Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Toucan Energy Holdings Ltd & Anor Wirsol Energy Ltd & Ors [2021] EWHC 895 (Comm) (14 April 2021)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2021/895.html

Cite as: [2021] EWHC 895 (Comm)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2021] EWHC 895 (Comm)

Case No: CL-2018-000640

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Royal Courts of Justice

Rolls Building, Fetter Lane,

London, EC4A 1NL

Date: 14/04/2021

Before :

THE HONOURABLE MR JUSTICE HENSHAW

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

(1) TOUCAN ENERGY HOLDINGS LIMITED (2) TOUCAN GEN CO LIMITED |

Claimants |

|

|

- and -

|

|

|

|

(1) WIRSOL ENERGY LIMITED (2) WIRCON UK SOLAR ASSETS GMBH (3) WIRCON GMBH |

Defendants |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Stephen Cogley QC, Samuel Townend and Sophia Hurst (instructed by Stewarts Law LLP) for the Claimants

Craig Morrison, Emily Husain and Jacob Rabinowitz (instructed by Enyo Law LLP) for the Defendants

Hearing dates: 7-8, 12-15, 19-23, 26-30 October and 4-5 November 2020

Draft judgment circulated to the parties on 20 March 2021

- - - - - - - - - - - - - - - - - - - - -

Judgment Approved

Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties’ representatives by email and release to BAILII. The date and time for hand-down is deemed to be 14 April 2021 at 10:00 am

Mr Justice Henshaw:

(2) Original acquisition and construction of the solar parks

(a) The EPC Contracts and O&M Agreements

(c) Design and construction of the solar parks

(3) Negotiation and execution of the SPAs and ALE Contract

(b) Negotiations and entry into the ALE Contract

(4) Taking Over of the solar parks and performance in 2017

(a) Issuing the Taking Over Certificates

(5) Performance under the ALE Contract

(c) Procurement of asset life extensions

(d) Events after December 2017

(6) Development of a dispute regarding the solar parks

(b) The Claimants’ refinancing

(d) The conclusion of Wirsol’s summary judgment application

(8) Brief summary of the components of a solar park

(1) Claimants’ witnesses of fact

(2) Defendants’ witnesses of fact

(E) DEFECTS: OVERVIEW OF CLAIMS AND CONTRACTUAL SCHEME

(2) The EPC Contractual Scheme

(F) CAPACITY DEFECTS AND PROTECTION SETTINGS (Scott Schedule Items 1 and 3)

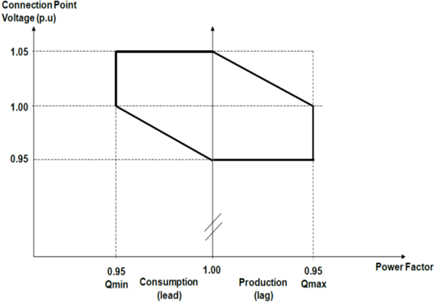

(4) Relevant combinations of voltage and power factor

(5) Voltage variations and use of transformer taps

(7) De-rating for Site Conditions

(8) Safety margin/protection settings

(9) Conclusions in relation to busbar capacity

(10) Conclusions in relation to transformer capacity

(G) LOSSES CAUSED BY CAPACITY DEFECTS: CAPPING OR ‘CLIPPING’ OF INVERTERS (Scott Schedule Item 2)

(3) Guaranteed Performance Ratio

(5) Application of EPC clause 17.6

(H) USE OF FORCED AIR COOLED TRANSFORMERS (Scott Schedule Item 4)

(1) Whether there was a breach of Employer's Requirements clause 4.4.7

(2) Rectification for common mistake

(3) Employer's Requirements § 2.1

(I) SUBSTATION HUMIDITY (Scott Schedule Item 5)

(1) Introduction and relevant standards

(a) Cranham transformer failure

(c) Voltage transformers (VTs)

(e) Condensation at cable entries

(J) INGRESS OF WATER (Scott Schedule Item 6)

(K) USE OF PLYWOOD IN SUBSTATIONS (Scott Schedule Item 7)

(2) Durability and water damage

(L) LACK OF HV AND LV CIRCUIT BREAKERS (Scott Schedule Items 8 to 12 and 14)

(2) HV Circuit Breakers (Scott Schedule Item 10)

(3) LV circuit breakers (Scott Schedule Item 8)

(4) Bus Section Breakers (Scott Schedule Items 9 and 11)

(5) Wilbees Third Circuit Breaker (Scott Schedule Item 12)

(6) Combiner box miniature circuit breakers (Scott Schedule Item 14)

(M) MONITORING DEFECTS (Scott Schedule Items 15 to 19)

(1) Measurement of voltage at string level (Scott Schedule Item 15)

(2) Voltage measurement at combiner box (Scott Schedule Item 16)

(3) Remote monitoring of transformer temperature (Scott Schedule Item 17)

(4) Alarms and alerts (Scott Schedule Item 18)

(5) Storage of reactive energy data for 90 days (Scott Schedule Item 19)

(N) INADEQUATE SITE FINISHING AND LANDSCAPING WORKS ((Scott Schedule Item 20)

(O) 25 YEAR MINIMUM OPERATIONAL LIFE WARRANTY (Scott Schedule Item 21)

(2) C’s case as to Wirsol’s design operational life

(4) Forced air cooled transformers, water ingress and excessive humidity

(P) OTHER ISSUES RELATING TO REMEDY

(1) General approach to quantification of loss

(2) The Claimants’ remedial scheme

(3) Replacement of substations

(5) Other costs of remedial work

(a) Downtime while remediation takes place

(b) Removal and disposal of transformers, switchgear and containers

(c) Disconnection, civils and installation works at final commissioning

(d) Specialist screw pile foundations: difference £68,400

(g) Contingency/ design development costs: difference £29,564.

(3) Factual witnesses’ evidence of blight

(4) Expert evidence as to existence of blight

(5) Inclusion of non-defective sites

(7) Conclusion on blight claims

(2) Quantum of the refinancing claim

(b) The 2018 refinancing: relevant capital sum

(c) The 2023 refinancing: interest and fees

(S) TERMINATION OF EPCS AND O&M CONTRACTS

(1) Termination of the EPC Contracts

(2) Termination of the O&M Agreements

(4) Clause 13.4 of the O&M Agreements

(4) SPVs’ intention or knowledge

(6) Inequitable for Claimants to resile from waiver

(U) ABAKUS BYES DELAY LIQUIDATED DAMAGES

(3) Disclosure by Wircon UK and Wircon Germany

(3) Toucan Gen Co’s pleaded case

(4) Toucan Gen Co’s proposed new case

(5) Conclusion on the Outwood Option

(W) BREACH OF WARRANTY: DEFECTS

(4) Type of waiver required by § 13 of the ALE Contract

(5) Whether Toucan Energy waived CS49 under the ALE Contract

(6) Non-disclosure under SPA clause 20.2

(7) Other matters concerning the waiver of CS49

(9) Whether compliant asset life extensions obtained

(b) Whether BLB consented to the final form option agreement

(c) Whether Toucan, acting reasonably, would have consented to the form of option

(e) Adequacy of the alleged written confirmation from the landlord

(f) Whether an engrossment form of option was provided to the Claimants

(g) Whether a planning extension was achieved

(10) Conclusion on ALE Contract claims

(Y) ADDITIONAL CLAIMS AGAINST THE SPVS

ANNEX - THE DEFENDANTS’ APPLICATION TO AMEND

(4) Transformer and busbar capacity

(5) ‘Capping’ or ‘clipping’ of inverters

(6) Adjustments to protection settings

(8) HV and LV bus section circuit breakers

(9) Miniature Circuit Breakers

1. This is a multi-faceted dispute arising out of the construction and sale of nineteen solar energy parks in various locations across England and Northern Ireland.

2. Most of the solar parks were designed and built by the First Defendant (“Wirsol”), between 2015 and 2017, as Contractor under a series of Engineering, Procurement and Construction Contracts (“EPC Contracts”). The Employers under the EPC Contracts, and owners of the leases of the solar park sites, were a number of special purpose vehicles (the “SPVs”) owned at the time by the Defendants’ group.

3. On 25 May 2017 the Second Claimant (“Toucan Gen Co”) purchased from the Second Defendant (“Wircon UK”) its shares in the two companies which ultimately owned the SPVs, thereby acquiring ultimate ownership of the solar parks. On the same date, the First Claimant (“Toucan Energy”), Toucan Gen Co and Wirsol entered into a collateral agreement for Wirsol to procure “Asset Life Extensions”, i.e. extensions to the solar parks’ leases and associated planning rights, in exchange for specified consideration (“the ALE Contract”).

