Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

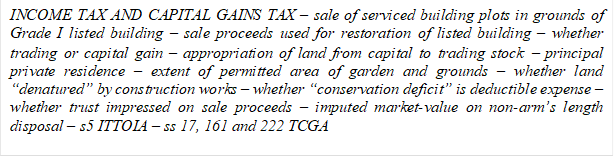

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Whyte v Revenue & Customs (INCOME TAX AND CAPITAL GAINS TAX - sale of serviced building plots in grounds of Grade I listed building - sale proceeds used for restoration of listed building) [2021] UKFTT 270 (TC) (26 July 2021)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2021/TC08215.html

Cite as: [2021] UKFTT 270 (TC)

[New search] [Contents list] [Printable PDF version] [Help]

![[2021] UKFTT 270 (TC)

TC08215](/uk/cases/UKFTT/TC/2021/TC08215.image001.png)

|

FIRST-TIER TRIBUNAL TAX CHAMBER |

|

Appeal number: TC/2015/02992/V |

BETWEEN

|

|

HEATHER WHYTE |

Appellant |

-and-

|

|

THE COMMISSIONERS FOR HER MAJESTY’S REVENUE AND CUSTOMS |

Respondents |

|

TRIBUNAL: |

JUDGE ALEKSANDER |

The hearing took place on 22 to 28 April 2021. Following a case management hearing on 22 July 2020, the Tribunal directed that the form of the hearing was V (video) using the Tribunal's Video Hearing service. A face-to-face hearing was not held because of the impact of the COVID pandemic. The documents to which I was referred include the skeleton arguments and notes on closing submissions of the parties, a chronology prepared by HMRC, and an amended hearing bundle of 2638 pages (including witness statements and expert reports).

Prior notice of the hearing had been published on the gov.uk website, with information about how representatives of the media or members of the public could apply to join the hearing remotely in order to observe the proceedings. As such, the hearing was held in public.

David Southern QC and Michael Avient, counsel, instructed by JS & Co LLP, chartered certified accountants, for the Appellant

Simon Pritchard, counsel, instructed by the General Counsel and Solicitor to HM Revenue and Customs, for the Respondents

Table of Contents

Schedular System of Income Tax. 6

Enabling development and conservation deficit. 10

Mr and Mrs Whyte's interest in buying the Bunny Hall Estate. 21

Following the purchase of the Bunny Hall Estate by Mrs Whyte. 27

Single Overall Transaction. 90

Offsetting the conservation deficit 120

Disposal proceeds held on trust 121

Right to apply for permission to appeal. 123

ANNEX 1- Extracts From Section 106 Agreement.. 125

Figure 1- Bunny Hall Estate before purchase. 129

Figure 2 - Location of Plots within Estate. 130

Figure 3 - Numbering of Plots. 131

Figure 4 - HMRC's Expert's Alternative Permitted Area. 132

Figure 5 - HMRC's Expert's Permitted Area. 133

Figure 6 - Appellant's Expert's Permitted Area on 1 December 2003. 134

Figure 7 - Appellant's Expert's Permitted Area on 12 July 2016. 135

DECISION

1. This appeal relates to the tax treatment of the sale of plots of land out of the Bunny Hall estate at Loughborough Road, Bunny, NG11 6QT, which were sold between 2003 and 2006.

2. Following enquiries, HMRC issued two closure notices. By these closure notices, HMRC amended Mrs Whyte’s self-assessment returns for the tax years 2003/04 and 2005/06. The amendments were made on alternative bases:

(1) Adventure in the nature of a trade: that the disposals of the plots were trading transactions and the profit arising from the disposals was therefore trade income liable to income tax;

alternatively

(2) Capital gains: that the disposals of the plots gave rise to chargeable gains liable to capital gains tax and Mrs Whyte did not qualify for private residence relief because (i) of alterations to the plots prior to disposal and/or (ii) most of the plots fell outside of the “permitted area” in s222(1)(b), Taxation of Chargeable Gains Act 1992 .

3. The closure notices were upheld (but varied) on review. A corresponding penalty that had been imposed was not upheld.

4. The amounts of tax in issue in this appeal are as follows:

|

Tax Year |

Income Tax on Trade Profits |

CGT |

|

2003/04 |

£736,291 |

£291,516.40 |

|

2005/06 |

£414,912 |

£162,564.80 |

5. On 29 April 2015, Mrs Whyte appealed against the closure notices on the grounds that:

(1) The disposals of the plots were not trading transactions; and

(2) The disposals of the plots were chargeable events for CGT purposes but because the plots fell within the “permitted area”, she benefitted from principal private residence relief.

6. On 25 October 2018, Mrs Whyte was given permission to amend her grounds of appeal to add a further argument that the "conservation deficit" on the Hall was deductible in computing her profit or gain.

7. The appeal was heard by video, using the Tribunal's Video Hearing service.

8. At the hearing, Mrs Whyte was represented by Mr Southern and Mr Avient, and HMRC were represented by Mr Pritchard.

9. Mrs Whyte was the only witness of fact; her witness statement was taken as read as her evidence in chief. She gave oral evidence and was cross-examined.

10. Expert reports were filed on behalf of Mrs Whyte by Alexander Hugh Garratt, and on behalf of HMRC by Emma Williams. Mr Garratt's first report is dated 20 July 2016. He prepared a "Further Opinion" relating to enabling developments and conservation deficits, which is dated 9 January 2020. He prepared a "Summary Opinion" dated 13 April 2021, which is responsive to Ms Williams report. Ms William's report is dated 29 March 2021. There are included in the bundle the two joint reports by Mr Garratt and Mr Coster (HMRC's previous expert) which are dated 7 November 2019 and 17 January 2020 (but not Mr Coster's original report), and a joint report by Mr Garratt and Ms Williams dated 19 April 2021. Both Mr Garratt and Ms Williams gave oral evidence and were cross-examined.

11. Documentary evidence in the form of an electronic bundle (the final version of the electronic bundle contained 2638 pages) was submitted, which included Mrs Whyte's witness statement and the experts' reports.

12. I was also referred to (and read) Mynors and Hewitson, Listed Buildings and Other Heritage Assets 5th edition (Sweet & Maxwell, 2017), Chapter 15, pp 493-538

13. At a case management hearing in July 2020, I gave directions which, amongst other things, related to the hearing window and dates to avoid in order to accommodate the availability of HMRC's expert, Geoffrey Coster, who was due to retire from the Valuation Office Agency ("VOA") by the end of 2020, but who was prepared to give attend the hearing and give evidence after his retirement. In late September 2020, the Tribunal determined the hearing dates (taking account of the parties’ dates to avoid). Although Mr Coster subsequently informed the VOA that he was no longer available for the hearing, due to a series of unfortunate errors HMRC's "case holder" only became aware of this on 27 January 2021, when Ms Williams notified HMRC that she had taken over Mr Coster's file. It was only on 26 February 2021 that HMRC issued formal instructions to Ms Williams to provide an expert report and appear at the hearing, and it was only on 23 March 2021 that Mrs Whyte's representatives were notified of the change in HMRC's expert.

14. On 25 March HMRC applied to the Tribunal:

(1) For permission to change their expert witness to Ms. Williams;

(2) For permission to rely on a new expert report to be produced by Ms. Williams; and

(3) For the hearing fixed for 22 to 28 April 2021 to be vacated.

In their application HMRC stated that they would not proceed with the application to vacate the hearing if Mrs Whyte considered that it was possible to proceed with the current listing dates.

15. As Mrs Whyte's representatives consented to the change in expert witness and to the hearing going ahead on the already fixed dates, I consented to HMRC's application to change their expert, and gave consequential directions for the delivery of the hearing bundle and exchange of skeleton arguments. I directed that any application as to costs in respect of the change in expert be addressed at the substantive hearing of the appeal.

16. At the commencement of the hearing, Mr Southern made an application that Mrs Whyte be treated as a vulnerable witness on account of her health. He submitted that it would be appropriate for HMRC to submit their questions to Mrs Whyte in writing, to which she could then give a written response. I warned Mr Southern that if I acceded to this application, I would inevitably have to place less weight upon Mrs Whyte’s evidence than if she gave evidence orally and was cross-examined. I adjourned the hearing to allow Mr Southern to take instructions, and on the resumption of the hearing he informed me that he would not pursue the application for Mrs Whyte to respond to questions only in writing and confirmed that Mrs Whyte would give evidence orally. However, in the light of Mrs Whyte’s health, I allowed regular brief adjournments during the course of her oral evidence in order to reduce the stress of the hearing so far as was possible.

17. Mrs Whyte started to give her evidence at about 12:15 on Friday 23 April and finished giving evidence at about 16:15 that same day. Mr Garratt gave his evidence on Monday 26 April, and Ms Williams gave her evidence in the morning of Tuesday 27 April 2021, with her evidence finishing just before the lunch adjournment. Immediately following the lunch adjournment, when Mr Pritchard was about to commence his closing submissions, an application was made by Mr Southern to admit a second witness statement made by Mrs Whyte. The witness statement addressed the date on which she exchanged contracts for the purchase of Bunny Hall, the dates on which she repaid the loan provided to her by Mr Whyte towards the purchase of Bunny Hall, and the involvement of Mr Whyte's businesses in relation to Clifton Hall.

