Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Darnitsa v Metabay Import/Export Ltd [2021] EWHC 1441 (Comm) (28 May 2021)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2021/1441.html

Cite as: [2021] EWHC 1441 (Comm)

[New search] [Printable PDF version] [Help]

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

Fetter Lane, London, EC4A 1NL |

||

B e f o r e :

Sitting as a Judge of the High Court

____________________

| Private Joint Stock Company "Pharmaceutical Firm "Darnitsa" |

Claimant |

|

| - and - |

||

| Metabay Import/Export Limited |

Defendant |

____________________

Joseph Sullivan (instructed by Humphries Kerstetter LLP) for the Defendant

Hearing dates: 19 May 2021

____________________

Crown Copyright ©

See Also: [2021] EWHC 1471 (Comm)

- This has been the return date of an injunction granted by HH Judge Pelling QC on 19 March 2021, when he granted ex parte a worldwide freezing order in favour of the Claimant and Applicant (Darnitsa), a Ukrainian pharmaceutical company, against the Defendant (Metabay), an English company, pursuant to s25 of the Civil Jurisdiction and Judgments Act 1982 ("s25") in respect of proceedings then intended and now issued in the Commercial Court of Kyiv in Ukraine. The proceedings are a shareholders' derivative action brought by Darnitsa, based upon its 31% shareholding in another Ukraine pharmaceutical company (BCPP) pursuant to Article 54 of the Commercial Procedural Code of Ukraine, which provides that a shareholder of more than 10% of the authorised capital of a company may file a claim in the interests of that company for damages caused to that company by its officer.

- Darnitsa became a shareholder of BCPP in 2015, when it bought a stake from Kyiv City Council at a public auction, subsequently increased to 31.55%. Its position as a shareholder was challenged by the other (controlling) shareholders in BCPP, the Bezpalko family, of which the principal characters have been called Mother, Father and a daughter, Iryna, but the Supreme Court on 29 October 2020 validated Darnitsa's shareholding.

- The Ukrainian proceedings, in respect of which the relief was sought and granted in this Court pursuant to s25, are a derivative action brought by Darnitsa, by virtue of its shareholding in BCPP, against a number of respondents, primarily the Bezpalko family. The freezing order is directed against Metabay, which is not a defendant, but a proposed third-party (now joined as such since the hearing before me), to those proceedings, but it is common ground that it is not a requirement for s25 that the party against whom the order is granted be a defendant in the foreign proceedings, but it is simply provided that "The High Court in England and Wales… shall have power to grant interim relief where...[relevant] proceedings have been or are to be commenced in a [relevant state] other than the United Kingdom."

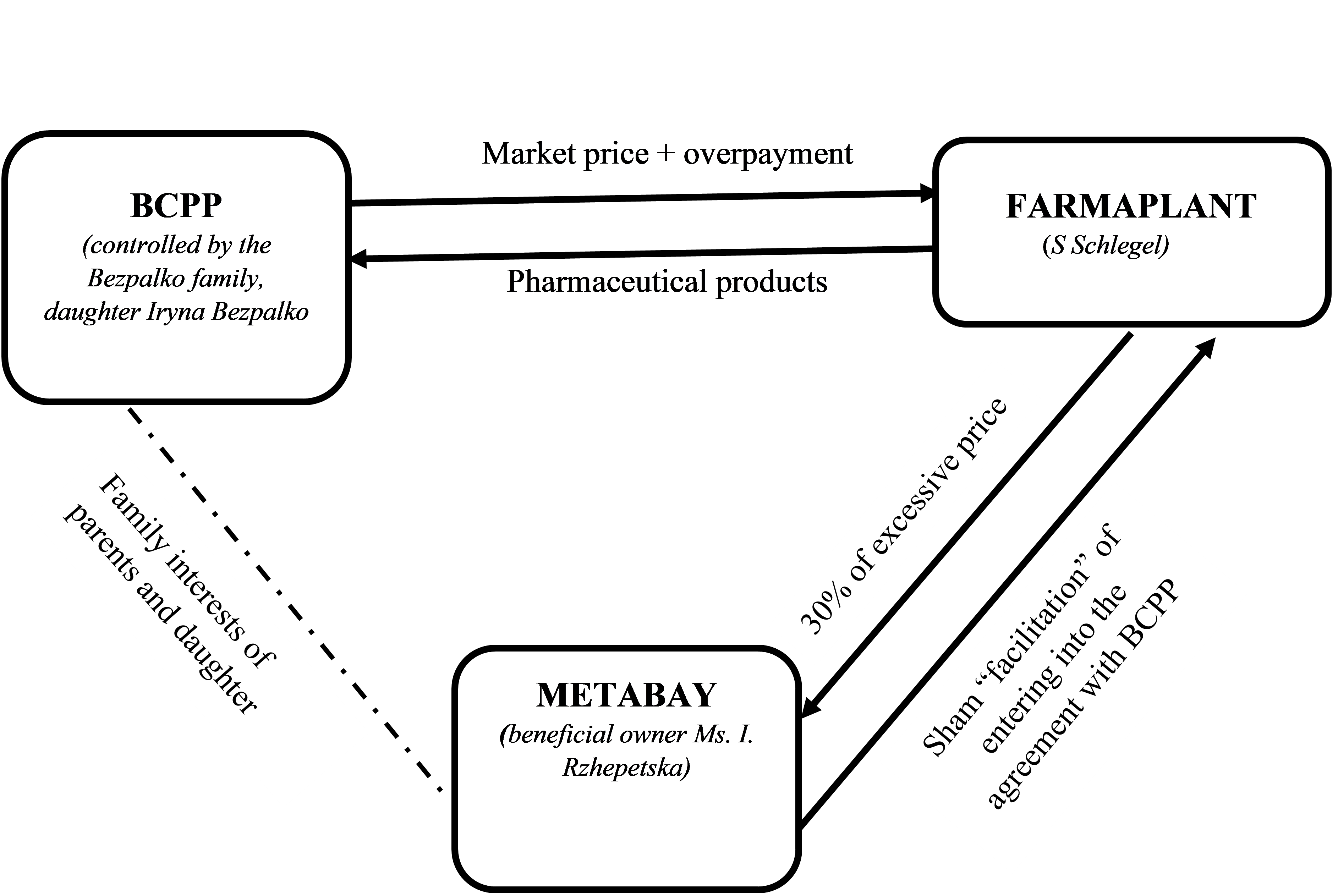

- The basis of the claim in the Ukrainian proceedings is that, after proceedings had been brought by Darnitsa in the Ukrainian courts for an audit of BCPP, contested by the Bezpalko family, it was discovered that there was an arrangement (subsequently discovered to be an Agency Agreement dated 1 January 2014 between Metabay and Farmaplant Fabrikation Chemischer Produkte GmbH ("Farmaplant")), by which Farmaplant, a regular and substantial supplier of BCPP, agreed to pay a commission of 30% to Metabay in respect of its sales to BCPP. Metabay on the evidence before me had no directors, a 'professional trustee', Mr de Merey, a Swiss fiduciary services provider, having died on 9 November 2020 and the other director, Elverin Associates Ltd ("Elverin") having been struck off on 6 July 2020. The Companies Registry, which on 8 April 2021 gave notice that Metabay will be struck off the register and dissolved not less than two months from that date, records as to its shareholding that Iryna has ownership of "75% or more" of the shares with the right to appoint and remove directors. Iryna has a power of attorney for Metabay, granted by Elverin on 26 May 2008.

- The Agency Agreement has no duration and has not apparently been terminated, and provides that "for each transaction which is brokered for Farmaplant through the agent, the agent shall receive a commission in an amount of 30% of the net sales price charged by Farmaplant for this transaction". Metabay, the agent, has no duties under the Agreement. The evidence provided by the Claimant, derived from expert reports obtained for the Ukrainian proceedings, is that (i) the prices which Farmaplant charged to BCPP (obviously incorporating the 30% commission) were excessive compared with the normal market price of the pharmaceutical products (APIs) in question, and (ii) a 30% commission is substantially more than a normal introductory commission, which would average 4.75%. Iryna has not provided to the Court any explanation either of the Agency Agreement or the role of Metabay, or of the 30% commission, but has simply stated in German criminal proceedings brought by Darnitsa that BCPP did pay dividends to Darnitsa. An order ancillary to this Court's Order was subsequently made on 19 March 2021 by a Swiss Court in Lugano, freezing Metabay's funds with PKB Privatbank SA ("PKB") in Geneva totalling US$ 1.17m.

- The Statement of Claim in the Ukrainian proceedings ("USC") is not in a form entirely consistent with English pleadings, though not greatly different. It includes a number of repetitions and some apparent inconsistencies or ambiguities, but in general terms it is, as translated, perfectly comprehensible. Metabay, and Farmaplant, are described in the title as third parties, and, as set out above, Metabay has now been joined as such. The following is clear from the USC:

- The position of Metabay is addressed several times in the USC (in which Father and Mother are First and Second Respondents and Iryna is Eighth), and not always consistently: –

- The Claimant asserts and asserted before HH Judge Pelling that there is a clear case that can be made against Metabay by virtue of the Chabra jurisdiction (TSB Private International SA v Chabra [1992] 1WLR 231) as far as English law is concerned and also by way of a similar jurisdiction, which it is common ground exists in Ukrainian law – hence the plea in the USC – and as described by the Claimant's legal expert Professor Kuznietsova in paragraph 78 of her report: "If it is indisputable that the monetary funds belong to the debtor, even if these funds are held by a third party, then such monetary funds may be collected to repay the debt of the debtor". Mr Harrison for the Claimant submits that the funds in Metabay belong either to Iryna or to the Father and Mother, who are also respondents in the Ukrainian proceedings.

- The Claimant submits, and submitted before HH Judge Pelling, that:

- The Defendant's attack on the Order, by way of application to discharge and/or opposition to its continuation is as follows:

- Mr Sullivan for the Defendant contends that there is no case against Iryna and, while accepting the applicability of the Chabra principle both in Ukrainian and English law, that there is thus no case against Metabay. Mr Harrison's case is that there is, by reference to the Ukrainian proceedings a good arguable case against Iryna and hence against Metabay, but in any event that there is a case against Mother and Father and similarly through the Chabra principle against Metabay.

- The case against Iryna. As Mr Sullivan himself made clear in his Skeleton, by reference to the approach of Snowden J in Yossifoff v Donnerstein [2015] EWHC 3357 (Ch) the case being brought in the foreign proceedings must be ascertained by reference to the pleadings in those proceedings. It is clear from paragraph 2.1.1 of the USC, that the case put against her is that she (like other respondents, including Mother and Father) is an officer of BCPP. The claim relates to the period since 2014. There seems little doubt that she was an officer before 2011, as she was from 2006 till December 2011 a member of the Executive Board of BCPP, as then constituted, but she ceased to be a member of that Board, and some time thereafter had acquired the title of Director of Business Development, which she still holds. Simply being an ex-officer would not be sufficient, as the fraud pleaded in the USC only began in 2014 (although there is now evidence as to it having commenced much earlier, as a result of disclosure in the German criminal proceedings referred to in paragraph 5 above). The Claimant alleges that the end of her formal role on the Executive Board did not result in any diminution of her actual authority within BCPP, indeed in such capacity she was responsible for the alleged Agency Agreement and the arrangements with Farmaplant. The Claimant alleges that such continued role as Director of Business Development in fact constituted her what would in English law be regarded as a shadow director. That there is a similar concept in Ukrainian law draws support from the expert report of Professor Kuznietsova at paragraphs 48 to 55. In any event the USC is founded upon the basis that she is an officer, and the motion to strike out has now been dismissed. I am entirely satisfied that there is a good arguable case in the Ukraine proceedings that she is such an officer. It is quite plain from the USC that on that basis there is a good arguable case in respect of the funds of Metabay.