4. The Claimants’ case is that, by reason of breaches by Wirsol of the EPC Contracts, the solar parks contain defects. The Claimants claim (as assignees of the SPVs’ claims) damages to compensate them for those defects. The damages sought include claims for alleged blight of the solar park investments, and damages for the costs said to have been incurred by the SPVs’ holding companies in refinancing their borrowings. A claim is also made for alleged breach by Wirsol of Operation and Maintenance Agreements (“O&M Agreements”) with the SPVs in the period immediately following the SPVs’ termination of the EPC Contracts. In addition, the Claimants pursue a number of claims for breaches of warranty under the Sale and Purchase Agreements by which their group acquired the solar parks. The Claimants claim approximately £7 million compensation for alleged defects in the solar park, a further £6.8 million (or more) for ‘blight’, £8.8 million alleged losses on a refinancing said to have been necessary by reason of the alleged defects, £2.5 million for the loss of an option over adjoining land at a site at Outwood, and a number of ancillary claims, making a total of around £28 million.

5. All these claims are denied by the Defendants, save that they admit liability for direct losses caused by certain of the alleged defects.

6. The Defendants counterclaim approximately £6.4 million under the ALE Contract. The Claimants deny that any liability arises under that contract, on the basis that (a) one of the conditions subsequent set out in the contract was neither satisfied nor waived and (b) no valid asset life extensions were procured.

7. For the reasons set out below, I have concluded (in outline) that:

i) the Claimants’ claims for damages necessary in order to rectify certain of the alleged defects succeed, as do certain warranty claims arising from the same defects (albeit the latter do not give rise to any additional damages);

ii) the Claimants’ other damages claims fail; and

iii) the Defendants’ counterclaim under the ALE Contract succeeds, save in relation to the Widehurst site.

8. Toucan Energy and Toucan Gen Co form part of a group of companies ultimately owned by Mr Liam Kavanagh. This group also includes Rockfire Capital Limited (“Rockfire Capital”). Toucan Energy wholly owns Toucan Gen Co. Prior to May 2018, Toucan Energy was named Rockfire Holdings Energy Limited and Toucan Gen Co was named RFE Gen Co Limited.

9. Wirsol is an English company engaged in the business of designing and constructing solar energy parks. It was initially 67% owned by the Third Defendant (“Wircon Germany”) and 33% owned by Mr Mark Hogan, who was its managing director with responsibility for the acquisition and construction of solar parks in the UK. On 31 May 2016, Wircon Germany acquired 8% of Mr Hogan’s interest in Wirsol, and on 14 November 2019 it acquired Mr Hogan’s remaining 25% Wirsol shareholding. Mr Hogan remains a director of Wirsol.

10. Wircon Germany also wholly owns Wircon UK. Prior to the Claimants’ 25 May 2017 acquisition, Wircon UK owned two ‘Topcos’, each of which owned a ‘Holdco’; and the shares in each of the SPVs were owned by one or other of the two Holdcos.

11. The current corporate structure is as follows:

i) Toucan Gen Co owns Toucan Solar Assets 1 Topco Limited (“Topco 1”) and Toucan Solar Assets 2 Topco Limited (“Topco 2”);

ii) Topco 1 owns Toucan Solar Assets 1 Holdco Limited (“Holdco 1”) and Topco 2 owns Toucan Solar Assets 2 Holdco Limited (“Holdco 2”);

iii) Holdco 1 owns the nine SPVs who own and operate the solar parks at Balcombe, Five Oaks, Mill Farm, Newton, Outwood, Shuttleworth, Trowle, Upper Wick and Wrea Green; and

iv) Holdco 2 owns the ten SPVs who own and operate the solar parks at Carrowdore, Cranham, Eckland Lodge, Home Farm, Lisburn, Moor House, Otherton, Widehurst, Wilbees and Woodhouse.

(2) Original acquisition and construction of the solar parks

12. In 2015 and 2016 the Wircon group acquired the 19 SPVs from various third parties, with the intention of constructing solar parks at each of the sites. By September 2016 the SPVs were ultimately owned by Wircon Germany in the holding structure referred to above. At this stage the directors of the SPVs and Wirsol were identical.

(a) The EPC Contracts and O&M Agreements

13. Each of the 19 SPVs entered into two key contracts: an EPC Contract and an O&M Agreement. The EPC Contract governed the design, construction and commissioning of the solar park, while the O&M Agreement governed the ongoing maintenance of the site once it had reached a certain construction milestone under the EPC Contract (known as ‘Taking Over’).

14. For fifteen of the solar parks (“the Wirsol Sites”), Wirsol was both the EPC Contractor and the O&M Contractor.

15. For the remaining four sites, the SPVs entered into EPC Contracts and O&M Agreements with Abakus Byes Solar UK Limited (“Abakus”). These were the sites at Mill Farm, Shuttleworth, Trowle and Upper Wick (“the Abakus Sites”). Abakus proceeded to construct these four solar parks as EPC Contractor. In late 2016 and early 2017, the SPVs for the Abakus Sites entered into settlement agreements with Abakus compromising the SPVs’ claims for delay liquidated damages at each of the four Abakus Sites pursuant to the four relevant EPC Contracts.

16. Wirsol provided performance bonds, issued by Euler Hermes, in support of its obligations under the EPC Contracts.

17. Financing for the construction of the solar parks was obtained from Bayerische Landesbank (“BLB”) under two facility agreements:

i) On 10 June 2016, Holdco 1 (as Borrower), Topco 1, and its nine SPV subsidiaries (as Guarantors) entered into an agreement (“Facilities Agreement 1”) under which BLB provided funding of £36 million.

ii) On 20 January 2017, Holdco 2 (as Borrower), Topco 2, and its ten SPV subsidiaries (as Guarantors) entered into an agreement (“Facilities Agreement 2”) under which BLB provided funding of approximately £46.3 million.

18. Prior to advancing money, BLB received ‘Lender’s Reports’ as envisaged by the Facilities Agreements, including two technical Independent Engineer’s Reports prepared by OST Energy Limited (“OST”), the lender’s Technical Advisor under the Facilities Agreements.

(c) Design and construction of the solar parks

i) “Commissioning” or “G59” was the process whereby the solar park was certified to export electricity by the District Network Operator (“DNO”), which then issued a G59 Certificate. Commissioning was required to take place on the Target Commissioning Date for each site, a date identified in each EPC Contract. Following Commissioning, steps were to be taken to ensure the site was revenue-generating and ready for Performance Testing designed to check that the park met the “Guaranteed Performance Ratio” required under each EPC Contract.

ii) At “Taking Over” or “Provisional Acceptance”, the solar park was said to be “taken over by the Employer”. The site had to have passed the Tests on Completion and satisfied the further conditions set out in § 10.1 of the EPC Contract, including signature by the Employer of a “Taking Over Certificate” or “Provisional Acceptance Certificate” (“PAC”). Taking Over was scheduled to take place at the conclusion of the “Time for Completion”, which ran for six months after the Target Commissioning Date.

iii) At “Intermediate Acceptance”, each solar park was subject to performance testing by an independent third party to ensure that it met the “Guaranteed Performance Ratio”. Intermediate Acceptance was to be achieved one year after Taking Over occurred.

iv) At “Final Acceptance”, each park was subject to further performance testing to ensure it met the “Guaranteed Performance Ratio,” assessed on the basis of the 12 month period following Intermediate Acceptance (i.e. the second full year after the date of Taking Over). Final Acceptance was to be achieved one year after Intermediate Acceptance. At this stage the Employer issued a Final Acceptance Certificate.

21. A failure to achieve Taking Over within the Time for Completion gave the Employer a right to claim Delay Liquidated Damages (“DLDs”). DLDs were to be calculated on a per Megawatt (MW) per day basis, reflecting the potential for lost revenue due to delays to the contractual milestones. The EPC Contracts provides for all DLDs for the period up to Taking Over to be claimed at that stage.

22. In early 2017 the solar parks had reached different stages of completeness. By 31 March 2017, all nineteen of the solar parks had achieved Commissioning and received their G59 certificates. That was important as the existing subsidy regime changed after this date. By the date of the sale on 25 May 2017, eight of the solar parks had already achieved Taking Over. After the sale, construction of the sites continued and the remaining eleven sites reached Taking Over on various dates from August to October 2017.

(3) Negotiation and execution of the SPAs and ALE Contract

23. At the beginning of 2017 the Wircon group sought a buyer for its portfolio. A number of established UK solar industry players made offers. The Wircon group ultimately entered into negotiations with the Claimants in February 2017.

