Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Ferand Business Corporation & Ors v Maritime Investments Holdings Ltd & Anor [2021] EWHC 40 (Comm) (29 January 2021)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2021/40.html

Cite as: [2021] EWHC 40 (Comm)

[New search] [Printable PDF version] [Help]

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Strand, London, WC2A 2LL |

||

B e f o r e :

SITTING AS A JUDGE OF THE HIGH COURT

____________________

| (1) FERAND BUSINESS CORPORATION (2) ANGELIKI FRANGOU (3) MARITIME ENTERPRISES MANAGEMENT S.A. |

Claimants |

|

- and |

||

| (1) MARITIME INVESTMENTS HOLDINGS LIMITED |

First Defendant/ Additional Claimant |

|

| (2) KOLEN INTERNATIONAL S.A. |

Second Defendant/ Additional Defendant |

____________________

Ms Caroline Pounds (instructed by Tatham & Co) for the First Defendant /Additional Claimant

Mr Richard Sarll (instructed by Waterson Hicks) for the Second Defendant/Additional Defendant

Hearing dates: 5-8 October 2020

____________________

Crown Copyright ©

- In essence this is a dispute between a brother and sister concerning their respective business and personal financial affairs, in which the claimants seek various declarations which she maintains will end the ongoing and multifaceted disputes between them that have existed for a number of years. It is clear that their relationship is now very strained and perhaps permanently fractured. Their disputes have been fought out with undisguised and uncompromising hostility in these proceedings, throughout this trial and in Greece.

- I now turn to the background to this dispute. The second claimant ("AF") and Captain John Frangos ("JF") are sister and brother. Both AF and JF are experienced ship owners and managers. AF and JF carry on business together although each have other business interests. Their joint business activity is carried on in part through the first defendant ("MIHL"). JF was at all material times MIHL's Chief Executive Officer. MIHL's business was at all material times to hire out ships owned by associated or subsidiary companies.

- AF and JF each owns his or her interest in MIHL via corporate vehicles that they respectively control. The first claimant ("FBC") is AF's vehicle through which she owns her interest in MIHL and the second defendant ("Kolen") is the vehicle through which JF owns his interest. At all times material to these proceedings, MIHL had a third shareholder called Oscaleta Limited ("Oscaleta") although currently it owns only 5% of MIHL's share capital.

- The instrument by which AF, JF and Oscaleta agreed to manage MIHL was a stockholder agreement dated 8 September 2014 ("SHA"). The SHA is governed by English law and is subject to the exclusive jurisdiction of the English courts see clause 13.13. The parties to that agreement are and are only Oscaleta, FBC, Kolen and MIHL.

- As I have said, both AF and JF have business interests other than their respective interests in MIHL. AF is the Chairman and Chief Executive Officer of Navios Group, which consists of three companies listed on the New York Stock Exchange and a further company listed on the NASDAQ. It owns or operates as disponent owner in excess of 200 ships. She is also the ultimate owner of the third claimant ("MEM").

- Turning to JF, as well as being the ultimate owner of Kolen, and the Chief Executive Officer of MIHL, he was at all times material to these proceedings the ultimate owner and operator of an entity called First Lines Company S.A ("FL"). Its business is that of technical and commercial ship management. It acted as ship manager for ships hired out by MIHL until 2017. There is a dispute between MIHL and FL as to whether MIHL owes FL unpaid management fees. That dispute is the subject of a London arbitration.

- AF maintains and I accept that JF has suffered significant financial difficulty in recent years. AF says and JF did not challenge her evidence that this was the result primarily of long running ruinous litigation in Greece that was concerned with or arose out of his divorce. It is not necessary that I mention any of the other parties involved. It is necessary only to record that as a result of that litigation JF had to pay a third party US$58.5m and it left him unable to raise finance to carry on his business career, which he was able to resume only in or about 2007. AF provided financial support for JF from at least 2012 until the break down in relations between them in 2019 to which I refer in detail below.

- The financial support that AF provided to JF has been substantial. In or about 2007, JF acquired a vessel (using a corporate vehicle) called "Taurus Two". It was acquired using finance provided by HSH Nordbank AG. The indebtedness was secured by a mortgage over the vessel. In August 2011, the vessel was arrested following a loan default. AF maintains that at the request of her father, she used her relationship with the bank to assist by negotiating a loan by HSH Nordbank AG to a company controlled by her, secured by her personal guarantee, to finance the acquisition of the vessel by her company. AF maintains that she assisted her brother in relation to other vessels owned by companies controlled by him where lending defaults had occurred.

- It was against that background that AF maintains that MIHL was formed at the end of 2012. AF maintains that she was a reluctant investor and was persuaded to invest as a means of assisting her brother with his business career. The initial purpose of the exercise was to acquire the corporate ownership of three vessels - the Christine B (IMBA Maritime S.A.), the Nikolas III (Iris Enterprises Company S.A.) and the Titan (Titan Maritime Enterprises S.A). A plan to raise funding for further ship purchases by an IPO failed for want of investor interest but a hedge fund agreed to invest US$25m in return for a 50% shareholding. The hedge fund invested through its subsidiary Oscaleta. Following this exercise, Oscaleta held 50% of the shares in MIHL and AF and JF each held 25%. The relationship of the three shareholders was governed by the SHA as I have explained already. Thereafter, MIHL acquired two further ships, each of which was owned by a subsidiary, being the Hope I and the Pacific Cebu. As provided for by clause 5.5 of the SHA, FL was appointed technical and commercial manager of MIHL's ships and thus JF was in practice the manager of each of the ships.

- In 2016, MIHL was short of cash and three rights issues took place. Oscaleta did not participate in any of them but AF (by FBC) and JF (By Kolen) did with the result that their respective shareholdings rose to 47.5% and Oscaleta's was diluted to 5% - see Amendments 1 to 3 of the SHA. In light of the reduction in Oscaleta's shareholding, it was agreed by clause 2 of Amendment No. 1 that clause 4.2 of the SHA be varied so that no shareholder whose shareholding fell beneath 12.5% would be entitled to designate a director of MIHL. In consequence, the two directors nominated by Oscaleta resigned, so that by 13 October 2016, AF and JF were the only directors of MIHL.

- There is a dispute as to what happened thereafter concerning membership of the Board. AF claims that she and her brother agreed that Mr. Sheldon Goldman be appointed as a director of MIHL on 25 November 2016. AF maintains that this agreement is contained in or evidenced by the minutes of a meeting of the board on that date. JF contended at one stage that his signature on this document had been forged. Both parties engaged handwriting experts. The experts are agreed:

- The next major area of dispute concerns the sale of the Christine B. MIHL had acquired the company that owned this vessel with the aid of a loan from Commerzbank secured by a marine mortgage over the Christine B. AF's evidence was that by late 2016, Commerzbank had decided to withdraw from the ship finance market and was willing to discount by 10% the amount of the loan outstanding in return for prompt repayment. JF does not dispute this. This reduced the amount outstanding from US$11.6m to UD$10.3m.

- An alternative lender known to AF (ABN Amro) was willing to provide a new loan of US$9m. MIHL did not have the funding to make up the difference but in any event, again according to AF, ABN Amro did not want to do business with JF or to fund a ship in the MIHL structure. She maintains that the Commerzbank loan secured against the Christine B was for a sum that exceed the then value of the ship. Assuming that to be so, a sale of the ship was plainly of benefit to MIHL. AF's evidence is that it was agreed between her and her brother (in their capacities as directors of MIHL) that MIHL would cause IMBA Maritime S.A to sell the ship to an entity called Plous Shiptrade Company SA ("Plous") at a price equivalent to the sum needed to discharge the Commerzbank loan with AF funding the balance of US$1.4m needed to discharge the loan to Commerzbank and Plous taking over responsibility for the ship's accumulated and unpaid trade debt. The sale was completed on or about 16 December 2016. Plous agreed to assume liability for the ship's accumulated and unpaid trade debt totalling a further US$1m. That this was what in fact happened is not in dispute between the parties to these proceedings. Plous was at all times material to these proceedings wholly owned by Maritime Enterprises Holdings SA, which in turn was wholly owned by AF.

