Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Kazakhstan Kagazy Plc & Ors v Zhunus & Ors [2017] EWHC 3374 (Comm) (22 December 2017)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2017/3374.html

Cite as: [2017] EWHC 3374 (Comm)

[New search] [Printable RTF version] [Help]

Neutral Citation Number: [2017] EWHC 3374 (Comm)

Case No: CL-2013-000683

IN THE HIGH COURT OF JUSTICE

BUSINESS & PROPERTY COURTS OF ENGLAND AND WALES

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Royal Courts of Justice

Strand, London, WC2A 2LL

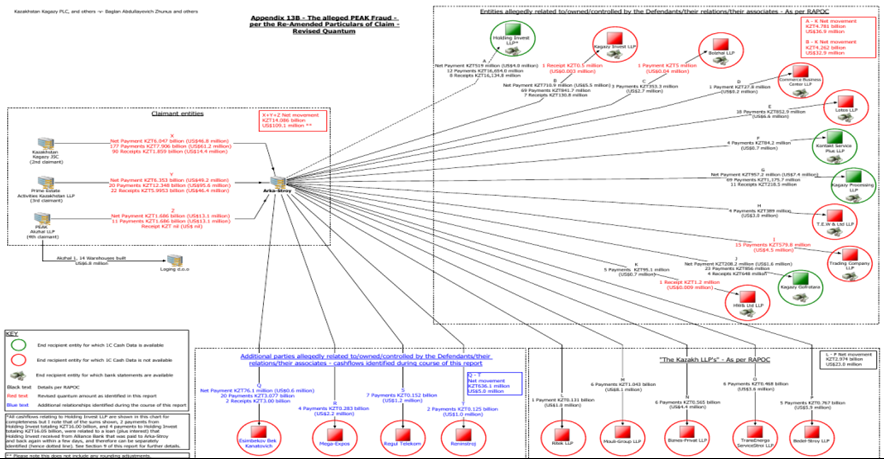

Date: 22 December 2017

Before:

THE HON. MR. JUSTICE PICKEN

- - - - - - - - - - - - - - - - - - - - -

Between:

|

|

(1) KAZAKHSTAN KAGAZY PLC (2) KAZAKHSTAN KAGAZY JSC (3) PRIME ESTATE ACTIVITIES KAZAKHSTAN LLP (4) PEAK AKZHAL LLP (5) (6) ASTANA-CONTRACT JSC (7) PARAGON DEVELOPMENT LLP |

Claimants |

|

|

- and -

|

|

|

|

(1) BAGLAN ABDULLAYEVICH ZHUNUS (formerly BAGLAN ABDULLAYEVICH ZHUNUSSOV) (2) MAKSAT ASKARULY ARIP (3) SHYNAR DIKHANBAYEVA |

Defendants |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Robert Howe QC, Jonathan Miller and Daniel Saoul (instructed by Allen & Overy LLP) for the Claimants

Andrew Twigger QC, Anna Dilnot and Adam Woolnough (instructed by Cleary Gottlieb Steen & Hamilton LLP) for the Defendants

Hearing dates: 25, 26, 27 and 28 April, 2, 3, 8, 9, 10, 11, 15, 16, 17, 22, 23, 24, 25 and 26 May, 12, 13, 14, 15, 16, 19, 20, 26, 27, 28 and 29 June, 3, 4, 5, 6, 17, 18, 19 and 20 July 2017

Judgment supplied in draft to the parties: 11 December 2017

- - - - - - - - - - - - - - - - - - - - -

Judgment Approved

THE HON. MR. JUSTICE PICKEN:

Contents

|

Introduction |

……………………………. |

|

|

An outline of the Claimants’ case |

……………………………. |

|

|

An outline of the defences raised |

……………………………. |

|

|

Procedural history |

……………………………. |

|

|

Factual witnesses |

……………………………. |

|

|

The Claimants’ factual witnesses |

……………………………. |

|

|

Mr Tomas Werner |

……………………………. |

|

|

Mr Hugh McGregor |

……………………………. |

|

|

Ms Viktoriya Gorobtsova |

……………………………. |

|

|

Mr Yevgeniy Kuzmenko |

……………………………. |

|

|

Mr Karim Khashimov and Mr Berik Nagashibaev |

……………………………. |

|

|

Mr Ilkham Gafurov |

……………………………. |

|

|

The absentees |

……………………………. |

|

|

The Defendants’ factual witnesses |

……………………………. |

|

|

Mr Arip |

……………………………. |

|

|

Ms Dikhanbayeva |

……………………………. |

|

|

Mr Alessandro Manghi |

……………………………. |

|

|

Mr Vladimir Gerasimov |

……………………………. |

|

|

Mr Nikolay Kosarev |

……………………………. |

|

|

Mr Alexander Sannikov |

……………………………. |

|

|

Mr Nurlan Sharipov |

……………………………. |

|

|

Mr Igor Zhangurov |

……………………………. |

|

|

Mr Erzhan Jumadilov |

……………………………. |

|

|

Mr Mamed Mamedov |

……………………………. |

|

|

Mr Rasul Khasanov |

……………………………. |

|

|

Mr Vladislav Belochkin |

……………………………. |

|

|

The expert witnesses |

……………………………. |

|

|

Forensic accountancy |

……………………………. |

|

|

Audit |

……………………………. |

|

|

Kazakh law |

……………………………. |

|

|

Land valuation |

……………………………. |

|

|

Real estate practice |

……………………………. |

|

|

Quantity surveying |

……………………………. |

|

|

Kazakh law applicable to the claims |

……………………………. |

|

|

The claims which are brought |

……………………………. |

|

|

The claims under the JSC Law |

……………………………. |

|

|

The claims in tort under Articles 917 and 932 of the KCC |

……………………………. |

|

|

The unjust enrichment claims under Articles 953 to 960 of the KCC |

……………………………. |

|

|

Proving fraud |

……………………………. |

|

|

The PEAK Claim |

……………………………. |

|

|

Introduction |

……………………………. |

|

|

Arka-Stroy |

……………………………. |

|

|

The US$ 49.1 million which Arka-Stroy did not pay out |

……………………………. |

|

|

The monies paid out by Arka-Stroy |

……………………………. |

|

|

Holding Invest |

……………………………. |

|

|

Kagazy Invest, Kagazy Processing and Kagazy Gofrotara |

…………………..………. |

|

|

Bolzhal and CBC |

……………………………. |

|

|

Lotos |

……………………………. |

|

|

Kontakt Service Plus |

……………………………. |

|

|

TEW |

……………………………. |

|

|

HW |

……………………………. |

|

|

Trading Company |

……………………………. |

|

|

The ‘Kazakh/Construction LLPs’ |

……………………………. |

|

|

The construction work which was carried out |

……………………………. |

|

|

Akzhal-1/Akzhal-2 |

……………………………. |

|

|

Warehouses: Akzhal-1 |

……………………………. |

|

|

Other Buildings: Akzhal-1 |

……………………………. |

|

|

Earthworks: Akzhal-1 and Akzhal-2 |

……………………………. |

|

|

Aksenger |

……………………………. |

|

|

Earthworks |

……………………………. |

|

|

Roads |

……………………………. |

|

|

Drainage |

……………………………. |

|

|

Centralised locking system |

……………………………. |

|

|

Other railway work |

……………………………. |

|

|

Relevance of Aksenger work |

……………………………. |

|

|

Work paid for by the Claimants direct |

……………………………. |

|

|

Overall conclusions in relation to the PEAK Claim |

……………………………. |

|

|

The Astana 2 Claim |

……………………………. |

|

|

Interest and penalties |

……………………………. |

|

|

The Land Plots Claim |

……………………………. |

|

|

CBC and Bolzhal |

……………………………. |

|

|

Holding Invest |

……………………………. |

|

|

Limitation |

……………………………. |

|

|

Applicable Kazakh law |

……………………………. |

|

|

The Claimants’ state of awareness |

……………………………. |

|

|

The PEAK and Astana 2 Claims: whether the Claimants “became aware” by 1 August 2010 |

……………………………. |

|

|

The PEAK and Astana 2 Claims: whether the Claimants “should have become aware” by 1 August 2010 |

……………………………. |

|

|

The Land Plots Claim: whether the Claimants “became aware” by 27 August 2012 |

……………………………. |

|

|

The Land Plots Claim: whether the Claimants “should have become aware” by 27 August 2012 |

……………………………. |

|

|

Overall conclusion on limitation |

……………………………. |

|

|

Restoration under Kazakh law |

……………………………. |

|

|

The Foreign Limitation Periods Act 1984 |

……………………………. |

|

|

Conclusion |

……………………………. |

1. This case has been very hard fought, culminating in a trial which spanned some thirteen weeks and which entailed written submissions (opening and closing) running, in total, to almost 1,100 pages (not including all the appendices). It involves very serious allegations of fraud made by the claimant corporate group against three of its former directors (two of whom were also previously substantial shareholders). The Claimants allege that the Defendants (I include in this description all three of the Defendants despite the fact that, as I shall come on to explain, the Claimants have settled with the First Defendant) have misappropriated company assets by way of several complex and elaborate frauds involving construction projects and land acquisitions, which have caused the Claimants to suffer losses of in excess of US$ 250 million. The Defendants strenuously deny these allegations, maintaining that they have at all times acted in good faith. The Defendants have also raised a limitation defence.

2. The dispute involves Kazakh parties (or in the case of one of the Claimants, KK Plc, an Isle of Man company operating in Kazakhstan), is concerned with events which took place in Kazakhstan and is subject to Kazakhstan law. Mr Andrew Twigger QC (leading Ms Anna Dilnot and Mr Adam Woolnough) drew attention to these aspects (as well as a timing point) during the course of his opening submissions, suggesting that the Court “is being asked to travel to a distant time and place” and, specifically, “to look at a large number of complex transactions conducted many years ago in the unfamiliar environment of an emerging country”. Memorably described by Mr Robert Howe QC (leading Mr Jonathan Miller and Mr Daniel Saoul) as the ‘Star Wars’ defence, this, Mr Twigger submitted, makes it necessary to adopt a cautious approach which avoids viewing transactions carried out in Kazakhstan prior to 2010 in the same way as commerce is conducted in London in 2017. I bear this point in mind when considering the evidence in this case, together with Mr Howe’s inter-galactic inspired riposte (although whether acts before 2010 do properly qualify as “a long time ago” or whether Kazakhstan, or anywhere else, counts as “a galaxy far, far away” are not issues which, thankfully, I am required to resolve). What matters for present purposes is simply the point that the case, like so many which become before the Commercial Court, is truly international in nature; indeed, it is litigation which, in truth, has nothing to do with this jurisdiction other than the fact that it has been commenced here.

3. As is common with fraud cases, there was a substantial dispute as to the underlying facts. In addition, both sides levelled accusations of dishonesty against the other, including accusations of deliberate destruction/deletion of documents (alleged by both sides), and intimidation by way of threats of physical violence (again, alleged by both sides). There were, therefore, a great number of factual and evidential issues to be resolved. I shall in this judgment try to deal with the main points rather than every point since to do that would make the judgment even longer than it is. Similarly, although I confirm that I have considered every submission which has been made and have taken into account all the evidence which was deployed before me, in what follows my aim is not to address everything but to focus on what seems to me to matter most and to seek to set out sufficient detail to enable the reader (including, most importantly, the parties) to see what I have decided and why I have decided it.

An outline of the Claimants’ case

4. I start with an outline of the Claimants’ case. Inevitably much of what follows is tendentious but it is important to give a flavour at the outset of what it is that is alleged by the Claimants in these proceedings. I shall come on to do something similar in relation to the case which the Defendants put forward in response to the Claimants’ case.

5. The Claimant group of companies (the ‘KK Group’) is in the business of logistics, recycling, paper and packaging in Kazakhstan, and is, according to its website “the largest paper packaging and recycling group in Kazakhstan and Central Asia”. The First Claimant (‘KK Plc’) is a company registered in the Isle of Man which was listed on the main board of the London Stock Exchange following an IPO which took place in July 2007. The Second Claimant (‘KK JSC’) is a Kazakh company ultimately owned by KK Plc. The Third to Seventh Claimants are Kazakh entities and subsidiaries of KK JSC, which I shall refer to as ‘PEAK’, ‘Peak Akzhal’, ‘Peak Aksenger’, ‘Astana-Contract’ and ‘Paragon’ respectively. Peak Aksenger’s claim was discontinued on 15 April 2016, for the reasons which I shall come on to describe.

6. The Defendants are all former directors of the KK Group. Prior to this, the First Defendant, Mr Baglan Zhunus, and the Second Defendant, Mr Maksat Arip, had been close business associates. Between 1999 and 2000, they had worked together as directors of a telecommunications company in Kazakhstan called Spectrum LLP, before moving on to work as directors of KazTransCom, another telecommunications company, between 2000 and 2003. In 2003 Mr Zhunus and Mr Arip joined the KK Group, then owned by an organisation called Seimar Holdings which was looking to sell the business, Mr Zhunus becoming Chairman of KK JSC’s Board (a position which he held between 2003 and July 2009) and Mr Arip becoming a director and KK JSC’s Chief Executive Officer (between 2003 and April 2008). The following year, in 2004, Mr Zhunus and Mr Arip bought the KK Group, each acquiring a 50% shareholding in KK JSC through Kagazy Invest LLP, a holding company which Mr Zhunus and Mr Arip both owned. The year after that, in 2005, another of their companies, Holding Invest LLP, was introduced into the top of the structure. Subsequently, on 5 March 2007, Mr Zhunus became Chairman of the Board of KK Plc from the date when that company was incorporated, 5 March 2007, until April 2008. He was also indirectly the beneficial owner of 50% of the shares in KK Plc until its entry into the IPO to which I have referred in July 2007 and which involved KK Plc being introduced into the KK Group structure and Kagazy Invest and Holding Invest being removed from it.

7. After the IPO, which raised US$ 273.5 million, Mr Zhunus was then the owner of a 28.6% shareholding until September 2009, at which stage both he and Mr Arip (who was Chief Executive Officer of KK Plc from its incorporation until April 2008 and also an indirect beneficial owner of 50% of KK Plc’s shares until the IPO and thereafter beneficial owner of a 23.9% shareholding until September 2009) sold their shares and left Kazakhstan for Dubai, along with the Third Defendant, Ms Shynar Dikhanbayeva, who had started with KK JSC as its Finance Director from the time when the company was incorporated in 2001 and who had become a Board member in April 2008 and then acting Chairman from around 5 September 2008.

8. In Dubai, Mr Zhunus, Mr Arip and Ms Dikhanbayeva worked on what was referred to internally, during their time in the KK Group, as “the oil business” and involved another Isle of Man company known as Exillon Energy Plc (‘Exillon’), owned in the main by Mr Zhunus and Mr Arip until October 2009, but which had previously operated through a Kazakh business called Caspian Minerals. This “oil business” was concerned with the exploitation of oil assets in Siberia. Mr Arip served as Exillon’s Chairman from 17 November 2009 until April 2011, with Ms Dikhanbayeva working for the company in a senior role under not only Mr Arip but also a Mr Alessandro Manghi, a previous Chairman of KK Plc and by this stage Exillon’s CEO, a position which he held until his resignation in April 2011 when Mr Arip also resigned as Chairman.

9. The circumstances in which Mr Zhunus and Mr Arip came to leave the KK Group were that in June 2009 Mr Arip contacted Mr Tomas Werner, suggesting that he might like to acquire an ownership interest in KK Plc. Mr Werner was a businessman based in London who had previously dealt with both Mr Zhunus and Mr Arip when he worked for HSBC as a private banker. Indeed, Mr Arip was one of his clients in that role both at HSBC and after he left HSBC to set up his own wealth management firm, Werner Capital, in April 2008. Specifically, at a meeting in London, Mr Arip provided Mr Werner with a copy of KK Plc’s IPO Prospectus together with audited accounts prepared by BDO for the period ending 31 December 2008, explaining that the KK Group needed to restructure its debt, having run into financial trouble as a result of the global financial crisis, and that he and Mr Zhunus wished to concentrate on their oil business rather than take responsibility for the restructuring required. Mr Werner was interested and so the following month visited Kazakhstan. The month after that, in August 2009, Mr Arip introduced Mr Werner to Mr Vladimir Gerasimov, somebody whom Mr Arip had in mind might work with Mr Werner as his ‘local partner’ dealing with operational matters whilst Mr Werner would focus on the KK Group’s financial needs. Mr Werner decided to go ahead later the same month, with Mr Werner ultimately purchasing not Mr Arip’s shareholding in KK Plc (as he had originally thought would happen) but the shareholding which Mr Zhunus held. So it was that on 2 September 2009 Mr Werner’s acquisition vehicle, Theta Investment Holdings Limited, agreed to pay a minimum of US$ 2.5 million in consideration for Mr Zhunus’s shareholding, and Mr Gerasimov acquired Mr Arip’s interest through another corporate vehicle.

