Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Blackrock Holdco 5 LLC v Revenue & Customs (NCOME TAX/CORPORATION TAX - Acquisition of Barclays Global Investors) [2020] UKFTT 443 (TC) (03 November 2020)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2020/TC07920.html

Cite as: 23 ITL Rep 323, [2020] UKFTT 443 (TC), [2021] SFTD 267, [2020] STI 2344

[New search] [Contents list] [Printable PDF version] [Help]

[2020] UKFTT 443 (TC)

INCOME TAX/CORPORATION TAX - Acquisition of Barclays Global Investors - Loan notes issued to parent company to finance investment - Whether loans would have been on the same terms and in the same amounts if between independent enterprises - If not, would independent enterprises have entered into the loans - Whether ‘main purpose’ of loan relationship was to secure a tax advantage - If so, what was the amount of any debit attributable to such a purpose - Appeal allowed

|

FIRST-TIER TRIBUNAL TAX CHAMBER |

|

Appeal number: TC/2017/08836 |

BETWEEN

|

|

blackrock holdco 5 llc |

Appellant |

-and-

|

|

THE COMMISSIONERS FOR HER MAJESTY’S REVENUE AND CUSTOMS |

Respondents |

|

TRIBUNAL: |

JUDGE BROOKS |

Kevin Prosser QC and David Yates QC, instructed by Simmons & Simmons LLP, for the Appellant

David Ewart QC and Sadiya Choudhury, instructed by the General Counsel and Solicitor to HM Revenue and Customs, for the Respondents

DECISION

Introduction

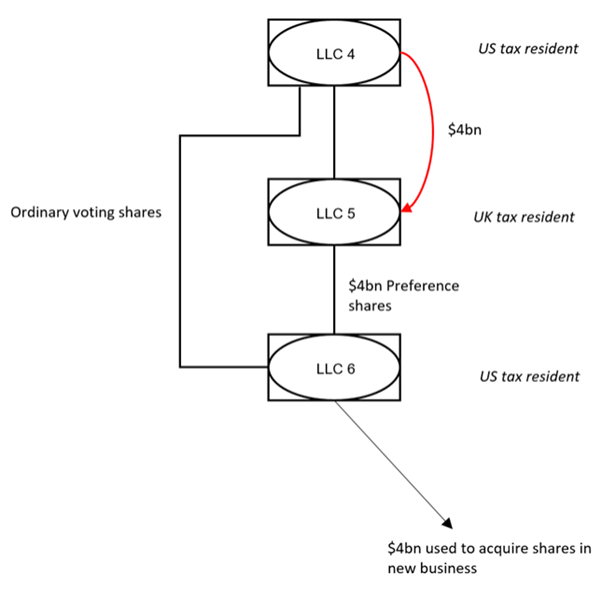

1. BlackRock Holdco 5 LLC (“LLC5”) appeals against closure notices issued by HM Revenue and Customs (“HMRC”) amending its company tax returns for the accounting periods ended 30 November 2010 to 31 December 2015, inclusive. The amendments to the returns disallow the deduction by LLC5 of loan relationship debits in respect of the interest payable (the “Interest”) on, and other expenses relating to, $4 billion worth of loan notes (the “Loans”) issued by LLC5 to its parent company, BlackRock Holdco 4 LLC (“LLC4”).

2. The parties have agreed that the following issues arise in this appeal:

(1) For each relevant accounting period, was a main purpose of LLC5 being a party to the loan relationships with LLC4 to secure a tax advantage for LLC5 or any other person?

(2) Insofar as securing a tax advantage was a main purpose of LLC5 for any relevant accounting period, what amount of any debit is attributable to such a purpose on a just and reasonable apportionment?

(3) Whether the Loans between the LLC5 and LLC4 differ from those which would have been made between independent enterprises, taking account of all relevant information, including:

(a) Would the parties have entered into the loans on the same terms and in the same amounts if they had been independent enterprises?

(b) If the answer to question (a) is negative, would they, as independent enterprises, have entered into the loans at all, and if so, in what amounts, at what rate(s) of interest, and on what other terms?

Issues 1 and 2 are described as the “Unallowable Purpose Issue” and Issue 3, the “Transfer Pricing Issue.

3. LLC5 was represented by Kevin Prosser QC and David Yates QC. David Ewart QC and Sadiya Choudhury appeared for HMRC. While I am grateful for their clear and helpful submissions, both written and oral which I have carefully considered, in reaching my conclusions I have not found it necessary to refer to each and every argument advanced on behalf of the parties.

facts

4. The parties produced the following Statement of Agreed Facts (“SOAF”):

Background

(1) LLC5 is a limited liability company incorporated and registered in the State of Delaware.

(2) LLC5 is resident for tax purposes in the UK and registered for corporation tax.

(3) LLC5 is a member of a group of companies ultimately owned by BlackRock, Inc. (the “BlackRock Group”), a publicly owned and traded company incorporated and resident in the United States of America.

(4) In December 2009, the BlackRock Group undertook the acquisition of the worldwide Barclays Global Investors business (“BGI”). The dispute with HMRC arises out of the way that the acquisition of the US part of the BGI business (“BGI US”) was structured.

Acquisition of BGI US

(5) On 16 September 2009 the following new limited liability companies were registered in the State of Delaware:

(a) LLC4;

(b) LLC5; and

(c) BlackRock Holdco 6 LLC (“LLC6”).

(6) On 30 November 2009:

(a) BlackRock Financial Management Inc., an indirectly owned subsidiary of BlackRock Inc, incorporated in Delaware and tax resident in the US (“BFM”), executed the Limited Liability Company Agreement of LLC4 as its sole member. LLC4 elected to be a disregarded entity for US tax purposes with the result that the interest accruing to it under these arrangements was not taxed in the US;

(b) LLC4 executed the Limited Liability Company Agreement of LLC5 as its sole member; and

(c) LLC4 and LLC5 executed the Limited Liability Company Agreement of LLC6.

(7) On 1 December 2009:

(a) BFM entered into a Contribution Agreement with LLC4, pursuant to which BFM contributed $2,252,590,706 in cash and 37,566,771 shares in BlackRock, Inc. (the “BRI Shares”) to LLC4.

(b) LLC4 entered into a Contribution and Issue Agreement with LLC5, pursuant to which LLC 4 contributed $2,144,788,229 in cash and the BRI Shares to LLC5 in return for 100 ordinary shares in LLC5 and the issue by LLC5 of the loan notes listed below (the “Loan Notes”).

The Loan Notes

(i) Tranche 1 - a short term loan note in the amount of $420,000,000, repayable 26 November 2010, with interest of 2.2% (the “Short Term Loan Note”);

(ii) Tranche 2 - a quoted Eurobond in the amount of $1,680,000,000, repayable 30 September 2014, with interest of 4.65%;

(iii) Tranche 3 - a quoted Eurobond in the amount of $1,400,000,000, repayable 30 September 2016, with interest of 5.29%; and

(iv) Tranche 4 - a quoted Eurobond in the amount of $500,000,000, repayable 30 September 2019, with interest of 6.62%,

(c) LLC4 entered into a Contribution Agreement with LLC6, pursuant to which LLC4 contributed $107,802,477 in cash to LLC6 in return for the issue of 100,000 common shares in LLC 6 (the “LLC 6 Common Shares”).

(d) LLC5 entered into a Contribution Agreement with LLC6, pursuant to which it contributed $2,144,788,229 in cash and the BRI Shares to LLC6 in return for the issue of 2,400,000 preferred shares in LLC6 (the “LLC 6 Preference Shares”).

(e) LLC6 completed the acquisition of BGI US by acquiring all of the outstanding shares in Delaware Holdings Inc from BGI for $2,252,590,706 and the BRI Shares.

The LLC6 Common and Preference Shares

(8) The LLC6 Limited Liability Company Agreement contained the following provisions regarding the LLC6 Common Shares and LLC6 Preference Shares (capitalised terms are as defined in that Agreement):

(a) Common and Preference share-holders had the right to attend and vote at meetings and the shares possessed voting power for the election of Board Members and for all other purposes under the Delaware Limited Liability Company Act or the LLC6 Limited Liability Company Agreement. Common Shareholders were entitled to 216 votes for each Common Share. Preference Shareholders were entitled to 1 (one) vote for each Preference Share. (sections 5.2(d) and 5.3(d)).

LLC5 had a total of 2,400,000 votes by virtue of its LLC6 Preference Shares. LLC4 had a total of 21,600,000 votes by virtue of its LLC6 Common Shares.

(b) The LLC6 Board of Managers (the “LLC6 Board”) with the approval of all Members could establish different classes of shares (section 5.1). The number of preference shares could be increased by unanimous vote of the holders of all Shares (section 5.3 (c)).

(c) Section 6.1 stated that the Board would determine in its sole and absolute discretion the amount of Available Assets that were available for distribution and the amount, if any, of such Available Assets to be distributed to Members in accordance with the following order of priority:

(i) A total annual distribution of $300 per Preference Share (section 6.1(a)).

(ii) A total annual distribution of $20 per Common Share, but no Common Dividend to be made unless and until all Preference Dividends for such period had been paid (section 6.1 (b)).

(iii) Any unpaid amounts of either Preference or Common Dividends would be carried forward. Interest on any sum accrued but unpaid would accrue from 30 November of the year in which payment was due (sections 6.1(c) to (e)).

The Loan Notes

(9) On 15 March 2010, Tranches 2, 3 and 4 of the Loan Notes were admitted to the Official List of the Cayman Islands Stock Exchange.

(10) On or around 24 September 2010, LLC5 received a distribution of US$162,100,000 from LLC6. On 24 September 2010, LLC5’s Board of Managers (the “LLC5 Board”) approved a payment to LLC4 of $162,100,000 in settlement of interest accrued on Tranches 2, 3 and 4 of the Loan Notes. The payment was funded by the distribution from LLC6.

(11) On 26 November 2010:

(a) The Limited Liability Company Agreement of LLC6 was amended and restated to re-classify the 2,400,000 LLC6 Preference Shares held by LLC5 into 131,356 senior preference shares (the “LLC6 Senior Preference Shares”) and 2,268,644 junior preference shares.

(b) LLC4 entered into a sale and purchase agreement with LLC5 to acquire the LLC6 Senior Preference Shares on 26 November 2015 for $420,000,000 (the “Prepaid Forward Contract”). The Prepaid Forward Contract gave the Appellant the option to settle the Contract in cash; and

(c) The obligation for LLC4 to pay LLC5 $420,000,000 for the LLC6 Senior Preference Shares was offset against the Appellant’s obligation to repay the Short Term Loan Note.

(12) On 30 March and 23 September 2011, LLC5 approved and made further payments of interest that had accrued on Tranches 2, 3 and 4 of the Loan Notes.

(13) During 2012, the BlackRock Group was uncertain about the tax consequences of LLC6 paying a dividend and LLC 6 delayed making distributions to LLC5 until that uncertainty was resolved. LLC5 obtained alternative funding to service the interest payable to LLC4 in March 2012 on Tranches 2, 3 and 4 of the Loan Notes. On 31 March 2012, LLC5 entered into a loan agreement with LLC6, pursuant to which LLC6 loaned $92,640,000 to LLC5 (the “March 2012 Loan Agreement”). LLC5 used these funds to make the interest payments due on Tranches 2, 3 and 4 of the Loan Notes.

(14) In September 2012, LLC4 agreed to reduce the interest rates payable in respect of Tranches 2, 3 and 4 of the Loan Notes. The interest rates applicable to Tranches 2, 3 and 4 of the Loan Notes with effect from 1 October 2012 were as follows:

(a) Tranche 2: 3.08% per annum

(b) Tranche 3: 3.5% per annum

(c) Tranche 4: 4% per annum.

(15) In consideration of the reduction in the applicable interest rates on Tranches 2, 3 and 4 of the Loan Notes, the Appellant issued a short term promissory note to LLC4 in the sum of US$6,265,000.

(17) At a board meeting on 8 November 2012, the LLC5 Board resolved to approve, ratify and confirm the March 2012 Loan Agreement and the September 2012 Loan Agreement. The minutes of the 8 November 2012 meeting and the loan document that was presented to the LLC5 Board described the amount of the September 2012 Loan as $93,140,256. However, the amount of the September 2012 Loan as advanced by LLC6 to the Appellant and recorded in the Appellant’s accounts was $92,728,008.

(18) In March and September 2013 and 2014, the Appellant made further payments to LLC4 in respect of interest that had accrued on Tranches 2, 3 and 4 of the Loan Notes. LLC5 funded these payments with dividends received from LLC6 in March and September 2013.

(19) Between September 2013 and June 2015, LLC5 made payments to LLC4 in accordance with the terms of the Limited Liability Company Agreement of LLC5. The details of those payments were as follows:

(a) In September 2013, a payment of $91,080,637;

(b) In December 2013, a payment of $184,950,255;

(c) In March 2014, a payment of $193,102,398;

(d) In June 2014, a payment of $237,840,114;

(e) In September 2014, a payment of $228,484,185;

(f) In December 2014, a payment of $269,889,965;

(g) In March 2015, a payment of $281,023,356; and

(h) In June 2015 a payment of $197,990,535.

(20) LLC5 funded these payments with dividends received from LLC6.

(21) Tranche 2 of the Loan Notes was refinanced in on or around its maturity date of 30 September 2014.

(22) In September 2015, LLC5 settled the Prepaid Forward Contract with a cash payment to LLC4 of $504,731,053.

Loan relationship debits claimed by the Appellant

(23) LLC5 has filed company tax returns for accounting periods ending 30 November 2010 to 31 December 2015.

(24) In computing its profits chargeable to corporation tax for the purpose of its tax returns, LLC5 took into account non-trading loan relationship debits to reflect the finance expenses that it had incurred in connection with the Loan Notes and the Prepaid Forward Contract in the periods to which the returns related (the “NTLR Debits”).

(25) When it first filed returns for the accounting periods ending 30 November 2010, 31 December 2010, 31 December 2011 and 31 December 2012, LLC5 did not record NTLR Debits in its returns in relation to all of the finance expenses as the Appellant applied the provisions of Part 7 of the Taxation (International and Other Provisions) Act 2010 (“TIOPA”).

(26) The NTLR Debits that LLC5 initially recorded on its returns for the accounting periods ending 30 November 2010, 31 December 2010, 31 December 2011 and 31 December 2012 may be summarised as follows:

|

|

30-Nov-10 |

31-Dec-10 |

31-Dec-11 |

31-Dec-12 |

|

|

$ |

$ |

$ |

$ |

|

LLC5 finance expense ($) |

194,520,000 |

16,915,072 |

197,639,405 |

217,012,641 |

|

TIOPA Pt 7 disallowance ($) |

(169,639,999) |

(15,440,001) |

(186,280,000) |

(169,360,148) |

|

Deduction claimed ($) |

24,680,001 |

1,475,071 |

12,359,405 |

47,652,493 |

|

FX rate USD to GBP per filed return |

1.55101989 |

1.55821346 |

1.603426 |

1.585025 |

|

|

|

|

|

|

|

|

30-Nov-10 |

31-Dec-10 |

31-Dec-11 |

31-Dec-12 |

|

|

GBP |

GBP |

GBP |

GBP |

|

LLC5 finance expense (£) |

125,414,252 |

10,855,427 |

123,260,696 |

136,914,333 |

|

TIOPA Pt & disallowance (£) |

(109,502,141) |

(9,908,784) |

(115,552,573) |

(106,850,143) |

|

Deduction claimed (£) |

15,912,111 |

946,642 |

7,708,123 |

30,064190 |

(27) At a meeting on 22 April 2013, BlackRock presented a paper to HMRC stating that it was now their view that the ‘gateway test’ in section 264(2)(c) TIOPA 2010 operated so that the provisions of Part 7 of TIOPA 2010 did not apply. BlackRock’s position was based on the way that the gateway test applied to treat returns on fixed income securities that were payable by BlackRock Life Limited to its policy holders as a ‘relevant liability’ for the purpose of calculating the ‘worldwide gross debt’ of the BlackRock Group.

(28) Following further correspondence, HMRC accepted BlackRock’s position in a letter dated 15 January 2014 and asked for gateway test calculations and revised computations detailing the interest deductions that were now being claimed. In late 2015, the Appellant therefore filed amended returns for the accounting periods ending 30 November 2010, 31 December 2010, 31 December 2011 and 31 December 2012 to reflect that there was in fact no disallowance of the NTLR Debits required by Part 7 of TIOPA 2010.

(29) The full amount of the NTLR Debits that the Appellant has claimed through these amended returns and the original returns that it filed for the accounting periods ending 31 December 2013 to 31 December 2015 may be summarised as follows:

|

|

30-Nov-10 |

31-Dec-10 |

31-Dec-11 |

31-Dec-12 |

|

|

$ |

$ |

$ |

$ |

|

LLC5 finance expense ($) |

194,520,000 |

16,915,072 |

197,639,405 |

217,012,641 |

|

TIOPA Pt 7 disallowance ($) |

0 |

0 |

0 |

0 |

|

Deduction claimed ($) |

194,520,000 |

16,915,072 |

197,639,405 |

217,012,641 |

|

FX rate USD to GBP per filed return |

1.55101989 |

1.5582135 |

1.603426 |

1.585025 |

|

|

|

|

|

|

|

|

30-Nov-10 |

31-Dec-10 |

31-Dec-11 |

31-Dec-12 |

|

|

GBP |

GBP |

GBP |

GBP |

|

LLC5 finance expense (£) |

125,414,252 |

10,855,427 |

123,260,696 |

136,914,333 |

|

TIOPA Pt & disallowance (£) |

0 |

0 |

0 |

0 |

|

Deduction claimed (£) |

125,414,252 |

10,855,427 |

123,260,696 |

136,914,333 |

|

|

30-Nov-13 |

31-Dec-14 |

31-Dec-15 |

Total |

|

|

$ |

$ |

$ |

$ |

|

LLC5 finance expense ($) |

139,337,886 |

128,243,284 |

138,688,610 |

1,032,356,878 |

|

TIOPA Pt 7 disallowance ($) |

0 |

0 |

0 |

0 |

|

Deduction claimed ($) |

139,337,886 |

128,243,284 |

138,688,610 |

1,032,356,878 |

|

FX rate USD to GBP per filed return |

1.564235 |

1. 647604 |

1.528227 |

|

|

|

|

|

|

|

|

|

30-Nov-13 |

31-Dec-14 |

31-Dec-15 |

Total |

|

|

GBP |

GBP |

GBP |

GBP |

|

LLC5 finance expense (£) |

89,077,323 |

77,836,230 |

90,751,315 |

654,109,576 |

|

TIOPA Pt & disallowance (£) |

0 |

0 |

0 |

|

|

Deduction claimed (£) |

89,077,323 |

77,836,230 |

90,751,315 |

654,109,576 |

HMRC enquiries

(30) Between 2012 and the date on which LLC5 lodged the appeal HMRC issued notices of enquiry into each of the Returns (the “Enquiries”) as follows:

|

Return period ending |

Date of Enquiry notice |

|

30 November 2010 |

29 March 2012 |

|

31 December 2010 |

29 March 2012 and 29 November 2012 |

|

31 December 2011 |

16 December 2013 |

|

31 December 2012 |

26 November 2014 |

|

31 December 2013 |

23 December 2015 |

|

31 December 2014 |

14 November 2016 |

|

31 December 2015 |

20 July 2017 |

(31) HMRC has issued notices of completion of its Enquiries (the “Closure Notices”) as follows:

|

Return period ending |

Date of Closure Notice |

|

30 November 2010 |

22 November 2016 |

|

31 December 2010 |

22 November 2016 |

|

31 December 2011 |

22 November 2016 |

|

31 December 2012 |

22 November 2016 |

|

31 December 2013 |

22 November 2016 |

|

31 December 2014 |

22 November 2016 |

|

31 December 2015 |

16 August 2017 |

(32) For each of the returns, the Closure Notices concluded that “no amount of the interest payable or the finance charges/or the payment to vary the terms of loan notes/or the other finance costs [by LLC5 in respect of the Loan Notes in the return period] is deductible for UK tax purposes and no amount may be included within the non-trade deficits arising on loan relationships as recorded on the company tax return for the period.” Each closure notice was accompanied by a Commissioners’ sanction under section 208 of TIOPA 2010.

(33) The schedule to each Closure Notice set out the amendments that the Appellant was required to make to the corresponding Return in order to give effect to the conclusions stated in the Closure Notice (the “Amendments”) as follows:

“Non-trade deficits arising £0

Non-trade deficits maximum available for surrender as group relief £0”

(34) HMRC reached its conclusions and made the Amendments on the basis that:

(a) The NTLR Debits are attributable in full to loan relationships that have an unallowable purpose within the meaning of section 441 of Corporation Tax Act 2009; and

(b) Alternatively, the loan relationships that gave rise to the NTLR Debits are provisions within the scope of section 147 of Taxation (International and Other Provisions) Act 2010 and those provisions differ from the arm’s length provisions that would have been made between independent enterprises.

Appeals against the Amendments

(35) LLC5 has submitted the following appeals to HMRC challenging the Amendments:

(a) On 9 December 2016, an appeal against the Amendments to the Returns for the accounting periods ending 30 November 2010 to 31 December 2014; and

(b) On 17 August 2017, an appeal against the Amendment to the Return for the accounting period ending 31 December 2015.

(36) On 20 November 2017, LLC5 lodged the present appeal proceedings against the Amendments.

Evidence and further findings of fact

5. In addition to the SOAF, I was provided with 12 lever arch files of documentary evidence. I also heard from the following witnesses of fact in support of LLC5:

(1) Nigel Fleming, who at the material time, as EMEA (Europe, Middle East and Africa) Head of Tax for the BlackRock Group, had been responsible for both product tax and corporate tax matters which included determining tax strategies and managing how the EMEA Group Structure fitted into the wider Group Strategies. Before joining the BlackRock Group Mr Fleming had been employed by Ernst and Young (“EY”), which he joined in 1987, where he was engaged in various roles in different jurisdictions. He attended the meeting (described below) of the board of managers of LLC5 on 30 November 2009; and

(2) J Richard Kushel, the Head of Multi-Asset Strategies and Global Fixed Income for BlackRock. He is a member of the BlackRock Group’s Global Executive Committee, the highest level management body in the BlackRock Group, and a member of the Global Operating Committee. He was Chairman of the BlackRock Group’s international business from February 2009 to August 2010. This role was classified as all business outside of the USA and Canada, which required him to move to London. He was resident in the UK between February 2009 and June 2011. Early in 2009 he was approved by the Financial Conduct Authority (“FCA”) to serve as Chief Executive (Controlled Function 3) of an FCA authorised firm. Whilst Chairman of the international business Mr Kushel served as Chair of the boards of a number of BlackRock entities in the UK including BlackRock Investment Management (UK) Limited, the principal UK investment management company. He was formally appointed to the board of LLC5 on 30 November 2009 and presided, as chairman, of its board meeting on the same date.

I found both Mr Fleming and Mr Kushel to be credible, truthful witnesses who at all times sought to assist the Tribunal.

6. Although HMRC did not call any witnesses of fact, both parties, with the permission of the Tribunal, relied on expert evidence in relation to the Transfer Pricing Issue. Timothy Ashley, of Centrus Financial Advisors Limited, for LLC5, and Simon Gaysford, of Frontier Economics Limited, for HMRC. Their evidence is considered below in relation to the Transfer Pricing Issue.

Approach to the evidence

7. In Gestmin SGPS SA v Credit Suisse (UK) Ltd & Anor [2013] EWHC 3560 (Comm) Leggatt J (as he then was) observed:

19. The process of civil litigation itself subjects the memories of witnesses to powerful biases. The nature of litigation is such that witnesses often have a stake in a particular version of events. This is obvious where the witness is a party or has a tie of loyalty (such as an employment relationship) to a party to the proceedings. Other, more subtle influences include allegiances created by the process of preparing a witness statement and of coming to court to give evidence for one side in the dispute. A desire to assist, or at least not to prejudice, the party who has called the witness or that party's lawyers, as well as a natural desire to give a good impression in a public forum, can be significant motivating forces.

8. However, in Kogan v Martin & Ors [2019] EWCA Civ 1645 Floyd LJ, giving the judgment of the Court of Appeal, said:

9. Taking such an approach, as there is little between the parties in relation to the facts, I make the following additional findings of fact to expand on those as set out in the SOAF to hopefully provide a better understanding of the circumstances of the case.

Background

10. On 11 June 2009 the following press release was issued:

“New York, June 11 June 2009, BlackRock Inc announced it had executed a purchase agreement to acquire Barclays Global Investors, BGI, including its market-leading ETF platform, iShares, from Barclays Plc. The combination of BlackRock and BGI would bring together market leaders in active indexed strategies to create the preeminent asset management firm operating under the name BlackRock Investors. …

As one, BlackRock and BGI will have a world class product offering greater solutions-centred approach to retail and institutional clients. BGI’s record of product innovation, risk analytics and leadership in quantitative investing, indexing and retirement solutions will complement BlackRock’s expertise in active fund management, tailored solutions, innovative culture and risk management by our BlackRock’s solutions.

The firm’s products will include equity’s fixed income, cash management and alternatives, and will offer clients diversified access to global markets thorough separate accounts, common trust funds, mutual funds ETFs, hedge funds and closed ended funds.

The ability to offer BlackRock’s global mutual funds alongside iShares will create an unmatched ability to tailor portfolios for retail investors. iShares is the industry leading ETF platform with over $300 billion of assets under management in more than 350 funds worldwide. iShares is a rapidly growing business ranking among the top three selling mutual fund and ETF families for the last three years.

…

We are incredibly excited about the potential to significantly expand the scale and scope of our work with investors throughout the world. The combination of active and passive investment products will be unsurpassed, and will enhance our ability to offer comprehensive solutions and tailored portfolios to duties and retail clients, said Laurence D Fink, BlackRock Chairman and CEO.”

The announcement also explained that,

“Under the terms of the transaction BlackRock would acquire BGI in exchange for 37.8 million shares and common equivalents in BlackRock and $6.6 billion of case. The shares would represent a 4.9% voting interest and an aggregate of 19.9% economic interest in the combined firm which will be renamed BlackRock Global Investors.”

11. The acquisition of BGI by the BlackRock Group was described by The New York Times, on 11 June 2009, as “one of the largest deals in the money management industry, creating a juggernaut with nearly $3 trillion in assets”. Ten years later, on 11 June 2019, Pensions and Investments quoted Daniel Sondhelm, CEO of Sondhelm Partners who described the BlackRock-BGI deal as “a game changer”. Its significance was also recognised by Asset Management which, on 13 June 2019, described the transaction as having been a “once in a lifetime” deal.

12. I should remind myself at this point that, although the purchase agreement to which the press release referred related to the acquisition of BGI generally, this appeal concerns only the acquisition by the BlackRock Group of BGI US which was achieved by acquisition of the outstanding equity interests in Delaware Holdings. All subsequent references to BGI are, unless otherwise stated, to BGI US.

13. Perhaps not surprisingly, there had been much discussion as to the structure of this acquisition before the agreement was executed on 1 December 2009. Mr Fleming said that he first became aware of the BlackRock Group’s intention to acquire BGI from Barclays around May 2009. He explained that it was common practice within the BlackRock Group (and in his experience other global organisations) to delegate primary responsibility for framing capital transaction structures to the Corporate Tax Group. This was because, given the complex and global nature of the BlackRock Group, the Corporate Tax Group is the best placed function within the BlackRock Group to suggest the means through which movements of capital should be achieved while not falling foul of any unintended or inefficient tax consequences drawing on external professional advice where appropriate. At the time of the BGI acquisition EY was BlackRock’s principal external tax adviser.

14. The first discussion between BlackRock’s Corporate Tax Group and EY in relation to the structure of the BGI acquisition took place on 12 June 2009. On 27 June 2009 Mr Harris Horowitz, the Global Head of Tax for the BlackRock Group, in an email asked EY to consider:

“Where should [BlackRock] do debt push downs?”

Mr Fleming explained that the concept of a debt push down involves taking a debt incurred for the purpose of an acquisition and “pushing” it down through the holding structure of the acquisition vehicle or an intermediate holding company making intercompany loans, something that had been utilised by the BlackRock Group on the advice of EY in connection with the acquisition of Merrill Lynch Investment Managers in 2006.

15. EY had been given, what Mr Fleming described as, a “very broad remit” to consider the whole structure of the acquisition of BGI taking into account a wide range of options. Mr Fleming understood that EY had initially suggested that BGI should be acquired through a UK resident entity taking on intercompany debt to take advantage of the “generous tax regime for interest deductions” operating at that time. He explained that he was already aware of the concept of including a UK resident entity in an otherwise US resident holding structure having previously discussed the possibility with HMRC and the then Financial Secretary to the Treasury, Stephen Timms MP, in connection with the “worldwide debt cap” rules subsequently introduced by Part 7 of TIOPA to limit the extent to which UK tax deductions can be claimed for finance expenses incurred on loan relationships entered into between group companies.

16. However, rather than a UK limited company the decision was taken “relatively quickly” for BGI to be acquired by a US limited liability company (“LLC”) that was UK resident. Mr Fleming believed that this change was because of potential changes to the US “check the box” regulations that were anticipated to operate so that non-US corporations would no longer be eligible to make an entity classification election and, if the change had come into effect, would have resulted in significant adverse US tax consequences which, if BGI had been held through a UK limited company, would have broken the US consolidated group. Although Mr Fleming understood it was possible that any amendment to the “check the box” regulations may have applied to a UK resident LLC, the risk was perceived to be much smaller.

17. Mr Fleming also recalled that there may have been some concerns as to whether the US financial regulator, the Office of the Comptroller of the Currency (“OCC”) would have been “comfortable” with BGI being held through a UK limited company but was unable elaborate further.

18. In an email dated 24 July 2009 to John D Hamilton, of BlackRock’s Corporate Tax Group New York whose responsibility included international tax globally including for the USA, Mr Fleming wrote:

“JD as discussed some thoughts and talking points on the use of a US LLC resident for UK tax purposes in the UK, to acquire non-UK companies such as the US bank [ie BGI] …

Risk Rating Issues

HMRC will likely view the transaction as being aggressive, which may lead them to: (1) revisit out low risk rating; (2) seek other issues to challenge us on; (3) seek every means possible to challenge the structure itself including:

· a more difficult thin cap negotiation.

· Para 13(generally accepted to be toothless, but will need to ensure we don’t create adverse evidence of intent.

…

Law Change Risk - I am somewhat wary that a “super-para 13” rule might get introduced (better grafted than toothless para 13). This was shelved by HMT/HMRC at the beginning of this year, but may come back on the table in coming years. This means that getting an arb clearance (where HMRC would have accepted that the allowed debt did not have a UK tax avoidance purpose) might be very valuable in the future.”

19. As is apparent from the email, Mr Fleming had some reservations as to how HMRC might regard the transaction. He explained that the reference to “para 13” in the email was to paragraph 13 of Schedule 9 to the Finance Act 1996 (now s 441 of Corporation Tax Act 2009). As for it being “toothless” Mr Fleming explained that it was generally accepted that paragraph 13 was intended to apply to situations where loan relationships were entered into specifically for the purpose of generating tax deductible finance expenses without any other commercial purpose, and that it was not intended to apply in situations where the debt was used to finance a bona fide commercial transaction. He considered that the accepted view was that if the borrowing party to a loan relationship was using the funds raised from the loan relationship for a commercial purpose, that commercial purpose, and not any related tax considerations, was taken as the main purpose for entering into the loan relationship for the purpose of applying paragraph 13.

20. Mr Fleming also explained that by “super-para 13” he was referring to a possible extension of the scope of paragraph 13 to include the situation where a taxpayer used borrowed funds to make a bona fide commercial investment but whose decision to take on the debt might have been influenced by tax considerations which could be considered to be a “main purpose” for entering into the loan relationship notwithstanding the genuinely commercial use of the funds raised. Such a possibility had been raised by a Treasury/HMRC document, The Taxation of Foreign Profits of Companies dated 21 June 2007 and discussed in the 10 September 2007 edition of the Tax Journal. However, the proposal was not implemented.

21. By late July 2009 the Corporate Tax Group was discussing the specific implications of the acquisition model, including any potential challenges that might be raised by HMRC or internal BlackRock Group stakeholders who would scrutinise any capital transaction from a corporate governance perspective. At that time it was envisaged that BGI would be acquired by the newly established UK resident LLC which itself would be wholly owned by a newly established US resident LLC. The newly established US resident LLC was to be wholly owned by BFM.

22. This is apparent from the following extracts from an EY memorandum of 29 July 2009:

“Proposed Acquisition Structure for BGI US - UK Tax Discussion Paper

…

Transaction description

1. A US entity, BFM incorporates two US Limited Liability Companies, (“LLC1”) and (“LLC2”) [ie the appellant in this case, LLC5], which will be by default disregarded for US Federal Tax purposes. LLC2 will be UK tax resident by virtue of its central management and control taking place in the UK.

2. BR Inc contributes BT Inc stock and makes a loan to BFM

3. BFM contributes the BR Inc stock and contributes cash to LLC1. LLC1 contributes BR Inc stock and makes a loan to LLC2 (“Loan 1”).

4. LLC2 uses the BR Inc stock and the Loan 1 proceeds to acquire the BGI US entities from Barclays Plc.

The Transaction expresses diagrammatically is shown in Appendix 1 [not reproduced].

Assumptions

…

4. The directors of LLC2 have sufficient experience to determine the merits of acquiring BGI US and the appropriate funding for such an acquisition.

Executive Summary

The expected summary UK tax consequences of the transaction to fund the acquisition of BGI US are:

1. The that the interest on Loan 1 should be deductible for UK tax purposes, subject to thin capitalisation and transfer pricing limits.

2. The ‘loans for an unallowable purpose’ provisions should not apply on the basis that LLC2 is making a third party acquisition, at fair market value, after due consideration by its appropriately qualified board of directors.”

23. The EY memorandum then set out an analysis of the UK tax position which considered, transfer pricing, loans for an unallowable purpose, avoidance using arbitrage, worldwide debt cap, controlled foreign companies, dividend exemption and substantial shareholding exemption. In relation to ‘unallowable purpose’ it notes that:

“On the assumption that the directors of LLC2 have sufficient expertise and experience to appraise the acquisition of BGI US, it should be clear that the purpose of loan one is to fund that acquisition as opposed to secure an advantage.

The directors of LLC2 will be acquiring BGI US from a third party for fair value with a mixture of debt and equity. The debt being a loan one, will be no more than a third party will amend as supported by a transfer pricing Thin Cap report. In such a case the interest expense on loan one, which causes a tax advantage, as defined, to arise, should properly be described as no more than an incidence of the borrowing”

24. However, because of anticipated reservations that the OCC might have about a UK resident entity controlling a US bank, UK Treasury consent rules and concerns around the UK controlled foreign companies (“CFC”) rules, it was decided to introduce a third LLC into the holding structure. An email of 14 August 2009 to Robert Connelly at Skadden Arps Slate Meagher and Flom (“Skadden”) external lawyers to the BlackRock Group in the USA, from Mr Hamilton, after setting out the structure of the transaction under the sub-heading ‘Objectives’ explained:

“The split ownership of the new LLC3 is intended to prevent the BGI US Group from being considered controlled foreign corporations for UK tax purposes. Although we think CFC status would be a manageable issue, there is little passive income in the group and it will be preferable to avoid as the cost/effort of future management and reporting would be reduced.”

25. The “new LLC3” referred to in that document was LLC6. Its ownership was split between LLC4 and LLC5.

LLC6 Agreement

26. Although elements of the LLC6 Agreement are summarised in the SOAF (see paragraph 4, above) a consideration of some of the provisions of the LLC6 Agreement, described by Mr Prosser as “effectively the constitutional document, like the memorandum and articles, for LLC6”, which sets out the share capital in LLC6 held by LLC4 and LLC5, provides further useful background to the transaction.

27. Article V of the Agreement is headed “Capital, Structure and Contributions”. Relevant sections provide:

“Section 5.1 Share Capital. The capital structure of the Company shall initially consist of two classes of shares, a class of common shares (“Common Shares”) and a class of preferred shares (“Preference Shares” and, together with the Common Shares, the “Shares”); provided, that the Board, with the approval of all of the Members, may establish additional classes of shares. Each of the Common Shares shall be identical and each of the Preference Shares shall be identical. No Shares shall be redeemable except as otherwise provided herein.

Section 5.2 Common Shares

(a) The Common Shares of the Company shall be represented by the number of Shares issued initially to Member A by the Company.

(b) Each of the Common Shares shall have a par value of $0.01 per share and the consideration paid for each Common Share shall not be less than its par value.

(c) Authorized Common Shares. The aggregate number of Common Shares the Company shall have authorized to issue is 100,000, subject to increase by amendment of this Agreement by unanimous vote of the holders of Common Shares outstanding at the time.

(d) Common Share Voting Rights. Common Shareholders shall have the right to attend and vote at Member meetings and shall possess voting power for the election of Board Members and for all other purposes under the Act or this Agreement. Each Common Shareholder shall be entitled to two hundred sixteen (216) votes for each Common Share standing in the Common Shareholder’s name on the books and records of the Company on the record date established for such vote.

…

Section 5.3 Preference Shares

(a) the Preference Shares of the Company shall be represented by the number of Shares issued initially to Member A by the Company.

(b) Each of the Preference Shares shall have a par value of $0.01 per share and the consideration paid for each Preference Share shall not be less than its par value.

(c) Authorized Preference Shares. The aggregate number of Preference Shares the Company shall have authorized to issue is 2,400,000, subject to increase by amendment of this Agreement by unanimous vote of the holders of all Shares outstanding at the time.

(d) Preference Share Voting Rights. Preference Shareholders shall have the right to attend and vote at Member meetings and shall possess voting power for the election of Board Members and for all other purposes under the Act or this Agreement. Each Preference Share holder shall be entitled to one (1) vote for each Preference Share standing in the Common Shareholder’s name on the books and records of the Company on the record date established for such vote.

…

28. Article IX of the Agreement makes provision for dissolution of the Company and at Section 9.2, under the sub-heading ‘Liquidation’ includes the following:

“(a) In the event that an Event of Termination shall occur, then the Company shall be liquidated and its affairs be wound up. Subject to the provisions of this Section 9.3, all proceeds from such liquidation shall be distributed in accordance with the provisions of Section 18-804 of the Act, and all Shares in the Company shall be cancelled. Distributions to the Members shall be made upon liquidation in the following amounts and in the following order:

(i) First, pro rata to Members holding Common Shares, in an amount equal to $400 per Common Share;

(ii) Thereafter, any amounts remaining to the Members pro rata in accordance with their respective number of Shares; provided that for the purposes of this Section 9.2(a)(ii), each Preference Share shall be treated as four (4) shares.”

29. Finally, Article X of the Agreement ‘Miscellaneous’ provides that it is to be “governed by and construed in accordance with the laws in the State of Delaware without giving effect to the principles of conflicts of law.”

30. The effect of these provisions is, as Mr Prosser explained, that although the holders of the preference shares have 10% of the voting rights under section 6.1 they would be entitled to 99% on a distribution and a similar proportion on the winding up of the company. As such the issue arises as to whether the Board could issue more common shares to LLC4, at par, or LLC4 use its voting power to procure the Board to do so and thereby swamp the preference shares in terms of how much they get by way of dividends or assets on a winding up. However, Mr Prosser submits that it would be precluded from doing so as a matter of Delaware law.

Delaware law

31. Section 18-1101 of the Delaware Limited Liability Company Act, which governs the regulation, structure and operation of a Delaware limited liability company provides that a limited liability company agreement may not eliminate the implied contractual covenant of good faith and fair dealing. It states:

“(c) To the extent that, at law or in equity, a member or manager or other person has duties (including fiduciary duties) to a limited liability company or to another member or manager or to another person that is a party to or is otherwise bound by a limited liability company agreement, the member’s or manager’s or other person’s duties may be expanded or restricted or eliminated by provisions in the limited liability company agreement; provided, that the limited liability company agreement may not eliminate the implied contractual covenant of good faith and fair dealing.

…

(e) A limited liability company agreement may provide for the limitation or elimination of any and all liabilities for breach of contract and breach of duties (including fiduciary duties) of a member, manager or other person to a limited liability company or to another member or manager or to another person that is a party to or is otherwise bound by a limited liability company agreement; provided, that a limited liability company agreement may not limit or eliminate liability for any act or omission that constitutes a bad faith violation of the implied contractual covenant of good faith and fair dealing.”

32. In Nemec v Shrader (2009) Chief Justice Steele, on behalf of a majority of the Delaware Supreme Court, affirmed the decision of the Court of Chancery to dismiss a plaintiffs’ claim for breach of the implied contractual covenant of good faith and fair dealing in relation to the timing and price of a stock redemption that had been expressly authorised as part of an agreed stock plan. He observed that:

“The implied covenant of good faith and fair dealing involves a “cautious enterprise,” inferring contractual terms to handle developments or contractual gaps that the asserting party pleads neither party anticipated.“[O]ne generally cannot base a claim for breach of the implied covenant on conduct authorized by the agreement.” We will only imply contract terms when the party asserting the implied covenant proves that the other party has acted arbitrarily or unreasonably, thereby frustrating the fruits of the bargain that the asserting party reasonably expected. When conducting this analysis, we must assess the parties’ reasonable expectations at the time of contracting and not rewrite the contract to appease a party who later wishes to rewrite a contract he now believes to have been a bad deal. Parties have a right to enter into good and bad contracts, the law enforces both.”

33. However, I agree with Mr Ewart who contends that, Nemec v Shrader provides little, if any, assistance on the application of Delaware law in the present case given the express provisions of the LLC6 Agreement.

Preparations for LLC5 Board Meeting

34. On 13 October 2009 Fletcher Clark, of BlackRock’s Legal Department, asked Mr Fleming to provide a briefing note to be shared with Colin Thomson (Head of BlackRock’s Financial Reporting Group for the international business), Roger Tooze (Head of BlackRock’s Business Finance) and James DesMarais (General Counsel for BlackRock’s international business) as potential members of the LLC5 Board. Mr Fleming provided the following note on 26 October 2009:

“Fletcher, the purpose of the LLC is to effect the acquisition of the BGI US business from Barclays. Ideally, we would have wished LLC5 to be a UK incorporated company, but, this was not possible for both US and UK tax and regulatory reasons. On that basis, it became necessary for the entity to be formed as a US LLC since (1) an LLC is a US entity and thus likely to be acceptable to the OCC, and (2) it is also transparent for US tax purposes.

However, this means that the LLC must have its central management and control located in the UK. I am sure that Jim [DesMarais], Colin [Thomson] and Roger [Tooze] are all familiar with the residency policy that Tax has imposed in order to ensure that our non-UK funds and group companies are not UK resident. What we need to do with LLC5 is reverse that and ensure that all activities (that we would normally ensure are conducted outside the UK) are in fact done in the UK.

On that basis, we must ensure that the central management and control of the entity is conducted in the UK, and is done through the medium of board meetings, which we will hold on a regular basis.

The business of LLC5 will be relatively simple. It will hold preference shares in LLC6 which will only provide for 10% voting control. Accordingly, it will not be in a position to manage any of the underlying US business activities, nor will it be called upon to do so. Rather, it will be required to consider its own business of making and managing passive investments and managing its commitments in terms of issuing a Eurobond (that will be listed on the Cayman Exchange) in order to finance the acquisition. Thus, it will consider the likelihood that the business conditions pertaining in the US subsidiaries will enable the preference share dividends to be met, in order to meet its own financing costs.

Let me know if you think it will be helpful for me to directly brief Jim, Colin and Roger on the specific transactions that LLC5 will conduct, but hopefully these will already be quite clear on the step plan.

Please let me know when the first board meeting is scheduled, so we can work together on the agenda. We need to get this conducted asap.”

35. In an email, dated 10 November 2009, to Mr Horowitz, headed “BGI US/UK Sandwich” (Mr Fleming said he used the term “sandwich” which be believed was a term of art in the USA to describe the position of the UK resident LLC between the US target, ie BGI) Mr Fleming wrote, in relation to valuation:

“QC said that the directors should be armed with the documentation that supports the fact that they were able to make a nuanced and informed commercial decision to buy the LLC6 prefs. EY believes that this issue might be an “Achilles heel” that HMRC might be able to use to undermine the commerciality of the decision by LLC5 (on a stand-alone basis).

In principle I’d agree that D&P [Duff & Phelps, who undertook the valuation] might make sense but it will be easier for the EY valuation team to quickly grasp what the tax guys want and can leverage from the data that the credit scoring guys have gathered.”

36. Also on 10 November 2009, Mr Fleming met with Mr Thomson, Mr Tooze and Mr DesMarais to discuss and answer any questions that they might have ahead of the LLC5 Board meeting. He explained that within the BlackRock Group it was common practice for the Corporate Tax Group to brief members of relevant group entity boards with details of any capital transactions that those boards were being asked to enter into. He recalled that the “main focus” of these discussions was to enable him to explain the UK tax rules around deductions for interest expenses.

37. By this time the proposed transaction had already been presented to the relevant regulator (the OCC) and internal stakeholders and the briefing of the entity board members was one of the final steps in the process of agreeing the form of a capital transaction. Mr Fleming explained that in practice, once external regulatory and senior internal stakeholder agreement had been obtained, any proposed transaction is considered largely final, and will only be subject to revision in limited circumstances.

38. However, it was important, he said, that the members of any affected board were fully briefed and content that the proposed transaction was acceptable in financial, regulatory and governance terms from an entity level perspective. He explained that this was because one of the purposes of Corporate Tax Group team members from the US and the UK working on the proposal was to ensure that any potential UK regulatory or governance issues that may not have been identified by the internal stakeholders in the US were picked up and taken into account when shaping the transaction. Mr Fleming recalled that the main focus of the discussions on 10 November 2009 had been to explain how the UK tax rules around deductions for interest expenses worked to reassure those present of the “solidity of the tax analysis” and had “mirrored” to a large extent the discussions that he had himself had with the EY Tax Partner advising the BlackRock Group in relation to the BGI acquisition in July 2009.

39. On 12 November 2009 Mr Clark advised Mr Fleming by email that Mr Kushel, Mr Thomson, Mr Tooze and Mr DesMarais had agreed to join the LLC5 Board. The email also noted that Mr Kushel would “come off the board after closing.”

40. The LLC5 Board was due to meet on 27 November 2009, the date on which the other entities involved in the BGI acquisition structure, BFM, LLC4 and LLC6, resolved to enter into the transaction. However, Mr Kushel, who was in the UK, was intending to attend the meeting by telephone. This was because, as Mr Fleming said, “it was impinging with US Thanksgiving”. Unable to contact Mr Kushel, by telephone Mr Fleming exchanged emails with him explaining that the meeting was important for UK tax purposes and that Mr Kushel’s presence on the LLC5 Board provided the additional support and participation of a senior business leader in the decisions to be taken. This would, he explained, provide an additional layer of assurance to the other members of the LLC5 Board that the transaction was a commercially and financially sound investment.

41. When he was able to speak to him on the telephone, later on 27 November 2009, Mr Fleming recalled that Mr Kushel expressed a degree of frustration at what had appeared to be inconsistent messages from the Company Secretarial team regarding the necessity of him attending the meeting in person. However, to enable Mr Kushel to attend, the meeting was re-arranged for 30 November 2009.

LLC5 Board Meeting

42. The documents provided to the LLC5 Board Members to be approved at the board meeting included:

(1) a draft limited liability company agreement for LLC6, to be entered into between LLC4 and LLC5 as members of LLC6;

(2) a draft contribution and issue agreement to be entered into between LLC4 and LLC5, pursuant to which (a) LLC4 was to contribute cash and stock in BRI to LLC5 and (b) LLC5 was to issue 100 ordinary shares and $4 billion of debt instruments (ie the loan notes) to LLC4;

(3) a draft contribution agreement to be entered into between LLC5 and LLC6, pursuant to which (a) LLC5 was to contribute cash and the BRI stock referred to in (2) above to LLC6 and (b) LLC6 was to issue 2,400,000 preference shares to LLC5;

(4) a draft agency and custodial agreement to be entered into between various BlackRock Group entities including LLC5;

(5) a draft capital and liquidity support agreement to be entered into between various BlackRock Group entities including LLC5;

(6) a draft Capital Assurance and Liquidity Maintenance Agreement to be entered into between various BlackRock Group entities including LLC5; and

(7) a draft of the side letter to be entered into between LLC4 and LLC5.

43. In addition to these documents the following documents were tabled at the LLC5 Board meeting on 30 November 2009:

(1) a copy of the Project Onyx Step Plan, dated 20 November 2009, as prepared by EY. In evidence Mr Fleming described this as being “the roadmap for the lawyers and everybody involved in the transaction to implement it”;

(2) the four intercompany loan notes to be issued by LLC5 to LLC4 that had been approved by the board of managers of LLC4 on 27 November 2009;

(3) Duff and Phelps’ report, dated 23 November 2009, on the relative values of the LLC6 preference shares and ordinary shares;

(4) the draft EY credit scoring advice, dated 21 November 2009, comprising (a) the Peer Group Selection Process, (b) the Credit Rating Analysis, and (c) the Credit Scoring Matrix table; and

(5) an Opinion on the anticipated tax treatment of the proposed transaction from Kevin Prosser QC.

44. As noted in the SOAF the board meeting took place on 30 November 2009. The minutes record that the meeting was attended by Mr Kushel, who took the chair, Mr Thomson, Mr DesMarais and Mr Tooze. The meeting was also attended by Adrian Dyke the company secretary and Mr Fleming who was there to explain the role of LLC5 in the proposed acquisition of BGI.

45. Mr Kushel had worked with Mr Thomson, Mr DesMarais and Mr Tooze for “many years” and served on other boards with them. He explained that he had always known them to be “diligent and thoughtful” in all their business activities and that he considered that they would not have seen it as their role to “rubber stamp” any transaction.

46. In addition to his position with LLC5, in 2009 Mr Kushel was also chairman of a number of companies in the BlackRock Group. These included BlackRock Group Limited which was the principal holding company for the EMEA businesses, a director of BlackRock Investment Managers (UK) one of two principal operating entities through which the BlackRock Group conducted its regulated business, BlackRock Advisors Limited the second of these entities, BlackRock International Limited an insurance annuity provider and was chairman of the supervisory board of BlackRock Asset Mangers (Deutschland). He was not, however, on the boards of either LLC4 or LLC6.

47. When asked about any conflict of his fiduciary duty and whether he could properly have taken a decision in respect of one company that would have damaged any other of the companies of which he was a director Mr Kushel said that he would have to act on behalf of the company concerned “even if it was disappointing or difficult for one of the other entities”. He was “quite confident” that he not only “could have done that but would have done that” and said that there were “certainly times” in his capacity at BlackRock where “I have had to do things like that. That is the nature of the business that we run.”

48. Mr Kushel explained that the relevant entities board would only be asked to pass the necessary resolutions to implement a transaction if it had been reviewed, refined if necessary and approved by all internal stakeholders. He saw it as his responsibility as a board member to satisfy himself that a proposed transaction had been:

“… properly advised on and poses no risk of reputational damage or other harm to either the entity or myself and my fellow board members. As a board member I may test a question or a proposal in terms of its anticipated financial outcomes or to ensure that all relevant regulatory considerations have been taken into account, but typically I will be able to take comfort that these matters have been considered fully by those responsible for framing and approving the transaction before it is presented to me in my capacity as a board member.

49. He considered his role as a board member was to be satisfied that a transaction was in the best interests of the entity concerned and did not see it as part of his remit to begin to question or suggest changes to the underlying capital structure that a proposed transaction should follow. Although expressed in general terms Mr Kushel confirmed that he, and he thought all the board members, adopted such an approach in relation to LLC5. Although, in evidence Mr Kushel used the term “we” to describe the actions of the LLC5 Board he accepted that he was only giving evidence on his behalf and could not say what was in the minds of the other board members when the decision were taken.

50. Mr Fleming recalled that the meeting took place “around about lunchtime” and lasted approximately 45 minutes and that the discussion on the tax aspects took place at the beginning of the meeting and “was not very long”. He explained that the meeting was “considerably longer” than the typical board meetings for holding companies within the group but “by no means as long” as the board meetings held for operating companies which he said could “run for many hours, or indeed days.”

51. Mr Fleming stressed that those attending the meeting were not doing so “in a vacuum”, there had already been discussions with the business finance team and the financial reporting team. However, Mr Fleming did confirm that there had been no discussion of alternative investments. He explained that this was because, at the date of the meeting, they were “days before the execution of a very complex multi-jurisdictional transaction for which a detailed ‘step plan’ had been prepared which we were to follow”. Provided the board felt the transaction was commercially advantageous for the company it “would not have been sensible or open to the directors to consider an alternative transaction.”

52. Although Mr Kushel said that there was “a chance” that he would vote against LLC5’s proposed transaction at the meeting he explained that having been involved in the step plan and various elements reviewing the transaction he felt “comfortable” with it and had no concerns over its commercial viability. As such, “unless one of the advisors during the presentation had brought out new information not previously circulated” or consistent with his understanding of the transaction, this was unlikely. He also said that he had considered whether to proceed with the transaction without taking any UK tax advantage into account and although he could not now recall the details of the board meeting he had no reason to think that he would have acted contrary to Mr Fleming’s advice, as recorded in the minutes of the meeting, that, “having noted that the Company itself would gain no benefit from a UK tax deduction for the interest” as it was group policy for such interests to be surrendered between group affiliates for no payment:

“… it was necessary for the transaction to be considered by the board and viable for the Company without taking any UK tax advantage into account.”

53. Mr Kushel also said that if the anticipated tax benefits of structuring the acquisition had for any reason fallen away it would have been too late to revise the structure and the acquisition would have gone ahead as planned.

54. The diagram in the appendix to this Decision shows the structure of the transaction after completion.

55. I now turn to the issues and, as Mr Prosser said, because the unallowable purpose provisions, if applicable, require debits which would otherwise have been brought into account to be left out of account, it would appear more appropriate to consider the transfer pricing issue first to ascertain whether and to what extent these loan relationship debits would be brought into account in the first place.

transfer pricing issue

56. The following provisions of Part 4 of the Taxation (International and Other Provisions Act 2010 (TIOPA) apply in relation to the transfer pricing issue:

147 Tax calculations to be based on arm's length, not actual, provision

(1) For the purposes of this section “the basic pre-condition” is that—

(a) provision (“the actual provision”) has been made or imposed as between any two persons (“the affected persons”) by means of a transaction or series of transactions,

(b) the participation condition is met (see section 148),

(c) the actual provision is not within subsection (7) (oil transactions), and

(d) the actual provision differs from the provision (“the arm's length provision”) which would have been made as between independent enterprises.

(2) Subsection (3) applies if—

(a) the basic pre-condition is met, and

(b) the actual provision confers a potential advantage in relation to United Kingdom taxation on one of the affected persons.

(3) The profits and losses of the potentially advantaged person are to be calculated for tax purposes as if the arm's length provision had been made or imposed instead of the actual provision …

…

148 The “participation condition”

(1) For the purposes of section 147(1)(b), the participation condition is met if—

(a) condition A is met in relation to the actual provision so far as the actual provision is provision relating to financing arrangements, and

(b) condition B is met in relation to the actual provision so far as the actual provision is not provision relating to financing arrangements.

(2) Condition A is that, at the time of making or imposition of the actual provision or within the period six months beginning with the day on which the actual provision was made or imposed-

(a) one of the affected persons was directly or indirectly participating in the management, control or capital of the other, or

(b) the same person or persons was or were directly or indirectly participating in the management, control or capital of each of the affected persons ...

…

(4) In this section “financing arrangements” means arrangements made for providing or guaranteeing, or otherwise in connection with any debt, capital or other form of finance.

…

150 “Transaction” and “series of transactions”

(1) In this Part “transaction” includes arrangements, understandings and mutual practices (whether or not they are, or are intended to be, legally enforceable).

(2) References in this Part to a series of transactions include references to a number of transactions each entered into (whether or not one after the other) in pursuance of, or in relation to, the same arrangement.

(3) A series of transactions is not prevented by reason only of one or more of the matters mentioned in subsection (4) from being regarded for the purposes of this Part as a series of transactions by means of which provision has been made or imposed as between any two persons.

(4) Those matters are—

(a) that there is no transaction in the series to which both those persons are parties,

(b) that the parties to any arrangement in pursuance of which the transactions in the series are entered into do not include one or both of those persons, and

(c) that there is one or more transactions in the series to which neither of those persons is a party.

(5) In this section “arrangement” means any scheme or arrangement of any kind (whether or not it is, or is intended to be, legally enforceable).

151 “Arm’s length provision”

(1) In this Part “the arm's length provision” has the meaning given by section 147(1).

(2) For the purposes of this Part, the cases in which provision made or imposed as between any two persons is to be taken to differ from the provision that would have been made as between independent enterprises include the case in which provision is made or imposed as between two persons but no provision would have been made as between independent enterprises; and references in this Part to the arm's length provision are to be read accordingly.

152 Arm’s length provision where actual provision relates to securities

(1) This section applies where—

(a) both of the affected persons are companies, and

(b) the actual provision is provision in relation to a security issued by one of those companies (“the issuing company”).

(2) Section 147(1)(d) is to be read as requiring account to be taken of all factors, including—

(a) the question whether the loan would have been made at all in the absence of the special relationship,

(b) the amount which the loan would have been in the absence of the special relationship, and

(c) the rate of interest and other terms which would have been agreed in the absence of the special relationship.

(3) Subsection (2) has effect subject to subsections (4) and (5).

(4) If—

(a) a company (“L”) makes a loan to another company with which it has a special relationship, and

(b) it is not part of L's business to make loans generally, the fact that it is not part of L's business to make loans generally is to be disregarded in applying subsection (2).

(5) Section 147(1)(d) is to be read as requiring that, in the determination of any of the matters mentioned in subsection (6), no account is to be taken of (or of any inference capable of being drawn from) any guarantee provided by a company with which the issuing company has a participatory relationship.

(6) The matters are—

(a) the appropriate level or extent of the issuing company's overall indebtedness,

(b) whether it might be expected that the issuing company and a particular person would have become parties to a transaction involving—

(i) the issue of a security by the issuing company, or

(ii) the making of a loan, or a loan of a particular amount, to the issuing company, and

(c) the rate of interest and other terms that might be expected to be applicable in any particular case to such a transaction.

…

154 Interpretation of sections 152 and 153

…

(3) “Special relationship” means any relationship by virtue of which the participation condition is met (see section 148) in the case of the affected persons concerned.

(4) Any reference to a guarantee includes—

(a) a reference to a surety, and

(b) a reference to any other relationship, arrangements, connection or understanding (whether formal or informal) such that the person making the loan to the issuing company has a reasonable expectation that in the event of a default by the issuing company the person will be paid by, or out of the assets of, one or more companies.

(5) One company (“A”) has a “participatory relationship” with another (“B”) if—

(a) one of A and B is directly or indirectly participating in the management, control or capital of the other, or

(b) the same person or persons is or are directly or indirectly participating in the management, control or capital of each of A and B.

(6) “Security” includes securities not creating or evidencing a charge on assets.

(7) Any—

(a) interest payable by a company on money advanced without the issue of a security for the advance, or

(b) other consideration given by a company for the use of money so advanced,

is to be treated as if payable or given in respect of a security issued for the advance by the company, and references to a security are to be read accordingly.

57. The definition of “guarantee” in s 154(4) TIOPA is considered in HMRC’s International Manual, which at INT413110 under the sub-heading ‘Implicit guarantees’, states:

“The wide definition of guarantee in TIOPA10/S154 (4) recognises the possibility that whilst a guarantee may not be formally documented, the behaviour of the parties indicates that a guarantee exists.

Implicit guarantees are difficult to evaluate, since their terms are not explicitly stated and motivation may be mixed and obscure. A major multinational may wish to protect its own credit status and reputation by making good any debts which its subsidiaries are unable to meet, but is it difficult to discern whether that is primarily a service provided to the subsidiary, whether it arises from a policy aimed at protecting the MNE’s own credit rating, or a mixture of both.

An implicit guarantee is perhaps more likely to exist where the recipient has an important role within the group or shows a close identification with the name or brand of the group.

Para 7.13 of the OECD Transfer Pricing Guidelines says that

“…no service would be received where an associated enterprise by reason of affiliation alone has a credit rating higher than it would if it were unaffiliated, but an intra-group service would usually exist where the higher credit rating were due to a guarantee by another group member…”

The paragraph goes on to distinguish “passive association” from “active promotion”. In circumstances where mere affiliation of the borrower to its group provides comfort to a lender, and leads to an improved credit rating there is no guarantee and therefore a fee would not be charged at arm’s length. Where there are intra-group guarantees, explicit or implicit, the effect that the guarantee has on the terms of the loan need to be separated from any effect that can be attributed to passive association. The track record of the group in situations where a group member is in financial distress will be instructive.”

58. Returning to the TIOPA provisions, these provide:

155 “Potential advantage” in relation to United Kingdom taxation

(1) Subsection (2) applies for the purposes of this Part.

(2) The actual provision confers a potential advantage on a person in relation to United Kingdom taxation wherever, disregarding this Part, the effect of making or imposing the actual provision, instead of the arm’s length provision, would be one or both of Effects A and B.

(3) Effect A is that a smaller amount (which may be nil) would be taken for tax purposes to be the amount of the person’s profits for any chargeable period.

Effect B is that a larger amount (or, if there would not otherwise have been losses, any amount of more than nil) would be taken for tax purposes to be the amount for any chargeable period of any losses of the person

…

156 “Losses” and “profits”

(1) In this Part “losses” includes amounts which are not losses but in respect of which relief may be given in accordance with—

(a) …

(g) Part 5 of CTA 2010 (group relief), …

(2) in this Part “profits” includes income.

…

164 Part to be interpreted in accordance with OECD principles

(1) This Part is to be read in such manner as best secures consistency between—

(a) the effect given to sections 147(1)(a), (b) and (d) and (2) to (6), 148 and 151(2), and

(b) the effect which, in accordance with the transfer pricing guidelines, is to be given, in cases where double taxation arrangements incorporate the whole or any part of the OECD model, to so much of the arrangements as does so.

…

(3) In this section “the OECD model” means—

(a) the rules which, at the passing of ICTA (which occurred on 9 February 1988), were contained in Article 9 of the Model Tax Convention on Income and on Capital published by the Organisation for Economic Co-operation and Development, or

(b) any rules in the same or equivalent terms.

(4) In this section “the transfer pricing guidelines” means—

(a) the version of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations approved by the Organisation for Economic Co-operation and Development (OECD) on 22 July 2010, or

(b) such other document approved and published by the OECD in place of that (or a later) version or in place of those Guidelines as is designated for the time being by order made by the Treasury,

including, in either case, such material published by the OECD as part of (or by way of update or supplement to) the version or other document concerned as may be so designated. …”

59. Although the 1995 OECD Guidelines, which are to be taken into account in accordance with s 164 TIOPA, were applicable in relation to LLC5’s accounting periods ended 30 November 2010, 31 December 2011 and 31 December 2012, I was referred to the 2010 OECD Guidelines which apply to all later accounting periods, the majority under appeal. No new principles are established by the 2010 Guidelines which expand on those stated in the 1995 Guidelines.

60. In relation to the arm’s length principle these Guidelines provide:

“B. Statement of the arm’s length principle

i) Article 9 of the OECD Model Tax Convention

1.6 The authoritative statement of the arm’s length principle is found in paragraph 1 of Article 9 of the OECD Model Tax Convention, which forms the basis of bilateral tax treaties involving OECD Member countries and an increasing number of non-Member countries. Article 9 provides:

[Where] conditions are made or imposed between … two [associated] enterprises in the commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which would, but for those conditions, have accrued to one of the enterprises, but by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxes accordingly.

By seeking to adjust profits by reference to the conditions which would have obtained between independent enterprises in comparable transactions and comparable circumstances (ie in “comparable uncontrolled transactions”), the arm’s length principle follows the approach of treating the members of an MNE [multinational enterprise] group as operating as separate entities rather than as inseparable parts of a single unified business. Because the separate entity approach treats the members of an MNE group as if they were independent enterprises, attention is focused on the nature of the transactions between those members and on whether the conditions thereof differ from the conditions that would be obtained in comparable uncontrolled transactions. Such an analysis of the …is at the heart of the application of the arm’s length principle.”

61. Paragraph 1.14 of “B.2 Maintaining the arm’s length principle as the international consensus” notes that:

“… This reflects the economic realities of the controlled taxpayer’s particular facts and circumstances and adopts as a benchmark the normal operation of the market.”

62. Section D provides guidance for the application of the arm’s length principle and includes the following:

“D.1 Comparability analysis

D.1.1 Significance of the comparability analysis and meaning of “comparable”

1.33 Application of the arm’s length principle is generally based on a comparison of the conditions in a controlled transaction with the conditions in transactions between independent enterprises. In order for such comparisons to be useful, the economically relevant characteristics of the situations being compared must be sufficiently comparable. To be comparable means that none of the differences (if any) between the situations being compared could materially affect the condition being examined in the methodology (eg price or margin), or that reasonably accurate adjustments can be made to eliminate the effect of any such differences.