- It is common ground that this transaction could not have proceeded without JF consenting to it both because of the transfer of title to Plous but also because the management of the ship was transferred on sale from FL to the third claimant ("MEM"). Its sale to Plous made commercial sense from MIHL's point of view since it relieved that company of the Commerzbank loan (including that part of it that was in excess of the vessel's value at the date of its disposal) and the accumulated unpaid trade debt. JF did not make any financial contribution to the acquisition of the vessel by Plous. I accept AF's evidence that ABN Amro did not want to do business with JF or to fund a ship in the MIHL structure because that is consistent with the transfer of management and with a sale rather than simply a re-finance by MIHL with ABN Amro in substitution for Commerzbank.

- The value of vessels such as the Christine B is substantially a function of the state of the charter market at the time of a sale. AF's evidence and there is nothing to contradict it is that the Dry Bulk charter market was at an all-time low at the date when the Christine B was sold by MIHL to Plous. Her evidence is that the market picked up steadily during 2017. None of this appears to be in dispute although JF maintains that this improvement was foreseeable as something that was likely to occur at the date of the sale of Christine B to Plous. His case is that it was agreed between him and AF at the time of the sale of the vessel to Plous, that Plous was to sell the vessel on to the Navios Group of which AF was CEO at a price of US$13.75m. He maintained at an earlier stage in these proceedings that the effect of the agreement was that the profit made by Plous would be shared equally between him and his sister. Such an agreement if made would have constituted a breach by AF and JF of their fiduciary duties to MIHL for reasons that are obvious. At a later stage (when is unclear) JF's case became that the effect of the agreement was that the profits would be paid to MIHL. There is no memorandum anywhere to that effect nor is it alleged by JF that any such memorandum was created. AF's case is that the sale to Plous was a purchase by Plous from MIHL of a vessel that was worth less than the sum secured against it and was of obvious benefit to MIHL because it was financially distressed and the effect of the sale was to relieve MIHL of all the debt associated with the vessel and benefitted it by the difference between the sum of the amount of the Commerzbank debt less the value of the vessel and the accumulated unpaid trade debt.

- What is not in dispute is that the Christine B was sold by Plous to a company within the Navios Group the following year. AF's case is that the Navios Group identified the Christine B as a vessel that it might wish to purchase in or around mid-2017. However, since AF was the Chairman and CEO of Navios Group, it followed that she could not properly be involved in the purchase of the Christine B by Navios since that vessel was now owned by Plous, which as I have explained was wholly owned and controlled by her.

- AF maintains that a committee of independent Navios directors was established with independent third-party advice to consider the purchase. AF maintains that the Christine B was a " high quality vessel that had enjoyed trouble free operations for several years ". AF's evidence is that this process culminated in the sale of the Christine B by Plous to Navios on 11 August 2017 at a price of US$13.75m, resulting in a gross profit of US$4.335m for Plous.

- AF's case is that from the moment when he became aware of the sale, JF demanded a half share of the profit. His case as I have said is that it had been agreed between AF and JF at the time the vessel had been sold to Plous that Plous would sell the vessel on into the Navios group at the price that in the end Plous sold it for and either the profit would be shared between them (his pleaded case) or the whole of the profit would be paid by Plous to MIHL (the case that Kolen wanted to advance by way of amendment and which JF advanced in his oral evidence at trial). I return to that issue later in this judgment.

- It is now necessary to mention albeit more briefly the arrangements concerning the remaining MIHL vessels. The common theme was that each was the subject of a mortgage that was in default and/or which required restructuring and whilst the lenders were prepared to restructure the lending, they were only prepared to do so (AF maintains) on the basis that ownership and management was moved to companies controlled by AF. In order to comply with these requirements management was transferred from FL to MEM and on 22 September 2017 the Titan was sold by Titan Maritime Enterprises S.A. to Leyde Shipmanagement S.A, an entity controlled by AF and Nikolas III was sold by Iris Enterprises Company S.A. to Smertos Shiptrade S.A., also controlled by AF. In the result, by the end of 2017, management of all the MIHL ships had been transferred from FL to MEM and ownership of all but two had been transferred to entities controlled by AF.

- AF maintains that while all this was going on, JF was suffering a series of financial reverses that meant he was in need of funds to finance both his commercial and personal requirements. As AF puts it in paragraph 44 of her first statement, " Apart from the MIHL fleet, John had other vessels that he owned and operated. He was constantly in need of funds to meet obligations, both business and personal. I had provided John with significant financial support since 2012 but what happened from 2017 to 2019 was on a different scale because of the volume of problems that John was encountering ". Her case as set out in her statement is:

- I now return to the sale of the Christine B by Plous. As I have said already, JF demanded a share of the profits from July 2017 when he learned of the sale. AF maintains that JF was entitled to nothing both because the sale by MIHL to Plous was a freestanding transaction that was not subject to any agreement to the effect that JF asserts and because in any event, even if that was wrong, JF owed her sums that in the aggregate exceeded what would have been JF's share had there been such an agreement. As she put it in paragraph 54 of her first statement:

- At this stage in my summary of the background, it is necessary to introduce Mr Alex Meraklis ("AM") and Mr. Evangelos Tsatiris ("ET"). AM is nominally the finance director of MEM and the company secretary of MIHL. In practice however he is AF's principal accounting and financial advisor. Mr. Tsatiris performs a similar role for JF.

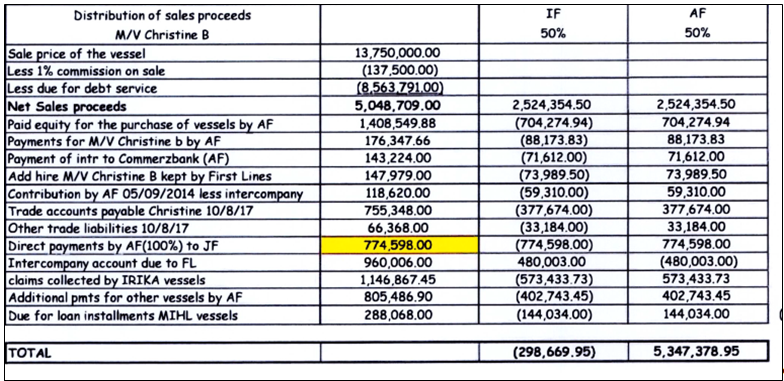

- AF maintains that notwithstanding her views as set out above and the levels of support that she says she provided to JF over the years, she instructed AM to meet ET in an attempt to arrive at an agreed position that nothing was due even if (which as I have said she denied and denies) the profit from the sale of the Christine B was to be shared equally between AF and JF. She maintains that once account was taken of the true cost of purchasing the Christine B, including the trade debt and other expenses that had been funded by either MEM as successor manager or AF, along with (i) various amounts that JF or his companies had received and was required to share but had not been accounted for, and (ii) the numerous payments made on behalf of MIHL that MEM or AF says she had funded, no money was payable to JF who in fact owed AF US$298,669.95. AF's case is that the outcome of these discussions was that it was agreed between AM and ET on behalf of their respective principals in August 2017 and recorded in what is known in these proceedings as the "Christine B Schedule":

- Given that JF now maintains that the effect of the alleged agreement he says was made between him and his sister at the time they agreed on behalf of MIHL that the vessel would be sold to Plous was that all Plous's profits from the sale of the Christine B would be paid to MIHL, it is extraordinary that this schedule should have been prepared on behalf of AF since it purports to be prepared on the notional basis that the proceeds would be shared between AF and JF and takes account of sums that could not be the subject of a set off as between Plous or AF on the one hand and MIHL but if at all only between AF and JF.

- The preparation of the schedule is consistent with only either the alleged agreement between JF and AF being that Plous's profits would be shared between them or an after the event request or demand by JF that they be split.

