Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Lands Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Lands Chamber) >> Robert Dyas Holdings Ltd v Moore (Valuation Officer) (RATING - valuation - alteration of 2017 rating list - distribution warehouse - rental evidence - evidence of other assessments - end allowance - appeal allowed - assessment determined at rateable value 825,000) [2025] UKUT 163 (LC) (05 June 2025)

URL: http://www.bailii.org/uk/cases/UKUT/LC/2025/163.html

Cite as: [2025] UKUT 163 (LC)

[New search] [Contents list] [Printable PDF version] [Help]

AN APPEAL AGAINST A DECISION OF THE VALUATION TRIBUNAL FOR ENGLAND

B e f o r e :

____________________

| ROBERT DYAS HOLDINGS LIMITED |

Appellant |

|

| - and - |

||

| MS J MOORE (VALUATION OFFICER) |

Respondent |

|

| Hemel Portal, Swallowdale Lane, Hemel Hempstead, Herts, HP2 7EA |

____________________

Mrs Mandy Franklin for the respondent

16 April 2025

____________________

Crown Copyright ©

- This appeal concerns the 2017 rating list assessment of a distribution warehouse ('the Property') in Hemel Hempstead, Hertfordshire. It deals primarily with the question of whether the rent on the Property, with only a limited amount of other evidence, forms the best guide to rateable value, or should evidence of other assessments, and the 'tone of the list' be preferred?

- The Property was originally assessed in the 2017 Rating List at rateable value £880,000 with effect from 1 April 2017 and in its decision of 30 August 2024 the Valuation Tribunal for England ('VTE') reduced the assessment to rateable value £875,000. In this appeal the appellant seeks an assessment of rateable value £750,000. The Valuation Officer ('VO') seeks the restoration of the original assessment.

- We inspected the Property on 1 April 2025 accompanied by a representative of Robert Dyas Holdings Limited and Mr Matthew Hawkins of Colliers International. Mrs Mandy Franklin and Mr Andrew Steel of the VO were also present.

- At the hearing Mr Laurence Hatchwell represented the appellant and Mrs Mandy Franklin represented the respondent VO. We are grateful to them both.

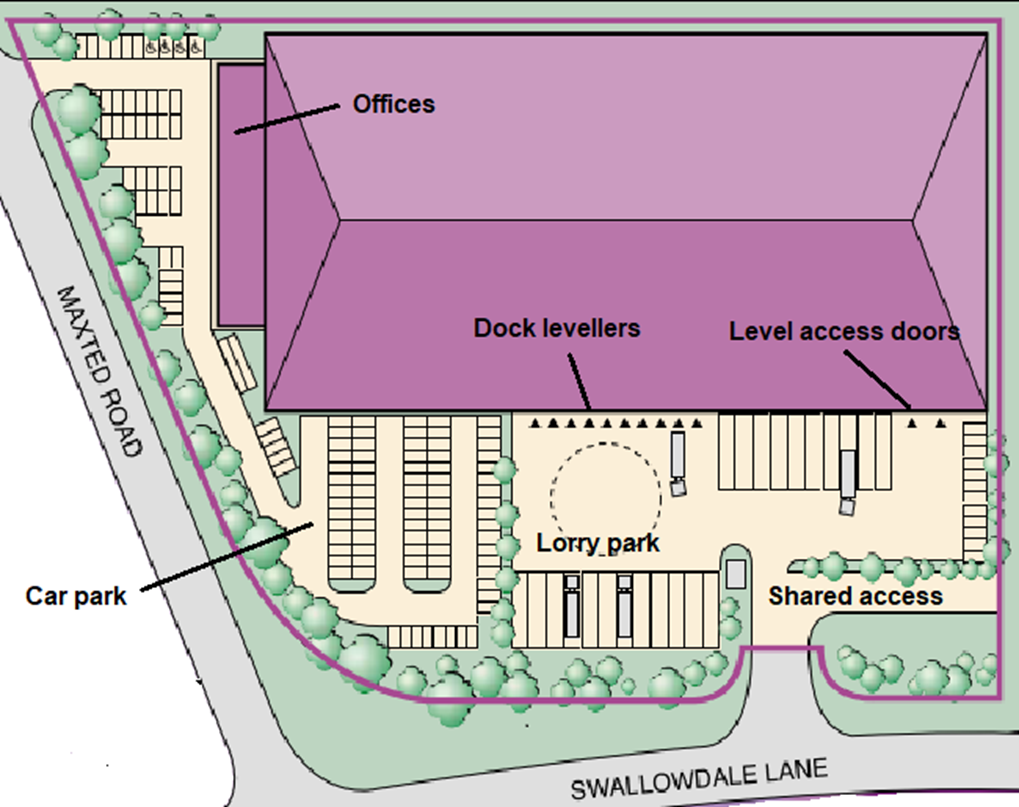

- The property is located in an established industrial and warehouse estate about 1.9 miles northeast of Hemel Hempstead town centre. Junction 8 of the M1 motorway is about 1.25 miles to the southeast and is accessed via Maylands Avenue, which is the spine road of the estate, and then by travelling eastwards along the A414 Breakspear Way. This route is 2.1 miles in length. Goods vehicle access to the site is from Swallowdale Lane by means of a short spur road which is shared with a neighbouring warehouse. Access to the 109 space car park is from Maxted Road. The plan below shows the general layout of the site and the access points.

- The Property is a purpose-built distribution warehouse which was first occupied in 1998. It is of steel, portal frame construction with a clear height to the underside of the eaves haunch of 11.9 metres. The gross internal area amounts to 18,349.06 m2 and the area expressed in 'terms of main space'('ITMS'), that is expressed as a total of the factorised areas, is 14,183.01 m2. We say more about factorised areas later in the decision.

- The warehouse is arranged as two bays, orientated on a northeast /southwest axis. Each bay is some 150 metres long and about 37 metres wide. A substantial mezzanine floor has been installed in the warehouse by a previous tenant and was demised to the appellant. It occupies about 50% of the available warehouse area. It is supported on steel joists and stanchions bolted to the floor slab. There is clear height of about 8 metres underneath and 3.2 metres above. It is served by two goods lifts. The remaining full height space is partly racked for palletised storage. We understand that the warehouse floor loading is 50 kilonewtons (5,098.6 kg) per square metre.

- The warehouse is equipped with 10 dock levellers, these are adjustable devices which allow level loading from the warehouse floor directly into a goods vehicle or trailer. In addition, there are five level access loading bays. All of the levellers and bays face on to an 'L' shaped yard which has space for 11 articulated lorries in addition to the spaces adjacent to the loading points. Part of the yard adjacent to the level access doors is used as canopied storage, the canopy extending to some 746.9 m2. A portion of the carpark at the northwestern end of the site is used as overflow lorry parking and containerised storage.

- Two storey office and ancillary accommodation is provided adjacent to the northeastern elevation of the warehouse. The ground floor is of brick construction, with cladding to the first floor. The double glazed windows are metal framed. Heating is provided by wall mounted hot water radiators and fluorescent lighting is recessed within suspended ceiling tiles.

- Prior to occupation by Robert Dyas the Property was let to Wickes who, it is understood, vacated in December 2013. The landlord marketed the Property with availability from July 2014 and Robert Dyas entered into a full repairing and insuring lease from 10 July 2014. We have been provided with details of the 'heads of terms' for the letting which are said to differ from the terms of the lease only in respect of the expiry date, the rent payable and the rent commencement date. We can therefore discern the following:

- The landlord completed a programme of works to put the Property into repair prior to the commencement of the lease to the appellant. After taking up occupation the appellant undertook works to create offices on the ground and mezzanine levels of the warehouse, and installed the racking.

- VO records of assessment apportionments obtained under s.44A of the Local Government Finance Act 1988 show that the Property was occupied in phases by the appellant. Between 5 September and 17 October 2014 only 2% of the property was occupied. The part occupied increased to 10% of the total area between 18 October 2014 and 27 February 2015. Thereafter, until 31 July 2015 about 97% of the property was occupied.

- The rent increased to £1,250,000 per annum at review in July 2019. The review clause pegged the value of the mezzanine platform to 25% of the value of the warehouse space beneath it.

- Non-domestic rates are a tax on property and the unit of property which is the subject of tax is the 'hereditament'. Section 64(1) of the Local Government Finance Act 1988 (the 1988 Act), defines a hereditament by reference to the definition in section 115(1) of the General Rate Act 1967, which provided that:

- Schedule 6 of the 1988 Act contains provisions about valuation for the purposes of non-domestic rating. Paragraph 2(1) provides that the rateable value of a hereditament is taken to be equal to the rent at which it might reasonably be expected to let from year to year if let on the antecedent valuation date on certain assumptions.

- The first assumption in paragraph 2(1)(a) is that the tenancy begins on the day by reference to which the determination is to be made. The second assumption, in paragraph 2(1)(b), is that "immediately before the tenancy begins the hereditament is in a state of reasonable repair, but excluding from this assumption any repairs which a reasonable landlord would consider uneconomic". The final assumption, in paragraph 2(1)(c), is that the tenant undertakes to pay all usual tenant's rates and taxes and to bear the cost of the repairs and insurance and the other expenses (if any) necessary to maintain the hereditament in a state to command the agreed rent.

- Statute requires that the appeal Property be valued reflecting certain matters as they existed on the material day, which for the 2017 Non-Domestic Rating List is 1 April 2017, and by reference to values pertaining at the Antecedent Valuation Date (AVD) which is 1 April 2015. The matters which must be taken at the material day are set out in paragraph 2(7) of Schedule 6 Local Government Finance Act 1988. The matters relevant to the appeal are:

- For the purposes of the 2017 rating list the VO have adopted a factorised approach to the analysis of rents and the subsequent valuation of distribution warehouses. This involves the adoption of a rate in terms of main space ('ITMS') which effectively expresses the value of each part of the building as a factor of the rate applied to the warehouse. As far as it is relevant for this appeal the following principal factors apply:

- The appellant's case is that there is sufficient rental evidence from local transactions agreed close to the AVD, including that of the Property, to indicate the level of value that landlords and tenants were prepared to agree on the Property and other comparable properties. Analysis of these transactions supports an assessment of rateable value £750,000 based on a main space rate of £52.21 per m2. In coming to this figure, the appellant takes account the age of the Property, the presence of a substantial mezzanine floor at the date of lease commencement, shared access to the loading area, and insufficient yard and loading facilities.

- The respondent submits that it is incorrect to be over reliant on the rent agreed for the Property and that greater weight should be attached to the basket of comparable evidence. The 2014 rent on the Property is said to appear out of line with the rents achieved on the comparable properties in the locality and to require significant adjustment to bring it into line with the statutory definition of rateable value. The respondent concludes that the assessment should be based on a main space rate of £67.50 m2, with an addition of £12,091 for plant and machinery, and incorporate an end allowance for access/circulation of 8.5%. The resultant figure is rateable value £880,000.

- For the appellant Mr Hatchwell called Mr Matthew Hawkins BSc(Hons) MRICS, a director at Colliers International specialising in rating appeals for business space across the South East, but with a particular focus on the Home Counties and Greater London.

- For the respondent Mrs Franklin called Mr Andrew Steel MRICS Dip.Rating, a member of the National Valuation Unit of the Valuation Office Agency. Since 2021 he has specialised in the valuation of large industrial properties for rating purposes on a nationwide basis. He had not been involved in formulating the tone for distribution warehouses in Hemel Hempstead or undertaken any of the valuations for the 2017 rating list. Mr Steel had, however, dealt with a challenge on Unit 1 at 1, Boundary Way, HP2 7EQ, revising the valuation before well-founding the challenge and updating the valuation list.

- We have identified the following issues between the parties:

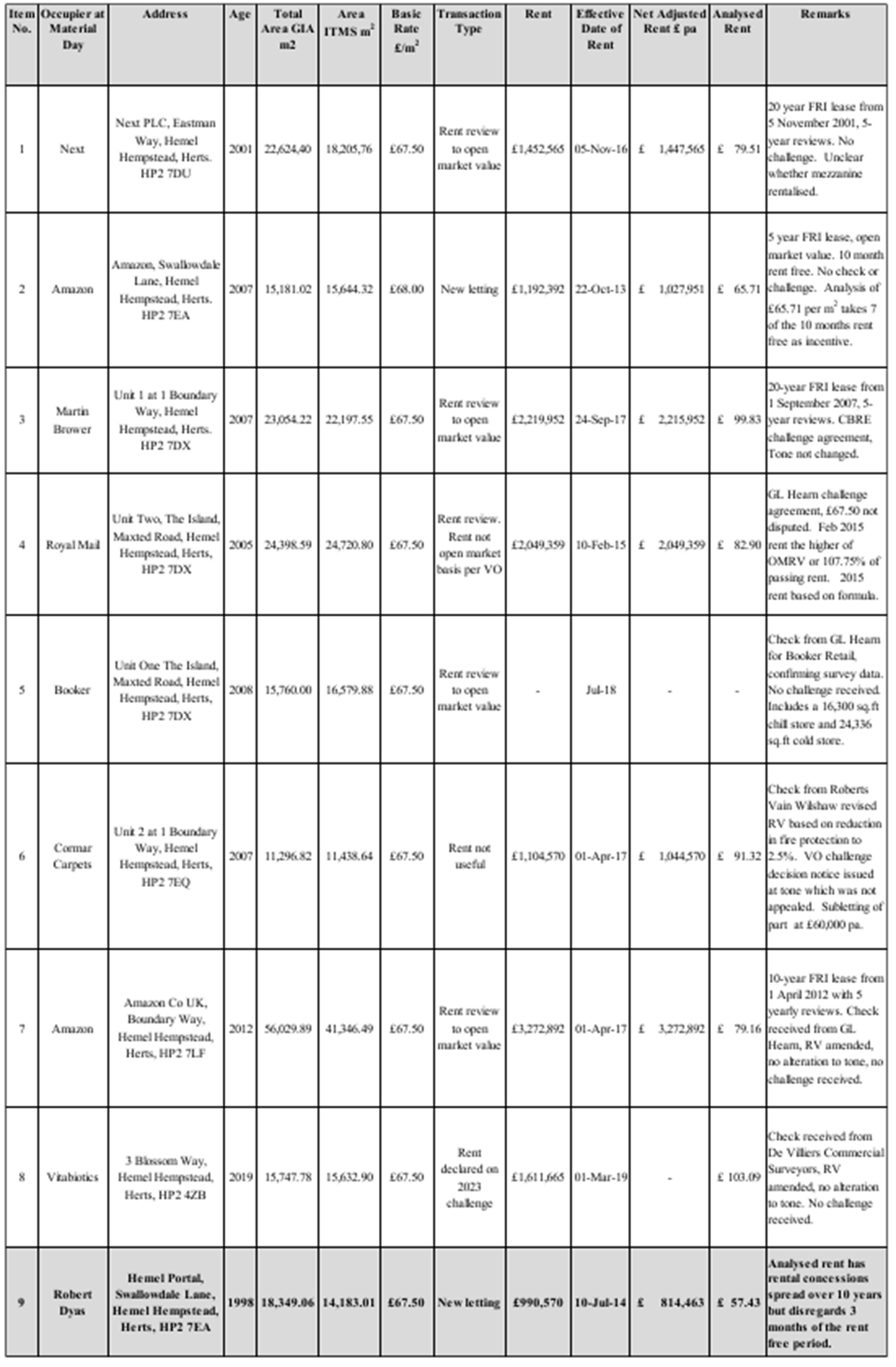

- We set out in the following table the rental and tone evidence referred to by the parties at items 1 to 8. We have added as an additional item (9) the Property itself and our analysis of the initial rent payable. In all cases where there is a dispute over the correct analysis, or where none was provided, we have recorded our own figures. We say more about the Tribunal's treatment of rental concessions later in the decision. We have also included remarks about matters which were relevant to the analysis, and details of the stage of the check, challenge and appeal process that the individual properties reached.

- Both parties referred to the guidance of the Tribunal (Mr J H Emlyn Jones FRICS) in Lotus and Delta Limited v Culverwell (VO) and Leicester City Council [1976] RA 141. It is germane at this point to set out the essence of this advice:

- In Lamb (VO) v Go Outdoors Ltd [2015] UKUT 366 (LC) the Tribunal (P D McCrea FRICS) commented that

- In his first report Mr Hawkins relied upon two transactions as a basis for his conclusions; the letting on the property itself and the letting of a unit in Swallowdale Lane to Amazon which occurred in October 2013. These are shown as items 2 and 9 in the table above. He was aware of other transactional evidence and had not placed any weight at all on it. He did not explain why he had rejected this evidence until he filed his supplementary, or 'rebuttal' as he termed it, report. The rationale for this approach was that the letting of the Property was aligned with the first and second propositions of Lotus and Delta and that the letting to Amazon fulfilled the third in that his analysis confirmed 'that the level of rent indicated by the rent on the Property was consistent with other market activity around the time'. We will return to these rents when we consider the detail of the rental analyses.

- Mr Hawkins also rejected the use of evidence of assessments that had been discussed and agreed between the VO and other occupiers and their advisors. It can be seen from the table of evidence that some of these had been the subject of checks and others both checks and challenges. None, with the exception of the Property had been appealed. Mr Hawkins noted that assessment evidence 'sat low in the hierarchy set out in Lotus and Delta' and that the sixth proposition stated that where rents were unavailable a review of assessments may be helpful. As rents were available there was, he said, no need to engage the final proposition.

- Mr Steel took a holistic approach, reviewing items 1 to 8 in the table of evidence and arriving at an analysis where appropriate. He questioned why the appellant had entered into a lease for a building nearly a year before taking full occupation and noted the generous rent free provisions. He decided that the VTE had been correct in its approach of not relying on the rent at the Property, electing instead to place greater weight on the basket of comparable evidence. In support of this methodology, he had compared the outcome of the 2019 rent review at the Property with contemporaneous evidence from other properties (Next and Amazon) and found that the rents 'unclouded by incentives' were closely aligned. He concluded that the rent agreed at the 2014 letting of the Property could not be attributed to characteristics that were individual to that property.

- Mr Steel further noted that the level of assessment on the comparable properties means there would have been significant payment liability, which would have provided an incentive to challenge the assessments if a ratepayer believed them to be excessive. Only three of the properties had been the subject of a challenge and of the remaining five properties, four were the subject of checks. This he said, was evidence of an established tone.

- In our view the correct starting point is the rental evidence available to the hypothetical tenant at the AVD. It is perhaps easier to start with the transactions that are not relevant to this exercise. Firstly, we exclude item 7 (Amazon, Boundary Way) which is three times the size of the Property. We also place no weight on item 8 (Vitabiotics, Blossom Way) because the letting occurred nearly four years after the AVD and is therefore too distant from the valuation date to be of any relevance. We also disregard item 5 (Booker, Unit One, The Island) because the rent commenced in July 2018 and the unit has a substantial chiller and cold store. It is therefore materially different to the Property. We place no weight on item 6 (Cormar Carpets, Unit 2 at 1 Boundary Way) as the only available rental information dates from April 2017. Item 3 (Martin Brower, Unit 1 at 1 Boundary Way) relates to a 'cross-docked' warehouse which has a particular internal layout and in our view is not comparable to the property. Finally, item 1 (Next at Eastman Way) has a rent that dates from 2011 but also has a large mezzanine floor and neither party is able to confirm whether or not it is included in the rent.

- That leaves three properties with potentially useful rents; item 2 (Amazon, Swallowdale Lane), item 4 (Royal Mail, Unit Two, The Island) and the rent on the Property itself. Item 4 was let in February 2010 and the subject of a rent review on 10 February 2015, a few weeks before the AVD. However, the review clause stipulates that the reviewed rent is to be the higher of 107.75% of the passing rent or the open market rent, whichever is higher. The VOA supplied information which shows the February 2015 rent to be precisely 107.75% of the passing rent and we therefore conclude that the market rent is less than the £82.90 per m2 shown in the table. The question is by how much? We cannot conclude that it must be either the same or higher than the 2010 rent as there is no evidence to support that view. It only tells us that the open market rent is no more than £82.90 per m2, an outcome that is of very limited use.

- The appellant sought to bring two further properties to the Tribunal's attention, namely Gist at Swallowdale Lane and Iron Mountain at Pennine Way. We do not consider either to be comparable to the Property and discount them entirely.

- We are therefore left with the two rents used by Mr Hawkins. At this point, and before we reach any conclusions about whether a tone exists, we need to scrutinise those rents to establish the correct analysis. We will deal firstly with the rent on the Property. We summarised the terms of the letting in paragraph 10. Both parties used the same methodology in their analysis but made assumptions which led to different results. The analyses were based on the annual equivalent (AE) of a rental cashflow (quarterly in advance) discounted to present value at 8.5%. The annual equivalent is determined by the application of Years Purchase (YP) at the same percentage for the required period, depending on whether the incentive is being spread over five or ten years. The discount and AE rates were agreed between the parties and reflect a nationally utilised approach by the VOA. Mr Hawkins produced two figures, namely £47.94 per m2 and £56.47 per m2 based on spreading the whole benefit of the rental concessions over five and ten years respectively. He made no allowance for a notional fitting out period but his preferred approach involved the averaging of the two outcomes resulting in a figure of £52.21 per m2.

- Mr Steel also provided us with two analyses. The first treated all of the rental concession as an incentive and was based on an AE spread over 10 years. The second was based on the same premise but with 6 months of the rent free period treated as a fitting out period and therefore ignored for the purposes of the calculation. The outputs from these endeavours were £56.21 per m2 and £60.89 per m2 respectively.

- Mr Hawkins, in making no allowance for a fitting out period, said that he had been unable to find any licences for works to the Property and had concluded that a fitting out period was unnecessary. Mr Steel said, without evidence, that it was standard practice in the market to allow for fitting out by giving occupiers a fitting out period and such period should not be treated as a concession because in many cases the property could not be occupied during fitting out. He drew attention to instructions in the VOA Rating Manual ("the Manual") which themselves referred to (now outdated) RICS Guidance (UKGN 6 Analysis of commercial lease transactions), both of which accorded with his position. The UKGN 6 says the following:

- The Amazon property is a little easier to analyse. The headline rent is £1,193,392 from 22 October 2013 with 10 months rent free. This property dates from 2007 and had been previously let. It is not known how much of the original occupier's fitting out was left but letting particulars from 2013 show it as being ready to accept the incoming tenant's racking.

- Both experts used the same methodology as for the Property except that Mr Hawkins treated the whole of the rent free period as an incentive. Mr Steel on the other hand excluded three months as a customary fitting out period. The term of the lease was five years which meant that there were two outcomes, Mr Hawkins at £59.82 per m2 and Mr Steel at £65.71 per m2. These figures exclude the value of plant and machinery.

- The Tribunal is not bound by what is written in the Manual. It amounts to instructions for Valuation Officers. We sensed a tension in some of Mr Steel's responses to questions from the Tribunal between the contents of the Manual and his duty as an expert witness. Although we were satisfied that he was earnest in his approach we are not convinced that an unquestioning adoption of a notional fitting out period is appropriate in every case. Rather, the use of such a method should be facts dependent. In the case of the Property there was no consensus that fitting out works had been done but the installation of racking would not be a matter undertaken over a weekend. Likewise, the construction of offices would require weeks of work. We therefore conclude that Mr Steel's approach is likely to be correct and some recognition of a fitting out period is appropriate. We note that only 2% of the floor area of the Property was occupied in the first three months, which lends weight to the notion that fitting out was occurring. We therefore adopt a three month fitting out period, reducing the true rent free concession to six months.

- We adopt the same rationale for the Amazon building.

- The remaining question is over what period should the incentive be spread? Mr Hawkins' compromise resulted in a period of 7.5 years and was based on an average of the positions likely to have been taken by the landlord and tenant. Mr Steel considered it inappropriate to amortise the incentive over five years due to the size of the concession. At the hearing Mr Hawkins said that the lengthy phased occupation of the Property resulted from a transfer of business from an existing fulfilment contract. It is possible that by securing a significant rental concession the appellant was seeking to avoid a double overhead, namely paying for the contract and rent on the property. In that scenario the concession constitutes an inducement to take the lease ahead of the optimal time.

- We have no evidence that the market at the AVD was any showing signs of growth and the hypothetical parties would not be certain that the concessionary rent would grow to the level of the headline figure by the first review. We therefore conclude that the rental concession should be spread over the term of the lease, namely ten years.

- It is useful at this juncture to consider the impact of our conclusions on the analysis of the rent paid for the Property. Using the methodology adopted by the parties but ignoring three months of the rent free period and amortising the concession over ten years we arrive at an analysis of £57.43 per m2. This figure represents the rent for the Property taking account of the rental concessions but devoid of any rateable plant and machinery. The equivalent figure for the Amazon unit in Swallowdale Lane is £65.71 per m2. We agree with Mr Hawkins that the Amazon unit is superior to the Property and this undoubtedly accounts for the differential between the two.

- Surprisingly, neither party, in either of their reports, had considered whether it was appropriate to adjust the rents at the Property or at Amazon Swallowdale Lane, for the effects of rental growth to the AVD. We would have been assisted by evidence about the state of the market at the time in Hemel Hempstead but we observe that all of the other distribution warehouses in the locality were occupied when the lease for the Property was agreed and there was no significant new supply until 2019 when the Blossom Way units were completed. The letting at the Property was completed in the space of seven months, perhaps indicating that distribution warehouse floor space was in short supply. The parties adduced the barest minimum of detail about the other transactions in the locality and without the knowledge of how the rents were arrived at we think it would be unwise to accord them much, if any, weight.

- Comparison of the 2014 headline rent and the 2019 rent review at the Property reveals a difference of 26.18%. A similar level of growth is evident in the Amazon Swallowdale rent which grew by 25.0% between the 2013 letting and the commencement of the subsequent lease in 2019. Mr Hawkins acknowledged at the hearing that 'markets fluctuate' and Mr Steel admitted that when considering the letting evidence some rental growth was implicit in the tone of £67.50 per m2.

- Whilst it is evident that rents grew strongly between 2013 and 2019 we have no evidence to show exactly when that growth took place. The similar relative growth shown at the Property and Amazon suggests that the market was flat between October 2013 and July 2014 and it would have been very unlikely to have grown significantly in the nine months that followed. We are inclined to the view therefore that the two lettings demonstrate that the rent for the Property, on the basis that the statute defines, should be based on a figure of £65.71 per m2, which we round to £65.75.

- In his rebuttal report Mr Hawkins had distinguished between the practice for the 2017 List under the check, challenge and appeal regime and earlier lists where evidence was openly exchanged between the VO and agents. Mr Hatchwell submitted that the absence of co-ordinated exchange in the Check/Challenge/Appeal in the 2017 List had led to lack of awareness of the 2014 letting at the Property and the 2013 Letting of Amazon, Swallowdale Lane. Mr Hawkins said that during a conversation with the agents dealing with the latter property it was revealed that they were unaware of the rent free period in the lease when they decided not to make a formal challenge. Mr Hatchwell submitted that neither rent had been "subsumed" in a tone and that "a pattern of assessments which has emerged in ignorance of actually existent rental evidence is not a tone".

- Mrs Franklin submitted that the tone value of the Property and the comparable properties was established and had been undisturbed for the last eight years. The levels of value adopted were a matter of fact, not opinion. The 2017 List is now closed and there are no challenges outstanding on distribution warehouses in Hemel Hempstead, so no further alterations can be proposed or made. She contended that the circumstances at Hemel Hempstead aligned with those in Futures London Limited v Stratford (VO) where tone was found to have been established in the closed 2000 List. At paragraph 24 Mr Peter Clark FRICS referred to the approach adopted by the VO when valuing properties and the same approach has been adopted in this instance.

- Mrs Franklin cited paragraph 25, where Mr Clark considered when tone is established.

- Mrs Franklin submitted that in line with Mr Clark's reasoning, the tone for distribution warehouses in Hemel Hempstead had been firmly established. Three of the eight properties had been subject to settled challenges made by experienced rating surveyors and none had resulted in the tone being altered. Of the remaining five properties, four had been subject to check confirmation which meant that the breakdown of their valuations had been scrutinised and no challenges had been made. Only one property had not been the subject of a check or challenge.

- She distinguished the situation at Hemel Hempstead from that in Arma Hotels Ltd v Dawn Bunyan (VO) [2023] UKUT 3 (LC) where the Tribunal (Mrs Diane Martin TD MRICS FAAV) found that the tone was not established owing to lack of evidence of agreement to the current assessments. In that case, Mrs Franklin submitted, some of the assessments on the comparable properties had been amended only a few months previously, and it was contended that many occupiers would have been eligible for Covid 19 relief. At Hemel Hempstead the list is closed to further challenges, the tone has remained undisturbed for eight years and significant payment liability means it would have been worthwhile ratepayers challenging assessments if they believed them to be excessive.

- In our judgement the introduction of the check, challenge and appeal methodology for the resolution or determination of appeals has changed the approach of ratepayers and their advisors to alteration of the rating list. We accept the point made by Mr Hatchwell concerning the absence of exchange of evidence and the consequent lack of awareness of relevant rental evidence around the AVD. At Hemel Hempstead there seems to have been very little co-ordination between advisors and the VO regarding rental information and it is surprising that key rents appear not have been at the forefront of discussions. This problem has possibly been exacerbated by an appeal process that meant in this case the issues have taken more than four years to be resolved. It appears that the stages set out in Futures London Limited v Stratford (VO) [2005] RA 75 are now less easily defined and establishment of a tone is less clear cut.

- Mr Hawkins relied on a valuation based on the rent passing at the property, and the disabilities that he identified in the property were effectively baked into his end figure rather than being accounted for separately. Mr Steel made an allowance of 8.5%, a figure that had been agreed on the 2010 List and carried over.

- Both parties therefore agree that the Property warrants an end allowance, it is just a question of quantum. It appears to us that the answer can most easily be derived from a comparison of the Property and Amazon in Swallowdale Lane. Mr Hawkins described Amazon as a 'high grade example of a post 2000 built distribution warehouse'. It appears to us to have no disadvantageous features and was developed by Prologis, a well-known participant in this sector of the market. It is a suitable baseline from which to make judgements about the features of the Property. It is in the same location, is similar in size, and it was let eight months earlier. It is possible to make a direct comparison and the difference between the two represents the disadvantages inherent at the Property. By our calculation the difference between the analysed rents of £65.71 per m2 for Amazon and £57.43 per m2 for the Property is 12.6%. It is not necessary for us to apportion this figure between the various factors identified by the parties, and we use this as our end allowance.

- Our analysis of the two pieces of rental evidence now known to have been available at the AVD, and our finding that there is no discernible evidence of rental growth between the dates of those lettings and the AVD, lead us to conclude that a main space rate of £65.75 per m2 is appropriate for distribution warehouses in Hemel Hempstead with 12 metre eaves.

- When this figure is applied to the Property, with an area ITMS of 14,183m2, the unadjusted assessment is £932,525. We then apply an end allowance of 12.6% for the various disabilities which brings us to £815,027. We then add plant and machinery at £12,091 leading to a final assessment of £827,118. We round to rateable value £825,000.

RATING – valuation – alteration of 2017 rating list – distribution warehouse – rental evidence – evidence of other assessments - end allowance – appeal allowed – assessment determined at rateable value £825,000

The following cases were referred to in this decision:

Arma Hotels Ltd v Dawn Bunyan (VO) [2023] UKUT 3 (LC)

Futures London Limited v Stratford (VO) [2005] RA 75

Lamb (VO) v Go Outdoors Ltd [2015] UKUT 366 (LC)

Lotus and Delta Limited v Culverwell (VO) and Leicester City Council [1976] RA 141

Introduction

The facts

The appellant's occupation and lease

| Term commencement date: | 10 July 2014 |

| Term expiry date: | 9 July 2024 |

| Initial rent payable: | £990,570 per annum |

| Rent commencement date: | 10 April 2015 |

| Rent review date: | 10 July 2019 |

| Rent free: | 9 months rent free and then 50% rent for 14 months |

| Rent review basis: | Open market rent or passing rent, whichever is higher |

| Mezzanine rent: | Geared to 25% of the base rent |

| Alienation: | Assignment of the whole permitted subject to entering into an Authorised Guarantee Agreement, underletting of the whole permitted outside the Landlord and Tenant Act 1954. No sub underletting of part. |

The statutory context

'"hereditament" means property which is or may become liable to a rate, being a unit of such property which is, or would fall to be, shown as a separate item in the valuation list.'

(a) matters affecting the physical state of the hereditament;

(aa) matters affecting the physical enjoyment of the hereditament;

(b) the mode or category of occupation of the hereditament;

(c) ....

(cc)

(d) matters affecting the physical state of the locality in which the hereditament is situated;

(da) matters which, though not affecting the physical state of the locality in which the hereditament is situated, are nonetheless physically manifest there, and

(e) the use or occupation of other premises situated in the locality of the hereditament.

Valuation of distribution warehouses for rating

| Accommodation type | Floor level | Factor |

| Warehouse | GF | 100% |

| Offices | GF & FF | 120% |

| Ancillary office | GF | 110% |

| Ancillary office | Mezz | 100% |

| Area under supported floor | GF | 70% |

| Supported floor | Mezz | 50% |

| Canopy | GF | 25% |

| Gatehouse | GF | 100% |

| Car and lorry parking | Reflected in the main rate |

None of these factors is disputed by the appellant. In Hemel Hempstead a main space rate of £67.50 or £68.00 per m2 has been adopted for distribution warehouses with 12 metre eaves. The table below shows the division of floorspace in the building, together with the factorised areas and the adjustments for air conditioning (+5%), fire protection (+2.5%) and lack of heating (-2.5%).

| Floor | Description |

Actual Area (m2) |

Area ITMS (m2) |

Air Con +5% | Fire protection + 2.5% |

Lack of heating | Adopted Area ITMS |

| Ground Floor | Warehouse | 5544.85 | 5544.85 | 1.025 | 5683.47 | ||

| Ground Floor | Area Under Mezz Floor | 5310.02 | 3717.01 | 1.025 | 3809.93 | ||

| Ground Floor | Office/WC's/Lockers | 267.86 | 294.65 | 1.025 | 302.02 | ||

| Ground Floor | Office | 461.28 | 553.54 | 1.05 | 1.025 | 595.75 | |

| Ground Floor | Office | 62.83 | 69.11 | 1.05 | 1.025 | 74.38 | |

| Ground Floor | Gatehouse | 21.38 | 21.38 | 21.38 | |||

| Ground Floor | Pump House | 48.33 | 36.25 | 36.25 | |||

| Ground Floor | Canopy | 746.90 | 186.72 | 1.025 | 0.975 | 186.60 | |

| First Floor (under Mezz) | Office | 62.83 | 69.11 | 1.05 | 1.025 | 74.38 | |

| Mezzanine Floor | Store/Packing Area | 5263.55 | 2631.77 | 1.025 | 2697.56 | ||

| First Floor | Offices | 461.28 | 553.54 | 1.05 | 1.025 | 595.75 | |

| Mezzanine Floor | Office/Server Room | 73.86 | 73.86 | 1.05 | 1.025 | 79.49 | |

| Mezzanine Floor | Office | 24.08 | 24.08 | 1.05 | 1.025 | 25.92 | |

| TOTALS | 18,349.05 | 13,775.87 | 14,182.88 |

The Parties' arguments

Expert evidence

a. Selection and weighting of evidence

b. Analysis of the rent for the Property and Amazon, Swallowdale Lane (treatment of rental concessions)

c. Rental growth

d. Whether a tone of the list for exists for distribution warehouses at Hemel Hempstead

e. End allowances

Selection and weighting of evidence

a. Where the hereditament which is the subject of consideration is actually let, that rent should be taken as a starting point.

b. The more closely the circumstances under which the rent was agreed both as to time, subject matter and conditions, relate to the statutory assumptions, the more weight should be attached to it.

c. Where rents of similar properties are available they too are properly to be looked at through the eye of the valuer in order to confirm or otherwise the level of value indicated by the actual rent of the subject hereditament.

d. Rating assessments of other comparable properties are also relevant. When a valuation is prepared these assessments are to be taken as indicating comparative values as estimated by the valuation officer. In subsequent proceedings on that list therefore they can properly be referred to as giving some indication of that opinion.

e. In light of all the evidence an opinion can then be formed of the value of the subject hereditament, the weight to be attributed to the different types of evidence depending on the one hand on the nature of the actual rent and, on the other hand, on the degree of comparability found in other properties.

f. In cases where there is no evidence of rents of comparable properties, a review of other assessments may be helpful, but in such circumstances it would clearly be more difficult to reject the evidence of the actual rent.

"These propositions provide guidance on the usefulness of different types of evidence but they should not be regarded as rules to be followed slavishly. It will be necessary to have regard to relevant evidence of all types, if available, but always with a clear focus on the statutory valuation hypothesis."

Analysis of the rent for the Property and Amazon, Swallowdale Lane

"4.1.3 The principle of granting a rent-free period to reflect the time required for fitting out the property to suit the tenant's reasonable needs is common practice in many markets. Therefore it may not normally be regarded as an incentive. It represents a balance between the landlord's need to secure an income from as early a date as possible and the tenant's need not to have a rent liability until the property can be occupied.

4.1.4 What is considered a reasonable length of time for the fitting out will vary according to the extent of the works, the size of the property in question and local market practice. Where specialist fitting out is involved, the time taken may go beyond a normal fitting-out period and an element may not be considered to be part of the reasonable fitting-out period."

Rental growth

Tone of the list

"Rateable value is based on market rents but these usually vary, sometimes

considerably, and it is often difficult to find a general pattern. When preparing a rating list the valuation officer is required to value each hereditament individually and to have regard to the underlying principle of uniformity, fairness and equality. Although rents may vary greatly assessments must show a uniform pattern. This has led to assessment by the use of common unit figures for classes of hereditament, location, finish, size etc, often with individual adjustments for particular characteristics."

"There are three stages leading to the establishment of tone of the list. At first, when a new rating list is put on deposit, assessments will carry relatively little weight: they are opinions of value by the valuation officer, as yet unchallenged and untested by negotiation. Over time assessments will be challenged and agreed or determined by a VT or this Tribunal or accepted by lack of challenge. Finally, a stage will be reached when enough assessments have been agreed or determined or are unchallenged to establish a pattern of values, a tone of the list. The list is then said to have settled: rents will be largely subsumed into assessments. At this stage rating surveyors will have little regard to rents and pay considerable attention to assessments. The position at any time regarding the tone of the list is a question of fact. When an assessment is challenged before a tribunal the correct time for deciding whether the tone of the list has been established is immediately before the hearing. The weight to be given to comparable assessments as evidence of value will depend on the circumstances in each case. These may indicate that little or no weight should be given to comparable assessments, eg where acceptance of value is more acceptance of rate liability or where a body of settlement evidence rests on a single agreed assessment."

End Allowance

Conclusion and determination

Mrs Diane Martin TD MRICS FAAV

Mr Mark Higgin FRICS FIRRV

5 June 2025

Right of appeal

Any party has a right of appeal to the Court of Appeal on any point of law arising from this decision. The right of appeal may be exercised only with permission. An application for permission to appeal to the Court of Appeal must be sent or delivered to the Tribunal so that it is received within 1 month after the date on which this decision is sent to the parties (unless an application for costs is made within 14 days of the decision being sent to the parties, in which case an application for permission to appeal must be made within 1 month of the date on which the Tribunal's decision on costs is sent to the parties). An application for permission to appeal must identify the decision of the Tribunal to which it relates, identify the alleged error or errors of law in the decision, and state the result the party making the application is seeking. If the Tribunal refuses permission to appeal a further application may then be made to the Court of Appeal for permission.