Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Lands Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Lands Chamber) >> The Beaches Management Ltd v Furbear & Ors (PARK HOMES - PITCH FEE REVIEW - validity of procedure - whether pitch fee review notice and pitch fee review form have to be different document) [2024] UKUT 180 (LC) (19 June 2024)

URL: http://www.bailii.org/uk/cases/UKUT/LC/2024/180.html

Cite as: [2024] UKUT 180 (LC)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation Number: [2024] UKUT 180 (LC)

Case No: LC-2023-759

IN THE UPPER TRIBUNAL (LANDS CHAMBER)

AN APPEAL AGAINST A DECISION OF THE FIRST-TIER TRIBUNAL (PROPERTY CHAMBER)

FTT REF: CHI/45UC/PHI/2023/0039-0043, CHI/45UC/PHI/2023/0045-0051

19 June 2024

TRIBUNALS, COURTS AND ENFORCEMENT ACT 2007

PARK HOMES - PITCH FEE REVIEW - validity of procedure - whether pitch fee review notice and pitch fee review form have to be different documents - requirements for signature by the site owner - reasons for displacement of the presumption that the pitch fee is to rise in line with the retail prices index - entitlement to receive a pitch fee

BETWEEN:

THE BEACHES MANAGEMENT LTD

Appellant

-and-

(1) MR D AND MRS J FURBEAR

(2) MS D FRAY (3) MRS S FELLOWS

(4) MR B CARTER AND MARS C GREEN-CARTER

(5) MR R SIMON (6) MRS J COX

(7) MR P AND MRS J BROWN

(8) The estate of MRS D ROSE

(9) MR G MAYES-JONES AND MS C MARCH

(10) MR AND MRS EDWARDS

(11) MRS L MARTIN (12) MISS S TIPLER

Respondent

1,2,8,12,14,19,20,21,22,23,24 and 27 Beechfield Park,

Hook Lane, Aldingbourne,

Chichester, West Sussex, PO20 3XX

Upper Tribunal Judge Elizabeth Cooke

13 June 2024

Mr David Sunderland for the appellant

Ms Caroline March for the respondents

© CROWN COPYRIGHT 2024

The following cases are referred to in this decision:

Vyse v Wyldecrest Parks (Management) Limited [2017] UKUT 24 (LC)

Wyldecrest Parks (Management) Limited v Truzzi-Franconi [2023] UKUT 42 (LC)

Introduction

1. This is an appeal from a decision of the First-tier Tribunal ("the FTT") that the appellant in late 2022/early 2023 failed to follow a valid procedure in order to raise the pitch fee in relation to 12 mobile home pitches at Beechfield Park, Chichester, and alternatively that if the procedure was correct that it was not reasonable for the pitch fee to be changed.

2. Beechfield Park is a residential mobile home site and it is not in dispute that the Mobile Homes Act 1983 applies to the agreements under which the occupiers live there. They are protected by the security of tenure provisions of the 1983 Act, and their pitch fee can only be changed if the procedure prescribed in the 1983 Act and in regulations made under it is followed.

3. The appellant, The Beaches Management Limited, holds a lease of Beechfield Park, granted in 2016, to expire in 2067. The respondents are the occupiers of mobile homes on 12 pitches at Beechfield Park.

4. The appellant was represented by Mr David Sunderland, and the respondents, with the exception of Mr Simon, Mr Mayes-Jones and the estate of Mrs Rose, were represented by Ms Caroline March. I am grateful to them both. The respondents whom she did not represent did not participate in the appeal.

The legal and factual background

The Mobile Homes act 1983, the owner and the occupier

5. Section 1 of the Mobile Homes Act 1983 says:

"(1) This Act applies to any agreement under which a person ("the occupier") is entitled–

(a) to station a mobile home on land forming part of a protected site; and

(b) to occupy the mobile home as his only or main residence."