- JF now accepts that an agreement between him and his sister to split the proceeds of a planned onward sale of the vessel to the Navios Group at a price of US$13.75m at the time when the vessel was sold to Plous would have been unlawful and a breach by both him and AF of the duties they owed to MIHL as its directors, although his pleaded case was that the agreement was that the proceeds would be split between him and his sister.

- That an agreement to the effect pleaded by JF is not now relied on by him and that it is now accepted by him that any such agreement would be unlawful (as obviously it would be, given the existence of a minority shareholder in MIHL at the time) persuades me that it is highly improbable that any such agreement was reached. I have had the benefit of seeing and hearing AF give evidence before me during this trial. I am satisfied and find that AF is an astute, experienced and well-advised business person who fully understands her obligations as a company director and the implications for her business career if she breached the fiduciary duties she owed to any company of which she was a director. I find her to be sufficiently astute to know that such an agreement (particularly if reached at the time they agreed on behalf of MIHL to sell the vessel to Plous) would involve a breach of duty by both her and her brother owed to MIHL and in probability of her duties to the Navios Group as well, since on JF's case the alleged agreement committed AF to causing the Navios Group to purchase the vessel at a price agreed between her and JF of US$13.75m.

- Returning to the preparation of the Christine B Schedule, I conclude that its preparation was inconsistent with JF's case that there was an agreement at the time of the sale of the vessel to Plous that the profit to be made by Plous would be paid to MIHL for all the reasons set out above.

- The only alternatives left are either that there was an agreement to the effect JF pleaded (which now JF denies and which I have concluded AF would not have agreed to) or with what has been AF's consistent case as to what happened namely an after the event demand by JF that he be given a share of Plous's profits from the sale by it to the Navios Group once he learned of the sale. I set out my final conclusions concerning this issue later in this judgment.

- AF's case is that thereafter JF continued to demand further financial support that she reluctantly agreed to provide but to which he had no entitlement since his only entitlement was to his share of any profits generated by MIHL. This led to the preparation in 2017 of a schedule of "Amounts Received from Maritime". This is said to record amongst other things the whole of the sums received by JF in the period between August and November 2017, which it is said totaled US$537,000. AF maintains that continuing support at this level was unsustainable because:

- At the same meeting AF maintains that it was agreed that formal records would be kept of all financial arrangements between her and her brother. She says her understanding was that the Christine B schedule would be included within these records. This further emphasises the impact of the preparation of this schedule on the alleged arrangements concerning the sale of the Christine B to which I referred above. These records consisted of (a) annual reconciliations of what was owed by each sibling to the other, (b) a separate record of payments made by or on behalf of AF to or for JF and (c) annual reconciliations that it was intended would be agreed between AM and ET on behalf of their respective principals. AF's case is that the first such schedule entitled "AMOUNTS RECEIVED FROM MARITIME records payments made between 25/08/2017 and 20/11/2017 and that preparation of such schedules continued on a rolling basis until July 2019, shortly before the present dispute arose. It is these three sets of records that AF calls the "private ledgers". The most recent of the reconciliations was signed in January 2019. It purported to show an accumulated deficit due from JF to AF of in excess of US$4m.

- During 2019, on AF's case, JF's financial needs and control did not improve. It is not necessary for me to set out the detail in this judgment. It is sufficient to say that increasingly JF was unable to manage his affairs without his sister's continuing support. AF says that she asked Mr Goldman (on AF's case JF and AF's fellow director of MIHL) to liaise with Ashley Katz, a restructuring specialist partner at the London office of the US law firm Fried Frank. This led to correspondence which seems to have been the trigger for the dispute that has led to these proceedings. In so far as is material, Mr Katz's initial letter stated:

- JF responded to this by instructing Mr. Michalis Dimitrakopoulos, a leading criminal lawyer in Greece, to represent him. What followed was what Mr. Allen describes in his written opening as " increasingly antagonistic correspondence ". This culminated in the service on AF in the name of Kolen of a series of five "Extra Judicial Notices". These are apparently Greek law instruments which, as their name suggests, are not court proceedings. Mr. Sarll submitted that they were no more or less than the equivalent of a letter of claim. There is no expert evidence that explains the role of these communications in the Greek legal system or in relation to claims that become the subject of civil claims before the Greek courts. There is nothing that suggests these documents are of any more significance than Mr. Sarll suggests. There is certainly no evidence that they constitute claims initiated before a Greek court. To treat them as formal claims before a Greek court would be inconsistent with their title.

- The Extra Judicial Notices ("EJNs") are referred to in these proceedings and in this judgment respectively as EJN1, which is the notice served on 21 October 2019, EJN2, which is the notice served on 22 October 2019, EJN3, which is the notice served on 23 October 2019, EJN4, which is the notice served on 9 December 2019 and EJN5, which is the notice served on 30 December 2019.

- Following service of these EJNs further acrimonious but ultimately unproductive correspondence followed. These proceedings have been commenced in an attempt to demonstrate that JF's allegations contained in the EJNs are false and wrong and, possibly, to discourage him from advancing the same allegations elsewhere. I refer to the EJNs in more detail below.

- This claim is concerned exclusively with the making of declarations. As I have explained, the immediate cause of the commencement of these proceedings was the service of the EJNs ostensibly on behalf of the first defendant and on behalf of FL by a Greek lawyer acting on the instructions of JF. Although the EJNs are not in themselves proceedings, it is implicit that the EJNs are the precursor to the commencement of proceedings in Greece. Since the service of the EJNs at least one claim has been commenced by JF against AF in Greece to which I refer in more detail below.

- That being so, a potential issue arises as to whether these proceedings should be regarded as an attempt to obtain orders from an English Court for deployment in anticipated or extant Greek proceedings for the purpose of circumventing the commencement of proceedings in Greece or influencing the outcome of such proceedings. Inevitably, this point has to be considered before turning to the substantive issues that arise. I start by setting out some general conclusions as to whether this should be treated as a discretionary bar to the grant of any of the declarations sought. If and to the extent that I conclude these principles do not have that effect, it will be necessary to return to them again later in this judgment in relation to EJN4, since the extant proceedings in Greece to which I have alluded earlier impact specifically on the dispute between the parties the subject of that EJN so that a different outcome may be appropriate in relation to the declarations sought specifically by reference to EJN4.

- Generally, English Courts will refuse to grant declarations that are intended to influence or are likely to have the effect of influencing the outcome of proceedings before the courts of other sovereign states. In such circumstances as a matter of discretion declarations will be refused unless there is some identified special reason why the court should grant the declaration sought see by way of example Howden North America Inc v. ACE European Group Limited [20-12] EWCA Civ 1624; [2013] Lloyds Rep I.R. 512 per Aikens LJ at paragraph 37, where he said " I would regard the idea that the English court should give its unsolicited judgment as 'advice' to a Federal Judge in the US District Court for the Western District of Pennsylvania on elementary principles of English law, in the expectation or even hope that such a judgment would be 'at the very least of considerable assistance' as both presumptuous and condescending. To use the phrase of Leggatt LJ in Barclays Bank plc v Homan, it smacks of 'unacceptable hubris ' and, most recently, The Bank of New York Mellon v. Essar Steel India Limited [2018] EWHC 3177 (Ch) per Marcus Smith J at paragraph 22(2)(c) and 22(3).

- Mr Allen asserted that this point is without substance in these proceedings because there had been no challenge to the jurisdiction of this court in relation to any part of the claim in these proceedings. Whilst that is true as far as it goes, it is not material because it means only that the court has jurisdiction over the claims that have been made. That is the start not the end of the point I am now considering. That there has been no jurisdictional challenge does not mean that the court should not or could not refuse the declarations sought or some of them as a matter of discretion and leave it to the parties to resolve their disputes in the courts of the states in which they all reside or of which they are all nationals (here, Greece).

- This point is one that I have been troubled by but in the end have concluded that it is not one that of itself should prevent me from considering the grant of the declarations sought on their individual merits, although as I have said this issue is one I will have to return to when considering the declarations sought in relation to EJN4. My reasons for reaching this conclusion are as follows.