18. Mr Southern submitted that it was important to admit Mrs Whyte's additional evidence, as the issues addressed in the statement were raised in the course of cross-examination, and any errors in her evidence needed to be corrected - there was an overriding duty to the Tribunal to correct mistakes. These issues went to the question of whether her actions were trading or capital in nature. Mr Southern stated that Mrs Whyte and her representatives started to prepare the statement on Friday 23 April, but the documentary evidence exhibited to the witness statement only came to hand in the morning of 27 April.

19. Mr Pritchard, on behalf of HMRC, objected to the application. He submitted that the points did not arise in the course of his cross-examination, but rather during the course of re-examination. Further, some of the points made in the witness statement were in conflict with the documentary record, and HMRC would need time to consider the implications, and might require time to undertake further research. Mr Pritchard referred me to Ladd v Marshall (1954) 1 WLR 1489 which addressed the circumstance in which the Court of Appeal would admit new evidence. The Court of Appeal held that new evidence must satisfy three requirements in order to be admissible, namely:

first, it must be shown that the evidence could not have been obtained with reasonable diligence for use at the trial; secondly, the evidence must be such that, if given, it would probably have an important influence on the result of the case, though it need not be decisive; thirdly, the evidence must be such as is presumably to be believed or in other words, it must be apparently credible although it need not be incontrovertible.

20. I decided not to admit the new witness statement. Mr Southern could have alerted the Tribunal to the fact that an additional witness statement was being prepared at the start of the hearing on Monday. At the point when the application was made, all the witness evidence had been heard, and the evidence had closed. In the light of Mr Pritchard’s submission that the new witness statement was inconsistent with the documentary evidence, if I were to admit the evidence, I would have to adjourn the hearing in order to allow HMRC time to consider the new evidence properly. As Ladd v Marshall dealt with the admission of new evidence on an appeal from the first-instance court, it could therefore be distinguished from the circumstances here, but nonetheless it provided helpful guidance. I considered that there was nothing in the new witness statement that could not have been obtained with reasonable diligence prior to the commencement of the hearing. Further, the new evidence would probably not have an important influence on the result of the case, and the new evidence was not "apparently credible" (in the light of Mr Pritchard’s submission that it was inconsistent with the documentary evidence).

21. In addition, I was concerned that if I adjourned the case, part heard, it was likely that there would be a considerable delay before the hearing could resume. The case management hearing, at which I had given instructions for listing, had been in July 2020, and the earliest date for which it was possible to find dates that did not clash with the pre-existing commitments of the various individuals involved was April 2021 (some nine months later). There was a very real risk if the appeal went part-heard, it could be another nine months before available dates could be found to resume the hearing.

22. The overriding objective is that the Tribunal must deal with cases fairly and justly, and I decided that it was not fair and just to admit the new witness statement at this late stage.

23. For the tax year 2003/04, the Income and Corporation Tax Act 1988 ("ICTA") provides that trading profits are taxable under Schedule D, Case 1:

Schedule D

(1) The Schedule referred to as Schedule D is as follows:

SCHEDULE D

Tax under this Schedule shall be charged in respect of—

(a) the annual profits or gains arising or accruing—

[… ]

(ii) to any person residing in the United Kingdom from any trade, profession or vocation, whether carried on in the United Kingdom or elsewhere […]

(2) Tax under Schedule D shall be charged under the Cases set out in subsection (3) below, and subject to and in accordance with the provisions of the Tax Acts applicable to those Cases respectively.

(3) The Cases are -

![]() Case I: tax in respect of any trade carried on in the United Kingdom […]

Case I: tax in respect of any trade carried on in the United Kingdom […]

24. By s60 ICTA, assessment is on the current year basis:

Assessment on current year basis

(1) […] income tax shall be charged under Cases I and II of Schedule D on the full amount of the profits of the year of assessment.

25. By s42, Finance Act 1998, the profits of a trade (or an adventure in the nature of a trade) must be computed in accordance with generally accepted accounting practice ("GAAP"):

Computation of profits of trade, profession or vocation.

(1) For the purposes of Case I or II of Schedule D the profits of a trade, profession or vocation must be computed in accordance with generally accepted accounting practice, subject to any adjustment required or authorised by law in computing profits for those purposes.

26. Section 832(1) ICTA, defines "trade" to include

every trade, manufacture, adventure or concern in the nature of trade.

27. Section 37, Taxation of Chargeable Gains Act 1992 (“TCGA”) provides that the income tax charge takes precedence over any charge to CGT:

(1) There shall be excluded from the consideration for a disposal of assets taken into account in the computation of the gain any money or money’s worth charged to income tax as income of, or taken into account as a receipt in computing income or profits or gains or losses of, the person making the disposal for the purposes of the Income Tax Acts […]

28. In 2005/06 the income tax provisions had been rewritten by the Income Tax (Trading and Other Income) Act 2005 ("ITTOIA"). Although the governing statutes changed, the substantive underlying law (at least as regards the issues to be considered in this appeal) was not changed by the re-write.

29. Section 5 ITTOIA provides for a charge to income tax on trade profits:

Charge to tax on trade profits

Income tax is charged on the profits of a trade, profession or vocation.

30. The definitions in section 832(1) ICTA (at least as far as they are relevant to this appeal) were not repealed with the enactment of ITTOIA, and those definitions (including the definition of "trade") apply generally to "the Tax Acts" (which are defined to include ITTOIA). So, the definition of "trade" in s832(1) ICTA continued to apply for 2005/06, notwithstanding the enactment of ITTOIA.

31. The definition of "trade" in ICTA was repealed and replaced with the enactment of the Income Tax Act 2007 ("ITA 2007"), but that was only in respect of tax years later than the tax years that are the subject of this appeal. For completeness, the new definition in s989 ITA 2007 is

“trade” includes any venture in the nature of trade

and in my opinion, there is no difference in the meaning of a “venture in the nature of a trade” and of “adventure in the nature of a trade” (nor should there be, given that the re-write was not intended to change the law - save for some very limited exceptions).

32. Section 7 ITTOIA states that income tax is charged on the full amount of the profits of the tax year.

Income charged

(1) Tax is charged under this Chapter on the full amount of the profits of the tax year.

(2) For this purpose the profits of a tax year are the profits of the basis period for the tax year […]

33. Section 25 ITTOIA provides that trade profits are to be calculated in accordance with GAAP:

Generally accepted accounting practice

(1) The profits of a trade must be calculated in accordance with generally accepted accounting practice, subject to any adjustment required or authorised by law in calculating profits for income tax purposes […]

34. As in relation to the tax year ending 2003/04, the income tax charge takes precedence over any charge to CGT (s37 TCGA).

Schedular System of Income Tax

35. With the enactment of ITTOIA, the UK’s schedular system of taxing income was effectively abolished. Although profits of a trade (including profits from an adventure in the nature of a trade) were taxed under Schedule D, Case I in 2002/03, they were taxed as trade profits in 2005/06. At least as regards the circumstances of this appeal, there is no difference between these charging provisions (including the basis on which GAAP is applied), and for convenience, unless the context otherwise requires, references to trade profits include profits of a trade taxable under Schedule D, Case I (and vice versa).

36. The Taxation of Chargeable Gains Act 1992 ("TCGA") governed the imposition of capital gains tax in both 2002/3 and 2005/6.

37. Section 2 TCGA imposes a charge to CGT on individuals in respect of chargeable gains accruing to him or her in a tax year after deducting any allowable deductions:

Persons and gains chargeable to capital gains tax, and allowable losses.

(1) Subject to any exceptions provided by this Act, and without prejudice to sections 10 and 276, a person shall be chargeable to capital gains tax in respect of chargeable gains accruing to him in a year of assessment during any part of which he is resident in the United Kingdom, or during which he is ordinarily resident in the United Kingdom.

(2) Capital gains tax shall be charged on the total amount of chargeable gains accruing to the person chargeable in the year of assessment, after deducting—

(a) any allowable losses accruing to that person in that year of assessment, and

(b) so far as they have not been allowed as a deduction from chargeable gains accruing in any previous year of assessment, any allowable losses accruing to that person in any previous year of assessment (not earlier than the year 1965-66).

38. Disposals between spouses are usually treated as being undertaken for a consideration that gives rise neither to a chargeable gain nor to an allowable loss under s58(1) TCGA. But this no gain/no loss rule is disapplied by s58(2) in circumstances where the asset is treated as trading stock in the hands of either the transferor or the transferee. In these circumstances ss17 and 18 apply to treat the disposal as taking place at market value.