24. CMS Cameron McKenna Nabarro Olswang LLP (“CMS”) were the transactional lawyers for Wirsol, Wircon UK and Wircon Germany, while Eversheds Sutherland LLP (“Eversheds”) and Gowlings WLG (UK) LLP (“Gowlings”) acted for the Claimants. The Claimants engaged both Eversheds and Gowlings because Eversheds also acted for BLB, giving rise to a risk of potential conflicts in relation to banking matters.

25. To marshal the relevant documentation Wirsol created a live online database of documents known as the “Data Room”. This ultimately contained some 20,000 items relating to the 19 sites, organised by site and class of document. These included pre-construction information such as planning and leases, relevant legal and financial documents, site designs and datasheets for all components purchased, testing certificates and underlying technical documents. The Claimants were provided with continuous access to the Data Room from April 2017.

26. During April and May 2017, CMS and Eversheds also exchanged a ‘Q&A Log’. This was a document in which Eversheds/the Claimants would insert questions relating to the Sale, to which CMS/Wircon/Wirsol would provide responses together with a ‘Data Room Reference’ for the documents referred to. The Q&A Log ultimately consisted of a substantial Excel file, with a separate tab for each site.

27. Prior to the sale Wirsol’s asset manager, Low Carbon, produced monthly asset management reports for each of the eight sites that had reached Taking Over. These were regularly uploaded to the Data Room, with the last report produced prior to signing the SPAs being dated 12 May 2017. This report referred to the inverter capping in place at Five Oaks, Newton and Outwood, referred to later.

29. The Claimants also carried out their own direct due diligence, with Wirsol’s assistance. Mr Brett Baber and Mr Barry Bennett (Toucan’s internal technical experts) conducted site visits to at least 12 of the sites in April 2017, accompanied by Mr James Richardson of Wirsol. The two Northern Ireland sites (Lisburn and Carrowdore) were visited on 19 April 2017 by representatives of Ethical Power Ltd, who were instructed by Toucan to conduct due diligence on those sites. Toucan has not disclosed any reports produced by Ethical Power, but Mr Baber subsequently wrote ‘Site Visit Reports’ for Toucan which have been disclosed and were positive. Mr Baber also raised specific queries with Wirsol regarding the performance at certain sites, which Wirsol addressed by explaining that the figures were caused (in part) by inverter capping, and the sizing of the transformers and busbars installed at the sites.

30. The parties entered into the two SPAs on 25 May 2017, under which Wircon UK sold Topco 1 and Topco 2 to Toucan Gen Co. In total, Wircon UK received the total sum of £53,718,054.46 under the SPAs.

(b) Negotiations and entry into the ALE Contract

31. At the same time, Toucan Energy, Toucan Gen Co and Wirsol also entered into the ALE Contract, which provided for Wirsol to seek to extend the leases and planning permissions for each of the 19 solar parks by five years.

32. The concept of the ALE Contract appears to have been proposed in April 2017 by Wirsol’s financial advisers. At a meeting between Mr Kavanagh and Mr Hogan on 4 May 2017, Mr Kavanagh proposed that the ALE Contract be linked to an element of deferred consideration under the SPAs. On the Defendants’ case, though this is to a degree in controversy, the sale price under the SPAs was reduced by £2 million and it was agreed Wirsol would receive an equivalent amount as a minimum payment under the ALE Contract irrespective of whether it achieved any asset life extensions. Wirsol would receive a higher amount if the value of the asset life extensions secured exceeded £2 million, at rates fixed on a per-site basis in the ALE Contract, up to a maximum of £7.2 million. However, the Claimants proposed linking the ALE Contract to the fulfilment of the list of conditions subsequent included in the Facilities Agreements. It was ultimately agreed that Wirsol would be paid under the ALE Contract only if these conditions were satisfied or waived prior to 30 June 2018.

(4) Taking Over of the solar parks and performance in 2017

(a) Issuing the Taking Over Certificates

33. During August to October 2017, Wirsol fulfilled the Taking Over requirements for the 11 sites that had yet to reach that milestone before the sale.

35. Over the course of September and early October 2017, Wirsol carried out the necessary further actions. On various dates in August to October 2017, Wirsol submitted requests for signature of the Taking Over Certificates for each of the relevant sites. The Claimants agreed and signed these, certifying that all steps necessary to reach Taking Over had been carried out. Some of the certificates were backdated by agreement, as the documentation had been ready to be signed by the SPVs for several weeks.

36. Under Clause 2 of the O&M Agreements, Wirsol’s obligation to provide O&M services to the SPVs was conditional upon the issue of the Taking Over Certificates. As the solar parks were already fully constructed prior to Taking Over formally occurring, Wirsol had in fact begun carrying out O&M services from July 2017 for a number of the sites, some months prior to Taking Over. O&M Reports for the relevant sites in July and August were also written and issued to Low Carbon and the Claimants. Wirsol invoiced the Claimants in October 2017 for these O&M services. However, the Claimants denied that O&M fees were payable before Taking Over and they were not paid. Wirsol ultimately agreed not to pursue these fees.

37. The Defendants say that during 2017 the portfolio performed well. The documents indicate that the four sites which had reached Taking Over prior to the Sale (Outwood, Newton, Balcombe and Five Oaks) each exceeded the monthly PR guarantee of 82% in July-October 2017. From July 2017, months in advance of Taking Over, nine of the remaining eleven sites were exporting power to the grid and generating revenue. In September 2017, each of the sites exceeded its required 82% Performance Ratio. In October 2017, all sites other than Lisburn exceeded their 82% required Performance Ratios. Overall, in the year June 2017 to June 2018, the actual revenue performance of the portfolio exceeded the budgeted performance of £7,081,227.98 by approximately £208,000 and the generated power exceeded the budget of 68,061.944MW by 2,110.05MW.

38. In August 2017, Mr Croucher of Toucan emailed his team saying that “[o]verall the eight Wirsol sights [sic] being asset managed by Low Carbon had a positive month in July producing 1.3% more output than the ‘budget’, so they have caught up on the expected position and are now just 0.2% behind target YTD”. In September 2017, Mr Croucher told his team “[m]onthly reports are starting to come through for September and Hassan will do the reviews to look at the issues per site and make an assessment of the significance. Most items are minor and do not impact export, so do not cost us any loses [sic] in revenue.” In October 2017, Mr Croucher reported to Mr Kavanagh and the wider Toucan team that “[i]n the main, sites have performed as well as could be expected with minimal issues of note” and that “[a]ll sites exceeded their guaranteed PR levels”, while “[a]vailability was good across the board”.

(5) Performance under the ALE Contract

39. After the sale Wirsol took steps to seek extensions under the ALE Contract, working with its English solicitors CMS (in particular Ms Eleanor Doherty and Ms Gabriella Vis) and Belfast solicitors Cleaver Fulton Rankin for the two Northern Ireland sites.

40. Wirsol’s original proposal was (in essence) that new and longer leases would be procured. Wirsol proceeded to discuss the extensions with BLB and the relevant landlord on this basis. However, on 26 October 2017 (just over two months before the 31 December 2017 deadline under the ALE Contract) Toucan Energy instructed Wirsol to obtain options to lease for the further five-year term, instead of lease extensions. Wirsol took steps accordingly.

41. During the same period, the parties sought to address the conditions subsequent incorporated into the ALE Contract. One such condition subsequent mirrored clause 31.23.1.2 of Facilities Agreement 1, and was set out as item 49 in the conditions subsequent scheduled to the ALE Contract (“CS49”):

“Each [SPV] shall procure delivery to the Agent [i.e. BLB] of: …

a certified true copy of each Final Acceptance Certificate within ten (10) Business Days of issue.”

42. As at the date of the ALE Contract, the earliest any of the solar parks had achieved Taking Over was 30 September 2016. As Final Acceptance under the EPC Contracts occurred two years from the date of Taking Over, none of the sites could achieve Final Acceptance before 30 September 2018 at the earliest. It was therefore plain that CS49 could not be satisfied by 30 June 2018 (the deadline specified in the ALE Contract). Wirsol’s case, which I consider later, is that CS49 was accordingly waived by both BLB and Toucan Energy in early November 2017.

(c) Procurement of asset life extensions

43. The Defendants allege that by 31 December 2017, following close liaison between CMS and Eversheds (acting for the Claimants and, separately, for BLB) and negotiations with all the relevant landlords, they procured the evidence required under the ALE Contract showing that the requisite lease and planning permission extensions were available.

