Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Urenco Chemplants Ltd & Anor v Revenue & Customs (Corporation tax - capital allowances) [2019] UKFTT 522 (TC) (07 August 2019)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2019/TC07318.html

Cite as: [2019] UKFTT 522 (TC)

[New search] [Contents list] [Printable PDF version] [Help]

[2019] UKFTT 522 (TC)

Corporation tax – capital allowances – ss11, 21, 23 Capital Allowances Act 2001 – expenditure on construction of a tails management facility at a nuclear site – identification of the assets – whether the assets function as plant – whether any of the expenditure is on the provision of a building within s21 CAA 2001 – if so, whether any of the expenditure is saved by List C s23 CAA 2001 – appeal dismissed

|

FIRST-TIER TRIBUNAL TAX CHAMBER |

|

TC07318

Appeal number: TC/2018/01445 TC/2018/01447 TC/2018/01448 |

BETWEEN

|

|

(1) URENCO CHEMPLANTS LIMITED (2) URENCO UK LIMITED |

Appellant |

-and-

|

|

THE COMMISSIONERS FOR HER MAJESTY’S REVENUE AND CUSTOMS |

Respondents |

|

TRIBUNAL: |

JUDGE JONATHAN CANNAN

|

Sitting in public at Taylor House, Rosebery Avenue, London on 17-20 December 2018

Mr Jonathan Peacock QC and Mr Michael Ripley of counsel instructed by Enyo Law LLP for the Appellants

Mr Jonathan Bremner QC and Mr Edward Waldergrave of counsel, instructed by Solicitor’s Office and Legal Services of HM Revenue and Customs for the Respondents

DECISION

Introduction

1. These appeals concern the extent to which capital allowances are available for expenditure on a major construction project.

2. The appellants are both companies in the Urenco corporate group, which provides enriched uranium for the civil nuclear industry and has uranium enrichment facilities in the UK, Germany, Netherlands and the USA. The UK facility is located at Capenhurst in Cheshire and is owned by the second appellant. The first appellant was responsible for the construction of what is known as a Tails Management Facility (“TMF”) and incurred the disputed expenditure.

3. Construction of the TMF was substantially completed in the late summer of 2018. The total cost of the project was some £1bn. The treatment for capital allowance purposes of most of that expenditure is agreed. The present dispute relates to expenditure of some £192m on which the first appellant has claimed capital allowances and in respect of which HMRC contend that capital allowances are not available.

4. The appeals by the first appellant are in respect of:

(1) two discovery determinations pursuant to paragraph 41(2), Schedule 18 Finance Act 1998. The effect of those determinations is to reduce the capital allowances and trading losses of the first appellant for the year ended 31 December 2013.

(2) four closure notices pursuant to paragraph 32, Schedule 18, Finance Act 1998 relating to its corporation tax returns for the years ended 31 December 2011, 31 December 2012, 31 December 2014 and 31 December 2015.

5. The appeal by the second appellant is in respect of an assessment pursuant to paragraph 76, Schedule 18 Finance Act 1998 for the year ended 31 December 2013, the effect of which is to reduce losses surrendered by the first appellant in consequence of its capital allowance claims.

6. All the decisions under appeal were made and notified in December 2017.

7. For the sake of simplicity and convenience I shall generally refer to the appellants and the Urenco group as a whole in this decision as “Urenco”. The separate corporate entities are not relevant for present purposes. The issue in the appeal is essentially whether Urenco is entitled to capital allowances in respect of the disputed expenditure. There are no other issues as to the validity of the determinations, closure notices and assessment.

overview of the facts

8. I make my detailed findings of fact in the next section, but it is convenient to give an overview of the facts first. My findings of fact are based on evidence adduced by Urenco, including witness statements and oral evidence from the following witnesses:

(1) Mr Christopher Chater, Chief Operating Officer for the Urenco Group;

(2) Mr Michael Peers, Independent Assurance Manager for the second appellant and formerly the Chief Nuclear Officer at Capenhurst;

(3) Mr Michael Banner, formerly Construction Manager for the TMF works at Capenhurst who also had responsibility for Local Authority planning matters;

(4) Mr Paul Nicholson, Design and Licensing Manager in respect of the TMF and formerly a mechanical engineer assisting with the design of the TMF.

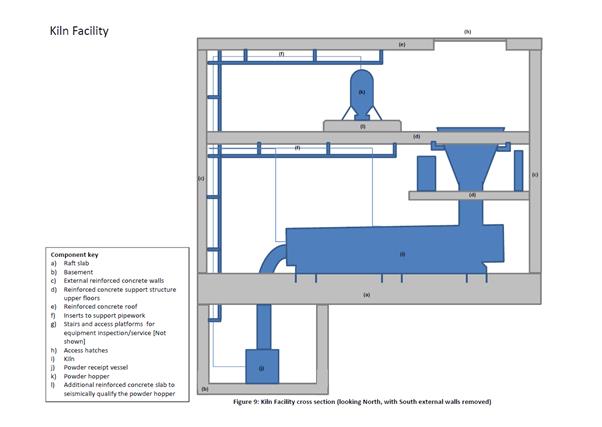

9. In addition to the witness evidence there was a considerable amount of documentary evidence in the form of photographs, plans and other documents. I also had the benefit of a site visit on 14 September 2018 at which I was shown all aspects of the TMF prior to it becoming operational. There was little if any dispute as to the primary facts. There was to some extent a dispute as to the inferences I was invited to draw from the primary facts. The following overview is not contentious.

10. The uranium enrichment process which has been carried out at Capenhurst since the 1950s produces a by-product in the form of depleted uranium hexafluoride, known as “Tails”. Tails are not only radioactive and unstable, but also highly corrosive and toxic due to their fluorine content. Urenco is subject to strict regulatory limits on the volume of Tails material which it can store. The uranium enrichment process therefore depends upon managing the inventory of Tails. Tails have been stored on the site and also sent to a French competitor to be “deconverted”. The process of deconversion involves removing the fluorine content in the form of hydrofluoric acid. This leaves a stable but still radioactive uranium oxide compound which can be stored more easily. The TMF will carry out this deconversion process. The hydrofluoric acid which is produced can be sold for industrial use unless it has any radioactive contamination in which case it is safely destroyed. The uranium oxide will be stored at Capenhurst for up to 100 years.

11. The TMF will process Tails from Urenco’s enrichment facilities in the UK, Germany and the Netherlands. Uranium oxide produced from the UK will remain at Capenhurst, whilst that produced from Germany and the Netherlands will be returned to facilities in those countries. Once operational the TMF facility will have only 8-10 operators on shift at any one time. Certain areas are designed to be unoccupied save for necessary inspection and maintenance purposes.

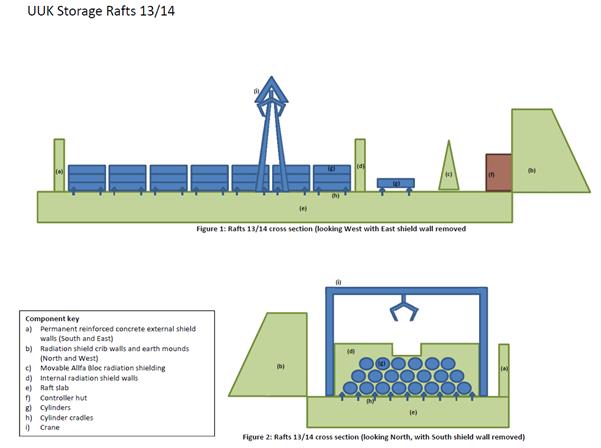

12. Tails produced at Capenhurst have until now been stored in cylinders on open air outside storage rafts prior to being sent for deconversion. Each full cylinder weighs about 15 tonnes. The outside storage rafts include insulating earth mounds, reinforced concrete radiation shield walls and temporary radiation shielding in the form of concrete “alpha blocks”. The cylinders, shield walls and alpha blocks all sit on a concrete raft slab which is seismically qualified, in the sense that it is designed to withstand a 1 in 10,000 years seismic event in Capenhurst.

13. The TMF comprises the following facilities in respect of which Urenco’s entitlement to capital allowances is disputed. For present purposes I shall assume that the TMF is operational and describe how it is intended to operate. I shall describe the construction of these structures in more detail in my findings of fact.

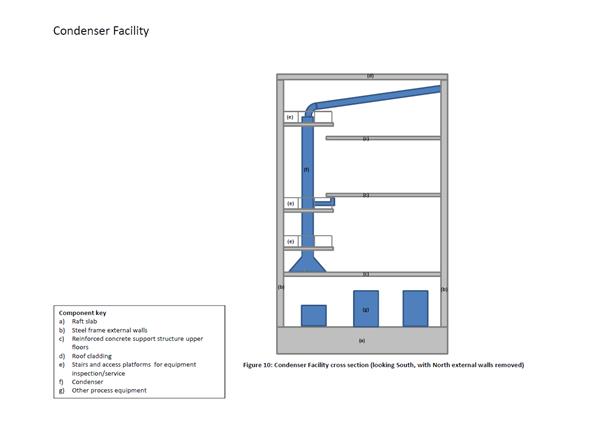

The Cylinder Handling Facility (“CHF”)

14. Cylinders containing Tails from the UK, Netherlands and Germany will be transported to the CHF by lorry where they are placed on cradles before being transferred to the vaporisation facility (see below) using a rail transport system. A separate area of the CHF will also receive emptied cylinders from the Vaporisation Facility. After a period of “cooling down” lasting approximately 90-100 days the emptied cylinders, known as “heeled cylinders” are washed and tested in a separate cylinder wash facility and returned to enrichment sites.

The Tails Deconversion Plant (“TDP”)

15. The TDP handles only relatively low volumes of Tails at any one time. It has a vaporisation facilitywhere full cylinders are steam heated in autoclaves to sublime the Tails to a gas which passes by pipeline to one of two deconversion kilns in the kiln facility. Steam and nitrogen are added to the kilns at high temperatures thereby producing uranium oxide, in powder form and hydrofluoric acid. There is potential to expand the TDP by adding two further kilns to the kiln facility.

16. The uranium oxide is transferred to a hopper and through a compactor into rectangular steel storage containers known in the industry as “DV70s”. The hydrofluoric acid generated from the deconversion process is transferred to the condenser facilityin order to reach sufficient concentration that it can be sold for use in other industrial processes. It is stored in large plastic storage tanks prior to being moved off site.

17. The healed cylinders contain a residue of radioactive decay products and emit a much higher radiation dose than full cylinders. When they are first emptied they are known as “hot” and they may be regarded as hot for up to 160 days. They are held in a separate area of the CHF where there is appropriate radiation shielding. Some hot heeled cylinders are held on the outside storage rafts although in much lower numbers than in the CHF at any one time. Once the healed cylinders have cooled down and become less radioactive they are washed and tested and then returned to the relevant enrichment site.

Uranium Oxide Store (“UOS”)

18. The DV70s containing uranium oxide are transferred from the TDP to the UOS receipt and dispatch area. From there the DV70s containing UK derived uranium oxide are transferred by crane into a storage location in the UOS where they will remain for up to 100 years.

legal framework and issues in outline

19. The Capital Allowances Act 2001 (“CAA 2001”) makes provision for writing down allowances in respect of capital expenditure on plant and machinery. The general conditions are set out in s11 and s11(4) provides:

“(4) The general rule is that expenditure is qualifying expenditure if—

(a) it is capital expenditure on the provision of plant or machinery wholly or partly for the purposes of the qualifying activity carried on by the person incurring the expenditure, and

(b) the person incurring the expenditure owns the plant or machinery as a result of incurring it.

(5) But the general rule is affected by other provisions of this Act, and in particular by Chapter 3.”

20. The issues in the present appeals concern whether the expenditure incurred by Urenco is on the provision of “plant” as a matter of common law such that the general rule in s11 CAA 2001 is satisfied; if so, what is the effect of provisions in Chapter 3, Part 2 CAA 2001? The relevant provisions of Chapter 3 are as follows:

“21 Buildings

(1) For the purposes of this Act, expenditure on the provision of plant or machinery does not include expenditure on the provision of a building.

(2) The provision of a building includes its construction or acquisition.

(3) In this section, “building” includes an asset which—

(a) is incorporated in the building,

(b) although not incorporated in the building (whether because the asset is moveable or for any other reason), is in the building and is of a kind normally incorporated in a building, or

(c) is in, or connected with, the building and is in list A.

LIST A

ASSETS TREATED AS BUILDINGS

1. Walls, floors, ceilings, doors, gates, shutters, windows and stairs.

2. Mains services, and systems, for water, electricity and gas.

3. Waste disposal systems.

4. Sewerage and drainage systems.

5. Shafts or other structures in which lifts, hoists, escalators and moving walkways are installed.

6. Fire safety systems.

(4) This section is subject to section 23.”

“22 Structures, assets and works

(1) For the purposes of this Act, expenditure on the provision of plant or machinery does not include expenditure on—

(a) the provision of a structure or other asset in list B, or

(b) any works involving the alteration of land.

LIST B

EXCLUDED STRUCTURES AND OTHER ASSETS

1. A tunnel, bridge, viaduct, aqueduct, embankment or cutting.

2. A way, hard standing (such as a pavement), road, railway, tramway, a park for vehicles or containers, or an airstrip or runway.

3. An inland navigation, including a canal or basin or a navigable river.

4. A dam, reservoir or barrage, including any sluices, gates, generators and other equipment associated with the dam, reservoir or barrage.

5. A dock, harbour, wharf, pier, marina or jetty or any other structure in or at which vessels may be kept, or merchandise or passengers may be shipped or unshipped.

6. A dike, sea wall, weir or drainage ditch.

7. Any structure not within items 1 to 6 other than—

(a) a structure (but not a building) within Chapter 2 of Part 3 (meaning of “industrial building”),

(b) a structure in use for the purposes of an undertaking for the extraction, production, processing or distribution of gas, and

(c) a structure in use for the purposes of a trade which consists in the provision of telecommunication, television or radio services.

(2) The provision of a structure or other asset includes its construction or acquisition.

(3) In this section—

(a) “structure” means a fixed structure of any kind, other than a building (as defined by section 21(3)), and

(b) “land” does not include buildings or other structures, but otherwise has the meaning given in Schedule 1 to the Interpretation Act 1978 (c. 30).

(4) This section is subject to section 23.”

“23 Expenditure unaffected by sections 21 and 22

…

(3) Sections 21 and 22 also do not affect the question whether expenditure on any item described in list C is, for the purposes of this Act, expenditure on the provision of plant or machinery.

(4) But items 1 to 16 of list C do not include any asset whose principal purpose is to insulate or enclose the interior of a building or to provide an interior wall, floor or ceiling which (in each case) is intended to remain permanently in place.

LIST C

EXPENDITURE UNAFFECTED BY SECTIONS 21 AND 22

1. Machinery… not within any other item in this list

4. Manufacturing or processing equipment….

22. The alteration of land for the purpose only of installing plant or machinery.”

21. In broad terms, the expenditure in dispute in this appeal will qualify for capital allowances if it is expenditure on plant and falls outside s21 (buildings). Even if it falls within s21 it will still qualify for capital allowances if it is on any item described in s23 List C. For the sake of completeness, both parties acknowledge that s22 would not operate to exclude the expenditure in the present appeal because it falls within Item 7(a) List B.

22. It will be necessary to break those issues down further to resolve this appeal. By way of outline at this stage the following matters are disputed:

(1) How assets should be identified for the purpose of identifying whether they satisfy the common law meaning of “plant” and whether they are affected by ss21 and 23 CAA 2001. Urenco submit that I should consider the disputed components separately. HMRC submit that each structure should be considered as a whole.

(2) Whether the assets function as plant according to common law principles.

(3) Whether the assets are excluded from capital allowances by virtue of s21 (buildings).

(4) Even if s21 would apply to exclude the expenditure, is the expenditure saved by s23 List C Items 1, 4 and/or 22?

23. There is also some dispute as to the order in which I should consider certain of these issues. Urenco contend that I should first address the question of whether expenditure on the assets as identified is on the provision of plant at common law, before going on to consider whether the general rule is affected by ss21 and 23. HMRC contend that I should first address the question of whether the expenditure is excluded from entitlement to capital allowances by virtue of s21 (buildings). If so, there is no need to consider whether the expenditure is on the provision of plant, although HMRC accept that for completeness I will have to address that issue.

Findings of Fact

24. The design and construction of the TMF and its various components is governed by stringent health and safety requirements. The regulatory regime is “principles based” and requires safety objectives to be met rather than specifying the means by which this is to be achieved. The safety requirements focus on outcome rather than method, for example specifying maximum levels of radiation dosages. The onus is on the operator to satisfy the regulator that the safety objectives are met. The Capenhurst site is required to have a nuclear site licence issued by the Office for Nuclear Regulation.

25. All the facilities in dispute were constructed to meet the site licence conditions. In particular the site licence requires the following:

“34(1) The licensee shall ensure, so far as is reasonably practicable, that radioactive material and radioactive waste on the site is at all time adequately controlled or contained so that it cannot leak or otherwise escape from such control or containment.”

26. In order to satisfy the safety objectives, it has been necessary to construct certain “safety significant structures”. The purposes of safety significant structures are:

(1) To provide radiation shielding, blocking the path of radiation, and/or

(2) To provide containment, preventing the release of radioactive particles, and/or

(3) To support machinery, equipment and various structures to ensure that they will continue to perform their safety functions in the event of a 1-in-10,000 year earthquake, known as “seismic qualification”.

27. The Tails and the uranium oxide product of deconversion are both relatively low-level radiation sources but the quantity of such material on site and the processing of that material mean careful management is required to minimise the radiation risk. A level of radiation risk is unavoidable but the regulatory regime means that the risk must be reduced to “as low as reasonably practicable”, known as ALARP. During the design stage the Office for Nuclear Regulation challenged aspects of the structures as to whether they satisfied the ALARP principle. In practical terms the risk is balanced against the sacrifice, namely the cost, time or trouble to avert the risk. A measure to mitigate risk will not be required if it would be grossly disproportionate to the risk. Cost is a key factor, but whether costs are affordable or commercially viable is not a valid consideration. Reducing risks to ALARP includes in a nuclear context making provision for external events including events such as earthquakes which have a probability of up to 1 in 10,000 years in Capenhurst. There was evidence as to where on various earthquake scales such an earthquake would lie by reference to “peak ground acceleration”. I do not need to recite that evidence. I am satisfied that the construction methods used go well beyond conventional health and safety requirements and building regulations. Seismic qualification is therefore required for safety significant structures and for machinery and equipment in the vicinity to prevent damage caused by collapse and the release of unacceptable radiation doses.

28. Processing at the TMF involves bringing full cylinders to the TMF, extracting the uranium hexaflouride, deconverting it to uranium oxide and hydrogen fluoride, packaging and storing or removing the uranium oxide and producing hydrofluoric acid for removal from the site. The original material is radioactive and toxic, and the processing of that material and dealing with the by-products involves managing radioactive and toxic hazards. In the words of Mr Nicholson “[it is]hazardous before it starts, it is hazardous when it finishes, albeit less so, and it is hazardous while we are processing it”.

29. It is important to keep the doses of radiation to employees, visitors, members of the public and the environment as low as reasonably practicable. This applies to acute radiation doses at any one time and collective radiation doses over time. There are three types of radiation. In simplistic terms, gamma radiation is high energy electromagnetic waves. Alpha and beta radiation are sub-atomic charged particles which lose energy very quickly. Exposure to radiation is measured in terms of “doses”. Radiation doses can be reduced by the following factors or a combination of them depending on the particular circumstances:

(1) Distance from the radioactive source – the further away an individual is from a radioactive source the less exposure there will be to ionising radiation.

(2) Time – radiological dose is proportional to the length of time an individual is exposed to a radiation source.

(3) Shielding – where the dose cannot be sufficiently mitigated by either distance or time, dense materials such as concrete, earth or lead can be used to block or reduce the dose.

30. Gamma radiation requires more dense shielding than alpha and beta particles which are easily shielded. However, the latter can still present a significant radiation hazard if inhaled or ingested which gives rise to the need for containment features in the safety significant structures.

31. When the Tails are in their cylinders they are to a large extent self-shielding in that uranium is itself a very dense material. However empty cylinders contain radioactive decay products and present the highest radiation risk on the site.

32. The need for shielding is to some extent reduced by using automated processes. Gamma radiation travels in straight lines but is deflected and scattered when it collides with an electron. Where required, shielding design must consider not only the direct path of radiation from the source to an individual, but also what is known as “skyshine”. This is the phenomenon whereby radiation can be reflected by the atmosphere and scattered back to earth. In certain situations it is therefore necessary to use concrete shield roofs.

33. In addition to radiological hazards, the Tails present a chemical hazard because of the uranium and fluorine content which makes them highly corrosive and reactive. Indeed, it is this chemical hazard which drives the need to deconvert the Tails into uranium oxide for long term storage. The hydrofluoric acid by-product of deconversion is also highly toxic and corrosive.

34. The construction methods used for parts of the structures which provide radiation shielding were far from conventional. Where concrete has been used for shielding purposes it was poured in situ. Some of the concrete pours took up to 36 hours because of the height and thickness required. Unlike conventional techniques, plywood shuttering used in the pours had to be substantially reinforced with steel. Enhanced quality control procedures were required to ensure the density and thickness of the concrete. The use of concrete for shielding is to some extent dictated by space restrictions at the site. For example, whilst earth mounds are used on the outdoor rafts it was not possible to use them in the TMF because of space restrictions.

35. The construction methods used for containment structures were more conventional, subject to seismic qualification requirements. Some of the chemical processes, for example the condenser facility, would normally be constructed in the open air. However, because of the need for containment of radioactive gases and particles this was contained within a clad structure.

36. Seismic qualification, where required, involved the use of concrete raft foundations, concrete structures and steel support structures. In some circumstances a 600mm concrete wall was required for radiation shielding purposes, but this was increased to 1,000mm together with additional steel reinforcement to ensure it was seismically qualified. The concrete elements involved highly complex and dense reinforcement bar construction. Steel support structures required much larger beams than might ordinarily be encountered, a greater number of steel braces and specialised bolts at each joint.

37. Stairs and access platforms are not cast into the facilities but were constructed on site and bolted or welded together. They are generally bolted to the relevant raft slab and walls in each structure.

38. The various structures and their components are all specifically and uniquely designed to ensure that radiation dosages to employees, visitors, members of the public and the environment are minimised.

39. From the outside the various facilities comprising the TMF give the appearance of a single modern industrial type building albeit with different roof heights. The CHF and the UOS give the appearance of being large warehouse type structures. This is the effect in part of the external cladding described below. It was a condition of the planning permission that the facilities have the appearance of a modern business park. The site is very close to local community facilities. Despite appearances, each of the facilities under consideration is structurally independent. The cladding can be removed and replaced.

40. I now describe the design and construction of the various components of the TMF. Given the nature and extent of the TMF this is inevitably a summary of the detailed evidence I have heard and seen. The various facilities and components are shown in the simplified block diagrams at Annex 1 to this decision. The diagrams are colour-coded and identify the elements of each structure along with the main equipment and machinery contained in each structure. Items which are agreed for capital allowance purposes and items in dispute are identified separately.

Cylinder Handling Facility

41. The CHF has essentially the same function as the outside storage rafts. However, at any one time it will contain a large number of hot heeled containers. In order to prevent skyshine it must have a reinforced concrete shield roof in addition to concrete shield walls. It is essentially a concrete box structure which is 16m high and covers an area of 3,030 m². The CHF comprises the following components relevant for present purposes:

(1) Permanent external radiation shield walls made of reinforced concrete (north, south and east) which also support the roof. They are covered by external steel cladding.

(2) An external radiation shield wall on the west side. The lower section of this reinforced concrete wall to a height of 6m is permanent.

(3) Removable radiation shielding above the permanent west wall up to the roof. This comprises pre-cast reinforced concrete blocks which have no structural or seismic function. It is removable to allow for possible future extension of the CHF if further kilns are installed in the kiln facility. Removal would be a substantial undertaking. In the event of extension, the permanent 6m wall on the west side would be retained as an internal shield wall.

(4) Steel frame support structure for the west wall. This supports the concrete blocks and is seismically qualified. It does not support the roof.

(5) Reinforced concrete radiation shield roof. This is a concrete slab 300mm thick covering 3,030m². It was cast in situ onto metal decking supported by a series of large steel beams which are cast into the permanent shield walls.

(6) Internal radiation shield walls. There are two such walls of reinforced concrete which run the full width of the CHF and a concrete wing wall which extends 4.5m into the CHF. These are of varying heights between 3m and 6m and provide shielding to operators in the CHF. They are tied in to the external walls and provide some seismic qualification to the external walls but that is incidental.

(7) Raft slab. This is a slab of reinforced concrete with a thickness of 625mm, and edge thickenings of 1,900mm. It bears the weight of the cylinders and provides seismic qualification to the radiation shield walls. Small cradles are bolted to the raft slab to hold cylinders in place.

(8) Roof cladding. This is proprietary cladding which is physically connected to the roof slab and protects the roof from the damaging effects of standing rainwater.

(9) Raised platforms for vaporisation transfer stations. These are reinforced concrete plinths on top of the raft slab designed to hold rails at the correct height to enable a rail transporter to transfer cylinders to the vaporisation facility. The height is set by reference to the autoclaves in the vaporisation facility.

(10) Stairs and access platforms. Steel access platforms run around the perimeter of the CHF, accessed by two steel staircases. They are intended only to service the crane.

42. The walls and roof are seismically qualified and provide a containment function. The walls support the shield roof and are required to be thicker than would be necessary just for radiation shielding. The north and south walls also support an overhead crane which is used to move individual cylinders about the CHF. There is a reinforced concrete crane beam and concrete plinths which support the crane. The beam and plinths are supported in turn by the external radiation shield walls and it is agreed that they qualify for capital allowances. The CHF also contains a controller hut which is not the subject of dispute.

43. Other than the roof cladding which protects the shield roof from standing water, the walls and roof are not intended to provide shelter for material, equipment, machinery or operators. The shelter they do provide is merely incidental to their shielding function.

Vaporisation Facility

44. The vaporisation facility is a two-storey structure occupying an area of 960m². Cylinders are transported from the CHF and two operators load cylinders into the autoclaves. Because of the risks associated with gaseous radioactive Tails there is a containment structure which is seismically qualified to support specific items of equipment. This is in effect a concrete box. In the upper story a non-seismically qualified steel structure houses a variety of ancillary equipment. No radiation shielding is required in the vaporisation facility to protect the public however some concrete shielding is required to minimise exposure to operators in the facility and around the perimeter of the facility.

45. The vaporisation facility comprises the following components relevant for present purposes:

(1) Raft slab. This is a 1,000mm reinforced concrete raft with edge thickenings. It provides seismic qualification for the autoclaves and hotboxes which are installed onto the slab. It also provides seismic qualification to the concrete walls. When it was cast, pockets were left out so that the feet of the autoclaves and hotboxes could be cast in afterwards for seismic anchoring.

(2) External reinforced concrete walls. These are built to first-floor level. They provide shielding for operators in adjacent areas and seismic support to the Tails pipework and to a reinforced concrete first-floor slab.

(3) Internal reinforced concrete dividing walls. These are within the ground floor concrete box and provide seismic support to the first-floor slab. They also provide radiation shielding for operators.

(4) Reinforced concrete first-floor slab. This is a 250mm slab. Tails piping and supports are fixed to the underside of the slab. It acts as a diaphragm to seismically qualify the concrete box structure and provides radiation shielding to protect operators in the upper storey.

(5) Upper steel storey and ground floor lean-to. The area above the first-floor slab and ground floor lean-to do not require seismic qualification so a steel structure is used. They contain utilities and other equipment that do not require shielding and have external roof and side cladding which provides shelter for the equipment.

(6) Stairs and access platforms. There are 3 sets of stairs and an access platform for maintenance and inspection of equipment.

46. It is agreed that the upper steel storey and ground floor lean-to do not qualify for capital allowances because they have no plant-like function. They have no shielding or containment function. It is also agreed that steel supports and inserts attached to the underside of the first-floor slab and the internal walls to secure pipework qualify for capital allowances. Connections for these items were pre-cast into the concrete structure.

47. The ground floor concrete box structure is not intended to provide shelter for the equipment housed in it. The autoclaves are quite sophisticated pieces of electronic equipment. In theory autoclaves could be designed to a specification which could be housed outside, however the autoclaves actually used in the vaporisation facility were not designed to that specification. I infer that is because they were to be housed inside the concrete box structure.

Kiln Facility

48. This is an area of 856m², separated from the vaporisation facility by a handling hall which is not in dispute. It is a multi-storey structure designed around the items of equipment which it supports. It is seismically qualified and provides containment. Occupancy is restricted to necessary inspection and maintenance. No radiation shielding is required to protect the environment or operators, save in relation to the oxide packing area.

49. The requirement for containment and seismic qualification comes from the presence of loose oxide powder, which is transferred using air pressure to a hopper at the top of the facility from where it is fed by gravity into the packaging system and the DV70s. The packing area where the DV70s are placed is on the ground floor raft slab.

50. The kiln facility comprises the following components relevant for present purposes:

(1) Raft slab. This provides seismically qualified support to the two kilns which requires it to be unusually thick. Each of the kilns is installed into a 20-tonne frame which is seismically anchored to the raft slab. To enable this installation a substantially thicker slab is provided than would have been required otherwise. The raft slab also acts as a diaphragm to support the external walls of what is a concrete box structure.

(2) Basement. There is a basement area underneath the kilns and part of the raft slab where oxide from the deconversion kilns is received before being transferred to a hopper at the top of the facility. It is constructed of reinforced concrete in the form of a box and provides seismic support to the raft slab above and the kilns.

(3) External reinforced concrete walls. The four walls of the kiln facility are reinforced concrete. Together with the reinforced concrete upper floors and the reinforced basement the kiln facility comprises in effect three reinforced concrete boxes. Were it not for the need to seismically qualify the equipment in the kiln facility the containment function could have been provided by a steel frame structure.

(4) Reinforced concrete upper floors. There is a reinforced concrete first-floor and a reinforced concrete mezzanine floor which seismically qualify the equipment installed onto them such as the kiln hydrolysis chamber and the powder hopper. The mezzanine is supported by steelwork attached to the external walls. The floors provide access to the equipment sited on them and act as a diaphragm to seismically qualify the structure as a whole. They also hold plant such as the hopper at a height to utilise gravity in the process.

(5) Reinforced concrete roof. This provides containment and acts as an additional diaphragm to seismically qualify the containment structure. It is clad with steel to prevent damage from standing rainwater.

(6) Stairs and access platforms. There are a variety of stairs and access platforms for access to instrumentation and for the operation, maintenance and inspection of equipment.

(7) Air sealed crane access hatch. This is incorporated into the roof above the hydrolysis chamber of each kiln to allow for installation and replacement of the hydrolysis chamber. The hydrolysis chamber is the conical part of the kiln as shown on the block diagram.

(8) Access hatches in the mezzanine and first-floor. These are incorporated into the floors and used to replace filters, taking them from the top section of the kilns back down to ground level.

(9) Additional reinforced concrete slab under powder hopper. The hopper sits on a concrete plinth which is necessary for its seismic qualification.

51. No radiation shielding is required in the kiln facility, save for certain blockwork walls in the oxide packing area which provide radiation shielding for operators in that area.

52. The structure as a matter of fact provides shelter to the equipment and operators in the facility, however this is incidental to its intended function of containment.

Condenser Facility

53. The condenser facility occupies an area of 755m². It is adjacent to the kiln facility and comprises a seismically qualified support and containment structure designed around the condenser. The condenser is essentially a long vertical metal pipe which causes the hydrogen fluoride gas to condense into a liquid at the top and then flow by gravity down the condenser into a receipt tank. Due to the height of the condenser the structure is particularly tall. Seismic qualification is required to prevent damage to the kiln facility in the event of a collapse and to mitigate the risk of release of hydrogen fluoride which presents a chemotoxic hazard. No radiation shielding is required because the volume of radiological contamination is low.

54. The condenser facility comprises the following components relevant for present purposes:

(1) Raft slab. The foundation of the facility is a reinforced concrete raft slab which provides seismic qualification to the structure as a whole.

(2) Steel frame external walls. This is a clad steel framework which is seismically qualified and provides seismic qualification to the structure as a whole.

(3) Reinforced concrete upper floor supports. The floors support various items of equipment including the condenser and provide seismic qualification to the external walls and vice versa. The first-floor extends across the whole structure. Upper floors extend only part way across the structure.

(4) Roof cladding. The facility is covered by steel cladding to contain the escape of any hazardous fumes which could be radiologically contaminated. Were it not for the need to minimise off-site radiation doses the walls and roof would not require cladding.

(5) Stairs and access platforms. There are a variety of stairs and access platforms for the maintenance and inspection of equipment.

55. The primary function of the cladding is containment and the shelter it provides is incidental. In a typical industrial environment, for example in an oil refinery, condensers would be situated in the open air.

Uranium Oxide Store

56. The UOS occupies an area of 6,700m² and is adjacent to the CHF. It is used for the long-term storage of uranium oxide in DV70 containers. Four external concrete walls all provide radiation shielding and are seismically qualified. It is divided into four areas: a receipt and dispatch area and three separate storage modules which are managed remotely via an overhead crane from a control room in the receipt and dispatch area. The storage modules are separated by internal radiation shield walls. The DV70s are made of steel and to ensure that they maintain their integrity the UOS is dehumidified to remove the risk of corrosion.

57. The UOS comprises the following components relevant for present purposes:

(1) Hammerhead crane support sections. These are reinforced concrete beams running the full length of the UOS along the north and south external shield walls to support the crane. They are integrated with the walls. In cross-section, the external walls have a hammerhead appearance. They also support a steel portal frame structure and the roof above the external walls. There would have been no requirement for the hammerhead beams were it not for the need to support the crane. They contribute to the seismic qualification of the structure.

(2) External radiation shield walls. The external shield walls are made of 1000mm reinforced concrete to a height of 10m. This provides lateral radiation shielding. Above that height they support a steel frame construction, and the roof cladding.

(3) Internal radiation shield wall. There is a reinforced concrete shield wall running the full width of the UOS at a height of 5m. This shields the receipts and dispatch area from the storage modules. It is required to be seismically qualified in its own right and also contributes to the seismic qualification of the external shield walls. There are also some smaller “wing walls” which provide localised shielding.

(4) Internal diaphragm walls. There are eight diaphragm walls separating each storage module and through the middle of each storage module at a height of 5m. They are reinforced concrete and provide seismic qualification by way of lateral support to the external shield walls and stiffening the edges of the raft slab. They also provide a degree of radiation shielding for operators.

(5) Raft slab. The raft slab is 1.4 - 2.0m thick reinforced concrete. It is seismically qualified to provide hard standing for the DV70 containers and designed to allow for settlement and movement. It also provides seismic qualification to the external walls, where it is thickest, and to the internal shield walls.

(6) Steel portal frame. To achieve seismic qualification of the steel roof, it is installed on a seismically qualified steel portal frame. This makes it significantly more substantial than a conventional steel frame.

(7) Steel roof cladding. The UOS is not climate controlled, but it must be dehumidified to preserve the DV70s. It therefore requires a roof which is provided by means of steel cladding. The roof also provides a containment function and is seismically qualified.

(8) Stairs and access platforms. Steel access platforms run along the north and south walls of the UOS and are accessed by two steel staircases. They are required only to service the crane, when that cannot be done from the receipt and dispatch area, and use will be rare. There is also a platform and stairs on the west wall for inspecting DV70s before they are put into store.

58. The walls and roof of the UOS provide shelter from wind and rain, allowing the air within to be dehumidified in order to prevent corrosion of the DV70s.

59. There is also a utilities structure and a dehumidifier structure associated with the UOS which it is agreed do not qualify for capital allowances because they have no plant-like function.

60. Urenco suggest that the hammerhead crane support sections are similar to a crane beam in the CHF for which capital allowances had been allowed. I am not satisfied that the crane beam in the CHF provides any seismic qualification to the CHF structure, unlike the hammerhead crane supports in the UOS.

discussion

61. I indicated above that there is an issue as to whether I should first address the question of whether the disputed expenditure is on the provision of plant at common law, before going on to consider whether the general rule giving relief for such expenditure is affected by ss21 and 23. Urenco contends that I should first consider whether the expenditure is on plant before considering whether it is excluded by s21 (buildings). HMRC contend that I should first consider the question of whether the expenditure is excluded from entitlement to capital allowances by virtue of s21.

62. Both parties acknowledge that whichever approach I adopt the result should be the same. I agree. I can see that in some cases it might be helpful to address first the question of whether the expenditure under consideration was on the provision of a building. Especially where that is likely to make any consideration of whether it is expenditure on the provision of plant unnecessary. It is really a question of the balance of convenience in the particular case. For present purposes it seems to me more convenient to consider first the question of whether the expenditure is on the provision of plant.

63. I shall therefore consider the issues under the following headings and in the following order:

(1) The identity of the assets.

(2) Whether the assets function as plant.

(3) Whether any of the expenditure is on the provision of a building.

(4) If so, whether any of the expenditure falls within Items 1, 4 and/or 22 List C

64. There was an issue during the hearing as to whether Urenco was entitled to rely on Items 1 and 4 List C, with HMRC contending that Urenco had not previously put its case on this basis. It is convenient to deal with that matter when considering the fourth issue.

(1) The identity of the assets

65. Urenco contends that I should consider entitlement to capital allowances in relation to each component of each facility identified above because they do not share a common form or function. This might be described as a piecemeal approach. The respondents invite me to take a “single entity” approach where each structure should be separately considered.

66. Some of the factors relevant to identifying the appropriate asset were considered by the Court of Appeal inWimpy International Ltd v Warland[1989] STC 273 in the context of whether disputed items of expenditure had become part of the premises or retained a separate identity. Lloyd LJ adopted the words of Lord Lowry inIRC v Scottish & Newcastle Breweries[1982] STC 296 as follows:

“ … the question seems to me to be whether it would be more appropriate to describe the item as having become part of the premises than as having retained a separate identity. This is a question of fact and degree, to which some of the relevant considerations will be: whether the item appears visually to retain a separate identity, the degree of permanence with which it has been attached, the incompleteness of the structure without it and the extent to which it was intended to be permanent or whether it was likely to be replaced within a relatively short period.”

67. I was referred to two cases to illustrate the process of identifying the relevant assets. InCole Bros Ltd v Phillips55 TC 188 the expenditure was on the installation of electrical apparatus in a department store. The House of Lords accepted that the Special Commissioners were entitled to find as a matter of fact and degree that entitlement to allowances was to be tested on a piecemeal basis and not as a single entity. That finding had been based on the numerous elements in the installation and the different purposes that they served.

68. InIRC v Anchor International Limited[2005] STC 411 the Court of Session was concerned with expenditure on synthetic grass football pitches. These were described as “carpets” laid on a stone pitch base. It was held that the Special Commissioner was entitled to reach the conclusion that the relevant asset was the carpet, which had a separate identity from the works underneath and was not fixed to those works.

69. On the present facts Mr Peacock submitted that visual identity, physical connection and permanence of attachment were not strong factors. Mr Peacock submitted that what was more significant was what he described as the “sense of a complete whole” which he submitted encompassed the existence of a common function or purpose. For present purposes the common functions or purposes were radiation shielding, containment and/or seismic qualification. Not all the disputed items fulfilled all those functions and Mr Peacock submitted that grouping the items by reference to one or more or all of these purposes did not lead to what might sensibly be described as a single entity.

70. Urenco contended that in discussions and correspondence between the parties leading up to the decisions under appeal the respondents were content to adopt a piecemeal approach. I have not been taken to that correspondence in detail and I do not consider it appropriate to take it into account in relation to the approach I should adopt on this appeal.

71. Mr Bremner submitted that each facility structure should be considered as a separate entity, that is the CHF, the vaporisation facility, the kiln facility, the condenser facility and the UOS. Within those structures there are individual items which retain their individual identity such as the kilns and the condenser and in those cases they have been separately identified and they are agreed to be plant. He submitted that the individual components within each structure were all physically very closely connected, supporting one another and working together to provide radiation shielding, seismic qualification and/or containment. They have an identity of their own in terms of form and function.

72. I accept that the disputed components in each facility are closely physically connected. To a large extent they support each other and work together in providing radiation shielding, containment and seismic qualification, or a combination of those three functions. The structures all have a separate visual identity, especially when they are considered without the cladding. In my view to a large extent each structure comprises a whole. Each structure can be described as a “safety significant structure” in its own right. Looking at each structure in turn:

(1) The items which comprise the CHF can readily be seen to form a separate structure and to function as such. Mr Nicholson described it as a monolith, by which he meant that the walls and roof act together to provide support and seismic qualification. The structure provides radiation shielding for the environment, and for operators within, and containment. It is seismically qualified as a whole. In my judgment it would be artificial to consider the raft slab, the walls, the roof or other components as having separate identities. The upper part of the west wall is designed to be removable but even that component naturally forms part of the facility as a whole. The only exceptions to this are the internal radiation shield walls where seismic qualification is merely incidental to the purpose of shielding operators in the CHF; the raised platforms or plinths which perform a specific function of supporting rails at the correct height for transportation purposes; and the stairs and access platforms which are intended only to service the crane. I might also add the crane beam and plinths where it is agreed that they qualify for capital allowances separately.

(2) The items which comprise the vaporisation facility can readily be seen to form a separate structure and to function as such. That structure includes the first-storey concrete box which Mr Nicholson also described as a monolith. The concrete box has a containment function, a shielding function and is seismically qualified as a whole. It would be artificial to consider the slabs, external walls and internal walls as having separate identities. The only exceptions to this are the stairs and access platforms which are for the maintenance and inspection of equipment. I might also add the steel supports and inserts which secure pipework and it is agreed that they qualify for capital allowances separately. As noted, it is agreed that the upper steel storey and the ground floor lean-to do not qualify for capital allowances. Visually they appear to be part of the structure and functionally they house and shelter equipment which is necessary for the operation of the facility. I shall therefore treat them as part of the single entity that is the vaporisation facility.

(3) The items which comprise the kiln facility can readily be seen to form a separate structure and to function as such. Mr Nicholson described it as a monolith. The structure provides containment and is seismically qualified as a whole. It would be artificial to consider the raft slab, walls, basement, upper floors or roof as having separate identities. The only exceptions to this are the stairs and access platforms, the access hatches and the concrete plinth supporting the hopper which perform specific, different functions.

(4) The items which comprise the condenser facility can readily be seen to form a separate structure and to function as such. That structure provides containment and seismic qualification for the plant in the facility. The structure was not described as a monolith, but it would be artificial to consider the raft slab, the steel frame external walls, the upper floors or the roof cladding as having separate identities. The only exception to this is the stairs and access platforms for the maintenance and inspection of equipment.

(5) The items which comprise the UOS can readily be seen to form a separate structure and to function as such. Mr Nicholson described the structure excluding the steel portal frame and roof as a monolith. The structure as a whole provides shielding, containment and seismic qualification for the plant in the facility. It would be artificial to consider the raft slab, the external walls, the internal walls, the steel portal frame or the roof cladding as having separate identities. The hammerhead crane support is integrated with the walls and forms part of the structure. The only exception to this is the stairs and access platforms for the maintenance and inspection of equipment.

(2) Whether the assets function as plant

73. In deciding whether an item is plant for the purposes of s11 CAA 2001 the starting point is a definition of plant given by Lindley LJ inYarmouth v France(1887) 19 QBD 647:

“ In its ordinary sense …[plant] includes whatever apparatus is used by a business man for carrying on his business — not his stock-in-trade which he buys or makes for sale; but all goods and chattels, fixed or moveable, live or dead, which he keeps for permanent employment in his business.”

74. Once stock in trade is eliminated, the test involves consideration of what operation the asset performs in the business, a functional test, and whether the asset is merely the premises or setting in which the trade is carried on as opposed to an asset by which the trade is carried on. Having said that, an asset which has a function in the trade and also provides the place in which the business is carried out will still qualify as plant. In some cases, the disputed assets are in part the mechanism by which the trade is carried on and in part the premises from which the trade is carried on.

75. InCIR v Barclay, Curle & Co Ltd(1969) 45 TC 221 the House of Lords held that a dry dock constructedby a company which carried on business involving repairs to ships constituted plant. The disputed expenditure was the cost of excavating the dock basin and of concrete work for the dock itself. Although it may have appeared to be the premises in which the taxpayers carried on their business, it was in fact used by them as plant. Their Lordships noted as follows:

“[I]t is apparent that there are two stages in the [taxpayers’] operations. First, the ship must be isolated from the water and then the necessary inspection and repairs must be carried out. If one looks only at the second stage it would not be difficult to say that the dry dock is merely the setting [i.e. premises] in which it takes place. But I think that the first stage is equally important, and it is obvious that it requires massive and complicated equipment. No doubt a small vessel could be got out of the water by the use of comparatively simple plant and machinery, but clearly this is impossible with a very large vessel. It seems to me that every part of this dry dock plays an essential part in getting large vessels into a position where work on the outside of the hull can begin, and that it is wrong to regard either the concrete or any part of the dock as a mere setting or part of the premises in which this operation takes place. The whole dock is, I think, the means by which, or plant with which, the operation is performed.”

Lord Reid at p239

“In order to decide whether a particular subject is an ‘apparatus’ [and so constitutes plant] it seems obvious that an inquiry has to be made as to what operation it performs. The functional test is therefore essential, at any rate as a preliminary. The function which the dry dock performs is that of a hydraulic lift taking ships from the water on to dry land, raising them and holding them in such a position that inspection and repairs can conveniently be effected to their bottoms and sides.”

Lord Guest at p244

“At the end of the day I find the functional test propounded [inYarmouth] to be as good as any, though, as was said inJarrold v. John Good & Sons, some plant may perform its function passively and not actively. But in the present case this dry dock, looked upon as a unit, accommodates ships, separates them from their element and thus exposes them for repair; holds them in position while repairs are effected, and when this is done returns them to the water. Thus the dry dock is, despite its size, in the nature of a tool of the respondents’ trade and, therefore, in my view, ‘plant’.”

Lord Donovan at p250

76. The reference by Lord Donovan to plant performing its function passively and not actively was to moveable partitions in Jarrold which, notwithstanding being described as performing their function passively, were held to be plant.

77. InWangaratta Woollen Mills Ltd v Federal Comr of Taxation(1969) 119 CLR 1the High Court of Australia was concerned with a dyehouse which was part of a larger complex constructed inside some external walls and including some demountable wall panels designed to act as shields to prevent fibre particles drifting into different areas of the dye house. The taxpayer’s business was the dyeing and spinning of worsted yarn. The dyeing process consisted of dipping wool tops in vats containing hot corrosive liquid dyes which gave off noxious fumes. The dyehouse contained pits into which the vats were set and incorporated specially designed drains for corrosive liquids leading to an external settling pond. There were structural features in the walls and ceiling to aid ventilation of clouds of steam and poisonous gases given off whenever a vat was opened. The external walls served only to provide protection from the elements. The court held that except for the external walls the whole dyehouse was in the nature of a tool and was much more than a convenient setting for the taxpayer’s business. For example, the ventilation system which was incorporated into the structure by design prevented the spoiling of materials. The drains removed volatile liquids which would otherwise disrupt the process.

78. I was referred to a number of authorities where consideration was given to the issue as to whether structures perform a function in the taxpayer’s business and ascertaining whether they are something “with which” the business is carried on or the setting “in which” the business is carried on. It is helpful to consider these cases not just for the principles identified but also as illustrations as to how those principles are applied to particular structures on the facts of each case.

79. InSchofield v R & H Hall Ltd49 TC 538a concrete grain silo for the temporary storage and delivery of grain was held to be plant by the Court of Appeal of Northern Ireland. Grain was loaded into the silos from ships and held for a short period of time before being delivered using gravity to lorries at the dockside. The Court of Appeal applied the reasoning of the High Court of Australia in Wangaratta Woollen Millswhich was itself decided after Barclay Curle & Co.Each silo was “a tool in the trade”carried on by the taxpayer.

80. InBenson v Yard Arm Club Limited[1979] STC 266, the Court of Appeal held that a ship which had been converted into a floating restaurant did not constitute plant because its only function was to serve as the premises of the restaurant. It made no difference in that regard that it constituted an attractive venue for customers. Buckley LJ described the distinction in these terms at 273b:

“The distinction, I think, is that in the one case the structure is something by means of which the business activities are in part carried on; in the other case the structure plays no part in the carrying on of those activities, but is merely the place within which they are carried on. So, in the case at any rate of a subject-matter which is a building or some other kind of structure, regard must be paid to the way in which it is used to discover whether it can or cannot be properly described as plant. This is what has been referred to as the functional test. Indeed I think that this test is applicable to every kind of subject-matter. In some cases the effect of the functional test may be so immediately apparent that the character of the subject-matter as plant goes without saying and the test need not be consciously applied. But in cases nearer the line, in my opinion, the functional test provides the criterion to be applied. Is the subject-matter the apparatus, or part of the apparatus, employed in carrying on the activities of the business? If it is, it is no matter that it consists of some structure attached to the soil. If it is not part of the apparatus so employed, it is not plant, whatever its characteristics may be.”

81. InSt John’s School vWard [1974] STC 69, Templeman J held (in a decision approved by the Court of Appeal: [1975] STC 7) that a pre-fabricated school laboratory and gymnasium did not constitute plant. Notwithstanding that they had been purpose built for such uses, their only function was to serve as premises on which the taxpayer’s educational activities were carried on.

82. These authorities were referred to by the Court of Appeal inWimpy International Ltd v Warlandwhere Fox LJ stated:

“ …There is a well established distinction, in general terms, between the premises in which the business is carried on and the plant with which the business is carried on. The premises are not plant…

… [I]t is not sufficient to say that something is part of the real property. It can still be plant as theBarclay CurleandBeach Station Caravanscases show. Moreover, the test is not whether the item is a fixture. Central heating apparatus must, I think, be plant. But there may be cases in which the degree of affixation is a matter to be taken into consideration.”

83. InBradley v London Electricity plc[1996] STC 1054, Blackburne J considered the structure for an underground electricity substation beneath Leicester Square. The structure was designed to include a system for cooling the three transformers which each had their own walled bays. The walls were designed to withstand explosions. The roof was designed to support earthing switches.The Judge identified the “essential question” as followsat p1081:

“… it can safely be said that the fact that … the substation is specially designed for LondonElectricity's trading activity—and cannot sensibly be used other than for the purposes of that activity—does not mean that the structure of the substation is plant. Conversely, the fact that it is a substantial fixed structure, with a roof and inner and outer walls and floors, and has in it what is accepted to be plant used for the purposes of LondonElectricity's business, does not mean that it must be regarded as premises rather than as plant.

The essential question is, as Nourse LJ put it inGray v Seymours Garden Centre, whether what was identified before the Special Commissioner as the structure of the substation, ie those items identified as 'the premises' in the Scott Schedule attached to the Special Commissioner's decision, as distinct from the equipment within (which, it is common ground, constituted plant used in LondonElectricity's business) can reasonably be called apparatus with which that business is carried on as opposed to the premises in which it is carried on.”

84. In answering this question it was not enough “to point to particular features of parts of the structure which perform plant-like functions”. Rather it was necessary to identify the overall function of the item in question. Although the structure in question “was carefully designed to accommodate the equipment within”, that did not alter the conclusion that it was “plainly the premises in which the activity is conducted” (p1082-1084). Plinths on which transformers were placed were accepted to be plant.

85. InAttwood v Anduff Car Wash Limited[1997] STC 1167 the Court of Appeal held that a car wash hall did not function as a whole as plant. The building functioned as premises. It housed the machinery used to wash cars which were pulled through the wash hall mechanically. The wash hall was the place where the car washing, drying and waxing were carried out. It retained noise and heat and provided protection from the elements. It was designed to recycle water, including rainwater, but this did not affect that conclusion.

86. InCooke v Beach Station Caravans[1974] 3 All ER 159 Megarry J held that costs incurred by a caravan park operator in excavating and constructing a swimming pool with associated terracing was expenditure on the provision of plant.

87. InCarr v Sayer[1992] STC 396 the question concerned whether quarantine kennels for animals constituted “plant”. The kennels had been constructed by taxpayers who carried on a business providing quarantine kennels and transport services for animals brought to the UK from abroad. In concluding that the kennels did not constitute plant, Sir Donald Nicholls set out a number of principles and held at p402-403 as follows:

“…[B]uildings, which I have already noted would not normally be regarded as plant, do not cease to be buildings and become plant simply because they are purpose-built for a particular trading activity. Such a distinction would make no sense.Thus the stables of a racehorse trainer are properly to be regarded as buildings and not plant. A hotel building remains a building even when constructed to a luxury specification. I say nothing about particular fixtures within the building. Similarly with a hospital for infectious diseases. This might require special lay-out and other features but this does not convert the buildings into plant. A purpose-built building, as much as one which is not purpose-built, prima facie is no more than the premises on which the business is conducted.

Fifth, one of the functions of a building is to provide shelter and security for people using it and for goods inside it. That is a normal function of a building. A building used for those purposes is being used as a building. Thus a building does not partake of the character of plant simply, for example, because it is used for storage by a trader carrying on a storage business. This remains so even if the building has been built as a specially secure building for use in a safe-deposit business. Or, one might add, as a prison. Again, I say nothing about particular fixtures within such a building.

When those principles are applied in the present case they seem to me to lead inevitably to the conclusion that the permanent quarantine kennels are not plant. On the primary facts found by the commissioners the kennels are purpose-built permanent buildings or structures and they are used as such. They are the premises at which and in which the business is conducted. True, they are specifically designed for quarantine purposes by having the structure made of particular materials: the roof is made of steel and the walls are impermeable. These features are building design features and no more. They do not result in the overall resultant structures being characterised as anything other than buildings. They do not lead to the end result having the character of equipment or apparatus”.

88. The decision inCarr v Sayerwas considered by the Court of Appeal inAttwood, where at 1176e Peter Gibson LJ stated:

“The question in each case is, as Fox LJ said (inWimpy[1989] STC 273 at 280): does the item function as premises or plant? To answer this may involve deciding whether it is more appropriate to describe the item as apparatus for carrying on the business or as the premises in or upon which the business is conducted. Thus inCarr v Sayerthere can be no doubt but that the kennels were an essential part of the business of providing quarantine kennels for dogs and cats brought into the United Kingdom and thus were part of the means by which the trading operation was carried out. Yet the premises test was not satisfied because the kennels performed a typical premises function, providing shelter.”

89. It seems to me that the following propositions relevant to the present case can be derived from the authorities:

(1) Plant can comprise large structural items.

(2) There is a distinction to be made between a structure which is merely the setting in which a trade is carried on and a structure which constitutes the apparatus with which the trade is carried on.

(3) The function of plant in a trade can be active or passive. For example, moveable partitioning might be said to perform its function passively but it may still be plant.

(4) Premises do not fall to be regarded as functioning as plant simply because they have been designed to satisfy the particular requirements of the business in question.

(5) A structure which is merely the setting in which a business is carried on is not plant.

(6) If a structure is both the setting and the means by which the business is carried on then it will be plant.

(7) An item that might otherwise be described as a building is likely to be a place in which the business is carried on and not plant, but not necessarily so.

(8) It is important to be careful and precise in analysing the function of the item for the purpose of distinguishing premises from plant.

90. It was not disputed that expenditure “on the provision of” plant includes installation costs. InBen-Odeco Ltd v Powlson[1978] 2 All ER 1111where it was held that financing costs were not qualifying expenditure, Lord Wilberforce stated at 1115g:

“ The words ‘expenditure on the provision of’ do not appear to me to be designed for this purpose. They focus attention on the plant and the expenditure on the plant – not limiting it necessarily to the bare purchase price, but including such items as transport and installation, in any event not extending to expenditure more remote in purpose.”

91. InJD Wetherspoon plc v HM Revenue & Customs[2012] UKUT 42 it was recorded at [40] as common ground between the parties that expenditure on the provision of plant extended toexpenditure to ensure that plant could actually be operated.

92. Mr Peacock effectively submitted that each of the structures and the other disputed items which I have identified above perform a function in the trade and are properly to be treated as plant, even if in the case of the structures they might also be described as the premises in which the trade is carried on. He placed particular reliance on the decision inWangaratta, noting that:

(1) expenditure on the dyehouse was allowed because it was seen as a functioning asset and not merely the setting in which the trade was carried on.

(2) expenditure on external walls in that case was not allowed because it did nothing more than exclude the elements.

93. Mr Bremner effectively submitted that the structures are merely the setting in which the deconversion process takes place and that they do not perform any function in that process. They simply housed the plant and machinery which performed the deconversion process.

94. Mr Bremner submitted that the radiation hazards which need to be controlled at the TMF are generated by the presence of Tails and the uranium oxide, rather than by any processes carried on at the TMF. I consider that submission is based on a view of the processes which is too simplistic. Mr Nicholson’s evidence which I accept was that processing the Tails gives rise to new and additional risks. There are hazards associated with the Tails and, albeit to a lesser extent, with the resulting uranium oxide and hydroflouric acid following the process. There are also hazards during the processing resulting from the production and movement of uranium oxide powder and the hydrofluoric gas which can also contain radioactive material. As soon as the Tails are removed from the cylinders the hazard increases. Having said that, whilst the processing could not take place without the safety significant structures being in place, that is not the test. It is not sufficient to say that “but for” the structures the process could not be carried out. It is necessary to identify a specific function of the structures. Mr Peacock accepted that the disputed assets and the structures do not themselves do the deconversion of Tails but he submitted that they provide an essential safety function in that process. The same might be said of the cylinders and the cranes which it is accepted are plant and machinery.

95. In my view the starting point is to identify the trade carried on by Urenco at the TMF. It may be described as the deconversion of Tails so as to produce and store uranium oxide and to produce hexafluoric acid for sale as an industrial material. All the processes carried out at the TMF are directed towards those ends. I consider that the safety functions of shielding, containment and seismic qualification are properly viewed as part of the setting in which that trade is carried out. Shielding and containment are akin to preventing noxious fumes or odours escaping from a processing plant. InWangarattathe dyehouse and the apparatus within it were treated as a complex whole in which every element including the structure was essential for the efficient operation of the whole. The structure did not just provide the setting but was part of the dyeing process, removing volatile gases and liquids which would otherwise adversely affect the dyeing process. That is not the case here. The safety significant structures provide a safe setting for the processes to be carried out. Without the structures the actual processes could still be carried on efficiently, although I accept that is entirely theoretical because the regulatory environment would not permit it to happen. But the regulatory environment is not in my view relevant to whether an asset performs a function in the trade. It cannot be said that in providing shielding and/or containment the structures have any function in the actual processing of Tails which is carried out by the plant and machinery in the TMF.

96. As far as seismic qualification is concerned, in a sense it is incidental to ensuring the integrity of the shielding and containment functions of each facility. It represents the standard and method of construction required to maintain shielding and containment in an extreme seismic event.

97. Mr Peacock submitted that the radiological hazards are a direct result of processes carried out at the TMF. All the features of the structures, namely their containment, shielding and seismic qualification are an essential and necessary part of the trade processes. They performed a trade function and not simply a premises function. Even if they were the setting in which the processes were carried out, they also enabled those processes to be carried out safely and performed a plant-like function. As such the expenditure on each structure was to make the plant and machinery usable. I do not accept that argument. In my view the expenditure cannot be regarded as part of the cost of installation of the plant and machinery within the structures merely because that plant and machinery could not safely be used without it.

98. I consider that there must be some other function performed by the structures in the trade if they are to be treated as plant. Looking at each structure and asset in turn as previously identified:

(1) The functions of the CHF structure are shielding and containment of radioactivity. It has the appearance of a building, with four walls and a roof enclosing a substantial volume of space. The walls and roof are not required or intended to provide shelter for material, equipment, machinery or operators. The roof cladding is intended to provide shelter, not for the items inside the CHF but for the concrete roof that would otherwise be damaged by the effects of standing rainwater. In my view the shielding and containment functions are functions of premises and not functions in processing the Tails. The structure is purpose built to house the plant and machinery required to carry out the processing of the Tails. Such a structure would not sensibly be used in any other context but fundamentally it simply provides a safe and secure setting in which the Tails are processed. It is not part of a complex whole in the same way that the dyehouse was inWangaratta.

(2) The function of the internal radiation shield walls is to shield operators in the CHF. In my view these walls are in the nature of fixed partitioning, although obviously more substantial and with a specific safety purpose in the context of processing radioactive material. I consider that they are part of the setting in which the processing takes place.

(3) The raised platforms or plinths perform the specific function of enabling rails to be at the correct height to enable transportation of cylinders to and from the vaporisation facility. That is a function in the processing of the Tails and in my view they fulfil the definition of plant. Even if the plinths themselves are not plant, I do not accept Mr Bremner’s submission that constructing the plinths is merely part of getting the premises ready to receive the plant. I agree with Mr Peacock that expenditure on the plinths is fairly described as part of the cost of installing the rail system in the sense of making it usable.