Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Harvey & Anor v Revenue and Customs (Gift Aid relief - section 416 Income Tax Act 2007 - qualifying donations) [2024] UKFTT 1098 (TC) (06 December 2024)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2024/TC09372.html

Cite as: [2024] UKFTT 1098 (TC)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation: [2024] UKFTT 1098 (TC)

Case Number: TC09372

FIRST-TIER TRIBUNAL

TAX CHAMBER

Taylor House Tribunal Centre

Appeal references: (1) TC/2022/11351

(2) TC/2023/08654

Heard on: 3, 4 July, 8 October 2024

Judgment date: 6 December 2024

Before

TRIBUNAL JUDGE RUDOLF KC

LESLIE HOWARD

Between

(1) JOHN HARVEY

(2) KESWICK ENTERPRISES HOLDINGS CHARITABLE TRUST

Appellants

and

THE COMMISSIONERS FOR HIS MAJESTY’S REVENUE AND CUSTOMS

Respondents

Representation:

For the Appellants: Ms Harriet Brown, counsel, instructed by Raffingers LLP, Chartered Certified Accountants

For the Respondents: Ms Ruth Hughes, counsel, instructed by the General Counsel and Solicitor to HM Revenue and Customs

Gift Aid relief - section 416 Income Tax Act 2007 - qualifying donations - no - closure noticed varied at HMRC request - otherwise charity appeal dismissed - discovery assessments - validity - section 29 Taxes Management Act 1970 - tax years ending 5 April 2016 - discovery assessment valid - tax year ending 5 April 2017 - information provided in charity’s enquiry relevant to donor’s enquiry - whether that information available to hypothetical officer in donor’s case - no - discovery assessment valid - donor appeal dismissed

DECISION

Introduction and Issues

1. The Appellants in this case are (1) Mr John Anthony Harvey CBE (‘Mr Harvey’) and (2) Keswick Enterprises Holdings Charitable Trust (‘the charity’). The Respondents are the Commissioners for His Majesty’s Revenue and Customs (‘HMRC’).

2. These are timely appeals to the First-tier Tribunal (Tax Chamber) (‘the Tribunal’) by Mr Harvey and the charity. Given the appeals arise out of the same set of facts the parties agreed, and the Tribunal concurred, that it would be appropriate to hear them together. That was given effect by the Tribunal’s direction of 9 November 2023. The appeals require the Tribunal to consider the provisions of the Income Tax Act 2007 (‘ITA’) relating to ‘Gift Aid’. That is where qualifying donations are made so higher and basic tax relief can become available to the donor and recipient respectively. Further, in the case of Mr Harvey only, the Tribunal is required to consider the validity of the discovery assessments raised.

3. Mr Harvey appeals against:

(1) A discovery assessment dated 3 March 2020 increasing his chargeability to income tax by £132,628.08 for the tax year 2015-16 and

(2) A discovery assessment dated 3 March 2020 increasing his chargeability to income tax by £139,460.16 for the tax year 2016-17.

4. Both relate to HMRC’s decision to require repayment of gift aid relief at the higher rate of income tax based upon gifts provided to the charity, but each must be considered separately.

5. The charity appeals against:

(1) A closure notice dated 4 January 2023 increasing the charity’s chargeability to tax by £101,250 for the tax year 2016-17 and

(2) A closure notice dated 4 January 2023 increasing the charity’s chargeability to tax by £100,000 for the tax year 2017-18.

6. In respect of both closure notices HMRC accept that they are excessive (as the wrong figures were calculated) and ask the Tribunal, irrespective of the merits of the appeals, to vary each to £75,000 under section 50 (7) of the Taxes Management Act 1970 (‘TMA’). That, it is said, would properly reflect the decision to recover gift aid relief at the lower rate from the charity. In the charity’s case the issue raised means both can be considered together.

7. The Appellants submit (a) that the gifts made by Mr Harvey to the charity were ‘qualifying donations’ as all six ITA conjunctive conditions were met and attracted the higher rate income tax relief claimed by him and ought not to be recovered from the charity by HMRC and (b) the discovery assessments against Mr Harvey were invalid.

8. HMRC submit (a) the gifts made by Mr Harvey were not ‘qualifying donations’ as three of the six ITA conjunctive conditions required to be met were not, so no higher rate income tax relief was available to him. Consequently, the charity could not have the benefit of the basic rate income tax relief that would have attached had the gift been a ‘qualifying donation’ and (b) the discovery assessments against Mr Harvey were validly raised.

9. We heard the appeal over three days having adjourned to receive written submissions in advance of the final day. The Tribunal was greatly assisted by the oral and written advocacy of Ms Brown and Ms Hughes.

10. We deal with the common issue of ‘qualifying donations’ first. If they were, then there is no need to consider the validity of the discovery assessments relating to Mr Harvey only.

Preamble

11. Prior to the hearing we received:

(1) An 867-page bundle that included the Notices of Appeal, HMRC’s statements of case (there were two as there were two appeals), witness statements of Officers Darren MacDonald and Alex Kempall, and those of Mr Harvey and Ms Philippa Reid. There were also many documents and correspondences. This bundle also included some legislation and authorities which we were invited to ignore as a further bundle was provided. That was upgraded to an 891-page version which was uploaded (timeously) but which we received during the hearing, which also included the same materials to be ignored

(2) A 54-page supplementary bundle including redacted bank statements that related to the enquiries into Mr Harvey’s self-assessments

(3) A skeleton argument of 23 pages from Ms Hughes for HMRC dated 12 June 2024 with a chronology and list of principal persons

(4) A skeleton argument of 14 pages from Ms Brown for the Appellants dated 13 June 2024 together with a chronology

(5) A joint reading list, which made our task considerably more efficient.

12. To ignore the original bundle’s legislation and authorities in an effective way, we were provided with a more comprehensive legislation and authorities bundle of 483 pages, ‘contemporaneous legislation’ in a 56-page bundle and additional authorities.

13. At the hearing we had the advantage of a transcriber and have a full record of each of the three days of the appeal. We record our thanks to the transcribers on each of the days who were, as ever, professional and efficient.

14. For convenience we heard first from Officer MacDonald for HMRC who was cross-examined. We then heard from Mr Harvey and Ms Reid for the Appellants. Again, both were cross-examined. Lastly, we heard from Officer Kempall for HMRC who was also cross-examined.

15. Finally in terms of documents, before the final day, we received written submissions from both sides together with glossaries and further legislation and authorities. We are pleased to record that the written submissions themselves did not exceed 33 pages each.

16. This decision is long. Given the wholesale attack upon the validity of the discovery assessments raised against Mr Harvey it has been necessary to delve interstitially into events up to the appeal notices lodged with the Tribunal. Those events take place between from 2015 to 2023 including, as they must, the enquiries into the charity.

Burdens of proof

17. Before we set out our findings of fact it is necessary to address a point made by Ms Brown in relation to burdens of proof.

18. It is agreed that HMRC have the burden of proving the validity of the discovery assessments in relation to Mr Harvey (the point does not arise in relation to the charity) and on the balance of probabilities. Thereafter it is for the Appellants to prove, again on the balance of probabilities, that the discovery assessments and closure notices are excessive.

19. Ms Brown submitted that although those burdens themselves do not change where HMRC make a positive allegation (which does not need to be one of dishonesty) they, “take both the evidentiary and legal burden of proving that positive allegation”. No allegation of dishonesty is made here, and we do not therefore need to consider dishonesty further.

20. For that submission Ms Brown relied upon Brady v Group Lotus Car Companies PLC and another [1987] STC 635 (‘Brady’) and the judgment of Mustill LJ. At page 643G-I he said:

“It is, however, submitted that the concept of a shifting burden has another meaning, relative to what is called the 'evidentiary burden of proof'. Although this term is widely used, it has often been pointed out that it simply expresses a notion of practical common sense and is not a principle of substantive or procedural law. It means no more than this, that during the trial of an issue of fact there will often arrive one or more occasions when, if the judge were to take stock of the evidence so far adduced, he would conclude that, if there were to be no more evidence, a particular party would win. It would follow that, if the other party wished to escape defeat, he would have to call sufficient evidence to turn the scale. The identity of the party to whom this applies may change and change again during the hearing and it is often convenient to speak of one party or the other as having the evidentiary burden at a given time. This is, however, no more than shorthand, which should not be allowed to disguise the fact that the burden of proof in the strict sense will remain on the same party throughout—which will almost always mean that the party who relies on a particular fact in support of his case must prove it. I do not see how this fact of forensic life bears on the present case. It is a commonplace that, if there is a disputed question of fact admitting of only two possible solutions, X and Y, with party A having the burden of proving X in order to establish his case, if A produces credible evidence in favour of X and B produces none in favour of Y, it is very likely that A will win. B must therefore exert himself if he wishes to avoid defeat. But this does not mean that B ever has the burden of proof.”

(emphasis added)

21. Ms Brown sought to buttress that with the consideration of Brady by the Upper Tribunal in Qolaminejite (also known as Cooper) v Revenue and Customs Commissioners [2021] UKUT 118 (TCC) (‘Qolaminejite’). On the principle they said:

[24] The tribunal will decide the question whether the assessment overcharged the taxpayer on ‘the balance of probabilities’. Mr Birkbeck says that term means what it says. But deciding something on the balance of probabilities does not, we consider, equate to balancing which, as between the appellant’s case and HMRC’s case, is the more likely. In showing the assessment overcharges the taxpayer, the taxpayer might advance positive propositions (eg the deposit had a particular explanation, it was received by someone else) or a negative one (it was not the sort of income that would give rise to the charge under assessment, or no deposit was in fact received). Whether the proposition is positive or negative, all that balancing probabilities means is that the FTT need not be sure X was definitely the case - it is enough that X is more likely to be the case than ‘not X’.

[25] Thus, the tribunal must weigh up which is the more probable as between the proposition advanced and the negative of that proposition. So, the probability the deposit was a loan versus the probability it was not a loan. As discussed, even if HMRC put forward no arguments or evidence for some of those counterfactual propositions (‘the not X’), it is still open to the tribunal to consider that the taxpayer has not shown X is more likely that ‘not X’. Because the burden is on the taxpayer it is entirely for the taxpayer to do the running on showing X is more likely than ‘not X’. That is not to say that HMRC might not still have to ‘exert’ themselves, as the extract from Brady above suggests, if HMRC fear the taxpayer’s case was strong enough to get across the threshold of proof.”

(emphasis added)

22. In our judgment, there is a danger of overcomplicating what are well known and well traversed principles in the Tribunal.

23. It is accepted that in the context of whether the Appellants have been overcharged by assessments they bear the burden of proving that on the balance of probabilities and that this does not change. However, Mustill LJ’s explanation of the ‘shifting’ burden in Brady could not be clearer. All it means is that, at any given moment in time, one party may have established something with evidence and if the other party wishes to de-establish it, they must do so with evidence. Nothing in Qolaminejite detracts from that.

24. Before weighing up whether ‘X’ is more probable than ‘not X’ the Tribunal will make findings of fact. Where the Appellants have the burden of proof, HMRC may decide to do nothing beyond submitting that they have not proved ‘X’ and, as a result ‘not X’ is more probable. Or HMRC may ‘exert themselves’ and call some evidence to help their case that the Appellants have not proved ‘X’.

25. Contrary to Ms Brown’s submissions, if HMRC ‘exert themselves’ that does not mean they take any burden at all. To submit HMRC do is to elide where the burden of proof lies with what the evidence, taken as a whole and adduced in the proceedings, may show and, therefore, whether ‘X’ or ‘not X’ is more probable. That HMRC have chosen to ‘exert themselves’ by calling evidence does not alter that. Making positive allegations that the evidence does not support the Appellants’ case (the ‘not X’) also does not alter that.

26. To illustrate the principle by reference to the other issue in this case, Mr Harvey has positively asserted that HMRC have invalidly raised discovery assessments against him. He has ‘exerted himself’ both evidentially (by cross-examination of HMRC’s witnesses) and in submissions. But by doing so he does not, to borrow the words from Ms Brown’s submission, “take both the evidentiary and legal burden of proving that positive allegation”.

27. We will make our findings of fact. In doing so there is no question we will find something ‘might’ have happened (per Lord Hoffman in Re B [2009] AC 11 (at [2])). We will find things did or did not occur, either because there is direct evidence to that effect or by inference, or there is not, as envisaged by Mustill LJ in Brady (see 643I set out at [20] above).

28. As we have said we will decide first whether the Appellants have shown the donations are ‘qualifying donations’ and been overcharged by the assessments or closure notices on the balance of probabilities (‘X’) or failed to show that (‘not X’) by deciding which is more probable. If it is ‘X’ then the Appellants will have discharged their burden and proven their case. If it is ‘not X’ then they will not have. We do that first simply because it is a matter that affects both Appellants.

29. If not, we will decide whether HMRC have proven the discovery assessments against Mr Harvey only are valid (‘X’) or not (‘not X’) in the same way.

Findings of Fact

30. The following are our necessary findings of fact for our analysis and conclusions in these appeals.

Witnesses

31. Each of the witnesses we heard from were honest witnesses doing their best to assist the Tribunal. Concessions were made where appropriate but on other matters each stood their ground when challenged. Inevitably, in relation to all the witnesses we heard, given the length of time between the hearing and the events that took place, memories were not perfect. However, the evidence that emerged was more than clear enough for us to make findings of fact. We also gained considerable assistance from contemporaneous documentation from the time of the donations and the time of the various interventions (to deliberately employ a neutral and non-statutory specific term) by HMRC (of which we count six in total) across the relevant returns of both Appellants.

HMRC interventions

32. Given the challenge to the validity of the discovery assessments in Mr Harvey’s case, our findings of fact contain details of one informal enquiry into Mr Harvey’s self-assessment for the tax year ending 5 April 2016, a formal enquiry into Mr Harvey’s self-assessment for the tax year ending 5 April 2017 and the discovery process in relation to both culminating in discovery assessments on 3 March 2020. We also detail the formal enquiries into the charity’s returns for the tax years ending 5 April 2017 and 5 April 2018 culminating in the closure notices dated 4 January 2023 in each case. Those are the six interventions we have referred to.

33. As both officers confirmed in evidence, the various enquiries and processes pursued by HMRC in relation to Mr Harvey and the charity were undertaken by different officers within different teams. Different events occur at different times. It seems that ‘Wealthy’ was the part dealing with Mr Harvey, through, most relevantly Officer Kempall. Officer Kempall told us that ‘Charities, Large Partnerships and International’ was the part dealing with the charity through, eventually, Officer MacDonald.

34. The case reference for Mr Harvey’s informal enquiry into his self-assessment for the tax year ending 5 April 2016 ended in 751 as it did for the formal enquiry ending in the closure notice for his self-assessment for the tax year ending 5 April 2017. For the enquiries into charity the case reference ended 903.

35. The reader will find paragraphs beginning with dates and “Mr Harvey” where events directly relate to him and dates and “the charity” where they directly relate to it (usually with a reference to the agents for both, who were the same). To ensure maximum clarity we have also made considerably greater use of (see [] above (or below)) then we usually would.

(i) Mr Harvey, his company, the charity, the donations and the loans

36. Mr Harvey is a committed Christian, a philanthropist and a wealthy businessman. Over the years many causes have benefitted considerably from the wealth he has accumulated. He was, and remains, a very active person with a busy working day. Some 75% of his available time is split between his charitable and business work.

37. Mr Harvey is also a shareholder and director of the Keswick Enterprises Group Limited (‘the company’) which he founded in 2004. At the material times he owned some 70% of the shares and a similar amount of the voting rights. As a result, there is no dispute, Mr Harvey and the company are “connected persons” and Mr Harvey had “control” over the company, for the purposes of the applicable law in this case (see [204] and [205] below respectively).

38. Mr Harvey had made significant loans to the company over the years since its founding. The company had to repay Mr Harvey for the loans he had made to it and did so by reducing his directors loan account (‘DLA’) when it could afford to do so.

39. He has also made significant donations to the charity. The appeals are concerned with £800,000 given in 2016 and 2017 (‘the principal donations’). Unfortunately, due to the statutory language, the word ‘gift’ or ‘gifts’ is also employed from time to time. ‘Gift’ and ‘principal donations’ are the same unless we specifically say otherwise.

40. Had the company not repaid Mr Harvey’s DLA when it did Mr Harvey would still have made the principal donations to the charity, as there was an advantage to the charity by the payment of interest upon the loans it gave the company as well as an advantage to the company. But as it happened it meant that this cash could be used. As a result, there were a series of pre-ordained steps. As Mr Harvey told us in answer to the question that the “corresponding payment [from the company to him] is part of the plan”:

“Yes, well, it's part of getting cash into the charity and away from me and what we wanted to do was to make sure that we -- the -- any cash we realised or redemption, went into the trust which is what happened.”

41. The company had several parts to its business including Keswick European Holdings (‘the associated company’) which had a Romanian subsidiary Tibbett Logistics SRL. That was an intermobile business in Romania. As Mr Harvey helpfully told us:

“This is where you take containers from a ship or a railway wagon and put them on a road wagon. To do that, you finish -- need a special terminal, you have to have customs clearance, government approval and so forth and you need cranes”.

42. Although they had a second-hand crane, they needed a better, newer crane or it was likely the business would collapse as timetables were very tight. A new crane was some £600,000 with £200,000 or so in moving and other logistical costs.

2015

43. The charity is a charitable trust established by deed on 22 December 2015 by Mr Harvey and Ms Phillipa Reid, who is one of Mr Harvey’s daughters. When Mr Harvey turned 80, he and his wife (‘the Harveys’) wanted to formalise their charitable giving and part with their money. Their children were financially independent.

44. Mr Harvey was the ‘donor’ (the term the charitable trust deed employs). The charity’s aims largely reflected the religious and philanthropic interests of the Harveys, namely, to advance Christianity, promote and advance education, sustainable development, preserving the environment and relieving poverty. The charity tries to give away about 75% of the income it receives in a year. About 50% of that it gives out are to Christian causes with the rest split amongst the others. The deed reposed the power to appoint trustees in Mr Harvey whilst he himself remained a trustee. There were to be no fewer than two trustees and no more than six.

45. Further gifts of shares and cash in later tax years not subject to appeal over £1m have been made.

46. Eventually, there were four trustees: Mr Harvey, Ms Phillipa Reid and two others. The three trustees other than Mr Harvey were his daughters. The charity was openly a family affair set up to give away a lot of the wealth that the Harveys had.

47. Ms Reid is a highly experienced director of human resources having had several senior jobs over the years. She has had board level experience. Ms Reid is a school governor and is active in her church and has been a trustee of the charity since inception. Ms Reid has been active in the charity’s distributions to the causes it assists. Ms Reid is a perfectly capable and independent trustee for the charity notwithstanding her relationship to Mr Harvey. On any view the trustees accepted Mr Harvey’s business experience and followed his guidance on such matters provided other professionals agreed. Mr Harvey agreed that “he called the shots” but that if disagreement was required, the trustees would provide it. As Ms Reid put it from the witness box:

“…the person who has got the big money experience and the investment knowledge is John Harvey, not any of the three of us, so in terms of how the investment strategy is done, the ideas for that are very often John Harvey's ideas and he will then talk to us about it and we will talk to professional advisers as a check and balance.”

48. Ms Reid continued:

“We would generally test any proposal that's put forward but yes, in principle, given that the point of this was that it was a charity that John and Jill Harvey were trying to get going, and the funding was coming from John and Jill Harvey in principle, yes, we would certainly, you know, look at their view because why not? I mean, they were the ones trying to give their money away.”

49. Any criticism that the familial relationship with Mr Harvey of the other trustees was omitted from her written evidence is misplaced; not least as HMRC knew about it in 2021.

50. At the relevant time Mr Harvey was in sole charge of the banking arrangements of the charity.

51. The establishment of the charity and the requirements of the company for a crane were entirely coincidental in terms of timing.

2016

52. The first donation, which was £100 and was needed to start the charity, was made by Mr Harvey on 16 February 2016.

53. In February 2016 the trustees sought advice from Raffingers when the company enquired of the charity whether that might be possible. The trustees were aware that this was for the purchase of a crane. Mr Harvey was not pleased (to put it mildly) with the response he was getting from various banks about the terms they would offer to purchase a crane including wanting interest at 10%. Mr Harvey’s view was that if 10% was the market rate, then the company could be loaned money and the charity receive the interest rather than the bank, “killing two birds with one stone” as Mr Harvey put it.

54. Raffingers responded with positive advice. With that request, as with subsequent requests, the trustees considered Mr Harvey’s relationship with the company and the fact he had stepped away from management. The investment opportunity was deemed a good one for the charity. Mr Harvey on behalf of the charity also sought legal advice from the solicitor who had drafted the documents setting it up. The trustees were not provided with any written report of that advice but were made aware of it.

55. On 3 March 2016 Mr Harvey donated £4,900.

56. In the course of 2016, the company made repayments to Mr Harvey to reduce his DLA.

57. On 22 March 2016 (or 5 April 2016: there are two copies of the same minutes differently dated but nothing appears to turn on this, it seems in a busy period they were sent around twice) the charity’s minutes record Mr Harvey making a declaration of interest in the company as a “director and major shareholder” (‘the pecuniary declaration’). The meeting was provided with a single page memo drafted by Raffingers, the charity’s accountants (‘the memo’) entitled “Report to the Trustees” of the charity. The meeting approved a loan of £200,000 from the charity to the company secured by a floating charge over the assets of the company for a term of six years with repayments deferred for 12 months and interest at 10% (‘the first loan’).

58. The first loan was to the company to principally assist it with the purchase of a mobile crane to assist with its business (as the subsequent loans also were).

59. The memo set out the amount of £200,000, the interest rate of 10% and its payment terms, the suggested capital repayments, the proposed security by way of the floating charge, and the purpose as “working capital requirement”. There was no issue that the terms of the charity deed permitted such a loan. The memo also set out under the heading Commerciality of the transaction: “the rate of interest to be charged on the loan is commensurate with current commercial lending rates and appears to be reasonable. From the Trustees point of view, the loan would provide a good rate of return on its funds”. The issue of risk was addressed (as the Trustees are obliged to consider that and the need to produce returns on its assets) but the company’s balance sheet showed a healthy net asset position so “was more than adequate for security purposes”. The memo did not, and did not purport to, give any advice in relation to gift aid or anything else beyond the narrow description of it we have set out here.

60. Ms Reid was taken to the minutes dated 22 March 2016 and said she remembered the meeting. Mr Harvey had indicated that there was the prospect of loaning the company money for a crane with a very good rate of return for the charity. Both Raffingers and the solicitor retained advised positively.

61. On 5 April 2016 three payments occurred. First, the company repaid Mr Harvey a part of his DLA in the sum of £200,000. Then Mr Harvey donated £200,000 to the charity. Finally, the charity loaned the company £200,000 on commercial terms.

62. The principal donations to the charity by Mr Harvey were conditional upon the loans being made to the company (and therefore loan agreements with repayment terms and interest being in place). The principal donations would not otherwise have been made as they were. Given the submissions made by Ms Brown upon this we set out, in full, the cross-examination of Mr Harvey by Ms Hughes and his answers:

“Q We can see that it's necessary for the payment in [from you] to happen, in order for the charity to afford this payment out [the loan to the company] –

A Yes

Q -- can't we? And there was never going to be any other use for those funds apart from payment to the company; that's right, isn't it?

A Yes

Q And HMRC suggest in relation to this payment and all of the relevant payments that that was effectively a condition of the gift that you made to the –

A Sorry, can you say that again?

Q So HMRC suggest in relation to this payment into the charity –

A Yes

Q -- and all of the relevant payments into the charity that it was essentially a condition of the payment that it would be paid on to the company?

A Yes. Implicit, if not actual, yes.

63. Ms Reid agreed that it was “in a way correct” that there was no real prospect of the donations from Mr Harvey being used for anything other than the loans but in another way pointed out that it created an income stream for the charity and was a good idea.

64. On 30 April 2016 the company and the charity signed the terms of the first loan. The trustees had delegated the agreement of the terms to Mr Harvey for this and subsequent loans. The sum identified was £200,000. The draw down date was 6 April 2016, and the interest rate was 10% “such rate may change by agreement between the parties”. The interest was to be calculated quarterly in arrears and payable quarterly in arrears and “accrued but unpaid interest shall be added to the principal amount of the loan”. The capital repayments were to begin from month 13 following the month of the drawdown and repayable over 60 months from that date. A default interest amount was imposed.

65. As to security, despite the minuted decision of the trustees, the loan said, “The loan will be unsecured”. Ms Reid told us when the issue of not being able to provide security was raised:

“I think it was absolutely clear to all the directors involved on the Keswick side that this was a non-defaultable thing. And it was clear to us that John Harvey would make sure that it -- that the charity was not out-of-pocket over this. I don't think we asked a specific question which is that this can't go ahead unless we see that kind of security.”

66. The trustees did not have any concerns over repayment to the charity by the company knowing, what they did, about the relevant finances. Had there been any default by the company Mr Harvey would have ensured the charity was not out of pocket for this, and subsequent, loans.

67. The loan document was signed by two people. Mr Harvey for the charity and the managing director of the company for the company.

68. On 12 July 2016 HMRC received Mr Harvey’s self-assessment return for the tax year ending 5 April 2016.

69. On the same date the charity was successfully registered with HMRC, which application was accepted as a charity for tax purposes by HMRC in August 2016.

70. On 13 July 2016 and 14 July 2016, a further three payments occurred. First on 13 July 2016, the company repaid Mr Harvey a further part of his DLA in the sum of £200,000. Then on 14 July 2016 Mr Harvey donated £200,000 to the charity. Finally, on 14 July 2016 the charity loaned the company £200,000 again on commercial terms.

71. On 15 July 2016 the charity’s minutes record Mr Harvey making the pecuniary declaration. The meeting possessed the memo. The meeting approved a loan of £200,000 from the charity to the company secured by a floating charge over the assets of the company for a term of six years with repayments deferred for 12 months and interest at 10% (‘the second loan’). Ms Reid believed that Raffingers were advising upon the principle of the loan. They were not contacted each time a loan was being considered for separate advice. The reference to 10% in the memo was the initial rate, but it was an error that the minutes reflected 10%. Reports from the investments managers were provided on an ongoing basis and 5% did not seem unreasonable.

72. Mr Harvey agreed that the reduction in interest rate would be beneficial to the company.

73. On 31 July 2016 the company and the charity signed the terms of the second loan. The sum identified was £200,000. The draw down date was 6 July 2016, and the interest rate was 5% “such rate may change by agreement between the parties”. The interest was to be calculated quarterly in arrears and payable quarterly in arrears and “accrued but unpaid interest shall be added to the principal amount of the loan”. The capital repayments were to begin from month 13 following the month of the drawdown and repayable over 60 months from that date.

74. Again, as to security, despite the minuted decision of the trustees, the loan said, “The loan will be unsecured”.

75. Again, the loan document was signed by two people. Mr Harvey for the charity and the managing director of the company for the company.

76. On 2 October 2016 the charity’s minutes record that the final two trustee appointments had been notified to the Charity Commission.

(ii) HMRC’s informal enquiry into Mr Harvey begins and the donations, the loans and the gift aid relief continue

77. On 20 December 2016 HMRC contacted Mr Harvey’s agents about his self-assessment for the tax year ending 5 April 2016 on an informal basis and the gift aid donations. No formal enquiry was opened. The informal enquiry asked for the names of the recipient(s) (of the donations upon which gift aid relief was being sought by Mr Harvey) and evidence to support the donations.

78. A further series of payments occurred in late December 2016. First, on 19 December 2016 £100,000 was transferred to the company from the charity. The charity had funds to make this payment. Secondly, on 19 December 2016 £300,000 was transferred to the company from Mr Harvey. That was an error. It should have been paid to the charity. Thirdly, on 21 December 2016 £100,000 was transferred to the charity from Mr Harvey. At that point Mr Harvey should have transferred £400,000 to the charity but as can be seen, only £100,000 was as £300,000 had gone to the company. Fourthly, on 22 December 2016 £400,000 was transferred to Mr Harvey from the company further repaying Mr Harvey’s DLA.

79. On 20 December 2016 the charity’s minutes record Mr Harvey making the pecuniary declaration. The meeting possessed the memo. The meeting approved a loan of £400,000 from the charity to the company secured by a floating charge over the assets of the company for a term of five years with repayments deferred for 12 months (‘the third loan’). The meeting also agreed to the consolidation of the three loans totalling £800,000 with interest at 4%. Again reports from the investments managers were provided and 4% did not appear to be unreasonable at this time. At this point no one had noticed the error in that the charity had only loaned £100,000 to the company rather than £400,000.

80. On 31 December 2016 the company and the charity signed the terms of the third loan. The sum identified was £400,000. The draw down date was 6 December 2016, and the interest rate was 4% “such rate may change by agreement between the parties”. The interest was to be calculated quarterly in arrears and payable quarterly in arrears and “accrued but unpaid interest shall be added to the principal amount of the loan”. The capital repayments were to begin from month 13 following the month of the drawdown and repayable over 60 months from that date.

81. Once again, as to security, despite the minuted decision of the trustees, the loan said, “The loan will be unsecured”.

82. This loan document consolidated the previous loans and reduced the interest to 4% in line with the previous loan documents and the decision of the trustees. It also stated, “The total interest due on all loans will be £32,000 per annum payable quarterly in arrears from 6th January 2017”. Therefore, none of the loans, individually or when consolidated, had any security at all as no floating charge was taken out as the company’s other lenders were not prepared to reduce their security. Additionally, the trustees reduced the interest rate that was to be paid. All of this was done without any further advice from Raffingers beyond the initial memo received before the first loan was provided to the company.

83. Again, the loan document was signed by two people. Mr Harvey for the charity and the managing director of the company for the company.

2017

84. On 2 January 2017 the charity’s minutes record that a gift aid claim was to be made in respect of the “second December injection” into the charity of £400,000.

85. As we have seen, an error was made. Instead of sending £400,000 to the charity, £100,000 was transferred to the charity on 21 December 2016 and £300,000 to the company directly. All £400,000 should have been transferred to the charity before the charity loaning the money to the company.

86. On 16 January 2017 Mr Harvey’s agents replied to HMRC’s informal enquiry about his self-assessment return for the tax year ending 5 April 2016 and the gift aid donations. That reply included the following:

“[the charity] is a registered charity … I attach a copy of the charity repayment claim summary giving details of the contributions totalling £405,000. This relates to a payment made on 14 - 2 - 16 of £205,000 and 15 - 7 - 16 of £200,000, which was carried back to the 2015-16 tax year …”

87. On 18 January 2017 HMRC responded to Mr Harvey’s agents reply of 16 January 2017. The noted the information about the recipient but requested proof of payment.

88. On 23 January 2017 copies of Mr Harvey’s bank statements were also supplied showing the payments of £4,900 on 3 March 2016, £200,000 on 5 April 2016 and £200,000 on 13 July 2016 (cleared on that date but made on 8 July 2016). Those bank statements were deliberately (but it was not suggested improperly) redacted so that only the outgoing payments from Mr Harvey’s account could be seen. There was no accident in copying. It stretches coincidence beyond breaking point to suggest, as it was to Officer Kempall, that it could have been a copy error. As Officer Kempall pointed out, the Sort Code and Account Number which could be seen were in a place which would have been similarly cut off had some sort of error occurred unless that error was confined by the photocopier only to the ‘money in’ column below them.

89. As a result, the amounts of the transfers into Mr Harvey’s account on 5 April 2016 and 13 July 2016 marked ‘F/FLOW THE KESWICK’ in identical amounts could not be seen at this stage (cf. 29 August 2018 when HMRC were supplied this information (see [101] below)).

90. At no stage in the informal enquiry was the connection between Mr Harvey and the company brought to HMRC’s attention.

(iii) HMRC close Mr Harvey’s informal enquiry

91. On 17 February 2017 HMRC wrote to Mr Harvey’s agents informing them they had no further questions about his self-assessment return for the tax year ending 5 April 2016 having been provided with proof of payment from the redacted bank statements. No formal enquiry into this self-assessment was ever opened under section 9A TMA into that self-assessment.

92. On 27 March 2017 the charity’s minutes record that the charity “now has £800,000 invested in an interest-bearing five-year loan” to the company with a floating charge over its assets.

93. The payment error was corrected on 30 and 31 May 2017. First, £300,000 was transferred back from the company to Mr Harvey. Secondly, on 31 May 2017 Mr Harvey transferred £300,000 to the charity. Thirdly, on 31 May 2017, the charity transferred £300,000 to the charity completing the loan.

94. On 15 August 2017 HMRC received Mr Harvey’s self-assessment for the tax year ending 5 April 2017. That included a total in ‘box 5’ of £414,490 as gift aid payments made in that tax year, the total of one-off payments in ‘box 6’ included in that sum being £414,400.

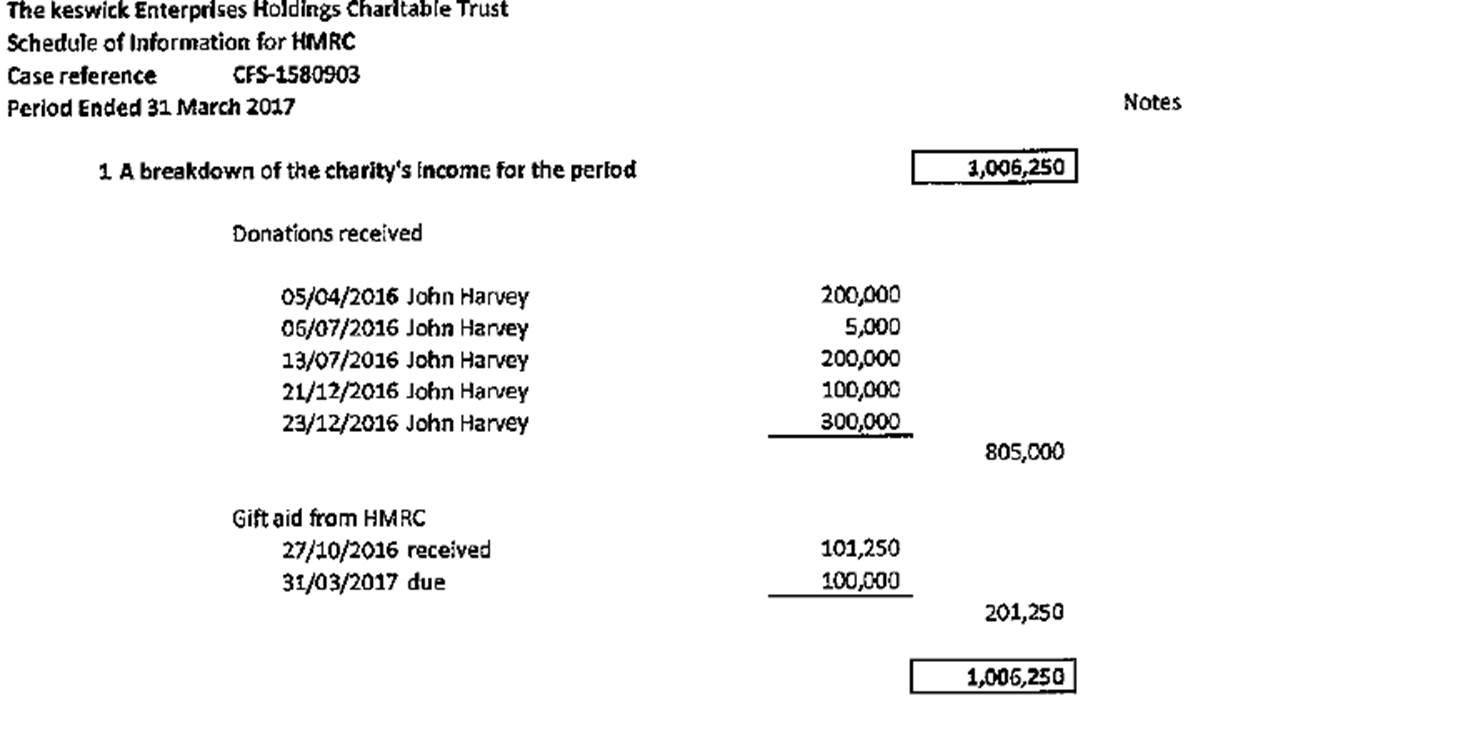

95. The charity sent its self-assessment tax return dated 21 August 2017 to HMRC for the tax year ending 5 April 2017. It declared that no tax was due with an exemption from tax being claimed due to the charitable status. The income upon which the charity was claiming exemption from tax included the sum of £1,006,250 in the box marked ‘Gift Aid’. That was said to be made up of (a) gifts totalling £805,000 from Mr Harvey and (b) £201,250 in gift aid relief for the period ending 31 March 2017. The declarations were made, quite properly, by Mr Harvey in his capacity as a trustee. The gift aid claim for 2016 was submitted for the gifts said to be made by Mr Harvey on 14 February 2016 of £205,000 and 15 July 2016 of £200,000. The total relief was said to be £101,250. £51,250 was paid by HMRC to the charity in that amount on 27 October 2016 (the remaining £50,000 included in the income for the return ending 5 April 2017).

96. As we have already found, the £200,000 dated 14 February 2016 was made on 5 April 2016 (and £100 was made on 16 February and £4,900 on 3 March 2016). In any event that is outside the scope of the charity’s appeal which relates to the tax returns of the charity for the years ending 5 April 2017 and 18. Officer MacDonald told us that HMRC would not pursue the £51,250 as that would require the use of extended time limits and HMRC did not believe it had an assessable position in respect of that donation made in the tax year ending 5 April 2016.

2018

97. On 4 January 2018 the £800,000 consolidated loan was repaid back to the charity. £28,000 in interest had already been paid (variously in July and October 2016 and January and April 2017). The company sold the Romanian business including the crane. None of that money was returned to Mr Harvey.

(iv) HMRC open separate formal enquiries into Mr Harvey and the charity

98. On 10 August 2018 HMRC through its wealthy team wrote giving notice of the opening of an enquiry into Mr Harvey’s self-assessment return for the tax year ending 5 April 2017 under section 9A TMA checking, inter alia, gift aid relief. Also, on 10 August 2018 HMRC through a separate team wrote to the charity. Officer MacDonald, who gave evidence in relation to the charity’s appeal, had knowledge of the charity’s case since the enquiry was opened in 2018 by a different case officer. There was liaison between the two teams in relation to the enquiries being undertaken.

99. On 29 August 2018 Mr Harvey’s agents provided a breakdown that of the total set out in ‘boxes 5 and 6’ £400,000 related to the charity (see [94] above). Although the reply dealt with other matters in relation to gift aid it said: “Gift Aid Relief We enclose the breakdown of gift aid donations below: [The charity] £400,000 …”

100. At no stage directly within the formal enquiry into Mr Harvey’s self-assessment for the tax year ending 5 April 2017 was the connection between Mr Harvey and the company brought to HMRC’s attention.

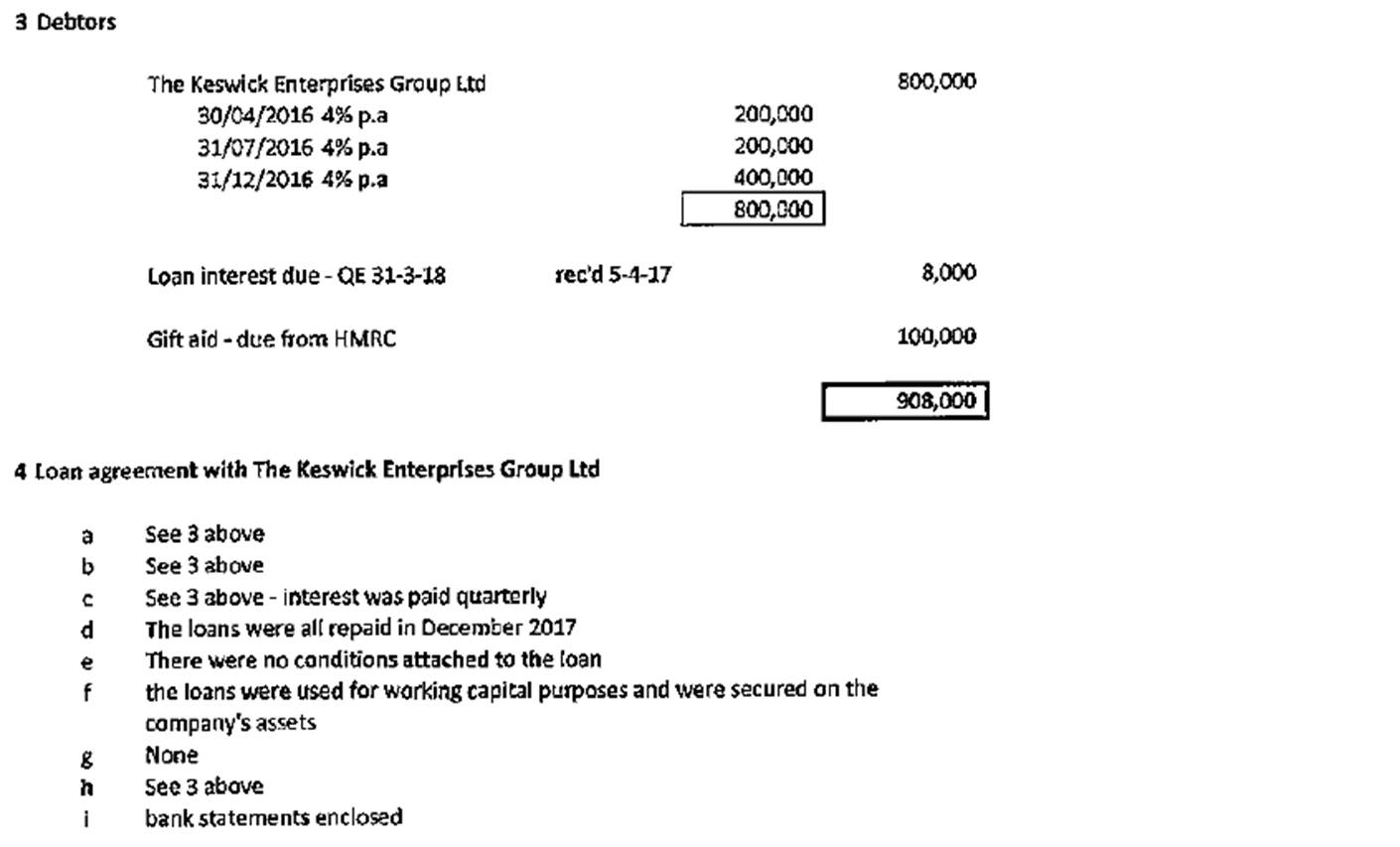

101. Additionally on 29 August 2018 in response to HMRC’s letter, the charity (through its agent) sent HMRC: (a) a spreadsheet with several details. This included the following:

102. After setting out the charitable giving at 2, the spreadsheet continued with the following:

103. Thus, this included a total of £805,000 from Mr Harvey said to be within 2016. In fact, as we have set out, £300,000 which was believed to have been donated in December 2016 by Mr Harvey but was not; such error corrected in 2017. Further information included (b) the bank statements of the charity for the period ending 31 March 2017 and (c) the charity’s trust deed approved by the Charity Commission (f) the minutes of the meeting dated 5 April 2016 and the memo (see [57]-[59] above), the minutes dated 15 July 2016 (and further copy of the memo) (see [71] above), the minutes dated 2 October 2016 (see [76] above), the minutes dated 20 December 2016 (see [79] above), the minutes dated 2 January 2017 (see [84] above) and the minutes dated 27 March 2017 (see [92] above). As we have said the total of the loans was £800,000 from the charity to the company from money donated by Mr Harvey.

104. The bank statements included the following (bank details redacted by the Tribunal: we do not consider it is necessary in the interests of justice for such a detail to be revealed. It adds nothing and is an unwarranted invasion into the privacy of Mr Harvey):

“Date Payment type Details Paid out Paid in

16 Feb16 Deposit Northwood £100

3 Mar 16 Deposit 500001 £4,900

5 Apr 16 Deposit FRM *** 460 £200,000

5 Apr 16 Transfer THE KESWICK £200,000

13 Jul 16 Deposit J.HARVEY £200,000

14 Jul 16 Transfer F/FLOW KESWICK-ENT £200,000

19 Dec 16 Transfer F/FLOW KEWSICK-ENT £100,000

21 Dec 16 Deposit 500003 £100,000”

105. The transfer to the company on 19 December 2016 was able to take place prior to the donation by Mr Harvey on 21 December 2016 as the charity had over the months received other income giving it a positive balance of above £100,000 by 19 December 2016.

106. The bank statements provided did not show the £300,000 received by the charity in 2017 - the correction of the error when £300,000 was sent to the company not the charity, in December 2016.

107. Between the correspondence and enclosures from the charity’s agent dated 29 August 2018 during the charity’s enquiry, the connection between Mr Harvey and the company was clearly disclosed. The declaration in the minutes by Mr Harvey as, “director and major shareholder” in the company (see, for example, [57] above), the donations made by Mr Harvey to the charity and the loans immediately made to the company by the charity were ample evidence of that.

108. On 5 October 2018 HMRC requested further information from the charity. That letter began with, “Thank you for your letter dated 29 August 2018”.

109. The charity sent its self-assessment tax return for the tax year ending 5 April 2018 to HMRC dated 8 October 2018. Again, it declared that no tax was due with an exemption from tax being claimed due to the charitable status. The income upon which the charity was claiming exemption from tax included the sum of £573,426 in the box marked ‘Gift Aid’. Again, the declarations were made, quite properly, by Mr Harvey in his capacity as a trustee.

110. The gift aid claim for 2017 was submitted for the gift said to made by Mr Harvey on 21 December 2016 of £400,000. The relief was said to be £100,000 (which had also been included as income in the return for tax year end 5 April 2017, but not yet received by the charity). The £400,000 was made up of two amounts: £100,000 on or about 21 December 2016 and £300,000 on 31 May 2017 (to correct an error made in December 2016 when the donation should have been for £400,000 but was not, but was believed to have been).

111. That caused a confusion as when the claims were being made and, therefore, the request for the Tribunal to correct the amounts in the closure notices (see [6] above and [187] below).

112. On 19 October 2018 the charity (through its agent) responded to HMRC’s letter of 5 October 2018. That letter began with, “Thank you for your letter dated 5 October 2018”. They further wrote:

“The interest can be seen on the statements already in your possession.”

…

“The £800,000 loan was used within [the company] partly for working capital purposes whilst banking finance was reorganised and partly to acquire Calamar Mobile Cranes for an associated business in Romania - the plan was that these assets would be refinanced and hence the loans were of a short-term nature.”

113. The letter then set out the amounts of each of the first, second and third loans and their original interest rates together with the information about the consolidation and reduction in interest rate to 4% in December 2016. They again enclosed the loan agreements.

114. The letter went on to state:

“The intention was to take a floating charge over the company’s assets in relation to these loans. This however was not possible as [the company’s] other funders would not agree to any reduction in their security. As the loans were of a short-term nature and repayment was forthcoming from an associated business sale, the trustees were prepared to defer the security issue pending the loans being repaid before the end of the 2017 calendar year”.

115. It also provided evidence showing repayment of the £800,000 to the charity on 4 January 2018.

116. On 22 November 2018 HMRC requested further information from the charity for the accounting period ending 5 April 2017. HMRC at the same time opened an enquiry into the accounting period ending 2018 under section 9A TMA. For the period ending in 2017, HMRC requested information about the £800,000 in loans between the charity and the company and the Calamar Mobile Crane Company. For the period ending in 2018, HMRC requested information about the charity’s fixed asset investments and whether the trustees or connected persons have an interest in the same investments.

117. On 28 November 2018 the charity’s agent replied expressing a degree of surprise at the enquiry. Some queries were answered. Others were not as they were not seen as relevant.

2019

118. On 8 January 2019 Mr Harvey’s agents wrote to HMRC identifying that due to a software error Mr Harvey’s chargeability to tax as set out in his self-assessment for the tax year ending 5 April 2017 had been understated.

119. On 25 January 2019 HMRC answered the charity’s letter dated 28 November 2018 and explained the relevant of its queries explaining that the information for the period ending 2018 was needed in detail which was why the enquiry had been opened.

120. On 30 January 2019 in response to the charity’s agent’s letter of 8 January 2019. Having responded to matters that do not concern the appeal HMRC wrote:

“Other matters

I confirm I have checked the calculation for the 2017 tax year and can see that taking into account the calculation error and the relief claimed error that an additional £31,822.25 will be payable … I can see that there was a problem when the return for 2017 was submitted as you had to send in a paper return …”

121. On 30 January 2019, in reply, the charity’s agent indicated that the information had already been supplied in the 28 November 2018 letter.

122. On 15 February 2019 Mr Harvey’s agents replied to HMRC’s letter of 30 January 2019.

123. On 8 March 2019 HMRC wrote to Mr Harvey’s agents indicating that they would be closing down the enquiry for the self-assessment for the tax year ending 5 April 2017.

(v) HMRC issue a closure notice ending Mr Harvey’s formal enquiry

124. On 26 March 2019 HMRC issued Mr Harvey a final closure notice under section 28A (1B) and (2) TMA, increasing his chargeability to tax arising from a software error that had used to complete his self-assessment for the tax year ending 5 April 2017, but not disqualifying the donations from gift aid relief.

(vi) HMRC’s enquiry into the charity continues

125. Having heard nothing in relation to the charity, its agent wrote again on 24 April 2019.

126. On 23 May 2019 HMRC responded to the charity’s agent apologising for the delay due to a change in caseworker and the need for the new officer to get up to speed. The officer wrote, inter alia, “I feel the information requested previously was reasonable required in order for HMRC to be satisfied the donations made by Mr J Harvey to the charity during the period under review were not made contrary to the tainted donation legislation … or under the qualifying donation legislation …”. Further, “I have been reviewing the accounts covering the period ended 31 December 2016 for [the company]. I note that point 26 that the company accounts shows a capital loan owing to Mr Harvey of £1,959,526. The company accounts for period ended 31 December 2015 show a capital loan balance owing of £2,778,800. The difference between these amounts is £819,274 and I must now seek assurances that the money advanced by the charity was not used to repay the loan owing to Mr Harvey.”

127. Further correspondence was exchanged with the charity. A request was made for any independent advice received from the charity in relation to the loans. A copy of the memo (again (see [59] above)) was enclosed with the explanation that it was provided with the terms of the charity’s deeds and powers in mind regarding making loans (which is very broad indeed). The agent explained that they would have reviewed the deed, the balance sheet of the company, the proposed interest rate to be charged, the security on offer and the timescales for repayment. The confirmed that after the initial memo no further advice had been sought.

128. On 18 July 2019 the agents for the charity wrote in reply to HMRC’s letter of 23 May 2019. That included the reference number for the charity (see [34] above). However, it was provided to us as the first document relevant to the discovery process in Mr Harvey’s case after the closure notice of 26 March 2019.

129. That letter included a considerable number of enclosures relating to six numbered paragraphs within the letter, reflecting the requests made by HMRC on 23 May 2019. At point 1 the charity’s agents listed donations made by Mr Harvey to the charity of £800,000. They said:

“The bank made an error in the instructions it received. The £300,000 which should have been paid to the charity was sent to [the company] account in error (see attached bank statements for [the company]). This position was corrected in May 2017 (see attached statements). We accounted for what the substance of the position should have been in the Charity accounts.”

130. At point 2 the loans to the company from the charity - reflecting point 1 were set out with the same error referred to.

131. At point 3 an explanation of who initiated the loans was given (with copies of the minutes, loans and relevant information having been requested by HMRC). Much of the information had already been provided “as set out in our letter of 19th October 2018” (see [112] above).

132. At point 4 further information was given in relation to the purchase of the mobile cranes.

133. At point 5 reference was made to the company bank statements. The paragraph ended with, “Repayment of capital to Mr Harvey - see point 6 below”.

134. At point 6, there is a heading, Full details of the repayments of the capital loan to Mr Harvey in the year ended 31 December 2016. Underneath it, the reader is directed to a schedule of the DLA movements.

135. Referring to point 1 a bank statement of the charity was provided showing the correction payment when it was realised that Mr Harvey had, in December 2016, paid £300,000 directly to the company rather than the charity. That showed, inter alia:

“Date Payment type Details Paid out Paid in

31 May17 Deposit FRM *** 460 £300,000

31 May 17 Transfer F/FLOW KESWICK ENT £300,000.

136. Referring to point 3 the minutes of the three meetings where the first, second and third loans were agreed to be made from the charity to the company were provided (again).

137. Referring to point 5, the company bank statements supplied showed:

(1) On 5 April 2016 £200,000 being paid to Mr Harvey

(2) On 5 April 2016 £200,000 being paid from the charity

(3) On 13 July 2016 £200,000 being paid to Mr Harvey

(4) On 14 July 2016 £200,000 being paid from the charity

(5) On 19 December 2016 £100,000 being paid from the charity

(6) On 19 December 2016 £300,000 being paid from Mr Harvey

(7) On 22 December 2016 £400,000 being paid to Mr Harvey.

138. Referring to point 6, the schedule supplied by the charity’s agents showed that Mr Harvey had been repaid by the company: £200,000 in April 2016, £200,000 in July 2016 and £400,000 in December 2016.

(vii) HMRC consider Mr Harvey’s self-assessments again

139. On 31 July 2019 Officer Kempall became involved with Mr Harvey’s case. This had happened when he received an internal referral, as the Customer Compliance Manager for Mr Harvey, from the Charities team. He was the decision maker from this point forward. From the information referred to him, in particular the letters and attachments received from Mr Harvey’s agents dated 19 October 2018 and 18 July 2019, he concluded that the donations made by Mr Harvey to the charity may have been ‘tainted’, as set out in schedule 3, Finance Act 2011 or did not meet the definition of a ‘qualifying donation’ in section 416 Income Tax Act 2007.

140. In both instances, income tax relief would need to be withdrawn. He told us he had therefore discovered a loss of tax and had done so after the dates section 29 (1) TMA required him to do so. Those dates were 12 July 2017 for the self-assessment for the tax year ending 5 April 2016 (that is 12 months after the return was delivered to HMRC (see [68] above)) and 26 March 2019 for the tax year ending 5 April 2017 (that is the date of the final closure notice issued (see [124] above)) respectively.

141. The letter and attachments dated 19 October 2018, and the letter dated 19 July 2019 that had been provided to Officer Kempall were originally, as we have seen, supplied by Mr Harvey’s agents in their capacity as the charity’s agents into the charity enquiry.

142. On 30 October 2019 HMRC wrote to the charity’s agents indicating they hoped to provide an update by 31 December 2019.

143. Before issuing the discovery assessments, on 6 November 2019 HMRC wrote to Mr Harvey’s agents indicating that both his self-assessments for the tax years ending 5 April 2016 and 2017 was believed to be incorrect and that an officer of HMRC had made a discovery of a loss to tax. This letter was written with the reference number that related to Mr Harvey (see [34] above).

144. It is necessary to set out most of this letter. HMRC wrote (in a letter authorised by Mr Kempall):

“Gift Aid Donations - 2015/16 and 2016/17

It has come to HMRC’s attention that your client’s tax return for the years ending 5 April 2016 and 5 April 2017 may be incorrect. For simplicity, I have decided to informally ask the questions I have under this letter, rather than writing a separate letter under the discovery provisions at Section 29 of the Taxes Management Act 1970.

I would welcome your cooperation in answering these questions in this manner to establish if your client’s tax return was completed correctly. Alternatively, I will use the available provisions described above.

It is understood that your client claimed Gift Aid relief on donations of £405,000 and £400,000 made to the Keswick Enterprises Holding Charitable Trust ([the charity]) in the years 2015/16 and 2016/17 respectively. At this stage, it must be noted that HMRC previously opened an intervention in both years to establish what charitable donations were made.

HMRC now understands that upon making the donations to the charity, the charity then loaned the money to a company, Keswick Enterprises Group Limited ([the company[), that your client is director and majority shareholder of.

The donations to Keswick Enterprises Holding Charitable Trust were made as follows:

• £200,000 05/04/2016

• £5,000 06/07/2016

• £200,000 13/07/2016

• £300,000 19/12/2016(Accidentally sent to [the company], corrected on 31/05/2017)

• £100,000 21/12/2016

Gift Aid claims were submitted by [the charity] to HMRC for the £805,000 in received donations and HMRC subsequently paid £201,250 to [the charity].

Loans from [the charity] to [the company] were then made as follows:

• £200,000 05/04/2016

• £200,000 14/07/2016

• £100,000 19/12/2016

• £300,000 19/12/2016 (As above, corrected on 31/05/2017)

HMRC understands that the loans were made to [the company] on a commercial basis. Interest was charged on the loans to [the company], all of which were repaid in full, including interest of £28,000 in December 2017.

HMRC now holds information to suggest that the loans made to [the company] from [the charity] have been used to repay capital owed to your client from [the company]. An analysis of the Directors Loan Account (DLA) shows the following:

• £200,000 Repaid in April 2016

• £200,000 Repaid in July 2016

• £400,000 Repaid in December 2016

It is for the reason above that HMRC believe that your client’s tax return for the years 2015/16 and 2016/17 are incorrect. From the information HMRC now holds it appears as though money donated to the charity has effectively returned to Mr Harvey by way of a repayment in the DLA. If this is the case, any gift aid relief claimed on your clients 15/16 and 16/17 tax return in respect of donations made to [the charity] may need to be withdrawn.”

(emphasis added)

145. That letter acknowledged that both self-assessments had been the subject of what the letter neutrally describes as “interventions”. It did not refer to ‘tainted donations’ or ‘qualifying donations’ - simply that the relief may have been incorrectly claimed.

146. Mr Kempall told us, and we accept, that when he received the correspondences from Charities he, “drew the conclusion that I felt that there may have been a loss of tax in terms of either them being tainted or them not being qualifying donations”. When taken to the letter of 21 August 2021 that he had written (see [169] below) he said, and we accept, before being shown any letters in between, “I think the tainted donation legislation was initially our first position, but it wasn't our only thing that we were considering and from memory, I'm pretty consistent in the other letters that I wrote, that both section 416 and section 809 are referred to”.

147. On 26 November 2019 Mr Harvey’s agents replied suggesting to HMRC that their questions were not appropriate to a personal tax enquiry being asked informally as they were. They referred the author of HMRC’s letter to the enquiry into the charity and said the questions had been, “asked and answered” there.

148. On 7 December 2019 HMRC responded (in a letter authorised by Mr Kempall). Again, it is necessary to set out most of this letter:

“Gift Aid Donations - 2015/16 and 2016/17

I understand that the questions asked under this section have not been answered on the basis that they have already been answered during the course of an enquiry into the Keswick Enterprises Holding Charitable Trust ([the charity]) for which you are awaiting a response. In addition, you do not believe the questions to be appropriate for a personal tax enquiry.

To clarify the above points, I am aware that [the charity] is currently under enquiry for the year ended 5 April 2017. Prior to sending out my letter of 6 November 2019, and on an ongoing basis, I have been in contact with the compliance officer … who has been running the enquiry into [the charity]. I believe the questions asked are not only relevant to the enquiry into [the charity], but also to Mr Harvey’s personal tax position. Furthermore, I understand that the questions asked either differ to those that have already received a response from yourselves during the enquiry into [the charity], or have not been answered fully.

As previously explained, it has come to HMRC’s attention that the gift aid claims in your client’s personal tax returns for the years ending 5 April 2016 and 5 April 2017 may be incorrect. I therefore believe the questions asked are appropriate for a personal tax enquiry. In order to verify that valid gift aid claims were made by your client I believe the answers to the questions that have been asked are required. I need to be satisfied that the conditions for a qualifying donation at s416 ITA 2007 have been met and that the donation does not meet the definition of a tainted donation under s809ZH ITA 2007. As director and majority shareholder in [the company] your client has the power to obtain the information required while he also has the ability to answer any questions relating to [the charity] in his capacity as a Trustee.

At this stage it must be noted that adequate answers have not been provided to the questions raised under this heading in my previous letter. In the absence of such answers HMRC may need to form a view which may involve raising an assessment on Mr Harvey, [the charity], or both, unless it can be shown that the donations made to [the charity] should obtain relief.

If a response is not received to the questions asked then I will need to consider issuing an information notice or whether or not HMRC should use the information we currently have to raise an assessment under the discovery provisions at s29 TMA 1970. For the avoidance of any doubt, the questions requiring a response have been asked again below. A copy of my letter dated 6 November 2019 has also been enclosed.”

(emphasis added)

2020

149. On 23 January 2020 HMRC provided an update to the charity that they hoped to be in a position to write further by 31 March 2020. On 16 June 2020 HMRC wrote indicating the enquiry into the charity was still ongoing.

150. On 20 February 2020 Mr Harvey’s agents wrote back to HMRC. This letter asserted that there was a confusion apparent from the letter dated 7 December 2019 and set out what they said the money movements in that (a) Mr Harvey’s director’s loan account with the company was in credit (b) the company made a cash repayment to Mr Harvey which was itself a return of a loan with no income tax consequences to Mr Harvey and reduced his director’s loan account (c) Mr Harvey made a donation to the charity (d) the charity made a commercial loan to the company on commercial terms charging a commercial rate of interest. Other questions were responded to.

151. On 26 February 2020 HMRC wrote to Mr Harvey’s agents indicating a colleague would be in touch at a later date.

(viii) HMRC raise discovery assessments against Mr Harvey

152. That colleague was Officer Kempall who had been the decision maker throughout and authorised the previous letters his involvement. On 3 March 2020 Officer Kempall issued discovery assessments under section 29 TMA against Mr Harvey for tax years ending 5 April 2016 and 2017 for £132,628.08 and £139,460.17 respectively which he had discovered before issuing the discovery assessments.

153. We set out the letter accompanying the assessments in full:

“Mr J A Harvey

1. Notices of amended assessment

I am writing to you to inform you that assessments have been raised in respect of your clients Self Assessment tax returns for the years ending 5 April 2016 and 5 April 2017. These assessments have been raised under section 29 of the Taxes Management 1970 as HMRC believes that additional tax is due.

I enclose copies of the notices of amended assessment that I have sent to your client today.

2. Reason for amended assessments

The attached assessments have been raised as it has come to HMRC’s attention that the gift aid claims in your client’s Self Assessment tax returns for the years ending 5 April 2016 and 5 April 2017 appear to be incorrect. This was explained in letters to yourselves on 6 November 2019 and 17 December 2019.

In both letters mentioned above, HMRC requested information that your client has the power to obtain in his capacity as a trustee of the Keswick Enterprises Holding Charitable Trust [the charity] and that of director and majority shareholder in Keswick Enterprises Group Limited [the company].

So far to date, no documentation has been provided and as a result the attached assessments have been raised to protect HMRC’s position. I believe excessive relief has been claimed by your client in both the years ending 5 April 2016 and 5 April 2017. I have therefore raised the attached assessment to make good this loss of tax.

Having reviewed bank statements provided during the course of an enquiry into [the charity], HMRC understands the following to be true:

05/04/2016 £200,000 was transferred to Mr Harvey from [the company]

05/04/2016 £200,000 was transferred to [the charity] from Mr Harvey

05/04/2016 £200,000 is transferred to [the company] from [the charity]

13/07/2016 £200,000 was transferred to Mr Harvey from [the company]

13/07/2016 £200,000 was transferred to [the charity] from Mr Harvey

14/07/2016 £200,000 was transferred to [the company] from [the charity]

19/12/2016 £100,000 was transferred to [the company] from [the charity]

19/12/2016 £300,000 was transferred to [the company] from Mr Harvey

21/12/2016 £100,000 was transferred to [the charity] from Mr Harvey

22/12/2016 £400,000 was transferred to Mr Harvey from [the company]

31/05/2017 £300,000 was transferred to [the charity] from Mr Harvey

31/05/2017 £300,000 was transferred to [the company] from [the charity]

3. Information and documentation requested

As previously explained, information and documentation have been requested in order to confirm whether the donations made by Mr Harvey to [the charity] meet the conditions for a qualifying donation at s416 ITA 2007 and that they do not meet the definition of a tainted donation at s809ZH ITA 2007. No documentation has been provided to date as you believe that the information requested is not part of your client’s statutory personal records.

The key issue at hand is the fact that there is a direct personal tax implication for your client. In addition, Mr Harvey has the power to obtain the requested information in his personal capacity as a trustee of [the charity] and that of director and majority shareholder in [the company]. The information and documents required are therefore within his power to obtain.

If the conditions for a tainted donation are met, as is believed, then Mr Harvey will not be eligible for any relief on the donations he made to [the charity]. From HMRC’s understanding of the series of transactions Mr Harvey has received a financial advantage. [The charity] has claimed gift aid on Mr Harvey’s donation and your client has also claimed gift relief on his Self Assessment returns for both 15/16 and 16/17. [The charity] has in turn invested in Mr Harvey’s own company once the amount had been paid out of the DLA to Mr Harvey. The transactions are essentially circular.

As a result, HMRC have come to the conclusion that the arrangement in place meets the definition of a tainted donation and as such any relief claimed by Mr Harvey in respect of the donations made to [the charity] will be lost. The attached assessments have withdrawn relief in respect of donations made of £400,000 to [the charity] in each tax year. If you believe this not to be the case, please set out the reasons why in response to this letter.

At this point I would like to stress that in order for HMRC to consider the position further, the previously requested documentation is required. For the avoidance of doubt, this is shown below:

1. An explanation as to why KEHCT loaned money to KEG

2. How was the money used by KEG?

3. An explanation as to why the money owed to Mr Harvey in the DLA for KEG was reduced by the same amount and in the same month in which the charitable donations to KEHCT were made

4. KEG bank statements / ledgers evidencing the reduction in the DLA for the years 2015/16 and 2016/17

5. Personal bank statements evidencing any money transferred to Mr Harvey from KEG.”

(emphasis added)

154. Drawing breath here, Officer Kempall had notified Mr Harvey of the assessments in paragraph 1 of his letter. His reasons, in paragraph 2 were that he believed he had discovered a loss to tax by way of excessive relief arising out of gift aid reclaims. That was a change in position from that previously notified to Mr Harvey in relation to each tax year in question as Officer Kempall had taken a different view. This view was honestly held by reference to the material he had at the time he made the discovery and, for the reasons he gives, reasonably held; looking at that point as it did that the payments were entirely circular. A reasonable officer could hold that belief on the material before Officer Kempall. At paragraph 3 he continued to seek information and documentation on the questions of both “qualifying donations” and “tainted donations”. The context for that request were the content of the letters sent under his authority on 6 November 2019 (see [143]-[144] above) and 7 December 2019 (see [148] above). At the discovery stage he concluded that the relief was excessive because the donations were “tainted donations” but wanted more material to consider the position further. At no point did he rule out that the donations were not “qualifying donations”.

155. On 23 March 2020 Mr Harvey (through his agent) requested a review and on 30 March 2020 Officer Kempall issued his view of the matter. Mr Harvey sought an independent review. They set out, in short form, that the donations were not tainted donations and that the discovery assessments were not validly raised.

156. On 26 March 2020 Officer Kempall postponed collection of the tax raised against Mr Harvey by the discovery assessments.

157. On 16 April 2020 Officer Kempall wrote to Mr Harvey explaining that there would be a pause due to the pandemic.

158. On 20 October 2020 Officer Kempall wrote to Mr Harvey’s agents asking for further documentation as, “It is clear that answers to the questions would facilitate a better understanding of the series of transactions as there are clearly some gaps that need to be filled.”

159. On 29 October 2020 Officer Kempall wrote to Mr Harvey’s agents. Having apologised for not being able to take a telephone call he said, “The last I heard from you on this was that you were having a look at the case into Mr Harvey and were intending to come back to me this week regarding the possible tainted donation”.

160. On 30 October 2020, having had a productive telephone call with Mr Harvey’s agents, Officer Kempall wrote:

“As I explained on the call, I have been considering what information and documentation HMRC would like to see in order to determine whether the gift aid claims made by Mr Harvey in 15/16 and 16/17 are correct. As you’re aware, HMRC have been considering whether the conditions set out within the tainted donation legislation have been met. I appreciate that you do not believe this to be the case due to the fact the transactions originated from the Company and not from Mr Harvey, however, I think we need a little more clarity and transparency on the series of transactions in order to be happy that the donations do qualify for relief.

As a result, I have provided a more comprehensive list of the information and documents I think HMRC will need to see in order to resolve this case. These have been provided below:

• An explanation of who initiated the loans from Keswick Enterprises Holdings Charitable Trust (KEHCT) to Keswick Enterprises Group Limited (KEG) with supporting evidence.

• What considerations/due diligence/advice did the trustees undertake before approving the loans to KEG? Please include any supporting evidence.

• Were all the trustees aware of the loans being made to KEG? Please include any supporting evidence.

• A copy of the loan documents for the loans from KEHCT to KEG.

• What was the money loaned to KEG spent on? Please include any supporting evidence.

• An explanation as to why were the loans repaid early if the original term was set to 6 years?

I am aware that there is a slight overlap in the above questions and the information that has previously been asked, most recently in my letter of 3 March 2020 …”

(emphasis added)

161. On 10 December 2020 the officer wrote to the charity’s agent noting that Officer Kempall was enquiring into Mr Harvey’s personal returns and that technical gift aid advice was being sought. HMRC noted that the enquiry into the charity returns was ongoing and no further information was required at this time.

162. On 21 December 2020 Mr Harvey’s agents provided a response to Officer Kempall’s email of 30 October 2020 with several enclosures (all of which having been provided to HMRC on a number of occasions previously). Having answered the bullet point questions their reply continued:

“We would like to provide you with some more background regarding the transactions in question which may help the understanding of the nature of the transactions. Please see below:

• Our client’s director’s loan account with [the company] was in credit.

• [The company] made a cash repayment to our client. This cash repayment was a return of a loan and carried no tax consequences for our client as far as income tax is concerned. Mr Harvey’s DLA credit was reduced.

• Our client made a donation to [the charity].

• [the charity] made a commercial loan to [the company]. The loan was made on commercial terms charging commercial rate of interest. Please refer to the documents mentioned earlier in the letter and enclosed with this letter for your review.

Based on this we do not believe that the transfers made by Mr Harvey to [the charity] meet the conditions for a tainted donation. We also do not believe that there was an arrangement in place which was set up by our client which sole or main purpose was to obtain a tax advantage. Our client drew on his DLA which was in substantial credit and made a donation to [the charity]. The trustees made a loan to the company on which they earn commercial rate of interest. Thus, it is an arm’s length transaction as no preferential credit terms were offered by the charity to the company.”

2021

163. On 11 February 2021 Officer Kempall wrote to Mr Harvey’s agents. He said: