Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Lazaridis v Revenue and Customs (STAMP DUTY LAND TAX - whether property entirely residential) [2024] UKFTT 925 (TC) (17 October 2024)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2024/TC09321.html

Cite as: [2024] UKFTT 925 (TC)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation: [2024] UKFTT 925 (TC)

Case Number: TC09321

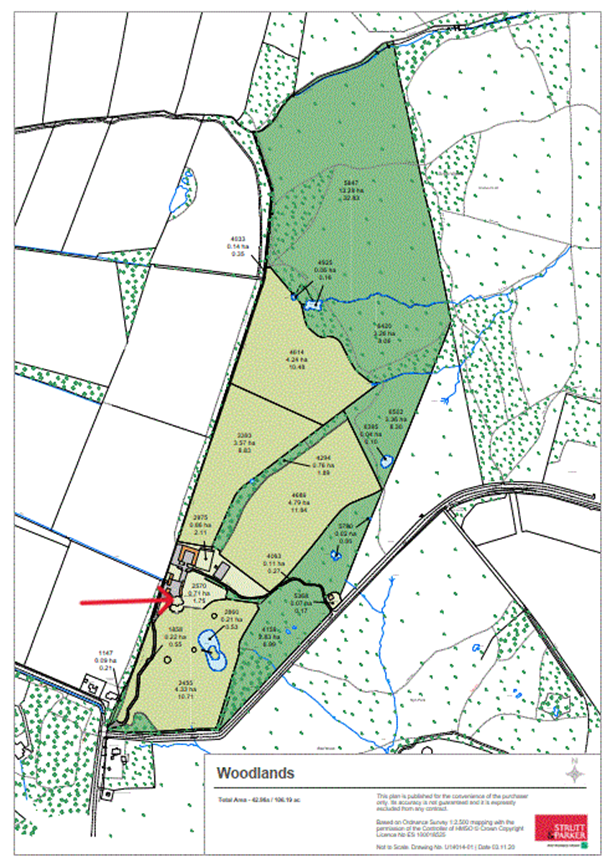

FIRST-TIER TRIBUNAL

TAX CHAMBER

Sitting at Taylor House, London

Appeal reference: TC/2023/07912

STAMP DUTY LAND TAX - whether property entirely residential within the meaning of section 116(1) of the Finance Act 2003 - 106-acre property including 40-acre fields used for growing and cutting grass - previous owner entered into series of "mowing licences" with a company - fields are close to, and partly visible from, the dwelling - whether the fields are part of the grounds of the dwelling - yes - appeal dismissed

Heard on: 10 June 2024

Written submissions: 8 August 2024

Judgment date: 17 October 2024

Before

TRIBUNAL JUDGE RACHEL GAUKE

HELEN MYERSCOUGH

Between

MIKE LAZARIDIS

Appellant

and

THE COMMISSIONERS FOR HIS MAJESTY'S REVENUE AND CUSTOMS

Respondents

Representation:

For the Appellant:†††††††† Sean Randall of Sean Randall Tax LLP

For the Respondents: †† Leah Fairhurst, litigator of HM Revenue and Customs' Solicitor's Office

DECISION

Introduction

1. This is an appeal by Mr Lazaridis against HMRC's decision in a review conclusion letter dated 27 February 2023 to uphold an earlier closure notice in which HMRC amended a stamp duty land tax (SDLT) return submitted by Mr Lazaridis. HMRC's decision was that Mr Lazaridis owed an additional £1,214,250 of SDLT.

2. HMRC's decision was made on the basis that the main subject-matter of the transaction giving rise to SDLT consisted entirely of residential property. Mr Lazaridis had self-assessed on the basis that the property in question was mixed use. The dispute concerns the meaning of the term "grounds", and how it should be applied in this case.

3. The documents to which we were referred were a hearing bundle (which was divided into two parts, one of 122 pages and one of 131 pages), an authorities bundle of 327 pages, and both parties' skeleton arguments. We also had a witness statement from Mr Russell Bone of AT Bone and Sons. Mr Bone attended the hearing remotely and was cross-examined. We had no witness evidence from Mr Lazaridis.

4. Following the hearing, the Upper Tribunal released its decision in Taher Suterwalla and another v HMRC [2024] UKUT 188 (TCC) ("Suterwalla"). We invited the parties to make written submissions on Suterwalla, to the extent that it related to Mr Lazaridis' appeal. These submissions were received by the Tribunal on 8 August 2024.

5. We have considered the evidence and the parties' submissions and have decided that the relevant land consisted entirely of residential property. We therefore dismiss the appeal, for the reasons given below.

Findings of fact

6. On 18 February 2022, Mr Lazaridis purchased the freehold estate of a property known as Woodlands, near Potters Bar in Hertfordshire. At the same time, he purchased the freehold estate of a much smaller adjacent property known as Keepers Cottage. Woodlands and Keepers Cottage have separate Land Registry title numbers but have been in common ownership since at least 1985, and are referred to together in this decision as the "Property". The principal dwelling on the Property is referred to in this decision as the "House".

7. We refer here to Keepers Cottage because it was purchased together with Woodlands, but Keepers Cottage is not otherwise relevant to this decision and we have not needed to refer to it again.

8. The Property is around 106 acres in size and the purchase price was £10,750,000. Mr Lazaridis bought the Property from its previous owner, Mrs Barham. The sales brochure described the Property as an "exceptional Nash style villa with three cottages set in a mature parkland estate of 106 acres". The features of the Property were described as including an "entrance hall, reception hall, drawing room, sitting room, dining room, study, kitchen/breakfast room, cloakroom, general stores. Master bedroom with twin bathrooms and dressing rooms, 4 principal bedroom suites."

9. The Appendix to this decision reproduces a plan from the sales brochure. The House is marked with a red arrow, and is at the southern edge of a collection of buildings, gardens and paved areas coloured orange, pale green and grey. We were not directed to a colour code for this plan, but from photographs in the sales brochure we understood that orange areas are buildings, grey are paved areas, and pale green are gardens and a swimming pool, although the House itself is also shown as pale green. The inverted U-shaped structure shown in orange is a collection of outbuildings including storage rooms, offices and kennels (the "Outbuildings"). The Outbuildings are not used as a dwelling.

10. The Property includes a 40-acre area to the rear of the House referred to in this decision as the "Fields". The Fields have clear boundaries, being mostly surrounded by trees or hedges, and are shown as the two separate areas coloured a medium shade of green to the north and east of the Outbuildings (one of the two areas is divided by a field boundary shown as a straight black line). The two separate areas of the Fields are divided by a wooded strip, shown as a darker green.

11. There is a continuous paved area between the House and the Outbuildings; they are not separated by a fence or other barrier. The Outbuildings directly adjoin the Fields. There is an open archway through the Outbuildings, leading from the paved area to the Fields. The distance between the House and the closest part of the Fields is around 150 metres. The Fields are partly visible from the rear of the House.

12. The Fields are not the furthest part of the Property from the House; as may be seen from the plan, the Property includes woodlands which extend for a considerable distance (similar to the length of the Fields) on the far side of the Fields from the House.

13. The House and the Fields are on the same Land Registry title and have been since at least 1980.

14. The sales brochure included a section titled "Gardens & Grounds", which stated "The gardens and grounds provide a tranquil and mature setting for the House." There is a description of the walled garden, conservatory, swimming pool and tennis court, and of the parkland and lake to the south of the House. The brochure then continued (still under the heading of "Gardens & Grounds"): "On the north side of the house are three level paddocks adjoining further woodland forming part of The Great Wood". The "paddocks" in this extract are the Fields.

15. The area around the Property is rural, consisting mainly of farmland and woods.

16. At the time of Mr Lazaridis' acquisition of the Property, there was a "mowing licence" (the "Licence") in place relating to the Fields. The Licence had been granted by Mrs Barham (the "Licensor") to AT Bone and Sons Ltd (the "Licensee" or the "Company"). The Licence had been granted on 1 September 2021 for a one-year period, which was due to expire on 31 August 2022. This was the latest in a series of one-year mowing licences that had been granted by Mrs Barham to the Company every year starting on 1 September 2016.

17. The licence fee paid by the Company was initially £1,200 (£30 per acre), increasing to £1,400 (£35 per acre) in 2019.

18. The Licence gave the Company permission to take and cart away one or two cuts of grass from the Fields (defined in the licence as the Mowing Area), "depending on the availability or crop due to weather conditions".

19. Under a heading of "licensor's rights", the Licence provided that:

"The Licensor has the Mowing Area at its disposal and the Licensee acknowledges that this licence is subject to the Licensor's rights to do all such things on the Mowing Area as the Licensor wishes including (but not limited to):"

20. There then followed a list of specified activities, including carrying out operations to protect and enhance the land (including observing applicable environmental legislation), maintaining hedges, ditches and fences, maintaining roadway, tracks and watercourses, and exercising overall management control. These rights were, in turn, subject to the proviso that Mrs Barham would, so far as possible, and subject to compliance with relevant agricultural and environmental legislation and the general law, not interfere with the permitted mowing activity.

21. Mrs Barham was expressed to have a number of obligations under the Licence, including using best endeavours to destroy noxious weeds, keeping the Fields fertilised, and when and where necessary re-seeding and cropping the grass.

22. The Licence also provided that Mrs Barham would not keep her own livestock, or permit livestock of anyone other than the Company to be kept, on the Fields.

23. The Company, in turn, had a number of obligations under the Licence. These included checking hedges and fences for damage, not erecting any building or structure other than agreed fencing, not wasting water, maintaining the Fields in "good heart and condition", acting in accordance with health and safety legislation, and not acting in a manner that would cause loss, damage or injury. The Company must also "not interfere with obstruct or in any way hinder the Licensor's right of occupation" of the Fields.

24. There are several provisions in the Licence that would be consistent with the Company keeping animals on the Fields. For instance, the Company agreed not to allow diseased or quarantined animals onto the Fields, and to hold passports for the "Approved Animals" (although the Approved Animals do not appear to be defined).

25. However, it was not disputed, and we find as a fact, that at no point between 1 September 2016 and the sale of the Property to Mr Lazaridis were the Fields used to graze livestock or horses, whether belonging to Mrs Barham, the Company, or anyone else.

26. The terms of the Licence permitted Mrs Barham to terminate the Licence immediately without cause at any time. If she did so, the Licence required her to reimburse the Company for a proportionate part of the licence fee.

27. The licences granted in 2017, 2018, 2019 and 2020 were in substantially similar terms to the Licence. There were some differences, but these are not material to this appeal, for instance referring to the Fields as the Grazing Area rather than the Mowing Area, and a requirement on the Licensor to provide a water supply for Approved Animals (although we repeat that no animals were in fact kept on the Fields during the period of the licences).

28. The licence dated 1 September 2016 had more significant differences from those for the following years. For instance, the Company was given the right to take the crop of grass from the Fields by mowing, and to graze livestock "if required". It was also provided "for the avoidance of doubt" that possession of the Fields remained with Mrs Barham, who was entitled to occupy the Fields and use them "in any way which is not detrimental to the Rights granted to the Licensee".

29. Since Mr Lazaridis acquired the Property, the Company has continued to mow the Fields. We were not shown any licences entered into during Mr Lazaridis' period of ownership and do not know whether, for instance, the Company has continued to pay the licence fee. The contract of sale for the Property stated that the sale was not subject to any occupational interest. The Licence was personal to the Company and Mrs Barham, and as we were shown no evidence that Mr Lazaridis agreed to be bound by its terms, we find that he did not do so.

Mr Bone's evidence

30. From Mr Bone's evidence (his witness statement, evidence-in-chief and cross-examination), we make the following findings of fact.

31. Mr Bone is a director of the Company. The Company provides a range of services across the agriculture, farming, civil engineering, sports and amenity, logistics and haulage, and biomass sectors. It was established in 1957 as a family-run farm.

32. The Company is principally an arable farming operation but also owns some cattle.

33. Since 2016, the Company has removed grass from the Fields under the licences once or twice a year. The process is as follows.

(1) In mid to late spring, the Company prepares the land by cultivation, "harrow and roll", and applying fertiliser and herbicide. We note that this does not accord with the terms of the licences, under which it was Mrs Barham's responsibility to fertilise the land and control weeds, but Mr Bone confirmed (and we accept) that in practice these activities were undertaken by the Company.

(2) In mid to late June, the hay is cut using a tractor. This takes slightly under one day.

(3) The mown hay is then spread over the fields and turned four or five times over the course of a week. This takes 30-35 hours.

(4) The hay is put into rows ("rowing up"). This takes around 4 hours.

(5) The hay is baled (gathered into bales for transportation). This takes around 4 hours.

(6) The bales are collected by tractor, placed on a trailer and transported to the Company's premises 7.3 miles away. This takes around half a day.

(7) The mowing process therefore takes between one and two weeks.

(8) Depending on weather conditions and the age and condition of the grass, it may be possible to cut a second crop of grass in September.

(9) These activities require the use of a range of expensive agricultural vehicles including a tractor, crop sprayer, disc mower, row machine, forklift and baler.

34. The Company uses the cut grass to make hay or "haylage". If the hay is good quality (which is usually the case if it does not rain between cutting and baling) it can be sold for horse feed. If it rains between cutting and baling, the Company may make haylage, which involves wrapping the slightly damp hay in polythene so that it ferments and does not rot. Haylage can be used for cattle feed, and sometimes for horses.

35. The Company either uses the hay or haylage to feed its own cattle, or sells it for profit.

36. About 120 to 150 half tonne bales of hay can be produced from the Fields if they are mowed once per year. Hay sells on the open market at trade prices for around £40-£50 per bale (£80-£100 per tonne), on the basis that it is collected in bulk from the farm. Hay for horses that is delivered by the farmer in smaller quantities commands higher prices, at around £80 per bale.

37. The Company incurs significant costs in its mowing activities. Fertiliser costs around £40 per acre, spraying for weeds costs around £15 per acre, and the other activities (cutting, spreading, rowing up, baling, and moving the hay from the land) also involve costs.

38. The Company has arrangements with other landowners that are similar to the arrangements it had with Mrs Barham relating to the Fields.

39. The Company's access to the Fields is via a rear drive, rather than passing by the House and Outbuildings.

40. The Company does not use the Fields, or perform any operations in them, in the period between removing the last crop (in June or September) and the preparation of the land in the following spring. Mr Bone described the Fields as "sitting" in this period.

41. Besides receiving the licence fee, Mrs Barham benefitted from the Company's mowing activities because otherwise the Fields would have become overgrown with brambles and weeds. The mowing arrangements also meant that she would have been informed if any fly tipping took place on the Fields.

42. Mr Bone was not aware that Mrs Barham used the Fields for any purpose herself, but he did not often visit the Property in person so could give limited first-hand evidence on this point. We accept, however, that it would not be compatible with the mowing activity for the landowner to hold, say, a social function on the Fields while the grass was growing, because there would not be a crop if it was squashed down. We also accept Mr Bone's evidence that when the grass was long it would not be possible to walk through it comfortably.

43. It was Mr Bone's evidence that the terms of his agreement with Mrs Barham prevented her from accessing the Fields at any time, but we do not accept this because the licenses did not have this effect. Mrs Barham had agreed not to interfere with the permitted mowing activity and not to keep her own livestock on the Fields, but the Company did not have exclusive possession, and had in fact agreed not to "interfere with obstruct or in any way hinder" the landowner's right of occupation.

44. Ms Fairhurst asked Mr Bone, in cross-examination, what would have happened if Mrs Barham had exercised her right to terminate the Licence immediately without cause. Mr Bone said that if this had happened after the crop had been removed, nothing would happen, but that if he had spent money (such as on fertiliser and herbicide) and was unable to remove the crop, he would seek reimbursement of his wasted expenditure.

45. The Licence does not specify reimbursement in these circumstances, only that there must be a proportionate reimbursement of the licence fee. However, we accept that if the Licence had been terminated at a time of year when the Company had already incurred costs on preparing the Fields but had not yet been able to remove the crop, it is likely that Mrs Barham would have needed to make a payment to the Company to avoid becoming involved in a dispute.

Legislation

46. SDLT is chargeable, by section 42 of the Finance Act 2003 ("FA 2003"), on a "land transaction", which in turn is defined, by FA 2003, s 43, as an acquisition of a "chargeable interest". A "chargeable interest" is defined by FA 2003, s 48(1) to include an estate, interest, right or power over land in England or Northern Ireland.

47. The rate at which SDLT is charged depends on whether the land in question is residential. If the relevant land consists entirely of residential property, the rates in Table A in FA 2003, s 55(1B) apply. If the relevant land consists of or includes land that is not residential property, the lower rates in Table B in FA 2003, s 55(1B) apply.

48. FA 2003, s 55(3)(a) defines the relevant land as "the land an interest in which is the main subject-matter of the transaction".

49. FA 2003, s 43(6) provides that:

"References in this Part to the subject-matter of a land transaction are to the chargeable interest acquired (the 'main subject matter'), together with any interest or right appurtenant or pertaining to it that is acquired with it."

50. FA 2003, Sch 4ZA provides that if a transaction is a "higher rates transaction", then FA 2003, s 55 applies with a modified version of Table A. The rates of tax in this modified version of Table A are 3% higher than the rates in the unmodified version.

51. Table A is further modified for "non-resident transactions" by FA 2003, s 75ZA. This adds a further 2% to each rate in Table A, as modified by Sch 4ZA. Non-resident transactions are defined in FA 2003, Sch 9A.

52. FA 2003, s 116 defines residential property as follows.

"116 Meaning of "residential property"

(1) In this Part "residential property" meansó

(a) a building that is used or suitable for use as a dwelling, or is in the process of being constructed or adapted for such use, and

(b) land that is or forms part of the garden or grounds of a building within paragraph (a) (including any building or structure on such land), or

(c) an interest in or right over land that subsists for the benefit of a building within paragraph (a) or of land within paragraph (b);

and "non-residential property" means any property that is not residential property."

Case law on the meaning of grounds

53. The dispute in this case concerns the meaning of the term "grounds" for the purposes of FA 2003, s 116(1)(b). This question has been considered in many previous cases including Hyman and Goodfellow v HMRC [2022] EWCA Civ 185, Faiers v HMRC [2023] 297 (TC) ("Faiers") and The How Development 1 Ltd v HMRC [2023] UKUT 84 (TCC) ("How"). We have not found it necessary to cite every case referred to by the parties in their submissions, but have set out some relevant extracts below.

54. ††We have followed the approach of the Upper Tribunal in Suterwalla at [18] in adopting the summary of relevant factors, derived from previous cases, set out by the Tribunal in 39 Fitzjohns Avenue Ltd v HMRC [2024] UKFTT 28 (TC) ("39 Fitzjohns Avenue") at [37]:

"(1) Grounds is an ordinary English word.

(2) HMRC's SDLT manual is a fair and balanced starting point (considering historic and future use, layout, proximity to the dwelling, extent, and legal factors/constraints).

(3) Each case must be considered separately in the light of its own factors and the weight which should be attached to those factors in the particular case.

(4) There must be a connection between the garden or grounds and the dwelling.

(5) Common ownership is a necessary condition, but not a sufficient one.

(6) Contiguity is important, grounds should be adjacent to or surround the dwelling.

(7) It is not necessary that the garden or grounds be needed for "reasonable enjoyment" of the dwelling having regard to its size and nature.

(8) Land will not form part of the "grounds" of a dwelling if it is used or occupied for a purpose separate from and unconnected with the dwelling.

(9) Other people having rights over the land does not necessarily stop the land constituting grounds. This is so even where the rights of others impinge on the owners' enjoyment of the grounds and even where those rights impose burdensome obligations on the owner.

(10) Some level of intrusion onto (or alternative use of) an area of land will be tolerated before the land in question no longer forms part of the grounds of a dwelling. There is a spectrum of intrusion/use ranging from rights of way (still generally grounds) to the use of a large tract of land, historically in separate ownership used by a third party for agricultural purposes under legal rights to do so (not generally grounds).

(11) Accessibility is a relevant factor, but it is not necessary that the land be accessible from the dwelling. Land can be inaccessible and there is no requirement for land to be easily traversable or walkable.

(12) Privacy and security are relevant factors.

(13) The completion of the initial return by the solicitor on the basis the transaction was for residential property is irrelevant.

(14) The land may perform a passive as well as an active function and still remain grounds.

(15) A right of way may impinge an owner's enjoyment of the grounds or even impose burdensome obligations, but such rights do not make the grounds any less the grounds of that person's residence.

(16) Land does not cease to be residential property, merely because the occupier of a dwelling could do without it."

55. The Upper Tribunal in Hyman and others v HMRC [2021] UKUT 68 (TCC) ("Hyman") observed at [33]:

"Section 116(1)(b) refers to a garden or grounds 'of' a dwelling. The word 'of' shows that there must be a connection between the garden or grounds and the dwelling. The section does not spell out what criteria are to be applied for the purpose of establishing the necessary connection."

56. The Upper Tribunal in How described the evaluative approach to be applied in determining whether land forms part of the grounds of a dwelling, stating at [34]:

"Neither the Upper Tribunal nor the Court of Appeal in Hyman attempted to give a definition of the word "grounds". Therefore, as the Upper Tribunal held, the correct approach to determining whether land forms part of the "grounds" of a property involves looking at all the relevant facts and circumstances and weighing up the competing factors and considerations, where they point in different directions, in order to reach a conclusion. This is, essentially, an evaluative exercise."

57. In Goodfellow v HMRC [2019] UKFTT 750 (TC), it was determined at [17] that the land surrounding the house was "very much essential to its character, to protect its privacy, peace and sense of space, and to enable the enjoyment of typical country pursuits". The property in question was found to be entirely residential.

58. In Faiers at [44], the Tribunal listed a number of "pointers" from previous cases. These included the following comments at [44](6) on whether unused land can be "grounds":

"One requirement (in addition to common ownership) might be thought to be that the use or function of the adjoining land must be to support the use of the building concerned as a dwelling (Myles-Till). That may be putting the test too high to the extent it suggests that unused land cannot form part of the "grounds" of a dwelling."

59. The Tribunal in Faiers also commented (at [44](9)] on the level of intrusion into, or alternative use of, an area of land that will be tolerated before it no longer forms part of the grounds of a dwelling:

"At one end of the spectrum, rights of way will generally not have this effect, even when the right is used for a commercial purpose and the existence and exercise of those rights is unconnected with the dwelling. At the other end of the spectrum, the use of a large, defined tract of land (which had historically been in separate ownership) for agricultural purposes by a third party who has rights enabling them to use that land in that way will result in that area of land not forming part of the grounds of a dwelling (Withers)".

60. The Tribunal in Myles-Till v HMRC [2020] UKFTT 127 (TC) ("Myles-Till") held at [44] that for commonly owned adjoining land to be "grounds", it must be, functionally, an appendage to the dwelling, rather than having a self-standing function.

61. In Harjono and another v HMRC [2024] UKFTT 228 (TCC) ("Harjono"), the Tribunal emphasised that the test of whether land is part of the garden or grounds of a dwelling is multifactorial, stating at [69]: "The fact that a piece of land might be used "commercially" is not decisive, and merely something that needs to be weighed in the balance." At [71], the Tribunal continued: "When considering the use to which land is put (a relevant but not conclusive) factor, it is our view that the weight given to that use is largely determined by the ultimate use of that land, and not by any "intermediate" use."

62. In Harjono, the Tribunal found that the ultimate use to which the disputed land (a paddock) was put was the grazing of a horse, which was consistent with the use of the land as grounds (see [93]).

63. In Lynch and another v HMRC [2024] UKFTT 350 (TC) ("Lynch"), the Tribunal considered the decision in Harjono and said at [66]: "The Tribunal considered that the actual use of the land was of more importance than the commerciality of any arrangements and it was important to consider whether that use is inconsistent with the householders' use of the dwelling as such."

64. Holding v HMRC [2024] UKFTT 337 (TC) ("Holding") concerned a dispute about whether some fields formed part of the grounds of a dwelling. In that case, the previous owners of the property had a verbal agreement with a local agricultural contractor, under which the contractor mowed the fields, and collected, baled and wrapped the grass. The contractor did not pay any rent; the previous owners simply wanted the fields to be kept weed free, cropped and looked after.

65. The Tribunal in Holding said, at [34], that it was necessary to consider the nature of the land as at the effective date of the transaction for SDLT purposes, but that the use of the property since that time may shed some light on whether the fields were part of the grounds at the date of the transaction.

66. At [39], the Tribunal said:

"The Fields were not being actively and substantially exploited on a regular basis for any commercial advantage to the vendors. It was clearly beneficial for the vendors to enter into the agreement, but I do not regard the benefit as a commercial benefit. It seems likely and I find that the vendors simply wanted the Fields kept in a good and tidy state and weed-free during the summer months."

67. The Tribunal's conclusion in Holding was that the disputed fields did form part of the grounds of the dwelling, and the taxpayer's appeal was unsuccessful.

68. The facts in Holding are similar to those in Modha v HMRC [2023] UKFTT 783 (TC) ("Modha"). The dispute in Modha also concerned the correct characterisation of a field that was mowed by a third party, who removed the hay or silage for sale. The Tribunal did not consider this arrangement represented a commercial use of the field, commenting at [21](8):

"I find that there was nothing to prevent the field being used as an extension to the garden. For instance children could have sledged in the snow or used for garden adventures, camping den construction etc. Vegetables could have been grown, and it could have been used as an additional paddock. That the Appellant did not chose to use the field does not preclude it from functioning in that way."

69. Suterwalla concerned a property that included a paddock and a tennis court. The paddock was separated from the tennis court by a hedge with only a small gate giving access to the paddock from the house and gardens. It was not possible to see the paddock from the house. On the same day as they purchased the property, the appellants granted a grazing lease of the paddock for one year to a neighbour for an annual rent of £1,000.

70. On appeal to the Upper Tribunal in Suterwalla, the question arose as to whether the First-tier Tribunal had been correct to take the grazing lease into account when considering whether the paddock was part of the grounds of the house, given that the lease had been granted on the same day as the acquisition of the property. The Upper Tribunal found that it did not need to decide this question, because the First-tier Tribunal was entitled, in light of the facts found, to conclude that the paddock, without the grazing lease, was not part of the grounds of the house.

71. Mr Randall submitted that the facts in Mr Lazaridis' case are similar to those in two other cases, in both of which the Tribunal decided that land purchased with a property did not form part of the grounds of a dwelling. These are Sloss v Revenue Scotland [2021] FTSTC 1 ("Sloss") and Withers v HMRC [2022] UKFTT 433 (TC) ("Withers").

72. Sloss concerned the purchase of a property with a total area of around 68.53 acres, of which 43.66 were pasture, 18.24 were woodland and 6.63 were buildings and grounds. At [88] the Tribunal observed that "there must be some link with the dwelling and the grounds beyond the fact that they had been purchased together in a single transaction. There must be a functional relationship between the dwelling and the grounds". The Tribunal found, at [103], that even though the landowner received no payment for allowing a neighbouring farmer to graze the pasture, both parties nonetheless benefited, and this constituted a commercial arrangement. The Tribunal concluded that at least part of the pasture was non-residential.

73. Withers concerned a dwelling house and independent annexe surrounded by about 39 acres of gardens, fields and woodlands. A farmer occupied around 20 acres of the property for grazing sheep and a further 5 acres for cutting hay, in return for payment of £800 per year. There was also an agreement with the Woodland Trust, under which it developed around 8.5 acres of woodland on the property. The dwelling was advertised as sitting in landscaped gardens and the fields were hidden from the house. The appellant identified an area of 10-12 acres surrounding the house which he considered to be the "garden or grounds", and was clearly visible from the house. The land subject to the grazing agreement and the Woodland Trust agreement were acquired in stages before coming under common ownership.

74. The Tribunal in Withers held that the grazing land and Woodland Trust land did not form part of the grounds of the dwelling, stating at [127] that "the grazing land has been used for a self-standing function, namely a commercial purpose being the grazing of land". The Tribunal commented, at [153], that to be classified as the grounds of a dwelling "the use or function of adjoining land itself must support the use of the building concerned as a dwelling. The grazing land and Woodland Trust land do not provide that support."

The SDLT Manual

75. As we have set out above, the summary provided by the Tribunal in 39 Fitzjohns Avenue at [37] indicates that HMRC's SDLT Manual is a fair and balanced starting point (considering historic and future use, layout, proximity to the dwelling, extent, and legal factors/constraints).

76. In this context, Mr Randall drew our attention to the following extracts from the SDLT Manual. As neither party suggested otherwise, we have taken these to be extracts from the SDLT Manual as it was at the time of Mr Lazaridis' acquisition of the Property.

SDLTM00450 (under the heading, "Historic use can be relevant"):

"The status of the land in question must be assessed at the effective date of the transaction but that does not mean that only the use on that day will be considered. The aim of the legislation is to capture the real or true relationship of the land to the building at the time of the land transaction. So provided the building still falls within section 116(1)(a) FA 2003 at the effective date, the history of use of the land is relevant in considering the nature/status of the land at the effective day.

We should seek to establish the traditional or habitual use of the land to establish its true relationship to the building. This can be difficult but you will be looking for customary, continued or regular use. Use that is ephemeral or appears to be part of an artificial/contrived arrangement will not be indicative of the true relationship of the land to the building."

SDLTM00460 (under the heading, "Use"):

"Although all factors must be taken into account and weighed against each other, the use of the land is potentially the most significant indicator of whether the land is 'garden or grounds'. The aim of the legislation is to distinguish between residential and non-residential status, so it is logical that where land is in use for a commercial rather than purely domestic purpose, the commercial use would be a strong indicator that the land is not the 'garden or grounds' of the relevant building. It would be expected that the land had been actively and substantively exploited on a regular basis for this to be the case.

Certain types of land can be expected to be 'garden or grounds' or be expected to be commercial land unless otherwise established. So paddocks and orchards will usually be residential, unless actively and substantively exploited on a regular basis. However, where a field usually exploited for an arable agricultural purpose is sitting fallow this is not an indicator that it has become 'garden or grounds'. Fallow periods are an integral part of commercial management of farmland. Such land may have been exploited using agricultural machinery over a period of time, and so is unlikely to have the nature of 'gardens or grounds'."

SDLTM00465 (under the heading, "Layout of land and outbuildings"):

"The presence of:

∑ commercial farming/horticulture;

∑ commercial woodland;

∑ commercial equestrian use; or

∑ some other commercial use

Would all indicate that the land may not be 'garden or grounds'."

Burden and standard of proof

77. The burden of proof is on Mr Lazaridis to establish on the balance of probabilities that the conclusion in the closure notice is incorrect. In essence this means that it is for Mr Lazaridis to show that the property was not entirely residential for SDLT purposes at completion.

Discussion

78. The parties agree that, except for the Fields, the Property consists of residential property for the purposes of FA 2003, s 55(1B), comprising four self-contained dwellings (the House and three cottages) and their gardens and grounds.

79. The question for the Tribunal in this case is whether the Fields are or form part of the garden or grounds of the House within the meaning of FA 2003, s 116(1)(b). If the answer is yes, it follows that the Property acquired by Mr Lazaridis consisted entirely of residential property, and the rates in Table B in FA 2003, s 55(1B) do not apply.

80. Mr Lazaridis accepts that, if the Table B rates do not apply, the residential "higher rates" in FA 2003, Sch 4ZA and increased rates for "non-resident transactions" in FA 2003, s 75ZA would apply to the transaction. There is no dispute between the parties as to the basis on which SDLT should be calculated, if HMRC are correct in their contention that the Fields form part of the grounds of the House. This means that we do not need to consider in detail the basis on which HMRC calculated their amendment to Mr Lazaridis' SDLT return.

81. Mr Lazaridis' case is that the Fields are not "grounds" because at the time of the transaction they served, and incidentally continue to serve, a distinct purpose unconnected with the House. According to Mr Lazaridis, the Fields are used for a commercial purpose, and this is not consistent with classifying the Fields as grounds.

82. We remind ourselves that we must conduct an evaluative exercise, weighing up the competing factors and considerations.

83. It is convenient to begin by considering factors relating to the use of the land, and geographic factors relating to the size and layout of the Property, before balancing the different factors to reach our conclusion.

The use of the land

84. As noted above, the Fields are used for growing and cutting grass. No animals are grazed on the Fields. The Company cuts the grass, and removes hay or haylage, once or twice a year. The Company also prepares the land in spring to produce the crop of grass, including by applying fertiliser and herbicide. The Fields have been used in this way continuously since 2016, until at least the date of the hearing.

85. We heard detailed submissions from both parties about how the Fields were used, if at all, by the owner of the House. For this purpose we should primarily consider the use by Mrs Barham, the seller of the Property, because we must assess the nature of the Fields at the time of their acquisition by Mr Lazaridis. However, some light may be shed on this question by Mr Lazaridis' use of the Fields since that time.

86. We did not have evidence from Mrs Barham or Mr Lazaridis, so do not know if they ever entered the Fields themselves, or permitted anyone other than the Company to do so. For evidence of the actual use of the Fields, we must rely on the terms of the mowing licences, and the testimony of Mr Bone.

87. From the terms of the Licence, we find that Mrs Barham was entitled to do anything she wished on the Fields, except that she had agreed, so far as possible, and subject to compliance with relevant laws, not to interfere with the Company's mowing activity. She had also agreed not to keep livestock on the Fields, or allow anyone other than the Company to do so. We accept from this, and from Mr Bone's evidence, that this restricted what Mrs Barham could do with the Fields: she could not obstruct the Company's ability to cut and remove the grass, and had to refrain from activities that would damage the crop, such as grazing animals or holding functions on the Fields.

88. We note in this context that the Licence, and previous licences, only ran for a year. Mrs Barham was also entitled to terminate the Licence immediately without cause at any time, subject to reimbursing the Company for a proportionate part of the licence fee. We have accepted that, although not within the terms of the Licence, in practice there were some times of year when, if she had exercised her right of immediate termination, she may also have needed to reimburse the Company for any wasted costs.

89. If Mrs Barham had wanted to put the Fields to a different use, therefore, it would have been relatively straightforward for her to do so, by ceasing to renew the licence when it expired or by terminating the licence at another time of year. If she had wanted to avoid a dispute with the Company, she may have chosen to avoid terminating the licence during the months after the Company's spring-time activities in the Fields began, but there were still a significant number of months in the year when she could have terminated the licence with no adverse consequences beyond the repayment of a proportionate part of the licence fee.

90. Mr Randall submitted that growing grass requires management to maximise yields, and that this is incompatible with the Fields being "grounds". Even though the mowing activity occupied a relatively short period each year and was not intrusive, the Fields were used throughout the year for growing grass and could not be used by the landowner on an unfettered basis.

91. While we accept that the terms of the Licence, and previous licences, placed restrictions on Mrs Barham, this does not mean that she was prevented from entering the Fields at all, for instance by simply walking through them, particularly at a time of year when the grass was short. The Company did not have exclusive possession. We had insufficient evidence to make a finding as to whether Mrs Barham did, in fact, enter the Fields, but we find that she was entitled to do so if she wished.

92. It is, in any event, our view that even if Mrs Barham did not choose to exercise her right to enter the Fields, this does not mean that the Fields had no use or function in relation to the House. It is relevant to note, in this context, the comments of the Upper Tribunal in How at [123], where it was stated that a landowner's use of grounds "need not be active, and nor was it necessary for grounds to be used for ornamental or recreational purposes". The Fields may still have a use that is connected with the House if they increase the privacy, peace and rural character of the House, and we comment on this further below.

Commercial purpose

93. Both parties made submissions on the question of whether the Fields were used for a commercial purpose. In previous cases, the Tribunal has found that commercial use indicates that land is not grounds. In Myles-Till, for instance, it was stated at [45] that "use for a "commercial" purpose is a good and (perhaps the only) practical example of commonly owned adjoining land that does not function as an appendage but has a self-standing function."

94. Mr Randall submitted that the Fields were used for a commercial activity: specifically, for an agricultural activity. The Company carries on an agricultural trade with a view to profit and it removes the crop of grass from the Fields in connection with that trade. The Company incurs relatively significant costs in terms of both time and money, and does this not from altruism but because the crop is valuable and can be used in connection with the trade. Mr Randall concluded from this that the Fields had a separate use and function unconnected with the House.

95. Ms Fairhurst drew attention to the views of the Tribunal in Holding at [39], as reproduced above. In that case, the Tribunal found that it was beneficial for the previous owners of the property to enter into an agreement under which a third party would mow the grass, but that this was not a commercial benefit. In the present case, according to Ms Fairhurst, the fee payable under the mowing licences was modest, and the main benefit to the landowner was that the land was well maintained. Ms Fairhurst further submitted that it was relevant that the sales brochure made no reference to any commercial use of the Property.

96. Mr Randall responded to these submissions, saying that the lack of a commercial benefit to the landowner was not relevant, as Mr Lazaridis was not arguing that the licence fee was Mrs Barham's only reason for granting the licences. As to the size of the licence fee, Mr Randall said that it was a market rate, and that in any event this is less important than the actual use of the land.

97. As we had no evidence to the contrary, we accept that the licence fee was set at a market rate. We also accept that the Company's motivations in entering into the mowing licences were commercial, in that they hoped to make a profit from the hay or haylage produced from the crop of grass. As such, we consider that the mowing licences were not simply a "barter of convenience".

98. We agree with the Tribunal in Harjono, and with the comments on that decision in Lynch at [66], that the actual use of land is more important than the commerciality of any arrangements, and that we must consider whether that use is inconsistent with the use of the land as grounds.

99. We find that the fact that the Company had commercial motives is not, on its own, sufficient to determine that the Fields are not grounds: if this were not the case, any domestic lawn maintained by a commercial gardening company would cease to be residential property. We should, in addition, consider whether the Company's use of the Fields amounts to a self-standing function such that the connection between the Fields and the House, as referred to in the passage cited above from the Upper Tribunal's decision in Hyman, is lost.

100. In this context it is relevant to consider whether the mowing arrangements support the use of the House as a dwelling. In our view, the answer is yes. The licence fee of £1,400 per year was not significant in the context of a property that was sold for £10,750,000, and Mr Randall conceded that Mrs Barham would not have been exclusively motivated by financial considerations. We find that the other benefits arising to Mrs Barham (beside the licence fee) were not commercial, but were consistent with the Fields being part of the grounds of the House. These are, essentially, that the Fields were kept in a good state of maintenance, and did not become wild and overgrown. †

101. We find that, considering all the circumstances, the main benefit arising to Mrs Barham under the Licence was not the licence fee, but that the Fields would be well maintained. A use that keeps land well maintained is consistent with that land functioning as an appendage to a dwelling. As such, we do not consider that the Company's mowing activities prevent there being a connection (per the Upper Tribunal in Hyman) between the Fields and the House.

102. In our view, taking all these considerations into account, the use of the Fields does not conclusively determine whether they are part of the grounds of the House. On the one hand, the Company used the Fields to grow grass for commercial purposes, and this restricted Mrs Barham's use of the Fields to the extent that she could not graze animals, damage the crop or interfere with the mowing activities. On the other hand, subject to these restrictions, Mrs Barham could still access the Fields. She also obtained a benefit from the mowing activities that was consistent with the use of the House as a dwelling, namely that the Fields were well maintained.

Geographic factors: layout and size

103. Our multifactorial assessment should include a consideration of factors relating to the size and layout of the Property, including the size of the Fields in relation to the size of the Property, and the location of the Fields relative to the House.

104. The area of the Fields is around 40 acres and that of the Property is around 106 acres. The Fields therefore make up somewhat less than 40% of the total area of the Property. It follows that, although the Fields are extensive, they are not disproportionately large in the context of the total size of the Property.

105. Mr Randall described the Fields as contiguous with the House. This does not mean that the Fields run up to the walls of the House; as we have found, the Fields begin around 150 metres away from the House. However, they are separated only by a paved area and the Outbuildings, and in the context of a property of this size, we would describe the Fields as being in close proximity to the House.

106. The Fields are not the furthest part of the Property from the House, as there are substantial wooded areas on the far side of the Fields. Mr Randall submitted that the Fields do form a break, by virtue of their size and proximity to the House, but that the main break is provided by the woodland. He further submitted that the Fields are not essential to protect the exclusivity or serenity of the House, as this is provided by the House's position, by the extent of the remaining land (being around 60 acres), and the surrounding countryside.

107. We consider that the proximity of the Fields to the House is a strong factor in favour of the Fields being part of the grounds of the House. They are partly visible from the House and, in our view, increase the privacy, peace and rural character of the House. They may not be a "treasured view", but they are undoubtedly rural. We accept that the greater part of the rural setting of the House derives from the remaining land and surrounding countryside, but, by virtue of their size and proximity, the Fields are also significant in this respect.

Balancing exercise

108. The following factors weigh against the Fields forming part of the grounds of the House.

(1) The Fields are used by the Company for the agricultural activity of growing and cutting grass. The Company carries out this activity on a commercial basis, for profit, under a formal licence. It incurs relatively significant costs, and pays a market rate licence fee.

(2) The Licence restricted how Mrs Barham could use the Fields. She could not interfere with the Company's mowing activities, and could not carry out activities that would damage the crop of grass, such as grazing animals or holding social functions on the Fields.

(3) The Fields are large, extending to some 40 acres.

(4) The rural character and tranquillity of the House do not derive exclusively, or even predominantly, from the Fields. The surrounding countryside and the other parts of the Property make up the greater part of the rural setting of the House.

(5) The Licence placed obligations on Mrs Barham, in that she had to use best endeavours to destroy noxious weeds, keep the Fields fertilised, and when and where necessary re-seed and crop the grass. We have placed relatively little weight on this factor, however, because we have found that in practice all these activities were carried out by the Company.

109. The following factors weigh in favour of the Fields forming part of the grounds of the House.

(1) The Fields and the House have been in common ownership since at least 1980. This is a necessary, but not sufficient, condition if we are to find that the Fields are part of the grounds of the House.

(2) While the Licence restricted Mrs Barham's use of the Fields, she remained entitled to enter them, and it would have been relatively straightforward for her to terminate the Licence if she wanted to.

(3) Growing and cutting grass is not an intrusive activity when conducted in close proximity to a dwelling, particularly as it only occupies a short period each year.

(4) The actual use of the Fields, for growing and cutting grass, supported the use of the House as a dwelling, because it meant that the Fields were well maintained.

(5) The licence fee was not significant in the context of the value of the Property.

(6) Although the Fields are large, they make up some 40% of the total area of the Property, and so their size is not disproportionate in the context of the Property as a whole.

(7) The Fields are in close proximity to, and partly visible from, the House.

(8) The Fields add to the peace, privacy and rural character of the House.

(9) The Property was not marketed as including any land that was in commercial use, but as a "villa with three cottages set in a mature parkland estate of 106 acres". The Fields were described in the sales brochure under the heading of "Gardens and Grounds".

(10) The Fields lie between the House and some woodland that also forms part of the Property. Mr Randall accepted that, except for the Fields, the Property is residential, comprising four dwellings and their gardens and grounds. It follows from this that the woodland areas of the Property also form part of the grounds. While we have placed relatively little weight on this factor, if the woodland areas in the parts of the Property lying furthest from the House are grounds, it is harder to accept that the Fields, lying as they do between the House and the woodland, are not also part of the grounds.

110. We have taken into account that the use of the Fields is long-standing and established since 2016, but would describe this as a neutral factor in the balancing exercise, because (as should be clear from the factors we have set out above) there are aspects of the use of the land that feature on both sides of the equation. As such we do not consider the duration of the use to be a factor that assists either party.

111. Taking all of the above factors into consideration, it is our view that the factors in favour of the Fields forming part of the grounds of the House outweigh those against.

112. Ms Fairhurst submitted that we should take into account that there is no evidence that Mr Lazaridis has granted a licence himself, and that therefore since completion the Company's occupation has been on an informal basis only, rather than under a formal licence. However, we agree with Mr Randall that we should assess use at the time of completion, rather than at any later time. To the extent that (per the Tribunal in Holding) the use since completion is relevant, we have found that the actual use of the land has not changed, albeit that we do not know what legal arrangements Mr Lazaridis may have entered into with the Company.

113. Mr Randall's submissions included reasons why we should follow the previous decisions in Withers and Sloss (in which the taxpayer was successful), and distinguish the decisions in Holding and Modha (in which the taxpayer lost). Unsurprisingly, Ms Fairhurst thought we should do the reverse.

114. As an overarching comment, we would observe that none of these decisions are binding on us, and each case must be decided on its own facts. We would, though, respond directly to these submissions by observing that we consider that there are important differences between this case and the facts in both Withers and Sloss. As regards Holding and Modha, we accept that there are differences compared with Mr Lazaridis' case, but not that these are such that we should reach a different conclusion: the multifactorial assessment is different in each case.

115. In Withers, the land that was found not to be grounds made up a significant majority of the total area of the property. The total property occupied around 39 acres, of which the Tribunal found that 20 acres of grazing land and 8.5 acres of woodland did not constitute grounds. This contrasts with the present case, in which although (at 40 acres) the Fields are large, they make up under 40% of the total area of the Property. We also do not accept Mr Randall's submission that the layout of the Property is similar to the layout of the land in Sloss. In that case, several of the disputed fields were not contiguous with the house, and lay in the parts of the estate furthest from the house. †

116. We also consider that there is a significant difference in the use to which the land was put. In Withers, the grazing land was grazed by sheep, and in Sloss, the fields that were found to be non-residential were also used for grazing sheep, or were left wild. The Tribunal in Withers at [130] commented that grazing by sheep is not the same as grazing by horses, as the "scale and quantity of grazing sheep is considerably different". We consider that using a field for growing grass is also considerably different from using it to graze sheep.

117. Mr Randall submitted that putting land to arable use is more restrictive than grazing, because it isn't possible to walk through an arable crop. However, we take the view that it remains the case that the use of the land is an important difference between the present case and both Withers and Sloss. We have also found that there was nothing to stop Mrs Barham from entering the Fields, although at some times of year the height of the grass may have made this difficult.

118. In relation to Holding and Modha, Mr Randall submitted that there are the following differences compared with the appeal by Mr Lazaridis:

(1) The arrangement with the farmer in Holding and Modha was verbal only, while in this case there are six written licences.

(2) The landowner in Holding and Modha did not receive anything in money or money's worth; it was merely a barter of convenience. In this case, by contrast, a licence fee was paid each year.

(3) There is no evidence in Holding of the duration of the arrangement, while in this case the arrangement has been in place since 2016.

(4) The relevant land in Holding was used by the appellant as winter grazing for their horses, for riding horses and for other domestic animals. In this case, the Fields were not available to be used by the Licensor in any way that would interfere with the Licensee's rights over the Fields. Were the Licensor to keep animals on the Fields, for example, this would affect the quantity and quality of the crop, and as such the Licensor would be in breach of contract.

119. We accept that there are differences between the facts in the present appeal and the facts in Holding and Modha, including that this case involves formal licences and a licence fee. However, we would describe the terms of the licences, and the payment of the licence fee, as being, to use the language of the Tribunal in Harjono, an "intermediate" use of the land, whereas we agree with that Tribunal that we should place most weight on the "ultimate" use of the land, namely the use of the Fields for growing and cutting grass. We therefore do not regard the formality of the licences, or the existence of the licence fee, as a strong factor against the Fields being grounds.

120. As regards duration, we accept (as, we understood, do HMRC) that the mowing arrangements are long-standing and continuous. Our view, however, is that this use is consistent with the Fields being part of the grounds of the House.

121. Concerning the winter use of the Fields, we had little evidence on this point. Mr Bone did not suggest that he visited the Property in winter, and we heard nothing to suggest that it would not be possible to walk through the Fields at that time. Mrs Barham may have agreed not to keep animals on the Fields, but the case law is clear that land may still be grounds even where the rights of others impinge on the owner's enjoyment of that land. And if Mrs Barham had ever decided she did want to keep animals on the Fields, she could have terminated the relevant licence, or simply allowed it to expire.

The SDLT Manual

122. Mr Randall cited the extracts from the SDLT Manual which we have copied above, and both parties drew our attention to previous comments by the Tribunal that the SDLT Manual is a fair and balanced starting point in assessing whether land forms part of the gardens or grounds of a dwelling. We confirm that we have considered the paragraphs copied above, and in particular certain wording within those paragraphs which Mr Randall highlighted for our benefit.

123. In our view, the guidance contained in these paragraphs is consistent with the reasoning we have adopted in reaching our conclusion. With regards to the commentary in SDLTM00460 and SDLTM00465 regarding commercial use and commercial farming, we would refer the parties to our discussion above on the topic of whether the Fields were used for a commercial purpose.

124. On the question of whether land is not "grounds" because it is in commercial use, SDLTM00460 states that it "would be expected that the land had been actively and substantively exploited on a regular basis for this to be the case". Mr Randall submitted that the Fields were actively and substantively exploited on a regular basis.

125. The answer to this question appears to depend on whether it is assessed from the perspective of the previous landowner (Mrs Barham), or of the Company. From Mrs Barham's perspective, we have found that the main benefit of the mowing arrangements was not the licence fee, but that the Fields were well maintained, and so we would not consider that the Fields were actively and substantively exploited on a regular basis by Mrs Barham. From the Company's perspective, the answer is more finely balanced: we consider that the Company's mowing activities are "active and substantive", but would not describe them as being undertaken on a regular basis, given that they occupy only a relatively short period each year.

126. However, the SDLT Manual is not legislation, and so the question of whether there is active and substantive exploitation on a regular basis is not determinative of this appeal. In our view, the more important consideration is that the actual use of the Fields was for growing and cutting grass, that the landowner benefited from this use because the Fields were kept well maintained, and that this is consistent with the Fields being part of the grounds of the House.

Suterwalla

127. As we have mentioned above, the Upper Tribunal's decision in Suterwalla was released after the date of the hearing, and so we invited the parties to make submissions on this decision so far as it related to the appeal by Mr Lazaridis.

128. Both parties submitted that the facts in Suterwalla are different from those in the present appeal. Mr Randall said that Suterwalla is largely irrelevant to the present case, and Ms Fairhurst said that it offers no new principles on its own merits. Ms Fairhurst further submitted that the Upper Tribunal confirmed that the correct approach when considering whether land is "grounds" is to conduct a multifactorial assessment, and that care should be taken when comparing one evaluative exercise with another.

129. Mr Randall said that to the extent that it is relevant, the decision in Suterwalla supports the arguments made on behalf of Mr Lazaridis, in that it reaffirms the need to undertake a multifactorial assessment, and that the relevant factors are summarised in 39 Fitzjohns Avenue. Mr Randall further submitted that Suterwalla is the third occasion, besides Withers and Sloss, of the courts finding that land adjoining a dwelling, owned by the dwelling owner, and purchased with the dwelling is not "grounds" of the dwelling, although in the case of Suterwalla, factors other than the use of the land were sufficient to establish that the land was not an appendage to the house.

130. We would like to thank both parties for these submissions. We agree that the principal relevance of Suterwalla to this appeal is to confirm the necessity of conducting a multifactorial assessment, and this is the approach we have adopted in reaching our decision. We acknowledge Mr Randall's comments about alleged similarities between the facts in the current appeal and those in Suterwalla, Withers and Sloss, but reiterate that we have decided this case on its own facts.

Disposition

131. Having conducted a multifactorial evaluation of the relevant factors, it is our view that the Fields form part of the grounds of the House, and that therefore the Property consists entirely of residential property. We therefore dismiss the appeal.

Right to apply for permission to appeal

132. This document contains full findings of fact and reasons for the decision. Any party dissatisfied with this decision has a right to apply for permission to appeal against it pursuant to Rule 39 of the Tribunal Procedure (First-tier Tribunal) (Tax Chamber) Rules 2009. The application must be received by this Tribunal not later than 56 days after this decision is sent to that party. The parties are referred to "Guidance to accompany a Decision from the First-tier Tribunal (Tax Chamber)" which accompanies and forms part of this decision notice.

RACHEL GAUKE

TRIBUNAL JUDGE

Release date: 17th OCTOBER 2024

†

APPENDIX