6. A "protected site" is defined by section 1(2) of the Caravan Sites Act 1968, and it is agreed that Beechfield Park is a protected site. A protected site has to be licensed, and the appellant holds the site licence for Beechfield Park. Its lease of the site, from 1 January 2016 to 1 November 2067, was granted by Silver Lakes Property Investments Limited. The lease states that the term is granted subject to a number of leases of individual pitches to Silk Tree Properties Limited, Silver Lakes Mobile Homes Limited, Harquail Properties Limited and Sussex Mobile Homes Limited, described as the "occupational leases", and those leases are noted on the charges register of the appellant's registered title and appear to be for terms of 20 or 40 years,

7. The respondents all have agreements entitling them to live in a mobile home on the site; ten of them have agreements with Wyldecrest Parks Management Limited (numbers 1, 2, 12, 14, 19, 20, 21, 22, 23 and 24), all granted in 2019 or later. The occupiers of pitches 8 and 27 have agreements with Harquail Homes Limited. Of those agreements a sample was provided in the appeal bundle, and hard copies of the rest at the hearing; it is not in dispute that all the agreements made provision for the payment not only of a pitch fee but also of a variable service charge.

8. Obviously an agreement entitling someone to live on land in a mobile home can only be made by a person with the right to possession of that land. The Mobile Homes Act defines an "owner" in section 5:

"owner, in relation to a protected site, means the person who, by virtue of an estate or interest held by him, is entitled to possession of the site or would be so entitled but for the rights of any persons to station mobile homes on land forming part of the site"

and the parties to the agreements regulated by the 1983 Act are referred to as the "owner" and the "occupier" throughout. The Act recognises that land can change hands and makes provision in section 3 for the benefit and burden of such agreements to pass to successors in title of the owner, or to persons who claim "through or under" the owner, such as a lessee.

9. The appellant's case in the FTT and on appeal is that it is the "owner" of Beechfield Park as defined in section 5, by virtue of its lease of the site and has been since the grant of that lease in 2016.

The pitch fee and the procedure for review

10. The statute sets out terms that are to be implied in all the agreements it regulates, one of which is that "The occupier shall ... pay the pitch fee to the owner" (Schedule 1, Chapter 2, paragraph 21); the pitch fee is defined in paragraph 29 of Schedule 1, Chapter 2, as follows:

""pitch fee" means the amount which the occupier is required by the agreement to pay to the owner for the right to station the mobile home on the pitch and for use of the common areas of the protected site and their maintenance, but does not include amounts due in respect of gas, electricity, water and sewerage or other services, unless the agreement expressly provides that the pitch fee includes such amounts"

11. Paragraph 16 of Schedule 1 to the 1983 Act says this:

"16. The pitch fee can only be changed in accordance with paragraph 17, either—

(a) with the agreement of the occupier, or

(b) if the [FTT], on the application of the owner or the occupier, considers it reasonable for the pitch fee to be changed and makes an order determining the amount of the new pitch fee."

12. So if an increase in the pitch fee is proposed by the site owner and the occupier does not agree to it, the pitch fee will not be changed unless the FTT so decides. Moreover, the site owner can only change the pitch fee by following the procedure set out in paragraph 17. The paragraph refers to the review date, which in the respondents' agreements is 1 November each year, and makes provision for review either as at the review date or later if the site owner is too late to change the fee at the review date. The paragraph so far as relevant reads as follows

" 17. (1) The pitch fee shall be reviewed annually as at the review date.

(2) At least 28 clear days before the review date the owner shall serve on the occupier a written notice setting out his proposals in respect of the new pitch fee.

(2A) In the case of a protected site in England, a notice under subparagraph (2) which proposes an increase in the pitch fee is of no effect unless it is accompanied by a document which complies with paragraph 25A.

(3) If the occupier agrees to the proposed new pitch fee, it shall be payable as from the review date.

(4) If the occupier does not agree to the proposed new pitch fee—

(a) the owner or (in the case of a protected site in England) the occupier] may apply to the [FTT] for an order under paragraph 16(b) determining the amount of the new pitch fee;

(b) the occupier shall continue to pay the current pitch fee to the owner until such time as the new pitch fee is agreed by the occupier or an order determining the amount of the new pitch fee is made by the [FTT] under paragraph 16(b); and

(c) the new pitch fee shall be payable as from the review date but the occupier shall not be treated as being in arrears until the 28th day after the date on which the new pitch fee is agreed or, as the case may be, the 28th day after the date of the [FTT] order determining the amount of the new pitch fee.

