Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

United Kingdom Upper Tribunal (Lands Chamber)

You are here: BAILII >> Databases >> United Kingdom Upper Tribunal (Lands Chamber) >> Alridge & Ors v London Southend Airport Company Ltd (COMPENSATION - runway extension at Southend Airport) [2021] UKUT 8 (LC) (11 March 2021

URL: http://www.bailii.org/uk/cases/UKUT/LC/2021/8.html

Cite as: [2021] UKUT 8 (LC)

[New search] [Contents list] [Printable PDF version] [Help]

UT Neutral citation number: [2021] UKUT 8 (LC)

UTLC Case Number: LCA/65-255/2019

TRIBUNALS, COURTS AND ENFORCEMENT ACT 2007

COMPENSATION - LAND COMPENSATION ACT 1973 Part 1 – runway extension at Southend Airport - whether use of extension depreciated the value of 10 representative properties - physical factors - noise - change in number and type of commercial aircraft using airport - assessment of effect on value - treatment of intensification of use - compensation awarded

IN THE MATTER OF NOTICES OF REFERENCE UNDER PART 1,

LAND COMPENSATION ACT 1973

|

BETWEEN: |

|

|

|

|

HEATH COLIN ALRIDGE & OTHERS |

Claimants |

|

|

and |

|

|

|

LONDON SOUTHEND AIRPORT COMPANY LIMITED |

Respondent |

|

|

|

|

Re: 10 representative properties in Rochford and Southend in proximity to London Southend Airport

Martin Rodger QC, Deputy Chamber President and Andrew J Trott FRICS

6 - 9 and 12 October 2020

Hearing conducted by remote digital platform

James Burton, instructed by Hugh James LLP, solicitors, for the claimants

Robert Walton QC, instructed by Hill Dickinson LLP, for the respondent

© CROWN COPYRIGHT 2021

No cases are referred to in this decision.

Introduction

1. On 8 March 2012 an extension to the existing runway at London Southend Airport was opened. The runway had been 1,605m long and it was extended to the south west by 300m plus a further 80m starter strip and turning head. This extension enabled the Airport to attract low cost commercial airlines operating much larger aircraft than had previously flown from it. In April 2012 EasyJet began to operate services from the Airport using Airbus A319 jets and shortly after that Ryanair commenced regular flights with similar aircraft.

2. The runway extension was one step in a planned expansion of the Airport which had been in prospect for a number of years and for which planning permission had been granted in 2010. The expansion was expected to lead to an increase in passenger numbers from levels below 50,000 a year in the 10 years before the extension to a projected two million passengers a year by 2020.

3. On 6 March 2019 190 current and former owners of houses in the vicinity of the Airport referred claims to the Tribunal for compensation under Part 1 of the Land Compensation Act 1973. The claimants assert that the value of their homes has been depreciated by physical factors caused by the use of the runway extension, and in particular by the increased noise they experience from the larger aircraft which now take off and land at the Airport. The respondent to the references is the Airport operator, London Southend Airport Company Ltd.

4. The parties identified 10 representative properties and agreed that the claims in relation to those should be determined first.

5. At the hearing of the 10 lead claims the claimants were represented by James Burton and the respondent by Robert Walton QC. Expert evidence on the noise environment at the Airport was given on behalf of the claimants by Rupert Thornely-Taylor of Rupert Taylor Ltd, and on behalf of the respondent by David Charles of Bickerdike Allen Partners LLP. Expert valuation evidence was given on behalf of the claimants by Simon Deacon FRICS of Wheeldon and Deacon, Chartered Surveyors and on behalf of the respondent by Paul Fosh MRICS FAAV of Strutt & Parker.

6. Evidence of fact was provided by the lead claimants in witness statements which in each case included a supplemental statement responding to observations made about their own properties by Mr Fosh in his report. The contents of the claimants’ various witness statements were not challenged and they were not called to give oral evidence. Two employees of the respondent gave evidence of fact which was also unchallenged.

The lead claims

7. The ten lead claims are thought to be typical of the properties of other claimants at different locations around the Airport perimeter and along the flight path at each end of the runway.

8. Four of the lead properties are in the village of Rochford, which is located to the north east of the runway. The outer edges of Rochford adjoin open farmland and have a very different feel from the much more urban areas closer to the Airport. One of the Rochford lead properties is on the village’s rural fringe, and one immediately adjoins the end of the runway. Two lead properties are adjacent to the south-east side of the runway and have postal addresses in Southend itself. The last four lead properties are to the south west of the runway. Three have postal addresses in Westcliff on Sea and the fourth has a postal address in Leigh on Sea. The land rises generally from the Airport towards Westcliff and the properties in this area look down on the runway.

9. The value of the lead properties at 8 March 2013 ranged from £150,000 to £280,000 and the quantum of the lead claims is put by the claimants at between £32,200 and £60,100. The respondent denies that the value of any of the lead properties has been diminished by relevant physical factors resulting from the use of the runway extension and it values each of the claims at nil.

10. After the hearing the Tribunal undertook an inspection of the lead properties and other properties relied on as comparables. We were given access to six of the lead properties. The remaining four lead properties have been sold by the relevant claimant and we were able to view these only from outside. We also viewed the comparable properties from the highway.

Relevant statutory provisions

11. Part 1 of the Land Compensation Act 1973 confers a right to compensation where the value of an interest in land is depreciated by physical factors caused by the use of public works: section 1(1). To be eligible for compensation a claimant must have a qualifying interest in land and must make a claim within a prescribed period. In these references, it is agreed that the claimants’ interests qualify for compensation, subject to proof of depreciation in value, and that the claims have been brought within time.

12. The physical factors which may give rise to a claim are identified in section 1(2) of the Act and include noise, vibration and artificial lighting. The relevant public works are listed in section 1(3) and section 9 and include any aerodrome.

13. Section 3(2) of the Act prohibits the making of a claim before the “first claim day”, which is the day next following the expiry of 12 months from the “relevant date”. Where the claim is in respect of physical factors caused by aircraft following runway or apron alterations to an aerodrome, the relevant date is the date on which those alterations were first used after their completion: section 9(2)-(3).

14. Section 4 provides for the assessment of compensation.

15. By section 4(1) the compensation payable on any claim is to be assessed “by reference to prices current on the first claim day”. Section 4(2) then provides:

“In assessing depreciation due to the physical factors caused by the use of any public works, account shall be taken of the use of those works as it exists on the first claim day and of any intensification that may then be reasonably expected of the use of those works in the state in which they are on that date.”

This provision does not alter the direction that compensation for depreciation in the value of an interest in land is to be assessed by reference to prices current on the first claim day. Its purpose, as it appears to us, is to rule out any argument that some part of a depreciation in value is ineligible for compensation because it is not due to physical factors caused by the use of the works at the first claim day, but instead reflects an expectation that greater interference will be experienced from physical factors in future as a result of a subsequent intensification of use. We will return to the issue of intensification when we consider the valuation evidence.

16. A claim for compensation is initiated by a notice of claim given under section 3(1). By section 4(4) the value of the interest in land in respect of which the claim is made is to be assessed by reference to the nature of the interest and the condition of the land as it subsisted on the date of service of the notice of claim. By section 16 disputes are to be referred to the Upper Tribunal.

17. For these references it is agreed that the relevant date, the date on which the runway alterations were first used, was 8 March 2012 and that the first claim day is 8 March 2013.

18. The claimants’ case is that each of their properties has been diminished in value as a result of aircraft noise caused by the runway extension and, in particular, by the much larger aircraft which are now able to use the Airport. Although other physical factors were mentioned in their statements of case, the claimants’ case as presented at the hearing was based entirely on the impact of additional noise. Each claim is quantified in two parts: the first measures the diminution in value of the properties at the first claim day, to which there is then added a further sum attributable to “intensification”.

Agreed facts

19. The parties helpfully agreed a number of facts about the use of the Airport before and after the runway extension.

20. In the 1960s and 1970s the Airport had a sizeable passenger operation focussed on Mediterranean charter services and at its peak in 1967 over 683,000 passengers passed through the Airport. Commercial air traffic then declined to around 100,000 passengers a year during the 1980s.

