Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Lidl Great Britain Ltd & Anor v Tesco Stores Ltd & Anor [2023] EWHC 873 (Ch) (19 April 2023)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2023/873.html

Cite as: [2023] EWHC 873 (Ch)

[New search] [Printable PDF version] [Help]

Claim No. IL-2021-000041 |

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INTELLECTUAL PROPERTY LIST (CHD)

Fetter Lane London, EC4A 1NL |

||

B e f o r e :

____________________

| (1) LIDL GREAT BRITAIN LIMITED (2) LIDL STIFTUNG & CO KG |

Claim No. IL-2020-000127 Claimants |

|

| - and – |

||

| (1) TESCO STORES LIMITED (2) TESCO PLC |

Defendants |

|

And Between: |

||

| (1) TESCO STORES LIMITED (2) TESCO PLC |

Claim No. IL-2021-000041 Claimants |

|

| -and- |

||

| (1) LIDL GREAT BRITAIN LIMITED (2) LIDL STIFTUNG & CO KG |

Defendants |

____________________

Mr Hugo Cuddigan KC and Mr Daniel Selmi (instructed by Haseltine Lake Kempner) for the Defendants/Claimants

Hearing dates: 7, 8, 9 and 14 February 2023

____________________

Crown Copyright ©

- The two consolidated claims in these proceedings between two well-known supermarket chains (to whom I shall refer as "Lidl" and "Tesco"[1]) involves allegations by Lidl of infringement of registered trade mark rights in Lidl's logo devices, passing off and infringement of copyright. Tesco pursue a counterclaim alleging that some of the Lidl trade marks are liable to be declared invalid on the grounds that they were registered in bad faith, and/or that they should be revoked for non-use and/or that they have no distinctive character.

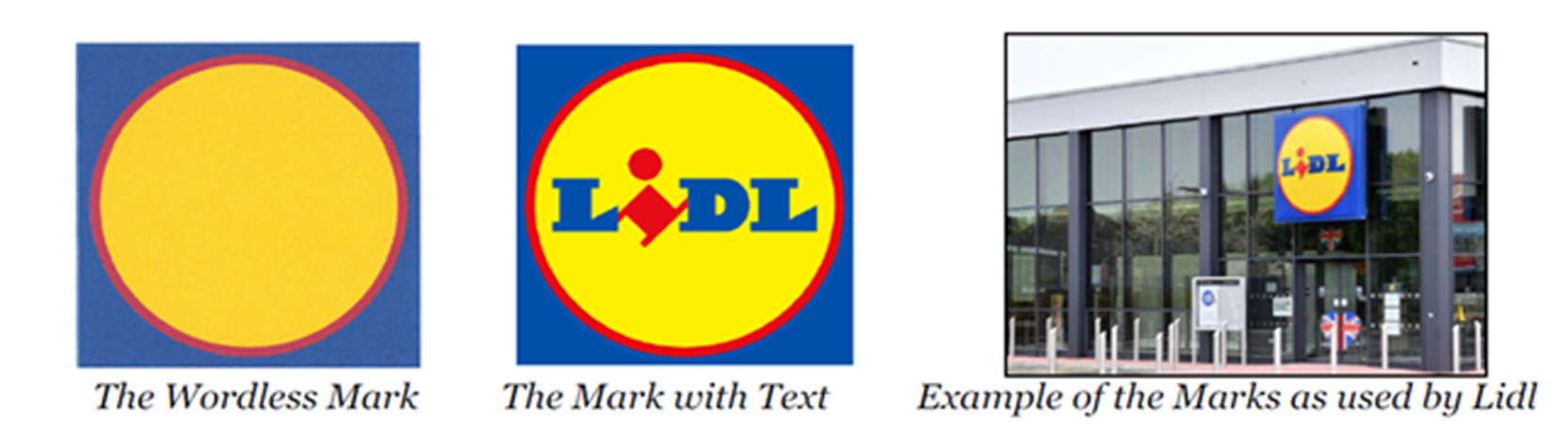

- In bringing the claim, Lidl relies upon its trade mark rights in relation to two versions of the Lidl logo: a logo which includes the word "Lidl" ("the Mark with Text") and a logo without that word ("the Wordless Mark"). Together, I shall refer to these as "the Lidl Marks" or "the Lidl Logo". The Wordless Mark is a graphical device consisting of a blue square background bearing a yellow circle, bordered with a thin red line. The Lidl Marks are reproduced below:

- Lidl is a German supermarket business established in 1973 which opened its first store in the UK in 1994. It has always operated in the UK under the Mark with Text.

- Lidl is the registered proprietor of UK registration 2570518, filed on 28 January 2011, in respect of the Mark with Text. Lidl is also the registered proprietor of four UK registrations: UK2016658A, UK2016658C and UK2016658D all filed on 4 April 1995 ("the 1995 Registrations") and UK 904746343 (originally filed as an EU trade mark on 17 November 2005 and created as a result of the UK's withdrawal from the European Union) ("the 2005 Registration") in respect of the Wordless Mark. By its defence, Tesco identifies two additional UK trade mark registrations made by Lidl for the Wordless Mark (UK00902936185 filed on 15 November 2002 ("the 2002 Registration" and 00906560571 filed on 13 November 2007 "the 2007 Registration") which it refers to as "the Additional Wordless Marks". Tesco also identifies a further application made for registration of the Wordless Mark in 2021 (UK00003599128) ("the 2021 Application").

- The Mark With Text appears throughout Lidl's stores, on their advertising and on their products.

- Lidl contends that the graphical device forming the Wordless Mark (which it accepts has never been used in the United Kingdom other than as a background to the Mark With Text) is distinctive of its service and goods quite apart from the name "Lidl" and that it has generated a huge reputation and goodwill in both the Mark With Text and the Wordless Mark. Central to this case is Lidl's contention that such reputation and goodwill is specifically that Lidl are a "discounter" supermarket that offers value; specifically quality goods at low prices – a reputation that it says has been encapsulated since 2017 in its marketing slogan "Big on quality, Lidl on prices".

- Lidl's complaint concerns what Lidl describes as the use by Tesco of an identifier for its Clubcard Prices promotion. In the Amended Particulars of Claim ("the PoC") this is identified as "the Sign" and consists of a graphical device formed of a blue square background and a yellow circle (as shown below in the form used in the PoC):

- Tesco Clubcard is a scheme that launched in 1995 and was created as a loyalty scheme to reward customers for shopping at Tesco. It is widely acknowledged to have set the gold standard for customer loyalty schemes globally. The Clubcard Prices promotion, about which Lidl complains, is a discrete advertising strategy which launched in September 2020. It was designed to promote the Tesco Clubcard in a new way, by providing discounts to clubcard holders at the point of sale on selected goods. It is Tesco's case that pursuant to the Clubcard Prices initiative, it uses the Sign in various guises, always with text overlaid and always as a signifier of its Clubcard Prices promotion.

- Sometimes the Sign appears together with a price figure, where the price will itself depend upon the corresponding product (in which case the accompanying text says "Clubcard Price"). Alternatively, the Sign is used more generally to indicate the promotion, in which case the accompanying text reads "Clubcard Prices". One such example appears in the right hand image shown in paragraph 7 above and two others are identified below.

- Tesco has referred to all of these icons in its statement of case as "the CCP Signs", and it refers to the background (i.e. the Sign as defined by Lidl) as "the CCP Signifiers Background".

- Lidl's complaint derives from the presence of the common element, the CCP Signifiers Background, in all of the uses made by Tesco of that background (referred to by Lidl as "the Uses"). Lidl points out that, in common with the Lidl Logo, the CCP Signifiers Background has a blue square containing a centred yellow circle extending towards the edge of that blue square. In the case of the Mark with Text, Lidl points to a further similarity, namely the presence of wording across the middle of the yellow circle. Lidl says that although the words differ, or are absent from the Wordless Mark, the Uses made by Tesco of the CCP Signifiers Background are of a kind where attention to the detail of the wording is often absent or limited. The consequence, says Lidl, is that a substantial number of customers are being deceived; some as to origin, although this is not a case that Lidl has sought specifically to make out in its pleading, but many because they see the CCP Signs, link them to Lidl's brand and reputation and believe that Tesco's prices are being said to be comparable to Lidl's (low) prices and/or that they are price matched to Lidl.

- Essentially, Lidl says that Tesco is seeking deliberately to ride on the coat tails of Lidl's reputation as a "discounter" supermarket known for the provision of value. It is Lidl's case that the Clubcard Prices promotion was adopted by Tesco as part of a campaign that was designed to improve Tesco's ability to compete with discounter supermarkets such as Lidl. At around the same time as the Clubcard Prices campaign was launched, Tesco also launched a price matching campaign against Aldi prices ("the Aldi Price Match"); Aldi being the other recognised 'discounter supermarket' in the UK.

- Lidl contends that the deception of Tesco's customers is not accidental. They maintain that Tesco deliberately copied the artworks that comprise the Lidl Marks to achieve the transfer of reputation for good value that they maintain is occurring and they also assert a claim in passing off on the grounds that, by their use of the Sign, Tesco has misrepresented that products sold by Tesco share the qualities of those of Lidl, including that they are sold at the same or equivalent price, or have otherwise been price matched with Lidl products.

- Lidl called three witnesses to give oral evidence, Mr Andy Paulson, Mr Simon Berridge and Ms Claire Farrant.

- Mr Paulson and Mr Berridge are two ordinary members of the public who gave evidence as to their responses to exposure to sight of the CCP Signs. I have no reason to think that they were not giving truthful evidence with a view to assisting the court.

- Mr Paulson first encountered the CCP Signs in September 2020 at the outset of the CCP promotion. It was his evidence that he had seen (on his phone) a tweet from Tesco which included a short clip from a tv advert[2] showing price drops and that he had then tweeted a response in the following terms "Suppose it's no coincidence that the offer notices appear to resemble a certain other supermarkets logo". He used the hashtag "cleveradmen". Below his tweet he included an image of the Lidl Mark with Text, pointing out in his statement that this tweet was intended to be a reference to Lidl. In summary, his evidence was that the Tesco advert reminded him of Lidl because the "offer notices" (by which he meant the CCP Signs) were "uncannily similar to the Lidl logo" and that he had used the hashtag "cleveradmen" because he "got the impression" that the ad men for Tesco had looked at budget supermarket signs "and tried to hint at Lidl, to say their prices were also as low as Lidl's". He went on to say that his understanding of the CCP Sign is that "it is saying that on the products that have been given a "Clubcard" price, the prices you can get for those products is the same or perhaps a bit better than the priced at Lidl". Under cross examination, he accepted that he had realised that the advert was not for Lidl, and he acknowledged that the Tesco promotion had not deterred him from shopping at Lidl.

- Mr Berridge, who was a frequent shopper with Lidl, had visited the Tesco website in November 2021 looking for a specific product. Upon visiting the website he described his confusion, saying he thought he had visited the Lidl website and that this caused him to do a "comedy double take" at the screen. He checked and saw that it was the Tesco site but the logo had tripped him up because it was "so similar to the Lidl logo". Under cross examination, Mr Berridge said that he had not initially seen the writing on the logo but that even when he did see it he remained confused, even though he noticed that Lidl was not referenced. He observed that what he considered to be "blatant mimicry" had made him angry and that it had certainly not encouraged him to shop at Tesco.

- Miss Farrant is marketing director at Lidl Great Britain Limited, where she has worked in that capacity since 2015. She is responsible for protecting, building and promoting the Lidl brand in Great Britain. She has worked in the grocery and retail industry for over 20 years, including in various marketing roles for Tesco between 2005 and 2015. It was clear from her evidence that she has a good understanding of the market sector, the marketing strategies employed for promoting supermarkets and the constraints on marketing. In her first witness statement, Miss Farrant provided some background to the grocery market in the UK before giving evidence about Lidl's business, its brand and its main brand assets, including the Lidl Logo, Lidl's advertising slogan and Lidl's corporate colours.

- Miss Farrant also described the circumstances in the market surrounding the launch of the Tesco Clubcard scheme, Tesco's use of the CCP Signs and the Tesco Aldi Price Match Campaign. Miss Farrant described her own surprise at first seeing the Tesco Clubcard logo, saying her reaction was "They're using our logo!". Her view was that Tesco's decision to choose this logo was deliberately intended to reference Lidl without using its name. In her evidence she described Lidl's concerns about the effect of the Tesco Clubcard promotion on the Lidl brand and explained that Lidl had been forced to take action to undo some of the damage by conducting corrective advertising in the form of the "Unmatched Value" campaign. She elaborated on this in her second statement.

- Miss Farrant was a hesitant witness. Sometimes she appeared to find it difficult to answer the questions put to her in cross examination and, although not always recorded in the transcript, there were frequently lengthy pauses between the question and her response. In closing, Tesco did not invite any formal criticism of Ms Farrant, but they did submit that her written evidence had put her in a somewhat uncomfortable position and that her evidence regarding the motivation for Lidl's Unmatched Value advertising campaign should not be accepted in the absence of corroborating documents.

- I shall return to this in more detail in due course, but record here that having considered the contemporaneous documents with care, I do not doubt that Ms Farrant gave truthful evidence (and much of her witness statement was not challenged). I strongly suspect that her hesitancy when giving oral evidence was the product of nerves exacerbated by robust cross examination and that from time to time she simply did not understand what was being asked of her.

- Lidl also relied upon three additional witnesses, whose written evidence went unchallenged by Tesco: Mr David Unterhalter, Mr Simon Sketchley and Mr Jake Gammon.

- Mr Unterhalter is a solicitor employed by Lidl Great Britain Limited as Director of Legal and Compliance for the business of Lidl in Great Britain. Relevant to the trial were his second, third and fourth statements. In his second statement he described the corporate investigation that he had instigated into the circumstances in which the Wordless Mark and the Mark with Text (which for these purposes he described as "the Works") had been created, together with his view in light of that investigation that the Works were created sometime in the 1980s, but before November 1987. In his third statement, Mr Unterhalter explained the context of documents relating to how Lidl's brand had been used in Lidl's business in the five year period from September 2015 to September 2020. In his fourth statement, Mr Unterhalter set out the available facts relating to Lidl's intention and rationale in relation to its trade mark filings for variations of the Wordless Mark.

- Mr Sketchley provided two witness statements in his role as Head of Research, Connected Data, of YouGov plc, designed to explain how a YouGov Survey conducted between 19 and 22 February 2021 on behalf of Lidl ("the YouGov Survey") had been carried out. The YouGov Survey was admitted into evidence in these proceedings further to a contested application which I heard on 5 and 6 April 2022 (Lidl Great Britain Limited v Tesco Stores Limited [2022] EWHC 1434 (Ch)) ("the Survey Application"). Shortly before trial, Mr Sketchley left his employment with YouGov and was no longer able to provide evidence in support of Lidl's case. Accordingly, Lidl obtained a statement from Mr Gammon, Global Head of Qualitative Research and Interim Head of UK Data Services at YouGov, designed to confirm Mr Sketchley's evidence. Mr Gammon confirmed in his statement that the Methodology Report for the YouGov Survey and Mr Sketchley's explanatory comments in his two statements represented an accurate and complete account of how the YouGov Survey was conducted.

- Lidl served a Civil Evidence Act Notice dated 22 September 2022 in respect of (i) social media posts found on Twitter by Bird & Bird, Lidl's solicitors; (ii) customer contact records extracted from Lidl's database of consumer feedback; and (iii) Tesco's customer communications database. For the purposes of the trial, the statements from the public obtained from these various sources (together with statements made by members of the public in the context of Tesco's own market research exercises) were helpfully gathered together by Lidl into an Appendix of so-called "vox populi" attached to their opening submissions. The parties disagree over the usefulness of this evidence and, in particular, whether it is a reliable source for ascertaining the opinions of the majority of consumers. I shall refer to this evidence as "the Lidl Vox Populi".

- Tesco called five witnesses to give oral evidence: Mr Simon Threadkell, Ms Michelle McEttrick, Ms Rachel Marks, Ms Nina Webb and Mr Richard Hing.

- Mr Threadkell has been Tesco's Brand Design and Format Development Director since 2015, having worked for Tesco since 2010. His statement recorded that "as the person who was responsible for the design of the disputed Sign" his evidence was designed to address the detail of the design process. Although much of his evidence referred to actions taken and documents generated by "my team and I" (by which he meant his internal team within Tesco), during cross examination it became abundantly clear that Tesco did not operate independently, but that it frequently worked together with design partners, including when creating a Master Brand document and developing the initial guidance for the Clubcard Prices project. This included, in particular, Wolff Olins, a British advertising agency and corporate identity consultancy ("Wolff Olins").

- Although I found Mr Threadkell to be a relatively straightforward witness who came across as trying to assist the court when giving his oral evidence, I agree with Lidl that his cross examination exposed the fact that his written evidence was both incomplete and inaccurate. His witness statement gave the impression that Tesco had (for the most part) acted alone in all material parts of the Clubcard Prices project (which was demonstrably erroneous having regard to the available documents) and that design changes were consistent with Tesco's Master Brand Guidelines or Clubcard guidelines, when they in fact appeared inconsistent with those documents. Tesco accepted in closing that in both of these areas, Mr Threadkell's evidence had "moved on" from his written statement.

- In my judgment, these significant difficulties with Mr Threadkell's written evidence (which was primarily addressed to the issue of copying) mean that I cannot sensibly accept his evidence, save where he made admissions or gave evidence contrary to Tesco's interests, or where it is shown to be consistent with contemporaneous documents.

- Ms McEttrick was, between 2015 and 2021, the Group Brand Director for Tesco. As at the date of trial, she was no longer employed by Tesco but was due to commence a new role as Primark's Chief Customer Officer sometime in February 2023. From 2015 onwards, Mr Threadkell reported directly to Ms McEttrick, whose team consisted of between 150 and 225 people. Ms McEttrick's statement records her 30 years of experience as a marketing executive and then deals with the Tesco Master Brand project, initiated in 2016, together with the development of Clubcard Prices, including work on the CCP Signifier Background and reasons for the ultimate choice of design for the CCP Signs, the roll out of Clubcard Prices and the importance of the Clubcard brand to Tesco.

- I found Ms McEttrick to be an impressive witness who gave careful and well-considered evidence plainly designed to assist the court. Her obvious anxiety to ensure accuracy meant that she qualified her written evidence in certain respects under cross examination, but, subject to those qualifications, I have no difficulty in accepting her evidence in its entirety.

- Ms Marks is Associate Director at The Source (W1) LLP ("The Source"), which, amongst other things, conducts consumer testing and research. Ms Marks has worked in consumer research and insight for over 7 years. In her two statements, she describes her involvement in consumer testing instructed by Tesco in relation to its CCP Signs in the summer and autumn of 2020 ("the Source Survey"). Together with her colleagues, Ms Marks designed four tests with a view to determining whether the CCP Sign was likely to be successful in communicating its associated offer message. Ms Marks describes the tests and their outcomes in her statements.

- Ms Webb is currently Tesco's Head of Insight, albeit that at the time of development of the Clubcard Prices promotion she was a Brand & Communication Manager within the Insight Team. The role of the Insight Team is to understand Tesco's customer needs and behaviour using a variety of research and analytical techniques. In her statement, Ms Webb deals with an email chain from July 2020 to which I shall return, together with the commissioning of Hall & Partners, Tesco's research supplier, to evaluate the Clubcard Prices campaign following its launch in September 2020.

- Mr Hing is legal counsel within Tesco's legal team, a position he has held since joining Tesco in February 2020. In his first statement he gives evidence designed to inform the court as to Tesco's uses of the CCP Signifier Background in stores and on line. In his second and third statements he describes investigations he has undertaken into a number of customer messages relied upon by Lidl as part of the Lidl Vox Populi in this case, together with identifying the types of products offered by Tesco through Clubcard Prices.

- Ms Marks, Ms Webb and Mr Hing were plainly all honest witnesses, whose evidence I have no hesitation in accepting, subject only to one point in relation to Ms Webb's evidence, to which I shall return.

- Tesco also relied for the purposes of the trial upon five additional witnesses whose written evidence was unchallenged: Mr John Lamont, Ms Naomi Kasolowsky, Mr Paul Jones, Ms Natasha Whitmey and Mr William Baker.

- Mr Lamont is Tesco's Head of Response and Legal, a position he has held since September 2020. In his statement he describes how point of sale materials for Clubcard Prices which used a yellow circle on a blue background were initially centrally printed and distributed to stores for printing with text in store, but that in February 2022 Tesco changed its system and instead provided stores with blank templates onto which Clubcard Prices "offer" information could be printed. He explains that Tesco has identified two errors in the use of point of sale materials, involving display of the CCP Signifier Background without the addition of text. It is accepted by Lidl that these were inadvertent errors and nothing turns on them.

- Ms Kasolowsky is Tesco's Group Insight and Foresight Director, a position she has held since January 2019. In her statement she addresses the role of Tesco's Insight Team, her involvement in considering the results of the Source Survey (which she accepts included mentions of Lidl or Aldi but which she did not understand to be "statistically significant") and her attendance at a Steering Committee meeting in the Summer of 2020.

- Mr Paul Jones is Tesco's Head of Design and he has worked for Tesco since February 2011. In his short statement he describes his reaction to the Source Survey results, including recommendations made by The Source. He explains that he was unconcerned by the percentage of consumers who mentioned Aldi or Lidl which "seemed to me to be very low".

- Ms Whitmey is Group Membership Loyalty and Customer Relations Management Director at Tesco, a position she has held since January 2018. Before joining Tesco she worked for the customer engagement agency Havas Helia which held the Tesco Clubcard account. In her last 5 years working at Havas Helia she was heavily involved in work on Clubcard. Ms Whitmey describes the origin and aims of the Clubcard Scheme, together with its global reputation and the steps taken by Tesco to monitor its member satisfaction levels and the data on Clubcard use. Ms Whitmey identifies various UK registered trademarks owned by Tesco relating to Clubcard and/or its logo, none of which is relevant to the issue arising in these proceedings. Ms Whitmey explains the recognition at Tesco in 2019 of the need to evolve the Clubcard message and the development of the idea of giving members money off selected products at the point of sale together with the substantial investment made by Tesco in advertising the new Clubcard Prices promotion and the success of the campaign.

- Mr Baker is Tesco's Head of In Store Marketing, a position he has held since June 2019. In his short statement he explains that he and his team are responsible for the printing and distribution of printed point of sale materials to stores and he confirms that to the best of his knowledge his team has never distributed any such materials incorporating the CCP Signifier Background without the words "Clubcard Price" or "Clubcard Prices" printed on them. He confirms that an example of the CCP Signifier Background with the word "Offer" on it was on the Tesco website before the launch of the Clubcard Prices promotion but that it is not one that has ever been distributed to stores. Nothing turns on this one example of the CCP Signifier Background being used without reference to "Clubcard Price" or "Clubcard Prices".

- Tesco served two Civil Evidence Act Notices dated 22 September 2022 and 9 November 2022 respectively. The first concerned a tweet from the LidlGB account, the second concerned a number of documents. I did not detect any real issue arising in relation to any of these documents.

- In closing, Lidl invited the court to draw an adverse inference by reason of the failure on the part of Tesco to call anyone from Wolff Olins, the external agency which it is now clear was involved in the design and development of the CCP Signs. No authority was cited to me, but I observe that Lord Leggatt JSC (giving a judgment with which the other members of the Supreme Court agreed) has recently provided clear guidance on the point in Efobi v Royal Mail Group Ltd [2021] UKSC 33 at [41]:

- I shall return to the question of whether it is appropriate in all the circumstances of this case to draw an adverse inference when I come to consider Lidl's claim of infringement of copyright.

- Although Tesco relied upon the expert report of Mr Philip Malivoire (an independent market research consultant and experienced expert) for the purpose of the Survey Application with a view to seeking to persuade the court not to permit Lidl to rely upon the YouGov Survey at trial, I was not persuaded by the content of that report for all the reasons I set out in my judgment on that occasion. Tesco did not serve any further expert reports from Mr Malivoire and has chosen not to rely upon his report at trial.

- Lidl relied upon the expert report and oral evidence of Mrs Sutton, a market research consultant with over 40 years of experience in conducting market research projects. She was instructed by Lidl late in the day following the sad and unexpected death of its original expert, Ms Julia Rogers, who had prepared a report for Lidl dated 23 November 2022. Upon Ms Rogers being taken ill, Bird & Bird prepared on her behalf a "summary of reply evidence" in response to the report of Mr Malivoire, which Tesco agreed could be submitted in the circumstances (Ms Rogers had not seen Mr Malivoire's report at the time of preparation of her original report). Mrs Sutton was subsequently instructed.

- Mrs Sutton's report is dated 30 December 2022 and sets out her own opinions formed without sight of Ms Rogers' report (albeit, in the event, entirely consistent with it). By way of an Annex to her report, Mrs Sutton provides some additional evidence in respect of matters addressed in the witness statement of Ms Marks, in particular concerning the Source Survey. For the most part, cross examination of Mrs Sutton focussed on the Source Survey rather than on the YouGov Survey.

- Tesco accept that Mrs Sutton was quite obviously a good and knowledgeable expert. In so far as it is relevant to the issues I must decide in this case, I accept her evidence.

- During Mr Hing's cross examination, it became apparent that searches by Tesco for messages and comments from the general public designed to respond to the issues of confusion and unfair advantage had only commenced from the date of the launch of Clubcard Prices (i.e.15 September 2020) and so would not have captured any comments made prior to this date in August 2020 when trials of the CCP Signs (using the word "Offer") were taking place. Further Mr Hing accepted that there appeared to be a level of inaccuracy in the searches conducted by Tesco. In the circumstances I accept Lidl's submission that the court cannot be confident that it has seen more than an incomplete snapshot of available consumer comments.

- Before considering the specific complaints levelled by Lidl at Tesco in these proceedings, it is first important to address the context in which these complaints are made.

- The UK grocery market includes various different categories of supermarket: (i) the top tier supermarkets, such as Waitrose and Marks & Spencer which focus on premium quality products at high(er) price points; (ii) the mid-tier supermarkets or "Multiples" which include the four biggest supermarkets in the UK - namely Tesco, Sainsbury's, Asda and Morrisons, together with the Co-Op. These supermarkets normally have a selection of own-brand and third party products at a range of price points; (iii) "Discounter" supermarkets, whose business model involves an emphasis on own-brand products and a more curated selection of goods thus enabling greater control over price and a streamlined operating base. This leaner business model ensures an ability to maintain what is referred to as an "everyday low price" ("EDLP") position. The two main discounter supermarkets are Aldi and Lidl, both German supermarkets and so, historically, known as "the German discounters"; (iv) lower-tier retailers who do not sell entire product ranges and focus heavily on price reduction or other unique market niches. These retailers would not normally be used for a full grocery shop.

- As the single biggest supermarket operator in the UK, Tesco had in the region of 26% of the UK market share in 2022. It is common ground that, no doubt owing in substantial part to its market share and commensurately high advertising spend, its levels of brand awareness when assessed by Ipsos in November 2021 (after the launch of Clubcard Prices) were far ahead of any other UK supermarket. Furthermore its brand assets (in the form of the Tesco logo and Clubcard) were the two best performing assets in the sector, with high levels of implicit brand association, rating above the Lidl Logo. In an Ipsos update to Lidl from March 2021, Tesco's loyalty scheme in the form of Clubcard was rated at 98% for scheme awareness, the best performing loyalty scheme in the sector. Ms McEttrick's unchallenged evidence about the Clubcard Scheme was that "As a brand asset it is unique in all the markets in which Tesco operates. It is one of the crown jewels of Tesco's goodwill".

- Although mid-tier supermarkets and discounters all offer generally similar standards of quality, albeit at different price points, it will be clear from what I have already said that they operate very different business models. Ms Farrant's evidence, which I accept, is that, as a discounter, Lidl's business is set up so that it won't be beaten on price. This is achieved through stocking a very high proportion (something in the region of 85-90%) of own brand goods, limiting the range of products available in store and operating smaller stores with lower operating costs and efficient supply chains. Lidl also does not offer an online delivery service in the UK and so has no call for warehouse space for that purpose.

- When Ms Farrant joined Lidl in 2015, its market share was about 3.5% in the UK and it had just over 600 stores. At that time, the label "discounter" was unattractive to some customers, carrying with it the perception of low quality products being sold as cheaply as possible. However, Lidl has worked hard to unpick and reframe this perception and instead to communicate a business model which enables it to offer value: quality products at affordable prices, a concept conveyed by the slogan "Big on Quality, Lidl on price" (to which I have already referred), launched at the beginning of 2017. Ms Farrant believes that Lidl's success in communicating this message lies behind its growth to around 920 stores in the UK and 7.2% of the UK market share in 2022.

- The available evidence shows that by 2019 Tesco was well aware of Lidl's gains in positioning itself as offering good value at low prices. In an internal Tesco powerpoint presentation from May 2019, looking at ways to strengthen Tesco's Clubcard offering, Tesco acknowledged that it was experiencing "customers trading out for EDLP" – i.e. price-conscious customers switching away from Tesco. Unsurprisingly, Tesco was anxious to win back these customers. In another powerpoint presentation produced by Ms Webb in June 2019, she observed that "consumers acknowledge that Tesco needs to work hard on its prices at an overall level, especially to win back the Wicks. The Wicks are quick to point out that Tesco has lost its market leading position as the best value supermarket"[3]. In a later slide comparing Tesco's performance on price by reference to its competitors, Ms Webb identified the extent to which both the Lidl and the Aldi branding communicates value, going on to observe that "If Tesco has an issue with value perceptions it may be because Aldi and Lidl have changed people's 'price anchors'" and noting that if this was the case, it would be difficult for Tesco to advertise its way out of the problem, at least when it came to the most price sensitive consumers.

- As the other discounter supermarket, Aldi has seen similar growth and success over the last few years and is Lidl's most direct competitor. However, there is enormous rivalry and competition between all of the supermarkets in the UK to win market share. All supermarkets want to encourage customers to switch from doing their grocery shop at a competitor to themselves, known as "switching" or "switching away". This will normally require an advertising campaign or advertising strategy that seeks to erode loyalty to an existing preferred supermarket and to encourage switching. It is not in dispute that winning this constant battle for customers is the main objective of every supermarket's advertising strategy and, with this in mind, their branding and messaging operations which are targeted at consumers via varying forms of media are very sophisticated and are the subject of regular research and monitoring designed to determine their effectiveness.

- There are of course various means by which the different supermarkets seek to win the battle for customers. Most supermarkets operate some kind of loyalty scheme, Tesco's "Clubcard" scheme being perhaps the best known. Lidl launched a loyalty program in August 2020 under the brand Lidl Plus. Price comparison campaigns (particularly outside the top-tier supermarkets) represent another important advertising tool. These can involve campaigns advertising a product or an illustrative basket of products as cheaper in price by comparison with the same (or an equivalent) product, or basket of products, at a competitor supermarket. Alternatively they involve price matching, i.e. monitoring and matching prices to those of a specific competitor, potentially a highly effective strategy, albeit one that requires constant vigilance and compliance with The Committee of Advertising Practice Code.

- National advertising campaigns by Supermarkets inevitably involve a very substantial financial commitment and, for this reason, they are frequently subject to trials and pre-testing. A recognised problem across the sector is the potential for misattribution of advertising campaigns to competitors, a phenomenon that Ms Farrant referred to in her evidence as "[t]he curse of Misattribution". Where this occurs at a substantial level, the time and money spent on the campaign may (at best) go to waste, and (at worst) benefit a competitor. Although it is difficult to quantify precise levels of misattribution, the research that is regularly commissioned by supermarket chains into the effectiveness of their campaigns, will (amongst other things) seek to analyse the extent to which members of the public are able to recognise campaigns and attribute them to the appropriate brand. Ms Farrant's evidence under cross examination, which I accept, is that misattribution is a problem faced by all of Lidl's competitors, who will all be seeking to reduce the misattribution associated with their promotional activity ("Absolutely, that is our main job").

- No doubt owing to their joint reputation as discounters, or "German discounters", Lidl has encountered particular problems with misattribution of its advertising campaigns to Aldi. Ms Farrant describes this as being a significant problem in 2015 in the sense that significant numbers of the public were seeing Lidl adverts and wrongly attributing them to Aldi. Since that time, Lidl has worked hard to address this issue, focussing on ensuring the consistent use of brand assets across all forms of advertising.

- Although Lidl often uses price comparison adverts to illustrate its affordable prices by comparison with a competitor, it has never sought to price match with other supermarkets because it considers that its customers already know that it will not be beaten on price. However, in around mid-March 2020, Tesco commenced the Aldi Price Match pursuant to which it sought to price match a limited range of products. Tesco used a red bubble logo for this campaign with the words "Aldi Price Match" and a tick in white ("the Aldi Price Match Logo"). Although there is no claim made in respect of this usage, Lidl has sought during these proceedings to identify the similarity between the Aldi Price Match Logo and a logo used by Lidl, also presenting as a red bubble with white text, which says "Always Lidl on price".

- Towards the end of June 2020, it was reported in the trade press that Tesco was planning a "major new price war" against Aldi and Lidl, including by way of a "ramp up" of Aldi Price Match and promotional activities "driven through its Clubcard loyalty card". Setting aside the somewhat sensational use of language in these press reports, Ms McEttrick's evidence, which I accept, is that the Covid lockdown saw a marked shift in customer behaviour and perception, one of the main drivers of the shift being the fact that more customers were shopping at Tesco than would normally have been the case. This appears to have been a function of the fact that Tesco has an enormous number of stores throughout the UK which were readily accessible to customers during lockdown and also that it had an online offering. In response to this shift in customer perception, Tesco decided upon a reassessment of its overall promotions strategy, ultimately determining that Clubcard Prices should become the sole promotional mechanic and replace all promotions for non-Clubcard members. Ms McEttrick's evidence, which I accept, is that, amongst other things, she wanted to target Tesco's loyal customers "to give them more value".

- In September 2020, Tesco duly launched its Clubcard Prices scheme using the CCP Signs, which were entirely new to the market. The campaign involved prominent use of the CCP Signs in print media, on Tesco's website, on social media channels, at so called out of home locations ("OOH") such as bus stops and on television. The television advert showing a woman in a supermarket 'zapping' around her Clubcard and bringing down prices as she did so ("the TV Advert"). Every time she 'zapped', a new lower price appeared in a CCP Sign. The CCP Signs were also used extensively in Tesco stores, where they were used on differently sized banners (both inside and outside the stores) and on shelf edge labels. The evidence shows that the CCP Signs were used on signage directly next to the Aldi Price Match Logo in a manner which Lidl says in these proceedings is only likely to increase misattribution between Aldi and Lidl, something it has been trying to minimise for some considerable time.

- Key to Lidl's case, however, are concerns around the use of the CCP Sign (identified in Ms Farrant's statement) as to (i) its effect on the Lidl brand, in particular the extent to which it is diluting the Lidl brand; (ii) the implied message to Tesco customers that Tesco's prices are at the same level as Lidl's prices, such that customers are likely to believe that the prices shown on the CCP Sign are price matched to Lidl, an impression that is likely to be reinforced by the use of the Aldi Price Match Logo in close proximity to the CCP Signs and the scope for customers to confuse Aldi with Lidl; (iii) the potential for subconscious association with Lidl, even where there is no conscious belief that Tesco is price matching to Lidl; and (iv) the possibility that consumers may form the impression that Lidl's prices are not as affordable as they in fact are, because they will see Tesco's higher prices and assume that Lidl's prices are the same.

- Tesco rejects the validity of these concerns in the strongest possible terms. I shall return to its case when I come to consider the evidence.

- Pursuant to section 9(1) of the Trade Marks Act 1994 ("the TMA"), the proprietor of a registered trade mark has exclusive rights in the trade mark which are infringed by use of the trade mark in the United Kingdom without his consent. The acts amounting to infringement are specified in section 10, which essentially identifies three distinct classes of infringement. The first (in section 10(1)) involves use of a sign in the course of trade which is "identical with the trade mark in relation to goods and services which are identical with those for which it is registered". The second, (in section 10(2)) involves the use of a sign in the course of trade which is identical or similar to the registered trade mark and in relation to goods or services which are identical or similar to those for which it is registered, and there is a likelihood of confusion. Unusually, neither of these provisions is relied upon in this case. Instead, Lidl relies upon section 10(3), which is designed to protect only trade marks that have a reputation against specific forms of damage.

- Thus, section 10(3) provides that:

- Pursuant to section 10(3A), "[s]ubsection (3) applies irrespective of whether the goods and services in relation to which the sign is used are identical with, similar to or not similar to those for which the trade mark is registered".

- Section 10(4) identifies the circumstances in which a person uses a sign for the purposes of the section, including by offering or exposing goods for sale under the sign and using the sign on business papers and in advertising.

- Pausing there, the aim of section 10(3) is to protect the reputation of a registered trade mark from damage in the form of unfair advantage or detriment to the distinctive character or repute of the mark. It is common ground that there is no requirement for confusion and no requirement for the infringing use to be in relation to identical or similar goods or services. It is worth observing that it was Lidl's case at trial that there is in fact evidence of confusion as to origin arising from Tesco's CCP Signs, albeit that no section 10(2) case has been pleaded. This was explained by Mr Brandreth KC as a function of the development of the case over time. It was in any event his case that Lidl could point to this evidence of confusion as a "paradigm basis for establishing 10(3) infringement", albeit that it remains Lidl's case that there is also evidence to support the damage to reputation which 10(3) is designed to prevent, namely the dilution of reputation by association, ultimately leading to lost trade. At no stage did Tesco seek to suggest that the evidence of origin confusion was not relevant.

- It is common ground that, in general, the question whether the use of a sign infringes a trade mark falls to be assessed as at the date that the use of the sign was commenced (see Enterprise Holdings Inc v Europcar Group UK Ltd [2015] FSR 22 per Arnold J at [129]).

- The law relating to section 10(3) infringement has been developed in a series of decisions of the CJEU, which remain part of retained EU law in the UK. The basic conditions were summarised by Kitchin LJ in Comic Enterprises v Twentieth Century Fox Film Corp [2016] EWCA Civ 41; [2016] ETMR 22 at [111]:

- Not all of these conditions remain in issue in this case. Key areas of dispute between the parties concern conditions (v), (vii), (viii)(a) and (c)[4] and (ix).

- Concentrating for present purposes on the law in relation to those of the conditions which remain in issue, the following propositions emerge from the authorities to which I was referred and did not appear to be controversial. In so far as either party sought to establish a difference of emphasis on the authorities, I shall return to such differences when I come to apply the law to the facts.

- In applying the law to the facts, as I must now do, I have not sought to repeat these principles (although I have addressed discrete issues of law where there is any dispute between the parties or where a particular focus is required). However, I have borne them all in mind.

- Until shortly before trial, it was Lidl's case that the correct comparison for the purposes of its trade mark infringement claim was between the Lidl Marks and the Sign/CCP Signifiers Background (i.e. the blue and yellow icon without the addition of any text). This prompted a strike out application by Tesco at the PTR on the grounds that it did not use the Sign, had never used the Sign, and that accordingly such comparison was erroneous and wrong in law, such that the trade mark infringement claim should be struck out in its entirety. In making the application however, Tesco accepted that there was a legitimate complaint available to Lidl (albeit, they said, not pleaded), based upon the comparison of the Lidl Marks and the family of signs referred to by Tesco as the CCP Signs, all of which include text.

- At the PTR itself, Mr Brandreth KC, on behalf of Lidl, made clear that he did not intend to amend his pleaded case, but that he accepted that the point being made against him was a point that could and should be run at trial. He confirmed in clear terms that Lidl's complaint was about the Sign and that it would be Lidl's case at trial that the consumer perception is that Tesco use an independent icon to which different words are applied on different occasions according to use. In other words, the text applied to the Sign is context only. Further to this confirmation, Tesco agreed that there was no need to pursue the strike out application on the understanding that it had given Lidl the opportunity to amend its case, that Lidl had refused to do so and that Tesco could now pursue the same point with impunity at trial. Accordingly the strike out application was dismissed.

- Notwithstanding the approach taken at the PTR, Lidl subsequently provided Tesco and the court with a proposed amended PoC pleading a secondary case by reference to a "family of signs including the words across them as they appear from time to time", thereby addressing the very complaint raised by Tesco. Although it initially objected to this amendment, Tesco ultimately withdrew its objection and I formally granted permission to amend on the first day of the trial.

- Although this issue originally promised to be controversial, it turned into something of a damp squib at the trial. In closing submissions, having referred to the importance of viewing the comparison from the perspective of the average consumer, Lidl indicated that it was content to treat the comparison "as being one between the Lidl Logos and the Uses" as they had been identified in paragraph 21(d) of the PoC and the evidence of Ms Farrant. Upon questioning from me, Mr Brandreth maintained that, in circumstances where the wording across the CCP Signs changes, the average consumer understands the text to be "just separate information", however he went on to concede that in fact it did not matter to Lidl's case whether the relevant sign for the purposes of the comparison was the CCP Sign(s) or the CCP Signifiers Background, because Lidl accepts that "the words are always there". Thus he accepted that, whether one treats the words purely as context or as an integral part of the Tesco Sign, one ends up "in the same place".

- This concession means that my decision on this issue will not be determinative in the context of any of the issues I must go on to decide in this judgment. However, having heard the arguments and considered the question from the standpoint of the average consumer (in this case the average supermarket shopper who will be paying no more than the average degree of attention and will most certainly not be a discerning intellectual property specialist with an understanding of the nuances of trade mark law), I consider that the correct comparison is quite obviously between the Lidl Marks and the CCP Signs. In circumstances where it is accepted that the average consumer would never encounter, or be exposed to, the CCP Signifiers Background and thus never see the background icon without the addition of text (specifically text which refers to "Clubcard Price" or "Clubcard Prices"), I consider the suggestion that she would nevertheless understand the sign to be merely the background icon formed of a yellow circle framed by a blue square to be unrealistic. Furthermore, the evidence confirms that "Clubcard" is a highly distinctive brand asset, which I do not therefore consider the average consumer would simply disregard as "context" or "separate information".

- It is common ground that use of the CCP Signs commenced in September 2020 when the Clubcard Prices promotion was launched by Tesco. This is therefore the primary date for the assessment of trade mark infringement. There is no suggestion that I need to consider different dates by reference to the use of different text on the family of CCP Signs.

- The importance of the reputation that resides in individual trade marks was highlighted by the General Court in SIGLA v OHIM-Elleni Holding [2007] ECR II-711 at [35]:

- Tesco accepts that the Mark with Text has a reputation in the UK for retail services for the purposes of condition (i) identified in Comic Enterprises. As was noted by Arnold J in Enterprise v Europcar at [120], this is not a particularly onerous requirement to satisfy. The Mark with Text has been used on a significant scale (or in Tesco's words in its Defence, "to a considerable extent") for many years. Unsurprisingly, Tesco also acknowledges that the Mark with Text is distinctive and has enhanced distinctive character. Ipsos research from November 2021 shows the Lidl Logo as it appears in the Mark with Text falling within the top 10% of brand assets in the sector. During his cross examination, Mr Threadkell confirmed that Lidl's reputation as a "value-oriented competitor with a reputation for price" was "common knowledge amongst the general public". Tesco's internal materials (as I have already said) expressly acknowledge this reputation, appreciating that the mere presence of the Lidl logo means that the same products at the same prices are perceived as better value.

- It is Lidl's case that the Wordless Mark has a similar reputation and level of distinctiveness to the Mark with Text. Mr Brandreth points out that distinctiveness can be acquired as a result of use in conjunction with, or as part of, another mark or sign (see Societe des Produits Nestle SA v Mars UK Ltd [2005] ETMR 96 at [26]-[32]). Although Tesco appeared to suggest at one point in its written closing submissions that there was no dispute on the issue of reputation, it is clear from its Defence and from the terms of its Counterclaim that Tesco continues to deny that the Wordless Mark has any reputation in circumstances where it says that it is a "legal fiction" and has never been used. Furthermore, Tesco strongly objects to the notion that the Wordless Mark has any distinctive character, referring to it in its Defence as "utterly devoid of any distinctiveness".

- In the circumstances, I need to address the Wordless Mark separately, and shall return to it later.

- Although Tesco originally suggested that its use of the CCP Signs was not in relation to the goods or services of Tesco "in the material sense", that assertion was not maintained at trial. It is now common ground that Tesco has used the CCP Signs in the UK, that such use has been in the course of trade, is in relation to identical or similar goods or services and that it has been without the consent of Lidl, as proprietor of the Lidl Marks.

- I agree with Lidl that in this case it is primarily the visual and conceptual comparison between the Lidl Marks and the CCP Signs that matters because the Lidl Marks and the CCP Signs will not usually be encountered in a context which involves aural identification. As was the case in Julius Sämaan, which concerned tree marks used in connection with a range of air freshener products, (at [54]):

- Turning first to the visual comparison between the Mark with Text and the CCP Signs, both involve background components made up of a yellow circle set within a blue square. Both have writing in the centre of the blue circle.

- However, there are also obvious differences. The CCP Signs do not have the thin red rim around the edge of the yellow circle which appears in the Mark with Text and the words used on the CCP Signs ("Clubcard Price", "Clubcard Prices" and sometimes a price figure) are different from the graphically stylised word "Lidl" which always appears in the Mark with Text, intersecting the part of the mark in the middle of the yellow circle.

- As for the conceptual comparison, neither party suggested that a conceptual comparison was really of significance one way or the other. The text is, of course, different and, to the extent that the words used are absorbed by the average consumer, they obviously carry a different conceptual message.

- Are the differences I have identified sufficient to negative any finding of similarity? Tesco says that they are, essentially because (i) the words "Clubcard" and "Lidl" are too well known and different for any other conclusion; and (ii) the similarities to which I have already referred are extinguished by the potency of the distinctive text marks – they "block out the sun", as Mr Cuddigan KC, acting on behalf of Tesco, so eloquently put it. Tesco submits that the word "Clubcard" dominates the CCP Signs and that its brand recognition is second to none. Further, that the additional words and figures (where used) are entirely descriptive and incapable of bearing any distinctive weight, conceptually adding nothing. Equally, it submits that the made-up stylised word "Lidl" has been used extensively in the UK and enjoys a substantial reputation, such that "Lidl" is clearly the most dominant and distinctive element of the Mark with Text – it is also the only element of the mark which exists aurally. Although the remaining elements of the Mark with Text and the CCP Signs are similar, those similarities involve elements which are individually trite, conceptually commonplace and are in any event drowned out by the text. Indeed, as I understood Tesco's submissions, a finding of similarity in such circumstances would "fly in the face of 150 years of trade mark jurisprudence".

- Standing back and approaching this task by reference to the overall impressions created by the Mark with Text and the CCP Signs on the mind of the average consumer and remembering that the average consumer rarely has the chance to make direct comparisons between marks, I am satisfied that the average consumer perceiving these signs as a whole would regard them as similar, notwithstanding the points made by Tesco to the contrary. The visual similarity is here the significant feature and, whilst I accept that the text represents an important point of difference, nonetheless I do not consider that it has the effect of extinguishing the strong impression of similarity conveyed by their backgrounds in the form of the yellow circle, sitting in the middle of the blue square. This was an impression that I formed myself upon seeing the Mark with Text and the CCP Signs.

- I am fortified in this view by the fact that there is clear evidence that members of Tesco's internal team (whose job it is to understand and consider the likely perceptions of the average consumer) identified the similarity between the Mark with Text and the CCP Signs (together with the scope for confusion) during the development phase of the CCP Signs. Ms Webb confirmed in her oral evidence that "I did think that the yellow and the blue were similar to Lidl" a view that others also shared. Thus:

- The similarity was also identified by Messrs Paulson and Berridge, whose evidence I accept and shall return to in a moment in more detail. For present purposes I note Mr Berridge's evidence that sight of the CCP Sign on the Tesco website "immediately made me think it was Lidl because it was similar to the Lidl logo" and Mr Paulson's evidence that the TV Advert "reminded me of Lidl straight away". Tesco's cross examination of these two witnesses did nothing to undermine this evidence.

- Furthermore, I consider that support for my view is also to be found in the Lidl Vox Populi. Taking by way of example a few of the Twitter messages collected by Bird & Bird:

- In all the circumstances I find that the overall impression formed in the mind of the average consumer is of similarity between the Mark with Text and the CCP Signs.

- Lidl submit that the available evidence establishes that the Uses of the CCP Signs clearly give rise to a link in the mind of the average consumer between those Uses and the Mark with Text. It says that the creation of the link in this case is substantially enhanced by reason of the reputation in, and distinctiveness of, the Mark with Text and the fact that the Uses by Tesco involve identical goods and services.

- Tesco strongly rejects this analysis. It contends that, when properly understood, the evidence before the court in fact supports its case that the reasonably circumspect and observant consumer would not make the link. Indeed, it maintains that any link would be entirely contrary to its intentions regarding the Clubcard Prices scheme as it would indicate undesirable association with Lidl and thus errors in the work undertaken by Tesco's internal teams and external agencies.

- I shall need to consider the evidence in some detail in order properly to address these conflicting positions.

- I begin by observing that it is possible in this case to address various of the factors identified in Intel Corp Inc at [42] (and set out above) relatively swiftly. The Mark with Text and the CCP Signs appear to me to be similar for all the reasons I have identified above. I have already observed that the goods or services for which the Mark with Text is registered and in respect of which the CCP Signs are used are identical, as is the relevant sector of the public. The Mark with Text has a strong reputation and enhanced distinctiveness, which in itself provides scope for a greater likelihood that a connection will be made (see PlanetArt at [157]).

- Further, and importantly in my judgment, there is in fact evidence of both origin confusion and price comparison confusion on the part of the public, together with internal recognition by Tesco of the potential for confusion. For present purposes, I shall focus on origin confusion.

- Evidence of origin confusion is to be found in the report[8] of an external research agency, Hall & Partners ("H&P"), commissioned by Tesco to evaluate the Clubcard Prices promotion in November 2020. H&P surveyed a total of 1,935 nationally representative respondents who were shown "creatives" from 7 different advertising media including TV and radio (both of which featured voiceovers), press, OOH and digital. It identified the size and reach of the Clubcard Prices campaign: 42.8 million impacts delivered by the TV Advert, 16 million on social media and a "first burst of Digital OOH" to reach over 8.8 million shoppers "across key arterial routes".

- Overall the report identified a strong campaign impact with a strong brand linkage and only 3 % misattribution to other supermarket brands. However, page 20 of the report identifies that "While misattribution was low across most channels, some thought the OOH creative was for Lidl" (emphasis added). Indeed 8% of the 276 customers who saw the OOH advert thought it was for Lidl. This led to the observation from H&P that "OOH confusion is likely due to the Tesco price tags looking like the Lidl logo and smaller Tesco branding". In making this observation, H&P referred directly to a still from the TV Advert (used in OOH advertising and referred to as a 'creative') showing the CCP Signs, which it compared with the Mark with Text, pointing out that comments from the public included "[c]onfused with Lidl"; "[t]he labels that were yellow and blue showing the prices were very eye catching BUT they made me think at first it was a Lidl advert" and "Lidl signs". In so far as is relevant for a point to which I shall return in a moment, I note also that the H&P report does not suggest any issue around confusion with Aldi or Aldi Price Match, clearly stating only that the confusion is in relation to Lidl.

- H&P recorded its thoughts in response to this issue as follows: "As OOH is static with no voiceover, and average viewing of the medium is around 2 seconds, its important that branding is clear". In its Recommendations, it suggested that Tesco needed to be "mindful of other brand Mnemonics in OOH advertising to boost brand linkage". Albeit that she was unable to give direct evidence on the issue, Ms Webb's evidence was that further to this recommendation, OOH and press creatives were amended to include the word "Tesco" before the word "Clubcard" in blue text appearing in the bottom right hand corner of the creative. She does not explain in her evidence why Tesco felt the need to amend the press creatives in addition to the OOH creatives, although I infer that this was because it appreciated that similar scope for origin confusion existed in relation to press and thus needed to be addressed. Of course, neither press, nor OOH creatives benefit from voiceovers to provide clarity.

- Tesco contends that it would not be appropriate for the court to have regard to the 8% figure for confusion in respect of OOH in isolation. Instead, it submits that it would be fair to take the whole ad campaign together and thereby to recognise that the campaign was viewed as a great success, with H&P identifying "the strongest brand linkage we have ever seen". In its closing submissions, Tesco made the point that "[i]t would be harsh indeed for this campaign to be held to have caused excessive origin confusion or link with Lidl" (emphasis added). Implicit in this submission is the acceptance that the campaign has plainly caused some origin confusion and I do not consider that it would be appropriate to ignore that confusion. It is clearly evidenced in connection with OOH advertising and Tesco appears itself to have considered that press advertising created a similar risk. It is difficult to see why any other low attention environment would not produce similar confusion in the mind of the average consumer. The H&P report says nothing about the perception of individuals encountering the CCP Signs in store.

- I reject the suggestion that I can safely ignore the result in relation to OOH advertising in circumstances where H&P thought that it could be explained by reference to an average viewing time of 2 seconds. I must have regard to the context in which the average consumer will encounter the CCP Signs and if that context is a low attention environment (as is the case with OOH advertising) then I disagree that the reasonably observant and circumspect average consumer would nevertheless experience no confusion. Tesco argue that a 2 seconds viewing time is "not easy to reconcile with a reasonable opportunity to observe", but that is not the test I must apply. I note in this regard, evidence in Tesco's own internal material that 2 seconds was viewed as the "average dwell time with ads" and that Tesco believed that "[a]ds can be successfully consumed in 2 seconds"[9].

- Tesco point to a later H&P report dated January 2021[10], by which time the Clubcard Prices campaign had been running for several months, and submits that there is no whisper of concern by this stage from H&P over misattribution. Tesco points out that this cannot have been an omission in circumstances where the same report records ongoing misattribution issues with Aldi Price Match.

- However, I do not attach a great deal of significance to this later H&P report. First, I note that I am concerned with Tesco's use of the CCP Signs as at the launch date in September 2020 – I am not much assisted by considering data collected several months later, by which time, as Tesco submitted in opening submissions "familiarity with the scheme [had] ramped up…swiftly…". The second H&P report itself records that identified "uplifts"[11] from its earlier results "may be because consumers are becoming more used to the proposition and have had more time to understand it". The fact that Tesco may have deluged the market with advertising in the form of the CCP Signs (connected with a very strong brand in the form of Clubcard) thereby leading to a strong association with the Tesco brand within a few months does not support the proposition that there could be no link with the Mark with Text as at the launch date.

- Second, as is confirmed by Ms Webb in her statement, for the purposes of this second H&P report, H&P only tracked creatives in the TV30s, press and social categories (i.e. not including OOH). In other words, it surveyed 642 respondents with Clubcard creatives in TV, Press & Social. The fact that, as Ms Webb points out, spontaneous brand linkage was 93% does not assist where the report has not sought to investigate the public response to the very section of the media which had encountered levels of confusion previously. Ms Webb does not explain what lay behind the limited nature of the research by H&P in January 2021 or why no attempt was made to see whether the amendment made by Tesco to its OOH creative following the first H&P report had been successful in diminishing levels of origin confusion.

- Lidl say that I should attach significant weight to the Lidl Vox Populi in considering whether the average consumer would make a connection between the CCP Signs and the Mark with Text. In particular, it contends that no witness gathering exercise has been carried out but that, instead, this material has been spontaneously generated by the public encountering the Uses complained of in the real world and that it clearly evidences the drawing of a link between the CCP Signs and the Mark with Text. Lidl also points to various authorities in which it has been recognised (in the context of considering evidence of confusion) that finding and producing actual evidence is difficult and that, "evidence of actual confusion and deception is often decisive, but its absence is not" (see Fine & Country Ltd v Okotoks Ltd [2012] EWHC 2230 (Ch) at [83]-[87] per Hidyard J).

- Tesco, on the other hand, seeks to diminish the significance of the Lidl Vox Populi by pointing to eight instances where Mr Hing has now established that the individuals concerned were mistaken when they made reference to Lidl in the context of price matching, and that in fact they meant Aldi. Accordingly, Tesco invites me to conclude that all mentions of price matching Lidl in the Lidl Vox Populi are mistaken references to Aldi and that all equivocal mentions of price matching must be assumed to fall within the same category. Furthermore, Tesco suggests that none of the Lidl Vox Populi make clear that it is the use of blue and yellow in the CCP Signs that make them think of a Lidl price match.

- However, in my judgment there are a number of difficulties for Tesco with the Lidl Vox Populi:

- I have already referred to a few examples from the Lidl Vox Populi above. For the sake of completeness it is worth providing some more:

- On balance, I accept Lidl's submissions that the Lidl Vox Populi cannot readily be dismissed in the manner suggested by Tesco. It is representative of spontaneous, unprompted comments from members of the public with, as Mr Brandreth put it, "no dog in the fight". Whilst there is clearly evidence from Mr Hing of a small number of occasions when individuals have been confused between Lidl and Aldi (which means that those responses must be discounted as coming from the reasonably observant and circumspect average consumer) I do not consider that the same may be said for the majority of the responses. The Lidl Vox Populi clearly contains instances of connections being drawn between the CCP Signs and the Mark with Text, connections which appear to be prompted by a perception of price matching by Tesco to Lidl. Furthermore, as Lidl correctly submits, the reference to "Clubcard" on the CCP Signs does not appear to be serving to disabuse customers of any value connection with Lidl's reputation for low prices. On the contrary, it would appear that there is an understanding that the special Clubcard prices are the very prices that are being matched to Lidl: "I now like the fact you price match with Lidl and the special price for Clubcard holders is great – I saved quite a bit today".

- Tesco points out that a reasonably circumspect and observant consumer will of course know which store she is in, which website she is looking at and whose Twitter feed she is reading and I accept that this is part of the relevant context of Tesco's use of the CCP Signs. However, in making this submission it appears to me that Tesco has failed to account for (i) the confusion experienced by consumers in respect of OOH advertising (and potentially other low attention forms of advertising such as press advertising where there are no aural or visual prompts to dispel confusion); and (ii) the link to Lidl's reputation as a discounter supermarket that members of the Lidl Vox Populi have made. For the purposes of Lidl's case, it is not necessary for it to establish that the average consumer would be confused as to origin, although it appears plain that (at least in some contexts) there would be such confusion, rather that a connection has been made in that consumers think that Tesco products to which the CCP Signs are attached are the same price as the same products when sold at Lidl – the evidence in the Lidl Vox Populi appears to me to bear out the making of such a connection.

- It would be convenient at this juncture to consider the evidence from Messrs Berridge and Paulson in a little more detail, as they were the only members of the Lidl Vox Populi who attended court. Lidl submits that Mr Paulson's evidence in particular encapsulates "[Lidl's] case".

- I have set out the evidence of both witnesses in some detail above. Under cross examination, Mr Paulson confirmed that he had regarded the TV Advert as designed to hint that Tesco was launching a low price campaign against discounter supermarkets. The following exchange then took place between Mr Paulson and Mr Cuddigan:

- At the end of Mr Paulson's evidence, I returned to this topic, asking Mr Paulson if he did in fact interpret the message from Tesco in this way:

- In closing, Tesco suggested that I should attach no weight to Mr Paulson's final answer in light of the rather more equivocal responses that he had previously given. However, as I have said, I formed the view that Mr Paulson was plainly honest and I consider that he was endeavouring to answer my questions as accurately as possible. I accept his evidence that he not only saw a link between the CCP Signs and the Mark with Text, but he also understood that link to reference Lidl's low prices and to hint that Tesco's prices were as low as Lidl's prices. Mr Paulson's response to my question was entirely consistent with his statement. Importantly, it was clear from his written evidence that Mr Paulson was not in any way disabused by the reference to a "Clubcard" price, his understanding being that "on the products that have been given a "Clubcard" price, the prices you can get for those products is the same or perhaps a bit better than the prices at Lidl".

- Mr Berridge's evidence was to similar effect. Mr Berridge's unchallenged evidence was that, after his initial confusion at seeing the CCP Sign on the Tesco website, he realised the CCP Sign was:

- That the evidence of Mr Paulson and Mr Berridge is consistent appears to me to be significant. As I have said, it was not suggested to either witness that he was confusing Lidl with Aldi, or that he was more suspicious than the average consumer. Independently, each man perceived the message portrayed by the CCP Signs in a similar way and was sufficiently annoyed by what he perceived to be underhand tactics on the part of Tesco that he found time to make his views known. Mr Cuddigan did not seek to identify any grounds (whether in cross examination or in submissions) on which Mr Paulson or Mr Berridge should be regarded as "outliers" when it came to considering the perceptions of the reasonably observant average consumer. Also significant, it seems to me, is the fact that other members of the Lidl Vox Populi appear to have formed the same impression.

- Standing back, I am inclined to think that Lidl's submissions to the effect that the evidence from the Lidl Vox Populi is best understood as representing the tip of the iceberg are likely to be correct. In my judgment, the fact that so many members of the public sent unprompted messages to Tesco or Lidl following the launch of the CCP Signs identifying a perceived link between those signs and the Lidl Logo weighs strongly in favour of Lidl's case.

- I bear in mind that evidence of a link being drawn is always going to be difficult to come by. The average consumer seeing the CCP Signs may not appreciate that they have made a subconscious link, or, if they do, that the link is erroneous or that they have some other reason to complain. Of the percentage of people that do appreciate this, relatively few are likely to regard the issue as having sufficient significance to merit spending the time communicating that fact to Tesco or to Lidl. One of the responses is "You say you are price matched to Lidl, but your Pepsi Max costs £1.50 and Lidl's is £1.49, that's not a price match". Few consumers will take the time to investigate in this way, understand that there is only a penny difference, but nevertheless send a message. That this individual took the trouble to do so is therefore of some significance, in my judgment. In the circumstances, I reject Tesco's case (advanced in its oral closing) that in the context of the enormous number of people who were exposed to the first salvo of Tesco's Clubcard Prices promotion (some 50% of the country) "it is perfectly proper to think that all the vox populi are outliers".

- Although in opening Tesco suggested that any misleading message arising in this context was inherently innocuous and thus a "niche concern" in the highly competitive world of supermarkets, it did not pursue the point in closing. It was right to abandon it. That there are sections of society who have no choice other than to exercise tight control over their budgets and apply heightened levels of consciousness to their spending is recognised in Tesco's internal materials, which expressly identify the need to target notional consumers falling within this category (including the "financially-squeezed" Wicks family who "have to be savvy"), not least because of a concern around losing market share from such price-conscious customers. I do not regard that as a "niche concern" and I have no doubt that Tesco does not either.

- Prior to launching its Club Card campaign, Tesco commissioned The Source to carry out consumer surveys designed to enable it to understand whether its planned design for the CCP Signs was likely to be successful in communicating the associated offer message when compared to existing signage. Tesco asked The Source to carry out testing that would cover different aspects of Tesco's proposed uses of the new icon, for example on Tesco's website and on shelf edges in store. The Source designed four tests with this objective in mind.

- The first test ("Test 1"), on which both parties focused at trial, concentrated specifically on testing consumer responses to shelf edge labels by comparing their responses to Tesco's existing value label (a yellow tile) with their responses to three different options for Clubcard Prices shelf edge labels (point of sale materials). These options were labelled 1-4 for the purposes of the test, with Option 1 representing the existing label, Option 2 showing the Clubcard Prices text on a yellow tile and options 3 and 4 both including a version of the CCP Signs. Ms Marks' evidence was that she understood that Tesco had already decided to use one of the two icons identified as Options 3 and 4 for Clubcard Prices and that they were in the final stages of testing to assess the potential impact of using these versus the existing tile. Both Options 3 and 4 included the CCP Background Signifier with text, although Option 3 also included a separate yellow tile. Option 4 was in fact the version that Tesco ultimately decided upon.

- Test 1 was conducted in June 2020. 800 shoppers were selected from a customer panel further to pre-survey selection questions designed to identify Tesco shoppers. The group was divided into four, with each group of 200 people seeing one of the four label options appearing on an image of supermarket shelves. The test proceeded in the following manner:

- The Source reported on the outcome of Test 1 via a Powerpoint Presentation[12]. In summary, this presentation showed that:

- Ms Marks' evidence was that she had not been asked to monitor any associations between the various options in Test 1 but that in any event, she regarded the number of people who mentioned Lidl in relation to Options 3 (3 people out of 200) and 4 (1 person out of 200 people) "as insignificant". However, she nevertheless flagged the association with Tesco because Lidl were a direct competitor and she considered it "may be of interest".