Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Technology and Construction Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Technology and Construction Court) Decisions >> Abbvie Ltd v The NHS Commissioning Board (NHS England) [2019] EWHC 61 (TCC) (18 January 2019)

URL: http://www.bailii.org/ew/cases/EWHC/TCC/2019/61.html

Cite as: [2019] EWHC 61 (TCC)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2019] EWHC 61 (TCC)

Case No: HT-2018-000139

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

TECHNOLOGY AND CONSTRUCTION COURT (QBD)

Royal Courts of Justice

Strand, London, WC2A 2LL

Date: 18 January 2019

Before :

MR JUSTICE CHOUDHURY

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

ABBVIE LTD |

Claimant |

|

|

- and –

|

|

|

|

THE NHS COMMISSIONING BOARD (OPERATING UNDER THE NAME OF NHS ENGLAND) |

Defendant |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Jason Coppel QC, Joseph Barrett (instructed by CMS Cameron McKenna Nabarro Olswang LLP ) for the Claimant

Philip Moser QC, Patrick Halliday (instructed by Blake Morgan LLP ) for the Defendant

Hearing dates: 13th, 14th, 15th, 20th and 22nd November 2018

- - - - - - - - - - - - - - - - - - - - -

JUDGMENT APPROVED

Introduction

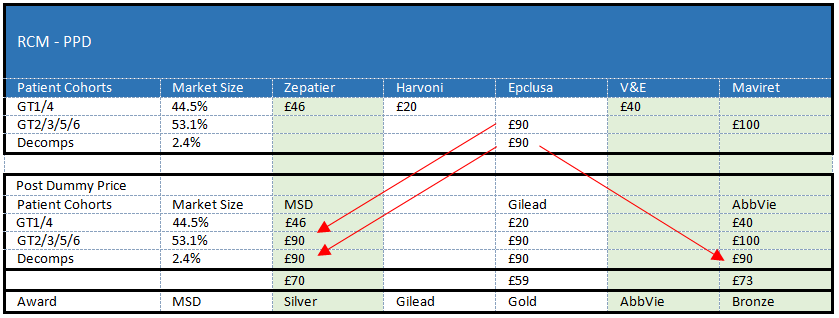

i) The first is the “dummy price mechanism” (“ DPM ”). The DPM operates under the Revenue Capped Model (“ RCM ”) of the Procurement to impute a price to a bidder in respect of a particular HCV genotype/patient group notwithstanding the fact that that bidder does not produce any drugs capable of treating that group. The Claimant contends that the DPM thereby confers an unfair advantage on a bidder unable to supply part of the market as compared to a bidder that can;

ii) The second relates to the rules under the Unmetered Access Model (“ UAM ”) of the Procurement. Part of the UAM involves the payment of a fixed fee in return for the treatment of a number of patients which the supplier has committed to treat. The Claimant contends that the relevant rules operate unfairly in that the failure by one bidder to treat the number of patients that it has committed to treat means that other bidders may be required to supply treatments to patients exceeding the number they have committed to treat without additional compensation or remuneration.

Confidentiality

Witnesses

Factual Background

HCV

11. HCV is a cancer-causing infectious virus. It is spread through infected blood which may be as a result of sharing needles, transfusion of unscreened blood, or unprotected sex. Those at risk of becoming infected by HCV include some of the most disadvantaged in society, such as those who inject drugs, who are homeless or who are in prison. HCV is a serious disease which presents a major public health threat. According to the World Health Organisation (“ WHO ”), there are an estimated 71 million people chronically infected by HCV worldwide resulting in around 400,000 deaths per year. As at 2015 there were approximately 160,000 people in England who were chronically infected, with an additional 5,000 becoming infected each year. HCV-related deaths in England doubled in the years 2005 to 2014.

12. Although the symptoms of HCV infection are initially mild, in the longer term, those infected suffer from liver damage. In 30% of those infected, liver damage progresses to cirrhosis (severe liver damage). The disease may then progress further so as to result in ‘ decompensated cirrhosis ’, where the remaining liver can no longer compensate for the loss of function.

Treatments for HCV

13. Up until a few years ago the only available treatments for HCV were complex and prolonged. Side-effects were numerous and severe, and many patients required sophisticated medical support to complete the therapy. Even for those patients who could endure the lengthy treatment the success rate was variable. On top of all that, the available drugs were very expensive. More recently, pharmaceutical companies have developed a new type of treatment, namely, direct acting anti-virals (“ DAAs ”), which are highly effective in curing HCV infection more quickly and with fewer side effects. Whilst DAAs are also relatively expensive, they are becoming increasingly affordable. DAAs present health services with the opportunity to eliminate HCV as a major public health concern. “Elimination” in this context has been defined by the Defendant (consistently with the WHO of definition elimination) as treating 80% of the chronic cases. WHO has set a target of 2030 to achieve this. The Defendant announced its intention for England to be the first country in the world to achieve that goal and to do so by 2025 at the latest.

14. The various categories of HCV patients can be placed into three key “Patient Groups” based on which one of the six HCV genotypes (“ GT1 to GT6 ”) by which they have been infected, namely:

i) those infected by GT1 or GT4 who do not have decompensated cirrhosis.;

ii) those infected by GT2, GT3, GT5 or GT6 who do not have decompensated cirrhosis; and

iii) those infected by any of GT1 to GT6 who have decompensated cirrhosis.

15. The market for HCV treatments can be divided up into corresponding segments. Thus, the GT1/4 patient group is referred to here as ‘Market Segment 1’ (“ MS1 ”); and the GT2/3/5/6 patient group is referred to as ‘Market Segment 2’ (“ MS2 ”).

16. There are three suppliers of DAAs: the Claimant, Merck Sharp & Dohme ( “MSD” ) and Gilead Sciences, Inc ( “Gilead” ). They currently supply the following drugs relevant to this procurement :

|

Supplier |

Drug |

Patient Group(s) |

Percentage of HCV-infected population in this group [1] |

Percentage of HCV-infected population treated by Drug |

|

MSD |

Zepatier |

GT1/4 (ND [2] ) |

51.4% |

51.4% |

|

Gilead |

Harvoni |

GT1/4 (ND) |

51.4% |

51.4% |

|

Epclusa |

GT1/4 (ND) |

51.4% |

100% | |

|

GT2/3/5/6(ND) |

45.3% | |||

|

Decompensated |

3.3% | |||

|

Claimant |

V&E |

GT1/4 (ND) |

51.4% |

51.4% |

|

Maviret |

GT1/4 (ND) |

51.4% |

96.7% | |

|

GT2/3/5/6 (ND) |

45.3% |

17. As the table above shows, all three suppliers have treatments suitable for the GT1/4 (ND) patient group, i.e. MS1. However, only Gilead and the Claimant have treatments suitable for all genotypes where patients have not developed decompensated cirrhosis. These “pan-genotypic” drugs have been developed fairly recently, with Gilead’s Epclusa being introduced into the market in April 2017, and the Claimant’s Maviret being launched in September 2017. Epclusa is also suitable for patients with decompensated cirrhosis making Gilead the only supplier able to supply a product suitable for the whole HCV population. MSD only provides one HCV treatment, namely Zepatier , suitable for GT1/4. MSD was developing a pan-genotypic HCV treatment which would have treated GT2/3/5/6 as well but ceased doing so in late 2017.

Recent Procurement History

18. As at 2015, it was estimated that about 160,000 people in England were infected with HCV. The average price per patient of HCV treatments available at that time was in excess of £20,000. The cost of treating the entire infected population would therefore have been around £3.2 billion. Patient treatment target figures published by the National Institute for Care and Health Excellence (“ NICE ”) of around 10,000 patients per annum in 2016/17 rising to 15,000 patients by 2020 and beyond, would have meant annual expenditure on HCV treatments increasing to £330 million if prices remained static. The annual budget for HCV treatments is £190 million inclusive of VAT. Affordability was therefore a real concern for the Defendant if it was to have any chance of meeting the HCV elimination target which it had set.

19. The Commercial Medicines Unit (“ CMU ”) runs procurement exercises to try and reduce the cost of the thousands of different branded and generic medicines used by NHS England. The structure of the CMU procurements, whereby all qualifying drugs were awarded a place on a framework, meant that, in effect, there was little competition to get onto the framework. Some competitive pressure was introduced with the implementation of a rate card system into CMU tenders in 2016. These rate cards directed clinicians towards prescribing particular medicines from the ones available, subject of course to contrary clinical indications requiring a different prescription. Compliance with the rate card was encouraged by means of a reduced payment from NHS England to the relevant hospital where there was non-compliance with the rate card recommendations.

20. The CMU commenced its first HCV–focused tender in around May 2017 with a proposed contract start date of 1 September 2017. This tender incorporated several new requirements. These included the requirement that suppliers provide a single price per drug (i.e. differential pricing for different patient groups was prohibited); and to provide a flat price per drug (i.e. volume discounts were precluded). Gilead’s new pan-genotypic DAA, Epclusa, became available around this time (April 2017). Gilead at this time had a monopoly on pan-genotypic DAA treatments and therefore faced no competition in setting the price of its new drug, which was correspondingly relatively high.

21. In order to facilitate the inclusion of new treatment options and greater competition, particularly in MS2 (which at that stage was supplied only by Gilead), the Defendant worked with the Claimant to enable its new treatment to be included in the CMU tender subject to the Claimant achieving market authorisation and in advance of NICE guidance being issued. As a result of this cooperation, the Claimant’s drug, Maviret, was made available from 1 September 2017, over 7 months earlier than might otherwise have been the case. As might be expected with the introduction into the market of an additional pan-genotypic treatment from the Claimant, the CMU tender did result in substantial reductions in the price of Gilead’s pan-genotypic drug. The rate card recommendations resulted in a very significant shift in market share as between the three suppliers. (Further findings in Confidential Annex).

22. Supplier feedback following the CMU tender suggested that the “winner takes all” approach of these tenders was leading to significant volume uncertainty for suppliers, big swings in usage, challenges for production and supply, and disincentives for suppliers to invest in case-finding (i.e. identifying patients in need of treatment).

23. By this stage, the Defendant had already commenced developing its new strategic procurement (the Procurement) with the objective of, amongst other matters, reducing the average cost per treatment, capping the total cost of treatments to the Defendant, creating incentives for suppliers to identify patients, and developing a mechanism that would encourage more patients to be identified and treated earlier during the term of any contract. The last of these objectives has the obvious consequence of reducing the impact of HCV by reducing the duration of patients’ pain and suffering and also reduces the number of people becoming infected due to the shorter time during which infections may be transmitted. Given the overarching aim of eliminating HCV, it was apparent that the Procurement would potentially be the last substantial tendering exercise in respect of HCV drugs.

24. Before the Procurement was ready, there was a need for a further procurement to bridge the change from the CMU style procurements to the strategic procurement. The Bridging Tender, as it was known, was published on 22 December 2017 with a view to contracts commencing on 1 April 2018. The Bridging Tender required suppliers to submit offers for two different models, with the model offering the best value to the Defendant being adopted. The first model was similar to the previous CMU tender. The second model introduced a number of new features, including the introduction of a market share award rather than a ‘winner takes all’ approach. The purpose of this was to encourage and maintain a healthy, sustainable and competitive market with multiple participants. Under this model, each supplier would be awarded a market share (either 65%/25%/10% or 55%/30%/15%). Furthermore, the Bridging Tender introduced a mechanism whereby the Comparison Price, i.e. the score by which bids were ranked, reflected the value offered across all market segments within the overall market, and not just the prices bid for individual drugs. The Bridging Tender resulted in further reductions in the average price per treatment for MS2. It is therefore apparent that with just two procurement exercises, the price per treatment for MS2 had fallen very substantially. (Further findings in Confidential Annex).

25. This background to the Procurement, and in particular these substantial reductions in prices, led the Claimant to challenge some of the Defendant’s assumptions about the market prior to going into the Procurement. The relevance of these challenges is somewhat limited given the nature of the issues I have to determine, and were not developed to any significant extent in oral submissions. Notwithstanding that, I deal with some of them very briefly out of deference to the amount of evidence adduced in relation to them:

i) The Claimant took issue with the emphasis placed by the Defendant in its evidence on the relatively low cost of manufacture of HCV treatments and the suggestion that prices being charged were “ excessive ”. Mr Huskinson relied upon publicly available research material which suggested that the cost of manufacture was in the region of £160 per treatment, which was many multiples below the cost per treatment to the Defendant. There was no evidence before me as to the actual cost of manufacture to the Claimant. As mentioned above, Mr Pumford claimed to have “ no idea ” of such costs but accepted that they would be fairly low. There is no doubt that manufacturing costs represent a relatively small part of a manufacturer’s outlay in getting a new drug approved for market. The research and development costs, including the costs that need to be recouped in respect of unsuccessful development work, are likely to comprise the major element of the cost to the business of developing new pharmaceutical products. This is recognised by the Department of Health’s non-contractual voluntary scheme for regulating pharmaceutical prices, the ‘Pharmaceutical Price Regulation Scheme 2014’ (“ PPRS ”). This notes the importance of pharmaceutical companies being able to recoup the costs of research and development, and incorporates an R&D allowance into a cap on companies’ overall profits. Mr Huskinson’s belief that the Claimant’s continuing costs would be limited to manufacturing costs alone appears to be based on an assumption that the Claimant had already recouped R&D costs for Maviret. There is no evidence before me that such costs have been recouped. In those circumstances, it might be said that it was somewhat inappropriate to use the emotive terminology of prices being “ excessive ”, but there was, in my view, a reasonable basis for the Defendant to assume that there was scope for further reductions to be achieved. To that extent, it was not unreasonable for the Defendant to refer to the prices as still being “high”. [3]

ii) The Claimant suggested that the problem of high costs had resolved itself with the reductions achieved in the two tendering exercises prior to the Procurement, and that the Defendant was, therefore, already in a position to achieve HCV elimination by 2025. Costs had certainly reduced but that did not mean, in my judgment, that the Defendant was not entitled to seek better value, in terms of elimination solutions and price, than had already been achieved.

iii) There is an allegation that the Defendant, and Mr Huskinson in particular, had set out to misrepresent to suppliers the true position in respect of HCV treatment prices after the 2017 CMU tender. The relevance of this allegation, other than to undermine Mr Huskinson’s evidence as to the background to the Procurement, is somewhat unclear. There is no specific claim or issue before me that the Procurement itself breached the duty of transparency and/or contained misrepresentations.

iv) The Claimant also attacks the suggestion made by the Defendant that there were unjustified price differentials between the treatments for MS1 and MS2. Once again, the relevance of this challenge is unclear. There were explanations for the difference in prices – including the longer time that MS1 treatments had been on the market and the functional advantages which the MS2 treatments had over MS1 treatments – and it was probably incorrect to describe these differentials as “ unjustified ”. However, it was open to the Defendant to seek to achieve further reductions in MS2 prices or to achieve a price per supplier taking account of all of the products (for both MS1 and MS2) which suppliers could make available.

The Procurement

The RCM and the DPM

“1.14 TREATMENT SCOPE ADJUSTMENT FOR RCM – ONE PRICE PER DRUG

1.14.1 In order to equitably compare the Comparison Price between a Bidder whose offered treatments cover the full spectrum of Patient Groups and a Bidder whose offered treatments do not cover the full spectrum of Patient Groups, the Comparison Price must be adjusted for the treatment scope.

1.14.2 The Authority will use a Dummy Price approach to achieve this adjustment.

1.14.3 The Dummy Price approach means that any gaps in one Bidders offering are filled by the best available Comparison Price from another Bidder.

1.14.4 This is explained by the hypothetical example below:

|

|

Market Segment I: x% |

Market Segment II 100-x% |

Comparison Price formula (if X equals 90%) |

|

Supplier A |

1000 |

1300 |

90% * 1000+10%*1300 = 1030 GBP |

|

Supplier B |

1100 |

1200 |

90%*1100+10%*1200 = 1110 GBP |

|

Supplier C |

1200 |

n/a |

90%*1200+10%* 1200 = 1200 GBP |

…

· In this example, the Comparison Price Average Cost (CPAC) for Bidders A and B, is calculated by weighting their Comparison Price per market segment with the size of the market segment (£1030 and £1110 in the example).

· In order to equitably compare Bidders to each other, the Authority will fill the gap for Bidder C in market segment II with the best available Comparison Price for this market segment. In the example this would lead to an CPAC for Bidder C of £1,200.”

38. RCM entails a ‘Whole Market Approach’. The Whole Market Approach, according to the Defendant, means that suppliers compete by each submitting a single bid for a share of the whole market for HCV treatments. The Whole Market Approach may be contrasted with the Separated Market Approach, which involves separate competitions for separate Patient Groups. The Claimant does not expressly challenge the use of the Whole Market Approach by the Defendant, but does contend that the Defendant has not been clear about what this approach entails, and that, in any event, it cannot provide a justification for the DPM. I shall return to that contention below.

39. It should be noted that, the ITPD expressly provides that under RCM:

“If a Supplier wins a Lot that includes more market share than they can serve, then [the] difference will be distributed amongst the other Lots proportionally to the market share of those Lots. Therefore, the maximum market share per supplier will be limited to the % of patients a supplier’s product(s) can cure.” [4]

UAM

41. The ITPD further recognises that the inclusion of non-price factors in the Procurement will mean that the biggest market share will be assigned to the best supplier overall and not just the supplier with the most attractive commercial offer on price procured per patient under RCM, or number of cured patients under UAM, respectively. That is to say, the best bid does not necessarily mean the ‘cheapest’ bid (in terms of the lowest price in RCM or largest number of cured patients in UAM).

The Procurement so far

42. The OJEU notice in respect of the Procurement was published on 19 April 2018 and the ITPD provided to bidders on 23 April 2018. Bidder briefings were held between 2 and 4 May 2018. On 17 May 2018, the Claimant wrote to the Defendant raising concerns about the methodologies used in the RCM and the UAM. The Claimant issued its Claim Form on 18 May 2018 and filed its Particulars of Claim on 5 July 2018. Thereafter, the matter proceeded with alacrity with the Defence being served on 29 July 2018 quickly followed by the Claimant’s Reply on 17 August 2018. Meanwhile, the Defendant decided to continue with the Procurement.

The Legal Framework

Relevant legislative provisions

43. The relevant duties imposed on contracting authorities are set out in Part 2 of the PCR.

44. Regulation 3(1) provides:

“This Part [i.e. Part 2] establishes rules on the procedures for procurement by contracting authorities with respect to public contracts”.

45. The principal duties relevant to the claim are set out in Regulation 18 in Part 2, which provides:

“ 18. — Principles of procurement

(1) Contracting authorities shall treat economic operators equally and without discrimination and shall act in a transparent and proportionate manner.

(2) The design of the procurement shall not be made with the intention of excluding it from the scope of this Part or of artificially narrowing competition .

(3) For that purpose, competition shall be considered to be artificially narrowed where the design of the procurement is made with the intention of unduly favouring or disadvantaging certain economic operators.” (Emphasis Added)

46. The EU principle of equal treatment is thus clearly reflected in Regulation 18(1). The requirements of that principle were set out in Cases C-21/03, C-34/03 Fabricom v Belgium [2005] ECR I-01559 , where the ECJ said as follows:

“…the equal treatment principle requires that comparable situations must not be treated differently and that different situations must not be treated in the same way, unless such treatment is objectively justified.”

47. Prof Arrowsmith in her text, The Law of Public and Utilities Procurement , Volume 1, 3 rd Edition, states at para 7-11, that in deciding which situations are ‘comparable’ in applying the Fabricom definition:

“… It is necessary to have regard to the purpose of equal treatment in this context. In general, this is to “ensure the development of effective competition”, leading to the selection of the best bid. Thus, it is submitted, the principle generally forbids different treatment of entities in a comparable competitive position. This approach to equal treatment, as articulated in the previous edition of the present book, was expressly endorsed in domestic law by Briggs J in the High Court in Azam v Legal Services Commission, concluding that all potential bidders need to be given access to substantially the same information. Similarly, all bidders will, for example need to be given the same opportunities (for example, to clarify or amend bids) and to be subject to the same rules (such as the same qualification requirements and time limits).…” (Emphasis Added)

48. The words in quotations in that extract are derived from Case C-243/89 Commission v Denmark [1993] ECR I-03353 at paragraph 33. It is clear, therefore, that the question of whether or not there has been a breach of the equal treatment principle is to be considered in context and having regard to the general purpose of ensuring the development of effective competition.

49. Of course, it is not the case that any difference between two contractors, however minor, would render them not comparable. In the procurement context, where different contractors will, almost of necessity, be in different competing positions, an approach to comparability based on ‘any’ difference would mean that no two contractors would ever be regarded as being in a comparable position. The difficulty of applying the equal treatment principle in the procurement context in a mechanistic or automatic way was highlighted by Prof Arrowsmith, at para 7-015 of her book:

“It needs to be emphasised that very often the equal treatment principle as described above cannot be applied automatically. In deciding whether firms should be considered in a comparable position in a particular case and/or in deciding what differences in treatment of such firms can be considered as justified, the CJ is frequently making policy decisions on how to balance the principle of equality of treatment and the policy consideration behind it with other goals of the procurement process and also with the interests of national authorities in deciding how those interests should be pursued. The existence of such a principle and its extensive scope under the procurement directives gives rise to both considerable uncertainty in the law and a very wide potential for the CJ to restrict the discretion of national authorities in implementing national public procurement objectives in all aspects of procurement procedures.”

50. One area where the ECJ has accepted that contractors may not be in a comparable position is where, in a re-tendering exercise, one of the bidders is the incumbent provider: see e.g. Case T – 345/03 Europaiki Dynamiki v Commission . The “inherent de facto advantage” of an incumbent provider over other providers was accepted as putting the incumbent in a different position such that differential treatment intended to neutralise the advantage enjoyed by the incumbent did not amount to a breach of the equal treatment principle. However, there are limits to that principle in that, according to the same case (at paragraph 76), the advantage can only be neutralised to the extent that to do so is technically feasible, economically acceptable, and does not infringe the rights of the existing provider or a tenderer connected with that provider.

51. A more recent example of the European Court applying the equal treatment principle to ‘neutralise’ what might otherwise be regarded as a competitive advantage is Case T-211/17 Amplexor Luxembourg Sarl v European Commission . In that case, upon which the Defendant places particular reliance, an incumbent (Amplexor) challenged, as a breach of equal treatment, a 3% funding allowance for new tenderers to finance take-over costs in the transition phase of the contract being procured; whereas the incumbent (Amplexor) would receive only 0.3%. The General Court held that the financial adjustment in question was lawful. Treating tenderers in different positions differently in this way was likely to encourage the development of healthy and effective competition between tenderers and ensure the broadest possible competition. By contrast, an absence of any remuneration during the transition phase would run the risk of deterring tenderers other than the incumbent contractor from participating in the relevant market. [5]

52. Regulation 67 concerns the criteria by which contracts are to be awarded. It provides:

“ 67. — Contract award criteria

(1) Contracting authorities shall base the award of public contracts on the most economically advantageous tender assessed from the point of view of the contracting authority.”

53. There can be little doubt that contracting authorities are afforded a wide margin of discretion in designing and setting award criteria. As Professor Arrowsmith states at para 7-195 of her book:

“Another issue is the extent to which the directive restricts the freedom to choose, or not to choose, particular award criteria for contracts, or to choose the weightings that are attached to each criterion. Since the choice of award criteria reflects the decision on what to buy, in the sense of how to allocate national financial resources between benefits such as quality of services, environmental benefits, etc., and it is not a concern of the directive to regulate these matters, it seems clear that the choice and weightings, etc. are not in principle constrained by the directive.”

54. Caselaw confirms that approach: In Case C-448/01 EVN AG v Wienstrom GMBH Austria [2003] ECR I-14527 , at paragraph 39, the ECJ stated:

“… provided that they comply with the requirements of Community law, contracting authorities are free not only to choose the criteria for awarding the contract but also to determine the weighting of such criteria, provided that the weighting enables an overall evaluation to be made of the criteria applied in order to identify the most economically advantageous tender.”

55. The Court in EVN went on to state, at paragraph 53, that the award criterion in that case - a requirement that a contractor supply energy which was produced from renewable sources - could not be regarded as unlawful “ simply because it did not necessarily serve to achieve the objective pursued ” by the contracting authority (i.e. increasing electricity produced from renewable energy sources). The ECJ’s refusal to interfere with an award criterion even where its application did not result in the stated objective being achieved is a measure of the wide margin of discretion enjoyed by contracting authorities when setting award criteria.

56. The same is reflected in domestic authority. As explained in Lion Apparel Systems Ltd v Firebuy Ltd [2007] EWHC 2179 (Ch); [2008] Eu. L.R. 191 at paragraph 93, the choice of methodology is:

“…a matter of evaluation by the procuring authority. The court can interfere with the decision of the procuring authority, if the decision is manifestly wrong. The fact that one scoring system favours one bidder as compared with an alternative system does not, ipso facto, make it manifestly wrong. There must be something else wrong with the system before the court could reach the conclusion that it is manifestly wrong.” (Emphasis Added)

57. It is clear, therefore, that a contracting authority does not necessarily breach the equal treatment principle simply by selecting a scoring system which could favour one bidder as compared with an alternative scoring system. As set out in Lion Apparel above, award criteria are a matter of choice for the contracting authority. That choice will reflect its views about what it considers valuable. If, as a result, a bidder is more or less likely to win, and another more or less likely to lose, that does not in itself entail any breach of the equal treatment principle.

58. The final regulation to mention at this stage is Regulation 91 (1) under Part 3, PCR, which concerns remedies. That provides that a breach of duties owed under Part 2:

“is actionable by any economic operator which, in consequence, suffers, or risks suffering, loss or damage.”

The margin of appreciation

59. It is appropriate at this stage to deal with some arguments made as to the margin of appreciation in the context of assessing whether there has been a breach of the equal treatment principle. The Claimant submits that there is no margin of appreciation available to the Defendant at all in this regard. It relies upon a trio of recent procurement cases in the domestic context. The first is Woods Building Services v Milton Keynes Council [2015] EWHC 2011 (TCC) in which Coulson J said as follows:

“8. Unlike other allegations commonly made during procurement disputes, such as whether or not a manifest error has been made in the evaluation, a breach of the transparency obligation does not allow for any “margin of appreciation”: see para 36 of the judgment of Morgan J in Lion Apparel Systems Ltd v Firebuy Ltd [2007] EWHC 2179 (Ch).

2.2 Equal Treatment

9. The duty of equal treatment requires that the contracting authority must treat both parties in the same way. Thus ‘comparable situations must not be treated differently’ and ‘different situations not be treated in the same way unless such treatment is objectively justified’: see Fabricom … Thus the contracting authority must adopt the same approach to similar bids unless there is an objective justification for a difference in approach.

10. Morgan J’s observation in Lion Apparel , noted above, is equally applicable to the duty of equality: again, when considering whether there has been compliance, there is no scope for any ‘margin of appreciation’ on the part of the contracting authority.”

60. This was followed by Fraser J in Energy Solutions v Nuclear Decommissioning Authority [2016] EWHC 1988 (TCC) at paragraph 276; and by O’Farrell J in MLS (Overseas) v Secretary of State for Defence [2017] EWHC 3389 (TCC) at paragraphs 63-80. It is notable, however, that the principal allegations in Woods (and indeed the other cases) were based on manifest error, and not specifically on a breach of the equal treatment principle. To the extent that, in Woods , there was a consideration of the breach of the equal treatment principle, it was said as follows (after setting out an extract from cross-examination in that case which suggested that the assessor had penalised one of the bidders):

“74. I consider that this answer was an admission of breach of the duties of both transparency and fairness. The expression “penalise” might have been shorthand but its meaning was clear: it meant giving Woods a lower mark than EAS. Because of these failures, there is therefore no question of any margin of appreciation...”

61. Thus, having concluded that there was a breach of the duty of fairness (or equal treatment) the authority was not afforded any margin of appreciation to explain away its treatment.

62. However, the question of whether there has been a breach of the duty of equal treatment in the first place is, in my judgment, somewhat more nuanced than the Claimant’s stark proposition that this is a “hard-edged question in respect of which a contracting authority is not to be afforded any margin of appreciation ”. It is helpful to be reminded of what Morgan J said in the Lion Apparel case at paragraph 36:

“ If the authority has not complied with its obligations as to equality, transparency or objectivity, then there is no scope for the authority to have a margin of appreciation as to the extent to which it will or will not comply with its obligations.” (Emphasis Added)

63. That suggests that the margin of appreciation is to be denied to the authority once a failure to confer equal treatment has been established.

64. The Defendant also relies upon three authorities in support of its contention that in analysing whether there has been a breach of the equal treatment principle, the court should permit a certain degree of deference to the decision-maker and its choice of counter balancing measures. The first two are the Supreme Court’s decision in R (Lumsdon) v Legal Services Board [2016] AC 697 , and the decision of Green J (as he then was) in Gibraltar Betting and Gaming Association Ltd v Secretary of State for Culture, Media and Sport [2015] 1 CMLR 28 . In both these cases there is a reference to a “measure of discretion” to be afforded to national authorities when applying the proportionality test. However, the context of those decisions was somewhat different from the procurement context before me and, on this issue at least, I found them to be of limited assistance. The Defendant’s third case was the Amplexor decision referred to above. That was a decision of the General Court in the procurement context where it was argued that a financial adjustment of 3% made to benefit a non-incumbent provider, as opposed to a 0.3% adjustment for the incumbent, amounted to a breach of the equal treatment principle. In concluding that there was no such breach, the court said as follows:

“In any event, it must be held that the threshold of 3% does not appear to be arbitrary or excessive. This threshold reflects the experience of the contracting authority acquired in previous years. In that regard, it is clear from the file that the applicant had itself benefited from a period of compensated resumption following a call for tenders in 2012 which gave rise to the contract it executed at the time of the launch of the invitation to tender. However, as the Commission explains, without being contradicted in that regard by the applicant, the amount collected as such was used as a basis by the Commission for settling the 3% threshold for the price of recovery for contractors in the context of the call for tenders at the issue in this case.”

67. However, if the difference in treatment falls outside of that margin and/or is considered to be ‘arbitrary or excessive’, then the Authority has no further margin of appreciation. The unequal treatment must be shown to be objectively justified and if it is not then the breach would be established. To the extent that the Defendant contends that the margin of discretion extends even to the stage of objective justification, I disagree.

68. As to objective justification, the principles are well-established in that it must be shown that the treatment amounts to a proportionate means of achieving a legitimate aim. There is a dispute between the parties as to whether the aims in this case are “purely economic”. The Claimant submits that if they are then such aims cannot justify any breach of the equal treatment principle. Reliance is placed upon the decision of the CJEU in C-322/01 DocMorris NV [2003] ECR I-14887 :

“122. Although aims of a purely economic nature cannot justify restricting the fundamental freedom to provide services, it is not impossible that the risk of seriously undermining the financial balance of the social security system may constitute an overriding general-interest reason capable of justifying a restriction of that kind…”

69. I shall return below to the question of whether the aims in question are indeed “purely economic” so as to invoke that principle.

The Issues

i) In relation to the RCM:

a) the first issue is whether the DPM under the RCM amounts to a breach of the Defendant’s duty of equal treatment contrary to Regulation 18 (1) of the PCR; and

b) if there is a breach of that duty, the second issue is whether the DPM is objectively justified for the reasons relied upon by the Defendant.

ii) In relation to the UAM,

a) the first issue is whether fixed fee provisions breach the Defendant’s duty of equal treatment; and

b) if there is a breach of that duty, the second issue is whether the fixed fee provisions are objectively justified for the reasons relied upon by the Defendant.

RCM

Does the application of the DPM amount to a breach of the equal treatment principle?

Submissions

Unequal Treatment - Conclusions

i) MSD was not able to supply MS2 as its drug, Zepatier, could only treat MS1 i.e. patients with GT1 or GT 4. The Claimant, on the other hand, was able to supply both MS1 and MS2.

ii) That difference is not the result of the assessment mechanism or the procurement design. It was the existing position from the moment that the Claimant’s drug, Maviret, came on the market in September 2017 and MSD ceased its R&D into a pan-genotypic treatment.

iii) The fact that the Defendant designed the Procurement specifically with these two bidders and Gilead in mind does not, in my judgment, undermine the conclusion that MSD was not in a comparable position to the others for these purposes. The DPM was introduced in order to address a difference in position for the purposes of assessment, but it did not generate or create that difference. That difference, as stated above, was already in existence irrespective of the DPM.

iv) The Claimant’s submission that the suppliers are in a similar situation because all three meet the qualifying condition of having a DAA in their portfolio and are participating in the same procurement (designed with them in mind) cannot be accepted. If all that is required to render suppliers comparable is participation in the same procurement and/or the satisfaction of a key qualifying condition, then there would be hardly any cases where a relevant difference in position could arise.

v) The situation is not wholly dissimilar to that which arises in the incumbent provider cases such as Europaiki Dynamiki v Commission and Amplexor considered above. There, both the incumbent (or, more accurately the supplier intending to use the incumbent as a subcontractor) and the other providers were in the same procurement and satisfied all qualifying conditions. However, treatment (in the form of a requirement to undertake an unpaid “running-in” phase) was permissible notwithstanding the fact that it would be to the disadvantage of the other providers without a connection with the incumbent. Whilst the advantage enjoyed by Gilead in the present case, namely its ability to serve the whole market, is not “inherent” (given that it is an advantage earned through its R&D efforts), it does nonetheless place it in a materially different position for the purposes of comparability.

vi) It is relevant to note that the design of this whole market procurement, which brings into the analysis a supplier who might otherwise have been excluded as having nothing to offer in MS2, can be said to be consistent with the purpose of equal treatment in this context, which is to ensure the development of effective competition leading to the selection of the best bid. Whilst MSD is unable to offer a specific treatment for MS2, it is able to serve MS1, which comprises a substantial proportion of the whole market, and is able to provide elimination solutions which would potentially be of benefit to the Defendant across all market segments.

Did the Defendant seek intentionally to unduly favour MSD?

“The other point I think I need to ensure we cover is how the tender accommodates MDS [sic] only being able to supply 45% of patients maximum (it might be inferred that they are purely a silver vs bronze candidate no matter how good their response)”

“any criteria that [the Defendant] could use to exclude AbbVie 2D/3D from the procurement that would also not exclude other more attractive treatments?”

i) It is clear that whatever might have been suggested by way of a query in this email, it was never acted upon. There is nothing in the remainder of the evidence to suggest that there was at any stage any serious, or indeed any, attempt to exclude any particular product from the Procurement. The inference to be drawn is that in the context of a long development period during which various ideas were considered with a view to achieving the Defendant’s objectives, Mr Perkins made a suggestion that gained no traction whatsoever.

ii) Mr Perkins accepted that he asked the question but could not recall the context in which it was raised. He did recall having discussions with the Claimant about the fact that it did not wish to continue providing V&E and preferred only to provide Maviret. Mr Perkins went on to reject the suggestion put to him that the mere fact he was thinking about a criterion to exclude V&E shows a certain hostility towards the Claimant. He pointed out that the Defendant had worked closely with the Claimant to get Maviret on to the market and said that there was no intention to disadvantage the Claimant.

iii) In my judgment, the evidence does not point to any hostility towards the Claimant. It was not disputed that the Claimant had obtained assistance from the Defendant in getting its new product on to the market sooner than might otherwise have been the case. Had there been any hostility towards or predisposition against the Claimant, it is highly unlikely that the Defendant would have provided such assistance. Indeed, if there had been a desire to keep the Claimant from participating in the Procurement, it could have accelerated the Procurement and left the Claimant to bring its new product to the market in the usual timescales (which might have resulted in Maviret being unavailable for the Procurement).

iv) Mr Perkins’ inability to recall the context in which he sent the email does not affect the position. It is possible that the Claimant itself was considering the future of its V&E offering once it had a pan-genotypic treatment available and that discussions along those lines with Mr Perkins (which were not disputed) might have provided the backdrop to the sending of the email.

v) I consider this email to provide a weak platform from which to mount an attack on the integrity of the Defendant and/or Mr Perkins. There is no express allegation that the Defendant was biased against the Claimant. The evidence clearly suggests that it was not. Not only did the Defendant provide the Claimant with the assistance referred to above, the Procurement itself conferred on the Claimant the benefit of the DPM in relation to the decompensated cirrhosis segment of the market.

vi) It would be extraordinary if contracting authorities had to guard against even thinking about or testing propositions in the course of designing a tender exercise for fear that any perceived unlawfulness in the propositions were subsequently held against them. In the absence of any allegation of bias, the focus should be on what makes it onto the tender documents; not on isolated emails taken out of context or which are infelicitously worded.

i) The Claimant submits that “ The “accommodation” of MSD which PH [Mr Huskinson] wanted to see was to ensure that it could win the gold lot in the first place. ” Mr Huskinson was certainly asked about this email, but it was not put to him that he wanted to ensure that MSD could win the Gold Lot in the first place.

ii) The word “accommodate” or “accommodating” is used no less than three times in this short email. The other contexts in which the word is used suggest that no more is meant by the use of the word than “to include”. It is certainly not conclusive that by using the word “accommodate”, Mr Huskinson was indicating that there should be some special arrangement for MSD to put it in an unduly favourable position.

iii) The desire to include MSD is entirely consistent with the Defendant’s overall desire to undertake a whole market approach to the Procurement whereby all suppliers are considered across the whole market.

iv) Mr Huskinson’s evidence in relation to this email was, in keeping with much of his evidence, rather rambling and unfocused. However, he did manage to say that there was a concern that the rules should “ accommodate all bidders ”; that there was a “ more broad structural concern about how do we make this work for the 3 suppliers in the market ”; that the context was “ whether in a price per supplier arrangement, how we accommodate a situation where all 3 bidders are bidding on a price per supplier and the question is how do we accommodate the fact that MSD in this case can only supply 45% of patients ”. In my judgment, none of these responses is inconsistent with the general case being put forward by the Defendant as to the purpose of the DPM as part of the whole market approach; they certainly do not indicate any more nefarious thinking such as intentional hostility towards the Claimant.

v) Mr Huskinson accepted that, as a matter of chronology, the DPM first appeared in the documents a week or so after this email but said as follows:

“MR JUSTICE CHOUDHURY: We can read all that, Mr Huskinson. As a matter of chronology, you make a reference to accommodating MSD the top of page 1339, and what [Counsel] is putting to you is that within a week the dummy price mechanism had been developed. Do you accept that as a matter of chronology that is what happened?

A. My Lord, I think it would be a question for Mr Perkins and Mr Moritz as to the development time of the dummy price. I would be staggered if, off the back of an email on the afternoon of the Friday, that by the Tuesday we had gone from no idea of having a dummy price to full – to developing and talking through the way that a dummy price would work, with slides being made available in advance of the Tuesday session, my Lord. I think it would be for the other witnesses to confirm, but my sense of the likely situation is that actually the dummy price was much, much longer in gestation that in relation to this particular email.”

vi) In my judgment it is not plausible that the DPM was invented at the 11 th hour in response to Mr Huskinson’s email. The tenor of the Claimant’s questions in relation to this correspondence appeared to imply that TWS had colluded with the Defendant to come up with a means of specifically favouring MSD unduly to the detriment of the Claimant and/or Gilead. The Defendant and its witnesses certainly appeared to understand that some sort of collusion was being alleged. However, no allegation of collusion or bias is actually made in the pleadings and therefore, as with Mr Perkins’ email, the relevance of this material to the Claimant’s case is somewhat limited, although I accept it is not irrelevant. Furthermore, Dr Moritz’s evidence was clear that DPM was not invented at the 11 th hour and that it is a mechanism that is a well-established means of assessing bids in order to determine the appropriate market share where one or more bidders are unable to supply a segment of the market. The Claimant criticised the Defendant’s failure to adduce evidence of past uses of the DPM in other procurements. However, the Court is faced with a situation where a witness of fact involved in the design of the Procurement gave clear evidence as to the well-established nature of the DPM. This is not an assertion that has only been made in Court. Both Mr Perkins and Mr Huskinson gave unchallenged evidence that TWS had informed them in the course of designing the Procurement that the DPM was well-established and had been used in many procurements before. It is implausible in the extreme that Dr Moritz would lie about the provenance of the DPM to his clients at a stage when there was no litigation in prospect and where TWS would gain no advantage from lying, and for him to then come to Court and repeat the same lie. Far more plausible, in my judgment, is the contention that the DPM is indeed a well-established mechanism; it is, as Dr Moritz described it, “ a conceptual answer to a conceptual question ”, which is how to evaluate bids across the whole market when one or more suppliers is unable to supply a particular segment of that market. I accept that evidence as to the DPM being ‘well-established’ in the sense that it has been used to address similar situations in other procurements.

vii) Mr Perkins was also asked about Mr Huskinson’s email and it was put to him that the DPM was the means by which the Defendant would ensure that it gave MSD the chance of winning the Gold Lot. Mr Perkins answered as follows:

“A. My Lord, I think we have an obligation to ensure that any of the suppliers could win gold, and that was what we have done in terms of the dummy price mechanism. I don't think it's fair to say that this is - should be interpreted that we are trying to favour MSD; purely that we are trying to make sure that each of the bidders can participate on an equitable basis. The dummy price mechanism, as I have tried to explain previously, does allow us to compare the whole market with different combinations of solutions to determine which of those solutions delivers the overall best value and from that to determine who should be awarded the Gold Lot, who should be awarded the Silver Lot, who should be awarded the Bronze Lot, and then go on to say what the market share should be. And in the event that somebody gets awarded a market share that they cannot deliver, then obviously - to the best of my recollection because I haven't read all the three or four pages that this relates to - we have this rule that scales back their market share.

Q. Mr Perkins, I put it to you that's not what is going on here at all, and you well know it, don't you?

A. I am being truthful, my Lord, in terms of the purpose of what I described to you, in terms of in the event that somebody who cannot deliver part of the market, their market share gets scaled back. And I can tell you hand on heart that we have not tried in any way in this procurement to favour one bidder or another.”

viii) The Claimant submits that Mr Perkins was wrong to suggest that there was an obligation to ensure that any of the suppliers could win the Gold Lot. That is undoubtedly correct; a contracting authority is not obliged to design a procurement so as to ensure that any bidder, irrespective of capacity, can win the biggest market share. However, the thrust of Mr Perkins’ position was that the DPM allows a fair comparison to be made in circumstances where one of the suppliers cannot supply the whole market, and that by implementing it the Defendant was not seeking to favour one bidder unduly over another. I accept that evidence as to the Defendant’s intention in implementing the DPM.

Does the DPM confer an unfair advantage on MSD?

i) The effect of the DPM is that MSD is always credited for the purposes of the evaluation with the lowest price bid in respect of MS2, which represents 50% of the market, and so 50% of MSD’s Final Comparison Price .

The DPM imputes a price to MSD, which is the lowest of the bids for MS2. If MSD had been capable of supplying MS2 then the imputed price would unarguably have put MSD in a very favourable position. However, the reality is that MSD cannot supply MS2. The purpose of imputing a price to MSD is simply so that a comparison can be made between the bids on a like-for-like basis. In this context, the term “dummy” price is particularly apt; as there is no prospect of the price translating to a real transaction price for MS2 treatments from MSD. In the event of MSD winning a market share greater than that which it can deliver, the tender rules require that the excess shall be redistributed amongst the other bidders who can. Thus, whilst the Claimant’s assertion is a factually correct description of what the DPM does, the end result is not unfair as MSD does not win market share that it is unable to service.

ii) It is therefore impossible for AbbVie or Gilead to better MSD’s Comparison Price for the purposes of 50% of the assessment that determines the allocation of gold, silver and bronze lots. They are deprived of the advantage that a bidder would ordinarily obtain, and can legitimately expect to obtain, from lowering its prices. No matter how low they go, and no matter what the cost to them of reducing their prices, MSD will get the benefit of that price. To put the point another way, in respect of 50% of the assessment (i.e. the part that relates to the MS2 pricing) AbbVie and Gilead each have the opportunity to submit, and be credited with, the lowest priced bid. However, the dummy price mechanism means that MSD always has a 100% guarantee of being credited with the lowest priced bid in respect of that 50% of the assessment.

Insofar as this implies that the Claimant could never win the Gold Lot then it is clearly incorrect. As the analysis in the section dealing with Dr Moritz’s calculations shows (see below), there are many permutations that would result in either the Claimant or Gilead earning a greater market share than MSD. Whether or not they do so will depend on the level of their bids. Whilst the DPM means that they cannot beat the price imputed to MSD in respect of MS2, their bids in respect of MS1 and relative to each other could well result in beating MSD overall and winning the Gold Lot. Indeed, one of the aims of the whole market approach incorporating the DPM, as will be seen below, was to encourage bidders to compete and lower their prices in this way. Dr Moritz explained how, notwithstanding the fact that MSD would be allocated the lowest Comparison Price for MS2, the two suppliers with pan-genotypic drugs would still be incentivised to compete and obtain greater market share overall:

“Q. I put it to you earlier on that if the dummy price is the lowest price, then AbbVie and Gilead can never beat MSD for market segment two because MSD will always get the lowest prices on offer.

A. Correct, we established that before, yeah.

Q. So if you use the average price as the dummy price, then AbbVie is in a position to reduce its price in the market segment to below that of MSD?

A. But still that is not the incentive that we wanted to create. We wanted to create an incentive where you have a plain competition across all of the three bidders, and in the example that you described with the minimum dummy, AbbVie and Gilead have at any point in time an incentive to compete. Let us walk through the three examples because it's so trivial. If I am the second best, yeah, talking AbbVie or Gilead, on the market segment two, that means if I improve my pricing on market segment two it helps me against the one who is leading on market segment two, and it helps me because it is a pan-genotypic drug against the supplier who is currently leading on market segment one. So, in that case lowering my pan-genotypic drug gets me necessarily into a better position, meaning more market share. Now, let's say I am leading on market segment number two. Now, what's the question, and we need to make a distinction how I am positioned with my non pan-genotypic drug in market section one. If I am leading there, no difference. What I'm doing probably with my market segment two price but I am willing, against my competitor in market segment two, the distance to the others in market segment one remains the same. So I'm not worse, but also not better off. If I am not - if my market segment price, market segment one price is higher than my market segment two price, it means again that if I move my pan-genotypic drug I gain market share by being in a better position in market segment one and in market segment two. That means in whatever situation you are, you have an incentive to move on your market price segment - in market segment two with your pan-genotypic drug - sorry. So, it's very clear that at any point in that procurement you have an incentive to move. And therefore, I don't see any disincentive, and let's say lack of incentive to compete just because MSD gets a lower dummy price. I can't share that.

Q. Would it not obviously provide an additional incentive to lower prices in market segment two for AbbVie and Gilead if they knew that they could get an advantage over MSD by doing that?

A. They are getting it, as I just explained, by lowering your price in market segment two, you necessarily gain an advantage, and as soon as you overtake MSD in market segment number one, you have every opportunity to win the Gold Lot. There is no question about that.”

The evidence that there is every opportunity to win the Gold Lot is not a bare assertion as the calculations below will show and as Mr Pumford, in his evidence, appeared to accept (whilst maintaining that the outcome was still unfair for the Claimant):

Q. What he says there is right, isn't it, as a matter of strategy. That is how that would be won?

A. My Lord, it's correct that if we bid lower for both [V&E] and for Maviret, then that would give us the best opportunity obviously to win gold.

Q. But again, don't you agree it is entirely within the power of any of the three bidders to offer a lower price, isn't it?

A. My lord, it's correct that bidders can obviously bid any price that they would like into either model of price per supplier or price per drug. The table there is to try and illustrate that it was helping MSD versus Gilead in that example. [6]

iii) This is on any view a significant competitive advantage for MSD. To use a simpler analogy, it is as if an authority prescribed a 50/50 quality/price evaluation methodology, but stipulated that one out of three bidders is not required to present a quality submission and will always be attributed the best quality score achieved by either of the other two bidders.

In my judgment, this analogy is not apt. That is because in the analogy the bidder could provide a quality submission but is being excused from doing so. That is to be contrasted with the situation here where MSD cannot bid any price at all for MS2, and is not therefore being excused from providing a submission that it could otherwise provide.

This appears to be simply another way of putting the points made in (i) and (ii) above.

v) MSD is advantaged in this manner despite the fact that it is unable to provide any treatment that treats MS2, still less to do so at the lowest price tendered by any other bidder. MSD tried but failed to develop a treatment capable of treating MS2. Accordingly, 50% of MSD’s Final Comparison Price is determined not by its own efforts or investments in developing a pan-genotypic treatment, but by those of AbbVie or Gilead. Put another way, MSD would be in a worse position in the evaluation if it had succeeded in developing its own pan-genotypic treatment, in which case it might or might not be assessed as offering the lowest price in MS2, rather than automatically being credited with the lowest price .

It is not correct, in my judgment, to say that MSD would be in a worse position if it had its own pan-genotypic treatment to offer. The application of the DPM in that situation would directly translate to an increased and actual share of MS2, whereas the reality is that MSD gets no part of MS2 at all. Many of the Claimant’s assertions as to unfairness appear to ignore or sidestep this important characteristic of the DPM.

vi) Conversely, the effect of the dummy price mechanism is to deprive AbbVie and Gilead of the legitimate commercial advantage they would otherwise possess over MSD in the Procurement, which they have developed as a result of their considerable investment, ingenuity and effort in developing innovative treatments capable of treating MS2. They are artificially deprived of the competitive advantage they have invested heavily to acquire.

This makes the same point as in (v) above.

vii) Perversely, therefore, the DPM inherently rewards, and treats more advantageously, the bidder that has tried but failed to develop an MS2 treatment, and has chosen not to invest the necessary resources in continuing to develop such a treatment, over the two bidders who have succeeded in bringing MS2 treatments to fruition.

This makes the same point as in (v) above.

viii) Whereas AbbVie and Gilead are evaluated and ranked based on what they are offering to provide, MSD is evaluated and ranked (to the extent of 50%) on the basis of treatments which it cannot provide.

This makes the same point as in (i) and (ii) above.

ix) Because MSD can only serve MS1, the effect of the DPM in respect of MSD is to determine how much of the MS1 market share it should be awarded. Yet 50% of that assessment is determined not by what MSD or the other bidders offer to provide in respect of MS1, but rather what AbbVie and Gilead offer in respect of MS2.

This is correct, but is a function of the whole market approach which the Defendant wished to adopt. The Claimant does not challenge the whole market approach as being unlawful.

The TWS Calculations

Table A

Whole market, min dummy

Separated Markets

Effect of dummy price on market shares

Example

MS

AbbVie

Gilead

A+G

MS

AbbVie

Gilead

A+G

MS

AbbVie

Gilead

A+G

1a (PPD)

44.5%

22.5%

33.0%

55.5%

24.5%

14.6%

60.9%

75.5%

Increases

Increases

Decreases

Decreases

1b (PPD)

17.0%

58.0%

25.0%

83.0%

6.7%

32.4%

60.9%

93.3%

Increases

Increases

Decreases

Decreases

1c (PPD)

17.0%

25.0%

58.0%

83.0%

6.7%

21.3%

72.0%

93.3%

Increases

Increases

Decreases

Decreases

1d (PPD)

25.0%

17.0%

58.0%

75.0%

13.4%

14.6%

72.0%

86.6%

Increases

Increases

Decreases

Decreases

2a (PPS)

44.5%

22.5%

33.0%

55.5%

24.5%

14.6%

60.9%

75.5%

Increases

Increases

Decreases

Decreases

2b (PPS)

10.0%

70.0%

20.0%

90.0%

6.7%

69.6%

23.7%

93.3%

Increases

Increases

Decreases

Decreases

2c (PPS)

17.0%

25.0%

58.0%

83.0%

6.7%

21.3%

72.0%

93.3%

Increases

Increases

Decreases

Decreases

2d (PPS)

25.0%

17.0%

58.0%

75.0%

13.4%

14.6%

72.0%

86.6%

Increases

Increases

Decreases

Decreases

3a (PPD)

38.0%

29.0%

33.0%

62.0%

40.1%

5.3%

54.6%

59.9%

Decreases

Increases

Decreases

Increases

4a(PPS)

38.0%

29.0%

33.0%

62.0%

40.1%

5.3%

54.6%

59.9%

Decreases

Increases

Decreases

Increases

87. Dr Moritz accepted that the table was an accurate summary of his calculations. The table shows that in 8 out of 10 of Dr Moritz’s worked examples the effect of the dummy price was to increase MSD’s market share when compared to the separated market approach. However, the table also shows that the Claimant’s share is greater as a result of the DPM in every case as compared to the separated market approach. Gilead’s share of the market decreases as a result of the DPM in all of the examples. [7] Notwithstanding that, Gilead wins gold on 4 out of 10 occasions when applying the DPM as does MSD, with the Claimant winning gold on two occasions.

i) Dr Moritz explained that the market share splits used in his calculations were a sample of the possible market share splits used in the table at figure 3 in appendix 5A of the ITPD. That table shows that the market share that would be awarded for each of the Gold, Silver and Bronze Lots would range from a 35%/33%/32% split up to a 100%/0%/0% split depending on the average Comparison Price of the bids. It is clear that the market share splits fixed upon by Dr Moritz had a rational basis. [8]

ii) As for the market share splits for the separated market analysis, as Dr Moritz explained, he had to make certain assumptions about what that approach would have looked like because it was not an option developed as part of the Procurement and the Claimant did not specify what those shares should be in its claim. Dr Moritz opted to use two different fixed market share splits: one involving 55%/30%/15% split in respect of MS1 (where there are 3 suppliers) and an 85%/15% split in respect of MS2 (where there are just 2 suppliers); and another involving a 90%/10%/0% split for MS1; and a 90%/10% split for MS2. Dr Moritz explained that the reason for adopting a more asymmetric split (where one bidder wins a very large share of 90%) was that it was “ a highly plausible option ” under the separated market approach and reflects the lower competitiveness under that approach as compared to the whole market approach involving three suppliers.

iii) In my judgment, Dr Moritz was doing no more than using a range of examples of market share split in order to analyse whether or not there was a ‘systematic disadvantage’ to the Claimant as a result of using the DPM. There is nothing to suggest that in doing so he was trying to mislead the Court or, as the Claimant put it, ‘fiddle’ the results. As Dr Moritz stated, there is an infinite number of permutations for market share split that could be used for the purposes of comparison, with the result that it is very difficult to say that one separated market comparator is better or worse than any other. What can be said, in my judgment, is that the Claimant’s reworked examples, which use a consistent set of market share assumptions across all examples, do not necessarily provide a more reliable guide as to the effect of the DPM. That is because the Claimant sought to use the actual prices bid under the RCM in determining what the outcome would be under the separated market approach. However, it seems to me that Dr Moritz is correct to say that one cannot assume that under the separated market approach the prices bid would be the same as under the RCM. That is because the situation where three suppliers are seeking a share of the whole market would be likely to engender different bidding strategies from one where two or three suppliers are seeking a share of only part of that market.

90. In any event, whatever the outcome of the various calculations, it seems to me that the exercise of comparing the level of market share achieved under the RCM (using the DPM) with what might be achieved under the separated market approach, does not greatly assist in determining whether there has been a breach of the equal treatment principle. The RCM is an example of a whole market approach. That is, by definition, different from the separated market approach. The fact that a bidder might fare better than a rival under a particular model does not necessarily mean that that model entails a breach of the equal treatment principle: see Lion Apparel Systems Ltd v Firebuy [2007] EWHC 2179 (Ch) at paragraph 93. The choice of model falls within the wide discretion available to contracting authorities to choose award criteria which suit their purposes. An alternative comparator model, which is closer to the RCM but without the DPM, would be the Bridging Tender. The parties agree that the Bridging Tender was another instance of a whole market approach. It is instructive that the Claimant fares better in terms of market share under each of Dr Moritz’s worked examples than it did under the Bridging Tender.

“Q. If we think about the prices in this hypothetical situation, if we look at your GT3 price, which if you go down the left-hand column, GT2, 3, 5, 6 and go across to AbbVie is £100 in this example, if instead of £100 you had bid, say, £91, that would bring your total down to 64, from 73, and you would already be in silver as opposed to bronze position. So, it just shows, doesn't it, that AbbVie was the master of its own fate. It could win, or win better, by simply lowering its prices as against its competitors?

A. My Lord, what I would say is that the arithmetical model that Mr Moser states is almost certainly correct. However, we would say that - I agree that the difference in price between Epclusa and Maviret and the difference in price between Viekirax and Exviera and Zepatier will overall dictate who gets the silver or bronze in this example. But I would say that because of the way the lowest price is working, it distorts and creates unfairness to AbbVie in terms of it gives greater chance for MSD to win than it does to AbbVie. We have to guess where those two prices are, and of course it is a sealed envelope but it is a bid.

Q. But that is in the nature of competition, isn't it, Mr Pumford? You have to guess and you have to try and put in the most competitive price. That is the idea, isn't it?

A. My Lord, certainly it is the nature of competition that we have been bidding and trying to come up with reasonable prices over the last three years. It's an ongoing function of the market.

…

MR MOSER: 96. Yes. Thank you. (To the witness) It would be better actually if we start at page 514. It is an email, so it goes backwards. I am not going to read it out now, although if it is felt more helpful, my Lord, then obviously people will have to pop out for a moment. There is an email here from Jerome Bouyer, on 514. For the avoidance of doubt, he is the general manager, UK - yes?

A. That is correct, my Lord.

Q. And he says what he says there. You are copied in on this email. You see what he says in the last paragraph on page 514?

A. Yes.

Q. What he says there is right, isn't it, as a matter of strategy. That is how that would be won?

A. My Lord, it's correct that if we bid lower for both Viekirax and Exviera and for Maviret, then that would give us the best opportunity obviously to win gold.

Q. But again, don't you agree it is entirely within the power of any of the three bidders to offer a lower price, isn't it?

A. My lord, it's correct that bidders can obviously bid any price that they would like into either model of price per supplier or price per drug. The table there is to try and illustrate that it was helping MSD versus Gilead in that example.

Q. As a matter of general observation (it is not really a question) I think we agree that these tables, like most of the tables that have been produced for the price comparison, they don't take into account the effect of the elimination solution - the other aspect of the comparison prices. That is right, isn't it?

A. My Lord, that is correct. These are based on drug prices.”

RCM - Objective justification

Does the use of the DPM pursue a legitimate aim?

96. The Defendant submits that its aims were as follows:

i) Firstly, it was to increase competition. This was achieved by adopting a whole market approach facilitated by the DPM. More specifically, the aim was to achieve three-way competition with respect to the decompensated cirrhosis market segment (which would otherwise be served only by Gilead) and within MS2 (which would otherwise be served only by Gilead and the Claimant).

ii) Secondly, by virtue of the increased competition, the Defendant aimed to achieve greater value from bids, value being measured by the Comparison Price, which includes prices and also Elimination Investments.

iii) Thirdly, by reducing cost and maximising elimination initiatives, the Defendant aims to maximise health benefits from the Procurement;

iv) Fourthly, the Defendant’s use of the DPM in its whole market approach aims to enable like-for-like comparison of different bidders’ bids in circumstances where two out of three bidders are unable to supply bids which are capable of serving the entirety of the market.

99. Para 52 of the Defence states as follows:

“Secondly, insofar as the RCM methodology does entail any prima facie discrimination, such discrimination is objectively justified and therefore unlawful.

i) On the basis of the Defendant’s chosen “whole market” approach, it follows that some mechanism must be found for coping with bidders who supply a substantial part, but not the whole, of the market. An imputed price is an obvious way to solve this problem.

ii) There is no presumption in favour of an approach restricted to individual Patient Groups or genotypes.

iii) Alternatively , if there were such presumption, the Defendant is in any event entitled to take a “whole market” approach to the procurement in order to ensure that excessive prices are avoided by facilitating tripartite competition for all Patient Groups, and/or to reflect the fact that elimination initiatives are inherently Patient Group-neutral and that pan-genotypic drugs can treat different Patient Groups: see paragraph 19 above.

iv) The imputation of the “best available Comparison Price” to a bidder which is unable to supply drugs for all Patient Groups is an appropriate proxy for the consequences of that bidder’s tender for the Defendant’s purchase of drugs for Patient Groups which such a bidder cannot treat. It is rational to assume that, if the Defendant purchases such a bidder’s drugs in order to treat the Patient Group which it is capable of treating, then it will purchase the best value drugs available from other suppliers in order to treat the remaining Patient Groups.

v) The use of the “best available Comparison Price” in this way is part of the overall mechanism for encouraging lower prices.”

“With the financial commitment on offer from NHS England, the right response to this procurement from industry, and the collective efforts of all stakeholders, England can be the first country in the world to seize this once in a generation opportunity to eliminate a major disease –while improving the lives of hundreds of thousands and saving money for its health system.”

106. For these reasons, I conclude that the Defendant is entitled to rely upon its four aims as set out. This is not a case where the Defendant is relying solely upon financial reasons to justify its actions. It is, therefore, unnecessary to consider whether the Claimant is right to say that unequal treatment in a procurement exercise cannot be justified on “ purely economic grounds ”. The Claimant did not seek to suggest that the Defendant could not include cost savings as one of several aims. Indeed, such a suggestion, if it had been made, would be difficult to sustain, since an authority that had several aims, of which cost reduction was only one, could not be said to be relying on aims of a “ purely economic nature” [9] .

107. The Claimant does, however, contend that whatever might be said or not said in the pleadings, the “ real justification ” [10] for the Defendant’s actions was the desire to avoid being charged excessive prices. I do not accept that that is the Defendant’s real justification. Mr Perkins and Mr Huskinson both gave extensive evidence supporting the aims articulated above. Much of that evidence went unchallenged, particularly in Mr Perkins’ case.

Was the DPM a proportionate means of achieving a legitimate aim?

i) Was the DPM suitable for securing the stated aims?

ii) Does the DPM go beyond what is necessary to achieve those aims?

iii) Were other means available to achieve those aims?

Was the DPM suitable for achieving the stated aims?

111. The Defendant’s case is that the DPM is suited to the stated aims for the following reasons.

i) The DPM is designed to enable the comparison of bids on a whole market basis.

ii) The whole market approach is, in turn, an effective way to enhance competition.

iii) As a matter of basic economic theory, greater competition should yield superior bids (in the form of lower prices and/or superior elimination solutions).