21. Passenger numbers fell to below 10,000 a year between 1993 and 2006. In June that year a regular charter flight commenced between Southend and Cologne which carried up to 43,000 passengers a year operating approximately seven times a week using 99 seat BAE 146 short-haul regional aircraft. The Cologne service was discontinued in 2008. In the 1990s commercial flights to Jersey were also operated from the Airport and carried up to 3,000 passengers a year. These services ceased in 2011.

22. Most of the 110,000 annual air traffic movements served by the Airport during the 1980s were not by commercial passenger services but by flying clubs and private flights. In 2007 the total number of air traffic movements from the Airport was a little under 40,000. Of these only about 3,500 were commercial passenger, cargo or mail services (referred to collectively as “commercial” flights). About 20,000 were by members of flying clubs and about 10,000 by private non-commercial owners and operators. The remaining flights included movements for the purpose of testing aircraft or training flying crew or ground personnel, and a small number of official and military flights.

23. The runway is aligned on a south west (now 230o magnetic) to north east (050o) axis. The runway extension is at the south-western end of the original runway. It was undertaken pursuant to a planning permission sought in October 2009 and granted in April 2010. Work on the runway extension began in September 2011 and was completed in February 2012 (the runway was not closed during the works, except for a short period in February and March 2011). The runway was first used on 8 March 2012.

24. The total number of aircraft movements in 2011 had been 25,470, considerably fewer than in 2007. In 2012 there were 27,715 aircraft movements of which 53% were flying club and private flights and 32% (8,883) were commercial flights. Almost as soon as the runway extension opened EasyJet began operating from the Airport, followed in 2014 by Ryanair and other low-cost carriers. By 2014 the total number of aircraft movements had increased to 30,514, an increase of about 10% compared with 2012, with the proportion of commercial aircraft movements increasing to 45% of the total (13,699).

25. Of greater significance than the raw number of aircraft movements of different classes was the change in the type of aircraft. In 2011 only five A319 Airbus commercial passenger flights had used the Airport. In 2012 this number rose to 1,683, representing 27.1% of total aircraft movements, and in 2014 it rose again to 1,909 (25.6%).

26. Some impression of the change in the size of the aircraft using the Airport after the extension of the runway can be gleaned from a comparison of total passenger numbers. In 2011 42,439 passengers had used the airport. In 2012 that figure rose to 617,027. By 2014 it had reached 1.1 million and although it fell slightly in the following two years it returned to that level in 2017. In 2018 almost 1.5 million passengers used the Airport.

27. The general picture since the opening of the runway extension has therefore been of a relatively modest increase in the total number of aircraft taking off and landing at the Airport, compared to traffic immediately before the extension. There was no return to the number of flights which had been seen in the 1980s or as recently as 2007 but there was a marked change in the composition of the total. In particular, the number of large commercial jets rose from negligible levels before the extension to significant numbers (some 25%) from 2012 onwards. The use of the Airport by flying clubs and other small private aircraft more than halved between 2007 and 2012 and has continued to fall.

28. The runway extension has not changed the areas overflown by aircraft, but it has brought about changes in the position of certain operations. Aircraft departing to the east now start their take off run from the new starter strip, which is more than 300 metres further from the houses north east of the Airport over which flights pass as they ascend. However, aircraft landing from the west also use the new runway extension and touch down much closer to the houses to the south west of the Airport than formerly. To try to ameliorate this adverse effect aircraft are now required to approach the runway at a slightly steeper angle. Also the preferred daytime runway procedure is for fewer than 50% of landings and take offs to be from/to the south west. The Airport’s annual reports state that this has been achieved each year between March 2012 and February 2019 (averaging 43%). By approaching from the rural north-east aircraft avoid crossing the more densely populated areas of Southend and Westcliff on Sea, but this is possible in fewer than 60% of aircraft movements.

29. New controls have been imposed on the number of night-time movements (meaning flights between the hours of 23:00 and 6.30) and the preferred procedure is for all such flights to take off towards or land from the north east. On average this was achieved two-thirds of the time. It was not suggested that these changes had reduced the number of night flights when compared to the number before 2012 (which are likely to have been very small). The number of aircraft movements, for both daytime and night time, has been well within the annual quota limits contained in the planning obligation agreement dated 30 April 2010.

30. There was evidence from Ms Jo Marchetti, the Corporate and Social Responsibility Manager at the Airport, to the effect that if planning permission had not been obtained for the runway extension the Airport would have sought to expand its business in other ways. This evidence was not challenged. We accept that there may have been an increase in private business aviation or recreational flying but, as the experts on noise agreed, it is not possible to model the consequences of changes which are themselves speculative. In any event, Part 1 of the 1973 Act does not require a comparison between circumstances as they were at the first claim day and as they might have been if the runway extension had not taken place. It requires an assessment of the diminution (if any) in the value of the subject properties by reason of particular physical factors resulting from the use of the relevant works. It may be a convenient shorthand to consider the value of the properties as if the works had never been carried out, but it is not permissible to speculate about what other sources of noise might have been introduced.

Noise

31. The experts on noise, Mr Thornely-Taylor and Mr Charles, agreed a helpful statement which covered most of the matters raised by their evidence.

32. The incidence of aircraft noise can be illustrated using annual equivalent (average) levels on the summer LAeq, 16h index for daytime flights (those occurring between 7am and 11pm). For night time noise (between 11pm and 7am) the appropriate index is the annual Lnight index.

33. The LAeq index is not simply a scale for measuring the level of noise at a particular location. It is a composite index of environmental noise taking into account the number of aircraft noise events, their noise level and duration. It is not a linear scale: if the number of noise events doubles the index rises by 3, and if the duration of noise doubles it also rises by 3. The index does not distinguish between a large number of quieter events and a small number of noisier events, both of which may have the same value on the LAeq index. While it is in common use, the experts agreed that the index was based on the general environmental noise scale, the dBA, which is less sensitive to the character of aircraft noise than scales used for the noise certification of aircraft types. Aircraft with the same value on the LAeq index might sound noticeably different. As a result, the public reaction to aircraft noise recorded at the same point on the index may vary significantly.

34. Daytime noise levels for each of the lead properties were computed by Mr Charles’ firm using the agreed index for the summer periods in the years 2007, 2011, 2014 and 2018. The resulting figures were adopted by both experts. Night time noise levels for each property were computed using the annual Lnight index for 2006, 2011 and 2016.

35. The levels of noise were not uniform at the ten lead properties. As one would expect, the closer a property was to the runway the higher the level on the day and night scales. The lead property which experienced the highest levels of noise on the scale was 57 Southend Road, belonging to Mr and Mrs Day. It is separated from the north eastern end of the runway only by the Airport boundary fence and the two lane public highway running around the perimeter.

36. For six of the ten lead properties summer daytime noise levels expressed in terms of the index were higher in 2007 than in 2014, but in all cases the noise level fell between 2007 and 2011 before rising again in 2014. That rise continued in all cases in 2018 by which time noise levels in six of the ten lead properties were higher than they had been in 2007, and all ten were higher than in 2011.

37. Relative to the levels calculated for 2011, the LAeq index for 2014 rose by 3 points at four of the lead properties and by 4 points at a fifth. It will be remembered that a rise of 3 points is equivalent to a doubling in the number or duration of equivalent noise events. Three of the properties experiencing these higher levels of increase were in Rochford, to the north east of the airport, one was in Southend, to the east of the airport, and one was in Leigh on Sea, to the south west of the Airport. Four properties experienced increases of 2 points on the scale, while the final property experienced an increase of 1 point.

38. By 2018 the level calculated for each of the properties on the daytime LAeq index was higher than it had been in 2011 and in 2014. Of the five properties which had scored lowest in 2011, two had increased by 6 points on the index since 2011 (one in Southend and one in Rochford), one had increased by five points, and two by four points. Four of the remaining properties had increased by four points since 2011 and one had increased by three points.

39. A similar pattern was shown for annual night time noise by the Lnight index figures. In nine cases night time noise was at a lower point on the index in 2011 than it had been in 2006 and in the remaining case it was the same. In all cases night time noise rose between 2011 and 2016. In 2016 night time noise registered on the index was lower than in 2006 at four properties, higher at five and the same at one. In all but one case the night time noise was 3 points or more higher on the Lnight index in 2016 than it had been in 2011, and at one property it was 7 points higher.

40. The experts also agree a number of matters concerning attitudes to aviation noise around airports and how they relate to the UK Aircraft Noise Exposure Indexes.

41. The World Health Organisation’s Environmental Noise Guidelines for the European Region published in 2018 identified an association between sleep disturbance and exposure to aircraft noise at noise levels above 40 dB on the Lnight index. The WHO’s Guideline Development Group strongly recommends reducing noise levels for aircraft at night to below 40 dB Lnight. This recommendation is much more demanding than the WHO’s previous guidance published in 2000, which recommended that night time noise exposure should not exceed 45 dB. Mr Charles drew attention to the WHO’s own description of the evidence base it had used when making its assessment as being of moderate quality and to its acknowledgement that adopting a 40-dB limit would require almost complete closure of all transport systems at night. The experts agreed that the published research showed that at night the percentage of the population that is highly sleep disturbed by aircraft noise rises from 11.3% at 40 dB Lnight to 15% at 45 dB Lnight.

42. In 2011, night noise levels were at 40 dB Lnight or above for six of the ten lead properties and above 45 at only one. By 2016, night noise levels were between 45 and 46 for seven properties, with one (57 Southend Road) at 54, one at 44, and one (5 Taunton Drive) at 40.

43. In 2017 the Civil Aviation Authority published a study entitled Noise Attitudes 2014: Aircraft (CAP 1506) which measured, on the basis of survey data, the proportion of the population who experienced annoyance at different exposure to aircraft noise by reference to the LAeq index. At levels on the daytime index between 54.0 dB and 56.9 dB 23.5% of respondents expressed themselves very or extremely annoyed by their exposure to aircraft noise. At the same level of the index 71.6% expressed themselves at least slightly annoyed. At 51.0 to 53.9 dB on the daytime index 11.1% of respondents expressed themselves to be very or extremely annoyed by their exposure to aircraft noise while 50.9% expressed themselves to be slightly annoyed or worse.

44. The Department of Transport responded to CAP 1506 and noted that the degree of annoyance previously occurring at 57 dB LAeq now occurs at 54 dB. Before the publication of CAP 1506 government policy had assumed that 57 dB marked the approximate onset of significant community annoyance.

45. In 2014, summer daytime noise levels calculated on the LAeq index were at or above 54, the level at which more than a quarter of respondents expressed themselves highly annoyed by their exposure to aircraft noise, at eight of the ten lead properties (with three properties at or above 57, the highest of which was at 63). In 2011 noise levels had been at or above 54 on the index at four properties (with the highest level at 61).

46. We were shown noise contour plans prepared by the respondent which mapped the areas affected by noise at 54 dB and above. There was some attempt to supplement these carefully considered documents with informed but inevitably impressionistic estimates from the witness box by Mr Thornely-Taylor and Mr Charles of where the 51-dB contour might lie. The purpose of this evidence was to call into question the assumption by the valuation experts that certain properties could be regarded as unaffected by aircraft noise and thus serve as useful comparators or as components in an index. We did not find it of much assistance.

47. The general impression created by the daytime noise data is that between 2011 and 2014 what was already quite a noisy environment got noisier and at four of the lead property locations by 2014 levels of noise had returned to or exceeded those which had been experienced in 2007. Levels of noise measured on the agreed scales continued to increase and by 2018 was at or above 2007 levels in seven out of ten locations. The only suggested cause of the increase is the runway extension and the larger, noisier aircraft which it allowed the Airport to accommodate.

48. The noise data was supplemented by the evidence of the claimants themselves and by the Tribunal’s observations on its inspection. Although the claimants’ own evidence is necessarily subjective and self-interested, and we bear that firmly in mind, the truthfulness of the claimants’ accounts of their own experiences was not challenged. It provides a much more immediate and vivid impression of the change in the noise environment following the runway extension than can be derived from the technical data alone. It also includes anecdotal accounts of the reactions of third parties, including visitors and potential purchasers, which the claimants have observed when marketing their properties.

49. One consistent theme of the claimants’ evidence was that, before the runway extension, the aircraft using the Airport were mostly very small. Mrs Hickman referred to it imaginatively as “a cottage airport”. Mrs Buckley, who lives at 161 Stambridge Road in Rochford, described it as “only a small airport with little light aircraft”. Ms Collins, whose house at 8 Dulverton Avenue in Westcliff on Sea is to the south west of the Airport described it as being “just used by little propeller planes, I presume from a flying school …[which] had very little noise coming from them.” She acknowledged that the Airport was also used for maintenance of larger planes but described this as “so sporadic that it did not make any impression”. Mr Glozier, Mrs Hooper, Mr Simpkins and Mr Tappin gave evidence to the same effect.

50. The Tribunal’s inspection occurred while traffic using the Airport was very substantially reduced as a result of the coronavirus pandemic. Most of the aircraft we observed taking off and landing were small private planes of the sort referred to by Mrs Buckley and Ms Collins. While it is likely that there were many more of these aircraft when the Airport was operating normally before the runway extension, the small numbers which we observed gave us a clear impression of the quite modest level of noise which they created.

51. The claimants also dealt in their evidence with their experiences of the much larger and more obtrusive aircraft which began using the Airport in significant numbers after completion of the runway extension. Flights leave from 6.30am every day of the week with up to six flights in the first hour of operation. They continue until 11.30pm, with occasional aircraft landing later in the night (Mrs Buckley said she was woken once or twice a month). Ms Collins described the planes which began to arrive when the extension was opened as “large and loud” and the noise they create as “thunderous and [lasting] for around 20 seconds” and as causing vibration “which makes it feel like the house is shaking”.

52. Mr Day, whose house at 57 Southend Road adjoins the northern end of the runway, referred to aircraft noise lasting three or four minutes. We do not think that is an accurate account of the duration of the noise experienced when an aircraft is landing, but we accept that because of its position Mr Day’s property is likely to be exposed to the noise of aircraft taxiing and waiting immediately before taking off. Mr Day was also one of those who referred to artificial light as an issue which he had encountered only after the runway extension, as well as fumes from aviation fuel.

53. Several of the claimants said that aircraft noise now interrupts their telephone conversations and while watching television. Mr Glozier referred to difficulty settling his children to sleep.

54. While the Tribunal was carrying out its inspection of Ms Collins’ home in Westcliff we witnessed a large jet passing overhead on its final descent to the runway. From inside the house we were distinctly aware of the aircraft approaching before we observed it from an upper window and we accept Ms Collins’ description of the duration and intensity of the noise incident and the vibration it caused. In contrast, we were mostly unable to hear the regular traffic of light aircraft taking off and landing while indoors at the properties we inspected and were generally aware of them only while outside.

55. We witnessed two other large jets during the day, both while standing outside; one took off while we were outside 161 Stambridge Road, while another landed while we were outside 22 Mendip Crescent. With the benefit of this experience we were better able to understand the evidence of the claimants about the effect these large aircraft have on the enjoyment of their homes and gardens.

56. The level of activity which the Tribunal observed on our inspection, involving large jet aircraft and smaller recreational and business flights, was very significantly reduced from the number of aircraft movements at the first claim day. By that time both EasyJet and Ryanair had ceased operating from the Airport because of the pandemic.

57. Several claimants gave accounts of the reaction of visitors, including prospective purchasers, to aircraft noise at their properties after the runway extension. There was no comparable evidence of the reaction of visitors to activity at the Airport before the extension.

58. Mrs Hickman, whose former home at 173 North Crescent is separated from the extended southwestern end of the runway only by an area of recreation ground, put it on the market in December 2016 and had fourteen viewings over a period of approximately three months. No offers were made and the feedback she received was generally that the property was too close to the Airport. Mrs Furnish had hoped to sell her mother’s home at 43 Treelawn Drive to a developer. She described meeting him at the property as an aircraft passed overhead and he showed no further interest in buying. She also referred to the time it had taken her neighbour to achieve a sale, which she attributed to aircraft noise. Mr Simpkins put his property at 5 Taunton Drive on the market in July 2011 and stated that there was no interest in it from potential buyers after the runway extension opened in March 2012 until he reduced the price on the advice of his estate agent before securing a sale in July 2012.

59. Mr Walton QC submitted, and we accept, that the Tribunal is charged with determining how (if at all) the change in noise levels affected the market, not how it affected individual claimants. A prospective purchaser at the first claim day may not have known about the historical change in the pattern and level of noise caused by the opening of the runway extension. The purchaser would not care about what the noise environment used to be like but might be concerned about the possibility of intensified use of the Airport in the future.

60. That is not to say the claimants’ direct evidence is irrelevant to the exercise which we must undertake, but it is not a determining factor in the valuation exercise to which we now turn.

Depreciation in value

61. The valuation experts were concerned with the “switched-on” and “switched-off” values of the lead properties as at 8 March 2013. The difference between the two, if any, represents the depreciation in value and therefore the basic amount of compensation claimed. The experts agreed that the expression “switched-on” means “the reality of the runway extension built and in use” and the expression “switched-off” means “the runway extension built but not in use”. Mr Fosh did not think the opening of the runway extension had diminished the value of any of the lead properties and therefore his switched-on values were the same as his switched-off values. Mr Deacon disagreed and produced a series of complex calculations to demonstrate there had been a significant reduction in the value of each of the lead properties. He also thought further compensation was payable because of expected intensification in the use of the runway extension.

62. The switched-on valuations were recorded in the experts’ statement of agreed facts, as amended during the hearing. The final figures are shown in Table 1 below:

Table 1: “switched-on” values

Lead property Mr Deacon (claimant) Mr Fosh (respondent)

5 Taunton Drive £250,000 £280,000

22 Mendip Crescent £160,000 £170,000

8 Dulverton Avenue £210,000 £245,000

173 North Crescent £185,000 £200,000

5 Bristol Road £255,000 £240,000

161 Stambridge Road £250,000 £260,000

57 Southend Road £180,000 £180,000

41 Queen Elizabeth Chase £150,000 £155,000

43 Treelawn Drive £185,000 £190,000

14 Millview Meadows £200,000 £200,000

63. Mr Deacon expressed the diminution in value of the lead properties as “growth foregone” and added to this his allowance of 5% for intensification of use to give the total compensation claimed. His final figures are shown in Table 2 (because Mr Deacon’s final figures were amended at a very late stage the Tribunal limited the “growth foregone” on which the Claimants could rely to a maximum of 16%):

Table 2: Mr Deacon’s calculation of compensation

|

Lead Property |

(A) Mr Deacon’s switched-on value (£) |

(B) Mr Deacon’s growth foregone (£) |

(C) Mr Deacon’s switched-off value (£) |

(D) Mr Deacon’s allowance for intensification of use (5% of C) (£)

|

(E) Compensation (B+D) (£) |

|

5 Taunton Drive |

250,000 |

37,650 (15.06%) |

287,650 |

14,383 |

52,033 |

|

22 Mendip Crescent |

160,000 |

26,000 (16.25%) |

186,000 |

9,300 |

35,300 |

|

8 Dulverton Avenue |

210,000 |

33,663 (16.03%) |

243,663 |

12,183 |

45,846 |

|

173 North Crescent |

185,000 |

30,192 (16.32%) |

215,192 |

10,760 |

40,952 |

|

5 Bristol Road |

255,000 |

40,622 (15.93%) |

295,622 |

14,781 |

55,403 |

|

161 Stambridge Road |

250,000 |

40,575 (16.23%) |

290,575 |

14,529 |

55,104 |

|

57 Southend Road |

180,000 |

32,238 (17.91%) |

212,238 |

10,612 |

42,850 |

|

41 Queen Elizabeth Chase |

150,000 |

23,565 (15.71%) |

173,565 |

8,678 |

32,243 |

|

43 Treelawn Drive |

185,000 |

30,211 (16.33%) |

215,211 |

10,761 |

40,972 |

|

14 Millview Meadows |

200,000 |

32,800 (16.40%) |

232,800 |

11,640 |

44,440 |

The case for the claimants

64. Mr Deacon has always practised in Essex, both before and after he qualified as a chartered surveyor in 1992. He has extensive experience of the area in which the claim properties are located, having undertaken 10,000 valuations, surveys and inspections for purchase and disposal. But he does not undertake estate agency and was not involved in the sale of any of the comparable transactions upon which he relies.

65. Mr Deacon estimated the switched-on values of the lead properties as at the first claim day by reference to transactions in the same or near-by streets using his expertise and knowledge of the local market.

66. Mr Deacon’s primary test for establishing whether the switched-on value of the lead properties had been depreciated by physical factors caused by the use of the runway extension was called the “repeat sales” test. This involved the comparative analysis of repeated sales of properties in the claim (or nearby) streets (“affected properties”) with repeated sales of similar properties in streets unaffected by the use of the runway extension (“unaffected properties”). Mr Deacon identified 26 affected properties, of which three were lead properties and one a claim property not selected as a lead property. The other 22 properties were not the subject of a compensation claim. He also identified 59 unaffected properties.

67. The affected and unaffected properties were chosen because each of them had been sold at least twice prior to the relevant date (the date the extended runway was first used, 8 March 2012) and at least once subsequently. Mr Deacon limited the choice of post-relevant date sales to those which took place before 8 March 2016. No limit was placed on the date of sales before the relevant date. The earliest date of sale relied upon by Mr Deacon was January 1995.

68. The purpose of the repeat sales test was to compare the performance of comparable affected and unaffected properties between the two pre-relevant date sales and then to see how, if at all, that relative performance changed once the runway extension was in use. Mr Deacon considered that, absent any other cause or explanation, any decline in the relative price performance of an affected property was attributable to the physical factors caused by the use of the runway extension.

69. Because the dates of sales varied, Mr Deacon indexed the sale prices of the affected properties to the corresponding dates of sale of the unaffected properties using the Southend section of the Land Registry’s UK House Price Index (“UKHPI”). None of the prices were indexed for longer than two and a half years and most were indexed for considerably shorter periods. Mr Deacon then calculated the percentage difference between the first and second (pre-relevant date) sale prices for both unaffected and affected properties. He did the same for the second and third (post-relevant date) sale prices and compared the two percentages (expressed as their difference in percentage points) to see whether there had been a change in the growth pattern.

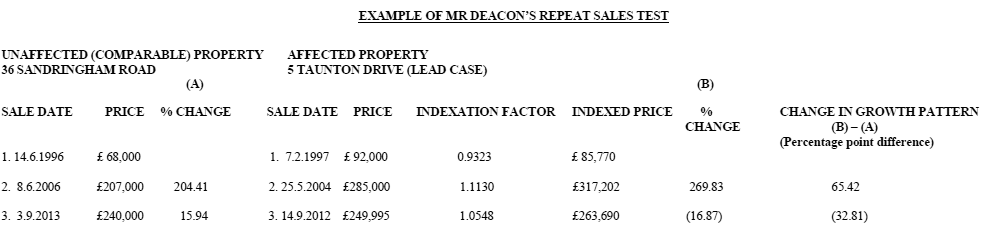

70. The table in Annex A illustrates this analysis using the example of 5 Taunton Drive (a lead property) as the affected property and 36 Sandringham Road as the unaffected comparator.

71. This example shows that the change in the indexed price of the affected property between the two pre-relevant date sales was 65.42 percentage points higher than the equivalent change in the price of the unaffected property. But the difference in the price of the affected property between the second pre-relevant date sale and the post-relevant date sale was 32.81 percentage points lower than that of the unaffected property. Mr Deacon said this suggested the affected property had underperformed because of the use of the runway extension.

72. Mr Deacon said the repeat sales test supported the notion of a diminution in value at the first claim day where claim (affected) street properties showed a similar or superior price performance to an unaffected street before the relevant date but an inferior price performance afterwards.

73. In Appendix 4 of his Addendum Report Mr Deacon said that of the 130 repeat sale matching pair tests, 66.2% showed a reversal in the price performance of claim streets (suggesting a depreciation in value) compared to 33.8% that did not.

74. He averaged the 130 test results to give the following data:

Table 3: Mr Deacon’s analysis of percentage price changes

Pre-relevant date Post-relevant date

Affected (claim) Unaffected Affected (claim) Unaffected

properties properties properties properties

% % % %

118.60 105.29 26.10 32.96

(A) (B) (C) (D)

Notes:

· The pre-relevant date columns show the % change in price between the first and second sales (both pre-relevant date)

· The post-relevant date columns show the % change in price between the second pre-relevant date sale and the third (i.e. post-relevant date) sale.

75. The price of affected properties performed better than that of unaffected properties before the relevant date by 13.31 percentage points (A-B). But after the relevant date the price of affected properties performed worse than that of unaffected properties by 6.86 percentage points (C-D). Mr Deacon said that but for the use of the runway extension the relative price performance of affected and unaffected properties would have remained the same, i.e. 13.31 percentage points in favour of affected properties. Therefore, had it not been for the runway extension the price of affected properties would have increased by 46.27% (D+(A-B)) and not 26.1% (C).

76. Using these figures Mr Deacon said that the price growth foregone was 16.00%, i.e. (1.4627/1.261) - 1 = 0.15995 or 16.00%. Mr Deacon accepted that his original description of this figure as the “fall in value” due to the runway extension was incorrect because he calculated it as a percentage of the switched-on value and not the switched-off value. Had he expressed it as a percentage of the switched-off value the depreciation would have been 13.79%, i.e. 1 - (1.261/1.4627) = 0.13789 or 13.79%.

77. Mr Deacon did not think all the claim properties would be depreciated by the same amount (16%). Since this was an average mid-point figure he considered it would correspond to the mid-point of the noise impact caused by the use of the runway extension. To establish this mid-point, Mr Deacon calculated the average change in LAeq,16h daytime noise of all the claim properties between 2011 (pre-relevant date) and 2014 (post-relevant date). The respective average (rounded) figures were 52dB in 2011 and 55dB in 2014. He therefore mapped depreciation of 16% to a change in noise levels of between 52 to 55dB.

78. Mr Deacon then considered how the level of depreciation in value for individual claim properties should be distributed around this mid-point range of noise level change. This involved a complex series of calculations designed to calibrate the changes in daytime noise levels of each claim property between 2011 and 2014 against published data concerning the effect of aircraft noise.

79. Mr Deacon began by referring to the “Survey of Noise Attitudes 2014: Aircraft (“SoNA 2014”) which was reproduced in Mr Thornely-Taylor’s evidence and which included a table showing the percentage of people who were “highly annoyed” as a result of exposure to average summer day noise levels ranging from 51dB to 69dB at 3dB intervals. Mr Deacon grouped his data into the “same [six] bands indicated by the SoNA table” and identified the percentage point increase between the noise bands in the percentage of people who were highly annoyed by aircraft noise. For instance, in the band 51 to 53dB, 7% of people were highly annoyed whereas the figure in the band 54 to 56dB was 9%, an increase of two percentage points.

80. The calculated depreciation of 16% was attributed to the band 54 to 56dB, since the average LAeq,16h for 2014 was 55dB. For claim properties which fell into lower 2014 noise bands the depreciation would be lower and for those in higher bands it would be higher, in each case calculated in proportion to the change in the percentage of people highly annoyed by that level of noise. In the example above where 7% of people were highly annoyed in the 51 to 53dB noise band compared with 9% in the 54 to 56dB band, i.e. 2 percentage points less, Mr Deacon calculated the depreciation in the 51 to 53dB band to be 16% x (1 - 0.02) = 15.68%.

81. Having attributed different levels of depreciation to each of the six 2014 noise bands, Mr Deacon then considered the effect of the specific changes in LAeq,16h for each of the claim properties in each band. The purpose of this further adjustment was to allow for the fact that the increase in noise at some claim properties would be greater than at others.

82. For example, Mr Deacon’s analysis showed there were 47 claim properties where the 2014 LAeq,16h levels were in the band 51 to 53dB. The equivalent 2011 LAeq,16h levels for these properties ranged from 48dB to 52dB. Mr Deacon reasoned that a property would be depreciated less where the noise levels had increased from, say, 52 to 53dB than from 48 to 53dB. The average 2011 noise level of the 47 properties was 50dB and the average 2014 noise level was 52dB. Mr Deacon attributed the 51 to 53dB (2014) band’s 15.68% depreciation to this average change range of 50 to 52dB and then calculated proportionately what depreciation was appropriate to each claim property. In the above example Mr Deacon calculated that a claim property whose daytime noise level had increased from 48dB in 2011 to 53dB in 2014 would have been depreciated by 16.16% compared to the band average depreciation of 15.68%. Conversely a claim property where the daytime noise levels had changed from 52dB in 2011 to 53dB in 2014 would have depreciated by 15.53% i.e. less than the band average.

83. Mr Deacon undertook an equivalent exercise in respect of the changes in Lnight noise levels for each claim property. The change in night noise was measured between 2011 and 2016. The daytime and night time values for the growth foregone for each claim property were then averaged to give a “blended” percentage which Mr Deacon applied to his “switched-on” values for the lead properties to give their “switched-off” values. These percentages are shown in Table 2 above.

84. In addition to the growth foregone Mr Deacon also made a 5% allowance for intensification of the use of the extended runway. He noted widespread reference in the documents to the respondent’s development case which forecast two million passengers per annum by 2020. This indicated that a significant increase in commercial air traffic movements, and therefore noise frequency, would have been anticipated at the first claim day.

85. In Mr Deacon’s experience a typical purchaser would take little account of what may happen in the future, being concerned only with circumstances at the time of purchase. So the price paid by a willing purchaser at the first claim day would be unlikely to reflect the diminution in value that the expected intensification in use of the runway extension would cause. Mr Deacon said in cross-examination that a purchaser would wait “until the point of pain” before reducing their bid. In his opinion the future intensification in the use of the runway extension was a “masked effect” at the first claim day that should be reflected in the amount of compensation payable. He considered a reasonable estimate of future intensification was 5% of the switched-off value for each of the claim properties.

86. Although Mr Deacon’s repeat sales test was the only method he used to quantify the amount of capital growth foregone, he also relied on three other tests. The first of these was called the “sales volume” test in which he analysed transactions in the lead claim streets where a property had been sold more than once to establish the change in value between the sale dates. He expressed this change as a daily rate of capital growth which he plotted on a graph against each property’s second sale date. Mr Deacon said this graph enabled the volume of sales at or around the first claim day to be seen easily. The graph also showed the financial performance of each claim street over time.

87. Mr Deacon concluded that there was a consistent reduction in (i) the pattern of daily growth, and (ii) the number of transactions at or near the relevant date. He said this strongly suggested that the impact of the physical factors arising from the use of the runway extension had had a significant negative impact on the value and saleability of properties in the lead claim streets.

88. The second additional test was to compare the repeat sales performance of claim and adjoining street properties against the Southend UKHPI. 26 properties were tested of which 16 (62%) suggested there had been a relative fall in the value of claim street properties after the relevant date. In his third additional test, instead of considering the performance of individual claim/adjoining street properties against the index, Mr Deacon extended this idea to the collective performance of the whole street. The change in value between sale dates was compared with the change in the Southend District UKHPI over the same period. The results were presented cumulatively for the year of each second sale and were represented as a bar chart showing the binary result of ‘yes’ (property price change greater than the index) or ‘no’ (property price change less than the index). The results were further consolidated into three bands to allow better appreciation of any trends: pre-2010, 2011-2013 and 2014-2019. Having reviewed the results for the 10 lead claim property streets Mr Deacon concluded that the test provided “further suggestions of a diminution in value as at 8 March 2013.”

