Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

First-tier Tribunal (Tax)

You are here: BAILII >> Databases >> First-tier Tribunal (Tax) >> Gardarsson (t/a Action Day) v Revenue & Customs (VALUE ADDED TAX - zero rating - whether Action Day planner is a book) [2019] UKFTT 441 (TC) (08 July 2019)

URL: http://www.bailii.org/uk/cases/UKFTT/TC/2019/TC07255.html

Cite as: [2019] UKFTT 441 (TC), [2019] SFTD 1185

[New search] [Contents list] [Printable PDF version] [Help]

[2019] UKFTT 0441 (TC)

VALUE ADDED TAX – zero rating – whether Action Day planner is a book – yes – appeal allowed

|

FIRST-TIER TRIBUNAL TAX CHAMBER |

|

TC07255

Appeal number: TC/2017/9547 |

BETWEEN

|

|

Thorsteinn gardarsson t/a action day a islandi |

Appellant |

-and-

|

|

THE COMMISSIONERS FOR HER MAJESTY’S REVENUE AND CUSTOMS |

Respondents |

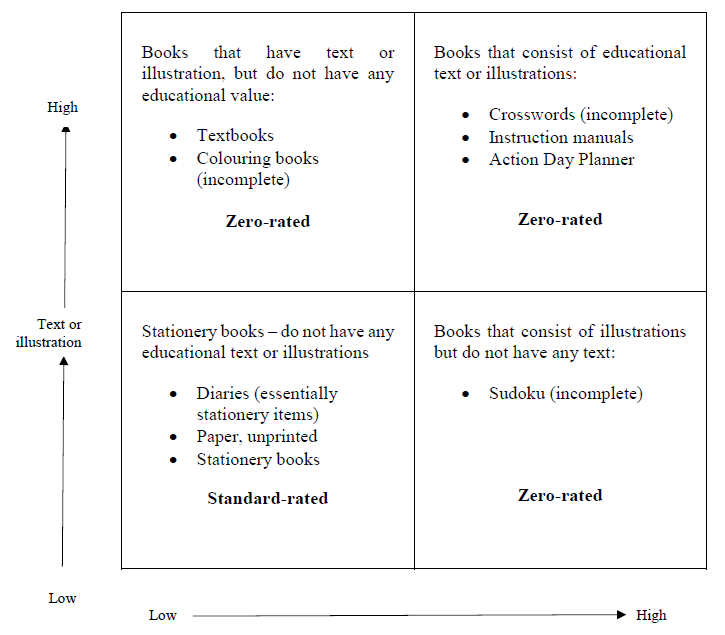

|

TRIBUNAL: |

JUDGE amanda brown sheila cheesman |

Sitting in public at Taylor House, 80 Rosebery Avenue, London on 14 June 2019

Mr Thorsteinn Gardarsson in person.

Mr Dermot Ryder, litigator of HM Revenue and Customs’ Solicitor’s Office, for the Respondents.

DECISION

Introduction

1. This appeal was bought in respect the decision by HM Revenue & Customs (“HMRC”) that Thorseinn Gardarsson (“the Appellant”) was liable to be registered for VAT with effect from 26 July 2013 as a consequence of sales made of the product known as the Action Day Planner (“the ADP”) in the UK. HMRC considered that the ADP was not a product eligible to be taxed at the zero rate and accordingly raised assessments to tax and associated inaccuracy penalty assessments together with a penalty for failure to notify a liability to be registered for VAT.

2. However, at the heart of the appeal was a dispute was whether the ADP was liable to VAT at the zero or standard rate. If, as the Tribunal has concluded, the ADP is a zero rated book the assessments to tax and penalties all fall away.

Brief chronology

3. The Appellant’s resides and operates his business from Iceland. He is an Amazon market place trader and effects sales of the ADP to customers in the UK through that platform. He began trading into the UK on 26 July 2013.

4. On 19 July 2017, as part of a routine check on what are known as non-established taxable persons, HMRC began an enquiry into the VAT registration status of the Appellant.

5. In response to that enquiry the Appellant claimed that the ADP was a zero rated book and that whilst he had submitted an application to be registered for VAT purposes on 4 July 2017 he considered that no VAT was payable.

6. Following further investigation into the ADP HMRC concluded that the ADP was not a book but was unused stationery falling outside the eligibility to be zero rated and thereby subject to VAT at the standard rate.

7. On 4 October 2017, having established that the Appellant’s Amazon trading account indicated that he had begun importing the ADP into the UK with effect from 26 July 2013, HMRC revised the Appellant’s effective date of registration to 26 July 2013.

8. On 17 November 2017 HMRC issued an assessment to VAT for prescribed accounting period 08/17 in the sum of £12,769.59. An assessment for the long first prescribed accounting period 26 July 2013 to 30 June 2017 in the sum of £158,024.77 was issued on 21 March 2018.

9. A late notification penalty in the sum of £33,188.98 and an inaccuracy penalty in the sum of £1,915.43 were also issued on 22 November 2017.

Action day planner

10. The Tribunal were shown an example of the ADP and find the following facts in relation to it:

(1) The external appearance if the ADP is that of a black leather/leather substitute covered book larger than A5 but smaller than A4 (its dimensions are 20.3 x 15.2 x 1.3cm). It has an elastic strap attached to the inside of the back cover that can be wrapped around the front to hold it closed. The Tribunal understands the ADP cover is available in different colours and a larger version is also available.

(2) Inside it has 115, 100gsm, slightly off white, pages.

(3) The ADP is described as a time management tool developed to “help people to grow; to teach and instruct people time management skills”. It is an interactive tool intended to facilitate the discipline of time management, step by step building habitual behaviour.

(4) The first 16 pages of the ADP contain text setting out a narrative of the ethos articulated by the Appellant for effective time management following themes of “attitude”, “goals” and “actions” together with the “discipline of rituals”.

(5) The remainder of the ADP is taken up with 52 double page planners. The layout follows the methodology advocated in the first 16 pages with space to set out “tasks to execute” “delegation and teamwork” a column for each day of a week and “goals/projects I am going to work on this week”. The columns for each day represent a little over one quarter of each double page.

(6) The 52 double pages are dated and the ADP is produced for a calendar or academic year.

(7) At the back is a cardboard slip pocket.

(8) The ADP retails for approximately £20.

Legislation

Zero rating

11. Section 30 Value Added Taxes Act 1994 (“VATA”) provides:

(1) Where a taxable person supplies goods or services and the supply is zero rated, then whether or not VAT would be chargeable on the supply apart from this section:

(a) no VAT shall be charged on the supply; but

(b) it shall, in all other respects, be treated as a taxable supply;

and accordingly the rate at which VAT is treated as charged on the supply shall be nil.

(2) A supply of goods or services is zero-rated by virtue of this subsection if the goods or services are of a description for the time being specified in Schedule 8 or the supply is of a description for the time being so specified.

12. So far as relevant Schedule 8 VATA provides:

Group 3

Item 1 – Books, booklets, brochures, pamphlets and leaflets

Registration

13. So far as relevant Schedule 1A VATA, Registration in respect of taxable supplies: non-UK establishment, provides:

1 Liability to be registered

(1) A person becomes liable to be registered under this Schedule at any time if conditions A to D are met:

(2) Condition A is that:

(a) The person makes taxable supplies, …

(3) Condition B is that those supplies … are … made in the course or furtherance of a business carried on by that person.

(4) Condition C is that the person has no business establishment, or other fixed establishment, in the United Kingdom in relation to any business carried on by the person.

(5) Condition D is that the person is not registered under this Act.

5 Notification of liability and registration

(1) A person who has become liable to be registered by virtue of paragraph 1(2)(a) … must notify the Commissioners of the liability before the end of the period of 30 days beginning with the date on which the liability arises.

(2) The Commissioners must register any such person (whether or not the person so notifies them) with effect from the beginning of the day on which the liability arises.

13 Exemption from registration

(1) The Commissioners may exempt a person from registration under this Schedule if the person satisfies them that the taxable supplies that the person makes …

(a) are all zero rated …

(2) The power in sub-paragraph 1 is exercisable only if the person so requests and the Commissioners think fit. …

HMRC guidance on zero rating of books

14. HMRC’s interpretation of the zero rating provisions for books are set out in VAT Notice 701/10: zero rating of books and other forms of printed matter. It provides:

“2 The format of the Group 3 items

The words in Group 3 are used in their ordinary, everyday sense. This means they are restricted to goods produced on paper and similar materials such as card. Most items qualifying for zero-rate will be products of the printing industry (including items printed in Braille), but goods which are photocopied, typed or hand-written will, in some cases, also qualify.

