Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

The Law Commission

You are here: BAILII >> Databases >> The Law Commission >> Enforcement of Family Financial Orders [2017] EWLC 370 (15 December 2016)

URL: http://www.bailii.org/ew/other/EWLC/2016/lc370.html

Cite as: [2017] EWLC 370

[New search] [Printable PDF version] [Help]

Enforcement of Family Financial Orders

Law Com No 370

The Law Commission

(LAW COM No 370)

ENFORCEMENT OF FAMILY FINANCIAL ORDERS

Presented to Parliament pursuant to section 3(2) of the Law Commissions Act 1965

Ordered by the House of Commons to be printed on 14 December 2016

HC 862

![]()

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence,

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at www.gov.uk/government/publications

Print ISBN 9781474139618

Web ISBN 9781474139625

ID 12121605 12/16

Printed on paper containing 75% recycled fibre content minimum

Printed in the UK by the Williams Lea Group on behalf of the Controller of Her

Majesty’s Stationery Office

THE LAW COMMISSION

The Law Commission was set up by the Law Commissions Act 1965 for the purpose of promoting the reform of the law.

The Law Commissioners are:

The Right Honourable Lord Justice Bean, Chairman

Professor Nick Hopkins Stephen Lewis

Professor David Ormerod QC Nicholas Paines QC

The Chief Executive of the Law Commission is Phil Golding.

The Law Commission is located at 1st Floor, Tower, 52 Queen Anne’s Gate, London SW1H 9AG.

The terms of this report were agreed on 22 November 2016.

The text of this report is available on the Law Commission’s website at http://www.lawcom.gov.uk/project/enforcement-of-family-financial -orders/.

ENFORCEMENT OF FAMILY FINANCIAL ORDERS

TABLE OF CONTENTS

Glossary and Abbrieviations

Chapter 1 ENFORCEMENT OF FAMILY FINANCIAL ORDERS

Chapter 2 LEGAL LANDSCAPE

Chapter 3 CLEARER RULES

Chapter 4 BETTER GUIDANCE AND ENFORCEMENT BY THE COURT

Chapter 5 THE GENERAL ENFORCEMENT APPLICATION

Chapter 6 ALLOCATION OF ENFORCEMENT PROCEEDINGS

Chapter 7 INFORMATION ABOUT THE DEBTOR

Chapter 8 INFORMATION REQUESTS AND INFORMATION ORDERS

Chapter 9 PENSIONS

Chapter 10 THIRD PARTY DEBT ORDERS

Chapter 11 ORDERS FOR SALE AND CHARGING ORDERS

Chapter 12 COERCIVE ORDERS

Chapter 13 PERMISSION TO ENFORCE AND POWER TO REMIT ARREARS

Chapter 14 STREAMLINING – THIRD PARTY DEBT ORDERS AND CHARGING ORDERS

Chapter 15 JUDGMENT SUMMONS

Chapter 16 COSTS

Chapter 17 BANKRUPTCY

Chapter 18 THINKING AHEAD TO ENFORCEMENT

Chapter 19 ALTERNATIVE DISPUTE RESOLUTION

Chapter 20 THE ENFORCEMENT PRACTICE DIRECTION

Chapter 21 LIST OF RECOMMENDATIONS

Appendix A LIST OF CONSULTEES

Appendix B ESTIMATED NUMBER OF APPLICATIONS TO ENFORCE FAMILY FINANCIAL ORDERS

Appendix C Record of examination

Appendix D Comments on the use of the EX140

Appendix E THE RELATIONSHIP BETWEEN THE 1984 ACT...

This Glossary does not provide an explanation of the methods of enforcing a family financial order; Chapter 2 (Legal Landscape) provides an overview of the methods discussed in this Report.

“ADR”: alternative dispute resolution: methods of resolving disputes without taking the case to court. The term “non-court dispute resolution” is an alternative, and is the title of Part 3 of the Family Procedure Rules, which deals with these methods.

“Beneficial interest” and “beneficial owner”: ownership of any asset is split into legal and beneficial ownership. Legal owners have the right to deal with the property, but it is beneficial owners who have the true benefit of the property. The beneficial owner may or may not be the same person as the legal owner. For example, A may be the legal owner of a property but A and B may own the beneficial interest in equal shares; if the property were sold, they would each receive half of the sale proceeds.

“Child Maintenance Service”: the Government organisation dealing with all new applications for maintenance assessed and calculated under a statutory formula (by 2017 any existing arrangements that are still managed by the Child Support Agency will have ended), in contrast to maintenance assessed and ordered by the court.

“Civil partnership”: a legal status acquired by same-sex couples who register as civil partners which provides substantially the same legal rights as marriage.

“Civil Procedure Rules”:1 the rules of court setting out the procedure in the civil courts in England and Wales.

“Clean break”: an order which imposes no ongoing financial liability on either party for the other, following a divorce or dissolution of a civil partnership.

“Codification”: the collection in one statute of all the law in a particular area.

“Committal order”: an order imposing a term of imprisonment.

“Commutation”: the process where a member of a pension scheme gives up all or part of the pension for an immediate lump sum payment. In this Report we use this term to refer both to this process in respect of a defined benefit pension scheme and to the ways in which a lump sum can be taken from a defined contribution pension scheme, which have been extended by the new pension rules applied from 6 April 2015.

“Consent order”: an order that is reached by agreement between the parties and then approved and made by the court, in contrast to an order that is imposed by the court. A consent order may be made at any stage in proceedings.

1 Civil Procedure Rules 1998, SI 1998 No 3132.

“Consolidation”: the replacement by a single statute of several statutes or parts of statutes.

“Consultation Paper”: Enforcement of Family Financial Orders (2015) Law Commission Consultation Paper No 219.

“Contempt of court”: conduct which includes disobedience to court orders and judgments, interference with the administration of justice and disrupting court proceedings.

“Creditor”: in this Report, the person to whom payment is owed, or to whom the other party has an obligation, under a financial order made in family proceedings.

“Debtor”: in this Report, the person who must make a payment or who has an obligation to the other party under a financial order made in family proceedings.

“Designated Family Judge”: the judge with responsibility for leading the family judiciary within a court centre or group of courts.

“Designated family judge area”: the geographical area for which a Designated Family Judge has responsibility.

“Dissolution”: the legal termination of a civil partnership.

“Divorce”: the legal termination of a marriage.

“Family Procedure Rules”:2 the rules of court setting out the procedure in family proceedings in England and Wales.

“Financial Dispute Resolution (FDR) hearing”: the (usually) second hearing that occurs following the making of an application for a financial order. The first hearing, called the First Directions Appointment, is for the court to make directions as to the provision of evidence and the conduct of the case. The purpose of the FDR hearing is to help the parties to agree a financial settlement with the assistance of the judge, whose role is to provide a neutral evaluation of the case, and to mediate between the parties. This may include providing an indication to the parties of what the judge believes to be the range of possible outcomes, were the matter to proceed to a final hearing. The FDR hearing is “without prejudice” so that anything said or any admission made in an FDR will not generally be admissible as evidence at any other hearing, in order to encourage open discussion and settlement.

“Financial needs”: this term is used in the checklist of factors to which the court is directed when considering whether to make financial provision under the Matrimonial Causes Act 1973, the Civil Partnership Act 2004 and Schedule 1 to the Children Act 1989. Its meaning is not defined in statute but, in the context of divorce and dissolution, encompasses where practicable the provision of a home for each of the former spouses and any dependent children, and an income with which to meet living expenses. The question of the level at which needs should be met, and for how long, on divorce and dissolution, is a complex one, which we address in our Report on Matrimonial Property, Needs and Agreements.3

“Financial order” or “family financial order”: financial orders made for the benefit of a spouse or children on divorce and dissolution, usually under the Matrimonial Causes Act 1973 or the Civil Partnership Act 2004, and financial orders made under Schedule 1 of the Children Act 1989 for the benefit of children.

“financial remedy proceedings”: in this Report, court proceedings where one party has (or both parties have) applied for one or more financial orders consequent on a divorce or dissolution of a civil partnership.

“Financial Remedies Working Group”: the group established by the President of the Family Division in June 2014 to explore ways of improving the accessibility of financial proceedings within the Family Court system for litigants in person and to identify ways of further improving good practice in financial remedy cases.

“Freezing order” or “freezing injunction”: a court decision restraining a party from dealing with his or her assets.

“Her Majesty’s Courts and Tribunals Service” or “HMCTS”: part of Government responsible for the administration of criminal, civil and family courts and tribunals in England and Wales.

“Her Majesty’s Revenue and Customs” or “HMRC”: the United Kingdom’s tax, payments and customs authority.

“Injunction”: an injunction is a court order which imposes an obligation on a party either to do a certain act or to refrain from doing a certain act. The former type of injunction is called a “mandatory” injunction; the latter a “prohibitory” injunction.

“Interim order”: a court order intended to last for a limited period of time, usually until the next court hearing or the making of a final court order or until a party has carried out a particular act.

“Judgment debt”: an obligation to pay money that is created by a court order.

“Land Registry”: the organisation responsible for registering the ownership of land and property in England and Wales.

“Lay justices”: also known as magistrates. These are volunteer judicial office holders who are not necessarily legally qualified and who decide cases in panels of three.

“Legal aid”: a means of funding legal advice, representation and mediation, by which a party receives such services on a free or subsidised basis. Legal aid is usually means-tested and is administered by the Legal Aid Agency.

“Legal help”: a form of legal aid that involves the provision of legal services other than issuing, or providing representation in, proceedings, or acting as a mediator or arbitrator.

“Legal services order”: an order for one party to make a payment or payments to the other party to fund legal costs (usually for legal representation) during the proceedings.

“Lump sum order”: an order for one party to pay to the other a specified amount of money. This can be payable as a single payment, in instalments or as a series of payments.

“Maintenance”: in English law, usually a term synonymous with periodical payments. In a European law context the term may be used more broadly, to cover all payments directed at meeting financial needs.

“Maintenance Pending Suit”/“interim maintenance”: a series of payments made by one party in financial remedy proceedings to the other to meet living expenses, typically on a monthly basis, before a final family financial order is made.

“Maintenance Regulation”: Council Regulation (EC) No 4/2009 of 18 December 2008 on jurisdiction, applicable law, recognition and enforcement of decisions and cooperation in matters relating to maintenance obligations.

“Mention hearing”: a short hearing listed by the court when making an order with the aim of monitoring proceedings and compliance with that order.

“Periodical payments”: a series of payments made for a definite or indefinite period of time, typically on a monthly basis.

“Penal notice”: a warning set out in a court order to the effect that if the recipient of the warning fails to comply with the order he or she may be imprisoned.

“Pension attachment order”: an order requiring a percentage of the income or capital benefits of a pension to be paid to the other party.

“Pension sharing order”: an order dividing an existing pension, giving the person benefiting from the order a percentage of the fund to invest in a pension of his or her own.

“Personal service”: when an application or an order is served personally it is delivered to a party in proceedings in person, rather than by another method of service, such as by post.

“Practice Direction”: a document that supports and aids the interpretation of procedural rules of court (such as the Family Procedure Rules and Civil Procedure Rules).

“Remit” or “remission of arrears”: the cancellation of arrears owed.

“Return date”: a hearing for both parties to attend, following an initial hearing or consideration of an application where only one party made representations to the court.

“Service”: the transmission of a document from one party to another.

“Sole trader”: a person trading as an individual, outside of a company or partnership structure.

“Spouse”: in this Report, we use this term to mean one of the parties to a marriage or a civil partnership.

“Stay”: an order halting court proceedings, either generally or for a set period of time.

“1998 Enforcement Review”: the Review of the Enforcement of Civil Court Judgments conducted by the Lord Chancellor’s Department over a number of years from 1998 onwards.

“2003 White Paper”: the document produced by Government setting out details of future policy on enforcement entitled: Effective enforcement: improved methods of recovery for civil court debt and commercial rent and a single regulatory regime for warrant enforcement agents: a white paper (2003) Cm 5744.

“2011 Consultation”: the consultation paper produced by Government entitled: Solving disputes in the county courts: creating a simpler, quicker and more proportionate system: a consultation on reforming civil justice in England and Wales (2011) Cm 8045.

“2012 Government response”: the response of Government to the responses to the 2011 Consultation entitled: Solving disputes in the county courts: creating a simpler, quicker and more proportionate system: a consultation on reforming civil justice in England and Wales: the government response (2012) Cm 8274.

PART 1

AN INTRODUCTORY PART

ENFORCEMENT OF FAMILY FINANCIAL ORDERS

To the Right Honourable Elizabeth Truss MP, Lord Chancellor and Secretary of State for Justice

CHAPTER 1 INTRODUCTION

WHAT IS THIS REPORT ABOUT?

-

This Report considers how the law can ensure that family court orders to pay money or transfer property are complied with so that individuals can obtain the money or assets they are owed. The report outlines the results of our consultation on this topic and makes recommendations to Government for reform.

-

The title of this Report – “The Enforcement of Family Financial Orders” – describes the boundaries of the Law Commission’s project. First, we are only concerned with the enforcement of orders, that is, the process of making people do what the court has ordered them to do. That may be to comply with an order for a one-off payment, to make ongoing periodical payments or to transfer or sell property. This Report is not about the rules governing the calculation of how much people should have to pay; we are looking at how to ensure that payment is made once a court order is in place.

-

Secondly, we are only looking at what we call “family financial orders”, that is, financial court orders made between family members.1 We are not considering the enforcement of other types of civil court financial order such as a claim for damages following a car accident or an order made following a commercial dispute. Nor are we considering the enforcement of non-financial issues such as the enforcement of child arrangements orders that may be made in the same context as a financial orders.

-

Family financial orders are most likely to arise on the ending of a marriage or civil partnership, which commonly requires some financial re-organisation between the two adults involved. A court order will be made where the parties cannot agree, or where agreement has been reached and the order is made by consent.

-

Family financial orders will be made for the benefit of the adults and any dependent children. Orders for the benefit of adults and children may be made in financial proceedings on the separation of spouses and civil partners. Orders for the benefit of children may also be made under the Children Act 1989, whether or

1 By “family financial orders” we mean orders made for the payment of money or transfer of property under the Matrimonial Causes Act 1973, Civil Partnership Act 2004, and Children Act 1989.

not the parents are married or civil partners.2 However, while some payments for the benefit of children are therefore within its scope, the project considers only selected aspects of child maintenance. Payments for child maintenance are largely administered by the Child Maintenance Service.3 Payments due in that way do not arise under court orders and the enforcement of such maintenance is not covered by this project.

WHY IS THE ENFORCEMENT OF FAMILY FINANCIAL ORDERS IMPORTANT?

-

Enforcement is an often overlooked area of the law, especially in family proceedings. Once the court order for payment has been made, there is a tendency for people to think that the process is all over and the matter is finished. Of course, that should be the case; the parties should comply with their obligations and move on with their lives. But sometimes, for any number of reasons, people do not comply and then the rights and benefits secured under the order become practically meaningless unless there is an effective way of enforcing them. The law of enforcement can be essential for ensuring that people receive what they are due.

-

Family financial orders are made taking into account what the debtor is able to pay out of his or her resources. This means that unless the debtor’s circumstances change after the order is made, the debtor should be able to comply. The debtors who can pay what is owed but choose not to, we term “won’t pay” debtors. The debtors who, for some reason, really are not able to pay, we call “can’t pay” debtors. It is important to distinguish between these two types of debtor. The impact of non-payment of family financial orders can be significant and so where the debtor is a “won’t pay” debtor, the law needs to be robust in achieving compliance. However, where the debtor is a “can’t pay” debtor enforcement action will not help; time consuming, and potentially costly, legal proceedings are likely to make the situation worse for both parties. The law needs to enable the creditor and the court to determine whether a debtor “won’t pay” or “can’t pay”.

-

Where the debtor is a “won’t pay” debtor, then making sure that family creditors receive what they are due is vitally important. Non-payment of a family financial order can have very serious consequences. Most such orders take account of the recipient’s needs in assessing what or how much should be paid or transferred. The money that creditors are owed is often money that they need to meet their day-to-day expenses and the expenses of dependent children. By definition, if the order is not complied with, the person to whom the payment is owed will be left in need. Rent or mortgage payments may be missed; basic necessities may

2 In financial remedy proceedings under the Matrimonial Causes Act 1973 or the Civil Partnership Act 2004, orders for the benefit of children may be made by agreement, or where the parties’ circumstances take them outside of the jurisdiction of the Child Maintenance Service, for example if the paying party lives abroad. The court can also make “top up” orders if the paying party’s income is beyond the maximum that the Child Maintenance Service can account for, and the court may make orders for the payment of school fees in any circumstances. Outside financial remedy proceedings, financial orders for the benefit of children can be made under the Children Act 1989, sch 1.

3 Some child maintenance arrangements are still managed by the Child Support Agency, but all new applications are dealt with by the Child Maintenance Service.

become unaffordable; loans or State benefits may become the only means of financial support.

-

The impact of non-payment was noted in a number of responses to our consultation paper. Penningtons Manches4 said that non-payment can have a “devastating impact”. They referred to a recent case they had encountered where the debtor’s non-payment left the creditor facing repossession of the family home. Resolution5 said similarly that “non-payment of a sum due under a family financial order can be catastrophic especially in average cases where people are living in ordinary circumstances without significant resources”. The Law Society6 noted that non-payment can lead to the creditor “incurring financial penalties through not being able to pay bills on time, or by being forced to take out high-interest loans to bridge the financial gap”. Janet Bazley QC7 said that non-payment is “prevalent” and its “emotional and financial impact is significant. It can alter the lives of those affected”.

-

This impact is felt by the adult to whom the payment is due. But it also affects that person’s dependants, in particular, any children. International Family Law Group8 thought that “children are the primary victims of the unduly complex enforcement law as presently exists”. In International Family Law Group’s view it is the impact on children that makes reform in this area “so important”. Dependants suffer indirectly from the financial problems encountered by the person who should have benefitted from the financial order. Children’s standard of living and care arrangements may be affected. If the family home can no longer be afforded, children may have to move schools.

-

Aside from the impact on individuals, the State has a direct interest in ensuring that family financial orders are enforced. As mentioned, those who are not paid what they are owed may fall back on welfare benefits for support. Both the Law Society and Resolution noted in their responses to our Consultation Paper that non-recovery of what is owed can result in increased claims for benefits and tax credits by creditors left unable to meet their financial needs. It is not possible to calculate the extent of such welfare claims, but it seems likely that the figures are significant.

-

Non-compliance with a family financial order is also a problem that extends beyond the individuals affected because of its impact on the justice system. Any inability to force a person to do what the court has ordered undermines the rule of law. The Law Society said:

The fact that the law in relation to enforcement of family financial orders is so complicated may well deter creditors from taking action to obtain payment. It is conceivable that this has an impact on the

4 A law firm with a specialist family law team.

5 An organisation representing over 6,500 family lawyers and other professionals working in family law.

6 The representative body for solicitors in England and Wales.

7 A barrister practising in family law. Janet Bazley QC’s consultation response was submitted with the approval of the Bar Council. The Bar Council represents barristers in England and Wales.

8 A specialist family law firm.

reputation of the family justice system, and the public’s perception of its effectiveness and fairness.

-

Similarly, the Family Law Bar Association9 said that the impact of enforcement issues on parties “undermines the whole financial remedies jurisdiction if orders made are unlikely to be enforceable”.

-

The failure of the law to obtain payment where it is due therefore presents significant problems to individuals and society. Further, the deficiencies of the current law have an impact even in cases where individuals eventually succeed in being paid all or some of what they are owed; the process can be difficult and slow. As the following chapters explain, the rules governing the enforcement of family financial orders are difficult to access and understand, and are inefficient. In many cases legal advice and representation will not be affordable or the cost would be disproportionate to the amount owed. Changes to legal aid have meant an increasing number of litigants in person in family proceedings, including enforcement, as individuals apply to the court without representation.10 Such applicants face the stress of dealing with complex law and court rules. Delays result from their understandable failures to navigate the system effectively and, in some cases, their applications fail as a result of mistakes in how they have attempted to use the law.

-

The difficulty currently faced by litigants in person seeking to enforce family financial orders was a recurring theme in consultation responses. Charles Russell Speechlys11 said:

We completely agree with the frustrations expressed by other members of the profession about the difficulties of enforcement. It is our experience as well that this is part of the process most often left to litigants in person as often by that stage they have exhausted both their emotional and financial resources.

-

The Justices’ Clerks’ Society12 noted that:

Creditors and debtors in enforcement proceedings are usually litigants in person, the system at the moment is difficult for the litigant in person to navigate.

-

The Family Justice Council 13 said: “a simplified system would be of great benefit to litigants in person”.

-

A final major adverse impact of the current law is the effect on the court service. The complexity of the enforcement rules means that lawyers and even the courts themselves find the enforcement of family financial orders difficult. Inefficiencies

9 A representative body for barristers who practise in family law.

10 https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/556715/ family-court-statistics-quarterly-apr-june-2016.pdf (last visited 28 November 2016).

11 A law firm with a specialist family law team.

12 The professional society for justices’ clerks, who are lawyers who advise lay justices.

13 An advisory non-departmental public body; the Council’s role is to promote an inter- disciplinary approach to family justice and to monitor the court system.

in the law lead to hearings taking longer than they should do and adjournments being granted where matters might have been dealt with without delay. Cases involving litigants in person are even more likely to contribute to longer hearings and delay, with an impact on the overall speed of the administration of justice and the satisfactory conclusion of individual cases. The Court of Appeal recently addressed this issue in a family matter where the husband was acting in person. Lady Justice Black noted that the fact that he was not represented meant that he “had approached [the application] on a mistaken basis”.14 As the court was without legal assistance, it had to “spend time researching the law for itself then attempting to apply it to the relevant facts in order to arrive at the correct legal answer”. With the law of enforcement often being left to litigants in person and judges, the law needs to be as clear as possible, and the system as efficient as possible. An inaccessible system of enforcement results in administrative costs to the justice system as well as costs to individuals.

HOW BIG A PROBLEM IS THIS?

-

An ineffective enforcement system, therefore, has an impact on individuals, on the family justice system and, ultimately, on the welfare system. But how great are the problems with the current law?

-

At the beginning of the project, Resolution conducted a survey of its members on the topic of enforcement. While the number of Resolution members who responded (47) was not large enough to be statistically significant, the results from the survey revealed a real concern about enforcement from those who practice in the area. Only around 11% of respondents thought enforcement works well for parties who are represented, and only about 3% thought it works well for those who are unrepresented. Difficulty in accessing the law and procedure was cited as causing a significant problem for creditors by just over 90% of respondents, and just under 90% thought that difficulty was caused as a result of a limited range of enforcement methods.

-

No national data are available on the number of applications for the enforcement of family financial orders that are made every year, and so it is not possible to tell with any precision how many people are affected by the difficulties with enforcement. However, data from the Central Family Court collected between August 2015 and August 2016 suggest that in just over 9% of cases where a family financial order is made, enforcement action will need to be taken.15 On that basis we calculate that family financial orders give rise to, on average, around 4,200 enforcement cases per year.16 That means around 8,400 individual litigants engaging with the enforcement rules, many without any legal representation or assistance.

-

The same data from the Central Family Court indicate that 28% of enforcement applications conclude without an enforcement order being made. Some of those

14 Lindner v Rawlins [2015] EWCA 61, [2015] All ER (D) 110 (Feb) at [32].

15 It may be that the nature of the cases heard at the Central Family Court, which tend to be complex in nature, means that the percentage may not be truly representative of the number of enforcement applications brought in different family court hearing centres. There are many variables that are difficult to account for, so we use the figure of 9% illustratively.

16 We set out our workings in Figure 1 of Appendix B.

will conclude because the debtor pays what is owed without the need for an order, and some will conclude without any order being made because the debtor is a “can’t pay” debtor. However, applications will also be unsuccessful because there is a lack of information about the debtor, or the debtor’s assets cannot be reached by the existing methods of enforcement, or the creditor has mistakenly made the wrong application. These types of unsuccessful enforcement application mean that the creditor is not receiving what they are entitled to.

-

It is difficult to calculate the amount of unrecovered debt caused by a failure to enforce family financial orders, particularly because there are no data routinely collected on the value of such orders. However, by using average data as to national wealth and applying our understanding of how family financial orders are made, we estimate that creditors are missing out on approximately £15 – 20 million17 every year because debtors are choosing not to pay and the current enforcement rules are not effective in achieving compliance.

-

The figures quoted above are almost certainly a significant underestimate of the real problems caused by weaknesses in the enforcement system. These figures do not account for the family creditors who are not receiving what they are owed but who do not take enforcement action. They may not take action due to a lack of understanding of the system, a feeling that they need legal representation that they cannot afford, concerns about their relationship with the debtor, or simply a lack of faith that action will achieve compliance.

WHY SEPARATE OUT FAMILY ENFORCEMENT?

-

Much of the law of enforcement that applies to family financial orders applies equally to the enforcement of other civil orders (for example, for the payment of a debt owing from a commercial dispute or where the court orders one party to litigation to pay damages to another). Our project considers enforcement only in the family context. We suggested in our Consultation Paper that different considerations arise in family law that make it desirable to consider and attempt to reform this area of enforcement separately from general civil law enforcement. Consultation responses echoed this approach.

The impact of non-payment

-

The potential impact of non-payment of family financial orders makes them different from other civil debts. Family financial orders are usually designed to provide financial support for the creditor and any children in his or her care. As we have explained, non-payment by the debtor has the potential to cause significant hardship. Further, unlike other civil debts, when a family financial order is made the court takes into account the debtor’s ability to pay ─ the financial order is one that the court is satisfied that the debtor can comply with.

The nature of the orders

-

Another important difference from other civil debts is that family financial orders may endure for a long time. For example, orders for periodical payments can last for many years or even for the lifetime of the parties. Such orders may, therefore,

17 For the calculation of these figures please see the Impact Assessment that accompanies this Report: Enforcement of Family Financial Orders (2016) LAWCOM0058.

require repeated or ongoing enforcement action. In addition, as the parties’ circumstances change over time, either may apply to vary the order.18 The potential for the order to be varied and the debtor’s liability to change as a result is an important consideration when thinking about enforcement – there may be no point in a creditor bringing costly enforcement proceedings if the circumstances mean that the arrears will be remitted and the ongoing order varied so that the debtor’s liability is reduced. If a change in circumstances means that the debtor cannot pay, then there is a route through which he or she can have the situation considered by the court; the debtor should not simply stop complying with the order.

Relationship between the parties

-

Finally, there are many emotions at play in family proceedings, which may not feature or may not feature so prominently, in most other civil proceedings. These emotions can influence the reasons for non-payment by debtors, the action or inaction taken by creditors, and the direction and progress of enforcement proceedings. For example, the Law Society noted that “non-payment can be used by a debtor to punish the creditor for the breakdown of the relationship and to exert power over them”. Often the creditor and debtor will have an ongoing relationship as parents to their children; misconceived or ineffective enforcement litigation can do great damage to that relationship which requires ongoing cooperation as parents. Care needs to be taken, therefore, to ensure that both parties have the necessary information to make good choices about enforcement and that if proceedings are started they are as fair, efficient and effective as possible.

HISTORY OF THE PROJECT AND THE NEED FOR REFORM

-

A project on the enforcement of family financial orders was recommended to us by the Family Law Bar Association in 2010 in its response to our consultation on our 11th Programme of Law Reform. It described the law of enforcement as “hopelessly complex and procedurally tortuous” and argued that the current system is ineffective.

-

We took on the project as part of the Commission’s 11th Programme, but the start of the project was delayed until the completion of the project on Matrimonial Property, Needs and Agreements (the scope of which was extended at Government’s request). Work began on the enforcement project in April 2014.

-

In the four years that elapsed between the Family Law Bar Association proposing the project and work beginning, two significant legal developments occurred; the introduction of the Family Court19 and the changes to legal aid in family (and

18 Some family financial orders can be varied by the court on an application by either party. On such an application the court may vary the ongoing liability and may remit any arrears that have accrued. For further consideration of the relationship between enforcement and variation of family financial orders, see Chapter 2.

19 The Family Court, which came into being by virtue of the Crime and Courts Act 2013, exercises jurisdiction in nearly all family proceedings (some family proceedings are still reserved to the High Court). The effect of the introduction of the Family Court was to end the separate family jurisdictions that previously existed in the magistrates’ and county courts. The Family Court is a national court and can sit anywhere, though most often sits in the buildings that also house Magistrates’ Courts and County Courts.

other) proceedings brought about by the Legal Aid, Sentencing and Punishment of Offenders Act 2012. The introduction of the Family Court remedied some of the procedural difficulties that existed in the enforcement of family financial orders. Previously different rules of court had applied depending on whether proceedings were in the magistrates’, County or High Court and the introduction of the Family Court removed this layer of complexity. However, procedural difficulties remain, and it is widely thought that the rules on enforcement in the Family Procedure Rules are in need of revision.20

CONSULTATION

-

We published our Consultation Paper “The Enforcement of Family Financial Orders” in March 2015.21 We accepted consultation responses until 31 July 2015

– this was a longer consultation period than usual to take account of a period of purdah for the general election that was taking place.22 We held consultation events in Cardiff, Manchester and London, all of which were well attended by practitioners and members of the judiciary. Following the period of consultation, we continued to meet with stakeholders to help us work through the detail of the recommendations.

-

We established an advisory group of practitioners, judges, Government officials and a representative from a debt advice agency. The group met twice to discuss issues that had arisen from the consultation and to consider a number of proposals for reform.

OUR RECOMMENDATIONS FOR REFORM AND THE STRUCTURE OF THIS REPORT

-

Our recommendations for reform are aimed at creating an effective system for the enforcement of family financial orders. By an effective system we mean one that produces compliance with a court order in a way that is fair to both the creditor and the debtor. Fairness requires equipping creditors with the information and options they need to stand the best chance of recovering what they are owed, but also ensuring that those debtors who cannot pay are not punished for involuntary non-compliance. It also means ensuring that neither party nor any of their dependants suffer undue hardship.

-

This report is divided into six Parts:

-

an introductory part;

-

our recommendations for a more effective and efficient system of enforcement;

-

our recommendations for additional options for enforcement;

20 We note the ongoing work in the area of family justice to make the system more efficient and simplify processes. For example, the recent joint statement by the Lord Chancellor, the Lord Chief Justice and the Senior President of Tribunals: Transforming Our Justice System (September 2016).

21 The Enforcement of Family Financial Orders (2015) Law Commission Consultation Paper No 219.

22 Purdah is the period leading up to an election when there is a restriction on certain activities of the civil service, including arms-length bodies.

-

our recommendations for a fairer system;

-

our recommendations for practical steps to achieve enforcement; and

-

a list of our recommendations.

-

-

Following this introduction, we provide an overview of the legal landscape in Chapter 2.

Part 2 – an effective and efficient system

-

Part 2 of the paper makes suggested recommendations for improving the system of enforcement, rather than recommendations for reform to specific methods of enforcement. In Chapter 3, we recommend consolidating the procedural rules governing enforcement within the Family Procedure Rules23 (at present they are split between the Family Procedure Rules and the Civil Procedure Rules24), and the introduction of a new Practice Direction on enforcement. In Chapter 4, we recommend a number of ways to improve and expand the information and guidance available to the parties in family enforcement proceedings. Further, we consider whether the option of enforcement by the court (an option for family creditors to ask the court to take responsibility for enforcing orders for periodical payments in certain circumstances) should be expanded and we recommend ways to increase awareness of this remedy. Chapter 5 sets out our recommendations for a revised procedure for the general enforcement application. We then explore in Chapter 6 how courts might improve their practice by the introduction of an enforcement liaison judge, new guidance on the allocation of enforcement and an increase in the enforcement powers available to lay justices. Finally, we make recommendations in Chapters 7 and 8 for a new obligation on the debtor to file a financial statement and for the introduction of new information-gathering powers for the court.

Part 3 – more options for enforcement

-

In Part 3 of the paper we set out our suggested recommendations for expanding the range of enforcement methods available to the family creditor. Chapter 9 contains recommendations for enforcement against a debtor’s pension. Chapter 10 explores third party debt orders and recommends expanding their scope so that they may operate periodically, and against joint accounts. We recommend, in Chapter 11, expanding the family court’s jurisdiction to make an order for sale of the respondent’s property consequent upon making a financial order, and we explore but ultimately reject the possibility of expanding the scope of charging orders. Chapter 12 sets out our recommendations for the introduction of new coercive orders that may be used to encourage payment by a debtor who the court is satisfied has the means to pay but whose assets are beyond the reach of direct methods of enforcement.

Part 4 – a fairer system: balancing the interests of the parties

-

Part 4 contains recommendations in respect of issues that overlie the enforcement of family financial orders. In Chapter 13, we recommend changes to

23 Family Procedure Rules 2010, SI 2010 No 2955.

24 Civil Procedure Rules 1998, SI 1998 No 3132.

the rule that permission is required to enforce arrears that are more than twelve months old and we recommend the introduction of a power for the court to remit, on the application of a debtor, arrears that have accrued under certain family financial orders. In Chapter 14, we consider the streamlining of applications for third party debt orders and charging orders, and recommend the introduction of a streamlined procedure for the latter. In Chapter 15, we explore issues arising from the judgment summons application. In Chapter 16, we recommend a change to the costs rules that apply in proceedings for the enforcement of a family financial order and in Chapter 17 we consider aspects of the relationship between enforcement and bankruptcy.

Part 5 – supporting enforcement in practice

-

In Chapter 18, we make a number of recommendations for changes to practice at the time the court makes the original financial order with the objective of reducing the likelihood of non-compliance and facilitating any future enforcement proceedings should enforcement become necessary. It has been a strong and consistent theme from stakeholders that a more pro-active approach to enforcement is required, from all involved, to ensure compliance. We consider, in Chapter 19, the role of alternative dispute resolution in the enforcement of family financial orders. Finally, in Chapter 20, we consider the content of a new enforcement practice direction.

Part 6 – a list of our recommendations

-

In Chapter 21, we set out a list of all the recommendations made in the Report.

ACKNOWLEDGEMENTS

-

Our thanks go to all who responded to our consultation or who have supported our project in other ways. As we have noted above, enforcement is an often overlooked area, and is not one which receives a great deal of attention in legal writings. However, it is a crucially important area of law and so we are very grateful to all who have put work, time and careful thought into commenting on the issues we have highlighted and answering the questions we have posed. We are grateful to Resolution for organising, at the very beginning of our project, an email survey of its members on the topic of enforcement on our behalf.

-

We offer particular thanks to the members of our advisory group, who met on two occasions before the publication of this Report to discuss issues arising from the consultation and to consider the detail of some of the recommendations we now make. The list of advisory group members, along with the list of consultees is at Appendix A.

-

We also thank the following individuals and organisations for their input into the project:

-

His Honour Judge Waller;

-

His Honour Judge Everall;

-

the Family Procedure Rules Committee;

-

the Judges of the Family Division of the High Court; and

-

the team responsible for administering and allocating enforcement cases at the Central Family Court.

-

-

We are also very grateful to the organisations that generously hosted events at which we were able to discuss the issues raised in our consultation paper. We would like to express our gratitude to 30 Park Place Chambers, Mishcon de Reya, and Slater and Gordon Lawyers.

-

Finally, we thank the officials from various Government departments who have given us their time to discuss the project and consider the recommendations that we make in this Report.

THE TEAM WORKING ON THE PROJECT

-

The following members of the property, family, and trust team have contributed to this Report at various stages: Matthew Jolley (team manager); Spencer Clarke (team lawyer); Amy Perkins (team lawyer); Rebecca Huxford (research assistant 2014–2016); Brad Lawlor (research assistant 2015-2016); Maxwell Myers (research assistant 2016-2017).

-

In this chapter we provide a sketch of the current law of the enforcement of family financial orders. We do not attempt to set out in detail the law governing individual enforcement methods, but only the detail necessary to explain our recommendations for reform. A fuller account is provided in our Consultation Paper.1

-

After looking at the current law, we will briefly explore the issue of variation of an order, which we understand is a feature of the enforcement of family financial orders. Variation of an order is a process by which either party asks the court to change the terms of an order already made. This might be to change the amount to be paid or to change the time(s) when payment is due. A debtor may respond to an application by a creditor to enforce an order with an application to vary that order, though not all family financial orders are capable of being varied.2

EXISTING METHODS OF ENFORCEMENT AND THE RULES THAT GOVERN THEM

-

In general, the methods for the enforcement of family financial orders are the same as the methods available for the enforcement of all civil orders for the payment of money. The rules governing the enforcement of family financial orders are found in statute and in the Family Procedure Rules, which in some instances simply cross-refer to the Civil Procedure Rules. However, there are a number of important procedural differences between the enforcement of orders made in family proceedings and those made in other civil proceedings. These differences will be highlighted as they arise throughout this paper.3 We have explained in the introduction to this paper why we are considering the enforcement of family financial orders as a distinct area.

-

There are, generally, two types of enforcement method. Direct enforcement methods target the debtor’s assets directly, whereas indirect methods seek to apply pressure to the debtor to obtain his or her compliance (we call these methods of enforcement “coercive orders”). Currently, the only examples of coercive orders available in the enforcement of family financial orders are the judgment summons application and the writ of sequestration.4

-

In this section we outline the existing methods of direct and indirect enforcement. We do not make recommendations for reform for all of these methods, but we

1 The Enforcement of Family Financial Orders (2015) Law Commission Consultation Paper No 219.

2 See paras 2.43 and following below.

3 For example, the requirement in family proceedings for the court’s permission to enforce arrears that are over twelve months old in Chapter 13, and the possibility in family proceedings to make an application for such method of enforcement as the court considers appropriate in Chapter 5.

4 Sequestration can lead to enforcement directly against the debtor’s assets in some circumstances. For an explanation of sequestration see para 2.35 below.

include them here to complete the picture. An important aspect of the legal landscape is bankruptcy. Although we make no recommendations to change the law, we discuss a number of issues arising from bankruptcy and family financial orders in Chapter 17.5 We make no recommendations to change the rules that apply when a debtor or creditor has died while outstanding obligations still exist under a family financial order. The rules governing claims following the death of a party to legal proceedings are detailed and go beyond the scope of this project.6 In general, however, where a debtor dies owing money under a family court order that debt is enforceable against his or her estate if the obligation to pay has crystallised by the time of the debtor’s death.7

DIRECT ENFORCEMENT METHODS

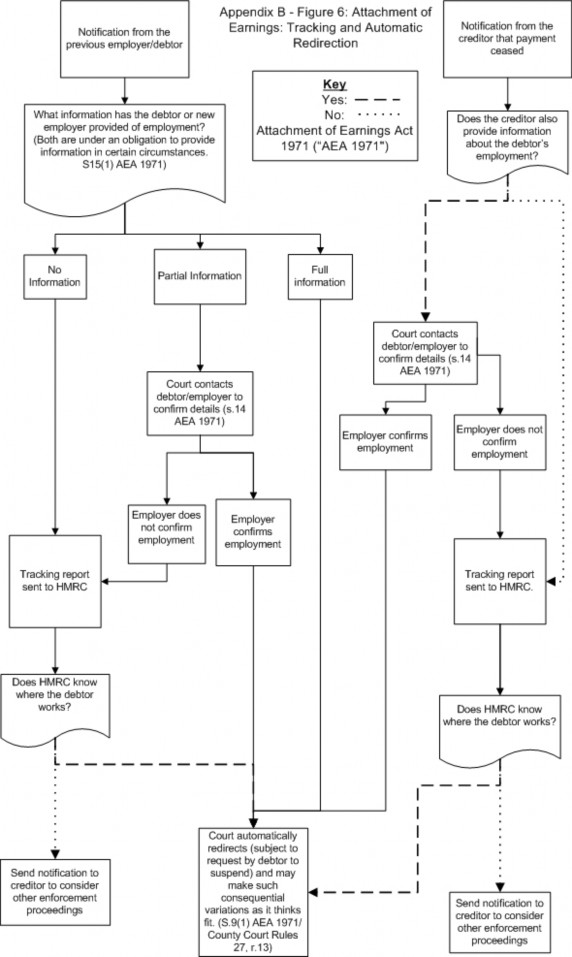

An attachment of earnings order

-

An attachment of earnings order can be used as a method of enforcement against a debtor who is employed. The order is directed to the debtor’s employer and requires the employer to pay an amount of the debtor’s earnings directly to the creditor. The order will typically be used to enforce arrears owed under any family financial order, and to recover periodical payments as and when they fall due. There are no statistics for the number of enforcement orders made specifically in family proceedings but we understand that these are a frequently used method of enforcement. In civil proceedings generally, 51,737 applications and 47,884 orders were made in 2011, the last year for which data are available.8

-

Attachment of earnings orders made in family proceedings are governed by the Attachment of Earnings Act 1971 and Part 39 of the Family Procedure Rules.9 In addition, there is provision under the Maintenance Enforcement Act 1991 to make an attachment of earnings order (or a suspended attachment of earnings order) at the same time as making an order for periodical payments where the debtor is ordinarily resident in England and Wales.

A third party debt order

-

A third party debt order enables enforcement directly against money owed to the debtor by a third party. The third party is required to pay to the creditor all or part of the debt owed by the third party to the debtor; payment to the creditor discharges the third party’s debt to the debtor. A third party debt order can be used to enforce arrears under any family financial order but cannot recover

5 Further, there are specific rules for enforcing orders against debtors who are in the armed forces; the main difference being that a separate regime applies to enforce against their earnings: Armed Forces Act 2006. We make no recommendations in respect of these rules.

6 Generally for the rules governing the effect of death in relation to causes of action see the Law Reform (Miscellaneous Provisions) Act 1934.

7 See for example Sugden v Sugden [1957] P 120, [1957] All ER 300.

8 Ministry of Justice, Judicial and Court Statistics 2011, Chapter 1: County courts (non-family work) table 1.18, available at https://www.gov.uk/government/statistics/judicial-and-court- statistics-annual (last visited 30 November 2016). These statistics, which we cite throughout this section of the Report, relate to applications and orders for enforcement in the County Court; there are no equivalent statistics currently available for the Family Court.

9 SI 1991 No 356.

ongoing periodical payments. A third party debt order will often be used to recover arrears of periodical payments or a (smaller) lump sum. They are not, however, frequently used with only 4,137 applications and 1,357 orders made in civil proceedings generally in 2011.10

-

The third party can be any individual or organisation11 situated within the jurisdiction.12 However, third party debt orders are usually directed to a bank or building society where the debtor has an account. The balance of the account is a debt owed to the debtor, which can be paid to the creditor in satisfaction of the monies owed.

-

Third party debt orders are governed by rule 33.24 of the Family Procedure Rules and Part 72 of the Civil Procedure Rules. The substantive rules are found in the latter.

A charging order

-

A charging order does not immediately recover the monies owed to the creditor; it makes an asset held by the debtor, for example property, into security for the debt. When the asset is sold, the creditor then receives the money due out of the proceeds of sale. The creditor can wait until the debtor chooses to sell the property, or the creditor may apply for an order for sale any time after the charging order has been made.

-

Any money due or to become due under a family financial order may be secured by a charging order. A charging order may, therefore, be used to secure a lump sum payable by instalments, including to secure instalments that have not yet fallen due. Ongoing periodical payments are unlikely to be secured by way of a charging order as there is specific provision in the Matrimonial Causes Act 1973 to make a secured periodical payments order. A charging order might be used to enforce the payment of arrears of periodical payments or, perhaps most typically, a lump sum (particularly where the lump sum is sufficiently large that a third party debt order against a debtor’s bank account is unlikely to yield a sufficient sum). Charging orders are the most common method of enforcement after warrants of control and possession in civil enforcement proceedings: 90,286 applications were made and 81,092 orders were granted in 2011.13

-

Charging orders made in family proceedings are governed by the Charging Orders Act 1979 and Part 40 of the Family Procedure Rules.

10 Ministry of Justice, Judicial and Court Statistics 2011, Chapter 1: County courts (non-family work) table 1.18, available at https://www.gov.uk/government/statistics/judicial-and-court- statistics-annual (last visited 30 November 2016).

11 Except that a third party debt order cannot be made against the Crown.

12 While the third party must be situated within the jurisdiction, the debt may be a foreign debt, but the court will only make such an order if satisfied that it will be recognised in the foreign jurisdiction so that the third party will not still be required to pay the debtor the full amount (Société Eram Shipping Co Ltd and others v Compagnie Internationale de Navigation [2003] UKHL 30; [2004] 1 AC 260).

13 Ministry of Justice, Judicial and Court Statistics 2011, Chapter 1: County courts (non-family work) table 1.18, available at https://www.gov.uk/government/statistics/judicial-and-court- statistics-annual (last visited 30 November 2016).

Appointment of a receiver

-

A receiver is appointed in respect of a specific asset or specific assets belonging to the debtor. The receiver’s function is to collect the monies receivable by the debtor in respect of that asset, or those assets, and to pay them to the court or directly to the creditor. For example, a receiver may be appointed to collect rents on properties owned by the debtor, or to collect payments from a trust fund in which the debtor has an interest. The court may direct or permit the receiver to do something, for example start legal proceedings or sell a property.

-

The receiver can be any individual who the court considers appropriate. The creditor may act as a receiver him or herself, but often the role is undertaken by professionals, such as accountants and insolvency practitioners. This can make enforcement by the appointment of a receiver very expensive and it is typically used only in cases where other methods of enforcement have been tried first. It is therefore often perceived as a remedy of last resort.14 The rules contemplate that other methods of enforcement will have been tried first.

-

The power of the court to appoint a receiver is found in section 37 of the Senior Courts Act 1981 and the procedure is governed by Part 69 of the Civil Procedure Rules.15

A means of payment order

-

A means of payment order specifies how payments under a periodical payments order or an order for a lump sum by instalments must be made. The order may require, for example, that payments are made by standing order or that they are made via the court. Such an order ensures that a clear record is kept of payments that are made and, perhaps, increases the likelihood of payment. If payments are made via the court, a court officer may take steps to enforce the order on the creditor’s behalf if necessary.

-

Means of payment orders are made pursuant to section 1 of the Maintenance Enforcement Act 1991.

An order for sale

-

If the court makes a family financial order under the Matrimonial Causes Act 197316 or the Civil Partnership Act 200417 for secured periodical payments, the payment of a lump sum, the transfer of property, or an order for payment in respect of legal services,18 then on making that order or at any time thereafter, the court may make an order for sale. The order for sale can be made against any property in which either or both of the parties to the marriage has or have a beneficial interest. The order for sale can be used to enforce any family financial order where the above criteria are met and is not limited to ordering the sale of

14 See Maughan v Wilmot [2014] EWHC 1288 (Fam), [2015] 1 FLR 567.

15 Applied by Family Procedure Rules, r 33.22.

16 Matrimonial Causes Act 1973, s 24A.

17 Civil Partnership Act 2004, sch 5, para 10.

18 An order for payment in respect of legal services is an order that one party pays or makes a contribution towards the costs of the other party’s legal fees: Matrimonial Causes Act 1973, s 22 ZA; Civil Partnership Act 2004, sch 5, para 38A.

property that has been the subject of a previous order. It may be particularly useful as a one-stage alternative to obtaining a charging order and a later order for sale.19

A writ or warrant of control (seizure and sale of personal property)

-

A writ or warrant20 of control enables enforcement by directing an enforcement officer to take control of and sell the debtor’s goods.21 The creditor then receives the proceeds, or part of the proceeds, in satisfaction of the debt that is owed. Together with warrants of possession, warrants of control appear to be the most frequently used method of enforcement in the recovery of civil debts generally.22

-

The rules governing the application and court procedure for writs and warrants of control are found in Parts 83 and 84 of the Civil Procedure Rules, which are applied to family proceedings by Part 33 of the Family Procedure Rules. The (very detailed) rules governing the taking control and sale of goods are set out in the Tribunal, Courts and Enforcement Act 200723 (“the 2007 Act”) and regulations made under it.24

-

As we explained in the Consultation Paper, comprehensive reforms of the law relating to taking control of, and selling, a debtor’s goods came into effect in April 2014. Consequently, we have not considered any proposals for reform. However, we have been told that the effectiveness of this enforcement method can be hampered by the lack of available bailiffs to execute the writs and warrants; this is an operational issue outside of our remit but we note it here as it may be an issue for consideration by Her Majesty’s Courts and Tribunals Service (“HMCTS”).

A writ or warrant of possession

-

A writ or warrant25 of possession can be used to enforce an order that provides for possession of land. The writ or warrant authorises an enforcement officer to take possession of the land on behalf of the creditor. In the family context a writ or warrant of possession may be useful to enforce vacant possession, for example, where one party is living in a property that the court has ordered to be

19 An order for sale to realise the charge created by a charging order is made under the Civil Procedure Rules or the Trusts of Land and Appointment of Trustees Act 1996, rather than under section 24A of the Matrimonial Causes Act 1973 or para 10 of sch 5 of the Civil Partnership Act 2004.

20 A writ of control would be issued by the High Court; a warrant of control by the Family (or County) Court.

21 “The debtor’s goods” means property of any description, other than land, in which the debtor has an interest, though particular goods are exempt. Goods in which another person also has an interest may still be seized and sold but different rules apply.

22 In the County Court, 129,778 warrants of control (then called warrants of execution), and 130,690 warrants of possession, were issued in 2011. Ministry of Justice, Judicial and Court Statistics 2011, Chapter 1: County courts (non-family work) table 1.18, available at https://www.gov.uk/government/statistics/judicial-and-court-statistics-annual (last visited 30 November 2016).

23 Tribunal, Courts and Enforcement Act 2007, s 62 and sch 12.

24 Taking Control of Good Regulations 2013, SI 2013 No1894 and Taking Control of Goods (Fees) Regulations 2014, SI 2014 No 1.

25 A writ of possession would be issued by the High Court; a warrant of possession by the Family (or County) Court.

transferred to the other party’s ownership.26 That said, we suspect (although no statistics are available), that writs and warrants of possession are used much more in the County Court jurisdiction than in that of the Family Court and that they are of limited application to enforce family financial orders. We have also not been alerted by consultees to any problems with the law in this area. Accordingly, we have not considered any proposals for reform.

-

Part 83 of the Civil Procedure Rules contains the rules governing writs and warrants of possession. Rule 33.1 of the Family Procedure Rules applies Part 83 to family proceedings.

A writ or warrant of delivery

-

A writ or warrant27 of delivery may be used to enforce an order for the delivery up of goods. If the original order required delivery up of goods or payment of the value of the goods, then the writ or warrant will be to recover the goods or the value.28 If the original order did not provide the option of paying the value of the goods, then the writ or warrant will be for “specific delivery”29 only. Again, we have not been alerted by consultees to any difficulties with this procedure and so have not considered reform in this area. Additionally, where the writ or warrant includes a power to seize and sell the goods, the reformed procedure that governs the taking and selling of goods under writs and warrants of control will apply.

-

An enforcement officer is directed to seize and, where appropriate, sell the relevant goods. The application is governed by Part 83 of the Civil Procedure Rules, which is applied to family proceedings by rule 33.1 of the Family Procedure Rules. Where the writ or warrant confers a power to take control of and sell the goods, the procedure in the 2007 Act (and subsequent regulations) applies.

An order to obtain information

-

An order to obtain information requires a debtor to attend court, answer questions on oath about his or her finances and produce supporting documents. The questioning usually takes place by a court officer but may be before a judge in certain circumstances.

26 Although this method of enforcement may be available only if the order has been drafted to provide that one party may occupy the property to the exclusion of the other. See G Smith and T Bishop, Enforcing Financial Orders in Family Proceedings (2000) p 213.

27 A writ of delivery would be issued by the High Court; a warrant of delivery by the Family (or County) Court.

28 This means that goods other than those specified in the order may be seized and sold.

29 Delivery of the exact goods specified in the order.

-

A creditor may apply for an order to obtain information so as to gain a better understanding of the debtor’s financial position before deciding whether to take enforcement action and for what enforcement order to apply. An order to obtain information is available to aid enforcement of any civil or family debt, however, in family proceedings, it has, to a certain extent, been superseded by the general enforcement application, which is discussed below.30

-

The rules governing an application for an order to obtain information are at Part 71 of the Civil Procedure Rules.

Bankruptcy

-

Bankruptcy, while not strictly a method of enforcement, might be used as such by a creditor. The creditor may make a formal demand of the debtor that he or she pays the amount that is due; if the debtor does not pay then the creditor may petition for the debtor’s bankruptcy. If a creditor is owed a lump sum or an amount for costs then he or she will be eligible to receive a share of the bankrupt’s property towards discharging the debt owed when this is distributed during the bankruptcy process.31 Of course, given that many bankrupts will have very little or no property, the chances of creditors recovering the sums that are owed to them using this method may not be very good. However, all debts arising from family financial orders survive the bankruptcy, unless the court orders otherwise.32

-

The rules governing bankruptcy are set out in Part 9 of the Insolvency Act 1986 and Part 6 of the Insolvency Rules 1986.

INDIRECT ENFORCEMENT METHODS

Committal on a judgment summons

-

A judgment summons requires a debtor to attend court where payment is due under an outstanding family debt. 33 If the creditor can prove beyond reasonable doubt that the debtor has the means to pay the sum owed, or has had the means at some time since the making of the financial order, and the debtor refuses or neglects to pay, or refused or neglected to pay when he or she did have the means, then the debtor may be committed to prison for up to six weeks, subject to being released earlier on payment of the money owed. Imprisonment does not extinguish the debt.

-

Instead of committing the debtor to prison, the court may make a new order for payment of the amount due under the financial order and the costs of the judgment summons, or may make an attachment of earnings order.

30 At paras 2.38 to 2.40 and Chapter 5 below.

31 Other family financial orders are not provable in the bankruptcy, and so, for example, a creditor who is owed money for arrears of a periodical payments order will not receive any share of the debtor’s estate to meet those arrears.

32 On being discharged from bankruptcy, a bankrupt is relieved of most of his or her debts – they no longer exist. However, debts arising from family financial orders “survive”, meaning that they remain and may be enforced.

-

The power to commit for non-payment of certain debts is in section 5 of the Debtors Act 1869. Apart from those arising from family financial orders, very few debts are enforceable in this way. The procedure for a judgment summons application in respect of family debts is contained in Part 33 of the Family Procedure Rules.34

Sequestration

-

A writ or warrant of sequestration is a High Court remedy for contempt of court.35 A sequestrator is appointed to take possession of, hold and deal with the debtor’s property in accordance with directions from the court. A writ of sequestration applies to all the debtor’s property. Although the court may give directions for the sequestrator to deal with the property in order to recover funds for the creditor, for example by raising money against an asset, the procedure is mainly aimed at applying pressure to the debtor to comply with the financial order. We understand that it is a rarely used remedy and, for this reason, we think it unlikely that there is scope for it to be used more commonly to enforce family financial orders.

-

The application procedure is governed by Part 33 of the Family Procedure Rules.36

TYPES OF APPLICATION AVAILABLE ONLY TO FAMILY CREDITORS

-

There are two types of enforcement application available to family creditors that are not available to creditors seeking to enforce other civil debts. The applications may result in the same orders for enforcement being made as can be made to enforce other civil debts but the procedure is very different.

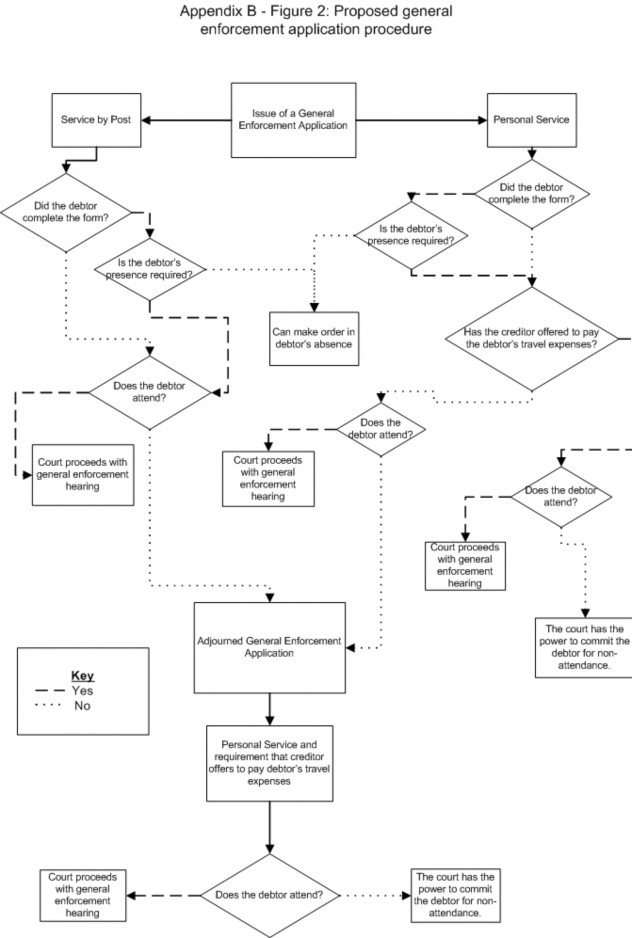

General enforcement application

-

The general enforcement application is a procedure that allows a creditor to apply for “an order for such method of enforcement as the court may consider appropriate” rather than having to apply for any specific method of enforcement. The procedure is particularly useful for litigants in person who may not know where to start in enforcing their unpaid order.

-

A general enforcement application triggers a process requiring the debtor to attend court, produce documents and answer questions about his or her finances with the objective of enabling the court to decide which enforcement method is most appropriate. The court is then able to choose from a “menu” of certain enforcement methods.

-

The rules governing the procedure are set out in Part 33 of the Family Procedure Rules, importing provisions from Part 71 of the Civil Procedure Rules.37

33 A debt owing under a “High Court maintenance order” or “Family Court maintenance order” may be so enforced. In this context, “maintenance order” is given a broad meaning: Administration of Justice Act 1970, s 28 and sch 8.

34 At Family Procedure Rules, rr 33.9 to 33.17.

35 A judge of High Court level sitting in the Family Court may exercise the power: Matrimonial and Family Proceedings Act 1984, s 31E.

36 At Family Procedure Rules, rr 37.18 to 37.26.

Enforcement by the court

-

Similarly, an application for enforcement by the court is not a method of enforcement, but an application that can assist a creditor in obtaining enforcement of a periodical payments order. In circumstances where payment of the order is being made via the court,38 the creditor can ask the court to take any necessary enforcement action on his or her behalf, with the request being made either when the debtor defaults or in anticipation of the debtor not paying. The creditor must still pay the costs of any enforcement. The application is likely to be of most use for litigants in person, particularly where the amount of arrears is not particularly large.

-

The ability for the court to enforce on the creditor’s behalf is set out in rule 32.22 of the Family Procedure Rules.

VARIATION

-

Part of the legal landscape of enforcement is the prospect of the debtor bringing variation proceedings.

-

A number of family financial orders, for example (and most pertinent in this context) orders for periodical payments and orders for lump sums by instalments, are open to being varied by the court on an application by either party.39 When considering an application to vary, the court looks at whether there have been any material changes of circumstances since the original order and the court must also look afresh at the parties’ existing financial circumstances to ensure that the order is still fair.40 On a variation application, the court has the power to remit any arrears that have accrued.41

-

An application to enforce a periodical payments order which can be varied is often met with an application by the debtor to vary the order. This tends to result in an adjournment of the enforcement application, pending the outcome of the variation application. Concern about this sequence of events arose in a few consultation responses and at our consultation events in London and Manchester. Penningtons Manches were concerned in their consultation response about variation applications being made “strategically”. Further, concerns were raised that debtors often stop making any payments upon issuing an application to vary. The Family Law Bar Association proposed that a warning notice should be included on final orders to the effect that payment should continue “unless and until varied” with the exception of an agreement in writing being reached to specify how the order should be varied. This seems a sensible idea.

37 The rules are sparse; we recommend a revised procedure and a comprehensive set of procedural rules, see Chapter 5.

38 See paras 4.21 to 4.40 below.

39 Matrimonial Causes Act 1973, s 31.

40 Matrimonial Causes Act 1973, s 31(7).

41 Matrimonial Causes Act 1973, s 31(2A).

-

It was suggested at consultation events that we should consider measures to prevent debtors making reactive variation applications. One consultee suggested introducing a permission requirement for making a variation application; another suggestion was to introduce a presumption that, unless the debtor had issued a variation application before enforcement proceedings, he or she could pay the amount owed.

-

We have given consideration to these ideas for reform, but do not recommend either. We understand and sympathise with the concerns raised but we think any reforms to applications for variation stray beyond the scope of the project. Although the point is not a new one, we think it is important to emphasise that a variation application should not inevitably lead to an adjournment of any enforcement proceedings; the appropriate action will depend on the circumstances of each case.

-

The law on enforcement can be hard to find and difficult to follow, particularly for litigants in person, but also for lawyers and the judiciary. Owing to the reduction in the availability of legal aid, a greater number of parties must participate in enforcement proceedings without the benefit of legal representation. Unnecessary complexity in the law leads to inefficiencies as litigants and the courts have to grapple with what the law is and how it should be applied.

-

In the Consultation Paper we noted that the number of litigants in person in the Family Court had been growing due to the reduction in the availability of legal aid, following the coming into force of the Legal Aid, Sentencing and Punishment of Offenders Act 2012. In only 21% of private family law cases are both parties represented, and in over one third of private law cases both parties are litigants in person.1

-

Accordingly, the case for making the law clear and easy to find is compelling. It benefits both the parties and the courts if the law is accessible to litigants in person. In this Chapter, we examine two ways in which to achieve that objective: by consolidating the procedural rules, and by creating a narrative practice direction to steer litigants in person (and others) through the process of enforcing a family financial order.

CONSOLIDATION OF PROCEDURAL RULES

-

The current enforcement regime for family financial orders is found across primary legislation and in both the Family Procedure Rules and the Civil Procedure Rules. The need to consult different sets of procedural rules in enforcement proceedings has been widely criticised by both judges and practitioners.2 Further, the relationship between the two sets of rules is not always clear, and is especially difficult for a litigant in person. For example, rule

33.1 of the Family Procedure Rules provides that:

Parts 50, 83 and 84 of, and Schedules 1 and 2 to, the CPR apply, as far as they are relevant and with necessary modification3 to an

1 In 2014, both parties were represented in 22% of private law cases, whereas, in 2015 both parties were represented in 21% of private law cases. For the same years, the figures for neither party being represented were, respectively, 33% and 35%. Private law cases include proceedings for divorce and annulment, both with and without financial remedies, domestic violence proceedings and private law children proceedings. We note that the table records that whether a party is represented is determined by whether the field “legal representation” in FamilyMan (the Family Court computer system) is left blank – so parties without a recorded representative may not necessarily be self-representing litigants in person. See https://www.gov.uk/government/statistics/family-court-statistics-quarterly- october-to-december-2015 (last visited 30 November 2016).