44. On 30 December 2017 Mr Hogan issued Wirsol’s invoice under the ALE Contract in the sum of £6,405,820.80 (the “ALE Invoice”), in expectation of fulfilling the final requirements of the ALE Contract well in advance of the 30 June 2018 deadline. At the date on which Wirsol issued the ALE Invoice, there remained two conditions subsequent outstanding (numbers 39 and 48) which related to the substation leases for Carrowdore and Lisburn, such that the ALE Invoice was not immediately payable. The ALE Invoice therefore stated that the applicable payment date was“10 Business Days from the Payment Date as specified under the asset life extension agreement.” The accompanying letter detailed the basis on which all the requirements for securing asset life extensions had been satisfied.

(d) Events after December 2017

45. On 9 January 2018 Toucan Energy wrote to Wirsol stating that the ALE Invoice was not payable because the conditions subsequent had not yet all been satisfied. Mr Hogan responded by email to Mr Kirk the same day, acknowledging that fact and confirming that Wirsol intended shortly to close out the remaining two conditions subsequent.

46. On 16 February 2018, conditions subsequent, 39 and 48 were discharged when the necessary substation leases for Lisburn and Carrowdore were issued.

47. On 26 February 2018, BLB (acting through Eversheds) confirmed that, from the bank’s perspective, all conditions subsequent had been satisfied or waived, “including the FAC CSs for Wirsol 1”. On the same day BLB and the parties to Facilities Agreement 1 had also agreed and signed a letter confirming the waiver of the obligation to provide Final Acceptance Certificates under Facilities Agreement 1 itself.

48. On 28 February 2018 Mr Hogan emailed Toucan Energy stating that “all CS’s have been satisfied on both the WEL45 and WEL 60 portfolio”. That email enclosed a letter stating the conditions were formally satisfied as of 16 February 2018, and thus the ALE Invoice in the sum of £6,405,820.80 was payable on 2 March 2018.

49. On 8 March 2018 Mr Hogan messaged Mr Kirk to say that the ALE Invoice “still hasn’t been acknowledged by anyone at Rockfire - nor was my letter re CS’s being satisfied.” Mr Kirk replied, “Understand if u need to take legal action under ALE, that’s fine - we have been working through list, if assets good and debt swept and OFGEM in, then ALE easier for all.”

50. It then emerged that the Claimants had instructed TLT Solicitors to review the ALE documentation provided by Wirsol in December 2017 (notwithstanding that Eversheds had already seen it). On 19 March 2018 Ms Maria Connolly, head of real estate at TLT, emailed CMS to request an overview of the asset life extension matters and documentation, in advance of a client meeting with Toucan on 26 March 2018. Ms Connolly stated that she was working with Mr Kirk on this matter. In reply Ms Doherty of CMS telephoned Ms Connolly to discuss and subsequently sent an email summarising the position. Ms Doherty then sent Ms Connolly six emails attaching the relevant documents.

51. TLT then scrutinised this documentation, and is said to have provided a ‘full report’ to its clients. The Claimants have claimed privilege over the documents generated during TLT’s review and have provided no disclosure in relation to it. At the time, CMS sought information about the outcome of the review, but none was forthcoming. Nor, though, did TLT or the Claimants make any suggestion that the documentation had been non-compliant in any specific respects.

52. On 20 March 2018 Mr Hogan asked Mr Kirk for an update on the ALE matter. Mr Kirk said, “TLT are speaking with CMS on the land rights in ALE, and I’ll put a proposal to you next week on ALE… Allows non contentious sites to progress, the £2m to be made, but where we have concerns - like Balcombe maybe a different route.” Mr Kirk did not elaborate on what was meant by “contentious” sites.

53. Mr Hogan continued to question Mr Kirk regarding non-payment of the ALE Invoice in April and May 2018.

54. In May 2018 Mr Kirk and Mr Kavanagh met with Mr Hogan on several occasions to discuss the ALE matter, but no agreement was reached.

55. Discussions having failed, on 1 June 2018 Wirsol issued a statutory demand for the sum payable under the ALE Invoice. In a letter dated 13 June 2018, Toucan Energy disputed the debt on three bases, all of which it later dropped. Following receipt of Toucan Energy’s letter, the statutory demand was withdrawn on 15 June 2018.

(6) Development of a dispute regarding the solar parks

56. During the same period, a dispute began to develop regarding alleged defects at the solar parks.

57. Defect notices were served on 13 April 2018, under the EPC Contracts, stating that there was ongoing water ingress into the transformer substations at ten of the solar parks and that the use of marine plywood flooring was in breach of the EPC Contracts.

58. In June and July 2018, the Claimants issued further defects notices:

i) on 15 June 2018, a notice relating to forced air cooling at Five Oaks and the restriction placed upon the inverters at that site;

ii) on 22 June 2018, nine notices regarding the capacity of transformers and busbars, and the monitoring system, at nine of the solar parks; and restrictions placed on the inverters at the Newton and Outwood sites;

iii) on 4 July 2018, three notices alleging defects with the monitoring system at Widehurst, Eckland Lodge and Woodhouse;

iv) on 5 July 2018, two notices alleging non-compliance with the required power factor under the applicable Connection Agreement at the Moor House and Otherton sites (this allegation is not pursued in the present proceedings); and

v) on 30 July 2018, 13 defects notices summarising and reiterating the notices sent to date, plus a defect notice relating to the restriction placed on the inverters at Widehurst.

59. On 1 August 2018 Wirsol replied substantively, by letter from Enyo Law, to the defects notices issued before 30 July 2018. The letter enclosed a 47-page schedule responding to each notice and identifying the remedial work carried out or scheduled. Wirsol accepted that certain updates to the monitoring systems were required. It also made proposals to install further protection to prevent water ingress. The Defendants say that work on both matters was interrupted by the termination of the EPC Contracts, referred to below.

60. No further progress was made in July 2018 regarding the ALE Invoice, and on 2 August 2018 Wirsol issued a claim against Toucan Energy for payment of the ALE Invoice in the Technology and Construction Court (the “ALE Claim”). Wirsol also issued a summary judgment application, on the basis that Toucan Energy had offered no credible justification for non-payment.

(b) The Claimants’ refinancing

62. The prospectus described the sites as “operating well and within the predictions expected at the outset”, “fully operational” and “within 2.5% of our expectations against revenue and costs to date.” The prospectus also stated that a significant number of the sites had a 30-year lease, thus apparently indicating that lease options under the ALE Contract had been obtained and exercised.

64. On 16 August 2018 Eversheds sent a letter before action setting out a series of claims under the EPC Contracts and SPAs. These included an allegation, not now pursued, that the Defendants had entered into an unlawful means conspiracy to conceal the alleged defects. The Claimants’ loss was estimated at “not less than GBP 10,000,000”.

65. On 16 August 2018 the SPVs sent a notice, purportedly under Clause 15.2 of the EPC Contracts, in respect of all 15 sites constructed by Wirsol. This notice enclosed all defects notices sent to date, which are summarised in a table set out at Schedule 4 of the Particulars of Claim, and gave Wirsol a further 14 days to remedy the alleged breaches.

66. On 24 August 2018 thirteen of the SPVs submitted a demand to Euler Hermes for the full amount of the performance bonds issued to them, in the aggregate amount of £2,995,716.57, based on the alleged breaches of the EPC Contracts. Euler Hermes paid the demands in early September, and Wircon Germany reimbursed Euler Hermes.

67. On 3 September 2018 the SPVs sent Wirsol notices of termination of the EPC and O&M Agreements for the 15 sites. The termination of the EPC Contracts was said to be justified by the matters identified in the defect notices. The termination of the O&M Agreements was said to be justified on the basis that the EPC Contracts had been terminated (the O&M Agreements containing a cross-default clause), and (in the case of four solar parks) on the basis that Wirsol had allegedly engaged unauthorised subcontractors.

68. Wirsol took the position that there was no valid basis on which to terminate the EPC Contracts or the O&M Agreements, and that the purported termination by the SPVs was itself a repudiatory breach. Wirsol claimed to accept that repudiation as bringing the contracts to an end. There is a dispute regarding which party’s understanding of the termination process is correct, which I address later.

69. Wirsol offered to continue to provide O&M services during what would (if the O&M Agreements had been validly terminated by the SPVs) have been the contractual notice period. There is a dispute about the basis on which Wirsol did so, and whether the Claimants failed to mitigate their loss by declining to accept Wirsol’s offer. The upshot was that Wirsol did not continue to provide the services, and the Claimants temporarily de-energised the sites pending appointment of new O&M contractors. PSH Operations Limited was appointed as new O&M Contractor for seven sites on 8 September 2018, and BayWa Energy Limited was appointed O&M contractor for eight other sites on 1 November 2018.