39. Where a person acquires an asset from a "connected person", s18 TCGA provides that they are treated as not having transacted at arm’s length and s17 TCGA is applied to deem the consideration to be market value:

17 Disposals and acquisitions treated as made at market value

(1) Subject to the provisions of this Act, a person’s acquisition or disposal of an asset shall for the purposes of this Act be deemed to be for a consideration equal to the market value of the asset (a) where he acquires or, as the case may be, disposes of the asset otherwise than by way of a bargain made at arm’s length, and in particular where he acquires or disposes of it by way of gift or on a transfer into settlement by a settlor or by way of distribution from a company in respect of shares in the company

[…]

18 Transactions between connected persons

(1) This section shall apply where a person acquires an asset and the person making the disposal is connected with him.

(2) Without prejudice to the generality of section 17(1) the person acquiring the asset and the person making the disposal shall be treated as parties to a transaction otherwise than by way of a bargain made at arm’s length […]

40. For these purposes, s286(2) TCGA (as in force at the relevant time) provides that a person is connected to another if, amongst other things, they are spouses:

Connected persons: interpretation.

(2) A person is connected with an individual if that person is the individual's husband or wife, or is a relative, or the husband or wife of a relative, of the individual or of the individual's husband or wife.

41. Where only part of an asset is sold s42 TCGA provides for an apportionment of the allowable expenditure between the part sold and the part retained:

Part disposals

(1) Where a person disposes of an interest or right in or over an asset, and generally wherever on the disposal of an asset any description of property derived from that asset remains undisposed of, the sums which under paragraphs (a) and (b) of section 38(1) are attributable to the asset shall, both for the purposes of the computation of the gain accruing on the disposal and for the purpose of applying this Part in relation to the property which remains undisposed of, be apportioned.

(2) The apportionment shall be made by reference—

(a) to the amount or value of the consideration for the disposal on the one hand (call that amount or value A), and

(b) to the market value of the property which remains undisposed of on the other hand (call that market value B), and accordingly the fraction of the said sums allowable as a deduction in the computation of the gain accruing on the disposal shall be (A)/(A+B) and the remainder shall be attributed to the property which remains undisposed of […]

(4) This section shall not be taken as requiring the apportionment of any expenditure which, on the facts, is wholly attributable to what is disposed of, or wholly attributable to what remains undisposed of …

42. Relief from CGT is given by s222 TCGA in respect of the disposal of garden or grounds of a dwelling-house, up to the "permitted area":

Relief on disposal of private residence.

(1) This section applies to a gain accruing to an individual so far as attributable to the disposal of, or of an interest in—

(a) a dwelling-house or part of a dwelling-house which is, or has at any time in his period of ownership been, his only or main residence, or

(b) land which he has for his own occupation and enjoyment with that residence as its garden or grounds up to the permitted area.

(2) In this section “the permitted area” means, subject to subsections (3) and (4) below, an area (inclusive of the site of the dwelling-house) of 0.5 of a hectare.

(3) Where the area required for the reasonable enjoyment of the dwelling house (or of the part in question) as a residence, having regard to the size and character of the dwelling house, is larger than 0.5 of a hectare, that larger area shall be the permitted area.

(4) Where part of the land occupied with a residence is and part is not within subsection (1) above, then (up to the permitted area) that part shall be taken to be within subsection (1) above which, if the remainder were separately occupied, would be the most suitable for occupation and enjoyment with the residence […]

43. The s222 relief is commonly known as private residence relief ("PRR").

44. Section 223 TCGA limits the amount of PRR depending on how long the property has been the taxpayer’s main dwelling:

Amount of relief

(1) No part of a gain to which section 222 applies shall be a chargeable gain if the dwelling-house or part of a dwelling-house has been the individual’s only or main residence throughout the period of ownership, or throughout the period of ownership except for all or any part of the last 36 months of that period.

(2) Where subsection (1) above does not apply, a fraction of the gain shall not be a chargeable gain, and that fraction shall be—

(a) the length of the part or parts of the period of ownership during which the dwelling-house or the part of the dwelling-house was the

(b) the length of the period of ownership.

(3) For the purposes of subsections (1) and (2) above—

(a) a period of absence not exceeding 3 years (or periods of absence which together did not exceed 3 years), […]

shall be treated as if in that period of absence the dwelling-house or the part of the dwelling-house was the individual’s only or main residence if both before and after the period there was a time when the dwelling-house was the individual’s only or main residence […]

45. Sections 222 and 223 TCGA have since been amended, but the amendments are not relevant to this appeal.

46. HMRC has published guidance in its manuals about PRR. The guidance is at CG64360 which states:

CG64360 - Private residence relief: garden and grounds: definitions

Whether you can regard a particular piece of land as garden or grounds of a residence is a question which must be decided on the facts. The phrase “garden or grounds” is not defined in the statute and neither has its meaning been considered in case law. Therefore, the words must take their everyday meaning.

A useful dictionary definition of the word garden is,

“a piece of ground, usually partly grassed and adjoining a private house, used for growing flowers, fruit or vegetables, and as a place of recreation.”

The word “grounds” infers a larger area than “garden”. A useful dictionary definition of the word grounds is,

“Enclosed land surrounding or attached to a dwelling house or other building serving chiefly for ornament or recreation.”

Generally speaking you should accept that land surrounding a residence which is in the same ownership, is the grounds of the residence, unless it is in use for some other purpose.

Land which at the date of disposal is in use for some other purpose for example agricultural land, commercial woodlands, land under development or land in use for a trade or business should not be regarded as part of the garden or grounds.

The following land should not necessarily be excluded from the garden and grounds:

· Land which has traditionally been the garden and grounds of the residence but at the date of sale is unused or overgrown.

· Paddocks or orchards providing there is no significant business use.

· Land which has a building on it, see CG64200, unless that building is in use for a business or is let.

Where the land in question was acquired on a different date to the residence, it should also be accepted as garden or grounds providing it was subsequently brought into use as the garden or grounds of the residence and remains as garden or grounds at the date of disposal.

Mixed Use

To qualify for relief land does not have to be exclusively in use for recreational purposes. For example, the owner of a guest house may allow guests to use the garden. In these circumstances the garden will still qualify for relief if the other tests are satisfied.

47. HMRC’s web site states that CG64360 was first published on “gov.uk” on 12 March 2016, but the manual’s introduction states that the content of a page will be older than the published date (presumably having previously been available on “www.hmrc.gov.uk”). It is therefore unclear when this information was first made available to the public. However, similar guidance as to the meaning of “garden or grounds” was previously available in the Inland Revenue’s Tax Bulletin 18 (August 1995) which said:

The phrase "garden or grounds" is not defined in the statute, nor is there judicial authority. The words must carry their everyday meaning and whether a piece of land can be regarded as the garden or grounds of a residence is a question of fact.

The word "garden" is taken to mean an enclosed piece of ground devoted to the cultivation of flowers, fruit or vegetables. The word "grounds" extends this and makes it more difficult to define. A useful dictionary definition of grounds is

"Enclosed land surrounding or attached to a dwelling-house or other building serving chiefly for ornament or recreation".

In general, the Revenue accepts that land surrounding the residence and in the same ownership is the grounds of the residence, unless it is used for some other purpose. The Revenue would not regard land used for agriculture, commercial woodlands, trade or business as part of the garden or grounds. Also, land which has been fenced off from the residence to be sold for development is excluded. Land which has traditionally been part of the grounds of the residence but which, at the date of sale, is unused or overgrown is not excluded, nor are paddocks or orchards if there is no significant business use. Included in the definition is land which has a building on it, provided the building is not let or in use for a business, and also land which is not used exclusively for recreational purposes. For example, the owner-occupier of a guest house may allow guests to use the garden. The land would still qualify for relief providing the other conditions are satisfied.

Enabling development and conservation deficit

48. The National Heritage List for England is maintained by the Historic Buildings and Monuments Commission for England, which also has responsibility for advising national and local government on the management and development of historic buildings. The Commission has operated under a number of different names. It used the name "English Heritage" until April 2015, when its activities were divided, and responsibility for management of the national collection of historic places was transferred to a new charity, also called English Heritage. The Commission's retained activities were thereafter carried on under the name "Historic England". For convenience, in this decision I will refer to the Commission using the name "English Heritage", as this is the name it used at the times relevant to this appeal.

49. "Enabling development" is not a statutory term. Its origins date back to the case of R v. Westminster City Council ex parte Monahan [1990] 1 QB 87. Monahan concerned the proposed development of the Royal Opera House that included, amongst other things, the erection of office accommodation in breach of the local development plan. In dismissing the appeal, the Court of Appeal held that since financial constraints on the economic viability of desirable planning developments were unavoidable, it would be unreal and contrary to common sense to exclude them from the range of considerations which might properly be regarded as material when determining planning applications. Whilst not a term used in the judgment, "enabling development" is jargon that is now used to describe a financially beneficial development that is undesirable in planning terms, but for the fact that it will enable some other, more desirable, public benefit.

