Introduction

1.

The claimants are a father and three sons. In this judgment I refer to

them by their first names when distinguishing between them. The Haider family

is Kuwaiti by nationality and domicile and is very wealthy. The first

claimant, Mahmoud Haji Haider Abdullah, is the father and head of the family.

He completed a secondary school education in Kuwait but did not go to

university; he has only very limited English. He established his business fortune

initially through a very successful retail jewellery business founded in the

late 1970s, subsequently expanding into many fields, including real estate,

media, telecoms, financial services, medical services, energy, oil and gas,

hospitality and retail.

2.

The second claimant, Maytham, is a medical doctor, qualifying at the

University of Kuwait in 1998. He also has a degree in Public Health and Policy

awarded jointly by the London School of Hygiene and Tropical Medicine and the

London School of Economics. Having practised for a few years as a GP, his

principal career since 2003 has been in the medical services business and he is

or has been a member of the Board of Trustees of the University of Sciences and

Technology, Kuwait, and of the University of Kuwait. He has also served on the

boards of other businesses, including the family holding company, Al-Zummorodah

Holding Company, and its financial services subsidiary, Zummorodah Investment

Company (known as Z-Invest); and in 2006, he was approved by the Qatar

Financial Centre Regulatory Authority to have an ‘Executive Governance

Function’ for United Gulf Financial Services Company.

3.

The third claimant, Mahdi, has an undergraduate degree from the

University of South Florida in Management Information Services and an MBA

(Marketing and International Business) from the University of Miami. He spent

four years at Al Ahli Bank in Kuwait, gaining some experience across all of its

activities (although I did not have any real evidence as to what those

activities entailed); then from 1998 his primary occupation was as director of

sales and business development at Wataniya Telecoms, to which I refer further

below. He was a vice-president of Al Qurain Holding Company, whose core

business involved investing in listed and unlisted companies. He was also,

from 2005 until 2008, chairman and managing director of Al-Zummorodah Leasing

and Financing Company; and for a time he was chairman and managing director of

Z-Invest.

4.

The fourth claimant, Mansour, is a graduate of the Commercial College at

the University of Kuwait with a degree in Marketing. He has spent his working

life to date in the family’s media business in Kuwait.

5.

The Haider family’s interest in the telecoms sector took the form of a

shareholding in Wataniya Telecoms. That interest, together with the interests

of other shareholders, was sold through the Kuwait stock exchange in 2003 for

US$1.5 billion, generating cash of US$150m for the family. That very large,

public transaction generated numerous approaches to the claimants on the part

of western banks offering investment services. One such was Credit Suisse and

as a result, from April 2004 the claimants were joint account holders and

clients of Credit Suisse’s London-based private banking business carried on by

Credit Suisse (UK) Ltd, the first defendant. Their relationship manager was

Mahmoud Zaki. The Haider family as constituted by the four claimants would no

doubt be characterised as an ‘ultra high net worth’ client by any private

banking investment service. I did not have comprehensive evidence of the

family’s total wealth, but I am satisfied that during the period when they were

investing in structured products through Credit Suisse, from mid-2004 until

late 2008, their net worth was of the order of US$500 million (at least).

6.

Once the private banking account was set up, there was effectively no

contact between Mr Zaki or anyone working under him and either Mahmoud or

Mansour. All relevant dealings and interactions during the life of the account

were conducted by Mahdi or Maytham on behalf of the family. In fact, as I

shall describe, there was precious little contact with Mahmoud even to set up

the account. Once the account was opened, it was used by Mahdi and Maytham to

invest on a leveraged basis in structured products (‘Notes’), sold to them by

Mr Zaki.

7.

These proceedings arise out of the global financial crisis and, in

particular, the market turmoil in October 2008 following the collapse of Lehman

Brothers in mid-September 2008. At that time, the claimants were invested

through the Credit Suisse account in three Notes of a product type labelled

‘SCARP’ by Credit Suisse. SCARP was an acronym for Structured Capital-at-Risk

Product. The claimants had an investment in those Notes net of borrowing of c.US$26m;

the aggregate redemption value, if the Notes redeemed at par, was US$58.4m.

One of the Notes was issued by BNP Paribas rather than Credit Suisse; the

issuer of the Credit Suisse Notes was Credit Suisse Securities (Europe) Ltd,

the second defendant. All the Notes were sold to the claimants as private

banking clients of Credit Suisse by Mr Zaki.

8.

The claimants had also borrowed c.€5.8m from Credit Suisse, equivalent

in late October 2008 to c.US$7.6m, and had cash at Credit Suisse of c.US$10.3m,

so there was a cash surplus above their Euro loan of c.US$2.7m.

9.

At the end of October 2008, Maytham and Mahdi chose not to meet a margin

call issued by Credit Suisse, resulting in the liquidation of their investment

in the Notes, as Maytham and Mahdi knew and intended it would. The claimants

suffered thereby a total loss of their net investment in the Notes and their

surplus cash at Credit Suisse and indeed were left overdrawn at Credit Suisse

by US$336,275.60. It is common ground that the

claimants owe that final overdrawn amount to Credit Suisse, subject to the

impact of their claim. That is not to say that the claimants necessarily have

a claim (if they establish liability) for the full amount lost by them at

Credit Suisse (on a simple view, c.US$29m as at the end of October 2008). Any

damages claim must compare the actual outturn (c.US$29m lost then) with the

outturn that would have resulted upon a hypothesis tailored to reflect the

court’s findings as to liability and causation.

10.

For example, if, without any breach of duty by Credit Suisse, the

claimants would have held to maturity, and suffered loss on, at least some of

the Notes purchased from Credit Suisse, then that must be brought into account

in any damages assessment. Or, to take another example, choosing to have their

investments closed out at the end of October 2008 cost the claimants, in the event,

c.US$21m as against retaining the Notes then held to maturity, meeting the

October 2008 margin call and any further margin calls that might have been made

along the way. Therefore, if the consequences of that choice are to be visited

upon the claimants, that will have a very significant impact on the amount of

any damages award. In that regard, Credit Suisse’s case is that the claimants’

refusal to meet the October 2008 margin call was so unreasonable as to amount

to a failure to mitigate loss, or was the sole cause of loss to the extent it

increased loss, or broke any chain of causation, which may be three different

ways of saying the same thing.

11.

Financial market conditions in October 2008 were extraordinary. As

anyone reading this judgment is likely to know already, they were, or were a

reflection of, a once in a century financial shock. It can be important in

such circumstances to distinguish between risk, as a function of the terms of

an investment, expressed by identifying the events in which, if they occur, an

investor will or may suffer loss, and risk expressed as an assessment or

opinion as to, or quantification of, the chances of one or more such events

occurring. An investor in structured notes who says he invested thinking his

capital was ‘safe’, or the investment was not ‘risky’, may be saying he thought

the terms of the notes did not provide for the possibility of loss of capital

(so that his only risk was the creditworthiness of the issuer); however, he may

well be saying, which is different, that he understood the terms of his

investment provided for events in which he could suffer loss, but thought them

extremely unlikely to occur. The investor with the latter state of mind may

invest with a confident expectation that he will not suffer loss. A once in a

century financial shock is apt to confound such an expectation, even if

reasonably well-founded at the time of investment. If it was not a reasonable

expectation at the time of investment, there can be a question of liability on

the part of an advisor who fostered it, depending on the full facts of any

given case.

12.

In Mahdi and Maytham, this case concerned investors who say, in that

latter sense, that they thought their investments were not risky. To the

extent they claimed ignorance (if in truth they did) that the terms of the

Notes created risk, in the former sense, I do not accept that claim, as will be

seen below. The claimants accepted that, given the extent of their wealth, no

issue arises as to their ability to stand the risks in fact involved in their

Credit Suisse private banking account. The case therefore concerns the extent

of Credit Suisse’s duties as regards suitability in the case of investors who

were aware of and understood the essential terms of their investments (a matter

of ‘product comprehension’, as I shall call it), and were well able to absorb

the risks generated by those terms (an issue of risk ‘capacity’), but who say

they under-estimated the magnitude of those risks (an issue of risk

‘evaluation’) so as to have had a misguided willingness to run those risks

(given their risk ‘tolerance’ or ‘appetite’).

13.

The claimants say that they were, and that Credit Suisse ought to have

assessed them to be, low risk investors unwilling to contemplate anything more

than minimal risk of loss of capital, for whom the last three Notes they

purchased (Notes 18, 19 and 20, as I refer to them below) were not suitable

investments, and moreover that they received bad positive advice from Credit

Suisse about those Notes, principally from Mr Zaki but also from Rabih Khodari

working under Mr Zaki, so that their losses are Credit Suisse’s

responsibility. Credit Suisse say the claimants were aggressive investors

looking for strong returns, even if that meant running a significant risk of loss

of capital, who were not badly advised at any point, and who in any event

committed “financial suicide” by choosing to have their investments

closed out at the end of October 2008, so that their losses should lie where

they fall and they should now discharge their overdraft.

14.

No distinction was drawn between the defendants at trial and I

understood that I should treat any liability on the claimants’ claim as jointly

and severally owed by both of them. By ‘Credit Suisse’ in what follows,

therefore, I shall mean the two defendants, without distinction, and I shall

not ask whether strictly any fact or comment may relate to one but not the

other.

The Notes

15.

The Notes held by the claimants in October 2008 and liquidated when they

refused to meet Credit Suisse’s call for margin, leaving them overdrawn, were

Notes 16, 19 and 20 in the sequence of structured products purchased by them

through Mr Zaki. In this section of the judgment, I identify and describe all

the Notes so purchased, taking them in chronological order and noting for each

Note how (if at all) the claimants’ investment put their capital at risk. In

that regard:

i)

The claimants’ investments in the Notes exposed them to the credit risk

of the issuer (i.e. Credit Suisse, or in one case BNP Paribas). It will be

cumbersome to keep re-stating that qualification every time. It should be

treated as implicit throughout, so that when I refer to there being, or not

being, a risk of loss of capital, I mean apart from the credit risk of the

issuer.

ii)

There is also a sense in which an investor loses capital – or, at least,

an investor’s capital loses value – if he invests in a note under which the

coupon is or may be below some measure of the time-value of money in the

investment currency that is relevant to the investor’s circumstances (e.g. an

inflation rate). Whatever the scope for argument over the economic equivalence

of different risks, I have no doubt that the claimants (like, I suspect, most

private investors) saw as different in kind (a) a purchase for US$Xm that could

redeem below US$Xm and (b) a purchase for US$Xm that would always redeem for at

least US$Xm but which carried a variable or at-risk coupon so that as an

investment it might or might not keep up with inflation. The former, not the

latter, would have been understood by the claimants as risking a loss of

capital; and in the claimants’ dealings with Credit Suisse and the product

explanations produced in writing by Credit Suisse, references to there being

(or not) a risk of loss of capital related likewise to the former, and not the

latter. Again, therefore, that is the sense in which I shall refer throughout

to risk of loss of capital.

iii)

Finally, there is similarly a sense in which an investor loses capital

if he invests in one currency (here, all the investments were in US$), but will

ultimately require the value of his investments (if he does, other than for

reinvestment) in another currency. Such an investor exposes himself to

exchange rate risk by choosing to invest in the first currency. Here, all the

claimants’ directly relevant investments were in US$, but it is not said

against Credit Suisse that it had, or failed to discharge, any relevant

responsibility in that specific regard, nor did the evidence explore whether

the claimants’ ultimate need for the value of their relevant investments (other

than for reinvestment) might be a need for value in another currency (e.g.

KWD). The purpose of the claimants’ Euro loan was touched on in the evidence

as part of exploring Mahdi and Maytham’s degree of sophistication and appetite

for risk; but that does not affect the point just made. So, once again, when I

refer to whether capital was at risk or not I am referring exclusively to the

claimants’ investment capital, denominated as it was in US$.

2004 – Notes 1 to 4

16.

The claimants contracted to purchase Note 1 on 28 April 2004 for

completion on 25 May 2004. Note 1 was a US$5m 8-year ‘Callable Range Accrual

Note’ (‘CRAN’) with quarterly coupon. It was a ‘Range Accrual’ Note because

daily coupon accrued (calculated on a 30/360 day basis at the rate of 8.25%

p.a.) only for days when the 12-month US$ LIBOR rate traded within a range

(min.0.00%, max.X%, where X% increased over time, from 3.25% for the first year

of the Note period to 7.50% for the final year). It was a ‘Callable’ Note

because Credit Suisse had a quarterly right (coincident with coupon payment

dates) to redeem early. Redemption, whether early or at full term, was always

at par.

17.

Upon its terms, therefore, Note 1 did not involve any risk of loss of

capital, if held by the claimants until it redeemed (whether early or at full

term). If the claimants sought to exit the investment when it was not

otherwise redeeming, they might or might not get par for it; there was,

therefore, that contingent risk of loss of capital.

18.

The claimants purchased Note 1 with 3:1 leverage (US$1.25m cash, plus a

loan of US$3.75m). They would therefore suffer loss if the variable coupon on

Note 1 did not cover the leverage borrowing cost. But that would not be loss

on Note 1 itself; and I do not think the claimants would have seen that (or

Credit Suisse would have presented that) as a risk of loss of capital (again,

whatever argument there could be as to its economic equivalence), given the

claimants’ financial circumstances. As is true of all of their Note

investments through Credit Suisse, the claimants could easily have afforded to

invest in Note 1 for the full amount invested, without leverage.

19.

The use of leverage did, though, affect the contingent risk of loss of

capital I identified in paragraph 17 above. In the usual way, the terms

upon which Credit Suisse allowed the claimants to invest on a leveraged basis

involved a requirement for borrowing not to exceed a ‘loan to value’ (LTV)

percentage of the value of the investment from time to time as might be

assessed by Credit Suisse. If the current value fell such that borrowing

exceeded LTV, there would be an entitlement in Credit Suisse to issue a margin

call and to close out the claimants’ investments if the margin call was not

met. A decision not to meet a margin call would therefore be, in effect, a

decision not to hold until redemption. I have expressed that solely in terms

of a decision not to meet a margin call, because just as the claimants could

easily have afforded, if they wished, to invest in their various Notes for the

full amounts invested, without leverage, equally they would always have been

able promptly to meet any margin calls by Credit Suisse, if they wished to do

so. The very serious risk of using leverage for some investors, namely that

they might lose capital, through being closed out, for want of ability to meet

a margin call, when they would have wanted to continue to hold the investment,

was not a risk run by the claimants by their investments through Credit Suisse.

20.

On 28 June 2004, the claimants agreed to buy Note 2, completing on 21

July 2004. Note 2 was a US$20m 7-year CRAN, with par redemption, quarterly

coupon and callability, and daily coupon accrual where the 3-month US$ LIBOR +

3.40% fell within a range (min.0.00%, max.Y%, where Y% was 4.00% in the first

year, increasing to 7.50% in the final year). It was purchased with 3:1

leverage (US$5m cash, US$15m loan).

21.

In July 2004, Mr Zaki sought to interest the claimants in an equity

barrier SCARP similar to what would later be Note 5. I cannot say on the

evidence whether he spoke to Mahdi, Maytham or both. His file note recorded

that whichever of Mahdi or Maytham it was, “did not like [the idea] due to

the 60% barrier and subsequent loss of capital protection. The client was

extremely knowledgeable on the financial markets and expressed interest to see

equity linked investment ideas.” Having seen and heard from Mahdi and

Maytham myself, I do not think that last is a view Mr Zaki could reasonably

have formed and this file note seemed to me to involve spin on his part.

22.

Note 2 was called by Credit Suisse at the first opportunity. The

proceeds were promptly reinvested, in that on 26 October 2004 the claimants

contracted to buy Note 3, completing on 3 December 2004. Note 3 was a US$20m

8-year CRAN, with par redemption, quarterly coupon and callability, and daily

coupon accrual where the 3-month US$ LIBOR + 3.00% fell within a range

(min.0.00%, max.Z%, where Z% was 4.00% in the first year, increasing to 8.00%

in the final year).

23.

Note 4 was acquired on 22 December 2004, completing a contract concluded

on 7 December 2004. Note 4 was an US$8m 2/3-year SCARP referencing a set of 50

individual stock prices. It had a ‘2/3-year’ maturity because Credit Suisse

had an option to extend the maturity from 2 years to 3 years, but only if they

announced the extension by 15 December 2005. It was callable by Credit Suisse

after 1 year, and again after 2 years (if extended). Coupon was semi-annual at

the fixed rate of 6.00% p.a.

24.

Capital was at risk under Note 4 by reference to a slightly

fearsome-looking redemption price formula. Thus:

i)

Note 4 redeemed at:

max (0%, min

(100%, 172% – 2% x Abnormality Score))

Putting that into words: the

‘Abnormality Score’ put capital at risk; if the Abnormality Score was 36 or

less, Note 4 redeemed at par; if the Abnormality Score exceeded 36, then Note 4

redeemed below par; the higher the Abnormality Score, the lower the redemption

price, with 2% of par value being lost for every Abnormality Score point above

36; if the Abnormality Score was 86 (or more), there would be a total loss of

capital (Note 4 would redeem at zero).

ii)

The key concept, therefore, was the Abnomality Score, defined to be:

i x i,

where Ni is the number of weeks out of 105

i x i,

where Ni is the number of weeks out of 105

where 45+i stocks were all higher or all lower

than the previous week

The ‘all higher or all lower’

determination referred to was the ‘Weekly Observation’ result obtained by

comparing the average of the daily closing prices for each stock with that

average the previous week. The 105 weeks referred to were the weeks of the

Note period, if Note 4 remained a 2-year Note, or the weeks of the second and

third years of the Note period if Credit Suisse extended it. Putting the

formula into words, then: every week within the applicable 105-week period

when at least 46 of the selected stocks traded higher than the previous week or

at least 46 traded lower than the previous week (in each case based on the

weekly average of daily closing prices for each stock) added to the Abnormality

Score; a week when 46 of the selected stocks all traded higher or all traded

lower than the previous week added 1 to the Abnormality Score; 47 stocks all

trading higher or all trading lower than the previous week added 2; and so on

up to an addition of 5 to the Score for a week, if it occurred, when all 50 of

the selected stocks traded higher or all 50 traded lower than the previous

week.

25.

Note 4 was purchased with 5:3 leverage (US$3m cash, US$5m loan). Since

capital was at risk, leverage had a 2⅔x multiplying effect; the maximum

loss on the US$3m cash investment was US$8m; 8 = 3 x 2⅔. That said, if

the investment were perceived from the outset as an investment of US$8m, by an

investor well able to afford to invest that sum in full, but for which Credit

Suisse was offering the opportunity not to pay the full US$8m up front, there

would not be the same sense of multiplying risk; the investor would understand

he was putting US$8m at risk and if in the event he lost more than US$3m on the

investment he would need to pay the additional amount lost at the time of the

loss whereas if he paid in full up front he would feel that loss by receiving

less back from Credit Suisse rather than having to pay more to Credit Suisse.

26.

Note 4 also involved the contingent risk that if closed out early the

claimants might lose capital (they might not be able to close out at par), even

if later events would show that it would have redeemed at par if held to

maturity. (At the same time, an early exit could potentially involve a

close-out price better than the final redemption price, depending on the

circumstances.) Again, as with Notes 1 to 3, the use of leverage added to that

risk, but only if the claimants might decide not to meet a margin call.

2005 – Notes 5 to 9

27.

Several of the other Notes purchased by the claimants through Credit

Suisse, including Notes 16, 19 and 20 that were closed out in late October

2008, were similar in nature to each other, if considered at a reasonably high

level of generality. They were all SCARPs and, like Note 4, they were all

derivative investments in equities. But they were less complex than Note 4, in

that capital was put at risk in a somewhat simpler way. The Note would redeem

at par if some equity-based reference value never fell below a stipulated

barrier during the Note period. If the barrier was hit on any day within the

Note period, the redemption price would be defined by the level of the

reference value at maturity, but capped at par, e.g. if the closing level was

80% of the ‘strike’ level that equated to par for the Note, and the barrier had

been touched during the life of the Note, the Note would redeem at 80%, a 20%

loss of capital, whereas if the closing level was 120% of strike, the Note

would redeem at par (not at 120%). Depending on the individual Note terms, it

might be also that coupon would cease to be payable if the barrier was hit; and

if that was the position, that might be permanent or it might be that coupon

would resume if the reference value came back above the barrier. In the

descriptions that follow, I do not refer to the impact of the barrier on coupon

from Note to Note as it was not a focus of the claim.

28.

The first of these equity barrier SCARPs purchased by the claimants was

Note 5, traded on 2 March 2005 for purchase on 23 March 2005. It was a US$15m,

3-year Note, with semi-annual coupon of 3% and semi-annual callability by

Credit Suisse. The Note referenced three major stock indices, the DJ Eurostoxx

50 Index, the S&P 500 Index and the Nikkei 225 Index. For each index, the

Note specified a strike level and a continuous ‘observation’ of the current

level, expressed as a percentage of the strike level. The Note reference value

was the lowest of those three percentages. The barrier was 60% of strike. In

short, then, Note 5 provided that it would redeem at par if none of the

reference indices ever fell 40% (or more) below strike during the Note period,

otherwise it would redeem at a percentage of par equal to the reference value

at maturity (but capped at par).

29.

Note 5 was purchased with 2:1 leverage (US$5m cash, US$10m loan). Since

capital was at risk, leverage had a multiplying effect, this time a 3x

multiplying effect; the maximum loss on the US$5m cash investment was US$15m;

15 = 5 x 3. Again, if the investment were perceived from the outset as an

investment of US$15m by an investor well able to afford to invest that sum in

full, but one for which Credit Suisse had offered the opportunity not to pay

the full US$15m up front, there would not be the same sense of multiplying

risk; the investor would understand he was putting US$15m at risk and if in the

event he lost more than US$5m on the investment he would need to pay the

additional amount lost at the time of the loss (whereas if he paid in full up

front, he would feel that loss by receiving less back from Credit Suisse rather

than having to pay more to Credit Suisse).

30.

Note 5, again, also involved the contingent risk that if closed out

early the claimants might lose capital (they might not be able to close out at

par), even if later events would show that it would have redeemed at par if

held to maturity. (At the same time, early close out could potentially involve

a close-out price better than the final redemption price, depending on the

circumstances.) Again, as with Notes 1 to 4, the use of leverage added to that

risk, but only if the claimants might decide not to meet a margin call.

31.

Note 6 was a derivative investment in the performance of the Nikkei 225

Index, traded on 22 September 2005 for purchase on 6 October 2005, but it was

not a SCARP. It was a US$5m, 1½-year Note, with no coupon, paying at

redemption either par or, if the Nikkei 225 at the end of the period was above

the strike level set at the time of the trade, a percentage above par equal to the

percentage by which that closing Nikkei 225 level exceeded par, but capped at

13%. So it offered the equivalent of a coupon of between nil and 13% for an

18-month period, with no risk to capital.

32.

Note 6 was purchased with leverage (US$1.5m cash, US$3.5m loan), so the

comments in paragraphs 18-19 above about risk in relation to Note 1 apply

again, mutatis mutandis (treating the uplift over par on maturity, if

any, as an effective coupon for that comparison).

33.

Also on 22 September 2005, two further trades by the claimants were

booked:

i)

selling Note 3 back to Credit Suisse at 95.03%, completing on 27

September 2005; and

ii)

buying new Note 7, a US$20m Note like Note 3, at 95.03%, completing on

14 October 2005.

34.

On 29 September 2005, another two trades were booked:

i)

selling Note 1 back to Credit Suisse at 95.50%, completing on 4 October

2005; and

ii)

buying new Note 8, a US$5m Note like Note 1, at 95.50%, completing on 20

October 2005.

35.

These four trades can be seen as two ‘switch’ trades. The claimants

realised a capital loss of US$980,000 on Note 3 and US$225,000 on Note 1, but

they were sold Notes 7 and 8 respectively at exactly corresponding discounts to

par, so that if the new Notes in due course redeemed at par the claimants would

recover those losses in full.

36.

Notes 7 and 8 were materially identical (for present purposes) equity

‘trigger’ SCARPs. Like Note 5, they referenced the worst performer of the DJ

Eurostoxx 50, S&P 500 and Nikkei 225 Indices, expressed as a percentage of

strike levels. They had a 6-year Note period and paid no coupon as such, but

operated as follows:

i)

They would be ‘triggered’ to redeem at the end of any quarter during the

period if the reference percentage was then above 100% (i.e. if all three

reference indices were then above strike). Hence, they were labelled by Credit

Suisse ‘Trigger Redeemable’ Notes.

ii)

If triggered, they redeemed at a price above par equivalent to

redemption at par plus payment of coupon of 8.40% p.a. (simple). For example,

triggered redemption after 2 years (8 quarters) would be at 116.80% of par.

iii)

If never triggered, however, they redeemed at the end of the 6-year Note

period at 150% of the reference percentage at maturity, capped at par. Thus,

if the Notes redeemed at the end of the Note period without being triggered,

(a) there would be no return on capital at all over that 6-year period and (b)

there would be a loss of capital if the worst performing of the indices was at

or below 66.66% of its strike.

37.

A file note of a meeting between Mr Zaki, Mahdi and Maytham on 22

September 2005 (resulting in the Note 3/Note 7 ‘switch’ trade) stated inter

alia that the claimants had “invested in these Trigger Notes with

success in the past”. There was no evidence that that was true, and I do

not believe it was. In my view, this was again spin on Mr Zaki’s part.

38.

My comments on leverage in the context of Note 5 (paragraphs 29-30 above) apply to Notes 7 and 8, mutatis mutandis. The multiplying effect

of leverage was c.4.7x (the original leverage for Notes 1 and 2/3 was in each

case 3:1, giving a 4x multiplying effect, but the new purchases were at c.95%

and none of the borrowing had been paid off).

39.

On 15 December 2005, Note 4 was called by Credit Suisse, with settlement

on 23 December 2005. The next day, 16 December 2005, Credit Suisse booked the

purchase by the claimants of Note 9, to complete on 6 January 2006.

40.

Note 9 was a trigger SCARP, like Notes 7 and 8, referencing (again) the

DJ Eurostoxx 50, S&P 500 and Nikkei 225 Indices, but also a barrier SCARP

like Note 5, with the barrier set at 60% of strike. It was a US$7.5m Note,

purchased with 1.5:1 leverage (US$3m cash, US$4.5m loan), with a 3-year period

and six-monthly trigger observations. If triggered (which would mean that all

three Indices were at or above strike on the observation date), it would redeem

at a price above par equivalent to redemption at par plus coupon of 20% p.a.

(simple). If not triggered, it would redeem at par if none of the indices had

ever hit the barrier during the Note period, otherwise at the level of the

lowest of the three indices (expressed as a percentage of strike) but capped at

par.

41.

Thus, under Note 9: capital was at risk in the manner of an equity

barrier SCARP as I described in paragraph 27 above; and leverage affected

risk as summarised in paragraphs 29-30 above (the multiplying effect here, if

relevant, being 2.5x).

2006 – Notes 10 to 14

42.

In January 2006, Notes 7 and 8 redeemed at their first trigger

observation date, just 3 months after issue, realising a gain. The proceeds

were reinvested into Notes 10 and 11. The aggregate nominal value was US$25m

(US$10m for Note 10, US$15m for Note 11), but the reinvested gain contributed

to a reduction in leverage: Note 10 was purchased at 101%, so it cost

US$10.1m, funded by cash of US$3m and borrowing of US$7.1m; Note 11 was

purchased at par, using cash of US$3.75m and borrowing of US$11.25m. Notes 10

and 11 were both traded on 17 January 2006, for settlement on 27 January and 8

February respectively.

43.

Note 10 (also referred to at trial as the ‘Gulf Note’) involved only

limited risk to capital (if held to maturity). The Note modelled an

investment, with specified weighting percentages, in five equity funds managed

by Gulf banks investing in Gulf region stocks, managed dynamically by reference

to the volatility of the resulting net asset value of the notional investment.

The target volatility was 18%, at which the notional investment would be a 100%

cash investment in the funds; at lower volatilities, the notional investment

was notionally leveraged (up to a maximum notional borrowing of 50%); at higher

volatilities, the notional investment was reduced to a cash investment of less

than 100% in the funds and the balance in low-risk money market funds.

44.

Note 10 had a 4-year Note period and no coupon. The redemption value at

maturity was taken from the net asset value at maturity of the notional

investment modelled by the Note, but with a guaranteed minimum of 95%. Thus,

since the purchase was at 101%, the maximum loss of capital, if held to

maturity, was 5.94%. The upside was not capped. The use of leverage in the

claimants’ investment (as opposed to the ‘internal’ leverage that might be

present in the notional investment modelled by the Note) had the usual

multiplying effect: if viewed as an investment of US$3m (the amount of cash

used to purchase), the multiplying effect of leverage was 3.366x (10.1 ÷ 3);

the maximum loss of capital on that view was therefore 20%, if Note 10 was held

to maturity; but my previous comments on that effect of leverage (e.g.

paragraph 29 above) apply again here.

45.

As with all the Notes, there was also the contingent risk of loss of

capital (and associated impact of leverage on that risk), as in paragraph 30 above.

46.

Note 11 was a trigger SCARP, exactly like Notes 7 and 8, referencing

once again the DJ Eurostoxx 50, S&P 500 and Nikkei 225 Indices, for a

6-year period with quarterly trigger observation periods and redemption, if not

triggered, at 150% of the reference percentage (but capped at par). If

triggered, because all indices were above strike on an observation date, it

redeemed at a price above par equivalent to par plus coupon of 10% p.a.

(simple). The risks involved in buying Note 11 were those described in

paragraphs 36-37 above; the leverage was 3:1 so its multiplying effect, if

relevant, was 4x.

47.

Note 12 was traded on 15 March 2006 and purchased on 30 March 2006. It

was a US$5m, 5-year Note, with semi-annual coupon and callability. The coupon

was fixed for the first year, 5% being paid after six months and again at the

end of the year; it was variable thereafter using a formula. The formula

calculated a six-monthly coupon by reference to the stock price performance of

20 selected stocks. Simplifying the formula (which was I think more complicated

than it needed to be), the semi-annual coupon for each coupon payment date was

4.6875% + ¼X, where X was the average of the percentage rises and falls over

the period of the Note up to that date of the five worst-performing stocks in

the basket over that period. X could be negative; if ¼X was –4.6875% or worse,

which would be the case if the five worst-performing stocks were down, on

average, at least 18.75% against strike, then the coupon for that payment date

would be nil.

48.

The terms of Note 12 did not put capital at risk, if held to redemption

(whether at maturity or upon being called by Credit Suisse). Redemption would

always be at par, so Note 12 was just a play on the future performance of the

referenced stocks with a view to higher rates of coupon but at the risk of low

(or nil) coupon. However, the purchase was leveraged 4:1 (US$1m cash, US$4m

loan); so my observations in relation to Note 1 apply (see paragraphs 17-19 above).

49.

Note 13 was purchased as a ‘switch’ for Note 5. By a trade booked on 29

March 2006, Credit Suisse agreed to buy Note 5 back from the claimants on 3

April 2006 in return for the issue of Note 13 to the claimants on 20 April

2006. Note 13 was a US$15m, 3-year equity barrier SCARP, with the same

structure generally as Note 5 (referencing the same indices), but with index

strike prices re-set (I assume to trade date values) and a quarterly coupon of

3-month US$ LIBOR + 2.65% rather than a semi-annual coupon of 3%. The risks

involved were the same, for the purposes of this judgment, as those of Note 5.

The investment was still leveraged 2:1 (US$5m cash invested, US$10m borrowed).

(I note in passing that the strike levels of Note 13 were well above those of

Note 5, by c.25% (Eurostoxx), c.7.5% (S&P) and over 40% (Nikkei). The

‘switch’ trade, from the claimants’ perspective, treated both their sale price

for Note 5 and their purchase price for Note 13 as par. Whether that

represented fair pricing was not explored at trial and no claim was made in

relation to the pricing of the trade.)

50.

Note 11 redeemed upon the first quarterly observation of the reference

indices, for US$15,229,818.75 payable on 8 May 2006. That represented very

nearly US$4m after repaying the borrowing on the Note. Those net proceeds were

promptly reinvested by the purchase of Note 14, a US$16m 4-year combination

trigger / barrier SCARP like Note 9, again referencing the DJ Eurostoxx 50,

S&P 500 and Nikkei 225 Indices. If upon any semi-annual observation all three

indices were above strike, Note 14 would be called automatically, redeeming for

par plus a coupon of 8% p.a. (simple). If Note 14 was not called and none of

the indices ever touched the barrier (set at 60% of strike), the Note redeemed

at par. If the barrier were touched by any index during the life of the Note,

Note 14 would redeem, if not called prior to maturity, at the level of the

worst performing index at maturity (expressed in percentage terms relative to

strike levels). The types of risk involved were therefore as I described in

relation to Note 9 (paragraphs 40-41 above). The leverage was 3:1 (the

purchase was funded by US$4m in cash and borrowing of US$12m) for a multiplying

effect by reference to the cash element, if relevant, of 4x.

2007 – Notes 15 to 17

51.

In early December 2006, Note 10 (the Gulf Note) was bought back by

Credit Suisse, at the claimants’ request, for a price of (only) 82.86,

realising a capital loss of US$1,714,000 rather than the US$600,000 maximum

loss of capital if held to maturity. That was a capital loss of some 57% of

the claimants’ US$3m cash invested; or 17% of the total investment in the Note

of US$10.1m. The claimants thus experienced, and realised in cash, a loss of capital.

It was, in particular, a loss of more capital than they could have lost if they

had held to maturity, due to the decision to liquidate early; this was a

materialisation of the contingent risk of loss I described in paragraphs 26 and 30 above.

52.

In late December 2006, Note 9 redeemed early. If I have understood

correctly the Credit Suisse ‘Redemption Summary’, this was a redemption upon

being triggered, for par plus 20% coupon, giving a return on equity (net of

borrowing costs for the leverage used) of 41.5% for 12 months.

53.

Although Note 9, therefore, had performed well, the claimants were

unhappy at suffering a loss on Note 10. On 6 March 2007, Mr Zaki discussed the

portfolio as it then stood with either Mahdi or Maytham (the evidence did not

enable me to say which) on the telephone. Whichever of Mahdi or Maytham it was

told Mr Zaki that he thought the account might be better simply holding cash

deposits and that he was “discussing with the family whether to liquidate to

cash for the time being” (to quote from Mr Zaki’s file note of the call).

On 13 March, according to another file note, Mahdi called Mr Zaki with an

instruction that “should any of the current investments redeem early in the

near future, the cash proceeds should be held on deposit until further

instructions”.

54.

On 29 March 2007, US$5m was transferred from the Credit Suisse account

to Citibank, as prelude, I infer, to Mahdi and Maytham investing in structured

products there (as I mention in paragraphs 64 to 66 below). On 2 April

2007, US$1m was transferred to Investcorp (as to whom see paragraph 64 below) for investment. Also in early April 2007, Credit Suisse Note 6 redeemed

upon maturity at its (capped) maximum price of 113. The redemption proceeds

were not immediately reinvested.

55.

The next investments by the claimants through Credit Suisse came in May

2007 (Note 15) and September 2007 (Note 16). The former followed a meeting in

Kuwait at which Mr Zaki persuaded Mahdi and Maytham to invest again and

presented what became Note 15. Those further investments were as follows:

i)

Note 15 was traded on 3 May 2007, for purchase on 24 May 2007. It was a

US$10m, 3-year combination trigger / barrier SCARP, like Notes 9 and 14 before

it. The types of risk involved were therefore as I described in relation to

Note 9 (paragraphs 40-41 above). If triggered, it would redeem for par plus

coupon of 14% p.a. (simple). Favourably for the investor (in comparison to the

previous similar Notes), Note 15 triggered if upon a semi-annual observation

all the reference indices were above 93.25% of their respective strike levels.

The barrier was the now familiar 60% of strike; and the reference indices were

again DJ Eurostoxx 50, S&P 500 and Nikkei 225. Leverage was used (US$4m

cash, US$6m borrowed, a multiplying effect, if relevant, of 2.5x). This was,

in substance, a reinvestment by the claimants of their ‘equity’ in Note 14

which redeemed early upon being triggered on 4 May 2007.

ii)

Note 16 was purchased in early September 2007, completing what was

effectively a ‘switch’ trade, switching out of Note 12 into Note 16. But Note

16 was a different type of investment. Note 12, as I observed when describing

it, did not put capital at risk and was rather a play on the performance of a

collection of individual stocks so as to generate (if the play went well) a

strong coupon. There was contingent capital risk in the claimants’ investment

in Note 12 due to the use of leverage, but that is a different point. Note 16,

however, was a trigger SCARP, like Notes 7, 8 and 11 (see above, paragraphs 36,

37 and 46). In relation to triggered redemption, Note 16, like Note 15, was

favourable to the investor in that triggering, so as to realise a good return,

did not require all the reference indices to be above strike. In the case of Note

16, the trigger point was 97% of strike. The reference indices were, as now

usual, DJ Eurostoxx 50, S&P 500 and Nikkei 225; the notional (and par

redemption) amount was US$5m; the period was 6 years; the observation for

triggering was quarterly and the coupon if triggered was 8% p.a. (simple).

Note 12 was sold back to Credit Suisse, and Note 16 bought, at a price of 92,

so the sale and purchase price for each US$5m Note was US$4,600,000. The

claimants thus realised a loss of US$400,000 on Note 12 and the leverage on

Note 16 was 4:0.6, for a multiplying effect, if relevant, of 7.66x.

iii)

Note 17 was also purchased in September 2007, a trade booked on 13

September and completed on 18 September. It was a US$6m, 3-year equity barrier

SCARP, referencing the now usual three indices, paying coupon quarterly at a

rate of 3-month US$ LIBOR + 5.5% p.a.; the barrier was set at 50% of strike, so

the redemption price was indexed to the worst performing index (but capped at

par), rather than simply being par, only if one of the indices fell by at least

50% at some point during the life of the Note. The claimants bought Note 17 at

par, with 2:1 leverage, giving a multiplying effect, if relevant, of 3x, i.e.

they used US$2m cash and borrowed US$4m.

2008 – Notes 18 to 20

56.

In March 2008, there was some discussion and correspondence between Mr

Zaki and Mahdi about the possibility of a margin call in respect of the Credit

Suisse Notes as markets were turbulent and had deteriorated. Mr Zaki indicated

that a transfer of anything over US$3m would be a good way to support the

account in the circumstances. In the event, no margin call was issued and no

fresh funds were applied to the account then.

57.

Two months later, however, on 20 May 2008, the claimants transferred

US$13m to Credit Suisse in order to, and it was used to, pay down sums

outstanding by way of borrowings against the Notes, in other words to reduce

the leverage in the claimants’ Note portfolio. In seeming contradiction of a

decision to reduce leverage, just a few days later, on 23 May 2008, Mr Zaki met

Mahdi and Maytham in Kuwait and booked on their instruction the purchase of

Note 18, a US$20m Note purchased at par funded entirely by borrowing. On one

view, the multiplying effect of that leverage was infinite (there was zero

equity and dividing by zero gives infinity). But that would consider the

decision to invest in Note 18 in isolation. If it was a decision, on

reflection, to revert to the previous leverage in the extant Note portfolio and

to use the fresh funds recently injected to support the new purchase (or indeed

if further investment was the intention all along, but for cash-flow efficiency

the new funds were used to reduce borrowing pending any new investment), the

leverage might be seen rather as 7:13 (US$13m cash, US$7m new borrowing), for a

multiplying effect of just over 1.5x. Note 18 is the first Note in respect of

which a claim is made, so the decision to invest in Note 18 was explored in

some detail in the oral evidence at trial and I shall revert to that decision,

and the 23 May meeting in particular, later.

58.

For now, it suffices to say as to the nature of Note 18 that it was a

US$20m, 3-year equity barrier SCARP, callable quarterly at par, paying coupon

quarterly at the rate of 12% p.a., with the barrier set at 60% of strike

levels. It referenced the usual three indices plus the Swiss Market Index.

The nature of the risks to capital were therefore the same as with a number of

the previous Notes. (Whether the magnitude of those risks in the prevailing

market circumstances was the same or similar as before may be a different

question, i.e. how real was the claimants’ chance of failing to earn coupon or

(more importantly) their chance of losing capital.)

59.

Note 19 was rather different to any of the other Notes bought by the

claimants through Mr Zaki. It was a US$2.4m, 1-year bet on the stock prices of

BNP Paribas, Barclays and JP Morgan, issued at a discounted price of 87, to

redeem at par (equivalent to paying coupon of 20.48% for the year) if none of those

prices fell during the year to 50% of strike. If the 50% barrier was touched

by any of the stocks, then redemption would be at the worst of the three

closing levels (expressed as a percentage of strike), but capped at par. Thus,

capital was at risk in a way that was broadly similar, in concept, to the risk

in the claimants’ equity barrier SCARPs; but by reference this time to the

three particular stocks only, rather than by reference to major stock indices.

60.

The purchase of Note 19 for US$1,992,000 was leveraged 1:1, i.e. the

claimants used cash and new borrowing each of US$996,000, giving a multiplying

effect (if relevant) of 2x.

61.

That brings me, finally, to Note 20, purchased in the eye of the fiscal

storm in October 2008. It was issued to the claimants as a ‘switch’ trade,

Note 20 being acquired in return for Notes 13, 15, 17 and 18 being taken back

by Credit Suisse. The circumstances in which that occurred, including the

advice on the basis of which the claimants acted, I shall consider in more detail

later in this judgment, but in short there had been a breach of the capital

protection barriers under Notes 13 and 15 and a restructuring to lower barriers

and extend maturity was sought by the claimants and recommended by Mr Zaki and

Mr Khodari, with a view to improving the ultimate outturn for the claimants at

maturity.

62.

For the present purpose of identifying the nature of the Note and the

types of risk involved, it suffices to say as follows:-

i)

Note 20 was traded on 9 October 2008 for purchase on 23 October 2008,

with a nominal amount (par redemption value) of US$51m, equal to the aggregate

nominal amounts of Notes 13, 15, 17 and 18.

ii)

The new Note had a 5-year Note period, thus a final maturity date of 23

October 2013 (if not earlier called), whereas Notes 13, 15, 17 and 18 were all

3-year Notes, with final maturity dates in April 2009, May 2010, September 2010

and June 2011 respectively. Note 20 was callable by Credit Suisse after 2

years, then every quarter thereafter.

iii)

Coupon was payable quarterly at 3-month US$ LIBOR + 1.65% p.a.

iv)

Note 20 was an equity barrier SCARP referencing the usual three

indices. Expressed as percentages of closing levels of those indices at the

trade date, the barriers were set at c.76% for the S&P 500, c.71% for the

DJ Eurostoxx 50 and c.68.5% for the Nikkei 225. Par redemption was guaranteed

only if all three indices stayed above their respective barrier levels

throughout the 5-year Note period.

v)

If the barrier was touched, redemption (capped at par) was calculated by

reference to the worst performing index at maturity, considering closing levels

as percentages of strike levels. However, strike levels were not index levels

at the time of the trade in October 2008 but substantially higher levels,

c.155% of trade date levels for the S&P 500 and DJ Eurostoxx 50 and c.175%

thereof for the Nikkei 225, because they were the weighted averages of the

strike levels of the ‘outgoing’ Notes 13, 15, 17 and 18.

vi)

The ‘switch’ out of Notes 13, 15, 17 and 18 into Note 20 was priced at

58.47, i.e. Notes 13, 15, 17 and 18 were sold back to Credit Suisse, and Note

20 was purchased from Credit Suisse, for US$29,819,700. In the case of the

outgoing Notes, the price of 58.47 was a weighted average of individual prices

of 54.95 for Note 13, 48.20 for Note 15, 62.65 for Note 17 and 65.00 for Note

18. Thus the claimants realised a capital loss of US$21,180,300 (in aggregate)

on Notes 13, 15, 17 and 18, each of which had been purchased at par, but if new

Note 20 in due course redeemed at par the claimants would recover that loss in

full.

Credit Suisse Notes

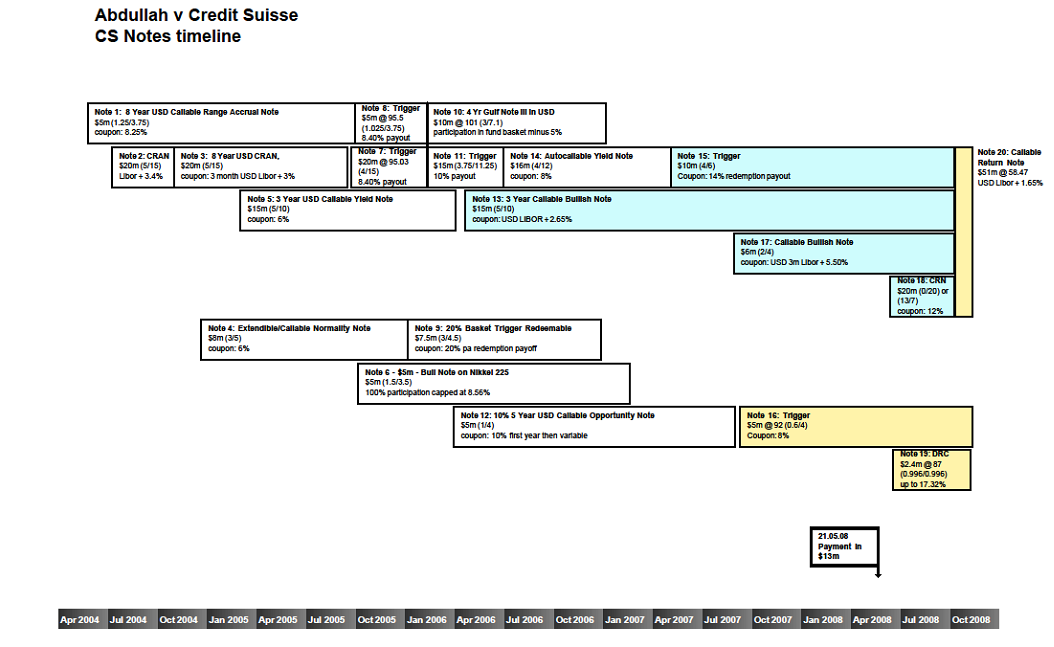

Timeline

63.

The chronology of the claimants’ investments in Notes through Credit

Suisse, as set out in narrative form above, is summarised, I hope conveniently

for anyone considering this judgment, in the ‘CS Notes timeline’ diagram

produced as an appendix to the judgment. The diagram captures not only the

basic details and lifespan of each Note, but also the extent to which, as I

have found in the narrative above, later Notes were in substance investment continuations

of prior Notes.

Investments Elsewhere

64.

The claimants’ investments through Credit Suisse, from April 2004, were

their first investments in structured products. They regarded themselves as

expert investors in Kuwait, identifying and participating in investment

opportunities by way of direct share ownership in Kuwaiti businesses. Whilst I

did not have much detail, my impression was that this was, or at any rate

included, what I would describe as entrepreneurial venture capital

investments. Outside Kuwait, they had a substantial portfolio of assets

comprising cash reserves in Zurich (Credit Suisse), Geneva (Deutsche Bank) and

London (Citibank), a hotel in Germany worth something like €150m, real property

in London, Paris, Brussels and Marbella, and from 2004 sums (ultimately

totalling c.US$10m) invested through Investcorp, a Bahraini company upon whose

recommendations the claimants took direct shareholdings in a number of

companies, mostly in the US.

65.

At Deutsche Bank, the claimants’ relationship manager was Patrick

Huser. From about the same time as their structured products investments with

Credit Suisse began, the claimants invested in structured products at Deutsche

Bank as well, through Mr Huser. Those products all had unconditional capital

protection guaranteeing par redemption, save for one with guaranteed minimum

redemption of 95% and one of 97%. I did not regard these investments through

Deutsche Bank as informative or useful in relation to the claimants’ investment

objectives, in particular their attitudes towards risk, for the Credit Suisse

portfolio. If anything, they assisted the claimants’ case, in that trading

even the Deutsche Bank products involved risk warnings and client

categorisations by the bank that might be thought, taken at face value, to

suggest a moderately aggressive risk appetite, yet the investments all in fact

fitted the generally conservative risk appetite the claimants claim to have

had.

66.

Rather later in the chronology, from about May 2007 only, the claimants

also invested through Citibank, Barclays and possibly BNP Paribas (disclosure

was incomplete), in products broadly similar to the Credit Suisse SCARPs, with

par redemption guaranteed only if equity-related price barriers were not hit

during the life of the investment and capital at risk if the barriers were

hit. The investments with Citibank and Barclays were closed out, crystallising

losses, at about the same time as was the Credit Suisse portfolio, similarly

because the claimants decided not to meet margin calls. The claimants made no

complaint or claim against Citibank or Barclays about their investments with

them or about those losses. I shall come back to that when considering the

claimants’ decision not to meet the Credit Suisse margin call. If there was

indeed any similar investment with BNP Paribas, I could not say on the evidence

what happened to it.

67.

As regards Citibank, Mahdi’s evidence, which I accept notwithstanding

criticisms of it by Mr Handyside QC for Credit Suisse, was that the Citibank

investments resulted from the claimants having invited Citibank to show them

products similar to the Notes they were buying from Credit Suisse, because they

liked them and were happy with them, based on their understanding of the risks

involved; and that they (the claimants, meaning in practice he and Maytham)

indeed regarded what they did with Citibank as similar in kind to what they did

with Credit Suisse. As with Deutsche Bank, indeed more so, the claimants’

investments through Citibank involved the generation of risk warnings and

client classifications that might suggest, read in isolation, a high risk

tolerance and aggressive investment approach. But again as with Deutsche Bank,

and accepting Mahdi’s evidence also on this, the claimants regarded those as

box-ticking by the bank, and a means of allowing for higher-risk investments if

he and Maytham wanted them in the future. In short, Mahdi and Maytham did not

understand from the Citibank documentation, to the extent they read it at all,

that by the particular products they bought they were in fact running more than

a small risk of loss of capital.

The Claimants at Credit Suisse up to March 2008

68.

The foundation of the claimants’ claim is their allegation (at paragraph

14(2) of the Particulars of Claim) that “Mahdi and Maytham (and, therefore,

the Haider family)” were only willing to invest with Credit Suisse on the

basis that “very little risk” was taken with their capital. It is said

that this was made clear to Mr Zaki at the outset, when he was introduced to

the family and the private banking relationship was established; and that it

remained a constant throughout, or at any rate the claimants never communicated

to Credit Suisse any change. Mr Handyside QC criticised what he said was

confusion and inconsistency in the way the claimants’ case had been formulated

over time. There was to my mind some force in that criticism, but not enough

to influence my assessment of the claimants’ case as pleaded by reference to

the evidence given at trial.

69.

The claimants’ claim, as thus pleaded, defines their collective (joint)

investment objectives and attitude to risk, for investments through Credit

Suisse, by reference to that of Mahdi and Maytham. That is important. At my

request, in the light of Mahmoud’s evidence in particular, the parties in

closing argument made some submissions as to the nature of any duties

concerning suitability of investments for a joint investment account if there

are differences of investment objective or risk appetite between account

holders. For example, suppose two joint account holders, one content to invest

in products involving at least some risk of loss of capital, to improve

returns, but the other dead set against anything other than full protection of

capital even though that might limit returns. At first blush, it is perhaps

tempting to say that the latter account holder’s stance should mean that any

product involving risk to capital must be considered unsuitable. Indeed, that

is the line seemingly taken by Credit Suisse’s 2008 “Client Classification

and Suitability & Appropriateness Policy”, at paragraph 4.3.1 stating

that, “If a relationship is held with more than one client (joint accounts)

the suitability and/or the appropriateness assessment must always be carried

out with respect to the client a) the least sophisticated and b) the least

financially able to bear the risks involved, of all such clients”.

70.

But that would be to focus on risk and ignore reward – the other account

holder might complain that the resulting portfolio under-performed. A correct

analysis may therefore be more complex, its starting premise that a joint

account requires a single investment objective and risk/reward strategy.

Conflicting investment objectives and attitudes to risk on the part of account

holders may just be inconsistent with the existence of a joint account (or its

continuation, as the case may be), at all events if the conflict cannot be

resolved. (Thus, for example, it may be the Credit Suisse policy quoted above

assumes that the bank’s approach would be explained to the more sophisticated

and/or risk-tolerant joint account holder whose consent to that approach for

the account would be obtained so it could be a joint account.) In that regard,

provisionally and with respect, I have some difficulty with Teare J’s view in Zaki

et al. v Credit Suisse (UK) Ltd [2011] EWHC 2422 (Comm), in which a father,

his wife and daughters were joint account holders and Teare J said at [29]

that: “… because Mr Zeid’s wife and daughters allowed Mr Zeid to deal with

Mr Zaki on their behalf in every respect, I do not consider that they can

assert that what was suitable for him was not suitable for them. … Mr Zeid had

authority to deal with the day to day conduct of the account. That must

include the imparting of such information as was necessary to enable Mr Zaki,

and hence CSUK, to advise whether an investment was suitable or not, for

example the investment objectives of the Claimants.”

71.

I do not need to take those thoughts any further, however. For Credit

Suisse, the primary submission on this point was that it is not open to the

claimants to advance a claim by reference to Mahmoud’s investment objectives or

attitude to risk, if different to that of, or at any rate communicated to

Credit Suisse by, Mahdi and Maytham. I agree. The claim is pleaded on the

basis that Mahdi and Maytham’s stance defined the claimants’; I am satisfied

that Credit Suisse reasonably sought to answer that case only, and that an

understanding that that was the case to be met informed Mr Handyside QC’s

cross-examination, particularly of Mahmoud and Mansour; so it would be unfair

to consider any possible claim founded otherwise than upon whatever findings I

now make as to Mahdi and Maytham’s investment objectives and attitudes. That

is not to say that Mahmoud’s evidence about his intentions for monies invested

with Credit Suisse is irrelevant. To the extent I accept that evidence, it may

inform my assessment of Mahdi and Maytham’s evidence about their intentions.

72.

I make two other observations, before turning to the claimants’

evidence:

i)

The first is that “very little risk” is not “no risk”.

The case, therefore, is one of degree. An investment product exposing the

investor to a risk of losing capital, but only a remote risk, because capital

would be lost if specified events occurred, but those events were very unlikely

to occur, would fit the pleaded criterion of running “very little risk”.

ii)

The second is that the only claims made are for alleged breaches of duty

on the part of Credit Suisse in respect of the claimants’ decisions to invest

in Notes 18, 19 and 20, decisions made in May, June and October 2008

(respectively). For Notes 18 and 19, the relevant foundation for any claim,

therefore, is Mahdi and Maytham’s investment objective and attitude to risk in

May/June 2008, albeit the history of investing with Credit Suisse since April

2004 may inform any assessment as to that. For Note 20, in my judgment rather

different considerations arise. As I have already described in part, and will

come to in more detail below, Note 20 was structured for and sold to the

claimants in very extreme circumstances for a special purpose, taking the Note

portfolio as it then stood as a given (comprising Notes 13, 15, 16, 17, 18 and

19). The sale of Note 20 stands to be judged in that rather particular

context, not by reference to whatever may otherwise have been Mahdi and

Maytham’s investment objectives and attitudes.

73.

The purpose of this section, then, is to identify and explain my

findings as to Mahdi and Maytham’s investment objectives and attitudes, in

relation to their Credit Suisse investments, during the life of the Credit

Suisse account until the US$13m cash injection in March 2008 and the purchase

of Note 18 two months later.

74.

All four claimants gave evidence at trial. Before I turn to their

evidence, it is convenient to say something about Mr Zaki and Gaby Bejjani, who

worked for the Haider family as Head of Treasury for the Al-Zummorodah group

from early 2007 until 23 October 2008 and who gave some advice to Mahdi and

Maytham in connection with investment ideas from late 2007. Neither Mr Zaki

nor Mr Bejjani gave evidence.

75.

In Mr Zaki’s case, I had some rather flimsy and out of date medical

evidence he had at one stage provided to Credit Suisse’s solicitors in an

attempt to persuade them he was unfit to help; but Mr Handyside QC did not rely

on that evidence, accepting squarely that Mr Zaki had been unwilling to

assist. For the claimants, Mr Mill QC submitted I should therefore draw “all

relevant adverse inferences from Mr Zaki’s failure to give any account of his

conduct in relation to this case”, in particular as regards his knowledge

and understanding of the claimants and their investment objectives, and as

regards what he may have said to Mahdi and Maytham in persuading them to

invest. Mr Mill QC referred me to Petrodel Resources Ltd v Prest [2013] UKSC 34, [2013] 2 AC 415, per Lord Sumption JSC at [44], Wisniewski v

Central Manchester Health Authority [1998] PIQR 324 (C/A) at 340 and re

Coroin Ltd [2012] EWHC 2343 (Ch), per David Richards J at

[274]-[275]. Since Mr Zaki was domiciled abroad and no longer in Credit

Suisse’s employ, Mr Handyside QC submitted that this was not a case of a party

failing to call a witness it could reasonably be expected to call and that it

would be wrong in those circumstances to draw any adverse inference. I have

not needed to resolve that difference between the parties and have been able to

reach clear conclusions on the evidence I did receive without the need to

bolster it by the drawing of adverse inferences.

76.

In the case of Mr Bejjani, his last day in the claimants’ employ was 23

October 2008, but Mahdi accepted in cross-examination that he knew of no reason

why Mr Bejjani could not have been called as a witness, and at the time of the

main case management conference in the case he was identified as a witness the

claimants intended to call. Mr Handyside QC submitted that I should draw

against the claimants an adverse inference as to what Mr Bejjani would have

said about their investment objectives and attitude to risk when purchasing

Notes 18 and 19, and what he would have said generally about the restructuring

(Note 20). I am not persuaded that is right. There is contemporaneous

evidence from Mr Bejjani, in telephone transcripts, that in my judgment broadly

supports the claimants’ case as to their investment objectives and attitude to

risk, and as to the extent of his involvement in their Credit Suisse

portfolio. It would be wrong in those circumstances, I think, to proceed, in

effect, upon the basis that had Mr Bejjani been a witness his evidence would

have been unhelpful to the claimants, which is the logic behind drawing an

adverse inference from his absence. I did though bear carefully in mind that I

did not have the benefit of hearing from Mr Bejjani when assessing what I made

of the claimants’ witness evidence and the contemporaneous material.

77.

Turning, then, to the claimants’ evidence, it was apparent to me that

Mansour had no relevant involvement, for the purposes of the claims made. He

was a joint account holder and account signatory and therefore signed various

documents by which the relationship with Credit Suisse was constituted

contractually. But he gave no thought at all to how or for what the account

was to be used or was in fact used; he had nothing to say as to Mahdi or

Maytham’s investment objectives or attitude to risk; he paid no real attention

to this aspect of the family’s dealings with the outside world. Whether it was

proper for Mr Zaki to accept Mansour as joint account holder, and then to deal

exclusively with Mahdi and Maytham in relation to the account, without

attempting to ascertain his (Mansour’s) own understanding, investment

objectives or risk/reward preferences, is not a question I need to consider,

given the claims pleaded (see again paragraph 71 above).

78.

Mahmoud gave evidence by video link from Kuwait, through an interpreter

present in court. He was not an easy witness, principally in my judgment

because he was not in court. He gave evidence from Kuwait by agreement in view

of his relatively frail health, so he is not to be criticised for that, as

such. However, in my judgment the distance from the formality of proceedings

that Mahmoud was thus afforded fostered in him a lack of care in his oral

evidence and a willingness to make speeches that did not assist me or do him

credit. As part of that, in his oral evidence he elaborated substantially

upon, and contradicted himself as to, what he had said in his witness

statement, and what Mahdi and Maytham said in their evidence, as to the length

and nature of his (Mahmoud’s) only contact with Mr Zaki, when he (Zaki) visited

Mahdi and Maytham in April 2004 to set up the Credit Suisse account. That

contact, I find, was limited to a brief introduction of Mr Zaki to Mahmoud,

pleasantries and platitudinous generalities to the effect that Mr Zaki would do

a good job looking after family money placed with him for investment. Again,

as with Mansour, I wonder how that could be an adequate basis for accepting

Mahmoud as joint account holder for structured products investments, but no

such question arises on the claims as made.

79.

My criticisms of Mahmoud as a witness notwithstanding, in my judgment

his central evidence had the ring of truth, and I accept it, namely that he

intended investments through Credit Suisse, which would be dealt with by Mahdi

and Maytham, to be safe, secure, family money, not exposed to the geopolitical

risks of investing in the Middle East and not at risk in the manner of the

family’s entrepreneurial venture capital investments in Kuwait. There was

neither evidence nor reason to suppose that Mahmoud’s intentions ever changed.

He left the Credit Suisse account entirely to Mahdi and Maytham to deal with

and paid it no attention, I find, at all events until the crisis hit in late

October 2008. It was not apparent to me from the evidence how much, if any,

real involvement he had even then. During the life of the account, Mahmoud did

not appreciate that Mahdi and Maytham were investing with Credit Suisse on a

leveraged basis. Although he was a signatory to the credit documents that

facilitated that borrowing, I accept his evidence that he neither knew nor

asked what those documents were for or what they achieved. He simply signed

because Mahdi and Maytham had signed and (I infer) indicated to him that his

signature was also necessary because the documents related to their Credit

Suisse funds and he was an account holder. That said, I do not believe it

would have troubled Mahmoud to know that the investments were leveraged as they

were (see paragraphs 18, 19 and 25 above, and what I say below about Mahdi

and Maytham’s approach).

80.

Turning, then, to Mahdi, I assessed him to be a generally honest witness.

That is not to say that I can accept everything he told me, as I think he now

has an exaggerated sense of how far some of Mr Zaki’s assurances went. For

example, he has persuaded himself, in relation to the Notes that put capital at

risk if specified barriers were hit, that during the life of the Credit Suisse

account Mr Zaki gave him and Maytham unconditional reassurances that if those

barriers were hit, the Notes could always be restructured by Credit Suisse in

such a way that loss of capital would be avoided. On the evidence I had about

him, although I did not have the benefit of evidence from him, it is clear that

Mr Zaki was a charming and persuasive man, well suited by personality and

cultural background to managing the accounts of wealthy Arab investors like the

Haider family. I am confident, and find, that in his dealings with Mahdi and

Maytham, he (Zaki) will have emphasised Credit Suisse’s experience and ability

in managing difficulties should they arise. I find it credible, and accept, that

this will have included reference to the possibility of seeking to restructure

with a view to avoiding or minimising loss. But I do not find credible, and

reject, the suggestion (though I think honestly advanced by Mahdi) that Mr Zaki

gave unconditional promises or reassurance in that regard, whether (a) that

Credit Suisse would always offer restructuring terms, or (let alone) (b) that

Credit Suisse would always offer a restructure that would ensure there was

never a loss of capital.

81.

During the life of the Credit Suisse account through 2007, as he and

Maytham invested successively in Notes 1 to 17 inclusive, Mahdi was well aware

of their essential features. For the Notes under which capital protection was

conditional upon barriers never being hit, in other words capital was in

principle at risk (‘in theory’, as Mahdi expressed it), Mahdi properly

understood that feature. He appreciated also that the Credit Suisse Notes

offered, and typically realised, good returns, especially with the use of

leverage, certainly returns well above anything available through simple time

deposits; and he understood the general relationship between risk and reward.

At the same time, he honestly regarded the returns offered by the Notes as not

especially high, certainly not like the levels of return he believed were

available through truly risky investments such as the family had in Kuwait. He

was not looking to be aggressive with the risk/reward balance at Credit Suisse

and did not believe that he and Maytham had been or were being. I accept his

evidence that he consistently made that clear to Mr Zaki. Leaving aside the

impact of leverage, Mahdi thought that the chances of losing capital were very

low, because he relied on Mr Zaki’s assessment and opinion, consistently given

when explaining any new Note with conditional capital protection only, that the

chances of barriers being hit were small. I accept his evidence that he made

clear to Mr Zaki that he (Mahdi) was relying on Mr Zaki for an assessment of

those chances and was only interested in investing where the assessment was

that those chances were small. Mahdi was not capable of making that assessment

for himself, nor could Mr Zaki have thought that he was. Mahdi was also

reassured, as regards the real likelihood of any loss, by the prospect (albeit

there was never any guarantee) that if there were difficulties, it might be

possible to restructure to avoid or recoup any loss.

82.

I have no doubt that Mahdi was aware from the outset of his father’s

intention that any investments at Credit Suisse be regarded as safe, secure,

family money, not risky venture capital. There is in my judgment no

inconsistency between that and what Mahdi believed he and Maytham had done with

Mr Zaki through to late 2007 and the purchase of Note 17. That is so

notwithstanding that Mahdi saw, even if he did not always focus on their

detail, term sheets for the Notes purchased through Credit Suisse that

contained, if capital was at risk, lengthy risk warnings in the terms set out

below (or similar). Those terms confirmed that par redemption was not

guaranteed (but Mahdi knew that); they warned that an assessment of the risk