Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

If you found BAILII useful today, could you please make a contribution?

Your donation will help us maintain and extend our databases of legal information. No contribution is too small. If every visitor this month donates, it will have a significant impact on BAILII's ability to continue providing free access to the law.

Thank you very much for your support!

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Northern Powerhouse Developments Ltd & Ors v Woodhouse [2023] EWHC 3124 (Ch) (20 December 2023)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2023/3124.html

Cite as: [2023] EWHC 3124 (Ch)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2023] EWHC 3124 (Ch)

Case No: BL-2019-001329

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

BUSINESS LIST (ChD)

The Rolls Building

London

Date: 20 December 2023

Before :

HER HONOUR JUDGE CLAIRE JACKSON

Sitting as a Judge of the High Court

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

(1) NORTHERN POWERHOUSE DEVELOPMENTS LIMITED (IN LIQUIDATION, ACTING BY ITS JOINT LIQUIDATORS ROBERT ARMSTRONG AND ANDREW KNOWLES)

(2) WOODHOUSE FAMILY LIMITED (IN LIQUIDATION, ACTING BY ITS JOINT LIQUIDATORS ROBERT ARMSTRONG AND ANDREW KNOWLES)

(3) LBHS MANAGEMENT LIMITED (IN LIQUIDATION, ACTING BY ITS JOINT LIQUIDATORS ROBERT ARMSTRONG AND ANDREW KNOWLES)

(4) FOURCROFT HOTEL (TENBY) LIMITED (IN LIQUIDATION, ACTING BY ITS JOINT LIQUIDATORS ROBERT ARMSTRONG AND ANDREW KNOWLES) |

Claimants |

|

|

|

|

|

|

-and- |

|

|

|

|

|

|

|

GAVIN LEE WOODHOUSE |

|

|

|

|

Defendant |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Mr Paul O'Doherty (instructed by Hewlett Swanson Limited) for the Claimants

Mr Max Cole (instructed by Preiskel & Co LLP) for the Defendant

Hearing dates: 10th to 20th November 2023

- - - - - - - - - - - - - - - - - - - - -

APPROVED JUDGMENT

This judgment was handed down remotely at 2pm on 20 December 2023 by circulation to the parties or their representatives by email and by release to The National Archives.

Her Honour Judge Claire Jackson :

1. The four Claimant companies, who act by their joint liquidators, Robert Armstrong and Andrew Knowles (as agents of the Claimants without personal liability) each bring claims against their sole director, Gavin Lee Woodhouse, for breach of his directors' duties and/or for repayment of sums owed to them by him pursuant to overdrawn directors' loan accounts operated by him in each of the Companies.

2. The claim of the Third and Fourth Claimants is brought as a debt claim for £20,000 per Claimant. The Defendant admits these claims and judgment will be entered accordingly.

3. The claims of the First and Second Claimants are admitted by the Defendant to an extent. The Defendant admits that he operated a director's loan account with each Claimant (together "the Loan Accounts"), that each loan account is overdrawn and that this is recoverable as a simple debt. The Defendant however puts the First and Second Claimants to proof of the sum due to each of them. The Defendant further denies that the sums are recoverable as a result of a breach of duties he owed to each respective Claimant.

4. This judgment follows the trial of the claim and deals with what sums are payable by the Defendant to the First and Second Claimants and on what basis (i.e. as a debt claim or as compensation for breach of duty). It does not address the remedies or form of Order the First and Second Claimants are entitled to as a result (e.g. tracing remedies, equitable compensation and/or continuation or dismissal of an extant freezing injunction). If this is not agreed by the parties following handing down of this judgment, then the form of the Order will be considered at a hearing listed on 6 February 2024.

Background

5. The Defendant was a joint founder of a business, the MBi Group, with a Robin Forster. The MBi Group operated within the care home, student housing and hotel sectors. The MBi Group raised money for its properties by promoting and selling rooms in properties to individuals (a process known as "unitised sales" or "fractional ownership"). The individuals were promised a yearly return on their monies (usually 10%) together with a full repayment with a bonus payment (usually 25%) at a future date (usually 10 years). The individuals had the option of paying less than 100% of the purchase price for the room by utilising the first three to four years' return to pay any deficit in the sums paid for the room ("developer deferred option"). The MBi Group schemes were a mixture of existing operational businesses and off-plan property development projects. Commission of 10% was paid to unregulated sales agents.

6. That business operated from 2012 to around 2016. In 2016 Mr Forster and the Defendant had a falling out and determined that they did not wish to continue in business together. The business of the MBi Group was therefore divided between them with the Defendant taking control, as sole director and member, of three of the companies which had formerly operated within the Group: MBi Hawthorn Care Limited ("Hawthorn"), MBi Clifton Moor Limited ("Clifton Moor") and MBi Smithy Bridge Limited ("Smithy Bridge"). Each of these companies was an off-plan care home project, with construction having started only on Smithy Bridge. Despite this returns were already being paid to those who had purchased rooms in the three developments. Clifton Moor was balance sheet insolvent as at 31 March 2016.

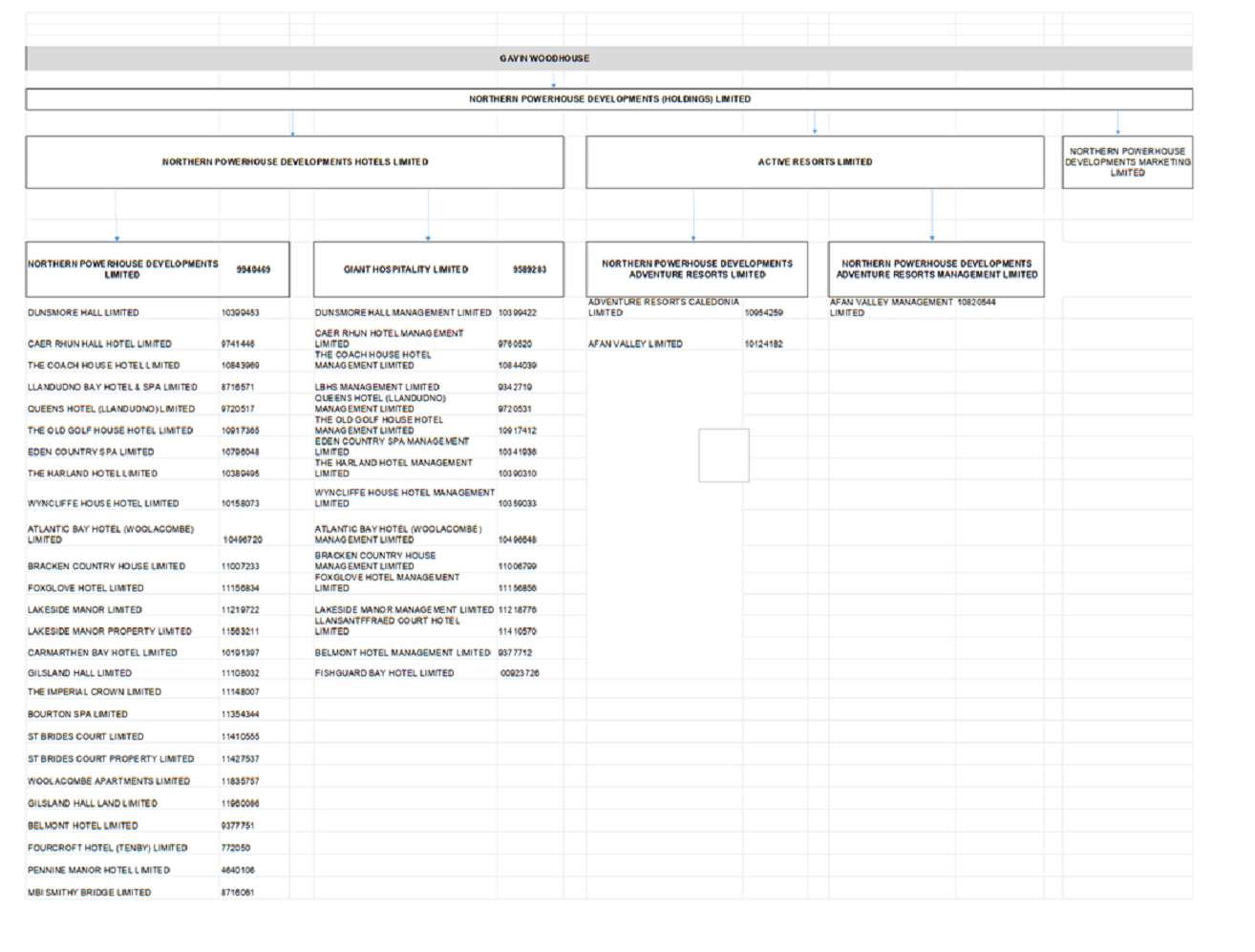

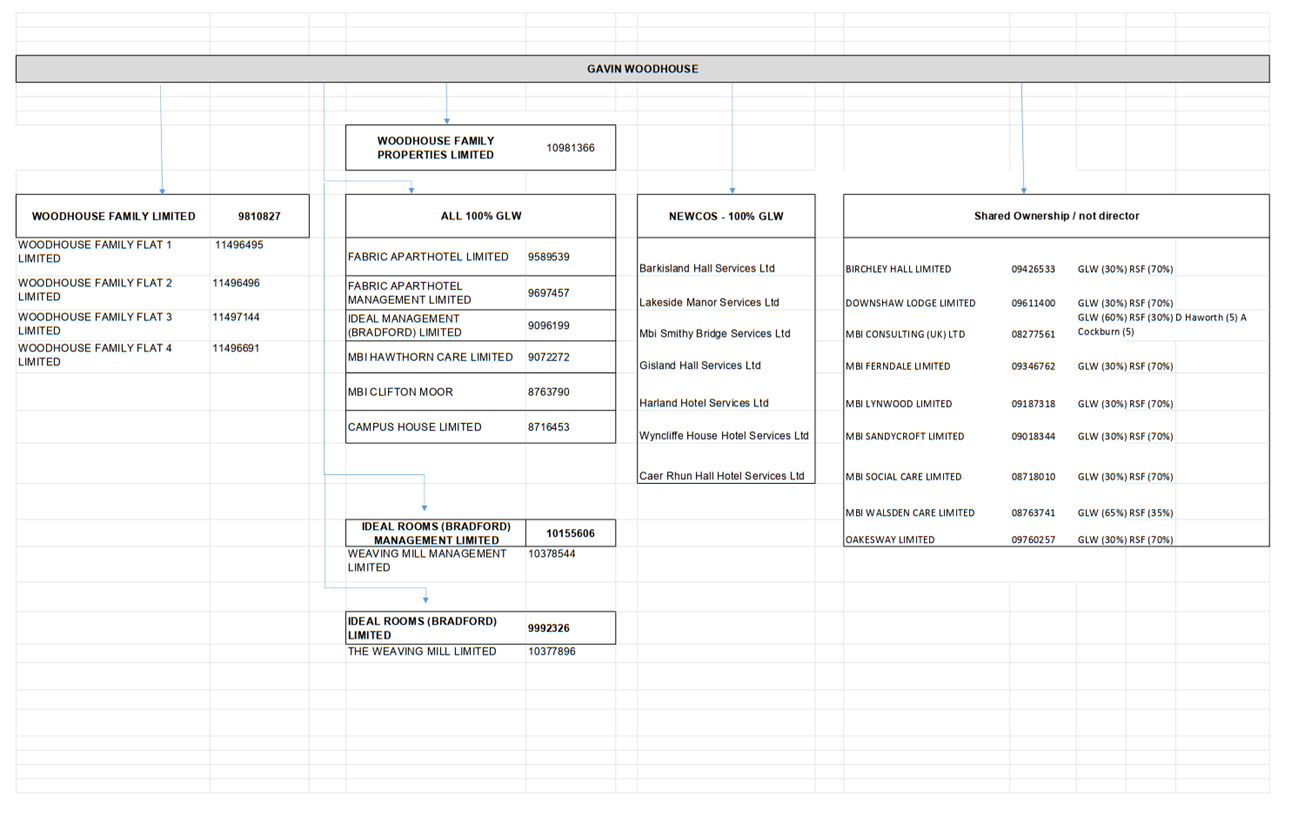

7. The Defendant then founded the Northern Powerhouse Developments Group (the "NPD Group"). An organisation chart of the Group and other companies operated by the Defendant is attached to this judgment at Appendix A.

8. At all material times, the Defendant was in control of, and was the ultimate beneficial owner of, the NPD Group. NPD Group operated from 2016 to July 2019. It operated, mainly, in the hotel and leisure sector, although its business model (i.e. unitised sales) was the same as the MBi Group. Ultimately the NPD Group operated or proposed to operate twenty-four hotels on this business model together with a leisure park. Each site was owned by a special purpose vehicle ("SPV").

9. The First Claimant is a company within the NPD Group used to promote and own the SPVs for hotels. For some hotels, the operation was conducted by a separate SPV, which was a wholly owned subsidiary of Giant Hospitality Limited ("Giant"), a sister company of the First Claimant. The Defendant was appointed the sole director of the First Claimant on incorporation on 6 January 2016 and remains the sole director. The First Claimant was placed into Interim Management on 7 July 2019, administration on 16 August 2019 and liquidation on 18 August 2022.

10. The three MBi companies were not initially, on paper, part of the NPD Group, however they did receive funding from it. Indeed, so far as Clifton Moor and Hawthorn were concerned, from 2016, the only means of paying returns to those who had bought rooms was through the NPD Group given that neither property had been constructed. By 31 March 2017 Clifton Moor owed the First Claimant £203,104 and Hawthorn owed the First Claimant £10,600 (debts entirely incurred in the year 1 April 2016 to 31 March 2017). The First Claimant was therefore funding the returns to individuals owed by those companies. Yet as at 31 March 2017 both Clifton Moor and Hawthorn were balance sheet insolvent, with millions due to creditors in the next year. Despite this, in Spring 2018 the Defendant told those who had bought rooms through those two companies that: "I am delighted to report we are now back on track and still in a position to deliver Hawthorn and Clifton Moor Care Homes, on time and on budget.".

11. In 2018 Smithy Bridge became a wholly owned subsidiary of the First Claimant. This transaction is considered in detail later in this judgment.

12. The Second Claimant is a company which was set up to hold investments for the Defendant and his family. It is not part of the NPD Group. The Defendant was appointed a director of the Second Claimant on its incorporation on 6 October 2015 and is now the sole director. The Defendant's wife, Charlotte Hannah Woodhouse, was also a director of the Second Claimant from 6 October 2015 but resigned on 28 June 2019. The Second Claimant was placed into administration on 29 July 2019 and liquidation on 23 July 2022.

13. The Third Claimant is a company which was formed for and participated in the operation of Llandudno Bay Hotel & Spa, one of the NPD Group hotels. The Defendant was a director of the Third Claimant from 20 July 2017 to 15 July 2019. The Third Claimant is a subsidiary of Giant. The Third Claimant went into administration on 13 August 2019 and liquidation on 3 December 2020.

14. The Fourth Claimant is a subsidiary company of the First Claimant. It was formed to promote and own the Fourcroft Hotel in Tenby, one of the NPD Group hotels. The Defendant was a director from 30 March 2017 to 9 July 2019. The Fourth Claimant went into administration on 8 August 2019 and liquidation on 3 December 2020.

15. Each of the Claimants is insolvent. Indeed, all the NPD Group companies are now in liquidation. The Claimants say that approximately £73 million was received by the NPD Group from individuals in relation to unitised sales up to July 2019.

16. At the date each of the Claimants entered into Interim Management or Administration the Defendant was indebted to them by way of overdrawn directors' loan accounts. In these proceedings the Claimants each seek to recover the sum showing in their respective account as due and owing to them.

17. I note that the bundles in this case were lengthy (exceeding 9,500 pages) with numerous additional pages of evidence or analysis handed up during the course of the hearing. As a result it is not possible for this judgment to refer to every piece of evidence submitted by the parties. I have however in preparing this judgment considered all documents the parties asked me to read or to which the Court or witnesses were referred during the trial. This includes Counsels submissions, the pleadings and the witness statements. A failure to refer to a document herein does not mean it was not considered by the Court.

The Claimant's Case

18. In his skeleton argument Mr O'Doherty, Counsel for the Claimants, summarised the claim as follows (cross-references removed for ease of reading):

"This case is centred around and about D's conduct in operating the businesses of NPD Ltd and WFL. ...

Cs contend that D was in wholesale breach of his directors' duties. These breaches can be summarised as follows:

i) D was the sole director of NPD Ltd, a business which promoted, operated and managed a series of collective investment schemes (the Schemes) through special purpose vehicle companies (SPVs) (the Investment Activities). It is Cs' case that the Investment Activities were unlawful: the Schemes were within the ambit of s.235 of the Financial Services and Markets Act 2000 (FSMA) which sets out the characteristics required for an investment scheme to be considered a collective investment scheme (CIS). The Investment Activities were carried out in breach of the general prohibition under s.19 FSMA. In order to carry out its business NPD Ltd was required to be authorised by the Financial Conduct Authority (FCA). It was not, and its promotion and operation of the CIS Schemes was a criminal offence and gave rise automatically to civil liabilities to the investors in the Schemes. NPD Ltd should not have traded at all, unless and until NPD Ltd was authorised by the FCA. D knew, or ought to have known that NPD Ltd's Investment Activities were unlawful; but in any event this matters not - as a matter of law Cs submit that it is clear that NPD Ltd was carrying out regulated activities where it was not appropriately authorised;

ii) D managed the NPD Group's Activities from January 2016 to July 2019, when NPD Ltd and a series of related companies were placed into interim management (which led to them being placed subsequently into administration and thereafter into liquidation). It is also Cs' case that, from the outset, it was clear that the businesses of NPD Ltd and the NPD Group, as well as being involved in the promotion and operation of unlawful CISs, were financially unsustainable and insolvent;

iii) During the course of the operation of NPD Ltd, D extracted significant sums from NPD Ltd and WFL, by way of director's loan account (DLA) drawings, for his own personal gain. D had also done this previously in the MBi Group. After the split with Mr Forster, NPD Ltd was left supporting earlier defunct MBi Group Schemes. The DLA drawings, which supported an expensive lifestyle for D, were extracted when it was clear that none of the Schemes (either NPD Group Schemes or MBi Group Schemes) had reached profitability and could not afford their own operational and financing costs, let alone support D's significant DLA drawings (paid on top of a substantial salary). NPD Ltd and WFL were insolvent and these drawings were extracted in breach of D's duties to the creditors of each;

iv) D admits that the DLAs are repayable but not the amount that is owed, nor that the DLAs were run up in breach of duty. Cs rely at trial on a detailed analysis of the NPD Ltd's and WFL's DLAs, undertaken from the books and records of Cs by Victoria Richards (Ms Richards) of the joint liquidators' team, to prove the quantum of the outstanding DLAs;

v) WFL was a separate business to NPD Ltd. WFL was a business set up, D says, to manage his family's personal investments. In managing the operation of WFL's business, D utilised assets from NPD Group Schemes, to build up a portfolio of buy-to-let property assets. WFL did not pay for these assets, rather, it built up a significant inter-company loan to NPD Ltd, which remains outstanding. Cs say that this was a misuse of NPD Ltd's assets (which had been funded by moneys received from investors in the various NPD Group Schemes). D's explanation of why he managed the business of WFL in this way, using NPD Group investors' moneys, lacks any credibility;

vi) Overall, Cs submit that it can be inferred from the circumstances of the Investment Activities that D's conduct was dishonest. NPD Ltd was insolvent, none of the Schemes were profitable, and D knew (or ought to have known) that the funds that he had drawn were required for the purposes of, not least to complete and deliver, the NPD Group Schemes as promoted to their investors. As to his dishonesty, the court must first ascertain (subjectively) the actual state of the individual's knowledge or belief as to the relevant facts. The court must then determine whether the individual's conduct was honest or dishonest by applying the (objective) standards of ordinary decent people. There is no requirement that the individual was subjectively aware that, by those standards, they have behaved dishonestly: Ivey v Genting Casinos (UK) Ltd (trading as Crockfords Club) [2017] UKSC 67;[2018] AC 391 paragraphs 62 and 74. It is submitted that, against this test, it is clear that D acted dishonestly.

vii) It should be noted that even if the court is not satisfied that NPD Ltd and the NPD Group Companies generally were insolvent at any given point, which Cs submit they clearly were, none of the Schemes had made any profit and therefore it was wholly wrong for D to have drawn any money by way of DLAs. By doing so he was funding an extravagant lifestyle with investors' money when the Schemes had not been completed and had not achieved profitability. A number of the off-plan schemes had not even been constructed over 3 years after investment moneys had been raised and at D's direction paid away. The fact that the DLAs were drawn in the context of the insolvency of NPD Ltd and the NPD Group generally, whilst these companies were conducting an unlawful CIS, make D's conduct even more egregious.

viii) Cs seek proprietary remedies against D, and personal remedies in the alternative. NPD Ltd claims the sum of £1,522,228 [being the amount of the overdrawn loan account of £559,228 and reversal of a credit to the Directors loan account relating to MBi Smithy Bridge in the sum of £963,000] in total, plus compound interest of £453,344 at 8%, being £1,975,572. WFL claims the sum of £798,963 in total, plus compound interest of £319,007 at 8%, being £1,117,970."

The Defendant's Case

19. The Defendant accepts part of the Claimants' claims but denies breach of duty in any of the ways claimed by the Claimants. The Defendant's position was further outlined in the skeleton argument for trial by Mr Cole, Counsel for the Defendant (cross-references removed for ease of reading):

"D accepts his liability to repay the value of his loan accounts. In the case of C1 and C2 he requires the sums to be quantified.

In the case of C3 and C4 he accepts that he received loans from each in the sum of £20,000.

This apparently straightforward claim is beset by a pleaded case which is excessively complicated and, in crucial respects, lacking in particulars. This is clear from D's Defence. It has not been improved by two subsequent rounds of amendments and a Response to a request for further information under CPR 18. These are not simply "pleading points"; they affect the substance of the claims advanced and fairness to D in respect of the claims he is required to meet.

...

This is not a claim about how monies came into Cs, or (more generally) how the business of the NPD group (and associated companies) was conducted.

...

They may be matters of great importance to individuals such as Allaway, Aggarwal and Devadoss and they may be of interest to the office holders of the companies in the NPD group in their general investigations. But they are outside the proper of scope of these proceedings. That is a consequence of the way in which Cs have pleaded their case and framed the relief sought.

This is a case about money paid out of Cs to D. Since the amounts paid of C3 and C4 are admitted, and are not said to be a breach of fiduciary duty, the focus of enquiry is on C1 and C2: what was the amount of the payments and were they a breach of fiduciary duty?

...

D's position on the loan accounts is as follows:

C1: £615,468 - Cs are required to prove the sum claimed [note the sum claimed was reduced by the Claimants in their skeleton argument to £559,228]

C2: £798,863 - Cs are required to prove the sum claimed

C3: £20,000 - admitted

C4: £20,000 - admitted

...

The value of the shares in MBi Smithy Bridge Limited as at 21 December 2107 (sic) was £963,000. This was the valuation given by C1's Finance Director Robert Atkin and used by C1's external advisers in advising C1 in the tax consequences of the transaction. Cs have not produced any evidence to suggest that Mr Atkin's valuation was wrong. In those circumstances D submits that Cs have no proper basis to dispute that valuation and it should be adopted by the court.

...

D's case is that the sums paid out of C1 and C2 were directors loans. D relies on the fact that:

i) each transaction was recorded in the relevant company's sage account as directors loans;

ii) In the case of C1 the company's finance director treated them as such for year end tax and accounting purposes;

iii) D does not dispute his obligation to repay the sums in question and has never done so (so that he does not, for instance say that they should be treated as remuneration or dividends).

Since D accepts that he must repay the value of his loan account, the question of whether these monies were paid in breach of duty is relevant only to the nature of the remedies available - in particular whether C1 or C2 is able to assert a proprietary claim and constructive trust over the loan monies."

The Law

20. The claim before the Court is a civil claim. The relevant standard of proof is therefore the balance of probabilities. This has been applied throughout the judgment. The burden of proof generally lies on the person asserting a claim and therefore in this case it generally lies on the Claimants. However, in relation to the items for which the Defendant seeks credit on the Loan Accounts the burden of proof is on the Defendant (see paragraph 21(v) below).

21. Counsel were broadly agreed on the legal principles applicable to the claim, albeit they relied on different precedent cases to come to the same principle. The agreed applicable principles were:

i) Given that this is a commercial case the Court should prefer contemporaneous documentary evidence and accounting records to oral evidence: Blue v Ashley [2017] EWHC 1928 (Comm);

ii) The duties owed by a director to a company are now set out in sections 171 to 177 of the Companies Act 2006 ("the 2006 Act"). I do not set out the duties in this judgment but have had full regard to the provisions when preparing this judgment;

iii) The duties are owed to an individual company even if the company is part of a corporate group. The Court should also have regard to sections 180, 197, 213 and 239 of the 2006 Act;

iv) The statutory provisions applicable to a regulated investment scheme are sections 19-25 and 235 of the Financial Services and Markets Act 2000 ("FSMA");

v) As a director challenging entries on his directors' loan accounts the Defendant bears the onus of proof on items for which he is seeking credit: GHLM Trading Ltd v Maroo [2012] EWHC 61(Ch) and Re Idessa (UK) Limited [2011] EWHC 804;

vi) Section 1157 of the 2006 Act cannot be relied upon by the Defendant so as to relieve him of liability where he received monies from a company (Henderson & Jones Limited v Price [2020] EWHC 3276 (Ch) at 62);

vii) The test for dishonesty is that set by Ivey v Genting Casinos (UK) Ltd (trading as Crockfords Club) [2017] UKSC 67. The Court must first ascertain (subjectively) the actual state of the individual's knowledge or belief as to the relevant facts. The Court must then determine whether the individual's conduct was honest or dishonest by applying the (objective) standards of ordinary decent people. There is no requirement that the individual was subjectively aware that, by those standards, they have behaved dishonestly;

viii) Whilst directors of a company are not strictly speaking trustees of company property they are treated as such as respects company assets which are under their control: Auden McKenzie (Pharma Division) Ltd v Patel [2019] EWCA Civ 2291 and JJ Harrison (Properties) Limited v Harrison (CA) [2001] EWCA Civ 1467, and;

ix) Where a director disposes of company property in breach of their fiduciary duty that breach is also treated as a breach of trust.

22. Mr O'Doherty additionally relied on the following principles:

i) The correct approach to determining whether a power was exercised for a proper purpose (section 171 of the 2006 Act) is set out in Extrasure Travel Insurances Ltd v Scattergood [2003] 1 B.C.L.C. 598; [2003] C.L.Y. 523 at [92]:

"92. The law relating to proper purposes is clear, and was not in issue. It is unnecessary for a claimant to prove that a director was dishonest, or that he knew he was pursuing a collateral purpose. In that sense, the test is an objective one. It was suggested by the parties that the court must apply a three-part test, but it may be more convenient to add a fourth stage. The court must:

92.1. identify the power whose exercise is in question;

92.2. identify the proper purpose for which that power was delegated to the directors;

92.3. identify the substantial purpose for which the power was in fact exercised; and

92.4. decide whether that purpose was proper."

ii) Where the power in question is to deal with the company's assets in the course of its business, the proper purpose is to advance the company's business and commercial interests: Re HLC Environmental Projects Ltd [2013] EWHC 2876;

iii) The duty under section 172 of the 2006 Act is to promote the success of the company for the benefit of its members, not to promote the interests of its members directly: Palmer's Company Law (Looseleaf, updated April 2022) at 8.2605. Section 172(3) includes the "creditor duty" or the "rule in West Mercia": BTI 2014 LLC v Sequana SA [2022] UKSC 25; [2022] Bus LR 920. Where the creditor duty is engaged, the directors have a duty to consider the interests of creditors. The creditor duty is engaged when the directors know or ought to know that either: (a) the company is insolvent or bordering on insolvency; or (b) an insolvent liquidation or administration is probable: Sequana. Members cannot ratify a decision of the directors "which is either (i) made at a time when the company is already insolvent or (ii) the implementation of which would render the company insolvent": Sequana, paragraph [149]. The insolvency of the company can also change the duty from a subjective duty to an objective duty: Re HLC Environmental Projects Ltd [2013] EWHC 2876 (Ch) at 91-92;

iv) Section 235 of FSMA is satisfied in respect of assets where the investors collectively surrender control over their property to the operator of a scheme so that it can be either pooled or managed in common in return for a share of the profits generated by the collective fund: FCA v Asset LI Inc [2016] UKSC 17, and;

v) Where a person has sought and obtained a legal opinion as to the legality of his activities or confirmation as to particular treatments from the FCA based on a false or knowingly incomplete set of facts, that can be clear confirmation both of the existence of a suspicion of a breach of the statute, and a desire for the true position not to be investigated: Financial Conduct Authority v Forster [2023] EWHC 1973 (Ch).

23. Mr Cole relied on two additional authorities:

i) A loan made to a director is not of itself a misapplication of the company's monies (or put another way a breach of fiduciary duty): Re Ciro Citterio Menswear plc v Thakrar [2002] EWHC 622 (Ch), and;

ii) In relation to inferences drawn from a failure to call a witness at trial the applicable principle is that set out in Wisniewski v Central Manchester Health Authority [1998] PIQR 324 at 340:

"1. In certain circumstances a court may be entitled to draw adverse inferences from the absence or silence of a witness who might be expected to have material evidence to give on an issue in an action. 2. If a court is willing to draw such inferences, they may go to strengthen the evidence adduced on that issue by the other party or to weaken the evidence, if any, adduced by the party who might reasonably have been expected to call the witness. 3. There must, however, have been some evidence, however weak, adduced by the former on the matter in question before the court is entitled to draw the desired inference: in other words, there must be a case to answer on that issue. 4. If the reason for the witness's absence or silence satisfies the court, then no such adverse inference may be drawn. If, on the other hand, there is some credible explanation given, even if it is not wholly satisfactory, the potentially detrimental effect of his/her absence or silence may be reduced or nullified."

24. Having read the authorities filed by the parties I accept that the principles set out above are derived from the relevant authority. When considering the relevant issues in the case I have applied the principles.

The Issues

25. The parties filed a lengthy agreed list of issues for trial. The list read as follows:

Valuations

1. What was the total outstanding value of D's director's loan account (DLA) with

each C?

Cs allege as follows:

C1: £[559,228]

C2: £798,863

C3: £20,000

C4: £20,000

2. What is the total outstanding value of the "inter-company transfers" made from C1 to C2 and three other companies within the NPD Group as set out below (whilst these are not pursued as a money claim, Cs seek a finding as to how much was transferred as corroboration for Cs' allegations of breach of duty in respect of the sums set out at paragraph 1 above):-

Cs allege as follows:

To Ideal Management Limited: £237,646

To Ideal Rooms Limited: £405,918

To C2: £2,305,809

To Campus House Limited (CHL): £77,219

3. What was the value of D's shares in MBi Smithy Bridge Limited as at 21

December 2017?3

Breach of directors' duties

4. In relation to his DLA with each of C1 and C2, did D:

a. make payments which did not relate to the proper business of C1 and C2?

b. Use company assets for improper purposes?

c. Misuse company assets?

5. Did D raise investments into unregulated investment schemes, where the schemes were regulated under FSMA 2000 and could only be promoted/operated by regulated entities?

6. Did D continue to trade and raise investment monies from investors when C1 (and other companies) were insolvent and had no prospect of trading out of insolvency?

7. In each case, did D breach his duties as a director/fiduciary duties to C1 or C2?

8. Did D breach his duties as a director/fiduciary duties by authorising the purchase by C1 from D of his shares in MBi Smithy Bridge Limited and crediting his loan account with C1 with the £963,000 consideration?

9. Did D breach his duties as a director/fiduciary duties by transferring (or

authorising the transfer) of the "inter-company transfers" (set out in [issue 2] above)?

10. If D breached his duties in the ways outlined above, were those breaches

Dishonest?

11. If D has breached his duties in the ways outlined above to what remedies are C1/C2 entitled?

12. Is D entitled to relief under s1157 of the Companies Act 2006?

Restitution

13. Is C1 entitled to repayment/restitution of the value of D's DLA with C1?

14. Is C2 entitled to repayment/restitution of the value of D's DLA with C2?

Claim in negligence

15. This claim is not pursued.

Claim in contract

16. Is C1 entitled to claim as a debt, alternatively damages for:

a. the value of D's DLA with C1;

b. £963,000 (the consideration paid for D's shares MBi Smithy Bridge

Limited)?

17. Is C2 entitled to claim as a debt, alternatively damages the value of D's DLA with C2?

18. Is C3 entitled to claim as a debt, alternatively damages the value of D's DLA with C3?

19. Is C4 entitled to claim as a debt, alternatively damages the value of D's DLA with C4?

26. Upon reading the papers for the trial I appreciated that this was a comprehensive list of all the issues raised by the pleadings in the case, but it was not a list focused on the real issues between the parties or the key issues the Court would need to determine at trial.

27. A more concise list of the key issues in the case would have been:

i) Did the Defendant operate the First Claimant and its SPVs lawfully?

ii) Did the Defendant wrongly take monies for himself from the First and Second Claimant and, if so, how much?

iii) Did the Defendant otherwise wrongly deprive the First and Second Claimants of money?

iv) What remedies should be granted given the findings on the above?

28. At the start of the trial Mr Cole made a request for a ruling by the Court that the issues regarding whether the Defendant had breached his duties to the First and Second Claimants by operating unregulated investment schemes should be struck out. I was aware from my pre-reading that a similar application had been made, and determined, at the Pre-Trial Review by Joanne Wicks KC sitting as a Deputy Judge of the High Court. The relevant Order from that hearing provided that "The Defendant's application for an order pursuant to CPR 3.1(2)(k) is dismissed. The Defendant has permission to restore at trial before the trial judge."

29. No formal application to restore was made prior to the trial and indeed Mr Cole's skeleton argument noted that "D anticipates that the court will not wish to make determinations before Cs put their case. However the court is asked to have these matters in mind." Despite this in his opening submissions Mr Cole invited the Court to strike out parts of the claim. I did not do so for reasons explained on day one of the trial.

30. Instead, I provided guidance to the parties as to how I would deal with the case. I therefore informed the parties that I would hear all the evidence they wanted to put before the Court but I would then decide the case on the key issues before the Court. I would not engage with issues which did not impact on the outcome of the case or likely remedies Therefore given no relief was sought in relation to items 1 and 3 of the concise list following the narrowing of relief sought by the Claimants in their skeleton argument at paragraph 160, the key issues were 2 and 4 and that would be where I would concentrate. I accepted however that to answer issue 2 I may need to consider the other wider issues raised in the case, especially group insolvency and inter-company loans given the decision in Sequana.

31. I confirmed to Mr Cole that given the serious consequences for the Defendant in relation to the Court's potential findings on the unregulated investment scheme point that I would only address this if necessary and that I would at the relevant times during his evidence ensure that the Defendant received a warning against self-incrimination.

32. At the close of Day 6 of the trial, and prior to the parties preparing their closing submissions, Mr Cole sought further confirmation from the Court as to whether the Court was proposing to consider remedies in this judgment. Having heard from Mr Cole and Mr O'Doherty I confirmed that this judgment would deal with two broad topics: How much was the Defendant indebted to a particular company for and how was the Defendant indebted to each company (i.e. simple debt, or breach of duty I note that the parties did not address the restitution or contractual damages claims at trial). The parties could then consider whether they could agree the remedy that the Claimants were entitled to and, if this could not be agreed, it would be addressed at a hearing.

The Witnesses

33. The Court received witness statements from five witnesses: Four for the Claimants and one for the Defendant. Hearsay notices were filed on behalf of three of the Claimants' witnesses: Mr Devadoss, Ms Allaway and Mr Aggarwal. The hearsay notices state that the evidence "is peripheral in nature". I have therefore read the statements of those witnesses and have taken them into account in reaching my decision. However, I have borne in mind that the witnesses were not subject to scrutiny on the contents of their statements and that on the Claimants' case they are, in any event, peripheral to the issues before me (the Defendant says that they are irrelevant). I have therefore placed limited weight on those statement unless otherwise stated in this judgment.

34. The remaining witnesses attended trial and gave evidence to the Court. My findings on the witnesses are as follows:

i) Victoria Richards: Ms Richards was a straightforward witness who accepted she had no contemporaneous knowledge of the operation of the Claimants or of the transactions and entries in the Loan Accounts. This is unsurprising given Ms Richards is an employee of the firm of the office holders.

ii) Ms Richards gave her evidence in a precise, controlled and compelling manner. She did not stray beyond the limits of her actual knowledge. She corrected Counsel when they made mistakes but equally made concessions, for example in relation to the Brierstone invoices. She answered all questions openly. Her evidence was supported by the documentation she placed before the Court. In my judgment she was a credible witness.

iii) Mr Woodhouse: The Defendant is plainly an intelligent individual. He is also an individual who can be persuasive when dealing with others. After all he was able to establish and operate for three years a web of companies with interlocking financial relationships and to obtain money for those companies running to over £70,000,000 from many individuals and from finance companies.

iv) As a witness however the Defendant was not compelling and was not credible. He frequently did not answer the question asked of him, even when the right against self-incrimination was not relevant. For example, when asked about monies that were paid into NPD Group he would answer not by reference to money but by reference to conversations. He would also confuse finance facilities which were available to the First Claimant with discussions he was having with finance providers for facilities. When he did answer questions his answers were frequently unclear, confused the Group with other companies and himself, and appeared to be attempts by him to distort or confuse issues rather than to provide information to the Court, for example in relation to Biomass boilers.

v) In his witness statement and in his oral evidence the Defendant sought to explain how entries could have been incorrectly entered onto his Loan Accounts with the First and Second Claimant. The explanation given by the Defendant was:

"I cannot explain why the various entries described above have been logged in against my DLA. They should have been logged in against the business ledger. I do not know why they have not been. I did not manually enter these transactions. I am not trying to point fingers but it was really a job of a book keeper to ensure various expenses are recorded in correct ledgers. This is clearly not the case here. The invoices were not apportioned when they should have been and business expenses are said to be my personal expenses. As can be seen from my DLA, a lot of the entries were entered by Victoria Wetherill, an accountant, who at the time was in an intimate relationship with Dax Bradley and expecting a baby. It is not impossible that her attention got diverted away because of these events and mistakes happened. I cannot be held responsible for incompetency of other people, I am not an accountant. A lot of the entries were entered by Victoria Wetherill, an accountant. She made mistakes. However, I do think that Victoria Richards should have spotted at least some of these."

vi) The Defendant's position is therefore he does not know why errors occurred but he is willing to engage in speculation and guesswork as to why this is the case. This was a repeated theme of the Defendant's evidence. As will be noted below in relation to the Loan Accounts, the Defendant on many occasions did not know why he was challenging an entry or how much of an entry he was challenging so he would simply engage in guesswork or hypothesis and then come up with a figure he was willing to dispute. Guesswork is not evidence. Nor is hypothesis. An honest witness knows that and simply accepts what they do not know.

vii) In any event the guesswork engaged in by the Defendant was frequently obviously wrong on the documents before the Court and his guesswork on the particular point above is demonstrably wrong from a review of the Loan Accounts. Leaving to one side that people who are in a relationship and who are pregnant are frequently able to hold down extremely senior jobs without making mistakes, whilst Ms Wetherill did make entries on both Loan Accounts she did not make the majority of entries, or even a lot of entries, on either account. So far as the First Claimant's loan account is concerned there are approximately 210 entries of which Ms Wetherill made 46, so less than 21%, and for the Second Claimant's loan account there are 15 entries of which Ms Wetherill made one entry (6%). Further of the entries challenged by the Defendant in the First Claimant's loan account seven out of twenty-seven entries (25%) were made by Ms Wetherill and none of the entries challenged in the Second Claimant's loan account were made by Ms Weatherill.

viii) Overall, the distinct impression I was left with was that the Defendant did not recognise the distinct legal personality of each company or that a company's assets did not belong to him as the ultimate sole shareholder. He did understand basic principles of company finances including that capital and turnover are not the same as profit but he did not want to admit this to the Court as he knew it undermined his actions in relation to the companies. Indeed, having heard the Defendant give evidence it was clear that he did not want to accept he had done anything wrong. He therefore sought to use his time in the witness box to create explanations for his actions. They were not believable. Even if therefore Counsel had not agreed that the Court should prefer contemporaneous documentary evidence over oral testimony I would prefer such documents to the testimony of Mr Woodhouse which lacked credibility, and integrity.

How much is due under the Defendant's Directors Loan account with the First Claimant ("the Loan Account")

The Account Entries

35. The correct sum due under the Loan Account operated by the Defendant with the First Claimant was the subject of a number of concessions by both sides in the lead up to, and at, trial. Counsel agreed in closing submissions that, taking into account all concessions made, the balance the First Claimant sought to recover was £552,564 and that the Defendant challenged 27 entries on the Loan Account seeking deductions of £414,889.

36. Given that the parties agree that the Defendant operated a loan account with the First Claimant and that this was overdrawn the burden of proof is on the Defendant to show why any particular item on the Loan Account is incorrect.

37. I set out at paragraphs 34v-vii above the Defendant's evidence on why there were errors on the Loan Accounts and that this evidence amounted to guesswork not supported by the documents before the Court. I am therefore satisfied that the Defendant's explanation for why errors were made on the Loan Accounts is not sufficient to show that the entries generally are wrong. His explanation is unsubstantiated guesswork which is undermined by the actual evidence before the Court. I therefore turn to the 27 individual item challenges. Given however many of the challenges are the same or similar to other challenged entries I consider them under composite headings. To aid the reader of the judgment in understanding the challenged entries, my judgment and the effect of this on the Loan Account is set out in tabular form at Appendix B to this judgment. Reference to the entries in this section of the judgment are by way of cross reference to the line on which the entry is found in the nominal ledger of the Loan Account ("the Ledger").

Brierstone Invoices

38. The Defendant challenged 6 entries on the Loan Account relating to invoices submitted by Brierstone for construction work. Brierstone was a construction company which operated from the NPD Group premises. It undertook work on NPD Group premises, the premises of other companies owned or operated by the Defendant and on the Defendant's residential property, Barkisland Hall.

39. Each of the entries challenged by the Defendant is supported by a contemporaneous invoice. The invoices can be divided into three categories:

i) Entries 25, 60 and 70: These are invoices addressed to the Defendant at his residential property. They state that they are for work undertaken "To valuation [x] at the above". They are stamped as having been processed by the First Claimant's accounts team and show the Loan Account as the relevant nominal account;

ii) Entry 33: This is an invoice addressed to the Defendant at his residential property. It states that it is for work undertaken "To valuation 3 at the above". It has not been stamped by the First Claimant's accounts team;

iii) Entries 108 and 155. These are invoices addressed to the Defendant at his residential property. They state on their face that they are for "works carried out at Barkisland Hall".

40. Each entry on the Loan Account is therefore supported by an invoice from the contractor. Each invoice refers to the work being carried out at Barkisland Hall, either directly or by implication. Each invoice is addressed to the Defendant and not to the First Claimant.

41. Against this, the evidence of the Defendant was that without seeing the valuations referred to in each of the invoices he could not state whether the work was undertaken to Barkisland Hall, NPD Properties or Barkisland Cottages. As a result the Defendant's position at trial was "I have no means of exact apportionment, but I would estimate that around 50% of work done by Brierstones was carried out on Barkisland Hall and the remaining 50% on the hotel sites. 50% of the Brierstone invoices, except for Item 38 below, is £359,375."

42. The Court therefore has clear contemporaneous documents all of which refer directly or indirectly to works at Barkisland Hall, with three of the indirect invoices having been stamped by the First Claimant's accounts team as being personal expenditure. Against that is guesswork by the Defendant.

43. In my judgment the contemporaneous documents should be preferred to the Defendant's objections given first the burden of proof and second the clarity of the invoices.

44. In this later regard I note that the Defendant's position is based on an incorrect statement regarding the evidence before the Court. As noted only four of the invoices refer to valuations. Two of the invoices are extremely clear and refer solely to work carried out at Barkisland Hall. There can be no confusion as to the location of works to which those invoices relate. The lumping together of the explicit invoices with the valuation invoices in my judgment shows that the Defendant's objections to the invoices from Brierstone is a smokescreen devoid of any factual basis. It is an objection which seeks to exploit indirect wording. Yet the four indirect invoices still state that the work was carried out "at the above" and the only property shown above is Barkisland Hall. Therefore, even reading those four invoices in the most favourable way to the Defendant there is no doubt as to the location of the works.

45. I therefore dismiss this dispute and order that there be no adjustment to the Loan Account in this regard.

Land Rover Payments

46. The Defendant challenges seven entries on the Loan Account relating to payments toward a Land Rover. There is no contemporaneous documentation relating to the payments save for the Ledger entries. The Ledger shows that entries were made contemporaneously by the accounts team of the First Claimant by way of reference to bank payments to Brierstone for "Gavins car" or "GW car".

47. Ms Richards accepted that she did not have first-hand knowledge of what the car was used for or who it was used by. However, she stated that it did not make sense for payments to be made to Brierstone if the car was a company car. The First Claimant therefore relied on the Ledger.

48. The Defendant's witness statement asserts that the vehicle was used by a lot of the First Claimant's employees. He therefore asserts that it was a company car and therefore the payments relating to it were a business expense.

49. In his oral evidence the Defendant stated that he was buying the car from Brierstone. However, the transaction had not completed and therefore Dax Bradley rented the car to the First Claimant until the sale completed and therefore the payments were a business expense.

50. The Defendant has therefore sought to give two reasons why the payments were a business expense. Those explanations are not consistent and in my judgment, it was obvious from the Defendant's demeanour when giving evidence on this point that the Defendant was changing his evidence as he knew his written account did not stand scrutiny but that even he had no belief in his new account.

51. Leaving this to one side however, simply because a car is used by other employees of a business this does not make a car a business asset and hence all expenses relating to the car a business expense. As the Ledger makes clear this was a vehicle sourced from Brierstone as a vehicle for the Defendant, not for the First Claimant. The fact that the Defendant let others use the vehicle did not mean the vehicle belonged to the First Claimant so as to make it a company car, nor did it make the First Claimant liable for the cost of the car. I accept it may have entitled the Defendant to seek to recover some of the running costs of the vehicle e.g. fuel or mileage. That has not been sought.

52. Having considered the evidence before me on this point I find that the payments were properly accounted for on the Loan Account. No adjustment is made in this regard.

Furniture

53. The Defendant challenges two entries on the Loan Account relating to furniture supplied by Top Secret Furniture. The Ledger notes that the entries relate to "chairs and seaters for Gavin" and "wing desk and chair for Gavin".

54. The invoices for the furniture are in the papers before the Court. They are addressed to the First Claimant. Each invoice is stamped by the First Claimant's accounts team who have entered the Loan Account details as the relevant ledger together with a notation that such posting has been authorised by "Gavin". The Defendant accepts that he was the only Gavin who worked at the First Claimant.

55. The Defendant points to the invoices being addressed to the First Claimant as evidence that the invoices are a business expense. He also asserts that the furniture went to the First Claimant's offices in Halifax and Caer Rhun Hall. Further furniture at Barkisland Hall as supplied under the invoices was swapped with Caer Rhun Hall. The Defendant therefore accepts 30% of the first invoice. He disputes the entire second invoice stating that this was for his room in the Group office in Halifax and was therefore a business expense. The Defendant's evidence was that he did not recall authorising the invoice to be put on the Loan Account.

56. Looking at all the evidence before the Court the Defendant has not shown that on the balance of probabilities the furniture supplied was a business expense. The contemporaneous evidence is extremely clear: The accounts staff who dealt with the invoices at the relevant time considered that the expense was personal to the Defendant and they were authorised to post the entry to the Loan Account by the Defendant. The inability of the Defendant to remember such authorisation does not mean it did not happen. Given the contemporaneous evidence the furniture was a personal expenditure by the Defendant. The fact that the Defendant may have, subsequent to its purchase, chosen to put it into the Group office or to swap pieces of it with property in a hotel does not change the basis of the expenditure.

57. No adjustment is made in this regard.

Gramra Incinerator

58. The Defendant challenges two entries on the Loan Account relating to a Gramra incinerator. The Ledger shows that the entries were made on two separate occasions by different individuals (neither of whom were Ms Wetherill). The entries show that two sources of information were used for the entries: First electronic bank payments, and, second "POS".

59. In his witness statement the Defendant stated that Gramra Limited was a company purchased by the First Claimant to manufacture and create a new style incinerator. The Defendant states that the payments referred to are payments made on behalf of Gramra which were posted on his ledger pending a new ledger being set up for Gramra.

60. In his oral evidence the Defendant was less clear as to who owned Gramra. The Defendant continued to assert that the expense, being the cost for developing the incinerator for use in the NPD Group, was not a personal expense.

61. Ms Richard's evidence was that she did not believe Gramra Limited was ever owned by the First Claimant. She understood it was owned by the Defendant. She could not understand why items would be posted to one ledger when all that needed to be done was to set up a new ledger which was a quick process. In the interim the invoice could have been posted to a suspense ledger. Ms Richards therefore questioned the accounting methodology used if the Defendant was correct in his assertions.

62. This is an issue which can easily be resolved by having regard to publicly available documents accessible from Companies House. Gramra Limited was a company (it is now dissolved) which originally had one issued share. That share was transferred to Shays Assets Limited on 25 January 2018. A further 99 shares were issued around 17 April 2018 and 50 of those shares were owned by the Second Claimant. The Defendant was a director of Gramra Limited from 13 June 2018, but he was not a shareholder.

63. Grama Limited was not therefore a company owned by the First Claimant or by the Defendant. It was a company owned (in part) at the relevant dates by the Second Claimant. If invoices were delivered to Gramra Limited which required settlement but settlement came from the First Claimant's accounts then either it should have been posted to an account in the name of Gramra Limited or to the Second Claimant's account. There was no basis to post the entry against the Loan Account. This is supported by notations on a debit on the Ledger relating to a third Gramra entry (line 140) which was subsequently credited on the Ledger at a later date.

64. An adjustment to the Loan Account is therefore made for the two entries challenged by the Defendant in this regard.

BT

65. The Defendant challenges three entries on the Loan Account relating to BT. The Ledger refers to each debit being for an account at Barkisland. The evidence used for the entries are invoices and the entries were made by two separate individuals (not Ms Wetherill).

66. The invoices are addressed to the First Claimant. They each show the same account number 41842334. The first and second invoices show that the nominal code was noted as being 700280 (which is not the nominal code for the Loan Account). The third invoice shows the Loan Account nominal code. The contemporaneous notations therefore are inconsistent.

67. The Defendant's evidence is that the invoices are from BT addressed to the First Claimant and that this therefore confirms that they are a business expense. He states that his job was well beyond normal/ traditional office hours and working from home was very common. He needed the infrastructure to do so including a very fast and reliable internet connection. Therefore the sum is a business expense. In his oral evidence the Defendant described the internet at Barkisland Hall as severe and that it had to be upgraded to enable him to perform his business duties at home as he worked beyond business hours. The Defendant refused to acknowledge that he would have used the high speed access for personal use as well.

68. Ms Richards evidence was that the account to which the invoices related was for Barkisland House as shown by the Ledger. This would therefore appear to be a personal expense. If the Defendant used the services at home then the correct way to account for that would be for the whole invoice to be put onto the Loan Account but with a credit for business usage. Given this had not been done she assumed it was for personal use but she accepted it could potentially be for business use.

69. It is clear from the evidence before the Court that the services provided by BT were provided to the Defendant's home address and not to the First Claimant's address. The Defendant's explanation for this is that he worked from home. However, there is no evidence from the Defendant that the work he was undertaking at home was work for the First Claimant. It is clear from the evidence before the Court, and from Appendix A, that the Defendant was involved in more businesses than the First Claimant. Even if the internet services were solely provided for the business use of the Defendant and were not used for his personal use, which I find to be unlikely, the Defendant's rather vague answers as to what he used the internet for at home have not satisfied me that this was an expense relating to the First Claimant. No adjustment is therefore made in this regard.

Marketing Services

70. This entry relates to a monthly content marketing retainer with Stada Video. The Ledger shows an entry on the Loan Account for 50% of an invoice, not the whole invoice.

71. The invoice is annotated with two nominal ledger codes: One of which is the Loan Account code. The invoice notes that Stada Video provided, first, services for creative and project management to Northern Powerhouse Developments Marketing and, second, services to "Gavin Woodhouse Personal Brand". The services to the Personal Brand are noted to include replying to comments, fan interaction and YouTube channel management.

72. The Defendant's evidence is that the invoice was addressed to the First Claimant, and not him, and therefore this confirms it is a business expense. The invoice was for promotion work done by Stada Video to promote him as Chief Executive Officer of the First Claimant and to boost awareness of the Group overall. The Defendant gave similar evidence during cross examination.

73. Ms Richards relies on the invoice on its face.

74. It is patently obvious on all the evidence before the Court, including the Defendant's accepted shareholding in Stada Video (see the Defendant's fifth witness statement) that the Defendant's business interests went well beyond the First Claimant or even the NPD Group. The Defendant at this time was active with many companies. The Gavin Woodhouse brand therefore extended beyond NPD Group.

75. The face of this invoice is also clear: Stada Video provided two sets of services. One for creative and project management to a company and the other for the Gavin Woodhouse Personal Brand. The word "personal" in the description is in my judgment key to this invoice. The services in that regard were for the Defendant personally and not for the First Claimant.

76. Having considered all the evidence before the Court on this point I accept the invoice on its face and I therefore accept that 50% of the invoice was correctly entered on the Loan Account. No adjustment is made in this regard.

Valuation/Re-finance

77. Four challenged entries on the Loan Account relate to either valuation of property or valuation/refinance of Barkisland Hall. The invoices originate from Bruton Knowles, Mark Brearley and Metis Law (x 2). The invoices were all incurred on or after 15 March 2019 and therefore at a time when, for the reasons set out below, the First Claimant was insolvent and the Defendant either knew or ought to have known this.

78. The details for each entry are:

i) Bruton Knowles: Entered on the Ledger as Barkisland Hall valuation. Invoice is dated 15 March 2019 and is addressed to the Defendant at the First Claimant expressly for the Defendant's attention. The description refers to "recent valuation in respect of" Barkisland Hall. From the reference on the invoice the valuation was for Leeds West One loans. The invoice has been stamped by the First Claimant's accounts team as an invoice for entry on the Loan Account.

ii) Mark Brearley: Entered on Ledger as PURCHASE INVOICE. The invoice is addressed to the First Claimant for the attention of Tara Davies. It relates to Barkisland Cottages & Land for a report and valuation for Ultimate Bridging Finance Ltd. It is stamped by the First Claimant's accounts department, but no nominal code has been entered on the invoice.

iii) Metis Law: Entered on the Ledger as Barkisland Hall disbursements and Barkisland Hall refinance. The first invoice is addressed to the First Claimant and relates to "Disbursement Only Bill - West One Loans" for "Refinance of Barkisland Hall". The second invoice is addressed to the First Claimant and relates to professional fees "West One Loan - refinance of Barkisland Hall". Both invoices have been stamped by the First Claimant's accounts department but no nominal code has been entered on the stamp.

79. The Defendant's evidence is that the invoices relate to valuations of Barkisland Hall which were used for the benefit of lenders looking to lend money to the NPD Group using the Hall and Cottages as security. The invoices all relate to valuations for lending purposes and therefore this is a business expense. The Defendant did not accept that he was the cause of the valuations. He did however accept that nobody forced him to offer the properties as security for a loan.

80. Ms Richards' evidence was that the invoices could potentially be a business expenses if the First Claimant was the sole borrower of the finance facilities. However, Barkisland Hall was not owned by the First Claimant and Ms Richards was unaware of any finance having in fact been obtained by the First Claimant as a result of the valuations.

81. Having considered all the evidence before the Court I am not satisfied that the invoices were incorrectly entered onto the Loan Account By March 2019, the date of the earliest invoice challenged in this regard it is clear that the financial problems surrounding the Defendant and the web of companies with which he was concerned extended far beyond the NPD Group (see for example paragraph 10 above).

82. There is no evidence that the valuations sought relate solely to the First Claimant. Rather the contemporaneous evidence is that the valuation obtained for Ultimate Bridging Finance Limited was not for lending to the First Claimant or even solely for use within the NPD Group. The relevant offers of finance which are in the bundle before the Court relate to Woodhouse Family Properties Limited, Woolacombe Apartments Limited and Smithy Bridge. There is therefore no evidence that the First Claimant was the proposed borrower or even a beneficiary of the loans for which the valuations were sought.

83. No adjustments are therefore made in this regard.

Bradford Directors Hospitality

84. Entry 197 on the Ledger relates to an invoice from Halifax Rugby League Football Club Ltd. The Ledger refers to the invoice and states that the entry relates to hospitality.

85. The invoice is addressed to the First Claimant and states that it is for "8 x Bradford Directors Hospitality". The invoice has been stamped by the First Claimant's accounts department. No nominal code has been written within the stamp, however a manuscript annotation of "DLA" has been made on the invoice.

86. The Defendant's written evidence states that this invoice is addressed to the First Claimant and not to him personally, that it related to hospitality/entertainment and that it is a business expense. In his oral evidence the Defendant accepted that the manuscript note had been put on the invoice. He noted that "we did a lot of sponsorship with Halifax Rugby and football Club. We - and there was a lot of hospitality taking our guests and colleagues that we worked with to these events. That's what it was for".

87. Ms Richards accepted her knowledge of the invoice was limited. She noted that it was not coded for the Loan Account but that it had the manuscript note of DLA. She accepted that leaving that to one side it would be proper for the First Claimant to pay for hospitality, if that is what the invoice represents.

88. Given the evidence before the Court I accept that this was a business expense and that an adjustment should be made to the Loan Account. The only indication that this is not a business expense, which is what the details on the invoice indicate, is the handwritten notation DLA and the invoices subsequent entry on the Ledger. The author of the note is not however known nor the reason why they made the annotation. A credit is therefore made in this regard from the Loan Account.

Great Outdoor Gym Company Limited

89. The final entry challenged by the Defendant relates to an invoice from Great Outdoor Gym Company Limited dated 27 June 2019. The Ledger shows this entry with the note "supply and install".

90. The invoice is addressed to the First Claimant. The Order No is "BH01" and the description is "other equipment." Details are then provided of the equipment supplied and installed which appears to consist of a sports pitch ("Muga") with recessed goals, chicane entrances and a basketball backboard and hoops. The delivery address given is Halifax. The invoice has been stamped and the Loan Account entered on the invoice together with a manuscript notation of "DLA".

91. The Defendant's evidence is that the invoice is addressed to the First Claimant and not to him. It refers to outdoor basketball/pitch /gym equipment. The Defendant does not have a basketball pitch at Barkisland Hall nor an outdoor gym (a point contradicted by a valuation of Barkisland Hall dated April 2019, although I accept that the Defendant was not taken to this document during his evidence and therefore I have placed no weight on the valuation in this judgment). The equipment was intended for Caer Rhun Hall. The equipment was delivered but the Defendant does not know if it was installed. The equipment is therefore a business expense. The Defendant gave similar evidence in cross examination.

92. Ms Richards evidence was that she does not know what the invoice refers to or where the equipment was installed as it is not stated on the invoice. She therefore relies on the reference BH, the Ledger and the notations on the face of the invoice.

93. Having considered all the evidence in this regard I am satisfied that on the balance of probabilities the Loan Account is accurate. Two separate notations were made on the invoice to show that this invoice related to the Loan Account: The invoice was then added to it. At the time it was therefore considered a personal expense.

94. Further and in any event the invoice is clear on its face that it was for the supply and installation of equipment with delivery in Halifax. The hotel that the Defendant asserts that the equipment relates to was in Conwy. It is in my judgment highly unlikely that large pieces of gym equipment destined for Conwy would be delivered to Halifax in West Yorkshire. No adjustment is made on this basis.

95. I therefore find on the evidence before the Court, taking into account the burden and standard of proof, that adjustments, by way of credit, of £18,320 should be made from the Loan Account balance set out at paragraph 35 above.

The Smithy Bridge Credit

96. The challenges raised by the Defendant to the Loan Account are not however the end of the court's consideration in that regard. The First Claimant seeks for an addition to be made to the Loan Account balance by way of reversal of a credit made to the Loan Account relating to the shareholding in Smithy Bridge. The burden of proof in this regard is on the First Claimant.

97. The relevant series of transactions, including the credit to the Loan Account, took place on 21 December 2017. On that date the Ledger shows a credit was made to the Loan Account by Ms Wetherill for the sum of £963,000. The details given in the Ledger are that the credit related to J000000152. The effect of the credit was to move the Loan Account from an overdrawn position of £865,603.39 to an account in credit in the sum of £97,396.61.

98. The First Claimant seeks to reverse the credit on the grounds that it was obtained due to a breach of duty by the Defendant toward the First Claimant as the credit related to a share transfer at a value the Defendant knew to be wrong. It is asserted that the Defendant knew that the shares transferred to the First Claimant were either valueless or worth less than the value stated in the share transfer form. The First Claimant therefore submits it has suffered a loss as a result and it should be compensated for the loss by reversal of the credit on the Loan Account.

99. The Defendant accepts that if he sold shares to the First Claimant for £963,000 but the shares were worth nil, that would be a breach of duty. However, he denies the claim in this regard as he submits that is not what happened. The Defendant submits that the value of the shares in Smithy Bridge as at 21 December 2017 was £963,000. This was the valuation given by the First Claimant's Finance Director, Robert Atkin, to the shares and used by the First Claimant's external advisers in advising the First Claimant on the tax consequences of the transaction. The Defendant submits that the First Claimant has not produced any evidence to suggest that Mr Atkin's valuation was wrong. In those circumstances the Defendant submits that the shares were valued by a senior employee of the First Claimant as the purchaser. There can be no real objection to the purchase of a care home by a business which operates care homes for arm's length consideration.

100. The dispute between the parties is not therefore one of law but of fact: Has the First Claimant shown that the valuation of the shares used in the transaction was wrong and that the Defendant knew this. There is no dispute raised that if the valuation is wrong and the shares were worthless at the relevant time that the First Claimant would be entitled to the relief sought. In this part of the judgment therefore I simply deal with the factual dispute between the parties.

101. Immediately prior to the sale of the shares by the Defendant to the First Claimant the Defendant owned 100% of the shares in Smithy Bridge. At the time of the share sale Smithy Bridge owned a partially constructed care home. The care home was not complete and was not operational. Smithy Bridge had no turnover. The care home property was the sole fixed asset of Smithy Bridge. Any valuation of the shares of Smithy Bridge therefore would substantially depend on the value of the care home.

102. The care home had been the subject of a prior professional valuation. This valuation had been undertaken on the basis of instructions by a finance provider, RQ Capital Ltd, to Christie & Co. The valuation was undertaken on a "Red Book" valuation basis. The valuation was therefore undertaken by a professional valuer on an arm's length basis from the Defendant.

103. It is clear from the instructions given to Christie & Co that the actual state of the building needed to be assessed for the purposes of their valuation as they were to provide a valuation for the purpose of loan security in respect of the financing of turnkey facilities. Turnkey is defined in the report as being "the development has been completed and the Property is fully equipped and ready to commence trade as a 57 bed care home".

104. The valuation is dated 25 February 2016. Christie & Co provided valuations on several bases. First, the then current (partially complete) market value was estimated at £2,000,000. This valuation assumed the property was a "partially completed care home with the condition of the property being as at the date of inspection". It was noted in the report that the Defendant had stated that it would cost £812,507 to complete the property. On the basis that the care home property was at turnkey status and completed to a high standard being comparable with a corporate standard purpose-built care facility to ensure that it becomes the home of choice across the local area, Christie & Co estimated the value of the Property would then be £3,850,000. The valuation assumed that the building would be at that turnkey stage within a six-month period.

105. It is of course now known that Smithy Bridge was not complete in 2016 or 2017. The six-month completion assumption in the turnkey valuation was not therefore met and therefore as at August 2017 that valuation was not a valuation of the actual property. Further, absent exceptional developments in the property market it was improbable that the value of the incomplete care home would have been as high as £3,850,000. No such developments have been drawn to my attention by the parties. The only valuation the Court has for an incomplete property is therefore the Christie & Co valuation of £2,000,000.

106. By late August 2017 the Defendant was indebted to the First Claimant in the sum of £823,296.20.

107. On 31 August 2017 Robert Atkin, an accountant employed by the First Claimant and by NPD Group, valued the shares in Smithy Bridge. He confirms that this was the date of the valuation in an email to Daniel Moon, an external tax adviser, on 18 October 2017. The suggestion by the Defendant that Mr Atkins was the Financial Director of the First Claimant is simply wrong in law and no evidence was provided to the Court that he was a de facto or shadow director of the First Claimant. The Defendant may have given Mr Atkin the title of Finance Director and permitted him to use such, but Mr Atkin was not a director of the First Claimant or the NPD Group. Rather Mr Atkin was an employee of the NPD Group.

108. Given Mr Atkin was an employee of the First Claimant and not a director his valuation was not at arm's length from the First Claimant. Further he must have been instructed to undertake the valuation. The sole director of the First Claimant was the Defendant and therefore I accept the submission of the First Claimant that the valuation must have been undertaken at the instruction of the Defendant. As a result, the valuation was also not at arm's length from the Defendant.

109. Why the Defendant chose Mr Atkin is not clear. He was not, on the evidence before me, qualified to act as a valuer of either properties or companies, nor is there evidence he had any experience of doing so before this. Accordingly, I accept that the valuation was not independent, and its accuracy can be scrutinised by the Court.

110. The valuation of the shares undertaken by Mr Atkin is not before the Court. Ms Richards confirmed in her oral evidence that the office holders had met with Mr Atkin and had sought information from him about the share valuation. She confirmed that Mr Atkin had undertaken the valuation himself but that she had no further information in that regard. She did not know if Mr Atkin had been influenced by others when undertaking the valuation, the assumptions he used or the circumstances when he prepared the valuation. She confirmed that the office holders had asked for documents relating to the valuation and for how Mr Atkin did the valuation, but he did not provide that information.

111. Mr Atkin was not called as a witness in the trial by either party. Mr Cole asks me to draw an adverse inference in this regard against the First Claimant given Mr Atkin's contact with the office holders. Having considered the principles set out at paragraph 23 above I do not consider that it is appropriate for me to draw adverse inferences against the First Claimant as regards the absence of Mr Atkin.

112. No evidence has been produced by the Defendant as to how Mr Atkin valued the shares. All that the Defendant says is that there was a valuation and the First Claimant relied on it, but the fact of the valuation is already agreed by the First Claimant. There is therefore no case to answer in that regard. The dispute in this case is whether the valuation was appropriate or not and the Defendant has produced no evidence in this regard above the fact of the valuation happening. Even if the Defendant had adduced some evidence in this regard the reason the First Claimant did not call Mr Atkin is obvious from Ms Richards' evidence: Mr Atkin had no evidence to provide the Court so far as the First Claimant was aware. I accept that that was his evidence to the Office Holders and on that basis, I am satisfied that the reason for Mr Atkin's absence as a witness for the First Claimant is satisfactory.

113. It was of course open to the Defendant to call Mr Atkin as a witness if he had wished to do so given there is no property in a witness.

114. The Court is therefore limited in considering the accuracy of the valuation undertaken by Mr Atkin to considering the contemporaneous documentation.

115. As noted, Smithy Bridge was a special purpose vehicle, with only one tangible asset, the part-built care home. The starting point in considering the valuation of the shares is therefore Smithy Bridge's statutory accounts and the tangible asset value of the land and property. I have before me the accounts as at 31 March 2018, i.e. after the date of the share sale. These confirm that Smithy Bridge had no turnover. Note 6 of the accounts records that as at 1 April 2017 the land and buildings belonging to Smithy Bridge were valued at £2,165,828. However, by 31 March 2018 the land and buildings had been revalued at £4.4 million. This despite the accounts noting that the assets "are currently under construction". No details are given as to the basis of the revaluation, who conducted this or on what basis.

116. From an email sent by Mr Atkin to Mr Moon on 18 October 2017 it is however clear that the valuation of £4.4 million was central to Mr Atkin's valuation: "Based on the valuation I did at 31/08/17 the market value will be £963k, which will be credited against the directors loan account (sic)... . The disposal must happen before we enter agreement to sell the property for an agreed price as a lower price than £4.4m would affect the market value we have placed on the company."

117. No valuation of the care home in the period 1 April 2017 to 31 March 2018 has been found by the Office Holders, and no such valuation is before the Court. The Court does however have before it a marketing document prepared by Bishops. The marketing document shows that the Property had been placed on the market for sale with a guide price of £4.4 million on 1 August 2017.

118. A guide price is not however a valuation. It is the price that the owner wishes to market the property for sale at, not the likely price that will be realised on a sale or the value of the property in accordance with the recognised standards.