Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Majid v Revenue and Customs (PENALTY - failure to notify - whether conditions for valid penalty were evidenced) [2024] UKFTT 491 (TC) (25 May 2024)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2024/TC09189.html

Cite as: [2024] UKFTT 491 (TC)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation: [2024] UKFTT 491 (TC)

Case Number: TC09189

FIRST-TIER TRIBUNAL

TAX CHAMBER

[By remote video/telephone hearing]

Appeal reference: TC/2023/00824

PENALTY - failure to notify - whether conditions for valid penalty were evidenced - no - reasonable excuse - no - appeal allowed

Heard on: 14 May 2024

Judgment date: 25 May 2024

Before

TRIBUNAL JUDGE AMANDA BROWN KC

IAN SHEARER

Between

IMRAN MAJID

Appellant

and

THE COMMISSIONERS FOR HIS MAJESTY'S REVENUE AND CUSTOMS

Respondents

Representation:

For the Appellant: No one appearing

For the Respondents: Fawzia Shamim litigator of HM Revenue and Customs' Solicitor's Office

DECISION

Introduction

1. With the consent of the parties, the form of the hearing was a video hearing using the Kinley video platform. A face-to-face hearing was not held because it was expedient not to do so. The documents to which we were referred were contained in a bundle of documents prepared by HM Revenue & Customs (HMRC) plus a witness statement prepared by Imran Majid (Appellant) and some additional authorities submitted on his behalf.

2. Prior notice of the hearing had been published on the gov.uk website, with information about how representatives of the media or members of the public could apply to join the hearing remotely to observe the proceedings. As such, the hearing was held in public.

Hearing in the Appellant's absence

3. The Appellant was not in attendance at the hearing.

4. Shortly prior to the commencement of the hearing an email was received by the Tribunal as follows:

"I write further to the hearing today at 10:00am.

Imran Majid will not be able to attend the hearing due to mental health issues and we kindly ask that the matter be dealt with in his absence if possible. We ask that the tribunal considers to waive the penalties or at the very least reduce the penalties to ensure that HMRC response is proportionate and fair given the circumstances.

Unfortunately we have attempted to settle the claim with HMRC in the sum of £1,151.29 to be paid in installments (sic) prior to the hearing as Imran was unable to attend the hearing today due to his mental health problems but we have failed to reach agreement. Imran cannot afford to make the payment in full and asked that the payment be made at £100.00 per month but we could not agree this with HMRC.

We kindly ask that the tribunal hearing go ahead in Imran's absence if possible to consider the full appeal to waive the penalties on the grounds set out in the appeal and my emails. If the tribunal does not consider that the appeal should be agreed in full and penalties waived then we ask that the tribunal considers at the very least to order a reduced penalty given the circumstances.

If the tribunal is minded to not waive the penalties or at the very least reduce the penalties than we ask that Imran be allowed to pay the sum claimed by HMRC of £1,151.29 in installments (sic) at £100.00 as he is unable to afford to pay the said sums in full but we would like the matter to be considered by the tribunal to waive the penalties and or reduce the penalties in any event given the circumstances.

5. In light of that email, and at the invitation of HMRC, we proceeded to hear the appeal pursuant to rule 33 Tribunal Procedure (First-tier Tribunal) (Tax Chamber) Rules 2009 (Tribunal Rules) on the basis that although the Appellant had indicated to HMRC that they were prepared to pay the penalties assessed, provided that a time to pay agreement could be reached, the email invited us to determine the appeal on the evidence before us.

Factual background

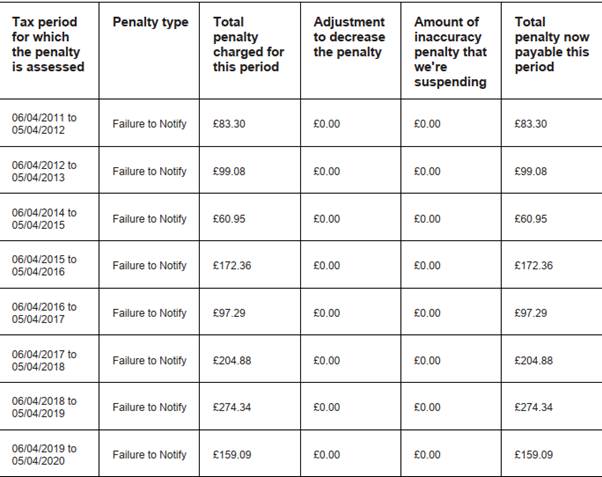

6. The appeal concerns the imposition of penalties pursuant to Schedule 41 Finance Act 2008 (FA 08), the Appellant having failed to notify his chargeability to tax for the tax years ended 5 April 2012, 2013, 2015, 2016, 2017, 2018, 2019 and 2020. The Appellant had also been penalised in respect of earlier tax years but had not appealed those penalties. No penalty was issued in respect of the year to 5 April 2014 as there was no liability to tax in that year.

7. On 15 December 2020, HMRC wrote to the Appellant advising that they believed that he owned and was receiving income from property in respect of which he may have been liable to pay tax. The letter was sent to the Appellant's address held on HMRC's file through his PAYE records. The letter was returned to HMRC with a handwritten note stating that the Appellant "does not live here, wrong address."

8. HMRC proceeded to issue an information notice which was sent to the same address. They left a voice mail on the mobile number held for the Appellant. A penalty notice for failure to comply with the information request was subsequently issued to the same address. When no response was received, on 7 May 2021, HMRC notified, again to the only address held on file, an intention to assess for tax years ended 5 April 2008 through to 5 April 2020. Subsequently, on 26 July 2021 they notified an intention to charge penalties in respect of tax years ended 5 April 2008 and 2009 only. This latter letter indicated that a penalty explanation letter had previously been issued but that it contained inaccuracies and was to be ignored (we were not provided with a copy of that earlier letter). The 26 July 2021 letter indicated that there would be a penalty loading of 30% (70% abatement for disclosure, co-operation and seriousness having been given). This was despite no engagement at all from the Appellant.

9. Despite the letter of 26 July 2021 having been sent to the same address as all other correspondence the Appellant certainly received that letter as, on 31 July 2021, he wrote to HMRC providing a new address and seeking an explanation for the proposed penalties to be applied.

10. All previous correspondence was provided to the Appellant under cover of a letter dated 24 August 2021. The Appellant was advised to "ignore" the correspondence of 7 May 2021 (i.e. the notification of a decision to assess). The Appellant was requested to provide the information which had previously been requested in the information notice.

11. The Appellant provided some of the information requested and correspondence ensued pursuant to which all (or at the least sufficient) information was provided concerning the Appellant's property income and expenditure in all tax years ended 5 April 2008 to 2020 together with the associated tax calculations. Following receipt of the requested information tax assessments were issued for each year in which tax was calculated to be due. The tax assessments were individually notified on 23 August 2022.

"Notice of penalty assessment

...

Income Tax penalty

This notice of penalty assessment shows the total penalties that we're charging you under Schedule 41 Finance Act 2008

Details of how we have worked out the penalties are shown on the enclosed schedule.

Penalty

Total penalty charged for all periods £1,151.29

Total amount suspended £0.00

Total amount payable by 25 September 2022 £1,151.29

[details of how to appeal the penalty]

Notice of penalty assessment schedule

13. The penalty or penalties so notified was/were appealed on 9 September 2022 on the grounds that the Appellant was not aware of the requirement to fill in a self-assessment tax return as he was, at the time notification was required, under the mistaken impression that no tax would be due. He believed the amount spent on the initial refurbishment of the property, deposit and full mortgage amount could be included as expenses.

"Penalty calculation

The penalty percentage rate is determined by the penalty range and reduction for the quality of disclosure (QOD). In your case the penalty has been calculated on the following basis:

• your failure to notify was not deliberate

• the potential lost revenue (PLR) is the amount of the assessment

• a reduction to reflect your co-operation

• the disclosure was prompted.

A disclosure is unprompted if it is made at a time when the person making it has no reason to believe that we have discovered or are about to discover the failure. Otherwise, it is a prompted disclosure.

In your case I agree the disclosure was 'prompted'.

The minimum 'prompted' penalty in a non-deliberate case is -

• 10% if HMRC becomes aware of the failure less than 12 months after the time when the tax first becomes unpaid by reason of the failure

• 20% if HMRC becomes aware of the failure more than 12 months after the time when the tax first becomes unpaid by reason of the failure

The amount of the penalty is determined by how much assistance you gave during the check (quality of disclosure). This is made up of 'telling, helping, and giving'. Where full assistance was given the minimum penalty amount will be charged. Where no or little assistance has been given during the check the maximum penalty rate of 30% can be used.

As you did not reply to HMRC's letters or respond to messages left on your mobile prior to 4 August 2021, full reduction for 'telling, helping and giving' cannot be given. This has been correctly applied to the penalties in your case.

15. When the appeal was notified to the Tribunal the Appellant's grounds of appeal were, in summary:

(1) He was not aware who HMRC were and when he first received the correspondence of 26 July 2021, he believed it to be a scam;

(2) He was not aware he had to pay tax on property rental income and because there was significant related expenditure, he was not making any money;

(3) He believed he had paid all tax due through PAYE.

16. HMRC's statement of reasons identifies the penalty charged by tax year but provides no more information as to the basis on which it was calculated.

Burden of proof

17. HMRC's statement of reasons records:

"The onus of proof is for [HMRC] to show that the Appellant failed to notify of his chargeability to tax under appeal and the penalty has been correctly calculated and issued. The burden then shifts to the Appellant to demonstrate that a reasonable excuse exists for their failure to notify."

18. This is a correct reflection of the burden of proof. In this regard it is important to note that the initial burden on HMRC must be discharged whether or not the Appellant challenges the validity of the penalty assessment (see Burgess and Brimheath v HMRC [2015] UKUT 578 (TCC) as applied more recently in the context of cases about failure to notify chargeability to tax, including Cooke v HMRC [2023] UKFTT 369 (TC)).

19. Therefore, before we consider whether the Appellant has evidence to satisfy us that he had a reasonable excuse for failure to notify we must be satisfied that there is evidence of a failure to notify and that the penalty assessments have been correctly calculated and issued.

Evidence and application to adduce further evidence

20. On 27 July 2023 HMRC served a hearing bundle of documents and authorities. Included within that bundle was a witness statement prepared by Ms M Collery.

21. Ms Collery's evidence included:

"14. Once the tax due was calculated, a Behaviour Audit Trail phone call took place on 05/07/2022 between myself and Mr Majid's agent.

15. A 'Behaviour Audit Trail' is a series of questions via phone or letter that focus on the taxpayers' individual behaviour. This helps us to understand how the failure took place, why it took place & whether there was any reasonable excuse(s) that could have stopped Mr Majid from advising HMRC of the income.

16. Mr Majid's agent was asked the below questions & provided the following answers:

a) Whether there are any health or personal circumstances to disclose. - None to disclose;

b) How the failure had occurred - Mr Majid's Agent stated that Mr Majid was under the impression that the expenses paid out for renovation and the mortgage would be offset against the rental income;

c) If they were uncertain about notification, what advice did they seek? If so, from whom & what advice was given? Did they follow that advice and if not, why? - Mr Majid did not seek advice until the letter was received from HMRC. Once the letter was received, an agent was appointed;

d) Who was at fault for the failure - Nobody else was at fault;

e) If there was a reasonable excuse(s)/ special circumstance. – No

17. After completing these questions, I advised Mr Majid's agent over the phone, that I believed this to be non-deliberate for the tax years ended 5 April 2012 through to 5 April 2020 and advised the penalties would be calculated accordingly.

18. Mr Majid's agent was asked if they agreed with my decision, and it was confirmed they agreed with my decision.

22. She went on to explain that the penalty had been issued on the basis that the Appellant had failed to notify property income and expenditure on which tax was due. The basis of calculation was explained including the abatement given, by reference to the answers given in the behavioural audit trail (BAT) call, for "telling, helping and giving." It noted that the Appellant had provided assistance in the calculation of the tax due and provision of documentation. It stated that for all years other than 2020 the penalty had been assessed at 23%; the Appellant having been given a 70% abatement between the maximum (30%) and minimum (20%) penalty applicable for tax errors arising from prompted non-deliberate behaviour. The penalty for 2020 was set at 15% applying the same 70% abatement to the difference between the maximum (again 30%) and 10% minimum applicable where, as per HMRC's own guidelines, the statutory minimum penalty applies for inaccuracies identified and corrected within 12 months.

23. By an application dated 23 April 2024, HMRC sought to replace the witness statement of Ms Collery with that of Mr D Hall as Ms Collery was no longer able to give evidence. It was explained that Mr Hall was an appropriate officer and had been involved in the appeal "since alternative dispute resolution". HMRC considered "he is a suitable replacement having reviewed the documents concerning this appeal and would be able to explain why the penalties were issued."

24. Mr Hall's statement contained none of the detail that had been provided by Ms Collery. It narrated the history of engagement between HMRC and the Appellant from the issue of the initial letter on 15 December 2020 to the holding of the BAT call on 5 July 2022. It did not refer to the penalty notification, the basis of calculation of the penalties, what consideration was given regarding abatement, reasonable excuse, or special circumstances.

25. As Mr Hall's statement replaced that of Ms Collery, her evidence was not before the Tribunal in this appeal. Indeed Mr Shearer had quite properly not read Ms Collery's statement, though I had.

26. We were therefore left with a bland recitation of correspondence but nothing in the correspondence explained the basis of calculation of the penalty beyond the information contained in the review conclusion letter as set out at paragraph 14. In particular, and as set out in paragraph 12 above, the penalty notification itself provided no information other than the total penalty and the amount referable to each tax year. If any other written communications to the Appellant and/or his agent contained such details, they were not mentioned in Mr Hall's witness statement, in which the chronology did not go beyond 5 July 2022, and we were not provided with them elsewhere in the bundle.

27. The only evidence with which we were provided about the BAT meeting was the following paragraph in Mr Hall's witness statement:

"On the 05 July 2022, HMRC received a telephone call from Mr Majid's Agent where a Behavioural Audit Trail took place. Mr Majid's actions were deemed as non-deliberate and a total Failure To Notify (FTN) penalty amount of £1151.29 was charged under Schedule 41 Finance Act 2008".

We were not provided with any meeting note or other record of it. Ms Shamim explained that it was HMRC policy that where there was a BAT meeting which resulted in an "agreed closure", it was their policy not to record in the penalty notification the basis on which the penalty had been calculated or the abatement given. We were also told that any notes of the BAT meeting were private and were never disclosed.

28. During the hearing we pointed out the deficiencies in Mr Hall's statement to Ms Shamim who indicated that she intended to address these through his oral evidence.

29. We invited Ms Shamim to explain the statutory basis for the internal guidance which provided for the issue of penalty notifications without any of the usual detail expected as to the basis on which it was calculated following a Behavioural Audit Trail meeting. Ms Shamim could not assist us.

30. The deficiencies in the statement presented us with a degree of difficulty. It is conventional in this Tribunal that a witness statement is taken as the witness's evidence in chief subject to questions of clarification and subject to cross examination. Guidance given to taxpayer appellants confirms that the statements they produce should set out the evidence on which the appeal is to be decided. The guidance further explains that the purpose of a witness statement is to give the other party advance warning of the evidence to be given. The oral evidence which Ms Shamim said that Mr Hall could give was not by way of clarification of anything in his witness statement: it was new evidence (albeit that it had previously been set out in Ms Collery's withdrawn statement).

31. Rule 15 of the Tribunal Rules provides us with a broad jurisdiction to admit or exclude evidence in accordance with the overriding objective to deal with matters justly and fairly, mindful of the issue in dispute including its value and the costs of litigation and in particular under rule 2 of the Tribunal Rules so as to ensure the participation of both parties in the appeal. Though Ms Shamim did not, in terms, make such an application we considered whether Mr Hall should be permitted to expand his evidence through oral evidence of which no notice had been given to the Appellant by way of a direction under rule 15. We determined it would not be in accordance with the overriding objective for us to do so. The Appellant was not in attendance, and by the email sent on his behalf, inviting the hearing to proceed in his absence, he was effectively asking the Tribunal to determine the appeal by reference to the evidence presented in the bundle and thereby on the terms of Mr Hall's statement. The Appellant essentially elected to not cross examine on the statement, but he cannot be said to have acquiesced to the admission of evidence not contained in the witness statement.

32. We considered whether it was appropriate to adjourn the hearing and direct that a supplementary statement be prepared and served but concluded that to do so was not in accordance with the overriding objective. In essence it gave HMRC the opportunity to have two bites at the cherry in circumstances in which they had withdrawn a witness statement and replaced it with one which did not adequately address the issues on which they bore the burden of proof.

33. Further, even had we admitted the evidence, we were not satisfied that it fully addressed our concerns. It may or may not have addressed the adequacy of the calculation of the penalty but could not address our concerns regarding the issue/notification of the penalty. We consider that it is fundamental to the validity of a penalty that the taxpayer is informed how the penalty has been calculated and, in particular, what abatement has been given for telling, helping and giving. This is so because under the Convention on Human Rights penalties issued by HMRC are treated as criminal penalties. Whilst simple mathematics would reveal that for the years ended 5 April 2012, 2013, and 2015-2019 the penalty had been assessed at 23% and for 2020 at 15%, the statutory justification for those rates was not communicated to the Appellant. Further any attempt to rely on the penalties issued on 26 July 2021 for the years ending 5 April 2008 and 2009 would provide little or no assistance and would be more likely to confuse, as the Appellant was apparently given the same level of abatement at a time when he had not responded to any correspondence with HMRC and provided no assistance at all.

34. Therefore, to have admitted the further evidence as to the basis of calculation could not have addressed what we see as an apparent deficiency in the evidence of notification/issue of the penalty assessment in any event. There was therefore no prejudice to HMRC in refusing to take the additional oral evidence.

35. We had a witness statement from the Appellant. HMRC indicated that they would have wanted to cross examine him on it. As he was not present to be cross examined, we place reliance on it only as regards his acceptance that the tax assessed in respect of his property income is properly due, that plainly being a matter which HMRC accepted from the statement.

Findings of fact

36. From the evidence available we make the following findings of fact:

(1) On the basis that the Appellant accepts that the assessed tax is due, there was a failure to notify chargeability to tax in each of the tax years to which these appeals relate (i.e. tax years ended 5 April 2012 - 20 excluding 2014).

(2) Whilst the penalty calculation can be discerned mathematically there is no evidence before us on which we can determine that it was correctly calculated.

(3) There is no evidence that the basis of the calculation, and in particular the reason for abatement, was correctly notified to the Appellant.

(4) The Appellant, having decided not to attend the hearing in circumstances in which HMRC wanted to cross examine him on his witness statement, gave no substantive evidence on which we could determine whether there was a reasonable excuse had we needed to do so. The explanation given in correspondence was in part incredible (i.e. his assertion that he did not know who HMRC were) and in part contradictory (an assertion that he believed that he had expenditure which could be offset against income cuts directly across the assertion that he did not know he needed to declare income and expenditure from property for tax purposes).

Disposition

37. As a consequence of the withdrawal of Ms Collery's witness statement and its replacement with a less detailed and incomplete statement HMRC provided no evidence as to the calculation of the penalty thereby failing to meet the burden of proof on them in this regard.

38. Further, and more significantly, their asserted policy to provide no explanation of the basis of calculation in the notification of the penalty where there is "agreed closure" following a BAT meeting carried the consequence that they were unable to meet the burden of proof regarding the issue/notification of the penalty.

Postscript

39. Neither member of the panel had previously encountered a "Behavioural Audit Trail" meeting or the concept of "agreed closure."

40. We discern from Ms Collery's withdrawn witness statement and Ms Shamim's explanation that a BAT meeting is aimed at establishing the behaviours of a taxpayer to determine whether penalties are due, in what category (deliberate/careless) and appropriate abatement. However, if that is the case, we can see no rational explanation for why the notes, or at least main points, of such a meeting are not shared with the taxpayer and could not be produced in evidence to support HMRC's case as to the calculation of a penalty and/or the process by which the law and policy in this area has been appropriately applied to the appealing taxpayer.

41. As to an "agreed closure," it was at least implicit from Ms Collery's withdrawn witness statement that at the end of the BAT meeting the taxpayer will be asked whether they agree HMRC's conclusion as to behaviours and thereby to the appropriate penalty percentage to be applied. Conceivably, a taxpayer's agreement to the percentage to be applied to agreed tax assessments could constitute a contractual settlement of the type which arises in a Code of Practice 9 investigation or under section 54 Taxes Management Act 1970 when an appeal is compromised. However, were it to do so we would not have expected the subsequent notification of the agreed penalties to carry a conventional right of appeal or indeed for it to have been appealed. There appears to be an "oxymoron" that arises from the appeal of an "agreed closure." We can see no basis on which HMRC should be permitted to circumvent what is not an onerous obligation of properly and fully notifying taxpayers as to how, and on what basis, a penalty has been calculated by reference to the potential lost revenue, the penalty range, abatement, and penalty loading. This is what HMRC would normally do outside of having achieved "agreed closure." A failure to do so will, in our view, carry the natural consequence that HMRC will fail in its burden of proving that it has correctly issued the penalty.

42. Ms Shamim described such an outcome as an unfair advantage to taxpayers who have shown no reasonable excuse for their failure. It is certainly the case that a taxpayer in such circumstances is not liable to pay a penalty that otherwise may have been payable, but where that arises as a result of a policy/procedural decision of HMRC not to provide information that would otherwise have been provided, whether it can be described as an "unfair advantage" is a matter for debate.

Right to apply for permission to appeal

43. This document contains full findings of fact and reasons for the decision. Any party dissatisfied with this decision has a right to apply for permission to appeal against it pursuant to Rule 39 of the Tribunal Procedure (First-tier Tribunal) (Tax Chamber) Rules 2009. The application must be received by this Tribunal not later than 56 days after this decision is sent to that party. The parties are referred to "Guidance to accompany a Decision from the First-tier Tribunal (Tax Chamber)" which accompanies and forms part of this decision notice.

AMANDA BROWN KC

TRIBUNAL JUDGE

Release date: 25th MAY 2024