Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales Court of Appeal (Civil Division) Decisions

You are here: BAILII >> Databases >> England and Wales Court of Appeal (Civil Division) Decisions >> London & South Eastern Railway Ltd & Ors v Gutmann [2022] EWCA Civ 1077 (28 July 2022)

URL: http://www.bailii.org/ew/cases/EWCA/Civ/2022/1077.html

Cite as: [2022] EWCA Civ 1077

[New search] [Printable PDF version] [Help]

ON APPEAL FROM Competition Appeal Tribunal

Mr Justice Roth (President), Simon Holmes, Professor Robin Mason

[2021] CAT 31

Strand, London, WC2A 2LL |

||

B e f o r e :

(Sir Julian Flaux)

LORD JUSTICE GREEN

and

LADY JUSTICE WHIPPLE

____________________

| London & South Eastern Railway Limited, First MTR South Western Trains Limited & Stagecoach South Western Trains Limited |

Appellants |

|

| - and - |

||

| Justin Gutmann |

Respondent |

____________________

First MTR SW - Daniel Jowell QC, Fiona Banks (instructed by Slaughter & May) Stagecoach - Daniel Jowell QC, Jonathan Scott (instructed by Dentons UK & Middle East LLP) for the Appellants

Philip Moser QC, Stefan Kuppen, Alexandra Littlewood (instructed by Charles Lyndon Ltd and Hausfield & Co LLP) for the Respondent

Hearing dates: Monday 13th - Wednesday 15th June 2022

____________________

Crown Copyright ©

- This is the single judgment of the court.

- Before the Court is an appeal against the judgment of the Competition Appeal Tribunal ("CAT") of 19th October 2021 by which the CAT granted two applications by a representative acting for a proposed class of claimants ("the class representative") for collective proceedings orders ("CPOs"). In that judgment the CAT dismissed applications made by the defendants to strike out the claim or part of it and/or for reverse summary judgment.

- The claim is brought pursuant to section 18 Competition Act 1998 ("CA 1998") which is known as the "Chapter II prohibition". Section 18(2)(a) prohibits unfair purchase or selling prices or other unfair trading conditions:

- The applicant in both cases is Mr Justin Gutmann. The claim in both cases is that the defendants, who are train operating companies ("TOCs"), unlawfully abused a dominant position by failing to make so-called "Boundary Fares" sufficiently available to consumers holding valid "Travelcards" issued by Transport for London ("TfL").

- Travelcards are TfL zonal tickets permitting unlimited travel on London's public transport network. This includes not only TfL's own services but, in addition, those of National Rail within their zone of validity excluding certain lines such as Heathrow Express. Travelcards can be issued for variable time periods and for a range of zonal combinations. There are in total nine TfL zones. However, zones 1 – 6 are the main zones and cover approximately 99% of all valid Travelcards.

- A Boundary Fare is a form of add-on or supplementary ticket for use in conjunction with the Travelcard for travel to/from the outer boundary covered by the Travelcard from/to the destination. If a consumer wishes to travel from central London to a destination on (say) the south coast, that consumer will travel from central London (A) to the boundary station of the Travelcard (B) and then onward to the destination (C). In this A-B-C journey the purchase by the consumer of the Travelcard should entitle the consumer to treat the A-B leg as having already been paid for with the consequence that the consumer should be charged only for the B-C leg. The nub of the claim is that the defendant TOCs failed to make Boundary Fares available either at all or in a way that was sufficiently available. The practical effect was that for a high percentage of journeys consumers with Travelcards paid the full fare and not the appropriate Boundary Fare. Put another way TOCs charged twice for the A-B leg of the journey.

- The claims relate solely to journeys out of, but not into, London. It was explained to the CAT that the claim had been framed in this manner for the sake of simplicity. The class is estimated to comprise about three million individuals who have suffered individual losses of about £33 - £55. The average claim per journey is about £5. The total claim against the defendants combined is about £93 million.

- The claim concerns Boundary Fares on two rail franchises: The South-Western franchise and the South-Eastern franchise. In both cases the claim covers the period from the 1st October 2015 to the date of final judgment or earlier settlement of the claims (in the case of the South Western franchise) or at 2am on the 17th October 2021 (in the case of the South Eastern franchise). The CAT treated the claims as substantially identical and with the consent of all parties, directed that the two applications be heard together and that evidence in the one would stand as evidence in the other so far as relevant.

- In relation to the South-Western franchise, during the relevant period there were two respondent TOCs to the first application: First MTR South Western Trains Limited ("First MTR") which held the franchise from and including the 20th August 2017; and, Stagecoach South Western Trains Limited ("Stagecoach") which held the franchise from 4th February 1996 until 20th August 2017. The South-Eastern franchise was held from the commencement of the relevant period until the 17th October 2021 by London South Eastern Railway Limited ("LSER").

- The definition of the class, as certified by the CAT, was in broad terms and encompassed "all" persons who held a Travelcard and who paid a full fare:

- The CAT ordered certification upon an opt-out basis. It directed that every person falling within the description of the class domiciled in the United Kingdom on the 19th October 2021 should be included in the collective proceedings. Any person falling within the class could opt out of the proceedings according to a process set out in the order.

- As explained in greater detail below, the defendants unsuccessfully sought to strike out the applications and/or obtain reverse summary judgment. The CAT refused permission to appeal.

- The proceedings concern Travelcards available for combinations within zones 1 – 6:

- The arrangements for the provision and honouring of Travelcards are governed by a Travelcard Agreement signed on the 15th October 1995 (the "Travelcard Agreement"). This is (for practical purposes) between TfL and the TOCs. This is a complex arrangement which has been subject to a series of subsequent amendments, modifications and restatements. The full terms of these arrangements were placed before the court subject to a confidentiality ring. It is unnecessary to delve into the detail. It suffices to record that in recital (B) to the Travelcard Agreement it is recorded that upon implementation of the restructuring of the passenger rail industry as contemplated by the Railways Act 1993:

- The arrangements include complex terms governing the apportionment of total revenue generated by the sale of Travelcards as between the parties to the agreement. As part of the methodology the parties, collectively, instituted a "Travelcards Survey Working Group" which was tasked with the creation of a survey enabling passenger kilometres travelled on each mode by Travelcard holders to be estimated and, thereby, to permit relevant apportionment factors to be derived. We were informed that the methodology presently applied to determine apportionment no longer includes evidence generated by such surveys.

- All the defendants either sell or have sold Boundary Fares for journeys originating in each TfL zone to destinations upon their networks. They are sold as single or return, peak or off-peak fares. They are not routinely available for certain discounted tickets of which the most significant are Advance Fares. Each of the defendant TOCs makes tickets available from a variety of outlets which include station ticket counters, ticket vending machines ("TVMs") operated by the defendants, TVMs operated by third parties, telephone call centres, online sales, TfL-controlled outlets and third-party vendors holding a licence permitting them to sell such tickets.

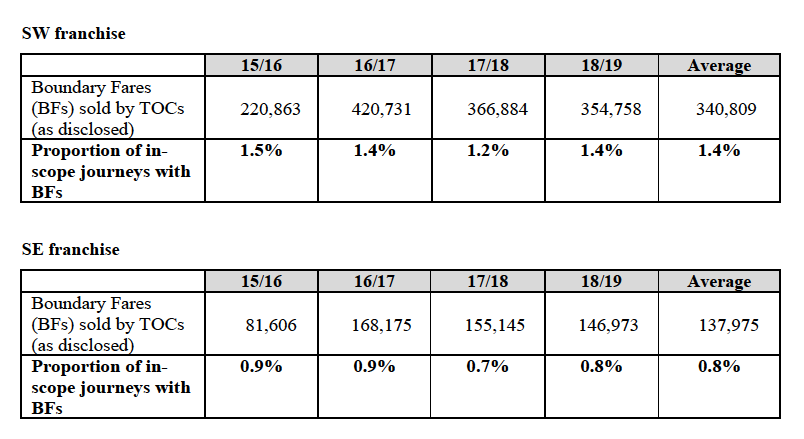

- The claims concern journeys out of London originating in a TfL travel zone on the networks of the defendants and are referred to as "in-scope journeys". Paragraph [20] of the judgment sets out tables recording the class representative's estimate of the proportion of in-scope journeys with Boundary Fares on the South Western and South Eastern franchises and the inference which could be drawn viz., that only a very small percentage of in-scope journeys are charged at the Boundary Fare rate[1]:

- In paragraph [26] of the judgment the CAT referred to evidence of the limited extent to which Boundary Fares were, in fact, available from different types of outlet:

- In a draft re-amended collective proceedings claim form, the class representative encapsulated the alleged abuse in the following terms:

- The following is also averred:

- The system of collective redress under the CA 1998 has been described in the Supreme Court judgments in Mastercard Inc v Merricks [2020] UKSC 51 ("Merricks") and Lloyd v Google LLC [2021] UKSC 50 ("Lloyd"). The system, as interpreted by those judgments, was considered in a judgment of this Court in BT Group plc v Justin Le Patourel [2022] EWCA Civ 593 at paragraphs [24] - [44] ("Le Patourel"). There is no need to repeat here what has been thoroughly rehearsed in these earlier cases. It suffices to highlight those features of the regime which are of relevance to the issues in these appeals.

- Under the CA 1998 and implementing regulations for a claim to be certified the CAT must assess whether the issues raised are the "same, similar or related". The shorthand for issues that meet this test is that they are "common" (Le Patourel (ibid) paragraphs [31] and [32]). The CAT has to determine whether the claim is "suitable" for certification as a collective action. The test of "suitability" is multifactorial: Le Patourel (ibid) paragraphs [81] – [83].

- In determining whether a claim is suitable the CAT does not consider the merits of the claim. However, putative defendants have the right to seek to have the claim struck out as unarguable or otherwise seek reverse summary judgment upon it. To this extent, when an application for summary dismissal is made, the CAT will, to the arguability threshold, consider the merits.

- To enable the CAT to form a judgment on commonality and suitability the class representative is required to put forward a "methodology" setting out how the issues that they have identified will be determined or answered at trial. In practice the methodology is prepared by an expert economist instructed by the proposed class representative. The methodology advanced will be counterfactual and therefore hypothetical in nature. It posits how the market would operate absent the alleged unlawful conduct and provides a benchmark against which to measure a defendant's actual conduct. It constitutes a critical document that the CAT will examine when determining commonality and suitability. The test to be applied to a proposed methodology to determine whether it is up to standard was articulated by the Supreme Court of Canada in Pro-Sys Consultants Ltd v Microsoft Corp [2013] SCC 57 ("Microsoft") and was endorsed by the Supreme Court in this jurisdiction in Merricks. We address the test in paragraphs [45], [46] and [52] – [63] below.

- The CAT also has a power to order that the claim proceed upon an aggregate basis. Section 47C(2) CA 1998 empowers the CAT to make an award of damages without reference to the position of individuals:

- The architecture of the UK regime has been partially modelled upon Canadian collective redress regimes which exist for all types of case, not just competition law. In Canada there are a variety of different provincial systems. Case law on these has, to date, been valuable in guiding the Courts in settling the broad principles which should apply. The relevance of this jurisprudence is considered at paragraphs [40] – [42] below.

- In the present case the CAT: dismissed the defendants' applications for strike out and/or reverse summary judgment; held that the methodology advanced by the class representative met the Microsoft test; directed that the case proceed under section 47C(2) as a claim for aggregate damages which was to include liability issues; and, certified the claim as "suitable" upon an opt-out basis thereby holding that the issues were sufficiently "common". The appeals raise a variety of issues in relation to these conclusions. We summarise the issues arising as follows:

- We deal with each of these issues in turn.

- The first issue is about how liability, as opposed to quantum, must be established in collective actions. This is a point of law. By "liability" we refer to the requirement to prove (a) causation and (b) the existence of some loss flowing from a breach. If section 47C(2) does not apply, liability issues must always be proven by reference to the position of individual claimants. This would have profound consequences for whether a claim was "suitable" for collective proceedings. The appellants argue that the CAT erred in holding that section 47C(2) covered liability and that as a result of this error it erred in concluding that the proceedings were suitable for certification. The CAT recorded this argument (judgment paragraph [77]) but held that section 47C(2) did embrace liability issues and that the question had already been decided by the Supreme Court in Merricks.

- The appellants argue now that the CAT erred in treating Merricks as having decided the point. The majority did not address the issue and the minority (which did) was obiter and unconvincing. Further, the analysis addressed a different factual matrix to that arising in the present case. In Merricks there was no possibility of class members suffering no loss, so the issue of aggregate liability did not arise. This contrasts with the present case where the defendants have identified numerous categories of consumer in the certified class who will have suffered no loss by not having been offered or obtained Boundary Fares and in respect of whom there can therefore be no liability. Merricks is distinguishable. Further, the observations of the Supreme Court in Lloyd were obiter and carry no persuasive weight. Applying normal principles of construction, section 47C(2) cannot lead to the conclusion that it extends to liability. Finally, Canadian authority, based upon legislation which does not include an aggregate damages system with class-wide liability, works well so that a construction of section 47C(2) which confines its scope to quantum is unproblematic. We turn now to address these arguments.

- Pass-on is relevant to liability. If a claimant has passed on an unlawful charge to its customers, it might have suffered no loss even if it was the direct victim of a cartel or other unlawful conduct. The Court of Appeal in Merricks [2019] EWCA Civ 674 held that the issue of pass-on was capable of leading to the conclusion that a claimant had suffered no loss but was nonetheless an issue that could be aggregated under section 47C(2) and was capable of being a common issue. The Court held:

- There was no appeal against this finding to the Supreme Court. Nonetheless, the Court approved of the conclusion of the Court of Appeal (ibid., paragraphs [64(a)] and [66] per Lord Briggs for the majority and paragraph [170] per Lord Leggatt and Lord Sales for the minority). This was noted and relied upon by the CAT in the present case (paragraph [113]) which held that properly analysed there was no inconsistency between the majority and minority in Merricks. The CAT also pointed out, by reference to an analysis in academic literature[2], that this conclusion differed from the conclusion of the Supreme Court of Canada in its jurisprudence under legislation of British Columbia which, as the CAT put it, reflected a "different statutory approach" (paragraph [113]).

- In Lloyd the entire court expressly held that the aggregated damages provisions in section 47C(2) could apply to liability as well as to quantum: see paragraph [31].

- These authorities were referred to with approval by this Court in Le Patourel (ibid at paragraph [32]), albeit in the context of the dichotomy between opt-out and opt-in claims.

- There is therefore a substantial body of case law treating section 47C(2) as applying to liability as well as to quantum. We do not accept that these authorities lack binding force. In Merricks it is true that the majority did not in terms explicitly apply section 47C(2) to liability but they nonetheless endorsed the judgment of the Court of Appeal which did adopt that position; and the minority was explicit. In Lloyd a unanimous court endorsed the conclusion that section 47C(2) applied to liability. That conclusion is in the part of the judgment where the court was considering alternative collective regimes to CPR 19.6 and is part of the overall logic of the judgment which was that where Parliament had intended to create collective regimes it had done so expressly. It can be inferred that the Court concluded that this was a reason not to endow the limited language in CPR 19.6 with a generous breadth. It is in our judgment an arid exercise to determine formulaically whether the Court's broad analysis of section 47C(2) formed part of the ratio. It is enough that it formed a part of the reasoning which led the court to its conclusion on CPR 19.6 and it is in any event, a unanimously expressed conclusion. We do not see any basis upon which we should decline to follow Lloyd.

- The appellants next argued that on the facts of Merricks the entire class was in an identical situation. All consumers using a card to make a purchase from a retailer paying an interchange fee had, to some degree, suffered loss. There were no scenarios where a no-loss situation could be identified. The observations of the Court of Appeal and Supreme Court had to be seen in this light and were accordingly distinguishable from the present case where there were many categories of consumer who had suffered no loss. Mr Moser QC disagreed referring to the treatment of pass-on in Merricks which was, he submitted, an illustration of possible no-loss claimants in a proposed class, and, the endorsement of the Supreme Court of the proposition that section 47C(2) could nonetheless apply (see paragraphs [31] and [32] above). Further, during the first instance proceedings in that case (when the facts were being determined) card issuers, in particular Mastercard, had tendered evidence highlighting differences between the various categories of cardholder and positing that there were no-loss categories and that this was relevant to their argument that the issues were not "common". The question of no-loss was accordingly a live issue which explained both paragraphs [45] and [47] of the Court of Appeal judgment and the analysis of the Supreme Court. We agree with Mr Moser QC. Supposed factual differences between Merricks and the present case are not a realistic way of distinguishing the judgment of the Supreme Court.

- The appellants further argued that section 47C(2) does not in its language refer to liability but only to damages. Read naturally the provision is limited to the size of an award of damages made in favour of an individual against whom a breach of duty had been established and who, by definition, had already been found (causally) to have suffered "some" (more than nominal or de minimis) loss from that breach. There was, it followed, no system of aggregation which could apply to the logically anterior liability issues of causation and loss.

- We disagree. It is common ground that quantum should be calculated so that an award of damages does not overcompensate. Section 47C(2) does not rewrite the constituents of the tort to remove liability issues; it merely permits those ingredients to be established deploying different - top down - evidence. In determining quantum, the CAT therefore necessarily ensures that it excludes from the calculation those who fail at the liability stage and the methodology must, at some point, include a device for winnowing out no-loss members of the class. When this methodology is applied it necessarily traverses the boundary between recoverability and non-recoverability. These are two sides of the same coin. We therefore have difficulty in understanding how an aggregate quantum exercise does not involve the CAT simultaneously determining liability for the simple reason that in fixing the outer-parameters of quantum it is also drawing the line between liability and non-liability. The language of section 47C(2) is consistent with this. It creates a power for the CAT in determining what is "recoverable" to apply an aggregate approach. The converse of recoverable is irrecoverable; the exercise of determining aggregate recoverability necessarily entails excluding categories of consumer who should recover nothing.

- In addition, section 47C(2) must be construed purposively. This includes: ensuring that the provision is "effective"; ensuring that it facilitates but does not hinder the enforcement of rights; and, enabling the collective regime to operate as a device which creates ex ante incentives for undertakings to comply with the law (see Le Patourel (ibid) paragraphs [25] – [30]). In NTN Corporation and others v Stellantis NV and others [2022] EWCA Civ 16 at paragraph [29] ("NTN"), the Court of Appeal, citing earlier Supreme Court and other judgments, described the principle of effectiveness: "… procedural and evidential rules must not make it practically impossible or excessively difficult to vindicate … justiciable rights". The appellants' construction of section 47C(2) does just that. If the appellants are correct, then the position of every individual in the class must be considered. Mr Moser QC did a quick calculation upon the basis that the claim of each individual was assessed by the CAT for a mere five minutes. He calculated that upon this basis the trial would last decades, which, as he put it, might pose a case management challenge for the Tribunal[3]. It is a defining feature of opt-out litigation that the class representative does not have to engage with individual class members until the distribution stage so that it would be inconsistent for the CAT, and inconsistent with the raison d'être of the collective action regime, to order opt-out certification but then require the class representative to be forced to call each member of the class to establish liability; thereby restoring opt-in by the back door.

- Finally, the appellants argued by reference to decisions of the Canadian courts which, it is said, are very important in shaping domestic law. They evidenced a robust and effective system of collective action operating without any form of mechanism for class-wide liability in the award of aggregate damages. This should lead this Court to adopt a limited construction of section 47C(2) confident that it would not undermine or emasculate the collective regime. We do not accept this argument. Unlike in Canada our domestic law does have an aggregate damages regime and it is the duty of this court to construe it in accordance with its purpose. Whether the Canadian system works well absent an equivalent is not a metric capable of sensible measurement and is not a proper approach to interpretation. How is this court to know whether the Canadian system is truly a success or not? In this regard Mr Moser QC drew our attention to academic literature on the Canadian regime which suggested that the absence of such a system for aggregation led to collective proceedings tending to fizzle out after common issues judgments with the parties diverting into ADR or mediation in order to find their own, non-judicial, aggregated ways of determining and distributing damages. In other words, because the legislation did not provide for aggregation the market was forced to find its own solution[4].

- In the course of the appeal, we were regaled with many Canadian and US authorities. It was said that the CAT erred in not following these cases. However, they pointed in all sorts of directions reflecting different governing laws and judicial practices and they revealed enduring differences between, for instance, judges in different circuits of the US. Standing back the value to date of Canadian authorities has been to assist in understanding the broad scope and architecture of the new domestic regime, introduced in 2015. They were useful in enabling the Supreme Court in Merricks to clarify some of the central guiding principles. In the present case the CAT helpfully summarised the main principles it considered could be drawn from the Canadian authorities which had both similarities but also important differences when compared with the domestic regime:

- Mr Moser QC expressed agreement with this summary. Neither of the appellants sought to pick holes in it. For our part we consider that it is a fair and accurate summary of the Canadian jurisprudence as it has continuing relevance to domestic law. It might, as case law evolves, not turn out to be exhaustive, but it is a very valuable starting point. At the more micro-level how different courts apply their discretion on an array of very particular certification issues under differing regimes to different facts is interesting and may have some modest illustrative value, but not much more than that.

- We treat the judgments in Merricks and Lloyd as dispositive and to be followed. In any event, in our judgment when interpreted purposively section 47C(2) is sufficiently broad to encompass liability and this conclusion is needed to ensure that the system of collective redress is workable. We reject this ground of appeal.

- This ground arises if the appellants are wrong in their submissions on Issue I and aggregation of liability is allowed under section 47C(2). The appellants then contend that the CAT erred in accepting that the methodology advanced by the class representative satisfied the Microsoft test. The methodology acts as a broad blueprint identifying the issues for trial and how they are to be resolved and provides important material from which the CAT can determine whether the issues are "common" and "suitable" for certification. It will therefore be relevant to a range of issues including breach of duty, causation, proof of loss and quantum.

- The claim in Microsoft was that Microsoft had overcharged electronics manufacturers for Intel-compatible PC operating systems and software purchased from retailers by class members. The Court held that the law permitted claims by indirect purchasers. In relation to certification the Court held that the standard of proof was the "some basis in fact" test set out in earlier case law (Hollick v Toronto (City), 2001 SCC 68). As to this Microsoft argued that the differences between the proposed class members were too great to satisfy the common issues requirement. The claim was based upon multiple separate instances of wrongdoing over a period of 24 years relating to 19 different products involving various co-conspirators and countless different contractual relationships. Further, the alleged overcharge had been passed on to the class members through the chain of distribution making it "… unfeasible to prove loss to each of the class members for the purposes of establishing common issues." The Supreme Court of Canada disagreed. Even a significant level of difference among the class members did not preclude a finding of commonality (applying Western Canadian Shopping Centres Inc v Dutton, 2001 SCC 46 ("Dutton")). If material differences did emerge during the proceedings the Court could deal with them at the time they arose (Dutton paragraph [54]).

- In relation to whether damages could be addressed as a common issue the Court considered that this depended upon the state of the expert evidence and the methodology proposed by the class. The articulation of the test to be applied by Rothstein J in Microsoft at paragraph [118] was adopted in Merricks in this jurisdiction. He said:

- The appellants highlight two aspects of the methodology advanced by the class representative's expert, Mr Holt, for particular criticism and argue that the CAT erred in law in accepting the methodology. The two areas of criticisms can be summarised as follows.

- First, they contend that the CAT was wrong to accept that the class could meet the Microsoft test by reference to a survey that the class intended to carry out in the future but had not, as of certification, conducted and/or that the description of the survey that was to be performed was so vague and imprecise that even if the CAT was entitled to defer it until later, it was still wrong to do so upon so insubstantial and flimsy a basis ("the survey issue"). Secondly, they contend that the CAT erred in coming to the conclusion that the class could take as a starting point an unproven and illogical assumption that no consumer would, rationally, wish to pay more for travel than they absolutely had to, and that it was therefore appropriate to certify a methodology which assumed but did not prove that all consumers in the class had suffered loss. This assumption was simplistic and unsustainable given that the defendant TOCs had adduced evidence before the CAT that there were many categories of case where Travelcard holders would not wish to obtain the lowest Boundary Fare or where Boundary Fares were simply irrelevant ("the assumption issue").

- In relation to both arguments the appellants contend that the paucity of detail in the methodology advanced by the class representative's expert failed to meet the Microsoft test. It was lacking in multiple respects: it was based upon speculation and unwarranted assumptions; it was based upon research and investigations which had yet to be carried out; it was incomplete in important respects in that it failed to grapple with issues such as the categorisation of no-loss claimants; it improperly reversed the burden of proof; and it created a risk that an award of damages would overcompensate the class and unfairly penalise the defendants.

- Mr Moser QC argued that the appellants' arguments came nowhere close to establishing that the approach of the CAT fell outside of its generous and broad margin of judgment or discretion. In its judgment the CAT summarised the step-by-step approach taken by Mr Holt, the expert instructed by the class representative. It expressed its own views upon the adequacy of each step. It evaluated whether the steps enabled the CAT at trial to adjudicate upon the issues arising. It addressed whether it could make adjustments later on during the course of the litigation to take account of variables and uncertainties and it addressed areas of the methodology which had yet, at the certification stage, to be undertaken and satisfied itself that they could be undertaken. The CAT questioned the class representative's expert from the witness box. The TOCs were entitled to pose questions but chose not to. When the judgment was fairly analysed there was no identifiable error of law which could be pointed to.

- These competing arguments raise an important issue as to the level of granularity and detail the CAT is required to demand of the methodology advanced by class representatives for the purpose of certification and compliance with the Microsoft test.

- We start with some observations on the Microsoft test based upon the facts of the present case and others recited in the authorities that we have been referred to.

- Not a statute: The Microsoft test is not a statutory test. There is no magic to it. It articulates a common sense approach that any court should be able to apply. It confers upon the court or tribunal a broad discretion to approve of the methodology to be used at trial. This is evident from the following terms used in the test: "sufficiently credible or plausible", "some basis in fact", "a realistic prospect of establishing loss on a class-wide basis", "the methodology cannot be purely theoretical or hypothetical", "grounded in the facts of the particular case", "some evidence of the availability of the data to which the methodology is to be applied." The words "sufficiently", "some" (used twice in the test), "grounded", "realistic" and "purely", highlight both the discretion conferred upon the CAT to make a value judgment, but also the relative nature of the exercise.

- The test is counterfactual: The methodology is based upon a counterfactual model of how the market would have operated absent the abuse. It is quintessentially hypothetical and, for this reason, will use assumptions and models and, frequently, regression analysis. It is therefore not a fair criticism to make of a methodology that it is hypothetical; though, equally, the CAT will expect to see "some" factual basis for the assumptions and models deployed, hence also the reference in Microsoft to the methodology not being "purely" theoretical or hypothetical.

- Absence of disclosure: The methodology is subject to a certification assessment prior to disclosure and is thereby necessarily provisional and might, properly, identify refinements and further work to be carried out after disclosure. In many competition cases there will be a distinct informational asymmetry between a claimant and a defendant which might be exacerbated in aggregate damages, top down, cases where the relevant information might predominantly be in the possession of the defendant. At the certification stage all that might be possible is for the class representative to advance a methodology identifying what might be done following disclosure. This is why in Microsoft the Court referred, in prospective terms, to there being "some evidence of the availability of the data to which the methodology is to be applied."

- Issues not answers: At the certification stage the methodology must identify the issues, not the answers. The CAT is concerned to identify the issues and gauge whether the methodology proposed for determining those issues is workable at trial when the issues are tested and might lead to different answers, some in favour of defendants. Because of this the CAT will wish to assess whether, if the defendants do win on some issues at trial, the methodology is capable of being adjusted so as to reflect only partial victory by the class.

- Intuition and common sense: Judges are expected to use their common sense. In this case the acceptance by the CAT of the assumption made by the expert, Mr Holt, that Travelcard holders could be assumed, rationally, to wish to pay the lowest possible fare is an example of the CAT arriving at a conclusion it considered was common sense or "informed guesswork". The validity of this approach has repeatedly been endorsed in case law: see e.g., Merricks (ibid) paragraphs [48] – [51].

- The breadth of the axe and the nature of the claim: In forming its judgment at the certification stage the CAT will bear in mind that at trial it is armed with a broad axe by which it can fill gaps and plug lacunae in the methodology. The axe head is adjustable and can expand and retract to meet the nature of the case. There might be less work for it to do in a case of a (relatively) straightforward counterfactual than in the case of a more complex one. In the present case the counterfactual might be relatively straightforward. At the risk of over-simplification, it is that in a journey from the start point within London (A) to the boundary (B) and then onwards to the destination (C) a consumer with a Travelcard is not charged for the A-B leg. In this case there already exists quite a lot of data capable of setting the starting parameters of the claim. Much of this is set out in the expert report of Mr Holt. More will become available following disclosure. At trial the CAT might be able to adjust the use of the data, for instance, by reducing the scope of the class and/or claim if the TOCs are correct that certain categories of the class should be excluded or that certain types of fare should not be subject to further reduction at the behest of Travelcard holders. If the data is relatively complete the CAT might not need to use the axe a great deal. However, in a claim by (say) indirect consumers in a pass-on case, the amount of available hard data might be far less at the certification stage (and indeed throughout the proceedings). The CAT might therefore be less demanding at the certification stage in the knowledge that the axe head can be expanded to facilitate the achievement of practical justice at later stages of the litigation.

- The axe and liability: The appellants argued that the broad axe did not apply to liability issues and that there was no authority establishing that it did. This misunderstands the purpose of the axe. It is not so much a substantive principle of law as a description of a well-established judicial practice whereby judges eschew artificial demands for precision and the production of comprehensive evidence on all issues and instead use their forensic skills to do the best they can with limited material to achieve practical justice. It was a term coined long before the introduction of the overriding objective into the Civil Procedure Rules but has continued vibrancy through that objective and its instruction to judges to act proportionately in the conduct of litigation having regard to the sums involved, the importance of the case, complexity, the financial position of the parties, and the need for expedition and fairness, etc. It was also a term coined long before Parliament conceived of collective redress mechanisms: see e.g. Sainsbury's Supermarkets Ltd v Mastercard Inc [2020] UKSC 24 at paragraphs [217] and [218] ("Sainsbury's") and the cases cited therein. The Supreme Court there treated the broad axe as a function of common law pragmatism: "The common law takes a pragmatic view of the degree of certainty with which damages must be pleaded and proved." The duty of the judge to do the best possible with the evidence available applies as equally to issues of causation and loss (liability) as it does to other issues relating to quantum. Further, when the appellants argued that there was no authority applying the broad axe to liability this assumed that Merricks, where the Supreme Court endorsed the use of the broad axe technique (see (ibid) paragraph [51]), was not a liability case. But as we have set out above, it was (see paragraphs [31] - [32] above).

- The test is about practical justiciability: Canadian case law suggests that when a decision is taken as to the methodology proposed the CAT is seeking, in broad terms, to determine whether that methodology will "advance the resolution" of the issues at trial and enable the court to determine the issue. These propositions were endorsed by the CAT judgment: paragraphs [102] – [104] citing the Canadian Supreme Court in Pioneer v Godfrey 2019 SCC 42 at paragraphs [107] – [109] and Vivendi Canada Inv v Dell'Aniello 2014 SCC 1 at paragraphs [45] and [46]. We agree that a central consideration for the CAT when scrutinising a methodology under the Microsoft test is to decide whether it is workable at trial, but always bearing in mind that the CAT has the power to wield its broad axe and work, in a relatively rough and ready way, with assumptions and common sense intuitions, and that it can permit or even require adjustments to the methodology prior to and at trial.

- The height of the bar: In Merricks Lord Briggs, for the majority, stated of the test, that the threshold for certification was not onerous not least because it had to be formulated in advance of disclosure (ibid paragraphs [40] – [42]). We do not demur but it is necessary to put this into context. The Court was not intending to indicate that the Microsoft test was toothless, or that the CAT would not closely scrutinise the methodology proposed by class representatives for the purpose of obtaining certification. The aggregate damages regime represents a paradigm shift in the dynamics of tortious recovery. A defendant subject to an award is required to disgorge the total loss flowing from its breach. This contrasts with the pre-existing position whereby a dominant undertaking exploiting its position through the imposition of (say) unfair prices on consumers was in practice immunised from the adverse consequences of its breach by the lack of any realistic ability or incentive for a small consumer to take on the dominant undertaking in litigation. The introduction of the collective action and aggregation mechanisms reversed the landscape and has in consequence materially heightened litigation risk for undertakings. The CAT therefore plays an important gatekeeper role in certifying claims and will always vigilantly perform that function (judgment paragraph [12]). It will seek to strike an appropriate balance between the right of the class to seek vindication and the right of defendants not to be subject to a top down claim unless it is a proper one to proceed.

- Calling members of the class: The appellants criticise the class representative for not being prepared to put up class members as witnesses to support the methodology. This is misplaced. The logic behind an opt-out order is that the representatives of the class will not have contact with class members at any point prior to distribution and in an aggregate damages case not only is the CAT forgiven the task of considering individual evidence but the probative value of evidence from a small handful of carefully selected consumers out of millions might be strictly limited. The class representative is not prohibited from looking to the class representative, for instance to answer a survey. But the CAT is unlikely to be moved by a generic complaint that the class representative is not calling individual members.

- De minimis or nominal claims: The appellants also argue that in determining the divide between loss and no-loss the CAT must take into account that many claims are de minimis. Quantum should be limited to those individuals who would be awarded more than nominal damages and the methodology must cater for this. Figures set out in Mr Holt's report indicated that some consumers might have suffered losses equivalent to the price of a takeaway cappuccino. The methodology failed to winnow out such claims from quantum. Mr Moser QC, relaying an observation of Mr Gutmann, retorted that for some consumers even a cup of takeaway coffee is meaningful but that in any event such marginal cases were extreme and unrepresentative. We approach the issue from first principles. First, by their nature collective actions are often brought on behalf of consumers who suffer small individual losses from a breach. The facilitation of such claims is part of the justification for the existence of collective redress regimes. A top down, aggregate, claim serves to ensure disgorgement of the fruits of the breach. In mass consumer claims quantum might characteristically be calculated by multiplying very small numbers (the individual claim) with very large numbers (the class) to arrive at a substantial aggregate award. An analysis of whether a claim or category of claims might be nominal or de minimis forms no part of such an exercise. There is no logic in the CAT calculating an aggregate award which is the sum of a multitude of small claims but then slicing off a percentage to reflect the fact that some (or even most) of the claims are small. To allow this would derogate from a central purpose behind the regime which is to vindicate the collective rights of consumers sustaining small losses. Secondly, and in any event, courts do not refuse compensation to those who only suffer very small losses from a breach. Nominal damages are paid to those who suffer no loss but in favour of whom the court nonetheless orders a small payment to reflect and mark the breach. The courts do order damages where the amount is small but nonetheless discernible (see generally McGregor on Damages (20th edition, 2017) paragraphs 12-001ff). For these reasons in a top down exercise no deductions are made upon the basis that some of the class will have suffered only small losses and there is therefore no requirement for a methodology to address this under the Microsoft test.

- With these considerations in mind, we turn now to the survey issue and the criticisms made of the methodology which we have summarised at paragraph [48] above. We do not accept these submissions.

- First, in its judgment (paragraphs [140] – [164]) the CAT set out a detailed summary of the methodology assessing it against the Microsoft test. It stripped it down into its constituent stages and set out its conclusions on the main issues in dispute between the parties. The starting point therefore is that the CAT applied the correct test in law. It did not take into account irrelevant considerations nor did it ignore relevant matters. In an area where this court accords to the CAT a broad margin of judgment and discretion the fact that the challenge is to the CAT's evaluation of conflicting economic evidence which involves a forward looking counterfactual assessment of how issues will unfold at trial, after disclosure, means that the hurdle for showing an error of law is high. To be fair Mr Jowell QC for First MTR and Stagecoach did not shrink from an acceptance that this was the task confronting the appellants.

- Secondly, the nature of the burden confronting a claimant is important under the Microsoft test. The issue relating to surveys concerns an estimate of Travelcard holdings. It is clear from the 1st expert report of Mr Holt that he had addressed this relying upon a variety of different data sources. However, he suggested that the data could be improved by use of a survey. This came under sustained criticism from the defendants who argued that the sources relied upon would not properly capture historical Travelcard holding patterns or the overlap between such holdings and TOC ticket purchase. In a second report Mr Holt addressed these concerns. He also set out, in detail, how a survey would be carried out. He described the methodology including its target population, the sorts of questions that would be asked, and how the results would be interpreted. He also set out the adjustments that would be made to take account of other variables. At paragraphs [162] and [163] the CAT emphatically, and in our judgment correctly, rejected the TOCs' criticism making the point that at the certification stage what was required was for the expert to "… explain the methodology proposed and indicate the available sources of data to which it will be applied, but … not … provide detailed elaboration of the way the analysis or analyses will be conducted." Demands from the TOCs that the methodology should go further were "disproportionate" and "wholly misconceived":

- Thirdly, the CAT went to pains to satisfy itself during the certification hearing that at trial the methodology could be adapted so as to reflect, for instance, issues upon which the defendants might be successful. For example, Mr Holt was questioned from the witness box by the CAT panel, and in particular by its economist member (Professor Mason), about various aspects of the methodology including whether it would be possible to exclude from aggregate damages certain fares or customers at trial. The exchange focused upon so-called point-to-point tickets. The purpose of the exchange was so that the CAT could satisfy itself that it had understood the methodology and how it could be adjusted at trial. This reinforces our conclusion that the CAT exercised a vigilant gatekeeper role and went to proper lengths to satisfy itself as to the robustness and fitness for purpose of the class representative's methodology[5].

- Fourthly, the transcript of the questioning of Mr Holt involved him explaining how his estimates would need to be perfected following disclosure. The CAT accepted that the methodology was based upon data that might be sub-optimal but took into account that at the certification stage disclosure was yet to occur. This was a relevant conclusion which was well within the CAT's margin of judgment to consider.

- With respect to the appellants' forceful arguments, it is our judgment that the challenge under this heading does not raise an arguable point of law. It merely reflects disagreement with the expert evaluation of the CAT. We reject this ground of challenge.

- We turn to the second ground of challenge. Boiled down to bare essentials it can be summarised in the following way. The expert methodology took as a starting assumption that no rational consumer would wish to pay more than was absolutely necessary. This enabled the class representative to devise a methodology that ignored consumers who did not wish to purchase Boundary Fares and certain types of journey for which a Boundary Fare was said by the TOCs to be inappropriate. Because of this assumption the methodology took as defining parameters: (i) the total number of Travelcard holders; and (ii) the total number of journeys made by such Travelcard holders where no Boundary Fare was offered. The CAT endorsed the assumption as valid as a starting point for the purpose of certifying the methodology (judgment paragraph [158]).

- The appellants argue that the CAT erred in approving this assumption. There were a range of categories of situation where passengers freely and deliberately chose not to use a Travelcard to obtain the best fare and as such they suffered no loss from any failure on the part of the TOC to offer such a fare. By permitting the class to build a methodology upon a hypothetical and assumed foundation it was, in effect, reversing the burden of proof because to succeed the burden now lay with the defendants to prove that there was no loss, rather than with the class to prove that there was loss. It created an unacceptable form of strict liability and could lead to an unfair and unprincipled overcompensation of the class. The categories identified were as follows:

- In oral argument Mr Jowell QC, for First MTR and Stagecoach, gave a series of examples which he said represented further cases where it could not be said that there was an abuse: a consumer at a TVM who failed to select a Boundary Fare through no fault of the TOC; a consumer who purchased a ticket at a ticket desk but who failed to mention his or her Travelcard and; a consumer who mentioned the Travelcard but when offered a Boundary Fare deliberately chose to buy a higher priced ticket. All the categories set out above and the examples given by Mr Jowell QC highlight different issues. Some are related to the scope and effect of the alleged abuse, others are related to the scope of the defined class and some are related to the conduct of the consumer. The argument goes to whether breach and liability issues are sufficiently "common" and, in consequence, whether the proceedings are "suitable" for certification.

- With one exception (concerning point-to-point fares – category (iii) which the CAT accepted should be carved out), the CAT analysed each of these categories rejecting, for a variety of different reasons, the argument that they were unsuited to being common issues for trial or rendered the proceedings unsuitable for certification. The starting points for the CAT's analysis were the broad propositions that: (i) the existence of some no-loss claimants in a class was not an obstacle to certification, and (ii) the interests of defendants could be catered for at trial by adjustments using sensible estimations and assumptions:

- In our judgment this was the appropriate point of departure. It recognises that a starting methodology will rarely, if ever, reflect a perfect blueprint for the trial and that rough edges can be smoothed by the court making adjustments in due course, including at trial using broad axe powers. Over and above this the CAT did proceed (in paragraphs [127] – [134]) to consider each of the categories and save in relation to point-to-point fares (paragraphs [132] - [134]) considered that the categories were not as relevant or significant as was suggested. We can identify no error in this analysis, and we do not repeat here the CAT's assessment. We do however add some limited conclusions of our own in response to specific arguments arising during the appeal which focus upon the assumptions made by the appellants as to what amounts to an abuse.

- First, some of the categories (e.g. (vi) and (vii)) assume that the counterfactual is a market in which to avoid acting abusively the TOCs need only offer choices of fares i.e. permit consumers to pay more if they wish to. That being so if consumers choose to pay more (because for instance they do not care about price optimisation or are in a hurry) the TOCs could not be held responsible for the loss flowing from this deliberate consumer decision. The determination of the correct counterfactual will be an issue for trial, but it is in our view arguable that in the correct counterfactual the only way to avoid an abuse is for the TOC to create a system where there is no material possibility that the Travelcard holder pays more than the Boundary Fare. If the duty of the TOC is simply to deduct Travelcard pre-payments from the ticket price, then the possibility that consumers choose to pay more than the Boundary Fare is eliminated or at least vastly reduced. In this no-abuse counterfactual when a consumer goes to a TVM to buy a ticket it will be swift, easy and automatic for the consumer to ensure that the TVM charges a sum for the journey reflecting the Travelcard prepayment[6]. Put shortly we are not convinced that the issue is about choice but, instead, is about the making of automatic deductions. Mr Jowell QC for First MTR and Stagecoach submitted that it was not as simple as we appeared to believe and that there were many obstacles lying in the way of the coding of the software in TVMs to achieve straightforward, simple, and automatic deduction of the pre-payment reflected in the possession of the Travelcard. We saw no evidence which established this proposition but such matters will be for the CAT to consider at trial both as to their technical correctness but also as to their relevance, even if correct.

- Secondly, the appellants assume that ostensibly irrational choices made by consumers may nonetheless be relevant: see the examples at paragraph [72] above. In the counterfactual however there would be a very high degree of transparency which would ensure the ready availability of comprehensive and accessible information about Boundary Fares and how to purchase them. Granted, there might be occasions when a consumer acts perversely, but these will or should be very rare and if the system is constructed so that the Travelcard pre-payment is also deducted at source the scope for even irrational decision making by consumers should be largely eliminated.

- Thirdly, categories (i) and (ii) (in paragraph [71] above) assume that there will be no abuse if another ticket for the full journey (such as an Advance Fare) may have been cheaper than a Boundary Fare. We analyse this in paragraphs [111] – [114] below and doubt the premise behind the proposition. But, even if the appellants are correct, as the CAT has observed, adjustments can be made at trial for example to exclude such fares from the quantum calculation.

- In argument the appellants raised the spectre that absent a detailed methodology to deal with these matters there was a real risk that any order for damages would be unfair to the defendants and would overcompensate the class. We disagree. This argument would only hold water if the CAT was unable to make adjustments at trial to take account of issues the defendants prevail upon. However, the CAT is alive to the need to do just this so as to avoid the risk of unfair overcompensation. Mr Moser QC made the valid point that the CAT might adopt a "conservative" (pro-defendant) approach to deductions. If (say) it was of the view that there was a category of person who had suffered no loss which accounted for between 2 – 3 % of the total class, the CAT might choose to reduce the total aggregate damages by a sum reflecting 3%, so as to err on the side of caution. At all events it is clear to us that the CAT is perfectly capable, making ample use of its broad axe and applying its acquired and evolving expertise, of making such adjustment as it sees fit to preclude over-compensation.

- In conclusion we reject this ground of appeal.

- In considering suitability the CAT held that the overall cost/benefit balance was "slightly" against certification (judgment paragraph [178]). However, and taking into account other considerations, the CAT nonetheless made the CPO. First MTR and Stagecoach argue that the CAT failed to attach sufficient weight, when considering suitability, to the fact that the collective proceedings would be "… hugely expensive, and overwhelmingly for the benefit of funders and lawyers". They point to the likelihood that, if the CAT makes an award of damages, few consumers will come forward to claim the paltry sums on offer and in any event even legitimate claimants will confront difficulties of proof, e.g. in presenting a valid ticket for travel.

- One component of a cost/benefit analysis involves assessing the costs predicted to be incurred by the class representative. The CAT noted that the costs budget of the class representative for the litigation was just over £11 million (judgment paragraph [48]). This included an assessment of costs for the certification stage of c£660,000. However, when, following the judgment, the class representative came to apply for the costs of the certification hearing they claimed a sum of c£1.94 million, over three times the budgeted figure. In its subsequent ruling on ancillary matters, the CAT expressed the view that this was "staggering".

- It is now argued that this shows that the initial cost budget may prove to be an underestimate. When it came to a judgment on cost/benefit the CAT therefore worked with out of date and materially inaccurate information and as such it proceeded upon a basis which was tainted by an error of law. Had the CAT been in possession of an accurate cost projection, given the marginal nature of the decision, it might not have made the CPO.

- By way of preface to our conclusions we acknowledge that it is important for the CAT to exercise close control over costs. There are conflicting considerations at play. On the one hand to enable mass consumer actions to be viable at all will invariably necessitate the assistance of third-party funders (see the discussion in Le Patourel (ibid) at paragraphs [75] – [80]) and the CAT must therefore recognise that litigation funding is a business and funders will, legitimately, seek a return upon their investment. On the other hand there is a risk that the system perversely incentivises the incurring or claiming of disproportionately high costs. And there is also the risk, highlighted in Canadian literature, that third-party funders have an incentive to sue and settle quickly, for sums materially less than the likely aggregate award. This, if true, risks undermining important policy objectives behind the legislation which include properly rewarding the class and creating ex ante incentives upon undertakings to comply with the law[7].

- The submission was touched upon only briefly during the oral hearing. We do not accept it. There are three points we would make.

- First, the appellants accept that the information now relied upon was unavailable to the CAT during the certification hearing and no blame is therefore attached to the Tribunal. It is raised, in effect, as fresh evidence upon the appeal. However, no application has ever been made to the CAT inviting it to reconsider its substantive judgment on certification in the light of this fresh evidence and there is no material evidence before us as to the reasons for the increase in budgeted costs or as to the implications of any increase for the overall cost budget. For all we know the increase might be justified and/or have no material effect or impact upon the overall budget. In these circumstances we do not consider it appropriate to adjudicate upon the matter. We do not consider that an issue of law properly arises for our determination.

- Secondly, in any event, the answer to concerns such as those expressed lies in the close supervision of costs by the CAT to ensure that they are proportionate: see Le Patourel (ibid) paragraph [78]. The proffering of an exorbitant costs budget does not mean that those costs will be ordered to be paid if the class prevails at trial; and the mere fact that at the certification stage costs seem high does not mean that the CAT will simply accept that figure as appropriate for the purposes of a cost/benefit analysis. We cannot see that the CAT would therefore necessarily have taken any materially different view of suitability had it known of the most up to date costs figures.

- Thirdly, as to the appellants' pessimistic prognosis that an award will not be claimed, this is an untested premise. It assumes that the CAT lacks the ability to find creative ways of ensuring that the award is distributed so as to maximise the benefit to relevant consumers. Once an award has been made the choice of distribution is binary and lies between distribution to the class and distribution to the selected charity. Whilst we express no decided position upon the issue it certainly seems arguable that it is open to the CAT, if it accepts the appellants' gloomy forecast, to consider whether there are appropriate proxies to distribution to individual claimants such as ordering a prospective reduction in certain fares upon the basis that if it is impossible from a practical perspective to cure the past then a forward-looking remedy might suffice. This might be because it would capture a substantial portion of the consumers who had sustained a past loss but who, for whatever reason, would not come forward to make a claim, perhaps because, as the appellants argue, they no longer possessed proof of travel. Given the legally binary nature of the choice of distribution – class or charity – then a method of distribution which, albeit in a relatively rough and ready way, goes to future travellers might be a far better fulfilment of the purposes of the collective redress scheme than payment to the nominated charity.

- For all these reasons we reject this ground of appeal.

- The CAT held that a broad formulation of abuse whereby the defendants failed to ensure that the class was not double-charged was arguable and had to go to trial and it refused summarily to dismiss the claim. The core allegation was in the following form:

- The abuse was manifest in two principal ways. First, where Boundary Fares existed, they were not offered from all outlets and/or they were not easily accessible (see paragraphs [17] and [18] above). Secondly, in relation to certain journeys no Boundary Fares were offered at all.

- Section 18 CA 1998 provides that the abuse of a dominant position may consist, inter alia, in directly or indirectly imposing "unfair" prices or other "unfair" trading conditions (see paragraph [3] above). The CAT set out in some detail the relevant law. It concluded that the law on "unfair" abuses was in a state of development and that the categories of abuse were not closed (judgment paragraph [60]). It held that it was neither an extraordinary nor a fanciful proposition to categorise as an abuse a "system operated" by a dominant company which failed to be transparent as to the availability of cheaper alternative prices for the same service (paragraph [64]). The CAT pointed out that in relation to alleged exploitative abuses, which it was the "special responsibility" of dominant companies to avoid, it was relevant that the customers charged were end-consumers (and predominately individuals), as opposed to commercial undertakings (paragraph [65]). It also pointed out that the law was concerned with substance and not form and that the case advanced was not a "dramatic" extension of the law (paragraph [65]). We agree with the CAT's general analysis; it is clearly arguable that for a dominant undertaking to create a system which routinely double-charges consumers may be unfair and abusive.

- In this appeal, two components of the CAT's conclusions are challenged. All appellants challenge the failure of third parties, who sell tickets for travel on the TOCs' services to passengers holding Travelcards, to offer Boundary Fares in relation to discounted fares, such as Advance Fares. The contention is that it is not arguable that such situations reflect abuse. Only LSER challenges the conclusion of the CAT that the failure to offer Boundary Fares in relation to "all" ticket types, and in particular Advance Fares, was arguably abusive.

- The law relating to abuse is concerned with consumer unfairness because when an undertaking is dominant it is, by definition, freed from the competitive shackles which otherwise incentivise and discipline it to maximise consumer welfare and benefit. This is why most laws worldwide which prohibit abuse of dominance include within the prohibition the imposition of some form of "unfair" terms and prices. These are often described as "exploitative" abuses. There is no single definition of unfairness set out in case law. One leading commentary (O'Donoghue and Padilla, "The Law and Economics of Article 102 TFEU", 3rd Edition, 2020), provides a useful summary of the case law (ibid pages [1031] – [1045]) and observes (page [1037]) that the test includes asking whether the disputed term is "reasonable" bearing in mind the legitimate interests of the dominant undertaking, its trading parties and consumers. It is commented that the reasonableness test seems vague but that a more developed definition from case law is one which involves two stages and entails an analysis of (i) whether the disputed term serves a legitimate purpose and if so (ii) whether it is proportionate relative to that purpose.

- Two judgments of the CJEU are of particular relevance. The first is Cases C-147 & 148/97 Deutsche Post ("DP"), EU:C:2000:74. This concerned charges levied by the German postal operator. In accordance with an international agreement, where mail was posted in another European country for delivery in Germany, the German operator recovered "terminal fees" from the operator in the third country. Such charges did not however cover the full cost of delivery. An international bank with a billing operation in Germany arranged to send its regular communications to customers in Germany and elsewhere from The Netherlands where it paid locally set international postal charges. DP claimed postage charges from the international bank at the full internal rate for domestic postage, on the basis that the communications, although posted in the Netherlands originated in Germany. It therefore charged the full rate and did not offset or otherwise account for that part of the service already paid for. On a reference from the German Court the CJEU held that this amounted to an abuse of dominance:

- The second case is Case C-385/07P Duales System Deutschland ("DSD"), EU:C:2009:456. This concerned a Commission decision that DSD, a company operating a system for collecting waste packaging on behalf of manufacturers and distributors, had abused its dominant position. Under German environmental protection laws, manufacturers and distributors of packaged goods were required to put in place arrangements for recovering from consumers sales packaging free of charge. Manufacturers were however exempt from this if they participated in a third party system guaranteeing regular collection throughout their sales territory of used packaging. DSD was the only operator of such a system throughout Germany but there were alternative operators at regional levels. Subscribers to DSD's system would affix DSD's green dot logo to their packaging and DSD would then collect the packaging. The fees charged by DSD were based on all packaging bearing the DGP logo irrespective of whether it was actually collected by DSD as opposed to the manufacturer collecting it themselves or using another third party. Before the Commission DSD argued that manufacturers could elect not to affix the logo to packaging not to be collected by DSD. For various reasons this was rejected by the Commission as economically unrealistic and impractical. A Grand Chamber of the CJEU noted that an abuse of dominance under the Treaty could be constituted by directly or indirectly imposing unfair prices or other unfair trading conditions. The Court then applied a proportionality test whereby the charge was disproportionate to the economic value of the service provided. It held that charging a fee for a service that was not used or wanted was abusive:

- Case 127/73 BRT v SABAM [1974] ECR 313 is another example of conduct by a dominant undertaking that sought something for nothing and which was held to be abusive. It concerned a provision in the terms and conditions set by a copyright collecting society which permitted the society to continue to exercise rights for five years following withdrawal of the member from the society. It was held to be unfair and abusive because it was not "absolutely necessary" to protect a legitimate interest of the dominant undertaking.

- In paragraph [61] of its judgment in the present case the CAT referred to the recent judgment of the Federal Supreme Court in Germany in Facebook, 23rd June 2020, ("Facebook") in which the Court set aside a decision of the first Cartel Panel of the Dusseldorf Higher Regional Court of 26th August 2019 which had suspended, pending a full appeal, a decision of the Bundeskartellamt dated 6th February 2019 (Reference B6-22/16). That decision had been taken under the provisions of German competition law prohibiting the abuse of a dominant position (in Chapter 2 of the "Gesetz gegen Wettbewerbsbeschränkung" or "GWB") which are identical to the Chapter II prohibition. The judgment of the Federal Supreme Court was limited to points of law (ibid paragraph [7]). It strongly endorsed the Bundeskartellamt decision. In Preventx Limited v Royal Mail Group Ltd [2020] EWHC 2276 (Ch) the High Court treated this judgment as illustrative of the broad range of potentially abusive trading conditions that a dominant undertaking might impose (ibid paragraph [88]). It was relied upon by the CAT in the present case to show the potential breadth of section 18 and its ability to challenge a wide range of consumer harms. The judgment in Facebook reflects the application of the reasonableness/proportionality test to a new factual scenario. Nonetheless, there is, in our view, nothing especially startling about the analysis of the Court.

- The Federal Supreme Court judgment[8] summarised the abuse in the following way:

- In paragraph [58] the Court, in rejecting the conclusion of the lower Court that there was no abuse because consumers could choose not to use Facebook at all in order to avoid having to permit Facebook to use their personal data, observed as follows:

- Facebook is an example of an unfair intrusion into consumer rights. It seems on a par with the case law. Further, illustrations of non-price abuse, which also highlight how the law protects consumers against unfair intrusions into their rights, are found in Case T-83/91 Tetra Pak v Commission [1994] ECR II-755 confirmed on appeal in Case C-333/94P [1996] ECR I-5951 ("Tetra Pak"). The case concerned machines and consumables sold by Tetra Pak, a dominant manufacturer of cartons (e.g. for milk). A decision of the Commission finding that many terms and conditions imposed by Tetra Pak were abusive was upheld by the CJEU. These included an absolute right of control over the equipment configuration prohibiting the buyer from adding accessories to the machine or making modifications to it or adding or removing anything from it or even from moving the machine. These terms were unfair because they deprived the owner of "certain aspects of his property rights", and they made the buyer "totally dependent on Tetra Pak's equipment and services". Other clauses concerning the operation and maintenance of the equipment which gave Tetra Pak the exclusive right of maintenance and repair were abusively unfair because they bound the customer to Tetra Pak and precluded maintenance even by the buyer's own repair staff. Clauses requiring the buyer to transfer ownership to Tetra Pak if they wished to sell the machinery and allowing Tetra Pak a right of re-purchase at a pre-ordained price were unfair because they were inconsistent with the buyer's right of ownership.

- A lack of transparency can be an important factor in rendering unlawful that which might otherwise be lawful. In Case 322/81 Michelin [1985] ECR 3461 the Commission found that the dominant undertaking had granted target rebates to its dealer customers which had the effect of tying them to supplies from Michelin and, in consequence, making it harder for smaller rivals to sell to Michelin's customers. The rebates were abusive for a number of reasons one of which was that they were lacking in transparency. The level of rebate applicable to purchases made by a dealer was not transparently set out. Rebates were offered under a system applied after the event and in uncertain and variable amounts. The lack of transparency and resultant uncertainty had the practical effect of making dealers unwilling to purchase from new sources of supply for fear of losing increased rebate and this in effect tied customers to Michelin and created an entry or expansion barrier to rivals. On appeal the CJEU (ibid paragraphs [84] and [85]) upheld the Commission decision. The rebates were abusive because they were part of a "discount system" which was "calculated" to prevent dealers from being able to exercise a free choice as between suppliers. The vice in that case was the exclusionary effect upon rivals to Michelin, not upon the fairness of the terms offered to dealers. Nonetheless, it illustrates how a lack of transparency can be relevant to whether conduct is abusive.

- To show that a term is unfairly abusive it is not always necessary to show that it is causally connected to the dominant position. In some cases it might be possible to establish that absent dominance the undertaking, in all likelihood, would not have been able to impose the term in question and this might be relevant to whether a term is unfair: See e.g. Case 27/76 United Brands v Commission EU:C:1978:22 at paragraphs [248] and [249]. But that is but one means of establishing abuse in cases of consumer harm. In neither DP (ibid) nor DSD (ibid) did the CJEU consider whether the terms in question would have been imposed in a genuinely competitive market. In both cases the Court simply examined the fairness of the disputed term as a standalone proposition. The same point was made in Facebook (ibid) at paragraphs [65ff] of the judgment of the Federal Supreme Court.

- In the light of this review of the case law we turn to the first ground of challenge which concerns whether the defendants are responsible for the conduct of third parties who sell tickets for use of a TOC rail service but who fail to honour Travelcards and/or offer Boundary Fares. This ground of challenge arises only if the defendants are found to be liable for their own conduct. If their own conduct is not abusive, the same conduct by third parties cannot engage the TOCs' liability. As to this LSER argues that third party retailers are licensed by all TOCs acting collectively through the Rail Delivery Group ("RDG"), an industry trade body of which the TOCs, among others, are members. LSER has no individual contract with those third parties. Further, third party sellers compete in various ways with TOCs as regards ticket sales. LSER submitted to the CAT that it: "… could not possibly be liable for any failure by such third parties … to inform customers about the possibility of a Boundary Fare, or to respond adequately to inquiries, since it is in no position to set the terms on which such independent entities sell their tickets". Mr Moser QC disputed this. He argued that the relationship between a TOC and third party outlets was one of agency with the latter selling on behalf of the TOCs as principals. No TOC could escape liability for abusing dominance upon the basis that it used agents to sell its tickets. At base all of this was however arguable and for exploration at trial.

- The CAT held that it was unnecessary at the certification stage to explore the nature of the boundaries of any agency relationship between a TOC and third parties. The position was analogous to the liability of cartelists for "umbrella pricing". This described the situation where cartelists unlawfully agreed to raise prices and were liable not only for the sale at inflated prices of their own, cartelised, products but, insofar as that led to an increase in prices across the market, also for over-priced sales made by producers outside the cartel who adapted their prices (upwards) so as to sit at or just below the cartel prices. This was a principle which was unrelated to principal and agent relations. The CAT cited by way of example Case C-557/12 Kone v ÖBB Infrastruktur, EU:C:2014:1317. The CAT held:

- In our judgment this is clearly an issue for trial. If the third parties are agents, whether selling via some species of collective joint venture or otherwise, then it is hard to see how a TOC can escape liability for abuse simply because it sells via that agent. But if a TOC sells under some different form of relationship then it is also arguable that, since they are assumed to be in a dominant position and have a "special responsibility", it is abusively unfair for them to set up a system (whether by themselves or with other TOCs through the RDG) whereby third parties can act in a manner which would be unfair and abusive if carried out by the TOC. Further, if TOCs have, inter se, under the Travelcard Agreement, an obligation to "honour" Travelcards (see paragraph [14] above) that fact might be relevant to whether when they relinquish responsibility for sales to third parties without ensuring that the third parties do honour Travelcards, they are acting lawfully.