Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Cabo Concepts Ltd & Anor v MGA Entertainment (UK) Ltd & Anor [2025] EWHC 1451 (Ch) (16 June 2025)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2025/1451.html

Cite as: [2025] EWHC 1451 (Ch)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2025] EWHC 1451 (Ch)

Case No: HP-2020-000016

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INTELLECTUAL PROPERTY LIST (ChD)

PATENTS COURT

Rolls Building

Fetter Lane

London, EC4A 1NL

16 June 2025

Before :

MRS JUSTICE BACON

- - - - - - - - - - - - - - - - - - - - -

Between :

(1) CABO CONCEPTS LIMITED

(2) THE LICENCE WORLD LIMITED

Claimants

- and -

(1) MGA ENTERTAINMENT (UK) LIMITED

(2) MGA ENTERTAINMENT, INC

Defendants

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Ronit Kreisberger KC, Mark Chacksfield KC, Stefan Kuppen, Alfred Artley& Greg Adey (instructed by Spector Constant & Williams Limited) for the Claimants

Victoria Wakefield KC, Jennifer MacLeod & Richard Howell (instructed by Fieldfisher LLP) for the Defendants

Hearing dates: 8 October15 November 2024, 1421 January 2025

- - - - - - - - - - - - - - - - - - - - -

Judgment Approved

This judgment was handed down remotely at 10 am on 16 June 2025 by circulation to the parties or their representatives by email and by release to the National Archives.

Introduction .............................................................................................................................. 1

The evidence of fact ................................................................................................................. 9

Cabo's witnesses of fact ..................................................................................................... 9

MGA's witnesses of fact .................................................................................................. 16

Mr Larian's breaches of purdah ....................................................................................... 27

The expert evidence................................................................................................................ 38

The toy industry experts ................................................................................................... 38

The economic and valuation experts: preliminary comments .......................................... 42

Assessment of the economic and valuation evidence ...................................................... 55

The Decision Tree Model (DTM) .................................................................................... 58

Issues ....................................................................................................................................... 62

Factual background ............................................................................................................... 66

The UK toy industry ......................................................................................................... 67

MGA and LOL Surprise ................................................................................................... 74

The founding of Cabo and development of Worldeez ..................................................... 79

The initial marketing of Worldeez.................................................................................... 89

Discussions with the launch retailers................................................................................ 93

MGA's intervention ....................................................................................................... 104

Worldeez repackaging and relaunch............................................................................... 154

Demise of Cabo............................................................................................................... 177

Procedural background....................................................................................................... 182

Abuse of dominance claim................................................................................................... 188

Overview of the legal framework................................................................................... 188

The relevant market definition........................................................................................ 192

Whether MGA was dominant on the relevant market.................................................... 255

Whether MGA's conduct amounted to an abuse............................................................ 306

Conclusion on abuse of dominance................................................................................. 357

Unlawful agreements claim.................................................................................................. 358

Overview of the legal framework................................................................................... 358

Agreements with the toy traders .................................................................................... 367

Anticompetitive object or effect ..................................................................................... 375

Exemption under the VBER............................................................................................ 387

Exemption under s. 9 / Article 101(3) ............................................................................ 411

Conclusion on the unlawful agreements claim .............................................................. 415

Patent threats claim.............................................................................................................. 416

Overview of the legal framework................................................................................... 416

Threats of patent infringement proceedings.................................................................... 421

"Person aggrieved".......................................................................................................... 444

Conclusion on the patent threats claim........................................................................... 446

Causation and quantum....................................................................................................... 447

Preliminary comments.................................................................................................... 447

Legal principles............................................................................................................... 451

Causative effect of MGA's conduct................................................................................ 478

Actionable damage and causation: Cabo's heads of loss................................................ 493

Whether Cabo would have traded profitably in the counterfactual case........................ 501

The parties' quantum models.......................................................................................... 594

Declaratory relief.................................................................................................................. 680

Conclusions............................................................................................................................ 682

MRS JUSTICE BACON:

Introduction

- This claim concerns the sale of rival brands of small plastic toys. In 2017 the claimants (Cabo), a toy start-up company, launched a new toy brand called Worldeez, which was a line of surprise collectible figurines with a world travel theme, packaged in a plastic capsule designed to represent a globe. Cabo contends that the defendants (MGA) stifled the launch of Worldeez by claiming that the globe was a "knock off" of MGA's very popular "LOL Surprise!" toy, and by threatening toy retailers that their supplies of LOL Surprise would be withheld if they stocked the Worldeez globe. The Worldeez toy went on to fail, and was discontinued in 2018.

- Cabo's case is that MGA's conduct amounted to (i) an abuse of a dominant position contrary to the prohibition in Chapter II of Part I of the Competition Act 1998 (the 1998 Act) and/or Article 102 TFEU; (ii) unlawful agreements contrary to the prohibition in Chapter I of Part I of the Competition Act 1998 and/or Article 101 TFEU; and (iii) unjustified threats of patent infringement proceedings within the meaning of s. 70 of the Patents Act 1977 (the 1977 Act). Cabo claims that but for MGA's unlawful conduct Worldeez would have been a successful product and Cabo would have gone on to become a successful toy business. Cabo claims loss and damage in the form of lost profits. The initial claim was for in excess of £170m. By the end of the trial, the claim had reduced to £5390m, depending on the assumptions used in Cabo's quantum models.

- MGA denies any infringement of competition law. It denies dominance during the relevant period; contends that even if dominant, its conduct was not abusive; and argues that any agreements between MGA and retailers not to stock the Worldeez globe were not restrictive of competition and were in any event exempted from the Chapter I prohibition and Article 101 TFEU by virtue of the Vertical Agreements Block Exemption Regulation 2010/330/EU [2010] OJ L102/1 (the VBER). MGA further contends that its threats to retailers were not (properly characterised) threats of patent infringement proceedings, and that even if there were such threats they did not cause retailers not to stock Worldeez. More generally, MGA argues that irrespective of its conduct Cabo's toy business would most likely have failed, on the grounds that the founders of the business were inexperienced and naοve, with inadequate operational control, insufficient capital support and an insufficiently appealing and innovative product to achieve commercial success in the highly competitive toy industry (both UK and worldwide). On that basis MGA says that Cabo's damages claim should fail.

- The case was originally listed for trial in June 2022. A few weeks before the trial was due to commence, however, it was adjourned because of the discovery of significant flaws in MGA's disclosure process. Further disclosure was then provided in 2023 and the trial was relisted for 2024. The main part of the trial took place over four weeks in October and November 2024. The trial was then adjourned by the court shortly before the written closing submissions were scheduled to be delivered, with the closing submissions ultimately filed in December 2024 and oral closing submissions in January 2025.

- Along with their written closing submissions, the parties filed various additional excel spreadsheets with further or updated figures and calculations supporting their respective submissions on the quantum assessment. The parties also filed an updated version of the agreed Decision Tree Model (DTM), an excel spreadsheet combining the parties' central inputs for the quantum assessment, in a form which could be manipulated by the court. Numerous further materials relating to (in particular) the economic evidence, including the quantum models, were filed during the course of the oral closing submissions, including further excel spreadsheets on both sides, and a further iteration of the DTM.

- By the last day of the oral closing submissions, it became apparent that the parties' positions on the quantum assessment were still evolving. The parties' final positions on a number of specific points were subsequently filed on 17 February 2025, and a final version of the DTM was provided on the same date. In response to questions from the court, further figures and explanations were provided by the parties on 12 March and 9 and 14 April 2025. Those addressed specific points on the market shares, the DTM, and the parties' profitability calculations.

- During the trial, submissions on behalf of Cabo were made by Ms Kreisberger KC, Mr Chacksfield KC and Mr Kuppen, with cross examination and re-examination divided between them and Mr Artley, and Mr Adey assisting as junior counsel. MGA's submissions, cross-examination and re-examination were divided between all three of its counsel team, namely Ms Wakefield KC, Ms MacLeod and Mr Howell.

- I am very grateful for the assistance of all of the counsel instructed in these proceedings, noting not least the efforts on both sides to accommodate the adjourned closing submissions in the case. It will be apparent from the comments above and the remainder of this judgment that this was a case of considerable complexity, on both issues of substance and procedure. It is, in those circumstances, to the credit of the counsel teams that the trial was conducted with the utmost professionalism and courtesy on both sides.

- Cabo's main witnesses were Mr and Mrs Michaelson and Mr and Mrs Cohen. These two couples were the founders of Cabo alongside two further individuals, Marc Sivner and Alexander Lazarus, who have since exited the company. The Michaelsons and Cohens are now the sole shareholders of Cabo; Mr Lazarus is, as discussed below, a witness for MGA; and Mr Sivner has not participated in these proceedings in any way. I will refer to the Michaelsons and Cohens in this judgment as the Cabo founders.

- Marc Michaelson had been a director of a sports equipment business prior to founding Cabo. Within Cabo he contributed to the product design of Worldeez and led the marketing of the product. Mr Michaelson provided five witness statements, giving extensive evidence about the background to the creation of Cabo, the design and launch of the Worldeez brand, MGA's intervention in May 2017 and the retailer response, Cabo's efforts to sell Worldeez despite the dispute with MGA, and the eventual demise of both the product and Cabo's business. He was cross-examined on that evidence over one and a half days (with the evidence of Mr Hunter, one of MGA's witnesses, interposed briefly on the second morning). His evidence was unfortunately very defensive, and evasive on numerous points. It was apparent that his answers were designed to advance Cabo's case, even when those answers were inconsistent with the contemporaneous documentation or otherwise implausible. It was also apparent that he did not have a firm grasp of the details of Cabo's business, including on points covered in his witness statements. I do not regard him as a reliable witness.

- Hayley Michaelson is married to Mr Michaelson and is the sister of Lauren Cohen. She had a degree in Childhood Studies and experience working with children, and she and Mrs Cohen had the initial idea for the Worldeez toy, based on observing their own children's interest in particular toys. Within Cabo, Mrs Michaelson was principally responsible for the Worldeez product design, alongside Cabo's designer Helder Olivier. She provided two witness statements addressing mainly that issue, and was cross-examined for around half a day. She was a frank and straightforward witness, who sought to answer questions directly. However, while her passionate belief in the prospects of success of the Worldeez brand was evidently sincere, she came across as rather naοve regarding the commercial challenges faced by a startup toy company.

- Johnny Cohen had previously operated multiple successive businesses selling heat packs, several of which had been liquidated with significant outstanding unsecured liabilities. His role in Cabo was mainly to oversee the manufacturing and import of Worldeez products. He was also (albeit to a more limited extent) involved with Cabo's finances, product design and marketing. Mr Cohen provided five witness statements, mainly addressing the design of the Worldeez toy, the manufacturing process, marketing, costs and sales projections, and the reaction to MGA's threats, as well as his initial discussions on international sales and licensing. His cross-examination took most of a day. He was another very defensive and sometimes combative witness, whose optimism regarding the success which he considered Worldeez would have enjoyed obscured a realistic assessment of the commercial position. He was very willing to blame others for problems, including internal logistical and administrative issues, and reluctant to take responsibility for matters that had been within his control. As with Mr Michaelson, I do not regard him as a reliable witness.

- Lauren Cohen is married to Mr Cohen. She practised as a solicitor before founding Cabo, and along with Mrs Michaelson her main responsibility was the design of the Worldeez products. She provided a very short witness statement addressing the alleged similarities between the Worldeez globe and LOL Surprise, and was cross-examined only very briefly. Her evidence was undoubtedly sincere, but (as with the evidence of the other Cabo founders) was coloured by her optimism in the likely success of the product.

- Nick Mowbray is the co-founder of Zuru Toys, which has marketed a number of commercially successful toys including "5 Surprise Mini Brands". He provided one short witness statement and was cross-examined remotely from New Zealand for around two hours. His evidence addressed, in particular, his knowledge of and interactions with MGA and Mr Larian, his experience of bringing a successful toy to the market, and his views on the likely commercial success of Worldeez (although he was called as a witness of fact, rather than a toy industry expert). I have no reason to doubt that his views were honestly held. Equally, however, it was clear that he and Mr Larian were longstanding rivals, and that he was keen to support Cabo as having been a small new entrant to the toy business and potential challenger to MGA. I do not, therefore, consider his evidence to have been entirely objective.

- Richard Spector is the solicitor at Spector Constant & Williams with primary conduct of the case for Cabo. He provided a very short witness statement describing a brief exchange of messages on the social media platform LinkedIn, between himself and Kevin Macnab, the former president of TRU International, in which Mr Macnab said that he had no recollection of speaking to Mr Larian about Worldeez in 2017, and did not want to become involved in the dispute between Cabo and MGA. Mr Spector was not cross-examined at the trial.

- Isaac Larian is the founder and CEO of MGA, and the main protagonist in the events of 2017 which form the subject-matter of this claim. He was therefore the main witness for MGA. He provided, prior to the trial, four witness statements, and was cross-examined over two days. His evidence was defensive and argumentative throughout, attempting to give speeches as to the evidence in the case rather than answering the questions put to him (to the extent that he had to be repeatedly reminded to address the question rather than trying to put his case). His mantra that a retailer stocking a "knock off" did not need the original product was repeated at least seven times during his cross-examination, frequently as a means to avoid giving a straight answer to the question put to him. He repeatedly refused to give proper (or any) answers to questions, instead making implausible denials or simply responding "no comment". By the second day of his cross-examination he was increasingly irascible, giving irritated and facetious answers.

- On the basis of the content and manner of Mr Larian's evidence during this part of the trial, I regret to say that I considered Mr Larian to be an unreliable witness who was less than candid in his evidence to the court. That impression was reinforced by Mr Larian's multiple breaches of purdah between the first and second days of his evidence, and the subsequent evidence that he gave when recalled to be cross-examined on this point, which I address below. My conclusion is that I can give no weight to Mr Larian's evidence where it is not corroborated by the contemporaneous documents or the evidence of other more reliable witnesses.

- Andrew Laughton was, during the events at issue in these proceedings, the managing director and senior vice president of MGA. He was a central figure in the implementation of MGA's conduct in relation to Worldeez, acting as Mr Larian's mouthpiece and enforcer. Numerous of the communications relied on by Cabo as constituting infringements of the competition rules and unjustified threats of patent infringement proceedings emanated from Mr Laughton, whether in the form of emails or telephone calls to retailers. Mr Laughton was therefore a central witness for MGA. He provided three witness statements and was cross-examined for a little less than a day. He sought to give the impression of being unwillingly caught in a conflict between Mr Larian and the retailers, with a rather grandiose suggestion that he played the part of a "Kofi Annan" peacemaker. In reality, it was apparent from the contemporaneous documents that he was a willing and proactive participant in Mr Larian's conduct. His answers to questions about the events of 2017 were often evasive, seeking to play down the impact of his communications with the retailers. I do not regard Mr Laughton as an entirely reliable witness, and have treated his evidence with caution.