The case for the respondent

89. Mr Fosh has over 35 years professional experience and heads the Eastern Region National Development and Planning Department of Strutt & Parker based in Chelmsford. He said in cross-examination that although he was very familiar with the town he did not have local market experience and did not undertake routine valuations of residential properties in Southend.

90. Mr Fosh inspected seven of the 10 lead properties in November 2019. The remaining three properties, which had been sold since the claims were made, were inspected from the outside and reliance was placed on the descriptions and photographs in sales particulars. Mr Fosh valued the lead properties as at the first claim day in accordance with the definition of market value contained in the RICS Valuation - Global Standard 2017. In preparing his “switched-off” valuations he made the special assumption that the runway extension had not been brought into use on the relevant date. His “switched-on” valuations took into account the future intensification that may reasonably have been expected in the use of the runway extension as at the first claim day.

91. Mr Fosh provided detailed descriptions of each of the lead properties, their present condition and, so far as possible, their likely condition as at the relevant date, and set out both pre- and post-relevant date comparable transactions. He also analysed the market performance of each lead claim street over time.

92. Unlike Mr Deacon, Mr Fosh’s primary valuation method did not rely upon at least two pre-relevant date sales and one post-relevant date sale. His method required at least one pre- and one post- relevant date sale. Mr Fosh looked at sales as far back as 1 January 2000 and as recent as 27 November 2019. He indexed all comparable sales, whether before or after the relevant date, to the first claim day. He used either the Rochford or Southend District UKHPI, depending upon where the property was located. This indexation enabled him to consider whether there was any difference between the indexed value of pre- and post-valuation date transactions by reference to a common date, i.e. 8 March 2013. If the indexed prices of post-relevant date sales were the same or higher than the indexed prices of pre-relevant date sales, that indicated no change in the value of the property relative to the general tone of properties in the area as represented by the index and therefore no depreciatory effect caused by the opening of the runway extension.

93. In undertaking his analysis, Mr Fosh commented on sales which he thought were distinguishable or atypical and gave reasons why that might be so. The results of this analysis were consistent for each of the 10 lead properties. Mr Fosh concluded that the physical factors arising from the use of the runway extension did not have any demonstrable effect on the value of the lead properties. He conceded there was discernible noise from overflying aircraft but said this had been the case before the runway extension came into use. Any effect of noise (whether actual, historic or potential) on values was already accounted for in the switched-off value. That accorded with there being no diminution in the switched-on value and therefore no compensation was payable.

94. Mr Fosh was cross-examined in particular and at length about the comparables which he did not consider represented market value. At the end of his cross-examination he was asked whether, as the evidence stood, and in the light of the lead claimants’ uncontested witness statements about the effect on them of the use of the runway extension, he would agree that there was an attributable diminution in value of the lead properties. Mr Fosh replied that he thought the strength and balance of argument varied across the lead properties but accepted that “for some of the properties there may have been an effect”.

Switched-on values

95. It is disappointing that the valuation experts have only been able to agree the switched-on value of two of the 10 lead properties, i.e. 57 Southend Road and 14 Millview Meadows. Of the remaining eight properties, seven are valued by Mr Fosh at higher figures than Mr Deacon. In only two cases are the differences between the values greater than 10% (5 Taunton Drive and 8 Dulverton Avenue) with the remaining differences ranging between approximately 2% to 8% (£5,000 to £15,000).

96. In fairness to the experts there were difficulties in valuing properties seven years in arrears. The condition of the properties at the first claim day was not known precisely and over the intervening years some of the lead properties, and the comparables used to value them, had been altered, improved or extended. This led both experts to undertake a detailed forensic historical analysis of numerous property sales which invited protracted cross-examination.

97. We do not consider it necessary or appropriate to analyse in detail the respective opinions of the experts about the retrospective value of each lead property and the comparables used to value them, where the differences between them fall within the range of reasonable valuation opinion, which we take in this case to be plus or minus 10% and where the absolute difference between them is no more than £15,000. We have considered the cross-examination of the experts which, while assisting in clarifying some of the fine detail of their valuations, did not lead to any change of opinion other than the revisions to his valuations which Mr Fosh helpfully made during examination in chief. For the lead properties other than 5 Taunton Drive and 8 Dulverton Avenue we determine the switched-on value to be the mid-point between the experts’ valuations.

5 Taunton Drive

98. Mr Deacon said the switched-on value of 5 Taunton Drive was £250,000 and Mr Fosh said it was £280,000. The difference between them was mainly due to Mr Fosh questioning the reliability of the sale figure of the subject property in September 2012 (£249,995) and disagreement about the condition of a comparable at 14 Taunton Drive.

99. Mr Fosh described the marketing history of 5 Taunton Drive from June 2011 to its sale in September 2012. He based this on data obtained from internet sites such as Rightmove and Zoopla. He said the property had first been marketed in June 2011 at a guide price of £315,950 but had been reduced to £264,950 in November 2011 when placed with The Express Estate Agency. It was advertised there as being priced “to encourage a quicker than normal sale”. The guide price was further reduced to £260,000 in February 2012 when the property was placed with Bairstow Eves. It eventually sold for £249,995 in September 2012. Mr Fosh also referred to the witness statement of Mr David Simpkins who was the then owner and vendor of 5 Taunton Drive. Mr Simpkins also described the marketing history although his figures differed from Mr Fosh’s.

100. Mr Fosh said a 16% reduction in the guide price from £315,950 to £264,950, together with The Express Estate Agency’s marketing descriptions, gave “the appearance of a forced or desperate sale”. As this price reduction occurred before the extended runway was first used Mr Fosh thought “that the reduction in the guide price (and then the sale price) is most likely the result of personal reasons of the claimant [Mr Simpkins], and not due to the use of the works.” The low sale price was “not due to market conditions”.

101. In a second witness statement Mr Simpkins gave more details of the marketing of the property including a review of the timings and the estate agents involved. He was adamant that the initial asking price was £350,000 and thought this was reduced to £319,950 in October 2011. The reduction in the asking price to £260,000 followed the instruction of The Express Estate Agency who Mr Simpkins explained were only instructed for a short while because of their questionable sales strategy. They were said by Mr Simpkins to advertise properties on the internet at “hugely discounted ‘offers in excess of’ prices” only to adopt “all sorts of tactics to drive the price above that”.

102. Mr Simpkins denied Mr Fosh’s inference that he had sold cheaply for personal reasons and said he had been guided throughout by the advice of his agents about the level of the asking price. There were no personal reasons for reducing the price to effect a quick sale. The reductions were made on the advice of the agents and because of a lack of interest in the property. The plans for the extended runway were already well-known in the area throughout the marketing period.

103. Mr Fosh accepted that his subjective conclusion about the 2012 sale price in this case may not be reliable, although it reflected his opinion based on the available evidence. He accepted he was wrong to say the sale price of 5 Taunton Drive reflected personal reasons but continued to query its reliability given the questionable marketing strategy adopted by The Express Estate Agency. However, Mr Fosh accepted in cross-examination that without evidence his inferences about the reasons why properties sold for a particular price might well be wrong.

104. In detailed cross-examination about the valuations of the lead properties Mr Fosh accepted that the sale of 5 Taunton Drive occurred at a time when easyJet and other commercial flights were using the extended runway and that there was no better indicator of the switched-on value of 5 Taunton Drive than its own sale in September 2012.

105. Mr Fosh was also asked about his comparable at 14 Taunton Drive which was sold in May 2013 at £267,000 and which he said was in very tired decorative order and smaller than 5 Taunton Drive. He thought No.14 was worth slightly less than No.5 but he conceded that since No.14 was a detached property and No.5 was semi-detached that lent some support to the sale figure of £249,995 for No.5 in September 2012.

106. Indexed to the first claim day the 2012 purchase price of 5 Taunton Drive is approximately £248,000. Mr Fosh commented upon its unusual and unattractive layout with four ground floor bedrooms and an upstairs living room. That offsets, at least to an extent, the smaller size of two other semi-detached comparables in Taunton Drive: No.11 that sold in November 2012 for £245,000 (indexed to £245,400) and No.16 that sold in November 2013 for £249,995 (indexed to £235,700). Mr Fosh’s other post-relevant date comparable was 10 Taunton Drive which sold in June 2012 at £345,000 (indexed to £343,300), but Mr Fosh said this property was worth “much more than 5 Taunton Drive”.

107. Mr Deacon relied on the same comparables as Mr Fosh.

108. In our opinion the switched-on value of 5 Taunton Drive at the first claim day is £260,000. We place most weight upon the sale of the subject property in September 2012 for £249,995 but recognise that it had been inappropriately marketed by The Express Estate Agency and that this might have tainted it to a limited extent in the market. We also think there should be a larger difference in value between No.5 and comparable semi-detached properties at Nos. 11 and 16 to reflect the much larger size of No.5 and despite its unattractive layout.

8 Dulverton Avenue

109. Mr Deacon said the switched-on value of 8 Dulverton Avenue was £210,000 and Mr Fosh said it was £245,000.

110. 8 Dulverton Avenue is a 1930s semi-detached three-bedroom bungalow with an attic conversion, rear dormer window, conservatory and double-glazing. It has an area of 84m2.

111. Mr Fosh criticised Mr Deacon’s reliance on only one out of 20 post-relevant date comparable sales in Dulverton Avenue and the one which he used, No.70, was said to be the smallest at 55m2. Mr Fosh referred in detail to five post-relevant date sales, two of which were of 18 Dulverton Avenue, before and after improvement. But three of these transactions, including both of those at No.18, took place more than 3 years after the first claim day. We share Mr Deacon’s view that indexation should not be used to analyse comparables over such long periods. Mr Fosh also considered the marketing of the subject property during 2019 but we consider that to be of no relevance to its valuation six years earlier.

112. Mr Fosh considered Mr Deacon’s comparable at No.70 but did not think it was helpful because it was a third smaller than No.8, only had two bedrooms, was in a tired condition and was located closer to the busy Prince Avenue/A127. No.70 sold for £198,000 in September 2014 which indexed to £170,400 at the first claim day. We agree with Mr Fosh that this is not a good comparable to use when valuing No.8.

113. In our judgment the sale of 32 Dulverton Avenue is the most useful comparable in assessing the switched-on value of No.8. It is larger than No.8 and has an additional bedroom. It sold in January 2014 for £242,500 which indexes to approximately £227,000 at the first claim day. Mr Fosh said that although No.32 was larger he thought it was worth slightly less than No.8 “due to its lower standard of fittings and not being as attractive externally”. We do not share Mr Fosh’s opinion concerning the respective merits of 8 and 32 Dulverton Avenue and consider the larger size of the latter to be the most significant distinguishing feature.

114. Mr Deacon also relied upon two sales of properties in nearby roads: 121 Bridgewater Drive, a semi-detached three-bedroom bungalow of some 60m2 (estimated) sold in March 2013 for £190,000 and subsequently improved and extended; and 8 Dulverton Close, a two-bedroom semi-detached bungalow of 61m2 sold in September 2013 for £174,000 (indexed to £163,600). We find these comparables to be of little assistance given their smaller size at the first claim day, uncertainty about their condition and quality of fixtures and fittings and their location.

115. In our judgment the switched-on value of 8 Dulverton Avenue at the first claim day was £225,000, in line with, but slightly less than, the indexed value of the larger property at No.32.

116. Our determination of the switched-on values of the 10 lead properties is shown in table 4:

Table 4: Tribunal’s determination of “switched-on” values

|

Lead Property |

Value |

|

5 Taunton Drive |

£260,000 |

|

22 Mendip Crescent |

£165,000 |

|

8 Dulverton Avenue |

£225,000 |

|

173 North Crescent |

£192,500 |

|

5 Bristol Road |

£247,500 |

|

161 Stambridge Road |

£255,000 |

|

57 Southend Road |

£180,000 |

|

41 Queen Elizabeth Chase |

£152,500 |

|

43 Treelawn Drive |

£187,500 |

|

14 Millview Meadows |

£200,000 |

Switched-off values

117. We are satisfied from the evidence of fact, the expert noise evidence and our site inspection that the use of the runway extension has caused depreciation in the value of most of the lead properties due to noise.

118. Mr Fosh’s primary method of establishing whether the value of the lead properties had been depreciated was to adjust pre- and post-first claim day prices of repeat sales in lead claim streets by indexing them to the first claim day and comparing the results. This analysis showed the indexed value of the claim street properties remained the same or even increased after the first claim day, so Mr Fosh concluded that the runway extension had no effect upon prices.

119. Mr Fosh supported his primary approach with an analysis of the sale prices per unit area. But this appeared to be based upon unreliable information about areas and added little insight. We did not find it helpful.

120. We found Mr Fosh’s evidence on this point to be unconvincing. His opinion that the use of the runway extension had caused no depreciation relied heavily upon his subjective explanation of comparable sales data which he thought were otherwise out of step with the market. His criticism of individual transactions often rested upon his belief that the marketing had been inadequate or that the personal circumstances of the vendor had led to a sale at under value. Mr Burton’s cross-examination revealed flaws in this approach and eventually Mr Fosh accepted that at least some of the properties may have been depreciated because of the use of the runway extension (see paragraph 94 above). That was a sensible concession and one which even a cursory “stand back and look” at the totality of the evidence would justify. We note that Mr Fosh did not even consider the level of night-time noise experienced by the claimants even though such noise was acknowledged by him to be important.

121. Reliance upon indexation over periods up to 13 years is unreliable and the Tribunal has previously expressed its concern at such an approach. Although Mr Deacon also relied upon indexation, at no point does he do so for longer than 30 months. We consider that to be an acceptable period in this context.

122. We acknowledge that indices are based on a basket of disparate properties and in this case, as Mr Burton submitted, are themselves tainted, at least to some degree, by the effect of the runway extension after the relevant date. But the basket is large and the number of properties adversely affected is likely to represent only a small proportion of its contents. We note that Mr Deacon also uses such “tainted” indices, albeit for shorter periods, and their use is inevitable whichever method is adopted.

123. Mr Fosh’s sole reliance on indexation, often over extended periods, was criticised by Mr Deacon who, while using indexation himself, said he “would not have wanted to base my opinion solely on index-related testing.” That was the reason Mr Deacon’s primary test was based on a comparison between affected and unaffected streets.

124. We accept Mr Deacon’s point that, without further commentary, the fact that a property’s value maintains parity with a local index does not necessarily establish there has been no loss of value since this may mask an improvement over time in the popularity of that location.

125. Mr Deacon rightly points out that it makes no difference to the result of Mr Fosh’s analysis whether one uses the first claim day as the base date for indexation or any other date; all Mr Fosh’s method does is compare the relative value of two (or more) sales of a property in a claim street expressed in common prices.

126. Mr Deacon’s primary approach (the repeat sales test) has the merit of trying to calibrate the relative value of affected and unaffected properties before the relevant date and then analysing the effect of the extended runway on those relative values. The use of indexation in his method is limited to no more than two and a half years and is used to express unaffected and affected property sales in common prices.

127. Mr Deacon’s method involves extensive data and calculation and while it gives the impression of mathematical rigour and objectivity, we think it is flawed in several respects. Our main concern, which we expressed during the hearing, is about the method Mr Deacon uses to calculate the growth foregone. We think this is wrong but, despite being given ample opportunity to reconsider the matter, Mr Deacon maintained that his approach was correct.

128. We have explained Mr Deacon’s repeat sales test at paragraphs 66-76 above and Table 3 summarises his results. It is clear from this table that price growth after the relevant date has been considerably less than before that date, both for affected and unaffected properties. That being so one would not expect the absolute difference between the growth in prices of affected and unaffected properties, expressed in terms of percentage points, to be the same before and after the relevant date. But that is what Mr Deacon has assumed.

129. Mr Deacon argued that the difference between the increase in affected and unaffected property prices before the relevant date, i.e. 13.31 percentage points (A-B) would have been maintained after the relevant date had it not been for the opening of the runway extension. So the price growth of affected properties after the relevant date would have been 46.27% (D+13.31%).

130. We suggested at the hearing that the proper relationship between the pre- and post-relevant date growth should be a relative rather than an absolute one. The ratio of the growth in prices between affected and unaffected properties before the relevant date should be the same as that afterwards; i.e. A/B = C/D. By adopting such a relative measure, the problem of the different market conditions before and after the relevant date is resolved.

131. Adopting Mr Deacon’s figures as shown in Table 3 above gives the following result using our preferred formula:

118.60 (A)/105.29 (B) = C/32.96(D)

Therefore C = (A/B) x D = 1.126 x 32.96 = 37.11%

Mr Deacon’s equivalent figure of 46.27% is significantly higher. Adopting our figure gives a value of growth foregone of approximately 8%, i.e. half Mr Deacon’s figure of 16%.

132. Mr Burton in his closing submissions argued that our preferred formula, and in particular dividing one percentage by another, is “mathematically incorrect”. There is, of course, no mathematical reason why one percentage should not be divided by another to give a ratio. As was pointed out to Mr Burton at the hearing it is entirely reasonable to compare, for example, the examination results of two students, one of whom has a mark of 80% and the other 40%, by saying one student has achieved twice the mark of the other, i.e. 80%/40% = 2.

133. Mr Burton tried to demonstrate the mathematical error in the Tribunal’s approach by what he described as a “stress test”. He assumed that the pre-relevant date growth on affected and unaffected properties was 30% (A) and 20% (B) respectively, while their respective post-relevant date growth remained as it actually was, i.e. 26.10% (C) and 32.96% (D). He said applying these figures to the Tribunal’s formula of C = (A/B) x D gave “the absurd result that in circumstances where the percentage point difference between A and B is only 10, so less than the 13.31 percentage points between the actual values of A and B, the ‘but for [the runway extension] growth’ figure is 49.44, so more than the ‘but for growth’ figure for the actual A and B figures of 46.27.”

134. There is nothing “absurd” or mathematically incorrect in this result given that, in Mr Burton’s example, the ratio of A to B, i.e. A/B, is 1.5 whereas the ratio of the actual values of A/B is 1.126. One would therefore expect the value of C to be higher, i.e. 49.44% compared to the actual value of 37.11%.

135. Given the significant difference in the absolute level of growth in prices before and after the relevant date, we think Mr Deacon was mistaken in applying the difference in percentage points between A and B which reflected a period of high growth, to C and D which reflected a period of low growth. We consider the mathematically correct approach to be that which we have explained above, namely one which equates the relative values of A/B and C/D.

136. We conclude from this that even if we were to accept Mr Deacon’s repeat sales test figures and his methodology in every other respect he has over-stated the growth foregone by 100% i.e. by saying it was 16% instead of 8%. This is a criticism of how Mr Deacon has interpreted his data but we also have several reservations about the data itself.

137. Mr Deacon’s analysis shows that one third of the results do not suggest a fall in the value of affected properties due to the opening of the runway extension and yet Mr Deacon’s method assumes that every claim property would have been significantly depreciated. The figures for the growth foregone range from 15.06% to 17.91%. Mr Deacon says that by using the average of the data any anomalies or outliers are effectively balanced out but we do not accept that averaging resolves the problem.

138. Mr Deacon’s repeat sales test is based on the analysis of repeat sales of 130 matched pairs of properties, one affected, one unaffected by the use of the extended runway. This does not mean 130 different affected and unaffected properties are used in the analysis. Only 25 different affected and 59 different unaffected properties are used. This means that most of the affected properties have multiple matched unaffected pairs and therefore the average figures used by Mr Deacon are, in effect, weighted towards those affected properties which appear most often, e.g. 44 Dulverton Avenue appears 14 times as a matched pair and 11 Millview Meadows appears 11 times. That means 44 Dulverton Avenue is involved in over 10% of the matched pairs. Only 19 Mornington Avenue appears just once as an affected property. The same is true of the unaffected properties used in the analysis. Three of these, 21 Victoria Road, 30 Brunswick Road and 36 Sandringham Road, appear seven times.

139. The affected properties in the 130 matched pairs are located in the lead claim streets or, in two cases, nearby streets. But some streets are much more heavily represented than others. For instance, there are 35 matched pairs in Southend Road (over 25% of the total) but only one, in Mornington Avenue, serving as a proxy for Stambridge Road. North Crescent and Millview Meadows have 17 matched pairs each whereas Eastwoodbury Lane (a proxy for Bristol Road) and Treelawn Drive only have six. Again, this uneven distribution skews the results of the analysis.

140. Mr Deacon acknowledges this problem in his report and says that “it is difficult to place strong reliance on the outcome of a single test … in cases where samples are lower more weight, in my view, must be placed on the outcome of the test as a whole.” But the test as a whole does not properly reflect the circumstances as they existed at affected properties where transactional data is sparse.

141. There are also anomalies in the results for individual claim properties. For instance, 185 Southend Road is analysed by reference to seven unaffected properties, six of which suggest there was no fall in value due to the extended runway. This is the most negative result of any of the 25 affected properties tested and yet Mr Deacon says the neighbouring property, No.187, a lead property, has lost 15.52% of growth foregone.

142. The only matching unaffected property which suggested 185 Southend Road had suffered a loss in value was 36 Sandringham Road which was also used as a matching pair in six other cases. This property was sold five times between 1996 and 2019. Mr Deacon did not take account of the last sale in any of the seven calculations because he said after the 8 March 2016 (three years after the first claim day), “there is a risk that the rising market may well mask any fall in value that had occurred at 8 March 2013.” Which three of the other four sales were used in each case depended upon the date of the repeat sales of the affected property. In the case of 185 Southend Road the sale dates chosen for 36 Sandringham Avenue were June 1996, June 2006 and September 2013, since these most closely matched the sale dates of No.185. But in the case of 135 Southend Road the sale date in April 2001 was used instead of June 2006. So the period between the first and second sales of Sandringham Road was 10 years in the case of 185 Southend Road and just over 4.75 years in the case of 135 Southend Road. The respective periods between the second and third sales was 7.25 years and 12.5 years. In both cases the overall period is the same (17.25 years) but the before and after the relevant date periods are different. In some cases this difference in the length between sales was even more exaggerated. In the case of 183 North Crescent (affected) and 18 Whistler Rise (unaffected) the period between the first and second sale was 1.7 years and that between the second and third sales was 12.75 years. This variation in the period between the first and second and the second and third sales is another source of potential distortion in the analysis.

143. We note that Mr Deacon made 29 late adjustments to the actual price of affected (7) and unaffected (22) properties to reflect information he had obtained about alterations and extensions to those properties by examining time lapsed Google Earth Pro satellite images. In the case of 185 Southend Road, for instance, Mr Deacon reduced the actual January 2004 sale price of £159,995 by £8,000 to reflect the absence at that time of a conservatory that was subsequently built. He also made adjustments to three of the unaffected properties that he selected as matching pairs for 185 Southend Road. The result of these collective adjustments was to change three of the results from a suggested fall in value to no change in value. The results are sensitive to the prices adopted and we do not consider Mr Deacon’s adjustments, which in the case of the conservatory at 185 Southend Road was backdated 16 years, to be robust or reliable figures.

144. The 2012 sale price of 135 Southend Road was also adjusted (reduced) to reflect the value of a conservatory. This altered the result of one of the six matching pairs from no depreciatory effect to a positive one. In this case the adjustment was much larger at £25,000. These adjustments based upon Mr Deacon’s assumptions introduce an element of valuation judgment and subjective estimation into the repeat sales test which Mr Deacon presents as objective and factual.