of US Dollar borrowing coming in 2011 at 31.2%. Aside from the fact that this analysis relates to a period which is, in any event, too wide given that the relevant period as regards the PEAK Claim is between 2005/6 and 2009, the other difficulty with Mr Thompson's approach is the point which I have just made: it ignores the fact that the funds misappropriated forming part of the PEAK Claim consisted substantially of monies drawn down in US Dollars and Euros rather than in KZT.

- That this is the case - that the monies lost were borrowed in US Dollars and Euros (and so in 'hard currencies') and then converted into KZT before being spent in the manner described in the Judgment - is demonstrated by a number of documents to which Mr Howe took the Court. As he submitted, although the sums paid to Arka-Stroy were paid in KZT and so the immediate losses to the Claimants were felt in KZT, having obtained funds in 'hard currencies', the KK Group was left as a result of the frauds with very substantial 'hard currency' borrowings which had to be paid back in those currencies or by converting much larger sums of devalued KZT. I agree with Mr Howe that, in such circumstances, it is right to regard the Claimants' losses in respect of the PEAK Claim as best expressed in a 'hard currency', and so either in US Dollars or in Euros but more appropriately the former given that the borrowing was, in the main, in US Dollars and given also that this was the currency (not the Euro) used by the KK Group for international reporting purposes as well as when obtaining funding through the IPO which took place.

- As to the documents relied upon by Mr Howe, the first of these was a report prepared by Pari Passu Advisory Ltd ('Pari Passu') for KK Plc dated 25 July 2013 which analyses "bank statements related to transfer of funds between certain companies of Kazakhstan Kagazy group". Specifically, as described under "Scope of analysis", Pari Passu performed an analysis of the bank statements of KK Plc, PEAK and Peak Akzhal "related to payments to Arka-Stroi LLP according to" the five contracts entered into with Arka-Stroy described in the Judgment at [191]. Pari Passu set out their findings in relation to four of those contracts, those dated 15 August 2005, 6 July 2006, 2 November 2005 and 11 January 2008; it was explained that it had not been possible "to identify in 1C accounting system any evidence and records of transactions performed on the basis" of the fifth contract dated 28 March 2008. The findings as regards the first four were these:

- Pari Passu went on in the accompanying four appendices to list the various transactions one-by-one, with the source of the lending identified in each case. In the case of Appendix 1, which dealt with the contract dated 15 August 2005 (to which KK JSC was Arka-Stroy's contractual counterpart), the lender was named as Alliance Bank or Kazkommertsbank, with the total borrowing adding up to KZT 4,165,876,394.14. Appendix 2 did the same in respect of the contract dated 6 July 2006 entered into between PEAK and Arka-Stroy, identifying the lending bank, again, as either Alliance Bank or Kazkommertsbank. The total borrowing was given as KT 11,592,781,240.03. Appendix 3 dealt with the contract dated 2 November 2005 entered into between Peak Azkhal and Arka-Stroy, identifying the lending bank as in one instance Alliance Bank, in four instances Kazkommertsbank and in six cases Nurbank with total borrowing of KT 1,686,604,860.36. Lastly, as to Appendix 4, this related to the contract between KK JSC and Arka-Stroy concluded on 11 January 2008 and identified Alliance Bank and Eurasian Bank as the lenders, with total borrowing adding up to KZT 2,229,648,589.00. Mr Howe made the point that, looking at these appendices, it is clear that the predominant part of the borrowing relating to the contracts relevant to the PEAK Claim came from a mixture of Alliance Bank and Kazkomertsbank. He was clearly right about that.

- Mr Howe went on to explain that that borrowing - the Alliance Bank and Kazkommertsbank borrowing - was in a mixture of Euros and US Dollars. This is apparent from the IPO prospectus which was produced in July 2007. Specifically, this set out details of "Borrowings" as at the date of the prospectus, as follows:

- Focusing on the borrowing obtained from Kazkommertsbank for the moment, Mr Howe highlighted how these extracts from the IPO prospectus illustrate that the facilities described both in the fourth bullet point relating to the US$ 10 million facility from EBRD and the US$ 42 million in loans and leases provided through the Kazkommertsbank loan facility and in the description of KK JSC's loans from Kazkommertsbank in the sixth to twelfth bullet points were all in US Dollars. So, too, were the three loans described as having been obtained by PEAK from Kazkommertstbank. Mr Howe observed that, as far as Kazkommertsbank was concerned, the only non-US Dollars borrowing involved Kagazy Recycling LLP, a different entity. Kazkommertsbank was, therefore, plainly a significant source of the borrowing which was used to make the payments to Arka-Stroy.

- As for the Alliance Bank borrowings and the reference in the IPO prospectus to PEAK having "a 29,968,323 loan facility with Alliance Bank JSC, due at 1 November 2013", this was a reference to a facility agreement entered between PEAK and Alliance Bank dated 1 November 2006 in the original sum of 3,350,720. However, the size of the facility was clearly thereafter increased since, not only does the Pari Passu report make that clear, but so, too, does the 2014 Co-Operation Agreement because that states by way of what is, in effect, a recital (under the heading "BACKGROUND") as follows at B:

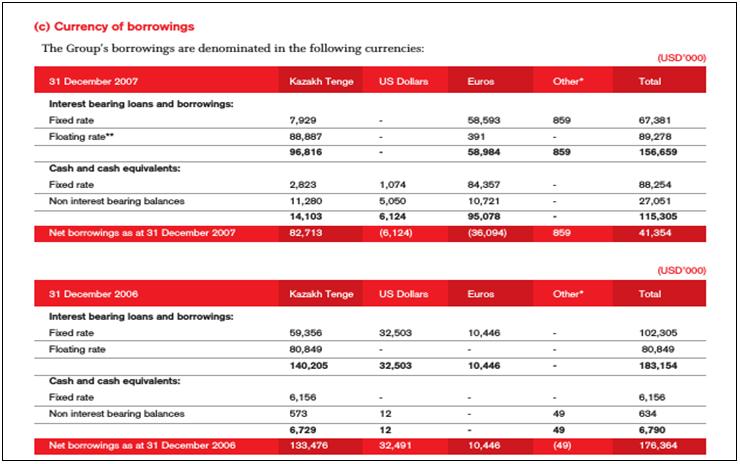

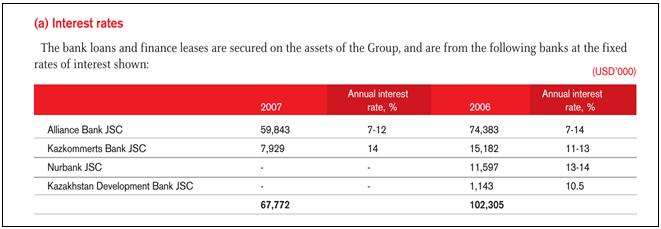

- It is quite apparent, therefore, that in the material period (2005, although more accurately, 2006 to 2009) the KK Group's borrowings were substantially in US Dollars and Euros as well as KZT. However, as Mr Howe was able to demonstrate, in that 2006 to 2009 period, the KK Group's KZT borrowings fell, with substantial US Dollar and Euro cash balances becoming very substantial debts in those currencies. This can be seen from the notes to the KK Group Annual Reports in 2007, 2008 and 2009. Thus, the 2007 Annual Report described the borrowing position, both as regards 31 December 2006 and as regards 31 December 2007, in this way:

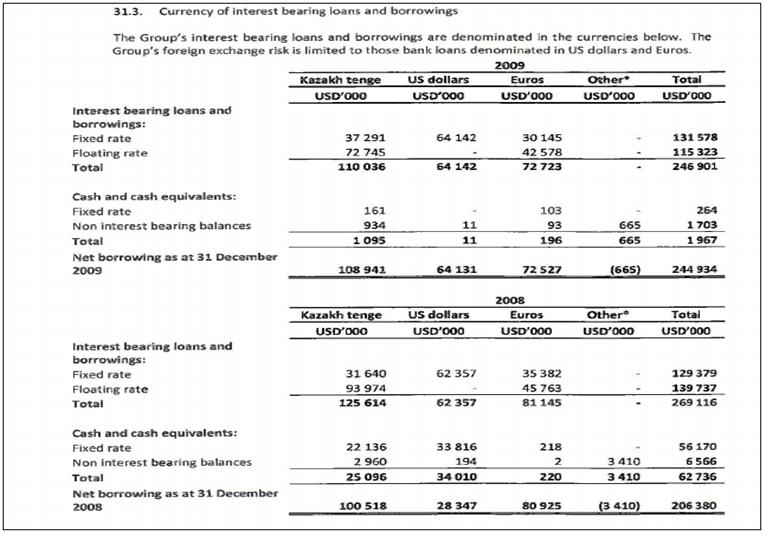

- The position in relation to 2008 and 2009 can then be seen in the 2009 Annual Report, which stated as follows:

- The position across the four years (2006, 2007, 2008 and 2009) is summarised in the table below:

- In the circumstances, I cannot accept that Mr Foxton's criticism of the witness statement recently made by Mr McGregor, his eighteenth witness statement no less, in which he stated that "the sources of funds which the Defendants misappropriated were mainly hard currency", can be justified. I consider that, on the contrary, what Mr McGregor had to say is right. I am satisfied that, based on the evidence to which Mr Howe took me, it is, indeed, the case that the funds which were misappropriated and which the Claimants seek to recover in putting forward the PEAK Claim were drawn from facilities (with Kazkommertsbank and Alliance) which were in 'hard currencies' (US Dollars and Euros) rather than in KZT. As Mr Howe put it, when addressing Mr Foxton's submissions concerning The Texaco Melbourne, the present case is not the same as that case; indeed, it is the precise opposite. This is because, whereas in The Texaco Melbourne, "if the department had bought a replacement cargo in Italy under a contract under which the price was payable in US Dollars, nevertheless in order to obtain those dollars the department, which carried on its business in Ghanaian cedis, would have had to expend cedis in order to acquire the US Dollars from the bank of Ghana". In the present case, the Claimants already had US Dollars (and Euros) which were converted into KZT amounts and then misappropriated. I agree with Mr Howe when he made the point that, had the department in The Texaco Melbourne had an account denominated in US Dollars which meant that the replacement cargo could be funded without the need to buy US Dollars with cedi, then, the decision in that case would have been different. It follows that, since that is the position in the present case, there is no justification for treating the losses as having been felt in KZT as opposed to US Dollars or Euros.

- Nor am I persuaded by Mr Foxton having taken me to how the PEAK Claim was pleaded in the Re-Re-Amended Particulars of Claim. In particular, Mr Foxton drew attention to the fact that in paragraph 36, which sets out particulars of the loss and damage alleged to have been suffered, the payments to Arka-Stroy there described are given in KZT. Thus, taking out various crossing out amendments, this is stated:

- It was Mr Foxton's submission that the fact that the payments were described in KZT (albeit with US Dollar amounts in brackets) supports his submission that that is the currency in which the losses were felt. I cannot agree with him about this, however, for the reasons which I have already given. The fact that the payments were made in KZT seems to me to be nothing to the point in a case like this where it has been demonstrated that the KK Group had US Dollars and Euros which were used to make the payments. The fact that the payments were not themselves made in US Dollars or in Euros but in KZT is not important and certainly cannot be determinative of the issue which I have to decide.

- Turning to the Land Plots Claim, Mr Foxton made the same point concerning how the case had been pleaded, referring to paragraph 37F of the Re-Re-Amended Particulars of Claim and the fact that the sums described as having been paid to Bolzhal, CBC and Holding Invest were KZT amounts. Again, however, this is not determinative of anything. The fact is that such payments were made in KZT; there is no dispute about that. It does not follow, however, that the losses were felt in KZT. I am clear that, on the contrary, that was not the position at all since, as Mr Howe explained by reference to certain appendices to the report prepared by Grant Thornton dated 11 November 2014 to which I referred in the Judgment at [362] and [519] and which, consistent with how the case was pleaded in the Re-Re-Amended Particulars of Claim, indicate that in three instances KK JSC received US Dollar amounts from KK Plc and that those sums were used by KK JSC to buy the KZT amounts which were then transferred to Bolzhal and CBC, and that in two other cases KK JSC received Euros from KK Plc and used those to buy the KZT amounts which were then transferred to Bolzhal and CBC. None of this was disputed by Mr Foxton. Nor was it in dispute that, as a matter of timing, the land plot transactions were first instigated soon after the IPO had taken place. Indeed, as I explained in the Judgment at [362], it was this that led to the Grant Thornton report being commissioned:

- In these circumstances, I have not the remotest difficulty in concluding that the relevant losses as regards the Land Plots Claim were felt in US Dollars. I reach this conclusion despite the lack of clarity as to why some of what was paid by KK Plc to KK JSC was paid in Euros since, as Mr Howe submitted, it is tolerably clear that the origin of all the funds which were used to purchase the land plots was what had been raised by KK Plc in the IPO, and those were US Dollar amounts.

- This leaves the Astana 2 Claim. Since it is not in dispute that the loan from DBK which funded the relevant payments was a US Dollar loan (see the Judgment at [307]), it must follow that the appropriate currency is US Dollars. The fact that the payments out were made by Astana-Contract and Paragon in KZT is, for reasons which I have explained, not determinative. The losses must, in my view, have been felt in US Dollars in circumstances where this was the denomination of the DBK loan. I reject Mr Foxton's argument to the opposite effect and note that even Mr Foxton was constrained to accept that inasmuch as the penalties and default interest liabilities of Astana-Contract and Paragon to DBK described in the Judgment at [345] and [347] to [349] have yet to be paid, the appropriate currency is US Dollars since those are, as he put it, "US$ liabilities".

- I conclude, in the circumstances, that the losses in this case are, in all respects, best expressed in US Dollars. This is a factual conclusion which I have arrived at by considering the totality of the evidence which is before me. In view of this conclusion, there is no need for me to go on and address Mr Howe's alternative application that, if the Court were to assess the losses in KZT, then, the Court should go on nonetheless to enter judgment in Sterling (at the prevailing exchange rate at the date of judgment) in accordance with the jurisdiction described in the White Book at paragraph 40.2.3, as follows:

- Although it appeared at one stage that the Claimants were seeking to have the judgment expressed in US Dollars rather than in Sterling, Mr Howe acknowledged that this would not be permitted. However, as I have observed, this application does not arise in view of the conclusion which I have arrived at since Mr Howe confirmed that all that the Claimants wished to achieve was a judgment in 'hard currency' rather than in KZT and clearly US Dollars (like Sterling) is such a currency.

- Various interest-related issues arise. They are significant, particularly the question of whether interest should be awarded on a compound (as opposed to a simple) basis, since the interest claimed adds up to a very sizeable figure: in the region of US$ 200 million no less.

- The appropriate approach as regards interest was not controversial as between Mr Howe and Mr Foxton. It is an approach which has very recently been explained by Hamblen LJ in Carrasaco v Johnson [2018] EWCA Civ 87 at [17], drawing upon various authorities ranging from Tate & Lyle Food and Distribution Ltd v Greater London Council [1982] 1 WLR 149 to Reinhard v Ondra [2015] EWHC 2493 Ch (Warren J):

- The cases considered by Hamblen LJ included Fiona Trust & Holding Corporation v Privalov [2011] EWHC 664 (Comm), in which Andrew Smith J stated as follows at [16]:

- In addition, Mr Howe relied upon The Texaco Melbourne, the authority which I have considered in some detail already when dealing with the currency issue, specifically this passage earlier in Lord Goff's judgment in that case, at pages 476-477:

- In this context Mr Howe sought an order for interest in line with the various explanations set out in Mr McGregor's eighteenth witness statement and on calculations prepared by ScolzvonGleich LLP ('SVG'), an independent financial advisory firm with offices in Almaty and Astana, those calculations being exhibited to that witness statement. As to Mr McGregor's evidence, he states as follows in paragraph 8:

- Mr McGregor went on in paragraph 9 to state this:

- It was Mr Howe's submission that, based on this evidence, the Court could be comfortable that the exercise performed by SVG, aimed at arriving at an interest rate which reflects the cost of borrowing US Dollars in Kazakhstan, is the appropriate approach in this case.

- Mr Foxton did not agree. His position was that, in the event that the Court were to conclude that the currency of loss is US Dollars, then, the right course would be to award what he described as "the standard Commercial Court award", namely US$ Prime with an uplift of 2.5%, and not the higher rate used by SVG and Mr McGregor. In this respect, Mr Foxton referred to certain authorities. Mr Foxton highlighted, in particular, that in Kuwait Airways v Kuwait Insurance [2000] 1 All ER (Comm) 973 Langley J stated as follows at page 992:

- That this is not an approach which must always be applied is, however, clear. This is apparent, indeed, from the other authority to which Mr Foxton referred, Mamidoil-Jetoil Greek Petroleum Company SA v Okta Crude Oil Refinery AD [2003] 1 Lloyd's Rep. 42, in which Aikens J (as he then was) stated as follows at [16]:

- In short, the determination of an appropriate rate need not be dictated by any norm. On the contrary, it is open to a claimant to adduce evidence, as the Claimants in the present case have done, and invite the Court to decide that some other interest rate would be more appropriate on the basis that that other rate better reflects the cost of borrowing US Dollars. Specifically, it is open to a claimant to do what, it seems, Jetoil and Moil-Coal omitted to do in the Mamidoil case, which is to demonstrate with evidence that a party in its position (with its characteristics) would be charged different rates to borrow US Dollars. I am satisfied that that is what the Claimants have in this case done through the work carried out by SVG. That work has focused not on the Claimants' own borrowing experience since, as authorities such as the Kuwait Airways case and the Privalov case make clear, the proper focus in this regard is not the actual party which seeks the interest but a party with the "general attributes of the successful party and so hypothetical borrower" (per Langley J in the Kuwait Airways case at page 992). However, as Mr Howe observed, it is instructive that the SVG analysis is broadly consistent with the evidence given by Mr McGregor (backed up by the IPO prospectus and KK Plc's 2007 Annual Report) concerning the rates which the Claimants were, in fact, charged to borrow US Dollars in the relevant period. This evidence, viewed in the round, establishes that to award interest at US$ Prime plus 2.5% would significantly under-compensate the Claimants and, as such, would not be an appropriate result.

- Mr Foxton had two further objections, however, to the exercise undertaken by SVG and to Mr Howe's submissions based on that exercise. First, Mr Foxton submitted that there is, in fact, no US Dollar borrowing rate in Kazakhstan, specifically that what has been produced by SVG is something different, namely a blended rate reflecting the cost of borrowings in Kazakhstan of various foreign currencies, not all of which are identified but which include, in addition to US Dollars, Sterling, Euros and Japanese Yen. It follows, Mr Foxton submitted, that there is no satisfactory evidence before the Court as the cost of borrowing US Dollars and only that currency. I see no merit in this objection, however, for two reasons. First, I can hardly overlook the fact that, as quoted in paragraph 8 of Mr McGregor's eighteenth witness statement (and as set out above), SVG have explained that, based on their experience, "USD is by far the most commonly- used currency in Kazakhstan". Although Mr Foxton complained that this is not a proposition which he was in a position to test, I see no reason to doubt that what has been stated by SVG is genuine. Secondly, although in a sense this follows on from the point just made, it is clear that a broad brush approach is required in this area. The evidence provided by SVG is the best evidence of what it would cost to purchase US Dollars in Kazakhstan. There is no evidence to suggest that the cost is more likely to be US$ Prime plus 2.5%, a rate which Mr Foxton is only able to suggest is more appropriate because it is a norm. Indeed, it should be noted that, in making his submissions on this topic, the most that Mr Foxton was able to say, or perhaps more accurately assert, was that the "inclusion of other currencies will have had some impact on the rates". That is no basis for rejecting clear and considered evidence given by SVG and supported by Mr McGregor's evidence concerning the KK Group's actual US Dollar borrowing experience.

- The second of Mr Foxton's objections seems to me, however, to have more substance. This was that SVG ought not to have used long-term financing rates. He submitted that, consistent with the approach described in both the Kuwait Airways case and the Mamidoil case, it is the short-term borrowing rate which is material. He submitted that the reason why a short-term rate is appropriate, as a matter of principle, is that, in awarding interest at the end of a trial, the Court is not doing so in a context in which it can be known at the outset over what period of time a claimant will be deprived of its money. In contrast, a party which takes out a fixed and long-term loan will have such knowledge when taking out the loan, and the rate will reflect that this is the position. I consider that Mr Foxton must be right about this, even if I suspect that Mr Howe was also right when he observed that ordinarily it might be expected that a long-term rate will be lower than a short-term rate, and so that a defendant will typically be content with the former rather than the latter. Mr Foxton having raised the point, the lengthy electronic spreadsheet produced by SVG was looked at by Cleary Gottlieb, only for it apparently to be discovered that the short-term rates given in that spreadsheet were, as Mr Foxton reported, "appreciably lower" than the long-term rates. In such circumstances, Mr Foxton's invitation to the Court was to order that interest should be calculated on the basis of the short-term rates in the spreadsheet rather than the long-term rates. If that is the case, then, in my view, the short-term rates should instead be used, and I did not understand Mr Howe to suggest otherwise.

- For these reasons, my conclusion is that the appropriate pre-judgment rate should be calculated in the manner undertaken by SVG but with the use of short-term rates rather than long-term rates assuming that the former are lower than the latter.

- Before coming on to address the next point which arises, it is convenient to note two matters. The first is that, although in Mr Foxton's skeleton argument it was stated that "since the amounts claimed in respect of liabilities to Alliance/Forte and DBK are themselves compounded interest amounts, and already reflect 'interest on interest'" it "cannot be appropriate to superimpose a third level of 'interest on interest on interest'", Mr Foxton confirmed that this was not a contention which he was advancing. Indeed, he rather charmingly observed, in doing so, that he "wasn't aware" that he was "taking this point". In the circumstances, I need say no more about this matter.

- The second point concerns another issue raised in Mr Foxton's skeleton argument concerning the PEAK Claim and as one of the reasons given why, in Mr Foxton's submission, it would be appropriate as regards that claim to order that interest should, in all respects, be calculated taking 1 September 2012 as a single starting point. That is a submission to which I shall return in a moment, but for present purposes what should be noted is that this was stated:

- It is important to appreciate that in paragraph 19.1 of his eighteenth witness statement Mr McGregor acknowledged that, as regards monies which had originated from Alliance Bank and in relation to which claims have been made which seek recovery in respect of KK JSC's liabilities to Alliance Bank for penalties and default interest, the fact that those claims have met with success means that interest ought not to run until 1 September 2012 and not before. Not unsurprisingly, Mr Foxton agreed with Mr McGregor about this.

- The passage quoted above, however, although directed towards his submission concerning the appropriate starting point more generally, appeared to Mr Howe also to involve a substantive objection to an entitlement to interest being recoverable at all on the basis that there has been no claim to interest by way of damages. As Mr Howe submitted, if that is what was being suggested in Mr Foxton's skeleton argument, it is an argument which is plainly wrong as a matter of principle since for interest to be recoverable there is no imperative on a claimant to plead a damages claim. Perhaps recognising this, in his oral submissions, Mr Foxton did not advance the submission foreshadowed by his skeleton argument, other than in support of his overarching argument that 1 September 2012 should be taken as an appropriate and broad brush starting point.

- Having clarified the position in relation to these two aspects, I should now deal with the submission which Mr Foxton did maintain. This was that to the extent that the interest and penalties in respect of which damages have been found payable have yet to be paid by the Claimants, interest ought not to be awarded since to require that interest is paid would not be consistent with the 'compensatory principle' which operates on the basis that a successful claimant has not only incurred the relevant liability but has made the relevant payment.

- In this regard, Mr Foxton drew an analogy with a case involving a liability under a repairing covenant in a lease which, although it had arisen, had not yet resulted in remedial works being carried out (and so in costs being spent). That was Hunt v Optima (Cambridge) Ltd [2013] EWHC 1121 (TCC), in which Akenhead J explained the usual position as follows at [2]:

- Although Mr Howe submitted that it makes no difference whether the liabilities concerned have been discharged or not since it is the date when a liability is incurred that the loss crystallises, I am not convinced by this argument. I acknowledge that the analogy which Mr Foxton sought to draw with the Hunt case is not perfect since, as Mr Howe pointed out, there is a difference between a case where remedial works are going to take place in the future and a case where there is a crystallised (though as yet unpaid) liability. In my view, however, it would not be right, as a matter of principle, to award interest in relation to a liability which has not to date had to be discharged (or, in fact, been discharged) and in relation to which, therefore, the party seeking the interest is not out of pocket. The fact that that party could have made other use of the money, had it been received, pending its use in discharging the liability is neither here nor there since, in my view, the appropriate assumption which falls to be made is that, had the claimant been put in funds to enable its liability to be discharged, those funds would have been used for that purpose and not in some other unconnected way. Even if this is wrong, in any event, as a matter of discretion, it seems to me that it would be appropriate to decline to award interest on these aspects of the claim. The position might have been different were it the case that interest was payable by the Claimants themselves on the amounts due by way of interest and penalties. That is not, however, how the claims have been put in these proceedings.

- As to the question of when interest should start running, the matter on which I have already briefly touched, Mr Howe's invitation to the Court was to order that interest should start running in accordance with the detailed analysis contained in Mr McGregor's eighteenth witness statement. I am satisfied that this is appropriate. I reject Mr Foxton's suggestion that in the case of the PEAK Claim the date should in all respects be 1 September 2012 since, as Mr Howe observed, this would involve elements of that claim attracting no interest for several years. This cannot be a fair outcome. Interest should be paid which will compensate for the payments which were made and it seems to me that, in the absence of anything more than Mr Foxton's somewhat generalised suggestion that 1 September 2012 should be a date which has universal application, Mr McGregor's approach should be accepted. I acknowledge that Mr Foxton sought to justify his 1 September 2012 submission by referring to the need to take account of the fact that in some instances monies "were recirculated back to the KK Group", but, as demonstrated that it was Mr McGregor who made this very point in paragraph 23 of his eighteenth witness statement, it seems to me that no further adjustment is required.

- I consider that Mr McGregor's approaches to the Land Plots Claim and the Astana 2 Claim are, likewise, appropriate. I reach this conclusion notwithstanding the various points which were made in Mr Foxton's skeleton argument. As to the Land Plots Claim, Mr Foxton suggested that a more appropriate starting date would be 1 May 2008, as opposed to 1 January 2008 which is the date taken by Mr McGregor. The difference is not vast and, in the circumstances, I see no reason not to adopt Mr McGregor's approach which is to take a mid-point date between 28 October 2007 and May 2008 when the majority of the relevant payments were made. Similarly, as to the Astana 2 Claim, the only dispute highlighted by Mr Foxton in his oral submissions was as to whether the appropriate date should be 1 January 2010 (as he suggested) or 1 November 2009 (as Mr McGregor suggested). Mr McGregor's rationale was set out in paragraph 47 of his eighteenth witness statement and, given that there is only two months between Mr Foxton's and Mr McGregor's suggested starting dates, it seems to me, again adopting a broad brush in the exercise of my discretion, to opt for the (marginally) later date.

- The next issue concerning interest which needs to be determined is whether interest should be awarded on a simple or on a compound basis. This is a matter which saw both Mr Howe and Mr Foxton take the Court to the statements of case as well as a number of authorities.

- It was Mr Howe's complaint that it was not until Mr Foxton's skeleton argument that any point was taken on Mr Arip's and Ms Dikhanbayeva's behalf that it is not open to the Claimants to obtain an award of compound interest because to do so would require them to establish that compound interest is recoverable as a matter of Kazakh law and this had not been done. Indeed, in Mr Howe's skeleton argument there was reference not to Kazakh law but to English law, specifically Westdeutsche Landesbank Girozentrale v Islington LBC [1996] AC 669, in support of the submission that, since in the present case money has been obtained and retained by fraud, the Court has a discretion to award compound interest. It was acknowledged, and is clearly the position, that compound interest is not recoverable under section 35A of the Senior Courts Act 1981.

- In the Westdeutsche case, as Mr Howe pointed out, although it was not agreed between their lordships whether compound interest is available in respect of restitutionary claims, the House of Lords proceeded on the basis that there is an equitable jurisdiction to award compound interest in cases of fraud: see, in particular, per Lord Goff at pages 692D-F and 696G-H, per Lord Browne-Wilkinson at page 702B-E, per Lord Slynn at page 718F and per Lord Woolf at pages 724H-725C and page 726B-E. Indeed, I did not understand Mr Foxton to have been contending to the contrary since, as will appear, he himself placed heavy reliance on a decision of the Court of Appeal, Kuwait Oil Tanker Co SAK v Al Bader [2000] 2 All ER (Comm) 271, in which Nourse LJ acknowledged that there is the equitable jurisdiction on which the Claimants rely, stating as follows at [209] (strictly in relation to breach of fiduciary duty claims since that was the nature of the claim in the Kuwait Oil Tanker case):

- Mr Foxton's submission was different: to repeat, that it was not open to the Claimants to invoke the equitable jurisdiction of the Court to award compound interest since the applicable law is not English law but Kazakh law, and the Claimants have not established that under Kazakh law compound interest can, and would, be awarded.

- Nor did Mr Foxton join issue (at least expressly) with Mr Howe's submissions as to why in this case, if the Court has a discretion to award compound interest, such an award should be made, given that Mr Arip and Ms Dikhanbayeva have been found to have been guilty of significant fraud and given that to award the Claimants only simple interest would not represent anything like proper compensation in respect of the frauds which were committed, particularly in view of the length of time of time which has passed since the frauds were committed. In truth, it is not surprising that Mr Foxton advanced no submissions on this aspect, instead concentrating on the prior question of whether the Court has the ability to award compound interest at all, since I am clear that, if the Court has such ability, the appropriate course in this case would, indeed, be to make an order that interest should be compounded. This is a case which saw Mr Arip and Ms Dikhanbayeva engage in prolonged and major fraud involving substantial amounts of money, and which entailed Mr Arip and Ms Dikhanbayeva (along with a succession of witnesses called by them) giving evidence to the Court which was profoundly dishonest and consistently so.

- I need, therefore, to address Mr Foxton's submissions on the prior question, beginning with what was stated concerning compound interest in the Re-Re-Amended Particulars of Claim at paragraph 53, as follows:

- Paragraph 53 was addressed in the Re-Re-Amended Defence at paragraph 119 in these brief (and not entirely grammatically correct) terms:

- In these circumstances, it was Mr Howe's submission that it is now too late for Mr Foxton to take the objection which he does, at least to do so in conjunction with the argument that, there being no evidence (if this is the position) that compound interest is available under Kazakh law, compound interest cannot be recovered in this case. Had Mr Arip and Ms Dikhanbayeva wished to raise the arguments now raised, Mr Howe submitted, it was incumbent upon them to do so in the Re-Re-Amended Defence in order to ensure that the issue was properly addressed, if necessary with Kazakh law evidence directed to it specifically, and that for the arguments to be raised for the first time in Mr Foxton's skeleton argument for the consequential hearing is unacceptable.

- I have sympathy for Mr Howe's position. Regardless of where, technically, the onus might lie from a pleading perspective, it is regrettable that it should have taken until the consequentials hearing for Mr Arip's and Ms Dikhanbayeva's case to be made known. The modern 'cards on the table' approach to litigation ought to mean that the present situation does not come about. In my view, the responsibility for what has happened in this case rests not with the Claimants but with Mr Arip and Ms Dikhanbayeva.

- As I have previously observed, it is tolerably clear that, in putting forward their compound interest claim, the Claimants were relying upon English law rather than Kazakh law. There was no mention of the Kazakh law concerning compound interest, as Mr Foxton himself pointed out, in paragraph 53 itself. The only mention of Kazakhstan was the reference to the interest sought "including as appropriate the interest rates applicable in Kazakhstan at the material times to the extent that the use of such rates is necessary adequately to compensate the Claimants". Indeed, strictly speaking, these words are followed by a semi-colon and it is only after this semi-colon that there is any mention of "compound interest" (and, even then, the reference to compound interest is "as damages", a point to which I shall return), and so the reference to compound interest is divorced from any reference to Kazakhstan. This is not, however, a point which, sensibly, Mr Foxton took.

- Mr Howe sought in his oral submissions to suggest that the pleader (not, as it happens, him at least not originally) should be taken as having alleged an entitlement to interest under Kazakh law. However, that seems somewhat unlikely given that paragraph 53 does not state this in terms. That the Claimants were apparently contemplating only English law is, furthermore, borne out by the fact that in Mr Howe's skeleton argument for the consequentials hearing there was no mention of Kazakh law concerning compound interest and, instead, reliance was exclusively placed on the Westdeutsche case. In these circumstances, it seems to me that it was incumbent upon Mr Arip and Ms Dikhanbayeva to set out their stall, whether in the Re-Re-Amended Defence, or at least in some form earlier than has happened in this case, so as to make the Claimants (and, indeed, the Court) aware that it was not accepted that the English law relating to compound interest is applicable and, furthermore, that under Kazakh law compound interest is not recoverable (assuming, of course, that that is the position a point to which I shall return). Had Mr Arip and Ms Dikhanbayeva done this, there would not be the present situation. I am inclined, in the circumstances, to agree with Mr Howe's characterisation of the arguments now raised as being "a classic after-the-event attempt to exploit the position in order to raise a point that was not raised on the pleadings and try and catch the court and the claimants by surprise".

- It should also be borne in mind that it was not only in paragraph 53 of the Re-Re-Amended Particulars of Claim that the Claimants made it clear that they would be seeking compound interest if successful in the action. On the contrary, it is right to point out that, in his third affidavit, produced in 2015 in the context of an application to reduce the level of the amount affected by the freezing order which the Claimants obtained two years earlier, Mr McGregor set out details which included amounts for compound interest in much the same manner as he did when producing his eighteenth witness statement for the purposes of the consequentials hearing. This did not provoke Mr Arip and Ms Dikhanbayeva, or those acting for them, to complain that compound interest cannot be recovered as a matter of English law since this is not the applicable law and that Kazakh law does not permit compound interest to be awarded. In all probability, this was for a very good reason: the arguments now advanced by Mr Foxton had not occurred to anybody at that stage.

- Coming on to address the substantive merits of the arguments now advanced by Mr Foxton, in my view, he was right when he submitted that the equitable jurisdiction to award compound interest is substantive rather than procedural in nature. Nourse LJ made this clear in the Kuwait Oil Tanker case at [211]:

- If it is right that the equitable jurisdiction is, indeed, substantive, the next question is whether Mr Foxton was right to submit that, in those circumstances, it is not open to the Claimants to rely upon what is sometimes described as the presumption that the relevant foreign law (here, Kazakh law) is the same as English law. I will deal with this point shortly. First, however, it is necessary to address another of the matters raised by Mr Foxton. This concerns his insistence that, in order to recover compound interest, the Claimants would need to do this by advancing a claim for damages in line with the decision of the House of Lords in Sempra Metals v IRC [2008] 1 AC 561 to the effect that compound interest may be recovered as damages at common law but that it is necessary for such damages to be pleaded and proved. As the Claimants had advanced no such claim, other than in the briefest and unparticularised of terms when referring at the end of paragraph 53 of the Re-Re-Amended Particulars of Claim to "compound interest as damages", it was Mr Foxton's submission that this means that compound interest cannot be recovered by the Claimants in this case, in any event. Mr Foxton, in this respect, referred the Court to JSC BTA Bank v Ablyazov [2013] EWHC 867 (Comm), another case (or, more accurately, cases) involving Kazakhstan in which Teare J rejected an attempt by the successful claimant to recover compound interest as damages on the Sempra Metals basis because there had been "no attempt to plead as damages the Bank's actual interest losses over and above the paying away of the principal sums".

- I agree with Mr Howe, however, that Mr Foxton's submissions on this aspect appeared to overlook the fact that there is a distinction between compound interest being claimed as damages, on the one hand, and such interest being claimed under the equitable jurisdiction of the Court, on the other. There is, in short, no obligation to overcome the Sempra Metals hurdle, which exists to enable a claimant to recover damages at common law, in seeking compound interest under the Court's equitable jurisdiction.

- There is, however, a further point which needs to be considered because it was Mr Foxton's submission that, putting to one side Sempra Metals and what is required as a matter of English law, it is still necessary to do whatever the relevant foreign law requires to be done in order to make a recovery of compound interest, and so that it is not enough for a successful claimant simply to say that there is a power to award interest which might enable compound interest to be recovered. All the more so, Mr Foxton submitted, if for these purposes the claimant is relying upon the presumption to which I have referred and not actual evidence as to what the relevant foreign law is, given that the presumption would entail, as Mr Foxton put it, "the obvious utter artificiality of presupposing that the courts of Kazakhstan have a jurisdiction akin to the equitable jurisdiction of the [English] court to award compound interest".

- Having considered Mr Howe's submissions in response to this suggestion, I consider that there is some force in the point which he made that in the Kuwait Oil Tanker case it appears that it was the existence of the power to award compound interest in the relevant foreign law which is what matters. Thus, Moore-Bick J concluded that an award of interest was not contrary to the law of Kuwait (and so not precluded by the then applicable double actionability rule) by finding at page 172 of his judgment (as recorded in Nourse LJ's judgment at [200]) that he was "satisfied that the Kuwaiti courts have the power under this Article to award interest where they are satisfied that the property in question could have been used to earn interest and would have been so used if the interests of the owner had been properly safeguarded". As Nourse LJ went on to explain at [204], a paragraph to which I have previously referred:

- It seems to me to follow from this that, as Mr Howe submitted, emphasising Nourse LJ's reference to the award of compound interest under the equitable jurisdiction being "the remedy appropriate in English law to give effect to the substantive right contained in art 267", there is some substance in the point that it is the fact that there is the power to award compound interest under Kazakh law which matters, not that the successful claimant can establish, through doing whatever Kazakh law might require for such a claim to succeed, that it would necessarily have been exercised in such a way as to result in an award of compound interest. I consider, in particular, that Mr Howe may well have been right when he submitted that it is the fact that there is an equivalent power which means that the Court here can exercise its own equitable jurisdiction just as it would do were this a domestic dispute with no foreign law aspect in play at all. Indeed, as Mr Howe went on to observe, if this was not the position, then, it seems that the Court of Appeal would have rejected the compound interest claim on the basis that it had not been established that compound interest would actually have been recovered under Kuwaiti law, not merely that there was power to award such interest under that system of law. If this is right, then, it follows that it makes no difference that, as Mr Foxton somewhat wryly observed, Kazakh law is unlikely itself to have an equitable jurisdiction comparable to that of England and Wales. However, ultimately, as I shall come on to explain, I do not consider that the point raised by Mr Foxton is critical in this case.