3 Meaning of the group 3 items:

3.1 Books and booklets

These normally consist of text or illustrations, bound in a cover stiffer than their pages. They may be printed in any language or characters (including Braille or shorthand), photocopied, typed or hand written, so long as they are found in a book or booklet form.

Supplies of any of the following are zero rated:

· Literary works

· Reference books

· Dictionaries or catalogues

· Antique books

· Collections of letters of documents permanently bound in covers

· Loose-leaf books, manuals or instructions, whether complete with their binder or not

· Amendments to zero-rated books loose-leaf books, even if issued separately

School books and other educational tests in question and answer format, are zero-rated because the spaces provided for the insertion of answers are incidental to the essential character of the book or booklet. The same applies to exam papers in question and answer format provided that qualify as books, booklets, brochures, pamphlets or leaflets.

But supplies of the following are standard-rated:

· …

· Products that are essentially stationery items, for example, diaries and address books …

4 Items not included within any of the Group 3 items

…

4.2 Stationery

Stationery items such as account books and exercise books are standard-rated. Some items which are standard-rates stationery when new and unused can be zero-rates if sold after they have been completed, provided that they have then the physical characteristics of a book or other zero-rated items. Examples are completed diaries or ship’s logs but not completed stamp albums.

8 Liability of some common items

In the lost below we five our views of the liability of items which are commonly the subject of queries about the zero-rating for books, etc.

However, you should not assume that an article is zero-rated under group 3 just because it is not shown as standard rated in the list, or determine liability by referring only to this list. You must satisfy yourself by reference to the general body of guidance in this notice that the product qualifies for zero-rating under one of the items of Group 3 …

|

Item |

Liability |

|

Account books |

Standard-rated |

|

Address books |

Standard-rated |

|

Colouring books (children’s) |

Zero-rated |

|

Crossword books |

Zero-rated |

|

Diaries (unused) |

Standard-rated |

|

Instruction manuals |

Zero-rated |

|

Stationery books |

Standard-rated |

Non exhaustive replication of the list – selecting those most relevant in this appeal

Case law concerning books

15. There are two cases to which the parties referred providing the guidance by reference to which the Tribunal must determine this appeal:

Customs and Excise Commissioners v Colour Offset Ltd – [1995] STC 85

16. The case concerned the sale of diaries and address books. The diaries in question were traditional pocket diaries and address books with flexible vinyl covers bearing the logo of a charity. For the diaries each page was horizontally divided into 7 days. At the front and the back were a number of pages mainly consisting of adverts but also what was described as “the kind of information often found in pocket diaries”. Critically, it was agreed that the main purpose was to provide blank spaces to be written in with the printed material being incidental to that purpose.

17. It was submitted on behalf of the revenue authorities in that case that whilst the items in question could be viewed as books in the widest sense the language of Group 3 should be construed in accordance with the apparent legislative policy and purpose of avoiding VAT on reading, such that a wide interpretation was inappropriate. May J accepted that where an item contained reading material and space for writing it was necessary to determine the main function of the article.

18. May J articulated: “In my judgment the English word ‘book’, although it always refers to an object whose necessary minimum characteristics are that it has sufficient leaves, now usually of paper, held together front and back by covers usually of more substantial than the leaves, is a word with a variety of possible meanings. For any particular use of the word, its particular meaning will be derived from the circumstances in which it is used … In the first instance, the only circumstance here is that the words ‘books’ and ‘booklets’ are used in the Schedule to a statute. They are accordingly relevantly devoid of context. Devoid of context, in my judgment the ordinary meaning of the word ‘book’ is limited to objects having the minimum characteristics of a book which are to be read or looked at.”

Tudor Print and Design Limited (decision number 17848)

19. Tudor Print concerned the liability of an item produced by the taxpayer. The item again had pages and a plastic cover into which the front and back card was inserted. The item included twenty pages of information about various sporting events both future and past, predominantly horse racing focused as the taxpayer’s customer was a betting shop. There were three pages of calendar and then a section laid out like a conventional diary save for the fact that the names of courses for race meetings were already inserted on the relevant dates and a picture of a race horse was lightly printed on each double page. At the end there were three pages in which to write addresses and an area for notes.

20. The dispute was stated to be whether the item in question was a book or a diary.

21. Having been referred to the judgment in Colour Offset the Tribunal stated:

“9. The essence of the judge’s conclusion was that the individual goods included in Item 1 of Group 3 were essentially those intended to contain reading matter. Items of the same superficial appearance but which were intended to be written on were of a different character, properly to be regarded as stationery. In the case of articles which performed both functions, as a typical diary does, the judge said this “where an article contains some reading material and some space for writing [counsel for the Commissioners] submits that it is necessary to consider whether the main function of the supply is to provide reading material or writing material. He submits that the main function of these articles is that they are supplied to be written in. I have already indicated that I agree with this last point””

22. The taxpayer in that case sought to assert that the items in question were not diaries in the ordinary sense but were properly described as fixture lists with the space for writing being inadequate to meet the function of a diary. HMRC’s predecessor contended they were diaries.

23. The tribunal determined that whilst the space available for writing was more limited than would normally be expected it was, nevertheless, adequate. Applying the approach in Colour Offset the tribunal determined that the item was a diary and therefore standard rated.

Parties submissions

Submissions for the Appellant

24. The Appellant passionately submitted that the ADP was a zero rated book. He had meticulously considered and analysed the provisions of Notice 701/10 producing a chart by reference to which he made his submission (inserted below).

25. In the submission of the Appellant the ADP is not a diary and despite it having space in which the “student” seeking to master skills of time management may enter information, doing so is merely part of the learning taught through the narrative sections of the book. In the Appellant’s submission the entries made were essentially represented the implementation and practice of the methodology set out in the early pages. He described that the ADP is designed to be read and to teach step by step viewing the space by reference to which the reader achieves effective time management representing text/illustration and thereby part of the educational features of the book and not for the main purpose of being written in.

HMRC’s submissions

26. HMRC submitted that the ADP was properly to be considered a diary and thereby standard rated. By reference to the ordinary meaning of the word ‘book’, as articulated in Colour Offset, the ADP was not a book on the basis that the ADP’s main function was to be written in and not to be read.

27. HMRC referenced that on Amazon, prior to the assessments being raised, the ADP was listed as a diary.

28. When questioned by the Tribunal as to the rationale for zero rating, for instance, GCSE revision questions or practice papers or crossword books which too had the unquestionable function of being written in (in the case of a crossword puzzle arguably the only function of being written in) the representative of HMRC, though seeking to assist the Tribunal as much as possible, was unable to articulate the rationale for treating these as zero-rated in the context of the test espoused to the Tribunal.

Discussion

29. With respect to the tribunal in Tudor Print this Tribunal considers that it is not the correct approach to look to compare, for instance, whether the ADP is a book or a diary. Zero-rating applies to ‘books’ with the consequence that in order to be zero rated the ADP must be a book. If it is not a book it matters little what it is.

30. Though an old case the judgment of the High Court in Colour Offset is binding on this Tribunal and the approach we must adopt in determining the liability to VAT of the ADP is to apply the ordinary meaning of the word ‘books’ and assess the qualities of the ADP against that meaning.

31. The approach to be adopted, perhaps not unsurprisingly, in applying the ordinary meaning when determining the question of zero-rating is more commonly applied when assessing the liability of food products, most particularly ‘cakes’. Those cases take a common sense approach when looking at what is frequently a very nuanced issued. The case of Lees of Scotland Ltd & Thomas Tunnock Ltd v HMRC [2014] UKFTT 630 provides some useful guidance. In that case it was highlighted that where a product has the characteristics of two statutory categories (in that case cake and confectionary), then it should be placed in that category for which it has sufficient characteristics to qualify.

32. The starting point is the ordinary meaning of the word book. It is unquestionably the case that many books have the main function of being read whether for the purposes of obtaining information, being educated or simply for recreational purposes. However, the Tribunal takes the view that the inclusion crossword books, exam study guides etc. appears to accord with a view that such books are generally accepted as falling within the ordinary meaning of the word ‘book’ and that position is accepted by HMRC and, as such, illustrates that ‘books’ are not only to be read.

33. The Tribunal considers that within the ordinary meaning of the word book is any item with the physical characteristic of a book (i.e. as a minimum covers, pages, text and/or illustration) which has as its main function informing/educating or recreational enjoyment. So defined every item listed in section 8 Notice 701/10 would pretty consistently be rated as per the Notice. It is not a question as to whether the item is to be written in or on it is the interaction between the space for writing and the text/illustration of which that writing space forms part which determines whether the item is a book, as distinct from stationery.

34. When applying that lens the Tribunal has, after much debate, taken the view that the section at the start of the book is educational and sets out both the theory and a guide for the practical application of effective time management and prioritisation skills. Had there been a single example of the weekly page inviting readers to photocopy and complete the template the Tribunal anticipates that HMRC would not have even questioned the liability of the ADP. On balance the Tribunal considered the fact there were 52 copies of the template was not enough to shift the main function or purpose of the ADP from being the means by which the ethos and approach for advocated for effective time management is delivered. The Tribunal considers that the main function of the ADP is to teach the user how to better or more effectively manage time. The writing space being, in substance, no different from a GCSE student filling out answers to practice papers or someone completing a crossword puzzle.

35. For these reasons the Tribunal concludes that the ADP is a book and should therefore be subject to VAT at the zero-rate.

36. As a consequence of that conclusion the Appellant is not liable to the assessments or to the tax geared penalties for late registration or inaccuracy.

Registration

37. As set out in paragraph 13 above where a non-established person meets conditions A – D as set out in Schedule 1A VATA there is a liability to be registered for VAT unless, at the request of that person, HMRC consider it fit to exempt that person from the liability to be registered.

38. By virtue of section 30(1) VATA zero-rated supplies are taxable supplies where the rate of tax is nil and, as the Appellant makes supplies of the ADP, in the UK Condition A is met. The Appellant makes the supplies of the ADP in the course or furtherance of a business and therefore Condition B is met. He is established in Iceland with no fixed establishment in the UK and he was not registered under the Act. There is no turnover threshold for non-established persons making taxable supplies in the UK.

39. The Appellant was therefore liable to be registered as a non-UK established taxable person pursuant to Schedule 1A unless, in accordance with paragraph 13 Schedule 1A, HMRC determine to exempt him. The power to exempt a person from registration is permissive and contingent upon a request being made by the person otherwise liable to be registered.

40. The Appellant did not register for VAT in the UK at the time he was liable to do so (i.e. when he began making supplies into the UK via the Amazon website in July 2013). He did submit his application for registration voluntarily on 4 July 2017 prior to the approach from HMRC on 19 July 2017. In response to the enquiry the Appellant has consistently maintained that his supplies are zero-rated but has not, except perhaps implicitly, requested to be exempted from the requirement to register.

41. This Tribunal’s jurisdiction in respect of what may and may not be considered by way of appeal is prescribed by statute (in s83 VATA). Section 83 does not provide any basis on which to challenge the liability to registration under Schedule 1A nor the exercise of HMRC’s discretion under paragraph 13. The Tribunal therefore has no power to require that HMRC exercise their discretion to exempt the Appellant from registration. The Tribunal merely observes that on the basis of the conclusion reached as to the liability of ADP the Appellant meets the requirements for exemption subject to a formal request being made.

42. The failure to register as required under Schedule 1A strictly renders the Appellant liable to a penalty for failure to comply with an obligation specified in Schedule 41 Finance Act 2008. However, by virtue of paragraph 6 the penalty payable is a tax geared penalty and, with no tax due, the penalty in this case is therefore nil.

Decision

43. For the reasons set out above the Tribunal determines that:

(1) The ADP is a book and is therefore to be taxed in accordance with section 30 and group 3 Schedule 8 VATA at the zero rate.

(2) The assessments to tax and penalties are therefore to be withdrawn.

44. The Appellant’s appeal is thereby allowed.

Right to apply for permission to appeal

45. This document contains full findings of fact and reasons for the decision. Any party dissatisfied with this decision has a right to apply for permission to appeal against it pursuant to Rule 39 of the Tribunal Procedure (First-tier Tribunal) (Tax Chamber) Rules 2009. The application must be received by this Tribunal not later than 56 days after this decision is sent to that party. The parties are referred to “Guidance to accompany a Decision from the First-tier Tribunal (Tax Chamber)” which accompanies and forms part of this decision notice.

amanda brown

TRIBUNAL JUDGE

RELEASE DATE: 08 JULY 2019