Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales Court of Appeal (Civil Division) Decisions

You are here: BAILII >> Databases >> England and Wales Court of Appeal (Civil Division) Decisions >> Evans v Barclays Bank Plc & Ors (Rev1) [2023] EWCA Civ 876 (09 November 2023)

URL: http://www.bailii.org/ew/cases/EWCA/Civ/2023/876.html

Cite as: [2023] WLR(D) 492, [2024] Bus LR 366, [2023] EWCA Civ 876, [2024] 1 All ER (Comm) 573

[New search] [Printable PDF version] [Buy ICLR report: [2024] Bus LR 366] [View ICLR summary: [2023] WLR(D) 492] [Help]

ON APPEAL FROM THE COMPETITION APPEAL TRIBUNAL

(Mr Justice Marcus Smith, Professor Neuberger and Mr Lomas)

[2022] CAT 16

Strand, London, WC2A 2LL |

||

B e f o r e :

(Sir Julian Flaux)

LORD JUSTICE GREEN

and

LORD JUSTICE SNOWDEN

____________________

| Mr Phillip Gwyn James Evans |

CA-2022-002002 Appellant |

|

| - and - |

||

| Barclays Bank PLC & Ors |

1st 15th Respondents |

|

| - and - |

||

| Michael O'Higgins FX Class Representative Limited |

16th Respondent |

|

And Between : |

||

| Michael O'Higgins FX Class Representative Limited |

CA-2022-002003 Appellant |

|

| - and - |

||

| Barclays Bank PLC & Ors |

1st 13th Respondents |

|

| - and - |

||

| MUFG Bank, Ltd and Mitsubishi UFJ Financial Group, Inc. |

14th 15th Respondents |

|

| Mr Phillip Gywn James Evans |

16th Respondent |

____________________

Aidan Robertson KC, Victoria Wakefield KC, Benjamin Williams KC, Jamie Carpenter KC, David Bailey & Sophie Bird (instructed by Hausfield & Co LLP) for the Appellant - Evans

Brian Kennelly KC, Paul Luckhurst, Thomas Sebastian & Hollie Higgins (instructed by Baker McKenzie LLP; Allen & Overy LLP; Herbert Smith Freehills LLP; Slaughter and May; Macfarlanes LLP; Gibson, Dunn & Crutcher UK LLP; Latham & Watkins (London) LLP) for the 1st to 15th Respondents - Barclays Bank PLC & Ors

Daniel Jowell KC, Gerard Rothschild, Charlotte Thomas and Shail Patel (instructed by Scott + Scott UK LLP) for the 16th Respondent - O'Higgins

CA-2022-002003

Daniel Jowell KC, Gerard Rothschild, Charlotte Thomas (instructed by Scott + Scott UK LLP) for the Appellant - O'Higgins

Aidan Robertson KC, Victoria Wakefield KC, Benjamin Williams KC, Jamie Carpenter KC, David Bailey & Sophie Bird (instructed by Hausfield & Co LLP) for the 1st Respondent - Evans

Brian Kennelly KC, Paul Luckhurst, Thomas Sebastian & Hollie Higgins (instructed by Baker McKenzie LLP; Allen & Overy LLP; Herbert Smith Freehills LLP; Slaughter and May; Macfarlanes LLP; Gibson, Dunn & Crutcher UK LLP; Latham & Watkins (London) LLP) for the 1st to 13th Respondents - Barclays Bank PLC & Ors and 1st to 2nd Proposed Objectors Barclays Bank PLC & Ors

Hearing dates: Tuesday 25th - Friday 28th April 2023

____________________

Crown Copyright ©

- This is an appeal from the judgment of 31st March 2022 of the Competition Appeal Tribunal ("CAT") following a five day hearing in July 2021 which was then followed by a series of written submissions from the parties to the CAT in September and November 2021 ("the Judgment"). The appeal is brought with permission of the CAT upon the basis that the issues are novel, difficult and evolving and there was disagreement between the tribunal members on the central points. The majority included the President, Mr Justice Marcus Smith, and Professor Neuberger. The dissenting minority comprised Mr Paul Lomas.[1]

- The issues relate to the system of collective actions instituted by the Consumer Rights Act 2015 which led to amendments to the Competition Act 1998 ("CA 1998"). Under this system representatives (who generally combine a named individual as figurehead, lawyers and funders) apply to be certified to act collectively for a class of claimants. In this case there were two rival claims for certification before the CAT brought by Mr Evans ("Evans") and Michael O'Higgins FX Class Representative Ltd ("O'Higgins") as putative class representatives. If a claim is certified as suitable for a collective claim, the CAT then decides whether it proceeds upon an opt-in or opt-out basis. This system and related issues have been the subject of a series of judgments of the Supreme Court and the Court of Appeal. They have set out detailed expositions of the system. Rather than repeat what has been extensively set out therein, it suffices to refer to those judgments for the background. The judgments are as follows: Sainsbury's Supermarkets Ltd v Mastercard Inc [2020] UKSC 24 ("Sainsbury's"); Merricks v Mastercard Inc [2020] UKSC 51 ("Merricks"); Le Patourel v BT Group PLC and another [2022] EWCA Civ 593 ("Le Patourel"); LSER and others v Gutmann [2022] EWCA Civ 1077 ("Gutmann"); and, MOL (Europe Africa) Ltd and others v Mark McLaren Class Representatives Ltd [2022] EWCA Civ 1701 ("McLaren").

- In the Judgment the CAT gave permission for the Appellants to submit revised applications to be certified on an opt-in basis a claim for damages against certain banks which had engaged in an unlawful exchange of competitively sensitive pricing and other data with the object of reducing the risks normally attendant upon genuine competition. The claim is that this illegal cartel resulted in the participating banks earning artificially inflated returns at the expense of competitors and counterparties. The total claim with interest approaches £2.7 billion.

- This judgment has been handed down at the same time as the judgment in UK Trucks Limited v Stellantis NV (Formerly Fiat Chrysler Automobiles NV) and others [2023] EWCA Civ [875] ("Trucks"). In that case an identically constituted Court of Appeal heard appeals in relation to a collective action against certain truck manufacturers for a price fixing cartel which it is alleged raised the price of trucks causing loss and damage to customers. There was overlap between some of the issues arising in the two appeals. Both cases are follow-on claims whereby, pursuant to section 60A CA 1998, the prior regulatory finding of the EU Commission is binding as to liability.

- The present case was the first coming before the CAT for certification following the seminal judgment of the Supreme Court in Merricks (ibid). There are however now over 30 collective actions before the CAT with vast total claims. Many of these claims are highly complex legally and economically. In the intervening period the CAT has grappled with a range of novel procedural and legal issues and has instituted, and fine-tuned, many case management techniques, all with the object of bringing order and control to what otherwise risks the unleashing of litigation leviathans.

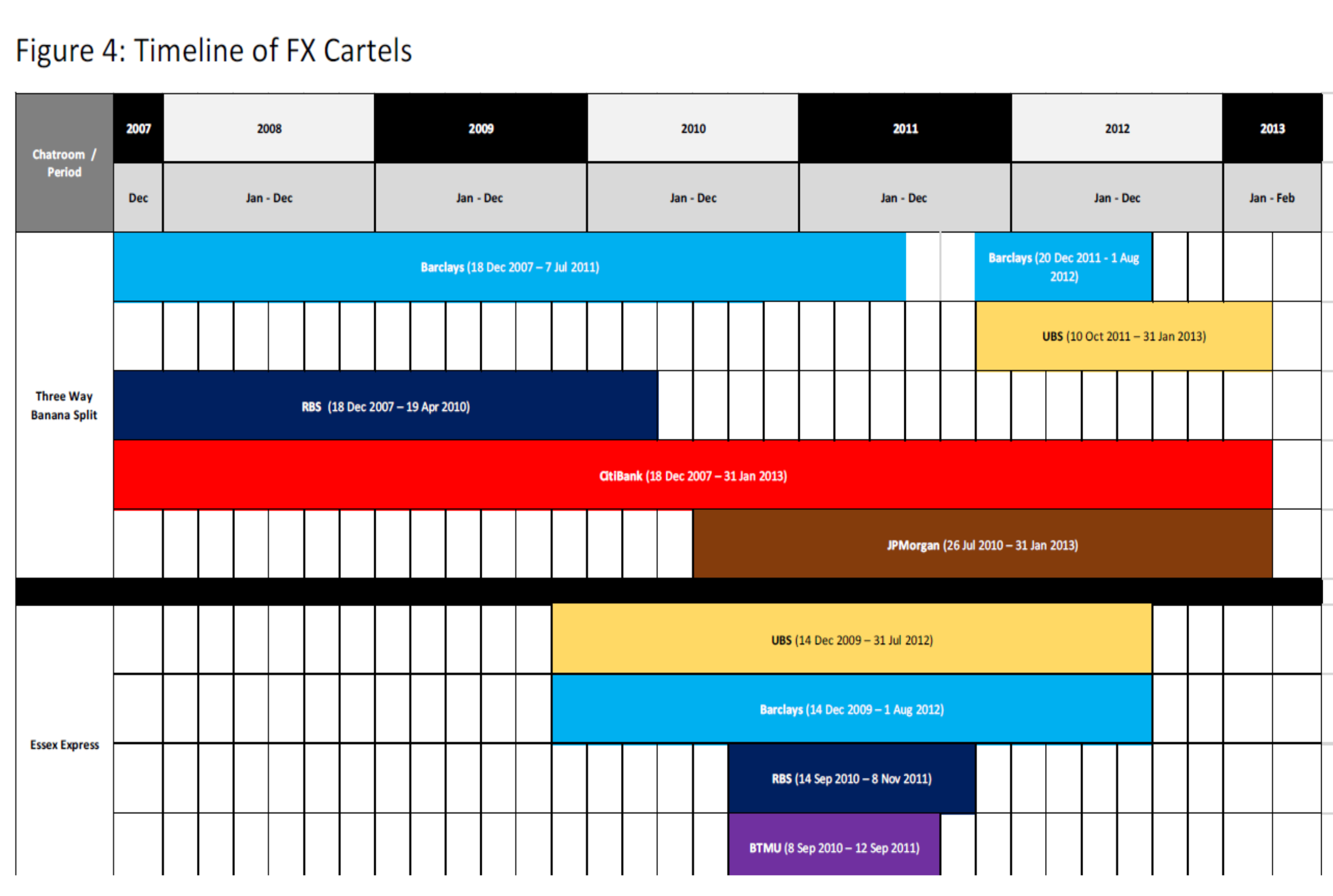

- On 16th May 2019, the Commission rendered two decisions finding infringements of Article 101(1) TFEU in relation to FX spot trading: (i) Case AT.40135 FOREX ("Three Way Banana Split"); and (ii) Case AT.40135 FOREX ("Essex Express"). The decisions are short form, settlement decisions, whereby the defendants made admissions to the Commission in return for a reduced fine. They have not therefore been made the subject of appeals. Both decisions are "object" decisions where liability is predicated upon the Commission proving, to the requisite standard, that the object of the cartel was to restrict and distort competition. This means that there is no detailed analysis of the "effects" of the cartel, which is the alternative predicate for liability. An important issue arising in this appeal is as to the probative value before the CAT of object based decisions. Taken at face value they provide limited information, evidence or guidance and offer only a relatively bare bones account of the impugned conduct and the law.

- As it happens, on 5th July 2022, following the hearing and judgment of the CAT and hence left out of account in the Judgment, the Commission published a fully reasoned decision addressed to Credit Suisse (which is not one of the defendant banks) finding an infringement of Article 101(1) TFEU in Case AT.40135-FOREX ("Sterling Lads"). This was not a settlement decision. As can be seen from a compare and contrast exercise with the two earlier decisions, the decision in Sterling Lads is a fleshed out version of the template used in Three Way Banana Split and Essex Express. There are numerous paragraphs of all these decisions which are identical. An issue in this appeal concerns the admissibility and probative value in these proceedings of the ordinary decision in Sterling Lads. The respondent banks argue that it is wholly inadmissible; but if admissible bears strictly limited evidential weight. The appellants argue that it is admissible, relevant and provides powerful support for their arguments on the appeal.

- At the certification stage the putative class representatives adduced a substantial volume of factual and expert economic evidence. This was subjected to detailed scrutiny by the CAT majority which expressed concern that, whilst a plausible case at the level of economic theory had been advanced, they could not detect how, at the evidential level, causation was to be established between the breach (as per the Commission decisions) and the alleged loss, nor how disclosure would fill this gap. Significantly, the banks did not seek to strike out the claim or adduce evidence (expert or otherwise) or give disclosure to refute it. The CAT, of its own motion, however, considered whether it should nonetheless dismiss the claims.

- The CAT majority ultimately decided not to strike out the claims. Instead, having set out in the Judgment why they considered a viable claim had not been formulated, and recognising that their concerns were described most fully and in some respects for the first time in the Judgment, they deferred a decision on strike out until the prospective class representatives had been given an opportunity to address the CAT's comments in relation to the question of pleading. They did however reflect their negative views in the decision to be made on whether the claims should be opt-in or opt-out. The criteria for this are set out in CAT Rule 79(3) under which the considerations to be taken into account are at large but the rule expressly stipulates that (i) the strength of the claim and (ii) practicability, are relevant. In relation to strength of the claim, the CAT majority treated their view that the merits were weak as a reason leading it to the conclusion that the proceedings should be opt-in. In relation to practicability the CAT majority found, as a fact, that if the claims were certified upon an opt-in basis there would be insufficient take up for any claim to be viable. Nonetheless, they concluded that an opt-in claim was practicable because, applying an overarching principle of access to justice, the class to be represented were well resourced and sophisticated entities capable of bringing proceedings. If they decided not to, it was to be inferred this was a deliberate decision upon their part. This was not an access to justice problem. In his dissent, Mr Lomas disagreed with both conclusions. He was materially more sanguine than the majority as to the ability of the class representative to articulate a sustainable theory of harm in relation to causation. He concluded that a viable claim had been articulated. He also disagreed that the order of the CAT should be for opt-in. He considered that the order should be opt-out since otherwise there would be no action at all which was inconsistent with the statutory objectives behind the collective action regime.

- The CAT also had to choose between the two competing applicant class representatives. There was unanimity in the decision to select Evans though the reasoning of majority and the minority differed. There was also unanimity that there was virtually nothing between the two candidates but since, perforce, a choice had to be made, the Evans team won, just. The majority judgment records that the Evans team had made a marginally better job of articulating a theory of harm. Though the majority added that the real answer to the question which of the two class representatives was suitable was, in view of their concerns about the strength of the claims, "neither".

- An agreed list of issues prepared by the parties identifies 20 issues, some incorporating multiple subsidiary questions. As a precursor, this Court must decide whether each is for the Court of Appeal by way of a statutory appeal or, alternatively, for the High Court by way of judicial review. The parties have, because of uncertainty as to the scope of the statutory appeal route, invoked both the statutory appeal route and commenced proceedings for judicial review. How each strand of the challenge is to be determined is a logically prior matter that must be determined for each of the issues arising.

- I have grouped the various issues as follows:

- Before the CAT the claim relied upon the decisions of the Commission in (i) "Three Way Banana Split" which operated between 18th December 2007 and 31st January 2013 and (ii) "Essex Express" which operated between 14th December 2009 and 31st July 2012. The parties to the Three Way Banana Split infringement included the defendants UBS, The Royal Bank of Scotland, Barclays, Citibank and JPMorgan. The Essex Express infringement included the defendants UBS, The Royal Bank of Scotland, Barclays, and MUFG. The Commission imposed cumulative fines exceeding Euros 1.1 billion. The ordinary decision in Sterling Lads involved only Credit Suisse, which is not a defendant to these proceedings (there is also a settlement decision in Sterling Lads, to which UBS, Barclays, RBS and HSBC are addressees). I take my account of the basic facts relating to the characteristics of the cartel and the market mainly, but not exclusively, from the ordinary decision in Sterling Lads.

- The cartel covered at least the whole of the EEA and consisted of agreements and concerted practices that had the object of restricting and/or distorting competition in the sector of foreign exchange spot trading of G10 currencies ("FX"). The G10 currencies concerned comprised the US, Canadian, Australian and New Zealand Dollars, the Japanese Yen, the Swiss Franc, the Pound Sterling, the Euro, and the Swedish, Norwegian and Danish Crowns.

- The affected market was that for FX spot trading of G10-currencies. This refers to an agreement between two parties to buy a certain amount (the "notional amount") of one currency against selling the equivalent notional amount of another currency at the current value at the moment of the agreement, for settlement on the spot date (normally the transaction day plus 2 days).

- The infringements involved the participation of the banks in conduct occurring within chatrooms in which traders engaged in recurrent and extensive exchanges of information through which they revealed to each other current or forward-looking information about confidential aspects of their market conduct. There were three types of orders relevant to the unlawful exchanges of information[2]:

- In Sterling Lads, Credit Suisse argued that the exchange was integral to the proper functioning of the FX market and, accordingly, it could not distort competition. The Commission disagreed holding that the market operated effectively absent the challenged exchanges of information:

- FX transactions represent the largest share of the world's financial transactions and are among the most liquid financial transactions. A 2013 survey conducted by the Bank of International Settlements indicated a total turnover of more than USD 5 trillion per day, of which USD 2 trillion resulted from FX spot transactions alone.

- To execute an FX transaction, end-customers typically contact "dealers" (financial institutions who employ "traders") acting towards end-customers as "market makers" via the latter's sales desk or directly on their internet trading platform. Dealers typically quote two-way prices (a bid and an ask price). These vary depending upon the transaction size and on the traded currencies. An end-customer can therefore contact several dealers and choose among the most favourable quotes before trading. All currencies are quoted in pairs, because each FX trade involves buying and selling two underlying currencies and each currency is valued in relation to another. Since currencies are always traded in this way, in foreign exchange there is no such thing as a currency's absolute value but instead there is a relative value compared with other currencies. The market price of one currency is set in a given currency pair, that is, a value if it is exchanged against another. The foreign exchange rate is the rate at which one currency will be exchanged for another.

- Historically, FX transactions were executed directly by telephone on direct lines between parties. FX trading was limited to contacts between trading parties for their business needs and proprietary activities. In order to gather information, traders often called each other asking for quotes or to pass off open risk positions with the intention to trade. The early 1990s saw the development of electronic screen-based broking systems such as the Reuters and the Electronic Broking System ("EBS") platforms. Electronic platforms now allow market participants to access streaming price information, which updates continuously. Trades entered on electronic platforms are cleared and settled electronically, thereby increasing operational efficiency, streamlining trade processing and settlement, reducing operational risks, and lowering trading costs.

- There are three broad categories of market participants: (i) end-customers; (ii) dealers and traders; and (iii) brokers.

- End customers: These typically include corporate customers and financial institutions, comprising asset managers, hedge funds, corporations, banks and central banks. They might use FX trading to support treasury operations associated with their core business activities. Corporate customers primarily use foreign currencies as a medium of exchange or as a means to hedge foreign cash flows. They pay little attention to future exchange rate movements and do not engage in speculative FX trading. Financial institutions cover a broad spectrum including: hedge funds, asset managers, banks and central banks. They usually trade larger amounts of currencies than corporate customers, hold FX positions for longer and use currencies primarily as a store of value. They have strong incentives to acquire information liable to influence the evolution of FX rates and will tend to be better informed than other end-users. Their trades may anticipate short-term FX movements and returns, hence, they are considered "informative".

- Dealers and Traders: Although the expression "dealers"' refers to the financial institutions dealing with currency exchanges and the term "traders" to the agents employed by the financial institutions to conduct their currency exchange trades, these terms are used inter-changeably. Historically, large commercial and investment banks have been dealers. They set up specific trading desks where individual traders trade in specific currency groups. FX traders are employees of financial institutions who trade the currencies on a specific trading desk. They stand ready to trade with anyone needing foreign exchange at a moment's notice. The sales desks are the interface between the traders and end-customers. They are responsible for maintaining good relationships with customers. FX traders will deal with large amounts of currencies, the transaction sizes being proportional to the size of the end-customers. Corporations or financial institutions trading with FX traders directly or via sales representatives are generally large companies. FX traders make money by selling a currency against another at a higher price than that at which they bought it. Trading revenue therefore depends on the amount of currency volume traded and on the difference between the purchase price and the sale price of the same currency (the "bid-ask spread"). Traders may also profit from holding a particular open risk position in their book (long or short) in anticipation of better trading conditions at a later stage. Traders typically receive bonuses tied to their individual profits and the profits of the entire trading floor while their individual risk-taking is constrained by position and loss limits.

- Brokers: These are financial intermediaries who match counterparties to a transaction without being a party to the trade. They can operate electronically (electronic broker) or by telephone (voice broker). Brokers' revenues are proportional to the amount of trades executed by traders on their platform.

- An important issue in this case concerns the causal effect of the cartel upon the trading position of counterparties. In Sterling Lads, Credit Suisse argued that even in the context of an object case, the Commission had to undertake "a detailed assessment, in each individual case, of the market shares of the parties involved or the effects in the market" (paragraph [424]) citing Case C-67/13P Groupement des Cartes Bancaires (CB) v Commission EU:C:2014:2204 (11th September 2014) at paragraph [53]. The Commission rejected this submission. The case law did not require that level of analysis of actual effects. Were the submission to be true it "would defy the very purpose of the category of restrictions by object" (paragraph [424]).

- The Commission accepted however that it had to demonstrate, by reference to the appropriate legal and economic context, that there was a real likelihood of an actual effect on competition. It held that there was such a likelihood basing its conclusion upon (a) the innate or intrinsic likelihood that harm would occur from the type of illegal cartel in issue and (b) its analysis of the actual evidence. The impact upon "competition" was reflected in the financial position of the cartelists relative to competitors and customers. The Commission found that the cartelists enjoyed artificially beneficial trading terms which were, as a matter of probability or likelihood, at the expense of competitors and trading partners.

- In relation to the intrinsically high likelihood of resultant harm, the Commission stated that a cartel of this type was "particularly likely to lead to a collusive outcome" and for this reason exchanges of this sort of information are " by their very nature, harmful to the proper functioning of normal competition". The Commission cited the Commission Horizontal Guidelines (paragraph [390]) which, applying well established case law, treated exchanges of sensitive forward looking information as especially harmful to competition: "The exchange of forward-looking information and price information is particularly likely to lead to a collusive outcome on the market. Therefore exchanges of information about such future intentions are, by their very nature, harmful to the proper functioning of normal competition." At paragraph [445] the Commission held that there was a likelihood of adverse effects on competition:

- In relation to likelihood of harm established by reference to the evidence, in paragraph [286] the Commission found on the facts that the frequent and recurrent exchanges of information could facilitate specific forms of coordination, which took place with a view to benefiting the participating traders or to avoiding trading against each other's interest. The Commission took account of such matters as the nature of the products or the services provided, the size and number of the undertakings and the volume of the market (paragraph [387]). The cartel was able to confer an opportunity to obtain "additional benefits" on the defendants:

- In paragraph [394] the Commission refers to the ability of cartelists to "exploit" the confidential data "for their own benefit" in order to "boost" their profits which would be at the "expense" of counterparties. The Commission concluded that the benefits could be "large" and work to the "detriment" of competitors and counterparties:

- Similarly broad findings about effects, and in particular detriment to counterparties, were repeated later:

- The evidence was enough to enable the Commission to conclude that there was a "sufficient degree of harm to competition" for the conduct to qualify as an object violation:

- In paragraph [473] the Commission reiterated that the intention behind the collusive exchange was to offer the most expensive spread to clients and thereby create "large" benefits for the cartelists and "detriment" to their clients:

- There is substantial overlap between the formulation of the Evans and O'Higgins claims. There are however two significant differences which concern, first, the way in which they described the two principal categories of claim, and secondly, as to the types of transaction covered. I set these out now but they are relevant to the carriage selection issue addressed at section G below.

- I take the following summary from the case as advanced by O'Higgins, because it is the broader of the two claims, but there is a comparable version set out by the Evans team, and nothing rests on the choice. Both take their core analytical format from the way in which the Commission analysed the position in Essex Express and Three Way Banana Split:

- In both claims damages are said, broadly, to arise in two ways: (i) direct losses attributable to the agreements as between the defendants and counterparties; and (ii), "umbrella" damages which arise because of an alleged tainting effect of the cartel on the (un-cartelised) remainder of the market. The artificial increase in spreads brought about by the cartel enabled other traders, unilaterally, to follow suit and increase their spreads in a way that would not have been possible in a genuinely competitive market. Put another way the cartel caused market wide contagion with the consequence that counterparties paid more for FX trades across the entirety of the market, and not just when trading with the cartelists.

- The O'Higgins claim treats both categories of loss as part and parcel of a single undifferentiated claim. The Evans case distinguishes claims into Category "A" and "B" with the former being direct claims and the latter being the umbrella claims.

- Mr Jowell KC for O'Higgins argued that there was no need to differentiate between the two claims and that it was artificial to do so. He might turn out to be right. But the Evans team disagrees and Mr Kennelly KC, for the respondent banks, when addressing the merits of the claims, reserved his most serious criticisms for the inclusion of the Category B losses. Quite irrespective of ultimate merits there is at least a possibility that during preparation for trial and at trial, the evidence and analysis might begin to differentiate as between direct and umbrella losses. At the level of theory, the chain of causation also seems more complex in relation to Category B, umbrella, losses relative to Category A losses.

- One expert instructed for the O'Higgins team sought to explain why an undifferentiated claim was unproblematic. He commented upon the difference in approach between the expert evidence of Mr Ramirez (for Evans) and Professor Breedon (for O'Higgins). I set this out to indicate only how the two claims could be viewed as different:

- The second difference lies in the choice of transactions which the two competing claims seek to encompass. As set out in the Commission decisions (see paragraph [16] above) there are three types of transaction. Different terminology is used to describe or label the different transactions. For present purposes it suffices to use the terminology used by the experts. The O'Higgins claim includes benchmark transactions, limit orders and resting orders. The Evans claim excludes these transactions.

- In the Joint CPO response of the respondent banks, their views on the differences between the two claims are set out. They adopt a 'plague on both your houses' approach, though in a footnote they express agreement with the narrower Evans claim (for obvious reasons), but still go on to explain how difficult the exclusion would be. Their view is interesting in the way in which the two claims are differentiated:

- In their evidence the Evans team explained that the reason for the exclusions was pragmatic. The excluded trades were of a type for which it could not be said with confidence that any loss would necessarily have been sustained by the class and, indeed, it was possible that some trades might even in fact have been profitable. The exclusion made the claim more focused and manageable.

- I turn now to the preliminary question of how disputes about a judgment of the CAT should be addressed and whether this should be by way of an appeal under section 49(1A)(a) CA 1998 or by way of judicial review to the High Court, or even both. At a directions hearing held on 6th December 2022 the Court ordered that all issues (whether procedural or substantive, interim or final) were to be addressed at a single rolled-up hearing with the Court sitting as both the Court of Appeal and a Divisional Court of the High Court. This was embodied in an order of the Court. By this device we have been able to consider all issues in the round. By clarifying the law it should be possible to avoid this unnecessary duplication of cost, resource and effort in the future. Nonetheless, should such a scenario arise again, this is a sensible way of dealing with these disputes.

- The right of appeal is set out in section 49(1A)(a) CA 1998:

- There is no difficulty in identifying a point of law when it concerns, for instance, the interpretation of a statute or other legal instrument. As set out below, the Supreme Court in Merricks identified many challenges which it treated as concerning "points of law". The area of greatest difficulty lies in categorising challenges to findings of fact or to evaluations of combinations of fact. The classic formulation of the test here is found in Edwards (Inspector of Taxes) v Bairstow [1956] AC 14 ("Bairstow") which held that an appellate court could reverse a finding of fact where it appeared that the decision maker acted without any evidence, or on a view of the facts which could not reasonably be entertained. Lord Radcliffe, at page 36, stated:

- In Secretary of State for Education and Science v Tameside MBC [1977] AC 1014 the House of Lords confirmed that where a public body had misdirected itself, or made a mistake, as to a material fact, that may suffice to allow a challenge as law. In a typical case an error of law might, for example, arise if a decision maker has in a material respect: failed to take account of a relevant fact; taken into account an irrelevant fact; or drawn an incorrect inference or conclusion from an established fact.

- Nonetheless, courts are careful to differentiate between challenges to evidence which amount properly to points of law and those which are, at base, disguised or camouflaged disagreements with the legitimate finding on the evidence of the decision maker. For example, in Napp Pharmaceutical Holdings Ltd v Director General of Fair Trading (No 5) [2002] EWCA Civ 796 the Court of Appeal refused to grant permission to appeal where the applicant sought to present as issues of law challenges to primary findings of fact about market behaviour.

- In drawing the line, a court will take into account the nature of the jurisdiction exercised by the decision maker being appealed against and will be more reluctant to interfere where the lower court or tribunal applies a specialist expertise to the evaluation of facts. The CAT is one such body: See e.g. Merricks (ibid) paragraph [63]. In Le Patourel the Court of Appeal gave some guidance on when a dispute focusing upon the evaluation of facts could amount to a point of law:

- The second limit is that the point of law must be "as to the award of damages" or other sum. The expression "as to" presupposes some degree of connection between the point of law and the damages or other sum, but there is no indication in the CA 1998 as to how close that nexus or connection must be. The judgment of the Supreme Court in Merricks (ibid) provides the clearest guidance as to what constitutes "a point of law as to the award of damages or other sum". The Court addressed seven grounds all of which were accepted as being admissible and it necessarily follows amounted to (a) points of law and (b) were "as to" damages. The Court held that there were errors in relation to five of the admissible grounds but not in relation to the other two.

- Those where the Supreme Court found an error can be summarised as follows:

- The following were admissible grounds of appeal where, on analysis, the Supreme Court found there to be no error:

- Like the Supreme Court, the Court of Appeal in Merricks ([2018] EWCA Civ 2527) articulated a broad test for jurisdiction. Patten LJ considered that even though the decision of the CAT itself did not address the viability of the underlying claims for damages (paragraph [27]) it was nonetheless: "a decision in collective proceedings as to the award of damages". This was because the refusal of a CPO was a determination of the Tribunal that the eligibility criteria were not met and the proposed representative was not therefore entitled to seek an aggregate award of damages under section 47C(2) which was a remedy "unique to collective proceedings". The refusal of a CPO was likely to prevent individual members of the represented class who had suffered loss from obtaining any compensation. It was therefore the "end of the road for a class action of this kind and, as such, a decision as to the award of section 47C(2) damages". The fact that class members were left with individual claims was "nothing to the point." Coulson LJ, in a concurring judgment, agreed (paragraph [29]) that a decision not to grant a CPO was a decision as to the award of damages.

- This court provided a summary of the above in Le Patourel (ibid) at paragraphs [50] [55] and in McLaren (ibid) at paragraph [9]. The Court of Appeal has considered whether particular issues are "as to" damages on a few earlier occasions. In Enron Coal Services Ltd v English Welsh & Scottish Railway Ltd [2009] EWCA Civ 647 at paragraphs [23]-[24] ("Enron") Patten LJ considered that decisions which amounted to the rejection of a claim (such as a strike out decision), and those refusing to strike out a claim were decisions "as to the award of damages" (within the meaning of section 49(1)(b) of the CA Act 1998, which was the relevant provision for the purposes of that case). The expression "as to" damages:

- In Paccar Inc and others v Road Haulage Association Ltd and others [2021] EWCA Civ 299 ("Paccar") the Court was addressing whether the proposed funding arrangements of a collective action amounted to an unenforceable damage-based agreement. It was not in dispute that if the issue was not within the scope of an appeal under section 49(1A)(a) it could nonetheless proceed by way of judicial review. The Court held that it was not appealable. The case was heard after the judgment of the Supreme Court in Merricks was handed down but does not treat that judgment as indicating the permissible bounds of an appeal. At paragraph [55] the Court treated section 49(A1)(a) as " descriptive of the type of decision from which an appeal may be brought, and not a description as to the type of proceedings in which the decision is made." This distinction was not arrived at by reference to the analysis of the Supreme Court in Merricks and was affected by the conclusion of the Court that " there [was] every reason to suppose that an acceptable way of dealing with the problem [of the proposed class representative] would have been found" (paragraph [59]). Hence the decision of the CAT was not an end of the road decision. Given the omission from the judgment of any reference to the Supreme Court in Merricks it should be seen as a decision on its own facts.

- Finally on this point, the approach currently adopted by the CAT to interlocutory decisions was recently set out in the decision on permission to appeal in Merchant Interchange Fee Umbrella Proceedings [2022] CAT 50 ("MIF") at paragraphs [4] - [22]. The question was whether Mastercard was entitled to appeal the substantive decision ([2022] CAT 31) on grounds concerning the extent of disclosure and witness evidence relevant to the issue of merchant pass-on. The CAT held that whilst there was jurisdiction to appeal (paragraph [22]) the appeal had no real prospect of success and permission should be declined. On the question of jurisdiction, the CAT asked "essentially whether the decision affects the amount of damages to be awarded in some causal way" (paragraph [14]). Further: " a case where no damages will arise at all because of an interlocutory decision will be a decision as to the award of damages" (paragraph [15]). In pragmatic terms the CAT observed (paragraph [18]):

- I see force in the CAT's analysis. The test: "whether the decision affects the amount of damages to be awarded in some causal way" highlights the need for there to be "some" (sufficient) causal link between the decision and damages. The guidance from Merricks is that the link or effect does not have to be very direct or close. The test is not one capable of being applied with mathematical exactitude. However case law indicates for example: that a decision which brings the possibility of a claim for damages to an end (such as a strike out) is "as to" damages; that a decision going to the amount of a possible claim (for instance a decision that part of a claim is unsustainable) is "as to" damages; that a decision that a claim should not be struck out is "as to" damages, not least because if the appeal prevails the effect is as if the CAT should have struck out the claim; and that decisions as to the procedure to be applied to determine damages claims are also "as to" damages because the procedure adopted could affect the ultimate quantum.

- There will however be an outer limit. In argument, citing Paccar, it was suggested that the outer limit was whether the decision under challenge brought the claim or part of a claim to an end. But that analysis seems too narrow. It follows from Merricks that decisions which affect how claims are to be run or adjudicated upon are also "as to" damages even where the decision does not bring the claim to an end. So for instance the Supreme Court treated whether the CAT was right to hold a trial within a trial as a decision "as to" damages and it also held that a dispute about whether distribution should be taken into account at the certification stage was "as to" damages. Disputes as to how broad common law principles apply to the evaluation of evidence relating to damages and as to the judicial tools and techniques at the CAT's disposal (such as the broad axe) have also been held to be proper subject of the statutory appeal process and are therefore "as to" damages. They are reasonably described as principles of law and procedure which govern how a damages claim is to be determined and they all could ultimately affect quantum.

- I am loathe at this stage in the development of the case law to express a definitive view as to how bright the line is as between an appeal and judicial review. I am though clear that the statutory right of appeal should be construed broadly in order to minimise the scope of judicial review. One of the legislative purposes identified by the Supreme Court in Merricks as guiding the operation of the regime was judicial efficiency. Judged through this optic there is only judicial inefficiency flowing from forcing litigants seeking to challenge CAT decisions to go via judicial review or (as in this case), even worse, proceed simultaneously via judicial review and a statutory appeal.

- There is no logic in a conclusion that Parliament wished to give an appeal route a narrow scope leaving judicial review with a concomitantly broader scope. To the contrary there are good reasons why an appeal should take precedence over judicial review. First, in terms of judicial hierarchy it makes sense for challenges to CAT decisions to flow, to the greatest degree possible and consistent with the legislative purpose, to the Court of Appeal. Institutionally the CAT is presided over by a specialist High Court Judge and in individual cases High Court judges with suitable experience are routinely appointed to sit as the presiding judge. Judges who sit in the CAT acquire specialist skills and receive specialist training. A CAT panel routinely includes an economist. If judicial review were a normal route of challenge this would entail a challenge from a three person specialist CAT, to a non-specialist High Court judge sitting in the Administrative Court which could then lead to an appeal to the Court of Appeal. Judicial review inserts an unnecessary non-specialist step in the progress of a CAT decision to an appeal. Secondly, it is relevant that in practical terms there is not a great deal of difference (if any) between an appeal on a point of law and judicial review. There is no clear benefit in permitting judicial review to have a broad scope where there is no inherent forensic value to the exercise. Both proceed upon the basis of facts as found by the lower court or tribunal and in both an appropriate margin of discretion or appreciation is accorded to the first level trier of fact, especially if it is a specialist body. The traditional grounds of an appeal on a point of law are closely related to the traditional grounds of judicial review. The authors of De Smith's Judicial Review, 9th Edition (2023) observe at paragraphs [16-018] and [16-019] that the powers of an appellate court will encompass all the grounds of judicial review within the rubric "points of law" and might "perhaps" even be greater.

- It is also an elemental principle that parties seeking judicial review should exhaust other judicial remedies first. The rigour with which this is applied will always be dependent upon the nature of the "other" remedy: In Glencore Energy UK Ltd v Revenue and Customs Commissioners [2017] EWHC 1476 (Admin) ("Glencore") at paragraphs [40] and [112] - [115] (upheld on appeal [2017] EWCA Civ 1716) the issue was whether the taxpayer could seek judicial review of a decision of HMRC instead of appealing to the Tax Tribunal. Where Parliament had created a statutory right of appeal it was important that the statutory route be taken advantage of for reasons of resources allocation and expertise. This is a principle which forms part of the Pre-Action Protocol for Judicial Review which, at paragraph [5], states that: "Judicial review should only be used where no adequate alternative remedy, such as a right of appeal, is available. Even then, judicial review may not be appropriate in every instance." In my judgment wherever an appeal lies in cases such as these, judicial review should not.

- Where there is any doubt about the route of challenge, the procedure adopted in this case whereby the Court sits as the Court of Appeal and High Court makes sense and avoids duplicated court time and expense. The occasions when the only issue is one of judicial review should be rare.

- I turn now to the first substantive issue. Both applicant class representatives argue that the CAT erred because, on any analysis, their pleaded cases went way beyond the bare minimum needed to pass any threshold strike out hurdle. The Court was taken at length to the pleaded cases of the applicants including to their expert and trade witness evidence to show both the soundness of the econometric approaches proposed, the sufficiency of the data sources available to populate future economic regression modelling, and the way in which trade witness evidence could plug any gaps which might exist in the data. It was also argued that the CAT was wrong to take the issue of its own motion, there having been no dismissal application made by the banks.

- It is important to be clear about the challenge. The CAT did not strike out the claims. The applicants live to fight another day. The challenge therefore is to the conclusion of the CAT that it would not, there and then, decide that the pleaded cases were sufficient as opposed to deferring the decision to a later day when the parties could replead having been placed on notice of the concerns of the CAT.

- The applicants advance two main arguments: (i) the CAT applied the wrong test in law; and (ii), in any event the claims advanced to the CAT met any test the CAT was entitled in law to apply. The respondent banks retort that the CAT was correct to consider upon an own-motion basis whether the claims were viable and to conclude that the claims as presented were speculative, ill formed and, in the round, "hopeless". The CAT was therefore justified in taking the weakness of the claim into account in relation to the opt-in v opt-out decision under CAT Rule 79(3). Mr Kennelly KC advanced a forensically spirited dissection of the applicants' cases though he did so without his clients having adduced any expert or trade evidence or offered any pre-action disclosure.

- In my judgment this issue proceeds by way of appeal only. It concerns the power of the CAT in law to consider strike out of its own motion; and the nature, scope and effect of the exercise of its case management powers to regulate how claims "as to" damages should be pleaded.

- The CAT has the power, of its own motion, to determine whether a claim is viable. It can do this both at the certification stage and/or thereafter. This is expressly set out in the CAT Rules and was confirmed by the Supreme Court in Merricks at paragraphs [26] and [59]. This power is an important tool in the CAT's gatekeeper armoury.

- It is argued that the CAT applied too onerous a standard and as a result was excessively demanding as to the detail expected to be provided. The appellants rely in particular upon the test at the certification stage. In Merricks the Court emphasised that the regime did not contemplate a merits assessment at the certification stage and expressly said that the threshold was low (paragraphs [44] and [45]). It also held (paragraph [73]) that all an applicant had to establish in a follow-on case was a reasonable prospect of showing "some loss":

- The case law on the threshold for certification is not the relevant test. In Merricks the Supreme Court recognised that there were exceptions to the rule that merits were irrelevant at the certification stage in that (i) putative defendants could seek to strike out the claim or obtain reverse summary judgment and (ii) the strength of the claim was relevant under CAT Rule 79(3) to the opt-in v opt-out decision.

- The issue for this Court is not the same as it would have been had the CAT actually struck out the claims. If that had happened, the Court would have had to decide whether on the claim as presented (including the formal pleading but also the "methodology" proposed and other evidence presented) a viable claim had in law been made out. The issue on this appeal however is only whether as a matter of case management discretion the CAT majority erred in deferring the possibility of a dismissal decision on the merits. Applying traditional strike out law, the CAT did not dismiss the claims. It is not said that the CAT misunderstood the strike out test. I therefore do not agree that the CAT applied the wrong test in law.

- The next strand of the argument goes to the heart of the issue. Did the CAT err in failing to accept as sufficient the cases as pleaded? If the CAT erred, then the logical consequence should have been that (i) there was no need to defer consideration of strike out or require any additional pleading; and (ii), the CAT should have taken a much more positive view of the strength of the claims when choosing between opt-in and opt-out (which is relevant to Issue III at section F below). It is important to set out the reasoning of the majority of the CAT.

- The CAT majority criticised the applicants' pleadings as based upon a plausible theory but lacking particulars of evidence. They could not see how the CAT could effectively case manage or ultimately try the claim (Judgment paragraphs [141] and [228ff]). A claim that was plausible in economic theory was insufficient in law to proceed. The CAT majority said under the heading "Market-wide harm":

- In paragraph [234] the CAT majority stated that it had not overlooked the guidance given by the Supreme Court in Sainsbury's which encouraged a highly pragmatic approach to quantification:

- In paragraphs [236] and [237] the CAT majority drew a distinction between a "theoretically plausible" pleading and one which particularised evidence sufficient to take the case beyond the theoretical and into the real:

- The CAT did not consider that the identified deficiencies could be overcome by disclosure. At paragraph [238(5) and (6)] the majority said:

- In paragraph [238(7)] the CAT majority said that to justify disclosure an arguable statistical case had to be pleaded first:

- Under the heading "Conclusions" the CAT majority said:

- At footnote [152] the CAT majority added a critical qualification:

- The final conclusion of the CAT was therefore that it should not exercise its strike out jurisdiction:

- I turn to my conclusions. The CAT majority examined causation in real depth. It addressed the facts it considered to be relevant and did not leave out of account facts that could be said to be germane to the analysis. It was cognisant of the approach it was required to take to the evidence. It did not for instance ignore that it had broad axe powers. There was a difficult and finely balanced judgment call to be made, as the existence of the minority judgment demonstrates, and all three judges were keen to emphasise the importance of a clearly formulated case on what was manifestly a complex and novel claim, even though they disagreed as to the intrinsic merits. Ultimately, the CAT has ordered further and better particularisation of the pleaded case on causation. The task of this court is not to decide whether we side more with the minority than the majority. We can ask only whether the CAT was within its broad case management discretion to defer the decision. In my judgment it was.

- It was suggested by the respondent banks that in McLaren the Court had imposed an onerous burden on the CAT to ensure that cases going forward were viable and this justified the CAT's very demanding approach to the merits in this case. On this I do not agree. To be clear, in McLaren the CAT had in its judgment identified "the" central issue in the trial but had then brought its analysis to an abrupt end. The view of this Court was no more than this created a lacuna in the exercise of the CAT's post-certification gatekeeper role and that it needed to have some "blueprint" for managing the issue going forward. Having identified the central issue, the CAT had to case manage it in some appropriate manner. This Court did not however indicate how the CAT should go about this task nor indicate that the "blueprint" for the conduct of this central issue necessarily had to be detailed. What the CAT would require would be an exercise of its discretion and would be fact and context specific.

- I should add one final observation concerning the applicants' criticism of the respondent banks for the position they adopted. Having declined, no doubt for tactical reasons, to put forward an application to dismiss backed by expert and other evidence and even early disclosure, it is said by the applicants that the banks opportunistically stood on the side line throwing rocks, many predicated upon assumptions or assertions about facts they were unwilling to make good. It is also said that the banks adopted this position to avoid having to give any disclosure, including pre-action disclosure, which might have revealed why the Commission arrived at the conclusions it did in Three Way Banana Split and Essex Express. The CAT has a standalone power to strike out a non-viable case. I do not suggest that the CAT should never adopt this course of action. There is nonetheless a risk where it does so because it compels the CAT to do its own thinking without the assistance of a properly formulated, evidence based, objection from the putative defendants. The CAT does not obtain the same level of assistance from a respondent jumping upon a passing bandwagon whilst, at the same time, keeping its cards far distant from the table. The CAT has a continuing power to strike out non-viable claims which it is in principle entitled to exercise after a defendant has given, for instance, disclosure. If the CAT has concerns, it always has the option to adopt a wait and see approach.

- In conclusion the CAT did not err in the application of the appropriate test to the facts.

- The second issue concerns the decision of the CAT, by majority, to certify the claim upon an opt-in basis. The test is set out in CAT Rule 79(3) and is essentially at large. The CAT may take into account all matters it thinks fit, including the matters set out in CAT Rule 79(2) and (3):

- The CAT unanimously held that it had the jurisdiction to choose as between opt-in or opt-out even where the applicants applied only for an opt-out CPO (Judgment [82] [88]). It was plainly correct in this. Nothing in the CA Act 1998 compels the CAT to accept the choice made by class representatives. Its discretion, in public law terms, cannot be so fettered. Were it otherwise, class representatives would invariably select opt-out thereby making the statutory choice illusory.

- The majority held that the proceedings should be certified upon an opt-in basis. In coming to this conclusion, they took account of the following two principal considerations. First, that the strength of the claim was very weak. Secondly, that by making the claim opt-in there was no access to justice deficit even though the CAT found as a fact that were it to make such an order the proceedings would not go ahead. The CAT also considered: (i) that the class representative did not amount to a pre-existing body such as a trade association; (ii) that the funding arrangements were such that there would be an incentive to settle at which point members of an opt-in class would be more likely to express an interest than in an opt-out case; and (iii), that the existence of settlements in the US showed that opt-in claims were practicable. These points were considered to be "weak" indicators of opt-in.

- Mr Lomas dissented. He considered that it was illogical for the majority to conclude that absent an opt-out order there would be no claim at all, but then order opt-in proceedings nonetheless. This was antithetical to the principle of access to justice and to the public interest in ensuring that wrongdoers disgorge their ill-gotten gains. An opt-out CPO would provide access to justice for all class members, whereas an opt-in CPO would be neither practicable nor economically viable nor be in the interests of the class members: see Judgment paragraphs [415], [435] - [449] and [455].

- The appellants argue that the CAT majority erred:

- In my view this argument raises a point of law as to damages and is subject to the right of appeal. The issue concerns: (i) the correct interpretation and application of provisions of the CA 1998 and the CAT Rules; (ii) the proper inferences to be drawn from essentially common ground facts and their relevance to the exercise of the discretion under CAT Rule 79(3); and (iii), the bringing of the claim to an end since, at the practical level, it is common ground that this procedural decision will result in no claim for damages being advanced at all.

- A consideration of statutory purposes is relevant to this dispute. The Supreme Court in Merricks held that in construing the rules it was important to interpret and apply them (ibid paragraph [45]) " in their context as a special part of UK civil procedure and with due regard paid to their purpose". Lord Briggs (ibid paragraph [37]) approved the threefold description of statutory purposes set out by Chief Justice McLachlin in Hollick v Toronto (City) 2001 SCC 68; [2001] 3 SCR 158 at paragraph [15] in relation to the Ontario Class Proceedings Act 1992:

- In Le Patourel the Court of Appeal summarised the legislative intention behind the creation of the collective damages regime:

- The respondent banks argue that there is a fourth guiding consideration which is that defendants should not be unfairly burdened or oppressed by this radical new regime which should therefore be strictly applied (in favour of defendants). Such an object is however not an identified legislative purpose and would run counter to the policy objective of ensuring that wrongdoing undertakings do not avoid the consequences of their illegal actions. On the other hand, in applying the broad principles governing the conduct of claims set out in CAT Rule 4, it is the responsibility of the CAT to ensure that defendants are treated fairly and proportionately but within the confines of the legislation properly construed. Taken as a whole the CA 1998 and the CAT Rules strike the proper balance between the various objectives and the need to protect defendants.

- Ms Wakefield KC, for Evans, argued that it was illogical for the CAT majority to defer the decision on the merits accepting that the lacuna identified were capable of being filled yet, at the same time, treat what of necessity had to be a tentative and provisional view on the merits as definitive and fixed and attracting decisive weight in the opt-in/opt-out scales. Further, she argued that if any weight was to be attributed to the merits it could only become relevant after the class representatives had exercised their right to resubmit a reformulated pleading. It was wrong in principle and procedurally unfair to pre-empt that right and treat a provisional view as, in effect, definitive without waiting to see if revised pleadings overcame the CAT's concerns. I see the force in both these points. If, as was the case, the CAT was prepared to await a reformulated case before arriving at a conclusion on the merits then it could not logically treat its provisional view on the merits as legally definitive.

- The second objection is that the CAT failed to explain how or why making an opt-in order would improve the conduct or fairness of the proceedings. Instead, the logic of the CAT was that by making an opt-in order the claim would collapse; in other words an opt-in order was the sanction for a non-viable claim. It is argued that this is an irrelevant consideration to take into account. The applicants add that the CAT did not have the benefit of the subsequent case law of the Court of Appeal in which this issue has been considered; had the CAT been aware of this case law it might have taken a different decision. It is pointed out that in Le Patourel the Court of Appeal, when considering the relevance of strength of the case under Rule 79(3) (ibid paragraphs [104] [108], observed that in most cases the strength of a case might be neutral as a factor in the choice between opt-in and opt-out. The Court also observed that it might be hard for the CAT confidently to assess the merits of the claim "because of the complexity of the legal and economic issues arising and the absence at the certification stage of expert evidence and disclosure".

- Again I see the force in this. The strength of a claim (either way) is but one relevant factor that might (but need not) be taken into account. Generally, the strength of a claim will be neutral regardless of whether the proceedings are opt-in or opt-out. Though in follow-on cases liability will already be established so (as in the present case) the issue will be as to causation and loss. There might therefore be some relationship between the relative merits and the mechanics of a trial process. Even assuming the CAT was entitled to take its negative view on the merits into account it follows that it still needed to show how that assessment made opt-in preferable to opt-out. The factors the CAT will take into account should bear upon such questions as which option is better able to vindicate the claim, which affords better access to justice and which enables the case to be best case managed from the point of view of judicial efficiency, or by reference to some other relevant consideration (e.g. under CAT Rule 4). By way of example it is said that in the main opt-out aggregate damages claims are likely to be easier to fund than opt-in claims (cf Le Patourel (ibid) paragraph [107]) and therefore likely to result in better run litigation. Further, an opt-out damages claim is easier to prove in terms of causation because there is no need to establish a causal link with individual claimants, that being an issue for distribution which occurs later, and, as the Supreme Court observed in Merricks, was rarely likely to have an impact at the early threshold stages. As matters stand the basis for the CAT's decision reflects a view that making the order will bring the claim to an end which is not, in my view, a consideration relevant to the choice to be made under Rule 79(2).

- The applicants next argue that, contrary to its statement that it was not reviewing the merits, the CAT did in substance apply a strike out test and, having done so, engineered a dismissal of the claim by the back door. As such the Court of Appeal should decide whether the CAT was right to dismiss the claims as lacking merit. There is some considerable logic in this, but the position is not straightforward on the unusual facts of this case. On balance I think the best way to proceed is to accept at face value that the CAT left the merits to be decided in the future and analyse the case upon that basis. This means that the merits will have to be reconsidered when the matter returns to the CAT, now upon an opt-out aggregate damages basis.

- However, since the matter was fully argued before us and raises some important points it is relevant to consider the main arguments advanced if only because they could be relevant when the issue returns to the CAT. Three central points were made by the appellants:

- The first issue was the subject of detailed oral argument. I have set out at paragraphs [25] [32] above the findings made by the Commission in Sterling Lads about likely effects. In this case, the decisions relied upon in pleadings as the relevant follow-on decisions are those in Essex Express and Three Way Banana Split. These are short form settlement decisions, drafted in relatively skeletal form, and they do not refer to evidence nor set out any of the detailed reasoning whereby the Commission came to the conclusion that there was a sufficient likelihood of actual harm to competition to justify the making of object based violation decisions. The decisions do not feature in any material way in the Judgment.

- The decision in Sterling Lads is of an altogether different nature. It is a disputed decision. Credit Suisse fought hard to refute the Commission's claims against it. The decision is detailed and refers extensively to evidence. It explains why and how the Commission concluded that the cartel was, on the facts, likely, causatively, to have benefitted cartelists and harmed competitors and counterparties. The CAT did not have this full decision before it. The appellants argue that the decision is highly significant and provides the answer to the CAT's concerns about theory not translating into reality. The respondent banks argue that the decision is inadmissible but alternatively of strictly limited, if any, probative value. It is contended that the rule in Hollington v Hewthorn [1943] KB 587 ("Hollington") applies to the findings in the decision, rendering it inadmissible. I do not agree. I address below first whether the decision is admissible and, secondly, if so, the approach to be taken to an evaluation of its evidential weight.

- I start with admissibility. The rule in Hollington is that absent the operation of estoppel, factual findings in civil cases in England and Wales are inadmissible in subsequent proceedings. The modern and most oft cited formulation of the rule is in the judgment of Christopher Clarke LJ in Rogers v Hoyle [2014] EWCA Civ 257 who noted that the rule had been extended to findings of facts of arbitrators (Land Securities v Westminster City Council [1993] 1 WLR 286), coroners (Bird v Keep [1918] 2 KB 692) and extra-statutory inquiries (Three Rivers District Council v Governor and Company of The Bank of England (No.3) [2001] UKHL 16, [2003] 2 AC 1). He stated:

- There are however a growing number of exceptions to the rule. Under section 11 of the Civil Evidence Act 1968, criminal convictions are admissible to evidence the fact that an offence has been committed. This reverses the position in Hollington which actually concerned a criminal conviction for careless driving. In Re W-A (Children: Foreign Conviction) [2022] EWCA Civ 1118, the issue concerned the admissibility of the previous conviction of a man for sexual offences against a child in Spain as evidence of relevant underlying facts in care proceedings before the Family Court. The Court of Appeal held that it was settled law in family proceedings that the Court could consider and attach weight to earlier findings. Any other approach would conflict with the overriding duty of the Court to discover the truth in the best interests of the child. It has also been held that a subsequent court can "have regard" to the evidence set out in an earlier case as part of the evidence in the later case leading the judge to arrive at the same conclusion: see e.g. Otkritie International Investment Management v Gersamia and Jemai [2015] EWHC 821 (Comm) per Eder J at paragraph [23].

- Most importantly, it is well established that the rule does not apply to the CAT which has its own rules of procedure and evidence. CAT Rule 55(1)(b) makes clear that the CAT has a wide discretion as to the evidence to be admitted. This has been recognised on many occasions and is, in my view, correct: see e.g. Agents' Mutual Limited v Gascoigne Halman Limited [2017] CAT 5 at paragraph [8]; Argos and Littlewoods v OFT [2003] CAT 16 at paragraph [105]; Aberdeen Journals v. OFT [2003] CAT 11 at paragraphs [126] and [134]), Consumer Association v Qualcomm [2023] CAT [9] ("Consumers Association") at paragraph [18]. In Le Patourel the CAT had relied upon the findings in a prior settlement decision between the respondent, BT, and OFCOM. The Court of Appeal agreed with the CAT that the findings were relevant as showing a serious case to be advanced but made clear that they were not binding upon the CAT at trial (ibid paragraph [106]). And of course, there is already a statutory exception to the rule in section 60A CA 1998.

- There is no need for the CAT to be hidebound by a common law rule on fairness. Whilst the CAT does not apply the strict rule in Hollington it does, of course, endeavour to secure fairness but it is a sophisticated tribunal well able to form its own view on the value, if any, of prior findings.

- The CAT, if confronted with prior findings said to be relevant, will carefully decide what weight can be attached to those findings. Without intending to be exhaustive, it will examine such matters as: whether the decision is a follow-on decision and the limits of the binding effect under section 60A CA 1998; where not a follow-on decision, the extent of the overlap between the prior findings of facts and the present case; who the earlier decision maker was and whether it was a specialist fact finder or otherwise; what the standard of proof was which was applied to the findings; and the nature of the legal analysis in the prior decision and the extent to which this affects the findings of fact made. The CAT will also consider to what forensic use the earlier findings are sought to be deployed. There might be many relevant uses some of which fall short of reliance upon earlier conclusions about the ultimate merits. The earlier decision might for instance identify relevant evidence and thereby demonstrate lines of inquiry relevant only to disclosure. The CAT will be conscious of the risk that being invited to perform a detailed inquiry into how prior findings came about draws it into disproportionate, satellite, litigation: see Consumers Association (ibid) paragraph [30].

- In the present case the CAT will consider the probative value of the Sterling Lads decision when the case returns to it. Various points were made to the Court which seem to me to have some force.

- First, this is not a Hollington type decision because it concerned Credit Suisse, not a defendant[3]. It is however a decision of the Commission in relation to more or less identical facts to those arising in the instant case. The findings also import a relatively high degree of probative value given the (quasi-criminal) standard of proof the Commission had to overcome before the findings could be made: See e.g. The Competition and Markets Authority v Flynn Pharma and others [2020] EWCA Civ 1847 at paragraph [136] and cases cited thereat. The analysis in the decision is based upon (i) the intrinsically high probability of conduct of this nature causing actual harmful effects and (ii) the evidence in the case justifying a conclusion that tangible harm was in fact likely to have been caused. The decision thus supports the case advanced by both class representatives that their cases on causation went beyond the merely theoretical.

- Secondly, the decisions in Essex Express and Three Way Banana Split, which are the foundations for the follow-on, are from the same decisional template or mould as that in Sterling Lads. As Ms Wakefield KC for Evans submitted, a side by side comparison of the various decisions showed many paragraphs which were common across all the decisions. In her submission, by a process of logical reverse extrapolation and inference, the ordinary decision in Sterling Lads indicated what was hiding behind the short form decisions in Essex Express and in Three Way Banana Split. When confronted with short form decisions, care therefore had to be taken to avoid underestimating their potential relevance which might only become apparent after disclosure.

- Thirdly, in an aggregate damages, opt-out, case generalised findings, such as might be found in an object violation decision (such as Sterling Lads), might have greater value than in an opt-in case. None of the decisions relied upon, including Sterling Lads, addressed how harm would be distributed as between the member of the class or categories thereof. However, in an opt-out case there may be less need for the CAT to delve into such details at the certification stage: see Le Patourel (ibid) paragraph [107]. It is only once the aggregate loss is determined that questions of distribution arise, and these can be resolved by ADR or by some flexible method of distribution (e.g. Le Patourel (ibid) paragraphs [87] [99] and Gutmann (ibid) paragraph [87]). In other words, in an opt-out case questions of causation might be simplified. Given that the principle of aggregate damages involved a "radical" (see Merricks ibid paragraph [58]) departure from normal tortious principles of compensation there remains scope for the CAT to apply the flexibility as to remedy which the Supreme Court emphasised existed in Merricks. There, in relation to distribution, the Court made clear that where any attempt to calculate individual losses was impossible the CAT was entitled to adopt " some other method [which might] be more reasonable, fair and therefore more just" (ibid paragraph [77]). This is an indication of the flexibility with which the CAT might approach issues of causation and damage. For instance, in a case where there is evidence that defendants have gained from their unlawful conduct but it is difficult to determine to what extent this caused loss to the class, it might be possible for the Court to adapt less standard remedies, for instance by ordering disgorgement of profits. One purpose behind the collective damages regime is the public interest in wrongdoers not retaining their unlawful gains. The use of an account of profits, or some equivalent remedy, is by no means unknown in tort claims. It might even be considered that the gain made by the wrongdoers amounted to a proxy for the loss of the class.

- Fourthly, whilst it was true that the Sterling Lads decision had little if anything to say about the existence of umbrella, Category B, damages (see paragraphs [35]-[38] above) the extent to which such damages are recoverable might depend upon findings by the CAT at trial about the manner in which Category A damages were sustained. One argument advanced by the respondent banks was that the traders concerned amounted to a few, random, individuals who would never, either individually or collectively as a cabal, have been able adversely to affect competition in either (a) the Category A segment of the market as a whole or (b), by extension of the same reasoning, the Category B segment of the market as a whole. The appellants in response refer to trade witness evidence from an FX trader who gave evidence on how FX market trading floors actually operated. It was explained that the FX traders concerned in the chat room cartel were relatively senior in their companies and operated in a trading room environment where they communicated real time information to other traders physically proximate to them who did not participate directly in the chat room but who were, thereby, able to benefit from the same artificially translucent trading conditions. Moreover, the defendants collectively accounted for up to 45% of the world FX trade so that the collusive contagion could have affected up to this volume of trade in the affected market. And if this was so, it was capable of causing a widening of spreads sufficient to have been visible to non-colluding banks who could, lawfully and unilaterally, have followed suit broadening their spreads accordingly leading to concomitant gains for them and losses for counterparties. The point goes only to show that a decision of relatively limited scope might act as a starting point or platform from which a broader case using statistical and witness evidence could be built to establish both Category A and B losses.

- Fifthly, it was proper to infer and should be inferred that the respondent banks would not have engaged in highly risky illegal and collusive behaviour unless they were confident that they would in actual fact extract financial gain from their conduct. A court might take as a starting point an inference that there was an actual gain where it could be assumed that the wrongdoers understood the regulatory and/or reputational risk of participating in unlawful behaviour but persisted nonetheless. Similar points were made in McLaren (ibid) paragraph [42]; and Stelianos (ibid) paragraph [73].

- The next point concerns disclosure. The CAT majority was sceptical that disclosure would prove to be valuable (see paragraph [72] above). However, the parties took the Court through the many different sources of data that might be available, including from third parties. This included material that would be relevant to a traditional regression analysis. They pointed to the decision in Sterling Lads as indicating how detailed the documentary evidence was that enabled the Commission to draw conclusions about the effects of the cartel in that case and they argued that this sort of evidence was likely to be available after disclosure from the respondent banks and would shed light on issues of cause and effect. Some of this could even be circumstantial. For example evidence of traders' bonus and performance related pay might show how the pay of cartelists was affected (boosted) by the illicit exchanges of information.

- One illustration referred to the Court showed the different periods in which different banks participated in the cartel (set out in Annex A to this judgment). This meant that it was possible to examine the trading record of the defendants during periods when they were in the cartel which could be compared with periods when they were not in the cartel but during which the cartel was still operating. They also had data which would enable the claimants to analyse the trading performance of the banks in the period before and after the cartel. All of this may be valuable in providing a test bed for regression analysis because modelling could apply to periods when the cartel did and did not operate and during when each defendant did and did not participate in the cartel.

- As an indication of the scale of the data likely to be available from disclosure, the appellants relied upon evidence as to the disclosure exercise conducted in equivalent US proceedings. A witness statement summarised the data collection exercise in the US which gave an indication of the scale of the data available:

- It is quite impossible for this Court, exercising an appellate function, to immerse itself in the minutiae of the data so as to be in a position to form any definitive view of the availability and value of data in the context of complex econometric modelling. I endorse the view of the Supreme Court in Merricks that the test of necessity has to be relatively high level. From a reading of the detailed expert reports and the data sources they describe to be relevant to a regression analysis, and in the light of the findings in the Commission decisions, it does though seem to me that the disclosure exercise is intrinsically likely to generate relevant material, especially if gaps can be plugged with witness statement evidence and the judicially wielded broad axe.

- The appellants say finally that this being the first case before the CAT following the Supreme Court in Merricks the CAT did not show the institutional confidence that it has shown in more recent cases where it has demonstrated that it is much more robust in addressing evidential problems such as those identified in the present case.