50. In June 1999, English Heritage published a booklet: "Enabling Development and the Conservation of Heritage Assets", which included a policy statement and practical guidance. The policy statement set out a presumption against the development of heritage assets unless the development met specified criteria, the most important of which was that the benefits should clearly outweigh the harms. The term "heritage assets" is used

as shorthand for any component of our historic environment, including

• scheduled monuments and other archaeological remains

• historic buildings both statutorily listed or of more local significance

• conservation areas

• historic landscapes, including registered parks and gardens and registered battlefields.

51. The booklet was republished in June 2001, and a further edition of the booklet was published in September 2008. English Heritage's fundamental policy did not change through the various editions, but the later editions clarified and gave more detailed explanations of the policy and guidance. References in this decision to English Heritage's booklet are to the June 2001 edition, unless otherwise stated.

52. English Heritage policy statements do not have the force of law, and do not purport to have the force of law. Rather they are helpful extra-statutory guidance (see R. (Davey) v Aylesbury Vale DC and Mentmore Towers Ltd [2005] EWHC 359 (Admin)).

53. The policy statement's "Overview" describes an enabling development as follows:

Enabling development is development that is contrary to established planning policy - national or local - but which is occasionally permitted because it brings public benefits that have been demonstrated clearly to outweigh the harm that would be caused. The benefits are paid for by the value added to land as a result of the granting of planning permission for its development, so enabling development can be considered a type of public subsidy. It has been proposed in support of a wide range of public benefits, from opera houses to nature conservation, but this guidance is concerned primarily with enabling development proposed to secure the future of heritage assets. Nonetheless, the principles are equally applicable to biodiversity interests, which often exist side by side on the same site.

54. The policy statement itself states that there should be a general presumption against enabling developments:

English Heritage believes that there should be a general presumption against "enabling development" which does not meet all of the following criteria:

• The enabling development will not materially detract from the archaeological, architectural, historic, landscape or biodiversity interest of the asset, or materially harm its setting

• The proposal avoids detrimental fragmentation of management of the heritage asset

• The enabling development will secure the long term future of the heritage asset, and where applicable, its continued use for a sympathetic purpose

• The problem arises from the inherent needs of the heritage asset, rather than the circumstances of the present owner or the purchase price paid

• Sufficient financial assistance is not available from any other source

• It is demonstrated that the amount of enabling development is the minimum necessary to secure the future of the heritage asset, and that its form minimises disbenefits

• The value or benefit of the survival or enhancement of the heritage asset outweighs the long-term cost to the community (i.e. the disbenefits) of providing the enabling development

If it is decided that a scheme of enabling development meets all these criteria, English Heritage believes that planning permission should only be granted if:

• The impact of the development is precisely defined at the outset, normally through the granting of full rather than outline planning permission;

• The achievement of the heritage objective is securely and enforceably linked to it, bearing in mind the guidance in DOE Circular 01/97, Planning obligations;

• The heritage asset is repaired to an agreed standard, or the funds to do so made available, as early as possible in the course of the enabling development, ideally at the outset and certainly before completion or occupation;

• The planning authority closely monitors implementation, if necessary acting promptly to ensure a satisfactory outcome.

55. Chapter 5 of the practical guidance included within the booklet sets out the financial criteria that should be used for judging whether consent for an enabling development should be granted. The chapter is written in the context of a development carried out by a commercial developer, rather than by a prospective owner-occupier, as can be seen from the introduction to the chapter in paragraph 5.1.1:

5.1.1 The essence of commercial property development is to endeavour to maximise the return on investment, to compensate for the risk and time taken in carrying out a development. The purchase price paid is an important factor in this. Development sites will often be the subject of intense competition between prospective buyers, all of whom are likely to have arrived at an offer figure aware of the competition and on the basis of likely returns. If, in the event, projected future returns need to be reduced, a distinct possibility in a falling property market, the viability of a scheme may be in doubt and it might not materialise.

56. The booklet addresses the profit a commercial developer should make from a development project:

5.8.1 It is naturally right and proper that a developer be allowed a fair and reasonable return on his investment, to reflect the risk involved in the development project. There are many different types of developer. The developer/builder will usually require a lesser profit than the pure entrepreneur, as the builder will usually generate a profit on the cost of carrying out the actual construction, whereas an entrepreneurial developer is purely the catalyst whose vision, management and development skills need to be rewarded. In the present competitive residential development market, development companies are accepting lower profits in the hope that the finished product will sell quickly. During a recession, however, risks are obviously greater and therefore a higher percentage return is required.

[…]

5.8.3. Developer’s profit is normally allowable on all valid development costs, including appropriate site costs (as defined above), since all involve financing costs and risk. The principal exception is cash subsidies from public sources, for example English Heritage or a regional development agency. These are deducted from total development costs before developer’s profit is calculated. Whilst enabling development is itself a form of subsidy, it is normally included in development costs, because it must be funded and bears risk. […]

57. The booklet sets out the concept of a "conservation deficit" in paragraph 5.4.1:

In financial terms, the case for enabling development normally rests on there being a conservation deficit. This is when the existing value (often taken as zero) plus the development cost exceeds the value of the heritage asset after development. Development costs obviously include not only repair, but also, if possible or appropriate, conversion to optimum viable use, and a developer’s profit appropriate to the circumstances. A development appraisal in such cases produces a negative residual value. If so, enabling development (provided it meets the other criteria in the Policy Statement) may be justified, but only sufficient to cover the conservation deficit, i.e. to bring the residual value up to zero. The principal exception to this rule is historic estates whose break-up and sale would result in significant loss of heritage value. Enabling development may be justified to ensure their long term viability in revenue terms, as explained in Section 4.5. Enabling development is not justified where the financial problems arise from the lack of resources of the owner, rather than the inherent need of the heritage asset.

58. The glossary includes an entry for "conservation deficit" as follows:

The amount by which the cost of repair (and conversion to optimum beneficial use if appropriate) of a heritage asset exceeds its market value on completion of repair and conversion, allowing for all appropriate development costs, but assuming a nil or nominal land value

59. The 2008 edition of the booklet confirms that the commercial risks associated with an enabling development must sit with the developer:

5.4.3 Fundamental to the concept of enabling development is that the developer takes on the commercial risk. The level of developer’s profit should be set to reflect those risks, and the public benefits, particularly securing the future of the significant place, must normally be delivered at the outset. There is no mechanism for claw-back if the financial outcome is better than anticipated; similarly there can be no expectation of further enabling development if it is worse than anticipated.

5.4.4 Taking an incremental approach to enabling development, in which additional enabling development is sought once the scheme is under way or completed, as a means of recovering unforeseen or underestimated costs, is not an acceptable practice. Such an approach distorts the process, because it is necessary to consider the effects of the enabling development proposals in their entirety before deciding whether the benefits outweigh the harm. The developer bears the risk - there can be no ‘second bite of the same cherry’. This does not, of course, apply to a strategic approach (for example to an historic estate), which is agreed at the outset and implemented in stages.

60. Where an enabling development is authorised, the booklet recommends that

7.1 […] legally enforceable arrangements must be put in place to ensure that the commercial element of the development cannot be carried out or used without the heritage benefits on which the scheme has been predicated materialising.

61. The recommended mechanism to ensure legal enforceability is an agreement between the developer and the local planning authority pursuant to s106, Town and Country Planning Act 1990 (“TCPA”). Section 106 TCPA gives local authorities the power to enter into agreements with landowners relating to planning obligations. At the relevant time, s106 was as follows:

Planning obligations

(1) Any person interested in land in the area of a local planning authority may, by agreement or otherwise, enter into an obligation (referred to in this section and sections 106A and 106B as “a planning obligation”), enforceable to the extent mentioned in subsection (3)—

(a) restricting the development or use of the land in any specified way;

(b) requiring specified operations or activities to be carried out in, on, under or over the land;

(c) requiring the land to be used in any specified way; or

(d) requiring a sum or sums to be paid to the authority on a specified date or dates or periodically.

[…]

(3) Subject to subsection (4) a planning obligation is enforceable by the authority identified in accordance with subsection (9)(d)—

(a) against the person entering into the obligation; and

(b) against any person deriving title from that person.

[…]

(5) A restriction or requirement imposed under a planning obligation is enforceable by injunction.

(6) Without prejudice to subsection (5), if there is a breach of a requirement in a planning obligation to carry out any operations in, on, under or over the land to which the obligation relates, the authority by whom the obligation is enforceable may—

(a) enter the land and carry out the operations; and

(b) recover from the person or persons against whom the obligation is enforceable any expenses reasonably incurred by them in doing so.

[…]

(11) A planning obligation shall be a local land charge.

[…]

62. A model form of an agreement under s106 is set out as an appendix to English Heritage’s booklet. The model form specifies the conservation work that must be done, but it does not prevent the owner of the heritage asset from undertaking additional work.

