Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Lands Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Lands Chamber) >> Nelson Plant Hire Ltd v Bunyan (RATING - PROCEDURE - scope of proposal - whether information provide at 'check' stage admissible as aid to interpreting scope of proposal - valuation - waste transfer station - contractor's basis - Non-domestic Rating (Alteration of Lists and Appeals) (England) Regulations 2009) [2022] UKUT 309 (LC) (24 November 2022)

URL: http://www.bailii.org/uk/cases/UKUT/LC/2022/309.html

Cite as: [2022] UKUT 309 (LC)

[New search] [Contents list] [Printable PDF version] [Help]

UPPER TRIBUNAL (LANDS CHAMBER)

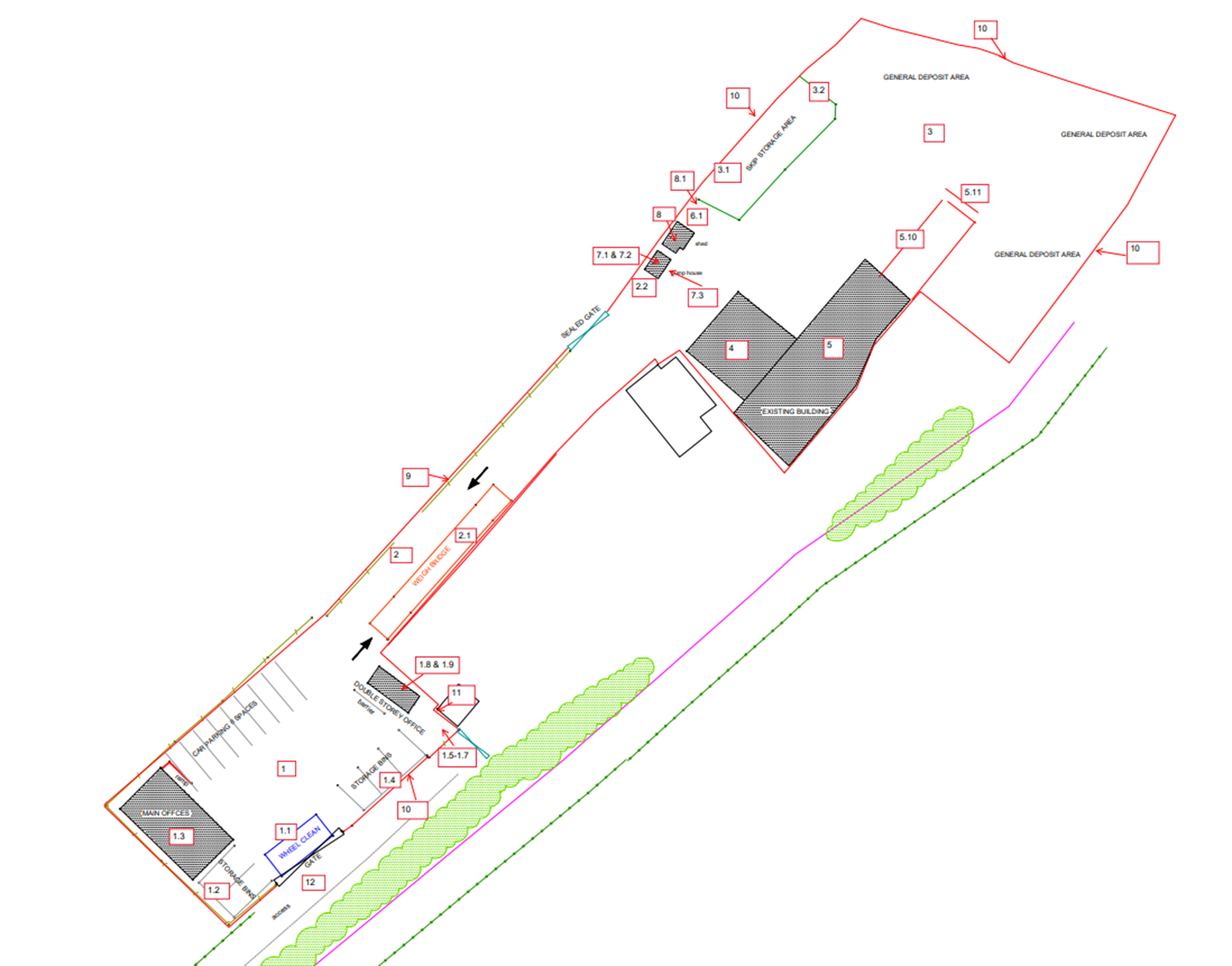

Neutral citation number: [2022] UKUT 309 (LC)

UTLC No: LC-2022-102

Royal Courts of Justice, Strand,

London WC2A 2LL

24 November 2022

TRIBUNALS, COURTS AND ENFORCEMENT ACT 2007

RATING - PROCEDURE - scope of proposal - whether information provided at “check” stage admissible as aid to interpreting scope of proposal - valuation - waste transfer station - contractor’s basis - Non-domestic Rating (Alteration of Lists and Appeals) (England) Regulations 2009 - appeal allowed

AN APPEAL AGAINST A DECISION OF THE VALUATION TRIBUNAL

FOR ENGLAND

BETWEEN:

Re: Nelson’s Yard, Homestead Farm,

Penton Corner,

Andover

Martin Rodger QC, Deputy Chamber President and Mark Higgin FRICS

Hearing: 12 October 2022

Mr Simon Nelson, company director, for the appellant

Mr Nicholas Grant, instructed by HMRC Solicitors, for the respondent

© CROWN COPYRIGHT 2022

The following cases are referred to in this decision:

Courtney Plc v Murphy (VO) [1998] RA 77

Galgate Cricket Club v Doyle (VO) [2001] RA 21

Hughes (VO) v York Museums and Gallery Trust [2017] UKUT 200 (LC)

Imperial College of Science and Technology v Ebdon (VO) [1986] RA 233

London Borough of Lambeth v Secretary of State for Communities and Local Government [2018] EWCA Civ 844; [2019] 1 WLR 4317

Lotus & Delta Limited v Culverwell (VO) and Leicester City Council [1976] RA 141

R v Northamptonshire Local Valuation Court [1990] RA 93

R v Winchester Area Assessment Committee (ex parte Wright) [1948] 2 KB 455

Simpsons Malt Ltd v Jones (VO) [2017] UKUT 460 (LC)

Trump International Golf Club Scotland Ltd v Scottish Ministers [2015] UKSC 74; [2016] 1 WLR 85

Decision

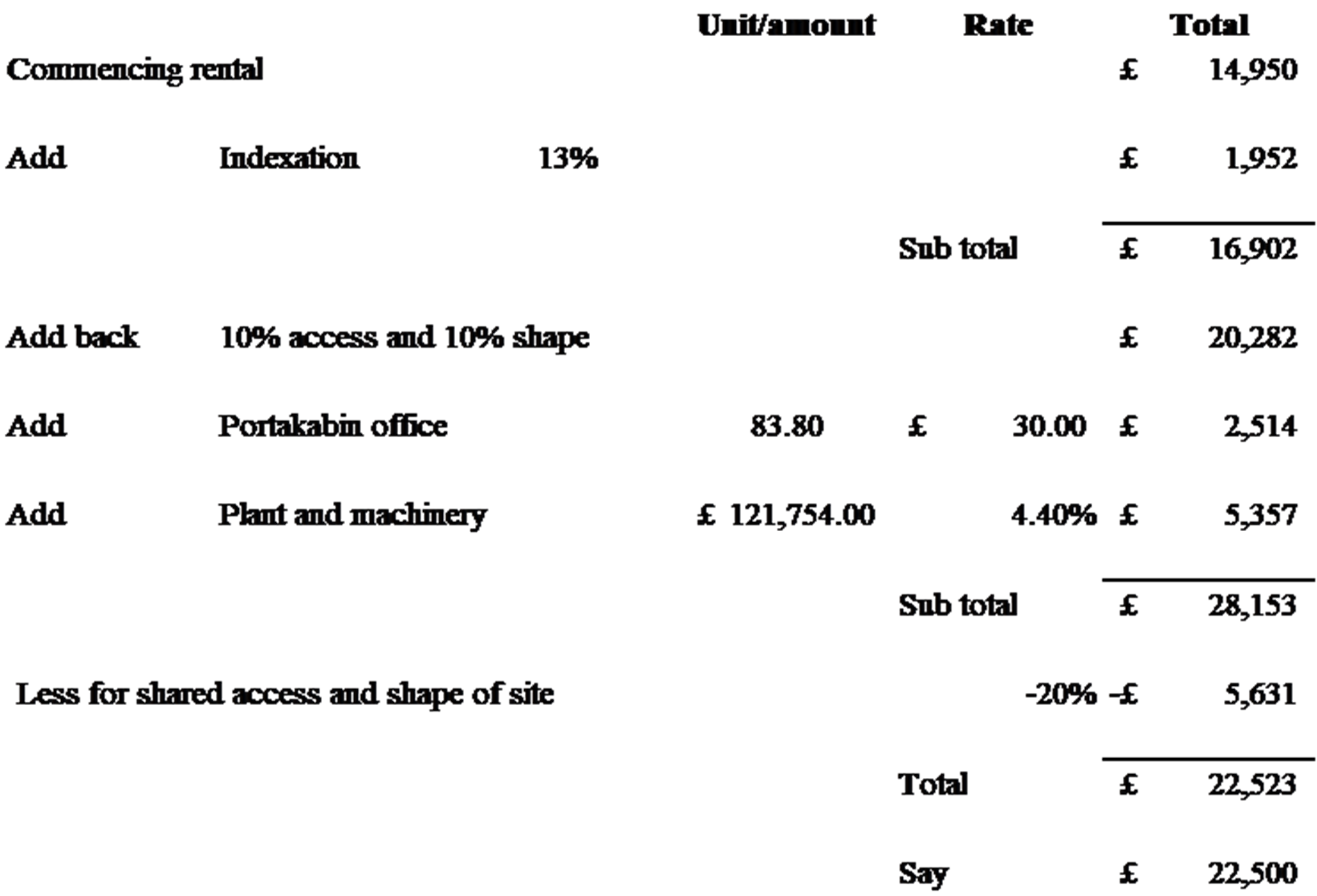

1. Our decision is that the rateable value of Nelson’s Yard is to be reduced from £28,750 to £22,500 with effect from 12 March 2018.

Introduction

2. This is an appeal by the ratepayer, Nelson Plant Hire Ltd, against a decision of the Valuation Tribunal for England (‘VTE’) published on 8 February 2022. The VTE dismissed the company’s appeal against a decision by the Valuation Officer (‘VO’) rejecting its challenge to an amendment to the 2017 rating list by which the rateable value of the ratepayer’s waste transfer station was increased from £9,300 to £28,750 with an effective date of 12 March 2018.

3. The appeal concerns a hereditament entered in the 2017 rating list as Nelson’s Yard, Homestead Farm, Penton Corner, Andover, Hampshire, SP11 0QX where it is described as a secondary aggregate processing plant and premises. The rating list does not provide any other means of identifying the boundaries or extent of the hereditament. As the whole yard is enclosed by a fence there is no real doubt about its maximum possible extent, but it is the ratepayer’s case (which the VO appears to have accepted for a time during the 2010 list) that the yard has more than one rateable occupier and ought therefore to appear in the list as more than one hereditament.

4. An appeal concerning a modest rateable value would ordinarily be determined under the Tribunal’s simplified procedure. In this case the VO requested the standard procedure and she has been represented by counsel, Mr Nicholas Grant who explained that this is the first time since the introduction in 2017 of the new “Check, Challenge, Appeal” regime that an appeal to this Tribunal has raised issues about the scope of a ratepayer’s proposal.

5. At the hearing of the appeal the ratepayer was represented by its director and principal shareholder, Mr Simon Nelson, who also gave evidence. The VO was represented by Mr Grant and evidence was given on her behalf by Ms Kate Young MSc MRICS of the Valuation Office.

The facts

6. The parties were unable to agree a statement of facts. Having inspected the site and heard the evidence of Mr Nelson, whom we found to be a straightforward witness doing his best to explain what in some respects is a complicated factual situation, we find the facts to be as follows.

The hereditament

7. Nelson’s Yard is used for the importation and processing of construction, demolition and builders’ waste. It occupies almost 0.3 hectares on the north western fringe of Andover. Open agricultural land forming part of Homestead Farm adjoins the western and northern boundaries. To the east lies the West Portway Industrial Estate. Sandwiched between Nelson’s Yard and the Industrial Estate is a small haulage yard in separate occupation. Access to the site is by a narrow farm track off Weyhill Road which leads to the A303. The track serves Nelson’s Yard, the haulage yard and a number of vehicle repair and storage businesses closer to the main road.

8. The land occupied by Nelson’s Yard and the adjoining haulage yard can roughly be visualised as forming a long narrow rectangle, a little wider at its northern than its southern end. Nelson’s Yard wraps around the haulage yard on three sides and is divided into two distinct areas, one to the south and the other to the north, with the haulage yard in between. A strip of land connects the two parts of the Yard at the pinch point between the western boundary of the site and the haulage yard. The plan below shows the site configuration:

9. The southern part of the hereditament contains a small modular office building, a parking area, five bays for storing recycled materials of different types and a pair of shipping containers stacked one above the other, the lower of which is used for storage and the upper as an office.

10. The strip of land connecting the southern and northern areas includes a weighbridge and was lined for most if its length by skips and other items of machinery when we carried out an inspection before the hearing.

11. Waste processing takes place at the northern end of the site. Various structures line the western boundary of this area including a portacabin equipped as a staff rest area and toilet block, and a number of redundant water tanks, metal storage containers and the like. There are also some more substantial buildings in the northern part of the site. The main waste processing building is an open-fronted steel-framed structure with an adjoining lean-to, all clad in profile metal sheeting. It houses processing plant including a feed-hopper, conveyers and screens for sorting different types of waste. At one end of this building stands a more modern shed where waste is received and held while awaiting processing. At the time of our inspection this shed contained a single large pile of unsorted waste.

12. Waste passing through the processing building is separated into usable product to be recycled and waste material to be disposed of. Concrete and rubble are crushed and graded using mobile plant. Recycled product of different types is kept in separate bays around the northern perimeter of the yard where there is also an area used for the storage of skips.

Occupation of the hereditament

13. Mr Nelson is the sole director and principal shareholder of four limited companies which operate from the site: Nelson Plant Hire (the appellant), Test Valley Skips, Nelson & Sons Demolition and Nelson Recycling. Despite his formal status with each of the four companies Mr Nelson told us that he has nothing to do with the day-to-day activities of any of them other than the appellant. Other people, whom he did not identify, ran those businesses, paying rent and other charges for their use of the Yard and making contributions to its upkeep.

14. In August 2012 planning permission was granted for a change of use of the site from a haulage storage yard to a waste transfer station. In October 2012 the Environment Agency granted the appellant a permit to use the northern part of the site as a waste transfer station. The permit was amended in 2014 to include the whole of the site. Separate licences to carry and sell waste have also been granted to the appellant, and to Test Valley Skips, and Nelson Recycling.

15. Mr Nelson explained that his involvement with the site began in about 2011. The freehold forms part of the neighbouring Homestead Farm and the site was originally occupied under a lease by a Mr Lane, trading as Lane Garage. In 2011 Mr Nelson reached an agreement with Mr Lane to occupy the northern end; at first their arrangement was undocumented but in 2013 Mr Lane became ill and Mr Nelson requested that it be formalised with the freeholders, Mr Langdon and Mr Campbell.

16. On 27 September 2013 Mr Lane granted a sub-lease of the northern part of the site to Nelson & Sons Civil Engineering Ltd (as the appellant was then known) for the remainder of the term of his own headlease expiring on 31 May 2015. The rent reserved under the sub-lease was £14,500.

17. At the same time Mr Nelson reached agreement with the owners of Homestead Farm for the grant to the appellant and Nelson Recycling jointly of a longer lease commencing on 1 June 2015 and continuing until 2037 (“the Lease”). The Lease included the whole of Nelson’s Yard. It was drafted by solicitors and executed on 27 September 2013, 21 months before the commencement of the term. It was then registered at the Land Registry.

18. The Lease provided for the rent to be determined in 2015 by uprating a base rent of £14,950 by reference to the change in the retail prices index between January 2011 and May 2015. Thereafter the rent was to be increased every two years by reference to RPI with a final review to open market value in 2033. The tenant agreed to pay all present and future rates, to keep the premises in repair and to reimburse the landlords’ costs of insurance. Underletting was prohibited but the tenant was permitted to share occupation with any company in the same group provided that no relationship of landlord and tenant was created.

19. After the Lease had been executed Mr Nelson used it as a model for three further documents which he prepared himself. These took the form of sub-leases to be granted by the appellant alone to Nelson & Sons Demolition, Test Valley Skips and Nelson Recycling. Mr Nelson brought the originals of two of these documents to the hearing; they had been signed by him on behalf of each of the companies. Mr Nelson explained that these homemade documents were prepared and signed by him but had never been registered because the Lease prohibits formally granting subleases. Because they have never been registered the subleases became void so far as they were intended to create a legal interest in the land to which they related. At most they might each take effect as a contract to grant a lease on the same terms, but for reasons which will become clear it is not necessary for us to form a view on their status.

20. The subleases were dated 1 June 2015 and substantially followed the form of the Lease with only minor differences including in the names of the parties and the rent payable. In each case the description of the property demised was taken directly from the Lease and so referred to the whole of the waste transfer station edged in red on an attached plan. Each sublease plan was based on the Lease plan with the same red line delineating the whole of Nelson’s Yard, but each plan also identified particular areas of the site within the red line which were individually coloured, and which were referred to in a manuscript key as demised premises. Mr Nelson explained that the coloured areas in the sublease plans were intended to be the areas demised to the different companies by the subleases.

21. The plan with the sublease to Nelson & Sons Demolition identifies four distinct areas of the site: two bays adjacent to the site entrance; the two-storey storage and office container building; a strip of land on the western boundary of the northern part of the site; and a strip of land within the processing building which is now occupied by one end of the processing and conveyor plant. The coloured areas identified as demised to Test Valley Skips on its sublease plan shows two bays adjacent to the entrance, the weighbridge, part of the building used for the reception of waste, two further containers and an area of land on the north western perimeter of the site. The two bays at the entrance and part of the area of land on the perimeter appear to be the same as areas shown in the Nelson & Sons Demolition sublease as having been allocated to it.

22. Although the plans may notionally have been intended to identify areas to be occupied by the different companies, with other areas to be used in common, Mr Nelson acknowledged very frankly in his oral evidence that in practice it was not realistic to keep the different operations entirely separate. Consistent with that acknowledgement, on our inspection we observed that skips belonging to Test Valley Skips were stored in the area allocated to Nelson & Sons Demolition in its sublease, and that the waste storage building was not divided into three distinct zones but instead housed a single pile of waste brought in by different operators.

23. Mr Nelson also explained that the weighbridge and the office housed in the upper of the two shipping containers are used by all four companies. The greater part of the yard is shared and subject to a maintenance contribution by each of the companies. The modern office portakabin is also a shared facility although each company has its own desk and its own staff working there.

Improvements

24. Mr Nelson’s evidence, which we accept, was that he agreed with his landlords in 2013 that they would each carry out work to make the site more suitable for his business. Mr Lane was to erect the metal framed building which now houses the waste processing plant and Mr Nelson was to improve the surface of the site. That involved laying tarmac over an existing crushed chalk surface in part of the southern portion of the site and laying concrete in the remainder of the southern yard and over the entirety of the northern part.

25. Not all of the buildings now present on the site were there in 2013 when the Lease was agreed between Mr Nelson and the owners of Homestead Farm. In particular the modern modular office building was not yet in place and the operations on the site were run from the two shipping containers stacked one above another. The office building was erected in November 2016 and at the same time the shipping containers were relocated to their current position in the southern yard adjoining the weighbridge. In 2013 a steel-framed farm shed in relatively poor condition stood in the place now occupied by the modern waste reception shed which was constructed in 2019. The main waste handling building had not yet been built, and an older agricultural building was used instead. A planning inspector who visited the site in May 2015 in connection with an application for retrospective planning permission recorded that the building which now houses the waste processing plant (and which was constructed at the expense of Mr Lane) was then in the course of construction in place of the former agricultural shed.

Rating history

26. Mr Nelson explained that in 2013 he had appealed against the rateable value shown in the 2010 rating list for the site. Before his appeal was due to be heard it was suggested by the Valuation Officer who was then responsible that the site should be split into three separate hereditaments. The occupiers of the different hereditaments were to be the appellant and two of its associated companies.

27. When the 2017 list was compiled the whole of the site was entered as a single hereditament with a rateable value of £9,300.

28. In January 2018 the site was inspected by Mr Banks of the Valuation Office who took note of the new office block, the relocation of the double storey container building, the completed waste processing shed and the resurfacing of the site. As a result the rating list was amended with effect from 12 March 2018 to show a new rateable value of £28,750. The effective date of this change was limited to the date of the alteration of the list. The 2010 list was also amended.

29. On 2 July 2019 a rating agent acting for Mr Nelson submitted a “check” in respect of the amended entry in the 2017 list. The form provided for this purpose explained that a check is a necessary first step before any challenge can be made to a valuation and it invited the ratepayer to inform the Valuation Office about any changes that had occurred inside the property boundaries or any external factors. It went on:

“If there had been no physical changes to the property but you still feel that your rateable value is incorrect, you will still need to confirm the facts about your property, sign the declaration, and return this form (this is called a check). You must wait for us to make a decision on your check, or for 12 months to pass from your date of submission if we have not made a decision, before you can submit a challenge. If you decide to submit a challenge, you can challenge any aspect of your valuation.”

30. The check form asked the ratepayer to select one option from a list to indicate the reason for submitting the check. A footnote stated: “If you feel that more than one option applies, please select the most appropriate or submit more than one check.” Amongst the menu of options the ratepayer could confirm that there had been “no physical changes to my property and all current property details are correct”. The notes advised that this option should be selected if there had been no physical changes to the property “but you still feel that your rateable value is incorrect.” A second option was to “split this into two or more properties”.

31. When he completed the check form Mr Nelson’s agent ticked the box for “I want to split this into two or more properties”. He attached copies of the various leases and subleases and a plan showing those areas occupied by each of the four companies operating from the site. He also attached a copy of the valuation officer’s valuation (compiled on the Contractor’s Basis) indicating against each element of the valuation those items or buildings which were shared and those which were occupied by a particular company.

32. The check was completed on 24 September 2019 when the VO issued a notice saying that she was not going to split the assessment and that no list alteration would be made.

33. On 26 November 2019 the appellant’s agent submitted a “challenge” to the rating list entry. The challenge form began with an instruction to “use this form to prepare your challenge to the rating list entry (including the valuation)”. Section B of the document required the ratepayer to provide details of the property including the number which had been allocated to the “check”. Section C, which asked “why do you want to challenge your valuation?”, contained a menu of 17 available responses. These included that “the rateable value shown in the rating list on 1 April 2017 was wrong”, that “the property should be shown as more than one assessment (split)”, and that “a change made by the valuation office on or after 1 April 2017 is wrong.”

34. The appellant’s agent selected only the first option from the menu: “the rateable value shown in the rating list on 1 April 2017 was wrong.” We were told that it was not possible to tick more than one option in the list. The advice in the check form to “select the most appropriate or submit more than one check” if the ratepayer felt that more than one option applied was not repeated in the “challenge” form.

35. Each of the challenge options identified sections of the document which were to be completed if that option was chosen. None of those sections provides an opportunity for the challenger to explain how it proposed that a single assessment should be split. That contrasts with a challenge on the basis that several properties should be merged as one or more different assessments for which a whole page was provided to explain what was proposed.

36. Section K of the document required the proposer to provide a statement to explain why the rating list entry should be altered (not to suggest how it should be altered). The statement completed by the appellant’s agent said this:

“A new lease was agreed as at 1 June 2015 at a market rent of £14,956. This is a market rent and the best possible to the landlord and should be applied to the RV accordingly.”

There was nothing in that statement to indicate that a challenge based on the suggested split of the hereditament which had been requested at the check stage was still in the ratepayer’s mind.

37. On 3 August 2020 the VO issued a decision notice rejecting the proposed alteration of the list and maintaining that the current entry was reasonable. Her decision notice explained the basis of her valuation and referred to the check stage, recording that the check submitted on 2 July 2019 had requested a split of the site which she had not agreed. She dismissed the evidence of the Lease rent on the grounds that it was “not considered to be a clean lease evidence and requires adjustment”. The only adjustments identified by the VO were that the Lease rent “includes additions for insurance and the payment of rates by the landlord”. These suggested points of distinction are puzzling, as the Lease in fact provides for the tenant to pay the rates and to be responsible for the cost of insurance and in both respects is consistent with the statutory rating hypothesis. The VO also stated that the capital land value used in her contractor’s basis valuation was “based on more robust evidence” and therefore was “more defendable” but she did not identify what that more robust evidence might comprise. She did record the evidence which she had considered when making her decision and included the check submission form in that list.

38. By this stage Mr Nelson had dispensed with the services of his agent and he submitted his own grounds of appeal to the VTE on behalf of the appellant on 13 October 2021. This Tribunal is not usually concerned with the case advanced by an appellant before the VTE, because each subsequent appeal proceeds as a re-hearing. Nevertheless, in this case the VO has sought to limit the permissible scope of the appeal to the Tribunal by reference to the grounds of the appeal presented to the VTE. It is therefore relevant to record that those grounds asserted that the site had been incorrectly entered in the list before 2017 but that issue had been resolved by the VO agreeing to split the site. Subsequently the VO had decided to value the site as one, despite being told that 5 different companies operated from it. Mr Nelson complained that the VO would not engage and refused to split the site correctly. He asserted that the decision had been made “based on incorrect information and is factually incorrect”. He went on: “We have paid more than £30k in rates to avoid further action which we are owed and if we cannot get it back we will be insolvent.”

39. On 27 October 2021, the VO asked the VTE to strike out the appeal, arguing that the appellant’s “challenge” to the list entry had not suggested that the hereditament should be split.

The VTE’s decision

40. By a decision issued on 8 February 2022 the VTE dismissed the appeal and confirmed the rateable value of £28,750. It ruled that the ratepayer’s challenge did not propose a split of the hereditament, which meant that it could not consider that aspect of the appellant’s case. It therefore considered only whether the rateable value shown for the hereditament was correct. It concluded that the VO’s preference for a contractor’s basis valuation was not unreasonable, as it was used for similar properties and there was no reliable rental evidence for such sites in the locality. It found the Lease to be of limited help for a number of reasons: the rent had been negotiated in September 2013, before the antecedent valuation date of 1 April 2015; the tenant paid an insurance rent, the VTE accepting the VO’s submission that the agreed rent would therefore require some adjustment to accord with the statutory valuation hypothesis; the Lease was inconsistent with a form of return completed by the appellant’s agent, which suggested (wrongly) that the rent included non-domestic rates and insurance; and, finally, it considered that the buildings on the site were unlikely to have been included in the rent.

The issues in the appeal

41. The appellant now appeals to this Tribunal against the VTE’s decision, continuing to act through Mr Nelson and without professional representation. In his comprehensive grounds of appeal Mr Nelson argued, in summary, that the VTE should have considered his case for splitting the hereditament into more than one entry, that it should not have preferred a contractor’s basis valuation when the Lease provided evidence of the rental value of the site, and that the rateable value should be reduced.

42. Having heard the submissions of Mr Grant on behalf of the VO the determination of the ratepayer’s appeal requires us to consider the following issues:

2. Does the Tribunal have jurisdiction to consider a challenge to the rateable value shown in the list for the hereditament, having regard to the terms of the appeal to the VTE?

3. If the hereditament is to be split, how should it be split and what rateable value should be given to the part occupied by the appellant?

4. If the hereditament is not to be split, is the rateable value shown in the list correct?

The relevant statutory provisions

43. Statutory provisions governing appeals against entries in the non-domestic rating list are found in regulations made under powers conferred by section 55, Local Government Finance Act 1988 (“the 1988 Act”). Two sets of regulations are relevant to this appeal; both were the subject of significant amendments in 2017.

44. The Non-Domestic Rating (Alterations of Lists and Appeals) (England) Regulations 2009 (“the 2009 Alteration Regulations”), were amended by the Non-Domestic Rating (Alterations of Lists and Appeals) (England) (Amendment) Regulations 2017. They contain detailed provisions including about who may make a proposal to alter a rating list, the grounds on which such a proposal may be made, and what a proposal must contain.

45. The Valuation Tribunal for England (Council Tax and Rating Appeals) (Procedure) Regulations 2009 (“the 2009 Procedure Regulations”), were amended by the Valuation Tribunal for England (Council Tax and Rating Appeals) (Procedure) (Amendment) Regulations 2017. They are concerned with procedure in the VTE.

46. In their original form the 2009 Alteration Regulations permitted an interested party to make a proposal for the alteration of the rating list on any of the grounds specified in regulation 4, which included that the rateable value shown in the list was wrong and that property shown as one hereditament ought to have been shown as more than one hereditament. A proposal could be made by reference to more than one ground provided that, for each ground relied on, the material date and the effective date were the same (regulation 4(3)(a)). If the VO accepted that the proposal was “well-founded” she was obliged by regulation 10 to alter the list accordingly. If the VO did not accept that the proposal was well-founded, and the parties were unable to reach agreement on an alternative basis, the VO was obliged by regulation 13 to refer the “disagreement as to the proposed alteration” to the VTE as an appeal by the proposer against the VO’s refusal to alter the list.

47. The amendments to the 2009 Regulations introduced in 2017 introduced a new regime pithily branded “check, challenge, appeal”. The explanatory memorandum to the Regulations amending the 2009 Alterations Regulations acknowledged that the system for business rates appeals was in need of reform, with the majority of appeals resulting neither in an effective hearing nor in any change to the rating list. The explanatory memorandum then described the changes and their objectives:

“7.5 The Government is committed to delivering a more efficient business rates appeals system. The business rates appeals reforms introduce a three-stage system: Check, Challenge, Appeal. This is designed to manage the flow of cases through the system in a structured and transparent way which will allow ratepayers to make an informed decision about how to proceed.

7.6 The Check stage, in which facts concerning the property are agreed between the VO and the ratepayer, is intended to be both swift and to lead to an agreed position for the great majority of cases. The proposal (“Challenge”) stage will deal with cases where the ratepayer challenges their rating assessment. And at the Appeal stage the ratepayer will be able to appeal their case to the VTE, if they continue to disagree with VO following the proposal stage.”

48. In their amended form the 2009 Alteration Regulations retain the original regulation 4 substantially unaltered but add new regulations 4A to 4F which provide for the “check” stage of the new procedure. It is now provided by regulation 4A(1), that a person may not make a proposal in relation to a hereditament unless a check of information about the hereditament has been completed. The check consists of steps described in regulations 4B to 4F which, if followed, would enable relevant facts to be identified by an exchange of information between the VO and the person wishing to make a proposal. This stage comes to an end when the VO serves a notice stating that the check has been completed or at the end of 12 months (or any longer period which the VO and the proposer have agreed), if no such notice has yet been served.

49. A new regulation 6 is substituted for the original text and describes in general how a proposal is to be made and what it must contain (the amendments continue to refer to a “proposal” rather than to a “challenge”). Amongst the information to be provided a proposal must identify the respects in which it is proposed that the list be altered and must include a statement of the grounds for making the proposal. In a change to the former procedure, if a proposal is incomplete because it lacks information required by regulation 6, the VO is required to refuse it (formerly the service of an invalidity notice was discretionary) (regulation 8). If the VO considers the proposal not to be well-founded, they must serve a decision notice on the proposer explaining their disagreement and stating, with reasons, that they have decided not to alter the list according to the proposal (regulation 13(3)-(4), as amended).

50. A new regulation 13A has been introduced, now placing the onus of making an appeal to the VTE on the proposer rather than on the VO. A proposer may appeal to the VTE on either or both of the grounds set out in regulation 13A(2), which are:

“(a) the valuation for the hereditament is not reasonable;

(b) the list is inaccurate in relation to the hereditament (other than in relation to the valuation).”

51. New regulation 13C(2) provides that a notice of appeal to the VTE must set out the grounds of the appeal and “identify which particulars of the grounds of the proposal have not been agreed with the VO.”

52. The 2009 Procedure Regulations have also been amended to requite compliance with the new process. This is done by very significantly limiting the evidence which may be relied on before the VTE to the evidence which was included in the Challenge. The Explanatory Memorandum to the amending Regulations explains, at paragraph 7.8, that:

“7.8 These Regulations prescribe the evidence and matters which are not to be taken into account by the VTE in order to limit the introduction of new matters at Appeal stage and to reinforce the incentive for all parties to engage fully at Check and the proposal/Challenge stages. The changes will not rule out new evidence and arguments being brought forward, where the evidence was not known and could not reasonably have been acquired by the appellant at an earlier stage.”

Issue 1: Does the Tribunal have jurisdiction to consider the suggested split of the hereditament, having regard to the terms of the ratepayer’s “challenge” to the entry in the list?

53. The arguments which Mr Nelson wished to make to the VTE, but which it refused to entertain, were in support of the ground of alteration identified by the appellant’s agent in the “check” document, namely that the hereditament should be split into two or more units. The check submission had been supported by copies of the subleases, a plan showing the areas said to be occupied by each of the companies, and a schedule explaining which items of rateable plant were in shared use and which were used by a particular company. In contrast, when the appellant’s agent submitted the proposal the only ground selected was that “the rateable value shown in the rating list on 1 April 2017 was wrong.”

54. Before the amendment of the 2009 Regulations in 2017 it was very well established that the jurisdiction of the VTE to determine appeals referred to it by the VO was limited by the terms of the original proposal. The VTE’s task was to resolve the disagreement between the person making the proposal and the VO concerning the correctness of the proposal. It followed that the rejection of a proposal made on ground (a) could not give rise to an appeal based on ground (b). This rule pre-dates the 1988 Act and the regulations made under it. An example of its application is the decision of the Lands Tribunal in Courtney Plc v Murphy (VO) [1998] RA 77 where it was accepted that the jurisdiction of a local valuation tribunal and then on an appeal to the Tribunal was limited to the issues raised by the proposal giving rise to the original appeal.

55. The first question is whether, following the 2017 amendments to the 2009 Regulations, the same principle continues to apply.

56. Mr Nelson objected in the most vehement terms to the position adopted by the VO before the VTE which, as it appeared to him, was simply designed to avoid the issue which he had first raised during the currency of the 2010 list (when it had been conceded by the VO) and which had been explained in considerable detail at the check stage. He had not submitted the proposal himself, because he found the whole process excessively complicated, but had left that job to an agent who had subsequently ceased trading during the pandemic. Mr Nelson had been shocked when, shortly before the VTE hearing, the VO had suggested that the issue of splitting the hereditament could not be raised because the proposal sought to challenge only the rateable value.

57. On behalf of the VO Mr Grant submitted that the scope of the VTE’s jurisdiction (and of this Tribunal’s jurisdiction on an appeal) was still restricted by the proposal. He made a number of related points.

58. First, in their amended form the 2009 Alterations Regulations retained regulation 4 substantially unamended and required the ratepayer to submit a proposal for the VO to consider. The VO was limited to making a decision on that proposal (in particular by regulation 13). An appeal could only be made once the VO had reached a decision responding to the proposal and the notice of appeal required, in addition to grounds of appeal, that the ratepayer state “which particulars of the grounds of the proposal have not been agreed with the VO”.

59. Second, the central significance of the proposal was emphasised by the amendments made to the 2009 Procedure Regulations which allowed the VTE to admit new evidence only if it related to the ground on which the proposal was made and could not reasonably have been acquired before the proposal was determined (regulation 17A(1), 2009 Procedure Regulations).

60. Third, the right to appeal to the VTE is triggered by the decision notice which is required by regulation 13(3) to include a statement that the VO is of the opinion that the proposal is not well-founded, disagrees with the proposed alteration of the list and has decided not to alter the list according to the proposal. The grounds of appeal must state which of the grounds of the proposal have not been agreed.

61. Fourth, there is nothing in either of the 2017 amending regulations or their explanatory material indicating an intention to depart from the long established and consistent line of authority that the scope of an appeal is restricted to the grounds stated in the proposal.

62. Fifth, allowing the VTE or the Upper Tribunal to consider issues not raised in the proposal would be contrary to the purpose of the 2017 reforms, as the issues would not be established at an early stage.

63. Sixth, the power to make the regulations (section 55, 1988 Act) also focusses on the proposal. Provision may be made by regulations “where there is a disagreement between a valuation officer and another person making a proposal for the alteration of a list”.

64. Finally, the check process is entirely separate from the proposal. It is a distinct stage at which facts are intended to be agreed and is unrelated to the Challenge stage, at which the proposal is made.

65. We accept Mr Grant’s general proposition that, following the 2017 amendments to the 2009 Regulations, the proposal to alter the list continues to define the scope of any appeal to the VTE or to this Tribunal. The proposal is central to any challenge to the list and the proposition that an appeal could be mounted on a ground which had not been the subject of a proposal is as inconsistent with the structure and language of the 2009 Alteration Regulations in their amended form as it would have been in their original form. Thus, the extent of the disagreement between the parties is framed by the VO’s response to a proposal recorded in a decision notice served under regulation 13. The decision notice will record the VO’s reasons for concluding that the proposal is not well-founded and will be accompanied by a statement in relation to each of the grounds of the proposal setting out why in the opinion of the VO the ground is not made out, including a summary of any particulars of the grounds of the proposal with which the VO does not agree. The right to appeal to the VTE is triggered by the decision notice (unless no decision is made for a period of 18 months from the date of the proposal). Although the grounds on which an appeal may be made do not themselves refer to the proposal, but only to the fact that the valuation is unreasonable or the list is inaccurate in some other respect, it is clear that the suggested inaccuracy on which the appeal rests must be the same inaccuracy (whether in relation to valuation or otherwise) as prompted the original proposal.

66. There is nothing in the 2009 Regulations in their amended form to suggest that it was intended to depart from the long-established position that the scope of any appeal depends on the scope of the proposal. In our judgment the old rule continues to apply.

67. That leads to a second question concerning the meaning of the proposal in this case. Is it possible to read the statement in the proposal that “the rateable value shown in the rating list on 1 April 2017 was wrong” as including a challenge to the single entry for Nelson’s Yard in the 2017 list on the basis that the entry should be split and Nelson’s Yard should appear as more than one hereditament?

68. Courts and tribunals have leaned against taking an excessively technical approach to the meaning of a proposal to alter a rating list. In R v Winchester Area Assessment Committee (ex parte Wright) [1948] 2 KB 455 the Court of Appeal stressed the importance of Parliament’s intention that a person aggrieved by a decision of a valuation officer should be able to challenge it without professional assistance (without having “to go to an expert or to a lawyer to draw up his proposal”). For that reason, Scott LJ explained (at 460) that, provided a proposer gave a legally valid and relevant reason for the intended challenge:

“The language of proposals, by whomsoever made, should therefore be read without too much legal strictness.”

Asquith LJ (at 463), was of the same opinion, describing earlier authorities as having “laid down emphatically that a proposal need not be a strict or formal document.”

69. Galgate Cricket Club v Doyle (VO) [2001] RA 21 and Hughes (VO) v York Museums and Gallery Trust [2017] UKUT 200 (LC) are both examples of this Tribunal and its predecessor adopting the same benign approach to the interpretation of proposals.

70. It is well-established that the meaning of a proposal is to be determined by the ordinary principles of construction of documents. In R v Northamptonshire Local Valuation Court [1990] RA 93, a proposal made in 1985 by a water authority identified the subject matter as a sewage treatment works which had closed and been removed from the valuation list in 1982. For some reason which was not explained, the VO initially treated the proposal as having been made in relation to different sewage treatment works which were in use and appeared in the list. Later the question arose whether the proposal was valid. In finding that it was not, Nicholls LJ, giving the judgment of the Court of Appeal, said at 101:

“In my view, the true position is that the adequacy of identification of the subject hereditament on a proposal … falls to be determined according to the ordinary principles of construction: how would the proposal reasonably be understood by those on whom the proposal is to be served? In answering this question, as with all questions of construction, common sense is to be applied plentifully. But special knowledge peculiar to the valuation officer, such as what a member of his staff may have been told orally or in a covering letter by the proposer is not normally material. The proposal form is itself intended to be adequately definitive of the property affected. It is a public document, available for inspection by ratepayers under s.108 [of the General Rate Act 1967].”

71. R v Northamptonshire Local Valuation Court was a case about the adequacy of identification of the subject hereditament on a proposal, but we see no reason to adopt a different approach to the interpretation of other parts of a proposal, including the statement of the grounds on which it is being made.

72. In Hughes (VO) v York Museums and Gallery Trust, at 82, the Tribunal referred to the question posed by Nicholls LJ in R v Northamptonshire Local Valuation Court and added:

“In answering that question the proposal must not be considered in a vacuum, but in its proper legislative and procedural context and with an appreciation of all the relevant facts which would inform the recipient’s understanding of it.”

In that statement the “relevant facts” comprise the information which, in R v Northamptonshire Local Valuation Court, Nicholls LJ had referred to as “the information generally available to any informed reader of a proposal: in particular, the contents of the proposal itself, knowledge of the locality and knowledge of the contents of the valuation list.” Material of that sort was to be distinguished from “special knowledge acquired from extrinsic sources” which was not generally available and could not assist in understanding a proposal.

73. Mr Grant adopted the somewhat extreme position that no document other than the proposal itself could be looked at to determine how it would reasonably be understood by the VO on whom it was served. In particular, he submitted, it was impermissible to have regard to the information supplied by the maker of the proposal to the VO at the “check” stage in order to understand what the proposal was getting at.

74. It is clear that Mr Grant’s submission goes too far. It is not how the ordinary principles of construction require documents to be interpreted and it would exclude the sort of “information generally available to any informed reader of a proposal” which Nicholls LJ suggested would be of assistance.

75. Nor is Mr Grant’s extreme proposition consistent with how the VO in this case actually approached the proposal. In addition to explaining the reasons for the VO’s decision, a decision notice is required by regulation 13(3)(b) to include a statement of the evidence and information used to make the decision. The decision notice of 3 August 2020 in this case records that the VO had regard to the check submission form. The VTE had access to the decision notice and it is not clear to us that there is any good reason why, if it was in doubt about what the proposal itself meant, it should be impermissible for the VTE to consider the same documents as were taken into account by the VO when she made her decision.

76. In the Northamptonshire case Nicholls LJ referred to the fact that the proposal was a public document as a reason for restricting the sort of material which could be referred to when interpreting it. The interpretation of documents which have a public purpose has been the subject of relatively recent consideration in the Supreme Court in Trump International Golf Club Scotland Ltd v Scottish Ministers [2015] UKSC 74; [2016] 1 WLR 85 and then in a number of cases in the Court of Appeal concerning planning permissions.

77. In London Borough of Lambeth v Secretary of State for Communities and Local Government [2018] EWCA Civ 844 at [23]-[26] Lewison LJ, giving the decision of the Court of Appeal, discussed “The current approach to the interpretation of planning permissions and similar public documents” and said this:

23. … As Lord Hodge pointed out in Trump at [33]:

“There is a modern tendency in the law to break down divisions in the rules on the interpretation of different kinds of document, both private and public, and to look for more general rules on how to ascertain the meaning of words. In particular, there has been a harmonisation of the interpretation of contracts, unilateral notices, patents and also testamentary documents.”

24. Where a public document differs from cases of that kind is not so much in the court’s approach to the meaning of words, but in the range of material that it can take into account in determining that meaning, as Lord Hodge went on to explain in the same paragraph,

“Differences in the nature of documents will influence the extent to which the court may look at the factual background to assist interpretation. Thus third parties may have an interest in a public document, such as a planning permission or a consent under section 36 of the 1989 Act, in contrast with many contracts. As a result, the shared knowledge of the applicant for permission and the drafter of the condition does not have the relevance to the process of interpretation that the shared knowledge of parties to a contract, in which there may be no third party interest, has. There is only limited scope for the use of extrinsic material in the interpretation of a public document, such as a planning permission or a section 36 consent.”

25. But having regard to the more limited range of material that can be taken into account in ascertaining the meaning of words in a public document, the ultimate question is still the same, namely:

“… what a reasonable reader would understand the words to mean when reading the condition in the context of the other conditions and of the consent as a whole. This is an objective exercise in which the court will have regard to the natural and ordinary meaning of the relevant words, the overall purpose of the consent, any other conditions which cast light on the purpose of the relevant words, and common sense.”

26. Agreeing with Lord Hodge, Lord Carnwath said at [66]:

“I do not think it is right to regard the process of interpreting a planning permission as differing materially from that appropriate to other legal documents.”

78. Planning permissions or permissions under the Electricity Act 1989 (the subject of the decision in Trump) are public documents addressed to the world at large and they concern the rights of persons other than those immediately concerned in the making of the application which gave rise to the permission. An entry in the rating list has obvious similarities, but whether a proposal to alter an entry (especially one which the VO considers not to be well-founded) has the same public quality and ability to affect the rights of others is less obvious.

79. We are therefore reluctant to accept Mr Grant’s submission that the check and challenge stages of the new three-stage process must be viewed in complete isolation from each other so that documents and information provided at the first stage must be excluded when considering the meaning of the proposal submitted at the second. Before that submission could be made good it would be necessary to consider more closely the nature of a proposal which is addressed primarily to the VO, and the extent to which third parties can be said to have an interest in its content (as opposed to the content of the rating list). The only submissions we have heard on this aspect of the appeal were those presented by Mr Grant on behalf of the VO, and he confined his citation of authority to the older cases about rating proposals, without referring to the more recent examination of the general principles concerning the interpretation of public documents by the Supreme Court and the Court of Appeal. Understandably Mr Nelson focussed his submissions on the facts of the case. We therefore prefer to avoid reaching a final conclusion on this issue unless it is necessary to do so in order to determine the appeal.

80. We are satisfied that it is not necessary for us to reach a conclusion on the material which may be taken into account when interpreting a proposal made in the context of the new check, challenge, appeal process. That is because we agree with the VO’s submission that, no matter how much of the material from the check stage is taken into account, it is not possible to interpret the proposal itself as requesting a split of the hereditament. Neither the selected ground (“the rateable value shown in the rating list on 1 April 2017 was wrong”), nor the brief narrative explanation of the challenge refer to the occupation of the Yard by companies other than the appellant or suggest that the list should be altered so that the appellant is not responsible for the whole of the burden of rates.

81. It is true that the online proposal form does not invite details of any proposed split, nor does it suggest that a separate challenge should be made if more than one ground of challenge is to be pursued, nor does it provide any means of identifying the extent of the hereditament which has been valued. Nothing in the form suggests that a challenge to the entry could not be based on a number of different strands without submitting multiple challenges (in contrast to the advice given on the check form). Section K of the document allows the proposer to provide a statement to explain why the rating list entry should be altered. The ratepayer who considered both that a hereditament should be split and that the valuation in the list should also be altered has the opportunity to make the full extent of their proposal clear by providing a narrative explanation, but that opportunity is not explicitly identified in the form.

82. Despite the limitations of the digital form, and the lack of any instruction or guidance on how it should be completed if more than one ground of challenge was intended, the absence of any mention of splitting the site in section K seems to us clearly to confine the challenge to the issue of whether the rateable value of the hereditament which appeared in the list was correct or not; in other words, the issue identified in the proposal was an issue of valuation only. We feel sure that a reasonable recipient of the proposal, even if they were fully familiar with the position taken by the appellant and the VO at the check stage would have concluded that the appellant must have accepted the VO’s indication that a split was not justified on the facts and decided to limit its proposal to valuation.

83. We therefore conclude that the VTE was correct in its refusal to consider Mr Nelson’s arguments about splitting the hereditament. They were not within the scope of the proposal and could not therefore be issues on the appeal to the VTE.

84. We would add, in case we are wrong about this issue, that in any event the case for splitting the hereditament appears very weak. The practical reality, as Mr Nelson very fairly acknowledged, is that use of the Yard is shared between its various occupiers and it is very difficult to identify areas which are actually used exclusively by one company or another. The subleases are not a reliable guide to what happens on the ground, as we saw on our inspection. Even if a small container here or a desk there are reserved exclusively for the use of one company, the appellant, as landlord under the subleases, is in overall control of the site and in our judgment, it is in rateable occupation of the whole.

85. The appellant’s overall control of the site is evidenced by the responsibility it has taken for planning, licensing and rating matters and by the fact that the appellant alone purported to grant the sub-leases to the other occupiers (including Nelson Recycling) despite the fact that the Lease of the whole site was granted jointly to the appellant and Nelson Recycling. There was no evidence that any other occupier exercised control over the site.

Issue 2: Does the Tribunal have jurisdiction to consider a challenge to the rateable value shown in the list for the hereditament, having regard to the terms of the appeal to the VTE?

86. This issue is much less complicated. Mr Grant submitted that, despite having correctly decided that the proposal raised issues of valuation only, the VTE should have refused to consider the appeal at all because the ratepayer’s grounds of appeal to it focussed exclusively on the VO’s refusal to split the site.

87. There are several answers to that unattractive submission. First, provided they were within the scope of the proposal, which valuation certainly was, whether the grounds of appeal were broad enough to include matters of valuation was a case management decision for the VTE. A case management decision will only be capable of being challenged in this Tribunal on very restricted grounds, as the Tribunal explained in Simpsons Malt Ltd v Jones (VO) [2017] UKUT 460 (LC), at [64]:

“An appellate tribunal should not interfere with a case management decision by a judge who has applied correct principles and taken into account matters which should be taken into account and not taken into account irrelevant matters, unless it is satisfied that the decision is so plainly wrong that it must be regarded as outside the generous ambit of the discretion entrusted to the FTT judge.”

88. Secondly, there was no unfairness in the VTE dealing with valuation issues as the VO came to the hearing prepared to meet the ratepayer’s case on valuation and did so successfully. No point was taken on behalf of the VO that the grounds of appeal were not sufficient to identify valuation as an issue. Quite the opposite; the VO insisted that valuation was the only issue which the appellant was entitled to be heard.

89. Finally, when read together with the proposal, the grounds of appeal are obviously concerned with rateable value as well as with whether the hereditament should be split. The VO’s decision was described as “factually incorrect” and claimed repayment of part of the sum of £30,000 which had been paid in rates in order to avoid enforcement. Matters of valuation are matters of fact, and a general challenge to the facts relied on by the VO is broad enough to include all of the facts, including the valuation of the site. There was no limit to the facts which were said to be incorrect and, in our judgment, the VTE was entitled to permit Mr Nelson to dispute the VO’s approach to valuation.

Issue 4: If the hereditament is not to be split, is the rateable value shown in the list correct?

90. In view of our conclusion on issue 1, issue 3 does not arise. The remaining issue concerns the rateable value of the site.

91. Mr Nelson acknowledged that he had no valuation experience, but he nevertheless produced values that he said were appropriate to the divisions in assessment that he sought. He took the Lease to Nelson Plant Hire and Nelson Recycling agreed in September 2013 and effective from 1 June 2015, as the starting point for the assessments. The commencing rental had been £14,956 per annum. Mr Nelson suggested the following rounded assessments:

|

Nelson Plant Hire |

£6,250 |

|

Nelson Recycling |

£8,000 |

|

Test Valley Skips |

£7,150 |

|

Nelson & Sons Demolition |

£5,500 |

92. In aggregate these figures amount to a rateable value of £26,900. Mr Nelson did not provide details of how he arrived at the individual assessments or how they related to the commencing rent.

93. The valuation evidence for the respondent was provided by Ms Young. She is a chartered mineral surveyor and RICS registered valuer. Ms Young explained that she had more than 15 years’ experience in the minerals and waste sector and had advised both landowners and minerals and waste operators. Since 2017 she had been employed by the Valuation Office Agency as a specialist surveyor and had undertaken valuation of secondary aggregate premises and waste transfer stations for rating purposes.

94. Notwithstanding that the grounds of the challenge document were that the assessment shown in the rating list as 1 April 2017 was wrong, Mr Nelson’s proposal had been processed on the basis that it challenged the later alteration, and it was this figure that Ms Young addressed in her report.

95. Ms Young commenced her valuation with what she described as comparable valuation methodology, comparing the actual rent for the hereditament to others in the same market. She considered the best evidence was ‘a suitable number’ of leases and rents in the same or similar mode or category of occupation in the locality. These should ideally be agreed close to the antecedent valuation date. The closer the lease terms were to the statutory assumptions and nearer the letting to the antecedent valuation date, the stronger the evidence and it would be weighted accordingly. She did not explain what ‘suitable’ meant in this context. She went on to consider six propositions regarding the weighting of evidence, which she said were set out in Lotus & Delta Limited v Culverwell (VO) and Leicester City Council [1976] RA 141. According to Ms Young the propositions are:

(1) Where the hereditament which is the subject of consideration is actually let that rent should be taken as a starting point;

(2) The more closely the circumstances under which the rent is agreed as to the time, subject matter and conditions relate to the statutory requirements contained in the definition of gross value in section 19(6) of the General Rate Act 1967, the more weight should be attached to it;

(3) Where rents of comparable properties are available, they too are properly to be looked through the eye of the valuer in order to confirm where otherwise the level of value indicated by the actual rent of the subject hereditament;

(4) The assessments of other comparable properties are also relevant. When a valuation list of prepared these assessments are to be taken as indicating comparative values as estimated by the VO. In subsequent proceedings on that list therefore they can properly be referred to as giving some indication of that opinion;

(5) In the light of all the evidence an opinion can then be formed of the value of the subject hereditament, the weight to be attributed to the different types of evidence depending on the one hand on the nature of the actual rent and, on the other hand, on the degree of comparability found in other properties;

96. Ms Young went on to say that although a passing rent should be considered as a starting point this may not be the best evidence of value for the hereditament. The actual rent would be less reliable if it was fixed some years ahead of the lease commencement and the circumstances and level of value may have subsequently changed. Similarly, adjustments would have to be made to reflect the statutory terms required if these were different to the actual agreement. Where a tenant has made improvements to the property the rent may need to be adjusted to reflect the alterations. Despite endorsing the hierarchy of evidence suggested in Lotus & Delta, Ms Young attached little weight to the passing rent. In response to questions from the Tribunal she explained her reasons, namely that there were a number of tenants improvements that need to be reflected in the assessment, the rent was agreed 18 months prior to the antecedent valuation date (‘AVD’), and it was not clear from the lease whether it related solely to the land or included the buildings as well. As to the last point, we note that the demise was clearly described in the Lease as:

“The property known as Waste Transfer Station, Weyhill Road, Penton Corner …”

Mr Nelson helpfully provided the original plan at the hearing. Photographs taken by Mr Nelson in 2014 showed buildings which had obviously been in place for a considerable time and certainly prior to the commencement of the lease. In addition, the site had been inspected by the VO in 2014. There is therefore no reason to think that the rent was not agreed for the whole of the site, including the buildings on it at the date agreement was reached.

97. Ms Young was at pains to point out that her experience in undertaking valuations based on rental comparison was limited. However, the necessary adjustments to the rent to take account of tenants’ improvements completed after the agreement of the Lease are relatively minor, and many could be valued by reference to the Valuation Office Agency (‘VOA’) cost guide. Ms Young acknowledged that it was common practice to adjust rents to take account of market conditions in circumstances where it was agreed some time prior to the AVD, and that indexation was a technique often deployed. In this case she said that she had not investigated the use of an index but thought it appropriate that the rent could be adjusted by the retail prices index. She did not identify any comparables that might be said to be in the same market, that is for sites used for secondary aggregate processing or waste transfer.

98. Notwithstanding that Ms Young did not provide an analysis of the rent on the property itself she confirmed that it produced an answer that was significantly lower than the storage land comparables that she had deployed in a ‘valuation in the alternative’. We will explore that valuation a little later in the decision.

99. Her conclusion on the choice of valuation methodology was that the contractor’s basis was to be preferred, particularly as the VO had used this method on almost all of the 437 secondary aggregate processing plants and waste transfer stations in the rating list.

100. We have not conducted a line-by-line appraisal of Ms Young’s contractor’s basis valuation as much of it relates to individual items of plant and machinery which have been valued by reference to the VOA cost guide and are not in dispute.

101. We do however note that Ms Young used a land value of £800,000 per hectare which she confirmed had been taken from a quarterly report published by the District Valuer Services (‘DVS’) arm of the VOA. It related to the value of industrial land in the Test Valley Council area in the first quarter of 2015. Ms Young had then adjusted this capital value by 50% to take account of the rural situation of the site and a further 5.4% ‘Ebdon Allowance’, this latter concession reflects what she described as ‘the encumbrance of the existing buildings on the site’ (see Imperial College of Science and Technology v Ebdon (VO) [1986] RA 233).

102. A properly constructed contractor’s basis valuation includes what is known as ‘Stage 5’ where the valuer stands back and considers whether further adjustments to the arithmetical total of the valuation are required. This site is very irregular in shape and shares a narrow access road with several other nearby occupiers. At the hearing Ms Young was asked whether she had considered any Stage 5 adjustments, particularly in relation to these two factors. She confirmed that she had regard to both in coming to a conclusion that neither merited any allowance.

103. It is worth noting that as at the date of submission of Ms Young’s report only two challenges in this mode or category of occupation had been settled, one by agreement and the other by a decision notice.

104. Ms Young’s alternative valuation was essentially based on the local tone for the component parts of the site with the plant and machinery added as a decapitalised cost. We have reproduced it in its entirety below:

|

Ref |

Description |

Area m2

|

£pm2

|

Value (£) |

|

1.0 |

North Yard (concrete) |

1856.0 |

7.50 |

13,920

|

|

2.0 |

South Yard (concrete) |

747.0 |

7.50 |

5,603

|

|

1.3 |

Office (Portakabin) |

83.8 |

30.00 |

2,514

|

|

1.5 |

Pressure Washer building |

4.3 |

22.50 |

97

|

|

1.8 |

Storage (container) |

14.4 |

10.00 |

144

|

|

1.9 |

Office (on top of 1.8) |

14.4 |

30.00 |

432

|

|

2.2 |

Mess Room (Portakabin) |

12.3 |

30.00 |

369

|

|

4.0 |

Lean to Store (steel frame and corrugated iron clad walls)

|

92.7 |

22.50 |

2,086

|

|

5.0 |

Waste processing building (steel frame structure, protected walls and roof)

|

220.0 |

22.50 |

4,950 |

|

5.10 |

Canopy (concrete wall lower 2.63m, profile metal walling and roof)

|

42.2 |

6.75 |

285 |

|

6.1 |

Store (container)

|

7.2 |

10.00 |

72 |

|

7.1 |

Laundry (brick walls, steel roof)

|

5.8 |

33.75 |

196 |

|

8.0 |

Welding and lubricant store

|

19.0 |

45.00 |

855 |

|

Sub Total

|

£31,523 | |||

|

Plant and Machinery Total Cost £121,754

Statutory decapitalization rate 4.4%

|

£5,357 | |||

|

TOTAL VALUATION

Stay

|

£36,880

£36,500 | |||

105. The value of the yard space is a significant element in the valuation. Ms Young noted a lack of useful rental evidence for secondary aggregate processing plants and therefore relied on evidence from storage land as the best alternative. Seven sites of differing quality were identified, ranging in size from 270 m2 to almost 3000 m2, in rateable value from £2,700 to £51,000, and in land value from £9.20 to £16.54 per m2.

106. We inspected all of the comparables most of which were used largely for storage. Although three of them were located close to the property they were all very small being barely 10% of the size. One of the comparables comprised land opposite Testway House, Andover which was a former car park in a business park and another at Plot 29 at North Way, Andover also appeared to have been previously used for vehicle parking. Steven’s Yard, Grateley had the most in common with the property, not least because it was being used as a recycling yard. It was a similar size and was in a rural position and the access appeared to be shared with other operators. Curiously, the valuation contained an allowance of 10% for difficulties with the access arrangements but we found them to be entirely satisfactory and certainly better than the situation at the property itself. There was an additional allowance of 10% for the shape of the site but we were unable to discern the boundaries and cannot comment on its appropriateness. A final site at Weyhill Road, Andover appeared to have been developed as a car and van hire operation and was no longer comparable. This site occupied a very prominent position adjoining an Aldi supermarket and a Shell filling station and we doubt that in its previous format, it would have been suitable for a secondary aggregate processing plant or waste transfer station. In the circumstances Ms Young’s adoption of £7.50 per m2 as a rate for the yards at the property did not appear unreasonable.

107. During the hearing Mr Nelson confirmed that the roadway that linked the entrance to the site with the northern and southern yards had a tarmac surface and was not concreted. Ms Young had assumed the whole of the yard area was reinforced concrete and commented that the tarmac surfaced area would attract a lower value. The extent of the area in question was not clear and we also noted that the total area in the valuation exceeded the site area of the contractor’s basis valuation by approximately 100 m2.

108. The remaining parts of Ms Young’s alternative valuation were more difficult to judge. Ms Young told us that the tone for portakabin offices was £30 per m2 but these types of buildings come in many guises and this particular example was quite basic. In the absence of any other evidence, we accept this figure at face value. However, the “office” (Ref 1.9) was a converted shipping container and should not have been valued at the same rate as the portakabin offices.

109. We had difficulty in reconciling the remaining parts of the valuation with what we found on the ground. The waste processing building (ref 5.0) was an open sided store of very basic construction which differed little from the canopy (ref 5.1) but was valued at more than three times the rate. The laundry was valued at 10% more than the portakabin offices and the welding store which is of timber construction at 50% more.

Valuation - Discussion

110. We begin, as Ms Young did, with the rent agreed in 2013. This transaction arose out of a need to regularise Mr Nelson’s occupation of the site as his immediate landlord, Mr Lane was suffering ill health. We are satisfied that the negotiations were concluded on an arm’s length basis. It is not known whether any valuation advice was sought by either side but bearing in mind that Mr Nelson was licenced to operate his business solely from the site it might be considered that the landlord had the upper hand. Nevertheless, terms and a commencing rent were agreed albeit they were somewhat unconventional in format. Rather than dismissing this important evidence out of hand we see no reason why the necessary adjustments should not at least be attempted to determine whether the resulting valuation would be a suitable basis for the assessment. We were surprised by Ms Young’s reluctance to place any weight on it, which may have been due to a lack of experience in carrying out comparative valuations, but we do not accept that the rent has no utility.

111. We appreciate that the VOA has an institutional preference for the contractor’s basis when valuing this type of site and that rental evidence is scarce. In our view, when a rent does exist, especially one struck only 18 months prior to the AVD, the valuer should consider very carefully whether it should displace the preferred methodology rather than being disregarded as unreliable. A more satisfactory approach, making use of all of the available evidence, is to consider whether a valuation based on market evidence corroborates or casts doubt on a valuation arrived at by the artificial and more subjective contractor’s basis which is usually seen as a method of last resort.

112. This is particularly true where a significant component of the contractor’s basis valuation is reliant on the views of others who did not give evidence and whose conclusions were simply adopted by Ms Young without consideration of the underlying evidence on which they were based. Ms Young had not investigated the basis on which her colleagues in the DVS team had concluded that the value of industrial land in the Test Valley area was £800,000 per hectare and we are therefore reluctant to place much weight on this figure. It related to sites which were suitable for speculative industrial development, not those fit for occupation for secondary aggregate processing and waste transfer. The adoption of a matrix derived adjustment of 50% for the rural position of the site was also surprising since the site forms a part, albeit a peripheral one, of an established industrial area. The absence of a Stage 5 narrative cast further doubt on Ms Young’s contractor’s basis valuation.

113. Ms Young placed little or no weight on her own alternative comparative valuation, which produced a substantially higher assessment. We share her lack of enthusiasm. The factual basis appears to be not entirely reliable, and application of the local tone seems arbitrary.

114. We therefore return to the rent as the starting point for the valuation. The guidance in Lotus and Delta and in particular the sixth ‘proposition’, assists the valuer in circumstances where comparables are difficult to find. The circumstances at the property are a case in point; it is precisely because comparables are hard to find that the rent for the subject site itself takes on more importance. We set out the basis on which the rent was agreed in paragraphs 17 and 18 and list the improvements and the dates they were completed in paragraphs 24 and 25. We have no evidence about what happened to rental values for this type of site in the locality during the period 2013 to 2015. It seems to us unlikely that values changed significantly, but the parties hedged their bets by electing to index the rent, albeit from the point when Mr Nelson first became involved in the site. The rent undoubtedly has limitations but to reject it over concerns relating to the degree to which it does not conform to the statutory hypothesis is unwarranted. It is a figure agreed between willing parties reasonably close to the AVD on the basis that the incoming tenant would be responsible for the cost of repairs and insurance. In those respects it reflects the statutory assumptions.

115. Several changes on site occurred after the agreement of the lease including the addition of the portakabin office, improvements to the boundary walls and fencing and installation of the weighbridge. It follows that the assessment at the material day should include the value of these more recent buildings and facilities which were not part of the original bargain. In the absence of more reliable evidence, we consider that the agreed rent, together with the annual value of the portakabin and plant and machinery installed prior to 1 November 2016 form a sound basis for the assessment. As far as the plant and machinery is concerned, we see no reason why Ms Young’s figure of £5,357 from her alternative valuation should not be adopted. It relates to the changes noted by Mr Banks on his visit but not the most recent alterations that we saw on our inspection. We have valued everything in the agreed list irrespective of which of the occupiers of the site uses it.

115. We are also of the view that the shape of the site and the shared access arrangements are worthy of allowances. Evidence from the site at Grateley indicates that allowances have been given in the locality (our concerns about whether they were appropriate in that particular case do not undermine the principle that an appropriate allowance should be made where it is warranted). We take the view that the rent reflects allowances of 10% each for the shape of the site and the shared access arrangements. We have applied the end allowance to the entire value as much of the value attached to the plant and machinery relates to items that are affected by the disabilities of the site. We further note that applying the same end allowances to Ms Young’s Contractor’s Basis valuation produces an assessment of rateable value £23,000, a figure some 2.2% higher than the assessment we arrived at by starting with the rent. The valuation is therefore as follows:

116. We therefore determine that there is no case to divide the assessment, but the rateable value currently shown in the rating list is excessive and should be reduced to £22,500.

Martin Rodger KC Mark Higgin FRICS, FIRRV

Deputy Chamber President Member

24 November 2022

Right of appeal

Any party has a right of appeal to the Court of Appeal on any point of law arising from this decision. The right of appeal may be exercised only with permission. An application for permission to appeal to the Court of Appeal must be sent or delivered to the Tribunal so that it is received within 1 month after the date on which this decision is sent to the parties (unless an application for costs is made within 14 days of the decision being sent to the parties, in which case an application for permission to appeal must be made within 1 month of the date on which the Tribunal’s decision on costs is sent to the parties). An application for permission to appeal must identify the decision of the Tribunal to which it relates, identify the alleged error or errors of law in the decision, and state the result the party making the application is seeking. If the Tribunal refuses permission to appeal a further application may then be made to the Court of Appeal for permission.