- Alexander Lazarus is one of the two founders and directors of Singleton Trading Limited (Singleton), a successful toy company which sells "close-out" stock to toy retailers, and the related company Sinco Toys Limited (Sinco), a licensing and distribution business. His business partner in both companies is Marc Sivner, who is Mr Michaelson's cousin. Mr Lazarus and Mr Sivner were initially shareholders in Cabo, alongside the Cabo founders, and Singleton provided both financial backing and logistical support for the launch of Worldeez. Mr Lazarus provided two witness statements, addressing Singleton's involvement with Cabo, the development of the Worldeez product, the launch of Worldeez and MGA's reaction, and the subsequent demise of Worldeez. He was cross-examined for almost a day, and his evidence was, in general, objective and candid. Cabo contended that Mr Lazarus' credibility was undermined by the fact that Sinco entered into a licensing agreement with MGA in 2018, while Mr Sivner and Mr Lazarus were still directors of Cabo. It is fair to say that when Mr Lazarus was questioned about that agreement, his answers were somewhat defensive. Ultimately, however, the Sinco licensing agreement has no bearing on the facts relevant to the present proceedings; and in relation to the events material to these proceedings Mr Lazarus' evidence was both measured and corroborated by the contemporaneous documents.

- Stuart Grant is a shareholder and director of The Entertainer, a family-owned toy business founded by his parents Catherine and Gary Grant. The Entertainer was one of the toy retailers threatened by MGA, and during that period Stuart Grant was the company's buying director. Stuart Grant provided three witness statements describing The Entertainer's initial order of Worldeez, MGA's intervention, and The Entertainer's subsequent decision not to stock the globe. He was cross-examined for around half a day, and was a straightforward witness, giving measured and candid responses. I consider him to be a reliable witness on the factual issues in dispute, albeit that (for the reasons discussed below) I do not entirely accept his characterisation of The Entertainer's decision not to stock the Worldeez globe.

- Hayley White is (and was, during the relevant period of time) the toy buyer at the retailer B&M Retail Limited (B&M). She provided a short witness statement describing B&M's sales of Worldeez during 2017 and its relationship with MGA in 2018. She was cross-examined very briefly, and was a straightforward and candid witness.

- Darran Garnham is the founder and CEO of Toikido Limited, an entertainment company specialising in digital design and toys. He gave some advice to the Cabo founders and Singleton on the design of the Worldeez product in 2016, and provided a witness statement responding to the Cabo founders' evidence about their discussions with him during that period. He was cross-examined very briefly, and his evidence was straightforward and entirely credible.

- John Hunter is a director and co-owner of AB Gee of Ripley Limited (AB Gee), a toy wholesaler which supplies smaller independent toy retailers. He provided a short witness statement addressing AB Gee's position in the toy market, its sales of Worldeez and its interaction with MGA regarding the sale of Worldeez. MGA then issued a witness summons to compel Mr Hunter's attendance at the trial. His (brief) cross-examination was interposed at the start of the second day of Mr Michaelson's cross-examination, and his evidence was entirely straightforward.

- Kathy Brandon is vice president of research and consumer insights at MGA. She provided a short witness statement to explain two viability studies conducted by MGA in 2017 and 2018, addressing the girls' collectibles market (with the focus apparently being on the US market) and MGA's products in that market. She was not cross-examined, but it was agreed that her evidence was admissible as hearsay evidence, and should be given the same weight as if she had been called and given evidence in court.

- Nicholas Pimlott is one of the partners at Fieldfisher with primary conduct of the case for MGA. He provided a very short witness statement recording a telephone call with Sally Hunter, who was the sales director at Sinco between July 2017 and March 2018, and subsequently worked at MGA. She had provided information to Mr Pimlott regarding the sales of Worldeez during the time of her employment at Sinco, but was not thereafter willing to give evidence in these proceedings. Mr Pimlott was not cross-examined on his witness statement and nothing ultimately turned on his evidence.

- Patrick Smyth is the co-founder and a director of Smyths Toys (Smyths). He provided two witness statements referring to his interactions with Cabo regarding the purchase of Worldeez, and denying that MGA had pressured him to drop the product. Shortly before the trial was due to start, Mr Smyth said that he was no longer able to attend court. It was therefore agreed that his evidence was admissible as hearsay, but I have treated it with appropriate caution where his account was inconsistent with the contemporaneous documentation and other witness evidence.

- During the first day of Mr Larian's cross-examination on Thursday 17 October 2024, he was twice warned by the court about the purdah rules for witnesses giving evidence, in terms which reminded him that he could not talk to his legal team or anyone else about the case until the end of his cross-examination the following day. He confirmed that he was aware of the rules.

- Before the start of the hearing the next day, however (i.e. Friday 18 October), the court was informed that after court on the previous evening (at 17:59) Mr Larian had sent an email concerning the case to his counsel Ms Wakefield, two of his solicitors, Stephen May and Nicholas Pimlott, and the head of litigation at MGA, Richard Grad. That email carried the subject line "Nick Mowbray" and set out a series of questions which Mr Larian proposed should be put to Mr Mowbray in his cross-examination which was scheduled for the following Monday. That email was, quite properly, immediately deleted by each of the recipients, and a reply was sent to Mr Larian from Mr Pimlott (at 18:02) saying "We cannot read this email. As explained, please do not email, text or otherwise contact us while you are in purdah before you have finished giving your evidence tomorrow."

- In discussion with Ms Wakefield and Ms Kreisberger at the start of the hearing on the Friday morning, it was agreed that Mr Larian would hand over his mobile phone to his solicitors until the end of his cross-examination that day, and that at the end of the day it would be examined by Ms Wakefield and his solicitors to ascertain whether Mr Larian had communicated (or had sought to communicate) with anyone else during the period while he was being cross-examined. The court could then consider what further steps to take in relation to this matter. During the course of that discussion, Mr Larian said that his email to his solicitors had been a mistake. He did not disclose that he had indeed sent further messages to other people.

- Following the review of Mr Larian's mobile phone by his counsel and solicitors, MGA filed over the weekend a further (fifth) witness statement from Mr Larian, and a witness statement from Mr May, with exhibits to both. That evidence revealed that Mr Larian had sent a number of messages concerning the case during the evening after the first day of his cross-examination on 17 October, in addition to the email to his legal team. These included the following WhatsApp message sent at 17:44 to Manny Stull, the chairman of Moose Toys, asking for a letter relating to a dispute between Moose Toys and Zuru Toys:

- In addition, between 08:46 and 09:54 the next morning, Mr Larian had sent a series of WhatsApp messages to Sara Taylor, the managing director of MGA UK, asking for information as to the sales of the Little Tikes brand by The Entertainer and Smyths, for the most recent year and also for 2017 and 2018. He also specifically asked whether The Entertainer was buying a particular Little Tikes toy called Story Dream Machine. Ms Taylor answered Mr Larian's questions, although by the time he recommenced his cross-examination he had not read her response to the last of those questions. Mr Larian's counsel and solicitors had not been aware of these further messages (or any of the other messages sent by Mr Larian) during the discussion at the start of the hearing on the Friday morning.

- It was also apparent that Mr Larian had used the information he had received in his evidence on the second day of his cross-examination. After the initial discussion about his breach of purdah on the Friday morning, that cross-examination had recommenced, and as soon as it did so Mr Larian said that he wanted to add one comment to his testimony from the previous day. He then went on to make comments about The Entertainer's sales of the Little Tikes brand in 2017/18 and 2024, with sales figures given purportedly "to the best of my recollection", asserting that these proved that The Entertainer and other retailers were more powerful than the toy vendors. Later on the same morning, Mr Larian twice repeated his comments about The Entertainer's failure to purchase the Little Tikes brand. What Mr Larian did not reveal, at the time, was that his comments about Little Tikes were based on the information he had received from Ms Taylor before court that morning.

- Mr Larian's subsequent witness statement explaining his breaches of purdah sought to explain his email to his legal team as having been sent by mistake: he said that he had intended to save it in draft, to send later, but then sent it by accident. He sought to explain his messages to others, including Mr Stull and Ms Taylor, on the basis that he had not properly understood the purdah rules, and did not consider those messages to be in breach of the instructions he had been given.

- Cabo considered Mr Larian's explanations to be unsatisfactory, and applied to recall him for further cross-examination on this issue. As he had by then left the country, he was cross-examined remotely from the offices of a law firm in Los Angeles on the afternoon of 4 November 2024, the last day of evidence before the break for closing submissions to be written. His answers were defensive and maintained the position set out in his witness statement.

- Mr Larian's evidence on this issue was not, in my judgment, entirely candid. Mr Larian is an intelligent businessman, who accepted that he had been warned about the purdah rules by his solicitors prior to his cross-examination, as well as by the court during his cross-examination. Mr Larian's communications with Mr Stull and Ms Taylor were quite obviously discussions about the case, and I do not accept his claim that he did not understand that these were prohibited by the purdah warnings he had been given. In Mr Larian's message to Mr Stull, he explicitly said that he was in court and wanted a document to use in Mr Mowbray's cross-examination. In the case of Ms Taylor, he asked for information which he went on to relay (repeatedly) in his evidence. His claim to have emailed his legal team accidentally was likewise unconvincing. The more likely explanation is that Mr Larian understood the purdah rules but did not take them seriously, and did not consider the implications of those rules for his communications with his lawyers and others during his cross-examination. It probably did not even occur to him that these communications might be revealed to the court.

- As Patten LJ noted in Jarvis v Searle [2019] EWCA Civ 1, §§2324 and 28, witnesses are commonly given warnings by the trial judge not to discuss their evidence until after it has been completed, the purpose being to ensure that the evidence given by the witness is their own best recollection, untainted by any influence or assistance from a third party. Where a witness does, notwithstanding such a warning, attempt to communicate with a third party, but does not get a response, there is no damage to the integrity of the trial process. If the witness does, however, discuss some matter relevant to their evidence with a third party, that may (if appropriate) lead the court to discount or give no weight to that evidence.

- In the present case, MGA invited the court to deal with the matter by striking from the record Mr Larian's repeated comments about Little Tikes, on the second day of his cross-examination; but said that Mr Larian's breaches of the purdah rules did not detract from his general credibility. I agree that the comments about Little Tikes must be disregarded. They were made on the basis of the information obtained by Mr Larian that morning before the court hearing recommenced. I do not, however, agree that this incident is irrelevant to the assessment of Mr Larian's credibility. On the contrary, Mr Larian's conduct and his unsatisfactory explanations for that conduct reinforce the conclusion that he was an unreliable witness.

- The parties' respective toy industry experts were Wendy Munt (Cabo) and John Harper (MGA). They produced initial reports and reply reports in 2022, followed by a joint report. After additional disclosure was provided by MGA (as explained below), both experts provided further individual expert reports and a further joint report during the course of 2024, prior to the trial. There were eventually a total of 15 toy industry reports: six reports from Ms Munt, seven from Mr Harper, and two joint reports.

- The joint expert reports identified a large measure of agreement regarding the characteristics and structure of the toy industry, the costs and operational requirements of bringing a toy product to the market, and the likely shape of the profit and loss (P&L) account for a toy company. The experts' main areas of disagreement were their assessment of the substitutability of LOL Surprise with other toys (such as Barbie), and their assessment of the likely success of Worldeez. The experts were cross-examined for a day each.

- Wendy Munt, Cabo's industry expert, has over 30 years' experience in the toy industry, as a toy buyer for Argos and subsequently working as a consultant to toy suppliers, retailers and licensors. She fairly accepted that she was not able to give evidence as to the financial metrics relevant to the profitability of a toy supplier; rather, her previous work with toy suppliers had primarily focused on product development. Within the scope of her experience, her evidence as to the toy market dynamics and operational requirements was objective and largely uncontroversial. However, on some key issues of disagreement between the experts, while I have no doubt that Ms Munt was genuinely seeking to assist the court, her evidence came across as rather partisan, leading her to adhere to positions that were not very convincing or well-explained.

- John Harper, MGA's industry expert, has nearly 40 years' experience in the toy industry, with executive and management positions at Mattel and Hasbro, and subsequent advisory roles at several toy companies. By contrast with Ms Munt, therefore, his experience was on the supplier rather than the buyer side of the industry. He was an impressive and knowledgeable witness, fairly accepting the limitations of his experience (for example the fact that he had no direct experience of surprise collectible toys), but demonstrating a very detailed knowledge of the areas within his expertise. His evidence was mostly balanced and cogently explained, although he strayed into arguing MGA's case on the market definition issue.

- The economic evidence covered two areas: first, the question of market definition and dominance, and secondly the issue of quantification of damages. The valuation evidence solely addressed the quantification of damages. The evidence on these issues evolved considerably during the course of the proceedings.

- Initial expert reports and reply reports were produced in 2022 by Liam Colley for Cabo and David Parker for MGA, covering both market definition/dominance and quantification of damages. There was then a dispute as to whether Cabo could advance, in addition to a claim for lost profits in relation to Worldeez, a further (then unpleaded) claim for the lost opportunity to develop a valuable business. At a hearing before Joanna Smith J on 24 March 2022, with an ex tempore judgment given at the hearing [2022] EWHC 702 (Pat), Cabo was given permission to amend its case to include a claim for loss of the value of the business that it would have been able to build. MGA was given permission to call an additional expert witness (Mr Davies) to address the valuation claim. Mr Colley's second report had by then already addressed the valuation issue, and Cabo was therefore not permitted to call an additional valuation expert. Mr Colley and Mr Parker then filed a joint expert report on the issues of market definition, dominance and quantum of damages other than the valuation claim. Mr Colley and Mr Davies filed a joint report on the valuation issues.

- After MGA's additional disclosure in 2023, all three experts provided (in the course of 2024) updated individual reports and thereafter further joint reports, again with separate joint reports from Mr Colley/Mr Parker and Mr Colley/Mr Davies, respectively. During the course of preparing their revised and updated reports, all three experts collaborated on the production and population of the DTM (which is described further below). That led Mr Parker to revise his assumptions, as set out in a further report. By the end of August 2024 there were a total of 19 economic and valuation reports that had been filed: six from Mr Colley, seven from Mr Parker, two from Mr Davies and four joint expert statements.

- As noted above, matters did not stop there. During September 2024 (i.e. prior to the start of the trial), and then during the course of the trial in October, up to the point at which the economic and valuation experts were cross-examined, there was a flurry of further reports and letters filled by all three experts, including documents filed by all three experts on 27 October 2024, only two days before Mr Colley was cross-examined. That gave a total of 33 economic and valuation expert reports and letters by the close of evidence in the trial.

- Thereafter, since the experts had given their evidence, no further reports or letters were filed. Instead, the parties continued to update the evidence by way of legal submissions and additional calculations and models (including updates to the DTM and other excel spreadsheets) filed alongside their written closing submissions and continuing during the course of the oral closing submissions. As set out above, the parties' final submissions on various of the quantum issues were not filed until 17 February 2025, almost a month after the end of the trial. Those submissions made further detailed comments on the economic evidence.

- It is an understatement to describe this process as unsatisfactory. In the first place, the volume of expert evidence filed by the economic and valuation experts, and the multiple amendments, revisions and updates to that evidence during the course of the trial, was such that it was impossible properly to digest the new material as it came in. That made following the evolution of the evidence very challenging for both the court and the parties. It was also difficult, in these circumstances, to distinguish material issues from ancillary points of detail.

- Secondly, significant shifts in position by an expert during the course of a trial may well lead the court to scrutinise the objectivity and independence of that expert's initial opinion. That does not of course mean that an expert should stubbornly maintain their initial position simply for the sake of consistency. As the Court of Appeal has emphasised, the court will expect and encourage experts to adjust their opinions during the course of the proceedings, including during the course of the trial, in the light of emerging evidence (see for example the comments of the Court of Appeal in Royal Mail Group v DAF Trucks [2024] EWCA Civ 181, §177). Many an expert will, quite properly, concede ground when their evidence is exposed to the spotlight of cross-examination and the hard stare of the judge. Where, however, an expert completely abandons a particular part of their evidence, not as a result of any new evidence available at the trial, but rather because it is plain that the original position was untenable from the outset, that may suggest that the expert's initial position was unduly influenced by a desire to advance their client's case, rather than representing evidence which was the independent product of the expert, uninfluenced by the pressures of litigation, as required by CPR PD 35 §2.1.

- Thirdly, and related to the second point, expert evidence at a trial is not and cannot be seen as a negotiation process, where the experts start from extremely polarised and partisan positions, only to edge incrementally towards the centre ground as the trial progresses. That would make the trial unworkable, for the parties as well as the court. The proper course is for each opposing expert to start from a position that is objective and defensible. Any differences in opinion between the experts should be discussed fully at the stage of a joint meeting of experts (if there is one). The experts should revise their opinions as appropriate following that meeting, with the joint statement reflecting their revised opinions. Any residual differences can then properly be tested through the experts' oral evidence at the trial.

- That process requires a willingness by the experts to engage with the evidence of the other side in a manner that reflects objective consideration as to the strengths and (importantly) weaknesses of their position. Where an expert fails to do so, and maintains instead an entrenched and polarised position right up to trial, that may again indicate a lack of objectivity in their approach, thereby undermining the credibility and reliability of their evidence.

- In the present case, prior to the trial, the positions of Mr Colley and Mr Parker were about as far apart as could be imagined on both the questions of market definition/dominance and the quantum assessment. The result of the evolution of their positions, during the course of the trial, was that significant parts of the evidence on both sides were essentially abandoned by the end of the trial. More than that, however, on the quantum analysis both parties not only updated their figures during the trial (for example on the costs stack), but materially changed or developed their positions on significant points, with the result that on several points the position finally advanced in closing submissions was one that had not been set out in Mr Colley and Mr Parker's expert reports, and therefore had not been tested in cross-examination.

- The court is obviously required to do the best it can with the material before it, and counsel on both sides went to considerable lengths to provide submissions that were as comprehensive and helpful as possible, including (as noted above) providing further written submissions after the hearing on points which had not been fully addressed in the closing submissions. But in a case where the parties and their experts have had over four years to prepare for the trial, with multiple rounds of expert evidence over the course of a three-year period, it is very unsatisfactory for the court to be asked to consider and make findings on material which could and should have been addressed by the experts, but which did not emerge until after the hearing of the expert evidence in the trial. I consider that considerably more progress could and should have been made in the succession of expert reports and joint reports prior to the start of the trial, so that the parties' final positions could be fully considered by the experts and properly tested in their oral evidence, rather than cobbled together in haste in the very last days of (and indeed after) a lengthy trial.

- Finally, even by the end of the trial the distance between the experts' positions, and the evolution of the arguments, was such that there were inevitably some lacunae in the evidence. There are several different approaches which the court can adopt in that situation, depending on the nature of and reasons for the evidential gap. One approach might be to rely on the burden of proof, and to say that if there is no evidence on a particular point then the party which has the burden of establishing that point should be taken not to have proven its case. In certain types of cases, as discussed further below, evidential presumptions arising from the conduct of one or other party might also come into play. In many cases, the court will simply do the best it can on the evidence, albeit incomplete. Where appropriate the court can, however, ask for further information to be provided, particularly where that simply requires the experts to carry out further calculations on the basis of the existing underlying data.

- All of those options were canvassed by the parties in the course of the trial, in relation to different issues. In most cases I have felt able to reach a conclusion on the evidence before the court, without needing to rely on the burden of proof or any evidential presumptions. On two issues, however, I asked for further calculations to be provided by the parties following the trial: (i) the market share figures implied by an extended version of Mr Colley's market definition (§271 below); and (ii) a further version of one of Mr Parker's quantum calculations, using a combination of Mr Parker's price assumptions and Cabo's cost stack (§661 below).

- Liam Colley is a partner at the economic consultancy firm Cornerstone Research, and has over 25 years' experience as an expert in competition disputes. He was cross-examined over two days, showing impressive understanding and depth of knowledge of the economic issues in the case. For the reasons set out below, I have largely accepted his market definition and dominance analysis. On the quantification of Cabo's counterfactual profits, however, Mr Colley provided models that were unrealistically slanted towards a picture of huge sales in the counterfactual scenario, without addressing the question of Cabo's profitability if Worldeez had enjoyed more modest levels of success. That was neither objective nor balanced, and left the court without any useful basis for the assessment of quantum if the very high levels of success assumed in his models were rejected.

- David Parker is a director of the economic consultancy firm BRG, with over 20 years' experience as an expert in competition disputes. He was cross-examined for almost two days. Again, unfortunately, while Mr Parker was clearly very knowledgeable in his area of expertise, I consider that some parts of his evidence crossed into advocacy for MGA and lacked the objectivity which I would expect from an expert witness. That was the case, in particular, for his evidence on market definition and the dominance assessment, in relation to which he had focused on a statistical analysis, with little or no regard to the qualitative evidence and the evidence of MGA's market conduct. Mr Parker's quantum analysis was ostensibly more balanced, by considering a range of comparators, but Mr Parker noticeably placed greatest reliance on a model of "moderate success" which was unreasonably unfavourable to Cabo. In addition, significant costs assumptions in Mr Parker's model were wholly unrealistic and indicated a lack of objectivity. These problems led to substantial amendments being made to Mr Parker's model by MGA in its closing submissions.

- Gary Davies is a senior managing director of the management consultancy firm Ankura, with over 25 years' experience of advising and providing expert evidence on valuation issues. He was cross-examined for around an hour, and it was common ground that he was a fundamentally honest and helpful witness. There was ultimately very little dispute between him and Mr Colley on the valuation issues, and in the light of the conclusions I have reached the relatively minor residual areas of difference between them do not arise for determination.

- The DTM was, over the course of the trial, a central tool for the parties and their experts to use, to set out their respective primary and alternative positions on the quantum modelling, and for the court to use, to understand the implications of the different approaches addressed in the expert evidence on each side.

- The purpose of the DTM was to allow the court to calculate Cabo's losses based on the variety of different assumptions that were disputed as between the economics and valuation experts. It operated through two basic functions. First, it enabled the court to select different primary input options from the alternatives presented by the experts, to model (in terms of cashflows) the likely success of Worldeez in the counterfactual scenario in which the impugned conduct of MGA had not occurred, as well as the parties' alternative estimates of Cabo's costs. Secondly, the DTM provided probabilistic functionality, enabling the court to adjust the key inputs for domestic and international sales, licensing, and the development of further products, by reference to an assessment of the probability of Worldeez achieving the success levels modelled by the experts.

- In broad outline, the DTM worked as follows:

- The DTM was a very useful analytical tool during the trial, because it enabled the parties to interrogate, with the experts, the implications of different permutations of the model, and to explain those implications in their submissions to the court. It also had the benefit of enabling the outputs of the experts' modelling to be presented to the court on a consistent and (reasonably) accessible basis. While I have not ultimately needed to use the DTM to calculate the quantum of Cabo's losses, in light of my conclusions as to the likely profitability of Worldeez, that does not, however, diminish the helpfulness of the model as a tool for understanding the parties' positions. I am grateful for the care taken by the experts and counsel to construct it and then to update it during and after the trial.

- Cabo claims damages against MGA on three bases: (i) abuse of a dominant position contrary to the prohibition in Chapter II of Part I of the 1998 Act and/or Article 102 TFEU; (ii) unlawful agreements and/or concerted practices contrary to the prohibition in Chapter I of Part I of the Competition Act 1998 and/or Article 101 TFEU; and (iii) unjustified threats of patent infringement proceedings within the meaning of s. 70 of the 1977 Act. The claims give rise to disputed issues of both liability and quantum. In the case of the patent threats claim there is also a question of whether other relief should be given.

- The liability issues are as follows:

- The causation and quantum issues arise across all of the claims for which liability is found, and are as follows:

- The final issue is whether declaratory relief should be given on the patent threats claim, irrespective of whether damages are awarded on that claim or the competition claims.

- The factual events which have given rise to these proceedings are largely uncontested, with the disputes focusing on the characterisation of some of the individual incidents. The description which follows is therefore mostly common ground, with findings of fact where necessary on specific disputed points.

- The UK's toy market is one of the largest in the world. NPD, which the parties agree is the authoritative source of market research in the toy industry, valued the UK toy market at £3.4bn in 2017. The toy experts broadly agree on the characteristics of the market. Two common themes emerge from their evidence.

- The first is that the toy industry is a fashion industry. While there are established brands that enjoy consistent consumer loyalty, the success of new products is determined by consumer trends, and the fickle tastes of children cause the market to be volatile. It is thus difficult to predict whether a new toy will be successful. The experts agreed that having an innovative product was critical, although that alone was not a guarantee of success. It was common ground that most new toys fail, and the majority of new toys launched in Europe do not last in the market for more than a year. That gives rise to a "close-out" industry of wholesalers (such as Singleton) and retailers, who specialise in purchasing and re-selling underperforming stock at discount prices.

- The second theme is the competitiveness of the market. A large number of manufacturers compete by offering differentiated and innovative products. The three largest manufacturers, Lego, Hasbro, and Mattel, had a combined market share on the overall toys market of only 28% in 2017.

- For the purposes of its data collection in the toy market, NPD segments toys into supercategories, segments and subsegments, classes, and subclasses, allowing the performance of individual products to be measured. The present case concerns the "dolls" supercategory. That supercategory is then divided into four segments as set out in the table below: nurturing dolls and accessories (nurturing dolls), fashion dolls/accessories and role play (fashion dolls), playset dolls and accessories (playset dolls), and large dolls and accessories/furniture (large dolls). The playset dolls segment is divided into two classes: playset dolls and collectibles, and playset doll accessories. Both LOL Surprise and Worldeez fell within the playset dolls and collectibles class, shown in bold in the table.

- During the relevant period, the UK market for playset dolls and collectibles was dominated by three specialist retailers: The Entertainer, Smyths and Toys R Us (TRU). General grocers such as Tesco and Sainsbury's also sell toys including playset dolls, but toy sales only constitute under 1% of their revenue. The toy experts agreed that a successful launch of a new toy product requires support from at least several of the key toy retailers, and that take-up by grocers such as Tesco is generally dependent on initial successful sales in the specialist toy retailers.

- During the period relevant to this dispute, toy sales were influenced by two particular trends. The first was the growing popularity of unboxing videos on platforms such as YouTube (and subsequently TikTok, which launched internationally in 2017). Unboxing videos consisted of child "influencers" unboxing various toys on camera. Many such influencers grew to become incredibly popular. The influencer of common interest to Cabo and MGA was a girl called Tiana Wilson (Tiana), who amassed some 16.5m subscribers on her YouTube channel. Both Cabo and MGA engaged Tiana to promote their products.

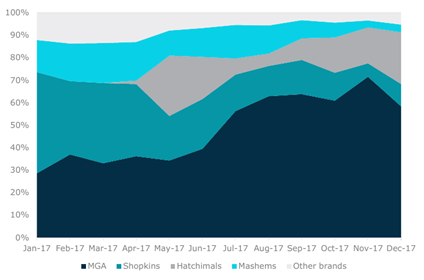

- The second trend was a spike in the popularity of collectible toys. Although the collectibles market is an established toy market, there were several brands which enjoyed particular success in and around 201617, including in particular Shopkins (produced by Moose Toys) and Hatchimals Colleggtibles (produced by Spin Master).

- MGA is North America's largest privately owned toy manufacturer. It owns a number of successful toy brands including Bratz, Num Noms, Little Tikes and LOL. The company was founded by Mr Larian in 1979. It began life as a licensing business, before starting to design and release its own toys in the mid-1990s. MGA's first major commercial success was the Bratz range of dolls, released in 2001, which became the main competitor to Mattel's Barbie range of dolls. This led to litigation between MGA and Mattel in the US between 2006 to 2010. MGA has subsequently engaged in litigation with other manufacturers, including a dispute with Mr Mowbray's company Zuru.

- MGA's LOL Surprise toy was launched in the US in December 2016, and continues to be a popular toy. The original version is pictured below. It comprises a small plastic collectible doll, approximately nine cm high, packaged in a spherical plastic container which is then wrapped in multiple layers of plastic wrapping, as depicted below.

- The removal of the first two layers of wrapping reveals paper "teasers" to the contents of the sphere. As further layers are removed, recesses in the sphere reveal miniature toy accessories (themselves in wrapped packages), such as a baby bottle, shoes and clothes. The final layer is the plastic sphere itself which opens revealing the doll. The container can be arranged to stand open as a presentation platform for the doll, and an arched handle is attached to the container, allowing the container and doll within to be carried like a handbag. An example of the container and doll, fully assembled, is shown below.

- LOL Surprise was an immediate and phenomenal success, selling out in weeks following its US launch. By January 2017 it was the top selling doll in the US. The industry experts agreed that toys that perform successfully in the US generally go on to repeat that success in the UK market. That was the case for LOL Surprise, which launched in the UK in February 2017. It is common ground that in the UK market, as in the US, the product was an outstanding commercial success. By May 2017 it was the second best-selling toy in the UK across all toy categories (the best-selling toy at the time being one of the Lego minifigures series). Mr Larian described it as a "once in a lifetime product" and a "billion dollar, lightning-in-a-bottle success stor[y]". Mr Laughton said that "as far as I am aware, no MGA toy (or indeed any toy) has sold as quickly in such a short period of time". Mr Hunter commented, similarly, that "I have dealt with collectibles for my entire career, and nothing has ever struck a chord with girls like that did". Stuart Grant said that at that time "LOL was the number one brand in the industry".

- Following the success of LOL Surprise, MGA expanded the range to include other LOL toys, releasing LOL Lil Sisters in August 2017 and a Big Surprise Ball in October 2017. These were also hugely successful toys, and by the end of the year all three toys were ranked within the top ten toys in the UK across all toy categories, with the original LOL Surprise as the best-selling toy. In the course of 2018, further products were added including Pets and Confetti Pop. Numerous further products have been added to the range since then, to maintain consumer interest in the brand.

- The Cabo founders came up with the idea for a new collectible toy, Worldeez, on a family holiday together in 2014. They were inspired by watching their own children's interest in unboxing videos and surprise collectible toys such as Kinder Eggs and capsules sold in vending machines. Their idea was for a range of collectible dolls from countries around the world, complemented by other objects associated with each country.

- The design process started in early 2016, with the help of an external designer, Mr Olivier. The initial range featured eight countries (UK, France, Italy, Brazil, India, Egypt, Japan and the US) with fifteen figurines for each country: a boy and girl figurine, plus thirteen figurines of associated cultural items. The UK range included, for example a teacup and a Loch Ness monster. The France range included a croissant and an Eiffel Tower figurine.

- The Cabo founders did not themselves have any experience of the toy market: for that they relied on Singleton. Mr Sivner had already expressed an interest in Singleton expanding into having its own "intellectual property", and was aware of the growing market for collectibles. Mr Sivner and Mr Lazarus agreed to enter into a business partnership with the Cabo founders to bring the product to market.

- Cabo was incorporated in August 2016 with an initial capital investment of £25,000 from each of Mr Sivner and Mr Lazarus, and investments of £12,500 from each of Mr and Mrs Michaelson and Mr and Mrs Cohen. Mr Sivner and Mr Lazarus each held 25% of the shares in Cabo, with the four Cabo founders each holding 12.5%. The directors of Cabo were Mr Michaelson and Mr Lazarus. Singleton agreed to provide the further funding required to market the products and to fund (at least) the initial production costs. The extent of its willingness to provide ongoing funding was, however, later a source of disagreement within Cabo, and remains a disputed issue in these proceedings.

- It was agreed that the Cabo founders would manage the design, marketing and sales of Worldeez. In addition to providing financial support, Singleton was to provide the use of its operational infrastructure and contacts within the toy business, including contacts at a number of leading retailers. In August 2016 Mr Sivner introduced the Michaelsons to Mr Garnham, who had been involved in the development of the Moshi Monsters brand. He offered advice on the design of the Worldeez characters, suggesting the addition of eyes to all of the figurines. Mr Garnham said that he did this as a favour to Mr Sivner, and because he liked to encourage entrepreneurs in the toy industry. He thought that the initial design of the product was too basic, but that it had a better chance of success once the design had been changed.

- A factory in China was identified to manufacture the products, and Mr Michaelson and Mr Cohen attended the Hong Kong toy fair in January 2017 where they showed samples of the product to Stuart Grant. He was enthusiastic about the product, and offered advice on the size and packaging. Initially, the Cabo founders had considered packaging the figurines in a toy suitcase, but Stuart Grant felt that this lacked the necessary "wow factor". Mr Cohen then came up with the idea of a globe design, which fitted the travel theme and was already present in the "O" in the Worldeez logo (which was drawn as a globe). Mr Cohen further suggested the use of a key to unlock a compartment in the globe. The Cabo founders then finalised the artwork for the packaging and wrapping. They were told by the packaging company that they would need two layers of wrapping (one vertical and one horizontal) to cover the globe.

- The final "hero" or anchor product of the Worldeez range was the Worldeez globe, consisting of a pink spherical capsule covered in two layers of plastic wrapping which (originally, before it was changed in the circumstances described below) displayed an image of the Italian girl figurine "Bella" riding on a scooter down a rainbow through the sky, the sky being represented with a blue background.

- The sphere was divided into two compartments, with one covered by a plastic lid with a locking mechanism, the key for which was in a "blind bag" in the other compartment.

- Once unlocked, the covered compartment revealed two blind bags containing Worldeez figurines, each around 2cm high, plus two small fact cards featuring a fun fact about a traditional cuisine or another cultural highlight from one of the countries included in the Worldeez range, and a pamphlet listing the range of figurines to collect. The pictures below show three of the figurines - "Lottie" (part of the England range), "Gina Gelati" (part of the Italy range) and "Chevy Cheese" (part of the France range), as well as an example of one of the fact cards.

- Alongside the globe, Worldeez figurines were also available in 5- and 10-piece blister packs. The RRPs for the Worldeez products were set at £2.99 (globe), £5.99 (5-pack) and £9.99 (10-pack).

- Cabo planned to launch Worldeez in late May and early June 2017. Mr Michaelson took the lead on marketing. He engaged a marketing agency, Evolution PR, which produced an initial marketing plan. Cabo eventually moved to using Weird Lime for their marketing, but the original marketing plan remained largely the same.

- Nickelodeon, which was then the most popular children's television channel in the UK, was approached to provide television marketing. Nickelodeon proposed a revenue-sharing partnership in return for advertising airtime. Cabo engaged Diaframma, an Italian production company specialising in children's television, to produce its advert.

- As part of the contract negotiations with Nickelodeon, Nickelodeon requested financial projections from Cabo. An initial set of projections over a three-year period (i.e. 2017 to 2019) was prepared by Mr Avrom Bishop, Singleton's Finance Director. He emailed those projections to Mr Cohen on 1 March 2017. Mr Cohen replied later on the same date with amended projections, which included increasing the predicted sales for 2019. In cross-examination, Mr Cohen said that he had done so because he expected Worldeez sales to grow year-on-year. The amended projections were sent to Nickelodeon, and a draft contract was subsequently drawn up.

- Cabo's digital marketing plan centred on the unboxing influencer Tiana. Her Worldeez unboxing videos proved to be popular, with the first, which launched on 19 May 2017, reaching around 500,000 views within a few days. Cabo also marketed on the children's social media platform Popjam. The Cabo founders and Singleton did not, however, agree a specific launch marketing budget. Again, this became a point of disagreement between them.

- Cabo intended to launch Worldeez in The Entertainer, Smyths and TRU, followed by the UK grocers (especially Tesco, Asda, Sainsbury's and Morrisons) and independent toy stores, followed by international markets. Initial discussions with the intended launch retailers were organised by Mr Sivner through his contacts.

- Stuart Grant, the buying director at The Entertainer at that time, was a friend of Mr Sivner. As noted above, he had already seen and discussed the Worldeez product at the Hong Kong toy fair in January 2017. He was keen to have the product before other retailers, and emailed Mr Sivner on 26 April 2017 saying "Marc we are 100% behind you to make this a success!! Love the final execution ... let's make this a winner!" The Entertainer placed an order for 40,000 items, including 30,000 globes, on 19 May 2017, and arranged a meet and greet event with Tiana to launch the products at its Birmingham Bull Ring store.

- The agreed wholesale prices were £1.20 for the globe, £2.40 for the 5-pack and £4.00 for the 10-pack. That gave The Entertainer a margin of around 52% for the globe, which Stuart Grant said was The Entertainer's "absolute minimum requirement".

- Mr Sivner and Mr Michaelson had a meeting with TRU on 19 April 2017, following which TRU agreed to hold a meet and greet with Tiana at its Nottingham store. Mr Michaelson and Mr Cohen both initially claimed that TRU placed an order, and Mr Michaelson gave evidence of the price that he said Cabo had "confirmed" with TRU.

- There is, however, no contemporaneous evidence of an order from TRU. Moreover, when cross-examined on this point, Mr Michaelson accepted that by the time of MGA's intervention, more than a month later, TRU had not placed even a verbal order for Worldeez (although he said that it would have done so but for MGA's conduct). Mr Cohen also accepted that neither a verbal order nor a formal purchase order had been placed by then. The evidence therefore clearly indicates that TRU did not, prior to MGA's intervention, place an order for Worldeez, whether verbal or in writing.

- There was a meeting with Smyths at its head office in Ireland on 10 May 2017, attended by Mr Sivner, Mr Michaelson, Mr Smyth and some of their buyers. Cabo's case is that Smyths placed a verbal order for 16,000 items, including 8,000 globes. There is no doubt that there was a discussion of initial order quantities at the meeting, as evidenced by Mr Michaelson's email shortly after the meeting saying:

- Two days later, Mr Michaelson sent an email to Mr Cohen and Singleton saying that Smyths had placed a "verbal order" for the quantities set out above, noting that it would be necessary to "officially agree the order". Mr Lazarus replied saying that Smyths would need to raise a purchase order. Mr Michaelson then acknowledged that he had not heard back from Smyths following his email to them.

- Mr Michaelson claimed in his oral evidence that an order from Smyths "must have existed. It did exist." There is, however, no evidence of a purchase order being raised by Smyths. As at 16 May 2017, an email between Singleton and Mr Michaelson said that they were expecting a purchase order "soon". There were then various emails setting up a meet and greet event with Tiana at the Tamworth store (scheduled for the end of July). Smyths emailed Mr Michaelson on 23 May 2017 enquiring when stock would be available, and asking "Can we get stock now?". On the same day Singleton asked Mr Michaelson and Mr Cohen for further information to send to Smyths, "so they can send PO". It is apparent, therefore, that a purchase order had not been raised by Smyths at that point.

- By 13 June 2017 (after the events described below) in an email exchange between Mr Smyth and Mr Sivner, Mr Smyth said that "we have none on order and not sure if are going to buy". The evidence of both Mr Smyth and Mr Lazarus was that no formal purchase order was ever placed by Smyths.

- Mr Michaelson's claim that a final order was placed is therefore not supported by any of the contemporaneous documents or the other witness evidence. The evidence indicates that while provisional initial order quantities were apparently discussed with Smyths at the 10 May 2017 meeting, no purchase order was subsequently raised by Smyths either prior to MGA's intervention or at any time after that.

- Tesco was approached by Cabo on 11 May 2017, but rejected the product saying that "it looks quite similar to a toy we ran before and unfortunately the world theme didn't work for us, so we wouldn't select Worldeez". Mr Michaelson later reported on one of the WhatsApp chats that this was a reference to Gift'ems. There was also an initial approach by Cabo to Argos, which did not result in any orders. Mr Lazarus' explanation was that Argos was not interested in selling products with a price point of £2.99. That was consistent with Ms Munt's evidence that collectibles were not a priority category for Argos, as it focused on the higher priced products.

- MGA's conduct, which is the basis of Cabo's claim in these proceedings, commenced on 23 May 2017. As set out below, the majority of MGA's disputed communications occurred in the last week of May 2017. Cabo also relies, however, on various further discussions between MGA and the toy retailers later in the summer of 2017 and (in one case) in the spring of 2018.

- On the morning of 23 May 2017, whilst Mr Larian was attending the Las Vegas toy fair, he received an email from Mr Andrew Laughton (at 07:29 local time, i.e. Pacific Daylight Time, or PDT) with the subject line "Worldeez - lol copy - even using Tiana (Toys & Me) who we used to launch". The email contained a link to the first Tiana Worldeez unboxing video. Mr Larian responded two minutes later (07:31) asking "Who are they?". Mr Laughton immediately sent a text message to Mr Sivner to ask whether he was behind Worldeez. Mr Sivner responded confirming that he had invested in the product, to which Mr Laughton replied "You do realise this infringes on our patent with LOL - we will protect so expect contact from MGA legal today Marc".

- Mr Laughton confirmed to Mr Larian that Singleton had invested in Worldeez. Mr Larian replied instructing Mr Laughton to "send the correspondence". What that meant became clear when later that day (by then the early hours of the morning of 24 May 2017 in British Summer Time, BST) Mr Benjamin Johnson, MGA's Senior Litigation Counsel, emailed Mr Sivner a cease and desist letter.

- The first paragraph of that letter stated that MGA had a patent pending for LOL Surprise. The letter went on to contend that Worldeez was marketing and/or selling toys in "packaging confusingly similar to that of LOL Surprise!, including color schemes, shape, art work, lettering, and play pattern replicating the unique unboxing aspect of L.O.L. Surprise!" After referring to MGA's "substantial goodwill" in its LOL Surprise products, the letter contended that:

- The letter then demanded that Cabo immediately cease offering the product for sale in packaging that resembles LOL Surprise packaging, and in general refrain from "any infringement on L.O.L. Surprise! products or trade dress, or any other intellectual property of MGA", failing which MGA reserved the right to take all available legal action to enforce compliance. It concluded by saying that this was "not a complete statement of MGA's rights in connection with this matter and/or L.O.L. Surprise!" and that MGA reserved all further rights.

- As it happened, Mr Sivner and Mr Lazarus were also attending the Las Vegas toy fair. On 24 May 2017, the day after receiving the cease and desist letter, they had a meeting with Mr Larian, at which they showed him samples of the Worldeez globe, and compared them with Mr Larian's samples of LOL Surprise.

- The reaction of Mr Sivner and Mr Lazarus at that meeting with Mr Larian is disputed. Mr Larian said that Mr Lazarus admitted the similarity between LOL and Worldeez. In email exchanges with Stuart and Gary Grant between 24 May and 1 June 2017, he claimed that Mr Sivner and Mr Lazarus had "agreed it is a knock off", and that they had agreed to change the design of the shrink wrap packaging to make it different to that of LOL Surprise (see §§125 and 129 below).

- Mr Lazarus in his evidence essentially confirmed that he had acknowledged that the Worldeez globe and LOL Surprise looked similar, and had suggested that Cabo could change the packaging design. At the time, however, when shown Mr Larian's claims about what had been agreed at that meeting, Mr Lazarus was rather coy. He did not deny acknowledging the similarity of the products, but suggested to Mr Cohen and Mr Michaelson that they should discuss the matter with a lawyer, and that an email should be sent from the lawyer "clarifying what we said how we said we would consider looking at things".

- It seems likely, on the evidence, that Mr Lazarus and Mr Sivner did indeed acknowledge that the products looked similar, and agreed to reconsider the design of the shrink wrap packaging around the globe, but were then reluctant to admit to the Cabo founders that they had done so. It is, however, very improbable that they agreed that the Worldeez globe was a "knock off": that was Mr Larian's mantra, repeated pejoratively throughout his email exchanges on this issue as well as in court, but there is no evidence other than his account that Mr Lazarus and Mr Sivner agreed with that description of their product (and I have already found Mr Larian to be a thoroughly unreliable narrator).

- On 25 May 2017, Mr Larian emailed Mr Sivner and Mr Lazarus, copying Ms Elizabeth Risha (MGA's general counsel) and MGA's solicitors Mishcon de Reya:

- Cabo's solicitors wrote to MGA the next day, 26 May 2017, responding to the cease and desist letter, and asking MGA to identify the patent or patent application on which it relied. MGA did not ever respond to that letter. Instead, on the same day Mishcon de Reya emailed a letter and draft undertaking to Singleton. The draft undertaking required all Worldeez stock to be withdrawn from sale and destroyed, along with any "components, moulds, prototypes and any other product-specific material", as well as all advertising materials. It also required any altered designs to be submitted to Mr Larian and MGA for approval, and that Singleton, Sinco and Cabo each admit liability for "in respect of MGA's claim for infringement of its intellectual property rights in the LOL Surprise! products". The nature of these rights was, however, not explained, either in the draft undertaking or in the covering letter from Mishcon de Reya.

- Cabo (unsurprisingly) did not sign the draft undertaking. It did, however, take MGA's threats seriously. Mr Lazarus wrote in an internal WhatsApp message "This guy will tie us up in a million dollar lawsuit ... He isn't a joke. He is not afraid of courts ... he will spend million dollars on court costs even if he [loses] just to fight for his brand. This is a serious and real issue now ... The guy will do everything to try stop this. And throw all his resources at it. It's what he does". Cabo therefore changed the packaging of the Worldeez globe, as described further below, and took steps to protect its intellectual property rights in the event of litigation by MGA.

- In the event, notwithstanding the threats made by MGA in correspondence, MGA did not ever bring proceedings against Cabo for infringement of any intellectual property rights related to LOL Surprise.