63. It is convenient in this decision to refer to Bunny Hall - the mansion house itself - as "the Hall", the land surrounding the Hall that is (or was at the relevant times) in the ownership of Mrs Whyte as "the Grounds", the entirety of the land and buildings owned by Mrs Whyte as "the Bunny Hall Estate" or "the Estate", and the plots that were sold (and which are the subject of this appeal) as "the Plots". The scheme for constructing houses on the Plots and the sale of the Plots is referred to in this decision (unless the context otherwise requires) as “the enabling development”.

64. On the basis of the evidence before me, I find that the background facts are as follows:

65. The Estate is in the village of Bunny, Nottinghamshire. Bunny is about seven miles south of Nottingham, and about seven miles north-east of Loughborough - roughly half-way between the two. It is in within the area of Rushcliffe Borough Council ("RBC"), which was and is the relevant local planning authority.

66. The name of the village has nothing to do with rabbits. Rather it means “reed island” or “island on the River Bune”.

67. There are about 400,000 listed building entries in the National Heritage List for England. The entries on the list are classified into one of three grades:

(1) Grade II buildings are of special interest warranting every effort to preserve them. Over 90% of all listed buildings are in this grade;

(2) Grade II* buildings are particularly important buildings of more than special interest. 5.8% of listed buildings are Grade II*; and

(3) Grade I buildings are of exceptional interest, only 2.5% of listed buildings are Grade I.

68. The Hall is a Grade I listed historic mansion house. It has 11 bedrooms, 5 principal reception rooms, and 6 bathrooms. It was designed by Sir Thomas Parkyns and built between 1710 and 1725. The Hall was enlarged in the late 18th century, with further additions being made in the 19th century.

69. When Mrs Whyte purchased the Estate in 2001, it comprised 6.88 ha (17 acres). She unsuccessfully attempted to sell the Hall between 2007 and 2009 with around 9.71 ha (24 acres) of Grounds. At the time of the hearing, the Estate is on the market again together with a reduced area of land of 5.87 ha (14.5 acres) (but the sale particulars state that an additional 3.39 ha (8.38 acres) is available by separate negotiation). Ms Williams comments in her report that Mrs Whyte must therefore have purchased additional land between 2001 and 2007. The latest sales particulars state that the gross internal floor area of the Hall is 1991 m2 (21,438 sq ft).

70. Included within the Grounds are walled and terraced areas of formal gardens, informal grassed and wooded areas, lawns, and fenced grass paddocks.

71. In June 2000 English Heritage prepared a brief analysis of the historic development of the Bunny Hall Estate landscape:

[…]

The second phase - late 18th to early 19th century

In the late C18 or early C19 it appears that the park was landscaped, probably in conjunction with the parish enclosure works dating from the late 1790s (Enclosure Map, 1797; OS 1820). At this time the curved north drive was inserted, entering off the west end of Keyworth Lane at the north-west corner of the site, together with the south drive which entered at the south-west corner of the site. These two drives met at an informal forecourt in front of the new entrance to the Hall on its east side. The new approaches to the Hall seemed to have been connected with the realignment of the main village road to the west of the estate (probably resulting from the enclosure works), and replaced the formal forecourt to the north side of the Hall. Before its realignment, the road lay immediately to the north of the former forecourt, continuing north from there between the present barns and possibly providing the basis of the later north drive (Enclosure map, 1797).

Also in the early C18 the Wilderness may have been reduced to its present size in conjunction with landscaping works in the park, and the south and east sides of the enclosing canal filled in, with the construction of the ha-ha dividing the remains of the Wilderness from the park. A significant feature of these works would have been the views from the Wilderness across the ha-ha to the east and south east of over the park towards Keyworth and Old Wood respectively, and from the drives and forecourt.

The third phase - mid to late 19th century

In the mid to C19 a further phase of landscaping seemed to have taken place, with the construction of the formal Italianate terrace to the south of the Hall, and possibly work within the Wilderness. The present tree cover in this area probably dates from this period or later.

The most sensitive areas of the historic landscape therefore cover the pleasure grounds, including the Wilderness, formal garden and areas adjacent to the west and north of the hall, together with the parkland immediately to the east and south east of the Hall.

72. In this decision, the area of land referred to in English Heritage’s analysis as “the Wilderness”, is called the “Wilderness Garden”.

73. Prior to Mrs Whyte acquiring the Estate, it seems that a large part of the land and buildings that once formed part of the Estate had been sold. In particular, the range of barns and other agricultural buildings to the immediate north of the Hall had been converted into six dwellings and sold to individual purchasers. The wall of the barn nearest the Hall is within 8 metres of the walls of the Hall. Ms Williams comments in her report that it is unusual for a property of the type and character of Bunny Hall to have such close neighbours occupying properties in separate ownership.

74. The original access road was to the north of the Hall and passed the six barn conversions. Having obtained the necessary consents in October 2001, Mrs Whyte constructed a new entrance to the Estate and an access road from the south. This access road also serves the houses that were constructed on the Plots that are the subject of this appeal.

75. At the time of Mrs Whyte's purchase, the Hall was unoccupied and extremely dilapidated. Although a part of the Hall had been divided-off as an apartment and was habitable, it had not been occupied for many years.

76. As regards the Grounds, everything was overgrown, and had not been touched for decades. Weeds were up to 4ft high. The ha-ha was largely derelict and had been filled-in, but the line it followed remained visible on the ground. The line of the ha-ha formed the boundary between (a) the Hall's formal gardens and the Wilderness Garden, to its north and west, and (b) parkland (now laid to lawn), to its south and east. As part of the restoration and landscaping works, the ha-ha was restored from the formal gardens to just before the new access road. A short stretch of the ha-ha, near to the new access road, was filled-in - to allow mowing and other machinery to cross between the lawned parkland and the Wilderness Garden.

77. For completeness, a ha-ha is a boundary feature used to stop grazing animals encroaching into the cultivated areas of a garden, whilst allowing unbroken views across the garden to the parkland and countryside beyond. The construction of a ha-ha involves digging a deep dry ditch. A vertical masonry wall forms the inner side of the ditch, while the outer side is turfed and slopes upwards before levelling out. Although animals can walk down the outer slope into the bottom of the ditch, they cannot climb up the vertical masonry wall on the inner side, and the ditch is too wide for animals to jump over.

78. An avenue of lime trees forms a walk that extends north-south along the length of the Wilderness Garden. Prior to the sale of the Plots, there was a large pond at the southernmost end of the Wilderness Garden, and the lime walk took a sharp turn to the east before it reached the pond. The pond was within the areas of Plots 1 and 2 (and possibly Plot 3 - the plans included within the Bundle are not particularly clear). It was agreed that a water feature would be retained as part of the enabling development. In consequence, although the original large pond was drained and filled-in, a new small pond was dug between Plots 1 and 2. The sharp turn in the lime walk was eliminated so that the walk follows a roughly straight line along the back of Plots 3 to 6, over the new pond on footbridge, and terminates at its junction with the access road.