(5) An application under sub-paragraph (4)(a) may be made at any time after the end of the period of 28 days beginning with the review date but, in the case of an application in relation to a protected site in England, no later than three months after the review date.

(6) Sub-paragraphs (7) to (10) apply if the owner—

(a) has not served the notice required by sub-paragraph (2) by the time by which it was required to be served, but

(b) at any time thereafter serves on the occupier a written notice setting out his proposals in respect of a new pitch fee.

(6A) In the case of a protected site in England, a notice under subparagraph (6)(b) which proposes an increase in the pitch fee is of no effect unless it is accompanied by a document which complies with paragraph 25A.

(7) If (at any time) the occupier agrees to the proposed pitch fee, it shall be payable as from the 28th day after the date on which the owner serves the notice under sub-paragraph (6)(b).

(8) If the occupier has not agreed to the proposed pitch fee—

(a) the owner or (in the case of a protected site in England) the occupier may apply to the [FTT] for an order under paragraph 16(b) determining the amount of the new pitch fee;

(b) the occupier shall continue to pay the current pitch fee to the owner until such time as the new pitch fee is agreed by the occupier or an order determining the amount of the new pitch fee is made by the [appropriate judicial body]3 under paragraph 16(b); and

(c) if the [FTT] makes such an order, the new pitch fee shall be payable as from the 28 th day after the date on which the owner serves the notice under sub-paragraph (6)(b).

(9) An application under sub-paragraph (8) may be made at any time after the end of the period of 56 days beginning with date on which the owner serves the notice under sub-paragraph (6)(b)... .

13. To summarise, in order to raise the pitch fee the site owner must send to the occupier a pitch fee review notice (paragraph 17(2) or 17(6)(b)), and it must be "accompanied by a document which complies with paragraph 25A". If the occupier agrees to the increase then it will take effect on the review date if the owner served the notice in time, or on the 28th day after service otherwise, and there are provisions to ensure that the occupiers only have to pay the current fee until a determination is made by the FTT if the new fee is not agreed.

The Pitch Fee Review Notice

14. The pitch fee review notice, as a written notice given pursuant to the site owner's agreement with the occupier, should comply with the provisions of paragraph 26(3) of schedule 1 to the 1983 Act, which reads as follows:

"(3) Where in accordance with the agreement the owner gives any written notice to the occupier or (as the case may be) a qualifying residents' association, the notice must contain the following information—

(a) the name and address of the owner; and

(b) if that address is not in England or Wales, an address in England or Wales at which notices (including notices of proceedings) may be served on the owner.

15. Paragraph 26(4) explains what is to happen if the notice does not contain that information:

"(4) Subject to sub-paragraph (5) below, where—

(a) the occupier or a qualifying residents' association receives such a notice, but

(b) it does not contain the information required to be contained in it by virtue of sub-paragraph (3) above,

the notice shall be treated as not having been given until such time as the owner gives the information to the occupier or (as the case may be) the association in respect of the notice."

The Pitch Fee Review Form

16. The document that must accompany the pitch fee review notice is known as the pitch fee review form; paragraph 25A was amended in July 2023 but the version in force at the date relevant to this appeal said this:

"25A. (1) The document referred to in paragraph 17(2A) and (6A) must—

(a) be in such form as the Secretary of State may by regulations prescribe,

(b) specify any percentage increase or decrease in the retail prices index calculated in accordance with paragraph 20(A1),

(c) explain the effect of paragraph 17,

(d) specify the matters to which the amount proposed for the new pitch fee is attributable,

(e) refer to the occupier's obligations in paragraph 21(c) to (e) and the owner's obligations in paragraph 22(c) and (d), and

(f) refer to the owner's obligations in paragraph 22(e) and (f) (as glossed by paragraphs 24 and 25)."

17. That is a complicated provision, but for present purposes the important point is that for this second document there is a prescribed form. It is prescribed by regulations, currently the Mobile Homes (Pitch Fees) (Prescribed Form) (England) Regulations 2023, but at the date relevant to this appeal the Mobile Homes (Pitch Fees) (Prescribed Form) (England) Regulations 2013, of which regulation 2 stated that the Pitch Fee Review Form "shall be in the form prescribed in the Schedule to these Regulations or in a form substantially to the like effect."

18.

|

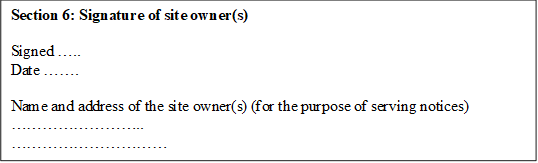

The form contained in the Schedule is headed "Form to accompany a pitch fee review notice" and contains numbered boxes with provision for the site owner to set out the parties, the proposed new fee, the date it is to take effect and the way it is calculated. Box 5 contains text setting out "What to do if you disagree with the proposed new pitch fee". Box 6 looks like this:

19. Box 7 contains extensive notes about the provisions of the 1983 Act and the effect of the pitch fee review notice.

The amount by which the pitch fee can be changed

20. Paragraph 20 of Schedule 1, Chapter 2 to the 1983 Act provided, at the time relevant to this appeal, that "unless this would be unreasonable having regard to paragraph 18(1), there is a presumption that the pitch fee shall increase or decrease by a percentage which is no more than any percentage increase or decrease in the retail prices index". Since July 2023 instead of "retail prices index" the paragraph refers to the "consumer process index". Paragraph 18(1) sets out various matters such as deterioration in the site since the last pitch fee review or (in certain circumstances) improvements.

21. Where none of the factors mentioned in paragraph 18(1) makes it unreasonable, the presumption arises that the pitch fee can be raised in line with the RPI (or CPI after July 2023). But that is a presumption, not a conclusion, and it can be displaced. In Vyse v Wyldecrest Parks (Management) Limited [2017] UKUT 24 (LC) the Tribunal (HHJ Alice Robinson) observed that there is no restriction on the factors that might displace the presumption, but that they would have to be factors "to which considerable weight attaches". If the FTT determines that it is reasonable for the pitch fee to change, and that the presumption in favour of increase or decrease by the RPI is displaced, then it will make its own decision as to the appropriate increase or decrease in the pitch fee.

The facts relevant to the appeal

22. I take the facts from the decision of the FTT. The pitch fee review date in the agreements under which the respondents occupy their pitches is said to be 1 November. A pitch fee review notice and pitch fee review form, combined in a single document and dated 5 December 2022, were sent by the appellant to all the respondents, stating that a new pitch fee would take effect from 5 January 2023. The relevant provisions are therefore paragraph 17, sub-paragraph (6) and following because it was by then too late to change the pitch fee on the review date (a previous notice and form changing the fee with effect from the review date was withdrawn). The proposed change in the fee was only the increase in line with the retail prices index as described in paragraph 20 of Schedule 1, Chapter 2.

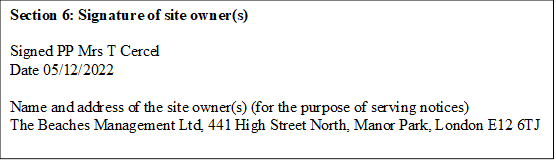

23. As I said, the pitch fee review notice and the pitch fee review form were combined in a single document. It was headed "Pitch Fee Review Notice"; below the heading it said "Accompanying this notice is a Pitch Fee Review Form. Please see below". There followed immediately the prescribed form as set out in the regulations (paragraph 17 above).

24. Box 6 of the form was as follows:

25. The respondents did not agree the new pitch fee and so the appellant made an application to the FTT under paragraph 17(8) in respect of each respondent.

The proceedings in the FTT

26. The applications to the FTT were made in February 2023. Three of them were accompanied by a pitch fee review notice and form dated 21 September 2022, and signed on behalf of Wyldecrest Parks Management Limited; the FTT took the view that that notice and form were defective and in May 2023 issued a notice under rule 9 of the FTT's rules requiring the appellant to say why the applications should not be struck out. In response, the appellant provided what it said was the correct form and notice, being identical to those sent to the rest of the respondents. On 7 August 2023 the FTT then issued a further rule 9 notice, again on the FTT's own initiative; there was no application by the respondents to strike out the applications and the concerns expressed in the rule 9 notice were not raised by the respondents. The rule 9 notice extended to 22 pages and 96 paragraphs, and included a lengthy review of the history of the legislation, most of which was reproduced in the eventual decision. After the second rule 9 notice was sent out it was realised that the concerns expressed in that notice applied to all the applications and on 9 August 2023 the FTT gave directions for all the applications to be heard together.

27. After those directions had been given the respondents filed a statement of case. They made no mention of the formal defects in the notices and forms complained of by the FTT, but expressed concern on two fronts.

28. First, the respondents said that none of them had an agreement with the appellant and the appellant had never sent out pitch fee review notices before. Their agreements were with a number of other companies, nine of them with Wyldecrest Parks Management Limited ("Wyldecrest") by which they believed the site was owned and run. They pointed out that of the 25 pitches on the site, all had received a notice on 21 September 2022, which had been withdrawn in relation to these 12 respondents but not in relation to the other 13 residents. None of the September notices was from the appellant; most were from Wyldecrest but some were from Silk Tree Properties Limited or from Silver Lakes Property Investments Limited. There were sub-leases of individual pitches (as referred to in paragraph 6 above). The respondents' pitch fee and service charge were paid to UK Properties Management Limited. They did not understand what was the role of the appellant in the "tangled web" of companies involved in the site

29. Second, they explained that many of them had initially entered into occupation agreements in respect of their pitches with Silk Tree Properties Limited for terms expiring in 2027, on the basis that the company's lease was to expire on that date. Recently they had been approached by Wyldecrest, whom they believed to be the owner of the site (although the registered freeholder was Best Holdings UK Limited) and offered a new lease for an indefinite term; the terms offered for the surrender of their current agreement and the grant of a new one were either a price of £40,000, or a doubling of the pitch fee from something over £200 per month to over £400 per month.

30. Most of them had accepted that offer. Ms March herself, for example, accepted the offer of a new agreement in 2020, at a new pitch fee of £413 in place of £214 per month. Others had paid the capital sum requested. The respondents' statement of case concluded:

"If there has been fraudulent or misleading information provided to the respondents, where pitch fees have been doubled or monies taken by promise of "in perpetuity or indefinite" leases, should the Pitch Fee be determined at the figure prior to these changes?"

31. The FTT's decision of 20 October 2023 extended to 47 pages, and 211 paragraphs (the final paragraph is numbered 157 because the numbering starts again after 54). It found that the applications were made in accordance with the time limits under paragraph 17(9). It found as follows:

a. At paragraph 103, the FTT found that the appellant was "the owner for the purposes of fulfilling the statutory requirements of the 1983 Act in respect of pitch fees".

b. As to the respondents' concern that they had been misled into signing new agreements, at paragraph 126 the FTT said that it "acknowledged the strength of the Respondents' concerns", but went on to say that it had to proceed on the basis that the original pitch fee had been agreed by the parties as a matter of contract, and that the respondents' concern that they had been duped was "not a matter that it could have regard to when considering the pitch fee."

c. The pitch fee review form was invalid because it did not set out the proposals for the review of the pitch fee, as required by paragraph 17(2), it did not include the name and address of the site owner, and it did not stand alone from the pitch fee review form.

d. Third, the pitch fee review form was invalid because it was not signed by a director or authorised person on behalf of the site owner as required by paragraph 25A(1a).

e. Fourth, those incidences of non-compliance meant that the pitch fee review notice and form were of no effect and the respondents were not liable to pay the proposed increase in the pitch fee.

f. Fifth, if the FTT was wrong about that it found that because the respondents' agreements required them to pay a service charge in addition to the pitch fee, the presumption that the fee would rise in proportion to the retail prices index was displaced.

32. The first two findings have not been appealed by the respondents.

33. The appellant has permission to appeal points c to f above, and I look at them in turn. As I shall explain, the appeal on those points is successful; I then turn to the question of disposal: should the Tribunal substitute its own decision for that of the FTT, or should it remit the matter to the FTT?

The pitch fee review notice

34. The requirement for the pitch fee review notice in paragraph 17(2) of Schedule 1 Chapter 2 to the 1983 Act is that it must set out the owner's proposals for the new pitch fee. As a notice sent by the owner to the occupier it must also comply with paragraph 26(3) of the Schedule and give a name and address for the owner. The FTT in its rule 9 notice expressed the view that because the pitch fee review notice did not stand alone as a separate document, it had not met the statutory requirements, despite the fact that it incorporated the form which contained all the material required for the notice.

35. Mr Sunderland for the appellant argued that by incorporating the form within the notice it has met the requirements for the notice, since both the proposals for the new fee and the owner's name and address are stated there.

36. The FTT explained that the requirement for a pitch fee review notice was added to the 1983 Act by amendment in 1983; the pitch fee review form was a later addition by further amendment in 2013. Accordingly the FTT said at its paragraph 70:

"The changes have come in two stages. The first stage was to provide an infrastructure to regulate the process of pitch fee reviews which involved a notice setting the proposals, a deadline for submitting the notice and a time restriction of an annual review. The second stage was aimed at improving transparency of the charges with the provision of a form containing prescribed information and the parties' rights to accompany the pitch fee review notice."

37. Therefore, the FTT concluded, in light of their having been introduced at different times and for different reasons, these documents must be separate documents.

38. I do not agree that the two documents have different purposes; both are to regulate the process of reviewing the pitch fee and, as part of that process, to provide the information the occupier needs. Even if the two documents did have different purposes I do not see why they would have to be on two separate pieces of paper and why information has to be duplicated. There is no authority on this point, although there are conflicting decisions of the FTT, and the Tribunal noted that the two documents had been combined, in the same way as they are here, in Wyldecrest Parks (Management) Limited v Truzzi-Franconi [2023]UKUT 42 (LC) without objection.

39. The FTT suggested that the fact that here was a mistake in the pitch fee review form in Truzzi-Franconi highlights the need for a separate pitch fee review notice. I do not understand that; there is no requirement for the notice to state the review date.

40. In my judgment the use of a combined pitch fee review notice and pitch fee review form was not wrong, because the material required to be included in the pitch fee review form was included in the combined document. To find otherwise would be to require duplication. If a site owner wants to send two separate documents, or for example to use a covering letter as the pitch fee review notice, that is of course equally acceptable.

The pitch fee review form

41. The pitch fee review form was signed (with a typed signature) by a Mrs T Cercel. Mr Sunderland said that she was a member of the accounts staff of the Wyldecrest group, and was authorised by the director of the appellant to sign the forms on behalf of the company, but did not produce a witness statement to verify the authorisation. The FTT acknowledged that there was no requirement in the statute for the form to be signed by a director or officer of the company. It said at paragraph 55:

"The Tribunal is satisfied that the affixing of the name "Mrs Cercel" on the form was for the purpose of providing a point of contact in the accounts department at Wyldecrest House. The Tribunal finds that Mrs Cercel did not sign the document on behalf of the Directors of The Beaches Management Limited."

42. At paragraph 87 it concluded:

"There was no evidence on the face of the form the capacity in which Mrs T Cercel was purportedly signing the form. The Applicant adduced no evidence from either a Director of The Beaches Management Limited or Mrs Cercel about her authority to sign the Form. The Tribunal confirms its finding that a director or an authorised person had not signed the Form on behalf of the Applicant as site owner."

43. So what troubled the FTT, it seems, was the absence of evidence, despite the presence of explanation.

44. I do not understand why the FTT was troubled by this point. There is no requirement for a signature in the statute; the requirement consists only in the presence of the space for a signature in box 6 on the prescribed form. A form submitted with the owner's name and address (which of course are very important to the recipient) could arguably be regarded as in "substantially to the like effect" as the prescribed form (see paragraph 17 above). It seems to me that it is open to the owner to authorise whomsoever it wishes to sign the form on its behalf, and that in the absence of positive evidence that the signatory was not so authorised there is no basis on which the FTT could have found that Mrs Cercel was not authorised to sign the form.

45. The FTT's misgiving about the signature was unfounded and I find that the pitch fee review form was valid.

The consequences of invalidity

46. In view of what I have said above I do not need to deal with the consequences of invalidity (and it is fair to say that neither of the parties addressed any argument to this point). It is fair to say that had the notice and the form both been invalid, I would have agreed with the FTT that the attempt to raise the pitch fee was of no effect.

The displacement of the RPI presumption

47. After its consideration of the validity of the pitch fee review form and notice the FTT went on to consider whether it was reasonable for the pitch fee to be changed, in case it was wrong in its conclusion about the notice and form.

48. It went through the concerns raised by the respondents, all but one of which it rejected including, as we have seen, the argument that the pitch fee was raised for spurious reasons and should be reduced (paragraph 31(b) above). What it did accept was the respondents' argument that the pitch fee was a payment "just for the concrete slab" without any services, because they were paid for separately under the service charge provisions of the agreements. The FTT reasoned that there was no need for an increase because the pitch fee did not represent any cost to the owner; the services it provided were paid for separately, and since the appellant's lease was granted for no premium and at an annual rent of £150 it had no capita costs associated with the site. It said:

"all the costs normally associated with the pitch fee have been stripped out by the Applicant and recovered by means of additional charges and a service charge. The Tribunal is satisfied that the structure of the 1983 agreements for the Park confers considerable benefits on the Applicant whilst disadvantaging the Respondents and as such amounts to a "weighty factor" which displaces the RPI presumption."

49. Whilst provision for a separate service charge is perhaps unusual in an agreement to which the 1983 Act applies, it is not unknown and certainly not prohibited by the statute, and indeed the FTT did not suggest that it was; nor did the FTT suggest that the presence of a service charge was by itself a weighty factor that could displace the presumption of an RPI increase. Instead it appears to have made an evaluation of the advantages and disadvantages conferred by these specific agreements on the parties. But it did not explain that evaluation. No reference was made to the amounts being charged by way of service charge. In saying "all the costs normally associated with the pitch fee have been stripped out by the Appellant and recovered by means of additional charges and a service charge" the FTT appears to have made an assessment that the respondents were not getting enough in return for their pitch fee. But there is no analysis to explain that. One is left with the impression that the FTT felt that the pitch fee was too high, did not think it was able to go into the reasons the respondents put forward as to why it was too high, and did what it thought was the best it could by denying the appellant an increase.

50. In my judgment the FTT did not properly explain its finding that it was unreasonable for the pitch fee to be changed, and that finding is set aside.

51. As I discuss below, since the date of the FTT decision now appealed, a different panel of the FTT in proceedings involving the appellant, most of the respondents, and several other companies has decided that the appellant is not entitled to receive the service charge; so had the FTT's decision on this point been upheld the situation would have been quite complex, but as the appeal succeeds on this point that difficulty does not arise. But the later FTT decision presents further problems which I discuss below.

Disposal

52. The FTT's decisions that the pitch fee review notice and pitch fee review form were invalid, and that that invalidity meant that there could be no change in the pitch fee, have been set aside; so has its alternative decision that it was not reasonable for the pitch fee to be changed. The Tribunal can either substitute its own decision, or remit the matter to the FTT.

53. Several difficulties stand in the way of my substituting the Tribunal's own decision.

54. The first is the number of unanswered questions left by the FTT's decision. I do not understand why the FTT found that the appellant was the site owner, when there were other lessees with apparently a better right to possession (the "occupational leases" subject to which the appellant's lease was granted; paragraph 6 above). I do not understand why the appellant was entitled to collect the pitch fee when, in respect of agreements made with the respondents subsequent to the grant of its own lease, it could not be said to be claiming through or under the site owner (section 3 of the 1983 Act) (first because Wyldecrest, the grantor of the agreements was on the appellant's own case not the site owner at the time the agreements were made, and second because they were made on a date after the grant of the appellant's lease). Mr Sunderland was not able to offer an explanation of either of those points and even though the FTT's findings have not been appealed by the respondents I cannot simply ignore them since they are points relating to jurisdiction. Evidence and explanation are required.

55. Second, the respondents' own arguments have not been properly addressed. I agree with the FTT that it cannot change the pitch fee agreed between the parties at the start of the agreement; but the FTT did not explain why the respondents' concern that the pitch fee was at the review date disproportionately high, having been set apparently in consideration of the surrender of an agreement with only seven or eight years to run, is not relevant on a review of the pitch fee (being the first review since the fee was set).

56. Third, since the FTT made its decision in October 2023, a differently constituted panel of the FTT made a decision, on 19 February 2024 in the matters CHI/45UC/PHC/2023/0004 and CHI/45UC/PHC/2023/0005, about the service charges under the agreements on Beechfield Park and another site. All but two of the respondents were party to those proceedings, as were the appellant, Wyldecrest, Best Holdings (UK) Limited, Silver Lakes Property Investment Limited, Silk Tree Properties Limited, and three other companies. The FTT in that case decided that the appellant is not the site owner of Beechfield Park. It noted the previous finding to the contrary, in the decision now appealed, but because there were more parties now involved it felt able to make a different decision.

57. It also decided that neither the appellant nor any other person is entitled to receive the service charges reserved by the occupiers' agreements, because no others were party to those agreements and none can claim to have become entitled to the benefit of the agreements under the Mobile Homes Act 1983.

58. As to that latter finding, the FTT in the February 2024 case focused on a point that the FTT in the decision presently appealed did not mention: that in order to collect sums due under the occupiers' agreements it is not enough to be the owner of the site as defined in the statute. It is also necessary to be entitled to the benefit of the agreement. The pitch fee is defined in the 1983 as "the amount which the occupier is required by the agreement to pay to the owner" (paragraph 10 above). If the appellant is not entitled to the contractual service charge, it follows that it cannot be entitled to receive the pitch fee, which is equally a payment due under the contract (as the FTT noted itself, in paragraph 137 of the February decision).

59. Those findings by the FTT in February 2024 remain unappealed. Mr Sunderland explained that the "occupational leases" subject to which the appellant's own lease had been granted were created in an attempt to have each pitch licensed as a separate site, which did not find favour with the local authority (unsurprisingly, one might add). It had been decided that instead of appealing the decision the better way forward would be to surrender those leases so that they did not stand in the way of the appellant's being the site owner as defined in the statute. He said that that had been done; he was of course speaking on instructions and not giving evidence, and the respondents did not accept that that had been done.

60. On the face of it the FTT's decision of 19 February 2024 creates an issue estoppel between the appellant and all but two of the present respondents (the two being Mr Simon and the estate of Mrs Rose); an "issue estoppel" means that the point has already been decided between the two parties and the FTT could not make a different decision later. But if what Mr Sunderland says is accurate, then it may be the case that some at least of the factual basis of the FTT's decision has changed so that there would no longer be an issue estoppel.

61. None of this can be disentangled without evidence, from the parties and probably from others as well. The FTT's decision of October 2023 is set aside in its entirety and the appellant's applications are remitted to the FTT. They are to be determined by a panel different from the ones who made the decision in October (the appealed decision) and in February. The appellant should apply to the FTT for directions, which should make provision for the parties to call evidence.

62. It would greatly assist the parties themselves, and the FTT, if they all had legal representation in view of the legal and practical complexity of this case. I urge the respondents in particular to take legal advice, perhaps by contacting Advocate (Advocate: Finding free legal help from barristers (weareadvocate.org.uk).

Upper Tribunal Judge Elizabeth Cooke

19 June 2024

Right of appeal

Any party has a right of appeal to the Court of Appeal on any point of law arising from this decision. The right of appeal may be exercised only with permission. An application for permission to appeal to the Court of Appeal must be sent or delivered to the Tribunal so that it is received within 1 month after the date on which this decision is sent to the parties (unless an application for costs is made within 14 days of the decision being sent to the parties, in which case an application for permission to appeal must be made within 1 month of the date on which the Tribunal's decision on costs is sent to the parties). An application for permission to appeal must identify the decision of the Tribunal to which it relates, identify the alleged error or errors of law in the decision, and state the result the party making the application is seeking. If the Tribunal refuses permission to appeal a further application may then be made to the Court of Appeal for permission.

ANNEX

2. MS D FRAY

3. MRS S FELLOWS

4. MR B CARTER AND MRS C GREEN-CARTER

5. MR R SIMON

6. MRS J COX

7. MR P AND MRS J BROWN

8. MRS D ROSE (DECEASED)

9. MR G MAYES-JONES AND MRS C MARCH

10. MR AND MRS EDWARDS

11. MRS L MARTIN

12. MISS S TIPLER