Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Patents Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Patents Court) Decisions >> Renaissance Technologies Plc v Comptroller General of Patents, Designs and Trade Marks [2021] EWHC 2020 (Pat) (27 July 2021)

URL: http://www.bailii.org/ew/cases/EWHC/Patents/2021/2020.html

Cite as: [2021] EWHC 2020 (Pat)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2021] EWHC 2020 (Pat)

Case No: CH-2021-000024

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

APPEALS (ChD)

PATENTS COURT

ON APPEAL FROM THE INTELLECTUAL PROPERTY OFFICE

HEARING OFFICER MS J PULLEN

7 Rolls Building

Fetter Lane

London, EC4A 1L

Date: 27 July 2021

Before:

MR JUSTICE ZACAROLI

- - - - - - - - - - - - - - - - - - - - -

Between:

|

|

RENAISSANCE TECHNOLOGIES PLC |

Appellant |

|

|

- and - |

|

|

|

COMPTROLLER GENERAL OF PATENTS, DESIGNS AND TRADE MARKS |

Respondent |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Nick Zweck (instructed by Clyde & Co LLP) for the Appellant

Anna Edwards-Stuart (instructed by Government Legal Department) for the Respondent

Hearing dates: 16 July 2021

APPROVED JUDGMENT

Covid-19 Protocol: This judgment is handed down remotely by circulation to the parties’ representatives by email, release to BAILII and publication on the Courts and Tribunals Judiciary website. The date and time for hand-down is deemed to be NB 10:30 AM on 27th July 2021.

Mr Justice Zacaroli:

Introduction

1. This is an appeal from the decision of a Hearing Officer, Ms J Pullen, (the “Hearing Officer”) of the United Kingdom Intellectual Property Office (“UKIPO”) dated 15 January 2021 (the “Decision”).

2. By the Decision, the Hearing Officer found that the Appellant’s patent application GB 1 505 456.2, published as GB 2 529 011A (the “011 Application”), was excluded from being patentable under section 1(2) of the Patents Act 1977 (the “1977 Act”) as (1) a method for doing business and (2) a program for a computer, as such. Accordingly, she refused the Appellant’s application for a patent pursuant to section 18(3) of the 1977 Act.

3. The Appellant requests that this Court set aside the Decision and remit the 011 Application to the UKIPO for further processing.

The 011 Application

4. The invention claimed in the 011 Application relates to computer-based financial trading systems. It is designed to address the following problem. When a trader (Trader A) places a large order which cannot be cost-effectively fulfilled by a single financial exchange, the trader may divide the order into smaller orders which are routed to separate exchanges. Because, however, the physical distance between Trader A and each of the relevant exchanges is different, and because the orders are placed over different communication links/networks, the separate orders are likely to arrive at the different exchanges at slightly different times. That is due to a combination of latency (caused by the signal travelling further to the more distant exchanges) and different congestion over different communication links/networks. The difference in arrival times, although small, is sufficient to enable institutions that implement high frequency trading to detect the first order before the other orders have arrived at the other exchanges. That enables such institutions to purchase the relevant financial instruments and sell them on (to Trader A) at the other exchanges at a higher price.

5. The claimed invention addresses this problem through a combination of co-location of servers (at or near each of the relevant exchanges) and utilising stored timing information provided to these co-located servers. This enables the co-located servers to place orders at each of the exchanges substantially simultaneously.

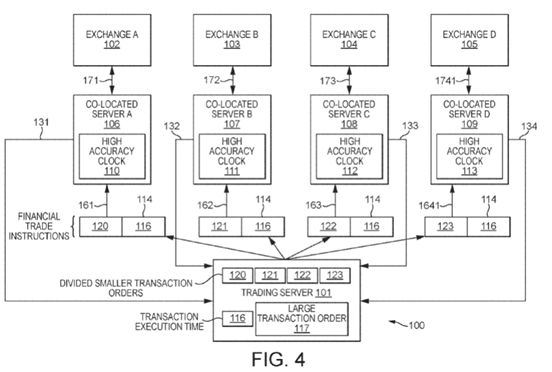

6. In the following diagram, taken from the 011 Application, 101 represents Trader A’s server. The large financial trade (117) is divided into four separate orders (120-123). Each of these is sent together with an execution time (116) to four servers (106-109), each with a high-accuracy clock, located on the same site or near the respective exchanges (102-105).

7. The 011 Application contained five separate claims: claims 1, 26 and 35 to computer-based methods and claims 11 and 21 to computer-based systems. It is common ground that they all stand or fall together, so it is only necessary to consider claim 1. I take the detail of claim 1, broken down into integers for convenience, from the skeleton filed on behalf of the Comptroller:

|

“1A |

A computer-based method configured and adapted to execute synchronized financial trading in an electronic trading environment that includes a plurality of financial exchanges, |

|

|

the method comprising acts of: |

|

1B |

storing, by a trading server, a large transaction order; |

|

1C |

dividing, by the trading server, the large transaction order into a plurality of smaller transaction orders; |

|

1D |

determining, by the trading server, a transaction execution time at which the plurality of smaller transaction orders are to be submitted for execution; |

|

1E |

generating, by the trading server, a plurality of financial trade instructions, each of the plurality of financial trade instructions containing a respective one of the smaller transaction orders and the transaction execution time; |

|

1F |

transmitting, by the trading server, each of the plurality of financial trade instructions to a respective one of a plurality of co-located servers, the plurality of co-located servers being respectively co-located at financial exchanges where respective smaller transaction orders are to be executed; |

|

1G |

storing, by each of the plurality of co-located servers, the respective smaller transaction order and the transaction execution time contained in the transmitted respective financial trade instruction; |

|

1H |

determining, by each of the plurality of co-located servers, a current time; and |

|

1I |

comparing, by each of the plurality of co-located servers, the determined current time and the stored transaction execution time, |

|

1J |

and when the determined current time is equal to the stored transaction execution time, each of the plurality of co-located servers submitting the stored smaller transaction order to the financial exchange where it is co-located, whereby the plurality of smaller transaction orders are received at their respective exchanges substantially simultaneously.” |

The Law

8. The parties were largely agreed as to the applicable law.

9. Section 1(2) of the 1977 Act provides as follows:

(2) It is hereby declared that the following (among other things) are not inventions for the purposes of this Act, that is to say, anything which consists of –

…

(c) a scheme, rule or method for performing a mental act, playing a game or doing business, or a program for a computer;

…

but the foregoing provision shall prevent anything being treated as an invention for the purposes of this Act only to the extent that a patent or application for a patent relates to that thing as such.”

10. In Aerotel Ltd v Telco Holdings Ltd [2006] EWCA Civ 1371; [2007] RPC 7, Jacob LJ at [40], giving the judgment of the Court of Appeal, set out a four-stage test to be applied when considering whether a patent application is excluded by section 1(2)(c) of the 1977 Act:

“(1) properly construe the claim;

(2) identify the actual contribution;

(3) ask whether it falls solely within the excluded subject matter;

(4) check whether the actual or alleged contribution is actually technical in nature”

11. Jacob LJ expanded on the parts of the test at [42] to [47]:

“[42] No-one could quarrel with the first step—construction. You first have to decide what the monopoly is before going on [to] the question of whether it is excluded. Any test must involve this first step.

[43] The second step—identify the contribution—is said to be more problematical. How do you assess the contribution? Mr Birss submits the test is workable—it is an exercise in judgment probably involving the problem said to be solved, how the invention works, what its advantages are. What has the inventor really added to human knowledge perhaps best sums up the exercise. The formulation involves looking at substance not form—which is surely what the legislator intended.

[44] Mr Birss added the words “or alleged contribution” in his formulation of the second step. That will do at the application stage—where the Office must generally perforce accept what the inventor says is his contribution. It cannot actually be conclusive, however. If an inventor claims a computer when programmed with his new program, it will not assist him if he alleges wrongly that he has invented the computer itself, even if he specifies all the detailed elements of a computer in his claim. In the end the test must be what contribution has actually been made, not what the inventor says he has made.

[45] The third step—is the contribution solely of excluded matter?—is merely an expression of the “as such” qualification of Art.52(3). During the course of argument Mr Birss accepted a re-formulation of the third step: Ask whether the contribution thus identified consists of excluded subject matter as such? We think either formulation will do—they mean the same thing.

[46] The fourth step—check whether the contribution is “technical”—may not be necessary because the third step should have covered that. It is a necessary check however if one is to follow Merrill Lynch as we must.

[47] As we have said this test is a re-formulation of the approach adopted by this court in Fujitsu: it asks the same questions but in a different order. Fujitsu asks first whether there is a technical contribution (which involves two questions: what is the contribution? is it technical?) and then added the rider that a contribution which consists solely of excluded matter will not count as a technical contribution.”

12. Further guidance by way of useful, non-prescriptive, "signposts” for determining whether the claimed invention constitutes a “technical effect” that lies solely in excluded matter, was initially provided by Lewison J in AT & T Knowledge Ventures LP’s Patent Application [2009] EWHC 343 (Pat), at [40]. These are (following reformulation by Lewison LJ in HTC Europe Co Ltd v Apple Inc [2013] EWCA Civ 451; [2013] RPC 30, at [50]) as follows:

“i) whether the claimed technical effect has a technical effect on a process which is carried on outside the computer;

ii) whether the claimed technical effect operates at the level of the architecture of the computer; that is to say whether the effect is produced irrespective of the data being processed or the applications being run;

iii) whether the claimed technical effect results in the computer being made to operate in a new way;

iv) whether the program makes the computer a better computer in the sense of running more efficiently and effectively as a computer;

v) whether the perceived problem is overcome by the claimed invention as opposed to merely being circumvented.”

13. It is also common ground that this appeal is to be conducted as a review, as opposed to a rehearing, and, as such, before interfering with the Decision, the Court must be satisfied that the Hearing Officer erred in law or was otherwise clearly wrong: REEF Trade Mark [2003] RPC 4 (CA), per Robert Walker LJ at [17] to [28]. At [26], Robert Walker LJ noted that the degree to which an appeal court will be reluctant to interfere with the trial judge’s evaluation of and conclusion on primary facts would vary, among other things, with the standing and experience of the fact-finding judge or tribunal. In this case, where the Hearing Officer is experienced in a specialist field, an appeal court should be reluctant (albeit not to the very highest degree of reluctance) to interfere (see [28] of REEF Trade Mark).

The Decision

14. The Hearing Officer cited both Aerotel and AT & T for the relevant principles of law, noting (at [14]) that the “signposts” in the latter case were just that - “a non-exhaustive list of factors that can indicate, in some cases, whether a particular contribution may be technical.”

15. There was (and is) no issue as to the first of the Aerotel steps, as there is no difficulty in construing the claims.

16. At [16] to [28] the Hearing Officer reviewed the opinion of the examiner (who determined that the hardware was a conventional arrangement of networked computers and that the contribution lay in the functionality or method performed by the hardware not in the hardware itself) and the contentions of the Appellant’s attorney. She was referred to prior art in the form of documents relating to three US patents, two of which (relating to “Schluetter” and “Vinokour”) she analysed.

17. At [25], she condensed the question posed (in light of the Aerotel test) as “essentially, what it is the inventor has really added to human knowledge, looked at substance, not form.” At [26], she identified the primary problem solved by the invention as “that of cost-effectively fulfilling large orders on financial exchanges” and that the claimed invention addressed the problem by “sending smaller orders to computers associated with each financial exchange and delaying all the smaller orders until a predetermined execution time.”

18. The core of her decision as to the second of the Aerotel steps is at [27] to [28] which, given that these were the focus of the Appellant’s attack on the Decision, I set out in full:

“27. The application describes a trading system which uses conventional computers connected via a conventional network and uses this arrangement to perform the method described. Whilst the particular arrangement of computers involved in the system and method may not have been used in previous trading systems, the computers, and their arrangement, are conventional per se. I believe that it is conventional to locate trading servers near exchanges to reduce communication times and gain a financial advantage. Even if that is not the case, I do not regard the physical proximity of the servers and exchanges, in itself, as giving rise to a contribution as it is common knowledge that reducing the physical distance will reduce the time lag/delay. Providing timing data as part of instructions to distributed servers so that they simultaneously execute code is known as illustrated in US 2013/0110700 A1 (Schluetter) figure 2 of which shows a packet 64 with timing data 68, client device information 66 and data 70.

28. When considering all of these factors I believe what has been added to the sum of human knowledge is the overall trading system, rather than a computer system per se. Therefore, I consider the alleged contribution to be:

A trading system to cost-effectively fulfill large orders in an electronic trading environment that includes a plurality of financial exchanges by:

dividing a large order into a plurality of smaller orders;

transmitting a plurality of trade instructions each containing one of the smaller orders and a transaction execution time to a plurality of servers each associated with one of the financial exchanges;

receiving and storing the trade instructions at the plurality of servers;

and, submitting the smaller orders to the associated exchange when the current time is the transaction execution time, whereby the smaller orders are placed substantially simultaneously.”

19. At [30] to [34], the Hearing Officer considered the “business method” exclusion. She cited Halliburton Energy Services Inc [2011] EWHC 2508 (Pat), where Birss J noted that business method cases can be tricky to analyse by just asking whether the invention has a technical effect or makes a technical contribution, because computers are self-evidently technical in nature. Thus, patentees may argue that a computer is a faster, more efficient computerized book-keeper than before, and that is a technical effect or technical advance. He said, however:

“And so, it is, in a way, but the law has resolutely sought to hold the line at excluding such things from patents. That means that some apparently technical effects do not always count. So a computer programmed to be a better computer is patentable (Symbian) but as Fox LJ pointed out in relation to the business method exclusion in Merrill Lynch, the fact that the method of doing business may be an improvement on previous methods is immaterial because the business method exclusion is generic.”

20. In reliance on this passage, at [34] the Hearing Officer concluded that the 011 Application was excluded as a method for doing business as such: “Even if the contribution can be regarded as producing a new result in the form of an improvement over prior art trading systems, it is still a trading system. It is a system for doing a specific business, trading in securities, which is rooted in the method of doing that business.”

21. At [35] to [45], the Hearing Officer also concluded that the 011 Application was excluded as a program for a computer as such, having regard to the five signposts from AT & T.

Grounds of Appeal

22. The primary submission of Mr Zweck, who appeared for the Appellant, was that the Hearing Officer failed correctly to identify the alleged technical contribution made by the 011 Application. He submitted that she should have found that the technical contribution is:

“…a computer-based method/computer system which allows a plurality of orders to be placed at a plurality of financial exchanges substantially simultaneously by a combination of co-locating servers at the relevant financial exchanges and utilising stored transaction timing information provided to those co-located servers by the originating trading server so as to place orders at those exchanges substantially simultaneously.”

23. In particular, he identified the following as errors in the Decision:

(1) By repeated use of the phrase “cost-effective” throughout the Decision, the Hearing Officer demonstrated that she was confusing the alleged contribution with its economic purpose;

(2) Her description of the alleged contribution was flawed in that she referred to the servers as “associated with” the relevant financial exchanges, as opposed to being “co-located” with them;

(3) The Hearing Officer’s analysis that the arrangement of computers was conventional and that the provision of timing data as part of instructions to distributed servers so that they simultaneously execute code was “known” was flawed, both because she misinterpreted the prior art (in particular Schluetter) and because there was no proper basis for these conclusions. It was not permissible, he submitted, for the Hearing Officer to reason from “first principles” (i.e. that reducing distance between two computers would ensure a faster signal between them).

24. I do not accept that these constituted errors of law or that they demonstrate the Decision was clearly wrong.

25. As to the first point, the essence of the technical problem as identified in the 011 Application was that of latency and congestion. The result of different orders (forming part of one larger order) being received by different financial exchanges at different times (due to their respective geographical locations) is that high frequency traders can determine at which exchanges orders will arrive later. To their advantage, they then purchase those types of instruments ahead of the late-arriving orders, in order to sell them on to the trader who placed the order for a higher price. The corresponding technical solution proposed by the 011 Application is aimed at eliminating the time differential, thereby preventing the tip off to high frequency traders and any consequent price increase. The Hearing Officer's references to this being "cost-effective" were in my view merely a short-hand explanation of the resultant effect the invention is claimed to make. As such, in the critical paragraph of the Decision, I do not regard her use of the phrase "cost-effective" as evincing any confusion between the contribution and its economic effect: she is simply including the effect in her definition.

26. As to the second point, I see no relevant distinction between “co-located” and “associated with”. I have no doubt that the Hearing Officer well understood the importance of the geographical location of the servers as part of the alleged contribution. She used the phrase “co-located” in describing the invention at [6] of the Decision. Conversely, the 011 Application itself uses both the phrase “co-located at” and “associated with” an exchange apparently interchangeably: see (57) of the Application and paragraph [20] of the Detailed Description of the Invention. Moreover, it is clear that “co-located” is not used in the 011 Application to refer to servers that are situated only within the relevant exchanges; paragraph [20] of the Detailed Description of the Invention refers to servers either “at the same site where the exchange is located” or “at an area in close proximity to the exchange”.

27. As to the third point, Mr Zweck subjected paragraph 27 of the Decision to detailed criticism. He submitted that there is an internal inconsistency in the second sentence between the following phrases: (1) “whilst the particular arrangement of computers involved in the system and method may not have been used in previous trading systems” and (2) “the computers, and their arrangement, are conventional per se”. He then submitted that the Hearing Officer’s conclusions as to the arrangement of the servers being conventional was based not on prior art (which - if supported by the prior art - would have been permissible), but on her perception of what is “obvious”. Obviousness, he submitted, is not a question the Hearing Officer was required to consider at this stage. He also submitted that, to the extent that she was relying on the prior art, she misconstrued it.

28. I do not accept there is any inconsistency in the second sentence of [27] of the Decision. The Hearing Officer was there drawing a distinction between the computers and their arrangement which, as disclosed by the prior art, was conventional, and their use specifically in connection with financial trades, which was not. Mr Zweck submitted that, had the Hearing Officer been basing this conclusion on the prior art, she would have said so. Her Decision, however, must be read as a whole. As I have pointed out, in the preceding paragraphs of the Decision, the Hearing Officer did indeed refer to the prior art to which she had been directed, including in particular the US patent Schluetter. She goes on to refer to Schluetter in the last sentence of [27], as evidence of the fact that providing timing data as part of instructions to “distributed servers” so that they “simultaneously execute” code was “known”. Her reference to “distributed servers” (as is clear from her description of Schluetter at [21] of the Decision) is to those that are “associated with” or “co-located” with other computers to which messages are to be sent. I also have no doubt, reading [27] as a whole, that her reference to it being common knowledge that reducing physical distance between computers reduced the time delay was based - at least in part - on the fact that Schluetter adopted that technique for the very purpose of reducing time delay. She was not, therefore, relying solely on her understanding of first principles in this respect.

29. Mr Zweck submitted that it was nevertheless impermissible to rely on Schluetter as relevant prior art, because it did not relate to the sending of orders for financial trades from a customer to a financial exchange. Instead, it related to the sending of information by an exchange to its numerous customers. In agreement with Ms Edwards-Stuart, who appeared for the Comptroller, this confuses the alleged technical contribution (the co-location of servers combined with stored timing information) with the business use to which it is put (sending trades from a customer to an exchange, or sending information from an exchange to customers). Indeed, Mr Zweck himself submitted that a helpful way of framing the technical contribution made by the 011 Application was “…if one strips out the language of placing trades on financial exchanges, what one is doing is facilitating the delivery of simultaneous electronic signals at multiple receiving servers by a combination of allocating those servers, receiving servers, and utilising stored time information provided to them from the originating server.”

30. Nor do I accept that the Hearing Officer misconstrued Schluetter. Mr Zweck submitted that the nature of the co-location of servers in Schluetter was significantly different to that in the 011 Application. In the former case, the servers were co-located with multiple client computers, by being situated in the same city, or even country, as the customers, whereas in the latter, the servers were co-located with a particular exchange. Again, I do not accept that this is a material difference in terms of the technical contribution of the 011 Application over the prior art. I have already pointed out that the precise degree of “co-location” of servers in the 011 Application is not specified (the servers may be either “at” or “in close proximity to” the relevant exchange, with no further elaboration of how close the proximity should be). In Schluetter, there are repeated references to the relevant servers being “local” or “geographically close to a concentration of client devices, such as the same city or country”. While the precise degree of proximity may be different as between Schluetter and the 011 Application, I do not regard that as being an essential aspect of the alleged technical contribution: the essential point is that by locating servers in multiple locations, each close to a computer or computers that is/are the intended recipient of the electronic signal, the problem of time differential (as a result of latency and congestion) is overcome.

31. Accordingly, I reject the contention that the Hearing Officer fell into error in defining the alleged technical contribution of the 011 Application.

32. Mr Zweck further submitted that the Hearing Officer erred in law in determining that the 011 Application fell solely within the “method of doing business” exclusion. This, he submitted, was as a consequence of her errors in identifying the alleged contribution. Given that I have rejected the premise, I can deal with this aspect quite shortly. I accept (as Mr Zweck pointed out) that merely because an invention (comprising some form of technical solution to a technical problem) is used in business, it does not follow that the invention falls within the business method exclusion. That, however, is not an error the Hearing Officer made. She did not conclude that because the 011 Application was used in relation to a trading business it was therefore a method of doing business. Instead she concluded (upholding the conclusion of the examiner) that the 011 Application was itself a system for doing a specific business, that system comprising breaking up an order into smaller orders delivered simultaneously at multiple exchanges.

33. As to the AT&T “signposts”, it was accepted before the Hearing Officer that the first was of no help to the Appellant, because there was no effect outside the computing arrangement. In my view, the second, third and fourth signposts do not assist in this case. In agreement with Birss J in Lenovo (Singapore) PTE Ltd v Comptroller General of Patents at [23], they are really concerned with the “better computer” cases, which is not this case.

34. As to the fifth signpost (whether the perceived problem is overcome by the claimed invention as opposed to merely being circumvented), the Hearing Officer concluded (at [44]) that it was not met, because (whether or not the 011 Application overcame, or simply avoided, the technical problems of latency and congestion) the problem which it addressed was a business problem and not a technical problem. I consider that the Hearing Officer overstated the position in this paragraph and thus was in error in describing the only problem as being a business problem. I prefer the analysis of the examiner (cited at [42] of the Decision) and of Ms Edwards-Stuart for the Comptroller that, while there is a technical problem, it is avoided rather than overcome by the solution adopted in the 011 Application. This can be tested by an example discussed during the hearing. The technical problem is one of latency and congestion in the sending of an electronic signal over distance, resulting in the signal arriving at different times at different locations. An invention of a new type of alloy, over which the signal travelled so fast that the differences in time over different distances would be imperceptible, could properly be described as a technical solution that overcame the problem of latency and congestion. In contrast, the solution in the 011 Application involves no technical solution in that sense. Instead, it works around the problems of latency and congestion by moving servers close to the relevant exchanges at which the signal is to be received. Accordingly, although I consider there is an error in the reasoning in [44] of the Decision, it does not undermine the Hearing Officer’s conclusion that signpost (v) does not assist the Appellant. More importantly, particularly since the signposts are intended only as a guide and are not prescriptive, it does not undermine the overall conclusion that the 011 Application is excluded as a method of doing business.

35. For completeness, I note that Mr Zweck relied on Lenovo (above) for the proposition that the bar for avoiding the business method exclusion by deploying an existing piece of ‘kit’ in a new arrangement was not high. Comparison with the facts of other cases is not of assistance (for the reasons Birss J pointed out in Lenovo at [30]). I do not find anything in the reasoning or conclusions in Lenovo to support the conclusion that the Hearing Officer in this case made the errors contended for by the Appellant.

36. So far as the “computer program” exclusion is concerned, Mr Zweck’s argument was also based on the premise that the Hearing Officer erred in defining the alleged technical contribution (which I have rejected), and no additional points were developed at the hearing. In light of that, and since the Decision is to be upheld in light of the conclusions I have already reached, and the point was not developed at any length during the hearing, I do not think it is necessary to consider this point further.

Conclusion

37. For the above reasons, I dismiss this appeal.