Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Tax and Chancery Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Tax and Chancery Chamber) >> Revenue and Customs v Blackrock Holdco 5 LLC (Tax) [2022] UKUT 199 (TCC) (19 July 2022)

URL: http://www.bailii.org/uk/cases/UKUT/TCC/2022/199.html

Cite as: [2022] STC 1490, [2022] BTC 519, [2022] UKUT 199 (TCC)

[New search] [Printable PDF version] [Help]

UT Neutral citation number: [2022] UKUT 199 (TCC)

Appeal number: UT/2021/000022

Upper Tribunal

(Tax and Chancery Chamber)

The Rolls Building,

London EC4A 1NL

Hearing dates: 7, 8 & 9 February 2022

Judgment given on 19 July 2022

Before

MR JUSTICE MICHAEL GREEN

JUDGE RUPERT JONES

Between

|

THE COMMISSIONERS FOR HER MAJESTY’S |

|

REVENUE & CUSTOMS

|

Appellants

and

BLACKROCK HOLDCO 5, LLC

Respondent

Representation:

For the Appellants: David Ewart QC and Sadiya Choudhury, Counsel, instructed by the General Counsel and Solicitor to HM Revenue and Customs

For the Respondent: Kevin Prosser QC and David Yates QC, Counsel, instructed by Simmons and Simmons LLP, solicitors

DECISION

Introduction

1. This appeal concerns the structure used by the BlackRock group of companies (“the BlackRock Group”) to acquire the North American investment management business of Barclays Global Investors (“BGI US”) from Barclays Bank plc in December 2009 [1]. The ultimate issue in this appeal is whether the Respondent, BlackRock Holdco 5, LLC (“LLC5”), which was created and used as part of the acquisition structure, was entitled to non-trading loan relationship debits in respect of the interest and other expenses payable on $4 billion worth of loan notes. The loan notes (“the Loans”) were issued in return for the loan LLC5 received from its parent, BlackRock Holdco 4, LLC (“LLC4”). As described in greater detail below, the Loans were part of the intra-group financing for the purchase by the BlackRock Group of BGI US.

2. HMRC made amendments to LLC5’s tax returns for accounting periods ending 30 November 2010 to 31 December 2015 inclusive disallowing the loan relationship debits in respect of interest payable on the Loans.

3. LLC5 succeeded in its appeal before the First-tier Tribunal (Tax Chamber) (“FTT”) against the amendments made by Her Majesty’s Revenue and Customs (“HMRC”). The FTT’s decision (“the Decision”) was released on 3 November 2020 as [2020] UKFTT 443 (TC). [2]

4. The FTT found that an independent lender acting at arm’s length would have made loans to LLC5 in the same amount and on the same terms as to interest as were actually made by LLC4 (the “Transfer Pricing Issue”). The FTT further found that the Loans had both a commercial purpose and a tax advantage purpose but that it would be just and reasonable to apportion all the debits to the commercial purpose and so they were fully deductible by LLC5 (the “Unallowable Purpose Issue”).

5. The Transfer Pricing Issue determines whether any loan relationship debits arise at all. The Unallowable Purpose Issue determines whether debits which would otherwise be brought into account ought to be disallowed. Both issues need to be determined separately.

6. HMRC, the Appellants, appeal the Decision to the Upper Tribunal submitting that the FTT erred in law in deciding both issues.

Summary of the FTT’s conclusions

7. The FTT concluded as follows in respect of each issue:

(1) As to the Transfer Pricing Issue, that although an independent enterprise would not have entered into the Loans on the same terms as the actual transaction, it would have entered into the Loans in the sum of $4 billion if certain covenants, including from third parties, had been given (see [103]).

(2) As to the Unallowable Purpose Issue:

(a) That a main purpose of LLC5 being a party to the Loans was to secure a tax advantage, on the basis that this was an “inevitable and inextricable consequence” of the Loans which could not be described as incidental (see [120]-[121]).

(b) That in addition, LLC5 entered into the Loans in the furtherance of the commercial purpose of its business of making and managing passive investments; this too was clearly an important purpose and, as such, was to be regarded as a main purpose (see [121]).

(c) That LLC5 would have entered into the Loans for commercial purposes even if there had been no tax advantage in doing so. As the tax advantage did not increase the debits, on a just and reasonable basis, none of the debits should therefore be apportioned to the tax advantage purpose (see [123]).

8. Given that LLC5 had succeeded on both the Transfer Pricing Issue and the Unallowable Purpose Issue, the FTT allowed LLC5’s appeal in full (see [124]).

The appeal to the Upper Tribunal

9. HMRC, with the permission of the FTT, appeal the Decision in respect of the FTT’s conclusions on the following broad grounds.

10. HMRC argue that the FTT erred in law in relation to the Transfer Pricing Issue by deciding that a hypothetical lender acting at arm’s length would have made loans to LLC5 in the same amount and on the same terms as LLC4 did. The FTT should not have taken account of additional covenants that would have been required by such a lender in the arm’s length transaction in order to make such loans but which were not present in the actual transaction.

11. HMRC submit that the FTT erred in law in relation to the Unallowable Purpose Issue in finding that there was any commercial purpose to the Loans when the only purpose was to secure a tax advantage. Further, even if there was any commercial purpose to the Loans, the FTT erred in finding that it would be just and reasonable to apportion the debits to the commercial purpose rather than the tax advantage purpose.

12. LLC5 seeks to uphold the Decision and submits that the FTT came to the correct conclusions on both the Transfer Pricing and Unallowable Purpose Issues. In addition, LLC5 seeks to challenge the FTT’s conclusion that there was any tax advantage purpose to the Loans. Its position is that their only purpose was commercial.

13. We are very grateful to Mr David Ewart QC, leading Ms Sadiya Choudhury, for HMRC and Mr Kevin Prosser QC, leading Mr David Yates QC for LLC5. We have had the benefit of three days of detailed oral argument from counsel, in addition to their helpful skeleton arguments and post-hearing written submissions.

14. In reaching our decision on this appeal we have taken into account everything drawn to our attention in both the written and oral submissions. It is however inevitable, given the detail of the arguments and given the quantity of material before us, that not everything in the appeal can be given specific mention in this decision. Where a particular fact or argument, or a particular authority or document is not specifically mentioned, that does not mean that it has not been taken into account.

Summary of the agreed statement of facts

15. The FTT received a statement of agreed facts (‘SOAF’) from the parties which is set out in the Decision at [4(1)-(36)]. The most important facts concerning the transactions in question are summarised below.

16. On 11 June 2009, it was announced that BGI US was to be acquired by the BlackRock Group. The steps involved in the acquisition of BGI US are set out in the Decision at [4(5) –4(7)]. These steps were carried out in accordance with advice given by the BlackRock Corporate Tax Group informed by external advisers, including Ernst and Young (“EY”). They include the following:

(1) On 16 September 2009, LLC4, LLC5 and BlackRock Holdco 6, LLC (“LLC6”) were registered in the State of Delaware. LLC4, LLC5 & LLC6 are limited liability companies incorporated and registered in the State of Delaware. They were each members of the BlackRock Group and its ultimate parent was BlackRock, Inc (“BRI”). In addition, at the material time, LLC5 was resident for tax purposes in the UK and registered for corporation tax.

(2) On 30 November 2009:

(a) BlackRock Financial Management Inc. (“BFM”), an indirectly owned subsidiary of BRI incorporated in Delaware and US tax resident, executed the Limited Liability Company Agreement of LLC4 as its sole member;

(b) LLC4 executed the Limited Liability Company Agreement of LLC5 as its sole member; and

(c) LLC4 and LLC5 executed the Limited Liability Company Agreement of LLC6. LLC4, LLC5 and LLC6 elected to be disregarded for US tax purposes so that all transactions carried out by them were treated as carried out by BFM directly.

(3) On 1 December 2009:

(a) BFM entered into a Contribution Agreement with LLC4, pursuant to which BFM contributed $2,252,590,706 in cash and 37,566,771 shares in BRI (the “BRI Shares”) to LLC4.

(b) LLC4 entered into a Contribution and Issue Agreement with LLC5, pursuant to which LLC4 contributed $2,144,788,229 in cash and the BRI Shares to LLC5 in return for 100 common or ordinary shares in LLC5 and the issue by LLC5 of loan notes in four tranches totalling $4 billion (the “Loan Notes”)[3].

(c) LLC4 entered into a Contribution Agreement with LLC6, pursuant to which LLC4 contributed $107,802,477 in cash to LLC6 in return for the issue of 100,000 common shares in LLC6 (the “LLC6 Common Shares”).

(d) LLC5 entered into a Contribution Agreement with LLC6, pursuant to which it contributed $2,144,788,229 in cash and the BRI Shares to LLC6 in return for the issue of 2,400,000 preferred shares in LLC6 (the “LLC6 Preference Shares”).

(e) LLC6 completed the acquisition of BGI US by acquiring all of the outstanding shares in Delaware Holdings Inc., the existing holder of BGI US, from BGI Finance for $2,252,590,706 and the BRI Shares.

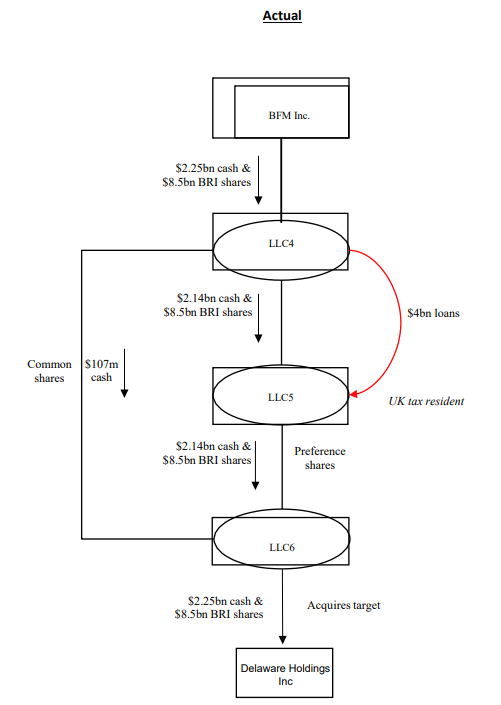

17. LLC6 was the direct holding company for BGI US following its acquisition. A simplified diagram was appended to the Decision which showed the structure after the completion of the transaction. A more detailed diagram of the structure is in Appendix 1 to this decision.

18. The holders of LLC6 Common Shares were entitled to 216 votes for each Common Share. Holders of LLC6 Preference Shares were entitled to 1 (one) vote for each Preference Share. LLC5 held 2,400,000 LLC6 Preference Shares and therefore had a total of 2,400,000 votes. LLC4 had a total of 21,600,000 votes by virtue of its LLC6 Common Shares. Section 6.1 of LLC6’s Limited Liability Company agreement stated that LLC6’s Board would determine in its sole and absolute discretion the amount of Available Assets (as defined) that were available for distribution and the amount, if any, of such Available Assets to be distributed to Members as follows:

(a) A total annual distribution of $300 per Preference Share.

(b) A total annual distribution of $20 per Common Share, but no Common Dividend to be made unless and until all Preference Dividends for such period had been paid.

(c) Any unpaid amounts of either Preference or Common Dividends would be carried forward. Interest on any sum accrued but unpaid would accrue from 30 November of the year in which payment was due.

19. We address the issues in the appeal in the same order that the FTT determined them, even though the parties addressed us in the reverse order.

The Transfer Pricing Issue

The FTT Decision

20. The Transfer Pricing Issue required the FTT to decide whether an arm’s length independent lender would have made the $4 billion of loans to LLC5 as LLC4 did and on the same terms. The FTT made further findings of fact in addition to the SOAF. The FTT heard expert evidence from Mr Timothy Ashley (“Mr Ashley”) on behalf of LLC5 and Mr Simon Gaysford (“Mr Gaysford”) on behalf of HMRC. They were quite different experts: Mr Ashley’s experience being in interest rate markets; whereas Mr Gaysford’s expertise was in economics.

21. The FTT began by recording the evidence of the two experts who gave oral evidence at [67]-[82]. It then identified the issue in dispute as follows at [87]-[88]:

87. Turning to the transfer pricing issue, it is common ground that a provision has been made as between two persons, LLC4 and LLC5, by means of a transaction and/or series of transactions thereby satisfying s 147(1)(a) TIOPA. Section 147(1)(b) TIOPA, the “participation condition” is also met. It is clearly a “financing arrangement” and, as LLC4 holds all the shares in LLC5, one of the affected persons is directly participating in the management, control of [sic] capital of the other. However, the parties part company in relation to s 147(1)(d) TIOPA and whether the actual provision, ie the $4 billion lending, differs from the “arm’s length” provision which would have been made as between independent enterprises.

88. This is the only issue between the parties in relation to the Transfer Pricing Issue.

22. It noted the agreed position between the parties at [89]:

89. It is clear from the evidence of the experts that the transaction that was actually entered into would not have taken place in an arm’s length transaction with an independent lender. It is therefore necessary to hypothesise a different transaction which independent enterprises would have entered into and, as it is for LLC5 to displace the closure notice and amendment made to its self-assessment, it can only succeed on the transfer pricing issue by positively establishing that there is a hypothetical transaction in which a hypothetical independent enterprise would lend $4 billion dollars to LLC5.

23. The FTT outlined the parties’ respective cases at [90]-[92]. The parties were agreed that an independent arm’s length lender would require to be provided with covenants from various third-parties (including BGI and LLC6) in addition to those from LLC5 were it prepared to stand in the shoes of LLC4 and make a $4 billion loan to LLC5:

90. Mr Prosser’s primary case is that although the parties to the Loans would not have entered into them on the same terms if they had been independent enterprises, independent enterprises would have entered into the transactions in the same amounts and at the same (or at no lower) rates of interest and would have agreed that LLC5, with the cooperation of LLC4, LLC6 and BGI, should give some or all of the following covenants to secure the expected dividend flow from BGI US to LLC5:

(1) covenants by BGI and LLC6 restricting the amount of debt that could be raised by them (to prevent profits to be diverted in repaying such debt);

(2) negative pledges by BGI, LLC5 and LLC6 restricting them from granting security to other lenders;

(3) a covenant by LLC4 that it would not interfere with the declaration of dividends by LLC6 and BGI;

(4) covenants by BGI and LLC6 that, without prejudice to their own discretion regarding the declaration of dividends, they would not frustrate the expected dividend flows (e.g. by making loans to LLC4); and

(5) change of control covenants by LLC4, LLC5 and LLC6 to block any sale of LLC6 or BGI.

91. Mr Prosser also says that independent enterprises would, in addition, have agreed a longer term for the first tranche, to ensure that it would be fully repaid out of the expected dividend flow and, subject only to this and the above covenants, that independent enterprises would have entered into the Loans on the same terms.

92. In essence Mr Ewart’s case is that the transaction, which he submits is everything that includes LLC4, LLC5, LLC6 and (in the hypothetical transaction) the independent lender, simply would not have taken place. He contends that in its argument LLC5 fails to take account of the part played by LLC4 and through LLC4 the rest of the BlackRock Group in providing either the whole of the funding in the real transaction or part of the funding in the hypothetical transaction.

24. The FTT made findings regarding the experts’ evidence as to whether such third-party covenants would be forthcoming and the extent to which they were agreed at [96]:

96. Clearly the primary case advanced by Mr Prosser very much relies on the evidence of Mr Ashley. However, while Mr Ashley has experience of capital debt markets on which he could draw, as he recognised himself (see paragraph 69, above) like Mr Gaysford, he did not have any experience of an independent enterprise making a $4 billion loan to a company like LLC5 which held preference shares. Nevertheless, the experts agreed that an independent enterprise would be willing to loan $4 billion to LLC5 provided that the covenants, “protection” and “structural enhancements”, as described above, could be put in place to ensure the guarantee of funds, ie the flow of dividends, from BGI to LLC6 and then from LLC6 to LLC5 via the preference shares but parted company on whether it would be possible to do so.

25. The FTT then came to its conclusion at [101]-[103] which was that an independent lender would have entered into the loans subject to the covenants which would have been forthcoming:

101. Therefore, the transactions to be compared are the actual transaction, a $4 billion loan by LLC4 to LLC5 and the hypothetical transaction, a $4 billion loan by an independent lender to LLC5 having regard to the covenants which such an independent lender would have required. It is clear from paragraphs 9.181 and 9.182 of the OECD Guidelines that for transfer pricing purposes it does not matter whether or not the arrangement was motivated by a purpose of obtaining a tax advantage (although it is something to be considered in relation to the Unallowable Purpose Issue).

102. Both experts agreed that an independent lender would have entered into an arrangement subject to it being able to obtain the necessary covenants. On balance, given that Mr Gaysford accepted that his concerns in relation to cost and complexity did not amount to “deal breakers”, I prefer the evidence of Mr Ashley that the covenants would have been forthcoming. Similarly I prefer the evidence of Mr Ashley regarding parental support especially as Mr Gaysford was unable to say with “certainty” that the transaction would not have proceeded in its absence.

103. Therefore, for the reasons above I find that although an independent enterprise would not have entered into the Loan on the same terms as the actual transaction it would, subject to the covenants described above, have entered into the Loans on the same terms as the parties in the actual transaction.

The Law

26. The relevant provisions of the Taxation (International and Other Provisions) Act 2010 (“TIOPA”) are set out in the FTT Decision from [56]. They include the following.

27. Section 147 TIOPA provides:

(1) For the purposes of this section “the basic pre-condition” is that—

(b) the participation condition is met (see section 148),

(c) the actual provision is not within subsection (7) (oil transactions), and

(2) Subsection (3) applies if—

(a) the basic pre-condition is met, and

(b) the actual provision confers a potential advantage in relation to United Kingdom taxation on one of the affected persons.

(3) The profits and losses of the potentially advantaged person are to be calculated for tax purposes as if the arm's length provision had been made or imposed instead of the actual provision…

…”

[Emphasis Added]

28. In respect of the predecessor legislation to section 147(1)(a), in DSG Retail Ltd v HMRC [2009] STC (SCD) 397 (“DSG Retail”), the Special Commissioners said at [65]:

“[The predecessor of s.147(1)] speaks of provision between two persons. For the [legislation] to apply those two persons must be identified. Whilst the transaction or series of transactions by which the relevant provision is made or imposed may encompass transactions between persons other than those two persons, the identified provision must be between two persons only. There is, in our view, no scope for reading 'two' as 'two or more'.”

29. Section 148 of TIOPA defines the participation condition for the purposes of section 147(1)(b):

“148 The “participation condition”

(1) For the purposes of section 147(1)(b), the participation condition is met if—

(a) condition A is met in relation to the actual provision so far as the actual provision is provision relating to financing arrangements, and

(b) condition B is met in relation to the actual provision so far as the actual provision is not provision relating to financing arrangements.

(2) Condition A is that, at the time of making or imposition of the actual provision or within the period six months beginning with the day on which the actual provision was made or imposed-

(a) one of the affected persons was directly or indirectly participating in the management, control or capital of the other, or

(b) the same person or persons was or were directly or indirectly participating in the management, control or capital of each of the affected persons ...

…

(4) In this section “financing arrangements” means arrangements made for providing or guaranteeing, or otherwise in connection with any debt, capital or other form of finance.

…”

30. Section 151 expands upon the definition of “arm’s length provision” set out in section 147(1)(d) to include the position where no provision would have been made on an arm’s length basis:

(1) In this Part “the arm's length provision” has the meaning given by section 147(1).

(2) For the purposes of this Part, the cases in which provision made or imposed as between any two persons is to be taken to differ from the provision that would have been made as between independent enterprises include the case in which provision is made or imposed as between two persons but no provision would have been made as between independent enterprises; and references in this Part to the arm's length provision are to be read accordingly.”

31. Section 152 applies where the actual provision relates to securities:

(1) This section applies where–

(a) both of the affected persons are companies, and

(b) the actual provision is provision in relation to a security issued by one of those companies (“the issuing company”).

(2) Section 147(1)(d) is to be read as requiring account to be taken of all factors, including–

(a) the question whether the loan would have been made at all in the absence of the special relationship,

(b) the amount which the loan would have been in the absence of the special relationship, and

(c) the rate of interest and other terms which would have been agreed in the absence of the special relationship…

(3) Subsection (2) has effect subject to subsections (4) and (5).

(4) If—

(a) a company (“L”) makes a loan to another company with which it has special relationship, and

(b) it is not part of L's business to make loans generally,

the fact that it is not part of L's business to make loans generally is to be disregarded in applying subsection (2).

(5) Section 147(1)(d) is to be read as requiring that, in the determination of any of the matters mentioned in subsection (6), no account is to be taken of (or of any inference capable of being drawn from) any guarantee provided by a company with which the issuing company has a participatory relationship.

(6) The matters are—

(a) the appropriate level or extent of the issuing company's overall indebtedness,

(b) whether it might be expected that the issuing company and a particular person would have become parties to a transaction involving—

(i) the issue of a security by the issuing company, or

(ii) the making of a loan, or a loan of a particular amount, to the issuing company, and

(c) the rate of interest and other terms that might be expected to be applicable in any particular case to such a transaction.”

32. Section 154 provides interpretation of defined terms such as ‘special relationship’ ‘guarantee’, ‘participatory relationship’ and ‘security’ in sections 148 and 152:

“154 Interpretation of sections 152 and 153

…

(3) “Special relationship” means any relationship by virtue of which the participation condition is met (see section 148) in the case of the affected persons concerned.

(4) Any reference to a guarantee includes—

(a) a reference to a surety, and

(b) a reference to any other relationship, arrangements, connection or understanding (whether formal or informal) such that the person making the loan to the issuing company has a reasonable expectation that in the event of a default by the issuing company the person will be paid by, or out of the assets of, one or more companies.

(5) One company (“A”) has a “participatory relationship” with another (“B”) if—

(a) one of A and B is directly or indirectly participating in the management, control or capital of the other, or

(b) the same person or persons is or are directly or indirectly participating in the management, control or capital of each of A and B.

(6) “Security” includes securities not creating or evidencing a charge on assets.

…”

33. Section 155 provides the definition of potential advantage in relation to UK taxation for the purposes of section 147(2)(b):

“155 “Potential advantage” in relation to United Kingdom taxation

(1) Subsection (2) applies for the purposes of this Part.

(2) The actual provision confers a potential advantage on a person in relation to United Kingdom taxation wherever, disregarding this Part, the effect of making or imposing the actual provision, instead of the arm’s length provision, would be one or both of Effects A and B.

(3) Effect A is that a smaller amount (which may be nil) would be taken for tax purposes to be the amount of the person’s profits for any chargeable period.

(4) Effect B is that a larger amount (or, if there would not otherwise have been losses, any amount of more than nil) would be taken for tax purposes to be the amount for any chargeable period of any losses of the person…”

34. Section 164 provides that Part 4 TIOPA “is to be read in such manner as best secures consistency between” the effect given to the legislation and the effect to be given in accordance with the OECD’s Transfer Pricing Guidelines (“the TPG”).

HMRC’s grounds of appeal

35. HMRC advanced five grounds of appeal on the Transfer Pricing Issue for which permission was granted by the FTT.

36. The first ground of appeal was that the FTT erred in law by concluding that while an independent hypothetical arm’s length enterprise would not have entered into the loans on the same terms as the actual transaction it would have done so if certain covenants had been given by entities other than LLC5. The argument is that the FTT impermissibly altered the economically relevant characteristics by reading covenants from third parties (other than LLC5) into the arm’s length transaction. This was impermissible because section 147(1)(a) TIOPA limits the provision of the loan to one made between two parties i.e. the independent lender and LLC5. Further, these covenants did not exist in the actual transaction.

37. Second, even if contrary to the first ground, it were permissible to consider (1) covenants which did not exist in the actual provision when determining the terms of the arm’s length provision; and (2) such covenants would include those provided by other group companies, the FTT failed to properly consider the level of parental support required or other covenants regarding control of the borrower that the independent lender would need, and whether such covenants would be forthcoming.

38. Third, the FTT’s findings in relation to the covenants that would have been required by a hypothetical lender before entering into the transaction were unsupported by the evidence and its own findings in relation to that evidence.

39. Fourth, the FTT also erred in failing to consider whether a lender with the characteristics of LLC4 would have entered into the transaction, namely to have lent $4 billion to an independent borrower in the position of LLC5 for it to acquire preference shares.

40. Fifth, the FTT made an error at [86] where it decided not to take any account of Mr Gaysford’s evidence so far as it concerned the construction of the TPG. To the extent that the TPG set out economic, not legal, principles Mr Gaysford was qualified to comment, being an economist.

41. Mr Ewart QC concentrated on the first and third grounds in oral argument.

42. Mr Prosser QC, for LLC5, submitted that the FTT did not err in law in any of the ways suggested in the grounds of appeal. We address his arguments within the discussion section below.

Discussion and analysis

Ground 1

43. The FTT found the “hypothetical” or “arm’s length” transaction to be a $4 billion loan by an independent lender to LLC5 having regard to the covenants which such an independent lender would have required.

44. Mr Ewart QC submitted that the FTT erred in law when it carried out the exercise of comparing the “actual transaction” with the “arm’s length transaction”, as required by s. 147(1)(d) TIOPA. Section 147(1)(a) refers to the “provision…made or imposed as between any two persons by means of a transaction or series of transactions” and he argued that that was necessarily limited, as per DSG Retail, to the provision between the borrower (LLC5) and the lender (LLC4). The hypothetical transaction has to be comparable to the actual transaction in terms of its economically relevant characteristics and therefore it is not permissible to add covenants from third parties such as LLC4, LLC6 and BGI that were not provided in the actual transaction. Mr Ewart QC submitted that the FTT had effectively reverse-engineered a fundamentally different transaction in a wholly different context so as to conclude that such a transaction would have taken place at arm’s length.

45. In reply, Mr Prosser QC submitted that the FTT was entitled to take into account covenants which did not exist in the actual transaction when determining whether there would be such a transaction at arm’s length. The relevant “provision” in s.147 TIOPA, is the loan from LLC4 to LLC5 and such a loan would have happened at arm’s length if LLC4 was an independent enterprise. The covenants that such a lender would require were, according to Mr Prosser QC, akin to services provided by third parties to the transaction in order to replicate the economically relevant characteristics of the actual transaction. The FTT was therefore allowed to take them into account and rely on such a hypothetical transaction as being sufficiently comparable to the actual transaction.

46. Mr Prosser QC further argued that s.152(5) TIOPA, which provides that no account is to be taken of any guarantee provided by a member of the borrower’s group, implicitly recognises that account may in principle be taken of services provided by another person, including by a member of the group. Moreover, he submitted that it was surprising that HMRC were advancing this ground, because if it is correct it would preclude the application of the transfer pricing legislation in many cases. Furthermore, there is no hint of HMRC’s approach anywhere in the TPG.

47. We begin our analysis by noting that, in fairness to the FTT, HMRC do not appear to have relied on the same arguments at first instance. Before the FTT, HMRC disputed whether the $4 billion of Loans to LLC5 would have been made by independent enterprises at arm’s length. HMRC submitted that the covenants that would have been required by an independent lender would not have been forthcoming. Nonetheless, permission was granted for HMRC to pursue this ground of appeal before us and no objection has been taken.

48. As correctly identified in the Decision at [101], the FTT considered that the exercise it had to carry out was to compare the “actual transaction” with an “arm’s length transaction”, as required by s. 147(1)(d) TIOPA 2010 and in a manner consistent with the TPG.

49. At [77] of the Decision, the FTT made an important finding of fact. It held that the arm’s length loan of $4 billion would not have been made by an independent lender on the terms and conditions of the Loans:

“[77] Both the Joint Statement and the Gaysford Statement[4] record that the experts agree that it would have been possible for LLC5 to execute a $4 billion debt transaction in December 2009 with an independent enterprise at similar interest rates to the actual transaction that took place between LLC5 and LLC4, but subject to different terms and conditions that independent lenders would have required to manage the credit risks appropriately.”

[emphasis added]

50. The FTT made it explicit at [89] of the Decision that the actual Loans would not have occurred at arm’s length with an independent lender:

“[89] It is clear from the evidence of the experts that the transaction that was actually entered into would not have taken place in an arm’s length transaction with an independent lender. It is therefore necessary to hypothesise a different transaction which independent enterprises would have entered into and, as it is for LLC5 to displace the closure notice and amendment made to its self-assessment, it can only succeed on the transfer pricing issue by positively establishing that there is a hypothetical transaction in which a hypothetical independent enterprise would lend $4 billion dollars to LLC5.”

[emphasis added]

51. As set out above, at [103] of the Decision, the FTT concluded that an independent lender would not have entered into the loans on the same terms as the actual Loans, and it would only have loaned $4 billion to LLC5 if the covenants (set out at [90] of the Decision) had been given by other entities in the BlackRock Group. The question is whether the FTT was entitled to conclude in those circumstances that the hypothetical provision with different terms is the appropriate comparator for the purposes of s.147(1)(d) TIOPA.

52. The focus of s.147(1)(a) TIOPA is on the “two persons” between whom the provision is made, in this case the lender and borrower. This is reinforced by Article 9 of the OECD’s Model Tax Convention, which is similarly worded to s. 147 (albeit it refers to “conditions” as opposed to “provision”) and refers to adjusting profits of “one of the enterprises” by reference to the conditions which would have been agreed between them if acting independently:

“…conditions are made or imposed between the two enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reasons of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly.”

53. The arm’s length principle embodied in s.147, and in particular the separate entity approach, is explained in para. 1.6 of the TPG, which the FTT referred to at [60] of the Decision:

“…arm’s length principle follows the approach of treating the members of [MNE, a multinational enterprise] group as operating as separate entities rather than as inseparable parts of a single unified business. Because the separate entity approach treats the members of an MNE group as if they were independent enterprises, attention is focused on the nature of the transactions between those members and on whether the conditions thereof differ from the conditions that would be obtained in comparable uncontrolled transactions. Such an analysis …is at the heart of the application of the arm’s length principle. [emphasis added]”

54. The hypothetical transaction must be sufficiently comparable with the actual transaction for the purpose of testing it. The 1995 version of the TPG, which was in force at the time of the transaction, discussed comparability at length (as do all subsequent versions). Paragraph 1.15 stated:

“Application of the arm’s length principle is generally based on a comparison of the conditions in a controlled transaction with the conditions in transactions between independent enterprises. In order for such comparisons to be useful, the economically relevant characteristics of the situations being compared must be sufficiently comparable. To be comparable means that none of the differences (if any) between the situations being compared could materially affect the condition being examined in the methodology (e.g. price or margin), or that reasonably accurate adjustments can be made to eliminate the effect of any such differences. In determining the degree of comparability, including what adjustments are necessary to establish it, an understanding of how unrelated companies evaluate potential transactions is required. Independent enterprises, when evaluating the terms of a potential transaction, will compare the transaction to the other options realistically available to them, and they will only enter into the transaction if they see no alternative that is clearly more attractive…[emphasis added]”.

55. The “economically relevant characteristics” are described at paragraph 1.17 of the TPG:

“…In order to establish the degree of actual comparability and then to make appropriate adjustments to establish arm’s length conditions (or a range thereof), it is necessary to compare attributes of the transactions or enterprises that would affect conditions in arm’s length dealings. Attributes that may be important include the characteristics of the property or services transferred, the functions performed by the parties (taking into account assets used and risks assumed), the contractual terms, the economic circumstances of the parties, and the business strategies pursued by the parties…[emphasis added]”.

56. In DSG Retail, the Special Commissioners stated at [78] that the similarly worded predecessor legislation to s.147(1)(d) TIOPA (paragraph 1(2)(a) of Sch 28AA of the Income and Corporation Taxes Act 1988) should be interpreted as requiring consideration of what provision independent enterprises sharing the characteristics of the actual enterprises would have made.

57. Risk is of particular significance in a lending transaction and is highly relevant to transfer pricing - see DSG Retail at [55]. It is discussed further at para. 1.23 of the TPG:

“…In the open market, the assumption of increased risk will also be compensated by an increase in the expected return. Therefore, controlled and uncontrolled transactions and entities are not comparable if there are significant differences in the risks assumed for which appropriate adjustments cannot be made. Functional analysis is incomplete unless the material risks assumed by each party have been considered since the assumption or allocation of risks would influence the conditions of transactions between the associated enterprises…[emphasis added]”.

58. The experts were agreed that the main concern of an independent lender of $4 billion to a company like LLC5 would be the risks around the fact that the borrower in the position of LLC5 had no control over the dividend flow to it and so its ability to repay the loan. In the actual transaction, LLC4 through its ownership of the LLC6 Common Shares, controlled LLC6 and so the dividend flow to LLC5. LLC4 did not therefore need covenants from LLC6 or BGI. In the hypothetical transaction however, the dividend flow would need to be secured so far as possible and this is what the covenants imposed by the FTT sought to do. Mr Prosser QC said that this was necessary to replicate the actual risks assumed by LLC4 in the Loans and that these were only services being provided by third parties that do not affect the substantive “provision” under consideration. By contrast, Mr Ewart QC submitted that not only did this materially alter the economically relevant characteristics of the transaction but also it changed the surrounding circumstances and context of the actual transaction, which is not permissible under the wording of the legislation.

59. We agree with Mr Ewart QC. Importing third-party covenants into a hypothetical transaction that did not exist in the actual transaction changes the nature of the provision which is to be compared. By permitting the introduction of third-party covenants, the FTT essentially compared a different transaction to the actual one. It enabled the FTT to reach the conclusion that the same Loans and terms including interest rates as between LLC4 and LLC5 would have occurred at arm’s length. However, we do not consider that new third-party covenants that were not present in the actual transaction and which materially affect the economically relevant characteristics of the transaction can be so imposed to provide a comparable arm’s length transaction.

60. In support of his argument that the provision of services by third parties can be introduced into the hypothetical transaction, Mr Prosser QC posited a number of examples that he said showed that HMRC’s so-called “two party rule”, that is that third parties cannot be introduced into the transaction as s.147 is only concerned with the “provision” between two persons, cannot be right. Indeed, he submitted that it may actually work against HMRC in certain respects. He gave three examples.

61. The first example was of a company, P, making a loan to its subsidiary S on terms that the interest rate is to be set by T, a third-party with no expertise in interest rate setting. In the arm’s length transaction, the experts agree that independent enterprises dealing at arm’s length would have agreed instead that the interest rates should be set by an expert interest rate setter rather than T. The expert setter would have set a higher rate of interest than T. Nonetheless, Mr Prosser QC submitted that if a fresh or different third-party could not be introduced in the arm’s length relationship, P could not be taxed on the higher interest rates it would have received.

62. The second example was of an interest free loan being made informally from a parent to its subsidiary with no detailed terms and without lawyers being utilised. However, in the arm’s length loan, independent enterprises would not have lent or borrowed at all without using third-party legal services to advise and draft the terms. Again, Mr Prosser QC submitted that if HMRC’s two party rule were correct, the parent could not be taxed on the interest which would have been charged on the arm’s length transaction.

63. Mr Prosser QC gave a further example in his oral submissions of an independent lender insisting on the borrower being credit-rated by an independent credit rating agency. Obviously, such would not be required in an intra-group transaction but at arm’s length there would be no transaction without the provision by a third-party of credit rating services.

64. Mr Ewart QC said that these examples are very different from the provision of third-party covenants that impinge on the very substance of the transaction and change the relevant risks and economic characteristics of the transaction. The first example would actually provide the evidence for what the interest rate would be at arm’s length. It also included a third-party in the actual transaction. And no one could seriously suggest that the provision of legal services in the second example or credit rating services in the third were akin to the provision of substantive third-party covenants.

65. We agree with Mr Ewart QC. The introduction of these types of third-party services in the hypothetical transaction are not a part of the substantive loan provision between the independent lender and the borrower. They do not affect the relevant economic characteristics of the parties or the transaction and may simply be helpful in determining the arm’s length price or interest rate that would have been agreed.

66. The other main strand to Mr Prosser QC’s argument was his reliance on s.152 TIOPA. Section 152(1)(b) applies where the actual provision is in relation to a security by an ‘issuing company’ (such as in this case, LLC5 which issued the loan notes to secure the loans). Section 152(5) requires, when conducting the analysis under sections 147(1)(d) and 152(6), that any guarantee provided by a company with which the ‘issuing company’ in the actual transaction has a participatory relationship (including membership of the same group of companies) should not be taken into account.

67. Mr Prosser QC argued that in this case there was no guarantee from LLC4 to LLC5 in the actual provision of the loan. However, ss.152(5) and (6) do not contemplate any guarantee from the parent company in the actual provision. The focus of ss.152(5) and (6) is on forbidding a guarantee to be taken into account in the hypothetical transaction because it would or might enable an arm’s length loan transaction to go ahead with the benefit of a deduction for interest which in the real world it would not. He submitted that it was most unlikely that Parliament was contemplating a situation where, and only where, there was a parental guarantee in the actual transaction which was then ruled out when considering the hypothetical transaction. He submitted that such a parental guarantee would be unnecessary in the intra-group transaction.

68. Mr Prosser QC’s main point was that the legislation specifically envisages or contemplates third-party involvement in the arm’s length transaction and this shows that there is no two party rule operating.

69. Mr Ewart QC disagreed with both the interpretation of s.152(5) and with its suggested effect. He submitted that Parliament did indeed contemplate the situation where, specifically for transfer pricing purposes, the group did provide parental guarantees to support the intra-group lending. It was precisely because Parliament did not want taxpayers to be able to argue that because a guarantee had been provided in the actual transaction, so it should be assumed that such a guarantee would be forthcoming in the hypothetical transaction. Therefore, the effect of s.152(5) is to remove consideration of such guarantees altogether when deciding whether the arm’s length transaction would have been made and if so on what terms. Such an interpretation is consistent with Mr Ewart QC’s overall thesis that third-party covenants can only be taken into account in the hypothetical transaction if they existed in the actual transaction.

70. Again, we agree with Mr Ewart QC’s interpretation of s.152(5). It is unclear why Parliament only chose to rule out guarantees (they are widely defined however in s.154(4)) and neither side was able to explain why the legislation is limited to guarantees. It could be, as Mr Ewart QC submitted, that this was a form of abuse that had been perceived in intra-group lending, and the provision of covenants to secure dividend flows was not something that was contemplated. It is clear to us that, whatever the reason for the specific exclusion of guarantees was, s.152(5) is intended to cover the situation where a guarantee has been provided, for whatever reason, in the actual transaction and it is then ruled out of the hypothetical transaction. This is because it would obviously have a potentially direct effect on price as a parental guarantee reduces the lender’s risk and therefore the interest rate to be charged.

71. We consider that what s.152(5) shows is that guarantees from third-parties affect the substance of the loan transaction, namely the “provision” between lender and borrower, and Parliament has therefore decided that they should be left out of account in determining the arm’s length provision. This strongly indicates that covenants from third-parties supporting the loan transaction similarly affect its substance. In the case of covenants that are not precluded by s.152(5), these can only be taken into account if they were provided in the actual transaction. If that were not so, the arm’s length transaction would not be sufficiently comparable to the actual transaction as the surrounding circumstances and context would not be the same. It is our view that Mr Ewart QC was correct to submit that the surrounding circumstances, such as the provision of third-party covenants, must be the same in both transactions to ensure that there is a comparison of like with like.

72. We understand that the effect of this is, as Mr Prosser QC argued, that LLC5 would not have been challenged if it had gone through the rather artificial exercise in the actual transaction of having covenants in place with LLC 4 and LLC 6 and BGI and so on as set out at [90] of the Decision. The BlackRock Group would not have needed to have such covenants in place in the actual transaction because these were intragroup companies, but if they went through that artificial process, then HMRC would have had to concede it would be possible to look at covenants provided by third-parties when considering the arm’s length transaction. This would therefore be open to abuse by a group determined to uphold the transaction for transfer pricing purposes.

73. We recognise that this is a possible effect. On our analysis, section 152(5) TIOPA was enacted in order to address this situation as regards the unnecessary introduction of guarantees in actual transactions. However, it does not cover covenants such as those provided in this case and it could therefore be used unscrupulously by groups seeking to gain a tax advantage.

74. However, we believe that this is unlikely to cause such a problem in practice and it will be very obvious if groups have sought to manipulate the actual transaction in that way by including wholly unnecessary covenants that attempt to anticipate what an independent expert might later decide would be required by an independent lender.

75. We accept that there is nothing in the legislation or the TPG that expressly rules out third-party involvement in the hypothetical transaction. But we consider that the focus of the legislation is clear and that is on the “provision…made or imposed as between any two persons”, which in this case is the Loans, and the only substantive changes that are tested by the “arm’s length provision” are to the terms of the Loans themselves, such as the interest rate. Third-party covenants that were not given as part of or in support of the actual transaction cannot be considered to be part of the hypothetical transaction as this materially changes the surrounding circumstances and alters the economically relevant characteristics of the transactions in question.

Conclusion on Ground 1

76. In conclusion, the FTT erred in law in permitting new third-party covenants absent from the actual transaction to be taken into account when considering whether an independent lender would make a $4 billion loan to LLC5. The FTT decided that such an independent lender would not have made a $4 billion loan to LLC5 without such covenants being in place and that important finding should itself have determined that there was no comparable arm’s length transaction. Having decided that, the FTT would have been bound to conclude that no “provision would have been made as between independent enterprises” (s.151(2)).

77. Therefore, we are satisfied that the FTT erred in law in a material manner and its decision should be set aside based upon this first ground of appeal. We will return to the consequences of this below, namely whether to remit or re-make the FTT’s decision.

78. In light of our decision on the first ground, the remaining grounds of appeal are no longer material, but we address them out of respect to the written and oral arguments we received.

Ground 3

79. Mr Ewart QC also concentrated upon the third ground of appeal in oral argument. This was that the FTT’s findings in relation to the covenants that would have been required by an independent lender before entering into the transaction were unsupported by the evidence and its own findings in relation to that evidence. He argued that the conclusion at [102] of the Decision that both experts were “agreed” that the covenants would be provided to an independent lender was wrong and based on a misunderstanding of the evidence given by both experts.

80. He took us through the transcripts of the evidence of the experts, Mr Gaysford and Mr Ashley, at the hearing before the FTT. He argued that the conclusion was wrong for two reasons. First, the experts were not agreed because they did not conceive of the covenants in the same terms. Secondly, Mr Gaysford did not accept, in either his written or oral evidence, that the covenants would have been provided or, that his concerns were not "deal-breakers”. At most, Mr Gaysford said he would rephrase the term “deal-breaker” as meaning there was a better commercial alternative. While he agreed with Mr Ashley that covenants would be required, he did not agree that they would be provided as it was his view that it would have been commercially irrational for the group to provide them, because of the cost and complexity involved in doing so.

81. Mr Prosser QC submitted that the FTT’s findings in relation to which covenants would have been required were supported by the evidence available to it. It made no error of law in finding so. In summary, it was entitled to find that the experts agreed that whatever covenants and other enhancements would have been required by an independent lender could probably have been achieved.

82. We are not satisfied that the FTT mischaracterised the evidence of Mr Gaysford in the way suggested. Ultimately, this was a challenge to the fact finding jurisdiction of the FTT. The FTT was entitled to reject HMRC’s interpretation of Mr Gaysford’s evidence. Even if there was a difference in the way the experts viewed the crucial covenant ensuring that preference dividends were paid, the FTT was entitled to decide that all the covenants would have been forthcoming at arm’s length. We accept Mr Prosser QC’s submissions that the FTT’s findings in relation to which covenants would have been required were supported by the evidence and its own findings in relation to that evidence.

83. Mr Ashley in his report stated that several covenants would be needed to provide protections to external bondholders including “Provision of additional covenants (e.g. preference share payment covenant)”.

84. This issue was further addressed in the experts’ joint statement set out at [78] of the Decision:

“f. The preference share structure was unusual but not necessarily problematic given BGI US was already a successfully performing business. The preference shares carried an expectation that the Appellant should receive over USD700m annually in income which would have given it a sizeable debt capacity. The main issue was that the flow of value from BGI US to LLC6 and then to the Appellant via the preference shares was paid at the discretion of LLC4. Whilst a lender would probably be unlikely to accept this position, it should have been possible for BGI US, and LLC5 - with the explicit consent of LLC4 - to effectively ratify the legal and financial position to which the Appellant was entitled, that is the receipt of the value from BGI US. This ratification would most likely have been effected via inter-company agreements and covenants which would have formed part of the Appellant's borrowing transaction. Both experts agree that an independent lender would have required the protection described in this paragraph and that it probably could have been put in place. Mr Gaysford believes it would have been costly and complex to do so. Mr Ashley believes it would have been straightforward and that the associated 'cost' would have been an 'opportunity cost' (i.e. reduced flexibility to enter into further transactions) rather than a cash cost.

g. In addition to the protections discussed in f above, the purpose of which would have been to secure the flow of value from BGI US and preference share dividends from LLC6, the experts agree that an independent lender would likely also have required other structural enhancements to the terms of the loans, to ensure the cashflow generation of BGI US could not be diverted in any way. Possible additional clauses would include (1) a negative pledge on further indebtedness within BGI US, LLC6 or indeed [LLC5], (2) a change of control clause and (3) a restriction on BGI US or LLC6 being able to lend money to any other entity- whether inside the BlackRock Group or not. These are well known standard clauses required in almost every external debt transaction- though to emphasise, one would not expect to see them in an inter-company transaction within a group.

h. The experts cannot say with certainty whether all of the possible additional clauses listed on paragraph g would have been required to support a USD4bn loan or bond transaction by [LLC5]. However, in view of the structural subordination of LLC5 (being 2 entities away from the generation of cashflows), the experts agree that an independent lender would have required at least some of the enhancements discussed in paragraph g.

i. Again, both experts agree that the enhancements discussed in paragraph g would have been necessary, and probably could have been achieved. Mr Ashley believes it would have been straightforward to do so and that the associated “cost” would have been an “opportunity cost” (ie reduced flexibility to enter into further transactions rather than a cash cost. In Mr Ashley’s experience, such enhancements are very common in debt transactions, including the BlackRock Group’s own revolving credit facility. Mr Gaysford believes it would have been costly and complex to do so, and that any “opportunity cost” would have been significant.” [emphasis added]

85. In summary, the experts agreed that whatever covenants and other enhancements would have been required by an independent lender, this probably could have been achieved. This issue was addressed further by Mr Ashley in his second witness statement at paragraphs 17-22 and he was cross-examined about this.

86. In cross-examination Mr Gaysford re-confirmed the view set out in the joint statement that any covenants required by the independent lender could have been given. Mr Gaysford, however, considered that the requisite covenants and other enhancements would have given rise to four particular costs and complexities on the borrowing side, namely (i) tax, (ii) the approval of the Office of the Comptroller of the Currency (“OCC”) [the US financial regulator], (iii) cost of debt, and (iv) loss of flexibility to move funds around.

87. These points were raised for the first time by Mr Gaysford in his evidence (the OCC arrangements in his report, and the other issues in oral evidence). Indeed, when he was questioned on these points, Mr Gaysford was unable to say whether any of them would actually be a problem. In any event, Mr Gaysford clarified in cross-examination that he was not suggesting that any of the four points was a “deal breaker”, merely that there was a “better commercial alternative” to the actual transaction, such that it would have been commercially irrational for the group to enter into it. To a certain extent, these points add to our concerns as to whether it is appropriate to take such third-party covenants into account in assessing the arm’s length transaction. But as findings of fact, they were open to the FTT.

88. Therefore, the FTT did not mischaracterise the effect of the evidence nor make unreasonable or unsupported findings at [102] of the Decision. It was entitled to conclude that an independent lender would have entered into the $4 billion loan arrangement made with LLC5 subject to it being able to obtain the necessary covenants and that the covenants would have been forthcoming.

Grounds 2, 4 and 5

89. HMRC had permission to argue further grounds of appeal. While he did not concentrate upon these orally, Mr Ewart QC did rely on three further grounds in his skeleton argument.

90. HMRC’s second ground of appeal was that the FTT failed properly to consider the level of parental support required and whether covenants would have been forthcoming, and in particular failed to consider why those covenants would have been given when, by so doing, they would enable a funding structure which was more expensive (circa $40m per year) than alternatives. By “alternatives”, HMRC had in mind in particular the alternative of the parent of the group, BRI, borrowing instead of a subsidiary with a lower credit rating, such as LLC5. This overlaps with Ground 3 above.

91. The fourth ground of appeal was that the FTT erred in failing to consider whether an independent lender with the other characteristics of LLC4 would have entered into the transaction, namely to have lent $4 billion to an independent borrower in the position of LLC5 for it to acquire preference shares. The independent lender’s most closely related option realistically available to the actual transaction would have been to invest directly in LLC6 or even elsewhere in the BlackRock Group, in order to avoid the added risk inherent in investing via an entity which did not control its income flows and required supportive covenants to mitigate that risk.

92. Both of these grounds of appeal suffer from the same problem that Mr Prosser QC identified. The transfer pricing legislation is concerned with whether, and if so on what terms, an independent enterprise would have lent $4 billion to LLC5 and whether a company with LLC5’s economic attributes would have been able to borrow $4 billion, not with whether it would be cheaper for the BlackRock Group to borrow elsewhere.

93. Mr Prosser QC was right to identify that the second and fourth grounds of appeal relied upon postulating a breach of the ‘separate entity approach’. It may be that a hypothetical arm’s length lender would have preferred to lend to a different entity in the BlackRock Group rather than LLC5 but that is not the point - that would be to compare a different transaction to the one that had actually taken place. The FTT conducted the necessary hypothetical exercise of examining the nature of the arms’ length lending to a company in the position of LLC5 and considering the question of the terms on which the arm’s length lender would lend to LLC5. As we have found however, it impermissibly took into account third-party covenants that such an independent lender would have required if it was to lend $4 billion to LLC5.

94. The fifth ground of appeal, regarding whether Mr Gaysford had the required expertise to express opinion on the TPG, was immaterial to the outcome of the case.

95. We conclude that there was no error of law by the FTT in relation to Grounds 2 and 4.

The alternative co-investor approach

96. The FTT at [104]-[105] disregarded an alternative argument relied upon by Mr Prosser QC which was described as ‘the co-investor’ approach - this was whether an arm’s length independent lender, in addition to the loaning of $4 billion to LLC5, would also have subscribed for the LLC6 Common Shares to put it in the same position as LLC4.

97. We are satisfied that the FTT made no error in disregarding that argument for the reasons it gave at [105] of the Decision:

‘However, I would note that neither of the experts had been instructed to consider this alternative hypothetical transaction. Mr Ashley, in evidence, said that in his experience he had neither “considered” or “come across” such a transaction. Mr Gaysford, whose evidence on this issue was not challenged in cross-examination, identified “several problems” with such a scenario. First, in carrying over that set of economic circumstances other economic circumstances of the actual transaction are lost; second, the ‘step plan’ or “wider delineation of the transaction” is “very sensitive” to a lot of “different moving parts” including the US tax position, the OCC and the flexibility that the BlackRock Group has to move funds around its group for “perfectly acceptable” commercial reasons; third the independent lender, “if it is now part of the structure” would be required to sign up to the capital and liquidity arrangements which Mr Gaysford described as a “significant” obligation; and finally, a “methodological point” that if the independent lender owned the common shares of LLC6 Mr Gaysford said he would “struggle” to see how that lender was “now independent”.’

98. We therefore do not accept that the FTT erred in discounting the alternative co-investor hypothesis of Mr Prosser QC.

Conclusion on the Transfer Pricing Issue

99. We have found that the FTT erred in law for the reasons set out above in relation to Ground 1 and we therefore allow HMRC’s appeal in this respect.

100. We are satisfied that we should remake the decision applying section 147(1)(d), (2) and (3) of TIOPA. The actual provision of the loans from LLC4 to LLC5 differed from any arm's length provision in that the loans would not have been made as between independent enterprises. The actual provision conferred a potential advantage in relation to United Kingdom taxation. The profits and losses of LLC5, including the allowing of debits for the interest and other expenses payable on the Loans, are to be calculated for tax purposes as if the arm's length provision had been made or imposed instead of the actual provision. In this case, no arm’s length loan for $4 billion would have been made in the form that LLC4 made to LLC5 and hence HMRC’s amendments to the relevant returns should be upheld and confirmed.

Unallowable Purpose Issue

101. The Unallowable Purpose Issue concerns whether there was a commercial purpose to the Loans or whether the purpose was to secure a tax advantage (or whether there were dual purposes). Both parties challenge some of the findings of fact made by the FTT on the Unallowable Purpose Issue so it is necessary to explore the findings in some detail.

102. Our conclusion on the Transfer Pricing Issue renders the Unallowable Purpose Issue immaterial to the outcome of this appeal. Nevertheless, we received full argument on this and deal with all the grounds raised by both HMRC and LLC5.

The FTT’s decision

Factual findings

103. The FTT received witness statements and heard oral evidence from two witnesses of fact on behalf of LLC5: Mr Nigel Fleming (“Mr Fleming”) who had been the BlackRock Group’s EMEA head of tax at the time of the acquisition; and Mr J. Richard Kushel (“Mr Kushel”) who was a member and/or chair of several BlackRock Group entities. Mr Kushel was appointed to LLC5’s board on 30 November 2009. He presided over the board meeting which took place on that date, the minutes of which are addressed below, and in respect of which the FTT made findings at [42]-[53] of the Decision.

104. The FTT made further findings of fact relevant to the purpose of the transactions at [10]-[30] and [34]-[54] of the Decision.

105. The FTT began by making findings regarding the proposed acquisition of BGI US by the BlackRock Group as from June 2009. It found there was much internal discussion as to the structure of the acquisition which ultimately resulted in the proposals by which LLC4, LLC5 and LLC6 would be registered and utilised. This occurred in the period July to November 2009 - well before the board meeting and minutes of LLC5 on 30 November 2009 and the execution of the agreement for LLC6 to acquire the shares in Delaware Holding Inc, BGI’s parent, on 1 December 2009 (see [10]-[30]).

106. In particular, the FTT made findings regarding the start of the relevant period in June 2009 at [15]-[16]:

“15. EY had been given, what Mr Fleming described as, a “very broad remit” to consider the whole structure of the acquisition of BGI taking into account a wide range of options. Mr Fleming understood that EY had initially suggested that BGI should be acquired through a UK resident entity taking on intercompany debt to take advantage of the “generous tax regime for interest deductions” operating at that time. He explained that he was already aware of the concept of including a UK resident entity in an otherwise US resident holding structure having previously discussed the possibility with HMRC and the then Financial Secretary to the Treasury, Stephen Timms MP, in connection with the “worldwide debt cap” rules subsequently introduced by Part 7 of TIOPA to limit the extent to which UK tax deductions can be claimed for finance expenses incurred on loan relationships entered into between group companies.

16. However, rather than a UK limited company the decision was taken “relatively quickly” for BGI to be acquired by a US limited liability company (“LLC”) that was UK resident………”

107. It went on to find the following at [18]-[20]:

‘18. In an email dated 24 July 2009 to John D Hamilton, of BlackRock’s Corporate Tax Group New York whose responsibility included international tax globally including for the USA, Mr Fleming wrote:

“JD as discussed some thoughts and talking points on the use of a US LLC resident for UK tax purposes in the UK, to acquire non-UK companies such as the US bank [ie BGI] …

Risk Rating Issues

HMRC will likely view the transaction as being aggressive, which may lead them to: (1) revisit our low risk rating; (2) seek other issues to challenge us on; (3) seek every means possible to challenge the structure itself including:

- a more difficult thin cap negotiation.

- Para 13 (generally accepted to be toothless, but will need to ensure we don’t create adverse evidence of intent.

…

Law Change Risk - I am somewhat wary that a “super-para 13” rule might get introduced (better grafted than toothless para 13). This was shelved by HMT/HMRC at the beginning of this year, but may come back on the table in coming years. This means that getting an arb clearance (where HMRC would have accepted that the allowed debt did not have a UK tax avoidance purpose) might be very valuable in the future.”

19. As is apparent from the email, Mr Fleming had some reservations as to how HMRC might regard the transaction. He explained that the reference to “para 13” in the email was to paragraph 13 of Schedule 9 to the Finance Act 1996 (now s 441 of Corporation Tax Act 2009). As for it being “toothless” Mr Fleming explained that it was generally accepted that paragraph 13 was intended to apply to situations where loan relationships were entered into specifically for the purpose of generating tax deductible finance expenses without any other commercial purpose, and that it was not intended to apply in situations where the debt was used to finance a bona fide commercial transaction. He considered that the accepted view was that if the borrowing party to a loan relationship was using the funds raised from the loan relationship for a commercial purpose, that commercial purpose, and not any related tax considerations, was taken as the main purpose for entering into the loan relationship for the purpose of applying paragraph 13.

20. Mr Fleming also explained that by “super-para 13” he was referring to a possible extension of the scope of paragraph 13 to include the situation where a taxpayer used borrowed funds to make a bona fide commercial investment but whose decision to take on the debt might have been influenced by tax considerations which could be considered to be a “main purpose” for entering into the loan relationship notwithstanding the genuinely commercial use of the funds raised. Such a possibility had been raised by a Treasury/HMRC document, The Taxation of Foreign Profits of Companies dated 21 June 2007 and discussed in the 10 September 2007 edition of the Tax Journal. However, the proposal was not implemented.’

108. The FTT recorded the agreed fact that LLC5 had been registered in Delaware on 16 September 2009 (see [4(5)] of the Decision). It made findings regarding the advice received and preparations for its first board meeting on 30 November 2009. At [34] the FTT addressed the briefing note that was provided on 26 October 2009 to three employees of the BlackRock Group who were ‘potential members of the LLC5 Board’:

‘34. On 13 October 2009 Fletcher Clark, of BlackRock’s Legal Department, asked Mr Fleming to provide a briefing note to be shared with Colin Thomson (Head of BlackRock’s Financial Reporting Group for the international business), Roger Tooze (Head of BlackRock’s Business Finance) and James DesMarais (General Counsel for BlackRock’s international business) as potential members of the LLC5 Board. Mr Fleming provided the following note on 26 October 2009:

“Fletcher, the purpose of the LLC[5] is to effect the acquisition of the BGI US business from Barclays. Ideally, we would have wished LLC5 to be a UK incorporated company, but, this was not possible for both US and UK tax and regulatory reasons. On that basis, it became necessary for the entity to be formed as a US LLC since (1) an LLC is a US entity and thus likely to be acceptable to the OCC, and (2) it is also transparent for US tax purposes.

However, this means that the LLC must have its central management and control located in the UK. I am sure that Jim [DesMarais], Colin [Thomson] and Roger [Tooze] are all familiar with the residency policy that Tax has imposed in order to ensure that our non-UK funds and group companies are not UK resident. What we need to do with LLC5 is reverse that and ensure that all activities (that we would normally ensure are conducted outside the UK) are in fact done in the UK.

On that basis, we must ensure that the central management and control of the entity is conducted in the UK, and is done through the medium of board meetings, which we will hold on a regular basis.

The business of LLC5 will be relatively simple. It will hold preference shares in LLC6 which will only provide for 10% voting control. Accordingly, it will not be in a position to manage any of the underlying US business activities, nor will it be called upon to do so. Rather, it will be required to consider its own business of making and managing passive investments and managing its commitments in terms of issuing a Eurobond (that will be listed on the Cayman Exchange) in order to finance the acquisition. Thus, it will consider the likelihood that the business conditions pertaining in the US subsidiaries will enable the preference share dividends to be met, in order to meet its own financing costs.

Let me know if you think it will be helpful for me to directly brief Jim, Colin and Roger on the specific transactions that LLC5 will conduct, but hopefully these will already be quite clear on the step plan.

Please let me know when the first board meeting is scheduled, so we can work together on the agenda. We need to get this conducted asap.”’

[emphasis added]

109. Mr Thomson, Mr Tooze and Mr DesMarais, to whom this note was sent, were to become three of the four members of the board of LLC5 (they were also to be joined by Mr Kushel, as set out below).

110. At [36], [38] & [39] the FTT went on to find that in November 2009 advice was given to the three proposed board members as to the tax implications of the proposed transaction in which LLC5 was to take part:

‘36. Also on 10 November 2009, Mr Fleming met with Mr Thomson, Mr Tooze and Mr DesMarais to discuss and answer any questions that they might have ahead of the LLC5 Board meeting. He explained that within the BlackRock Group it was common practice for the Corporate Tax Group to brief members of relevant group entity boards with details of any capital transactions that those boards were being asked to enter into. He recalled that the “main focus” of these discussions was to enable him to explain the UK tax rules around deductions for interest expenses.

…

38. However, it was important, he said, that the members of any affected board were fully briefed and content that the proposed transaction was acceptable in financial, regulatory and governance terms from an entity level perspective. He explained that this was because one of the purposes of Corporate Tax Group team members from the US and the UK working on the proposal was to ensure that any potential UK regulatory or governance issues that may not have been identified by the internal stakeholders in the US were picked up and taken into account when shaping the transaction. Mr Fleming recalled that the main focus of the discussions on 10 November 2009 had been to explain how the UK tax rules around deductions for interest expenses worked to reassure those present of the “solidity of the tax analysis” and had “mirrored” to a large extent the discussions that he had himself had with the EY Tax Partner advising the BlackRock Group in relation to the BGI acquisition in July 2009.

39. On 12 November 2009 Mr Clark advised Mr Fleming by email that Mr Kushel, Mr Thomson, Mr Tooze and Mr DesMarais had agreed to join the LLC5 Board. The email also noted that Mr Kushel would “come off the board after closing”.’

[emphasis added]

111. The FTT then addressed the evidence regarding the board meeting of LLC5 on 30 November 2009 by reference to the oral evidence of Mr Kushel, being the only one of the board members to give evidence before the FTT:

‘44. As noted in the SOAF the board meeting took place on 30 November 2009. The minutes record that the meeting was attended by Mr Kushel, who took the chair, Mr Thomson, Mr DesMarais and Mr Tooze. The meeting was also attended by Adrian Dyke the company secretary and Mr Fleming who was there to explain the role of LLC5 in the proposed acquisition of BGI.

…

46. In addition to his position with LLC5, in 2009 Mr Kushel was also chairman of a number of companies in the BlackRock Group…’

112. The FTT accepted Mr Kushel’s oral evidence at [49]-[53] as follows:

‘49. He considered his role as a board member was to be satisfied that a transaction was in the best interests of the entity concerned and did not see it as part of his remit to begin to question or suggest changes to the underlying capital structure that a proposed transaction should follow. Although expressed in general terms Mr Kushel confirmed that he, and he thought all the board members, adopted such an approach in relation to LLC5. Although, in evidence Mr Kushel used the term “we” to describe the actions of the LLC5 Board he accepted that he was only giving evidence on his behalf and could not say what was in the minds of the other board members when the decision were taken.