10. Having made the purchase, Mr Werner arrived in Kazakhstan very shortly afterwards. Mr Arip had by this time already left and Mr Manghi, then serving as KK Plc’s Chairman (as well as Head of Investor Relations) indicated that he, too, planned on leaving to work in Dubai on the venture involving Exillon along with other KK Group personnel (including KK Plc’s Legal Director and other senior employees). Mr Werner decided that he needed help and so appointed SP Angel to assist him in what needed to be done. SP Angel started the following month, in October 2009, by which time the KK Group was facing a number of pressing financial problems. These included falling cash levels which resulted in defaults on loans and threats by lenders to enforce against the KK Group’s assets. In late October 2009, Mr Werner and SP Angel decided to instruct PwC to produce a report “to understand the flow of funds expended on investments in land, machinery and company acquisitions…”. PwC reported back on 3 December 2009, identifying three categories of “questionable transactions”, noting in particular: that significant sums had been spent on developing the Aksenger Industrial Park and Akzhal Logistics Park, a significant portion of these costs lacked detailed supporting documents, creating a risk that some of the funds could have been misused or not spent effectively; that the general contractor, Arka-Stroy, had a common director (Mr Bek Esimbekov, sometimes referred to as Mr Bek Yesimbekov) with PEAK which was commissioning the work; that the Astana Contract Group had been acquired by the KK Group for substantially more than its book value; and that land had been bought for substantial sums from companies connected to the prior management. These are matters which I shall have to explore in some detail later when addressing the question of time-bar, specifically as to what Mr Werner should be taken as having found out when he received this report.

11. Meanwhile, Mr Werner and SP Angel carried on trying to deal with the financial problems which were besetting the KK Group, whilst also trying to run the operational business. These efforts were made all the harder because Mr Gerasimov suddenly wished to dispose of his shareholding. He did so through SP Angel acquiring his shareholding as a stopgap in November 2009. In any event, work continued apace to steady the KK Group’s finances. This proved a lengthy and challenging process. Over three years of negotiations, from December 2009 until December 2012, the KK Group was able to finalise the restructuring of all of its issued bonds and most of its loans. In conjunction with this, after declaring losses of US$ 250 million in 2009 and US$ 50 million in 2010, the KK Group made a small profit of US$ 2 million in 2011.

12. Subsequently, the Claimants maintain, in 2012, and not before, concerns about the past activities of the Defendants developed. Specifically, a shareholder in the KK Group, called Phoenicia Capital LLC (which had invested in 2011 and was owned by an American, Mr John Khabbaz) was considering commencing derivative proceedings against Mr Arip and others in New York in relation to what Mr Khabbaz considered to be their fraudulent conduct. Mr Werner took legal advice and was told, he says, that there was insufficient evidence of fraud to sustain a claim. In September 2012 Phoenicia issued derivative proceedings against Mr Zhunus and Mr Arip in New York, advancing a claim which is broadly based on what in these proceedings has been described as the ‘PEAK Claim’, although without the same focus as that claim in these proceedings has on the role played by Arka-Stroy. In response to certain motions to dismiss, Phoenicia’s claim was withdrawn in mid-2013.

13. Throughout this period, again the Claimants maintain, their own investigations continued. Those investigations were made more challenging by what the Claimants say was a lack of relevant documentation and attempts at concealment by the Defendants in conjunction with certain KK Group employees who had remained behind in Kazakhstan after others had left for Dubai. In late 2012, Mr Werner and his relatively new colleague, Ms Viktoriya Gorobtsova, discussed discreetly engaging a construction firm to investigate the nature of the works done at the sites known as Akzhal-1, Akzhal-2 and Aksenger (related to what is now described as the ‘PEAK Claim’). Ms Gorobtsova knew Mr Gafurov, who with his father ran a construction company with suitable experience. Mr Gafurov and his father visited the three sites in December 2012, and Mr Gafurov returned in January 2013 to carry out a more detailed review and analyse relevant paperwork. At the end of January 2013 Mr Gafurov produced a report, which he discussed with Mr Werner, concluding that the amounts paid for the work at Akzhal-1 appeared inflated, with little or no work at all having been completed at Akzhal-2 and Aksenger. Contemporaneous documents purporting to certify certain works (the ‘Acts of Acceptance’) appeared to be seriously inaccurate, recording, for example, earthworks of a scale of which there was no evidence and which it was highly improbable had been carried out. Mr Gafurov’s report also noted the consistent involvement of Arka-Stroy as general contractor. His view was that it seemed likely that a fraud had taken place.

14. At this point, the Claimants insist, Arka-Stroy’s role and relationship to the Defendants remained unknown. Their position is that this was only discovered when, after Mr Gafurov had delivered his findings, Ms Gorobtsova approached Mr Kuzmenko, the KK Group’s Head of IT, for his assistance in searching for any information related to Arka-Stroy. Mr Kuzmenko thought that Arka-Stroy’s accounting (or 1C) database might have been backed up on to the KK Group’s computer servers. He enlisted another IT department employee, Mr Rasul Khasanov, to assist in the search which resulted in the discovery of Arka-Stroy’s 1C database on the KK Group’s systems, effectively containing its accounting history. Other databases of entities owned or controlled by the Defendants, and implicated in the frauds as set out further below, were also discovered. Mr Khasanov then helped to extract relevant data from the Arka-Stroy database, preparing a list of significant transactions which Arka-Stroy had been involved in. This quickly revealed that it had engaged in numerous payments to entities which Mr Kuzmenko and Mr Khasanov knew had been managed by Ms Dikhanbayeva.

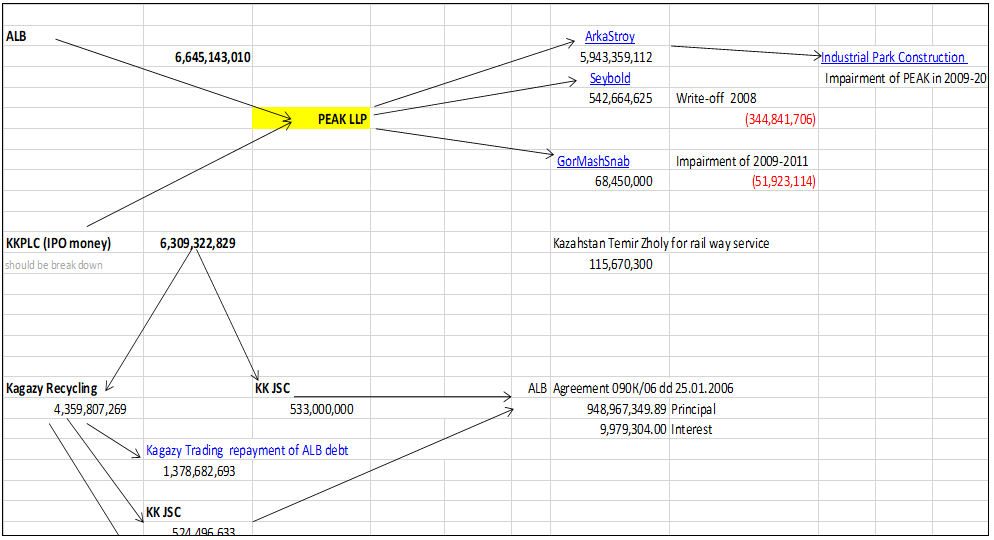

15. As a result, as at March 2013, the Claimants say, but not before, they had critical evidence that Arka-Stroy had been very substantially overpaid for the work it had done and also that the Defendants had, through Arka-Stroy, received the benefits of those overpayments. A few months later, the Claimants issued these proceedings and, as I shall come on to explain in a moment, obtained a worldwide freezing injunction which remains in place. The Claim Form was issued on 2 August 2013. This, and the Particulars of Claim, were subsequently amended on a number of occasions. At the time of trial, the Claimants’ claims related to three alleged fraudulent schemes. The first of the frauds alleged by the Claimants - the PEAK Claim - entails the case that, between 2005 and 2009, the Defendants dishonestly caused KK JSC, PEAK and Peak Akzhal to make payments in the total net amount of US$ 109.1 million (I should say that the parties used various US Dollar amounts to indicate the size of the payments which were made in Tenge/KZT and I have adopted these but almost certainly there is an inconsistency in exchange rates used and so the US Dollar figures are to be regarded as approximate) to a purportedly independent construction company, Arka-Stroy LLP (‘Arka-Stroy’), for the development of a logistics centre and industrial park on three sites in Kazakhstan (referred to as Akzhal-1, Akzhal-2, and Aksenger). It is alleged that only a minimal amount of construction work was actually done, that Arka-Stroy was secretly controlled by the Defendants and that a total net amount of around US$ 52.9 million was paid on to 16 entities associated with the Defendants. The Claimants say that all the monies paid to Arka-Stroy (the entire US$ 109.1 million) have been misappropriated and/or constitute a loss suffered by the Claimants as a result of breaches of duty by the Defendants. In the alternative, if the Claimants are required to give credit for the limited amount of construction work done by or on behalf of Arka-Stroy, the Claimants say that the quantum of such credit should be no more than between US$ 6.5 million and US$ 16.4 million, so giving a net loss of between US$ 92.7 million and US$ 102.6 million. The Claimants further allege that, as a result of these losses, KK JSC, PEAK and Peak Akzhal have been unable to repay the commercial borrowing which was the original source of the misappropriated funds, and have therefore become liable to their banks and bondholders for interest, default interest and penalties in the sum of around US$ 78 million, which is claimed as damages.

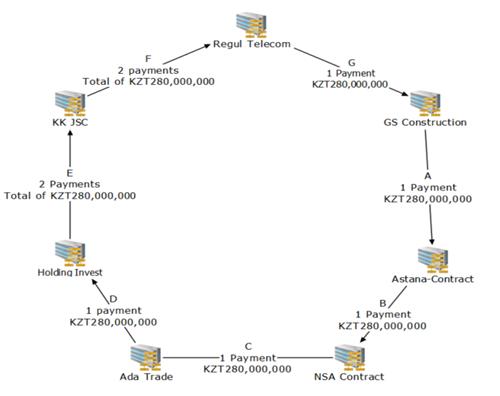

16. The second of the frauds alleged by the Claimants - the Astana 2 Claim – entails the allegation that, in 2008 and 2009, the Defendants committed a similar fraud (Mr Howe described it as a “re-run of the PEAK Fraud on a slightly smaller scale”) involving payments purportedly made by Astana Contract for construction work in relation to a project to build a logistics centre with Class A warehouses outside Astana (the capital of Kazakhstan, some 600 miles from Almaty). This breaks down into three parts. First, Astana-Contract paid GS Construction LLP (‘GS’), purportedly an independent contractor but, the Claimants allege, in fact, connected with the Defendants, US$ 18.6 million, of which GS returned US$ 11.9 million, giving a net payment to GS of US$ 6.72 million with GS carrying out only minimal works in exchange. Secondly, Astana-Contract paid TransEnergoServiceStroy (‘TESS’) US$ 4.45 million to design a transport and logistics centre, which it did not do, instead sub-sub-contracting the work for a fraction (just over 10%) of the price it received from Astana-Contract, giving a net amount extracted, so the Claimants allege, from the Claimants of approximately US$ 3.9 million. Thirdly and lastly, the Claimants say that Astana-Contract paid NSA Contract LLP (‘NSA’) US$ 11.014 million for the delivery of goods which were never supplied, NSA returning US$ 750,000 of this to Astana-Contract but paying the majority of the remainder (US$ 9.72 million) to another entity allegedly connected with the Defendants, Ada-Trade LLP (‘Ada-Trade’), which shared a director with Arka-Stroy. The Claimants say that Ada-Trade then channelled back (directly and indirectly) just under US$ 7.5 million of this to KK JSC, and paid on approximately US$ 2.17 million to Holding Invest, which it is common ground was Mr Zhunus’s and Mr Arip’s entity. The net loss on this element of the fraud was, therefore, so it is alleged, US$ 2.83 million. The Claimants’ Astana 2 Claim, therefore, entails a claim, in total, for a loss of US$ 13.45 million. In addition, as with the PEAK Claim, the Claimants allege that, as a result of these losses, Astana-Contract and Paragon have become liable for interest, default interest and penalties in the sum of around US$ 10 million, which is claimed as damages.

17. A third claim – the Land Plots Claim – was added by amendment in 2015 and involves the allegation that the Defendants used nominee companies to acquire land plots cheaply from farmers in Kazakhstan which were then re-sold to KK JSC, ostensibly for development, at highly inflated prices. Specifically, the Claimants say that, at the instigation of the Defendants, KK JSC paid out a net total of US$ 52.097 million to three entities associated with the Defendants (Commerce Business Centre or ‘CBC’, Bolzhal and Holding Invest), purportedly in payment for the purchase of fourteen land plots. These three entities then paid on US$ 44.29 million to seven further entities associated with the Defendants, each of which was also a recipient of money in the context of the PEAK Claim. There are no records as to what happened to this money, but it is the Claimants’ case that the entire amount paid by KK JSC to the three entities connected with the Defendants, US$ 52.097 million, has been misappropriated, on the basis that there was no sound commercial reason for the purchase of the land plots. In the alternative, in the event that KK JSC is required to give credit for the limited value of the land plots which it acquired, the Claimants’ case is that they are, in any case, entitled to the difference between the amounts which KK JSC paid out purportedly in payment for purchase of the land plots, and the price at which the land was originally bought from the farmers at the Defendants’ initiative.

18. It is the Claimants’ position that there are a number of significant similarities and telling overlaps between these three claims, including: the use of what Mr Howe described as ‘Connected Entities’, a number of which appear in two or indeed all three of the claims, used as ‘funnels’ to siphon off substantial sums of money from the KK Group; the use of relatives, employees or other people known to the Defendants to act as nominal directors or shareholders of the ‘Connected Entities’ as a device to obscure the connections between those entities and the Defendants; the existence of elaborate webs of payments into the KK Group, out of the KK Group and between the ‘Connected Entities’ for which there is no proper or innocent explanation; and a lack of proper documentation to sit behind (and explain or justify) the various payments. Mr Howe suggested that, although each of the three claims can be considered independently of the others, “the crossover and cross-fertilisation and the common features of all three of them provides a further powerful evidential demonstration that the defendants are indeed involved in all three of them”.

19. Lastly and by way of completeness, I should add, before coming on to deal with the defences which have been raised, that previously Peak Aksenger advanced a claim which was referred to as ‘the Astana 1 claim’. In essence, this claim entailed the allegation that the Defendants caused Peak Aksenger to purchase Astana-Contract and its subsidiaries for some US$ 39.3 million more than they were worth; this was said to be a preparatory step to the Astana 2 aspect. HHJ Mackie QC decided that there was no good arguable case in relation to the Astana 1 claim ([2013] EWHC 3618), and it was discontinued in April 2016. As a result, Peak Aksenger is no longer a claimant in these proceedings.

An outline of the defences raised

20. Mr Zhunus served his Defence on 27 January 2014. In summary, he asserted that his role in the KK Group was essentially a non-executive and not a managerial one, that he was not responsible for the relevant transactions, that he at all times acted honestly and in what he believed to be the best interests of the KK Group, and that he did not receive any illicit payments. Mr Arip and Ms Dikhanbayeva served a joint Defence on 6 February 2015. In summary, they largely admitted that they were involved in the decisions to enter into the relevant transactions but asserted that those were commercial decisions taken in what was perceived to be the best interests of the KK Group at the time and not in furtherance of any fraudulent scheme. They denied that there was any fraud or that they personally benefited from the transactions.

21. This denial was maintained before me at trial. Specifically, Mr Arip and Ms Dikhanbayeva pointed to the fact that the Claimants’ case in relation to the alleged PEAK Claim is that all sums paid to Arka-Stroy (less only those sums which can be shown to have been returned to the KK Group) were misappropriated by the Defendants, the contention, therefore, being that a total of US$ 109.1 million is due. Mr Twigger highlighted, however, that the Claimants do not allege how US$ 49.1 million of this total sum is supposed to have been misappropriated by the Defendants. The submission is made that it can be demonstrated that Arka-Stroy paid monies to a wide variety of entities in respect of whom there is no pleaded case of any connection with Mr Arip and Ms Dikhanbayeva. Accordingly, Mr Twigger suggested, there is simply no case to answer in respect of this US$ 49.1 million. As to the balance, Mr Arip and Ms Dikhanbayeva pointed out that US$ 37 million was paid to eleven entities which, on the Claimants’ case, were connected with the Defendants and that US$ 23 million was paid to five other entities also alleged to be “related to or associated with the First and Second Defendants”. As to the US$ 37 million, Mr Arip and Ms Dikhanbayeva question how the Court is in any position to make findings about net figures, many of which result from a large number of debits and credits between Arka-Stroy and the various entities. Mr Twigger also highlighted how, in relation to many of the payments made by Arka-Stroy to the eleven entities alleged to have been connected to the Defendants, it has been possible to see what the entity has then done with the money and in many cases it can be seen that the money was used for a legitimate purpose. In relation to the US$ 23 million paid to the other five entities, Mr Twigger submitted that there is no evidence that these entities have any connection with Mr Arip and Ms Dikhanbayeva whatsoever. It is equally unclear, Mr Twigger suggested, how the Claimants say (if they say) that the relevant monies paid for the land plots which are the subject of the Land Plots Claim found their way to Mr Arip and Ms Dikhanbayeva in circumstances where it is possible to identify the entities to which CBC and Bolzhal (the companies from whom KK JSC purchased the land plots) paid the money received.

22. Similarly, Mr Twigger contended, the Astana 2 Claim is without merit given that Mr Arip and Ms Dikhanbayeva (and Mr Zhunus) were not directors of Astana-Contract or Paragon at the relevant time and did not cause either of these companies to enter into the relevant contracts. Furthermore, he suggested, there is no evidence that the contractors to whom Astana-Contract made payments had any connection with the Defendants, nor that any of the payments found their way to Mr Arip or Ms Dikhanbayeva. Moreover, Mr Twigger emphasised, whereas Mr Arip’s and Ms Dikhanbayeva’s quantity surveying expert’s conclusion was that substantial work was carried out at the site in Astana, the Claimants’ equivalent expert had been instructed not to consider this claim at all. Mr Twigger submitted that, in such circumstances, the case that “such works as were done were minimal and only preparatory” is not tenable.

23. A further defence, that of time-bar, has also been raised by Mr Arip and Ms Dikhanbayeva. This involves the contention that the claims brought by the Claimants are all time-barred under the law of Kazakhstan, which has a three-year limitation period. Specifically, Mr Arip and Ms Dikhanbayeva allege that the claims are time-barred on the basis that the Claimants were aware or ought to have become aware of the material facts more than three years before this action was commenced. Mr Arip’s and Ms Dikhanbayeva’s position is that Mr Werner has pretended that he had insufficient awareness of the Claimants’ claims until the discovery of the Arka-Stroy 1C database in 2013 and that the true position is that Mr Werner knew about all of the necessary elements of the claims at a much earlier stage. Mr Arip and Ms Dikhanbayeva rely, in particular, upon the report produced in December 2009 by PwC Russia, contending that, combined with other information available to Mr Werner, this would have enabled the Claimants to launch the Claims much earlier than they did and well before the expiry of the applicable three-year time-bar. Mr Arip and Ms Dikhanbayeva suggest that the reason why the Claimants did not pursue the allegations which they now make was because they were concerned about the impact this would have on their attempts to restructure the KK Group.

Procedural history

24. I have mentioned previously that this case has been hard fought. Consistent with this, there has been a considerable amount of interlocutory skirmishing in this case, both at first instance and before the Court of Appeal. It is necessary to set out a brief summary of some of the procedural events in these proceedings to date because I refer to these events later in this judgment.

25. Things started on 2 August 2013, when HHJ Mackie QC granted a worldwide freezing injunction in the sum of £100 million in favour of the Claimants against Mr Zhunus and Mr Arip and in support of the Claimants’ fraud claims against them. On the same day, the Claim Form was issued and permission was given to serve Mr Arip and Ms Dikhanbayeva out of the jurisdiction. On 13 August 2013, Particulars of Claim were served. The following month, on 2 September 2013, Mr Arip applied to set aside the injunction on the grounds of material non-disclosure and no good arguable case on the merits in two respects, first because the claims of all the Claimants except KK Plc were time-barred, second because one particular fraud claim known as ‘Astana 1’ did not have sufficient merit and third, because the First Claimant’s loss on its claim was merely reflective of that suffered by the other Claimants. Those applications were heard over three days following which HHJ Mackie QC delivered a lengthy reserved judgment. He held that the Claimants (other than KK Plc, for which the application of the reflective loss principle prevented its case from being a good arguable one) had a good arguable case, which was not prevented from being so due to limitation (i.e. that they were not time-barred) but that there was no good arguable case to support the Astana 1 Claim. He also held that there was no material non-disclosure or, if there was any at all, it was not such as to lead to a discharge of the Injunction. He therefore continued the injunction in the reduced sum of £72 million (i.e. excluding the sums claimed in Astana 1). Both sides appealed and in a judgment given by the Court of Appeal on 2 April 2014, Mr Arip’s appeal and KK Plc’s cross-appeal (on reflective loss) were both dismissed.

26. Subsequently, all three of the Defendants sought summary dismissal of the claims under Part 24 on the basis that there was no real prospect of the Claimants avoiding being time-barred under Kazakh law. In the alternative, they sought the discharge of the Injunction on the basis that there is no good arguable case that the Claims are not time-barred and/or because of deliberate and material non-disclosure. They relied on a number of documents disclosed to them by SP Angel in support of these applications. These applications were dismissed by HHJ Waksman QC for the reasons set out in a judgment dated 27 October 2015. A few months after this, the Claimants settled their claim against Mr Zhunus in February 2016 with the consequence that the claim against him has been stayed. The remaining Defendants subsequently issued a Contribution Notice against Mr Zhunus. Mr Arip also applied for a worldwide freezing injunction against Mr Zhunus. Leggatt J refused to give permission to bring a claim for contribution, and also refused to grant a freezing injunction. However, his decision was overturned by the Court of Appeal, which granted permission to file and serve a contribution notice ([2016] EWCA Civ 1036). Subsequently, on 17 February 2017, I directed that for all purposes connected with the Contribution Notice, Mr Zhunus would be bound by all findings made by the Court based on the evidence heard at the trial. Mr Zhunus was not represented at trial, nor did he participate in the trial any other way.

Factual witnesses

27. It is appropriate at this stage to give my impressions regarding the factual witnesses who gave evidence before me. There were many such witnesses: seven on behalf of the Claimants, and no fewer than eleven on behalf of the Defendants, including Mr Arip and Ms Dikhanbayeva themselves. This was in addition to the expert evidence which was given by a further ten witnesses. Counsel for both the Claimants and Mr Arip and Ms Dikhanbayeva each made criticisms of certain witnesses, Mr Howe for the Claimants labelling Mr Arip and Ms Dikhanbayeva and each of the factual witnesses whom they called as “wholly unreliable” and (with the single exception of a Mr Kosarev, who was very elderly) “demonstrably dishonest”. Mr Howe submitted, quite bluntly, that Mr Arip and Ms Dikhanbayeva simply lied in the evidence which they gave in order to cover up the frauds of which they were accused. For his part, Mr Twigger for Mr Arip and Ms Dikhanbayeva accused Mr Tomas Werner, the Claimants’ principal witness and the driving force behind the Claimant, of fabricating evidence, specifically in relation to the extent to which he knew about the Defendants’ activities at given times. I shall need to consider these submissions in some considerable detail, particularly the criticisms which have been levelled at Mr Werner, Mr Arip and Ms Dikhanbayeva in view of the importance of each of these people’s credibility to the outcome of these proceedings. This section is, for that reason, somewhat longer than might normally be the case.

The Claimants’ factual witnesses

28. I start with the Claimants’ witnesses. In the order in which they were called, these were: Hugh McGregor, Tomas Werner, Viktoriya Gorobtsova, Yevgeniy Kuzmenko, Karim Khashimov, Berik Nagashibaev and Ilkham Gafurov (who gave his evidence via video link). I start with Mr Werner rather than Mr McGregor but shall otherwise deal with the witnesses in this order. Before coming on to consider Mr Arip’s and Ms Dikhanbayeva’s witnesses, I shall then consider Mr Twigger’s submissions concerning certain witnesses who were not called by the Claimants.

Mr Tomas Werner

29. As I have previously explained, Mr Werner has, since late 2009, been a shareholder in, and CEO of, KK Plc and also CEO of KK JSC. Mr Twigger, quite accurately, described him as the driving force behind these proceedings. He, correctly, also characterised Mr Werner’s evidence as being of central importance to the issues regarding limitation since his evidence before me addressed primarily his relationship with the Defendants (in particular, Mr Arip) and the discovery of the (alleged) frauds (albeit in addition to what might be described as the architecture of the PEAK and Astana 2 Claims). Mr Werner’s evidence principally went to the issue of limitation.

30. Mr Werner stands most to benefit from the present claims succeeding since, not only does he currently own around 30% of the shares in KK Plc, but he also stands to receive 5% of the net proceeds of this litigation under certain success fee arrangements which he (together with Mr McGregor and Ms Gorobtsova) have entered into. Even on a conservative estimate and taking the calculations set out in Mr Howe’s written closing submissions, this is likely in Mr Werner’s case to amount to something in the region of US$ 3.5 million. Mr Twigger’s submission is that, given this incentivisation, the evidence which Mr Werner gave should be treated with some circumspection. I agree with Mr Twigger about this. It does not follow, however, that Mr Werner should necessarily be regarded as somebody who would be prepared to give evidence which he knew to be false. On the contrary, in circumstances where Mr Werner, Mr McGregor and Ms Gorobtsova would inevitably have found themselves giving evidence in any event, given their continuing roles within the KK Group, it would hardly be right to view the only reason why they gave evidence at trial as being their hope that they will be paid the success fees to which victory would entitle them.

31. Mr Twigger went on to suggest that the fact that, as he put it, Mr Werner was incentivised by the success fee agreement into which he has entered ought to lead the Court to conclude that he is willing to do whatever it takes to help the Claimants succeed in these proceedings, including by giving evidence which is unreliable at best. Again, I cannot accept that this necessarily follows, however. Mr Werner insisted that “doing the right thing” is his motivation for bringing (through the Claimants) this claim, and I accept Mr Werner’s evidence about this: I reject the suggestion that Mr Werner was willing to mislead the Court because he stood to benefit from the success fee. It seems to me that, ultimately, I must make an assessment of the evidence given by Mr Werner (and by Mr McGregor and Ms Gorobtsova) which takes into account a range of matters not limited to the fact that a success fee is potentially payable.

32. In short, when evaluating the evidence given by Mr Werner (and every other witness, including the witnesses called by Mr Arip and Ms Dikhanbayeva), I must have regard to the contemporary documents and to what were described by Robert Goff LJ (as he then was) in The ‘Ocean Frost’ [1985] 1 Lloyd’s Rep. 1 as “the overall probabilities” in the following passage of his judgment at page 57:

“Speaking from my own experience, I have found it essential in cases of fraud, when considering the credibility of witnesses, always to test their veracity by reference to the objective facts proved independently of their testimony, in particular by reference to the documents in the case, and also to pay particular regard to their motives and to the overall probabilities. It is frequently very difficult to tell whether a witness is telling the truth or not; and where there is a conflict of evidence such as there was in the present case, reference to the objective facts and documents, to the witnesses’ motives, and to the overall probabilities, can be of very great assistance to a Judge in ascertaining the truth.”

Subsequently, Lord Goff (as he had by then become) endorsed this approach in Grace Shipping v. Sharp & Co [1987] 1 Lloyd’s Law Rep. 207 at pages 215-6:

“And it is not to be forgotten that, in the present case, the Judge was faced with the task of assessing the evidence of witnesses about telephone conversations which had taken place over five years before. In such a case, memories may very well be unreliable; and it is of crucial importance for the Judge to have regard to the contemporary documents and to the overall probabilities.”

Lord Goff went on to remark that:

“That observation is, in their Lordships’ opinion, equally apposite in a case where the evidence of the witnesses is likely to be unreliable; and it is to be remembered that in commercial cases, such as the present, there is usually a substantial body of contemporary documentary evidence.”

In evaluating Mr Werner’s evidence (and, indeed, the evidence given by all the other witnesses, including Mr Arip’s and Ms Dikhanbayeva’s witnesses), this is the approach which I have adopted.

33. It is right, however, also to have regard to other matters, not only matters which bear on the question of motivation such as (at least potentially) the success fee issue. First, Mr Twigger submitted that Werner became a shareholder of KK Plc knowing that it was in severe financial difficulty but thinking that it would somehow ‘turn to gold’ and that he would make his fortune. Mr Twigger suggested that Mr Werner went to considerable lengths to cling on to that dream, including paying sums which the KK Group could ill afford in order to buy out SP Angel for US$ 750,000 and subsequently Mr Khabbaz, for around US$ 8 million. The realisation, Mr Twigger suggested, that the dream would never come true has left Mr Werner with a sense of considerable resentment towards Mr Arip. I consider that there is some force in this suggestion.

34. Secondly, Mr Twigger highlighted the manner in which evidence came to be given. It was Mr Twigger’s submission that Mr Werner displayed an untrustworthiness and evasiveness, specifically, so Mr Twigger suggested, in often laughing or smiling when answering questions about serious matters to which he failed to give convincing answers, and in adopting an argumentative approach when being asked reasonable questions during the course of cross-examination. I am not persuaded by Mr Twigger’s criticism in these respects. There is, of course, a danger in placing too much reliance on, for example, demeanour since different people react differently to the task of giving evidence in court. It was certainly clear to me that Mr Werner was very much alive to the need to ensure that the evidence which he gave did not harm the Claimants’ case on limitation and that he understood the importance of his own evidence in this regard. He was, at times, indeed, seemingly reluctant to give straightforward answers to questions put to him. As a result, at times he appeared somewhat cagey and there were certainly inconsistencies between what he was prepared to admit that he knew at particular times and what the documentary evidence suggested that he knew. Some of these contradictions may be ascribed to misremembering caused by the natural passage of time since it is obviously not always easy to recall after the event what was known at a particular point in the past. Another possibility, however, is that Mr Werner set out to mislead the Court. Although I am not persuaded that this is what he set out to do, I am nonetheless clear that, because of the importance of this case for Mr Werner and perhaps because also of a desire to avoid criticism concerning his previous actions, Mr Werner was determined in his evidence to say nothing which might be used as indicating that he knew more than he was at trial prepared to admit. This is not quite the same thing as setting out to give evidence which was untruthful, although I recognise that adopting such an approach was not what a witness in Mr Werner’s position ought to be doing. However, I reject Mr Twigger’s suggestion that, as he put it, as an “attempt to salvage some part of his ambitions”, Mr Werner sought to fabricate evidence which he gave before the Court – at least when he came to give evidence at trial. I am very clear nonetheless that it is important that I should not accept what Mr Werner had to say in evidence without adopting considerable care to evaluate its reliability by reference to the contemporaneous documents or inherent probability.

35. Mr Twigger relied on several examples of what he suggested amounted to Mr Werner engaging in fabrication at the pre-trial stage, specifically when seeking injunctive relief at the outset of these proceedings. He pointed out, for example, that Mr Werner’s first affidavit contained a fabricated account of how the Arka-Stroy 1C database came to be discovered. Specifically, Mr Werner claimed in paragraph 63 of this affidavit that he had approached somebody, whom he described as ‘X’ but which was a reference to Mr Kuzmenko, in late February or early March 2013, and that after he had given assurances to X/Mr Kuzmenko about his future, X/Mr Kuzmenko told him that Mr Werner ought to dismiss ‘Y’ (a reference to Mr Khasanov). During cross-examination, Mr Werner conceded that he himself had had no such conversation with Mr Kuzmenko at all and that it was Ms Gorobtsova who had had the conversation and who had given the relevant assurances to Mr Kuzmenko. His explanation was that he wanted to protect Ms Gorobtsova and so did not wish to identify her as the person who had had the conversation which he described in paragraph 63. Although Mr Twigger was understandably critical of this as an excuse, not least because it would have been open to Mr Werner to have protected Ms Gorobtstova by describing her with another letter (almost certainly as Z), I am not persuaded that this is, in and of itself, a reason to conclude that Mr Werner is a witness in whom the Court can have no confidence. It is unlikely that it will ever be justifiable to give evidence, whether orally or in a witness statement or affidavit, which is knowingly misleading. In my view, there was no justification in the present context, but I nonetheless accept that Mr Werner’s explanation was genuine. In short, whilst I agree with Mr Twigger that this incident should make me cautious in accepting everything which Mr Werner had to say at face value, it would be a mistake to treat Mr Werner as a witness who is inherently unreliable.

36. I am not swayed from this view by the second 1C database example relied upon by Mr Twigger. This concerns the next two paragraphs of Mr Werner’s first affidavit, paragraphs 64 and 65, in which Mr Werner described, after the exchange with Mr Kuzmenko (as is now known, Ms Gorobtsova’s exchange rather than Mr Werner’s) calling Mr Khasanov into a meeting and telling him that he knew that he had been co-operating with the former shareholders and giving him an ultimatum to take sides with the KK Group or leave (paragraph 64), and how subsequently, on 4 March 2013, Mr Khasanov provided him (Mr Werner) with copies of relevant 1C databases (paragraph 65). Mr Twigger’s position was that this is evidence which can be shown to be wrong in a number of respects. First, Mr Twigger made the point that Mr Khasanov’s evidence at trial was inconsistent with Mr Werner co-opting Mr Khasanov as he stated in paragraph 64 of his first affidavit since, on the contrary, it was Mr Kuzmenko who had first approached Mr Khasanov to assist in looking for the Arka-Stroy 1C database, which he managed to find in just a few minutes. Secondly, as Mr Twigger pointed out, both Mr Kuzmenko and Mr Khasanov confirmed in evidence that, by the time that the relevant meeting between Mr Werner and Mr Khasanov took place, at the Esentai Tower on 18 March 2013, Mr Khasanov had already found and provided the Arka-Stroy 1C database to Mr Werner. Thirdly, when asked about paragraph 65 by Mr Twigger, Mr Werner gave evidence that he himself did not receive the 1C databases, suggesting that when he used the word “I” in his written evidence he should not be taken as meaning him as opposed to the KK Group. Mr Twigger submitted that this again demonstrated a willingness on the part of Mr Werner to give evidence which he knew to be untrue, specifically in this instance evidence which, deployed in support of an injunction application, would give the impression that he had needed to exert pressure on KK Group employees before they would co-operate in searching for the Arka-Stroy 1C database, so suggesting that it was not readily discoverable. I agree with Mr Twigger that, in the circumstances, a cautious approach needs to be adopted to the evidence which Mr Werner gave.

37. This brings me on, however, to another submission which was made by Mr Twigger concerning Mr Werner specifically and the Claimants (and their witnesses) more generally. It was Mr Twigger’s submission that Mr Werner has not been candid with the Court about the existence of documents created or received by him which are (or may have been) relevant to Mr Arip’s and Ms Dikhanbayeva’s limitation defence. Mr Twigger referred, in particular, in this context to Mr Werner’s authorising of the deletion of various email accounts since these proceedings were commenced. Mr Twigger also observed that many of the documents relevant to limitation which were before the Court at trial had not been disclosed by the Claimants but by Phoenicia and SP Angel. He suggested, indeed, that, had the Court been reliant on Mr Werner and the Claimants for documents, the true position on limitation would, as he put it, “have remained buried to this day”.

38. There is, in my view, little merit in Mr Twigger’s criticisms in this regard. They are, indeed, as I shall come on to explain, criticisms which might be regarded as somewhat rich in circumstances where it seems to me that there is very considerable force in Mr Howe’s observation that the disclosure process in this case has been “uncommonly one-sided”. It is striking that Mr Arip’s and Ms Dikhanbayeva’s standard disclosure consisted of only 5,434 documents - a figure which came down to under 3,000 once it was appreciated that individually-scanned pages of a single larger document were being treated as individual documents. This compares to the 44,000 documents which have been disclosed by the Claimants after a review of approaching 300,000 documents. It is striking also that neither Mr Arip nor Ms Dikhanbayeva disclosed any emails from or to themselves as part of the standard disclosure process. The Claimants obtained emails involving them not from Mr Arip and Ms Dikhanbayeva but from Mr Zhunus after they had reached their settlement with him. Nor, Mr Howe pointed out, did either Mr Arip or Ms Dikhanbayeva search a single desktop computer, laptop, hard drive, tablet or mobile phone as part of standard disclosure. This was only done when the Claimants made an application requiring such searches to be undertaken and, even then, only a fairly modest (some 750) number of additional documents came to be disclosed. Furthermore, and directly relevant to the criticism concerning deletion of emails by the Claimants, Mr Howe pointed out that Mr Arip’s own solicitors, Cleary Gottlieb LLP (‘Cleary Gottlieb’), have referred to Mr Arip deleting “large numbers of emails” as a matter apparently of routine.

39. Mr Twigger made the submission, specifically in relation to Mr Howe’s “uncommonly one-sided” submission, that Mr Arip and Ms Dikhanbayeva can only disclose what is within their control. He elaborated on this submission by pointing out that Cleary Gottlieb reviewed all emails in Mr Arip’s two email accounts and Ms Dikhanbayeva’s email account within the relevant date range that had not been previously reviewed. There was no deliberate concealment, Mr Twigger explained, highlighting how Mr Arip explained at trial that, during the disclosure process, he provided Cleary Gottlieb with the access details to his email account so that they could review the contents, and that he identified in detail all of the electronic devices that were in his control or had been at any material time and gave all electronic devices still in his control to Cleary Gottlieb to be searched (including old mobile phones which he had given to family members after he had purchased newer models). As to deletion of emails by Mr Arip, Mr Twigger made the point that this took place before commencement of these proceedings and not after, and that the deletion was, indeed, routine because it entailed Mr Arip merely deleting emails from his ‘arip.co.uk’ account when the limit on the relevant mailbox was reached.

40. Whilst I take on board these various points, it is nonetheless difficult to view too favourably the position concerning the Defendants’ disclosure given the significant disparity between the amount of disclosure given by the Claimants, on the one hand, and Mr Arip and Ms Dikhanbayeva, on the other. Mr Twigger is, no doubt, right that Mr Arip and Ms Dikhanbayeva can only give disclosure of documents which are in their control. What is surprising is that there are so few such documents. Returning, however, to the disclosure which was given by the Claimants, Mr Twigger made the point, not unreasonably, that there was a delay between the Claimants obtaining injunctive relief in late July 2013, in fact from the time when litigation must have been in contemplation which must have been several months before the injunction was obtained, and a formal instruction being given within the KK Group to preserve electronic documents. That instruction was, somewhat surprisingly, not given until June 2015, which was two months after Allen & Overy LLP (‘Allen & Overy’) took over from Zaiwalla & Co (‘Zaiwalla’). Plainly, this is regrettable. It is not something which should have happened. The fact, however, is that this particular error was made not by Mr Werner or, for that matter, Mr McGregor (and the KK Group) but by the solicitors formerly instructed by the Claimants. Specifically, although it was suggested to Mr McGregor in particular, during the course of cross-examination, that he was at fault as regards the giving of a retention notice, he was not employed by the KK Group until some nine months or so after Zaiwalla had been instructed to act. In my view, when he started at the KK Group, Mr McGregor was entitled to take it that Zaiwalla had given the relevant notice. Although Mr Twigger suggested that he ought to have checked whether this was the case, I consider this an unfair criticism. I appreciate that he was the General Counsel of the KK Group, but to suggest that he should have checked whether a retention notice had been issued in circumstances where an experienced firm of solicitors were acting for the KK Group is, in my view, not realistic. As Mr Twigger reminded me, I asked Mr McGregor during the course of cross-examination why it took almost 2 years for the relevant notice to be issued. Mr McGregor’s suggestion was that there was a lot going on when he arrived in his new job at the KK Group. He explained that there had not been “a quiet day really and it was something that was eventually considered at the commencement of - just after Allen & Overy had come on board and we had changed law firms”. Mr McGregor likened the circumstances in which he joined the KK Group as being akin to “parachuting into a battle” since he was dealing with Financial Police raids and “aggressive” enforcement proceedings by various banks. I can understand why, in such circumstances, he assumed steps had already been taken before he joined the KK Group and simply gave no thought to the question of whether a retention notice had been issued.

41. Coming to Mr Werner, his evidence was that, prior to December 2012, he routinely deleted emails but that he would have kept those which were important. The significance of December 2012 is that Mr Werner initially identified that as the time when litigation was first in contemplation, but in evidence three days later he explained that litigation was in contemplation in September 2012. Furthermore, Allen & Overy had previously, when dealing with the question of litigation privilege, identified the relevant date when litigation had been in contemplation as having been July 2012. Ultimately it does not seem to me that much turns on these date differences, however, in circumstances where it was Mr Werner’s evidence that, even when he did delete emails, he confined that deletion to emails which were not important. I accept that evidence, despite Mr Twigger’s ability to point to certain examples of documents which Mr Arip and Ms Dikhanbayeva have been able to obtain from third parties and which are exchanges to which Mr Werner was a party. A particular example of this is a document dated 24 April 2012 setting out workings on “impaired receivables”, which Mr Werner accepted in evidence must have been on his computer since, several months later, in December 2012, he forwarded a version of it to Mr Khabbaz of Phoenicia Capital, a former shareholder in KK Plc which pursued a derivative action in New York in late 2012. Mr Werner was unable to explain why this document (and the email forwarding it to Mr Khabbaz on 17 December 2012) had not been disclosed, having earlier explained (more than once) that disclosure was not something with which he had been involved. The documentation concerned (both the email and its forwarded attachment) had been obtained by Mr Arip and Ms Dikhanbayeva from Phoenicia Capital rather than from the Claimants. Why that should be the case is not clear. I am unwilling, however, to conclude that it was the result of any deliberate decision on the part of the Claimants to suppress relevant documents relating, in particular, to the limitation issue.

Mr Hugh McGregor

42. Mr Hugh McGregor is a solicitor who joined the KK Group as its General Counsel on 7 August 2013. This was after the material events relating to this claim had occurred, and indeed, was after the proceedings had been issued (but before the claim was amended to include the Land Plots Claim). My impression of Mr McGregor is that he was a generally straightforward witness.

43. Mr Twigger submitted that Mr McGregor was not an untruthful witness but that his evidence was not impartial. He highlighted, in particular, how what he described as “large tracts” of his witness statements consisted of commentary and argument on matters in relation to which he had no first-hand knowledge. He emphasised also that, whether as a current employee of the KK Group and a colleague of Mr Werner or because he and Mr Werner are friends, Mr McGregor is not somebody who can properly be regarded as independent. In this context, Mr Twigger pointed (as he had done in relation to Mr Werner) to the fact that Mr McGregor stands to benefit from payment of a not insubstantial success fee in the event that the claimants are successful in these proceedings. Mr McGregor was cross-examined about this, specifically as to the circumstances in which the remuneration committee of KK Plc awarded various individuals, including Mr McGregor, a percentage (2% in Mr McGregor’s case) of the “net proceeds” of this litigation and as to the nature of the arrangements. Mr McGregor explained that under the arrangements, as they currently stand, he and the other success fee beneficiaries (Mr Werner, Ms Gorobtsova, and Sir Tony Baldry, a former chairman of KK Plc) are entitled to differing percentages of the “net proceeds” of the litigation, “net proceeds” meaning sums recovered by the Claimants in relation to the PEAK and Land Plots Claims after deduction of the Claimants’ net costs (costs incurred less costs recovered) and the investment of Harbour, the litigation funder. Mr McGregor explained (Mr Twigger suggested somewhat cryptically) that there were a number of “financial hurdles” which had to be passed before he and the other success fee beneficiaries would receive any of the litigation proceeds, including a payment to the Claimants’ creditors (which he believed to be subject to a cap of circa US$ 20 million), and payments due under the funding arrangements with Harbour. Mr Twigger suggested that Mr McGregor clearly in his evidence wanted to downplay the fact that his 2% success fee could amount to a sum of several million dollars, if the claims succeed.

44. Mr Howe explained that the amount which Mr McGregor would receive would be a more modest US$ 1.4 million. On any view, however, it is in Mr McGregor’s (and Mr Werner’s and Ms Gorobtsova’s) interests if the Claimants were to succeed against Mr Arip and Ms Dikhanbayeva in this action. I have not lost sight of this when considering Mr McGregor’s evidence, but my overall view remains that he gave evidence which was not only honest (as Mr Twigger accepted) but which was also, at least in general terms, reliable.

Ms Viktoriya Gorobtsova

45. Ms Viktoriya Gorobtsova joined KK JSC in May 2012 as an assistant to Mr Werner. She was just 23 at that time with only a short period of prior work experience in marketing with KPMG in Kazakhstan. She is now the CEO of the KK Group’s operating subsidiary, Kagazy Recycling LLP. The Claimants say she played an instrumental part in relation to what they would characterise as the discovery of the frauds in 2013, and it was clear to me that she did, indeed, play a key part in the investigations which took place in late 2012/early 2013. She gave evidence in relation to these investigations, as well as the circumstances prevailing in the KK Group at this time. Ms Gorobtsova’s evidence was that, within a few months of joining the KK Group, by around August 2012, through general “chit-chatting” and “gossips” with KK employees, whose trust she had gained, she learnt that some employees believed the former shareholders to be “fraudsters”. She discussed this with Mr Werner, who had his own suspicions but “no real evidence”. She explained how, in November/December 2012, she and Mr Werner decided to instruct a friend of Ms Gorobtsova, a Mr Gafurov, who worked in the construction business, to carry out an investigation into the construction works which had been carried out at the various sites. Mr Gafurov produced a report which reached the conclusion that the former management of the KK Group had executed “a large scale fraud”. Ms Gorobtsova also gave evidence as to her own subsequent investigations into Arka-Stroy, which led to the discovery of the 1C database for Arka-Stroy. Under cross-examination, Ms Gorobtsova gave straightforward and candid evidence, and my overall impression of her was that she is clearly an intelligent and highly capable person. I found her an impressive witness.

46. Mr Twigger, however, questioned her partiality. He drew attention, in particular, to the fact that she is in a personal relationship with Mr Werner, something which Mr Werner only revealed in his most recent statement. This, combined with the fact that (like Mr Werner and Mr McGregor) Ms Gorobtsova stands personally to gain in the event that the claims succeed, through the 2% success fee which has been awarded to her, Mr Twigger submitted, calls into question her reliability as a witness. In this context, Mr Twigger drew attention to the fact that Ms Gorobtsova has only recently been awarded this success fee by Mr Werner exercising a discretion to make such awards vested in him by the KK Group, suggesting that it cannot be a coincidence that award of it came only shortly before Ms Gorobtsova served a supplemental witness statement for the purposes of trial, having initially not served a trial statement. Although, as with Mr Werner and Mr McGregor, it is appropriate that I should bear in mind that Ms Gorobtsova stands to benefit, not insubstantially, from the Claimants meeting with success in these proceedings, and so to approach her evidence on the basis that it is not wholly impartial, I am not persuaded that I should proceed on the basis that what Ms Gorobtsova had to say is, for this reason, questionable. Nor do I consider that her relationship with Mr Werner makes her necessarily an unreliable witness. I agree that I should not accept Ms Gorobtsova’s evidence without question. I do not, however, start from the premise that she was an unreliable witness. In fact, the evidence which she gave is, to some extent, supportive of the Defendants’ position in that she explained how it was possible to gather information about the frauds alleged by the Claimants with relative ease.

Mr Yevgeniy Kuzmenko

47. Mr Kuzmenko has been employed by the KK Group in the IT department since 2005 and has been the Senior IT Manager in the KK Group since September 2009. He gave evidence to the effect that, as part of his duties between 2005 and 2009, he was asked to provide IT support to a number of companies (including Arka-Stroy) which he understood at that time to be part of the KK Group. He also described the instructions which he received from Ms Dikhanbayeva and persons connected with the Defendants to delete data from the KK Group’s systems prior to their departure, and gave evidence relating to his involvement in the investigations undertaken by Ms Gorobtsova in 2013, and his part in the discovery of the 1C databases.

48. Mr Howe submitted that Mr Kuzmenko gave evidence which was reliable, consistent with the documents and inherently plausible. Mr Twigger, perhaps unsurprisingly, adopted a different stance. He submitted that, in certain important respects, Mr Kuzmenko’s evidence was unreliable, suggesting that he was motivated by financial incentives in the form of a salary increase. Mr Twigger pointed, in particular, to certain inaccuracies in his evidence which he suggested were “indisputable”. All in all, however, my view of Mr Kuzmenko was that he was a careful witness who was doing his best to assist the Court. I certainly did not get the impression that he was intending in his evidence to be misleading.

49. Specifically, Mr Twigger pointed to the fact that in his witness statement he had referred to having installed the 1C databases of CBC and Bolzhal in 2006, yet that cannot have been the case since, as he acknowledged during the course of cross-examination, this was a timescale which pre-dated the registration of those companies. As he explained, however, and as is hardly surprising given that he was giving his evidence over a decade later, it was “difficult for me to remember the exact dates” since it “was a long time ago” and these were “normal routine works and jobs”. He was perfectly willing to accept that “I may be wrong. I may be slightly mistaken with specific dates”. It seems to me that this was a sign of an honest witness. Mr Twigger also pointed to the fact that in his fourth witness statement Mr Kuzmenko stated that Ms Gorobtsova approached him in February 2013 about looking for the Arka-Stroy 1C database and that, prior to this, he had no knowledge or suspicion of the fraudulent activity which is alleged in the current proceedings, yet during the course of her evidence Ms Gorobtsova referred to having picked up on gossip within the KK Group after she started work there in May 2012 to the effect that former shareholders “were fraudsters” and identified Mr Kuzmenko as one of the people who was saying this. Mr Twigger submitted that, in the circumstances, the Court should infer that in his fourth witness statement Mr Kuzmenko was seeking to support the impression created by the Claimants that the present claims could not have been advanced prior to the discovery of the Arka-Stroy 1C database, when actually he harboured suspicions (at a minimum) much earlier. I am, however, not persuaded by this submission. It is not a point which was put to Mr Kuzmenko during the course of cross-examination. Furthermore, reviewing the evidence which Ms Gorobtsova gave, during the course of her cross-examination, it is perfectly possible that she was mistaken in thinking that Mr Kuzmenko told her that the former shareholders “were fraudsters”. She explained that it was not a case of “lots of people” telling her that this was the position “but people that I used to communicate with a lot”. True it is that she mentioned Mr Kuzmenko. She, however, went on to refer to others, such as a Mr Berdibekov, an engineer, and “some accountants from the group”, explaining that “in the kitchen when we were having lunch together we were just discussing like - we used to have very nice times, expensive cars and helicopters and lots of money. But they all knew that money was taken from the bank, so it could not - it could have not possibly been nice times, because money was taken from the banks, so something was obviously happening, in the opinion of those people”. This was not the most precise evidence. I can quite see, in the circumstances, that Ms Gorobtsova may have been mistaken in recalling Mr Kuzmenko as being one of the people who told her that the former shareholders “were fraudsters”.

50. Mr Twigger went on to refer to Mr Kuzmenko’s account of the difficulty encountered in locating the Arka-Stroy 1C database. He submitted that Mr Kuzmenko was wrong to suggest that there was anything like the difficulty which he described. He contrasted the evidence which was given by Mr Khasanov on the topic, pointing out that that evidence was supported by certain screenshots showing the location of particular databases (including the Arka-Stroy 1C database). Mr Kuzmenko, so Mr Twigger submitted, was, therefore, wrong to suggest that Mr Khasanov had to scan through lots of databases individually and open each of them to find out to which company the database related. The explanation for this, in my view, is that, as Mr Kuzmenko explained at the outset of his cross-examination, although he was head of the KK Group’s IT Department, his expertise was not the same as that of Mr Khasanov, who was the manager of what he described as “the developers department” and (unlike Mr Kuzmenko) “the programmer”. Mr Kuzmenko went on to acknowledge, in frank terms, that, whilst he could himself have located the Arka-Stroy 1C database, “it would have taken me much more time”. If Mr Kuzmenko was somewhat insistent in response to Mr Twigger’s questions on the topic of accessibility, I am clear that it was not because he was trying to be obstructive. On the contrary, my impression was that he was doing his best to describe the technical position from his perspective. I reject the suggestion, or implication, that he was endeavouring to make the process undertaken by Mr Khasanov sound more complicated than it was. Had that been his objective in giving his evidence, then, he would not have acknowledged as readily as he did that, once asked to look for the Arka-Stroy 1C database, Mr Khasanov had “found it very quickly”. I am in no doubt, in the circumstances, that the suggestion made by Mr Twigger that Mr Kuzmenko’s evidence on this issue was so unreliable as to render all parts of his evidence, which are not supported by contemporaneous documents, unreliable is unrealistic and should not be accepted.

Mr Karim Khashimov and Mr Berik Nagashibaev