- Firstly, had this point been one that was of general significance in the circumstances of this case I would have expected Mr Sarll to deploy it on behalf of the second defendant but he did not except perhaps in relation to EJN4. In any event, secondly, like all discretionary issues, it is fact sensitive. Here, other than in relation to the EJN4 issue, no proceedings have been commenced in Greece, contrary to the position in both the authorities referred to above and may never be commenced. Thirdly, whether a court will grant declarations that might incidentally impact on foreign proceedings will depend in practice on whether the proper parties are before the court (as they may not be if the purpose of seeking declarations is to influence foreign proceedings), on whether the declaration sought will serve any practical utility other than to influence the outcome of foreign proceedings and on whether there is a real and present dispute between the parties before the court that the declarations sought will or are intended to resolve. These are factors that are material to the exercise of discretion in any event. In those circumstances that is where no foreign proceedings have been commenced other than in relation to part of the EJN4 issues, the impact of these proceedings on any proceedings that might be started in Greece has not been relied on by Mr Sarll (other than perhaps in relation to EJN4) and the other factors I have mentioned will have to be considered as part of the discretion exercise in any event, all lead me to conclude that the potential impact of any declarations that I might grant on yet to be commenced foreign proceedings is something that I should leave out of account other than to the extent referred to below.

- More generally and in summary the applicable principles that a Court should apply when considering whether to grant declarations are:

- EJN1 was served by Kolen as shareholder in MIHL on AF and MEM and is dated 21 October 2019. The EJN text is lengthy but is summarised in the re-amended Particulars of Claim at paragraphs 27 in these terms:

- The declarations sought in these proceedings in relation to EJN1 are set out in paragraphs 47 - 48 and 49.9 of the re-amended Particulars of Claim (where what is set out is sought in relation to each of EJN1, 3 and 4), and paragraphs 49.1 49.3, 49.8 and 49.10 of the re-amended Particulars of Claim, where what is set out are the declaration sought specifically by reference to the allegations made in EJN1.

- This issue is one that arises in relation to EJN1, 3 and 4. It is convenient that I reach conclusions in respect of it at this stage so that I don't have to return to it again.

- In substance the point is that each of EJN1, 3 and 4 purports to assert rights to information or payment that can only arise if it arises at all under the SHA. However clause 13.13 of the SHA provides:

- The claimants allege that service of EJN1,3 and 4 constitutes a breach of clause 13.13 of the Stockholder Agreement, as the claims were the subject of extra-judicial process in Greece and not a claim brought before the English Courts. I accept that this is a submission that if otherwise correct is potentially available in relation to EJN1,3 and 4 because Kolen is the or one of the parties in whose name those notices have been issued and is a point that is available to any of the parties to the SPA to which EJN1, 3 or 4 is addressed. I consider whether it is open to any party to whom these notices have been addressed who is not a party to the SHA later in this section of the judgment.

- For clause 13.13 to apply, the service of the EJNs would have to constitute "Litigation" within the meaning of that clause. That concept is widely defined by Article 1 of the SHA to mean " any claim, action, suit, audit, inquiry, proceeding or governmental investigation." In consequence, clause 13.13 applies to " any claim, action, suit, audit, inquiry, proceeding or governmental investigation against any party to this Agreement arising out of or in any way relating to this Agreement (including any non-contractual obligations arising out of or in connection with this Agreement) ".

- The words " arising out of or in any way relating to " are of very wide scope (see by analogy the case law in relation to the scope of such language in arbitration agreements) and here there is no real doubt and in any event I find that EJN1 and 3 each concern issues arising from or relating to the SHA. EJN1 is concerned with complaints made by Kolen in its capacity as a shareholder in MIHL and relates to accounting in respect of vessels owned by MIHL. The material that is sought by EJN1 is material that Kolen can be entitled to (if at all) only in its capacity as a shareholder in MIHL. ERJN3 was issued by Kolen in its capacity as a shareholder in MIHL, is concerned with the operation of the MIHL fleet and seeks information that it is entitled to if at all only by reason of it being a shareholder in MIHL. Finally EJN4 was issued by Kolen but is exclusively concerned with the issue already considered at some length earlier in this judgment as to whether Plous or AF has accounted correctly to MIHL in respect of the sale of the Christine B pursuant to the alleged agreement that JF alleges was made at a time when that vessel was ultimately owned by MIHL. It is probable that the phrase " arising out of or in any way relating to " is wide enough to include such an issue.

- There are two generic issues that remain however. The first is whether the EJNs are each a " claim, action, suit, audit, inquiry, proceeding or governmental investigation " and secondly whether clause 13.13 can have any application to anyone who is not a party to the SHA.

- It is plain that the EJNs contain claims in the sense that each contains a demand made in the name of the party on whose behalf the notice is said to have been issued. However the word "claim" in the context in which it is used in clause 13.13 means something more narrow than that and plainly means a formal process. This is apparent from the words and expressions that follow it in the definition. There is no evidence that suggests that compliance with the notices is anything other than a matter of choice for the recipient. As I said earlier, this point tends to be emphasised by their description as being "Extra Judicial" which as a matter of language suggests that it is something issued without invoking the jurisdiction of (in this case) the courts of Greece. The only reference within the documents to the Greek Courts seems to be limited to issues of service. There is no evidence of Greek law or practice adduced by either party. There is thus no evidence that the issue of such a notice compels the recipient to do anything as a matter of Greek law.

- The definition and clause 13.13 have to be read together with the result that the apparently wide scope of the definitional language has to be read as qualified in two ways first what would otherwise come within the scope of the definition of Litigation is qualified by limiting it to any formal process coming within that definition that is started in a court of competent jurisdiction but is capable of being " brought in the courts of England " and by limiting the scope of the clause as a matter of construction to prohibiting the initiation of any claim or other proceedings otherwise coming within the scope of the definition of Litigation before any state court with jurisdiction that otherwise could be brought in the courts of England. Understood in that way, in my judgment the clause operates like any other exclusive jurisdiction provision and would preclude the second defendant from bringing proceedings against any other party to the SHA in any court of competent jurisdiction other than the Courts of England and Wales.

- In my judgment that provision so understood has not yet been breached by Kolen because no such proceedings have been commenced, other than in relation to EJN4. As Mr Sarll put it in his oral closing submissions " because no process was ever engaged through the sending of this letter, there cannot be a breach. these are mere letters, the same way that one might write a letter before action and there is no process that they engage. If you get a letter from a lawyer, you could throw it in the bin if you wanted to unless, of course, actually there is process involved and then there might be sanction of some sort."

- The other issue that arises concerns the parties to whom the notices have been addressed. The parties to the SHA are MIHL, FBC and Kolen. Oscaleta is also a party but that is not material to any issue in this case because it is not a party to these proceedings and the EJNs have not been addressed to it. Clause 13.13 expressly applies for the benefit only of " any party to this Agreement ". It cannot therefore be enforced against Kolen by either AF (to whom EJN1,3 and 4 are each addressed), by MEM (to whom EJN1 and 3 are addressed) or by AM (to whom EJN3 is addressed). AM is not a party to these proceedings. It has not been argued that FBC could or is seeking to enforce clause 13.13 on behalf of AF, MEM or AM, nor was it argued on behalf of the claimants that it was open to either AF or MEM to enforce clause 13.13 against Kolen by operation of the Contracts (Rights of Third Parties) Act 1999 and it does not appear to be arguable that they would be entitled to, given the language of clause 13.13 and applying ss.1(1)(b), 1(2) and 1(3) of the Act.

- I turn now to the declarations sought by reference to the clause 13.13 point. The Declaration sought by paragraph 49.9 of the re-amended Particulars of Claim is not one that can or should in the exercise of discretion be granted because the service of EJN 1, 3 and 4 is not a breach of clause 13.13 for the reasons set out above. Even if that is wrong it is not a declaration that could be made in favour of the claimants to whom the EJN1, 3 or 4 are addressed because none of them are parties to the SHA. EJN1 is addressed to AF and MEM, neither of whom are parties to the SHA; EJN3 is addressed to AF, MEM and AM, none of whom are parties to the SHA and EJN4 is addressed to AF, who is not a party to the SHA as I have said. In those circumstances, there is no real and present dispute between the parties before the court as to the existence or effect of clause 13.13 and in any event, the most effective way of resolving any issue concerning the scope and effect of clause 13.13 is on an application for an anti-suit injunction as and when any proceedings are commenced otherwise than before the Courts of England and Wales by a party to the SHA against any other party or parties to it or against any other party who is not a party to these proceedings and claims to be entitled to take advantage of the provision.

- In those circumstances, the claims for declarations as set out in paragraphs 47, 48 and 49.9 are refused.

- The declarations sought by reference specifically to EJN1 are sought by all the claimants and are in these terms:

- As to the balance of the declaration sought, in my judgment it is necessary throughout to have clearly in mind Neuberger J's warning in Finance Service Authority v. Rourke (ibid.) set out in paragraph 43(iii) above and set out in the same paragraph.

- Paragraph (a) of the demands set out in EJN1 calls on AF and MEM to provide to Kolen (i) " detailed accounts for the management of Hope 1 and Pacific Cebu from 10 March 2017 to date". The reference to "date" can only be to the date of EJN1 that is 21 October 2019. The claimants' case is that Kolen has received all the documents that it is entitled to for the period referred to. JF's evidence contained in paragraph 35 of his first witness statement is that:

- Article 8 of the SHA governs what information was to be maintained by MIHL and what access each shareholder was permitted to have to that information. This provision included:

- When considering some aspects of what Lawton LJ says in that case it needs to be borne in mind that the principles that apply to the conduct of civil litigation have changed significantly since 1986. However the principles relating to the importance of pleadings as the means by which the issues to be determined at trial are identified and defined remain as important now as they did then. At the start of the trial Mr Sarll applied for permission to make wholesale amendments to his client's Defence. That application failed for reasons that I gave at the time but which included that the application was a very late application. In light of that result, Mr Sarll and his client are in principle limited to the issues that arose on the pleadings as they are. That said, there are limits to how far this principle can be taken in a claim where the only remedies being sought are declarations. As I have said repeatedly, whether a declaration is granted in the terms sought is a matter of discretion, and as Neuberger J held in Finance Service Authority v. Rourke (ibid.), "The court should not grant any declarations merely because the rights, facts or principles have been established and one party asks for a declaration. The court has to consider whether, in all the circumstances, it is appropriate to make such an order." If the evidence suggested an entitlement to particular types of information for example and there was a doubt as to whether such or all such information had been provided, it may be appropriate to decline to grant a declaration that suggested otherwise on appropriateness grounds notwithstanding the state of the pleadings. However, whether that is the correct response is acutely fact sensitive.

- In relation to EJN1, Kolen pleads only that MEM:

- In the end the only objection in relation to the first declaration sought was that (a) the accounts for the 9 months ending 30 September 2019 were not audited and (b) no accounts had been provided for any period thereafter. As to the first of these points, it is mistaken because clause 8.1(d)(i) of the SHA does not require the production of audited accounts unless the conditions set out in the clause (which require the provision of audited accounts only following their approval by the Board) have been met. There is no evidence that they have been and it is not alleged in the pleadings by Kolen that those conditions have been met. The key point is however, that the declaration as drafted does not suggest that audited accounts have been provided for the last 9 month period referred to in paragraph 49.1 of the re-amended Particulars of Claim.

- The second point has more substance only because the accounts that have been provided for 2019 are for the 9 month period ending on 30 September 2019 whereas EJN1 is concerned with the period down to 21 October 2019. However, provisionally, I consider that can be addressed by qualifying the words " and have accordingly received the detailed financial accounts as required by the Stockholder Agreement" by adding the words " down to 30 September 2019". However I will hear counsel further on this drafting point following hand down of this judgment.

- This declaration is concerned primarily with the dry-docking costs incurred in respect of the Hope I and Pacific Cebu and the purchase cost of all spares placed on board those vessels. This is addressed in EJN1 at paragraph (d) where Kolen requested "certified copies" of the "relative official statements" showing actual payment of these costs. These expenses relate to the years ending 31 December 2017 and 2018 - see paragraph 29.1 of the amended Particulars of Claim. Assuming this factual assertion to be correct, these expenses thus relate to years in respect of which Kolen has been provided with audited accounts.

- The claimants' case concerning this issue is pleaded at paragraph 29 of the amended Particulars of Claim (which remained unaltered in the re-amended Particulars of Claim) in these terms:

- Paragraph 29 of the amended Particulars of Claim is addressed in Kolen's amended Defence at paragraph 14, where it is pleaded:

- AM asserts in paragraph 94 of his statement that Kolen had called for " documentary proof of the costs incurred ". On this basis Mr Allen submits that the claimants are entitled to the declaration sought because Kolen has been provided with evidence for all these costs " being " " 463 pages of invoices and proofs of payment for drydocking costs, repairs and purchase of spares with respect to PACIFIC CEBU " and " 477 pages of the same for HOPE I " and because " There is no pleaded suggestion by D2 that any of this information is incomplete or defective in any way " The difficulty about this material is that EJN1 was not concerned with proof that costs had been incurred but with payment of the costs. That being so, the volumes of evidence showing that the costs had been incurred is beside the point other than to the extent that it can be inferred that because the costs had been incurred they must also have been paid. As to this point, AM states in paragraph 95 of his statement that:

- The audited financial statements for MIHL for the year ending 31 December 2017 record the dry-docking/special survey costs for Pacific Cebu totaled $950,780 in 2017 and that those costs were "capitalized". That cost receives the same treatment in MIHL's accounts for 2018 and those of the vessel owning subsidiary Rigel. The Hope I costs are recorded as to US$870,222 in the audited financial statements for her owning company Cordelia as well as MIHL's accounts for the year ending 31 December 2018 and as to the balance (being costs incurred in 2015) as part of Cordelia's 2018 accounts. The spares are likewise set out in the accounts of the vessel owning subsidiaries and the underlying vouchers and receipts evidencing the sums recorded in the accounts have been disclosed and are in evidence.

- In light of this, Mr Allen submits that this material contains all the evidence of payment that can or should be required contained as it is in transparent audited accounts prepared and audited by Grant Thornton. As he put in his oral closing submissions, " these expenses have been exhaustively evidenced". He concluded this part of his submissions by saying:

- Mr Sarll submitted that this was all entirely wrong. First he submits that " article 8 of the Stockholder Agreement entitled Kolen to audited financial reports, and the unaudited consolidated financial statements, the management accounts, for the interim period to 30 September 2019 are no substitute." In my judgment that is not a submission that is available to Kolen on the pleadings because no such allegation has been pleaded. Indeed, on Kolen's own pleading the period 1 January to 30 September 2019 is entirely immaterial because it has admitted that these costs were incurred in 2017 and 2018 as alleged by the claimants in paragraph 29 of the amended Particulars of Claim. In his closing submissions Mr Sarll did not really grapple with this part of the case at all see T4/56/13-57/2.

- On the pleadings, the only point that could be made is that the sums in issue had not been paid. However that point was not deployed by Mr Sarll in the course of his closing submissions. It is in any event not arguable because of the treatment given to the items in the audited accounts that are available. The absence of yet further audited accounts that I infer would have provided exactly the same treatment of the same items would not assist.

- In those circumstances, I consider that in principle I could declare that Kolen has received audited financial statements for Cordelia and Rigel for 2017 and 2018, and unaudited consolidated financial statements for the MIHL for the interim period to 30 September 2019, verifying the repair (dry-docking) costs, and purchase cost of all spares placed on, the Hope I and the Pacific Cebu. However, in principle I do not consider that any declaration should go further than that on the evidence that is relied on and should not include the final sentence to the effect that Kolen has accordingly received the detailed financial accounts required by the Stockholder Agreement. That sentence is not justified because the declaration sought is concerned ostensibly with the treatment of dry docking and spares costs. It is inappropriate to include within it general words that could be interpreted as applying to issues other than drydocking and spares costs for the two vessels in question.

- The declaration sought is to the effect that MIHL and/or Kolen are aware of and have approved the management fees charged by the Third Claimant in the amount of US$30,000 per vessel per month. It is said that this declaration is material to a dispute between the parties to the effect that the management fees and consultancy fees in respect of the Hope I were never agreed and requests an explanation as to why consultancy fees were incurred and disclosure of invoices.

- The difficulty about this formulation (which comes from paragraph 70 of Mr. Allen's opening submissions) is that it does not actually reflect the true nature of the dispute between the parties as set out in EJN1. As Mr. Sarll said in the course of his submissions:

- The only issue that remains therefore is whether I should grant the declaration sought at paragraph 49.3 of the re-amended Particulars of Claim given that as Mr Sarll indicated it is not objected to simply because what it refers to is not in dispute between the parties and because the real issue (charging in excess of the admitted figure) is not addressed by the declaration sought. This is more difficult. Generally, there must be a real and present dispute between the parties as to the existence or extent of a legal right between them before court will grant a declaration concerning that legal right. However, that has to be balanced by other factors including the balance of justice between the parties, whether the declaration would serve a useful purpose and whether there are other special reasons why the court should or should not grant the declaration see the summary of applicable principles in paragraph 43 above.

- On balance I consider it is appropriate to grant this declaration. My reasons for that conclusion are as follows. First, the claimants pleaded their case concerning this issue in clear terms in paragraph 30 of their amended and re-amended Particulars of Claim. Whatever else might be said of paragraph 15 of Kolen's amended Defence, it does not contain the admission or concession made by Mr Sarll referred to above.

- In those circumstances, while there is currently no issue between the parties concerning what had been agreed concerning the payment of fees, that was not the position when the Defence was filed. It is possible that there may be other litigation between some or all of these parties. It is possible that at least some and possibly all of the parties may be differently represented in such litigation than they are today. In those circumstances, justice to the claimants requires that there be a declaration to the effect sought in order to preclude any misunderstandings as to the position later. There is no injustice to Kolen in adopting this course because of the concession that it has now made, because that concession was not made in its Defence and the only injustice that might arise would occur if I had granted the declaration sought at paragraph 49.8 of the re-amended Particulars of Claim, which as I have said I do not intend to grant in any event. The declaration will serve a useful purpose by eliminating the possibility that Kolen might attempt to withdraw its concession in subsequent proceedings either here or elsewhere and I conclude that would be a special reason for granting this particular declaration even in the face of the concession now made.

- There is a short issue I should mention concerning consultancy fees. The claimants' case is pleaded in paragraph 31 of their amended and re-amended Particulars of Claim. Kolen's pleaded response to this was in paragraph 16 of its Defence and was "Paragraph 31 is noted". As I have said that is an implicit admission since it is neither a non-admission or a denial. Although there was some discussion about the issue there is no specific declaration sought in relation to it. Thus while this issue is the subject of the first sub-paragraph (b) and the second sub-paragraph (c) within EJN1, no declaratory relief has been claimed in respect of the issue. In those circumstances, as I see it provisionally I need say no more about this issue although if counsel take a different view I will hear brief further argument on this point following the hand down of this judgment.

- In summary therefore in principle the claimants have made out their case on the evidence to be entitled to declarations as sought in paragraphs 49.1 (provisionally, subject to the qualification referred to above), 49.2 (omitting the final sentence) and 49.3.

- The remaining question is whether as a matter of discretion, I should grant the declarations sought. I have already addressed this issue in relation to paragraph 49.3. Mr Sarll did not specifically submit that any of these declarations should be refused on discretionary grounds because he focussed instead on what he considered to be the evidential issues that arose in relation to each declaration sought. The real issue that arises is whether the fact that AF and MEM should benefit from declarations made by reference to obligations imposed by the SHA when neither are parties to it. As I have noted, this is not a bar to the grant of what is otherwise appropriate declaratory relief. As will be apparent from what I have set out above, in reality all these parties are closely inter related and it is probable that if there is any further litigation it will involve at least some of those who are not parties to the SHA.

- In those circumstances, in the exercise of my discretion, I consider that the declarations sought in paragraphs 49.1 to 49.3 are ones I should grant subject to the provisional qualifications and qualifications already referred to.

- EJN2 was issued by First Lines against AF, MEM and AM. Its effect is summarised accurately at paragraph 34 of the re-amended Particulars of Claim as alleging that MEM owes it the sum of US$1,182,218.06, plus interest, by way of management fees said to have become due to First Lines during its time as manager of MIHL's ships as provided for by clause 5.5 of the SHA. EJN2 demands payment within 5 days of service from MEM.

- Although EJN2 is addressed to AF and AM (as well as MEM), no claim is made against either of them by EJN2. As EJN states:

- Although management of MIHL's ships by First lines is provided for by the SHA, it was carried into effect by two other agreements a ship management Agreement ("SMA") made on 8 September 2014 between First Lines and MIHL, which was subject to a London arbitration agreement contained in clause 16 and an Administrative Services Agreement ("ASA") between the same parties made on the same date that was also subject to a London arbitration agreement contained in clause 17 of that agreement. It follows from this that (a) any claim concerning the fees due at any rate as a matter of contract is an issue that arises only as between MIHL and First Lines and (b) any dispute between them concerning fees must be referred to arbitration in London. The claimants allege and it appears not to be disputed that First Lines' claim for management fees is currently the subject of an ongoing arbitration in London, brought by MIHL.

- I now turn to the declarations sought by reference to EJN2. Aside from the general declaration sought in paragraph 49.8 that I have addressed already, the declaration sought specifically by reference to EJN2 are those set out in paragraphs 49.4 and 49.11 of the re-amended Particulars of Claim. They respectively provide:

- In my judgment the claimants are not entitled to either of these declarations. I reach that conclusion for the following reasons.

- The claimants no longer pursue the application for these declarations on behalf of MIHL (the first defendant) see paragraph 54.1 of Mr Allen's closing submissions. This was an inevitable concession since referring back to The Bank of New York Mellon v. Essar Steel India Limited (ibid.) the claim for a declaration as to the liabilities between MIHL and FL raises the issue in a very direct way as to whether it is appropriate for the court to grant declarations that may then be deployed to influence other tribunals. It is obvious that a declaration that FL was not entitled to recover money from MIHL would be an attempt to defeat the resolution of the dispute between MIHL and FL by the method they agreed and have embarked upon on the pending arbitration proceedings. As Marcus Smith J said in Essar Steel (ibid.), the possibility of a declaration having such an effect " would amount to an improper interference in a process being conducted by a party not before me, who has been unable to make submissions." It was also entirely inappropriate since FL is not a party to these proceedings.

- It follows from the concession just referred to that this part of the claim is pursued only on behalf of AF and MEM.

- Turning first to the declaration sought in paragraph 49.4, no claim has been made by FL in EJN2 against anyone other than MEM (the third claimant) (and so not against AF (the second claimant)). AF is not a party to either the ASA or the SMA and FL is not a party to the SHA. There is therefore no issue as between FL and AF to which the declaration sought in paragraph 49.4 of the re-amended Particulars of Claim could play any useful role. It follows that it would be wrong to exercise my discretion by granting a declaration in the terms sought and pursued.

- In relation to this part of the claim as it related to MEM, I repeat that FL is not a party to these proceedings. This raises a number of potential difficulties. First, it is questionable whether any declaration made in these proceedings could be technically binding on FL, secondly Mr Sarll is not instructed on behalf of FL not least because FL is not a party to these proceedings and thus any concessions he makes are or may not be binding on FL, and thirdly it raises the question whether its case will be fully and properly put, given that there are extant arbitrations proceedings in London which engage the same issues.

- Mr Allen in the course of both his written and oral submissions has repeatedly complained that facts and matters relied on by Kolen have not been pleaded. However, in paragraph 19 of Kolen's Defence it has pleaded that:

- The claimants have spent much time and energy in these proceedings attempting to demonstrate that FL is not entitled to any part of the sum it claims from MIHL. This part of the case is pleaded in paragraph 35 of the re-amended Particulars of Claim. In summary, the claimants allege that the total sum owed is US$960,006 not US$1,182,218.06 and that sum has been discharged not by payments by MIHL to FL but by a combination of payments or credits by AF to JF of US$480,003 referred to in the Schedule set out earlier in this judgment as " Intercompany account due to FL " and/or payments by MIHL to JF of US$699,700 and/or to FL totalling US$330,2017, the sums due have been discharged.

- This is not the correct or appropriate forum to resolve this dispute, as I have explained earlier and as is apparently now conceded. The correct forum for this issue to be resolved is either in the arbitration currently on foot in London (where all issues concerning third party set offs and cross claims can be resolved if truly relevant) and (in relation to parties who are not parties to the arbitration agreements) in proceedings in Greece. As Kolen correctly pleads in paragraph 19A of its Defence:

- It would be an entirely impermissible exercise of discretion to attempt to resolve in these proceedings issues that can or should be resolved elsewhere. If it is contended that as a result of agreements between AF and JF the sums otherwise due from MIHL to FL have been discharged then that issue should be resolved in the arbitration in which MIHL's alleged indebtedness to FL is to be resolved. If and to the extent this part of the case is not covered by the concession referred to earlier, the declaration pursued is nevertheless an attempt to sidestep the arbitration and to avoid the need to litigate the issues between the parties other than those who are party to the arbitration by litigation in Greece.

- As I said earlier a court asked to grant a declaration is required to ask itself whether the grant of declarations by a court in England and Wales is the most effective way of resolving the issues raised. In answering that question it must consider the other options of resolving this issue - see Rolls Royce plc v. Unite the Union (ibid) per Aikens LJ at paragraph 121(7). It is manifest that there are other more effective ways of resolving the issues that arise that is by arbitration between the parties to the arbitration agreement in the arbitration that is now proceeding with any claims against anyone not party to the arbitration agreement being litigated elsewhere. This is not a jurisdiction issue as Mr Allen suggests but a strong reason why in the exercise of its discretion the court should not grant the declarations sought.

- In relation to the declaration referred to in Paragraph 49.11, neither MIHL (the first defendant) or Kolen (the second defendant) have made any claims for money from AF or MEM by EJN2 or at all. The claim in EJN2 is a claim for money by FL from MEM that plainly MEM cannot owe since it was not a party to either the ASA or the SMA under which FL apparently claim entitlement to be paid. This does not justify a declaration in the terms set out in paragraph 49.11 however, because there is no mention of FL anywhere within it. Mr Sarll accepted in the course of his closing submissions that EJN2 was " not legally right. Of course it is not legally right " see T4/59/10-14. This raises the possibility that it may be appropriate to grant a much more narrowly formulated declaration focussed exclusively on MEM's alleged liability to FL in respect of the sums the subject of EJN2. In the end there are three reasons why I think I should not adopt that course.

- First, no such claim has been made. As Mr Allen has submitted repeatedly, the parties should be confined to their pleaded cases.

- Secondly, Mr Sarll is not instructed by FL and it would be wrong to grant a declaration that may impact on rights that FL has without FL being a party to these proceedings and advancing whatever argument might be thought available to it. Mr Allen argued that this was not relevant because Aikens LJ held in Rolls Royce v. Unite the Union (ibid.) that

- Thirdly, if the issue is as straightforward as it appears to be then it can and should be summarily disposed of if and when any claim is brought by FL against MEM. As I have said earlier the EJNs are not themselves proceedings but an apparent threat to commence proceedings. The issue can and should be resolved by the court before whom any such claim is brought by reference to the legal principles that apply to any such claim. Those principles would not I think necessarily be English law principles because MEM is not a party to any of the relevant agreements.

- Finally, before leaving this point I should record Mr Allen's submission at paragraph 55 of his closing submissions that:

- EJN3 dated 24 October 2019 is addressed to AF and MEM as well as other individuals who are not parties to this litigation. It is concerned with the management by MEM of the MV Nikolas III and MV Titan owned by MIHL through its subsidiaries Iris Enterprises Company SA (MV Nikolas III) and Titan Maritime Enterprises SA (MV Titan).

- Management of these ships was transferred from FL to MEM on 21 and 22 May 2017 as a condition of the re-financing of those vessels as explained earlier. Both vessels were sold on 23 September 2017 and so were managed by MEM for four months between 21 May and 23 September 2017.

- EJN3 is not clearly expressed as to who is alleged to have done what. I accept however that as alleged by the claimants it makes allegations against AF and MEM. As summarised accurately in paragraph 37 of the re-amended Particulars of Claim, EJN3 alleges as against AF and MEM that they:

- The notice goes on to make various demands for information and accounting as summarised in paragraph 38 of the re-amended Particulars of Claim accurately as being:

- The only pleaded defence to these paragraphs is in paragraph 20 of the amended Defence. It admits the sale of the vessels on 23 September 2017 and then pleads:

- The relief sought by the claimants by reference to these allegations are the declarations set out in paragraphs 49.5, 49.6 as well as paragraphs 49.8 and 49.11. Paragraphs 49.5 and 49.6 are respectively to the following effect:

- Kolen denies that the claimants are entitled to either of the declarations referred to in Paragraphs 49.5 and 49.6 of the re-amended Particulars of Claim see paragraph 49 of the amended Defence. Although the basis of this general denial is not pleaded, if the pleading is read as a whole it is clear that the entitlement to the declaration sought is denied by reference to what is pleaded in paragraph 20.

- The claimants rely on the financial statements for MIHL for the period ending 31 December 2017 audited by Grant Thornton and two Reports of Factual Findings dated 13 December 2018 on the position of Iris Enterprises Company and the Nikolas III and Titan Maritime Enterprises and the Titan. Although, as Mr. Allen submits, the allegations in paragraph 39 have not been denied, no doubt that was because at that stage the accounts referred to had not been provided. However, they were subsequently.

- Mr Sarll's case was that identified by him in his closing submissions at T4/60/9-12 that MEM has wrongfully retained the earnings of both ships during the four month period between management of the ships being transferred to MEM and the sale of the vessels. This issue is one that the claimants addressed in paragraphs 90 91 of and Annex 1 to their opening submissions.

- Mr Allen complains in both his written opening and closing submissions about a supposed lack of particularity of Kolen's case on this issue. As long as the focus of this complaint is what is set out in the Defence, this is a point with at best forensic substance for three reasons. First it was open to the claimants to apply to strike out the Defence if they considered it so lacked particularity that it was embarrassing to the fair trial of the claim. No such application was made. Secondly it could have requested Further Information under CPR Part 18 if further particulars were in fact required but again they did not. Thirdly the opening outlined in great detail and by reference to an 8 page annex to the written opening why this point is not maintainable. Thus in my judgment there is no substance to the complaints made concerning lack of particularity. However, if and to the extent the complaint concerns a departure from the strict confines of what is pleaded then there is more substance to the point.