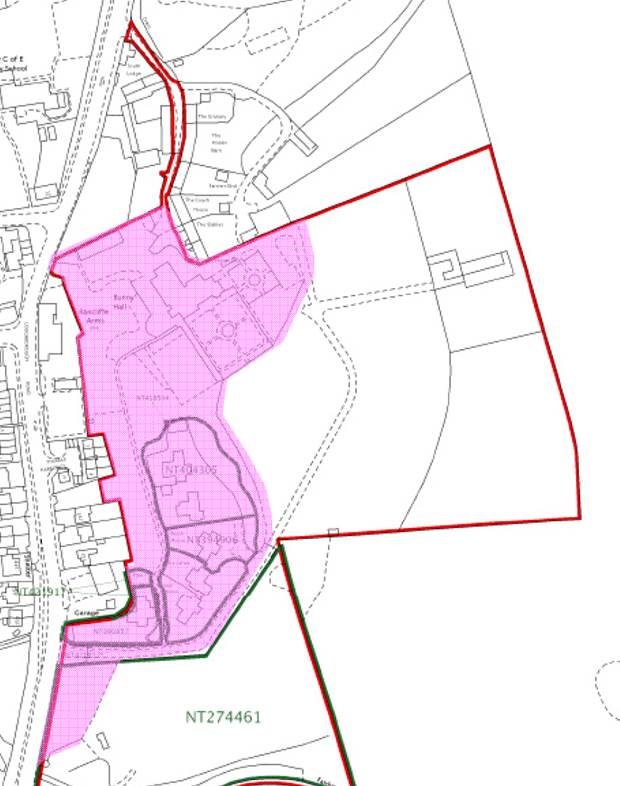

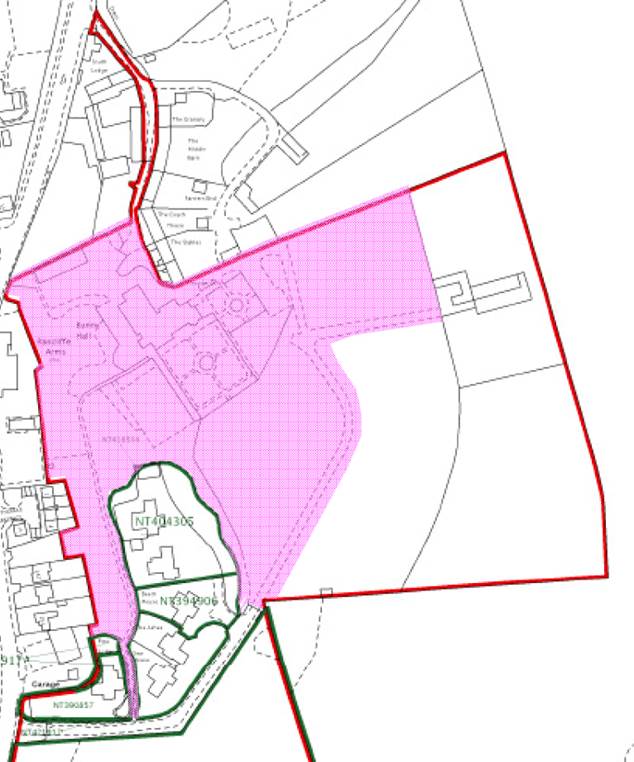

79. Plans of the Estate are included in Annex 2. The top of the page is orientated to the north:

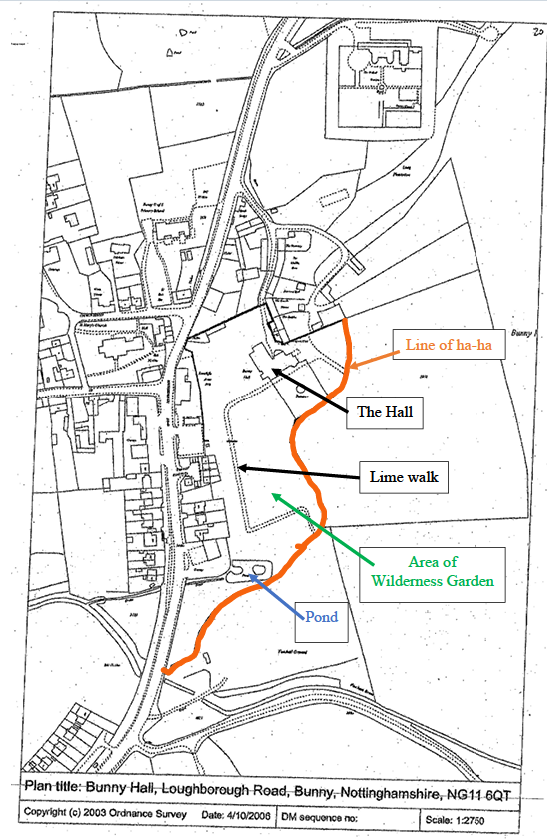

(1) Figure 1 is a plan of the Estate at some time prior to its purchase by Mrs Whyte, showing the location of the Hall, the area of the Wilderness Garden, the original line of the ha-ha, the original path taken by the lime walk, and the original large pond.

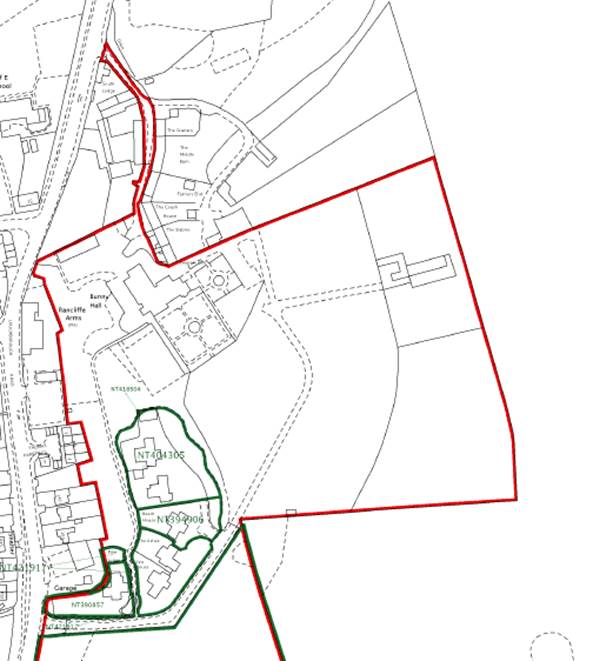

(2) Figure 2 shows the location of the Plots outlined in green, with the boundary of the Estate marked in red. The new access road (shown with dotted lines) enters the Estate at its south-west corner, goes around Plots 1 to 4, and then up to the Hall. The restored ha-ha can be seen as a solid line commencing just to the east of the boundary between Plots 1 and 2, and continuing north towards the Hall. The Wilderness Garden is the area to the west of the ha-ha. The parkland area between the access road and the ha-ha is laid to lawn. There is a gate across the access road just to the east of Plot 3 (marked with a solid line across the road). The short length of dotted line from that gate to the restored ha-ha shows where the ha-ha has been filled-in to allow garden equipment to cross between the Wilderness Garden and the lawns. There is a short stub of road (not shown on this plan) which has a junction with the access road just before the gate, and then extends northwards past Plots 4 and 5, terminating at Plot 6.

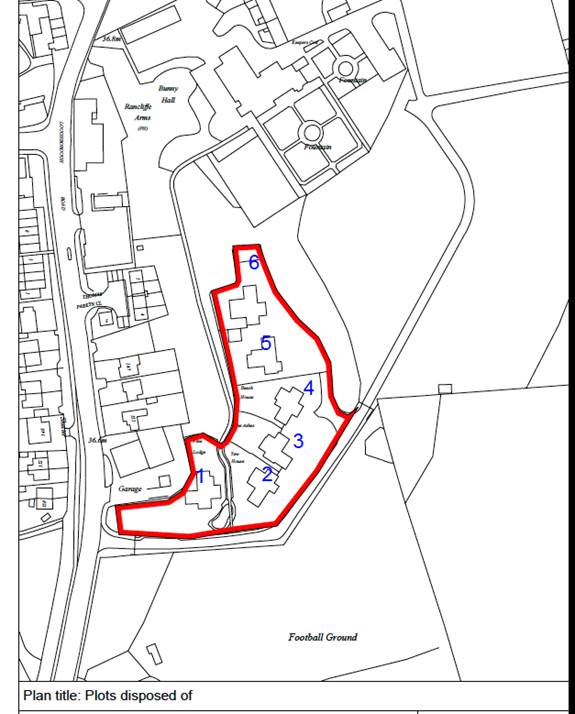

(3) Figure 3 shows how the Plots were numbered, with Plot 6 closest to the Hall, and Plot 1 furthest from the Hall. The lime walk would have originally turned sharply to the east somewhere around Plot 4, but it now continues south between Plots 1 and 2 until it reaches the access road. The new pond (with a footbridge over it) is at the southern end of the walk.

(4) Figure 4 shows Ms William's alternative permitted area outlined in green, with the boundary of the Estate (other than the old access road to the north) outlined in red.

(5) Figure 5 shows Ms William's preferred permitted area outlined in green, with the boundary of the Estate (other than the old access road to the north) outlined in red.

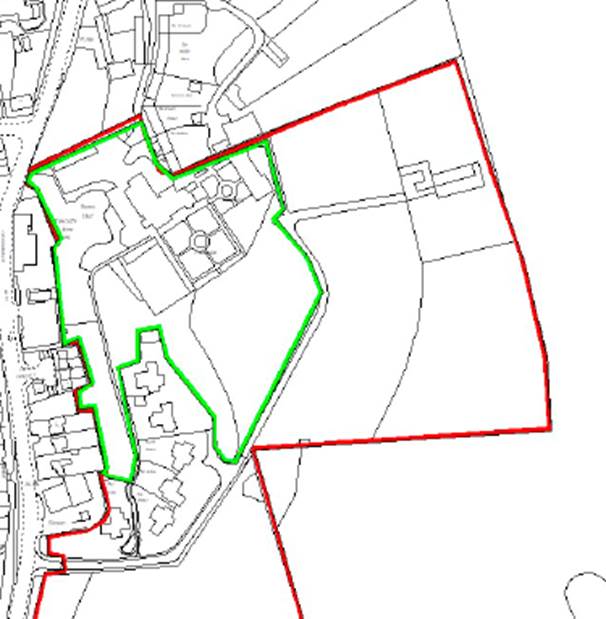

(6) Figure 6 shows Mr Garratt's permitted area shaded in pink ,with the boundary of the Estate outlined in red. Note that the permitted area includes an irregular area of land to the south of the access road, which I refer to as the "triangle".

(7) Figure 7 shows, shaded in pink, Mr Garratt’s permitted area as it would be after the sale of all of the Plots. The boundary of the Estate is outlined in red.

80. Prior to her purchase of Bunny Hall, Mrs Whyte and her family lived at Gotham Moor Farm. Mr and Mrs Whyte first lived there as tenants, and Mrs Whyte purchased the property in 1994.

81. She was, and continues to be, married to Chek Whyte, who is a builder and property developer. Mr Whyte was an undischarged bankrupt at the time Mrs Whyte purchased Gotham Moor Farm (his bankruptcy was discharged in 1995).

82. Mrs Whyte was the sole proprietor of the unincorporated business "Matrix Design and Build", until 31 March 1994 when it was incorporated as Union Brothers Limited.

83. From 1 April 1997 until 30 June 1999, she and her husband were partners in the unincorporated business TFD Midland ("TFD"), which was a firm of builders. Mrs Whyte resigned from the partnership on 30 June 1999, and since that date TFD continued in operation under the sole proprietorship of Mr Whyte.

84. Mrs Whyte was asked about these various businesses, and her involvement in them. She described Matrix Design and Build as a small building company that her husband had been running. Union Brothers Limited were demolition contractors, mainly of industrial buildings. She confirmed that she had been a director, but she could not remember the dates. Companies House records show that she was a director of Union Brothers Limited until it was liquidated on 1 April 1998 and that its business was described as "builders and dismantlers".

85. Mrs Whyte described TFD as being a small building and repairs business, which undertook small building projects and some demolition. Mrs Whyte described her role as "purely administrative", being office-based and limited to office administration, and she could not remember any particular projects undertaken by TFD. She was asked if she would have known about projects that TFD was undertaking, and she said that she did not. In August 1998 she took time off from the business when she had her daughter. Mrs Whyte was asked about her income tax returns, which, since 1 July 1999, showed employment income from TFD 2 Limited and of TFD. The declared income from these sources has fluctuated between £29,886 (in 2002) and £40,000 (in 2008). Mrs Whyte confirmed that she was an employee of TFD at the time she purchased Bunny Hall, during the course of the restoration of the Hall and the sale of the six Plots.

86. TFD got into financial difficulties, and Mr Whyte entered into an individual voluntary arrangement (“IVA”) towards the end of 2009.

87. According to HMRC's notes of a meeting on 31 July 2007 with Mr Whyte and his accountants, Mr Whyte told HMRC that Union Brothers Limited was incorporated following his discharge from an earlier bankruptcy. Union Brothers subsequently got into financial difficulties and became insolvent. Mr Whyte admitted that Union Brothers' financial records were poor, and in consequence in 1999 Mr Whyte was disqualified from being a company director for ten years.

88. Because of the risks associated with Mr Whyte's business activities, Mrs Whyte's evidence was that she and her husband have been careful to keep their respective financial affairs separate, which is why Mrs Whyte purchased both Gotham Hall Farm and Bunny Hall in her own name.

89. In 1995, an 8-acre field adjoining Gotham Moor Farm was purchased in Mrs Whyte's sole name from her neighbours, and in 1998 Mr and Mrs Whyte jointly purchased a further 5 acres including a derelict barn. The derelict barn was converted into a home by Mr Whyte's business, TFD, and renamed Sunningdale Barn.

90. Mrs Whyte's evidence during cross-examination was that Sunningdale Barn was to be a home for her parents, but that they never lived in it, as the Rectory in Plumtree had come onto the market, and her intention was that they should all move to the Rectory (including her parents). Mrs Whyte said that her mother now lives with her at Bunny Hall.

91. Mrs Whyte's evidence was that when she sold Gotham Moor Farm, Sunningdale Barn was sold with it, that she declared a capital gain on her tax return, and paid CGT on the sale. During the course of cross-examination, Mrs Whyte said that she was not aware of the profit being recategorized as trading following an HMRC enquiry - she said that she had paid capital gains tax and had not been asked to pay any more tax.

92. HMRC's records show that the disposal of Sunningdale Barn was declared on Mrs Whyte's 2001/2 tax return as having occurred in December 2001 and returned as a capital gain. HMRC's notes of a meeting on 31 July 2007 with Mr Whyte (who had written authority to represent Mrs Whyte) and his accountants, Hacker Young, state that there was a discussion at that meeting about Sunningdale Barn, and that although Mrs Whyte returned a capital gain in respect of its sale, Mr Whyte did not declare the sale on his return at all, even though he jointly owned the barn with her. At the meeting, Mr Whyte agreed with HMRC that the development of the barn gave rise to a trading profit taxable under Case I Schedule D, which would be split equally between Mr and Mrs Whyte. The consequential adjustments to Mr and Mrs Whyte's respective returns resulted in additional tax being paid by Mr Whyte (plus penalties and interest), and a refund being due to Mrs Whyte.

93. On 21 August 2009, Berryman’s wrote to Mrs Whyte in relation to Mr Whyte’s proposed IVA in order to advise Mrs Whyte on the risk of Mr Whyte’s creditors making claims against her. The letter states that it is based on Berryman’s own records and on bank statements provided by Mrs Whyte. The letter records that the sale of Sunningdale Barn was completed on 10 December 2001, that the net proceeds of sale were £346,348.50, and that Mrs Whyte transferred £345,000 to Mr Whyte on 13 December in partial repayment of the loan advanced for the purchase of the Estate. The letter also states that the sale of Gotham Moor Farm (with some adjoining land) completed on 8 February 2002, the sale consideration was £250,000 and acceptance of the buyer’s property (Parker Gardens) in part-exchange. Additional land was sold with Gotham Moor Farm for £75,000. Parker Gardens was transferred into Mr Whyte’s name. The net cash proceeds (after repayment of the mortgage) were £177,778.49, of which £105,000 was paid by Mrs Whyte to Mr Whyte on 13 February 2002 in partial repayment of the loan. Parker Gardens was sold on 9 May 2005 and the net proceeds of £221,053.43 were retained by Mr Whyte.

94. I therefore find that Sunningdale Barn was not sold with Gotham Moor Farm.

95. Mrs Whyte was asked whether she and her husband were accustomed to buying land, bettering it and then selling it, to which her answer was "no". She was asked whether she and her husband had experience of making money from the sale of land, to which her answer was also "no". She was asked whether she had experience of developing land and selling it for more than she had spent on the development. Her answer was that she had experience of developing land at Gotham Moor Farm and had paid tax on the capital gain she had realised. She was asked whether Mr Whyte is in the business of building houses, to which her answer was "no, he wasn't building houses at that point, he was a small builder".

96. Mrs Whyte was asked whether Bunny Hall was worth more following its renovation than it cost, to which her answer was "obviously yes". She was referred to screen shots of Savills' web site, where Bunny Hall was advertised for sale, and as having been sold. Mrs Whyte's response was that the Estate was up for sale, but that it had not been sold and that she was not sure what price (if any) she would accept for it.

97. The commercial developer, David Wilson Homes, were the owners of the Estate immediately before Mrs Whyte. In March 1999 they had an appraisal prepared to justify the granting of planning consent for the redevelopment of the Hall and its conversion into four flats, plus an enabling development of ten new houses in the Grounds.

98. It seems that David Wilson Homes were not the first business to contemplate redevelopment of the Hall and development within the Grounds. The report to RBC’s Development Control Committee of 18 August 2003 (which considered Mrs Whyte’s application for the enabling development) referred to previous planning applications relating to the Hall and its Grounds, including consent granted in 1989 to convert the Hall into three flats and the barns into six dwellings (although the barns were converted, no work was done to the Hall). Since then applications were made to convert the Hall into a hotel/health farm, offices, a hotel and restaurant, nine flats, and ten flats. All of these applications were withdrawn before formal decisions were reached.

99. David Wilson Homes’ appraisal was updated in February 2000. Only the first page of the March 1999 appraisal was included in the documents bundle, and a copy of the February 2000 appraisal was not provided. However the report to the RBC Development Control Committee refers to an application to convert the Hall into four flats and to build ten dwellings in the Grounds. These applications are discussed in RBC's letter of 5 May 2000 to English Heritage which asks for advice about the location of the new dwellings, and considers the state of the Wilderness Garden:

On the matter of the location of new units within the grounds I am hoping that Dr Jordan will provide me with advice on the value of the "Wilderness Garden". Although the whole of this is the subject of an Area TPO, it has become apparent that only a handful of trees are worthy of retention and many have already been felled on the grounds of safety (some substantial Beech trees have already fallen naturally). It would seem inappropriate to encourage any new development in the open countryside to retain a particular area of garden which may not be worthy of retention and which may be a better location, adjoining the village core, for at least at least a proportion of the new buildings.

I feel that consideration of the structure of the hall itself and its restoration cannot be divorced from the original concept of house and garden with expansive views across the ha-ha to open countryside and obviously the views of the hall itself from that countryside. As a result your views on this particular issue would also be much appreciated.

100. RBC write to Dr Jordan at English Heritage on the same date (5 May 2000) about the importance of the Grounds (a copy of this letter was not included in the bundle, but extracts from this letter were quoted in other documents):

The discussions currently revolve around the development of large new houses in the open countryside to the east and south east of the hall. Although we considered this open countryside to be an important part of the concept of the hall as viewed from the hall itself and from the countryside, its development has been considered to be the lesser of two evils. The alternative location for such development is part of the Wilderness Garden to the south west of the hall where existing vegetation would, to some extent, screen any new buildings and the new buildings would be close to the existing built-up village core.

Until now, the existing trees within this area have been considered to be of extreme importance with the Beech and Yew dominating the skyline of the village. The whole of the Wilderness Garden is the subject of an Area TPO. However several of the Beech have fallen naturally and almost all are extremely decayed and in need felling for safety reasons. The Yew tree roots are lifting and several of the Lime trees in the original avenue have fallen with more being suspect. The Wilderness Garden is rapidly becoming a series of large open glades with still further work to be done.

101. On 23 June 2000, English Heritage wrote to RBC stating that the Grounds just fell short of being included in the Register of Historic Parks and Gardens, but their importance as a designed ornamental landscape was such that they would urge RBC to consider any plans for its future development with this in mind.

102. On 30 June 2000, English Heritage responded to RBC with their initial thoughts about the possibility of an enabling development by David Wilson Homes. They recommended that further work needed to be done to establish whether an enabling development was justified.

103. On 22 June 2001, RBC write to English Heritage saying that David Wilson Homes' planning application had been withdrawn.

Mr and Mrs Whyte's interest in buying the Bunny Hall Estate.

104. Mrs Whyte in her witness statement says that Gotham Moor Farm was set in a beautiful country location, and she had moved there as it was within the catchment area of the school to which she wanted to send her son. Although the family had spent many happy years at Gotham Moor Farm, the house did not have character or historic architecture, in which she had a keen interest.

105. In 2000, Mr Whyte's business was doing well, and Mrs Whyte says that she decided that she would like to move to a larger home. She says she was looking for a Georgian property and through Savills, the estate agent, was shown "The Rectory" in Plumtree, for which she made an offer. However the purchase of The Rectory was dependent on the sale of Gotham Moor Farm, and before she could sell Gotham Moor Farm, the Rectory was sold to someone else.

106. At around this time, Savills mentioned that David Wilson Homes were considering selling Bunny Hall, although the Estate was not (yet) formally on the market. Mr and Mrs Whyte then visited Bunny Hall. Mrs Whyte describes the Hall as being boarded-up and in a dreadful condition, and they needed torches to look inside the building. The roof was leaking, floors had collapsed, there was no electricity and no heating, and the building was covered with mould, and she could see evidence of dry rot. She says that she later discovered that Bunny Hall was on English Heritage's "at risk" register.

107. In her witness statement Mrs Whyte says:

16. […] the property had retained many of its original features like fireplaces and I could see what a magnificent family home it could be. I fell in love with it and decided to buy it. I must admit this was not a rational but an emotional decision.

17. I understood that it would take a considerable amount of time to renovate and also at significant cost. I considered that it was going to be a "labour of love" which would satisfy my interest and passion in architecture but also be a beautiful home for my family to live in.

108. She said that did not know how she would finance the restoration work. She and her family would have to live in a small part of the Hall whilst the rest of the Hall would be slowly renovated as her finances allowed.

109. In her witness statement, Mrs Whyte says that as her knowledge was limited, she asked her husband to investigate the feasibility of her taking on the restoration of a Grade I listed building. Apparently it was during the course of Mr Whyte's discussions with RBC that the possibility of an enabling development first came to his attention and that RBC had also told Mr Whyte that David Wilson Homes had applied for consent to convert the Hall into four flats and build ten houses in the Grounds. Mrs Whyte's witness statement refers to English Heritage's letter of 29 June 2001 (see below) which warns that Mr Whyte should not assume that permission for an enabling development would be granted, but in her witness statement, she says that she would have gone ahead with the purchase of the Hall even if RBC and English Heritage had not consented to an enabling development. She confirmed this in the course of cross-examination, even though she had said that she did not know how the refurbishment work would have been financed.

110. There are inconsistencies between Mrs Whyte's witness statement and the documentary evidence on the one hand, and her oral evidence on the other. During the course of her oral evidence, she said that she and Mr Whyte had no knowledge of David Wilson Home's discussions with RBC and English Heritage about an enabling development until after she had bought the Hall, whereas in her witness statement, she says that RBC told Mr Whyte about David Wilson Home's application when they first raised the possibility of an enabling development with him:

20. During his discussions with RBC it was suggested to him by one of the people in the planning department that one of the potential ways of funding the renovations was to consider the possibility of obtaining planning permission within the grounds under strict requirements of Enabling Developments. It was my understanding that he also told my husband that a previous planning application for 10 dwelling houses and conversion of the hall into 4 flats had been submitted by David Wilson Homes, but it had not been accepted.

111. I note also that Mr Whyte's letter to RBC of 25 May 2001 refers to David Wilson Home's proposal to build 10 homes in the Grounds and convert the Hall into four units, and a letter from English Heritage to Mr Whyte of 29 June 2001 refers to a previous proposal to convert the Hall into four units.

112. Mrs Whyte says that she asked her husband to deal with the detailed negotiations and other discussions relating to the Hall renovations and the enabling development. Indeed, it is striking how the documentary evidence shows that it is Mr Whyte who drives forward the restoration of the Hall and the discussions and negotiations relating to the enabling development, virtually to the exclusion of Mrs Whyte - notwithstanding that Mrs Whyte in her evidence said that the restoration of the Hall was a "labour of love", and that she has an interest and passion for architecture. Whilst Mrs Whyte is a party to some of the contracts, it is clear from the correspondence that it was Mr Whyte who has been responsible for their negotiation. It is Mr Whyte who deals with, and corresponds with, the various professionals, RBC and English Heritage. It is Mr Whyte's firm, TFD, that is the main contractor for the renovation of the Hall and the construction of the houses on the six Plots, and it is Mr Whyte's firm that buys five of the six Plots. Mrs Whyte was cross-examined about her involvement with the professional team responsible for the renovation work, and her evidence was that she had no direct contact with them at any time. Her oral evidence was that prior to her purchase of the Estate she did not even discuss either the renovation of the Hall, nor the enabling development, with her husband. However, her husband had discussed the renovation work and the enabling development with her - but only after she had purchased the Estate. Her evidence was that she was not aware, for example, of the discussions that the architects (whom Mr Whyte had instructed on her behalf) had with RBC in March 2001 about the recreation of the Wilderness Garden and the development plan for new houses in the Grounds, and she was not aware of the invoices rendered by the architects to TFD for the work they did in respect of Bunny Hall prior to her purchase.

113. On the basis of the correspondence, I find that Henry Mein Partnership ("HMP") (a firm of architects) were instructed by Mr Whyte, on behalf of Mrs Whyte, and they met RBC. On 7 March 2001, HMP wrote to RBC enclosing "thoughts on a development plan to create six Plots and recreate the wilderness woodland" at the Bunny Hall Estate and asking for their comments and those of English Heritage. On the same day HMP wrote to Mr Whyte enclosing a copy of "our revised sketch 5218/SK2", which had been sent to RBC. I note that HMP (in their letter of 13 April 2010) state that at no time did they meet, correspond, or have any dealings with Mrs Whyte - at all times their only contact was Mr Whyte. It seems that HMP ceased to be instructed at some point, as some of the later plans for the Plots have "Roger Harrison Architects" stamped on them, and Mrs Whyte in the course of her evidence refers to a "Mr Burtenshaw" as being the architect (and it is Mr Burtenshaw of ADA Architects whose name appears as Mrs Whyte’s agent on the 21 November 2011 application for listed building consent for the works to the Hall, and on the 21 May 2002 application for planning permission for the enabling development).

114. Mrs Whyte's evidence was that she was not aware that the architects (or indeed any other professionals) had been instructed prior to her purchasing Bunny Hall, and when she was taken to any correspondence in the bundle between her husband on the one hand and professional advisors, RBC or English Heritage on the other, she denied ever having seen it. However, I find that HMP were instructed on her behalf prior to her purchase of Bunny Hall. The TFD work ledgers show fees payable to “Mein” (which I find is a reference to HMP) under the heading “Architect” on 29 June 2001 for £3309, which amount was wholly allocated in the ledgers to the infrastructure works on the new houses - in other words, the enabling development. In addition, English Heritage’s letter of 29 June 2001 is marked “cc Mr B Mills, Henry Mein Ptnrship”. Although not included in the bundle, there are references in schedules and correspondence to letters from HMP to Mr Whyte and to RBC dated 7 March 2001 about a plan to create six plots, and to another letter dated 17 April 2001 about the funding of essential repairs to the Hall by the generation of additional plots within the Grounds. I therefore find that HMP were instructed to undertake architectural work in relation to the enabling development prior to Mrs Whyte’s purchase of the Estate.

115. On 28 March 2001, GG&P (UK) Limited ("GG&P"), a firm of quantity surveyors, wrote to Mr Whyte with a fee proposal headed "Bunny Hall" relating to a site visit and provision of copies of a "bound document for grant submission purposes".