70. On 25 September 2018 the SPVs assigned their claims under the EPC Contracts to Toucan Energy, which relies on them as providing a defence of set-off to Wirsol’s claim under the ALE Contract.

71. On 1 October 2018 Toucan Energy and Toucan Gen Co issued their claims in these proceedings, claiming damages of approximately £30 million.

(d) The conclusion of Wirsol’s summary judgment application

72. On 16 October 2018 Toucan Energy abandoned the three defences to the ALE Claim that it had offered to date. Instead, it asserted that it was entitled to set off the ALE Claim against Toucan Energy’s own (recently assigned) claims under the EPC Contracts. In addition, Toucan Energy raised for the first time a defence based upon the alleged non-waiver of CS49.

73. On 2 November 2018 Wirsol filed its responsive evidence, and filed its Defence and Particulars of Additional Claims against the SPVs.

74. On 20 November 2018 Toucan Energy filed further evidence in the Defendants’ summary judgment application, which included witness statements from both Mr Newbery of Gowlings and Mr Hill of Eversheds denying that a waiver of CS49 was given. At this point, Wirsol accepted that the ALE Claim raised contested points of evidence that could not be dealt with at a summary judgment hearing, and (after further correspondence) Wirsol withdrew its application.

75. A dispute arose regarding costs. Toucan Energy sought costs of the entire Defendants’ Summary Judgment Application, including payment of costs incurred after 16 October 2018 on the indemnity basis. Wirsol sought its costs of the application until Toucan first raised the CS49 defence on 16 October 2018, and submitted that thereafter costs should be in the case. At a hearing on 6 December 2018, Waksman J awarded Wirsol 100% of its costs up to the point at which Toucan Energy changed its case on 16 October 2019, finding that the claim and summary judgment application was “entirely properly raised” and that Wirsol was “perfectly entitled to keep on going” until this point. Costs thereafter were reserved, save that the Judge also awarded Wirsol 75% of the costs hearing itself ([2018] EWHC 3924 §§ 33-38).

76. Waksman J also ordered that the ALE Claim should be transferred to the Commercial Court, with a view to the parties seeking consolidation of both sets of claims. This was done, and the ALE Claim was repleaded by Wirsol as a counterclaim.

77. Further claims were subsequently added by the Claimants by amendment in spring 2019, alleging that Wirsol was liable for DLDs in respect of certain sites, and that Wircon UK had failed to disclose certain compromise agreements with Abakus. At the same time the Claimants produced a ‘Scott Schedule’, which set out their various allegations as to defects at the solar parks. In March 2020 the parties settled several minor claims and counterclaims.

78. Following disclosure and witness statements, the Claimants applied for summary judgment/strike-out of the counterclaim under the ALE Contract. Teare J accepted the Defendants’ contention that the application should not be listed, because it could not be accommodated in July 2020 and the trial was due to commence the first week of the following term in October.

79. At a pre-trial review on 24 July 2020, Foxton J ordered Wirsol to identify the documents from the disclosed documents which it contended satisfied the requirements of the ALE Contract. Further documents were disclosed following that order.

80. Both sides agreed to provide security for costs of the other’s claims and counterclaims, without prejudice to their respective positions that such security was not required.

(8) Brief summary of the components of a solar park

81. I set out below a general description of the elements of a solar park, albeit differences occur between different parks.

82. On the low voltage (“LV”) side of the park:

i) Photovoltaic panels (or ‘PV panels’) are solar panels arrayed on a fixed mounting structure in groups (or ‘strings’) connected to an inverter. Sunlight is absorbed by the solar panels and converted into direct current (“DC”). This apparatus can be referred to as the photovoltaic system or “PV system”.

ii) The direct current travels to the inverters, which convert DC into alternating current (“AC”) for export to the electric grid. Each of these inverters is connected to multiple strings of solar panels. There are approximately 140 inverters on a 5MW site. The voltage output from the inverters is approximately 400V.

iii) The AC output from a group of four or five string inverters travels into combiner boxes, and then into feeder pillars (inside the substation) which combine the output from the inverters.

iv) The combined current from the feeder pillar pass through the LV busbar, a large copper bar.

v) The low-voltage 400V current passes into the transformer, which increases the voltage to either 33kV or 11kV as required by the grid. This is the point of transition to the high voltage (or “HV”) side of the solar park.

vi) There are various elements of circuit protection on the LV side including miniature circuit breakers (“MCBs”), low voltage fuses and (in each substation) a Woodward relay or equivalent device. This type of equipment is collectively referred to as ‘switchgear’.

83. On the HV side of the park:

i) The 33kV or 11kV output from the transformer passes through the HV busbar.

ii) The HV current then travels through lengths of cabling to the point of connection with the DNO’s network, i.e. the local electricity grid.

iii) There are various elements of circuit protection on the HV side including an HV circuit breaker, HV switches and Micom relays.

84. In the present case, save at Carrowdore and Lisburn, each transformer substation is a metal structure based upon a shipping container, inside which the transformers, switchgear and busbars are contained. There are two substations at each of the solar parks with the exception of Cranham and Otherton, at which there is only one.

85. The voltage in the DNO’s network may vary from the standard (or ‘nominal’) voltage, depending on the balance of power generation and consumption on the network. Minor variations can occur in the short term, reflecting the changing patterns of use during the day. More substantial variations arise from long-term changes in usage patterns: for example, a major electricity consumer (say, a smelting plant) may materially reduce the long-term voltage in a given network. The DNO is required by regulation to operate in the range of 94% to 106% of nominal voltage. The transformers have the ability to compensate for periods of long-term high or low voltage by adjusting their ‘taps’ - bolts on the transformer that can be physically adjusted, in 2.5% increments, up to a total of -5% or +5%. I discuss later whether, and if so when, it is appropriate to use the transformer taps.

87. It is conventional for ‘real’ power to be expressed in kilowatts (kW), one Watt being equal to 1 Amp (current) x 1 Volt (voltage); and for ‘apparent’ or ‘total’ power (the aggregate of the real and reactive power) to be expressed in kilovolt amps (kVA). The power ratings of the transformers involved in this case are expressed in kVA.

88. This judgment refers to two different types of transformer:

i) power transformers (to which I refer, simply, as ‘transformers’ in this judgment) are used to step up or down the voltage of power supplies; and

ii) voltage transformers, used to step voltage down for a specific purpose in the context of protection and measuring equipment such as (in the present case) switchgear.

89. Defects In sections (E) to (P) below I consider the Claimants’ defects case. This involves determining whether defects existed in fifteen of the solar parks, and the appropriate remedial work arising.

90. Blight Section (Q) considers the Claimants’ claim that the measure of damages for breach of the EPC Contracts should include compensation for blight of the solar parks and/or the Claimants’ investment in them. The contents of this section are also relevant to the Claimants’ separate claim for breach of warranty (section (W)) insofar as it seeks compensation for blight.

91. Section (R) addresses the claim that the Claimants are entitled to recover damages for refinancing costs said to have been incurred as a result of defects in the sites for which Wirsol is responsible.

92. Section (S) concerns the Claimants’ entitlement to have terminated the EPC Contracts and O&M Agreements, and a resulting claim against Wirsol for breach of the O&M Agreements during the termination notice period.

93. Sections (T) to (W) deal with claims brought by the Claimants for breach of warranties in the SPA relating to various matters.

94. Section (X) addresses Wirsol’s counterclaim under the ALE Contract.

(1) Claimants’ witnesses of fact

95. The Claimants provided statements from seven witnesses of fact.

96. Mr Liam Kavanagh is the ultimate owner of the Claimants. I found Mr Kavanagh to be an unsatisfactory witness. In his witness statements he had a tendency to purport to give evidence based on his review of the disclosed documents, including assertions that turned out to be demonstrably wrong. In cross-examination, when faced with difficult questions he would frequently retreat into stating simply that he did not agree with the questioner. As set out in more detail later in this judgment, his evidence on the refinancing issue in particular strained credulity, and I have concluded that the bond prospectus which bore his name was materially false in a significant respect. His evidence about the meaning of internal emails about the ALE Contract lacked credibility. I have concluded that I should not rely on his evidence on contested matters save where supported by independent reliable evidence.

97. Mr Daniel Kirk is an accountant who joined Toucan in January 2018 as managing director of Toucan Energy. Mr Kirk gave evidence in relation to both technical and commercial matters. I did not accept Mr Kirk’s evidence on all points, and felt that the account given in his witness statement of his discussions with Mr Hogan relating to the ALE Contract did not provide a fair reflection of those exchanges (many of which were documented in one form or another). I did not, however, consider that Mr Kirk was at any stage seeking to mislead the court, and in oral evidence he was willing to make appropriate concessions.

98. Mr Ieuan Spencer, the Technical Director of Toucan Energy, gave evidence relating to the technical elements of the defects claims. Some of the contents of Mr Spencer’s witness statements involved selective quotations from contemporary documents, and (as set out later) there are other aspects of his evidence which I was unable to accept. Like Mr Kirk, though, he was prepared to make appropriate concessions in cross-examination.

99. Mr Steven Croucher, the Chief Operations Officer of Rockfire Capital from March 2017 to January 2018, gave evidence largely relating to the ALE Claim. I found his evidence on that topic, particularly the meaning of certain important contemporaneous emails, to strain credibility and was not satisfied that I could rely on his evidence.

100. Ms Sarah Farrelly, the Technical Manager of Toucan Energy since January 2018, gave evidence relating to discrete technical and accreditation issues involving the Lisburn and Widehurst solar parks. She was a straightforward witness.

101. Mr Andrew Newbery, a partner at Gowlings, which formerly acted for the Claimants (though the scope of his retainer was in dispute). Mr Newbery gave evidence in relation to the ALE Contract claim. Though I am satisfied that Mr Newbery gave his evidence honestly, I did not find it entirely satisfactory. His witness statements were argumentative in tone, and purported to give evidence as to matters in which he was not directly involved, such as the correct interpretation of emails regarding the alleged waiver of a condition subsequent to the ALE Contract. They also made somewhat strident assertions about Wirsol’s knowledge regarding Gowlings’ role, which other evidence in the case gives reason to doubt.

102. Mr Stephen Hill, a partner at Eversheds, who also formerly acted as the Claimants’ solicitors, gave evidence in relation to the ALE Claim. Mr Hill’s witness statement suffered a similar fault to Mr Newbery’s: he made assertions as to what (in his view) Mr Hogan of Wirsol and Mr Currier of Wirsol’s solicitors CMS could or could not have believed, and in substance made submissions about key matters in issue regarding the ALE claim. Mr Hill was straightforward in his oral evidence, and it would have been preferable for his witness statement to have been confined to matters of fact within his own knowledge.

(2) Defendants’ witnesses of fact

103. Mr Mark Hogan, managing director of Wirsol, gave the Defendants’ primary evidence of fact. Mr Hogan frankly accepted that (like Mr Kavanagh) he retained a financial interest in the outcome of the case, and at times he had a slight tendency to be argumentative or to down-play problems with the sites. He sometimes gave longer answers than were necessary, and could be diffuse in his answers. Having said that, I did not at any stage consider that he was giving his evidence less than honestly, and by and large have accepted his evidence. I specifically reject the Claimants’ contention, in their written closing submissions, that Mr Hogan’s answers in cross-examination were not credible or were evasive.

104. Mr Charles Currier of CMS, who acted as Wirsol’s solicitors, gave evidence in relation to the ALE Claim. He was a straightforward witness.

105. I have taken into account the Claimants’ submission that the Defendants refrained from calling a number of witnesses who might have had relevant evidence to give, and the comments of Fraser J in Energy Solutions v Nuclear Development Authority [2016] EWHC 1988 (TCC) at §§ 317-322 (citing Wisniewski v Central Manchester Health Authority [1998] PIQR 324) about inferences that may be drawn. In the light of the issues in this case, I have found the Claimants’ point to be significantly overstated. As appears later in this judgment, I have found it permissible to draw an inference on one issue where Mr Turner was not called. However, this is not in my judgment a case where individuals who were (adopting Fraser J’s words) ‘intimately involved’ in important issues and had ‘far greater knowledge’ about them than Mr Hogan were not called.

106. Permission was given to call expert evidence in four disciplines, dividing into three areas, as follows:

i) Technical defects experts: Mr Simon Ryder and Mr Robin Halliday on electrical engineering issues (called by the Claimants) and Dr Morris Lockwood on those issues (called by the Defendants).

ii) Solar asset valuation: Mr Colin Johnson (called by the Claimants) and Mr Richard Slark (called by the Defendants).

iii) Quantity surveying: Mr Michael King (called by the Claimants) and Mr Roy Andrew (called by the Defendants).

107. Although I have not accepted every aspect of their evidence, I am satisfied that each expert was appropriately qualified, and gave evidence reflecting his genuine considered opinion. It is appropriate to comment briefly at this stage on Dr Lockwood’s evidence, as the Claimants in cross-examination sought on several occasions to impugn his relevant experience, independence and impartiality. Dr Lockwood accepted that his experience did not lie in the design of transformers or solar parks. However, I am completely satisfied that his experience in electrical engineering in general, including specifically the operation of transformers, fully equipped him to provide the evidence he did. Dr Lockwood’s demeanour as a witness could occasionally appear dogged, but having heard and carefully considered the evidence he gave over three reports and two days of cross-examination (in the context also of the other experts’ evidence and the relevant documents), I am fully satisfied that his evidence reflected his genuine, considered opinions. I therefore reject the Claimants’ criticisms of his evidence indicated above.

(E) DEFECTS: OVERVIEW OF CLAIMS AND CONTRACTUAL SCHEME

108. Wirsol was required to provide to the SPVs defect and damage free solar parks designed, constructed and installed to specified standards. In the words of the Employer’s Requirements contained in Schedule 1 of each EPC, (also referred to in the EPC Contracts as the Employer’s Construction Requirements or Specification), the overarching intent was for Wirsol:

“to procure for the Employer a modern, functional, well-designed solar power plant capable of continuous, efficient and reliable operation with minimum maintenance. The equipment supplied shall be of proven, robust and reliable design incorporating protective systems and devices with adequate factors of safety and maintainability built-in.”

109. The Claimants allege defects at fifteen sites. In summary, they allege that:

i) ten solar parks suffered from transformers and busbars with insufficient capacity unable to cope with the supply of power from the Photovoltaic System (Scott Schedule item 1) with four of those having the supply of power from the inverters clipped or capped by Wirsol and with other adjustments that were a means adopted by Wirsol to seek to ameliorate the effects of the lack of capacity (Scott Schedule Items 2 and 3);

ii) at thirteen sites, Wirsol deployed forced air cooled transformers, rather than natural air cooled transformers (Scott Schedule Item 4);

iii) twelve sites suffered from excessive humidity and water ingress, dangerous plywood flooring, and a lack of sufficient circuit breakers (Scott Schedule Items 5- 11 and 14);

iv) all fifteen sites suffered from inadequate monitoring provision (Scott Schedule Items 15, 16 and 19), with one such defect alleged in respect of three sites only (Scott Schedule Item 17);

v) the Lisburn and Carrowdore sites were inadequately landscaped (Scott Schedule Item 20);

vi) at thirteen sites, Wirsol failed to comply with a warranty that it had designed the solar parks so that when completed they provide a minimum of 25 years operational life (Item 21); and

vii) by reason of the failure by Wirsol to remedy the defects, the SPVs were entitled to and did operate the termination provisions of both the EPC Contracts and the O&M Contracts.

110. In September 2018 the SPVs assigned absolutely to Toucan Energy the benefit of their claims against Wirsol under the EPC and O&M Contracts. Notice of the assignments was given on 28 September 2018.

111. By way of the claim assigned from the SPVs, Toucan Energy claims under and for breach of the EPC Contracts: the costs of reinstatement; diminution in value or blight reinstatement; lost revenue as a result of defects; together with a number of other losses.

(2) The EPC Contractual Scheme

112. The EPC Contracts are materially in the same form and contents.

113. Wirsol was required to carry out and complete the Works, including the Permanent Works, being the design and engineering, procurement, manufacture, installation, construction, testing and commissioning of the solar power plant and ancillary equipment at the site, including as described in the Employer’s Requirements.

114. The EPC Contracts imposed general obligations upon Wirsol as Contractor as to the quality of design, construction, and defects, including at clause 4.1 of the Conditions of Contract. This clause also contained the Contractor’s warranty that the Works when completed shall provide a minimum design operational life of 25 years.

115. Clause 5.3 of the EPC Contracts contained an undertaking by Wirsol that all of its work was in accordance with, inter alia, the terms of the EPC, Good and Prudent Practice, and the technical specification and requirements of the Connection Agreement. The Connection Agreement is the agreement with the relevant DNO permitting the export of power to the network.

116. Clause 7.1 of the EPC Contracts made provision as to the quality of plant, materials and workmanship used and deployed by Wirsol.

117. Clause 11 of the EPC Contracts provided a scheme that granted a right to Wirsol during the Defects Notification Period, the two year period following the issue of the Taking-Over Certificate, to remedy defects or damage in the Works itself at its own risk and cost. By clause 11.4 in respect of a failure by Wirsol to carry out remedial work to defects or damage, the Employer may have the work carried out at Wirsol’s cost.

118. The Employer’s Requirements in each EPC essentially set out a specification against which Wirsol’s Works were required to comply. The Employer’s Requirements of particular general relevance include: Clause 2.1 (general intent); clause 2.4 (intended purpose including to provide continuous operation subject to actual irradiation levels); clause 2.12 (25 year design life requirement); clause 3.2 (general design requirements including that no single fault shall cause the failure of any duty equipment); clause 4.1 (design and operational requirements of the electrical specification); clause 4.4.5 (requirements for transformers); and clause 4.4.7 (requirements for dry type transformers).

119. Pursuant to clauses 4.1, 5.3 and 5.4 of the Conditions of Contract and clause 2.11 of the ERs the design shall comply with all laws and regulations. The Electricity at Work Regulations 1989, regulations 5 and 11 detail requirements for electrical equipment. Regulation 5 requires that “No electrical equipment shall be used where its strength and capacity may be exceeded in such a way as may give rise to danger.” Regulation 11 provides that “Efficient means, suitably located, shall be provided for protecting from excess of current every part of a system as may be necessary to prevent danger.”

120. Clause 15 of the Conditions of Contract provided a stepped mechanism for the SPVs to terminate the EPC Contracts for a wide range of causes including a failure of Wirsol to make good a notified failure to carry out any of its obligations under the EPC (clause 15.2 (a)) and a failure of Wirsol to remedy a notified remediable material breach of obligations under the EPC (clause 15(2)(g)(i)).

121. The O&M contracts were agreements entered into by the SPVs and Wirsol by which Wirsol agreed to carry out maintenance, monitoring and repair services in relation to the 15 sites including to the standards set out in clause 11.

122. Clause 24 of the O&M contracts provided that Wirsol may sub-contract the performance of all or part of the Services to any sub-contractor “provided that such sub-contractors and the terms and conditions of their appointment have first been approved by the Employer in writing, such approval not to be unreasonably withheld.”

123. A similarly extensive scheme permitting termination of the O&M contracts by the SPVs was provided in clause 20. This included that the SPV may terminate the employment of Wirsol by written notice if specified events of default occurred including breach by Wirsol of its obligations under clause 24 (clause 20.5.3) and the corresponding EPC is terminated under clause 15 of the EPC (clause 20.5.4). The O&M contracts provided that termination takes effect 30 business days after the date of a termination notice.

(F) CAPACITY DEFECTS AND PROTECTION SETTINGS (Scott Schedule Items 1 and 3)

124. The Claimants’ case is that in relation to ten of the solar parks, Wirsol provided transformers and busbars of insufficient capacity to process the current from the inverters and this constituted a material breach of the EPC Contracts.

125. An initial point arises about the scope of this part of the claim. The Claimants’ Re-Re-Re-Amended Particulars of Claim (“RRRAPoC”) allege that:

“In breach of clauses 4.1, 4.9, 5.1, 5.3, 5.4, 5.8, 9.6 & 11.1 of the EPC Contracts and paragraphs 2.4, 2.5.1, 3.1, 3.2, 4.2, 4.4 & 4.4.5 of Schedule 1 to the EPC Contracts (at least) each of the Wrea Green, Cranham, Wilbees, Moor House, Otherton, Five Oaks, Outwood, Newton and Widehurst Solar Parks the transformers, busbars and Woodward relays installed are, in combination and when operated at appropriate settings, of insufficient capacity to allow the transformers to operate at their rated output for the maximum load curve provided by the PV systems on any ratio (“the Capacity Defect”).” (§ 21)

126. The Scott Schedule, dated (in various iterations) 26 March 2019, 28 May 2019, 24 August 2019 and 1 September 2020, at “item 1”, added a tenth site, Home Farm. No claim was advanced referring specifically to the Eckland Lodge or Woodhouse solar parks.

127. The Claimants’ expert, Mr Ryder, addressed the capacity issue in his first report dated 24 June 2020 as concerning the capacity of the transformers and busbars at the ten sites named above. The relevant section (“Scott Schedule Item 1”) of the experts’ Joint Memorandum, dated 29 May 2020, dealt in the lists and tables at §§ 1.1.1.8, 1.1.2.14 and 1.1.2.20 only with the nine sites referred to in the RRRAPoC.

128. Dr Lockwood’s second report, dated 31 July 2020, included a table setting out the available data relating to all of the transformers, including those at Eckland Lodge and Woodhouse. Mr Ryder’s second report, also dated 31 July 2020, likewise included tables setting out capacity information in relation to the transformers and busbars including those at Eckland Lodge and Woodhouse.

129. The exhibits to Dr Lockwood’s third report, dated 11 October 2020, included information in relation to the busbars and transformers at Woodhouse but not Eckland Lodge. Mr Ryder in his third report, dated 21 October 2020, stated that he was applying his methodologies for determining the required capacity for the busbars and transformers “to calculate the required [busbar] [transformer] capacity for the sites covered by item 1 of the Scott Schedule and two sites with a similar conceptual design (Eckland Lodge and Wood House)”. The Claimants’ quantum expert set out figures for remedial work including the replacement of transformers and busbars at both these sites.

130. The cross-examination of Mr Ryder included the following exchanges:

“Q. Yes. So just picking up one point to make sure it's common ground, you say you include Eckland Lodge in your table in Ryder 2, for comparison purposes. …

So you say there, the mini paragraph: "I've included Eckland Lodge (Reading to the words) for completeness and for comparison purposes." Yes?

… That's because, isn't it, that as regards capacity there's actually no claim in respect of Eckland Lodge or indeed Woodhouse, is there?

A. That's quite correct. I think Dr Lockwood included Woodhouse for completeness or perhaps just because he visited the site, and I included Eckland Lodge as well.

Q. That's fine, thank you. In that case my final substantive category relates to forced air cooling.” (Day 13/48/3-23)

131. The Claimants now seek to advance a claim in relation to busbar and transformer capacity at Woodhouse, though not at Eckland Lodge. They submit that the words “at least” in the RRRAPoC mean that such a claim is sufficiently pleaded, and that the parties have proceeded on the basis that it is included. Failing that, by their written closings they seek permission to amend, suggesting that “there is no question of any further or different evidence being required”.

132. I do not accept that any capacity claim relating to the busbars and transformers at Woodhouse is sufficiently pleaded. The Claimants’ case on capacity is set out in its RRRAPoC § 21 and, in more detail, item 1 of the Scott Schedule. In circumstances where the Scott Schedule specifies ten sites, not including Woodhouse, in relation to which the claim is made, the words “(at least)” in RRRAPoC § 21 do not suffice to bring Woodhouse within the claim.

133. Nor would it be just to grant permission to amend. As the exchange quoted above indicates, the Defendants presented their case at trial on the basis that no capacity claim was advanced in relation to either Eckland Lodge or Woodhouse, and (it can fairly be inferred) refrained from pursuing lines of questioning in relation to those sites on that basis. It is unnecessary and inappropriate to speculate on what further questions might have been asked, or with what outcome, had the Claimants been advancing a claim in relation to Woodhouse. Had the Claimants wished to add such a claim, they could and should have made a timely application to do so. The exchange quoted above put the Claimants explicitly on notice of the assumption the Defendants were making in this regard. In these circumstances, it is far too late to seek to amend during closings. I decline to grant permission to amend.

134. Separately, the Defendants submit that the claim for the replacement of a transformer at Cranham has been overtaken by events. The Particulars of Claim were first settled in 2018. In April 2019, the Cranham transformer failed, and it has already been replaced with an outdoor oil-immersed transformer. The Claimants have suggested that that failure was evidence of the alleged humidity defect, but no claim has been brought alleging that the Defendants are responsible for the transformer’s failure. Nor have the costs of that replacement been claimed.

135. The Defendants say any capacity defect in the transformer previously in place at Cranham is therefore irrelevant, since the transformer has since been destroyed by reason of something other than any capacity defect, which can therefore have caused no loss.

136. However, as the alleged capacity defect at Cranham has possible relevance to the Claimants’ alleged entitlement to terminate, I include it in my consideration below.

137. By amendments made during the course of trial, following the rulings referred to on their partly unsuccessful application for permission to amend at the start of trial, the Defendants have admitted that:

i) the transformers at Five Oaks TX2, Newton TX1, and Outwood TX1 lack sufficient capacity and require replacement; and

ii) the busbars at Five Oaks TX2, Newton TX1, Outwood TX1 and Wilbees TX1 lack sufficient capacity and require replacement.

I have in this judgment adopted the parties’ practice of using the designations “TX1” and “TX2” to refer to the first and second transformers at particular sites.

138. The main contractual requirements relevant to transformer and busbar capacity are set out in the EPC Conditions of Contract and the Employer’s Requirements.

139. Clauses 4.1, 5.3 and 5.4 of the Conditions of Contract provide as follows:

“4.1 Contractor’s General Works Obligations

The Contractor shall design, execute, install, test, Commission and complete the Works in accordance with this Contract, and shall remedy any defects in the Works, in each case:

a) in accordance with Good and Prudent Practice;

b) in accordance with all relevant Standards and codes of practice to which the Contractor would be expected to have regard;

c) in accordance with the Employer’s Construction Requirements and the other terms and conditions of this Contract;

d) in compliance with all applicable Laws and Permits; and

e) in a manner that is not likely to be injurious to health or cause damage to property.

When completed, the Works shall meet the requirements as set out in paragraph 2.4 of Schedule 1 (Employer’s Construction Requirements) and in the Contractor warrants that it has designed the Works to have a minimum design operational life of 25 years under the operational conditions set out in the Employer’s Construction Requirements, provided that the same are operated and maintained (and where relevant, replaced) in accordance with the operational and maintenance manuals received in accordance with Clause 5.7 (Operation and Maintenance Manuals) and provided that the individual component parts sets out in Clause 4.5 (Key Sub-Contractor) shall only be warranted for the periods set out in that Clause 4.5.

The Contractor shall provide the Contractor’s Documents specified in this Contract, and all Contractor’s Personnel, Goods, consumables and other things and services, whether of a temporary or permanent nature, as are required in and for the design, execution, installation, testing, Commissioning and completion of the Works and remedying of defects, in each case in accordance with this Contract.

The Works shall include any work which is necessary to satisfy the Employer’s Construction Requirements, or is implied by this Contract, and all works which (although not mentioned in this Contract) are necessary for stability or for the completion, or sale and proper operation, of the Works.

…”

“5.3 Contractor’s Undertaking

The Contractor undertakes that the Contractor’s Documents, the design, execution, installation, testing, Commissioning and completion of the Works, the remedying of defects and the Works when completed will be in accordance with:

a) all applicable Laws, Permits, licences and approvals;

b) the documents forming this Contract, as altered or modified by any variations;

c) Good and Prudent Practice;

d) the technical specification and requirements of the Connection Agreement;

e) the requirements to the register on the Ofgem Renewables and CHP Register and to qualify for Renewable Obligations Certificates

and shall be free and clear of all liens, charges and encumbrances of any kind.

5.4 Technical Standards and Regulations

The Contractor undertakes that the Contractor’s Documents, the design, execution, installation, testing, Commissioning and completion of the Works, the remedying of defects and the Works when completed will comply with the applicable technical standards (as described in the Employer’s Construction Requirements(s) the “Applicable Standards” and all applicable building, construction and environmental Laws’ Laws applicable to the product being produced from the Works (as applicable), and other standards specified in the Employer’s Construction Requirements, applicable to the Works, or defined by the applicable Laws.

Where there is any conflict between any of the standards or Laws specified in the preceding paragraph, the highest of the conflicting standards or Laws shall apply, unless otherwise agreed by the Employer in writing (as its absolute discretion).

All these Laws shall, in respect of the Works, be those prevailing when the Works are taken over by the Employer under Clause 10 (Employer’s Taking Over). References in this Contract to published standards shall be understood to be references to the edition applicable on the Base Date, unless stated otherwise.”

140. The Employer’s Requirements include the following relevant provisions:

2.1 (Introduction) “The intent of the Specification is to procure for the Employer a modern, functional, well-designed solar power plant capable of continuous, efficient and reliable operation with minimum maintenance. The equipment supplied shall be of proven robust and reliable design incorporating protective systems and devices with adequate factors of safety and maintainability built-in. …”

2.4 (Intended Purpose) “The Works will comprise a solar powered power generating station with an installed generating capacity as set out in the Contract.

The Works will be connected to the existing DNO system via a new 11/33kV connection.

The Works will be:

· new, proven and safe

· designed for high availability, reliability, and efficiency

· comply with the connection agreement standards as defined by the DNO

…

· … capable of long term continuous operation subject to actual irradiation levels during the operating life of the Works.

For the avoidance of doubt, this Section is not an exhaustive statement of the “Intended Purpose””

2.12 (Design life) “The Works shall be designed for a minimum operating life of a period of at least 25 years, taking full account of proximity to coastal environment and ground type (PH).”

3.2 (General Requirements) “…The Works shall be designed so that no single fault shall cause the failure of any duty equipment. The design shall incorporate adequate redundancy to achieve high reliability and availability incorporating redundant equipment and components with automatic startup of the standby item in the event of failure of the duty item. …

All equipment shall be designed to permit safe shutdown on loss of electrical power supply or on loss of control equipment. The Works shall fail safe and all protection devices shall be de-energised to trip.”

4.1 (Design and Operational Requirements) “Electrical equipment shall:

· Comply with the “Requirements for Electrical Installations” BS7671 - 2008 and all other appropriate codes and standards.

Be designed to ensure satisfactory operation under such sudden variations of load and voltages as may be met under working conditions, including those due to starting loads, transient short circuits and internal/external fault conditions. The equipment shall be designed to withstand the specified maximum short circuit currents and duration without the temperature exceeding the value permitted for the related class of insulation. The equipment shall be considered as being operated at maximum permitted current under normal operating conditions prior to the occurrence of any short circuit current.

· Include protective relays and systems to detect all credible faults on each item of plant and equipment and their primary interconnections, and arranged so that on functioning only the faulty apparatus is removed from the circuit.

· Incorporate safety interlocking systems to ensure correct system operation, to avoid unsafe switching conditions and to ensure safe isolation for maintenance. …”

4.4.5 (Transformers) “Transformers and associated equipment will comply with the requirements of IEC 60076. In addition to type testing to IEC60076 standard, Each transformer shall be routinely tested at factory prior to acceptance by the Contractor to IEC60076 standard. The tests are specified in Schedule 8.

Each transformer will be suitable in all respects to operate without injurious heating at its rated output for the maximum load curve provided by the PV System under the Site Conditions and for the transformer on any ratio operating with daily cycling. …”

141. International Standard IEC 60076 Part 11 (“IEC 60076-11”) deals with dry-type transformers. Part 11 § 11 relates to temperature-rise limits and is relevant to the concept of “injurious heating”. I consider it under sub-heading (7) below. IEC 60076 Part 12 (“IEC 60076-12”) is entitled “Loading guide for dry-type power transformers”. Part 12 § 4 relates to the “Effect of loading beyond nameplate rating” and states:

“4.1 General

Normal life expectancy is a conventional reference basis for continuous duty under design ambient temperature and rated operating conditions. The application of a load in excess of nameplate rating and/or an ambient temperature higher than specified ambient temperatures involves a degree of risk and accelerated ageing. It is the purpose of this part of IEC 60076 to identify such risks and to indicate how, within limitations, transformers may be loaded in excess of the nameplate rating.

4.2 General consequences

The consequences of loading a transformer beyond its nameplate rating are as follows:

– the temperatures of windings, terminals, leads, tap changer and insulation increase, and can reach unacceptable levels;

– enclosure cooling is more sensitive to overload leading to a more rapid increase in insulation temperature to unacceptable levels;

– as a consequence, there will be a risk of premature failure associated with the increased currents and temperatures. This risk may be of an immediate short-term character or may come from the cumulative effect of thermal ageing of the insulation in the transformer over many years.

NOTE Another consequence of overload is an increased voltage drop in the transformer.

4.3 Effects and hazards of short-time emergency loading

The main risks, for short-time emergency loading over the specified limits, are

– critical mechanical stresses due to increased temperature, which can reach an unacceptable level causing cracks in the insulation of a cast resin transformer;

– mechanical damage in the winding due to short and repetitive current above rated current;

– mechanical damage in the winding due to short and repetitive current combined with ambient temperature higher than specified;

– deterioration of mechanical properties at higher temperature could reduce the short-circuit strength;

– reduction of dielectric strength due to elevated temperature.

As a result the maximum overcurrent is limited to 50 % over the rated nominal current.

The agreement of the manufacturer is necessary in case of overloading in excess of 50% to assess the consequences of such overloading. In any case the duration of such overloading should be kept as short as possible.

4.4 Effects of long-time emergency loading

The effects of long-time emergency loading are the following: