Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Great Station Properties SA & Anor v UMS Holding Ltd & Ors [2017] EWHC 3330 (Comm) (20 December 2017)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2017/3330.html

Cite as: [2017] EWHC 3330 (Comm)

[New search] [Printable PDF version] [Help]

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Rolls Building, 7 Rolls Buildings Fetter Lane, London EC4A 1NL |

||

B e f o r e :

____________________

| IN AN ARBITRATION CLAIM (1) GREAT STATION PROPERTIES S.A. (2) INTER GROWTH INVESTMENTS LIMITED |

Claimants |

|

- and – |

||

(1) UMS HOLDING LIMITED (2) ENERGY STANDARD FUND LIMITED (3) ENERGY STANDARD INDUSTRIES LIMITED (4) STREMVOL HOLDINGS LIMITED |

Arbitration Respondents |

|

-and- |

||

| (1) UMS HOLDING LIMITED (2) ENERGY STANDARD FUND LIMITED (3) ENERGY STANDARD INDUSTRIES LIMITED |

Defendants |

|

AND IN THE MATTER OF AN ARBITRATION Between : |

||

| (1) GREAT STATION PROPERTIES S.A. (2) INTER GROWTH INVESTMENTS LIMITED |

Arbitration Claimants |

|

-and- |

||

| (1) UMS HOLDING LIMITED (2) ENERGY STANDARD FUND LIMITED (3) ENERGY STANDARD INDUSTRIES LIMITED (4) STREMVOL HOLDINGS LIMITED |

Arbitration Respondents |

____________________

John Brisby QC and Tom Gentleman (instructed by Hogan Lovells International LLP) for the Defendants

Hearing dates: 4 and 5 December 2017

____________________

Crown Copyright ©

- On 5 October 2017 I gave judgment dismissing the challenge made by the Grigorishin Respondents to an arbitration Award pursuant to section 68 of the Arbitration Act 1996; see [2017] EWHC Comm 2398. The arbitration Award had concluded that the Grigorishin Respondents were liable to pay to the Claimants the sum of US$305.8 million together with interest and costs. As a consequence of the failed challenge to the Award permission was granted to enforce the Award as a judgment of this court. In circumstances where the judgment debt has not been satisfied and where no proposals have been made for the payment of the judgment debt the Claimants now seek a Worldwide Freezing Order ("WFO") to aid enforcement of the Award and judgment.

- The principal issue which falls to be decided on this application is whether the Claimants are able to establish the necessary risk of dissipation of assets by the Grigorishin Respondents.

- I can take the statement of the relevant test from the recent decision of the Court of Appeal in Holyoake v Candy [2017] 2 AER (Comm) 513 at paragraph 34:

- The basis of the Claimants' case is that the necessary risk is established by the facts found by the arbitration tribunal regarding the existence of the "Illicit Scheme". Further, the risk is exacerbated or accentuated by the "Svarog Transfers" of which extensive evidence has been given.

- In my earlier judgment in this matter I summarised the parties and the disputes between them in these terms at paragraphs 5-8:

- Thus it was the case of the Claimants (see paragraph 108 of the Award) that the Grigorishin Respondents engaged in the wrongful diversion of profits from NPO to intermediary companies which the Grigorishin Respondents had inserted into the trading relationships between NPO and its end-customers. These intermediaries were said to be under the control of the Grigorishin Respondents (and ultimately Mr. Grigorishin himself) and received profits that should otherwise have fallen to the account of NPO and, ultimately, to the Claimants.

- That case succeeded before the arbitration tribunal. The tribunal's reasons are set out at paragraphs 164-202 of the Award, entitled "Illicit Scheme". The Grigorishin Respondents' case before the tribunal was that the alleged "intermediary companies", Technoimport and ES LLC, were not under their control. That indeed was Mr. Grigorishin's evidence. He said he did not know who owned Technoimport. The tribunal had "little hesitation" in rejecting that evidence; see paragraph 170. "It is simply impossible to accept that nearly half NPO's business was being conducted with a company about which nothing was known." The tribunal explained between paragraphs 171 and 175 why it was clear that Technoimport was part of same group of companies under control of Mr. Grigorishin. In paragraphs 176-177 it explained why it had reached the same conclusion in respect of ES LLC. At paragraph 178 the tribunal said:

- The tribunal went on to consider the reason why the intermediary companies were used. The explanation put forward by the Grigorishin Respondents was rejected; see paragraphs 181-185. The tribunal concluded at paragraph 186:

- The same conclusion was reached with regard to ES LLC; see paragraph 187.

- It is clear from the findings of the tribunal that Mr. Grigorishin used the companies within his control to ensure that profits which ought to have been shared with the Claimants were instead paid to companies within his control. This was an action which deliberately harmed the interests of the Claimants. In my judgment the tribunal's findings are solid evidence which demonstrates that there is a real risk that Mr. Grigorishin may use companies within his control to seek to ensure that assets of the Grigorishin Respondents are beyond the reach of the Claimants when they seek to execute the judgment on those assets.

- The Illicit Scheme was operated in 2012-2013. It is now 2017 and Mr. Brisby submitted that it is of "historical interest only". I am unable to accept that submission. It is plain from the strenuous efforts which Mr. Grigorishin made to challenge the Award in 2017 that he is not at all content with the Award in favour of the Claimants. If he was prepared, as the arbitrators have found, to manipulate his companies to deprive the Claimants of the profits to which they were entitled, there appears to me to be a real risk that he will be prepared to manipulate his companies to seek to ensure that the Claimants do not recover damages in respect of the loss caused by his action or the sum of $250 million due to the Claimants in respect of the sale of their interest in the joint venture as also found by the tribunal. It is true that there is no suggestion that in the 18 months since the Award was published any dissipation of assets has taken place. That is a matter to be borne in mind but it does not serve, in my judgment, to show that the required real risk does not exist.

- Mr. Jowell described the conduct of Mr. Grigorishin as found by the arbitrators as "fraudulent" and said that the Grigorishin Respondents had given "false" evidence before the tribunal. He said that they had "brazenly lied" as to the ownership and control of the companies in question. Mr. Brisby said that such language had not been used by the tribunal and therefore it was impermissible for the court to accept Mr. Jowell's characterisation of the tribunal's findings.

- I do not consider that it was necessary for Mr. Jowell to use the language he did since, as I have explained in paragraph 10 above, the findings of the tribunal give rise to the necessary risk. However, whilst I accept that it may be inappropriate to use the adjective fraudulent (because it might be thought to refer to the tort of deceit, which was not the cause of action relied upon by the tribunal) I find it impossible not to conclude from the tribunal's findings that the conduct of Mr. Grigorishin was dishonest. Deliberate conduct which deprives a person of money to which he was entitled is dishonest by the ordinary standards of reasonable and honest people. The tribunal did not say so in terms because the cause of action relied upon was breach of contract. But I do not consider that the court cannot properly describe the conduct of Mr. Grigorishin as dishonest when that adjective is a fair and reasonable description of the conduct found by the tribunal.

- Mr. Brisby submitted that the Claimants had alleged that there had been wilful misconduct and dishonesty and that in circumstances where the tribunal had not made any such finding the court could not properly describe the conduct as found to be dishonest. It is true that the Claimants had alleged that it was an implied term of the JVA not to commit fraud or wilful misconduct in the performance of their obligations under the JVA. The tribunal rejected the suggested implied term because there was no need for any such implication given the express terms of the JVA; see paragraph 122 of the Award. That appears to me to be the reason why there was no express finding of fraud, dishonesty or other wilful misconduct. Such conduct did not have to be established in order to establish breach of the express terms of the JVA. However, the arbitrator did find that corporate vehicles owned or controlled by Mr. Grigorishin had been "inserted in the chain to extract profit from NPO". That appears to me to be the plainest case of dishonesty.

- Mr. Brisby further submitted that Mr. Grigorishin's conduct was not concealed from the Claimants (and so could not be dishonest) because the role of Technoimport was clear from documents provided to the Claimants and that each of the contracts under which profits were diverted away were approved by the Claimants' representatives on the board of the joint venture vehicle. It is said that the tribunal had that well in mind (as I had found in my earlier judgment rejecting the section 68 challenge, see paragraph 93) and that that explains why there was no finding of dishonesty.

- In considering this submission it is necessary to have in mind the tribunal's finding at paragraph 175:

- The finding that the arrangement was opaque and certainly not transparent in circumstances where the intermediary companies had been inserted for the purposes of extracting profit supports the description of the Grigorishin Respondents' conduct as dishonest.

- But, as I have explained, it is not necessary to describe the conduct of Mr. Grigorishin as dishonest in order to demonstrate that the required risk arises from the findings of the arbitrators.

- So far as the "false" evidence and "brazen lying" is concerned it is to be noted that the tribunal clearly rejected the evidence of the Grigorishin Respondents (including that of Mr. Grigorishin) to the effect that Technoimport and ES LLC were not companies under their control. That evidence must have been false and it is difficult not to accept that it must have been known to be false. I therefore consider that there is solid evidence that the Grigorishin Respondents lied before the tribunal, though I am not sure that the adjective "brazen" adds anything. In any event the facts as found by the tribunal appear to me, for the reasons I have given, to be solid evidence of a risk of dissipation.

- In February 2016 the shares in certain Ukrainian companies were transferred by the Cypriot companies which held them to a Ukrainian asset manager, Svarog. An intention to effect this transfer was published on 5 February 2016. The Claimants became aware of that on 8 February 2016 and were concerned that the proposed transfer was a device to enable the Grigorishin Respondents to dissipate their assets. They therefore applied to the Cypriot court for an order preventing the transfer. On 19 February 2016 the Cypriot court declined to grant the order ex parte and ordered an inter partes hearing on 26 February 2016. The Claimants served their application on the Cypriot defendants (including the Grigorishin Respondents) on 22 February 2016. On 26 February 2016 the Cypriot court gave further directions for the hearing of the Claimants' application. The Claimants learned from searches made of the website of the Stock Market Infrastructure Development Agency of Ukraine that the transfers had already taken place. They believed the transfer had taken place on 24 February 2016 which supported their belief that the transfers were an attempt to dissipate assets. However, the extensive evidence adduced by the Grigorishin Respondents in response to the application before this court suggests that the Claimants' fears were mistaken in that the transfer was motivated, not by a desire to make the assets of the Grigorishin Respondents "judgment proof", but by a desire to avoid the Ukrainian companies being subject to sanctions by the Ukrainian government on the grounds that they were controlled by a Russian. The evidence further suggests that the transfer began in early February and was completed by 19 February 2016. Indeed, for the purposes of this application the Claimants are content to proceed on the basis that the Svarog Transfers took place on or by 19 February 2016 and were not themselves motivated by or in response to the Claimants' application in Cyprus.

- However, the events leading up to and concerning the Svarog Transfers are still relied upon as supporting the case for a WFO because, so it was alleged by Mr. Jowell, Mr. Grigorishin showed himself as willing to make statements to a Ukrainian state agency as to the "ultimate beneficial owner" of his asset management companies which were not true. Such conduct was said to demonstrate a lack of probity and a clear propensity to transfer assets covertly and to use complicated ownership structures to seek to conceal the real identity and location of assets. In response Mr. Brisby said that untrue statements had not been made to the Ukrainian state agency and, in particular, that the person said to be the ultimate beneficial owner of the asset management companies was true as a matter of Ukrainian law. Under that law the ultimate beneficial owner was the person who, "irrespective of the formal ownership, was capable of exercising a decisive influence on the management or business activities of a legal entity, either directly or through other persons". It is therefore necessary to set out the circumstances leading up to the Svarog Transfers and to consider who had decisive influence on the management or business activities of the relevant companies.

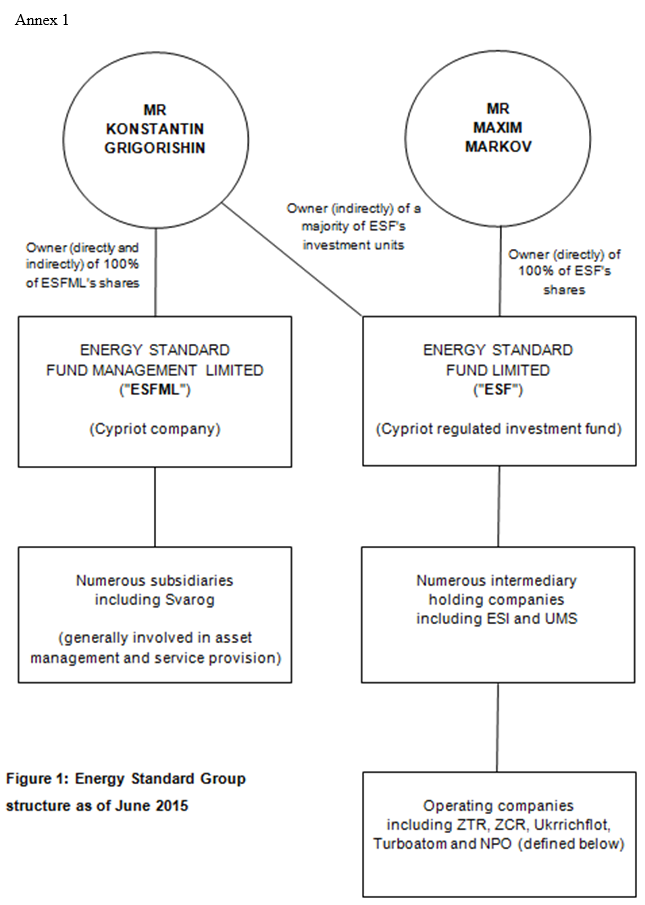

- I begin with the position prior to June 2015. The relevant assets in which Mr. Grigorishin had an interest are illustrated by a chart prepared by Mr. Sciannaca of Hogan Lovells, the solicitors acting for the Grigorishin Respondents. A copy of the chart is annexed to this judgment marked Annex 1.

- Annex 1 illustrates two corporate groups.

- The first, on the right hand side, is headed by Energy Standard Fund Limited ("ESF"), the second of the Grigorishin Respondents and a Cypriot regulated investment fund. It can be seen that the shares in ESF are owned (directly) by Mr. Maxim Markov. He is a lawyer with both Russian and Bulgarian citizenship. It can also be seen that Mr. Grigorishin is said to be the owner (indirectly) of a majority of ESF's investment units. Investment units were not, I think, defined in the evidence before the court but Mr. Sciannaca gave evidence that the investment units gave their holder the right to benefit financially from ESF's activities. Below ESF in the corporate chart were "numerous intermediary holding companies including ESI and UMS". ESI and UMS are the third and first Grigorishin Respondents. I infer that shares in those companies are held by ESF. Below those "numerous intermediary holding companies" are the operating companies, including ZTR, ZCR, Ukrrichflot, Turboatom and NPO. Thus the holding companies held shares in the operating companies, though, as Mr. Brisby told me, not directly. Mr. Sciannaca described the shares in the operating companies as being indirectly owned by ESF. My understanding is that the operating companies were in the energy sector in Ukraine. They presumably produce the financial benefit to which Mr. Grigorishin has a right pursuant to his holding (indirectly) the majority of the investment units. The precise nature of the investment units or how they were held indirectly by Mr. Grigorishin was not, I think, explained.

- The second corporate group, on the left hand side of Annex 1, is headed by Energy Standard Fund Management Limited ("ESFML"), a Cypriot company. 100% of the shares in ESFML were owned (directly and indirectly) by Mr. Grigorishin. ESFML held shares in numerous subsidiaries including Svarog, a Ukrainian asset management company.

- One of the issues debated during the hearing was whether Mr. Markov was free to exercise his own judgement as holder of 100% of ESF's shares or whether he was required to do as Mr. Grigorishin instructed. Although Mr. Markov was one of those who provided information to Mr. Sciannaca for the purposes of the latter's 95 page witness statement very little information on this subject appears in that witness statement. At paragraph 95 it is said that as sole owner of ESF's issued shares he has "enjoyed, alone, the corporate rights associated with those shares, including full voting rights". At paragraph 146 and following, when dealing with the question who is the ultimate beneficial owner of EFS as a matter of Ukrainian law, reliance is placed on (a) the opinion of Professor Dovgert, an independent Ukrainian lawyer, that Mr. Markov would be recognised as the ultimate beneficial owner, and (b) on Mr. Markov's confirmation that he had been uniformly reported to the Ukrainian authorities as the ultimate beneficial owner, that no information had been provided to the authorities which would suggest that anyone else was and that Mr. Markov's status as such had been accepted and recognised. However, no reference was made to those passages in Mr. Markov's evidence to the arbitration tribunal which would suggest a different picture (though reference was made to other passages in that evidence).

- In his witness statement dated 17 February 2015 Mr. Markov said that he reported directly to Mr. Grigorishin and that he spoke to him daily (often several times a day) and often at the weekends. At paragraph 24 he said this:

- At paragraph 138 Mr. Markov referred to the problems caused by the resignation of the Claimants' directors from the supervisory board of NPO (one the issues in the arbitration) and said:

- These passages cogently suggest that Mr. Markov took his instructions from Mr. Grigorishin. This is not surprising in circumstances where he is the (indirect) owner of a majority of ESF's investment units. Indeed, in the arbitration the Claimants pleaded that the Grigorishin Respondents, of which ESF was one, were "owned by and/or under the effective control of Mr. Grigorishin". In their turn the Grigorishin Respondents pleaded that the "majority beneficial owner of the Grigorishin Respondents is Mr. Konstantin Grigorishin, a successful Russian businessman. Mr. Grigorishin is best known by reason of his association with the Energy Standard group of companies, of which the Grigorishin Respondents form part." They admitted the Claimants' allegation that ESF was "owned by and/or under the effective control of Mr. Grigorishin". That admission appears to me to be consistent with and supported by Mr. Markov's evidence to the tribunal.

- Mr. Grigorishin gave oral evidence before the arbitration tribunal. He was asked whether he was the major investor and owner in the Energy Standard Fund group of companies. He replied: "as I know, yes". He was asked whether he controlled the group directly or indirectly. He replied: "I cannot say in legal terms. I think I am controlling it through some Cyprus directors, or some – I think it is, but not straight." He was asked whether he indirectly controlled it. He replied: "Yes, maybe."

- There is therefore compelling evidence that Mr. Grigorishin exercises control over ESF through Mr. Markov.

- It is true that Professor Dogvert expressed the opinion on the basis of certain factual assumptions that Mr. Markov exercised "a decisive influence" on the management and business activities of the ESF investment board and was therefore, in Ukrainian law, the ultimate beneficial owner of ESF. However, he added this rider:

- If Professor Dogvert had seen the common ground established by the pleadings in the arbitration, the written evidence of Mr. Markov to the arbitration tribunal and the oral evidence of Mr. Grigorishin to the tribunal it seems likely that he would have concluded that it was Mr. Grigorishin who exercised "decisive influence" over ESF and that therefore it was Mr. Grigorishin who was, in Ukrainian law, the ultimate beneficial owner of ESF.

- Similarly, if Mr. Grigorishin or Mr. Markov had disclosed to the Ukrainian authorities that which they told the arbitration tribunal there must be serious doubt as to whether those authorities would have "accepted and recognised" Mr. Markov as the ultimate beneficial owner of ESF.

- As a result of the hostilities between Ukraine and Russia the Ukrainian government introduced laws in 2014 and 2015 which were targeted at Russian owned businesses. The Ukrainian law requiring the disclosure of a company's ultimate beneficial owner had been introduced in October 2014. In April 2015 Svarog's Director-General, Mr. Kolobrodov, was summoned to a meeting at the Ukrainian Securities Commission. He was told that the Commission believed that Svarog had a Russian citizen in its ownership structure. The meeting was attended by about 50 individuals, all of whom represented companies licensed by the Commission but which had a Russian citizen in their ownership structure. The chairman of the Commission said that Russian citizens had to be removed from corporate structures by 28 June 2015, otherwise their licenses would be removed. Dual citizenship would not assist. Proof would be required that Russian citizenship had been revoked. When this was reported to Mr. Markov it was appreciated that all Ukrainian companies of which Mr. Grigorishin was the ultimate beneficial owner "of record" were at risk of having their business licenses revoked. Mr. Grigorishin's dual Cypriot nationality would not assist. Accordingly, on 26 June 2015, Mr. Grigorishin transferred his shares in ESFML to Mr. Pivovarov who was manager of the Energy Standard Group's Swiss office and a friend of Mr. Grigorishin since their youth. He had a Swiss passport. Two days later the Licensing Law came into effect and within one month the licences granted to several Russian banks were revoked.

- On 15 July 2015 Svarog provided the Commission with information (in the form of a chart) which showed the ownership structure of Svarog as of 30 June 2015. Mr. Pivovarov was shown as the 100% owner of ESFML. On 7 August 2015 the Commission stated that their information was that Mr. Grigorishin was the indirect holder of a major shareholding in Svarog and required Svarog to say whether or not Mr. Pivovarov was the ultimate beneficial owner of Svarog. On 20 August 2015 Svarog stated that Mr. Pivovarov was the ultimate beneficial owner of Svarog. Finally, on 15 September 2015 the Commission approved Mr. Pivovarov's "acquisition" of a major shareholding, "resulting in indirect holding of 99.9% ownership interest in" Svarog.

- There is no evidence that Mr. Pivovarov purchased Mr. Grigorishin's shares in ESFML. Mr. Sciannaca merely states that they were "transferred". It therefore appears that the shares have been gifted to Mr. Pivovarov. The question arises whether, like Mr. Markov, Mr. Pivovarov, although the nominal holder of all the shares in ESFML as from 26 June 2015, in fact took his instructions from Mr. Grigorishin.

- Mr. Pivovarov is not listed by Mr. Sciannaca as one his sources and so, although Mr. Sciannaca describes the allegation that Mr. Pivovarov acts under the direction of Mr. Grigorishin as unsubstantiated, there is no evidence from Mr. Sciannaca as to what Mr. Pivovarov says about the allegation. But in the arbitration Mr. Grigorishin was asked whether Mr. Pivovarov was a senior manager or director in Energy Standard in Switzerland and Cyprus. He replied: "I don't remember. I don't know the whole legal structure. Mr. Pivovarov is my classmate. I know him since 13 years old." He was asked whether he was in the Energy Standard group. He replied: "Not sure, it is better to ask Mr. Markov, he know better about Mr. Pivovarov. I am [not?] absolutely sure about Mr. Pivovarov maybe he is just a consultant but I don't know. He is a friend of mine but I don't know his formal position."

- This cross-examination took place in September 2015. If, three months earlier, Mr. Grigorishin had handed to Mr. Pivovarov "decisive influence" over ESFML and the numerous subsidiaries involved in asset management and service provision I would have expected him to recall that. I would not have expected him to suggest that he was "maybe …just a consultant". Mr. Markov was also "not quite sure about" the position of Mr. Pivovarov. He could only agree that he was part of the Energy Standard Group. Again, given his involvement in the transfer of shares to Mr. Pivovarov in June 2015 one would have expected him to recall that Mr. Pivovarov, rather than Mr. Grigorishin, had "decisive influence" over ESFML.

- Mr. Brisby said that there was nothing surprising in the evidence of Mr. Grigorishin because "he operates at a very high level…….in the stratosphere". I accept that he probably does operate at a high level but I nevertheless consider it likely that if he had handed over "decisive influence" to Mr. Pivovarov in respect of ESFML he would have recalled that. Further, Mr. Markov does not operate at the same high level (he was described by the tribunal as "responsible for the paperwork"; see paragraph 176 of the Award) and there can be no doubt that if he had been instrumental in arranging for "decisive influence" over ESFML to be transferred to Mr. Pivovarov he would have recalled that.

- The hurried circumstances in which the shares in ESFML were transferred in June 2015, the absence of any evidence that Mr. Pivovarov purchased the shares and the failure of Mr. Grigorishin and Mr. Markov to recall in September 2015 that three months earlier Mr. Pivovarov had replaced Mr. Grigorishin as the person with "decisive influence" over ESFML collectively amount to cogent evidence that Mr. Grigorishin remained the ultimate beneficial owner of ESFML.

- The attention of Mr. Grigorishin and those advising him then turned to ESF. The Ukrainian authorities announced that future privatisations would not be open to companies controlled by Russians. This was of concern because the operating companies indirectly held by ESF had participated in earlier privatisations and wished to do so in the future. On 7 July 2015 the Prime Minister of Ukraine expressed the hope, with reference to the proposed privatisation of Centrenergon (a power generating company), that "we won't see Russian businessman Konstantin Grigorishin's people at the Ministry of Energy". On 11 August Mr. Markov had a meeting with Vasil Kisil & Partners, a law firm ("VKP"). On 14 August 2015 VKP provided certain advice "relating to the eligibility of legal entities affiliated with citizen of the Russian Federation to participate in the privatisation of Ukrainian state property". The letter of advice does not in terms mention ESF but the description of a fund registered in Cyprus, voting shares being held by a resident of Bulgaria and the Russian Federation and non-voting shares being held by several shareholders including a citizen of Cyprus and the Russian Federation is consistent with the subject of the advice being ESF, Mr. Markov and Mr. Grigorishin. VKP was asked, in particular, who was the beneficial owner. They advised that the holder of the voting shares should be disclosed as the beneficial owner. They further advised that since that person is or will be registered as a citizen of Bulgaria then the fund will not be regarded as formally controlled by citizens of the Russian Federation. However, they said there was a risk that the privatisation body might find out that the voting shareholder had a second citizenship of the Russian Federation and would deny participation in the privatisation process on that basis. "To eliminate this potential risk, it is advisable that controller(s) of the Fund has/have no citizenship of the Russian Federation".

- In mid-October 2015 Mr. Markov considered a different solution, namely, transferring the operating companies to Svarog. Mr. Grigorishin suggested that advice on this solution be sought from VKP. That advice was provided on 23 December 2015. It referred in terms to ESF and advised that the ESF group be restructured so that "Mr. Markov is not seen as the Subsidiaries' UBO". The detail of the advice is difficult to follow but Mr. Sciannaca states that the material part of the advice may be understood as follows:

- SIF means, according to footnote 24 of Mr. Sciannaca's witness statement, a share investment fund. He states the Svarog funds are all SIFs.

- It is apparent from this advice that VKP considered that Mr. Pivovarov was the ultimate beneficial owner of ESFML and hence of Svarog. Professor Dovgert said the same in his expert's report. However, there is no indication that VKP and Professor Dovgert were aware of the facts and matters summarised in paragraph 41 above which would suggest that Mr. Grigorishin was in truth the ultimate beneficial owner.

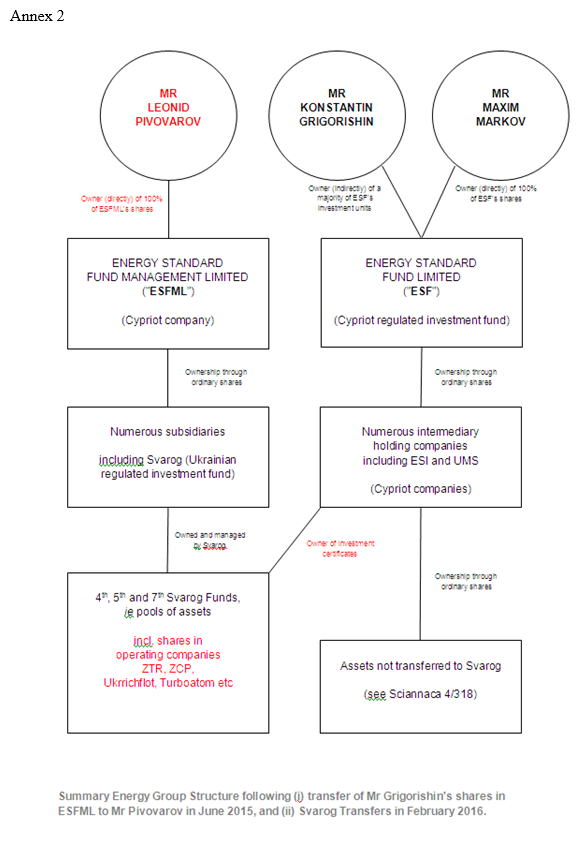

- Accordingly the transfers to Svarog went ahead between 1 and 19 February 2016. In return for the transfer of the assets subsidiaries of ESF received investment certificates. Thus the new structure, as of 19 February 2016, was as set out in a second structure chart annexed to this judgment marked Annex 2.

- There were at least two consequences of the Svarog Transfers. On the one hand the operating companies were "protected" from the anti-Russian legislation and were able to participate in the privatisation process. It may be noted however that that protection and ability to participate were dependent upon the Ukrainian authorities not learning of the facts and matters which suggested that Mr. Grigorishin retained "decisive influence" over ESFML notwithstanding the transfer of his shares to Mr. Pivovarov. On the other hand the investment certificates were bearer certificates and so could be easily transferred. Thus Mr. Jowell said that they could be "transferred at whim without any protection for the Claimants" and that "many of the Grigorishin Respondents' assets have been converted from traceable shareholdings to untraceable bearer instruments".

- Having set out the events leading up to the Svarog Tranfers I can return to the question whether or not those events support the Claimants' case that there is a real risk of dissipation.

- Mr. Jowell said they did for three reasons, the first of which was that the events demonstrated a lack of probity on the part of Mr. Grigorishin in that he was willing to give the Ukrainian authorities misleading information as to the ultimate beneficial ownership of both ESF and ESFML. I accept that there is solid evidence that he, or Mr. Markov, on his behalf did so. There is cogent evidence that Mr. Grigorishin has at all times been and remains the ultimate beneficial owner of both ESF and ESFML. There is no evidence as to the motivation behind the notification of Mr. Markov as the ultimate beneficial owner of ESF. There is evidence that the motivation behind the notification of Mr. Pivovarov as the ultimate beneficial owner of ESFML as from June 2015 was to prevent the Ukrainian authorities from revoking the licences of ESFML and, in particular, Svarog, to do business in Ukraine. I was referred to evidence that it was a criminal offence in Ukraine to submit documents for state registration of a legal entity (including information as to the ultimate beneficial owner) which contains knowingly misleading information. The offender may be punished by a fine or imprisonment up to 2 years.

- I have stood back from the detail of the evidence and have asked myself whether, in circumstances where a person seeks to protect his business interests from harmful and discriminatory action of government (namely, the withdrawal of licences from Russian controlled businesses and the refusal to allow such companies to participate in privatisation schemes) he demonstrates a lack of probity when he makes a statement to the authorities as to the ultimate beneficial owner of his company which is not correct. Notwithstanding the motivation for making the misleading statement it appears to me that the action does demonstrate a lack of probity, for these reasons. First, the laws in question were introduced at a time when there were hostilities between Ukraine and Russia. The laws were designed to protect the interests of Ukraine. There is therefore a case for saying the discrimination was justified. Second, the giving of misleading information to the authorities was a criminal offence.

- The solid evidence of a lack of probity therefore adds to the real risk of dissipation established by the findings of the arbitrators.

- Mr. Jowell's second reason for saying that the Svarog Transfers support the case on risk of dissipation is that the substitution of bearer investment certificates for traceable shares renders future dissipation easier and harder to identify. Although the motivation for the substitution of bearer certificates was not to render enforcement of the Award or judgment more difficult and although the corporate reorganisation appears to have held off the threat of action by the Ukrainian companies against the operating companies the fact is that, if there is otherwise established a risk of dissipation (as there is by reason of the arbitrator's findings), the substitution of bearer certificates has rendered it easier for that dissipation to take place. In that sense the risk of dissipation has been increased by the Svarog Transfers. This is a permissible approach to the question whether a corporate reorganisation can contribute to the risk of dissipation; see Holyoake v Candy at paragraph 59(i) per Gloster LJ.

- The Grigorishin Respondents have sought to deal with this concern by offering to undertake that "they (1) will [by a certain date] identify the number and whereabouts of the Svarog Investment certificates that were issued as a result of the Svarog Transfers and (2) will not until further order move, transfer, assign, pledge, charge or otherise deal with or dispose of such certificates without the prior written consent of [the Claimants] (which may be given on their behalf by Skadden) or the leave of the court." Mr. Jowell said that this offer did not assist because it was not known where the certificates are presently located. Although Hogan Lovells (the Grigorishin Respondents' solicitors) have informed Skadden (the Claimants' solicitors) that the Grigorishin Respondents have confirmed to Hogan Lovells that "they continue to hold (indirectly) their investment certificates in the Svarog Funds" there is in fact no evidence as to where the certificates presently are or by whom they are held. At any rate I was not referred to any such evidence. In those circumstances I was not persuaded that the undertaking on offer means that, if a risk of dissipation otherwise exists, the substitution of bearer certificates has not rendered it easier for that dissipation to take place.

- Mr. Jowell's third reason for saying the Svarog Transfers support the case on risk of dissipation is that there is reason to doubt that the sole motivation was the decision to avoid the impact of anti-Russian laws. This was said to be supported by the fact that the discussion concerning the Svarog Transfers took place in October/November 2015 shortly after Mr. Markov had returned to Moscow from the hearing of the arbitration in London. Whilst this gives rise to suspicion I do not consider that it can be said to be solid evidence that one motive for the Svarog Transfers was to make enforcement of a future arbitration Award difficult. There really is compelling evidence that the motivation for the Svarog Transfers was the wish to avoid the effect of the anti-Russian legislation.

- I have no doubt that the findings of the arbitrators by themselves amount to solid evidence of a risk of dissipation. That risk is increased by the solid evidence that (i) there has been a lack of probity by Mr. Grigorishin in his dealings with the Ukrainian authorities and (ii) the substitution of bearer investment certificates for shares has made dissipation easier.

- It is unnecessary to establish that there is a good arguable case because the Claimants have the benefit of an arbitration Award and judgment in their favour. In the light of the court's finding that there is solid evidence of a real risk of dissipation of assets there is therefore a powerful case for granting the requested WFO. Mr. Brisby relied upon a number of factors to suggest that the court ought to exercise its discretion by refusing to grant a WFO.

- The first matter relied upon was an allegation concerning the conduct of the Claimants and Mr. Lukyanenko Jnr. The Grigorishin Respondents "have come to believe that Mr. Lukyanenko Jnr. has been involved in a campaign against Mr. Grigorishin, his family, assets and reputation." Three matters are said to support this belief: first, evidence given by Lukyanenko Jnr. to the Russian authorities on 24 December 2015 which, it is said, was false and led to an investigation being opened against Mr. Grigorishin which has led to the seizure of assets and to Mr. Grigorishin being placed on Russian and international "wanted" lists; second, the fraudulent obtaining of a judgment of around US$230 million against Mr. Grigorishin by a senior manager of a company thought to have business ties to Mr. Lukyanenko Jnr.; and third, the suggestion that someone from the Claimants leaked information about the Award in this case to the press. The first two allegations have been "categorically denied" by Mr. Lukyanenko Jnr. in a statement dated 30 November 2017. The third allegation had been answered earlier by letter dated 24 May 2016 when it was said by Skadden that their clients had complied with their obligations of confidentiality. In the circumstances where the allegations are very much in dispute I am unable to make any finding on these matters. They can therefore have no relevance to the court's decision as to whether to grant the WFO.

- The second matter relied upon was delay. Reliance was placed on the elapse of time from February 2016 (when the Svarog Transfers were announced) until 12 August 2016 when the present application was issued. Reliance was also placed on the elapse of time from then until the hearing of the application in December 2017. It is said that the delay demonstrates a complete lack of urgency on the part of the Claimants and a lack of genuine concern about the risk of dissipation.

- Ordinarily applications for freezing orders are sought promptly once the grounds for seeking such an order are known. Delay therefore can demonstrate that there is a lack of genuine concern about a risk of dissipation. However, before reaching that conclusion it is necessary to examine carefully the reasons for the delay. On 17 February 2016 the Claimants sought an order from the Cypriot court prohibiting the transfer of the operating companies to Svarog. That order was refused on 19 February 2016 and an inter partes hearing was ordered. Further directions were given on 26 February 2016. On 24 March 2016 and on 10 May 2016 the respondents to the application filed their evidence in opposition. The application had been issued in anticipation of the arbitration Award. After the Award was published the Grigorishin Respondents issued their challenge to the Award before this court. The Claimants took stock of the matter and issued their application on 11 August 2016 seeking an order that security be paid into court pending the determination of the challenge. In the alternative a freezing order was sought. At about the same time the application in Cyprus was discontinued. These facts do not suggest a lack of genuine concern as to the suggested risk of dissipation. On the contrary they tend to suggest that the Claimants' concern was genuine.

- Thereafter the Claimants considered that it was better case management for the section 68 challenge to be heard first and that explains the delay in bringing the matter on for hearing. Since the primary basis for seeking the WFO was the finding made by the tribunal regarding the illicit scheme to divert profits the application for the WFO had to await the determination of the challenge to the Award. The challenge and the application could have been heard in the same hearing rather than, as the Claimants decided, consecutively. But had the challenge and the application been heard at the same time a 6 day hearing would have been required and that might have caused further delay. I therefore do not consider that the delay in hearing the application for a WFO can fairly be said to evince a lack of genuine concern as to the risk of dissipation.

- The third matter relied upon was the absence of assets in England and related proceedings in Cyprus. Mr. Brisby asked why it was just and convenient for the English court to make a freezing order in circumstances where (i) there are no assets in England and (ii) the Claimants have initiated proceedings in Cyprus to register and enforce the English judgment. Mr. Brisby said that it would have been more efficient for the Claimants to seek freezing order relief in Cyprus. The explanation for the registration and enforcement proceedings in Cyprus is, I infer, the presence of Grigorishin companies or assets in Cyprus. I assume that a freezing order could also have been sought there (though if it had been the application before this court would have to be discontinued). But it does not follow that there is no good reason for this court to grant freezing order relief. This court has given permission for the Award to be enforced as a judgment of the court and it is in the public interest that the judgment of the court be respected and enforced. A WFO, if otherwise appropriate, is a means of ensuring, so far as that is possible, that the judgment will be enforced.

- That approach is supported by authority. In Maclaine Watson v ITC (No.2) [1989] 1 Ch. 286 at p. 304 Kerr LJ cited with approval the dictum of Stephenson LJ in A.J.Bekhor v Bilton [1981] QB 923 that "it is, within proper limits, the policy of these courts to prevent a defendant from removing its assets from the jurisdiction or concealing them within it, so as to deny a successful plaintiff the fruits of his judgment." In Republic of Haiti v Duvalier [1990] 1 QB 202 at p.214 Staughton LJ said that "our courts are more willing to restrain a defendant from dealing with his assets after, than before, judgment has been given against him." In Cruz City 1 Mauritius Holdings v Unitech [2013] 2 AER (Comm) 1137 at paragraph 31 (the final unnumbered paragraph) Field J. stated that "it is the policy of the law that judgments of the court and arbitration Awards should be enforced, and this applies a fortiori where the Award in question, as here, was made in an arbitration whose seat was within the jurisdiction."

- These dicta all show that the policy of the law is to enforce judgments (and particularly so where the judgment enforces a London arbitration Award) so that freezing orders can, in an appropriate case, be granted after judgment. They also show that such orders may more readily be made after judgment than before. That may be because it is easier to infer a risk a dissipation. Thus, in Distributori Automatici Italia v Holford General Trading [1985] 1 WLR 1066 at p.1073 Leggatt J. cited with approval the dictum of Farquharson J. in Orwell Steel v Asphalt and Tarmac [1984] 1 WLR 1097 that "in one sense it could be said that there is greater justification for restraining a defendant from disposing of his assets after judgment than before any claim has been established against him." Leggatt J. agreed that "grounds for believing that the judgment debtor would dispose of his assets before execution might perhaps be more readily established after judgment than before." It may also be because factors which are said to weigh against the making a freezing order (for example delay or the absence of assets within this country and the presence of related proceedings in another jurisdiction, two of the factors relied upon in this case) have less weight where judgment has already been obtained. In circumstances where judgment has been given and there is solid evidence of a real risk of dissipation there would have to be particularly strong grounds for refusing freezing order relief.

- In the present case I am satisfied that the matters relied upon by Mr. Brisby are not sufficient to cause me to decline to grant the WFO which has been requested by the Claimants. In his written submissions Mr. Brisby also relied upon the prejudice that would be caused to the Grigorishin Respondents by a WFO. It would restrict their flexibility and their ability to raise or maintain access to financing – a particular concern given the straitened financial position of the Grigorishin Respondents arising in large part from the conflict between Russia and Ukraine and the impact that has had on the business of the operating companies. However, when weighed against the fact that the Claimants have an unsatisfied Award and judgment for over $300 million in circumstances where there is solid evidence of a real risk that assets will be dissipated the balance of convenience comes down firmly in favour of granting the freezing order.

- The draft order was based upon the standard form of freezing order to be found in the Commercial Court guide. Two points were debated on which it is appropriate to rule now.

- The first concerned the exception in respect of dealing with or disposing of assets in the ordinary course of business. Although there is authority for the proposition that this exception need not always be included in a post-judgment freezing order (see Nomihold Securities Inc v Mobile Telesystems Finance SA [2012] Bus LR 1166 at paragraph 33 per Tomlinson LJ) it has been included in the draft order but coupled with the following words "but before doing so the Respondent must tell the Applicant's legal representatives". Those words are included in the standard form as an optional requirement. Mr. Brisby suggests that this notification requirement should contain what he described as "de minimis limit" by which he meant that the notification requirement should not apply to assets worth less than US$100,000. I am not sure that such a figure can properly be described as de minims. Given that the WFO is in support of a judgment I am not persuaded that it is appropriate to include the sort of term requested by Mr. Brisby.

- The second point concerns the exception in favour of legal expenses which has not been included in the draft. Mr. Brisby says it should be included in circumstances where the order contains disclosure obligations in respect of which legal costs are likely to be incurred. The White Book Vol.2 at p.3007 suggests that the exception in favour of legal expenses is appropriate where the court is satisfied that the respondent does not have "other available funds" from which to pay legal expense and will therefore have to draw upon assets covered by the injunction. Mr. Jowell says that there is no such evidence and therefore the exception should not be included.

- The Grigorishin Respondents will almost certainly incur legal costs in complying with the disclosure obligations regarding their assets. I do not know what their resources are, though they are presumably able to pay Hogan Lovells and their counsel. I consider that the legal expenses exception should be included but the Claimants may have liberty to vary the order once some disclosure of assets has been given. The picture may be clearer at that stage. The exception applies only to the costs of complying with the disclosure obligation and the Grigorishin Respondents must, before spending any money in that regard, tell the Claimants where the money is to come from (in accordance with the standard form).

Mr. Justice Teare :

"However, the threshold in relation to conventional freezing orders is well established. There must be a real risk, judged objectively, that a future judgment would not be met because of unjustifiable dissipation of assets. But it is not every risk of a judgment being unsatisfied which can justify freezing order relief. Solid evidence will be required to support a conclusion that relief is justified, although precisely what this entails in any given case will necessarily vary according to the individual circumstances. "

The Illicit Scheme

5. The Claimants are two companies beneficially owned by Mr. Vladimir Lukyanenko, a citizen of Russia and Ukraine. The Grigorishin Respondents are three companies beneficially owned by Mr. Konstantin Grigorishin who was born in Ukraine where he lived for 16 years before moving to Russia.

6. Stremvol Holdings Limited is a Cypriot company owned as to 51% by one of the Grigorishin Respondents and as to 49% by the Claimants. It is the joint venture vehicle through which the Claimants and the Grigorishin Respondents hold interests in a number of companies including NPO, a company based in Ukraine and involved in the manufacture of gas compressors.

7. The commercial relationship between Mr. Lukyanenko and Mr. Grigorishin broke down in 2013.

8. There were in essence two disputes, one relating to the Joint Venture Agreement ("the JVA") and the other relating to an Option Agreement. The Claimants alleged that the Grigorishin Respondents perpetrated an "Illicit Scheme" whereby they covertly diverted profits and opportunities away from NPO to two companies connected to the Grigorishin Respondents, namely, Technoimport and ES LLC. This was said to be in breach of the JVA, which breach was said to have caused damage to the Claimants in the sum of US$55.8m. The Claimants also alleged that they had been entitled to exercise a Put Option under the Option Agreement relating to their shares in Stremvol and so were entitled to a sum of US$250m. in return for the sale of those shares. The Grigorishin Respondents denied that there was any Illicit Scheme and, with regard to the Option Agreement, alleged that the business of Stremvol had been conducted oppressively by the Claimants such as unfairly to prejudice the shareholders of Stremvol with the result that under section 202 of the Cyprus Companies Law they were entitled to an order that the Claimants sell their shares in Stremvol at the market price, which I was told was no more than $4m.

"The fact that both Technoimport and ES LLC were in fact Grigorishin companies in contrast to the denials of Mr. Grigorishin's witnesses is itself a telling point in support of the Claimants' case that there was an illicit scheme to hive off NPO profits to the Grigorishin interests."

"The inference is overwhelmingly that Technoimport was a Grigorishin entity inserted in the chain to extract profit from NPO."

"However we accept Messrs Lukyanenko Snr and Jnr's evidence that they were not paying any detailed attention to these accounts. It strikes us as clear that the scale of Technoimport's involvement in the supply chain, the degree of mark up, the alleged need to pay commission to Gazprom executives, the level of indebtedness that had been created all came as a surprise to the Lukyanenko interests. The whole arrangement was opaque and certainly not transparent. In short whilst it may be that the Lukyanenkos could have been more alert and inquisitive the situation was a long way short of their representing approval of the nature of Technoimport's involvement. "

The Svarog Transfers

The position prior to June 2015

"The vast majority of my discussions with Mr. Grigorishin are either about court cases with which the group or one aspect of it is engaged or about transactions involving a group company or asset, or a possible acquisition of a new asset for the group. The discussions about transactions are often very detailed to enable me, where appropriate, to continue negotiations with a counterparty with which Mr. Grigorishin has already agreed heads of terms. In these situations, often Mr. Grigorishin and a counterparty of similar standing will have agreed the basic terms of an agreement, and I, together with my opposite number (ie another head of legal), will then negotiate the precise, detailed terms to put that agreement into full effect."

"I spoke to Mr. Grigorishin about how to deal with the situation of the inquorate Supervisory Board. He instructed me to do whatever was necessary legally and as quickly as possible to restore the Supervisory Board with the least damage being caused to the operation and functioning of NPO."

"I am not aware of any information that there are any other verbal or written agreements between Mr. Markov and Mr. Grigorishin that would enable Mr. Grigorishin to give binding instructions to Mr. Markov or any other instructions relating to the business activities or management of the ESF investment fund. If such agreements could be shown to exist, and if their effect would be to give Mr. Grigorishin the right to exercise decisive influence on the management of business activities of the ESF investment fund, then my conclusion likely would be different. "

The position after June 2015

Since (i) the assets of the SIF are managed by [Svarog]; (ii) the SIF participants have no influence on the management of [Svarog]; and (iii) the SIF is not a legal entity, there will be no need to disclose Mr. Markov as the UBO of the Subsidiaries.

Thus, taking into consideration that the management of the Subsidiaries in this case shall be exercised by [Svarog] acting in the interest of the SIF, we believe that the Subsidiaries should disclose Mr. Pivovarov as their UBO.

Therefore, in case of structuring the holding of the Subsidiaries through the SIF the Subsidiaries (a) should change their reported UBO's [sic] to Mr. Pivovarov, but (b) would avoid control by the [Russian] person.

The relevance of the Svarog Transfers to this application

Conclusion on risk of dissipation

Whether a Worldwide Freezing Order should be granted

The terms of the freezing order