Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales Family Court Decisions (High Court Judges)

You are here: BAILII >> Databases >> England and Wales Family Court Decisions (High Court Judges) >> Collardeau-Fuchs v Fuchs (Rev1) [2022] EWFC 135 (14 November 2022)

URL: http://www.bailii.org/ew/cases/EWFC/HCJ/2022/135.html

Cite as: [2022] EWFC 135

[New search] [Printable PDF version] [Help]

This judgment was delivered in private. The judge has given leave for this version of the judgment to be published on condition that in any report of this judgment or of the proceedings the children shall not be named and the address of the family home in West London shall not be stated. All persons, including representatives of the media, must ensure that these restrictions are complied with. Failure to do so will be a contempt of court. Otherwise, there are no reporting restrictions applying to the judgment or the proceedings.

Neutral Citation Number: [2022] EWFC 135

Case No: ZZ20D65691

IN THE FAMILY COURT

Royal Courts of Justice

Strand, London, WC2A 2LL

Date: 14/11/2022

Before :

MR JUSTICE MOSTYN

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

ALVINA COLLARDEAU-FUCHS |

Applicant |

|

|

- and –

|

|

|

|

MICHAEL FUCHS |

Respondent |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Nicholas Cusworth KC and Eleri Jones (instructed by Payne Hicks Beach) for the Applicant

Patrick Chamberlayne KC and Daniel Bentham (instructed by Harbottle and Lewis) for the Respondent

Hearing dates: 11, 13, 14, 17 and 19 October 2022

- - - - - - - - - - - - - - - - - - - - -

Judgment Approved

Mr Justice Mostyn:

- This is my judgment on the following applications:

- The matter previously came before me on 9 February 2022 when I awarded maintenance pending suit to the wife: Collardeau-Fuchs v Fuchs [2022] EWFC 6, and on 26 April 2022 when I heard an application by the wife to enforce that award: Collardeau-Fuchs v Fuchs [2022] EWFC 45.

- Although the husband maintains that the wife has come close during the course of the proceedings to repudiating the terms of the modified PNA, her clear stance before me is that she accepts its binding nature. However, the parties do not agree on the interpretation of the modified agreement and leave me to resolve their differences. Further, they do not agree what level of child support should be awarded.

- Therefore, I have to decide two matters:

- The husband was born on 25 January 1960 and is 62. He is a highly successful real-estate developer and investor. Originally from Germany, he moved to the US in the 1990s, completed an MBA in California and concentrated on purchasing property in New York as well as Germany, ultimately acquiring a significant portfolio of prime Midtown Manhattan real estate. He holds both US and German citizenship.

- The wife was born on 19 March 1975 and is 47. She is a French national with UK pre-settled status and a US Green Card which will be relinquished. She was raised in France until age 14 when she and her family moved to London. She attended university in Florida and embarked on further studies in New York. She is a former journalist but left her career in the early days of their relationship as the husband’s lifestyle was and remains one of constant travel, and she wished always to be by his side.

- According to the wife, they met in 2006 and began cohabiting in 2008; according to the husband, it was in 2008 that they met. The dispute is of no relevance. They began living together, according to the husband, in the USA in 2010. Their first family homes were in New York (they have always had more than one home). They oscillated between London and the US until they settled into London in 2018, where the wife and children remain.

- They married on 14 April 2012 and separated in March 2020. The wife’s divorce petition was issued on 22 December 2020. Decree Nisi was pronounced on 24 August 2021 and is yet to be made Absolute.

- The husband has two adult daughters from a previous marriage and a son from another relationship.

- The parties have two children together, A, now aged 6, and B, now aged 4. They attend pre-preparatory school together and live with their mother in the family home. In Children Act 1989 proceedings the circuit judge on 1 September 2022 ordered a structured development of staying contact with their father. Contact will develop so that the husband will soon have the children on alternate weekends during term-time, together with around 8 weeks a year in school holidays.

- On two occasions, the husband has disclosed his billionaire status. The schedule appended to the PNA dated 2 March 2012 stated his wealth to be $1,018,215,671. The schedule produced by him on 25 June 2021 (in response to an order made by me on 19 April 2021) stated his wealth to be $1,731,289,558. Between those dates, which approximately correspond to the span of the marriage, there was therefore an increase in the husband’s wealth of $713,073,887, although in his oral evidence he claimed that the value of his fortune had plummeted recently due to the turbulent economic climate. In cross-examination Mr Cusworth KC put to him that during the marriage there had been an acquest of $713 million. This was the ensuing exchange:

a. by Michael Fuchs (“the husband”) in Form A dated 30 March 2021 for financial remedies against Alvina Collardeau-Fuchs (“the wife”);

b. by the husband dated 15 April 2021 that the wife do show cause why a prenuptial agreement (“PNA”) dated 2 March 2012 (as modified on 23 March 2014 after the marriage) should not be made an order of the court;

c. by the wife in Form A dated 24 March 2022 for certain financial remedies against the husband (but not then including secured child periodical payments); and

d. by the wife dated 12 October 2022 against the husband for secured child periodical payments.

a. The correct entitlements of the wife under the modified PNA and their value. Although the agreements are governed by New York law, I have not been burdened with any legal arguments about the meaning of the agreements. Rather, I have been asked to construe, by reference to the ordinary meaning of words, common sense, and the intentions of the parties, what the agreements, properly interpreted, provide for the wife.

b. The quantum of child support to be awarded to the wife for the benefit of the children, and whether the award should be secured. The wife makes a very substantial claim of £1.13 million per annum for the children, excluding school fees. The competing arguments have involved close consideration of the terms of the legislation and of much case law.

Background

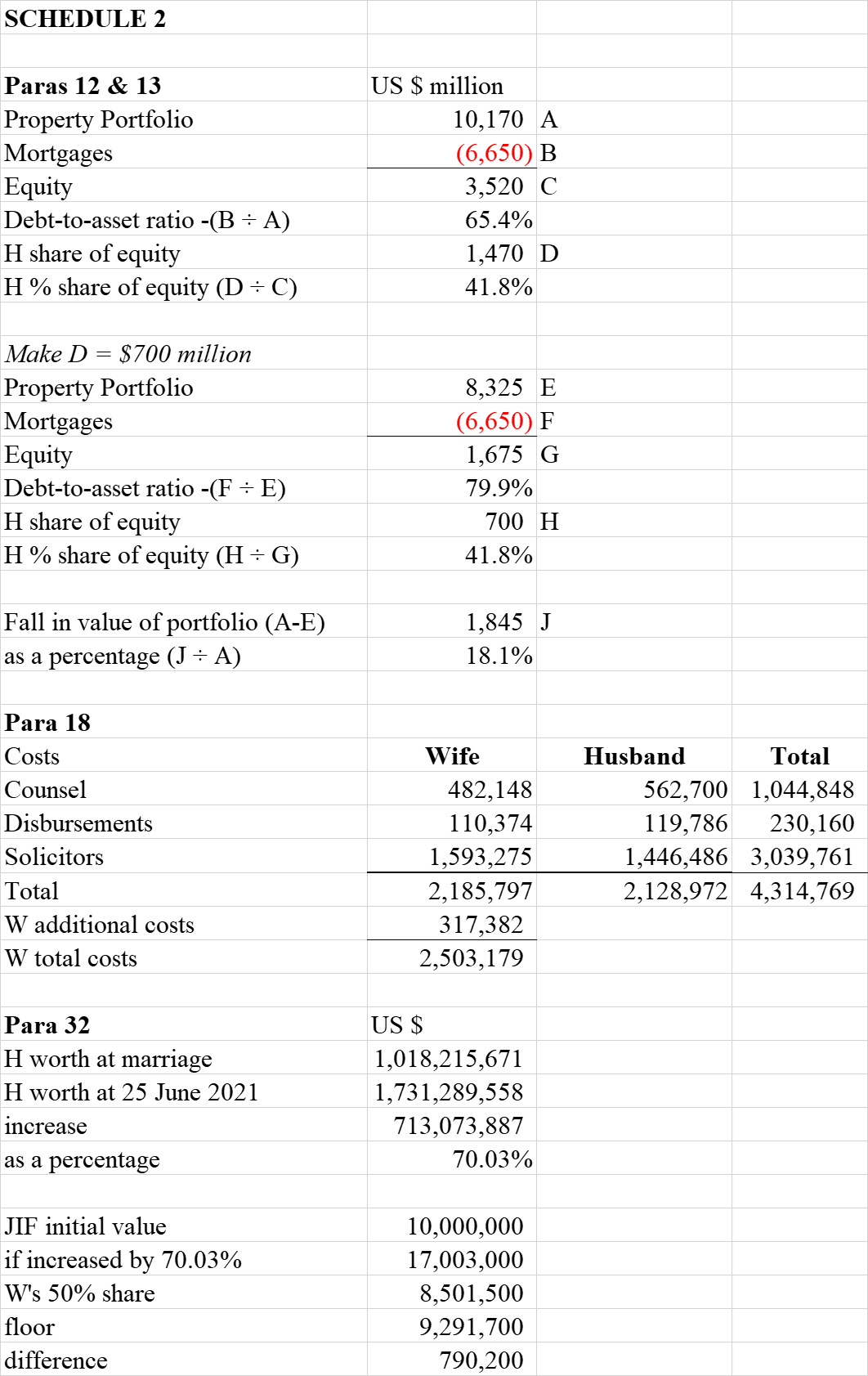

- The husband’s evidence is not that surprising. The schedule summarising his investment property portfolio, disclosed on 25 June 2021, identifies numerous commercial properties, mainly in New York. These properties are all co-owned, in varying shares, with other investors. The properties are said to be worth $10.17 billion with mortgages of $6.65 billion. The properties are thus all highly leveraged. The overall debt-to-assets ratio is 65%. The equity is $3.52 billion of which the husband’s share is $1.47 billion (41.8%).

- It would not take much movement downwards from the top figure for the husband’s share of the equity to fall to $700 million. Mathematically, a reduction of the $10.17 billion figure by 18.1% to $8.33 billion results in a halving of the value of the husband’s share of the equity. It seems to me plausible that the blows to the global economy since June 2021 could have resulted in such a reduction in the value of the property portfolio. But as the husband rightly says, it is not important. The result of this case does not differ depending on whether the husband is worth $700 million or $1 billion or $1.7 billion.

- The parties certainly lived a billionaire lifestyle during their marriage. The nature of the parties’ relationship was such that money (and particularly the detail of family expenditure) was never a concern. I described their lifestyle in my maintenance pending suit judgment. At [12] I stated:

- They ran at least five fully staffed homes in fashionable places such as The Hamptons, New York City, Paris, Miami, Cap d’Antibes, Capri and London.

- The wife and the children have their primary residence at the family home in West London, and when in London the husband lives in an apartment near the family home. The family home is over 8,500 square feet in area. Its agreed value is £35,000,000 and the mortgage is £21,500,000. It is a property of exceptional amenity, but with extraordinarily high running costs. It has six stories, five bedrooms, and an indoor heated pool in its basement. It has a private garden and access to a communal garden. The parties had a retinue of staff at the family home. They formally employed two rota chefs, a house manager, two or three housekeepers, a laundress and two full-time nannies, in addition to a multitude of contractors (gardeners, pool maintainers, builders, plumbers, electricians and handymen).

- In the maintenance pending suit judgment, I described and analysed the annual expenditure. According to a schedule produced by the husband on 25 June 2021, in 2019, the last calendar year of the marriage, the expenditure was £4.78 million. Mr Cusworth KC submits that an analysis subsequently made of the American Express statements shows that this figure is understated. Be that as it may, the rate at which the family lived was phenomenally high. This is not a common-or-garden big-money case; this is a case of the super-rich who, as I stated in my previous judgment (quoting F Scott Fitzgerald), are truly different to you and me.

- This family’s custom of unrestrained expenditure has been practised in the litigation. Prodigious amounts of legal costs have been incurred. The parties’ Forms H filed at the start of the trial show a combined expenditure on these financial remedy proceedings of £4,314,769, broken down as follows:

- I gather that the parties have spent much the same in the Children Act proceedings. To spend over £8 million in family litigation in such a short period must be almost a record. The scale and intensity of the financial dispute between the parties, and the amounts spent on it, demonstrate the enduring vigour of the law of unintended consequences. The intended consequence of the modified PNA was to spell out with clarity the financial outcome in the event of divorce, and in so doing to prevent, or at least seriously circumscribe, any future litigation. In fact, the exact opposite has happened. The parties have furiously and expensively litigated, probably more intensely and extensively than would have occurred in a routine financial remedy case without a PNA.

- The parties executed the PNA in accordance with the law of the State of New York on 2 March 2012, some six weeks before the marriage. As stated above, the husband’s net worth was disclosed in the sum of $1,018,215,671. The wife’s net worth was stated to be $4,471,500. Both parties had advice from, and were represented by, distinguished lawyers and there has been no suggestion of deficiency or pressure within the process leading up to the execution of the PNA.

- The parties signed a subsequent Modification Agreement on 23 March 2014. In her evidence, the wife described how this was presented to her in completed form as a birthday present. It increased the financial provision to be made to the wife pursuant to the PNA. As with the PNA, there has been no suggestion that the process leading to its execution was in any way flawed.

- The PNA creates a regime of separate property and includes a waiver of spousal maintenance claims in consideration of the provision made in the agreements. The key features of the agreements are as follows:

- Notwithstanding the detail and clarity of the modified agreement, there are numerous disputes between the parties as to its true meaning. I required the issues to be expressed narratively in a Scott Schedule and numerically in a spreadsheet (“the Outcome Schedule”).

- On the face of it there are 17 separate issues, although Issue 17 is nothing to do with the interpretation of the agreement. Further, I think that some of the issues are duplications. One issue was resolved by agreement on the last day of the hearing. I consider there are 10 separate issues, to which I now turn.

- Article 6.1 provides for the establishment by the husband of a ‘Joint Investment Fund’ (“JIF”). The husband was to fund it and the parties were to share its growth and value equally.

- Specifically, Article 6.1 provides:

- Article 6.1.2 goes on to reinforce the provision made to the wife by the JIF to give her a guaranteed (or “floor”) amount depending on the length of the marriage.

- Specifically, Article 6.1.2(b) provides:

- Thus, the Event of Marital Dissolution having occurred on 22 December 2020, the wife was to receive half the value of the JIF, or, if more, a sum calculated as follows: [$5,000,000 + (103 x $41,667) = $9,291,701]. This was payable as follows:

- However, unbeknown to the wife, the husband did not establish the JIF. His explanation was that he believed that the subsequent purchase by him in joint names of other properties pursuant to the Modification Agreement, and voluntarily, satisfied this obligation. He was wrong about that. He now accepts the advice from his New York attorney Allan Mantel who wrote on 20 June 2022 that the New York court would not accept that these property purchases constituted a substitute for the JIF.

- Much has been made by Mr Cusworth KC of the husband’s failure to establish the JIF but there is no numerical difference between the parties in relation to these issues in the Outcome Schedule. The entry for each party in that Schedule is $9,291,700. The wife’s position in the Scott Schedule is stated thus:

- The husband’s position is that there is no evidence of any loss. In [11] above I gave the figure for the increase in the husband’s fortune from the date of the marriage until June 2021. That increase was 70.03%. If the husband had in fact established the JIF there is no reason to think that it would have increased at a rate markedly higher than the rate of increase of the value of the husband’s overall assets. An increase of 70.03% would mean that the JIF would have been worth $17,003,000 in June 2021, and in my opinion certainly no more today. The wife’s 50% share would thus be worth today no more than $8,501,500, rather less than the amount provided for by the “floor” of $9,291,700.

- I accept the husband’s submissions. The figure I use in the Outcome Schedule is $9,291,700. The husband’s breach of the agreement, while regrettable, is redressed by using that figure. There is no warrant for assessing the household needs for the purposes of the award of child support in a more liberal way than I would do otherwise because the husband failed to comply with that term of the agreement. The argument is a non- sequitur.

- This property was purchased by the husband in his sole name in September 2006 with a mortgage of $8 million. The mortgage now is $13 million. The wife correctly says that the $5m increase in the mortgage debt derives from a re-mortgage in 2016 when the husband raised a lump sum amount to pay off his first wife’s mortgage under a long-standing obligation in a court order.

- The wife’s position is that she did not agree to the re-mortgage. The husband’s position is that the wife did agree to it; that the debt to his ex-wife was genuine; and that there is no basis for artificially excluding the value of this re-mortgage. Mr Chamberlayne KC submits that this was not ‘wanton expenditure’ within the add-back jurisprudence.

- The original Article 6.6 provided:

- As stated above, the Modification Agreement provided that Article 6.6 was amended to provide that the husband would on the earlier of the breakdown of the marriage, or the wife becoming a US citizen, transfer to her a one-half interest in this property. Nothing was said in the MA about any mortgage, but it was implicit that the wife’s half share would be subject to such mortgage as existed at the time the transfer took place. There was nothing in the MA freezing the mortgage at the level at which it stood at the date of its execution; there was nothing in the MA prohibiting the husband from, in accordance with his customary practice, mortgaging the property for his personal purposes. The wife knew perfectly well that it was the husband’s customary practice, indeed it was the very essence of his entrepreneurial spirit, to raise money on existing properties to fund investment in other projects or to meet his own personal needs. The wife was well aware of the husband’s fractious relationship with his first wife and the financial obligations under the order and, indeed, was a drafter of proposed emails to be sent to the first wife’s lawyers.

- These matters seem to me to favour taking the true mortgage position. On the other hand, on the basis that equity treats as done that which is agreed to be done, the husband is in effect requiring the wife to pay half of the lump sum raised to discharge his obligations under a divorce order to his first wife. Further, I am not satisfied that the wife knew about the raising of this re-mortgage in 2016 for this particular purpose. Indeed, Mr Cusworth KC demonstrated in his cross-examination of the husband, that he had not given a correct account in his witness statement where he said that the borrowing against Meadow Lane was used to meet living costs and improvements to the property as well as to meeting obligations to his first wife. On the contrary, the contemporaneous documents include a completion statement which shows quite clearly that the entirety of the re-mortgage money went to pay off the mortgage of the husband’s first wife.

- In my judgment, a reasonable interpretation of the Modification Agreement is to be gained by asking what the Commuter on the Bronx Subway[1] would have said in answer to this question:

- This next-door property was purchased by the husband in his sole name on 10 April 2014, a few weeks after the signing of the Modification Agreement on 23 March 2014. It is therefore not covered by it. It could only be covered by Article 6.7 of the PNA if the parties had lived in it as a primary or vacation residence, and they did not. Article 6.7 provides:

- A great deal of forensic energy has been expended on this issue, and some quite serious allegations have been bandied around. Yet the sum at stake, so far as the wife is concerned, is £1 million. While this is objectively a large amount of money, it is but a small element of the overall value to which she claims she is entitled under the modified PNA.

- The family home in London was purchased for £30.2 million in 2017 in joint names. A mortgage of £19.6 million was raised with a five-year term. Of this, £4.53 million was to be repaid over the term at the rate of £940,000 per annum; the balance was interest only. All of this was arranged by the husband; such transactions were his meat and drink.

- In 2020, having made only two such capital repayments, the husband renegotiated the mortgage. The borrowing was increased, and a fresh five-year term was commenced. In so doing the interest-only element of the mortgage was reset at £18 million and the repayment element was reset at £4.5 million, now repayable up to 2025. The husband did not make a capital repayment in 2020. In this way he raised £4.6 million which was used to buy in his sole name an adjacent property to preserve the amenity of the family home.

- The wife says she did not consent to the remortgage; it was presented to her as a fait accompli. A great deal of time was spent scrutinising the wife’s signature on various documents, although these did not include the critical document, namely the formal legal charge (presumably in Form CH1), which would have been submitted to the Land Registry for registration.

- The wife is adamant that she did not sign the mortgage offer dated 23 January 2020. She says that the signature on that document, purportedly dated 24 January 2020, was not made by her. The husband is equally adamant that she signed it in his presence. I fear that his memory must be at fault because Mr Cusworth KC convincingly demonstrated that the wife did not sign that document.

- The evidence establishes that there was a practice within this family of proxies signing documents on behalf of the principals. The wife was well aware of this. Indeed, much to the surprise of all, in her oral evidence she averred that she did not sign the offer for the 2017 mortgage either. I have no reason to doubt that evidence. It showed that she was well aware that the 2017 mortgage documents had been signed on her behalf and that she condoned such practices.

- Mr Cusworth KC took the husband through the contemporaneous emails. These showed that on 3 February 2020 the bank emailed the husband saying that they needed the wife’s signature on the mortgage offer. At that time, the wife was in London and the husband was in New York. On the same day a member of the husband’s staff in New York replied to the bank saying “please find the document attached as requested. The original will be sent via FedEx today.” The document attached was the mortgage offer dated 23 January 2020, now bearing the wife’s signature purportedly made on 24 January 2020. It looks as if someone signed the mortgage offer on 3 February 2020 on behalf of the wife and backdated that signature to 24 January 2020.

- A similar conclusion is reached when consideration is given to the “cooling off” document purportedly bearing the signatures of the parties and dated 4 February 2020. The husband accepted that the date had been overwritten; it had originally given a date in January 2020. The husband accepted that the signature on the document was not made by him; he did not know if the other signature on the document purportedly made on the document by the wife was made by her. It certainly looks as if someone also signed that document on the wife’s behalf.

- The proxy-signing practice was also in use on 14 February 2020 when a “Deed of Confirmation” was purportedly signed by the wife in the “presence” of a witness (a member of the husband’s staff), who gave her address in New York City. It was also signed by the husband in the “presence” of another witness (another member of his staff) who gave his address in New York City. The husband said he did not know if he made “his” signature. The husband doubted that the wife was in New York on 14 February 2020. It would seem that she was not.

- It may well be the case that there has been proxy-signing of the wife’s signature on the three documents and that she did not sign any of them. However, if this did in fact occur, it is obvious that this was a practice condoned by her. That may account for her surprising inertia when the bank asked her for details of her allegation that her signature had been forged. On a number of occasions, the bank asked for evidence so they could investigate the matter properly. But the wife deliberately declined to cooperate in that investigation, with the result that the bank closed its enquiries. It seems to me that it is arguably an abuse of process - a procedural abuse - for the wife to raise this serious issue so late in the day in circumstances where she has eschewed the opportunity, in conjunction with the bank, to get to the bottom of it. Even now her position as stated in the Scott Schedule is a paradigm example of fence-sitting. She says:

- However, in circumstances where the money raised by the re-mortgage has been used to purchase a neighbouring property in the sole name of the husband in which the wife will not share, and where it is clear that the wife did not actively participate in the raising of the mortgage, I am convinced that the Commuter on the Bronx Subway would be of the view that it would not be a reasonable interpretation of the agreement for her to have to share in the higher mortgage figure of £18 million. The figure that I will use in the Outcome Schedule is £16 million.

- In reaching that conclusion I make it clear that I am not making any positive findings of falsification against the husband.

- Article 6.2 states:

- Article 6.2.1 states:

- When they signed the PNA on 2 March 2012 the parties were about to purchase their primary residence in Downing Street, New York for $14.25 million with borrowing of up to $10 million. They duly did so and lived there, as their primary residence until May 2017. It was sold on 25 July 2018, with net proceeds of sale of $8.8 million, 14 months after the purchase in May 2017 of the family home in London. That property was purchased for £30.2 million with a mortgage of £19.63 million, the husband putting in about £10.6 million of his own money.

- If Downing Street had been sold just before the purchase of the family home in London its net proceeds of $8.8 million would surely have been put towards the purchase price of that family home, with the husband providing that much less of his own money. It seems to me to be obvious, and in accordance with normal practice, that the proceeds of sale of the previous main family property would be put towards the purchase price of the new one. By the same token, if the new family property was in fact purchased shortly before the sale of the previous one, and bridging finance was obtained to enable that to happen, then the normal practice would be to use the proceeds of the previous home, when available, to discharge the bridging finance. It would not make any difference if the bridging finance was provided by a commercial lender, or (as here) by the purchaser using his other funds.

- I am certain that the Commuter on the Bronx Subway would say that of course the proceeds of Downing Street of $8.8 million should be treated as if they were used to purchase the London property.

- If that had happened, the husband would have put from his other funds that much less than the £10.6 million he in fact put towards the purchase of the London property. The wife’s interest in the equity of the London property would of course be the same, but that equity would encompass the proceeds of sale of 26 Downing Street. Accordingly, I agree with Mr Chamberlayne KC that were the wife to receive a credit for half the net proceeds of 26 Downing Street that would represent a double recovery. It would not reflect the fair interpretation of Article 6.2 that the proceeds of Downing Street of $8.8 million should be treated as if they were used to purchase the London property.

- Article 6.3 provides:

- The wife’s case is that a reasonable interpretation of Article 6.3 is that its terms should cover any property adjoining Rue Duphot (1) which is purchased with the intention of conjoining Rue Duphot (1) with it. The problem with that interpretation is that the parties purchased the adjoining apartments in joint names. If they had intended them to be knocked together with Rue Duphot (1) they could easily have purchased those adjoining apartments in the wife’s sole name. At [40] above I set out the terms of Article 6.7 concerning future residences, which I repeat for convenience:

- As the wife will retain the apartments, she has to give credit for the value of the husband’s half share. The parties are agreed on which properties will be retained by the wife, and their advisers will bring into account all the relevant credits and debits when calculating the money or money’s worth to be provided to the wife by the husband under the PNA.

- There was an issue about another French property called Montfort. The issue related to its value in circumstances where the wife is going to retain it. There was no dispute that whatever its value, half would be attributed to the wife under the agreement. However, on the final day of the hearing it was agreed that the husband will now retain this property and that the value attributed to it will be €2.9 million, rather than the lesser figure provided by the Single Joint Expert. I will therefore use the agreed figure of €1,184,916 for half of the net proceeds in the Outcome Schedule.

- It is agreed that there is latent US capital gains tax on the Southampton residence (Meadow Lane (1)) in the sum of $5,052,000 and on the Miami penthouse in the sum of $897,000.

- The husband argues that in accordance with authority and convention, these latent taxes should be allowed when calculating the net proceeds of sale which will be shared with the wife when calculating her entitlement under the PNA. The wife argues that this is completely unreal because the husband will never pay such taxes, not least because he has millions of dollars of unused losses which he will be able to apply to extinguish the tax liability were he ever to sell the properties. The husband’s response is that a tax loss is no different from cash in the bank. Money is fungible, and it can take many shapes and forms. His tax loss is an asset, a chose in action, just as real as a piece of property or money in the bank. The PNA does not require him to use cash to reduce debt on properties, and so by parity of reasoning he should not be required to use an asset, namely a tax loss, to reduce a specific debt on the two properties namely latent taxes.

- In White v White [2001] 1 AC 596, Lord Nicholls stated at 612:

- From this dictum a convention has arisen whereby latent tax which cannot be avoided, and which will likely be payable when a property is sold, is almost invariably deducted when computing the value of a property to go on the asset schedule. For example, in DR v GR & Ors (Financial Remedy: Variation of Overseas Trust) [2013] EWHC 1196 (Fam) at [50](iv) I stated:

- However, in K v L [2010] EWHC 1234 (Fam) [2010] 2 FLR 1467 Bodey J held:

- I made similar comments in BJ v MJ (Financial Remedy: Overseas Trusts) [2011] EWHC 2708 (Fam), [2012] 1 FLR 667 where I said:

- In my judgment the usual convention should apply here. This is not a case where the court is blinding itself to a truth that a party will never pay such latent tax because he has entered into arrangements the whole object of which is to avoid paying that very tax. In this case the taxes are very real, and the husband will have to pay them with money or with other assets in the shape of tax losses. The wife would be given very short shrift if she suggested that the calculation of the net value of these two properties should ignore the latent taxes because the husband has money in the bank and could just pay off the taxes. I agree with Mr Chamberlayne KC that there is no difference in principle or substance between the husband paying a tax debt in cash or eliminating it by deploying a loss.

- Accordingly, I take the above latent tax figures of $5,052,000 and $897,000 into account in my calculations. The result is that the Outcome Schedule will show the net proceeds of the Southampton residence to be $16,542,500, of which the wife is entitled to half - $8,271,250 - under the PNA. And it will show the net proceeds of the Miami penthouse to be $4,654,842, of which the wife is also entitled to half or $2,327,421.

- Following circulation of this judgment in draft I have been informed by junior counsel for the wife that the Outcome Schedule failed to reflect costs of sale and latent tax on two properties to be retained by the wife namely an apartment in New York and Rue Duphot (1). I have now been given the omitted figures. It has not been explained to me why the Outcome Schedule was wrong. Nevertheless, there is no reason to believe that the new information is inaccurate and I have therefore adjusted the Outcome Schedule to show the correct net value of those two properties.

- Article 13 provides, so far as is relevant to this case:

- The husband’s stance is based on a very literal reading of these provisions, which I do not believe that the Commuter on the Bronx Subway would consider was a fair reflection of the mutual intention of the parties. The husband says that in the Children Act proceedings he has paid the wife’s costs in the sum of £2,337,122. He relies on a letter written on 12 August 2021 where his then solicitor wrote:

- I have no doubt that, inasmuch as this term is relied on to add back costs incurred and paid by the husband in the Children Act proceedings, it should be construed with the concept of fairness at the forefront of my mind. The first point to be made is that the limitation of $750,000 is completely arbitrary. I am not setting out in this judgment, which will be made public, the findings of the circuit judge. I will merely point out that to have this arbitrary cap in place irrespective of what future litigation about the welfare of the children might entail has the potential to be extremely unfair. Further, there is nothing in the agreement to prevent the husband paying the wife’s legal costs of the children proceedings on a voluntary basis over and above the capped figure of $750,000. Indeed, it is clear to me that is what he has done, and he has gone on to proclaim his largesse to the circuit judge. On 4 April 2022 his leading counsel stated to the circuit judge:

- In my judgment it would be grossly unfair for these provisions to be relied on to require the wife to reimburse the husband with her Children Act costs paid by him, and I decline to do so. I am satisfied that the husband represented to the circuit judge that he was paying the wife’s costs with no strings attached. His solicitor’s letter of 12 August 2021 was overreached by those representations.

- The husband’s stance in relation to the financial remedy costs is even more relentless. He says that the wife must give credit not only for her financial remedy costs of £2,185,797 which he has paid, but also for his financial remedy costs of £2,128,972. One of the reasons for such high costs was the husband’s woeful non-compliance with his voluntary agreements to pay costs and all outgoings, and latterly with his obligation under my maintenance pending suit order to pay a monthly allowance and to discharge all outgoings. I had to deal with enforcement applications on two occasions on each of which I made an order for indemnity costs against the husband.

- The husband does not seek to escape that costs liability which he accepts in the full amount of £260,601 claimed by the wife for those hearings. He therefore seeks under the terms set out above a credit in the Outcome Schedule of £2,185,797 + £2,128,972 - £260,601 = £4,054,168.

- In my judgment it would be grossly unfair, on the facts of this case, for the wife to be required, in effect, to pay the husband’s indemnity costs of these proceedings. I reach that conclusion having regard to the general rule as set out in FPR 28.3(5) of no order as to the costs of a final financial remedy hearing. That general rule can be displaced under FPR 28.3(7)(a) - (e) by reference to the conduct of the parties, but there has been no relevant conduct on the part of the wife justifying its displacement. I therefore flatly refuse to reach a conclusion about the meaning of the PNA which has the effect of requiring the wife to pay the husband’s costs on the indemnity basis.

- On the other hand, I cannot see any good reason why the wife should not pay her own costs of the financial proceedings with credit for the orders for costs which she has obtained. In addition to the £260,601 already mentioned the wife argues that I should make an order in her favour for her costs of the maintenance pending suit proceedings, which were reserved to me at this final hearing. The wife’s Form N260 for that hearing states that she incurred costs of £109,995. Following the distribution of this judgment in draft I have been informed by the wife’s junior counsel that there were further costs not captured in her Form N260 for the maintenance pending suit hearing totalling £44,692. No explanation was given as to why these costs were omitted from the form. I am not prepared to enlarge the husband’s liability on the basis of this late submission. It is not acceptable that the Form N260, endorsed with a statement that the costs did not exceed the stated amount, should have been inaccurate. It is in order to emphasise the imperative necessity of Form N260 being completed accurately that I make a different decision on the includability of this new figure to the one I made in relation to latent tax under [71].

- FPR 28.3(4)(b)(i) provides that an application for maintenance pending suit is not covered by the no-order-for-costs general rule in FPR 28.3(5). The wife plainly prevailed on that application and is entitled to her costs of it. In my judgment those costs should be assessed on the indemnity basis because the husband’s conduct leading up to that hearing, and his stance at that hearing, took the case “out of the ordinary”. That is the criterion which I apply when considering whether an order for costs should be made on the indemnity basis. I am required under CPR PD 44 para 9.1 to consider making a summary assessment and I do so in the sum of £109,995.

- Accordingly, in my judgment the wife should pay her own costs in the financial remedy proceedings. This means that she must “reimburse” the husband with the sum he has paid of £2,185,797 less the value of the orders for indemnity costs which I have made in the sum of £370,596. This means that the negative figure of £1,815,201 is used in the Outcome Schedule.

- Article 6.9 provides:

- Under cross-examination there was this exchange between the husband and Mr Cusworth KC:

- The husband was unable to explain to me why, if the great majority were recognised as being jointly owned, these seven items were different. In his final submissions, Mr Cusworth KC stated that he would not resist a finding by me that all of these items were jointly owned.

- In my judgment this is a particularly sterile dispute given that the parties have agreed how the pieces will be physically distributed. The parties are battling for me to make findings purely for personal financial advantage.

- In my judgment there is no solid evidence showing why the eight disputed items should be treated any differently to the 32 items where there is no dispute that they are to be treated as joint items.

- I therefore rule that the eight disputed items are all to be treated as jointly owned with the result that half of their value will be used in the Outcome Schedule. The wife seeks the sale of the Mike Kelley piece as she believes that its value is more than the $1,083,000 in the expert’s report. I decline so to order. Its value will be taken at $1,083,000, and it will be retained by the husband.

- Issue 17 is whether the husband should pay the wife €300,000 compensation for the theft of her jewellery. I do not understand how this matter has been allowed to arise as an issue in this phase of the proceedings. It has nothing to do with the construction of the PNA.

- Schedule 1 contains the Outcome Schedule incorporating my rulings. The total value which must be provided to the wife pursuant to the terms of the modified PNA is £37,489,392. In addition, the wife has 17 years’ use of the husband’s share in the family home worth £9.15 million.

- The parties are agreed as to how assets should be distributed and will work out the cash payment that needs to be made by the husband to the wife to reflect my decision.

- In addition to her entitlement of £37,489,392 under the PNA the wife seeks further payments of £750,000 as a refurbishment fund for the family home; €300,000 compensation for stolen jewellery (as mentioned above); and £450,000 as a form of parachute payment to ease her transition to a standard of living which she says will be several levels below that which she has enjoyed hitherto. These applications are misconceived. They are in plain breach of the terms of the PNA which the wife accepts as binding. They are refused.

- The sum of £37,489,392 is the cornerstone of my calculations set out below of the sum to be received by the wife to fund her household. It must therefore be received by the wife net in her hand and not be depredated by tax. To the extent that he had not done so already the husband must indemnify the wife in respect of any taxes that may arise in respect of any transfers of property or other assets into her sole name.

- Once the wife has received her full entitlement under the PNA the parties’ remaining claims for financial remedies will be dismissed on the clean break basis in life and in death (although the husband being domiciled outside England and Wales there is no possibility of a claim under the Inheritance (Provision for Family and Dependants) Act 1975).

- In this phase of my decision, I need to calculate how much the wife will have as a Duxbury fund on the assumption postulated by Mr Cusworth KC on her behalf, namely that the family home in London aside, all the assets distributed to her under the modified PNA are to be treated as cash to provide for her capital needs, with the residue furnishing a Duxbury fund.

- I therefore turn to examine the wife’s reasonable capital needs.

- She intends to stay in the family home until B is 21 pursuant to her entitlement under Article 6.2.1. The husband will be paying the instalments on the actual mortgage which is of course more than the deemed figure of £16 million which I have ruled is to be used in the Outcome Schedule. Therefore, the parties’ lawyers need to agree figures to ensure that the wife receives money or money’s worth of £28,339,392, being her PNA entitlement of £37,489,392 less the deemed value of her half share in the family home of £9,150,000. The values of all the items in question having been either agreed or ruled on by me, it will be a very simple task to add up the values of the items being distributed to the wife and to subtract that figure from £28,339,392, to give the residual sum to be paid by the husband to the wife in cash.

- As mentioned above, the wife says she needs £750,000 for refurbishment costs of the family home. She also says she needs £165,000 for a car fund. She says she needs £6 million to buy a holiday home. There was no oral evidence about these claims. The husband does not accept any of them.

- In my view the claims for refurbishment costs and for a car fund are reasonable capital needs of the wife, which she should pay from her own funds. Given the standard of living enjoyed during the marriage it is not unreasonable for the wife to acquire a holiday home from her own funds. I take a figure of £4 million for this purpose. I am sure that it will be clearly appreciated that while it is reasonable for the wife to spend her own capital for these purposes (with a consequential reduction in her Duxbury income) it is completely unreasonable that the husband should directly pay for any of them.

- It is also necessary for the wife to pay her outstanding costs of £317,382. This leaves the sum of £23,107,010, calculated as follows:

- For the reasons given below at [147] the wife should reasonably be expected to use 94% of this fund, or £21,720,767, as a Duxbury fund to meet the needs of her household. She should be entitled to carve out 6% of this fund, or £1,386,243, to meet her own personal needs unconnected to her role as primary carer of the children..

- My next step is to undertake a reverse Duxbury calculation on £21,720,767 to see how much income it will generate for the wife to put towards the cost of running her household.

- For the purposes of this reverse calculation, I apply four assumptions:

- In applying these assumptions, I follow my own decision in CB v KB [2019] EWFC 78. In that case the wife was 45. I said this:

- As to the amortisation issue, I remain puzzled by the proposition that says it is a mere fact-specific question whether the provision by one spouse to meet the needs of the other spouse could include meeting a “need” to leave money to testamentary beneficiaries. In my opinion, it is a clear matter of principle. Accordingly, where a wife has received a substantial sum under a sharing or compensation claim, or under a PNA, it is hard to conceive that it would ever be reasonable to expect a husband to top up that sum to enable the wife to keep her capital intact to leave to testamentary beneficiaries.

- I suggest that this is entirely consistent with Lord Nicholls’ well-known passage in White v White [2001] 1 AC 596 at 609 under the heading “The next generation”, where he said:

- In that momentous case the long-standing criterion of resolving cases solely by reference to the reasonable requirements of the claimant was overturned, but no firm alternative technique was enunciated other than the criterion of fairness (at 589) and the application of the yardstick of equality as a check against the possibility of discrimination (at 605).

- What Lord Nicholls was saying is that while a claimant’s wish to leave money to her testamentary beneficiaries is not a reasonable need for the purposes of s. 25(2)(b) of the Matrimonial Causes Act 1973, the court may yet grant her an enhanced award enabling her to do so on application of the then protean criterion of fairness.

- It was not until the decision of the House of Lords in Miller v Miller, McFarlane v McFarlane [2006] 2 AC 618 that the concept of “sharing” as an element or strand of the requirement of fairness emerged. The three elements - sharing, needs and compensation - constituted compendiously the fairness requirement. Therefore, the claimant’s testamentary wish, which Lord Nicholls in White had left to a protean general “fairness” discretion on the part of the judge, now has to be accommodated within the sharing principle. Logically, it is only there that it can find expression. If a claimant has earned a right to share equally (or unequally) in the marital acquest, then what she receives is her money and what she does with it is her business alone. It only becomes the other party’s business if the claimant argues that her needs exceed her sharing entitlement and that she therefore requires her sharing entitlement to be topped up to meet those needs. The needs in that scenario cannot, as Lord Nicholls explained in White, encompass a testamentary wish.

- There is another reason in this case why full amortisation is clearly appropriate. Article 5.1 of the PNA provides:

- In any event, the wife will, at the appointed time for her to expire, have unspent housing capital of £9.15 million in today’s money, which will on any view provide her children, even after the depredation of inheritance tax, with a very substantial inheritance. Further, I do not overlook the fact that these children will probably receive inheritances of vast size upon the demise of their father.

- A reverse Duxbury calculation on a capital sum of £21,720,767 for a woman aged 47 applying the assumptions set out above, provides a net of tax income of £1,110,316 per annum in today’s money until 2042 when it will fall by 40% to £666,190, again in today’s money.

- I shall first examine the applicable legislation and the case-law.

- An unsecured child maintenance award may be made under the following statutes:

- The award in each case is discretionary. The criteria governing the exercise of the discretion is similar, but not identical, under the statutes.

- Under Schedule 1, para 4(1):

- Under s. 25(3) of the 1973 Act:

- Section 18(4) of the 1984 Act provides:

- A further difference is that, unlike a child maintenance claim under the 1973 or 1984 Acts, the court under Schedule 1 is not expressly required to give first consideration to the welfare of the child. This is of no significance. In J v C (Child: Financial Provision) [1999] 1 FLR 152 Hale J explained at [156]:

- In my opinion where a court is considering a claim for child maintenance under the 1973 or 1984 Acts it must have careful regard to the standard of living enjoyed by the family before the breakdown of the marriage because it has been instructed to do so by Parliament. This factor should not however be allowed to dominate the picture as there will be many children, particularly children dealt with under Schedule 1, who will not have experienced a standard of living within a functioning relationship either because the liaison between the parents was very brief, or because the child was born after the relationship had come to an end: see J v C (Child: Financial Provision) at [156]. However, in some cases, and this is one of them, the standard of living enjoyed by the whole family before the breakdown of the relationship will be of great importance.

- The other difference between a claim for unsecured child periodical payments mounted under Schedule 1 and one mounted under the 1973 or 1984 Acts is that a under the former statute the child support claim will be front and centre in the litigation. Along with the claim for a home for the child it will be the centrepiece of the litigation. In contrast, a claim for unsecured child payments mounted under the 1973 or 1984 Acts will be distinctly subsidiary to the primary claim made by the parent as a spouse. A child periodical payments claim made as part of a routine financial remedy claim by a spouse following a divorce will generally be dealt with perfunctorily. Indeed, the court will have no jurisdiction in the majority of cases to deal with child support unless there has been an agreement between the parties under the terms of the Child Support Act 1991. I suggested in CB v KB at [49] that the child support formula should apply to gross annual incomes in excess of £156,000 up to £650,000. That pragmatic, and I believe useful, guideline is obviously intended to apply forcefully to those cases where the court is considering child support as a subsidiary claim within a wider financial remedy claim. It will be a rare case where the court in a financial remedy claim between divorcing spouses will spend much time and forensic energy analysing a child maintenance budget. In contrast, in a case under Schedule 1 the child maintenance budget is the principal litigation battleground.

- However, there are some cases where for one reason or another the court hears a claim under the 1973 or 1984 Acts for child maintenance alone, and not alongside a wider spousal claim. The most obvious example is an application to vary an existing child maintenance order. Other examples would include situations where the claimant does not have a personal spousal claim to advance, because she has means of her own; or because she has remarried before she made a claim; or where for personal reasons she chooses not to make a personal claim (as in the Maktoum case, see below); or where (as here) the terms of a prenuptial agreement prevent her from making a personal claim. In such a case the child maintenance claim will be subjected to the same degree of scrutiny as a claim under Schedule 1 but with the court looking specifically at the standard of living enjoyed by the family before the breakdown of the marriage.

- I therefore agree that the case law under Schedule 1 is relevant to those claims for child maintenance made under the 1973 or 1984 Acts where there is no corresponding spousal claim being heard at the same time.

- The most significant cases under Schedule 1 are J v C (Child: Financial Provision) [1999] 1 FLR 152, FD, In re P (Child: Financial Provision) [2003] 2 FLR 865, CA, and In re A (A Child) (Financial Provision: Wealthy Parent) [2015] Fam 277. These authorities demonstrate the legitimacy of a HECSA and explain how such an award should be calibrated.

- In J v C , Hale J stated at [159]:

- In Re P, a case involving a very rich father, this approach was approved and confirmed although Thorpe LJ expressed the objective slightly differently. First, he emphasised in [44] the importance of the child’s welfare:

- Next, he explained how, after the housing question had been addressed, the wife’s budget should be judged. At [49] he stated:

- At [76] - [77] Bodey J summarised the legal principles applying to a Schedule 1 claim as follows (omitting citations):

- In Re A, Macur LJ stated at [21] - [22]:

- Drawing the threads together, the cases establish the following propositions.[2]

- Historically, an award over and above the direct expenses of the child was rationalised as being a “carer’s allowance,” with the unfortunate consequence that in some cases evidence of the commercial costs of nannies was adduced. Thus is A v A (A Minor) (Financial Provision) [1994] 1 FLR 657, in explaining his quantification of an allowance for the mother’s care, Ward J said (at 665):

- That approach was disapproved in Re P at [43] and [77(ii)], and rightly so, as a HECSA does not seek to put a value on, or attribute a cost to, the claimant’s primary care of the child. That exercise is not only irrelevant - a complete red-herring - but seems to me to have unpleasant transactional overtones. I agree with the judgment of HHJ Horowitz QC in Re V [2012] EWHC B36 (Fam) at [106] where he suggested that the concept of a carer's allowance “is past its utility”. I would go further and consign it to the history books.

- Recently, in Hussein v Maktoum [2021] EWFC 94, Moor J applied the governing principles in that notorious huge-money case. Mr Chamberlayne KC argues that this decision is a unique outlier of such extraordinarily singular features that nothing in it is of any relevance to the case before me. I disagree. Obviously, there were singular features in that case in that the husband was the ruler of Dubai, and the wife was the sister of the King of Jordan. However, when it came to assessing the wife’s claim Moor J faithfully and clearly applied the relevant principles.

- In that case the wife had commenced Schedule 1 proceedings in respect of the two children. She later obtained leave under Part III of the 1984 Act to claim in her own right as well as for the two children. In [45] Moor J observed that the claim under Schedule 1 for the children had been overtaken by the wider claims made under the 1984 Act, which included claims for those children. For personal reasons that wife did not make any claim for herself under the 1984 Act other than for (i) the cost of security, (ii) to compensate her for chattels she has lost as a result of the ending of the marriage, and (iii) for certain other incidental expenses she had incurred.

- These limited personal claims were resolved by Moor J awarding her a lump sum of £41.5 million principally as compensation for jewellery and horses of which she had lost possession, as well as to enable her to pay an inheritance tax charge on her home. In addition, he awarded a lump sum of £210 million to cover the cost of the security for the wife and the children for their lifetimes.

- That wife’s budget was in the sum of £17.5 million per annum. It covered the entirety of her household expenses. She sought that the entirety of that budget should be covered by an award of child periodical payments under Part III of the 1984 Act. Moor J did not require the wife to put any part of her £41.5 million compensation lump sum towards her household budget.

- While her budget of £17.5 million was objectively massive, allowing a lifestyle of the utmost luxury, it was nonetheless several levels below the standard of living enjoyed by that family before the breakdown of the marriage. In his judgment, Moor J stated:

- That wife’s budget of £17.5 million included very high additional security costs of £2.45 million when on holiday, £750,000 for running an office in each of London and Amman, £550,000 for the legal and professional fees of running the trusts that owned the wife’s homes, together with other highly atypical expenses referable to the status of the wife and the children (“the atypical expenses”). The figures in the judgment are not complete. Doing the best I can, I calculate that the typical expenses claimed by that wife were just under £11 million which Moor J reduced by 27% to just under £8 million, as per the table below. It can be seen that the largest cuts were in respect of holiday flights and leisure. The nature of the leisure expenses which were in part disallowed have been obscured in the judgment, so it is difficult to understand this aspect.

- Moor J made a HECSA that covered (a) the atypical expenses in the sum of £3,224,714, and (b) the typical categories of expenditure tabulated above totalling £7,930,267. This produced a total award of £11,154,981, rounded to £11.2 million, which was divided equally between the two children.

- In this case, the wife’s initial budget was produced on 28 July 2022 and was in the amount of £4,686,620 per annum. In her witness statement of 23 September 2022, she said:

- Under cross-examination on Thursday, 13 October 2022 the wife admitted that there was no budget or breakdown on how she could live on £2 million. But she said she was trying to “crunch down the numbers” and that she had “a working draft” of a revised budget, to “get down” to £2 million. She said (at odds with her witness statement) that her original budget “was the actual rate of living and in that it pertains to how we’ve lived, how I’ve lived the last 12/14 years”.

- This was not at all satisfactory. It was not fair to the husband, who had instructed his counsel to cross-examine the wife on what he thought was her proposed future budget. Therefore, the wife agreed that overnight she would amend her budget to include a column that applied the cuts that perforce would have to be applied to her original budget if she was to live on £2,090,000. I gave her permission to speak to her solicitors for the purposes of preparing this revised document.

- The following morning, Friday 14 October 2022, the wife produced an amended budget which reduced the figure of £4,686,620 to £2,369,920. This new figure did not include mortgage costs, or school fees.

- Mr Chamberlayne KC then cross-examined the wife on this revised budget, making predictable points about figures that jumped off the page. His first question related to the amount spent on children’s clubs and classes totalling £73,000 per annum. He put it to the wife that this was plainly inflated but the wife gave a reasonable and measured response that for better or for worse this is what the children were given, what they were used to, and what they enjoyed. The cross-examination continued in similar vein, with the wife trenchantly defending figures that looked extremely high.

- The husband gave evidence later that day. Under cross-examination he stated:

- Over the ensuing weekend the husband in conjunction with his lawyers prepared a counter-budget for the wife and the children amounting to £1,090,000. With my permission the wife lodged on Saturday 22 October 2022, after submissions had been concluded on 19 October 2022, a rejoinder. This (a) reduced her budget to £2,355,520; (b) itemised and totalled those expenses that were exclusively referable to her alone in the sum of £206,500; (c) itemised and totalled her claim for the cost of nannies in the sum of £190,420 and (d) gave a detailed commentary on her figures and on the husband’s figures. Her final, re-revised household budget excluding any costs exclusively referable to her alone, and the cost of nannies which the husband will be meeting directly, is £1,958,600.

- I now reach my decision on the issue of child support. In so doing I give first consideration to the welfare of the children pursuant to s.25(1) of the Matrimonial Causes Act 1973. I pay particular regard to s. 25(3)(a) and s.25(2)(a), (b), and (c) of the Act, viz:

- In my judgment a reasonable figure for the wife to be able spend on her personal expenses is £125,000. This is to meet things such as socialising without the children, gifts and support to family members, and holidays without the children. Added to the figure of £1,958,600 above gives an overall budget for household and personal expenditure, but excluding nannies, of £2,083,600. Of this the personal element of £125,000 is 6% of the total. I therefore consider that 6% of the wife’s income producing fund, or £1,386,243, should be carved out for the purposes of her personal expenditure, and this the figure I have used at [100] above.

- I remind myself that I must not examine this child support claim through a middle-class, middle- income lens. In my opinion the husband’s view that the children should not be spoiled (which some critics might regard as forensically opportunistic) in fact deserves some credit. There are aspects of the expenditure which, even allowing for the fact that the rich are different to you and me, are exorbitant.

- I take the advice of Mr Justice Bodey to heart. I shall not labour over a detailed analysis of the wife’s household budget of £1,958,600. Having regard to the husband’s moral stance, and to certain aspects which are plainly inflated, I think that a cut of 15% across the board would be appropriate. This is not as high as Mr Justice Moor’s cut of 27%, but it the figure which I judge to be, in the words of Mr Justice Bodey, a “fair and realistic outcome by the application of broad common sense.”

- This leaves a household budget of £1,664,810. The wife’s Duxbury income will be £1,110,316, as calculated above. The shortfall is £554,494. I am satisfied that it is reasonable, just, and in the best interests of the children to make a HECSA in this amount. It is an amount that will ensure that their lifestyle is not out of kilter with the father’s present and likely future lifestyle, and with the lifestyle the family enjoyed before the relationship breakdown. The monthly award for each child will be £23,104, which I round to £23,100. The award will be CPI index-linked, and will endure until the relevant child is 18 or completes full-time tertiary education, if later. In addition, the husband will pay the school fees and extras.

- I cannot accept that it is reasonable to employ two full-time nannies at an annual salary for each of £85,000 per annum, plus additional expenses relating to the nannies of £20,000. I agree with the husband that £190,000 per annum for nannies is exorbitant. In my judgment, the children do not need two nannies. The husband’s liability to pay for nannies will be capped at £100,000 per annum, CPI index-linked.

- I am satisfied that the child maintenance award should be secured for two reasons. First, I consider that the husband has for reasons best known to himself deliberately disobeyed my order for maintenance pending suit, necessitating enforcement proceedings before me on two occasions. The wife should not have to suffer the anxiety of not knowing month-to-month if the maintenance is going to be paid, or the school fees paid, or the nanny paid.

- Payment of the mortgage will be pursuant to an undertaking, breach of which would carry a potential two-year prison sentence for contempt of court: see Hussain v Vaswani & Ors [2020] EWCA Civ 1216. In such circumstances I do not include the mortgage repayments within the order for security.

- The second reason is this. If the child maintenance order is not secured it comes to an end on the death of the husband: see s. 29(4) of the Matrimonial Causes Act 1973. If the order is secured, however, then it will endure beyond the husband’s death until its expiry when the child turns 18 or completes university education.

- The form of the security should be the same as that ordered in the Maktoum case, namely a guarantee given by a reputable London bank. The wife should be entitled to trigger the guarantee by giving the bank notice of a breach of the order by the husband. The notice must specify the sum which is said to be in default. If the notice is not challenged within 14 days by the husband, then payment of the default sum shall be made by the bank under the guarantee. If the notice is challenged, then the matter is to be restored to the court as a matter of urgency. The precise terms are to be agreed between the parties and in default of agreement I shall rule on them.

- The guaranteed sum will be £14,320,000. I have calculated this sum in accordance with the table below where I have made the following assumptions:

- The secured amount of £14,320,000 will reduce by one-sixteenth, i.e. £895,000, on 1 January 2024 and annually thereafter by that amount until 1 January 2039 when the guarantee will come to an end.

- All of these provisions may be the subject of later variation.

- I do not award a contingent lump sum as a fighting fund. I am aware that case law has said that this is a permissible exercise of the court’s powers. However, given the security I have ordered, I do not consider that an award for this purpose is either appropriate or necessary.

- As regards the PNA:

- By way of child support the husband will pay:

- The security shall be a bank guarantee for £14.32 million reducing annually by £895,000 from 1 January 2024 until 1 January 2039 when it shall come to an end.

- In Schedule 2 I have set out the various calculations used in this judgment.

- I ask counsel to agree an order to reflect my decisions. I will rule on any disputed matters.

- If a party intends to appeal the following steps will apply:

“A. Yes, I need to correct him, because it was in - when I made the statement like nine months ago that was the assets. Today, if I would make a similar statement, it would be between 600 and 800 million.

MR JUSTICE MOSTYN: Really. Your total net worth.

A. Yes, and I can give the –

MR JUSTICE MOSTYN: Between 600 and 800 million.

MR CUSWORTH: As of now, you have lost in the last nine months about $1 billion worth of assets?

A. Yes.

MR JUSTICE MOSTYN: Okay.

A. Yes, I can explain if it's necessary.

MR JUSTICE MOSTYN: No, I am just processing that, okay.

MR CUSWORTH: You have never asserted or relied on that fact before today, have you? There has been no updated evidence from you about the state of your assets.

A. It is not important.”

|

Wife |

Husband | |

|

Counsel |

482,148 |

562,700 |

|

Disbursements |

110,374 |

119,786 |

|

Solicitors |

1,593,275 |

1,446,486 |

|

Total |

2,185,797 |

2,128,972 |

Since the date of her Form H (29 September 2022) the wife has incurred a further £317,382 in financial remedy costs, giving a final total for her of £2,503,179.

The PNA

a. The preamble to the PNA states that it is intended to be in full satisfaction of all the parties’ rights arising out of the marriage or its dissolution except with respect to issues relating to custody and child support of any children of the marriage. To reinforce their mutual intention, the PNA concludes by stating in Article 17, in uppercase and in bold type:

“EACH PARTY TO THIS AGREEMENT FULLY UNDERSTANDS AND AGREES THAT HE OR SHE IS RELINQUISHING VALUABLE PROPERTY RIGHTS BY SIGNING THIS AGREEMENT.”

b. The parties acknowledged that they had received independent legal advice and that each had made clear and comprehensible financial disclosure (Article 2 and Exhibits A and B).

c. Separate property is defined in Article 3 and any claims in respect of such property is waived in Article 4.

d. The right to claim maintenance or alimony is waived in Article 5.

e. Article 6 establishes the rights that arise on an Event of Marital Dissolution, which is defined, for the intents of the case before me, in Article 11 as the commencement of divorce proceedings by either party. That occurred on 22 December 2020, and so for the purposes of the PNA this was a marriage of 8¾ years (to be exact, 103 months). An important provision is article 6.2.1 which permits the wife, in the event of the breakdown of the marriage, to remain in the primary residence of the parties until the youngest child of the marriage attains 21 years of age, with the husband discharging the mortgage repayments, and paying for major repairs and the household staff, with the wife bearing all other expenses of the property.

f. The terms of Article 6 are of central relevance to the dispute that I have to resolve and will be addressed in detail later in this judgment.

g. Article 13 provides that on the occurrence of an Event of Marital Dissolution, the husband shall pay the wife’s legal fees necessary to resolve all issues between the parties, including issues relating to child custody, access and child maintenance, but capped at $750,000. Further, it provides that if either party should commence proceedings to set aside the agreement, or to claim spousal support other than in accordance with the terms of the agreement, then that party shall pay all the legal costs of the other party.

h. Article 16.3 provides that the agreement, its validity and interpretation, and the rights of the parties under it, shall be governed and construed under the laws of New York.

i. The Modification Agreement provides that on the first happening of an Event of Marital Dissolution, or the wife becoming a US citizen, the husband will transfer to the wife a one-half interest in the Miami apartment and the residence in Southampton, New York.

The disputes about the agreement

Issues 1 & 2: The failure by the husband to set up the Joint Investment Fund

“Within three years from the date of the marriage, Michael shall establish, from his Separate Property assets, a joint investment fund (the “Joint Investment Fund”), in the name of both parties or in the name of an entity owned by both parties, with a minimum balance of Ten Million ($10,000,000) Dollars. Each party shall have a 50% interest in the Joint Investment Fund (with Alvina’s share vesting from the date of the marriage)…”

“If an Event of Marital Dissolution occurs after the establishment and full funding of the Joint Investment Fund and before the ten year anniversary of Michael’s management of the Fund, but in no event beyond the thirteenth anniversary of the parties’ marriage, Michael shall be entitled to the contents of the Joint Investment Fund, provided that he shall pay to Alvina a cash amount equal to the greater of (i) half the value of the Joint Investment Fund, or (ii) the cash sum of Five Million Dollars ($5,000,000) plus an amount equal to the product of (x) the number of full months the parties were married prior to the Event of Marital Dissolution up to a maximum of 120 months, and (y) $41,667. Such cash amount shall be paid to Alvina as a tax-flee distributive award payable as follows: (1) $1 million within ten days from the Event of Marital Dissolution; (2) an amount equal to the remaining sum due, less $1,500,000, within ninety days from an Event of Marital Dissolution; and (3) a payment of $500,000 each year on the first, second, and third anniversary of an Event of Marital Dissolution.”

|

1-Jan-21 |

$1,000,000 |

|

22-Mar-21 |

$6,791,701 |

|

22-Dec-21 |

$500,000 |

|

22-Dec-22 |

$500,000 |

|

22-Dec-23 |

$500,000 |

|

$9,291,701 |

“Floor provision in PNA [is] only applicable as a floor. If needs require a greater sum in replacement, that is legitimate.”

Issue 3: The mortgage on Meadow Lane (1), Southampton, New York

“Southampton Residence. Michael is the sole owner of a house located at Meadow Lane, Southampton, New York (“the Southampton Residence”). In the event that the Southampton Residence is sold prior to an Event of Marital Dissolution, Michael agrees to pay to Alvina an amount equal to one-half of the excess of the net sales price (defined as the gross sales price less broker’s fees, transfer taxes, and customary closing costs, but not deducting any mortgage) of the Southampton Residence over $20 million, but in no event less than a minimum of $1 million. For example, if the Southampton Residence sold for a net sales price of $25 million during the marriage and prior to an Event of Marital Dissolution, Michael would pay to Alvina the sum of $2.5 million. In the event that Michael still owns the Southampton Residence at the time of an Event of Marital Dissolution, he shall pay to Alvina the sum of $1million within ninety days of such Event.”

This original agreement shows that the existence of a mortgage was recognised, although its value would not be taken into account in computing the wife’s relatively modest share of the proceeds of sale if the property were sold prior to the breakdown of the marriage. It also shows, on the facts as they have unfolded, that the wife would have got $1 million under this unmodified term in circumstances where the property has not been sold.

“Should the wife’s half share that was promised to her in 2014 in the Modification Agreement be depredated by a further mortgage to pay off her predecessor’s own mortgage? ”

I am convinced that such a reasonable person would say:

“It would be unfair, and therefore outside the contemplation of the parties, that such a further debt should be taken into account against the wife’s promised share.”

Therefore, the figure that I use in the Outcome Schedule for the mortgage against Meadow Lane (1) is $8 million.

Issues 4 & 5: Does the Modification Agreement cover Meadow Lane (2)?

“Future Residences. In the event that either 26 Downing Street, the Paris Apartment, or the Miami Apartment are sold during the marriage and prior to an Event of Marital Dissolution, any residence (a) purchased as a residence in which the parties reside as a family either as a primary or vacation residence, or (b) purchased as an investment property but subsequently resided in by the parties as a family either as a primary or vacation residence, shall be titled in the joint names of the parties (or otherwise deemed jointly owned by the parties) with each party having a 50% interest in such property. Any other residences which the parties choose to put in joint names (or hold title through an entity in which both parties are members or partners) shall be considered to be equally owned by the parties, with such property to be sold upon an Event of Marital Dissolution and the net proceeds of sale equally divided.”

The parties never lived in this property as a vacation residence. Indeed, it was purchased in a derelict condition, no doubt with the intention of renovating it and perhaps incorporating it into the domain of the next-door property. But such plans were never put into effect, and it stands derelict to this very day. The wife claims that 50% of the value of the equity in that property, or around $1.25 million should be attributed to her. This is an argument bereft of merit. The figure of zero will be used by me in the Outcome Schedule.

Issues 6, 7, 8 & 9: Should the mortgage on the family home be taken at £18m or £16m?

“No finding is required as to whether or not W signed the re-mortgage documentation. It is clear from the evidence that no finding that she signed the documents is in any way possible.”

Yet the husband was very extensively and rigorously cross-examined by Mr Cusworth KC about this matter.

Issue 10: Is the wife entitled to a credit of half the net sale proceeds of 26 Downing Street?

“The parties acknowledge that Michael has signed a contract to purchase a townhouse located at 26 Downing Street, New York for a purchase price of $14.25 million, which the parties intend to utilize as their primary residence and which shall be considered a joint asset of the parties vesting at the date of closing. Michael shall be permitted to finance the purchase price by taking a mortgage on the property of up to $10 million. The contents of 26 Downing Street (or any replacement residence) shall also be considered the joint property of the parties, except for artwork which disposition shall by governed by paragraph 6.9 of this Agreement.”

“Within thirty days from the occurrence of an Event of Marital Dissolution, if there are children of the marriage under the age of twenty-one, Alvina shall have exclusive occupancy and shall be permitted to remain in the 26 Downing Street (or if this property has been sold, in the parties’ then primary residence) until the youngest child of the marriage attains the age of twenty-one. Michael shall be responsible for making the monthly mortgage payments, payment of any real estate taxes, major repairs (subject to his being given the opportunity to arrange for such repairs), and maintaining at his expense the household staff (subject to a cap of $60,000 per year, not including a nanny, if applicable) for the 26 Downing Street (or equivalent payments for any replacement primary residence) during Alvina’s period of exclusive occupancy of the residence and Alvina shall pay all other expenses attendant to the primary residence. Alvina shall maintain the primary residence in reasonably good condition during the period of her exclusive occupancy. Upon the youngest child of the marriage attaining the age of twenty-one, the 26 Downing Street or any replacement primary residence then owned by the parties) shall be placed on the market for sale and the net proceeds of the sale, after the payment of the mortgage, broker’s fees, and all reasonable and customary clothing expenses, shall be equally divided between the parties. Michael shall not be entitled to a credit for paying down mortgage principal, if any, during Alvina’s exclusive occupancy of the residence (or otherwise).”

Issue 11: Should the wife be entitled to 100% or 50% of Rue Duphot Nos. 2 and 3?