Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Financial Conduct Authority v Forster & Ors [2023] EWHC 1973 (Ch) (28 July 2023)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2023/1973.html

Cite as: [2023] EWHC 1973 (Ch)

[New search] [Printable PDF version] [Help]

CHANCERY DIVISION

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

BUSINESS LIST (Ch D)

Fetter Lane, London, EC4A 1NL |

||

B e f o r e :

(Sitting as a Deputy High Court Judge)

____________________

| THE FINANCIAL CONDUCT AUTHORITY (A Company Limited by Guarantee) |

Claimant |

|

| - and - |

||

| (1) ROBIN SCOTT FORSTER (2) FORTEM GLOBAL LIMITED (3) RICHARD PAUL TASKER |

Defendants |

____________________

The First Defendant in person

The Second and Third Defendants did not appear and were not represented

Hearing dates: 2nd, 3rd 4th, 5th and 15th May 2023

____________________

Crown Copyright ©

- This is a trial of a number of preliminary issues arising out of the activities of the first defendant, Mr Forster. In essence, the claimant, the Financial Conduct Authority (the "FCA") says that Mr Forster was responsible for the operation of an unauthorised collective investment scheme, that units in that scheme were sold to investors through deception, that Mr Forster was knowingly involved in that deception, and that he should therefore make restitution. The second and third Defendants did not appear. The second defendant is in liquidation, and the liquidators have confirmed that they do not intend to take part in the proceedings, having provided a witness statement to this effect.

- The facts of the case raise a number of difficult points, both factual and legal. Mr. Forster appeared at the hearing as a litigant in person, and it has therefore been necessary for me to to some extent construct his case for him. However, I was assisted in this by the fact that Mr Forster was represented by solicitors and counsel until shortly before the hearing, and a defence drafted by leading counsel, Saima Hanif KC, was filed on his behalf. I confirmed with Mr Forster at the hearing that the reason that he appeared in person at the trial was not the result of any disagreement between him and his advisers as to the substance of his case, and I therefore took that defence as the basis of his position. More importantly Ms. Hanif, with Mr Forster's consent, was prepared to appear pro bono in order to make representations on one specific point, but the point which I felt to be the most difficult aspect of the case – the extent to which Mr Forster's position had a defence to allegations of knowing concern in illegal activity on the basis that he had received independent legal advice to the effect that the activity was not illegal. I would like to express very great gratitude to Ms Hanif for the assistance which she provided to the court. I would also like to thank Mr Temple, who appeared for the FCA, for the way in which he sought to accommodate Mr Forster's position as a litigant in person, and to present the facts in as balanced a manner as possible – although I note that Mr. Forster disagrees with this assessment.

- Mr Robin Foster, was at the time when the events which gave rise to these proceedings occurred, no stranger to the business of doing business with other people's money. In September 2011 he had set up a company ("MBI") with an associate, Mr Gavin Woodhouse, which operated on what he described in his witness statement as "the lease model". I describe this below. Mr Forster was a director and shareholder of the MBI companies. When the relationship between Mr Forster and Mr Woodhouse broke down in 2016, the MBI business was essentially split between them into a care home business (Mr Forster) and a student accommodation and hotel business (Mr Woodhouse). The six MBI care homes were each owned by a single legal entity, and each of those legal entities seems to have been owned by or transferred to Mr Forster. Mr Forster also owned Qualia Care Limited ("QCL"), the service provider entity which operated the MBI care homes. Mr Forster also established first Qualia Care Developments Ltd ("QCD") and then Qualia Care Properties Ltd ("QCP") (together "the Investment Companies"). Both of these entities operated "the lease model". They raised money from the public to invest in the acquisition of further care homes which would subsequently be operated by QCL. Mr Forster subsequently established another Qualia entity, Qualia Care Holdings ("QCH") which also makes an appearance. All of these entities presented themselves to the public and investors under the "Qualia" brand, and Mr Forster seems to have acted on behalf of all of them. I have therefore referred to actions being taken by "Qualia" unless a specific legal entity is named.

- The second defendant, Fortem Global Limited ("FGL"), was the main sales agent for the investments offered by QCD and QCP. It is now in liquidation. It was owned by Mr Forster and Mr Tasker, the Third Defendant.

- The essence of this model was that capital was raised from private investors by selling them a leasehold interest in a room in a rented commercial property – care homes, student accommodation and hotels – at a very substantial overvalue. These offerings were presented as "buy-to-let" investments. The fact that these sales were at an overvalue was not concealed – the sales pitch seems to have been that the surplus funds over and above the cost of purchase of the asset would be used to renew and refurbish the property concerned, thereby improving its rental yield. The thing that made this offer attractive to investors was that MBI (and later Qualia) was prepared, in effect, to guarantee the returns. The typical offering indicated that investors would receive a guaranteed rental of 10% of their investment per annum for the first twenty-five years, and that at various points during that period the operator would be prepared to repurchase their room for at least 115% of their initial investment, regardless of the commercial performance of the actual business concerned, and regardless of whether the specific room leased by the investor was in fact let or not.

- The legal structure was a standard opco/propco arrangement. The propcos (in this case QCD and QCP) took in money from investors and acquired assets (in this case the homes). The propcos then employed the opco (in this case QCL) to manage the assets. The opco collects the revenues from customers, pays its operating expenses, and shares the resulting profit in some manner with the propco for distribution amongst investors.

- Part of the appeal of this "model" to investors was that it appeared to offer enhanced security. At least part of their payment would be applied in the acquisition of a long lease of a specific room, and that interest would be registered in their name with the Land Registry. The evidence of that registration, as provided to them, gave the appearance of securing at least part of their investment.

- The Company and its auditors took the view that it was not required to recognise its obligations to investors under these guarantees as liabilities on its balance sheet. The argument seems to have been that these obligations might not arise - each room might have generated the necessary revenue, and the repurchase option might not be triggered - so the obligations were mere contingencies. A company with no capital was therefore able to raise funds from retail investors at high promised rates of return without recognising its liabilities under those promises to those investors on its balance sheet. If those liabilities had been recognised at any time, it would have been transparently clear that the company was hopelessly balance sheet insolvent. However, because this was not done, the "lease model" appeared to be a viable financial structure.

- An important feature of this structure was that it did not require any investment at all from its originator. Because the sales were at an overvalue, each sale created an accounting profit which appeared to constitute capital of the company. Thus, once sufficient sales were made, the result was an apparently well-capitalised and solvent company. What was happening in reality, of course, was that investors were taking all of the risk of the commercial operation of the property concerned.

- In order to understand what it was that investors were actually sold, it is necessary to address three things – (a) what investors were told about what they were investing in ("The promotional materials"), (b) what they actually legally acquired, and (c) the economics of the arrangements in which they were invited to invest.

- The investments were marketed to investors in the UK by the Investment Companies, FGL and other sales agents (FGL being the main agent in terms of commission received). Potential investors were usually given Qualia's promotional materials, including brochures for individual care homes. A wide range of these brochures were before the Court.

- The investments were also promoted using a report produced in June 2016 by Lupton Fawcett LLP – a firm of solicitors used by Qualia – entitled 'The Operations of Qualia Care and Qualia Care Developments' ("the Lupton Fawcett Report"). The fact that the Lupton Fawcett Report was used to promote the scheme(s) does not appear to be controversial, though whether it was intended to be used for promotional purposes has been raised in witness evidence served by Mr Forster.

- The investments were made up of various contractual documents between the relevant Investment Company and the individual investor, namely: a 'Sale Agreement', a 125-year 'Lease', a 25-year 'Sublease', a 'Developer Assured Buy Back Option Agreement', and a 'Developer Call Back Option Agreement'. By these agreements:

- The Investment process was as follows. The investor would pay a deposit (of usually £500) and a standard suite of conveyancing documents would be provided to them. The investor would sign and return the contracts and pay the balance of the purchase price. The first annual interest payment was presented as "payable immediately", and was usually deducted from the purchase price or paid within 28 days of exchange. Subsequent returns would usually be paid annually, in arrears. Investors were encouraged to use Qualia's recommended solicitors – Gaddes Noble Property Lawyers – for the conveyancing process, with Qualia paying Gaddes Noble's fees.

