Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> UnipolSai Assicurazioni SAP v Covea Insurance PLC (Rev2) [2024] EWHC 253 (Comm) (09 February 2024)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2024/253.html

Cite as: [2024] Bus LR 664, [2024] EWHC 253 (Comm), [2024] WLR(D) 82

[New search] [Printable PDF version] [View ICLR summary: [2024] WLR(D) 82] [Buy ICLR report: [2024] Bus LR 664] [Help]

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

COMMERCIAL COURT (KBD)

Fetter Lane, London, EC4A 1NL |

||

B e f o r e :

____________________

| UNIPOLSAI ASSICURAZIONI SPA (substituted as Claimant for UNIPOLRE DESIGNATED ACTIVITY COMPANY, IRELAND) |

Case No: CL-2023-000494 Claimant |

|

| – and – |

||

| COVÉA INSURANCE PLC |

Defendant |

|

And Between: |

||

| MARKEL INTERNATIONAL INSURANCE COMPANY LIMITED |

Case No: CL-2023-000132 and CL-2023-000159 Claimant |

|

| – and – |

||

| GENERAL REINSURANCE AG |

Defendant |

____________________

Aidan Christie KC and Jocelin Gale (instructed by DWF Law LLP) for UnipoleRe

Alistair Schaff KC and Simon Kerr (instructed by Slaughter and May) for Covéa

Case No: CL-2023-000132 and CL-2023-000159

Rebecca Sabben-Clare KC (instructed by CMS Cameron McKenna Nabarro Olswang LLP) for Markel

Dominic Kendrick KC and Rebecca Jacobs (instructed by DLA Piper UK LLP) for General Reinsurance

Hearing dates: 11 and 12 January 2024

Draft Judgment Circulated: 30 January 2024

____________________

Crown Copyright ©

- This judgment is given in two appeals brought under s.69 of the Arbitration Act 1996:

- In very broad terms, the appeals raise the following issues:

- The losing parties appealed against those findings. Markel and General Reinsurance consented to both parties having permission to appeal on the point on which they had lost (as recorded in a Consent Order dated 21 March 2023). I granted UnipolRe permission to appeal on 25 October 2023 and, after holding a directions hearing in both cases, I ordered that the hearings should be heard before the same judge on consecutive days, with the parties to both appeals having access to and the ability to make submissions on the materials deployed in the other appeal.

- These remain separate appeals, and the conduct of the arbitral references and (to a lesser extent) the arguments on the appeal differed to some extent. However, the substantial overlap between the issues and the matters relevant to their determination has led me to conclude that I should produce a single judgment resolving both appeals, recognising as appropriate within that judgment the differences between them. While the Markel Award came first in time, the appeal against the Covéa Award involves a single applicant, against an award in which the issues are canvassed at somewhat greater length. For that reason, I have reversed the chronological order of the appeals in this judgment.

- The following principles were common ground in both appeals as to the proper approach of the court to a s.69 application (and, to the extent that they were not, I find that these are the applicable principles):

- The following summary is taken from the Covéa Award, and paragraph references are to the award.

- Covéa provided cover to policyholders engaged in the business of running nurseries and childcare facilities, including under a standard NurseryCare Policy wording ([5]). The NurseryCare Policy "covered the wide miscellany of risks that are commonly found in commercial cover written by a property department"[28], including cover for "business interruption caused by a peril other than physical damage to insured property" [35]), referred to by the Covéa tribunal as "non-property damage business interruption".

- So far as the development of the Covid-19 pandemic is concerned, the tribunal was provided with "a detailed agreed chronology" ([17]) which revealed "[a] growing sense of crisis during the second half of February 2020 leading to an explosion of cases within the UK during the first half of March 2020" ([18]).

- "By 16 March, the date of the Prime Minister's broadcast and his advice to avoid non-essential social contact and travel, to work from home and to avoid all social venues, the number of cases along with the predicted rate of exponential increase in infections were threatening to overwhelm the NHS and to lead to many thousands of deaths" ([18]).

- "By March 2020, the Covid-19 pandemic had swiftly developed into a disaster engulfing the whole of the UK" ([18]).

- It was not until 2 March 2020 that the UK recorded its first death of an individual who had tested positive for Covid-19 and not until 5 March 2020 that Covid-19 was made a "notifiable disease" ([20]).

- On 18 March 2020, SAGE concluded that the evidence "now supports implementing school closures at a national level as soon as practicable to prevent NHS intensive care capacity being exceeded" ([21]).

- The UK Government's instruction to close all schools, colleges and early years facilities in England with effect from Friday 20 March was issued on 18 March 2020 ([21]) and endorsed in law by the Health Protection (Coronavirus, Restrictions) (England) Regulations on 26 March 2020 ([21]). I shall refer to the order of 18 March 2020 as the 18 March Closure Order.

- On 16 April 2020, those restrictions were renewed for a further three weeks ([22]).

- On 1 June 2020, the phased reopening of schools, colleges and nurseries began in England ([22]).

- "On 23 June 2020, the Prime Minister announced the lifting of all restrictions with effect from 4 July (effectively ending the first lockdown)" ([22]).

- By 8 June 2023, Covéa's paid losses under nursery care policies amounted to £69.3m plus £3.2m in loss adjuster's fees, and Covéa sought indemnity for those losses under the Covéa Reinsurance ([5]).

- UnipolRe raised two objections of principle to payment ([6]) which I have outlined at [2] above.

- Those issues of principle were determined by an arbitral tribunal chaired by Michael Crane KC and comprising lawyers with great experience of reinsurance law and the reinsurance industry ([4]).

- In addition to the detailed agreed chronology, both parties called expert evidence on market practice and understanding relevant to the questions of construction before the tribunal ([23]).

- Covéa's principal case was that "the outbreak of cases of Covid-19 in the UK in the period immediately preceding the closure of schools and nurseries on 20 March 2020 was a catastrophe", alternatively that the various government orders or decisions constituted one catastrophe ([39] and [8]) (that case having been introduced by an amendment following the decision of Mr Justice Butcher as to what constituted an "occurrence" in the direct business interruption insurance policies he considered in Stonegate Pub Company Limited v MS Amlin [2022] EWHC 2548 (Comm), [70]).

- The tribunal found that "if the idea of a 'sudden disaster' is inherent in the meaning of catastrophe" then "the exponential increase in Covid-19 infections in the UK during the first three weeks of March 2020 did amount to a disaster of sudden onset such as to qualify as a catastrophe" ([49]), and that "the outbreak of Covid-19 disease in the UK during the few weeks preceding the schools and nurseries closure instruction ... amounted to a large-scale national disaster of sudden onset that may accurately be described as a catastrophe" ([54]).

- The Covéa tribunal held that the various instructions to close schools and nurseries issued by the UK and national governments "cannot be regarded as one or more catastrophes, at least not if they are to be viewed separately from the underlying pandemic to which they were a response" ([74]).

- Construing the "Hours Clause", the Covéa tribunal held that the reference to an "individual loss" in that clause meant "a loss sustained by an original insured which occurs as and when a covered peril strikes or affects insured premises or property" ([95]).

- The following summary is taken from the Markel Award, and paragraph references are to that award.

- Markel wrote a large book of direct insurance of nurseries and childcare facilities which included business interruption cover ([2]), including direct insurance written on the "Social Welfare Combined" wording and on the "Towergate" wording ([11]). The losses covered by the Social Welfare Combined wording included "closure or restriction in the use of the premises due to the order or advice of the competent local authority as a result of … an occurrence of an infectious disease" ([12]). The losses covered by the Towergate wording included extensions for business interruption caused by "access to or use of the Premises being prevented or hindered by (a) physical loss or damage to property in the Vicinity of the Premises …. [and] any action of Government or Police or Local Authority due to an emergency which could endanger life or neighbouring property" and "any occurrence of a Notifiable Disease … at Your Premises … which causes restrictions on the use of Your Premises on the order or advice of the competent local authority" ([13]).

- There was no agreed statement of facts and no expert evidence in the Markel arbitration. The Markel tribunal recorded that on 18 March 2020, the UK Government had announced a decision that "schools, nurseries and such-like childcare facilities would close from the end of Friday 20 March 2020" ([1]), and that following the 18 March 2020 Closure Order, Markel had suffered "a tsunami of claims notifications of business interruption losses" ([11]).

- Markel's paid losses by the time of its statement of claim were £23,620,466, and Markel sought indemnity for those losses under the Markel Reinsurance ([14]). (I am told that by the start of the hearing, the figure was in excess of £31m.) General Reinsurance wrote a 35% line on the reinsurance.

- General Reinsurance put forward two reasons why the Markel Reinsurance did not respond to those losses ([3]) which I have outlined at [2] above.

- Those issues were determined by an arbitral tribunal chaired by Professor Sir Bernard Rix and comprising lawyers with great experience of reinsurance law and the reinsurance industry ([6]-[10]).

- Markel originally contended that "all of the losses arise from the occurrence of cases of Covid-19 within the United Kingdom, or from any one such case" ([22]). However, following Mr Justice Butcher's decision in Stonegate, it amended its case to contend that "all of the losses arise from the UK Government's decision on 18 March 2020 that all nurseries and early learning centres must close with effect from the end of 20 March 2020 … That decision, and therefore all of the losses, arose from the occurrence of cases of Covid-19 within the United Kingdom by 18 March 2020, or from any one such case" ([23]).

- On 20 October 2022, Markel's solicitors confirmed that:

- The Markel tribunal concluded on balance "that the order relied on by Markel may be described as a catastrophe, both in general and for the purposes of this treaty" ([40], [55]), noting "the order cannot be viewed separately from the pandemic which demanded (however controversially) its response" ([55]).

- On the second issue, Markel submitted that the Hours Clause was "concerned with the duration of the catastrophe and causation within the specified hours, but not with the duration of losses" ([33]), and that the words in the Hours Clause "the duration and extent of any 'Event' referred to the duration and extent of the catastrophe, for instance a hurricane, which causes loss", such that the closing words of the clause ("no individual loss from whatever insured peril, which occur outside these periods or areas, shall be included in that 'Event'") "should be read as referring to a 'peril which occurs outside those periods', not to a loss which does so" ([34]).

- Construing the "Hours Clause", the Markel tribunal said that it was "natural to think that business interruption losses occur day by day" ([58]), albeit the issue was thrown into "greater uncertainty" by General Reinsurance's acceptance that business interruption resulting from physical damage "is not only caused but also occurs and is sustained on Day 1" ([58]). The tribunal held that the closing words of the clause were "not … dealing with causation but with the occurrence of a particular loss" and that the "subject-matter of an 'Event', its duration and extent, and its occurrence, are all referenced to losses, not perils" ([62]).

- I have set out the pertinent clauses from the two Reinsurances in Appendix 1. The following principles as to how the construction of those clauses should be approached were common ground:

- In the Markel appeal, Ms Sabben-Clare KC placed particular emphasis on Lord Hodge's statement in Wood v Capita Insurance Services Ltd [2017] UKSC 24, [12], which emphasised the need for an "iterative process by which each suggested interpretation is checked against the provisions of the contract and its commercial consequences."

- I was also referred to various cases discussing the approach to the construction of aggregation clauses in insurance and reinsurance contracts, including the following:

- The parties advanced conflicting arguments as to the perspective from which the application of the aggregation clause was to be approached.

- To the extent it matters, I agree that the approach stated by Mr Justice Butcher is the appropriate one in this context, albeit in the reinsurance context, this is likely to be less significant than in a direct insurance.

- All parties accepted that, in accordance with Investors Compensation Scheme v West Bromwich Building Society [1998] 1 WLR 896, 912-13, I should seek to ascertain the meaning which the Reinsurances "would convey to a reasonable person having all the background knowledge which would reasonably have been available to the parties in the situation in which they were at the time of the contract (save for the parties' previous negotiations and their declarations of subjective intent)."

- As I explain below, the Reinsurers placed emphasis on materials said to show the origins of the word "catastrophe" in the Reinsurances, in the form of:

- It is accepted, rightly, that Mr Kiln's evidence as to his own intentions in drafting "his baby" are not admissible (Blackwell v Gerling [2008] Lloyd's Rep. IR 529, [20]); Lehman Brothers Finance AG (In Liquidation) v Klaus Tschira Stiftung GmbH [2019] EWHC 379 (Ch), [165]-[166]). However, there was a dispute as to the admissibility of the remainder of this material.

- I accept that, in broad terms and with appropriate regard for the limitations on the weight which can be placed on it, the history of a particular market wording, and the events which led to its introduction and modification, do form part of the admissible factual matrix, at least where the contract was entered into by market participants and the materials are reasonably available to the parties (whether they chose to avail themselves of them or not). There is strong academic support for a difference of approach between the admissibility of material of this kind when construing market standard forms on the one hand, and bespoke contracts on the other (see Professor Louise Gullifer KC (Hon), "Interpretation of Market Standard Form Contracts" (2021) JBL 227, 236-238). A number of decisions of the English courts have had regard to material of this kind when resolving disputed issues of constriction. The Reinsurers referred the court to a number of such decisions, including:

- For the purposes of an appeal under s.69 of the Arbitration Act 1996, it seems to me that the existence and content of materials of this kind ought ordinarily to be apparent from the award or the documents referred to in the award. That requirement is satisfied in respect of both awards in this case in relation to Mr Kiln's book. The position is less clear in respect of the account given in Butler & Merkin, but footnote 1 to the Covéa Award appears to be a reference to the Butler & Merkin text, and no distinction was drawn between the two awards in this respect on the appeals.

- Both UnipolRe and General Reinsurance placed reliance on what they said was the market background to the use of the expression "one catastrophe" in property catastrophe excess of loss reinsurance wordings as derived from Butler & Merkin's Reinsurance Law and RJ Kiln's Reinsurance in Practice.

- Butler & Merkin (at [C-0294]-[C-0295]) explain the origins of the Lloyd's market physical damage excess of loss wording "LPO 98" as follows:

- Article 6 of the revised wording – in the version before me, entitled "(RJK (B) Lloyd's – August 1969 Physical Damage Excess Loss Wording" – provided:

- The initials "RJK" in the title are a reference to Mr Robert Kiln, a member of the Lloyd's market working party which produced the LPO 98 wording. In Reinsurance in Practice, Mr Kiln described the definition of "loss occurrence" as "one of the most difficult and contentious clauses in any catastrophe wording". Mr Kiln offered his own views as to the meaning of this wording (which he described as "my baby", stating "I was largely instrumental in drawing up this wording in the 1960s"), but observed:

- When discussing the background to the wording, Mr Kiln referred to issues which had arisen in the reinsurance market during the 1950s and 1960s as to whether losses arising from certain phenomena – for example a warm air front which generated a number of tornados, bush fires during a particularly dry summer, an exceptionally cold winter in the US which led to a greater level of motor claims and the cold winter in the UK in 1962/63 – could be aggregated for the purposes of claiming under property excess of loss reinsurance. Mr Kiln stated that in the revised wording drawn up against this background, the working party had used the words "occasioned by one catastrophe":

- Butler & Merkin explain the subsequent history of the LPO 98 wording:

- The market debates discussed in Butler & Merkin and Kiln reflect one of the dividing lines in the types of reinsurance protection available. As noted in the fourth edition of Kiln, 429-430:

- The distinction between types two and three is often easier to identify conceptually than to demarcate in practice. A similar debate emerged regarding the treatment of asbestosis claims under catastrophe excess of loss reinsurance policies in the liability (or casualty) market in the early 1980s, which was the subject of discussion in two "White Papers" written by reinsurance underwriters at Lloyd's in September and December 1981 and which are printed as an appendix to the third edition of Kiln. The papers are titled "Discussion Document on Loss Occurrence Definitions in Respect of Reinsurance Contracts Covering Casualty Business" and ""Occurrence Coverage on Excess of Loss Contracts Covering Casualty Business. The second of those White Papers distinguished between "each and every loss" reinsurance contracts and "stop loss" or "aggregate loss" contracts, noting that with a Global Cover (which covered "almost all classes of business"):

- The paper later observes:

- I accept that the history of Article 6 of LPO 98 serves as an important reminder of the difference between a series of losses which can be linked at some level and which are catastrophic in their effect on the reinsured, and losses caused by a catastrophe properly so called. However, I am not persuaded that the materials before the court provide a basis for giving the word "catastrophe" in a property catastrophe excess of loss reinsurance any meaning other than that which it would bear on the application of ordinary principles of construction in the context in which it appears.

- First, the material referred to was produced at a considerable remove, chronologically and textually, from the writing of the Covéa and Markel Reinsurances. We are told that the LPO 98 wording produced in the late 1960s was itself twice amended, first through the LPO 98 Amended Hours Clause and then by a London market committee which produced two new articles. Those articles were "themselves subsequently revised" by the LIRMA property catastrophe excess of loss clause which provided:

- Second, knowing the target at which the change in wording discussed in Butler & Merkin and Kiln was aimed – to address the argument that all losses from a severe winter could be aggregated for the purpose of collecting under an excess of loss reinsurance protection, or (per Reinsurance in Practice, 78) the argument that it was possible to aggregate by reference to "something which might have been the cause of a catastrophe rather than the catastrophe or disaster itself" – does not of itself tell you where the line of permissible aggregation is to be drawn in a very different context such as the present. As explained at [105]-[109] below, the conclusions of the Covéa and Markel tribunals do not depend on embracing the broad approach to an aggregating factor which sections of the reinsurance market sought to embrace following the cold winters of 1962/63 and 1978/79 or by reference to something which is not the direct cause of the individual losses in issue.

- Finally, as I explain at [59]-[63] below, there were also significant changes in the content of the books of direct business in respect of which property catastrophe excess of loss reinsurance was purchased. Mr Kiln himself recognised that "it is impossible to envisage all the forms future catastrophes will take" (Reinsurance in Practice, 175). The mere fact that, in the 1960s and 1970s, a reinsured's property account may not have included non-damage perils, with the result that a reinsurer providing (or indeed drafting) catastrophe excess of loss reinsurance for such an account would not have expected losses which impacted the cover to occur without physical damage to the original insured's property does not mean that the wording used in the reinsurance would not extend to such losses as a matter of its ordinary meaning. There is a distinction between the meaning of words in context, and their expected field of practical application from time-to-time, and market reinsurance wordings which are used for lengthy periods against a background of developments in the relevant book of business of the reinsured are, in a sense, "always speaking" in the manner of statutes (cf R v Ireland [1998] AC 147, 158-59).

- It was common ground in both appeals that direct business written in an insurer's property account now gives protection against business interruption even when that interruption is not consequential upon damage to the insured's property – the so-called "non-damage BI" cover. Examples of non-damage BI cover offered as part of property damage and business interruption cover include:

- There were a number of detailed findings about these non-damage extensions in the Covéa Award, the tribunal finding that:

- These findings are important given the terms of the Covéa Reinsurance as summarised in Appendix 1:

- The treatment of this issue was briefer in the Markel Award, but this appears to have been because there was broad consensus as to the position (as there was before me, General Reinsurance accepting that "in recent years direct insurances have extended protections to insureds so that they can in some instances recover business interruption losses … without physical damage.") The Markel tribunal found as follows:

- Once again, this finding is important given the terms of the Markel Reinsurance as summarised in Appendix 1:

- UnipolRe and General Reinsurance advanced a number of similar arguments as to why there had been no catastrophe for the purposes of the Covéa and Markel Reinsurances respectively, although presented in different "batting orders". I have approached the points in the following order:

- In addition, General Reinsurance advances a further argument, reflecting the matters found to constitute the catastrophe in the Markel Award, namely that the 18 March 2020 Closure Order could not constitute a catastrophe, being simply "a sensible order to mitigate further damage".

- It was not suggested by any of the parties that the word "catastrophe" had acquired a settled and particular meaning in the reinsurance market, and neither the Covéa nor Markel Awards found that it had. Indeed, it was common ground in the Covéa arbitration that "there is not a common market-wide understanding or definition of what constitutes a catastrophe" (Covéa Award, [26(i)], [51]).

- In those circumstances, I accept that a useful starting point in seeking to establish the meaning of the word as used in ordinary speech are the definitions given in dictionaries.

- Markel and UnipolRe placed reliance on the definition to be found in the full Oxford English Dictionary ("OED"). This explains the etymology of the word "catastrophe" as follows:

- I was also referred to the Shorter Oxford Dictionary ("SOED") which contains the following definitions:

- I accept that both definitions embrace usages which refer to sudden events. However, they also show that the ordinary use of the word is not always so confined, with both dictionaries offering meanings which do not require "suddenness" (OED 1, 2(a) and 3(a) and SOED 1 and 2, with 3 and 4 including, but not being confined to, matters with the characteristic of suddenness). Many of the definitions emphasise the existence of a significant break with the position up to that point (OED 1, 3(a) and 3(b); SOED 2, 3 and 4), and something which is seriously adverse in its nature or effects (OED 2(a) and 4; SOED 4). The final usage offered in the SOED embraces all of these themes, and significantly offers "sudden or widespread or noteworthy" as alternatives. Further, the definitions offered include those appropriate to particular contexts (literary analysis or geology) which would have to be applied with care in other contexts.

- In considering which meaning is the most appropriate in the present context, it is helpful to consider the three aspects of the meaning of the word "catastrophe" which the appellants argue applied here, but which it is said the Covéa and Markel tribunals erred in law in failing to recognise.

- Neither UnipolRe nor General Reinsurance sought to argue that, as a matter of everyday usage, the word "catastrophe" is confined to things which cause, or can cause, physical damage, and I am quite sure that they were right to do so. Nor could it be argued that, in the reinsurance market, the term "catastrophe" is so understood, there being frequent usages of the term in other areas of business. I have already referred to the use of the expression in the context of casualty reinsurance discussed in the White Paper at [53]-[54]. Ms Sabben-Clare KC referred to reported authorities dealing with catastrophe XL reinsurance cover for PA business (considered in Sphere Drake v Euro International Underwriting [2003]1 LRIR 525, especially at [5]-[7]) and liability reinsurance (AstraZeneca Insurance Co Ltd v XL Insurance [2013] EWHC 349, [1]). To these might be added the reinsurance of professional indemnity risks (Standard Life Assurance Ltd v Oak Dedicated Ltd [2008] EWHC 222 (Comm), [17]).

- Both appellants essentially relied upon the same points to argue that such a requirement was inherent in the reference to "one catastrophe" in the Reinsurances, nonetheless.

- First, what was said to be the origin of the property catastrophe excess of loss class of business, which was said to go back to San Francisco earthquake in 1906, and the origin of the LPO 98 wording following the physical damage claims brought following the severe winter of 1962/63. However, for the reasons set out at [55]-[58] above, I am not persuaded that the fact that non-damage business interruption does not appear to have been written when the LPO 98 wording was formulated (with the result that claims emanating from that class of direct business would not have been expected when that wording was formulated) confines the meaning of the word "catastrophe" in a market excess of loss reinsurance wording.

- By contrast, I agree with both the Covéa and Markel tribunals that the established market practice by the time the Reinsurances were written (as summarised at [60] and [62] above), and the terms of the two Reinsurances (as summarised at [61] and [63]) above, provide strong support for the tribunals' rejection of this supposed limitation in the nature of a catastrophe for the purposes of the respective Reinsurances. In particular:

- Second, the description of the reinsurances as "Property Catastrophe Excess of Loss Reinsurance Contracts". However, in addition to the wide terms of the reinsurances as set out at [61] and [63] above, both arbitral tribunals were right to note that the claims for business interruption consequential upon loss of access to the insured's property do involve an interference with the original insured's premises, such that reinsurance cover for losses arising from such denial of access is apt for inclusion within the scope of "Property Catastrophe Excess of Loss" reinsurance: see the Covéa Award, [58] and [64]; and the Markel Award, [44]. Indeed, many property theorists would regard the right to use property as a key component of the "bundle of rights" which the concept of property can be regarded as comprising (AM Honoré, Making Laws Bind (1987), 161-192) and some argue it is the defining right (Professor JE Penner, 'The 'Bundle of Rights' Picture of Property' 43 UCLA Law Review 711-820, 758).

- That argument does not apply as forcefully to a form of non-damage business interruption cover not in issue in this case – Loss of Attraction cover – but even there, the impact of the peril on the original insured's property is an essential feature of any claim for indemnity and, for my part, the reasoning both tribunals adopted in relation to Denial of Access cover in this particular respect seems equally applicable.

- Third, the fact that those perils which are specifically identified in the two "Hours Clauses" are of such a nature as to be capable of causing physical damage, it being suggested that this gives rise to a contractual genus into which all catastrophes must fall. Both tribunals rejected this argument for essentially the same reasons, with which I am in full agreement. After listing those various perils, both "Hours Clauses" state:

- Mr Christie KC and Mr Kendrick KC both pointed to contexts in which the use of the word "whatsoever" following a list of specified items did not, as a matter of construction, preclude the ejusdem generis rule of construction (so as to require other matters not specifically identified but embraced within the closing words to be of the same "kind" or "genus" as those specifically identified). In BOC Group v Centeon LLC [1999] 1 All ER (Comm) 970, for example, Evans LJ noted that:

- In this case, however, I agree with the Covéa and Markel tribunals that the words "of whatsoever nature" are clearly intended to extend beyond unidentified members of the same "nature" as those specifically mentioned, the word "nature" being a particularly powerful indictor in this regard. As the Covéa tribunal notes, the various listed perils were "not attempting to create a class or genus but is simply ascribing hours to specific, well known catastrophes" (Covéa Award, [63]).

- There are two further arguments which featured in this context.

- First, Mr Christie KC pointed to clause 18 in Covéa Reinsurance, extending the Covéa Reinsurance to include "direct loss and damage arising from the action or actions taken when complying with an order of a duly constituted Civil Authority at the time of and only during a conflagration, flood or similar insured peril, and only when necessary for the purposes of restricting the loss or damage of other property from the respective insured peril, subject however, to the terms and conditions of this Contract." He argued that this suggested that, absent such an extension, there would be no coverage for losses resulting from denial of access by government order. As to this:

- Finally, both tribunals referred by way of subsidiary reasoning to the presence of Exclusions within the respective Reinsurances which suggested that non-damage business interruption was otherwise covered.

- Taking the Covéa Award first:

- I have not found the Covéa Transmission Exclusion particularly informative, both because it is (as the Covéa tribunal observed) "convoluted and obscure" (Covéa Award, [67]), and because it contemplates the operation of a peril which has caused and is capable of causing physical damage, albeit to the property of a third-party rather than the original insured.

- Turning to the Markel Award, the tribunal referred to:

- For all of these reasons, I agree with the conclusions of both the Covéa and Markel tribunals that the word "catastrophe" in both Reinsurances is not limited to those which cause or are capable of causing physical damage.

- Reinsurers' argument that there is such a requirement rests on:

- It was not always clear in the course of argument whether the requirement of suddenness was intended to refer only to the emergence of the catastrophe, or its duration, although Mr Christie KC's submissions argued for the former.

- I have dealt with the historic materials at [47] to [58] above, and would note that neither uses the word "sudden", save for the Butler & Merkin discussion of the LIRMA wording in which the word "sudden" appears. I have addressed the dictionary definitions, which offer meanings which involve sudden happenings but are not limited to such meanings, at [67]-[71] above.

- Turning to the wordings:

- Further, identifying whether a happening is "sudden" will not always be a straightforward task, which suggests that some caution is required before treating this as an inherent but unspoken requirement for a catastrophe. Strong winds may build over time (even ignoring more extreme causation hypotheses, such as Edward Norton Lorenz's fabled butterfly whose flapping of its wings in Brazil brings a tornado into being in Texas, Presentation before the American Association for the Advancement of Science, 29 December 1972).

- The difficulties of importing a requirement of "suddenness" into the definition are also apparent in the approach taken in the two cases. The Markel tribunal held that there was no requirement of suddenness (Markel Award, [41]), while the Covéa tribunal held that, if there was such a requirement, it was met by "the exponential increase in Covid-19 infections in the UK during the first three weeks of March 2020", with 14 days elapsing between the first death from a person with Covid to the Prime Minister's "stay at home" broadcast of 16 March 2020 (Covéa Award, [49]). Mr Kendrick KC did not shy away from the submission that, on this part of his case, the issue of whether or not there had been a catastrophe depended on the issue of whether or not the rate of increase "fell just short of sudden", saying "it's a stark submission, but it's right in law".

- Mr Kendrick KC suggested that violence was required in the sense of "a drastic physical change which would strike so forcibly the ear and eye of any onlooker that it is liable to stay in his memory or her memory forever." It is not entirely clear what this requirement of "violence" is intended to add to those of "suddenness" and the ability to cause physical damage, but in any event, neither the dictionary definitions nor the words of the Reinsurances suggest that a catastrophe must satisfy this requirement.

- I accept, however, that the radical discontinuity with what went before which is inherent in OED meaning 3(a) and SOED meaning 3, and which appealed to the Markel tribunal, contemplates the ability to distinguish between the period when the catastrophe is in existence and when it is not. This can be seen as an aspect of the distinction (discussed under the next heading) between something which is coherent, particular and readily identifiable, and a collection of things or a continuing state of affairs. The more diffuse and extended the matter alleged to amount to a catastrophe is in the manner in which it arises, the period of its existence and the circumstances in which it ceases to be, the more difficult it may be to establish the coherent, particular and identifiable character which a catastrophe will have.

- It is in addressing that issue, when answering the question "was the outbreak of COVID-19 a 'conflagration or other catastrophe'?", that Derrington and Colvin JJ in the judgment of the Full Federal Court of Australia in Swiss Re International Se v LCA Marrickville Pty Limited [2021] FCA 1206, [355] observed:

- For these reasons, I reject the appellants' argument that a catastrophe must necessarily be "sudden" in onset, or short in duration, or that it must be "violent". Even if I had accepted that argument, it would not have provided a basis for challenging the Covéa Award in which the arbitral tribunal found that any requirement of "suddenness" was satisfied. There was no suggestion that this conclusion was "necessarily inconsistent" with the correct application of the relevant legal test, nor could that submission have realistically been advanced.

- UnipolRe and General Reinsurance also argue that a catastrophe has to be something which satisfies the unities of an "event" as set out by Lord Mustill in Axa v Field [1996] 1 WLR 1026, 1035:

- UnipolRe relies on the use of the phrase "Loss Occurrence", which it notes has been held to have the same meaning as "Event" (Kuwait Airways Corporation v Kuwait Insurance Co SAK [1996] 1 Lloyd's Rep 664, 686).

- This argument is in some ways both the easiest and most difficult of the issues raised on this part of the appeals.

- The easy answer is that neither the Covéa Reinsurance nor the Markel Reinsurance uses the words "Loss Occurrence" or "Event" (as the case may be) as a standalone term, but as a defined term whose meaning is set out in the "Hours Clause". I am unable to accept the argument of definitional determinism, to the effect that the shorthand selected itself informs the meaning of the word beyond what appears in its associated definition.

- Further, in the case of both Reinsurances, there are factors which point strongly away from anything but the most generous application of two of Lord Mustill's three unities:

- The more difficult question is how to distinguish between a catastrophe properly so-called, which is an appropriate basis for aggregating individual losses when seeking indemnity under a property catastrophe excess of loss policy, and a series of discrete losses which share some common point of ancestry, but the adverse effects of which so far as a direct insurer is concerned are properly the subject of stop-loss protection (cf [52]-[53]). As Sir Jeremy Cooke observed in Simmonds v Gammell [2016] EWHC 2515 (Comm), [29], the "unities" are merely an aid to determining whether a series of losses involve such a degree of unity as to satisfy the contractual aggregation requirement.

- It is not necessary, for the purposes of disposing of these appeals, to provide a definition of catastrophe which can demarcate these distinct scenarios for all purposes, even assuming it is possible to do so. The answer is likely to be heavily dependent on the commercial and contractual context in which it arises. However, in the context under consideration here, I am satisfied of the following:

- The Covéa tribunal recorded the "explosion of cases" from the second half of February to the middle of March, the Prime Minister's broadcast and the closure order (Covéa Award, [18]). In the "Award and Disposition" they found that:

- Having rejected UnipolRe's legal arguments at [72] to [102] above, there is no basis on which it can be said that this answer is "necessarily inconsistent" with the proper interpretation of the word "catastrophe" in the Covéa Reinsurance, indeed quite the contrary:

- In considering the Markel Award, it is important to note the background to the manner in which the catastrophe argument came to be formulated:

- There has been no suggestion that the finding made by the Markel tribunal was not open to them on the basis of the case advanced at the hearing. What is said is that the 18 March 2020 Closure Order itself, being intended to ameliorate or mitigate the position, cannot be a catastrophe. The Covéa tribunal had suggested that the various Government measures "cannot be regarded as one or more catastrophes, at least not if they are to be viewed separately from the underlying pandemic to which they were a response …" because they were "rational and considered measures taken in the public interest ….." (Covéa Award, [74]). However, importantly they went on to say the following at [75]:

- In these circumstances, it is not necessary to explore the issue of whether a government order in isolation could ever be a catastrophe and in what circumstances. The Markel tribunal found that the 18 March 2020 Closure Order was "inseparably linked to the emergency of a devastating pandemic", had "consequences which in their different ways are as bad or almost as bad as the disease" and "cannot be viewed separately from the pandemic which demanded … its response". Their conclusion that, so viewed, the 18 March 2020 Closure Order was a catastrophe for the purposes of the Markel Reinsurance, was the result of an evaluative exercise, and is a conclusion the Markel tribunal could "properly" reach (cf Sir Jeremy Cooke's approach in Simmonds v Gammell [2016] EWHC 2515 (Comm), [37]). That conclusion discloses no error of law and is not "necessarily inconsistent" with the proper interpretation of the word "catastrophe" in the Markel Reinsurance:

- For these reasons, the appeals against the conclusions of the Covéa and Markel Awards that there had been a catastrophe for the purposes of the relevant Reinsurances are dismissed.

- UnipolRe and General Reinsurance contend that even if there has been a catastrophe for the purposes of the Covéa and Markel Reinsurances respectively, only business interruption during the 168 hours stipulated by the relevant section of the "Hours Clause" can be relied upon for the purposes of seeking an indemnity under the relevant Reinsurance.

- Markel contends that the "Hours Clause" periods were concerned with the duration of the catastrophe that causes the individual losses, not the individual losses themselves, and in the alternative supports Covéa's submission that the date of an individual loss for the purposes of the "Hours Clause" is the date when the original insured was first denied access to the insured premises.

- In what might be regarded as a conventional scenario, where an insured peril damages commercial property such as a hotel, which then endures a period of interruption to its business while it is repaired, it is accepted that, for the purposes of a property catastrophe excess of loss reinsurance, the entire loss which the hotel owner recovers under the direct insurance is treated, for the purposes of any temporal limitations in the reinsurance, as having occurred on the day of the property damage. This was common ground in both the arbitrations.

- The Covéa Award, [26(iv)] recorded that:

- UnipolRe argued that this was "driven by pragmatic considerations and wrong in principle" ([86]), but noted that in such a case, there was undoubtedly physical damage when the peril hit, on which the business interruption was "parasitic" ([87]).

- In the Markel arbitration, General Reinsurance accepted in its Defence (Markel Award, [50]) that:

- The Markel tribunal appears to have been sceptical as to whether that approach had a principled, as opposed to pragmatic, justification ([58], [60], [65]-[66]).

- Both Mr Christie KC and Mr Kendrick KC sought to identify a principled distinction between the market's approach to what I shall refer to as "damage business interruption" and that which they contended was required for "non-damage business interruption".

- Mr Kendrick KC's approach is reflected in the passage from the General Reinsurance defence which I have set out at [116] above, which effectively treats the damage business interruption claim as the unfolding of the consequences of physical damage which occurred on "day 1". By contrast, he argues that there is no "day 1 damage" controlling the subsequent business interruption in a non-damage business interruption claim, and that the parties are (in effect) in a "wait and see" situation, with the order precluding access taking effect "from day to day", and the business being interrupted on the same "day by day" basis.

- I am not persuaded that a clear line can be drawn between damage and non-damage business interruption as Mr Kendrick KC suggests:

- Further, Mr Kendrick KC's "wait and see" and "day by day" analysis does not sit easily with Mr Justice Butcher's analysis of the effect of the various closure orders in Stonegate Pub Company Ltd v MS Amlin Corporate Member Ltd [2022] EWHC 2548 (Comm) and Various Eateries Trading Ltd v Allianz Insurance Plc [2022] EWHC 2549 (Comm), which treat the closure orders as having an immediate impact on the insured property analogous to physical damage to a building.

- In Stonegate, Mr Justice Butcher identified the forced closure as a "trigger" with continuous effect, rather than involving a series of day-by-day triggers:

- Mr Justice Butcher's analysis to similar effect in Various Eateries Trading Limited v Allianz Insurance Plc [2022] EWHC 2549 (Comm) which he had set out in Greggs plc v Zurich Insurance plc [2022] EWHC 2545 (Comm), [86] was approved by the Court of Appeal: [2024] EWCA Civ 10, [84].

- In Various Eateries, Mr Justice Butcher also rejected the argument that the effect of the words "Prevention of Access – Non Damage during the Period of Insurance" was that only losses suffered during the Period of Insurance could be recovered, and that if access was prevented by an order during the period of insurance, the continuing operation of which was that restaurants were required to remain closed until sometime after the end of the period of insurance, December 2020, only losses incurred up to the end of the period of insurance could be recovered:

- That conclusion was upheld by the Court of Appeal at [92]-[93], who observed in the latter paragraph:

- Relying on this analysis does not involve interpreting the aggregation provisions in the Reinsurances on the flawed premise that they are intended to operate in the same manner as those in the direct insurance (cf Axa Reinsurance (UK) Ltd v Field [1996] 1 WQLR 1026, 1034). The reference to "individual losses" in both Reinsurances naturally directs attention to the position at the level of the original insured, and the Markel tribunal's overriding consideration – that "it is natural to think that business interruption losses occur day by day" (Markel Award, [58]) – is also concerned with the nature of such losses at the position of the original insured.

- Finally on this issue, I should also note that it is possible to conceive of denial of access losses which would involve no realistic "wait and see" element in the sense on which Mr Kendrick KC relies – for example a ban on accessing land contaminated by radiation or chemicals. Gruinard Island was the subject of an exclusion order from 1942 to 1990. It is not clear whether these are said to require a different analysis. As this example demonstrates, the "wait and see" and "day by day" aspects of Mr Kendrick KC's argument may conflict in cases in which the next "decision" is to be taken at some fixed interval sometime in the future.

- This all suggests that the distinction which Mr Kendrick KC seeks to draw between the treatment of damage and non-damage business interruption is significantly overstated, and, on the contrary, that there are strong similarities between the two.

- Mr Christie KC suggests that different insured perils are involved when considering claims for damage and non-damage business interruption. Relying on FCA v Arch [2021] UKSC 1, [215], Mr Christie KC submitting that in cases of damage business interruption "the insured peril is the damage to the property". He submitted that this provided a reason for distinguishing between damage and non-damage business interruption.

- In considering this submission, it is helpful to set out Arch, [215] in its surrounding context:

- I accept that a necessary element in a claim for damage business interruption is that the business interruption results from physical damage itself caused by an insured peril. However, that is also true of some forms of non-damage business interruption claims (see [120]) and it is not of itself particularly informative. If it matters (and I am not persuaded that this does provide a principled basis for any difference in treatment on its own, in any event), I do not read Arch, [215] as suggesting that damage to property is the insured peril to which damage business interruption cover responds. At [215], the Supreme Court is equating the interruption to the policyholder's activities in a non-damage business interruption claim with the "destruction of or physical damage" in the Court's three stage "insured peril > proximate cause > physical damage" sequence. The implication of the Supreme Court's analysis is that the proper sequence for non-damage business interruption of the kind they were considering was "insured peril > proximate cause > business interruption". It is of interest, however, that the Supreme Court identify the "correct causal sequence" for one type of pure business interruption claim as follows:

- In this analysis, the impact on the insured's ability to use their premises is seen as an anterior and separate stage from the interruption to their activities, and in many ways can be said to approximate to the damage business interruption sequence of:

- As will be apparent from Appendix 1, there are differences in the formulation of the "Hours Clauses" in the Covéa and Markel Reinsurances which may explain why this argument was run in the Markel arbitration only. In short, Ms Sabben-Clare KC contends that the periods in the "Hours Clause" are concerned with identifying the duration of the catastrophe, and that all individual losses directly caused by the operation of the catastrophe during that period can then be aggregated, regardless of the date of the individual loss. Ms Sabben-Clare KC accepted that it would be rare that any difference would result from this being the correct interpretation, as against her alternative case that it was the date when the individual loss began which was relevant. However, one situation in which it might make a difference would be if an order such as the 18 March 2020 Closure Order had provided for staggered nursery closures, some commencing within and some outside the 168 hour period.

- The "Hours Clause" in the Markel Reinsurance offers something for both sides on this issue:

- The Covéa tribunal concluded that an "individual loss … occurs" for the purpose of the "Hours Clause" when the nurseries were closed on 20 March 2020, even though the business interruption continued until the nurseries were allowed to re-open when the first lockdown restrictions were lifted (Covéa Award, [102]), that being when "the insured first sustains indemnifiable business interruption loss within a nominated 168-hour period", with loss which the insured continues to sustain afterwards being aggregated with the loss sustained during the 168 hour period ([104(2)]).

- By contrast the Markel tribunal took the view that the original insured's business interruption losses occur "day by day" (Markel Award, [58]) and that only those losses which occurred (on that construction) during the 168 hour period can be recovered ([68]).

- Before exploring these competing analyses further, it is helpful to set out how business interruption losses are assessed under direct insurance policies.

- Business interruption insurance provides cover during the period which it takes the business to return to normal trading (i.e. the level of trading which would have prevailed but for the operation of the insured peril), subject to a "Maximum Indemnity Period" which will provide a cut-off. There was a three-month cut-off in the Covéa NurseryCare Policy (Covéa Award, [92]). As UnipolRe and General Reinsurance noted when seeking to address the argument, there can be substantially longer Maximum Indemnity Periods, for example 36 months is not uncommon.

- One of the leading texts, Riley on Business Interruption Insurance (11th, 2021), [7.3] explains the position as follows:

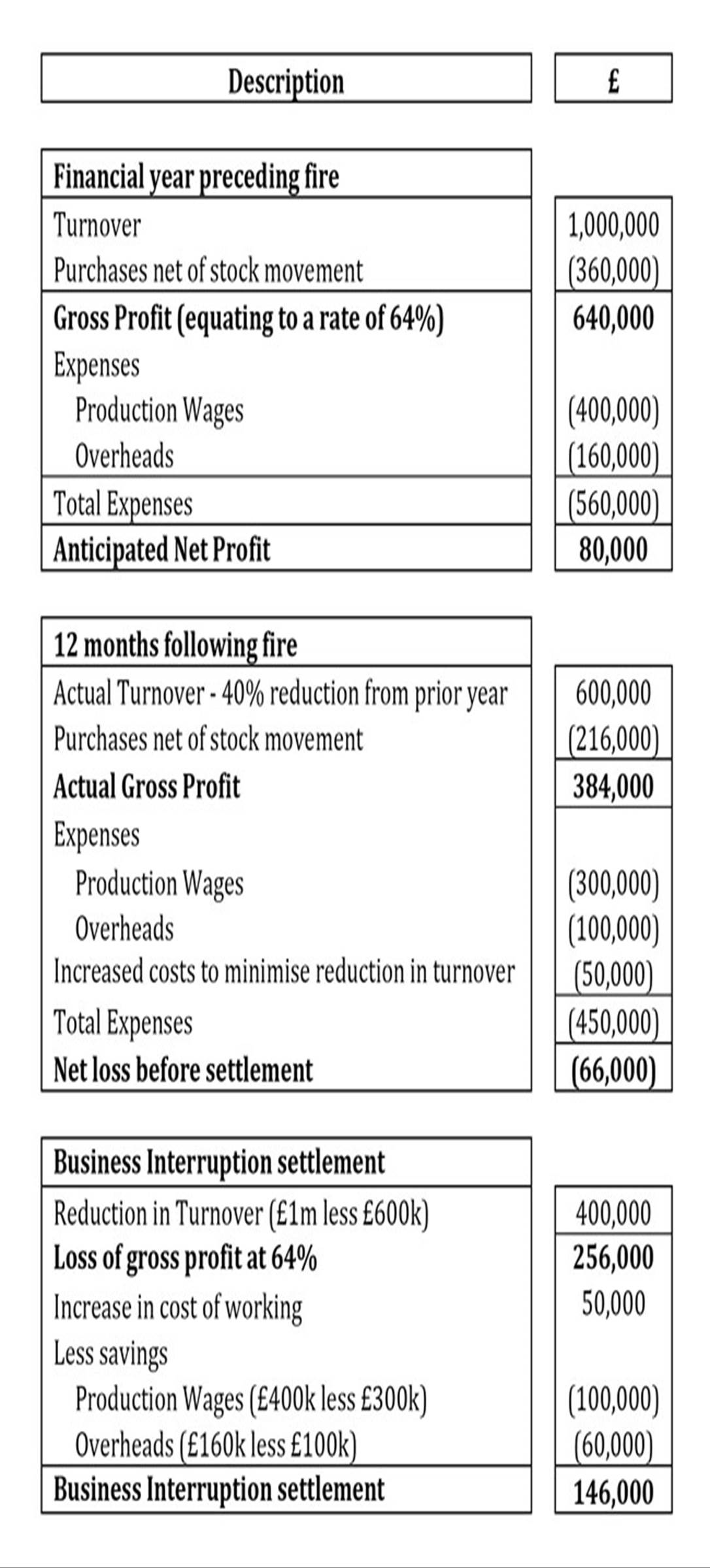

- Further, within the relevant indemnity period (i.e. the actual recovery period, or, if shorter, the Maximum Indemnity period), the amount of the indemnity is not calculated on a "day-by-day" basis at the direct policy level, but across the period, with claims for increased cost of working, and credits for saved expenses. Riley, [1.12], offers the following hypothetical calculation for a business interruption settlement on a policy with a 12-month indemnity period:

- There is usually provision for adjustment of the trend of the business which is the subject of the Business Interruption claim. As the Supreme Court explained in Financial Conduct Authority v Arch (Insurance) UK Ltd [2021] UKSC 1, [253]-[254]:

- It will be apparent from the above that the amount paid to settle an individual business interruption loss can reflect a combination of credits and debits over a certain period, and that there may be considerable variation over time before you arrive at the final amount. This is very far-removed from a "day by day" calculation which UnipolRe's and General Reinsurance's arguments appear to assume. It is also clear that the assessment of a Business Interruption loss at the direct insurance level involves looking at the net effect over a particular period, not the aggregation of a series of daily losses (which answers Mr Christie KC's point that Covéa's case involves a "double aggregation").

- There are various other provisions of the Reinsurances which are of relevance when considering the meaning of the words "individual loss which occurs".

- Taking the Covéa Reinsurance first, there are two provisions concerned with the timing of losses:

- There are also clauses which address how the quantification or assessment of losses at the insurance level impact on the reinsurance: the Ultimate Net Loss clause, with the allocation of loss adjustment expenses, litigation costs and the application of salvage and recoveries, and the "follow the settlements" clause. On UnipolRe and General Reinsurance's case, business interruption losses and associated expenses and credits paid by the reinsured have to be unpicked at the reinsurance level to distinguish between expenses and credits referable to interruption during the relevant "Hours" period, and that referable to any subsequent period. While this is an aspect of a more general issue where a settlement or loss at the reinsured level reflects both losses which are reinsured and those which are not, it does present that difficulty in a particularly acute form.

- There are similar provisions in the Markel Reinsurance. Mr Kendrick KC accepted that when dealing with a non-damage business interruption loss which ran over a number of days, the LOSS DATE ORDER clause would fall to be applied by reference to the date "the loss first occurred". That concession (which I am satisfied was rightly made) is of some significance, because it involves accepting that, for one purpose at least, a non-damage business interruption loss at the reinsured level is treated as a single loss occurring on the date it started for the purposes of the Markel Reinsurance. Similar issues arise on the ULTIMATE NETT LOSS and LOSS SETTLEMENTS CLAUSE.

- It was common ground in both appeals that the references in the two "Hours Clauses" to "individual losses" mean the loss sustained by the original insured. That is significant, because it points the enquiry in the direction of the direct insurance. Further, as the Covéa tribunal noted, the "Hours Clause" defines "the extent and duration of a 'Loss Occurrence'" (or in the Markel Reinsurance, "the duration and extent of any 'Event'"), not the duration of an "individual loss" (Covéa Award, [91]).

- As the Covéa tribunal found ([96]), and as was common ground before the Markel arbitration, when considering damage business interruption, the individual loss occurs when the insured peril damaged the insured premises. I agree with the Covéa tribunal that this supports an analysis which treats an individual loss as occurring "when a covered peril strikes or affects insured premises or property" ([95]), and that when the insured peril which strikes the premises is the loss of the ability to use it (whether through damage to other property or premises or a closure order), the individual loss occurs at the same point.

- The Markel tribunal reached a different view, principally because they concluded "it is natural to think that business interruption occurs day by day" (Markel Award, [58]). However, that approach seems to focus on the third stage of the sequence set out at [131]-[132] above, rather than the second which closely approximates to the moment when the peril "strikes" in damage business interruption cover, and it does not readily accommodate with the manner in which business interruption losses under direct insurance policies are assessed (see [138]-[142]).

- Mr Christie KC identified what were said to be a number of practical difficulties with the construction which appealed to the Covéa tribunal and to me:

- Second, he posited the example of a (for example) retail premises undergoing repairs scheduled to last many months when a closure order took effect which allowed workers to attend at the premises, but not customers. He suggested that no business interruption "loss occurrence" could occur until the premises re-opened, and that it would make no sense for there to be a different result if "the direct insured's business was interrupted, however fleetingly, when the restriction on access was first imposed." However, I do not accept the correctness of Mr Christie KC's premise, to which the points made in the preceding paragraph are equally apposite.

- Finally, Markel relied upon a number of cases which held, in the case of damage business interruption insurance, that the insured's cause of action against the insurer for business interruption "accrues when the business is first interrupted": Carraig v Great Lakes [2021] NIQB 63, [17] and Globe Church Incorporated v Allianz Australia Insurance [2019] NSWCA 27, [130]-[132]. I agree with the Covéa tribunal that these cases are not "germane to the issue it had to decide", albeit they are consistent with the decision which they, and I, have reached (Covéa Award, [103]).

- For these reasons:

- I would like to conclude by thanking all counsel for the high quality of their written and oral submissions.

- The TYPE entry stated:

- The CLASS entry provided:

- The TERRITORIAL SCOPE of the Covéa Reinsurance was:

- The Limits of cover were as follows:

- There were the following Reinstatement Provisions:

- The PREMIUM provisions provided for Deposit Premiums, which were to be adjusted to an amount equal to:

- "Premium Income" was defined as follows:

- There was an "EXPRESS WARRANTY" that "two or more risks insured by the Reinsured to be involved in one Loss Occurrence before recovery hereunder."

- Special Condition (ii) provided:

- Condition 1 provided:

- Condition 2 contained the following definition of "Loss Occurrence":

- 120 consecutive hours as regards the insured perils referred to in paragraph (i) above; and

- 72 consecutive hours as regards the insured perils referred to in (ii) and (iii) above.

- 120 consecutive hours as regards the insured perils referred to in paragraph (i) above; and

- 72 consecutive hours as regards the insured perils referred to in (ii) and (iii) above; and

- 504 consecutive hours as regards the insured peril referred to in paragraph (v) above.

- Condition 3, Extended Expiration, provides:

- Condition 6 defined he term "Ultimate Net Loss" as follows:

- Condition 11 provides:

- Condition 18 provides:

- Finally, Appendix 1 contained various exclusions:

- The TYPE entry stated:

- The CLASS OF BUSINESS was described as

- Two exclusions featured in the argument:

- The TERRITORIAL SCOPE was:

- There was a REINSTATEMENT PROVISION as follows:

- The PREMIUM clause provided:

- The TWO RISK CONDITION made it "a condition of this Reinsurance that no claim will be paid hereunder unless two or more risks are involved in the same Event."

- The HOURS CLAUSE provided:

- The LOSS DATE ORDER clause provided:

- The ULTIMATE NETT LOSS CLAUSE provided:

- The EXTENDED EXPIRATION clause provided:

- The "LOSS SETTLEMENTS CLAUSE (including compromise)" clause provided:

The Honourable Mr Justice Foxton:

A INTRODUCTION

A1 The appeals

i. The appeal by the Claimant formerly UnipolRe Designated Activity Company ("UnipolRe") against a Partial Final Arbitration Award of 24 July 2023 ("the Covéa Award") determining issues of principle regarding the treatment of claims by Covéa under a Property Catastrophe Excess of Loss Reinsurance ("the Covéa Reinsurance") for indemnity against business interruption losses caused by the Covid-19 pandemic.

ii. The appeal by Markel International Insurance Company Limited ("Markel") and cross-appeal by General Reinsurance AG ("General Reinsurance") against a Partial Final Arbitration Award of 27 January 2023 ("the Markel Award") determining issues of principle regarding the treatment of claims by Markel under a Property Catastrophe Excess of Loss Reinsurance ("the Markel Reinsurance") for indemnity against business interruption losses caused by the Covid-19 pandemic.

i. First, whether the Covid-19 losses for which Covéa and Markel sought indemnity under, respectively, the Covéa and Markel Reinsurances, arose out of and were directly occasioned by one catastrophe on the proper construction of the Reinsurances. Both the Covéa and Markel Awards found that they did.

ii. Second, whether the effect of the respective "Hours Clauses" in the Covéa and Markel Reinsurances, which confined the right to indemnity to "individual losses" within a set period, had the effect that the reinsurances only responded to payments in respect of the closure of the insured's premises during the stipulated period. The Covéa Award found that this was not the effect of the "Hours Clause" in the Covéa Reinsurance. The Markel Award found that this was the effect of the "Hours Clause" in the Markel Reinsurance.

A2 Section 69 of the Arbitration Act 1996

i. As s.69(1) makes clear, the issue of law must be one "arising out of an award made in the proceedings".

ii. Where a tribunal's experience assists it in determining a question of law, "the court will accord some deference to the tribunal's decision" (Silverburn Shipping (IOM) Ltd v Ark Shipping Co LLC (The Arctic) [2019] EWHC 376 (Comm), [20]).

iii. Where the arbitral tribunal's decision is one of mixed fact and law, the court cannot interfere unless it is shown that the arbitral tribunal either erred in law or reached a conclusion on the facts which no reasonable person, applying the relevant law, could have reached. It is not enough that the court would or might not itself have reached the same conclusion (Sylvia Shipping Co Ltd v Progress Bulk Carriers Ltd (The Sylvia) [2010] EWHC 542 (Comm), [54]). In short, it must be shown that the conclusion reached by the arbitral tribunal is "necessarily inconsistent" with the correct application of the relevant legal principle.

iv. Provided the substance of the point of law remains the same as that for which permission to appeal has been granted (or consented to), the court will permit minor refinements to the formulation of the issue at the hearing which involve no prejudice to the respondent (Cottonex Anstalt v Patriot Spinning Mills Ltd [2014] EWHC 236 (Comm), [20]).

v. The only admissible documents on the appeal are documents which are referred to in the award and which the court needs to read to determine the issue of law arising out of the award: ibid, [27].

vi. A respondent to an appeal under s.69 of the 1996 Act can seek to uphold the award on grounds not expressed in the award only where those grounds are based on a point or points of law (CTI Group Inc v Transclear SA (The Mary Nour) (No 2) [2008] 1 Lloyd's Rep 250, [13]).

A3 The background to the Covéa Award

A4 The background to the Markel Award

"in the light of the Stonegate judgment, the Claimant will not advance arguments at the forthcoming hearing in support of an analysis that the relevant 'Event' was any given case of COVID-19 or cases of COVID-19 generally" ([26]).

B THE APPLICABLE LEGAL PRINCIPLES

B1 The approach to construing the Reinsurances

B1(1) General principles of construction

i. "The core principle [of construction] is that an insurance policy, like any other contract, must be interpreted objectively by asking what a reasonable person, with all the background knowledge which would reasonably have been available to the parties when they entered into the contract, would have understood the language of the contract to mean" (The FCA Test Case [2021] UKSC 1, [47]).

ii. "Evidence about what the parties subjectively intended or understood the contract to mean is not relevant to the court's task" (ibid).

iii. I was also referred to the summary of the general principles of construction in the judgment of Flaux LJ and Mr Justice Butcher in the Divisional Court decision in The FCA Test Case [2020] EWHC 2448 (Comm), [62]-[70].

The construction of aggregation clauses

i. In Mann and Holt v Lexington Insurance Co [2001] 1 Lloyd's Rep 1, Waller LJ stated that the aggregating concept in that case ("occurrence") had to "take its meaning finally from the surrounding terms of the policy including the object being sought to be achieved by the retrocession".

ii. Aggregation clauses are to be construed "in a balanced fashion without a predisposition towards a narrow or a broad interpretation": Stonegate, [80] citing Spire Healthcare Ltd v Royal and Sun Alliance Insurance Ltd [2022] EWCA Civ 17, [19].

i. The reinsurers referred to following statement by Lord Toulson (in the context of direct insurance) in AIG v Woodman [2017] UKSC 18, [25]:

"There was some debate about whether the question of the application of the aggregation clause was to be viewed from the perspective of the investors or the solicitors. The answer is that the application of the clause is to be judged not by looking at the transactions exclusively from the viewpoint of one party or another party, but objectively taking the transactions in the round".

That quotation, however, was comparing the perspectives of the many investors, who had each paid money into the trusts under separate transactions, and the solicitors, who were the trustees and who had wrongly disbursed from all of those trusts (and, to that extent, were the "hub" with a link to each claiming investor). Lord Toulson was not addressing the position as between the insured and the insurer.

ii. The reinsureds referred to the statement of Mr Justice Butcher in Stonegate, [84], that "in considering whether there has been a relevant 'occurrence' 'the matter is to be scrutinised from the point of view of an informed observer placed in the position of the insured'". That was also the conclusion reached by Mr Justice Rix in Kuwait Airways Corporation v Kuwait Insurance Co SAK [ [1996] 1 Lloyd's Rep 664, 686.

B1(2) The admissible materials

i. A section from Butler & Merkin's Reinsurance Law (2022, Looseleaf) tracing the development of the catastrophe reinsurance excess of loss line of business from what were believed to be its origins in the aftermath of the San Francisco earthquake of 1906, through to the LPO 98 and LIRMA wordings.

ii. An extract from RJ Kiln, Reinsurance in Practice (4th, 2001), 178 (a reinsurance text written by a leading Lloyd's reinsurance underwriter from the 1960s to the early 1980s).

i. Netherlands v Deutsche Bank AG [2019] EWCA Civ 771, [11] and [56] and Re Lehman Brothers International (Europe) (in administration) [2016] EWHC 2417 (Ch), [28], in which reference was made to ISDA Guides to the ISDA Master Agreement. To these can be added: The Joint Administrators of Lehman Brothers International (Europe) v Lehman Brothers Finance SA [2013] EWCA Civ 188, [57]-[60]; Lehman Brothers Special Financing Inc. v National Power Corporation, Power Sector Assets and Liabilities Management Corp [2018] EWHC 487 (Comm) and Swiss Marine Corp Ltd v OW Supply and Trading A/S [2015] EWHC 1571 (Comm), in all of which the court had regard to what the User's Guide had said about the purpose of changes made to the 1992 ISDA Master Agreement form in the 2002 version.

ii. Global Maritime Investments Ltd v STX Pan Ocean Co Ltd [2012] EWHC 2339 (Comm), [14], in which Christopher Clarke J, when interpreting a clause in a charterparty drafted by the Documentary Committee of The Baltic and International Maritime Council, took into account a circular issued by the Committee explaining the thinking behind the clause.

iii. Charter Re Insurance Co Ltd v Fagan [1997] AC 313, in which Mr Justice Mance undertook a detailed review of the market history of the UNL clause in arriving at his conclusion as to the meaning of the words "actually paid". In the House of Lords, (1996) 5 Re LR 411, 419-420, Lord Hoffmann approved Mr Justice Mance's judgment (Staughton LJ having found the material of "no assistance": [1996] 1 Lloyd's Rep 261, 270). Lord Hoffmann also placed emphasis on the market history of the UNL clause in his judgment, albeit as filtered through decisions of the courts (as was also the position in Insurance Company of Africa v SCOR [1985] 1 Lloyd's Rep. 312 in relation to the "follow the settlements" clause).

C THE CONTEXT

C1 The market history

C1(1) The origins of LPO 98

"Where property excess of loss covers are concerned the main function of the 'any one event' provision is to serve as an aggregating factor. … [T]he question therefore resolves itself into one of determining what can be said to constitute an 'event', within the terms of the reinsurance treaty, to permit the aggregation of losses for the purpose of claiming against the reinsurer. However, while the matter is obviously one of considerable importance, the forms of wording most commonly used up to 1963 simply provided coverage for all losses resulting from 'any one event'. The uncertainty surrounding the permitted aggregation under such policies came to a head in the severe winter of 1962/1963 in the British Isles, when reinsureds were faced with a large number of water damage claims arising as a result of burst water pipes following the thaw. In these circumstances reinsureds argued against their reinsurers that the severe weather conditions constituted either one or, bearing in mind the partial thaw that took place in January 1963, two 'events', thereby entitling them to aggregate together all water damage losses as well as any other weather-related losses for the purpose of claims on excess of loss catastrophe covers. Reinsurers for their part resisted these claims on the basis that bad weather constituted a state of affairs rather than an 'event' so that a broad aggregation of losses was not permissible. Eventually, all claims were compromised, but the need for some form of standardised wording was recognised. Ultimately, as a result of the work of various market committees, a standard form of wording - LPO 98 - which contained a standard 'hours' clause, came to be widely used. The clause was not universally accepted, but formed the basis for most of the alternative wordings adopted by reinsurers. The essence of the clause as originally drafted was to provide for the aggregation of 'loss occurrences' arising out of and directly occasioned by 'one catastrophe'. 'Loss occurrences' were defined in terms of losses occurring within specified periods of time, which were seventy-two hours for listed phenomena and 168 hours for all other catastrophes. It will be noted that the word 'event' was abandoned in favour of the word "catastrophe" to make it clear that the intention was to cover happenings that were short, sharp and devastating; this indeed was historically the correct analysis of catastrophe covers, which are commonly believed to have originated after the San Francisco earthquake of 1906. In the result, then, all losses occurring within the relevant periods of hours and stemming from one catastrophe were to be aggregated …."

C1(2) The LPO 98 wording

"Definition of Loss Occurrence.

The words 'loss occurrence' shall mean all individual losses arising out of and directly occasioned by one catastrophe. However, the duration and extent of any 'loss occurrence' so defined shall be limited to:-

(a) 72 consecutive hours as regards a hurricane, a typhoon, windstorm, rainstorm, hailstorm and/or tornado

(b) 72 consecutive hours as regards earthquake, seaquake, tidal wave and/or volcanic eruption.

(c) 72 consecutive hours and within the limits of one City, Town or Village as regards riots, civil commotions and malicious damage

(d) 72 consecutive hours as regards any 'loss occurrence' which includes individual loss or losses from any of the perils mentioned in (a), (b) and (c) above

(e) 168 consecutive hours for any 'loss occurrence' of whatsoever nature which does not include individual loss or losses from any of the perils mentioned in (a), (b) and (c) above

and no individual loss from whatever Insured peril, which occurs outside these periods or areas, shall be included in that 'loss occurrence'".

"It will be interesting to see in the years ahead if arbitrators and the Courts interpret the words in the way in which they were intended."

"because we felt it was more specific. It implied a violent happening which in itself caused damage. The word 'event' we felt might have applied to something which might have been the cause of a catastrophe rather than the catastrophe or disaster itself."

C1(3) The subsequent market history

"The hope that LPO 98 would remove the possibility of disputes over claims as had occurred in 1963 was dashed in the aftermath of the unusually hard winter of 1978/1979, which again witnessed a large number of water damage claims against reinsureds. While it had been difficult for reinsureds to argue in 1962/1963 that the severe weather constituted an 'event' for the purposes of a catastrophe cover, it became even more tenuous to allege that severe weather was a 'catastrophe' within the meaning of the new wording. Undaunted, reinsureds advanced the alternative theory that, because they had suffered catastrophic losses as a result of the weather, the event which had caused those losses - the cold winter - could itself correctly be described as a 'catastrophe'. This line of argument neatly reversed the process actually called for by the clause: instead of having to identify a catastrophe out of which losses had arisen for the purpose of aggregating those losses, it was being suggested that the totality of the losses was itself a catastrophe. Apart from this fundamental analytical flaw in the argument in favour of reinsureds, it suffered from the weakness that the losses incurred by reinsureds had not threatened their solvency - irrespective of reinsurance cover - and thus could scarcely be described as catastrophic. Moreover, the causative requirement that losses had to be 'directly occasioned' by the catastrophe was hardly met by the cold weather; the direct cause was clearly the thaw, but it is by no means clear that a natural phenomenon which is regarded as beneficial by the community as a whole can be taken to be a catastrophe for reinsurance purposes. However, despite these important considerations, the reinsurers chose to pay. The reaction to all this, compounded by heavy losses in the North American continent, was the introduction of the LPO 98 Amended Hours Clause, which accepted that winter losses were recoverable and provided aggregate extension cover to deal with such losses. Soon afterwards, the wording of LPO 98 as amended was referred to a London market committee for its consideration, and the committee produced in the place of LPO 98 two new articles, based broadly on the old wording. These articles were themselves subsequently revised by the now current LIRMA property catastrophe excess of loss clauses, which read as follows:

'For the purposes of this Agreement a loss occurrence shall consist of all individual insured losses which are the direct and immediate result of the sudden violent physical operation of one and the same manifestation of an original insured peril and occur during a loss period of 72 consecutive hours as regards any:

(a) hurricane, typhoon, windstorm, rainstorm, hailstorm or tornado;

(b) earthquake, seaquake, tidal wave or volcanic eruption;

(c) fire;

(d) riot or civil commotion which occurs within the limits of one city, town or village; or

(e) 168 hours as regards all other insured perils.