Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Barclays Bank Plc v Dylan & Ors [2024] EWHC 1994 (Ch) (31 July 2024)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2024/1994.html

Cite as: [2024] EWHC 1994 (Ch)

[New search] [Printable PDF version] [Help]

BL-2021-002082 |

CHANCERY DIVISION

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

Fetter Lane, London, EC4A 1NL |

||

B e f o r e :

____________________

| Barclays Bank PLC |

Applicant |

|

- and – |

||

| (1) Scott Dylan (2) David Samuel Antrobus (3) Jack Mason |

Respondents |

____________________

Ian Bridge and Gurprit Mattu (instructed by Lewis Nedas Law) for the First Respondent

John McKendrick KC and Anson Cheung (instructed by Janes Solicitors) for the Second Respondent

James Counsell KC and Michael Uberoi (instructed by Janes Solicitors) for the Third Respondent

Hearing dates: 25, 26, 27, 28 June, 1, 2,3 ,4 ,15 July 2024

____________________

Crown Copyright ©

- This judgment arises from a trial, over nine days, of applications made by Barclays Bank Plc ("Barclays") to commit each of Scott Dylan ("Mr Dylan"), David Antrobus ("Mr Antrobus") and Jack Mason ("Mr Mason") (together "the Respondents") for breaching three freezing orders.

- On the fifth day Mr Dylan accepted that he was in contempt of court in respect of two of the four charges levelled against him. Barclays did not pursue the remaining two charges and Mr Dylan ceased to attend the hearing. One or both of his counsel attended for the remainder of the hearing to deal with consequential matters arising from his change of position and by way of watching brief. Mr Dylan will be sentenced at a hearing to be listed after 1 October 2024.

- This is the judgment on liability in respect of Mr Antrobus and Mr Mason. I have already made clear that if there is to be any sentencing which flows from this judgment it will happen at the sentencing hearing for Mr Dylan.

- On 23 March 2022, an entire group of companies ultimately owned and controlled by the Respondents (with Mr Dylan's partner) through two English holding companies, was transferred to two companies in the British Virgin Islands. Although not all of the companies were the subject of freezing orders, certain companies clearly were, and their transfer abroad is an apparent breach of at least three freezing orders.

- On 2 July 2024 Mr Dylan produced an affidavit accepting that he was in contempt but stating that his role was limited. He said that while he had advised on the steps which should be taken, they were carried out by unnamed "others". I have made clear that I am not bound in any way by Mr Dylan's statements as to his role in the findings I may make in this judgment.

- Both Mr Antrobus and Mr Mason deny that they had any involvement in these transactions. They say they had no prior knowledge that these transfers were to happen and they discovered them after the event. An important issue in this case is whether the transactions were arm's length sales carried out by a director based in the Seychelles called Rea Barreau ("Rea Barreau").

- Barclays' primary case is that this was a joint enterprise by all three Respondents to move the companies out of the jurisdiction. Whether this was a joint enterprise or not Barclays must prove each of the elements of each charge of contempt against each of Mr Mason and Mr Antrobus to the criminal standard. In respect of one charge relating to the discharge of a debenture there is an issue as to whether there was any debt secured by it when the debenture was released. In respect of a movement of shares belonging to Mr Mason personally there are issues as to why these were moved and when, whether this was beyond his control, and whether Mr Antrobus was involved in it.

- There was no disagreement on the applicable principles, although the parties placed emphasis on different aspects.

- Civil contempt proceedings are quasi-criminal in nature and the Court applies a high standard of procedural fairness; Navigator Equities Ltd and another v Deripaksa [2021] EWCA Civ 1799 at [79] and [132].

- Where the alleged contempt consists of a breach of an order by the respondent to the order, the Claimant must prove: (i) that the respondent knew of the terms of the order; (ii) that he acted (or failed to act) in a manner which involved a breach of the order; and (iii) that he knew of the facts which made his conduct a breach: Kea Investments Ltd v Watson [2020] EWHC 2599 (Ch) at [19], per Nugee LJ. In this regard, the Claimant need not prove that the respondent knew or believed that his acts amounted to a breach of the order; notice of the order and proof that the respondent's conduct has breached the order is enough to give rise to a contempt: Varma v Atkinson [2020] EWCA Civ 1602, [2021] Ch 180 at [54], per Rose LJ. It is irrelevant whether the respondent is a party to the proceedings in which the order is made or named in the order.

- A director of a company subject to a court order "is under a duty to take reasonable steps to ensure that the order or undertaking is obeyed, and if he wilfully fails to take those steps and the order or undertaking is breached he can be punished for contempt. We use the word "wilful" to distinguish the situation where the director can reasonably believe some other director or officer is taking those steps. [.]

- The Court of Appeal in Templeton Insurance Ltd v Thomas [2013] EWCA Civ 35 at [23] considered when a person "knowingly permitted" a breach of an order:

- The burden is on the applicant to prove the contempt to the criminal standard – beyond reasonable doubt. In this judgment, unless I indicate otherwise, my findings are made to the criminal standard. If I say I am satisfied, or that I am sure, of a fact or conclusion, I am satisfied, or sure, beyond reasonable doubt.

- In finding a contempt proved, the Court can draw inferences. Vice Chancellor Scott in Masri v Consolidated Contractors [2011] EWHC 1024 explained the position.

- Finally, I remind myself of the well know words of Robert Goff LJ (as he then was) in The Ocean Frost [1985] 1 Lloyd's Reports 1 at p.57 when he said:

- Mr Dylan, Mr Antrobus and Mr Mason are entrepreneurs.

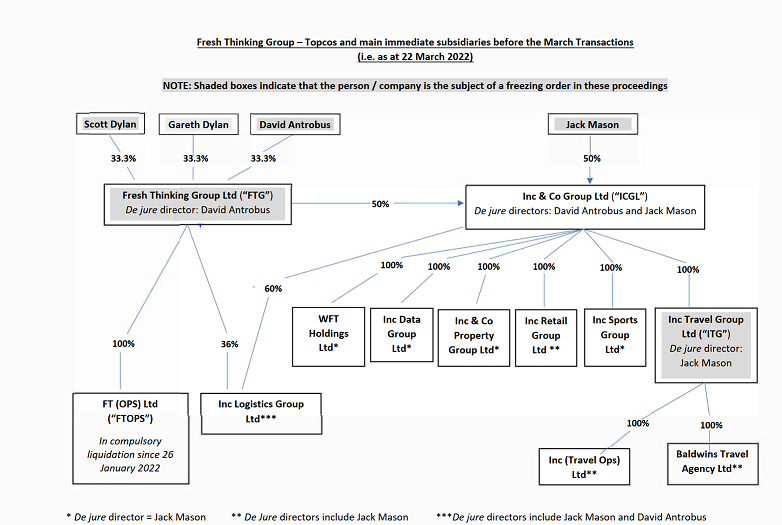

- Mr Dylan and Mr Antrobus co-founded Fresh Thinking Group Limited ("FTG") which was incorporated on 25 January 2018. The shareholders of FTG are Mr Dylan, Mr Antrobus and Gareth Dylan (Mr Dylan's partner) in equal shares. Mr Antrobus was FTG's sole director until his resignation on 22 March 2022.

- FTG is an independent capital investment group which invests in distressed companies and companies looking to grow. It did this by acquiring them and integrating them as subsidiaries of a holding company called Inc & Co Group Limited ("ICGL"). Such funding was channelled through a wholly owned subsidiary of FTG called FT(Ops) Limited ("FT(Ops)"). FTG's last filed accounts (for the year ending 30 June 2020) disclosed shareholder funds of over £2.7 million, with assets including investments valued at over £3.8 million.

- Mr Mason and FTG each owned 50% of ICGL which was incorporated in 2019. Mr Mason and Mr Antrobus were the directors of ICGL. I shall refer to the combined structure of FTG and its subsidiaries and ICGL and its subsidiaries as "the FTG/ICGL structure". By March 2022 the FTG/ICGL structure had approximately 60 companies in a complex structure of interconnected companies and shareholdings. In a witness statement served on behalf of FTG and ITG by Mr Dylan on 8 February 2022 (i.e. shortly before the transactions of which Barclays complains), it was said that the FTG/ICGL structure had a turnover of "more than £130,000,000".

- Mr Mason was the CEO of the Inc & Co Group and on its Senior Leadership Team. There was some debate as to which companies formed part of the Inc & Co Group. Mr Mason was adamant that FTG was not part of the Inc & Co Group. In this judgment I will refer to the wholly or partially owned subsidiaries of ICGL as "the Inc & Co Group", "the Group" or "Group companies".

- Mr Antrobus was the Group's Chief Technology Officer and on the Group's Senior Leadership Team.

- Mr Dylan, although not a director of any company in the FTG/ICGL structure was a significant figure in that structure. He was described by his previous solicitors as "a person of significant control of ITGL, Fresh Thinking Group Limited, and its subsidiary companies" who made "operational decisions". Mr Dylan, if not formally on the Senior Leadership Team, was consulted as if he was. Mr Mason said Mr Dylan had complete autonomy on financial transactions for the Group, including acquisitions, and the structuring and restructuring of the FTG/ICGL structure.

- Other members of the Senior Leadership Team included the Finance Director, Chris Hatfield and Lynne Makinson-Walsh, Chief People and Culture Officer.

- One of ICGL's wholly owned subsidiaries was Inc Travel Group Ltd ("ITG"). ITG in turn owned 100% of the shares in Baldwins Travel Agency Ltd ("Baldwins") and Inc Travel Ops Ltd ("ITOL"). Mr Mason was the sole director of ITG until his resignation on 22 March 2022. FTG held security over many Group companies. In particular it held security (in the form of a debenture and a mortgage of chattels each dated 9 September 2021) over Baldwins ("the FTG/Baldwins debenture").

- Inc Logistics Group Limited ("ILGL") was a subsidiary that was owned as to 36% by FTG and as to 64% by ICGL. Mr Mason and Mr Antrobus were the directors of ILGL.

- In 2021 Barclays became the bankers to FTG and ITG and a number of Group companies.

- On 18 November 2021 Barclays commenced two connected sets of proceedings against a number of parties including each of the Respondents, FTG and ITG ("the Proceedings"). In the Proceedings Barclays alleges that there was an unlawful conspiracy to take advantage of automated decision making at Barclays to make unauthorised borrowings through group companies which were paid away. It claims loss of at least £13,734,716.57.

- Barclays applied for and obtained a number of freezing orders prohibiting the respondent from disposing of, dealing with or diminishing the value of any assets within England and Wales up to the value of £13,734,716.57. The three relevant freezing orders for the purposes of the committal applications are:

- At the beginning of March 2022 the top level companies in the FTG/ICGL structure looked, diagrammatically, like this.

- It is now clear from documents Barclays has obtained from the administrator of FTG that on 17 and 18 March 2022, Mr Dylan sought an overnight valuation of FTG and ITG from Plimsoll Publishing Ltd ("Plimsoll"). In the course of an email exchange Mr Dylan stated that '[w]e are looking to do an insolvency restructure', and that '[i]ts [sic] Fresh Thinking Group Ltd and Inc Travel Group Ltd we want to put into administration, with the 50% shares of Inc & Co Group Ltd and Baldwins Travel Agency Ltd being purchased by a third party'.

- From these documents, it is now also clear that on 21 March 2022, Plimsoll provided the valuation reports requested, and valued FTG at £0, ITG at £333,000 and (curiously) FTG's 50% shareholding in ITG at £0.

- The next day, on 22 March 2022, a number of things happened.

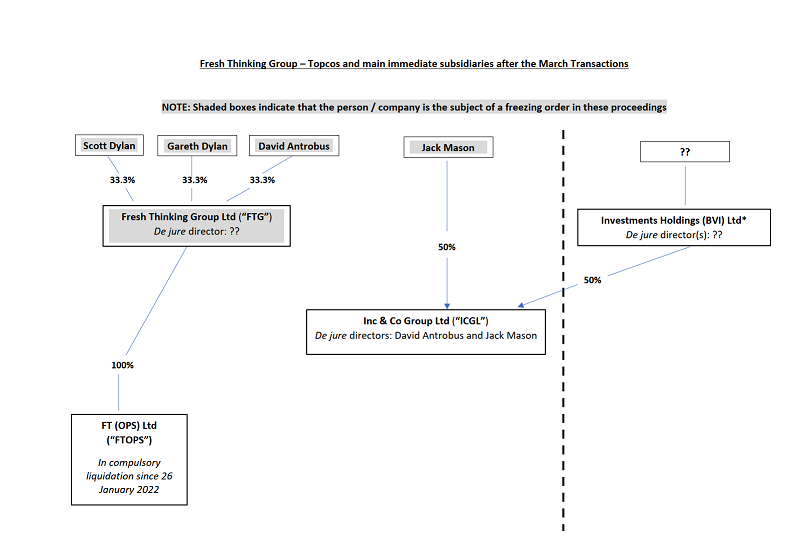

- The following day, on 23 March 2022:

- I will refer to Investments Holdings (BVI) Ltd as "Investment Holdings", International Travel Holdings (BVI) Ltd as "Travel Holdings" and the two companies together as "the BVI companies".

- At the same time, on 23 and 24 March 2022, ICGL's shares in all the other top level Group companies (which were not the subject of a freezing order), were transferred to Investment Holdings – these were Inc & Co Property Group Ltd, Inc Retail Group Ltd, WFT Holdings, Inc Sports Group Ltd, Inc Data Group Ltd, and its share of ILGL which it co-owned with FTG.

- Further, on 28 March 2022, Companies House was notified that Investment Holdings had taken a series of debentures dated 24 March 2022 over these subsidiaries. The debentures were all redacted so that it was not possible to identify the persons who had signed on behalf of Investment Holdings or on behalf of the subsidiaries. On 28 March 2022, Travel Holdings was registered as holding a debenture over Baldwins (also redacted) dated 24 March 2022 and forms were filed at Companies House stating that the FTG/Baldwins debenture had been satisfied in full.

- Immediately after these transfers the FTG/ ICGL structure looked like this:

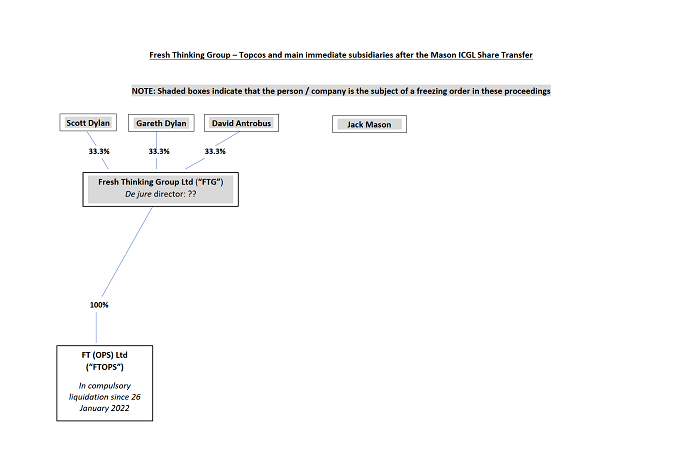

- Also on 23 March 2022 Barclays says there was a purported transfer of Mr Mason's 50% shareholding in ICGL to Investment Holdings ("the Mason ICGL Share Transfer"). This is deduced from documents which were electronically filed much later, between 24 September and 30 October, at Companies House which did not identify the person who had filed them. The filings recorded that Mr Mason had ceased to be a person with significant control of ICGL on 23 March 2022 and that Investments Holdings held 100% of ICGL's shares.

- I will refer to the FTG Transfer, the ITG Transfer, the discharge of the FTG/Baldwin debenture and the Mason ICGL Share Transfer as "the March transactions".

- After the Mason ICGL Share Transfer the FTG/ICGL structure looked like this:

- On 25 March 2022, Eversheds, who act for Barclays, discovered the transactions from electronic filings at Companies House (which, as with all subsequent filings in respect of the FTG/ICGL structure at Companies House, failed to identify who was filing the documents). It sent a letter to the Respondents' then legal representatives (Pannone Corporate LLP for Mr Dylan, and Brabners LLP for Mr Antrobus and Mr Mason), as well as FTG and ITG, setting out its view that the FTG and ITG Transfers constituted breaches of the freezing orders and demanding a full explanation from the Respondents of their knowledge of and involvement in the transfers.

- A response came later that day, from an anonymous email account purporting to be from FTG's Legal Department, 'legal@freshthinking.group' (into which the Respondents' solicitors were copied, as well as Mr Mason personally), stating that none of the Respondents had been directors at the time of the asset sale and the FTG and ITG Transfers were part of a sale at fair value to a third party unconnected with the Respondents by new (unidentified) directors. The email concluded that any steps taken by Barclays to reverse the transfers or bring proceedings for contempt would be "vigorously defended".

- Both Brabners and Pannone declined to respond to Evershed's correspondence on the basis that they were not instructed on this issue.

- On 29 March 2022, Mr Mason emailed Barclays copying in lawyers acting for the Respondents, stating that he had not personally authorised any sale of any Group company, and that to his knowledge, 'I still retain 50% of all companies and therefore have not gone against any Freezing orders'. On the same date, an email from legal@freshthinking.group' to Barclays and Mr Mason, said that, '[w]hilst it holds no value as per the valuations, we can confirm that Mr Mason still holds 50% of his shares in Inc & Co Group'.

- In response to further correspondence from Eversheds, a letter dated 31 March 2022 in the name of FTG was sent on behalf of unidentified "defendants" and "parties". It did not identify the individual who had written it. The key points made in that letter was that (a) Mr Mason and Mr Antrobus had resigned before the asset transfers and could not therefore be in breach of the freezing orders, (b) Mr Dylan was a shareholder and had no power to effect the asset transfers and could not therefore be in breach of the freezing orders, (c) that the asset transfers had been effected by new (but unidentified) directors at a fair value having regard to (undisclosed) independent valuations that the companies were worthless (d) that Mr Mason, Mr Antrobus and Mr Dylan were not directors or shareholders of the purchasers who were (unidentified) third parties (e) that the purchaser had acquired the assets in good faith and without notice of the freezing orders and therefore had acquired good title and (f) otherwise declining to respond to detailed requests for information and documentation from Eversheds.

- In April 2022 a newly incorporated company in the State of Delaware in the United States of America, called Global Investment Management Holdings Inc ("GIMH") became the principal funder of the group companies transferred to the BVI companies in place of Investment Holdings. This was the role which had before the March transactions been performed by FTG. Some 21 companies, eleven of which had Mr Mason as sole director, granted debentures to GIMH in connection with secured lending, and debentures in favour of Investment Holdings were discharged. The filings in relation to these debentures at Companies House were again anonymous and the debentures were redacted so that the signatories could not be identified. The involvement of GIMH was discovered by Barclays in May 2022. I will discuss GIMH further below in connection with the documents later obtained from Citibank and in the section below headed "GIMH".

- There was in 2022, as one might expect, much correspondence between Eversheds and the Respondents, their lawyers, FTG and ITG, in respect of these developments but little further information was forthcoming. None of the underlying documentation giving effect to the transactions being notified to Companies House in anonymous filings was produced to Eversheds despite repeated and detailed requests. Mr Antrobus in a short email to Eversheds on 21 June 2022 dismissed Evershed's requests for information and documentation including as to identity of the new directors, the persons who had signed the transfers, the ultimate beneficial owners of the purchasers, the person sending emails from "legal@freshthinking.group" and as to Mr Antrobus' role in what had happened as "fishing for information that you are not entitled to". No response was received from correspondence to the BVI companies.

- ITG was placed in administration on 8 April 2022. On 28 April 2022 FTG entered administration. On 30 October 2022 the Administrator of both companies wrote to Barclays stating that he had, since his appointment, been told by Mr Dylan of the purported sale of the assets of FTG and ITG in March 2022 but there had been no cooperation whatsoever from any of the Respondents in providing information in relation to the sale, the location of assets or the production of books and records for the Companies. He noted that Respondents appeared to continue to have access to the IT systems of FTG but seemed unwilling to provide him with either the information relevant to the companies or the sale.

- Notwithstanding the appointment of an Administrator, there continued to be anonymous filings made at Companies House in respect of FTG without the authority, knowledge or consent of the Administrator. Significantly, there were FTG electronic filings in April, May and October 2022 in relation to the purported directorship of Rea Barreau which I discuss below in the section headed "Rea Barreau".

- On 27 February 2023 the Barclays issued these committal applications ("the Applications") by a separate Form N600 against each Respondent.

- On the same date, Mr Mason received a loan from GIMH, in the sum of £82,472.12. Barclays had served a statutory demand on Mr Mason on 19 August 2022 in respect of an unpaid costs order made against him in July 2022 in the Proceedings and this sum was used to pay the debt due to Barclays. Mr Mason has produced a loan agreement pursuant to which he agreed to pay GIMH an arrangement fee of £45000 and 3000% interest every six months.

- On 1 November 2023 Investment Holdings was struck off the BVI Register of Companies.

- On 5 December 2023 Mr Mason contacted Eversheds stating that the 50 ICGL shares had been transferred back to Mr Mason by Investment Holdings on 4 December 2023 (notwithstanding the fact that Investment Holdings had at this date been struck off).

- At some point in 2024 Mr Mason says he sold these shares in ICGL, now an empty shell, to Mr Hatfield for £20,000 to meet his legal costs. Barclays says it consented to that sale without any admissions as to whether the shares had genuinely been returned to Mr Mason and as a matter of pragmatism.

- In January 2024 Barclays obtained orders, opposed by GIMH, for third party disclosure from Citibank of documentation relating to GIMH. That documentation appears to show a strong connection between GIMH and each of the Respondents, and also a connection between GIMH and the BVI companies. The documentation includes:

- Notwithstanding the transfer of virtually the entire business of FTG and ICGL to the BVI companies, there is no dispute that the day to day management and control of the Inc & Co Group has remained unchanged. Mr Mason is still the CEO of the Inc & Co Group. Mr Antrobus is still the Chief Technology Officer of the Group. Mr Dylan continues to be involved with the Senior Leadership Team in making business decisions for the Group. He describes himself on his personal website as a "Founder and Partner" at "Inc & Co" overseeing the strategic direction of the company.

- The Applications contain the following charges of contempt.

- For much of the time since the Applications were issued one or more of the Respondents has been without legal representation. Mr Antrobus and Mr Mason in particular did not have solicitors on the record until earlier this year, although they were represented at various hearings by counsel instructed on a direct professional access basis. That changed in March 2024 when each of the Respondents instructed their present solicitors who obtained criminal legal aid to act for them. On 25 March 2024 I authorised the instruction of two counsel by Mr Dylan and leading counsel and junior counsel by each of Mr Antrobus and Mr Mason. Mr Dylan was therefore represented by Mr Bridge and Ms Mattu. Mr Antrobus was represented by Mr. McKendrick KC and Ms Cheung. Mr Mason was represented at the trial by Mr Counsell KC and Mr Uberoi.

- Barclays' case is based on documentary evidence and Mr Peto KC and Mr Knott opened the case over two days on those documents. The documents were exhibited to a series of witness statements by Mark Cooper of Eversheds. Mr Cooper was tendered as a witness for cross examination but neither Mr McKendrick nor Mr Counsell had any questions for him.

- The Respondents had each made an affidavit in October 2023 ("the First Affidavits") when Mr Antrobus and Mr Mason at least did not have solicitors acting for them. All three were given permission at a pre-trial review before me on 15 April 2024 to file further evidence which they took the opportunity to do. All three elected to give evidence, and deployed all the affidavits filed, including the First Affidavits.

- Mr Dylan decided to admit he was in contempt before he went into the witness box. No other party sought to adduce Mr Dylan's affidavits as evidence of their truth as part of their case, although there was reference to them, and to their exhibits, in the evidence and cross examination of Mr Antrobus and Mr Mason.

- Mrs. Lynne Makinson-Walsh was called on behalf of Mr Mason. I considered her an honest witness.

- As far as documentary evidence is considered there is a dearth of contemporaneous documentation. The Respondents say that FTG's emails and documentary records were lost because the administrator failed to pay a Microsoft 365 subscription. Inc & Co documentation and emails are available but have not been produced. For example, unredacted copies of the various debentures granted by Group companies to Investment Holdings and GIMH have not been produced. The transfers of shares in ICGL and Baldwins (which must have been produced to the ICGL and Baldwins to register in their books) have not been produced. ICGL's register of members is one of the documents that has not been produced – and as appears below this gives rise to a legal submission on behalf of Mr Mason which I consider below. Where I draw an adverse inference from the failure to produce documents, as I consider I am entitled to do, I say so expressly – see the section below on the FTG/Baldwins debenture.

- I make findings on the key matters which need to be decided later sections of this judgment. Although I have considered and assessed Mr Mason and Mr Antrobus' evidence separately, there are some general observations which apply to both Mr Mason and Mr Antrobus which it is convenient to make here.

- In a significant blow to their credibility, neither Mr Antrobus nor Mr Mason could stand behind their First Affidavits as the truth, and neither wished to adopt them as their evidence for trial. The First Affidavits presented a united front by all three Respondents. In their evidence, both Mr Antrobus and Mr Mason said that the First Affidavit was a joint effort by the Respondents with input from Mr Hatfield and others. Mr Dylan created the first draft. Mr Antrobus stated that large parts of it were beyond his knowledge (or could not explain how things had come to be said) whilst Mr Mason disavowed his first affidavit entirely, and accepted he should never have sworn it, that he made a false statement in swearing that the material in the affidavit came from his own knowledge and that he would accept punishment for doing so. Various excuses were proffered for why Mr Antrobus and Mr Mason had signed the First Affidavits. Mr Mason, for example, said he did not have time to fully digest what was in the document. Both, however, said they had read the affidavits before they had signed them. Both knew they were swearing that the contents of their First Affidavit were true. I do not accept the excuses proffered.

- Mr Antrobus and Mr Mason are, on any view, two of the senior leaders of this Group. They are directors of many of the underlying companies. They presented as competent, confident and able business people. Both of them fenced with Mr Peto in cross examination and in doing so showed that they were clever, at times quick thinking and on top of the documents. Neither seemed to me to be naïve or supine or easily led. Their evidence that they had naively and unquestioningly accepted important matters they were told by Mr Dylan or others, or signed important documents that were drafted for them by nameless people, strained credulity.

- For example, on 2 February 2023 Mr Antrobus and Mr Mason sent a letter to Eversheds which contains inconsistent statements on which Barclays rely in relation to the Mason ICGL Share Transfer. I will refer to this letter further in the section below dealing with the "Mason ICGL Share Transfer". Mr Antrobus said it had been drafted for him by the "in house legal team" and "put under our noses" to approve. Mr Antrobus was not able to name, when asked, a single member of the "inhouse legal team" on whom he had apparently blindly relied to prepare this letter. He apparently did not know who had drafted it but had approved it anyway.

- Mr Antrobus suggested that the Group's "legal team", comprising freelancers and paralegals, would act (including in preparing legal letters on his behalf, on behalf of FTG and ITG) without his talking to them to give them instructions, saying that "they would just be dealing with things as they came in". The idea that a freelance or consulting legal professional to a group of companies which was the subject of litigation, freezing orders, corporate insolvencies and allegations of contempt of court (and of which they were neither employees nor officers) would act without instructions from the directors of the Group is also not credible.

- Mr Mason too could not name a single member of the "inhouse legal team" either although he maintained it was responsible for communications and that emails from legal@freshthinking.group came from this group of nameless individuals. This was not credible. The only person he could name who had sent an email from that email address was Mr Dylan. Contrary to Mr Antrobus' evidence, Mr Mason knew the 2 February 2003 letter had been drafted for them by Mr Dylan. Ms Makinson-Walsh, a member of the Group's "Senior Leadership Team" did not know whether there was an inhouse legal team and had never come across it in her day to day work as Chief People and Culture Officer at the Group.

- I am satisfied that the various documents ascribed to the "in house legal team" in this case, including the emails from "legal@freshthinking.group", were drafted by Mr Dylan, and both Mr Antrobus and Mr Mason know full well that this was the case and approved of what he was doing.

- In the First Affidavits, the Respondents presented a united front that the transfers by FTG and ITG had been effected by Rea Barreau. She was said to be a Seychellois national and resident, and professional corporate administrator, who had been appointed as a director of FTG on 22 February 2022. It was said that the FTG and ITG Transfers were arms' length sales to independent companies.

- The involvement of Rea Barreau continues to be at the heart of Mr Antrobus's case in relation to all the FTG and ITG transfers, namely that the transactions which breached the freezing orders took place without his knowledge. It is his evidence that he did not know of any of the transactions which took place or are supposed to have taken place in March 2022 because he was no longer a director and was focussing on other activities within the Group in his role as Chief Technology Officer. He said that he wished to resign because of the stress and pressure caused by the litigation with Barclays. Mr Dylan sourced a new director, and she, Rea Barreau, was appointed on 22 February 2022 to be his replacement. In his third affidavit sworn on 25 May 2024 Mr Antrobus produced for the first time a director's service agreement which he says he signed as a shareholder of FTG appointing Rea Barreau as director. He says that at the time of the March transactions the sole director of FTG was Rea Barreau.

- Mr Mason in his evidence in the witness box sought to distance himself from the previously united front of the Respondents that the FTG Transfer and the ITG Transfer were carried out by Rea Barreau. His evidence was that he was told of the FTG and ITG Transfers on 24 March 2022 after they had happened and he was not involved in them. He now says there was no mention of Rea Barreau at the time, and the first time he came across her name was when she was mentioned in correspondence from Barclays.

- Rea Barreau was not called as a witness by Mr Antrobus or Mr Mason. No evidence from Rea Barreau was filed with the First Affidavits as part of the Respondents' evidence in answer to the committal applications in accordance with initial case management directions. In a pre trial review hearing in January 2024 Mr Antrobus and Mr Mason were given permission by Mr Justice Meade to rely on her evidence and for her to give evidence by remote video link from the Seychelles. Several extensions of time were granted for the filing of her witness statement finally expiring on 15 March 2024 with no evidence filed.

- Incredibly, Mr Antrobus and Mr Mason say they had made no attempt to contact this key witness to their case either directly or through their solicitors, leaving it instead to Mr Dylan. I should record for completeness the following matters relating to evidence from Rea Barreau :

- I am satisfied that there was no appointment of Rea Barreau on 22 February 2022. My main reasons for doing so can be summarised as follows.

- Rea Barreau's appointment on 22 February is not consistent with earlier filings at Companies House. Her name was first mentioned in connection with FTG when an anonymous filing of Form AP01 at Companies House was made on 21 April 2022 stating that she had been appointed a director of FTG on 12 April 2022. A further anonymous filing on 12 May 2022 said that her appointment had been terminated on 27 April 2022. On 28 April 2022 FTG went into administration. It was not until 21 October 2022 that a further anonymously filed AP01 stated, inconsistently with the first filed AP01, that Rea Barreau had been appointed a director of FTG on 22 February 2022. This filing was filed without the authority of the Administrator. The Administrator has confirmed that he has no knowledge of Rea Barreau, whose name had not been mentioned prior to his appointment, and from whom he has received no communication.

- Rea Barreau's appointment on 22 February 2022 is not consistent with the other contemporaneous documents. For example:

- Mr Antrobus had no contact with Rea Barreau. According to Mr Antrobus, Rea Barreau was a director with Mr Antrobus for about a month until his resignation on 22 March 2022 and was the sole director when the March transactions took place. Yet, in the period between her appointment and his resignation, there is no contemporaneous record of Rea Barreau having any involvement with FTG, and Mr Antrobus admitted that he had in this period, indeed any period, no contact with Ms Barreau of any kind. That is an extraordinary contention by an outgoing sole director of a company in the midst of litigation with Barclays and with freezing orders against it and its assets. Ms Barreau apparently had no contact with Mr Antrobus to perform any due diligence or to decide whether this was a suitable role for her and apparently Mr Antrobus did not feel the need to tell her about the freezing orders. There were no handover meetings or discussions, or briefing papers, or messages or emails, as to the issues which the business faced, including non-litigation issues. There were no introductory, welcome or farewell emails or messages or telephone calls passing between them, and no emails or messages or calls in between. There were no directors' meetings between them, whether in person, by telephone or by video conferencing. There was no contact between them at all. This is very far removed from the real commercial world. It is inherently incredible.

- It is also inherently incredible that Rea Barreau, without prior warning or discussion with Mr Antrobus (a director and 33% shareholder of FTG), made an independent business decision from the Seychelles to sell the group, formed a view about its value, sourced a purchaser and sold – all either behind Mr Antrobus' back, or within 24 hours of his resignation. If she had been responsible for the March transactions, it is also not credible that none of the Respondents said so in response to Barclays' correspondence in 2022. That assertion was not made until they filed their affidavits in October 2023.

- As for the purported Director's Service Agreement dated 22 February 2022, this first emerged as a purportedly executed document less than a month before trial with no explanation as to why it had not been found before. I am satisfied that this agreement was either never entered into at all, or was never given effect to. I note that its terms envisage that the appointed director will act on the written instructions of the shareholders and shall be indemnified and held harmless for doing so. This is, in any event, not consistent with the appointment of an independent director with full autonomy to make the business decision to sell the Inc & Co group without reference to its shareholders.

- As Mr Peto observed, if, as I find, Ms Barreau was not appointed as a director on 22 February 2022 then it means that (i) the Court has been lied to on a prolific scale; (ii) the lie was perpetrated in order to disguise at least Mr Antrobus' involvement in the FTG and ITG Transfers; (iii) the lie was backed up by a false filing at Companies House in October 2022.

- If, as I find, Ms Barreau was not appointed as a director on 22 February 2022 then the united front of the Respondents in presenting this false story in the First Affidavits is evidence that this was a joint enterprise by the three of them.

- The Citibank documentation shows a strong connection between GIMH and each of the Respondents, and also a connection between GIMH and the BVI companies. Both Mr Mason and Mr Antrobus gave evidence that they had no involvement or connection with the BVI companies or with GIMH. When confronted in cross examination with the Citibank disclosure they both pointed out that the structure charts showing them as directors and co-owners of GIMH had been prepared by Mr Dylan and they had not been copied in when he sent them to Citibank. Neither attempted to explain why Mr Dylan might have wanted to make such false representations to the apparent benefit of Mr Mason and Mr Antrobus, and to his detriment. I did not find their evidence on this issue credible.

- In Mr Mason's case, there is also the fact that he says he took out a loan with GIMH – on his evidence knowing at the very least that GIMH was a creature of Mr Dylan's half-brother at an interest rate of 3000% every six months. Mr Mason maintained this was an arms' length transaction in order to avoid bankruptcy, and the best deal he could get (in the hope that he could negotiate it down in due course). It is, however, simply not credible that any businessman would enter such a transaction with an entity which they had no interest in or control over.

- In Mr Mason's case there is the further point that when asked in cross-examination who his boss was, his first, rather proud response, was that he was his own boss. He realised his error and corrected himself to say that he had been his own boss until he sold his shares in ICGL to Chris Hatfield and that Chris Hatfield was now his boss. If that answer had been correct, his first answer might have been a mere slip. But I do not see how Mr Mason could think that Chris Hatfield was his boss. The shares in ICGL which he sold to Chris Hatfield were of an empty shell company after the Group companies had been transferred to the BVI companies. Mr Mason clearly understood that he was being asked who was the ultimate beneficial owner of the Inc & Co Group. His boss for these purposes must be the ultimate beneficial owner of the BVI companies or whoever they have transferred the Group to. In my judgment Mr Mason's instinctive response that he was his own boss correctly stated his belief, and revealed more than he wished to.

- I am satisfied that there is a strong connection between the BVI companies, GIMH and the Respondents. I am satisfied that this was not an arm's length sale, but a transfer to offshore entities in which each of the Respondents has an interest.

- The Rea Barreau story is an integral part of Mr Antrobus' case that he resigned after she was appointed as his replacement. If, as I have found, there was no appointment of Rea Barreau, then Mr Antrobus' resignation story falls apart.

- Further, Mr Antrobus says he wished to resign because of the stress of the litigation. Yet he took on the conduct of the litigation on behalf of FTG after his purported resignation, and, of course, he remained a Defendant personally in the litigation with Barclays. His reason for wanting to resign does not stand up to scrutiny.

- Nor does Mr Mason's. Mr Mason says he resigned from ITG because he was concerned that as he had a freezing order against him personally, his continued directorship might affect Baldwin's IATA and ABTA licences. He could not explain why his resignation from ITG would have made any difference when he did not resign as a director of Baldwins and there remained a freezing order on ITG itself after his resignation. He was eventually driven to saying it was a personal choice to resign as he did not wish to be a director of a company with a freezing order against it. Such sensitivity is hard to understand when Mr Mason had a freezing order against him personally which he could not distance himself from.

- The reality, therefore, is that neither Mr Antrobus nor Mr Mason can explain satisfactorily why they resigned. I am satisfied to the criminal standard that they resigned in anticipation of the transfers which were made the next day, to assist the plan to move the companies out of the jurisdiction and obscure the involvement of each of the Respondents. The fact that they both resigned on the same day is not coincidence. It is clear evidence that this was a joint enterprise.

- Barclays has proved beyond reasonable doubt that Mr Antrobus and Mr Mason breached the FTG Freezing Order by knowingly assisting or permitting the FTG Transfers and breached the ITG Freezing Order by knowingly assisting or permitting the ITG Transfers.

- This was a plan to which each of the Respondents was party to transfer assets out of the jurisdiction to new vehicles in which they were interested in breach of the freezing orders. Mr Antrobus resigned as a director of FTG and Mr Mason resigned as a director of ITG to assist in that plan. Mr Antrobus could have stopped the plan by not resigning and preventing FTG entering into the FTG Transfer and the ITG Transfer. Mr Mason and Mr Antrobus could have stopped the plan by refusing as directors of ICGL to register the FTG Transfer. Mr Mason could have stopped the plan as a director of Baldwins by refusing to register the ITG Transfer.

- Barclays' position is that the Mason ICGL Share Transfer involved the disposal of, dealing with and transfer out of the jurisdiction of Mr Mason's ICGL shares and was therefore a breach of the Mason Freezing Order. Barclays also say that it would have required the involvement of Mr Mason as the shareholder required to execute a transfer or authorise someone to do so on his behalf and by Mr Mason and Mr Antrobus as the directors of ICGL required to approve the registration of the transfer.

- The first explanation given by Mr Mason and Mr Antrobus is in the letter dated 2 February 2023. In that letter they said that "Mr Mason did not remove these [i.e. the Mason ICGL shares]", and then stated, "the BVI Companies as shareholders and/or secured charge holders have rights under any shareholders agreement, any asset purchase agreement, any lending agreement or various other agreements to demand transfer of shares on the basis of: a) Any insolvency events; b) Any cash calls that aren't fulfilled by existing shareholders; c) Any insolvency threats or steps taken against other directors or shareholders; d) Any allegations of misfeasance by a third party". The letter asked for further questions to be directed to Investment Holdings and not to them.

- In his First Affidavit of 30 October 2023 Mr Mason expanded on this first explanation:

- Mr Antrobus's First Affidavit was in virtually the same terms. Neither affidavit exhibited the shareholders agreement relied upon.

- In Barclays' evidence in response (Mr Cooper's seventh affidavit dated 18 December 2023) Barclays pointed out that the Mason ICGL Share Transfer was recorded at Companies House as having occurred on 23 March 2022, whereas the bankruptcy proceedings against Mr Mason had not been initiated until 19 August 2022 by service of a statutory demand. The first explanation that the Mr Mason's shares had been taken by Investment Holdings because of insolvency or bankruptcy proceedings could not be correct.

- In his Affidavit of 29 May 2024 Mr Mason produced (for the first time) a copy of a shareholder's agreement with FTG dated 26 June 2019 ("the SHA") and said:

- The explanation that his shares had been taken by Investment Holdings because of civil litigation was thus raised for the first time a month before the trial and over two years after the alleged transfer.

- In his affidavit he went on to deny having signed any share transfer or receiving any money for the shares and said:

- The SHA is between FTG and Mr Mason as shareholders and ICGL as the company concerned. It had provisions which required a shareholder to transfer shares to the other shareholder in certain specified circumstances including the shareholder becoming subject to civil litigation. The circumstances did not include, at least not expressly, any of the trigger events referred to in the letter of 2 February 2023 and the affidavits of 30 October 2023. The SHA cannot, therefore, have been the shareholder's agreement referred to in that letter and those affidavits.

- Under its terms, even if a compulsory transfer was triggered, none of the consequential procedures for serving notices, valuing shares and paying consideration are alleged to have been complied with. Under its terms, even if a compulsory transfer was triggered, there is no provision which allows a shareholder exercising the right to force a transfer to take the shares without a transfer executed by the transferring shareholder and registration of the same by the directors. On the face of it, therefore the SHA does not explain how the Mason ICGL Share Transfer could have taken place without the involvement of Mr Mason and Mr Antrobus.

- In the witness box Mr Antrobus professed ignorance about the circumstances of the Mason ICGL Share Transfer (notwithstanding his statements in his First Affidavit) and said that any questions had to be directed to Mr Mason.

- Mr Mason's evidence was teased out over two days with new information coming out as it progressed.

- His initial explanation ("the 23 March 2022 transfer story") was that his shares had been transferred on 23 March 2022 but he had first discovered this on 29 March 2022 when he received a letter from Investment Holdings and he had been livid. The chronology of events which he eventually settled upon was as follows:

- Apart from saying he believed the assurance given to him by Mr Dylan, Mr Mason was unable to explain why he thought he was still the 50% owner of the Group when he could see that all the ICGL subsidiaries had been transferred to Investment Holdings on 23 March 2024. He denied that this is because the BVI companies were holding their interest for him in some way.

- This detailed story, weaving in the known documents, namely the emails referred to at paragraph 43, unravelled by the end of his evidence when he was cross examined about the statements made in the letter of 2 February 2003. He was driven to admit that in fact the shares in ICGL had not been moved on 23 March 2022 at all. They had been moved in October 2022 when he was facing a bankruptcy petition by Barclays. He said that Mr Dylan told him in October that Investment Holdings were taking his shares under the SHA because of the insolvency proceedings. He says Mr Dylan came up with the idea that it could be backdated because of the civil litigation clause. He said he was told that he would be removed from his role as CEO and would lose his job, his partner would lose his job in the Inc & Co Group too, and the visa dependent on it, if he challenged the transfer. He said he felt he had to give up the shares in ICGL which he described as "the only thing that I have ever had in my entire life as a real asset". He described the immense pressure he was under in strong terms and broke down in tears in the witness box necessitating a short break. I refer to this as the "October 2022 story".

- It follows from the October 2022 story that the passages of Mr Mason's sworn affidavit of 29 May 2024 set out above and his sworn evidence in the witness box were deliberately false evidence intended to deceive the Court. There was no transfer of shares on 23 March 2022 as Mr Mason and Mr Antrobus had been asserting right up until this point on the eighth day of the trial. There was no letter from Investment Holdings on 29 March 2022 informing him of this fictitious transfer of his shareholding in ICGL, or that it was being transferred because he was the subject of civil litigation. Mr Mason did not retain the letter safely in his office until a few months ago. It was not lost or taken by someone. The privileged email to Brabners cannot have referred to a letter in relation to his ICGL shareholding –this was another lie.

- If there was a letter from Investment Holdings on this date it can at best only have referred to the transfer of the ICGL subsidiaries which Mr Mason confirmed with his search of Companies House. The conversation Mr Mason had with Ms Makinson-Walsh can at best only have been prompted by the transfer of the ICGL subsidiaries. The emails referred to in paragraph 41 can also only have been prompted by the transfer of the ICGL subsidiaries. It may be that this aspect of the plan was not known to Mr Mason, and took him momentarily by surprise, which may explain some of these events.

- Nor do I accept Mr Mason's version of his involvement in the shares moving in October 2022. In his evidence he continued to assert that Investment Holdings were entitled to take his shares because of the bankruptcy petition although that is not one of the express triggers under the SHA. He said that the transfer was backdated to 23 March 2022 because of the civil litigation clause, but if that was the reason it was backdated that is the reason which would have been given in the 2 February 2023 letter and the First Affidavits in October 2023. It was not. Nor does the story of the immense pressure he felt to give up "the only thing that I have ever had in my entire life as a real asset" stack up. By October 2022 the shares in ICGL were worthless because it was an empty shell.

- Paradoxically Barclays in opening and Mr Counsell and Mr Uberoi for Mr Mason in closing all argued that the only way for Mr Mason's shares to have been transferred is by his execution of an instrument of transfer and the entry of the transferee's name in the register of members by the directors (Mr Mason and Mr Antrobus). Mr Uberoi submitted that in the absence of an instrument of transfer or a register, coupled with Mr Antrobus and Mr Mason's denial that they agreed to or signed any documentation in relation to this transfer I cannot be sure that that there was a transfer of Mr Mason's shares by Mr Mason, whether on 23 March 2022 or in October 2022. Barclays say that I can infer that these steps must have taken place, thereby implicating Mr Mason and Mr Antrobus.

- I can be sure, and am sure, that any documentation in relation to this transfer has been deliberately suppressed and not disclosed by all of the Respondents. I can be sure, and am sure, that Mr Mason's various explanations about this alleged transfer of shares were deliberate falsehoods. I cannot be sure that Mr Dylan dotted the "i"s and crossed the "t"s in terms of compliance with company law, but I can be sure that the Respondents wanted to achieve the movement of these shares out of the jurisdiction to stop them from falling into the hands of a trustee in bankruptcy who might investigate the March transactions and to give the impression that this had happened on 23 March 2022. I can be sure, and I am sure that Mr Mason and Mr Antrobus knew about and permitted the filing of the documents with Companies House in September and October 2022 which indicated that Investment Holdings had been the owner of his ICGL shares since 23 March 2022. As directors of ICGL they could have, but did not, correct those entries at Companies House. That is a dealing with Mr Mason's shares which is a breach of the Mason Freezing Order. To the extent that is different from the terms of the contempt alleged (which alleges that Mr Mason transferred the shares on 23 March 2022) I do not consider it material and if necessary I will allow the contempt application to be amended. These differences have arisen because of the false impression which the Respondents have sought to give Barclays, which has unravelled during the trial.

- Baldwins' audited accounts for the financial year ending 31 October 2021 disclose a figure of £2,688,485 as a secured debt owing to group companies, expressly including FTG and that FTG held security in respect of that debt ("the FTG Liability Asset").

- The FTG/Baldwins debenture comprises a debenture and a mortgage of chattels, each dated 9 September 2021 (prepared by solicitors and executed by Mr Antrobus and witnessed by Mr Dylan). Each of the security documents recited that FTG had agreed to provide Baldwins with loan facilities on a secured basis and that Baldwins provided, under the security documents, security to FTG "for the loan facilities made available under the Facility Agreement". "Facility Agreement" was defined as "the facility agreement dated 9 September 2021 between [Baldwins] and [FTG] for the provision of the loan facilities secured by this deed".

- Between 23 and 28 March 2022, and in apparent breach of the FTG Freezing Order, any debt owed to FTG, and the FTG Baldwins Debenture, were released by FTG and new debentures granted by Baldwins in favour of Travel Holdings for new secured loan facilities under a facility agreement dated 24 March 2022.

- In his affidavit of 29 May 2024, Mr Mason said – on the basis of purportedly having "checked with Mr Hatfield" (the Group's Chief Financial Officer), from whom no evidence has been obtained by Mr Mason – Baldwins owed no money to FTG so nothing was secured by the debenture.

- Barclays dispute this and have focussed on a specific part of the figure of £2,688,485 amounting to £350,000 which it says it can prove was an outstanding debt. At the time the FTG/Baldwins debenture was created, the documents show that FTG had transferred £350,000 to Baldwins. FTG and ITG's Defence in the Proceedings, which was signed by Mr Antrobus and Mr Mason and dated 25 February 2022, pleads that these payments "were loans by [FTG] to address Baldwins' short-term cashflow issues". There is no evidence, and it was not asserted by any of the Respondents, that any of the sum of £350,000 had been repaid to FTG by March 2022.

- In their evidence both Mr Antrobus and Mr Mason sought to contradict the statements in the pleadings signed by them. In his evidence Mr Antrobus denied that the sum of £350,000 had been paid to Baldwins saying it had been paid to ITG – until he was shown documents showing the contrary. When pressed in cross examination Mr Mason accepted that £350,000 had been provided by FTG to Baldwins for the purposes of an ABTA bond, but he said it was not a loan but a gift. There was no explanation as to why FTG might want to make a gift of half of £350000 to Mr Mason as the other 50% shareholder of the Group and it is not recorded in Baldwins' accounts as an asset or capital of Baldwins. It would be uncommercial for FTG to make a gift of £350000 to a subsidiary of ICGL in respect of which it only had, indirectly, a 50% interest.

- Baldwins must have the necessary documentation to be able to show what it did and did not owe FTG as at 23 March 2022 and Mr Mason as its director (and Group CEO) was able to procure that any necessary documentation was produced. He said as much in cross examination when being asked about the redacted debentures granted to the BVI companies and GIMH by Group companies. No Baldwins documentation was produced to show that £2,688,485 was no longer secured by the FTG/Baldwins debenture as at 23 March 2022. No Baldwins documentation was produced to show £350,000 which had been paid by FTG and received by Baldwins was not a loan. I infer that this is because the documentation would not have shown either of those things.

- I am satisfied that the sum of £350,000 was a loan and there was at least £350,000 due to FTG as at 23 March 2022 which was released along with the FTG/Baldwins debenture which secured its repayment.

- Mr Antrobus could and should have prevented FTG from releasing the debts owed to it and the FTG/Baldwins debenture. Mr Mason could and should have prevented Baldwins participating in the release and replacement of the FTG/Baldwins debt and debenture with debt and debentures in favour of Travel Holdings. The release of the FTG Liability Asset and the FTG/Baldwins debenture was therefore a breach of the FTG Freezing Order by both Mr Antrobus and Mr Mason.

- I am satisfied, beyond reasonable doubt, that Mr Antrobus and Mr Mason breached the FTG Freezing Order by knowingly assisting or permitting the FTG Transfers.

- I am satisfied, beyond reasonable doubt, that Mr Antrobus and Mr Mason breached the ITG Freezing Order by knowingly assisting or permitting the ITG Transfers.

- I am satisfied, beyond reasonable doubt, that Mr Antrobus and Mr Mason breached the FTG Freezing Order by knowingly assisting or permitting the release of the FTG/Baldwins debenture.

- I am satisfied beyond reasonable doubt that Mr Mason breached the Mason Freezing Order by making or attempting or permitting the purported Mason ICGL Share Transfer and the Companies House filings in relation to it.

- I am satisfied beyond reasonable doubt that Mr Antrobus committed a contempt of court by knowingly assisting or permitting Mr Mason's breach.

Mr Justice Rajah :

Introduction

Summary of the dispute

Law

There must however be some culpable conduct on the part of the director before he will be liable to be subject to an order of committal…; mere inactivity is not sufficient".

(Attorney General for Tuvalu v. Philatelic Distribution Corp Limited

[1990] 1 WLR 926 per Woolf LJ (as he then was) at 936E-F and 938A)

"I accept the submission made on behalf of Templeton that "permit" denotes a party standing by while a breach of injunction takes place in circumstances where the relevant act can only take place with his wilful forbearance".

"Inferences

In reaching its conclusions it is open to the court to draw inferences from primary facts which it finds established by evidence. A court may not, however, infer the existence of some fact which constitutes an essential element of the case unless the inference is compelling i.e. such that no reasonable man would fail to draw it: Kwan Ping Bong v R [1979] AC 609.

Circumstantial evidence

Where the evidence relied on is entirely circumstantial the court must be satisfied that the facts are inconsistent with any conclusion other than that the contempt in question has been committed: Hodge's Case [1838] 2 Lewin 227; and that there are 'no other co-existing circumstances which would weaken or destroy the inference' of guilt: Teper v The Queen [1952] AC 480, 489. See also R v Blom [1939] AD 188, 202 (Bloemfontein Court of Appeal); Martin v Osborne [1936] 55 CLR 367, 375. It is not, however, necessary for the court to be sure on every item of evidence which it takes into account in concluding that a contempt has been established. It must, however, be sure of any intermediate fact which is either an essential element of, or a necessary step on the way towards, such a conclusion: Shepherd v The Queen 170 CLR 573 (High Court of Australia).

Adverse inferences

Mr James Lewis QC on behalf of the judgment debtors accepted that, although (i) an application for contempt is criminal in character, (ii) an alleged contemnor may claim a right to silence, and (iii) the provisions of sections 34 and 39 of the Criminal Justice Act 2003 do not apply, it was open to the Court to draw adverse inferences against the judgment debtors to the extent that it would be open it to do so in comparable circumstances in a criminal case. Thus it may be legitimate to take into account against the judgement debtors the fact (if it be such) that, when charged with contempt, as they have been in these proceedings, they have given no evidence or explanation of something of which they would have had knowledge and of which they could be expected to give evidence if it was true."

"It is frequently very difficult to tell whether a witness is telling the truth or not; and where there is a conflict of evidence such as there was in the present case, reference to the objective facts and documents, to the witnesses' motives, and to the overall probabilities, can be of very great assistance to a Judge in ascertaining the truth."

This passage has been cited with approval in the highest courts; see for example Bancoult, R (on the application of) (no3) v Secretary of State for Foreign and Commonwealth Affairs [2018] UKSC 3 at paragraphs 100-101.

The background

a. the freezing order against FTG, obtained without notice on 18 November 2021 and renewed on 25 November 2021 and again on 5 July 2022 ("the FTG Freezing Order"). The FTG Freezing Order specifically identified FTG's shares in ICGL as assets to which the Order applied;

b. the freezing order against ITG, obtained without notice on 18 November 2021 and renewed on 25 November 2021 and again on 5 July 2022 ("the ITG Freezing Order"). The ITG Freezing Order specifically identified ITG's shares in Baldwins as assets to which the Order applied; and

c. the freezing order against Mr Mason, obtained without notice on 18 November 2021 and renewed on 25 November 2021 and again on 5 July 2022 ("the Mason Freezing Order"). The Mason Freezing Order specifically identified Mr Mason's shares in ICGL as assets to which the order applied.

a. Mr Dylan, in his capacity as a charge holder over FTG, filed a Notice of Intention to appoint an administrator of FTG.

b. FTG, as a charge holder over ITG, acting by Mr Antrobus, filed a Notice of Intention to appoint an administrator of ITG.

c. Mr Antrobus resigned as a director of FTG, as reflected in a document filed at Companies House two days later, on 24 March 2022.

d. Mr Mason resigned as a director of ITG.

a. FTG's 50% shareholding in ICGL, and its 36% shareholding in ILGL was transferred to a BVI company called Investments Holdings (BVI) Ltd ("the FTG Transfer");

b. ITG's 100% shareholding in Baldwins, and its 100% shareholding in ITOL was transferred to another BVI company, International Travel Holdings (BVI) Ltd ("the ITG Transfer"). This was apparently effected by FTG pursuant to powers conferred on it under a debenture it held over ITG.

a. an Annual Franchise Tax Report to the State of Delaware for the tax year 2022 showing that Darryl Dylan, Mr Dylan's brother, was the ostensible ultimate beneficial owner of GIMH, although it was Mr Dylan's address which was given as GIMH's principal place of business and Mr Dylan's mobile telephone number for that principal place of business.

b. The tax report shows Shirley Kerkhove as GIMH's sole director in 2022– this is significant because she was also a director of Investment Holdings in March 2022.

c. Minutes of a meeting of a quorate number of directors of GIMH (comprising Mr Dylan and his brother) on 6 September 2022 at FTG and ITG's offices at which it was resolved to open bank accounts with Citibank with each of the Respondents, as well as Chris Hatfield and Daryl Dylan, having full individual authority to deal with Citibank, including having individual signing rights in respect of any accounts opened.

d. Internal emails from Citibank in relation to the opening of those bank accounts indicating that they had already preformed KYC checks in relation to Mr Dylan and his brother in opening accounts for Investment Holdings, and that seed money for the GIMH accounts was Inc & Co Group funds.

e. Although initially the documents (including a structure chart) suggest that GIMH was owned as to 50% by each of Mr Dylan and his brother as a "personal holding company for Scott & Daryl Dylan's private investments", by September 2023 there were structure charts (certified by an accountant as a true representation of the beneficial ownership structure and directors) sent to Citibank by Mr Dylan showing the ownership of GIMH as owned in equal shares by Mr Dylan, Mr Mason and Mr Antrobus, and that they were the three directors of GIMH.

f. An email chain showing that by October 2023 Citibank were the bankers for many Inc & Co Group companies and treated GIMH's account as part of that group.

The Trial of the Applications

a. Mr Dylan, Mr Antrobus and Mr Mason breached the FTG Freezing Order by knowingly assisting or permitting the FTG Transfers. Mr Dylan has admitted this breach.

b. Mr Dylan, Mr Antrobus and Mr Mason breached the ITG Freezing Order by knowingly assisting or permitting the ITG Transfers. Mr Dylan has admitted this breach.

c. Mr Antrobus and Mr Mason (the claim against Mr Dylan under this head no longer being pursued) breached the FTG Freezing Order by knowingly assisting or permitting the release of the FTG/Baldwins debenture.

d. Mr Mason breached the Mason Freezing Order made against him by making the Mason ICGL Share Transfer;

e. Mr Antrobus (the claim against Mr Dylan under this head no longer being pursued) committed a contempt of court by knowingly assisting or permitting Mr Mason's breach.

Mr Antrobus and Mr Mason

The FTG Transfer and the ITG Transfer

Rea Barreau

a. An email dated 29 December 2023 apparently from a person called "Rea Barreau" (but with no other contact information revealed) was exhibited to Mr Dylan's witness statement together with a scan of a passport of a citizen of the Seychelles called Rea Barreau. The email confirmed her willingness to give evidence and set out what her evidence might contain. There are a number of oddities about this email and its authenticity is not accepted. Neither Mr McKendrick nor Mr Counsell sought to adduce this email as evidence of its truth.

b. At 1.35am on 3 July 2024 (before the start of day 7 of the trial) the Court was sent an email from "Rea Barreau reabarreau@mail2world.com" copied to the Respondents and their solicitors. It enclosed a witness statement apparently from Ms Barreau and exhibited what appears to be the same scan of her passport. Mr Counsell, with Mr McKendrick's support, invited me not to read it until its authenticity had been verified by Mr Mason and Mr Antrobus' solicitors. No further mention was made of this witness statement during the trial, and no application was made to adduce it as evidence of its truth.

a. The Plimsoll valuation on 21 March 2022, obtained on Mr Dylan's instructions, identifies the directors of FTG at that date as Mr Antrobus only.

b. Each of Mr Dylan, Mr Antrobus and Mr Mason signed statements of case settled by leading and junior counsel in the Proceedings between 22 February 2022 and 22 March 2022 admitting that Mr Antrobus was the sole director of FTG. FTG and ITG's statements of case in the same period, settled by counsel, were signed by Mr Antrobus and Mr Mason on behalf of the companies and also admitted that Mr Antrobus was the sole director of FTG. This means that three different legal teams were separately instructed that Mr Antrobus was the sole director of FTG at this time. Mr Antrobus' and Mr Mason's evidence that this was an oversight was not credible.

c. Mr Antrobus continued to act as the sole director even after his resignation, signing a consent order on behalf of FTG on 24 March 2022 agreeing to be FTG's representative in the Proceedings, and signing statutory declarations as director on 30 March 2022, 6 April 2022 and 19 April 2022. Mr Antrobus' explanations that he was under pressure to sign these documents, he misunderstood the capacity in which he was signing, or that he was somehow reappointed briefly as a director at the request of the Administrator, raise more questions than they answer, and do not explain why Rea Barreau did not sign these documents if she was by then the sole director of FTG.

GIMH

Timing of resignations

Conclusion on FTG Transfer and ITG Transfer

Mason ICGL Share transfers

"the Shareholders Agreement I had with Investment Holdings (previously with OLD3 Ltd) enumerates precise conditions under which Investment Holdings could either annul or assume control of my shares in ICGL. This mechanism becomes particularly salient when faced with insolvency proceedings or in the event of a looming bankruptcy petition. Both scenarios were regrettably extant in my case. Consequently the transfer of my ICGL shares was a direct corollary of this binding agreement, leaving me with no discretion or capacity to forestall or modify said transfer".

"What I was told by Investment Holdings (BVI), by way of a letter after the share transfer had already gone ahead without my knowledge, was that, clause 41(b)(iii) permitted Investment Holdings (BVI) (which purchased the assets of FTG) to assert that it could sell or revoke my shares because I was the subject of civil litigation. (emphasis added).

"I first discovered that my shares had been sold on or around 29 March 2022 when I received the letter, referred to above, from Investment Holdings (BVI). I am currently trying to find a copy of this letter, which as far as I can recall, was only received in hard copy, and it will be provided as soon as I can locate it. When I found out what had happened, I was livid. I wrote to the Claimant about this, copied to FTG, (exhibited at MNC8/1380), explaining that I did not authorise any sale, so this shouldn't be a surprise to Barclays. I also recall sending at least one other email to FTG direct, outlining my anger and surprise about what had happened and also speaking to others in the SLT. Unfortunately, it appears those emails have been deleted from my Inc&Co account. I have raised this with the tech team as per Page 79-84.

a. On 29 March 2022 he had arrived at the offices of Inc & Co to discover a hard copy letter from Investment Holdings informing him that (a) his 50 shares in ICGL had been transferred to Investment Holdings on 23 March 2024 because of the civil litigation against him by Barclays pursuant to a shareholder's agreement with FTG which had been novated to Investment Holdings and (b) all of the subsidiary companies owned by ICGL had also been transferred to Investment Holdings. Mr Mason said he had a copy of this letter until a few months ago when he discovered it was missing from his papers in his office.

b. Mr Mason sent an angry email to FTG, copied to Mr Dylan and Chris Hatfield. No copy of that email has been produced. Mr Mason says that Mr Dylan has access to his email account and has been deleting certain of his emails, and this is one which has been deleted.

c. Mr Mason then telephoned his friend and colleague Ms Makinson-Walsh. Ms Makinson-Walsh was called as a witness and confirmed that at some point in this period, give or take a few days, she had a conversation with Mr Mason in which he had been angry that his shares had been "taken".

d. Mr Mason then did a search at Companies House– from which he could see that the subsidiary companies of ICGL had been transferred but at that point the records at Companies House still showed him as the owner of 50% of ICGL (albeit ICGL was now an empty shell).

e. Although this was not part of his evidence initially, he eventually said he then had a communication of some kind with Mr Dylan and received an assurance from him that he still owned 50% of ICGL and all its subsidiaries.

f. He then sent the email to Eversheds and all the lawyers and parties involved at midday referred to in paragraph 43 above -stating that he had not authorised any sale of any company within the Inc & Co Group and he still retained 50% of all companies and had not breached any freezing orders. The email said that any movement of shares was not authorised by him as 50% shareholder.

g. A few minutes later he says he sent an email to his solicitors Brabners about these events which he says corroborates what he says, but privilege in that email was not waived and it was not produced.

h. At 12.30pm the email from legal@freshthinking.group referred to in paragraph 43 above was sent in reply to Mr Mason's email to Evershed confirming that Mr Mason did indeed remain the owner of 50% of the Inc & Co group, although it was valueless.

FTG/Baldwins debenture

Concluding remarks