- It seems to have been a regular occurrence that rooms were sold in this way before the Investment Company had completed the acquisition of the relevant home. Mr Forster's evidence was that the marketing of rooms commenced when contracts had been exchanged for the purchase of a home, and the sale of a number of rooms prior to completion appears to have been necessary to raise the funds needed for completion.

- Some investors therefore paid for their room and signed their contractual documents prior to the Investment Company owning the care home. This meant that, if the Investment Company's purchase of the care home did not complete (for instance, because the CQC refused approval) then the investors' room purchases also could not complete. It is a matter of dispute between the parties as to whether the investors understood this to be the case. In particular, as explained below, there were three specific homes - Alder Manor, Heather Hall, and Poppy Grove (together, "the Unowned Care Homes") where CQC approval was refused after a number of rooms were sold. Thus completion of the purchase of the home never occurred, and these investors never acquired anything.

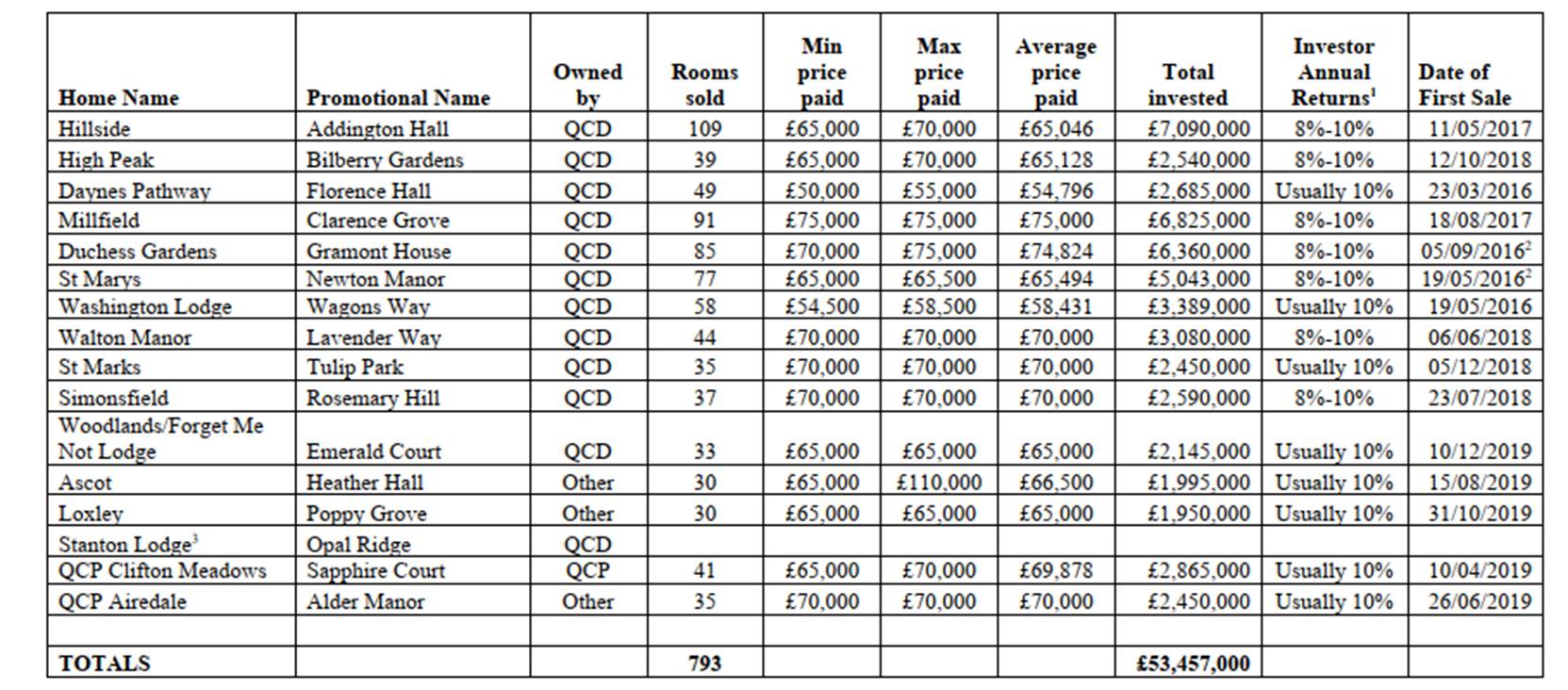

- A potentially confusing feature of this case is that each care home had at least two names: (i) a name under which the care home actually operated; and (ii) a 'promotional name' under which the investments were promoted. This was explained to investors on the basis that Qualia did not want investors to contact the homes directly.

- In total, it appears that 793 rooms were sold or agreed to be sold to investors, with total investments of £53,457,000 across 16 care homes. Including Stanton Lodge, the FCA believe the total number of investments to be 858 rooms with a total sales value of £57,834,900. For the sake of clarity I have reproduced below the table created by the FCA which summarises the position as regards the different homes owned by Qualia entities.

- In addition to the Qualia homes, QCL also operated other homes. When Mr Woodhouse and Mr Forster separated, Mr Forster acquired six care homes owned by single-asset 'MBI' companies. These were Downshaw Lodge, Gilwood Lodge, Birchley Hall, Sandycroft, Ferndale and Oakesway (together, "the MBI care homes"). These had also been sold to investors on the same long lease model.

- This action is a trial of four preliminary issues. Deputy Master Nurse, by an order dated 4 October 2021, ordered that these issues should be determined at a first trial, with further hearings to be scheduled depending on the findings. Those four issues are as follows:-

- The question as to whether final restitution orders against the Defendants should be made under s. 382 FSMA (and if so, in what amounts) is not an issue for this hearing. However, the FCA has indicated that it is likely to seek an interim restitution order against Mr Forster if successful at this Trial.

- The FCA's case in relation to the preliminary issues is that:

- Mr Forster's case with respect to the preliminary issues is as follows:

- The issues which arise in this case relate to the business operated by Mr Forster under the name "Qualia". However, the story begins before the establishment of Qualia, when Mr Forster and Mr Woodhouse operated MBI. As noted above, when Mr Forster and Mr Woodhouse separated, Mr Forster's company, QCL, continued to operate a number of MBI care homes.

- Mr Forster established QCD in order to raise money to buy more care homes. However, at least some of the money raised was used to pay interest returns to investors in the MBI care homes. The terms on which these payments were made are mysterious – there seem to have been no signed contracts in place. These payments were not confined to investors in homes managed by QCL - two further MBI homes were not operated by QCL (because they were closed), but QCD made payments to the owners of those care homes nonetheless.

- It is clear that from the very early days of Qualia, the contributions of investors in the Qualia care homes were used to finance the returns owed to investors in the MBI care homes. Mr Sowden, the FCA's expert witness, calculates that some £4.9m was advanced to MBI companies by QCD. Mr Forster himself accepted that there were significant amounts being paid out to MBI companies, and through them to their investors, in the first couple of years of Qualia.

- It may be asked why Mr Forster felt the need to use new funds raised by his new vehicle to discharge the liabilities of his former vehicles. I think that there is a simple answer to this question. Mr Forster's new business was based on the same "lease model" as the MBI business and, as he said in evidence, involved many of the same investors. If an MBI home failed with substantial losses to investors, his prospects of raising substantial new investment would be seriously harmed. Also, for as long as QCL continued to operate these homes, it was the recipient of the revenues derived from running them. He therefore clearly felt that it was worthwhile to use his existing investors' money to prop up the MBI businesses, since the failure of those businesses would reduce his ability to raise new money.

- One of the key differences between the MBI model and the QCD model was that whereas MBI had had each home held by a separate legal entity, the Qualia model involved all homes being owned by a single legal entity, QCD. The reason for this was explicitly set out in para. 18(c) of Mr Forster's Second Witness Statement:

- The reason that this is important is that it makes clear that Mr Forster did not regard investors as entitled only to the revenues arising only from their specific room, or even from the home in which their room was situated, but that returns to investors in the scheme as a whole were to be paid out of the revenues of the scheme as a whole. The revenues of the portfolio as a whole were to be used to pay investors as a whole.

- It is clear on the facts that for some years the payment of returns to existing investors were funded entirely through the sale of rooms to new investors. The FCA says that this is evidence of malpractice. Mr Forster's defence is that it was simply cash flow management. Specifically, what he says is that when he acquired a property, he commenced a substantial programme of updating and refurbishment, the outcome of which could reasonably have been expected to be an enhancement of the revenues received from that property so great as to cover all of the amounts due to investors and to leave a surplus.

- In order to assess the credibility of Mr Forster's position, it is necessary to consider in some detail the course of the Qualia business during the years in which it was in existence.

- QCD began acquiring care homes with alacrity. One of the first to be acquired was Duchess Gardens. QCD bought Duchess Gardens for £1.9m in December 2017 and sold 85 rooms for approximately £6.3m. This meant that it assumed buyback obligations in the region of £7.2m, and annual obligations to investors of approximately £575,000 per year.

- It became necessary to establish the value of Duchess Gardens. A valuer (GVA) valued the property at £1.5m. However, Qualia seem to have asked for an enterprise valuation based on profitability, and provided some assumptions as to the future commercial success of the home. On that basis, GVA calculated the value of the enterprise would be £5.05m. Applying a further assumption of 3% annual increases in income, a further projection for a value in year 10 was reached of £6.57m. Mr Forster accepted in evidence that the assumptions provided by Qualia to GVA were unrealistically optimistic, and that this figure was unrealistic. However, the FCA notes that the value achieved through the application of these assumptions was still less than the £7.2m which would be due to investors at that date.

- GVA also pointed out in their valuation that in order to achieve these projected returns, a further £1.44m of capital expenditure would be required.

- When cross-examined, Mr Forster did not produce any evidence of any sort of financial plan for Duchess Gardens. His explanation for his decision to make the acquisition was that he 'liked Duchess Gardens, [he]liked the area, [he] felt that it could work really well…'. The FCA suggests that if Qualia had performed financial modelling, or even followed the advice given to them by their own expert valuers, they must have (or should have) realised that there was no way in which investors in Duchess Gardens could be repaid without recourse to the profits of other homes.

- The same scenario was repeated for Hillside, which was bought in August 2017 having been valued by CBRE in June 2017. QCD's total buyback obligations were in the region of £8m, yet CBRE's maximum valuation for the care home was only £5.06m.

- When asked in cross-examination why he thought Qualia could do so much better than the previous owners, who had traded at significant losses, Mr Forster relied on his experience:

- The problem with this answer is that at the time of the Hillside valuation in June 2017, Mr Forster had no such experience to draw on. At that stage, he had been in charge of the MBI homes, and some earlier Qualia homes (including the non-operational Daynes Pathway) but none of them could be said to have been turned around. There are no documents showing precisely how much money the care homes were losing in June 2017 but, as set out below, they were still losing money in November 2017 and March 2018.

- This takes us to the financial position of QCD in June 2017. It had upcoming payments due to investors by the end of July 2017 of £454,000, and only £426,000 in its bank accounts. It was therefore only able to make these payments if it received further proceeds from the sale of new care home rooms to new investors, since it does not appear to have had any other source of revenue.

- This position was made explicit in an email from Mr Howarth to Mr Forster on 7 July 2017, where (in the context of a discussion about lack of funds), Mr Howarth suggested that Qualia hold off making payments due to investors until further funds came in from the completion of sales of rooms in Hillside. It must have been clear, as accepted by Mr Forster, that the care homes were not supporting themselves at this point.

- An email in November 2017 from Mr Whitaker to Mr Forster and Mr Howarth suggested that:

- The lack of a successful turnaround for the homes (and the lack of profits to fund rental payments or buyback obligations) continued to be evident in 2018. It is clear from the January 2018 QCD Board Minutes (one of the very few internal Qualia documents available) that the care homes made a combined £150,000 loss in the month of November 2017 alone. This is against the 2017-2018 budgeted profit of £900,000. Accordingly, up until this point, all of the investors' returns had been financed from the contributions of other investors, since QCD had no resources of its own other than those contributed by investors.

- These Board Minutes also break down the profits/losses by care home in November 2017. Birchley Hall had made a small profit (£2k), as had Duchess Gardens (£3k) and Washington Lodge (£5k). That was set against losses in all other care homes, including the MBI homes Downshaw Lodge (-£3k), Gilwood Lodge (-£23k) and Sandycroft (-£6k).

- This is a significant point in the chronology. At this point, there was simply no ground for any reasonable board to have concluded that it would be possible to meet the periodic investment returns due to investors with regard to the homes which they currently owned. It must therefore have been clear to them that the options were (a) to agree a restructuring of the arrangements with the investors, whereby the promised returns were significantly reduced, (b) to put the company into administration and admit defeat (with a probably very significant loss for investors) or (c) to gamble for resurrection. This last would have involved deciding that they could acquire more homes with sufficient profit uplift potential that increased profit would wipe out the losses.

- By May 2018, Mr Monnickendam (a qualified accountant and consultant to Qualia) provided the directors with provisional accounts to March 2018. These accounts showed that the care homes had collectively lost c. £986,000 before overheads (an approx. £1.8m shortfall from budget). That email set out the profits/losses by home for the year to March 2018, showing that only Washington Lodge (£52k) and Downshaw Lodge (£47k) made profits before central overheads, and only Downshaw Lodge made profits after central overheads (£5k). All other homes made losses. Including overheads, Sandycroft lost £124k, Gilwood Lodge lost £170k, and Birchley Hall lost £37k. It also confirmed that, two years since the start of QCD, its first care home (Daynes Pathway) was still non-operational and had not therefore been turned around.

- In June 2018, the accounts for the then current financial year (FY18-19) showed that there had already been a shortfall to budget for QCL to the tune of £78,000.

- The losses for Q1 2018 were confirmed in the August 2018 Board Report to be £95,000. Losses in the first five months of 2018 were again confirmed in the sum of £25,000 in the October 2018 Board Report. The Report does suggest that there might be profits in the latter half of FY2018/19, though these figures are before rent and do not come close to satisfying the investors' periodic investment returns.

- Nowhere in these documents, even despite the significant losses, shortfalls to budget, and inability to pay investors from the profits generated by the care homes business, is there any evidence that anyone at Qualia – including Mr Forster – queried the sustainability of the Qualia investments or reflected on the business model. There is, for instance, a distinct lack of any such discussion in the Board Minutes of September 2018.

- By January 2019, it must have been clear that the 2018 gamble for resurrection had failed. It was therefore necessary to find an alternative source of repayments for investors. Mr Monnickendam therefore proposed that QCL should start paying rent to QCD at a rate of 70% of profits from profitable care homes with weekly payments on account in the sum of £25,000. Payments at this level were clearly unsustainable - QCL appears to have made a net profit before rent of £22,800 in the month of November 2018, whilst this proposal would have had it paying £84,100 of rent for that month.

- The FCA says that there can be absolutely no doubt that Qualia – including Mr Forster – must have known that the model was unsustainable from at least April 2019 onwards. In that month, Mr Forster emailed Mr Monnickendam with a plan to reduce investors' returns down to 6% (from 8-10%). The email from Mr Forster suggests that investors would be told that the need to reduce the rental returns was to 'protect property owners in future in what is a very challenging & regulated market'. Further that: 'Many of [FGL's] clients will have suffered with losses with other investments and huge drops in returns. Qualia's will still look attractive!!!!!...'. The email continues in capitals to suggest investors would be told that:

- It is hard to see why investors might have agreed with any such suggestion, unless it were put to them that the alterative was failure and insolvency. The FCA says that this e-mail demonstrates that at this point it was clear to Mr. Forster that a significant reduction in promised returns was necessary to avoid insolvency.

- This e-mail was put to Mr Forster repeatedly in cross-examination. He was unable to explain its genesis or purpose, and in my view had nothing substantive to say about it.

- QCP was used to replicate the activities of QCD. It is highly unclear why Mr Forster began to sue QCP for this purpose, since his expressed strategy to date was that economies could be maximised if all the homes were held by a single legal entity. QCP raised funds from investors using the same "leasehold model" that MBI and QCD had used.

- In August 2019 three new applications were made to the CQC for new approvals (the Unowned Care Homes). This was met by the CQC with a request for an independent business review to consider the financial stability of QCL. QCL was not prepared to engage in any such review. At this point it must therefore have become clear to Mr Forster and the management of Qualia that there could be no more room sales, which, in turn, would mean no new money.

- Since QCP could not complete on its acquisition of the Unowned Care Homes, it had large uninvested cash balances. It is accepted that QCP would ultimately have been obliged to return these cash balances to investors. However, in the meantime a use was found for them.

- Mr Temple for the FCA put to Mr Forster that this last loan was a clear example of money from new investors being used to meet the obligations of old investors; a characteristic of a classical Ponzi scheme. Whilst denying that analysis, Mr Forster accepted 'it might look that way'.

- In November 2019 Downshaw Lodge, a care home owned by MBI but managed by QCL, was placed in administration through a CVA. This is notable because Mr Forster in his evidence several times put forward Downshaw lodge as a successful turnaround of a home, showcasing QCL's management and turnaround abilities.

- The effect of the CVA deserves a little consideration. There are broadly three possible values for a nursing home. Where the home is self-managed and generating an income, its value is the value of that income – the enterprise value of the business, floored at the bare building value. Where the management of the home is separate from the asset ownership, the asset owner can, on its own, realise only the bare building value – it is only if the asset owner and the manager co-operate that enterprise value can be realised. There is, however, a third situation. Where the building is encumbered with multiple long leases of individual rooms, its sale becomes effectively impossible unless a buyer can be found who is prepared to take it subject to those encumbrances – which means that, without the co-operation of the manager, the building is effectively valueless. In the Downshaw CVA, the only possible buyer was therefore another Qualia entity. The home was therefore sold to Qualia Care Holdings, "QCH", which named its price as the bare building value - £1.125m. Investors received 23.66p in the pound.

- Downshaw Lodge was one of a number of MBI entities which were placed in administration. Since QCD had in effect been keeping the investors in the MBI homes which it managed at bay by paying their returns out of QCD funds, at this point the various MBI entities owed £4.9m to QCD. These amounts were written off in full.

- The point which Mr Temple makes – with some force - is that at the moment that they realised that this £4.9m was irrecoverable, the directing minds of Qualia must have realised that in order to have any hope of meeting their obligations to investors they would have needed to earn £4.9m on top of their existing obligations. In other words, this was the point in which any reasonable manager must have realised any prospect of the Qualia entities being able to meet their commitments to their investors had evaporated. The question of how Qualia should have dealt with their existing investors at that point is an open one. However, Mr Temple submits that it is crystal clear that they should not have continued selling rooms on the basis of promised returns which were now clearly undeliverable, and that the fact that they continued to do so is prima facie evidence of dishonesty.

- In September 2019, Qualia – in particular Mr Forster – saw a witness statement of Mr Duffy from Duff & Phelps, which was filed in the MBI insolvency proceedings. On Mr Duffy's analysis, Qualia would have to make c. £5m in profit per annum simply to satisfy its obligations to investors which represented a 300% growth in capital value over a 6 to 10 year period. At this point, QCD only had £58,000 in its bank account, whilst QCP had £1.9m (mostly in respect of the Unowned Care Homes). Mr Forster's evidence is that he did not sit down with Mr Duffy's analysis and reflect on its implications – presumably because he was already well aware of the true position. He did not, however, stop selling care home rooms on the basis of promised returns which he must have known to be unachievable.

- At the beginning of 2020, QCL was still trying to convince the CQC that is should approve the QCL takeover of the Unowned Care Homes without subjecting it to an independent business review. As part of that process, QCL submitted what they claimed to be QCD's FY19 draft accounts. This is an extraordinary document. It includes a revaluation of the Investment Property portfolio from £9.7m as at 1 April 2018 to £55.2m as at 31 March 2019. Mr Forster was unable to assist us in evidence as to the basis of this valuation, save to suggest that it had been based on the advice of "an independent third party valuer". Needless to say, no such valuation was produced in disclosure, and the figure bears no relation to any plausible valuation of QCD's assets on any basis. More importantly, what QCD actually owned was the reversion of the 125-year leases which had been granted over almost all of the properties, plus the value of its tenancy rights under the 25-year sublease at a significantly above-market rental. The value of the reversionary interests would be negligible, and it is hard to ascribe any substantial value to the sub-lease tenancy rights given the rental commitments. The figure of £9.7m used in the prior year seems indefensible, and the £55.2m figure fantastic.

- It was suggested to Mr Forster – and he accepted – that the likely reason for this presentation was that the CQC was required to ensure that licensed care home operators were financially sustainable, and had a revaluation not taken place, QCD would have appeared to be balance sheet insolvent and apparently unable to pay its debts as they fell due.

- The inference which Mr Temple sought to draw from these facts was that these accounts were designed to deceive the CQC into believing that the funding model for QCD (which sat behind the provider, QCL) was sustainable and the companies were profitable.

- As noted, the accounts delivered to the CQC were draft accounts. When full accounts were filed at Companies House, they showed a revaluation – based apparently on the QCD's director's own estimation - of c. £38m. This figure could not be explained by Mr Forster in cross-examination, and was double the valuation of c. £19m given in the spreadsheet created by Mr Monnickendam on 25 March 2020. Here again, Mr Temple suggested that this figure must have been included in the accounts of QCD to create the illusion (including to investors) that QCD was a substantial and stable company.

- By March 2020, Qualia knew that a number of buyback dates were coming up including three in 2021 and forty-eight in 2022. The total buyback amount was in the sum of £2,948,225. It was put to Mr Forster that QCD could not possibly have had any prospect of meeting these obligations out of its own resources, and that therefore recourse to the monies held by QCP for investment in the as yet unacquired care homes would be necessary. Mr Forster was unable to give an answer. Mysteriously, however, he was unwilling to concede that Qualia ought to have stopped selling rooms at this point.

- One of the few items of management information which were available to the court were a set of management accounts prepared in March 2020. These made clear that the care homes in aggregate were expected to either break even or make a small loss. The idea that Mr Forster can at that stage have held any serious belief that the business would in fact make the £5m profit which it needed to meet investors' entitlements is not credible.

- By August 2020, with the purchase of the Unowned Care Homes still uncompleted, the Investment Companies had access to about £3m of cash. However, QCP owed c. £6m to the investors in the Unowned Care Homes. On top of that, Qualia had rental obligations of c. £5 million over the same year. It therefore needed to find £11 million just to stay afloat, and its access to new funds from the sale of new rooms had been terminated.

- It is therefore no surprise that on 11 September 2020 the Investment Companies were placed in administration. However, the previous day a very curious pair of documents had been created and signed between QCD or QCP on the one hand, and QCL on the other. What these documents provided for was a substantial reverse rent to have been due from QCD or QCP to QCL over previous years. In reality, QCL had been paying around £25,000 or £27,500 per week to QCD. However, when the reverse rent provided for in these agreements was taken into account, QCL was said to be owed c. £2m (QCL, it may be remembered, was at this point still solvent and wholly owned by Mr Forster). This money was transferred immediately before the commencement of the Administration. The administrators regarded these documents as evidence that these amounts were legitimately due.

- The FCA provided evidence from the lead FCA investigator, from a representative of the Care Quality Commission, and from a number of investors. None of this evidence was formally challenged as to its substance. Having regard to the fact that Mr Forster appears as a litigant in person, I do not regard this lack of challenge as an absolute bar to his introducing other evidence. However, in broad terms Mr Forster did not dispute the substance of this evidence at any point during his appearance before me, with one exception which I will come to. Mr Forster relied upon his own witness statement and a further statement provide by Mr Lindsay, Qualia's former solicitor, who was at the time a partner in Lupton Fawcett.

- As part of the process of selling investments in the Qualia scheme, Lupton Fawcett produced a report in their own names (the "Lupton Fawcett Report") which appears to have been prepared for the purpose of being distributed to investors in order to promote the investment to them. The insolvency practitioner for QCD, QCP and QCL has now waived privilege over documents that show the drafting process, such that no issue with any ongoing privilege seems to arise.

- Mr Forster has not filed any witness statements from investors.

- Neither FGL nor Mr Tasker has filed any witness statements, other than that from FGL's liquidator confirming that they do not intend to take part in the proceedings.

- The FCA has also filed and served a Hearsay Notice. The reason for this is that the way in which the FCA conducts an investigation of this kind is to send questionnaires to investors in the scheme asking for their responses to particular questions about the way in which they were dealt with. The responses to such questionnaires are necessarily hearsay evidence for the purpose of these proceedings. I did not see any reason why these responses should not be admitted in evidence in these proceedings.

- The documents provided by Mr Forster are extremely limited. I am required to form a view as to whether the paucity of disclosure by Mr Forster is the result of a lack of information, or a deliberate attempt to conceal.

- Some documentation was obtained from the insolvency practitioner of the various Qualia companies as to the preparation of the Lupton Fawcett report. These documents were obtained after the service of Mr Forster's witness statement. None of those documents were disclosed by Mr Forster, despite 8 of them (of 12 in total) being sent to/from a personal email address that he still uses. These contemporaneous emails contradicted Mr Forster's evidence as to the purpose of the Lupton Fawcett Report and the extent of his involvement in its creation. The FCA applied for consent under paragraph 12.5 of practice Direction 57AD for these documents to be admitted as evidence, and, applying the principles lucidly set out by Vos LJ in McTear v Engelhard [2016] EWCA Civ, there was no reason to withhold consent. Mr Forster did not oppose this. Again, these e-mails contradicted Mr Forster's evidence that he was not involved in the creation and distribution of these documents

- The essence of Mr Forster's case was that the business model of Qualia was viable at all times. Ordinarily, this should be evidenced by contemporaneous business plans, projections and cash-flow forecasts. In pre-trial correspondence, the FCA raised the fact that Mr Forster's disclosure lacked any such documents. Mr Forster was specifically invited to provide such further documents that fell within this category by the FCA's letter dated 22 July 2022 (at a time when he still retained solicitors to act for him). A few additional documents were provided but, otherwise, his solicitors' response was that (save for a very limited number of documents withheld for privilege) everything had been disclosed. During his cross-examination, Mr Forster repeatedly asserted the existence of documents that he said demonstrated financial modelling, analysis and similar, but no such documents were produced. Finally, when preparing his closing submissions and having had full sight of the FCAs case, Mr Forster was invited by the court to provide any further documents. No such documents were provided.

- Mr Forster's status as a litigant in person is potentially relevant in this regard, since a litigant in person cannot be expected to understand the full niceties of the disclosure regime. However, the FCA points out that throughout the disclosure process Mr Forster was in fact represented by solicitors.

- I therefore cannot follow Mr Forster to conclude that the absence of documentation supporting his evidence shows his non-involvement in the activities before me. Indeed, my conclusion is exactly the opposite – the fact that the few documents that have been disclosed largely contradict his evidence suggests that other documents, if they had been disclosed would have disclosed the same.

- The parties were given permission to adduce oral expert evidence from one expert in the field of forensic accountancy to address issues relating to the sustainability of the investments, to be served sequentially. The FCA served the evidence of Mr David Sowden, who is a director in the forensic department of Grant Thornton UK LLP and a Fellow of the Institute of Chartered Accountants. His report was both comprehensive and helpful, and had clearly involved a very great deal of research into the financial position of the Investment Companies. None of the Defendants have adduced expert evidence.

- In the event, only three witnesses attended for cross-examination: Ms Chambers and Ms Jupp on behalf of the FCA, and Mr Forster for himself. The FCA offered eight investor witnesses for cross-examination, of which Mr Forster was invited to pick three. This included Mr Wadham as well as Mr Cronin and Mr Woodward. It also offered its expert, Mr Snowden. Mr Forster decided not to cross-examine any of the FSA's investor witnesses, nor Mr Sowden.

- Because Mr Forster presented his case as a litigant in person, it is probably wrong to apply the presumption that evidence which is not explicitly challenged in cross-examination is therefore treated as accepted. However, nothing in Mr Forster's presentation of his case called into question the contents of the investor witnesses, and I accept their evidence as it stands. In particular, I accept Mr Cronin and Mr Woodward's evidence as to their belief as to ownership of the Unowned Care Homes.

- The FCA produced two witnesses, Ms Chambers, the lead investigator from the FCA, and Ms Jupp from the CQC. Mr Forster cross-examined both of these witnesses, but the issues which he raised were not relevant to the issues before me. In particular, he did not seem to dispute the facts set out in either witness statement. As regards Ms Jupp, he sought to demonstrate that the CQC's decision to refuse consent to the transfer of the Unowned Care Homes was based only on the CQC's concerns about Qualia's business structure, and not on its record as a care provider. Ms Jupp accepted that this was the case. However her evidence was that one of the statutory obligations of the CQC is that, before they approve the registration of a care home to a new service provider, they must be satisfied that the service provider must be financially viable (Reg 13 (part 4) of the Care Quality Commission (Registration) Regulations 2009), they felt unable to do this.

- On 16 August 2019, QCL made an application to add two additional care homes to their registration. These were Ascot Nursing Home and Loxley Chase Care Home. They also applied to add a further two homes, Airedale Care Home on 29 August 2019 and Forget Me Not Lodge on 7 April 2020. These applications were all formally refused on the 6 October 2020. Ms Jupp's explanation for this refusal was, in my view, illuminating. She said:

- Both Ms Chambers and Ms Jupp were reliable witnesses who sought to answer (and confine their answers to) the questions asked of them.

- Mr Forster was a curious witness. He presented himself as having an almost Olympian detachment from the financial operations of Qualia, and his default position when asked about any particular aspect of Qualia's activities – be it a communication, a calculation or a projection – was that he did not get involved with that sort of thing at that level of detail, and left it to others. When presented with contemporaneous documents demonstrating his direct involvement in the creation of particular documents, he consistently responded that these were one-offs.

- The correspondence between Mr Forster's evidence and his witness statement can best be described as approximate. When asked in cross-examination how long it would take to turn around a failing care home, his responses varied between the statement in his witness statement (no less than five years and often more) to two years. More significantly, he stated in his trial witness statement that he did not recall ever meeting a potential leaseholder to discuss investments, but withdrew this when presented with an email discussing exactly such a meeting.

- Because the FCA's case largely revolves around allegations that misleading statements were made to investors, it is interesting to consider Mr Forster's evidence as to the inclusion of incorrect statements. For example, it was put to him that his letter to investors on 30 September 2020 to the effect that the FCA had instructed Qualia to stop making payments to investors was untrue, since this was not what the FCA had said. His response was that the letter may have been 'slightly misleading'. In other instances, misleading statements to investors were defended on the basis that the statements were 'not entirely factual', and 'the wording wasn't quite right'. When confronted with the email that demonstrated an intention to reduce investor returns to 6% (by stating or implying that Qualia was not sustainable without that reduction), he said 'I don't like the wording, obviously, that's been used there from myself' and 'I don't like my wording'.

- I concluded that Mr Forster was mentally trying to put as much distance as he could between himself and the consequences of his actions. I think it is entirely possible that he is still trying to come to terms with the massive loss to investors which he has undoubtedly caused, and is seeking – in his own mind – to excuse himself. However, the practical result of this is that I did not find his evidence to be reliable, or his account of his own lack of involvement in the activities of Qualia to be credible.

- Mr Forster put forward a witness statement from Mr Lindsay, the partner at Lupton Fawcett who had been responsible for advising QCD and MBI, obtaining the counsel's opinion regarding CIS status, and for preparing the Lupton Fawcett Report. Mr Lindsay was not available for cross-examination, and Mr Forster's evidence was that this was because he was seriously unwell. If he had attended for cross-examination, it would have been possible to throw some further light on the way in which the instructions to counsel were created, and as to his understanding as to the aims of the report.

- Mr Forster described the business strategy behind his operations at some length in the witness box. However, it was succinctly summed up in the witness statement of Mr Lindsay as follows

- There are two ways of looking at this. One is Mr Forster's case, as advanced in his evidence, which is to the effect that he sincerely believed that these homes were "diamonds in the rough", capable of being turned around to highly profitable businesses. The other is the FCA's suggestion, that since the cash inflow of the company involved the purchase of a care room, the optimisation of cash inflow involved the purchase of the cheapest possible rooms, and that a strategy of identifying and purchasing cheap rooms maximised inflows.

- In order to understand this case, it is essential to understand what Mr Forster was doing, and how he perceived it.

- The basic business model was that investors were offered investments on terms that they would receive a (high) fixed rate of return for a 25-year period, and would then be offered a choice between selling the investment back to the company at a fixed price (at various fixed points, though Qualia's modelling in March 2020 was based on an assumed exit at 10 years) or electing to move to a basis where they would receive a return of 50% of the revenue generated by the investment property. There are two ways of analysing this arrangement. One is that it is a loan by the investor to the scheme with a fixed return and fixed maturity, subject to an ability to redeem at earlier dates, but with an option at maturity to elect to receive an interest in the future revenues of the investment property instead of cash repayment. I will call this the "Debt Model". The other is that it is an investment in the scheme property, with a specified return for an introductory period and a proportionate return thereafter, but with an option at various points of the introductory period to cash out at a specified price. I will call this the "Investment Model

- It is entirely clear from Mr Forster's evidence that he thought about the arrangements exclusively in terms of the Investment Model. At a number of points during his cross-examination he expressed the view that the investors were "not creditors". More importantly, when pressed on the point that the revenues from the investment properties were never anything like sufficient to enable the redemption of the investments at the specified redemption price, he replied that this was not a prospect which was seriously considered – his expectation was that investors would simply remain as investors. This approach is confirmed by the accounts of the companies concerned, which did not take into account the obligations that would be owed to the investors if the redemption rights were exercised. This is consistent with the Investment Model but wholly inconsistent with the Debt Model.

- This is also to some extent how the investments were presented to investors. The headlines in the various brochures provided to investors specified that this was a "buy-to-let" investment, with a number of different "exit strategies" available on request. Emphasis was placed on the element of fixed return in the brochures, but there is no doubt that what was being offered to investors was an income stream to be derived from a particular asset, backed by an undertaking to make up any shortfall with revenues from other assets.

- It is therefore clear to me that the arrangements, in the minds of both Mr Forster and of the Investors, took the form of the Investment Model, not the Debt Model.

- The preliminary issue which falls to be decided is as to whether the arrangements with which we are concerned fall within the scope of the Financial Services and Markets Act 2000. This takes us to the question of whether they constituted a "collective investment scheme" (CIS) within the meaning of section s.235 of that Act.

- CISs are defined by s. 235 FSMA, which provides:

- The fact that the definition in s.235 may be a constitutive element of a criminal offence has created a certain amount of discussion about how the burden of proof should be applied in a case where the question of whether the facts satisfy s.235 is in question. As Arden LJ said in FSA v Fradley, cited with approval by Lord Carnwarth at [6] in Asset Land,

- This is, of course, clearly correct. However, it does raise the issue of what a "fair" approach might be in this context. There seem to be two intertwined issues of fairness here. One is as to what standard should be applied to the findings of fact – does the fact of the potential criminal consequences of the application of the section mean that the court should require some higher standard of proof before finding such facts? The other is as to the approach to construction of the words used – should construction strain against an interpretation which potentially gives rise to a criminal consequence?

- I think that the answer to both questions is clearly no. As regards the facts, the position seems to me to be perfectly summed up by Baroness Hale in Re B (Children) (Care Proceedings: Standard of Proof) [2009] 1 AC 11; [2008] UKHL 35 at [70]:

- As Mr Temple correctly submitted, fairness here cuts both ways. Where there is a risk of a person suffering a criminal penalty, it might be argued that it is fair to adopt a more restrictive approach. However, where a statute has the express intention of protecting consumers, it might be argued that it is fair to adopt a broad, protective approach to its construction. I agree with both of these positions, and I think the necessary conclusion is that the section must simply be interpreted in accordance with the ordinary, natural meaning of the words used.

- Before coming to construe the section in detail, it is helpful to place it in context. Viewed from one perspective, it is simply a definition of investment funds, and many thousands of investment vehicles fall uncontroversially into its scope. However, viewed from another, it determines one of the most ineffable boundaries of the regulatory perimeter.

- Financial services legislation must catch two different types of activities. One is dealings in investments qua investments -shares, bonds &c. These are relatively easy to define. The second is more tricky. These are dealings in non-investments where the mode of dealing brings the transaction within the scope of the legislation. These latter include, as well as collective investment schemes, futures, options, contracts for differences and deposits (money is not an investment – it is only when it is paid by way of deposit that the legislation applies). The common element of these categories is that they bring dealings involving non-investments within the scope of the financial regulatory perimeter.

- The key to the applicability of s.235 is the distinction between the purchase of an asset, and the making of an investment in an asset whose economic substance derives from its common management. As Lord Sumption said in FCA v Asset LI Inc (trading as Asset Land Investment Inc) [2016] UKSC 17 at [99]

- This distinction between sales of things and sales of financial investments is an almost universal feature of financial regulatory law. In 1946 the US Supreme Court ruled, in respect of an arrangement where investors were invited to invest in orange groves, that the US securities laws should apply to any arrangement where there is "the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others" (Securities and Exchange Commission v. W.J. Howey Co., 328 U.S. 293 (1946)). This observation highlights the distinction which is at the core of s.235 – if the investor is being invited to participate in a common enterprise where both his contribution and his return will be monetary, the enterprise is very likely to be a CIS unless it falls within one of the existing exemptions (for example, because it is a company or an LLP).

- Another important aspect of the question as to whether an arrangement is a CIS or not is that what is assessed is the "purpose or effect" of the arrangements made, not their legal structure. It is not possible to contract out of s.235 if the economic reality of the contracts concerned does not correspond to the legal terms of the contracts. As the US Supreme Court said in Howey, "The statutory policy of affording broad protection to investors is not to be thwarted by unrealistic and irrelevant formulae". I think this equally true under English law.

- As noted above, a CIS arises where property is sold in a particular way. It is therefore very common for offerors of investments to seek to structure such arrangements in such a way as to enable them to claim that they are merely selling property and not investments. Such schemes frequently involve the sale of parcels of land – as, for example, in FCA v Capital Alternatives [2015] EWCA Civ 284 (and indeed in Howey in the US), but can relate to any type of asset – wine, cryptoassets or, in one celebrated case, ostriches. Thus, Capital Alternatives involved a rice farm in Africa and various forestry projects, and Asset Land (and various other 'land-banking' cases) involved the sale of sub-plots in land in the UK.

- The FCA's case is that the overall structure of the Qualia investments is broadly identical to that in Asset Land. In both cases, the investor purchases a smaller part of a larger whole which, in reality, the investor cannot exploit themselves. It is left to the scheme operator to make arrangements for the larger whole which are intended to generate profits. Although structured as a property purchase, both cases in practice involve the investor's participation in a business carried on by the scheme operator, with the real property replacing a share, or bond, which might otherwise be issued by the business. Any argument that the Qualia investments are not CISs therefore needs to distinguish the Asset Land case.

- The distinction that was urged upon me in this case is that in this case investors were offered a fixed return. Whereas in a normal land banking scheme, an investor's entitlement to returns is limited to the profits of the scheme, in this case investors were promised a fixed return for a number of years after their investment.

- I think there are two ways of putting this argument, but both fail. The first is that the fact that returns to investors were not expressed to fluctuate directly with the performance of the underlying assets meant that the investors were not participating in a scheme in relation to those assets. I think that this is clearly wrong. The requirement of s.235 is that the overall effect of the arrangements must be a participation, not that an arrangement can only be a scheme if it is a pure pass-through. The overall effect of these arrangements was clearly that investors participated in the arrangements, simply because (a) all the property that the scheme had was the result of investor participation, and (b) the only possible outcome of the arrangements was that that property would be divided between those investors. The second way of putting the argument is based on the Debt Model – that what the investors were really doing was making a fixed-rate, fixed-term loan to the Investment Company. Now I think it is clearly correct that a lender does not necessarily become a participant in a scheme simply by making a loan to that scheme, even though his returns will be entirely derived from the scheme property. However, as I have held above, in this case the Debt Model was neither the intended purpose nor the intended effect of the arrangements. It is therefore inappropriate to seek to invoke it in these circumstances.

- A payment of returns of this kind was considered in Anderson v Sense Network [2018] EWHC 2834 (Comm); and on appeal at [2019] EWCA Civ 1395. Anderson involved a deposit-taking scheme operated by 'Midas', whereby investors were told that their funds would be invested under special arrangements with the Royal Bank of Scotland, enabling high interest rates to be paid to investors.

- The means by which RBS would provide returns was not entirely clear, with the decision at first instance at [171] noting various explanations given to depositors, some of which referred to high interest payments from RBS and some of which referred to RBS trading with the money. In truth, there were no special arrangements with RBS. However, at [173], Jacobs J summarised that investors were told that they would obtain the benefit of a relationship with RBS and therefore enhanced returns on their money.

- Some of the investors claimed against Sense Network, the network of an IFA who had advised clients to enter the Midas scheme. In order to succeed against Sense Network, investors needed to show (i) that they had invested into a CIS; and (ii) that Sense Network was liable for advice to enter into the Scheme under s. 39 FSMA and/or at common law.

- At both first instance and on appeal the investors lost on the second question, and therefore the question of whether the claimants had invested in a CIS was not critical to the result. Nevertheless, both judgments contain detailed obiter conclusions, finding that the deposit scheme did constitute a CIS (a point which was fully argued by the parties). At first instance, Jacobs J concluded at [177]:

- On appeal, David Richards LJ reached the same conclusion at [73]:

- It seems to me that the facts of this case fall clearly within the last sentence of David Richards LJ's observations above. Accordingly, a scheme will still be a CIS where its purpose or effect is to pay investors fixed contractual entitlements from the income generated by the management of the underlying property. Such returns clearly fall within the ordinary – and wide – meaning of the words used in s. 235 (whether characterised as 'profits', 'income', or as 'sums paid out' of profit or income).

- The relevant arrangements in this case consisted of: (a) the contractual and conveyancing documentation, and (b) the brochures and other promotional material used to advertise the investment to prospective investors. Whilst Mr Forster admits the former, he denies the latter on the basis that the contractual documentation contained an 'entire agreement clause'.

- Mr Forster's position in this regard is untenable. In Asset Land, Lord Sumption JSC stated at [91] that:

- Lord Carnwath at [54] similarly held that no special weight should be given to contractual documents in assessing the arrangements in which investors participated.

- Another point which Mr Forster raised in his closing submissions was that the investors cannot all have been involved in a single scheme, since different investors were dealt with on different terms. Again, I do not think that there is anything in this argument. In the first instance judgment in Asset Land [2013] EWHC 178 (Ch) at [158] (not the subject of an appeal), Andrew Smith J held that there can be a collective set of arrangements even if different investors had different understandings of how the scheme would work. With respect, I agree.

- I therefore find that in identifying the arrangements for this purpose, I must look at all of the material presented to potential investors, and that includes the promotional material that was used to explain the investments to investors. This material clearly presented "Qualia Care" as the investee, and – as was clear from Mr Forster's evidence – care had been taken to render this term non-specific to any individual legal entity. I therefore think that the "arrangement" here is a single arrangement encompassing all of the homes where rooms were sold to investors under the "Qualia" brand.

- The arrangements must be in respect of 'property of any description, including money'. As such, the underlying property can take any form and can include the contributions made by the participants themselves (Fradley at [33], Anderson v Sense Network [2018] EWHC 2834 (Comm) at [175]), as well as any property managed in common with that of the investors (Capital Alternatives at [48]-[51]).

- I therefore conclude that the scheme property included all of the homes in which rooms had been sold, the cash balances received from investors and not applied in the purchase of rooms, and any other property derived therefrom, apart from those amounts paid to investors pursuant to their income entitlements.

- The importance of the "purpose or effect" wording is that it actually creates two tests. One is as to what the purported purpose of the scheme was – put simply, the question of what investors thought that they were investing in. If an offeror offers investors an investment which is, as described, a CIS, he is offering a participation in a CIS, even if his true purpose is that once he has received the money he will simply abscond with it. The other is as to what the actual effect of the arrangements is. If the facts of the arrangement are that it satisfies the definition in s.235, what is offered is a participation in a CIS, even if that is not the purpose of any of those involved.

- The best evidence of the 'purpose' of an arrangement is likely to be that set out in the promotional material and contractual documentation in relation to it. The best evidence of the 'effect' of an arrangement is likely to be the evidence of how the scheme was actually operated.

- The question of the "purpose" of the arrangements takes us to the question of how the investments were in fact marketed. It is common ground that investors were led to believe that they were advancing money to an asset holding company which would own care homes, that those care homes would be operated by a separate entity (QCL), that the investor's entitlement to the promised returns would be a claim on that asset holding company, and that those returns would be financed through the proceeds of the operation of the care homes.

- It is clear that this was indeed how the investments were marketed. A document entitled 'Introducing Qualia' sent by Qualia to sales agents (expressly to help promote the investments), stated:

- A 'Frequently Asked Questions' document, also provided to agents, stated:

- A Qualia 'Agent Training Pack' for the Newton Manor care home stated:

- The Lupton Fawcett Report seen by many investors also refers to QCD receiving 90% of QCL's profits.

- When a client asked about the financial strength of QCD, he was told:

- What is important in this regard is that at no point were investors given any reason to believe that the source of the repayment due to them would be anything other than the profits made by QCL out of the operations of the homes collectively. I therefore do not believe that it can be argued that the offering to investors was made on any basis other than that their potential return on their investment was entirely conditional on the profitable operation of the Qualia portfolio of homes.

- Finally, on "purpose", Mr Forster's position is that it cannot have been his purpose to offer investors participations in a CIS because he had received counsel's opinion to the effect that the arrangements were not a CIS. I will return in due course to the question of how much reliance Mr Forster is entitled to place on this opinion. However, the point here is that the purpose of the scheme is different from the purpose of the promoter. The purpose of the scheme was to permit participants to participate in the revenues to be derived from the operation of the homes, and that remains true regardless of Mr Forster's state of mind.

- Mr Forster – quite properly - admits that the investors had no day-to-day control over the management of the property and that the property was managed as a whole by or on behalf of the operator(s). As such, the FCA does not need to show that the investors' contributions, and the profits or income out of which payments were to be made, were pooled.

- However, the Defence prepared by Counsel for Mr Forster argued that where a participant both owns an asset of the scheme and is entitled to a fixed return, there is no "pooling", since the return due is payable regardless of the performance of the asset. I should therefore deal with the question of pooling here.

- In FCA v Capital Alternatives [2014] EWHC 144 (Ch) at [159], Nicholas Strauss KC stated:

- Where – as I have held above – the fixed element of the amount payable to participants is in fact primarily performance dependent, the result is a single scheme, and the assets of the scheme are properly regarded as pooled. If the economic effect of the arrangements taken as a whole is a pooling, the mere fact that the contractual terms specify otherwise does not save the arrangements from constituting a pooling.

- It should also be noted in this regard that it was clear to investors that the returns due to them were to be paid to them regardless of whether their room(s) were occupied or not. Some investors were explicitly told that income and profit generated from the care homes would be pooled together within QCD, and that if a care home was not performing at a profitable level, returns to investors would be paid from the group and not tied to a specific care home (let alone the investor's care room). Given this background, I can see no argument that there was no pooling.

- The fact that I have concluded that the investments were, as offered, participation in a CIS, means that the question of whether the effect of the triggering of the Management Provisions would have been to turn them into a different kind of CIS is not relevant. However, since I heard detailed argument on the point, I shall express my conclusions.

- Investors in the scheme were told that they had – in effect – two options as regards their room. One was to sell it back to Qualia at a specified price, and the other was to allow it to be operated by Qualia on the basis that they would continue to receive a proportion of the rental received for that room. Opting for the latter arrangement was described as "triggering the Management Provisions".

- I think that it is clear that the Management Provisions, once triggered, would have eliminated all of the grounds on which Mr Forster relied to support his argument that the arrangements were not a CIS. Prima facie there would have been no pooling, but there would necessarily have been "management as a whole" (since it would have been both physically impossible and illegal for the investor to manage the room directly himself), so the other requirements of CIS characterisation would have been satisfied.

- The question which arises is therefore as to whether, even if the investments as initially offered were not participations in a CIS, the fact that they could be varied in such a way as to make them participations has the effect of making the offer of the initial investments an offering of a participation in a CIS.

- As a preliminary point, Mr Forster argues that the Management Provisions are not in fact relevant, since they were never triggered for any investment. Mr Temple argues that the answer to that question must be 'no'. As observed by Lord Sumption in Asset Land (SC) at [91]:

- One way to approach this question is to ask who has the option to trigger the conversion. If there is no option – that is, if the instrument will automatically convert into a participation in a CIS at a specified point in time – then it seems to me that the offer of the instrument must be regarded as being an offer of a participation in a CIS. Equally, if the offeror of the instrument can unilaterally convert that instrument into a participation in a CIS, then the offer of that instrument is an offer of a participation in a CIS. However, if the holder of the instrument has an option to convert the instrument into a participation in a CIS, but also an economically realistic option not to do so, then the offer of the instrument should not be regarded as an offer of a participation in a CIS.

- In this case, the Management Provisions would necessarily take effect in due course. The effect of the contractual arrangements between the parties was therefore that investors would end up owning a participation in a CIS unless they sold the investment before the relevant date. It seems clear to me that an offering of an investment with these characteristics does constitute an offer of a participation in a CIS.

- For all of these reasons I am of the view that the arrangements with respect to the businesses of QCP and QCD constituted a CIS, and that the investments that were offered to investors constituted participations in a CIS.

- There are a number of things which follow from a finding that the arrangements constituted a CIS.

- The establishment and operation of CISs in the UK constitutes a regulated activity under FSMA, as does the sale of units in a CIS to investors. Section 19 FSMA provides that no person may carry on a regulated activity in the United Kingdom unless they are authorised or exempt. None of the entities involved in the sale of the Qualia investments were authorised. It is therefore clear that the Investment Companies, and any other person involved in the offering of units, would have been acting in breach of s.19 for the whole of their commercial lives.

- Section 21 of the FSMA prohibits, in the course of business, the communication of invitations or inducements to engage in investment activity unless the person is authorised or the content of the communication is approved by an authorised person. Any unauthorised person contravenes s. 21 FSMA where, in the course of business, they communicate an inducement or invitation (and that communication has not been approved by an authorised person) to either:

- There is no suggestion that any materials in this case were approved by an authorised person. Accordingly, any promotion of them by the Investment Companies or FGL breached s. 21 FSMA.

- Both s.19 and s.21 operate on the traditional UK legislative model in this area, where a very broad prohibition is qualified by a very large number of exemptions. It is common ground that none of these exemptions apply in this case.

- Questions about the state of mind of a company are not always straightforward. In FCA v Avacade [2020] EWHC 1673 (Ch) at [398]-[402], Mr Johnson KC (sitting as a DHCJ) concluded that, where it is alleged that a corporate entity made false and misleading statements, it is necessary for the FCA to show that the entity's controlling mind and will (i.e. its directors) were aware of relevant statements, and knew them to be false, or made recklessly.

- The first question that requires to be addressed is therefore the extent to which Mr Forster was in fact the controlling mind and will of both the Investment Companies.

- There is no doubt that he was presented externally as such. He was variously described as the 'Chief Operating Officer' and the 'Chief Executive Officer' of the Investment Companies in promotional materials.

- The Lupton Fawcett Report describes Mr Forster's role as being:

- The evidence that we have as to the internal administration of these entities shows that this was an entirely accurate picture. Mr Forster was not only responsible for the overall direction and strategy of the companies, but was active in their management and operations.

- Mr Forster had oversight of every aspect of the operation of the Qualia scheme and business. There were several points in Mr Forster's oral opening and cross-examination when he describes actions that were taken, and decisions that were made, in the first person ('I' or the collective 'we' or 'our'). Mr Forster also accepted that he had read and agreed with the description of his role in the Lupton Fawcett Report as being 'responsible for the operation, direction and growth of [QCD]'. He also accepted that he was the head of the Board for the Investment Companies and QCL. It is also clear that:

- That other directors or staff members were also involved in various aspects of the business – from marketing to contract administration – is beside the point. He is a classic example of a 'moving light' behind a company – a hands on owner and director who led the strategy of the company and was involved in its day-to-day operations. It is also clear from his own witness statement that he was the driving force behind the establishment of the Qualia companies and investments.

- I am therefore entirely satisfied that Mr Forster was in practice the guiding mind of the Investment Companies. Thus the question of whether the Investment Companies made statements which they knew to be false or misleading is simply a question as to whether Mr Forster knew that those statements were false or misleading.

- Section 89 (misleading statements) of FSA 2012 provides, relevantly, as follows:

- Section 93(3) of FSA 2012 defines 'relevant agreement' as 'an agreement – (a) the entering into or performance of which by either party constitutes an activity of a kind specified in an order… and (b) which relates to a relevant investment.' Section 93(5) defines 'relevant investment' as 'an investment of a kind specified by an order…'. In respect of which:

- Section 90 (misleading impressions) of FSA 2012 provides as follows:

- Subs (5) and (6) define the terms 'gain' and 'loss' for the purposes of subs (4).

- The effect of these sections is as follows. S. 89 criminalises the making of any misleading statement where (a) the person making the statement knows that, or is reckless as to whether, the statement is false, and (b) the statement is made with the intention of inducing a person to (inter alia) purchase an investment.

- Section 90 of the FSA2012 criminalises doing any act, or engaging in any course of conduct, which has the effect of creating a false or misleading impression as to the value of an investment. It applies where (a) the person responsible for the act or conduct intended to create the misleading impression, and either (b) the misleading impression was created for the purpose of inducing another person to deal in investments, or (c) the misleading impression was deliberately or recklessly created for the purpose of enabling the person making it to make a gain for himself or another.

- In relation to s. 397(1) FSMA, the predecessor to s. 89 of FSA 2012, HHJ McCahill KC in Capital Alternatives at [368] held that knowledge includes wilful blindness and recklessness which should be construed consistently with R v G [2004] 1 AC 1034 at [41]:

- Accordingly, the issues that need to be decided are:

- The FCA in effect identifies two ways in which it says that the promotional materials were misleading. The first applies to all of the materials, and is that they collectively gave the impression that the Qualia business model was viable and capable of repaying on the terms agreed the investments which it had raised (the "Sustainability Impression"). The second is specific to a number of sales of care homes (the "Unowned Care Homes"). In these cases, the FCA say that the Investment Companies made statements and/or gave the impression that they owned the rooms that they were selling, when in fact they did not (the "Unowned Care Homes Impressions")..

- The FCA's case is that investors were given the following impressions ("the Sustainability Impressions"):

- It is clear that the Sustainability Impressions were in fact communicated – they occur regularly throughout the available documentation, and Mr Forster affirmed his belief in their truth on every possible occasion during his testimony.