- The specific allegation made in the Defence is that " the income of "Titan" and "Nikolas Ill" through the period 21 May 2017 and 22 May 2017 respectively up to 23 September 2017 has been retained by the Third Claimant ". The material that is set out in paragraph 90-91 of the claimants' opening submissions together with the 8 page annex demonstrates that this point lacks any substance. The contents of the annex is a distillation of the material that is contained in the statements of account issued by Credit Agricole Indosuez Bank ("CA") in relation to both Iris and Titan, copies of which have been included in the trial bundles, the internal accounts maintained by MEM in respect of the management of each vessel and the charter hire invoices for each vessel. It is not suggested that the distillation contained in Annex 1 is not accurate. It follows from this that the assertion that the income of either ship has been retained is unsustainable and, as the claimants submit:

- It is now necessary to consider Mr Sarll's response. Notwithstanding this material, Mr Sarll maintained that all hire charges during this period had been retained by MEM. He advanced this case in cross examination and in his closing submissions on the basis that (a) the ships were managed by MEM throughout the relevant period (T4/60/22-24); (b) no audited accounts for either ship owning company have been produced (T4/60/25-27); (c) the consolidated accounts on which the claimants rely record that " hires were earned in the amount of $1.8 million and there were liabilities of about $3.1 million " (T4/60/32-33); (d) the expenses incurred by the companies to whom ownership was transferred in September 2017 purported to be about US$24,000 a day by contrast with what was to be expected which is about US$6,000 per day (T4/61/8-13) and (e) that " If you take that and then multiply it by the 100 days in question, that would cover the entire period between May and September when the ships were managed by " MEM. In other words, what Mr Sarll appeared to be suggesting was a sophisticated fraud being operated by those controlling MEM by which the or part of the charter receipts due ultimately to MIHL during the relevant period had been retained by MEM by claiming false expenses for the ships. Mr Sarll submits that whether or not there was an agreement to the effect pleaded in Paragraph 20 of the Defence does not matter see T4/61/27-29 because the trade debt should have gone to the new owners with the ship but hire earned prior to transfer of the ship should have remained with the selling companies.

- There are a number of difficulties about this theory. The first is a genuine pleading point. None of these allegations have been pleaded. Although I do not accept that Mr Allen is entitled to be critical about the lack of particularity in paragraph 20, because as I said earlier his clients had remedies available to them if they had wanted to address this point ahead of the trial, he is fully entitled to complain that a wide ranging allegation of what amounts to a fraudulent conspiracy has not been pleaded at all. That of itself is enough to mean this point cannot be permitted to go further.

- This point is made worse in my judgment by the fact that Mr Sarll simply abandoned what in fact was his client's pleaded case. His pleaded case depended on an agreement between FBC and AF on the one hand and Kolen and JF on the other that the hire for the two vessels down to 23 September 2017 would be for the benefit of the selling Owners but the operating costs of those vessels down to the same date would be met by the new Owners. As he put it in the course of his closing submissions, " I do not need anything about whether they agreed for the hire to enure to the benefit of the first and for the operating costs to be transferred to the second. I do not really, I am not really very interested in that ". This is a somewhat surprising position to adopt given what had been pleaded and what was being alleged.

- In order that this theory can work, Kolen has to avoid the documentary evidence available which shows the sums billed to charterers, the sums received from charterers being the same sums and those sums being credited to the bank accounts of the ship owning companies. Unless this can be explained away, it is fatal to Kolen's theory. As Mr Sarll accepted in the course of his oral closing submissions, " we fully accept that there were $1.8 million received into the bank accounts of the ship owning companies, Titan and Iris ". Mr Sarll's answer to this point was to say that the whole of the funds should still have been in the account. However, that takes no account of the fact that running a ship involves incurring and paying expenses. Expenses fall into two categories expenses paid as they fall due and expenses incurred but not paid immediately as they fall due which become part of the trading or operating expenses of the ship concerned. Mr Sarll suggested that all of these costs should have been accumulated and transferred on sale as part of the ships trading debt. I reject that notion. It is wholly uncommercial to suppose that any business can simply stop paying its running expenses in the hope that its owner might sell the business at some future date, at any rate in the absence of an agreement to this effect which was Kolen's pleaded case that Mr Sarll abandoned.

- As I have said more than once, Kolen's case on this issue depends on its pleaded assertion of an agreement " that the operating costs of those vessels through that time would be met by the new Owners who assumed Ownership of the vessels from 23 September 2017 ". There is no independent evidence of any such agreement. As AF says of Kolen's pleaded allegations:

- Mr Sarll completed this part of his submissions by saying:

- Where does this leave me? First, as I have said, Kolen's pleaded case must be rejected both because Mr Sarll did not seek to make good the pleaded agreement on which it was based and in any event because it must be rejected since I have accepted AF's evidence to contrary effect. As to the unpleaded case theory concerning what amounted to an allegation of fraudulent accounting, it is wrong in principle that the claimants should be expected to respond to allegations of this sort, when they have not been pleaded and seemed to change as the hearing progressed. Mr Allen asked rhetorically in the course of his reply submissions " How on earth can my clients engage with whatever my learned friend's theory is in his head at any particular moment of time?". That was unfair to Mr Sarll, since I am sure that what he said at any time reflected exactly the instructions that he received. As to the substance if "Kolen" was substituted for " my learned friend's ", the answer is however that the claimants cannot and should not be required to.

- I was willing to extend some quite significant latitude to Kolen (and rather more than Mr Allen considered I should) because Mr Sarll had been instructed late, his client's case was in disarray and I wanted to be absolutely sure that his client had a fair opportunity to advance its case within the constraints that applied to it. Perhaps I should have been firmer. However, having listened to what Mr Sarll had to say on this issue I remain satisfied that his client was not entitled to advance the theory he advanced on its behalf concerning what amounted to serious allegations of fraud. It was not a case open to his client on the pleadings, was contrary to the evidence that I have accepted and was entitled to accept for the reasons set out above and amounted, as Mr Sarll fairly acknowledged, to nothing more than speculation.

- Plainly, the claimants have demonstrated that "The charter hire earned by the "MN NIKOLAS III" and "MN TITAN" for the periods 22 May 2017 to 23 September 2017 and 21 May 2017 to 23 September 2017 respectively have been paid into the bank accounts of Iris Enterprises Company S.A. and Titan Maritime Enterprise S.A." In principle, the claimants are entitled to a declaration to that effect. A declaration to that effect will serve a useful purpose by ensuring that this particular issue is not one that any of the claimants will be put to the cost and inconvenience of having to prove again. Such a declaration of itself does not preclude Kolen from advancing a case in fraud based on the allegations made on its behalf by Mr Sarll providing it can properly be pleaded and proved in whatever jurisdiction it chooses to advance that allegation.

- The next question is whether I should go further and declare that the charter hire for each ship has in all the circumstances been properly accounted for, including as earnings of the First Defendant. The only answer as to why a declaration in those terms should not be granted depends on what is set out in paragraph 20 of Kolen's Defence, which I have rejected. That depends on an agreement that Mr Sarll chose not to rely on and on a pleaded assertion that " the income of "Titan" and "Nikolas III" through the period 21 May 2017 and 22 May 2017 respectively up to 23 September 2017 has been retained by the Third Claimant". That is plainly unsustainable on the documentation that has been produced, the authenticity of which was not in dispute.

- In those circumstances, I consider that AF and MEM are entitled to a declaration against Kolen that the charter hire for each ship has in all the circumstances been properly accounted for, including as earnings of the First Defendant. The burden of pleading and proving the allegations that Mr Sarll advanced in his closing submissions rested on Kolen. It failed on both counts.

- In summary therefore, there will be a declaration in favour of AF and MEM in the terms set out in paragraph 49.5 of the re-amended Particulars of Claim.

- The remaining question is whether I should also declare MIHL and Kolen are not entitled to any further sums with respect to the charter hire earned by the Nikolas III and the Titan for the periods 22 May 2017 to 23 September 2017 and 21 May 2017 to 23 September 2017 respectively. In light of my findings to date I consider it appropriate to declare in favour of both AF and MEM that MIHL is not entitled to any further sums with respect to the charter hire earned by the Nikolas III and the Titan but I do not consider I should go further than that. What Kolen is entitled to is a matter of accounting in relation to MIHL. What is due as between Kolen and MIHL is not the subject of EJN3.

- EJN4 was issued by Kolen and addressed to AF and notified to MIHL. Its effect is summarised in paragraphs 41-42 of the re-amended Particulars of Claim in these terms:

- The claimants' pleaded case as to this part of Kolen's factual case is set out in paragraph 45 of their re-amended Particulars of Claim, in these terms:

- Kolen's pleaded Defence to this part of the claim is at paragraph 21(ii) of its amended Defence and is in these terms: