Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Lands Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Lands Chamber) >> The Chimes (Blackpool) Ltd, In the Matter Of (LANDLORD & TENANT - SERVICE CHARGES - whether services charges reserved as rent - legal costs in connection with service charges - whether appeallant provided sufficient information to the FTT to enable it to exercise its jurisdiction under sec.27A Landlord and Tenant Act 1985) [2024] UKUT 431 (LC) (19 December 2024)

URL: http://www.bailii.org/uk/cases/UKUT/LC/2024/431.html

Cite as: [2024] UKUT 431 (LC)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation Number: [2024] UKUT 431 (LC)

Case No: LC-2024-566

IN THE UPPER TRIBUNAL (LANDS CHAMBER)

AN APPEAL AGAINST A DECISION OF THE FIRST-TIER PROPERTY CHAMBER

REF: MAN/OOEY/LSC/2022/0109

19 December 2024

TRIBUNALS, COURTS AND ENFORCEMENT ACT 2007

AN APPEAL FROM A DECISION FOR THE FIRST-TIER TRIBUNAL (PROPERTY CHAMBER)

LANDLORD AND TENANT - SERVICE CHARGES - whether service charges reserved as rent - legal costs in connection with service charges - whether the appellant provided sufficient information to the First-tier Tribunal to enable it to exercise its jurisdiction under section 27A of the Landlord and Tenant Act 1985

An appeal brought by the chimes (blackpool) ltd

Flat P,

The Chimes,

1a Forest Gate,

Blackpool,

FY3 9AR

Upper Tribunal Judge Elizabeth Cooke

Determination on written representations

© CROWN COPYRIGHT 2024

Introduction

1. This is an appeal from a determination of the First-tier Tribunal about whether service charges were payable in respect of Flat P, The Chimes, Blackpool. The appellant has been represented by its managing agent Mr Michael White; the tenant, Mr James Murray, took no part in the FTT proceedings and has chosen not to participate in the appeal, which has been conducted under the Tribunal’s written representations procedure.

The background

2. Flat P, The Chimes, is one of 15 flats in the building. The appellant holds a 999-year lease of the building and has granted long underleases of the flats; all the underlessees of the flats are members of the appellant, including Mr Murray. The lease of Flat P, granted in 2004 to a predecessor in title of Mr Murray, contains the usual obligations on the part of the appellant as landlord to insure, repair and maintain the building, and covenants by the lessee to pay service charges. By clause 3(7) of the lease the lessee covenanted:

“To pay the Underlessor … all costs charges and expenses (including legal costs and fees payable to a Surveyor) which may be incurred by the Underlessor … in connection with the recovery of arrears of rent or for the purposes of or incidental to the preparation and service of any notices or proceedings under section 146 and 147 of the Law of Property Act 1925 …”

3. The appellant appointed Mr White as manager of the building with effect from 1 July 2021, when there were arrears of service charges in respect of Flat P. Up until that date the service charge years ran from 1 July each year, which did not accord with the provisions of the leases; accordingly the period was changed so as to end on 31 December each year as the leases prescribed. That meant that the next service charge period ran for 18 months to 31 December 2022.

4. Further arrears accrued. The FTT has jurisdiction under section 27A of the Landlord and Tenant Act 1985 to determine whether and to what extent service charges are payable, and it has a corresponding jurisdiction in respect of administration charges under paragraph 5 of Schedule 11 to the Commonhold and Leasehold Reform Act 2002. The appellant applied to the FTT for a determination that service charges for five periods were reasonable and payable, namely:

a. The three 12-month periods ending on 30 June 2019, 2020 and 2021,

b. the 18-month period ending on 31 December 2022, and

c. the 12-month period ending on 31 December 2023.

5. It also asked the FTT to determine whether its legal fees in respect of the proceedings could be recovered under clause 3(7), presumably by way of administration charge.

6. The FTT made its decision on the papers without a hearing. No representations were received from Mr Murray. The FTT held that the service charges for the periods ending on 30 June 2019, 2020 and 2021 were reasonable and payable and that service charges of no greater amount than the sum budgeted for the period ending 31 December 2023 would be reasonable. However, as to the 18-month period ending on 31 December 2022 it said this:.

“22.2 Service charge period 1 July 2021 to 31 December 2022

The Tribunal notes as follows:

(1) There is no breakdown of the amount of £1070 charged [for that period] and

(2) Mr White’s statement that the accounts for this period are in the course of preparation.

(3) In the absence of any information regarding the service charge items and/or the amounts charged in respect thereof for the period in question, the Tribunal is unable to make any determination under section 27A of the 1985 Act. In particular, the Tribunal is surprised by the Applicant’s failure to provide any budget or draft accounts for the relevant period or that, having regard to the date of this determination, that the service charge accounts have not been finalised.”

7. As to the legal costs of the proceedings, the FTT said that there was no evidence before it that the appellant intended to issue any notices or proceedings for forfeiture of the lease, and that therefore the costs of the FTT proceedings could not be recovered under clause 3(7).

The appeal

8. The appellant has permission to appeal on two grounds.

9. The first is that the legal costs were payable under clause 3(7) of the lease on the basis that the service charges were reserved in the lease as rent, so that proceedings to recover service charges were in fact proceedings to recover rent and were within the scope of the clause.

10. On perusal of the lease it is clear that that is not the case. On page 3 of the lease, in clause 2, the underlessee covenants to pay “by way of further or additional rent” the appellant’s costs of insuring the building; but the covenant to pay service charges is simply a covenant to pay, and payment is not said to be by way of rent. The appeal therefore fails on that point.

11. The other ground of appeal is that the FTT was not correct to find that there was insufficient information on which to base a determination of the service charges payable in the 18 months ending in December 2023.

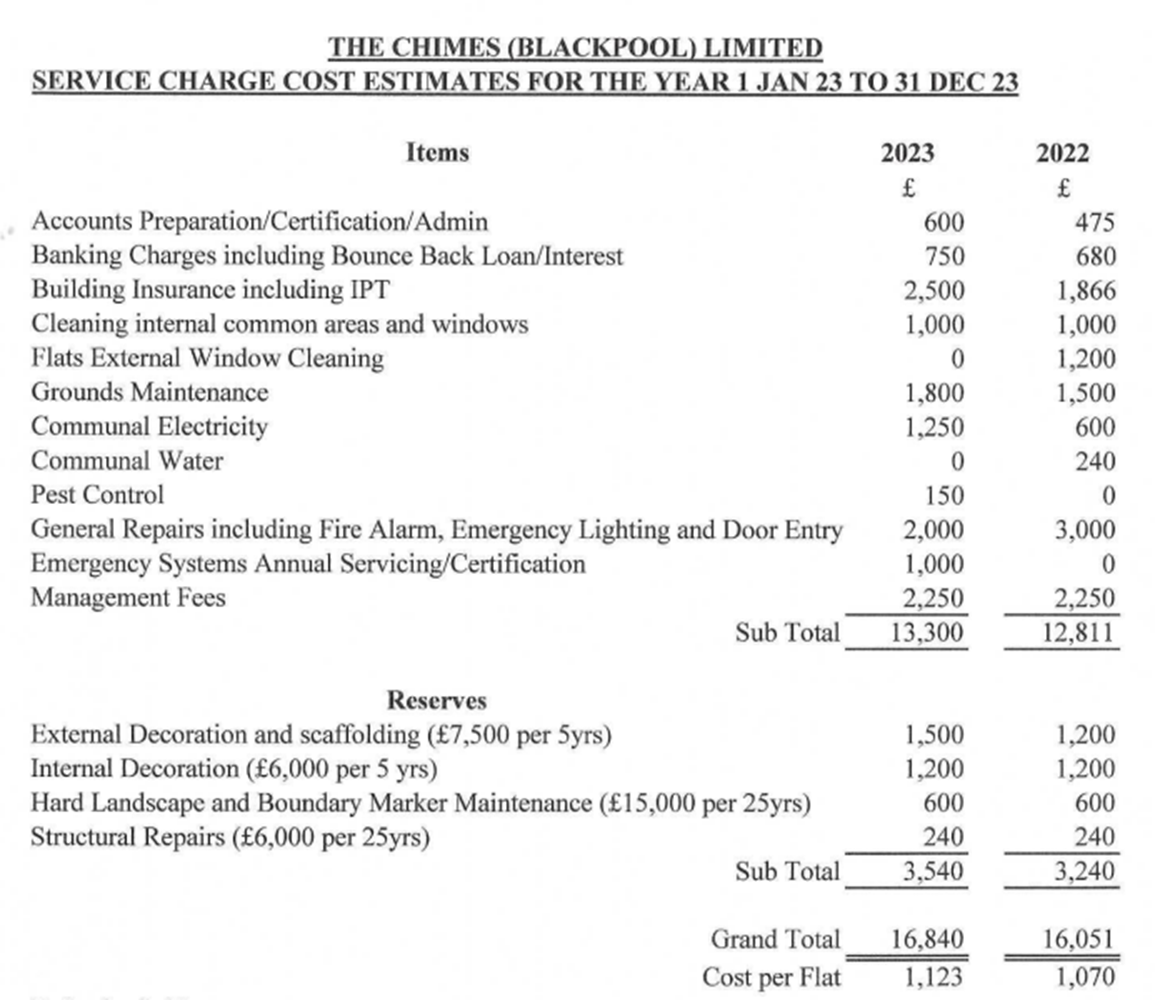

12. On that point I take the view that the appellant is correct: a breakdown of the £1,070 was provided. It may not have been entirely easy to find, because it was part of a document attached to the invoice for 2023, in which the charges for the 12-month 2023 service charge period were set out side by side with the amounts charged for the preceding 19-month period. True, the appellant had not provided to the FTT a copy of the identical breakdown sent to the tenant with the demand for the £1,070, dated 1 August 2022 (which the appellant has now sent to the Tribunal in the course of the appeal, but which is irrelevant to the appeal because it was not shown to the FTT). But the FTT did have the breakdown. Had there been a hearing the appellant would have been able to point the FTT to the relevant document.

13. The other difficulty with the FTT’s decision about this period is that the absence of accounts for the period, is not relevant to what the FTT had to decide, which was whether the charges for the 18-month period were reasonable.

14. The FTT in making its decision insofar as it related to the period from 1 July 2021 to 31 December 2022 failed to take into account a relevant consideration, namely the breakdown of charges, and took into account an irrelevant consideration, the absence of accounts, and is set aside.

The Tribunal’s decision about the charges for the 18-month period

15. There is no point remitting the matter to the FTT since the Tribunal has the material the FTT needed in order to make a decision about the period 1 July 2021 to 31 December 2022, and so can substitute its own decision.

16. The breakdown of the costs for this period appears to have been no less detailed than that provided for the other years in issue. Mr Murray has not taken part in the proceedings and so there is no suggestion from him that the charges in issue are unreasonable. The figures given are as follows:

17. From the parallel figures it can be seen that the charges for the 18-month period are rather less than the estimates for the following 12 months, which the FTT regarded as reasonable. For a building of this size, and in the absence of challenge from Mr Murray, the charges are clearly reasonable and therefore payable.

Conclusion

18. The appeal fails as regards the costs of the proceedings; but service charges in the sum of £1,070 in respect of the costs incurred in the period 1 July 2021 to 31 December 2022 are payable by Mr Murray.

19. In written representations in support of the grounds of appeal Mr White has raised other points such as the payment of interest on unpaid service charges. Permission to appeal was granted only on the two grounds discussed here and I cannot comment on any other matters.

Upper Tribunal Judge Elizabeth Cooke

19 December 2024

Right of appeal

Any party has a right of appeal to the Court of Appeal on any point of law arising from this decision. The right of appeal may be exercised only with permission. An application for permission to appeal to the Court of Appeal must be sent or delivered to the Tribunal so that it is received within 1 month after the date on which this decision is sent to the parties (unless an application for costs is made within 14 days of the decision being sent to the parties, in which case an application for permission to appeal must be made within 1 month of the date on which the Tribunal’s decision on costs is sent to the parties). An application for permission to appeal must identify the decision of the Tribunal to which it relates, identify the alleged error or errors of law in the decision, and state the result the party making the application is seeking. If the Tribunal refuses permission to appeal a further application may then be made to the Court of Appeal for permission.