Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Patents Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Patents Court) Decisions >> Interdigital Technology Corporation & Ors v Lenovo Group Ltd (FRAND Judgment - Public Version) [2023] EWHC 539 (Pat) (16 March 2023)

URL: http://www.bailii.org/ew/cases/EWHC/Patents/2023/539.html

Cite as: [2023] EWHC 539 (Pat)

[New search] [Contents list] [Printable PDF version] [Help]

Neutral Citation Number: [2023] EWHC 539 (Pat)

Case No: HP-2019-000032

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INTELLECTUAL PROPERTY LIST (ChD)

PATENTS COURT

Rolls Building Fetter Lane,

London, EC4A 1NL

Date: 16th March 2023

Before :

THE HON MR JUSTICE MELLOR

- - - - - - - - - - - - - - - - - - - - -

Between :

|

|

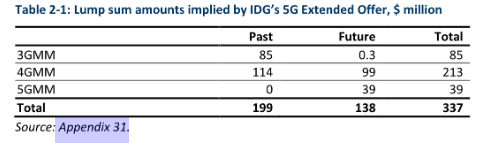

(1) INTERDIGITAL TECHNOLOGY CORPORATION (2) INTERDIGITAL PATENT HOLDINGS, INC. (3) INTERDIGITAL, INC. (4) INTERDIGITAL HOLDINGS, INC. |

Claimants | |||

|

|

- and - |

|

| ||

|

|

(1) LENOVO GROUP LIMITED (2) LENOVO (UNITED STATES) INC. (3) LENOVO TECHNOLOGY (UNITED KINGDOM) LIMITED (4) MOTOROLA MOBILITY LLC (5) MOTOROLA MOBILITY UK LIMITED |

Defendants |

| ||

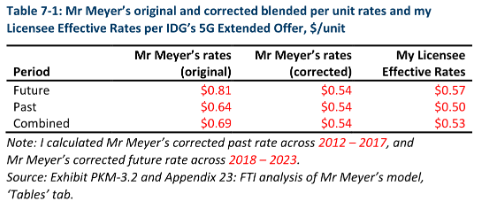

- - - - - - - - - - - - - - - - - - - - -

Adrian Speck KC, Mark Chacksfield KC, Isabel Jamal, Thomas Jones and Edmund Eustace (instructed by Gowling WLG) for the Claimants

Daniel Alexander KC, James Segan KC, Ravi Mehta and William Duncan (instructed by Kirkland & Ellis International LLP) for the Defendants

Hearing dates: 13th-14th, 17th-21st, 24th-28th & 31st January, 2nd-3rd, 8th-11th February 2022

Further evidence 7th & 13th December 2022. Further submissions 13th January 2023.

Draft Judgment sent to the parties 1st March 2023

- - - - - - - - - - - - - - - - - - - - -

APPROVED JUDGMENT - PUBLIC VERSION

Remote hand-down: This judgment will be handed down remotely by circulation to the parties or their representatives by email and release to The National Archives. A copy of the judgment in final form as handed down should be available on The National Archives website shortly thereafter but can otherwise be obtained on request by email to the Judicial Office (press.enquiries@judiciary.uk).. The deemed date of hand down is 10.30 am on Thursday 16th March 2023.

Mr Justice Mellor:

1. This is my judgment from the FRAND trial in this action. It is organised as follows:

Topic/Heading Page

Notes concerning this Judgment 4

Observations on the witnesses of fact 19

Patent Counting and Patent Counting Studies. 21

The development of InterDigital’s licensing ‘program’ 26

Overview of licensing discussions. 34

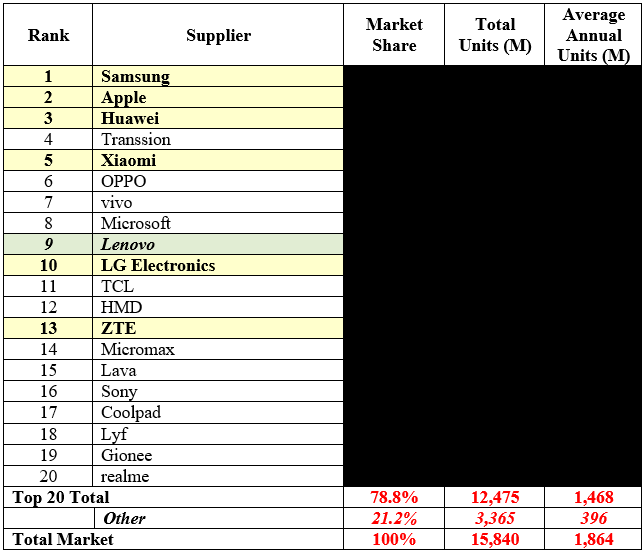

Lenovo’s position in the Global Market for mobile handsets. 36

PRINCIPLES APPLICABLE TO CONDUCT. 39

The Unwired Planet Judgments. 40

Other ETSI materials: The ETSI Guide. 51

Other ETSI Materials: the FAQs page. 53

How The Issues on Clause 6.1 and French Law Evaporated. 53

Other proceedings between these parties. 54

PRINCIPLES APPLICABLE TO THE COMPARABLES & TOP-DOWN CASES. 60

The SEP Licensing Landscape. 69

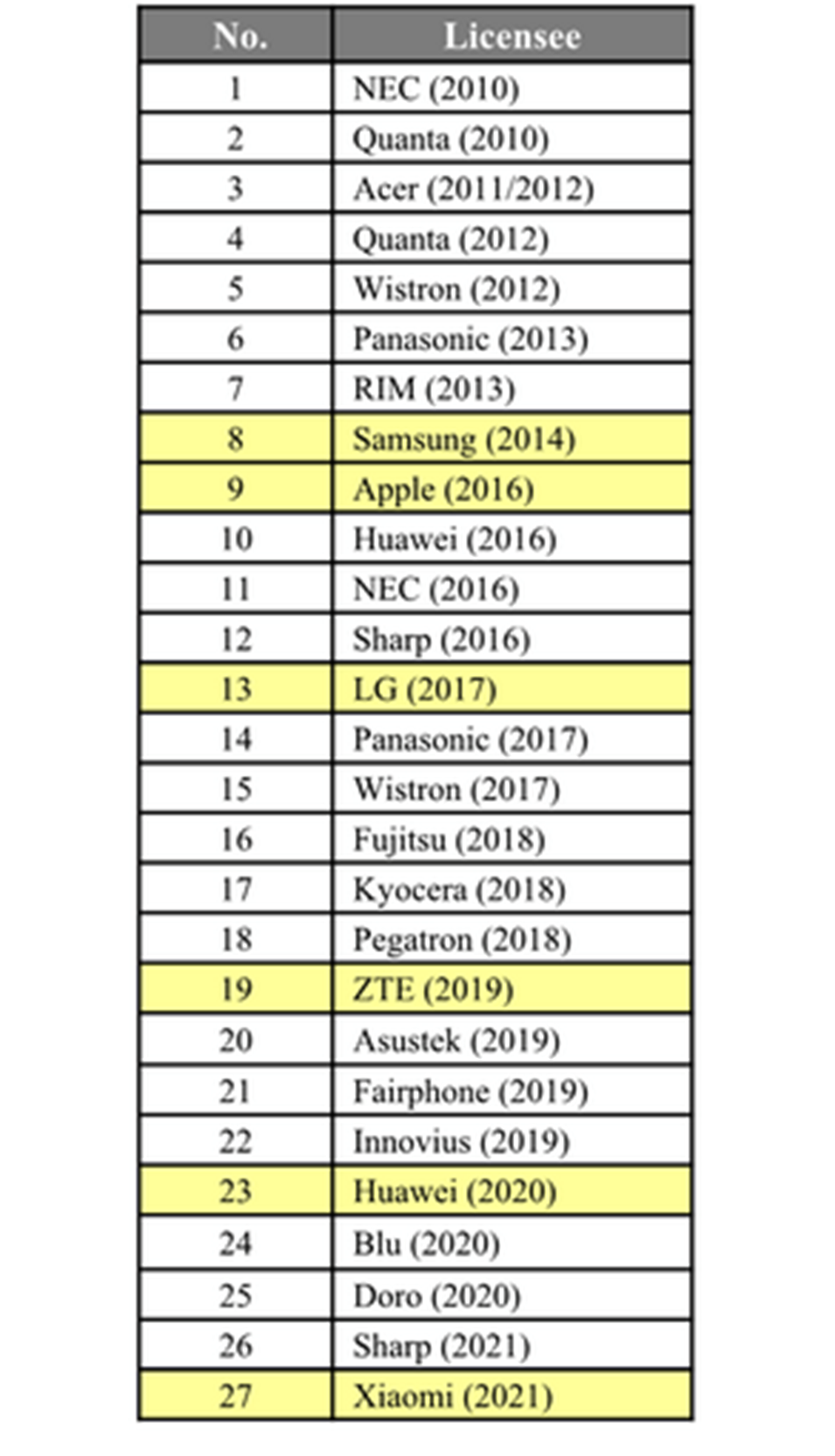

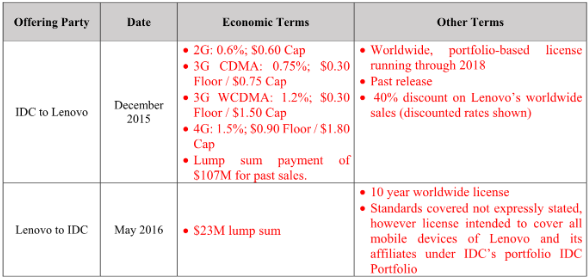

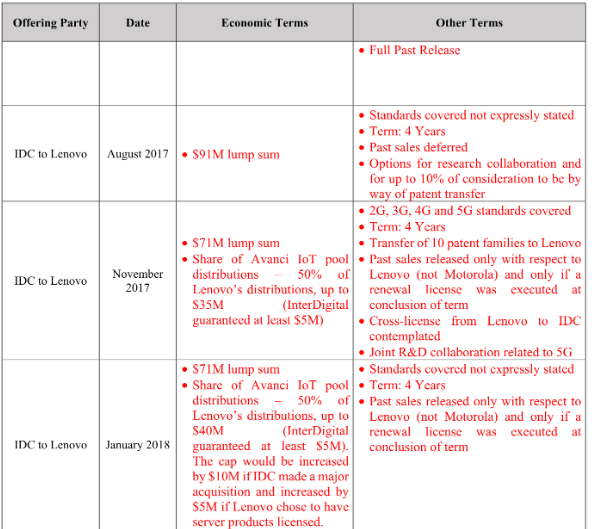

Unpacking of the allegedly comparable licences. 76

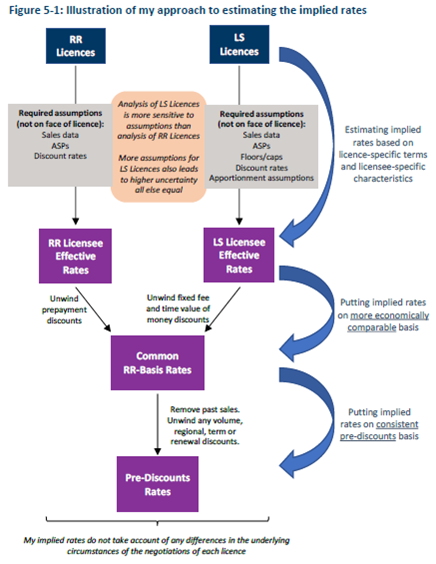

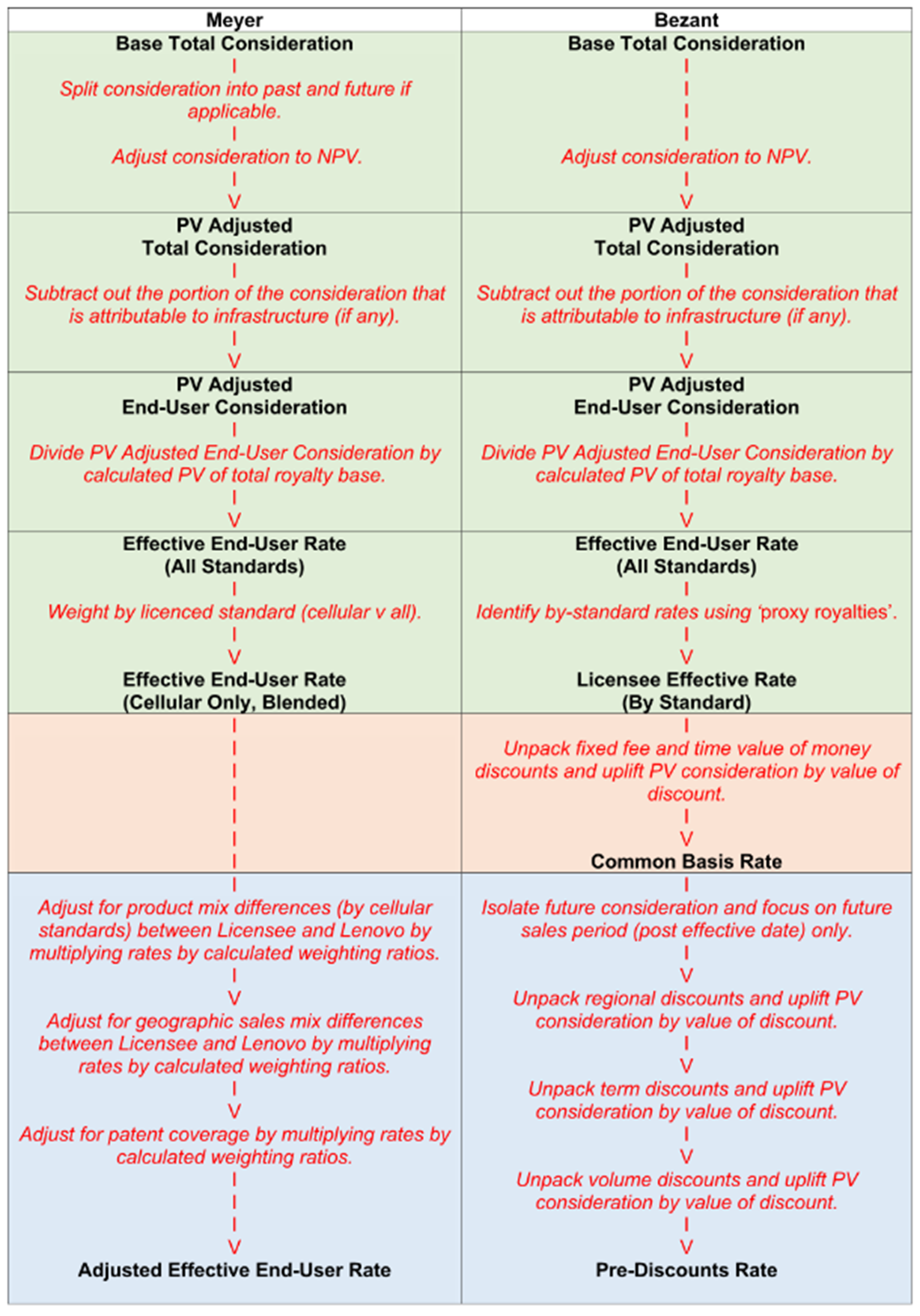

THE INTERDIGITAL/BEZANT APPROACH TO UNPACKING AND COMPARISON.. 76

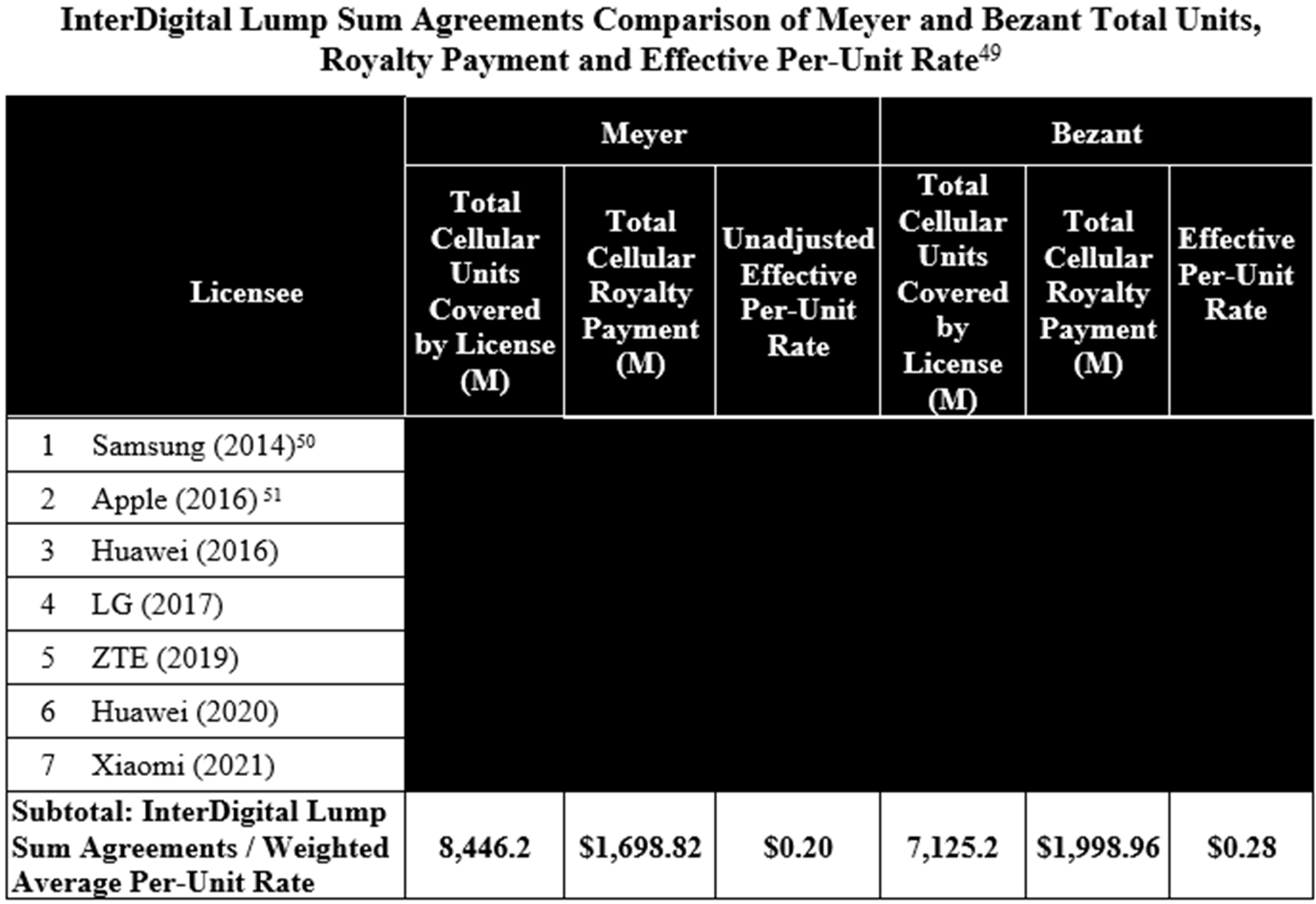

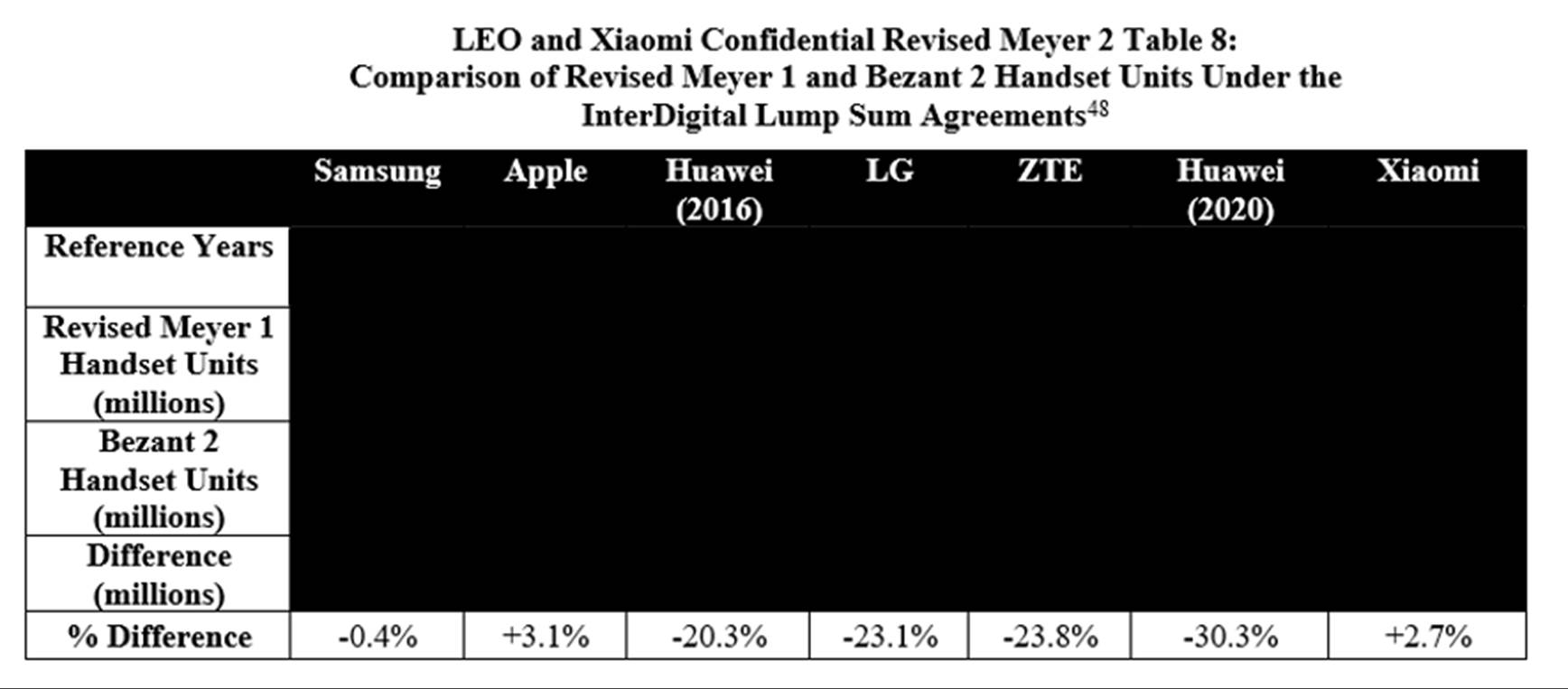

Mr Meyer’s criticisms of Mr Bezant’s approach. 86

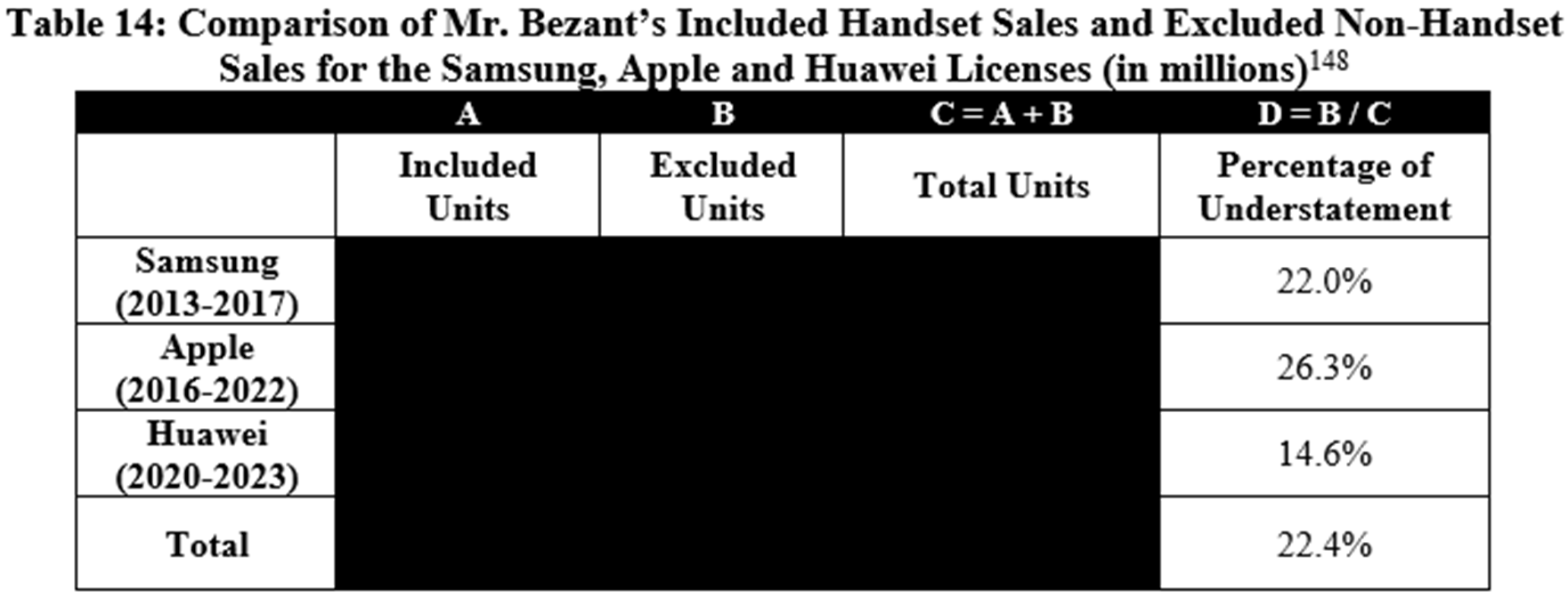

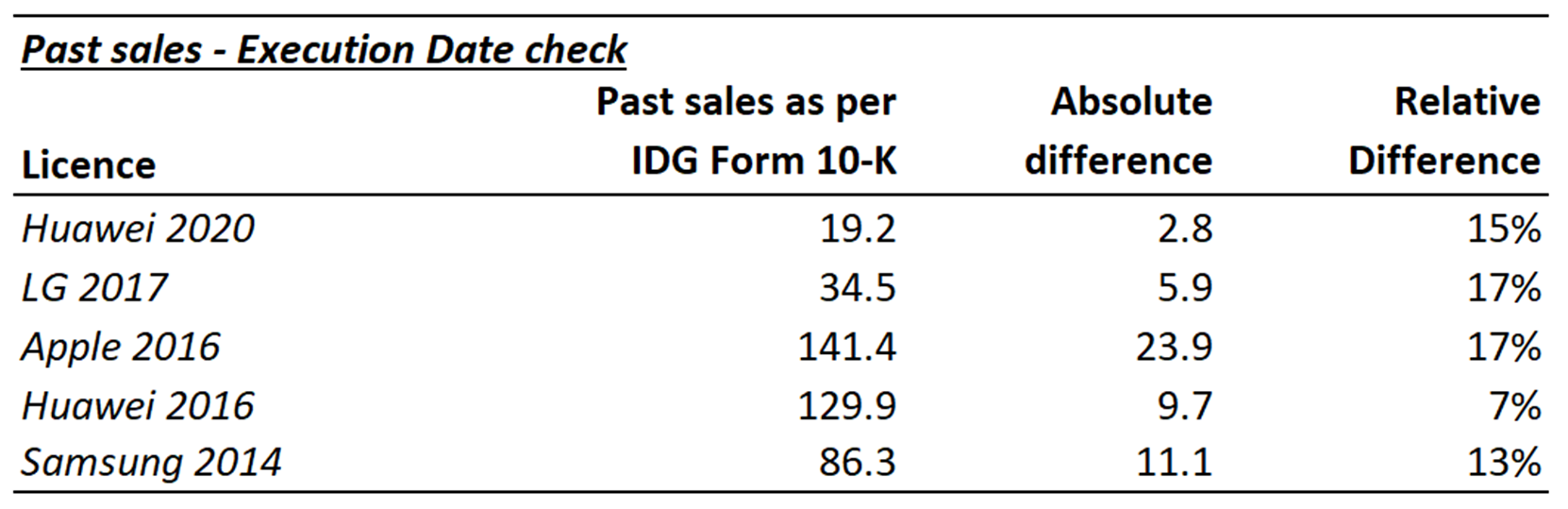

The effects of Mr Bezant’s treatment of past sales. 87

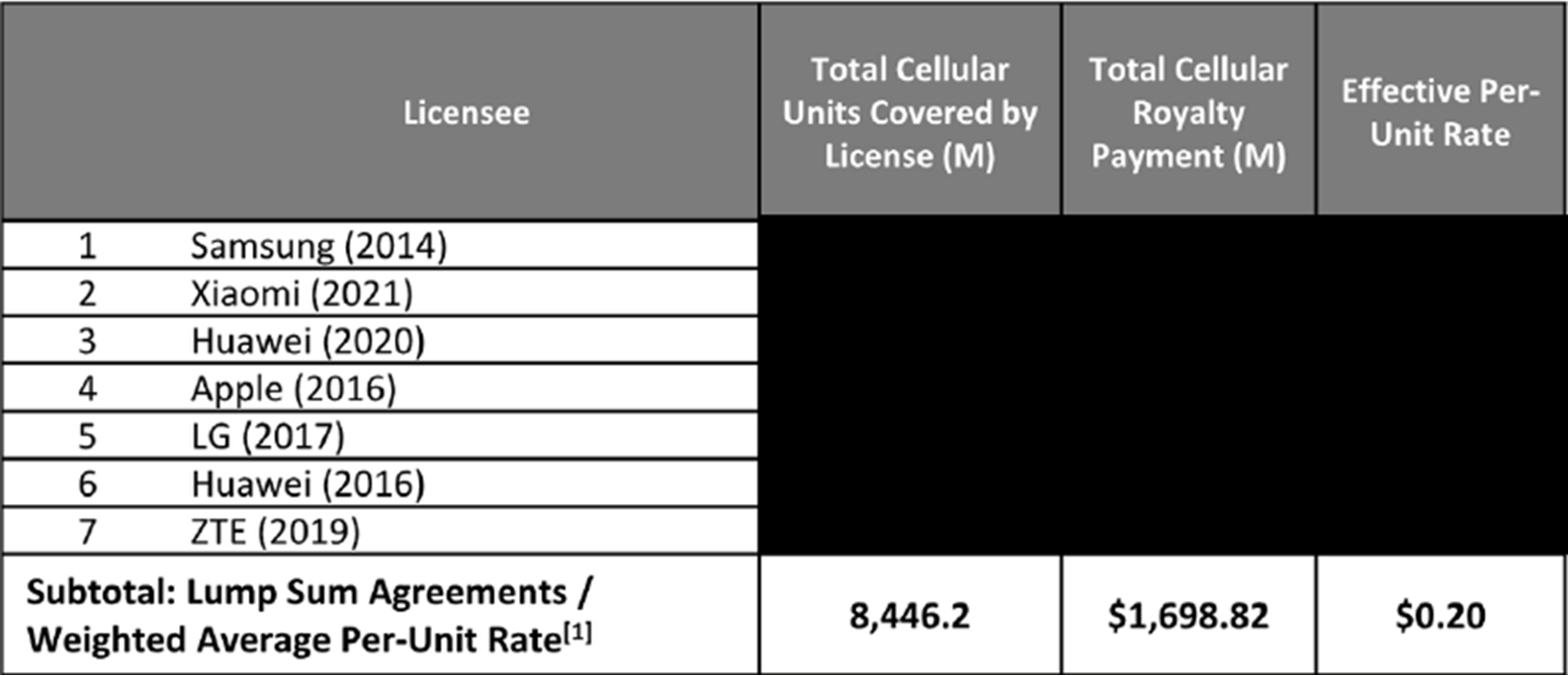

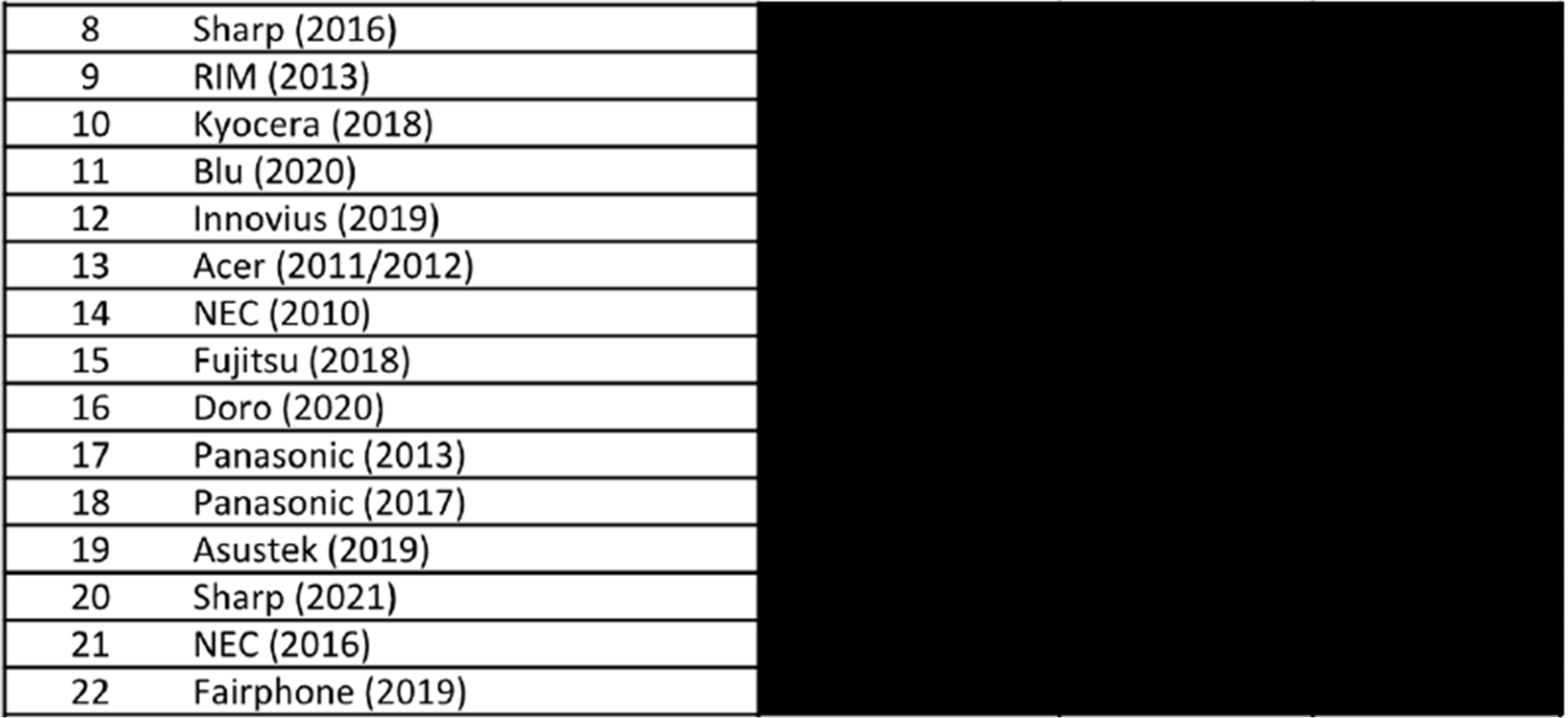

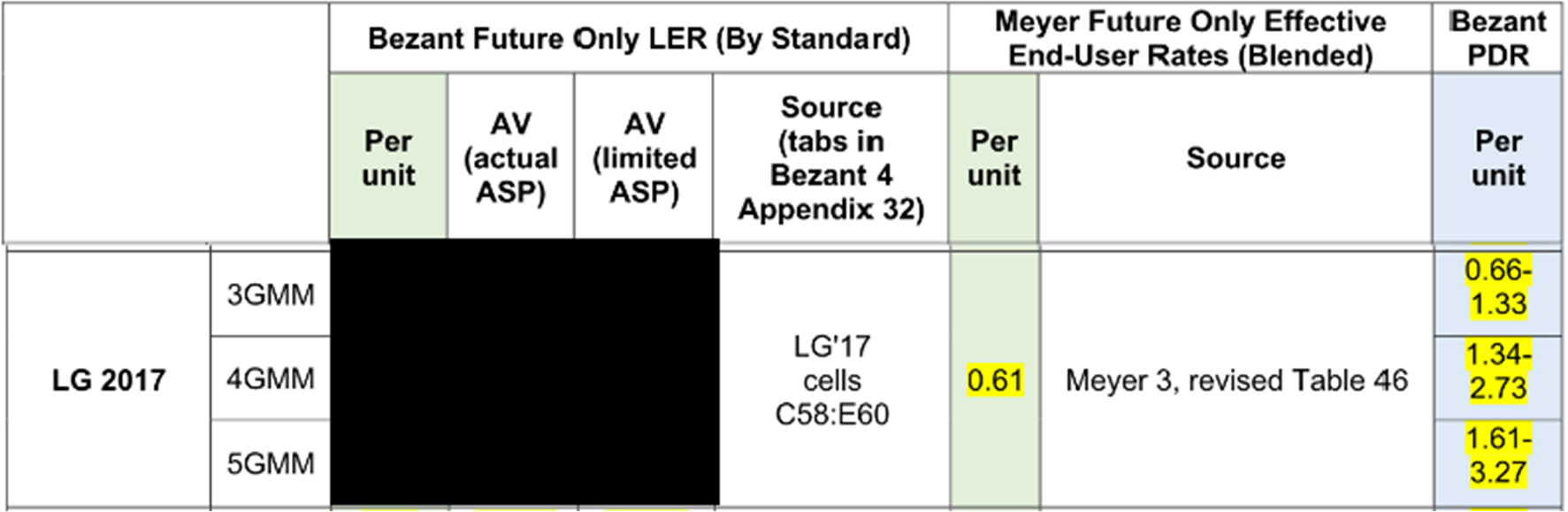

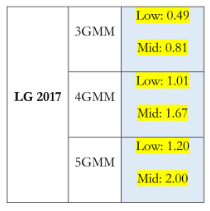

Mr Bezant’s unpacking of the Lenovo 7. 94

Mr Bezant’s derivation of separate rates per standard. 94

Early termination of Samsung 2014. 96

THE LENOVO/MEYER APPROACH TO UNPACKING AND COMPARISON.. 97

The emergence of LG 2017 as an ‘awesome’ comparable. 105

THE APPROACH TO PAST SALES. 106

FRAND - GENERAL PRINCIPLES. 115

Points of Principle which arise in this case. 118

1) Value to the SEP licensor vs royalty payments. 118

InterDigital’s Other Discounts. 128

3) Do Limitation Periods have a role to play? 133

4) How to eliminate or discourage hold-out 136

5) The treatment of and InterDigital’s discounting in relation to past sales. 138

Should interest be awarded on past royalties?. 138

6) The role of subjective and/or ex post facto views, more generally. 139

The Effects of my findings on the points of principle. 140

7) Is the effect discriminatory against Lenovo?. 141

The general features of the licence required by Lenovo. 143

The cases on comparable licences. 143

The InterDigital comparables. 150

InterDigital’s alternative case based on LG 2017. 151

MY ANALYSIS OF THE LENOVO 7. 153

Two other PLAs relied upon. 171

Were the Lenovo 7 all the result of hold-out?. 172

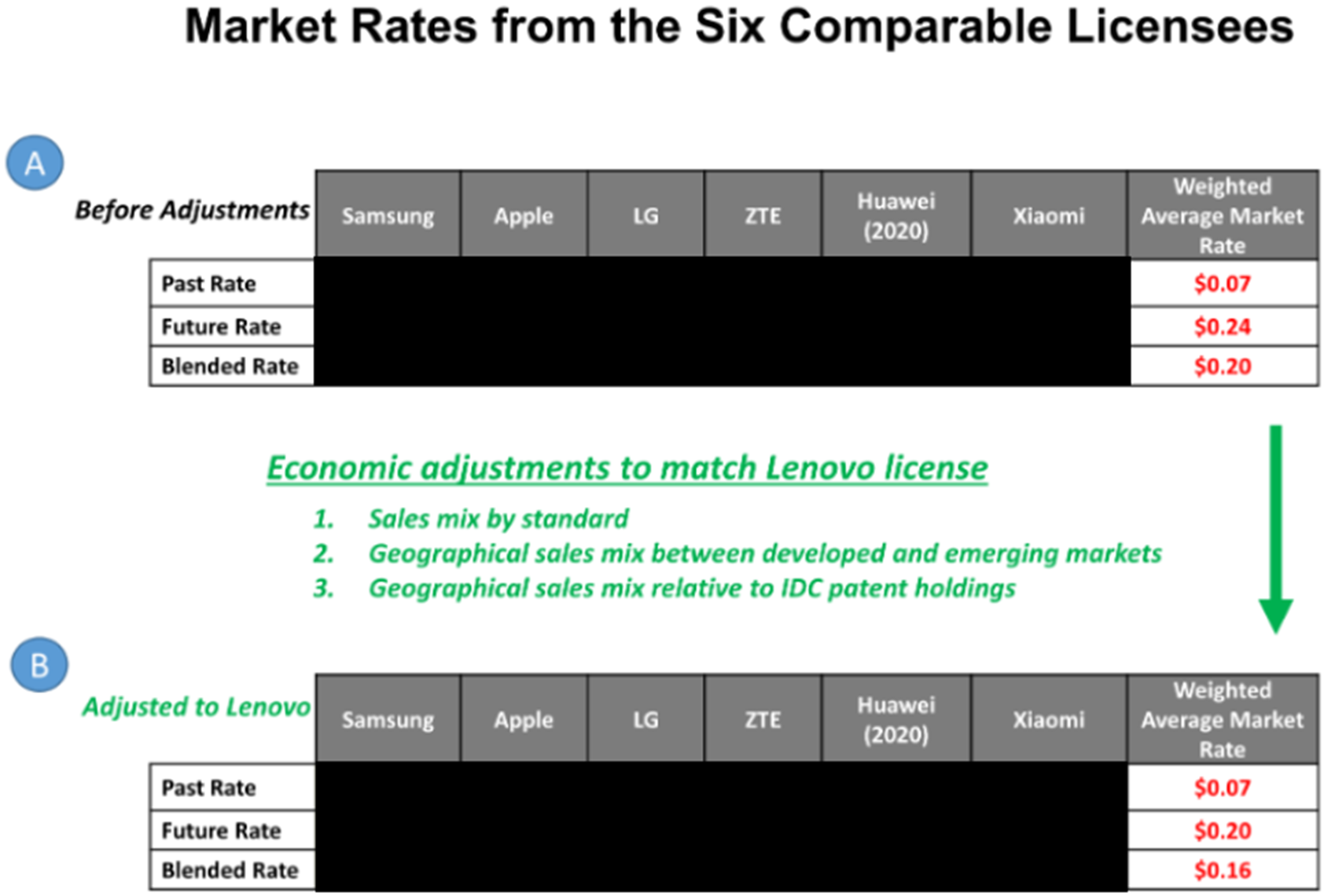

Mr Meyer’s three economic adjustments. 175

(1) Adjusting for sales distribution by cellular standard. 176

(2) Adjusting for sales distribution by geography relative to emerging markets. 177

(3) Sales distribution by geography relative to patent coverage. 182

My request for further analysis. 184

Mr Meyer’s weighting process(es) 186

My assessment of Mr Meyer’s three adjustments. 187

Conclusions on the comparable licences. 188

INTERDIGITAL’S TOP-DOWN CROSS-CHECK.. 191

The patent counting studies. 193

THE RESPECTIVE CASES ON CONDUCT. 206

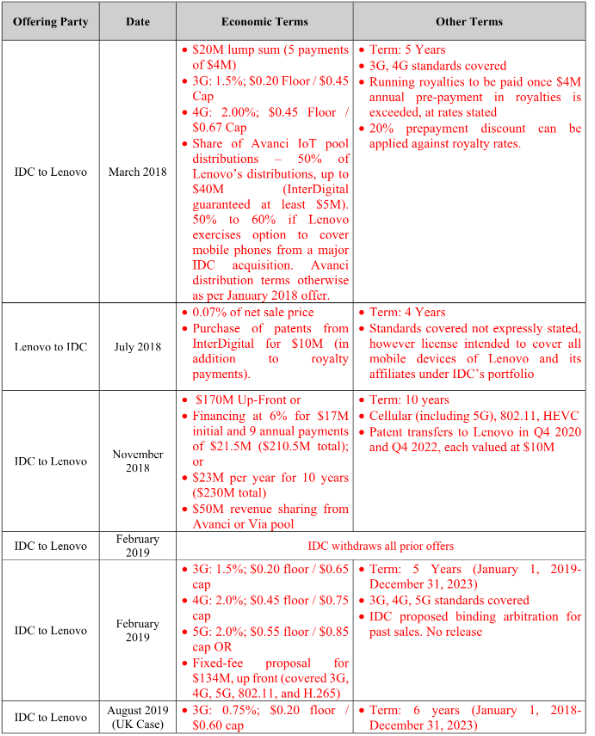

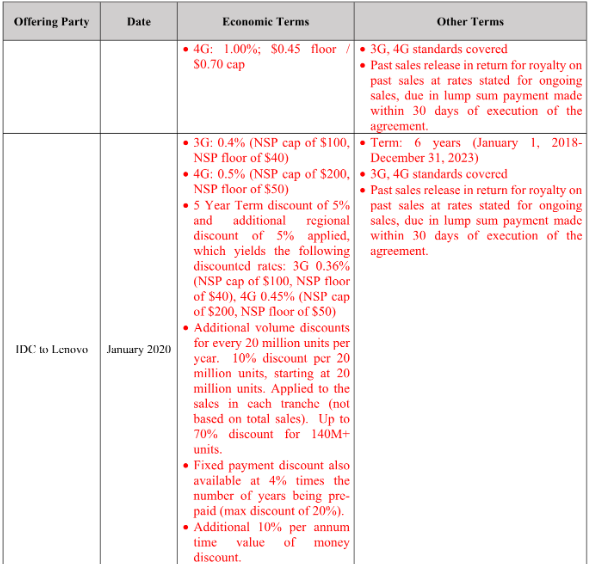

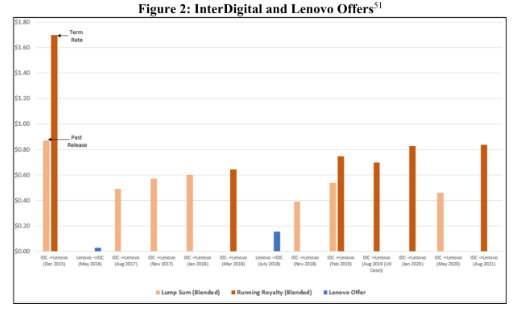

The Offers made by the Parties. 209

Did InterDigital act as a Willing Licensor?. 219

Did Lenovo Act as a Willing Licensee?. 220

Case Management of FRAND Trials. 222

Notes concerning this Judgment

2. There are two versions of this Judgment: the full version [2023] EWHC 538 (Pat), which comprises 225 pages, is available only to the parties and those in the appropriate level of the confidentiality regime because it contains a considerable amount of information confidential to one of the parties and/or third parties. I have received the parties’ contentions and submissions on what should be redacted from the full version to protect information said to be confidential either to InterDigital or one of their licensees. In line with the approach taken by Birss J. to redactions to his main judgment in Unwired Planet: see [2017] EWHC 3083 (Pat) (‘the Confidentiality Judgment’), I have taken a generous view of the claims to confidentiality at this initial stage, pending further evidence and representations. Having said that I have not accepted every claim to confidentiality because I must ensure that the public version fairly sets out the important parts of my reasoning. This version containing an initial set of redactions [2023] EWHC 539 (Pat) is available for general publication. Redactions made to various diagrams are evident. Redactions in the text are indicated [………] or by ██. Any attempts to estimate or reverse-engineer figures by reference to the size of the redaction would be unwise since there is no correspondence. It is highly likely that a further public version of this judgment containing fewer redactions will be published in the future and I aim to issue that version as soon as possible. In this regard, I am currently engaged in almost exactly the process described by Birss J. at [1]-[4] of his Confidentiality Judgment. I will appoint a further hearing at which confidentiality issues will be finally resolved, in which the parties and interested third parties can participate. This will take place shortly and before this term ends on 5th April 2023.

3. To aid understanding, in the Annex I have set out the paragraph in the Judgment where various terms and abbreviations used by the experts in the comparables analysis are defined.

INTRODUCTION

4. This litigation is essentially a dispute between the Claimants (who I shall refer to as InterDigital[1]) and the Defendants (Lenovo) as to the terms on which Lenovo should take a licence to InterDigital’s portfolio of Patents which have been declared essential (i.e. Standard Essential Patents or SEPs) to the European Telecommunications Standards Institute (ETSI) 3G, 4G and 5G Standards. The proceedings were case managed into 6 trials: five technical trials and this FRAND trial. The purpose of this FRAND trial is to identify what terms are Fair, Reasonable And Non-Discriminatory.

5. When this FRAND Trial occurred, two out of the five planned Technical Trials had taken place. InterDigital prevailed in Trial A and the Court of Appeal has recently dismissed Lenovo’s appeal: [2023] EWCA Civ 34. Lenovo prevailed initially in Trial B, although my decision in that trial has very recently been overturned: see [2023] EWCA Civ 105. Three further Technical Trials were scheduled after this FRAND/Non-Technical Trial, and indeed I have heard Trials C and D. InterDigital have prevailed in Trial C and no appeal has been filed. I aim to deliver judgment in Trial D shortly. It remains to be seen whether Trial E is required. At the time of the trial, InterDigital had established their right to a FRAND determination and their position has only been strengthened by subsequent events.

6. The parties identified two headline issues for me to determine:

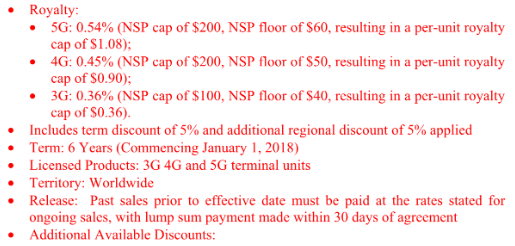

i) The first was whether InterDigital’s January 2020/5G Extended Offer is FRAND and if not, what terms are FRAND for a licence to Lenovo of the InterDigital patent portfolio? This headline issue resolved into two major parts: first, the comparables case and second, the top-down cross-check. These are familiar concepts.

ii) The second was what remedy is appropriate and in particular, whether InterDigital is entitled to an injunction in respect of the ‘Asserted Patents’ (and if so, in what form), in so far as the Asserted Patents are held valid and essential? This issue resolved into three parts: first, whether Lenovo was a willing licensee during the extensive negotiations which occurred prior to the commencement of this action; second, was InterDigital a willing licensor during those negotiations; third, the consequences of Lenovo’s failure to commit to take a FRAND licence.

7. On the second headline issue (which needs a little more introduction), InterDigital maintained that Lenovo is not entitled to enforce the ETSI undertaking, because they did not fall within the class of beneficiaries of the ETSI undertaking, as defined by Meade J. in Optis F. InterDigital maintained this case on two separate bases:

i) The first was termed ‘the fact sensitive case’, in which InterDigital relied on Lenovo’s alleged general conduct in negotiations. InterDigital alleges that Lenovo adopted at all material times a strategy of deliberate hold-out and that their conduct demonstrates that Lenovo has - despite protestations to the contrary - had no intention to work the standard under a licence from InterDigital. Accordingly, so InterDigital’s case goes, Lenovo have not been and are not a beneficiary of the ETSI undertaking. On this basis, InterDigital sought an unqualified injunction against Lenovo.

ii) The second was termed ‘the fact insensitive case’, in which InterDigital relied upon the two alternative ways in which Meade J. found Optis to be entitled to injunctive relief in Optis F at [285] and at [288]/[341]. InterDigital says each of those two ways apply here and do not depend on or require any finding of fact as to Lenovo’s conduct. On this basis, InterDigital sought a FRAND injunction.

8. Lenovo’s counter-attack on the fact sensitive case was their allegation that InterDigital had not conducted themselves in negotiations as a willing licensor. More broadly, Lenovo submitted that, when assessing the remedies for InterDigital, the Court should have regard not only to Lenovo’s behaviour but also InterDigital’s throughout the negotiation process. Lenovo’s argument was that a SEP licensor cannot for years and years only offer supra-FRAND rates and conduct themselves to try to extort supra-FRAND rates from licensees and then purport to overwrite that behaviour retrospectively by agreeing to the Court-determined FRAND rate, whilst casting the blame on others. More specifically:

i) Lenovo alleged that every offer InterDigital made to Lenovo was at multiples of the rates they were offering and agreeing with other substantial entities during the same period. Lenovo characterises this as an act of discrimination particularly focussed on Lenovo. Lenovo says this got worse when InterDigital took unreasonable positions in the lead-up to and in the context of this litigation. InterDigital’s offers went up and InterDigital attempted to support them by adopting an unsupportable set of comparables. Lenovo also point out (correctly) that the very licences which InterDigital put forward as comparables during negotiations were not included in the comparables adopted for this case.

ii) Lenovo also allege that InterDigital’s whole licensing ‘programme’ was unreasonable and non-FRAND because (i) the ‘program rates’ were not updated from 2012-2020 despite licences being routinely granted below those ‘program rates’ (ii) forcing negotiations to be wholly cloaked by NDAs to avoid any transparency in respect of its licensing programme (iii) refusing to give transparent information or assurances about other licensees for years and (iv) providing huge volume discounts to discriminate intentionally against smaller players.

9. I emphasise that so far I have been summarising various allegations made by one side against the other. Whether any of them are justified and if so, to what extent, are points I consider later.

10. I found the notion that InterDigital really wanted an unqualified injunction against Lenovo to be unreal. As I remarked during the trial, the only reason InterDigital was trying to obtain an injunction against Lenovo was to force Lenovo to take a licence. In fact, the last thing that InterDigital as a SEP licensor wants is to take an implementer off the market. They want the implementer on the market, selling products which are standard compliant and paying royalties on them.

11. I also found the notion that InterDigital might be entitled to an unqualified injunction against an implementer like Lenovo to be unreal, unless Lenovo had unequivocally refused to take a FRAND licence. I shall explain my view in greater detail below, but there is a very simple reason for it. InterDigital’s undertaking to ETSI is ‘irrevocable’. InterDigital cannot revoke its undertaking to license on FRAND terms, whether generally or in respect of any particular implementer.

12. InterDigital’s arguments about injunctive relief, it seems to me, are driven not by a desire to keep Lenovo’s standard compliant products off the market (i.e. in the future) but much more by a desire to obtain recompense for the long period during which Lenovo has been selling standard-compliant products and not paying any royalties to InterDigital. On the current state of this action, ever since judgment was handed down in Trial A regarding EP558, Lenovo has continued to infringe a valid patent. Furthermore, it has managed to avoid, through various tactics, making any unqualified commitment to take whatever FRAND terms are determined by this Court. Understandably, InterDigital points to this latest conduct as simply further hold-out by Lenovo. More generally, a strong theme running throughout InterDigital’s case is that Lenovo benefits from any delay. This theme chimes with the way in which each side suggested that past events should be dealt with, a point I consider in much more detail later.

13. It is worth recording my rather basic understanding of how it comes about that an implementer like Lenovo is able to use the standardised technology, perhaps for many years before being licensed to use it. The development of each generation of standardised mobile phone technology has been part of a remarkable success story taking years of collaborative effort by the many companies involved and their highly skilled individual engineers. At a particular point in the development, various specifications which make up a particular release of an overall standard are frozen. Development usually continues, with additional features being added in later releases, but the freezing of specifications is an important step which, in time, leads to products being launched onto the market embodying a particular release/generation of technology, of which the principal generations, 2G, 3G, 4G and 5G are well-known. As Mr Brismark touched upon in his evidence, originally companies made their own chipsets which implemented the 2G standardised technology. Perhaps not surprisingly, that model was not sustainable and soon just a few specialised chipset manufacturers came to dominate the market. As I understand matters, each manufacturer developed and marketed a range of chipsets which provided a range of features, but all implemented, for example, 3G technology as set out in the various ETSI specifications. That was the whole point.

14. In practice therefore, any company wishing to make a 3G mobile phone could do so by purchasing an appropriate 3G chipset. So too, with 4G and 5G. Some, but not all of the technology utilised in each generation is covered by patents. Again, some but not all of those patents cover technology which is considered to be or is in fact essential to the operation of the standard. Other patents cover technology which is not essential but may be optional and desirable to include. A very considerable number of patents have been declared to a Standard Setting Organisation (SSO) to be essential, the number increasing with each generation. Over-declaration is a known issue.

15. However, by manufacturing mobile devices incorporating purchased chipsets which embody the technology set out in the relevant standard, an implementer is able to start using the standardised technology before it has obtained the necessary licences to all the SEPs which are essential to the standard. As the history of this case demonstrates, many years can pass before an implementer takes a licence and the treatment of past (unlicensed) sales is a major issue in the comparables part of the case.

16. This brief overview explains, I hope, why I have divided this judgment into three major sections in which I deal with first, the comparables case, second, the top-down analysis and third, the allegations regarding conduct. I propose to deal with those matters in that order for two main reasons: first, because it is clear that the comparables analysis is the primary if not exclusive indicator of the appropriate FRAND financial terms, the top-down analysis being deployed by InterDigital only as a cross-check; and second, because I believe that the various allegations as to conduct can only really be assessed against the backdrop of my conclusion as to the appropriate FRAND terms. It is those terms which will help me to identify whether InterDigital or Lenovo made FRAND offers, whether InterDigital was making unreasonably high demands, whether Lenovo unreasonably refused to engage at various points, and generally the causes of the inability of these two parties to reach a deal during the 11 years between first contact between the parties and the issue of this claim by InterDigital.

17. Naturally before embarking on those sections, I need to orient myself correctly. I am able to do this with the considerable assistance I can derive from the existing caselaw in the UK, by paying attention to existing caselaw in both the US and China and by identifying further points which emerge from the ETSI materials which are applicable to the circumstances of this case. Before I can explain how the existing caselaw assists me, it is necessary to set out, in much more detail, the basis of the disputes which I have to resolve.

18. The final point I wish to make by way of introduction is that I have left entirely out of account any views I formed of the validity or significance of individual patents considered at any of the Technical Trials. I have had to consider just three of InterDigital’s patents in those trials. It would be wrong to allow my views on just three patents to influence, one way or another, the licensing of InterDigital’s entire portfolio of patents said to be standard and essential.

The scope of this dispute

19. Although it will be seen later that over the years InterDigital made a number of offers (actually 14) to Lenovo, and Lenovo made a limited number (2) of counter-offers, a total of four offers were pleaded to be FRAND - two from each side –but the trial concentrated on the following two.

|

The 5G Extended Offer | |

|

Scope |

Worldwide, 2G (past sales only), 3G, 4G and 5G patents |

|

Licensed products |

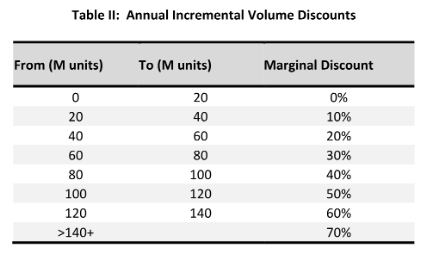

3G, 4G and 5G terminal units |

|

Term |

6 years (commencing 1 January 2018) |

|

Royalty |

By standard rates: 5G: 0.54% of ASP, where the ASP is subject to a cap of $200 cap and a $60 floor 4G: 0.45% of ASP, where the ASP is subject to a $200 cap, and a $50 floor 3G: 0.36% of ASP, where the ASP is subject to a $100 cap, and a $40 floor |

|

Release |

Full, upon payment for past sales at above rates |

|

Discounts embedded into royalty rates |

5% term discount 5% regional sales mix discount |

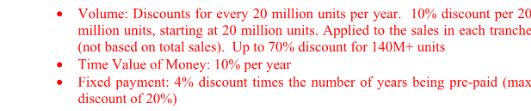

|

Discounts available |

Volume discount: 10% per 20M units sold applied progressively, up to a maximum 70% discount for sales over 140M units in a calendar year. Time value of money discount: 10% per year prepaid. Fixed payment discount: 4% per year pre-paid (to a maximum 20%). |

21. This offer embodies the ‘program rates’ which InterDigital has published on its website since early 2020, as part of its ‘transparency’ initiative. It should be noted that the stated royalty rates reflect the embedded discounts, hence the stated 4G ‘program rate’ is 0.5% for example.

22. I should add that in its oral opening, InterDigital agreed that the Court should determine a lump sum. In his fourth report, Mr Bezant (the accountancy expert called by InterDigital) calculated the lump sum from the 5G Extended Offer as $337m, made up as follows:

23. It is obvious that the past makes up a very substantial proportion of any overall lump sum (about 2/3, in Mr Bezant’s calculation). In his lump sum calculation, Mr Bezant worked on the basis that the licence would have an effective date of 1 January 2018 (albeit signed on 1 January 2023) with a six-year term ending on 31st December 2023, with Lenovo paying royalties on sales up to six years prior to the effective date (i.e. from 1 January 2012). The total handset sales in his Appendix 31 amount to 675.7m units (accepting there may be an error in the total caused by rounding in App31). Thus, the total of $337m indicates a blended per unit dollar rate of $0.498. On these figures, each cent in the rate accounts for roughly $6.6m.

24. At first sight, the choice of 1 January 2018 as the effective date appears random, having no relation to the commencement of this action in August 2019 nor any other immediately relevant date. It is explained by the terms of the 5G Extended Offer which is specified as having an effective date of 1 January 2018 (in common with InterDigital’s November 2018 offer, see below). I assume InterDigital favour this effective date because it allows them to reach back to include sales from 1 January 2012, on an apparent assumption that a 6-year limitation period applies.

25. Mr Meyer (the accountancy expert called by Lenovo) also worked on the basis that the limitation period ‘in many jurisdictions’ extends back a maximum of 6 years from the date of the start of proceedings. Hence, he considered Lenovo’s ‘past sales’ to be those in the period from Q3, 2013 to (the end of) 2020. He also calculated adjusted figures for the period 2007 to 2020, representing the longest period for which historical sales figures were available, but also reflecting the fact that Lenovo and InterDigital had been negotiating since 2008.

27. In connection with its Lump Sum Offer, Lenovo draws attention to the ninth offer made by InterDigital in November 2018 and withdrawn in February 2019. That was also a lump sum offer which Lenovo says is consistent with its Lump Sum Offer and supports a finding that its Lump Sum Offer is FRAND. In the November 2018 offer, Lenovo says that InterDigital represented that $120m was an appropriate part of the overall lump sum to attribute to a 10-year 3G/4G/5G licence from 2018-2028 with a release for all sales prior to 2018. For its part, InterDigital says its offer does not indicate that Lenovo’s offer is FRAND. It points out that it was an offer made after 10 years of attritional negotiation, in an attempt to reach a deal.

i) Term: 6 years from date of the agreement.

ii) Licensed Standards: 2G, 3G, 4G, 5G.

iii) Territory: Worldwide, but incorporating the FRAND/RAND decisions of the US and Chinese courts.

iv) Royalty Payments: a per unit rate subject to an annual cap:

a) Either a single blended global rate, adjustable for outcomes of the US and Chinese proceedings, no higher than $0.12 with a 50% reduction for sales in China; or

b) A global licence with separate regional rates no higher than: $0.06 for sales in China, Rest of World, Emerging Markets and non-patent countries; and $0.12 for sales in the USA and RoW Developed Markets including the UK.

v) Past sales: released for no additional payment.

vi) Discounts/Other Terms: Most favoured licensee i.e. InterDigital would need to offer to Lenovo the same terms as it grants to any similarly situated licensees in the 12 months following the effective date.

29. Although this Pleaded Case was overtaken and replaced by Lenovo’s Lump Sum Offer, this pleaded position does explain some of the analysis which was undertaken.

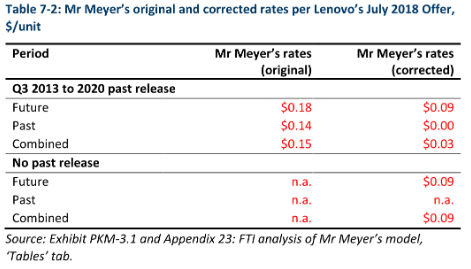

30. The analysis by each expert of InterDigital’s 5G Extended Offer and Lenovo’s July 2018 Offer (see further below) illustrates some of the differences between them and the complications to which they can give rise.

34. It appears the most significant flaw was the use of retail and not wholesale ASP data. Having seen Mr Bezant’s use of wholesale ASP data in his first report, Mr Meyer agreed that was more appropriate and presented, in his second report, revised calculations. So, by the time Mr Meyer read Mr Bezant’s second report, he had already revised his calculations using wholesale ASPs presented in his (Mr Meyer’s) second report. His revised combined rate implied by the 5G Extended Offer was $0.51.

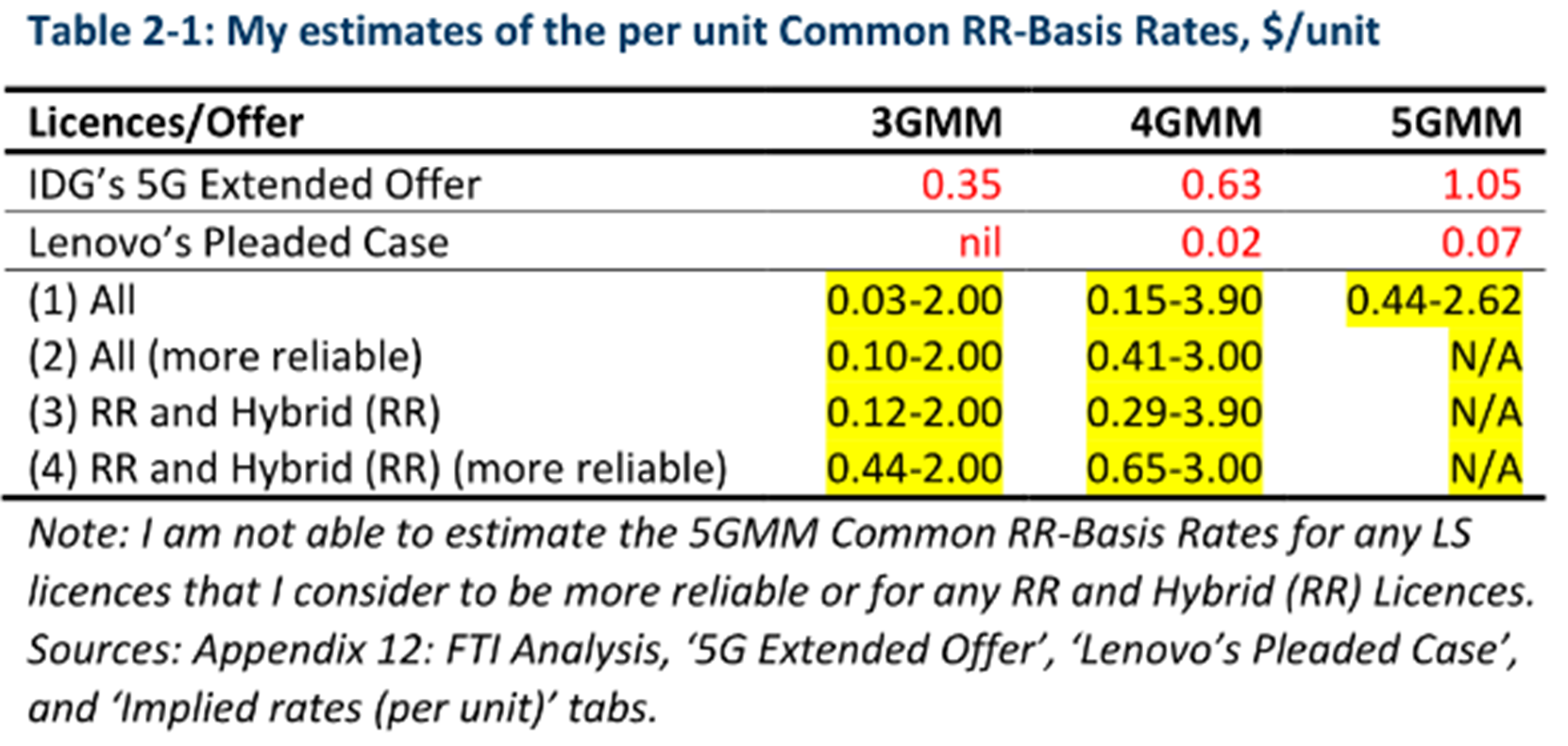

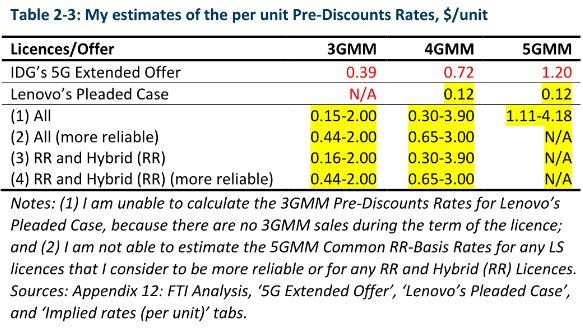

35. In his second report, Mr Bezant corrected the alleged flaws and presented the following comparison.

38. Mr Bezant did not analyse Lenovo’s July 2018 Offer in his first report because it had not been pleaded.

39. In response to Mr Meyer, Mr Bezant identified a number of differences in their respective analyses, including (a) whether the 4 year-term ran from July 2018 or from 1 January 2021; (b) whether royalties would be paid at the stated rate on past sales or not (Mr Bezant assumed there was no past release because none was explicitly stated in the offer); (c) the period of the past release period, if applicable; (d) whether cellular PCs and tablets should be included or not; (e) the difference between using retail or wholesale ASP data; (f) whether it was appropriate to use the same by-standard split for 2022 and 2023 (derived from the actual in 2021); and (g) whether it was appropriate to assume that Lenovo’s ASPs would remain constant in 2022 and 2023 or were likely to decline. The application of Mr Bezant’s views on those points resulted in the following comparison table.

40. The debate continued in Mr Bezant’s third report.

41. I do not find it necessary or helpful to resolve any of these disputes over the analysis of the 5G Extended and July 2018 Offers. I consider there is enough information to be able to make a comparison with the rates I decide are FRAND, in so far as any comparison is necessary. However, these disputes give a flavour of the considerable extent of the disagreement between the forensic experts as to the correct approach to unpacking, selecting comparable agreements and, ultimately deriving a rate or rates for Lenovo in the FRAND range.

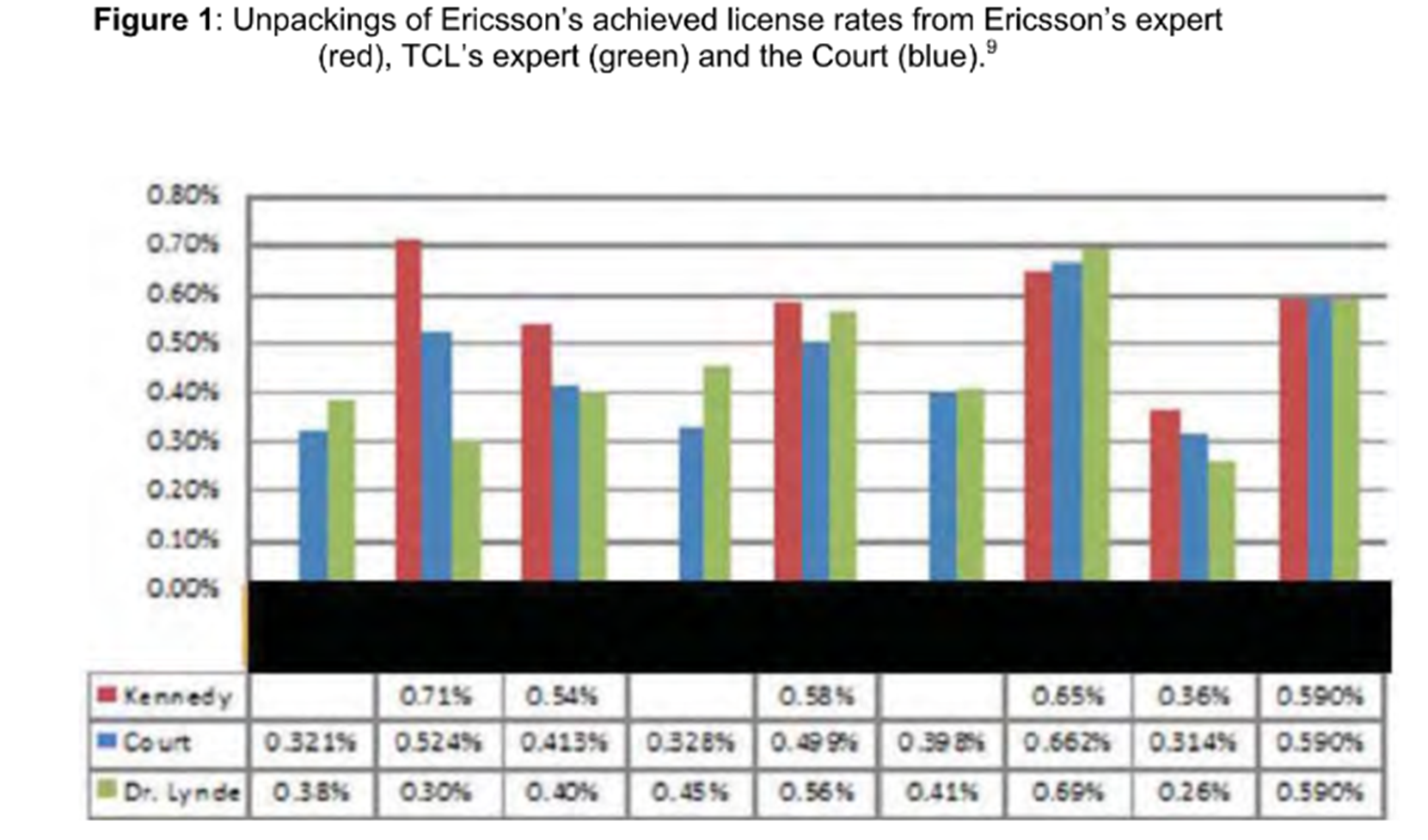

42. For differing reasons, each side says the other’s approach and offer is flawed. In order to decide whether either of the two is in the FRAND range or what is FRAND in this case, in very general terms I take the same approach as that of Birss J. in Unwired Planet International Ltd v Huawei Technologies (UK) Ltd & Anr [2017] EWHC 711 (Pat) (the public version) (‘UPHC’). However, the issues I have to decide are different in a number of respects. It will be recalled that UP had acquired its portfolio as a spin-off of part of the larger Ericsson portfolio. In his comparables analysis, Birss J had a couple of UP licences, which he rejected as comparables, plus a series of Ericsson licences, some of which he regarded as useful and one in particular he selected as the best place to start. The rate(s) he derived from the Ericsson comparables then had to be scaled to fit the UP portfolio. Birss J. also conducted a top-down analysis and found it, on the evidence before him, to be a useful cross-check which served to confirm the rates he derived from his comparables analysis.

44. There was no overlap between the parties’ chosen comparables. So, in this case a considerable number of possible comparable licences were put before the Court.

45. As I indicated above, InterDigital also proposed a top-down case as a cross check for their primary comparables approach. As is well known, top-down approaches have been applied in various cases including UPHC, TCL v Ericsson, In Re Innovatio IP Ventures and Huawei v Conversant (see further at paragraphs 165-166 below). The experts in this case accepted that in principle, top-down analyses can be informative. However, the general category of ‘top-down’ embraces a wide range of possible approaches and this case is a prime example of the fact that the devil is in the detail.

46. The general approach is very simple. The relevant formula is:

ARBTOTAL = ARBInterDigital / ShareInterDigital

Where: (i) ARB is Aggregate Royalty Burden,

(ii) ARBTOTAL is the implied royalty for the total stack of 4G SEPs, by way of example,

(iii) ARBInterDigital is the aggregate royalty for InterDigital’s 4G SEPs, and

(iv) ShareInterDigital is InterDigital’s share of 4G SEPs.

47. InterDigital seeks to establish its share of 3G, 4G and 5G SEPs by reference to various patent counting studies, principally from PA Consulting. InterDigital seeks to establish the level of a reasonable total royalty stack in two ways: first, through ‘hedonic regression’ analyses and second, through public statements made by various third parties.

The Trial

48. The trial took place over 17 days with an allocated 4 days of pre-reading, 2 of which were interspersed between hearing days. For the complexity of some of the expert evidence and the volume of material, even 4 days of pre-reading was woefully inadequate within which to master the materials and the myriad issues. I was supplied with over 50 bundles of material, with further bundles (mostly slim) of cross-examination materials. The largely introductory material in the Opening Skeleton Arguments (but with considerable detail in various Annexes) comprised over 360 pages, with the Closing Skeleton Arguments accounting for a further 400 pages.

49. Oral openings accounted for the first two days of trial. Certain of InterDigital’s fact witnesses were cross-examined on days 3 and 4. Mr Brismark’s evidence accounted for day 5, Mr Bezant for days 6 and 7, Mr Djavaherian for day 8 and Mr Meyer for days 9 and 10. The French law experts gave evidence on day 11. Days 12 and 13 were devoted to evidence on the Top-Down case, with Dr Peters and Dr Putnam on day 12, and Dr Kakaes and Dr Wang on day 13. Understandably, there was then a break to allow the parties to complete the preparation of their Written Closings. Oral closing argument occupied days 14, 15, 16 and about half of day 17.

50. The forensic accountancy evidence (from Messrs Bezant and Meyer) was unnecessarily complicated for several reasons including (a) the fact that each expert used different data in their unpacking analyses and (b) they worked to differing definitions of what constituted past sales. As in UPHC at [227], I was presented with ‘a blizzard of figures’. Even checking an individual value often took considerable time. It was usually necessary to locate an equivalent figure in the initial analysis, trace the response to it, check or locate the revised value, and check the detailed calculations in one or more of the exhibits, which were sometimes large Excel spreadsheets. By the end of the trial, I was left with the strong impression that cases of this type require extensive and much closer case management than occurred in this case, not least in an attempt to ensure that at least there is agreement as to the data which is used for the purposes of analysis. This impression was strengthened during my preparation of this judgment. I have to discuss other case management issues below regarding the development of the Top-Down case and, in particular, the Hedonic Regression analysis.

51. This trial was originally listed for 15 days and, when case managing other FRAND disputes, I have noticed that nearly all FRAND trials have been estimated at 15 days. This occurs at an early case management stage, when the action as a whole is being divided into technical trials and a FRAND trial and long before anyone has a clear idea of the scale of the issues which actually have to be determined at the FRAND trial itself.

52. In this case, the parties evidently decided they were going to (try to) fit everything into the original estimate. In order to do this, the parties wisely decided not to cross-examine where there were no disputes of real significance for example, on the expert evidence of US and Chinese Law. It also meant that cross-examination of important witnesses had to be restricted. After the trial had concluded, I was left with the impression that some important points in the evidence had not been the subject of proper challenge or, in some cases, any exploration at all in cross-examination or adequate focus in submissions, and this impression only increased as I prepared this judgment. Certain important issues were mentioned, if at all, only in passing but several were not adverted to at all.

53. Looking back at the trial, what happened in cross-examination was each side attempted to damage the case presented by the other side and promote their own case, as one expects to take place. InterDigital also attempted to suggest a measure of equivalence between the analyses of Messrs Bezant and Meyer, and I have to consider this below. I observe that this sort of FRAND case is not well suited to adversarial litigation because there is (and was in this case) very little, if any, exploration of the middle ground between the positions taken by the two sides. Whilst it is possible that the Court will adopt one side’s analysis wholesale, in practice this is unlikely. The consequence is that the Court is likely to be much more interested in the middle ground between the two side’s positions.

54. This is another reason why, in my view, much closer case management is required over future FRAND cases and trials. The pre-trial review (PTR) must be a proper review of the case and the issues which the parties wish the Court to decide at the trial. This may require the Judge to engage in several days pre-reading prior to the PTR to ensure he or she is on top of the issues. There was no opportunity to do that in this case. There was a brief PTR (lasting about ½ day) but this did not provide an opportunity to get properly on top of the issues, not least because important expert reports were served after the PTR and all the issues had yet to crystallise.

THE EVIDENCE of fact

55. The evidence, in the form of witness statements, expert’s reports and exhibits was extremely voluminous. It is neither practical nor necessary to discuss all the evidence in this judgment. In these sections, I provide a brief summary of the evidence and my views on the witnesses, in so far as they are material.

56. InterDigital served some 23 witness statements from 10 witnesses. Here I summarise the various deponents and an outline of the topics dealt with.

57. Richard Brezski is the Chief Financial Officer of the Third Claimant, the ultimate parent company of the InterDigital Group. In his witness statement, he explains InterDigital’s approach to revenue recognition including how they account for past sales and any non-monetary consideration. His statement went in unchallenged.

58. Bradley Ditty is the General Patent Counsel of the Fourth Claimant. He oversees InterDigital’s patent activities. He provides an overview of the InterDigital patent portfolio, including its size over the years, makeup and geographical scope. Again, his evidence was not challenged.

59. Anthony Grewe retired from InterDigital in April 2021 but was Vice President of the Licensing Group of the Fourth Claimant from 2015 until his retirement. He joined InterDigital in January 2011 being progressively promoted in the Licensing Group. In his first witness statement, he explains InterDigital’s approach to licensing negotiations but also summarises his recollection of certain of the PLAs in which he had some involvement with Huawei, ZTE, Apple, Samsung, Asustek, Pegatron, Wistron, NEC, RIM and Acer.

60. In his second witness statement, Mr Grewe addressed questions which had been raised by Lenovo concerning the various discounts in InterDigital’s licensing arrangements.

61. In his third witness statement, Mr Grewe was asked to consider questions arising from paragraph 6.6 of the first expert report of Mr Djavaherian (also referred to by Mr Meyer in his first report at [59]), and from Meyer 1 at [102].

62. William J. Merritt was the President and Chief Executive Officer of the Third Claimant between May 2005 and April 2021, having commenced his employment with InterDigital in January 1996 as Vice President, Legal. He became General Counsel in 1998 and General Patent Counsel in 2001. In his first witness statement he gives an overview of InterDigital’s business, InterDigital’s general approach to licensing and the licensing program, including a section on unsuccessful negotiations, InterDigital’s negotiations with Lenovo and then his recollections of his involvements with the following InterDigital PLAs with Huawei, ZTE, LG, Apple, Samsung and Innovius.

63. In his second witness statement, he addressed volume discounts and regional sales mixes. In his third witness statement he addresses the November 2018 Offer made by InterDigital to Lenovo.

64. Julia Mattis is Vice President, Deputy General Licensing Counsel at the Third Claimant, a position she has held since January 2020. Originally qualifying as a lawyer in 2004, she commenced employment with InterDigital in February 2010 and has had a number of promotions in the patent licensing team. In her current role, she leads the legal team which is responsible for supporting the licensing business. Her team is responsible for all the legal negotiations for InterDigital’s licensing deals and converting the commercial deal into an executable licence. She has given a total of four witness statements.

65. In her first, she starts by explaining her role and background. Then she explains InterDigital’s January 2020 License offer to Lenovo. She summarises her recollections of a number of the PLAs which are in issue in this action, namely Huawei, ZTE, Apple, Fairphone, Innovius, Fujitsu, Panasonic, Wistron, Sharp, NEC, RIM, Quanta and Acer.

66. In her second witness statement, Ms Mattis covered her recollection of a recent PLA, designated the ‘2021 Sharp PLA’ and similarly, in her third, she covered a further recent PLA, designated the 2021 Xiaomi PLA.

67. For her fourth witness statement, Ms Mattis was asked to and did explain the relationship between InterDigital and the Signal Trust.

68. Sireesha Ancha is a Managing Consultant at PA Consulting Group. She has been employed by PA since April 2006. She provides evidence about PA Consulting, and specifically about the Patent Essentiality Reports which have been prepared by engineers at PA, how the reports are compiled and something of the status of those reports in the market. In her first witness statement, although she describes all the PA Reports relating to various standards, she explains the methodology employed for the 3G, LTE and LTE-A Reports. In her second witness statement she addresses the 5G Report.

69. Shival Virmani is the Head of Mobile Patent Licensing and a Vice President at the Third Claimant. In his first witness statement, he explains his recollection of the patent licensing negotiations between InterDigital and Lenovo in his role as the primary contact at InterDigital between April 2010 and June 2011 and after he re-joined InterDigital in January 2019. In his second witness statement, he provides his recollections of the negotiations which led to PLAs with Blu and Doro, and in his third, with Xiaomi.

70. John Garland runs his own business providing licensing negotiation support to clients including InterDigital. He summarises his recollection of his involvement in the negotiations which led to the PLAs between InterDigital and Blu and Doro. He was not required for cross-examination.

71. Michael B. Levin is a US lawyer. He gives evidence of the status of the proceedings between the parties in the United States District Court for the District of Delaware (claims for patent infringement and declaratory relief by InterDigital and breach of contract (InterDigital’s ETSI FRAND commitments) and violations of the Sherman Act by Lenovo) and in the Patent Trial and Appeal Board (PTAB) (Lenovo’s challenges to the 8 InterDigital patents asserted in the infringement claim).

72. Dr Fang Qi is a Chinese lawyer. In his first witness statement Dr Qi gives an overview of the proceedings in China between the parties:

i) There are proceedings brought by Lenovo in the Beijing Intellectual Property Court in which Lenovo requests that the Court determine FRAND licensing conditions for all Chinese 3G, 4G and 5G SEPs owned by InterDigital.

ii) There are also a series of invalidity petitions filed by Lenovo at the China National Intellectual Property Administration (CNIPA) in which Lenovo challenges the validity of 17 of InterDigital’s Chinese Patents. He relates that hearings have been held in all 17 cases, of which 9 were held invalid (and InterDigital has appealed), 5 were held valid (in respect of 2 of those cases, both sides have appealed, and for a further case, Lenovo has appealed) and 3 were partly invalid (Lenovo has appealed in 2 of those cases).

73. In his second witness statement, Dr Qi provided an update:

i) In the Beijing Intellectual Property Court proceedings, InterDigital’s jurisdiction challenge was dismissed in a judgment dated 8th November 2021. Even allowing for an appeal, Dr Qi considers it likely that a first instance judgment will be handed down towards the end of 2023.

ii) At the CNIPA, Lenovo has filed one further appeal in respect of an InterDigital patent held to be valid. Dr Qi does not indicate when all the appeals are likely to be determined or whether the FRAND proceedings are dependent on the outcome of the invalidity petitions.

74. Lenovo called no fact witnesses. In their case on conduct, InterDigital made much of Lenovo’s failure to call the key personnel on Lenovo’s side who were involved in the negotiations with InterDigital, with particular stress being placed on the absence of evidence from Mr Ira Blumberg. I will consider this later.

Observations on the witnesses of fact

75. Mr Grewe was called as InterDigital’s first witness. He was a satisfactory witness but tended to be guarded in his answers, although not as guarded as Mr Virmani (see below).

77. Ms Mattis was only cross-examined for a relatively short time, but she gave clear and open answers. She was a good witness, albeit her evidence is not that material to anything I have to decide. Part of her cross-examination was conducted in private because it related to the Xiaomi 2021 PLA.

78. The final factual witness was Mr Virmani. In his cross-examination it was quickly apparent that Mr Virmani was not going to add anything to what can be seen from the face of the documents. Whenever he was asked about an email he had written or received, his answer was along the lines of ‘that is what the document says’. He came across as a very literal and defensive witness with no independent recollection of any of the negotiating history. To the limited extent that he did add anything to the documents, I find he was essentially programmed to characterise Lenovo as unreasonable. I discuss one particularly egregious example in the Conduct section of this Judgment. He gave views which did not appear to me to be consistent with the contemporaneous documents and so likely to be driven by hindsight.

79. Looking more generally at InterDigital’s factual evidence, the purpose of it was clear. It was to characterise Lenovo as the unwilling licensee and InterDigital as the patient (sometimes overly patient) licensor trying everything in its power to achieve a deal. As I indicate elsewhere in this judgment, I do not find it possible to reach any concluded view as to the reasonableness of the conduct of the two sides without taking into account where the Court ends up on valuation.

THE EXPERT EVIDENCE

80. I received a total of 17 expert reports served on behalf of InterDigital and 13 served on behalf of Lenovo. I introduce here each of the areas on which expert evidence was given, the respective experts and some brief views.

Accountancy

81. Mark Bezant was the expert instructed on behalf of InterDigital in relation to accounting matters. He served four reports with substantial Appendices, a number of which were very large Excel files which could only be supplied in electronic form.

82. Paul Meyer provided equivalent evidence on behalf of Lenovo, serving three reports, also with substantial and detailed Appendices.

83. The evidence of Messrs Bezant and Meyer is central to the comparables part of the case which I discuss in much greater detail below and my decisions in that part of the case reflect the degree to which I felt able to accept their evidence.

84. Mr Bezant has a great deal of experience giving expert forensic accountancy evidence in litigation and in IP cases. He gave such evidence before Birss J in UPHC. He was a careful and considered witness and I am satisfied he was trying to assist the Court to reach a fair outcome, bearing in mind some of the fundamental assumptions on which his analysis had proceeded. He was expertly cross-examined by Mr Segan KC.

85. Naturally I have to discuss a number of aspects of Mr Bezant’s evidence in the comparables analysis. However, in general, I found his evidence less useful than that of Mr Meyer precisely because of the fundamental assumptions on which he (Mr Bezant) proceeded. On reflection, I found some of those assumptions to be unrealistic, which perhaps indicates he had identified too much with InterDigital’s case.

86. As will appear below, I had more confidence in some parts (but not all) of Mr Meyer’s approach. Both experts (and their teams) did an immense amount of work, often under pressure, and I am very grateful for all the work which was done.

87. Furthermore, as I discuss below, after the trial had concluded I made requests for further analysis and assistance from these experts. Messrs Meyer and Bezant co-operated to produce the requested materials within a short space of time and made brief observations on them in line with my requests. I am very grateful to them for carrying out these additional tasks.

Patent Counting and Patent Counting Studies

88. Ruud Peters was instructed on behalf of InterDigital to provide his expert opinion in relation to the issues concerning the patent counting studies pleaded by InterDigital as part of their top-down cross check.

89. Apostolos ‘Paul’ Kakaes provided expert evidence on these topics on behalf of Lenovo.

SEP Licensing

90. Gustav Brismark was asked to address the Court on behalf of InterDigital in relation to industry practices regarding licence terms and negotiations for SEP licences. Subsequently, he was asked to comment on the parties’ respective positions on the licence terms and their negotiations.

91. Mr Brismark was cross-examined over a full day. At first, he gave the impression of being careful and considered in his answers. He was obviously extremely knowledgeable based on his long experience in running Ericsson’s substantial licensing operation for many years. However, as his cross-examination progressed, I formed the distinct view that his opinions came from the viewpoint of the licensor, and from the particular Ericsson viewpoint as licensor. In that regard, his evidence indicated to me that Ericsson was an unusual SEP licensor in that (a) it published its rates long before others started to do so and (b) it had a portfolio which was generally considered to be one of the strongest in the SEP field.

92. There were two particular areas of Mr Brismark’s evidence which gave me some concern.

93. First, in his written reports he was asked to review the course of negotiations between InterDigital and Lenovo and he presented what, on the face of it, was a review from an independent expert. He confirmed in cross-examination that he had not taken account of valuation when conducting his review i.e. he did not consider the valuation of any of the offers made by InterDigital or Lenovo. This was not quite accurate. Although he had in the main refrained from commenting on any of the offers, he did describe one of Lenovo’s offers as ‘low-ball’. This was revealing. It meant, in my view, that he had implicitly adopted the position of InterDigital as licensor and had analysed the negotiations on the implicit assumption that InterDigital had made reasonable offers and it was Lenovo holding out.

94. This was confirmed in further cross-examination as to some of the details of the negotiating history. This revealed that Mr Brismark had not taken an even-handed view. In his review, he was ready to criticise Lenovo for periods of delay, but he did not mention equivalent or even longer periods of delay which were attributable to InterDigital. Mr Brismark nonetheless maintained his view that the negotiating history revealed deliberate delaying tactics on the part of Lenovo. To the extent that such issues need to be resolved, they are issues for the Court and not for the experts.

95. Overall, I was puzzled as to how anyone could reach conclusions effectively as to whether Lenovo was an unwilling licensee without considering the all-important valuation of the offers which were under discussion. In other words, how can a final conclusion be reached until it is possible to review the negotiating history against what is found to be FRAND. To give a hypothetical example, if what is found to be FRAND happens to coincide with even what the licensor considers to be a low-ball offer and the licensor has maintained much higher offers for years, then any periods of delay or failure to reach agreement take on a very different hue than if the FRAND rate is in line with the much higher offers.

96. When reviewing the negotiating history, I find that Mr Brismark lost sight of his duty to present an independent and objective view.

97. Second, in his first report and during cross-examination, Mr Brismark maintained that he had never experienced hold-up from a licensor. This was a striking statement, perhaps in part explained by his unusual experience at Ericsson but perhaps more so by his definition of ‘hold-up’. He said:

‘47. …‘hold-up’ refers to behavior of the licensor and is a theory which assumes that SEPs confer market power which enables a patentee to hold up the licensee by denying them access to a market unless they pay license rates which are above what a FRAND rate should be.’ (my emphasis)

98. He explained further in his second report, in the following passage where he summarised what he considered to be Mr Djavaherian’s position and then responded:

‘52 Mr. Djavaherian's overall position appears to be that smaller licensees are more likely to agree to terms that are supra-FRAND, and that SEP owners are regularly structuring SEP license agreements in order to have rates "appear higher". I disagree to both of these positions.

53 I consider that these claims are unsupported and are at odds with my experience from licensing over the past 15 years. It is my experience that licensors have no ability to force (and 'hold-up') a licensee into signing an SEP license agreement on terms they do not agree to, as licensees can rely on FRAND commitments made by the SEP owner when negotiating the license agreement terms and in the meantime continue to sell products and generate revenues, while using the patented SEP technologies. As I describe in my First Report (see paragraph 47), I am not aware of any evidence that 'hold-up' exists or has caused harm in the mobile telecommunications market.’

99. When I raised this definition with him, Mr Brismark confirmed my view that ‘denying access to a market’ was done by actually obtaining (and I infer, enforcing) an injunction or exclusion order against the products of the licensee. At this point, he then started talking (for the first time) about something different, what he called ‘hold-up power’ i.e. the mere threat of litigation by a licensor to force a licensee to pay above a FRAND rate. He said ‘I have not experienced that there is such a thing as hold-up power’. It may be that his experience at Ericsson was unique in that regard, but I strongly suspect that many licensees have experienced some degree of hold-up pressure from licensors. In terms of how this licensing market works, I consider it is unrealistic to say there is no hold-up power. Once again, this was Mr Brismark taking a very licensor-centric view.

100. David Djavaherian was instructed on behalf of Lenovo to give equivalent evidence. Subject to what I say below, I found him to be a good witness.

101. InterDigital criticised Mr Djavaherian’s evidence because, although he discussed hold-up, he made no mention of hold out at all. They were also critical of his attempts to minimise the effects of hold out, in particular his points that (a) any detrimental effects of delay can be addressed by the SEP holder suing the implementer at an earlier stage; and (b) the SEP holder can always borrow against his portfolio to fund litigation. The ‘fire-sale’ recounted in UPHC shows his evidence to be unrealistic.

102. However, having heard both Mr Brismark and Mr Djavaherian in the witness box and having considered their evidence generally, I have come to the clear conclusion that Mr Brismark was essentially expounding every point which could be made in favour of the SEP licensor with Mr Djavaherian providing the opposite viewpoint. In particular, Mr Brismark’s views were heavily influenced by what I consider to be his unusual and long experience at Ericsson. Notwithstanding those observations, I found the evidence from both experts very interesting and useful. These experts covered some fundamental issues in SEP Licensing, and some such issues were not touched on in cross-examination. Although I have not accepted every point made by Mr Djavaherian, nor rejected every point made by Mr Brismark, in general I found Mr Djavaherian’s evidence to be more balanced and realistic.

Hedonic Regression

103. Dr Jonathan Putnam on behalf of InterDigital explained hedonic regression analysis and presented the results of his analysis in relation to the additional benefit of 3G, 4G and 5G functionality. His first expert report was served on 6th October 2021. He served a second (relatively lengthy) report on 29th December 2021. Dr Putnam is clearly an enthusiastic proponent of hedonic regression in general and of the particular analysis he presented in this case.

104. Dr Elizabeth Wang on behalf of Lenovo reviewed Dr Putnam’s first report and responded to it in her first report which was served on 25 November 2021. She did not serve a second report. During her cross-examination, it became apparent that a second report from Dr Wang ought to have been prepared and served. Following Dr Putnam’s second report, Dr Wang had undertaken some further analyses, identified certain papers by way of response to papers he had cited and had a number of positive points in answer. Although she had discussed her responses to Putnam II with Lenovo’s lawyers, none of these additional points or materials were put to Dr Putnam in his cross-examination. Some of this material emerged in Dr Wang’s answers in cross-examination, which took InterDigital’s Counsel on this part of the case, Mr Chacksfield KC, and myself by surprise. As I made clear at the time, this was completely unacceptable and should not have been allowed to occur. I do not place the blame for this on Dr Wang, who was a careful witness. Rather, Lenovo’s lawyers ought not to have allowed this situation to develop. I discuss the consequences below in the context of the issues on Hedonic Regression.

French law

105. Dr Geneviève Helleringer provided evidence on French law on behalf of InterDigital and specifically relevant aspects of the French Civil Code relating to contracts and the concepts of stipulation pour autrui (SPA) and stipulation de contrat pour autrui (SCPA). Her report was properly restricted to providing evidence of French law.

106. Professor Phillipe Stoffel-Munck provided equivalent evidence on behalf of Lenovo, although, as he pointed out, Dr Helleringer’s approach was to explain just the principles of law whereas he delved further into how the issues arising under the ETSI regime would be decided under French Law. InterDigital therefore submitted that substantial parts of his evidence, where he opined on what a French Court would do on the issues before me, were inadmissible.

107. It is not profitable to debate precisely where the dividing line lay on admissibility. However, I have little doubt that the reason why the Professor was invited to express views on the application of the French law principles to the facts was so that his evidence could be deployed, as it was, before HHJ Hacon at the form of order (FOO) hearing in Trial A, to provide a foundation for Lenovo’s arguments (a) that the issue Lenovo wished to raise in this case had not been dealt with in Optis F and (b) the issue could not be resolved without cross-examination.

108. As matters turned out, the force of the evidence which persuaded HHJ Hacon to decline to grant an injunction at the Trial A FOO hearing rather evaporated in cross-examination, during which the Professor accepted it was a question of fact for this Court to determine.

Chinese law

109. Hong Ai gave evidence on Chinese law on behalf of InterDigital.

110. Professor Xiangjun Kong provided equivalent evidence on behalf of Lenovo

US Law

111. Richard S. Taffet provided evidence on US law on behalf of InterDigital and addressed the questions of how US courts approach setting FRAND terms and whether this is settled and various topics referred to in the Statements of Case on US law.

112. Professor Jorge L. Contreras provided evidence on US law on behalf of Lenovo.

113. There was no cross-examination on either Chinese or US law and I was left to read the various reports for myself. This was very interesting, but only revealed a few points which I comment on below.

FACTUAL BACKGROUND

114. What I set out in this section is drawn generally from the evidence and represents my findings.

InterDigital

115. InterDigital was founded in 1972. The following is taken from various of its regulatory filings:

i) Its various subsidiaries engage in technology research and development activities or in the prosecution, maintenance, enforcement and licensing of patents.

ii) Its patents relate to wireless communication technologies and video technologies and as of the 31st of December 2020 its regulatory filing suggests the group held a portfolio of approximately 28,000 patents and patent applications related to wireless to communications, video coding display technology and other areas relevant to the wireless communications and consumer electronics industries. Its patent portfolio is said to comprise patents that are essential or may become essential to cellular wireless standards including 3G, 4G and 5G technologies and other wireless standards including the IEEE 802.11 suite of standards (‘Wi-Fi’) and video codec standards (H.265/HEVC).

iii) InterDigital says it monetises such technologies through licensing and other revenue opportunities with the vast majority of its reported revenues earned from licensing products that allegedly incorporate InterDigital’s wireless technology patents including mobile devices such as cellular phones, tablets, notebook computers and wireless personal digital assistants; wireless infrastructure equipment; modems and components; dongles and modules for wireless devices and Internet of Things devices.

116. It is clear from data presented by Mr Meyer that InterDigital has an uneven geographical distribution of patent rights. For example, on Mr Meyer’s analysis InterDigital had the highest number of distinct patent families in the United States, with a total of 543 patent families, with Taiwan in second place with 357 distinct patent families, followed by Japan with 354 and China with 334. Germany, the UK, France and the Netherlands sit around the 250-260 mark. Argentina and Mexico are around the 150 mark, with Canada, Israel and Australia in the 110’s. After that, there is a long tail of countries with fewer than 100 distinct patent families: 3 in the 90’s, 8 in the 60’s by way of example, before the final 11 countries who have less than 10 distinct patent families, of which the last 5 have only 1 distinct patent family. Mr Meyer presented a heat map of InterDigital’s global patent coverage and, as he observed, the InterDigital Declared Cellular SEP Portfolio is most heavily concentrated in the US, China, Europe, Taiwan, Japan and South Korea. By contrast, InterDigital has relatively few patents in South and Central America, India, South East Asia, the Middle East and Africa.

The development of InterDigital’s licensing ‘program’

117. Mr Merritt described the mobile phone industry as nascent, at the time when he joined InterDigital in 1996, with only a very small number of companies engaged in technology development and licensing. He related that InterDigital were approached by a consultant representing a group of some 20-25 handset manufacturers who had come together to gain a better understanding of the licensing environment for GSM/2G, under the umbrella of the International Telecommunications Standards User Group (ITSUG).

119. These early developments are important, because Mr Merritt said those foundational concepts (developed in 2G licensing) remained part of the InterDigital ‘program’ from 1997 to 2019, even though he acknowledges that the rates and terms evolved over time.

120. InterDigital began to license 3G technology in the early 2000’s. Mr Merritt said that many market participants negotiated 3G licences with InterDigital because (a) they were familiar with their practices from 2G; (b) InterDigital’s long history of offering terms for essential patents that Mr Merritt contended were consistent with FRAND; (c) InterDigital’s ‘heavy’ participation in and contribution to 3G Standards and (d) InterDigital’s 3G portfolio. InterDigital adopted 3G rates which were based on but slightly higher than their 2G rates, but still in the 1-2% range, and subject to the same discounts.

121. Mr Merritt says that they went through a similar process in 2009 for formulating their 4G rates, using their 3G rates as a foundation but again increasing the rates ‘as a starting point for negotiations for LTE products’. In both cases, Mr Merritt considered the premium was justified because all licences are usually multimode: so a 3G licence included 2G and a 4G licence is usually a 4G/3G licence.

122. Over the period from 1997-2019 (which I note is a long period of time in the fast-changing world of cellular technology), Mr Merritt referred to a number of ‘significant changes and challenges in the mobile industry and in the licensing environment’. I need to take account of these later, so I will summarise his points.

123. First, he said that unit volumes were continuing to grow significantly. He said this presented a unique dichotomy. He attributed the rise in part ‘to the incredible success of companies like InterDigital in developing the wireless technologies’. New applications and services were developed leveraging this technology. Mr Merritt continued:

‘Given this, one would expect that everyone would place a high value on the inventions driving this technology. It is therefore strange that at the same time as wireless technologies became ever more important they also started to be viewed as a commodity and there began to be push-back, and downward pressure from some in the industry, on the royalties that the developers of wireless technology were receiving.’

125. Third, Mr Merritt said the Chinese manufacturers began to enter the mobile device market, focussing first on domestic sales and then slowly moving into the international market. He said they had a lack of experience of IP and a very different view of pricing of IPRs. As his example, he said they were the first to insist on a different, lower royalty structure for China, with the Chinese government also pushing the same concept. He said the result was downward pressure on royalties and the emergence of arguments on regionalisation.

127. Against that rather InterDigital-centric backdrop, in order to get into more specific matters, it is necessary to start with an understanding of what Mr Grewe meant when he referred in his witness statements to the ‘program’:

‘Where I refer below to the ‘program’ I am referring to the body of information comprising the company's position as to the rates, caps, floors and discounts that were used as the basis for its offers to third parties at any particular time to ensure that we kept within the parameters of InterDigital's licensing activities. There was not a single document that encapsulated the 'program'. Instead it was a body of information which was known and followed by those of us who were involved in licensing and would have been incorporated in opening offers. As I will explain below the program also developed over time to reflect the deals we were concluding.’

128. Next, it is clear from Mr Grewe’s evidence that the ‘program rates’ from time to time were InterDigital's undiscounted ‘program rates’ as presented in their opening offers to companies.

129. Thus, in 2011, he said that InterDigital’s opening offers to companies were those which were set out in [….. …….], being 1% for 2G, with a $0.75 floor, 2% for 3G and 4G only devices, with a $1.50 floor, and 2.5% for 4G multimode devices with a $2.50 floor. Then:

‘I recall that shortly after this, in 2012, we entered into the agreement with RIM / Blackberry and the rates, caps and floors set out in that agreement, together with the volume discount table referred to in our opening offer, became the new ‘benchmark' for the program.’

130. RIM had previous PLAs with InterDigital in 2003 and 2007. RIM 2012 took just over a year to negotiate and agree. It covered 2G, 3G and 4G handsets, various other devices and infrastructure. It had an effective date of 1 January 2013 and a five-year term. It was a running royalty licence with the following rates:

i) 3G (CDMA2000) ██% of the ASP of ‘Basic Communication Devices’, with a floor of $███ and a cap of $███;

ii) 3G (excluding CDMA 2000) ██% of the ASP of ‘Premium Communication Devices' with a floor of $███ and a cap of $███;

iii) 4G-only: ██% of the ASP of ‘Premium Communication Devices’ with a floor of $███ and a cap of $███;

iv) 4GMM: ███% of the ASP of ‘Premium Communication Devices’ with a floor of $███ and a cap of $███.

131. The parties agreed that for 2013, the prices for the Basic and Premium devices would be $████and $████, with prices for future years based on data from internationally recognised organisations.

132. There was a prepayment credit of $███m from the prior PLA and RIM agreed to make a mandatory pre-payment of $███m, based on projections and agreed discounts for the first two years of the term, but which included a release on past 4G only and 4GMM sales (up to a limit of 10,000 devices).

133. Mr Bezant calculated LER per unit rates of 3GMM at $1.56 and 4GMM at $2.11.

‘We also have a number of discounting structures which form part of InterDigital's licensing program which we look to when negotiating a license and assessing internally whether that license is aligned with our licensing program. I have set out some of them below. Our rate and discounting structure has changed over time in an effort to provide additional transparency. For example, historically we used primarily a volume discount approach where a discount was applied to all sales as a licensee hit various volume thresholds. The volume discount used in the 2011 - 2018 time-frame was derived using a company's three year aggregated projected volume against a discount table for the projected 3 year volumes of a company. That discount was then applied across the term of the agreement. Since then, the volume discount has been arrived at by looking at a company's volumes by individual years and the volume from the discount table is arrived at by looking at the various volume thresholds within a given year (much like a US income tax table) to provide incremental discounts levels as the annual volumes increase.’

135. A volume discount table was included in InterDigital’s initial offer to RIM, but Mr Bezant assumed it only applied to LS licences and not to RR licences like RIM 2012. Although I am uncertain whether the document dates from InterDigital’s initial offer to RIM, in InterDigital’s disclosure, document F143 contains a table which is said to be the RIM volume discount table. The discounts are based on ‘Guaranteed Unit Volume’ over a 3-year period. If that volume was less than 5m units, the discount was 0%; volumes between 5 and 10 million attracted a discount of 3%. The size of the discount rose with increasing volumes, so for example, volumes between 25 to 100 m units attracted a 20% discount, 400-500m: 50%; 500-999m: 60% and >1 bn units: 75%.

136. Mr Grewe said they had to extrapolate the table for Samsung 2014 because Samsung’s 3-year volume was predicted to be in the ███ range. Samsung qualified for an 80% volume discount.

137. The RIM volume discount table was used from 2013 to about 2018. Mr Grewe said they moved at the end of 2019 to more of a ‘tax table’ type structure for volume discounts, as part of the move to InterDigital’s new programme for licensing. A copy of the ‘tax table’ was set out in the January 2020 offer to Lenovo:

138. Using the example in the January 2020 offer letter, for an annual sales volume of 45m units, the top 5m units would attract a 20% discount, the 20-40m tranche a discount of 10% and the first 20m units, 0% discount.

139. From 2020 onwards, InterDigital published its ‘rates per standard’ on its website. Mr Grewe said that meant that InterDigital did not have to wait for a NDA to be agreed and signed before making an opening offer.

|

|

Technology |

Rate |

ASP Floor |

ASP Cap |

|

|

3G |

0.40% |

US $40.00 |

US $100.00 |

|

4G |

0.50% |

US $50.00 |

US $200.00 | |

|

5G |

0.60% |

US $60.00 |

US $200.00 |

140. The website makes certain additional points clear:

i) These are the ‘program rates’ currently available for a SEP licence for handsets.

ii) The rates are ‘for informational purposes only, does not constitute a binding offer, and is subject to additional terms and conditions and execution of a definitive [PLA]’

iii) The pricing is for new licensees, covering sales from 1 January 2020.

iv) For ‘qualifying new handset licensees, additional discounts may apply based on duration of the agreement, product volumes, payment timing and structure, special market considerations and other factors.’

141. Before and after the 2020 rates were published, InterDigital applied a range of discounts in addition to the volume discounts. Mr Grewe discussed these in more detail in his second witness statement. Before doing so, he described how they might be applied. The following extracts give a flavour of his evidence on this point:

‘6. In preparing an offer to a prospective licensee InterDigital will, based on the information it has about a licensee and the proposed structure of the license, assess whether the prospective licensee may be eligible for certain discounts. A licensee may be eligible for discounts in accordance with InterDigital's licensing program based on a variety of factors. …

7. Prior to the publication of InterDigital's licensing program rates in 2020, the application of a discount in an opening offer, and whether that was explicitly stated, would depend on the level of discussions that had taken place before the opening offer was made, whether an NDA was in place, and how much we knew about the prospective licensee and the structure of licence they were looking for. Often, the opening offer (which would usually be running royalty but may set out both a running royalty and a lump sum or fixed fee offer - what is set out will depend on what conversations have already taken place) would set out the undiscounted rates and would state (either in the offer itself or the meeting discussing the offer) that discounts may be applied depending on certain factors (i.e. those outlined above). As aspects of the agreement were better understood during subsequent discussions, such as the length of term, type of payment structure and timing etc., the related discounts would be included in future offers, even if this was not explicitly stated in the opening offer…

8. I cannot think of an example of where a licensee might be eligible for a type of discount but was not offered it during the course of the discussions / negotiations, and cannot think of any reason why that would be the case. However, as is also explained in more detail below, any resulting discount calculated based on an initial assessment of eligibility is a starting point in the negotiations and may well be subject to change as the structure of the license becomes more clear (for example changes could be made to address information conveyed by the licensee and/or information that emerges from other sources), and as the top line number and payment structure of the license is negotiated between the parties.’

142. From these extracts and the one quoted in paragraph 134 above, I was left with the distinct impression that a licensee may well not be aware of the specific discounts which InterDigital included in various offers and that there was no guarantee that the discounts were uniformly applied. It was clear both from Mr Grewe’s evidence and from Mr Merritt’s evidence that InterDigital regard discounts as mechanisms which they can adjust in order to reach an agreed PLA.

143. The various discounts discussed by Mr Grewe in detail in his second witness statement are:

i) Fixed-fee discount: a licensee would be eligible for a fixed fee (FF) discount if it entered into a lump sum or fixed fee licence.

ii) Time value of money discount: typically around 10% per annum but higher at certain points, and in part based on InterDigital’s cost of capital. Mr Grewe described the FF discount as accounting for the value InterDigital places on the certainty of the sum they receive, whereas the Time Value of Money discount accounts for the increased value InterDigital places on money received today rather than in the future.

iii) Term discount: a licensee would be eligible for a term discount if it agreed to a licence of 3 years or more in length, with the discount increasing from 3% at 3 years to a maximum of 10% at 10 years.

iv) Pre-payment discount: which only applied to RR licences where sums were paid in advance.

v) Volume discounts: as above, although Mr Grewe stated that for LS licences, the volume discount was incorporated into the lump sum using sales forecasts. He also said he didn’t recall working on any RR agreements under the new programme prior to his departure from InterDigital on 2 April 2021. I note that Mr Bezant assumed that the volume discounts did not apply to RR licences, and there is no indication that anyone from InterDigital indicated he was mistaken.

vi) Regional Sales Mix Discount: a licensee is eligible if a proportion of their products are manufactured and sold in China primarily for use in China (‘China-only products’), which are subject to a 50% discount. Mr Grewe also mentioned Panasonic 2013 as an example where different 3G and 4G rates were set as between Japan and the Rest of the World. It appears a similar arrangement was provided in Panasonic 2017. I assume these Panasonic arrangements were the result of Panasonic being a ‘local king’ in Japan, so I need not consider them further.

vii) Renewal Discount: this is a discretionary discount, both in terms of when it might be offered and, if offered, the amount. Mr Grewe said the discount was something in the range of 5-20% and was available to be offered if a licence was renewed early or about the time a previous licence was expiring. He indicated that any discount was determined on a discretionary basis, taking account of the cost of litigation and the other party’s behaviour, such as their litigious and negotiating history.

144. Following receipt of Mr Grewe’s first witness statement, Lenovo requested a list of the discounts actually applied (and how they were determined in each case) if they were not determined in the same way for each licensee. I assume the request concerned each of the pleaded PLAs. Mr Grewe began his response to this request as follows in his second witness statement: