Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Lidl Great Britain Ltd & Anor v Tesco Stores Ltd & Anor [2022] EWHC 1434 (Ch) (13 June 2022)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2022/1434.html

Cite as: [2022] EWHC 1434 (Ch)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2022] EWHC 1434 (Ch)

Case Nos: IL-2020-000127/IL-2021-000041

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INTELLECTUAL PROPERTY LIST

Rolls Building

Fetter Lane

London, EC4A 1NL

13 June 2022

Before :

MRS JUSTICE JOANNA SMITH DBE

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

(1) (1) LIDL GREAT BRITAIN LIMITED (2) (2) LIDL STIFTUNG & CO KG

|

Claimants |

|

|

- and -

|

|

|

|

(1) (1) TESCO STORES LIMITED (2) (2) TESCO PLC |

Defendants |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Benet Brandreth QC and Tristan Sherliker (instructed by Bird & Bird LLP)

for the Claimants

Simon Malynicz QC and Daniel Selmi (instructed by Haseltine Lake Kempner LLP) for the Defendants

Hearing dates: 5 and 6 April 2022

- - - - - - - - - - - - - - - - - - - - -

JUDGMENT APPROVED

This judgment was handed down remotely by circulation to the parties’ representatives by email and release to The National Archives. The date and time for hand-down is deemed to be 10.30 am on Monday 13 June 2022.

Mrs Justice Joanna Smith:

1. The claim in these proceedings between two well-known supermarket chains (to whom I shall refer as “Lidl” and “Tesco”) involves allegations by Lidl of infringement of registered trade mark rights in Lidl’s logo devices, passing off and infringement of copyright. Tesco counterclaims alleging, amongst other things, that some of the trade marks in issue should be declared invalid on grounds of bad faith. Lidl applies to strike out that counterclaim, alternatively for summary judgment (“the Strike Out Application”). At the same time, Lidl seeks permission from the court to rely at trial upon survey evidence said to go to the issue of distinctiveness of certain of the trade marks (“the Survey Evidence Application”). Both applications are hotly contested by Tesco, which has itself applied for permission to rely upon expert evidence in dealing with the Survey Evidence Application.

2. I deal with the Strike Out Application at paragraphs 35-107 and the Survey Evidence Application at paragraphs 108-205 of this Judgment.

The Trade Marks in Issue

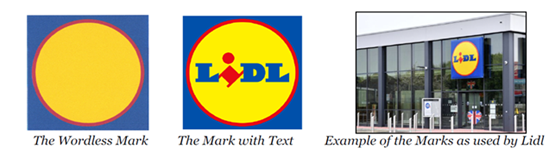

3. In bringing the claim, Lidl relies upon its trade mark rights in two versions of the Lidl logo: a logo which includes the word “Lidl” (“the Mark with Text”) and a logo without that word (“the Wordless Mark”). The Wordless Mark is a graphical device consisting of a blue square background bearing a yellow disk, bordered in a thin red line. These marks are reproduced below:

4. Lidl is the registered proprietor of the Wordless Mark pursuant to the following UK registrations: UK2016658A, UK2016658C and UK2016658D all filed on 4 April 1995. For the purposes of its claim, Lidl also asserts that it is the registered proprietor of the Wordless Mark pursuant to EU trade mark EU004746343, filed on 17 November 2005 (“the EUTM”), and pursuant to a UK trade mark right no. UK00904746343 created as a result of the UK’s withdrawal from the European Union and derived from the EUTM. By its defence, Tesco identifies two additional UK trade mark registrations made by Lidl for the Wordless Mark (UK00902936185 filed on 15 November 2002 and 00906560571 filed on 13 November 2007) which it refers to as “the Additional Wordless Marks”. Tesco also identifies a further application made for the Wordless Mark in 2021 (UK00003599128).

5. Lidl is the registered proprietor of the Mark with Text pursuant to UK registration UK2570518, filed on 28 January 2011. It is asserted in Tesco’s Defence and was common ground at the hearing that use of the Mark with Text as a logo dates back to around 1987 (although neither party appears to have pleaded or relied upon any registered trade mark in respect of the Mark with Text prior to UK2570518 filed in January 2011 [1]).

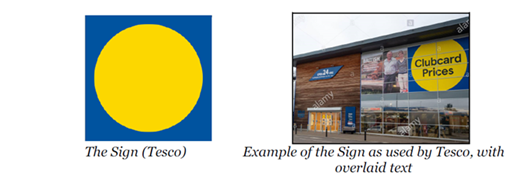

6. In short, Lidl contends that Tesco’s use of a new sign in their “Clubcard Prices” marketing (as shown below in the form used in the Particulars of Claim), which is used by Tesco with text overlaid (“the Sign”), is an infringement of these marks:

7. Before I go on to look in more detail at the nature of the allegations, Tesco’s response and the grounds for the Strike Out Application, I should first set the claim in its proper statutory context.

The Relevant Statutory Framework

8. Pursuant to section 9(1) of the Trade Marks Act 1994 (“the TMA 1994”), the proprietor of a registered trade mark has exclusive rights in the trade mark which are infringed by use of the trade mark in the United Kingdom without his consent. The acts amounting to infringement are specified in section 10.

9. Section 10(3) provides that:

“A person infringes a registered trade mark if he uses in the course of trade, in relation to goods and services, a sign which

(a) is identical with or similar to the trade mark,

where the trade mark has a reputation in the United Kingdom and the use of the sign, being without due cause, takes unfair advantage of, or is detrimental to, the distinctive character or the repute of the trade mark”.

10. Section 10(4) identifies the circumstances in which a person uses a sign for the purposes of the section, including by offering or exposing goods for sale under the sign and using the sign on business papers and in advertising.

11. Section 46 TMA 1994 is concerned with revocation of registration of a trade mark. Insofar as relevant, section 46 provides that:

“(1) The registration of a trade mark may be revoked on any of the following grounds

(a) that within the period of five years following the date of completion of the registration procedure it has not been put to genuine use in the United Kingdom, by the proprietor or with his consent, in relation to the goods or services for which it is registered, and there are no proper reasons for non-use;

(b) that such use has been suspended for an uninterrupted period of five years, and there are no proper reasons for non-use;

…

(2) For the purposes of subsection (1) use of a trade mark includes use in a form (“the variant form”) differing in elements which do not alter the distinctive character of the mark in the form in which it was registered (regardless of whether or not the trade mark in the variant form is also registered in the name of the proprietor)…”

12. Pausing there, trade mark owners therefore have a period of grace after registration in which to make use of the mark before it becomes vulnerable to attack for non-use.

13. Section 47 TMA 1994, is concerned with grounds for invalidity of registration and insofar as is relevant provides that:

“(1) The registration of a trade mark may be declared invalid on the ground that the trade mark was registered in breach of section 3 or any of the provisions referred to in that section…

…

(5) Where the grounds of invalidity exist in respect of only some of the goods or services for which the trade mark is registered, the trade mark shall be declared invalid as regards those goods and services only.

(6) Where the registration of a trade mark is declared invalid to any extent, the registration shall to that extent be deemed never to have been made…”

14. Section 3 TMA 1994 contains the grounds for refusal of registration. Section 3(6) provides that “A trade mark shall not be registered if or to the extent that the application is made in bad faith”.

15. Thus having regard to both sections 47 and 3 of the TMA 1994, a trade mark may be declared invalid to the extent that it was applied for in bad faith. There is a significant public interest objective in this provision “which is that of preventing trade mark registrations that are abusive or contrary to honest commercial and business practices” (see Hasbro Inc v EUIPO (T-663/19) [2021] ETMR 39 (“Hasbro”) per the General Court of the CJEU at [37])

16. Section 32 of the TMA 1994 is concerned with the procedure for, and contents of, applications for national trade marks. Section 32(2)(c) requires that the application contain a statement (or specification) of the goods or services in relation to which it is sought to register the mark. Section 32(3) provides that:

“(3) The application shall state that the trade mark is being used, by the applicant or with his consent, in relation to those goods or services, or that he has a bona fide intention that it be so used”.

17. It is common ground that the applications for registration in respect of the Wordless Mark and the Additional Wordless Marks will have included a statement to this effect.

The Claim

18. It is common ground that Lidl has made substantial use of the Mark with Text in the United Kingdom and has acquired a substantial reputation in connection with the goods and services for which it is registered. For reasons which will become clear, it is not necessary for me to examine the claim any further insofar as it relates to infringement of the Mark with Text; suffice to say that the allegations to which I shall refer in the context of the Wordless Mark are also made in relation to infringement of the Mark with Text.

19. Lidl’s use of the Wordless Mark is disputed.

20. In its Particulars of Claim, Lidl relies upon its various uses of the Mark with Text “as uses of the Wordless Mark in a form that does not alter their distinctive character”. Lidl does not assert that the Wordless Mark has been used on its own in the United Kingdom but says that, because it has been used in conjunction with the Mark with Text, it is recognised in the United Kingdom as being distinctive of Lidl’s business in respect of those goods and services for which it is registered and that it “is capable of being, and is, perceived by the public in the United Kingdom as being distinctive of the Lidl group of companies”.

21. Lidl pleads that as a consequence of its use, the Wordless Mark is a trade mark having a reputation in the United Kingdom within the meaning of section 10(3) TMA 1994. Lidl asserts that Tesco has used the Sign within the meaning of section 10(4) TMA 1994 without due cause and that it is taking unfair advantage of the reputation of the Wordless Mark (so-called “free-riding”), alternatively that the use of the Sign is detrimental to the distinctive character of the Wordless Mark, contrary to section 10(3) TMA 1994. There is no plea of confusion (pursuant to section 10(2) TMA 1994).

22. Essentially, Lidl says that Tesco is seeking deliberately to ride on the coat tails of Lidl’s reputation as a “discounter” supermarket known for the provision of value. It pleads that Tesco’s use of the Sign in connection with Tesco’s discount prices is intended to, and does, cause members of the public to call to mind Lidl’s business and the Marks, including being suggestive of the fact that the prices of goods offered by Tesco for sale under or in connection with the Sign are offered at the same prices, or lower prices, than could be obtained for the same or equivalent goods in Lidl stores.

23. In addition to the claim of trade mark infringement, Lidl also asserts (i) a claim in passing off on the grounds that by their use of the Sign, Tesco has misrepresented that products sold by Tesco share the qualities of those of Lidl, including that they are sold at the same or equivalent price, or have otherwise been price matched with Lidl products; and (ii) a claim of infringement of copyright in the artworks that comprise both the Mark with Text and the Wordless Mark.

24. By its Amended Defence and Counterclaim, Tesco disputes the basis of each of the claims made by Lidl. Focusing specifically on the Wordless Mark, it pleads (in somewhat discursive form) as follows in paragraphs 4.10 to 4.13:

“4.10 The Wordless Mark is a figment of Lidl’s legal imagination and a product of its trade mark filing strategy. It does not exist in the real world. The fact that Lidl have illegitimately obtained registered trade mark protection does not assist Lidl and only means that it should be expunged from the Register on grounds of Lidl’s bad faith and/or the lack of distinctiveness of the mark in any event. Lidl have never used the Wordless Mark and never intended to use it. Lidl argue that its use is validated by use as part of the Mark with Text. But if that is so, then there is no legitimate reason for Lidl having applied for it over and above a registration for the Mark with Text - other than to extend the protection already conferred by that registration. This is therefore a case of applying for a mark for the sake of legal protection per se, for its value as a legal weapon (just as it has been deployed in this action) and contrary to the true functions of a mark– in short, a paradigm case of bad faith.

4.11 As if that were not enough, Lidl have sought to “evergreen” the Wordless Mark as evidenced by duplicative protection sought in 2005 and even in 2021, the latter being after Lidl became aware that the Wordless Marks advanced in this claim could be vulnerable on grounds of non-use. Evergreening, Lidl seem to believe, confers fresh grace periods with no need to show use for 5 years following registration. But Lidl is wrong. Evergreening is characteristic of a bad faith actor since it allows a trade mark to be extended indefinitely, and the use provisions to be circumvented, with the mark maintained on the register for reasons unconnected with its purpose as a badge of origin. Again, paradigm bad faith.

4.12 In any event, the Wordless Mark was never a distinctive trade mark to begin with, being utterly devoid of any distinctiveness when applied for, and never having been used by Lidl in a way that could confer distinctiveness through use. Consumers, if they even would recognise the Wordless Mark as such, certainly would not rely on it on its own to indicate origin, which is the requisite test.

4.13 The Wordless Mark registrations should be revoked or declared invalid as sought in the Counterclaim.”

25. In paragraph 19 of the Amended Defence and Counterclaim, Tesco pleads that “[t]here has been no use, let alone substantial use, of the Wordless Mark”. Tesco goes on to deny that the Wordless Mark has any reputation or goodwill and it asserts that “Consumers do not rely on it exclusively for the purposes of indicating the origin of Lidl’s goods or services or for any other purpose” (paragraphs 20-21).

26. By its Counterclaim, Tesco asserts that the Wordless Mark, together with Additional Wordless Marks “are liable to be declared invalid because they were applied for in bad faith” (“the Bad Faith Allegation”). The basis for this plea is then set out in paragraphs 47 and 48 (which are the subject of the Strike Out Application by Lidl) as follows:

“47. As regards the 1995 UK application for the Wordless mark (UK trade mark registration nos. UK2016658A, UK2016658C and UK2016658D):

47.1 The Wordless Mark is and always was a legal artifice with no corresponding mark in the real world. It has never been used by Lidl in the form appearing on the register.

47.2 Given that, as pleaded, Lidl apparently devised its logo corresponding to the Mark with Text in 1987 or thereabouts, there is a reasonable inference that, at least by 1995 there was no bona fide intention (if there ever was, which is denied) to use the Wordless Mark in the form as registered. This is supported by the lack of use of that mark in the period both before and since the date of application.

47.3 It is denied that use of the Mark with Text amounts to use of the Wordless Mark, but even if it did, that would have no bearing on the bad faith nature of the application. If the Mark with Text supported the use of the Wordless Mark, then there was no need to apply for the Wordless Mark separate to that unless the purpose of the Wordless Mark application was to give Lidl wider or different protection. Lidl makes that argument in the present proceedings.

47.4 The result was an application for a Wordless Mark made solely for the purposes of deployment as a weapon in legal proceedings, not in accordance with its function of being used on goods or services to indicate the origin thereof.

48. Further or alternatively, as regards the Additional Wordless marks and the 2005 version of the Wordless Mark (UK trade mark registration no. 904746343), Tesco will contend as follows:

48.1 The Additional Wordless Marks and the 2005 version of the Wordless Mark, namely the EU marks from which those UK comparables are derived, are evergreened versions of the 1995 mark in that they duplicate coverage of various goods and services covered by the earlier mark.

48.2 There was no reason for Lidl to re-apply for the same marks and goods/services other than to avail itself of a fresh grace period during which it would not be required to show use of, in effect, the same marks.

48.3 In the circumstances, the Additional Wordless Marks and the evergreened 2005 application are probative of bad faith in relation to the marks themselves and the 1995 mark. As regards the 1995 mark, although the bad faith assessment is at the date of application, facts and matters subsequent to that date, such as evergreening, have a bearing on that assessment. The fact that Lidl considered it necessary to evergreen that 1995 mark in 2002, 2005 and 2007 is further proof of its bad faith at the date of application of the 1995 mark.

48.4. As regards the Additional Wordless Marks and the 2005 version of the Wordless Mark, paragraph 47 above is repeated. However, in addition to those matters, the fact that those applications were made in order to evergreen an earlier trade mark is itself probative of bad faith as regards those later marks.

48.5. In the premises, Lidl made applications not in accordance with the functions of a trade mark but purely to obtain exclusive rights for ulterior and illegitimate purposes. In respect of the UK comparable marks that derive from the EUTMs, because the EUTMs were applied for in bad faith, the UK comparable marks should be invalidated for the same reasons.

48.6. Pending further information and/or clarification, Tesco notes that Lidl has made yet further applications for the Wordless Mark in 2021, i.e., well after this dispute began. The said marks represent yet further attempts to evergreen the Wordless Mark in order to benefit from yet further fresh grace periods without any requirement to prove use. These applications, although they have not yet proceeded to registration, will be the subject of invalidation counterclaims should Lidl seek to introduce them here. They will in any event be opposed before the UK-IPO if they proceed to publication. At that point the UK-IPO will be invited to stay those oppositions pending the outcome of this Counterclaim. Meanwhile the fact of the 2021 evergreened applications stands as yet further evidence of bad faith regarding all prior applications for the Wordless Mark and the Additional Wordless Marks.”

27. In paragraph 49 of the Counterclaim, Tesco advances the alternative case that the registrations for the Wordless Mark and the Additional Wordless Marks “are devoid of distinctive character and have not been used so cannot have acquired such character through use”. It goes on to say that even if these marks can be regarded as having been used as part of another trade mark, or in conjunction with another mark, “Lidl cannot prove that the relevant class of persons perceive the goods or services designated exclusively by the Wordless Mark and the Additional Wordless Marks…as originating from it”.

28. In a yet further alternative case, Tesco pleads at paragraph 50 of its Counterclaim that the Wordless Mark and the Additional Wordless Marks are liable to be revoked on the ground that they have not been used genuinely in the United Kingdom or anywhere else during the relevant period. At paragraph 50A, Tesco contends that even if there has been use of these marks as part of, or in conjunction with, the Mark with Text, Lidl cannot prove that the relevant class of persons perceive the goods and services designated exclusively by the Wordless Mark and the Additional Wordless Marks, as opposed to any other mark which might also be present on the overall Mark with Text, as originating from it.

29. The relief sought by Tesco in its prayer to the Counterclaim includes an order at paragraph 1 declaring invalid or revoking the Wordless Mark and the Additional Wordless Marks “as at the date of the filing for these trade marks or any subsequent later dates that the Court shall think fit”.

30. Lidl responds to the Bad Faith Allegation in paragraph 26 of its Reply and Defence to Counterclaim, pointing out that the allegations of bad faith amount to serious allegations of commercial dishonesty and asserting that they have not been “distinctly pleaded and distinctly proved”. Accordingly the pleading of bad faith is said to be “demurrable and liable to be struck out”.

31. In response to Tesco’s case in paragraphs 19-22 of the Amended Defence and Counterclaim of lack of use of the Wordless Mark, lack of recognition by consumers and lack of distinctive character and reputation (and in response to the Counterclaim more generally), Lidl pleads at paragraph 9 of its Reply and Defence to Counterclaim that it:

“…will rely on the evidence of a consumer survey that has been conducted in the course of preparing this Reply & Defence to Counterclaim. Lidl will in particular say that the results of that survey prove that the average consumer can, and does, perceive the Wordless Mark, and that the Wordless Mark is associated in the minds of consumers with the business of Lidl, having a reputation. Pending the provision of evidence in support of the same, the complete results, methodology, coding basis and coded data relating to that survey are set out at Annex 36 hereto and will also be made available to Tesco and their representative in native digital form”.

32. At paragraph 31 of the Reply and Defence to Counterclaim, Lidl makes it clear that it “will rely on the evidence of a consumer survey described at paragraph 9 of the Reply above in answer to the Counterclaim…”.

33. I shall refer to the consumer survey carried out by Lidl in this judgment as “the Survey” and return to the detail of it later when I come to consider the Survey Evidence Application.

34. For the sake of completeness, the question of whether or not Lidl has used the Wordless Mark lies at the heart of this action, is said to justify the application to rely on the Survey, and will remain in issue whether or not I accede to the application to strike out the Bad Faith Allegation.

The Strike Out Application

35. By its application notice dated 13 October 2021, Lidl applied to strike out the Bad Faith Allegation as set out in paragraphs 46 to 48 of the Amended Defence and Counterclaim together with paragraph 1 of Tesco’s prayer for relief. Alternatively, Lidl sought summary judgment, albeit that the procedural requirements in the Practice Direction at 24PD do not appear to have been complied with. The reasons for the application were said to be “set out in detail” in a letter from Lidl’s solicitors dated 17 September 2021. No additional reasons were included in the application notice and no evidence was served in support.

36. The letter of 17 September 2021 identified two reasons why the Bad Faith Allegation was said to be “disproportionate and hopeless”, namely (i) that it is redundant because “it can only potentially succeed in circumstances where the revocation for non-use has succeeded; and is bound to fail in circumstances where the revocation for non-use would also fail” - and so should be struck out pursuant to CPR 3.4(2)(b); and (ii) it is bad in law because “the facts alleged do not come close to an arguable case of the commercial dishonesty required to sustain the allegation” - and so should be struck out pursuant to CPR 3.4(2)(a).

37. In his skeleton argument for the hearing, Mr Brandreth QC, on behalf of Lidl, focussed on the strike out application, albeit continuing to maintain orally that he was also entitled to summary judgment by way of alternative - essentially on the basis that the grounds for summary judgment were similar, that the pleadings were verified with a statement of truth and that it was an acknowledged fact that when Lidl obtained its UK registration it must have ticked the box on the form TM3 confirming an intention to use the Wordless Mark. Mr Malynicz QC, on behalf of Tesco, complained at the rather unconventional approach to the application, involving a cross reference to the 17 September 2021 letter and the failure to have regard to PD24, but did not suggest that he was not in a position to deal with the application on its merits.

38. The case came before Master Pester on 3 November 2021 for a case and costs management conference. In his Order, the Master provided for the Strike Out Application to be adjourned to be disposed of at a subsequent hearing, together with the Survey Evidence Application. Tesco sought disclosure from Lidl in respect of Lidl’s intention and rationale when it applied for, and filed the Wordless Mark and the Additional Wordless Marks at all times (including 1995, 2002, 2005, 2007 and 2021). Subject to the outcome of this hearing, Lidl was ordered to disclose under Model D, with the question of disclosure of narrative documents a reserved matter. As at the date of the hearing, Lidl has accordingly provided no disclosure on this issue.

The Law on Strike Out/Summary Judgment

39. The applicable principles do not appear to be in dispute. The court may strike out a statement of case, or part of a statement of case, pursuant to CPR 3.4(2)(a), read together with 3.4(1) on the grounds that it “discloses no reasonable grounds for bringing the…claim”. It may grant summary judgment under CPR 24.2(a)(i) if it considers that there is “no real prospect of succeeding on the claim or issue”.

40. In a case such as this, where the Strike Out Application is based on the nature of Tesco’s pleading, there is no difference between the tests to be applied by the court under the two rules (see Begum v Maran (UK) Ltd [2021] EWCA Civ 326, per Coulson LJ at [20]). The test was identified by Coulson LJ at [22] in that case as follows:

“As to the applicable test itself:

(a) The court must consider whether the claimant has a “realistic” as opposed to a “fanciful” prospect of success: Swain v Hillman [2001] 1 All ER 91. A realistic claim is one that carries some degree of conviction: ED & F Man Liquid Products v Patel [2003] EWCA Civ 472. But that should not be carried too far: in essence, the court is determining whether or not the claim is “bound to fail”: Altimo Holdings v Kyrgyz Mobil Tel Ltd [2012] 1WLR 1804 at [80] and [82].

(b) The court must not conduct a mini-trial: Three Rivers District Council v Governor and Company of the Bank of England (No 3) [2003] 2 AC 1, in particular paragraph 95. Although the court should not automatically accept what the claimant says at face value, it will ordinarily do so unless its factual assertions are demonstrably unsupportable: ED & F Man Liquid Products v Patel; Okpabi and others v Royal Dutch Shell Plc and another [2021] UKSC 3, at paragraph 110. The court should also allow for the possibility that further facts may emerge on discovery or at trial: Royal Brompton Hospital NHS Trust v Hammond (No 5) [2001] EWCA Civ 550; Sutradhar v Natural Environmental Research Council [2006] 4 All ER 490 at [6]; and Okpabi at paragraphs 127-128.”

41. At paragraph [23] Coulson LJ drew attention to the fact that it is not generally appropriate to strike out a claim on assumed facts in an area of developing jurisprudence. However, I did not understand Mr Malynicz to suggest that the issues arising in respect of the Bad Faith Allegation were novel such that, for this reason alone, they would be better dealt with on the basis of actual facts found at trial.

42. In the context of determining whether or not the claim is bound to fail, Peter Gibson LJ observed in Richards v Hughes [2004] PNLR 35 at [22], that “the court must be certain that the claim is bound to fail” (see also Duchess of Sussex v Associated Newspapers [2020] EMLR 21, per Warby J at 33(2)).

43. Here the strike out application is also brought pursuant to CPR 3.4(2)(b) which confers powers on the court to strike out a statement of case (or part of a statement of case) if it appears that it is “an abuse of the court’s process or is otherwise likely to obstruct the just disposal of proceedings”. This provision is broader in scope than 3.4(2)(a) and must be interpreted by reference to the overriding objective of dealing with cases justly and at proportionate cost, including that trials be kept strictly to the issues necessary for the fair determination of the dispute. It enables allegations which it would not be proportionate to permit to be tried, to be struck out (see Duchess of Sussex v Associated Newspapers [2020] EMLR 21 per Warby J at 33(3) and 34).

44. Mr Brandreth drew my attention to a helpful summary of the relevant principles on what is often referred to as “Jameel abuse” in Harlow Higinbotham (formerly BWK) v Wipaporn Teekhungam [2018] EWHC 1880 (QB) per Nicklin J at 44:

“(i) The Court has jurisdiction to stay or strike out a claim where no real or substantial wrong has been committed and litigating the claim will yield no tangible or legitimate benefit to the claimant proportionate to the likely costs and use of court procedures: in other words, “the game is not worth the candle”: Jameel [69]-[70] per Lord Phillips MR and Schellenberg -v- BBC [2000] EMLR 296, 319 per Eady J. The jurisdiction is useful where a claim “is obviously pointless or wasteful”: Vidal-Hall -v- Google Inc [2016] QB 1003 [136] per Lord Dyson MR.

ii) Nevertheless, striking out is a draconian power and it should only be used in exceptional cases: Stelios Haji-Ioannou -v- Dixon [2009] EWHC 178 (QB) [30] per Sharp J.

iii) It is not appropriate to carry out a detailed assessment of the merits of the claim. Unless obvious that it has very little prospect of success, the claim should be taken at face value: Ansari -v- Knowles [2014] EWCA Civ 1448 [17] per Moore-Bick LJ and [27] per Vos LJ.

iv) The Court should only conclude that continued litigation of the claim would be disproportionate to what could legitimately be achieved where it is impossible “to fashion any procedure by which that claim can be adjudicated in a proportionate way”: Ames –v- Spamhaus Project Ltd [2015] 1 WLR 3409 [33]-[36] per Warby J citing Sullivan –v- Bristol Film Studios Ltd [2012] EMLR 27 [29]-[32] per Lewison LJ”.

45. In Dow Jones & Co Inc v Jameel [2005] EWCA Civ 75, a libel case, Lord Philips focused on the need for the court to consider not only the position of the parties, but also the wider position, saying at [54]:

“…An abuse of process is of concern not merely to the parties but to the court. It is no longer the role of the court simply to provide a level playing-field and to referee whatever game the parties choose to play upon it. The court is concerned to ensure that judicial and court resources are appropriately and proportionately used in accordance with the requirements of justice.”

46. Against this background, Mr Malynicz also drew my attention to Alsaifi v Trinity Mirror Plc [2019] EMLR 1. At paragraphs [44] and [45], Nicklin J said this:

“44. At the heart of any assessment of whether a claim is Jameel abusive is an assessment of two things: (1) what is the value of what is legitimately sought to be obtained by the proceedings; and (2) what is the likely cost of achieving it?

45. It is clear from Sullivan that this cannot be a mechanical assessment. The Court cannot strike out a claim for £50 debt simply because, assessed against the costs of the claim, it is not ‘worth’ pursuing. Inherent in the value of any legitimate claim is the right to have a legal wrong redressed. The value of vindicating legal rights - as part of the rule of law - goes beyond the worth of the claim. The fair resolution of legal disputes benefits not only the individual litigants but society as a whole”.

The Law on Bad Faith

47. Bad faith as a ground for invalidity requires “a use of the system of trade mark registration which would be regarded in commerce (“in the course of trade”) as not in accordance with honest practices or acceptable commercial behaviour” (per Sir Christopher Floyd in Sky Limited (formerly Sky PLC) v Skykick UK Ltd [2021] EWCA Civ 1121 (“Skykick”) at [59]). This will be the case where the legal right is being sought for purposes other than those falling within the functions of a trade mark (Skykick at [60]).

48. Lack of intention to use a trade mark may, in some circumstances, be relevant to, and evidence, bad faith (see Case C-371/18 Sky plc and another v Skykick UK Ltd and another (EU:C:2020:45], [2020] ETMR 24). However, it is not possible to equate a lack of intention to use with bad faith; as Sir Christopher Floyd said in Skykick at [45] “lack of intention to use, on its own, does not amount to bad faith”.

49. The main principles on which Lidl relies for the purpose of the Strike Out Application were summarised by Arnold J, as he then was, in Walton International Ltd v Verweij Fashion BV [2018] ETMR 34 at [186]:

“(i) A person is presumed to have acted in good faith unless the contrary is proved. An allegation of bad faith is a serious allegation which must be distinctly proved. The standard of proof is the balance of probabilities, but cogent evidence is required due to the seriousness of the allegation. It is not enough to prove facts which are also consistent with good faith.

…

vi) Consideration must be given to the applicant’s intention. This is a subjective factor which must be determined by reference to the objective circumstances of the particular case.”

50. I consider it important also to bear in mind various of the factors gleaned by Sir Christopher Floyd from the relevant CJEU authorities in respect of which he carried out an exhaustive review in Skykick. These are identified at paragraph [67] of his judgment, where he first identified the nature of the concept of bad faith, noting that an allegation that a trade mark has been applied for in bad faith “is one of the absolute grounds for invalidity of an EU trade mark” and then went on:

“…

(3) The concept of bad faith presupposes the existence of a dishonest state of mind or intention, but dishonesty is to be understood in the context of trade mark law…

(4) The concept of bad faith, so understood, relates to a subjective motivation on the part of the trade mark applicant, namely a dishonest intention or other sinister motive. It involves conduct which departs from accepted standards of ethical behaviour or honest commercial and business practices: Hasbro at [41].

(5) The date for assessment of bad faith is the time of filing the application: Lindt at [35].

(6) It is for the party alleging bad faith to prove it: good faith is presumed until the contrary is proved: Pelikan at [21] and [40].

(7) Where the court or tribunal finds that the objective circumstances of a particular case raise a rebuttable presumption of lack of good faith, it is for the applicant to provide a plausible explanation of the objectives and commercial logic pursued by the application: Hasbro at [42].

(8) Whether the applicant was acting in bad faith must be the subject of an overall assessment, taking into account all the factors relevant to the particular case: Lindt at [37].

(9) For that purpose it is necessary to examine the applicant’s intention at the time the mark was filed, which is a subjective factor which must be determined by reference to the objective circumstances of the particular case: Lindt at [41] - [42].

(10) Even where there exist objective indicia pointing towards bad faith, however, it cannot be excluded that the applicant’s objective was in pursuit of a legitimate objective, such as excluding copyists: Lindt at [49].

(11) Bad faith can be established even in cases where no third party is specifically targeted, if the applicant’s intention was to obtain the mark for purposes other than those falling within the functions of a trade mark: Koton Mağazacilik at [46].”

51. In considering bad faith in the context of an intention to use the trade mark at the time of registration, Sir Christopher Floyd set out extracts from the CJEU’s judgment in Skykick, summarising them at paragraph [70] as follows:

“Lack of intention to use is accordingly a factor which may be relevant to bad faith where there is no rationale for the application in accordance with the aims of the Regulation, and there are objective, consistent and relevant indicia of bad faith”

52. As defined in paragraph 77 of the CJEU’s judgment, these objective, consistent and relevant indicia would tend to show that:

“…when the application for a trade mark was filed, the trade mark applicant had the intention of undermining, in a manner inconsistent with honest practices, the interests of third parties, or of obtaining, without even targeting a specific third party, an exclusive right for purposes other than those falling within the functions of a trade mark”.

53. Accordingly, as the CJEU went on to say at [78]:

“The bad faith of the trade mark applicant cannot, therefore, be presumed on the basis of the mere finding that, at the time of filing his or her application, that applicant had no economic activity corresponding to the goods and services referred to in that application”.

54. Thus, as Sir Christopher Floyd observed in Skykick at [71]:

“There will only be bad faith where the absence of intention to use is coupled with objective, relevant and consistent indicia of the additional positive intention identified in [the CJEU’s judgment at] [77]”.

55. At paragraphs [74] and [75] Sir Christopher Floyd drew attention to the grounds on which Nugee J had rejected a claim of bad faith in Jaguar Land Rover Ltd v Bombardier Recreational Products Inc [2016] EWHC 3266 (Ch) on a summary judgment application, including his observation that “the charge of bad faith is akin to dishonesty and must be ‘fully and properly pleaded’”. At [78], Sir Christopher Floyd said:

“I agree with Nugee J that an allegation of bad faith is “akin to an allegation of dishonesty”. In accordance with conventional principles, the party against whom bad faith is alleged must be told in clear terms the respects in which his conduct is to be so characterised, and the facts on which such an allegation is being made”.

56. At [79], Sir Christopher Floyd set out an extract from the judgment of Mr Daniel Alexander QC sitting as an Appointed Person in HTC Corp v One Max Ltd (O/486/17), including his observation at [21] that:

“it is necessary to give an applicant for a trade mark very considerable latitude before treating an application as filed in bad faith on the basis that the applicant…did not have a sufficiently specific intention at the time of the application to use the mark in respect of all the goods or services for which application was made”

and at [22] that:

“…it is therefore appropriate for the relevant tribunal to consider, in particular, in any case where bad faith is alleged whether, at the date of the application, having regard to the chronology and all the circumstances, the applicant had commercial reason to register the mark at all or to register it for the goods or services applied for on the basis of an arguable claim to legitimate protection of its actual or potentially extended future business under the mark”.

57. Sir Christopher Floyd then observed at [80] that he agreed:

“…that such a cautious approach is mandated in all cases where bad faith is alleged, and that the concept of justification by considering whether there is an arguable claim to legitimate protection of the applicant’s actual or potential business is a useful one.”

The relevant law as to “Use”

58. In Specsavers International Healthcare Ltd v Asda Stores Ltd (C-252/12) [2013] ETMR 46, the CJEU (on a reference from the English court) considered the issue of the use of a trade mark in a form differing in elements which do not alter its distinctive character.

59. Specsavers sued Asda for trade mark infringement. They relied (inter alia) on two trade mark registrations: one consisted of two ellipses partially super-imposed over each other so as to resemble spectacles; another consisted of the same image with the word SPECSAVERS over it. The CJEU held that there was no inherent problem in relying on use of one mark overlaid with another that was itself a registered trade mark. The CJEU also held that the presence of the overlapping word changed the form of the mark but that the use of a mark in a form which differs from the form in which it is registered may nevertheless amount to use of the registered mark to the extent that its distinctive character is not altered. The question was ultimately one of consumer perception:

“23. The distinctive character of a registered trade mark may be the result both of the use, as part of a registered trade mark, of a component thereof and of the use of a separate mark in conjunction with a registered trade mark. In both cases it is sufficient that, in consequence of such use, the relevant class of persons actually perceive the product or service at issue as originating from a given undertaking…

24. It follows that the use of the wordless logo mark with the superimposed word sign “Specsavers”, even if, ultimately it amounts to a use as a part of a registered trade mark or in conjunction with it, may be considered to be a genuine use of the wordless logo mark as such to the extent that that mark as it was registered, namely without a part of it being hidden by the superimposed word sign “Specsavers”, always refers in that form to the goods of the Specsavers group covered by the registration, which is to be determined by the referring court.”

60. The case returned to the Court of Appeal, Specsavers International Healthcare Ltd v Asda Stores Ltd [2014] EWCA Civ 1294; [2015] ETMR 4 (“Specsavers”). At paragraph [9], Kitchen LJ identified two issues raised by the allegation that the use of the logo mark constituted use of the wordless logo mark too, namely:

“The factual issue is whether the Wordless logo mark is distinctive of Specsavers through use of the Shaded logo marks; or in other words, whether the average consumer recognises the Wordless logo mark when he sees the Shaded logo mark. The legal issue is whether the use of the Shaded logo mark therefore constitutes use of the Wordless logo mark”.

The legal issue was the issue that had been referred to the CJEU.

61. At paragraph [34], Kitchen LJ said that in the unusual circumstances of the case:

“…Specsavers have established that much of the use they have made of the Shaded logo mark, including, in particular, its use on signage, does also constitute use of the Wordless logo mark, for the evidence in this case shows that it has been such that the Wordless logo mark has served and does serve to identify the goods and services of Specsavers, and that the average consumer has perceived and does perceive the Wordless logo mark as indicative of the origin of the goods and services supplied by Specsavers. In short, much of that use has been such that the differences between the Shaded logo mark and the Wordless logo mark have not changed the distinctive character of the Wordless logo mark; and the Wordless logo mark has itself been seen as a trade mark and not simply as background. It follows that Specsavers have established that they have made genuine use of the Wordless logo mark”.

The competing arguments on strike out pursuant to CPR 3.4(2)(a)

62. As set forth in its skeleton argument, Lidl’s application to strike out the Bad Faith Allegation under CPR 3.4(2)(a) may be summarised as follows: the inferences that Tesco seeks to draw in its pleading (as to (i) the fact that Lidl applied for the Wordless Mark without an intention to use it; (ii) that accordingly its true intention must have been simply to register the Wordless Mark as a legal weapon against others and (iii) that Lidl has sought subsequent registrations for identical marks, the 2005 mark and the Additional Wordless Marks, in order to create a new 5 year period of monopoly protection without the need to show use) do not follow from Tesco’s case that Lidl has never used the Wordless Mark. This is because the question of use of the Wordless Mark is in dispute. Lidl says it used the Wordless Mark in conjunction with the Mark with Text; Tesco disagrees, but Tesco does not suggest that Lidl’s case on use is unarguable. Lidl relies for this case on Specsavers. The inferences that Tesco seeks to draw are dependent upon it succeeding in its case on lack of use. However, the existence of a disputed legal argument does not give rise to “objective, relevant and consistent indicia” showing bad faith.

63. In his oral submissions, Mr Brandreth contended that the key issue between the parties on the strike out application was encapsulated in Hasbro, a CJEU decision made shortly prior to the Court of Appeal’s decision in Skykick, and referred to by Sir Christopher Floyd in his judgment. In Hasbro, the Board of Appeal had found bad faith in filing the application for registration of the MONOPOLY mark. At paragraphs [41]-[43] the General Court said this:

“41. The concept of bad faith thus relates to a subjective motivation on the part of the trade mark applicant, namely a dishonest intention or other sinister motive. It involves conduct which departs from accepted principles of ethical behaviour or honest commercial and business practices…

42. It is for the applicant for a declaration of invalidity…to prove the circumstances which make it possible to conclude that an application for registration of an EU trade mark was filed in bad faith, the good faith of the trade mark applicant being presumed until proven otherwise…

43. Where EUIPO finds that the objective circumstances of the particular case which were relied on by the applicant for a declaration of invalidity may lead to the rebuttal of the presumption of good faith which the proprietor of the mark at issue enjoys when he or she files the application for registration of that mark, it is for the proprietor of that mark to provide plausible explanations regarding the objectives and commercial logic pursued by the application for registration of that mark.”

64. Essentially, says Mr Brandreth, the starting point is always a presumption of good faith and there will be no need or justification for considering the matter further unless that presumption can be rebutted by reference to objective circumstances. There are no such objective circumstances in this case; on the contrary, even taken at their highest, the matters on which Tesco relies are entirely consistent with good faith. Tesco pleads nothing that might be said only to be consistent with bad faith. The justification for the plea of commercial fraud comes down to “[o]nly their own lawyers’ argument that the use Lidl believes it has made of the Wordless Mark is not, in law, use of the mark in a form that does not differ in its distinctive elements. It is hopeless”.

65. In support of this proposition, Mr Brandreth drew my attention to the judgment of Richard Arnold QC (as he then was) sitting as an Appointed Person in Robert McBride Ltd v Reckitt Benckiser [2005] ETMR 85 (“McBride”). Mr Brandreth accepted that this judgment was long before SkyKick and that it was neither binding on this court, nor dealing with exactly the same factual scenario, but he submitted that the reasoning applied by the judge was supportive of the proposition he is making in this case.

66. In McBride, the applicant had applied for a trade mark for the shape of its air freshener and included a photograph of the same. However, in its application it had failed to indicate that it relied upon the three-dimensional shape of the article shown in the two-dimensional image. A notice of opposition was filed raising (amongst other things) grounds of opposition under section 3(6) TMA 1994 (bad faith on the grounds that there was no intention to use the two-dimensional trade mark as filed, but only an intention to use a three dimensional mark). The Registrar upheld this ground of opposition and the applicant appealed. The dispute on appeal turned on the correct inferences to be drawn from the primary facts and whether such inferences were capable of establishing bad faith.

67. One of the arguments raised by the applicant was that sale of the product was use of the mark applied for “in a form differing in elements which do not alter the distinctive character of the mark in the form in which it was registered” within section 46(2) TMA 1994. The judge noted that he had not received full argument from either side on this point and said that absent full argument he was reluctant to come to a final conclusion on the point. However, he went on to say this at [42]-[44]:

“42. …It is not necessary to reach such a conclusion in order to dispose of this appeal however. It is sufficient that I am satisfied that it is at least arguable that sale of the product…would be use within s. 46(2). The significance of this conclusion is that it means that what the applicant intended to do as at the date of filing the Form TM3 may constitute use of the two-dimensional trade mark applied for, and hence its statement that it intended to use the mark may be a true statement. Contrary to the opponent’s argument. I consider that this is highly relevant to bad faith.

43. This ties in with the applicant’s sixth ground and with the requirement laid down in Harrison to consider the applicant’s subjective state of mind. The applicant’s argument is that at worst the applicant made an error of judgment: if it turns out that sale of the product does not constitute use of the mark applied for, then the applicant may suffer the consequences of revocation under s. 46(1)(a) or (b) of the 1994 Act, but this does not mean that it knowingly made a materially false statement on the Form TM3 or otherwise acted in a manner falling short of the standards of acceptable commercial behaviour.

44. I accept this argument. Even if it was not clear beforehand, I consider that Harrison makes it clear that, to constitute bad faith within s. 3(6), it is not enough for the applicant to have made a statement of intention to use the mark applied for that turns out to have been incorrect: it must be shown that the applicant knowingly made a false statement (or, possibly, made a statement with reckless disregard for whether it was true or false). An honest but mistaken statement that the applicant intends to use the mark is not bad faith”.

68. Mr Brandreth says that, by analogy, Tesco’s recognition in this case that the use of the Wordless Mark is an arguable point precludes the possibility that Tesco can demonstrate bad faith - any inference can go no further than that Lidl made an error of judgment when filing its application for registration, in thinking that it could rely upon the Mark with Text and ticking the box on the form TM3 confirming its intention to use. An error of judgment does not come close to satisfying the requirements for establishing bad faith, much less is it sufficient to establish that Lidl’s registration was with the sole purpose of circumventing the non-use provisions (see Skykick at [117] where Sir Christopher Floyd identified that an absence of rationale for the application for registration “might be demonstrated by a strategy of the kind owned up to in Hasbro, where the sole purpose was to circumvent the non-use provisions in the regulation. That is something quite different from an absence of a commercial strategy to use the mark”).

69. During the course of Mr Brandreth’s submissions, I asked whether the issue around use of the Wordless Mark is a mixed question of fact and law. Mr Brandreth pointed to the passage in Kitchen LJ’s judgment in Specsavers at [9], to which I have already referred, identifying that the factual issue will be whether the Wordless Mark is distinctive of Lidl through use of the Mark with Text, while the legal issue is whether the use of the Mark with Text therefore constitutes use of the Wordless Mark. Mr Brandreth says that Tesco relies on nothing more than a contested legal argument to raise inferences of serious commercial misconduct and that such reliance (which is no more than a “legal fiction”) falls far short of what is required. Tesco must show that Lidl knew that they had no intention to make genuine use of the Wordless Mark when they applied for it, but instead intended to register it for an illegitimate purpose; the basis for that allegation is an inference from their defence that there has been no use, an inference which is unsustainable in circumstances where the question of use is arguable.

70. As for Tesco’s argument on “evergreening”, Mr Brandreth says that these allegations are not sufficient on their own and that, in any event, insofar as the evergreening allegation is dependent upon the proposition that the Wordless Mark has not been used, there is an arguable case that Lidl has used it and thus no basis for inferring a nefarious motive. Further, Mr Brandreth points out that the later registrations (the first of which - filed in 2002 - was not filed in the grace period of 5 years following the 1995 registration [2]) cover a wider specification of goods and different territories to the 1995 registration (many of the marks were originally EU trade marks - they have become UK trade marks as a consequence of Brexit but at the time of application they did not cover the UK alone but also the other 26 countries in the EU), and that they are for different signs - the colour identification having been updated. Inherently, therefore, Lidl submits that the later registrations of the Wordless Mark had their own commercial rationale and that Tesco’s pleading raises nothing that is not consistent with good faith.

71. In Hasbro, the evidence showed that the applicant had intentionally sought to circumvent a fundamental rule of EU trade mark law, namely that relating to proof of use, in order to derive an advantage therefrom to the detriment of the balance of the EU trade mark system. However, the CJEU made clear at [70] that:

“…it must be stated there is no provision in the legislation relating to EU trade marks which prohibits the refiling of an application for registration of a trade mark and that, consequently, such a filing cannot, in itself, establish that there was bad faith on the part of the trade mark applicant, unless it is coupled with other relevant evidence which is put forward by the applicant for a declaration of invalidity or EUIPO” (emphasis added).

72. As an overarching point, Mr Brandreth submits that Tesco’s pleading does no more than plead a bad faith case in the abstract. Tesco invites speculation as to what might “come out” at a later stage, but on the authorities there is no proper basis for the court to engage with such invitation absent objective reasons which are only consistent with bad faith.

73. Tesco rejects these arguments. Mr Malynicz argues that use and intent to use (the latter being the key issue in the context of an allegation of bad faith) are two separate enquiries. He contends that on the accepted fact that the Wordless Mark has never been used in the form applied for, there is a strong (and so far unanswered) inference that Lidl’s application for the Wordless Mark was made for purposes other than to be used as a trade mark, i.e. it was thought that it would expand Lidl’s monopoly in the Mark with Text over and above the existence of that mark alone. In Mr Malynicz’s words, the Wordless Mark appears to have been “contrived purely as a means of suing people like Tesco who dare to use a circle in price signage”. This, he says, is paradigm bad faith because it is a motive that is ulterior to the purpose of trade mark registration - to use the mark in the form applied for in relation to goods or services.

74. On the subject of genuine use, Mr Malynicz rejects the proposition that, because Lidl may have an arguable point by analogy with Specsavers, Tesco’s plea of bad faith is hopeless. Indeed he says that even if Lidl were to establish genuine use on the evidence at trial, that would not be enough to protect them against the Bad Faith Allegation - use and intention to use being different enquiries. He relies on Skykick in support of the contention that it may constitute bad faith to register a trade mark without any intention to use it.

75. Mr Malynicz submits that each of the three separate allegations of bad faith pleaded by Tesco (each of which amounts to an inference) has a real prospect of success at trial:

i) The objection that the Wordless Mark has never been used and so must have been filed without a bona fide intention to use it is well-founded in law - see Skykick at paragraphs [69]-[71];

ii) The objection that Lidl filed the Wordless Mark as a legal weapon to deploy in proceedings such as these is also well-founded in law - see Skykick at [70] and the CJEU judgment at [77];

iii) It is well-established in trade mark law that evergreening is indicative of bad faith because it shows that an applicant has intentionally sought to circumvent a fundamental rule of EU trade mark law, namely the requirement to prove use - see Hasbro at [69]. Further, an allegation of bad faith based on evergreening is not dependent upon use - see Hasbro at [82]:

“As regards the second argument, relating to the use of the mark MONOPOLY in connection with games, the Board of Appeal was right in finding…that whether or not the applicant could have actually proved such use was irrelevant, as it is the intention of the applicant for a mark which is to be evaluated”.

In his oral submissions, Mr Malynicz noted that even where a subsequent application had a narrower or broader scope, any overlap for the purposes of identity would always raise an issue owing to the fact that “there is no reason for it”. In circumstances where the existing trade mark provides an existing monopoly, there is no need to re-apply. Accordingly, the fact of evergreening is sufficient to shift the evidential burden.

76. Mr Malynicz submits that these inferences are all the more compelling in circumstances where Lidl “already own[ed] the Mark with Text registrations” [3] (upon which Lidl seek to rely to establish use of the Wordless Mark). He queries what purpose could possibly have been served by registering the Wordless Mark where Lidl already had the Mark with Text registered and he points out that Lidl has never answered that question (although during the course of submissions, Mr Brandreth confirmed that the Wordless Mark was applied for to expand monopoly rights). Furthermore, Mr Malynicz says that none of these arguments has been rebutted with anything other than bare denials and that, importantly, Lidl has said nothing in the pleadings about their intentions in seeking registration of the Wordless Mark, whether originally or by regular re-application. He submits that Mr Brandreth’s argument based on the existence of an arguable legal issue is a “lawyer’s argument” which might succeed at trial but that it is “fanciful, or at least questionable”, that Lidl had that legal issue in mind in 1995 or on any of the subsequent re-registrations. Tesco is entitled to see Lidl’s disclosure and evidence on intention and to test that evidence at trial.

77. Finally, in oral submissions, Mr Malynicz asserted that (i) there are clear indications in the pleadings of solus use of the Wordless Mark, a point on which he relies in suggesting that there is, at the very least, “a question over what the intention was at the date of application; no more than that”; (ii) there are new applications in the pipeline; and (iii) the use of a background mark to challenge other backgrounds which have different text (i.e. the Tesco yellow disk which has completely different text from that used by Lidl) is itself potentially indicative of bad faith because it is capable of being anti-competitive (see para [50] of Skykick).

78. I shall return later to point (ii) above, which is pleaded as part of the Bad Faith Allegation. However, point (i) does not appear to take matters any further given the need for Tesco to unpick the presumption of good faith, and point (iii) is not pleaded in support of the Bad Faith Allegation. There was no suggestion from Mr Malynicz that there was any intention to amend to plead either of these points in support of the Bad Faith Allegation, notwithstanding the evidence in Mr Whitehead’s second statement to the effect that “it is Tesco’s intention to submit substantial evidence at trial that yellow (and other brightly (sic)) circles are and were at all material times used extensively in price signage to indicate prices and/or special offers”.

Discussion

79. In light of the submissions made by the parties, the central issue for determination is whether Tesco’s pleading raises sufficient objective circumstances to overcome the presumption of good faith, such that there is a case to answer. That this is the central question appears to be accepted by both parties albeit that the difference between them is that Lidl contends that Tesco has done nothing in its pleading to shift the burden, or to raise a prima facie case of bad faith, whereas Tesco says that it has and that the matters on which it relies are consistent with bad faith. Indeed Lidl goes further and says that without pleaded indicia consistent only with bad faith, Tesco should not be allowed to proceed with the Bad Faith Allegation.

80. In considering these questions it does seem to me that, for the purposes of this application, I must proceed on the assumption that Tesco may be correct in their assertion that use of the Wordless Mark in conjunction with the Mark with Text is not use. Mr Brandreth did not appear to dissent from this approach, although he says that even if Lidl was wrong on its understanding of “use” that does not establish that Lidl knew it was wrong or intended some quite different use and so is not enough to establish bad faith.

81. Proceeding then on the assumption that there has been no use of the Wordless Mark, that in itself (without more) does not indicate bad faith. The trade mark scheme expressly allows for a period of non-use, but also provides for a consequence of non-use beyond the 5 year grace period in the form of revocation. It is not (without more) inherently bad faith to register a mark without knowing precisely the use that will be made of it and it is not bad faith to register a trade mark and then not to use it. As Mr Brandreth correctly submitted, the point of the grace period is to allow registration in circumstances where an entity may not know immediately how their commercial plans will develop (see Skykick at [69] referring to paragraphs [76]-[78] of the CJEU decision).

82. The question of whether there was in fact no intention to use the trade mark will depend upon the evidence. However, even assuming it is correct to say that there was in this case no intention to use, Skykick plainly establishes that such lack of intention is not in itself sufficient to give rise to bad faith. There will only be bad faith where the absence of intention to use is coupled with objective, relevant and consistent indicia of the additional positive intention of obtaining an exclusive right for purposes other than those falling within the functions of a trade mark (See Sir Christopher Floyd in Skykick at [69] and [70] referring to the CJEU decision at [77]).

83. The first of the indicia on which Tesco relies in this case is that the Wordless Mark was designed as a legal weapon (a point that Mr Malynicz accepts overlaps with Tesco’s lack of intention to use allegation). However, whilst objective, relevant and consistent indicia of a desire to obtain exclusive rights for purposes other than those falling within the functions of a trade mark (i.e. for legal deployment) would be capable of tipping this case into the realms of bad faith, there are no such indicia here. Indeed I agree with Mr Brandreth that this element of Tesco’s case on bad faith is really inextricably tied to their contention that a lack of use gives rise to an inference of lack of intention to use. The allegation that the Wordless Mark is merely a legal weapon is no more than assertion. Tesco does not cite any objective basis for such contention. It cannot be sufficient on the authorities to construct an edifice of inferences based purely on an assumed/inferred lack of intention to use (which on its own is insufficient to amount to bad faith in any event).

84. Mr Malynicz appears to recognise this problem in his skeleton argument when he says at paragraph 90 that “Lidl’s behaviour in applying for marks that it does not intend to use might not be bad faith were it not also coupled with the fact that Lidl already own the Mark with Text registrations and it is those marks that Lidl rely on to show use of the Wordless Marks” (see paragraph 47.3 of the Counterclaim). This was a point he repeated in his oral submissions, accepting that it is not sufficient for there to be no use of the Wordless Mark and no intention to use the Wordless Mark but submitting that “the added ingredient here is Mark with Text. That is the problem”. (I observe as an aside that given the reliance placed on the existing registration of the Mark with Text, it is somewhat surprising that Tesco’s pleading does not refer to or plead the date of its filing or registration prior to the 1995 filing of the Wordless Mark and nor does it identify the class or classes of goods and services covered by any such registration.)

85. Mr Brandreth’s answer is to point to the decision of the CJEU in Specsavers, in particular paragraph [24] to the effect that there is nothing inherently wrong with having overlapping trade mark registrations (thereby implicitly accepting the existence of an earlier registration of the Mark with Text prior to 1995 despite also not having pleaded it). Although bad faith was not in issue in Specsavers and the point that is now raised before me was not before the court, he says that it supports the proposition that there is nothing surprising in an organisation with a background element that they consider to be distinctive wanting to protect it, and that in such circumstances there can be nothing wrong with the wider monopoly that is thereby created. He also points to the fact that section 46(2) TMA expressly provides for registration of a trade mark in a variant form, submitting that there is nothing objectionable in that.

86. Against that background (and in circumstances where the Reply (at paragraph 27.2) denies the inference and reasoning in paragraph 47.3 of the Counterclaim, but makes no positive case as to the purpose of registering both the Mark with Text and the Wordless Mark), the key question is whether Tesco’s prima facie case on this point is enough to shift the burden of proof and require a response from Lidl, such that the issue must go to trial. For the reasons identified by Mr Brandreth, I certainly cannot see that it is. Aside from the fact that Tesco has not pleaded details as to the registration of the Mark with Text prior to 1995 and has not sought to identify the class of goods covered by it, I fail to see how the mere existence of an overlapping mark is enough, without more, to undermine the presumption of good faith.

87. The second of the indicia on which Mr Malynicz relies is evergreening. However, I reject the contention in his written submissions that the mere act of re-registration/evergreening on its own is indicative of bad faith, or that paragraph [69] of Hasbro supports such a proposition. Indeed that passage appears to me to be wholly inconsistent with the proposition made by Mr Malynicz in his skeleton argument:

“69. The Board of Appeal’s reasoning, as summarised in [59]-[64] above, unambiguously shows that it is not the fact that an EU trade mark is re-filed that was found to be indicative of bad faith on the part of the applicant, but the fact that the information in the case file showed that the applicant had intentionally sought to circumvent a fundamental rule of EU trade mark law, namely that relating to proof of use, in order to derive an advantage therefrom to the detriment of the balance of the EU trade mark system established by the EU legislature.”

88. Neither the fact that there was no use, nor the fact that there were subsequent re-registrations is sufficient in itself to establish bad faith. Mr Malynicz accepted this during his oral submissions, just as he also acknowledged that it was always possible for there to be an innocent explanation for re-registration.

89. In the circumstances, Mr Malynicz’s argument on evergreening really came down to two points; the first is similar to the point he makes about the mere existence of the Mark with Text, namely that the mere existence of subsequent re-registrations raises a question mark over the purpose of those re-registrations in circumstances where they overlap with existing protection. In this context, Mr Malynicz showed me an excel spreadsheet prepared by a trainee trade mark attorney and exhibited to the second statement of Mr Whitehead (Tesco’s solicitor) which identifies the specific goods and services falling within each class covered by each filing. Mr Whitehead points out in his statement that the spreadsheet shows that some goods and services are identical to those in earlier filings and that some are covered by a broader or highly similar description to an earlier filing. Mr Malynicz pointed out the similarities with the original Wordless Mark, the inclusion of additional goods which appear (in his submission) almost “arbitrary” and contended that this is “a fingerprint of what we say is conduct which is not in accordance with honest practices”.

90. The second point is that evergreening in fact has nothing to do with use because it can be designed to circumvent the need to prove use (as was the case in Hasbro). This says Mr Malynicz, is the answer to McBride, because whether or not Mr Brandreth is correct in his interpretation of the reasoning in McBride, it does not apply to evergreening, which is unrelated to use.

91. I am not convinced by these points. The first point appears to me to be little more than speculation flowing from Tesco’s case that there has been no use of the Wordless Mark. Even assuming that case to be correct, I fail to see that the mere existence of overlapping filings is enough on its own to give rise to a prima facie case of bad faith.

92. As Mr Brandreth pointed out “the evolution over time of a logo intended as the graphic representation of a mark constitutes normal business practice” (see Pelicantravel.com s.r.o v OHIM, Pelikan Vertriebsgesellschaft mbH & Co KG (intervening) Case T-136-11 (“Pelikan”) at [36]). There is nothing on the face of Tesco’s pleading to support the proposition that the re-registrations must have been bogus and made no commercial sense (see by analogy Pelikan at [46]), much less has it pleaded anything to suggest that the mere fact of those re-registrations is capable of rebutting the presumption of good faith at the time of filing of the original Wordless Mark in 1995. In particular:

i) The assertion in paragraph 48.1 of the Counterclaim that the Additional Wordless Marks and the 2005 version of the Wordless Mark “duplicate coverage of various goods and services covered by the earlier mark” (the earlier mark apparently being a reference to the 1995 Wordless Mark), is not adequately particularised. What are the duplications alleged and how are they said to be material? How is it said that those alleged duplications (which appear to spawn the remainder of Tesco’s “evergreening” case) give rise to an inference of bad faith such that the presumption of good faith is overturned? If it is said (as Mr Malynicz submitted when drawing my attention to the excel spreadsheet) that the addition of new goods and services in later registrations is “arbitrary” and a “fingerprint” of dishonesty, why has that not been clearly and properly pleaded, as ought to have been the case where a plea that is tantamount to dishonesty is being advanced?

ii) The assertion in paragraph 48.3 of the Counterclaim that “the fact that Lidl considered it necessary to evergreen that 1995 mark in 2002, 2005 and 2007 is further proof of its bad faith at the date of application of the 1995 mark” is wholly unparticularised. During the hearing it appeared to be acknowledged by Mr Malynicz that the 2002 filing was well outside the grace period for the 1995 registration, a point which, if correct, would appear to negative any suggestion of bad faith. However, for reasons already identified I do not rely upon that point in this judgment. Nevertheless, I fail to see how the mere fact of an application for re-registration in 2002 (whether inside or outside the grace period), 2005 and 2007 is itself capable of giving rise to a prima facie case of bad faith in relation to the original 1995 registration.

iii) The assertion of bad faith in relation to the Additional Wordless Marks and the 2005 version of the Wordless Mark in paragraph 48.4 of the Counterclaim does no more than repeat paragraph 47 and assert that “the fact that those applications were made in order to evergreen an earlier trade mark is itself probative of bad faith in regards those later marks”. However, this pleading does no more than beg the question as to the purpose of the re-registrations. I fail to see how it can properly be asserted, without more, that the later registrations were made “in order to evergreen” the original Wordless Mark. In the circumstances I cannot see how this is “itself probative of bad faith in regards those later marks”. Certainly there is nothing pleaded that would give rise to a clear inference of bad faith.

iv) The assertion in paragraph 48.6 that “the fact of the 2021 evergreened applications stands as yet further evidence of bad faith regarding all prior applications for the Wordless Mark and the Additional Wordless Marks” is also wholly unparticularised.

93. On the subject of the excel spreadsheet illustrating the scope of the later applications for registration, I accept Mr Brandreth’s submissions that it is plain that although there was an overlap between the original application and the later applications, those applications were different in scope, covering different goods and services and relating to a larger geographical area (the 2002, 2005 and 2007 filings were intended to cover the EU). If Tesco intended to rely on specific points of detail arising in these applications in support of its Bad Faith Allegation it should have pleaded them. However, it has not done so. Instead Mr Malynicz has simply addressed me on his feet as to examples of overlapping classes etc. on which Tesco relies - to my mind this is not appropriate or sufficient in a case where bad faith is alleged.

94. As to the second point, whilst Hasbro is authority for the proposition that bad faith need not turn on the issue of non-use, here the case that is actually pleaded by Tesco appears to my mind to be obviously premised upon the alleged lack of use of the Wordless Mark. As Tesco says in its Counterclaim at 48.2, “there was no reason for Lidl to re-apply for the same marks and goods/services other than to avail itself of a fresh grace period during which it would not be required to show use of, in effect, the same marks”. There is no other objective, relevant or consistent indicia of bad faith on which Tesco relies in this context.

95. In my judgment, there is nothing in Tesco’s pleading which can positively be said to be consistent only with bad faith and although Mr Malynicz’s submissions were couched in terms of “paradigm bad faith” and the existence of the “finger print” of dishonest practices, I did not in fact detect him to suggest (at least during his oral submissions) that any aspect of the Bad Faith Allegation was only consistent with bad faith. Indeed it was an important part of his submissions that Tesco needed to see Lidl’s disclosure and evidence in due course “to bottom out” the true position in any event.

96. In my judgment, the test to be applied by the court at this stage should not in any event be whether what is pleaded is consistent only with bad faith - that would be an extremely exacting standard at a preliminary stage. Instead, it seems to me that the question to be determined is whether the Bad Faith Allegation is, or may be, sufficient to shift the evidential burden and lead to the rebuttal of the presumption of good faith (see Hasbro at [43])). Applying that test, I do not consider that Tesco is able to establish that its Counterclaim as pleaded discloses reasonable grounds for making the Bad Faith Allegation. Mr Malynicz has been forced to make various concessions during his oral submissions as recorded above. Tesco’s case as now presented ultimately boils down to the proposition that in the event of it being established that the Wordless Mark was not used, the mere existence of the Mark with Text combined with the pleaded examples of “evergreening” is enough to shift the burden to Lidl to provide a plausible explanation of the objectives and commercial logic pursued by its applications for the Wordless Mark and the Additional Wordless Marks.