- The other way the case is put by the Claimant is by reference to the Mother and Father, who are plainly officers. The question is whether their liability would found a Chabra type claim against Metabay. Although according to the Companies Registry records Iryna is the owner of more than 75% of the shareholding, there is plainly room for a shareholding held by the Mother and Father, certainly in the circumstances in which the 30% commission was extracted from the company they controlled. as described in the USC, with their involvement or connivance, although subsequently to the hearing Mr Sullivan drew attention to Iryna's evidence that she is the sole shareholder . The pleading in the USC is, as I have said, somewhat inconsistent. Paragraph 2.3 ends "These funds [in Metabay] are actually held, used and administered by Respondent 8 [Iryna], in other words they are owned by her rather than Metabay. Hence those funds may be recovered subject to the claims for recovery against Respondent 8", and paragraph 1.4.4 pleads her beneficial ownership of Matabay. On the other hand, it is plain from a number of other paragraphs that the case is put that Metabay's funds belong to the Bezpalko family and/or the Mother and Father: see paragraph 2.2.2(4) ("controlled by them"), 2.3 ("The Respondents' property"), 2.3 (5) ("probably in the interests of the other Respondents") and above all the very clear chart in paragraph 1.4.5 as to the "family interests of parents and daughter". I have no doubt that on the basis of the USC there is a good arguable case against Metabay via the Mother and Father.

- I consequently conclude that there is a good arguable case against Metabay.

- The risk of dissipation. Although Mr Sullivan accepts that the existence of a strongly arguable fraud can be a starter for a case of risk of dissipation, he submits that it is not sufficient of itself. He points out that the Claimants have known about Metabay since 2018, when criminal proceedings in Switzerland were commenced and, as the PKB account still contains substantial funds, there can have been no dissipation, and can now be no risk of dissipation. He refers to the words of Gloster LJ in Holyoake v Candy [2018] Ch 297 at [62], when she referred to the "stable door point" (i.e. that where there has been a delay there might be no point in making a freezing order) as being "a powerful factor militating against any conclusion of a real risk of dissipation. If there had been a real risk of the defendants unjustifiably dissipating their assets it would have materialised by the time of the application." Mr Harrison submitted that the words of Gloster LJ were very much dedicated to the facts of that case, and should not detract from the well-established principles that require the court to look at the facts of each case and decide whether the passage of time had rendered a freezing order pointless. He refers to the words of Longmore LJ in Ras al Khaimah Investment Authority v Bestfort Development LLP [2018] 1 WLR 1099 at [55], where he expresses the view that the stable door argument "assumes that a Defendant is already of dubious probity, and it is a curious principle that would allow such a defendant to rely on his own dubious probity to avoid an order being made against him". In any event, on the facts of this case the following can be said:

- Full and frank disclosure. It has over many years become an inevitability that there is in almost every application to discharge or opposed application to continue an injunction an allegation of full and frank disclosure, which is often, as Slade LJ described it in Brink's Mat Ltd v Elcombe [1988] 1 WLR 1350 CA, used as a "tabula in naufragio". There will be cases where the consequence of a non-disclosure can be shown to be that the order would not, or at least might not, have been made, had the truth been told. There may also be cases in which, even if the order would still have been made, the seriousness of a non-disclosure must be marked either by a discharge of the order or at any rate by a suitably penal order for costs. But in the ordinary case a judge on the return day or on a discharge application must really have his timbers shivered by something serious that has gone wrong, rather than a litany of matters that could have been put differently or could have been expanded. My timbers have not been shivered in this case:

- Having recited what I believe to be the substance of Mr Sullivan's litany of complaints (there were one or two others, which I have considered and not identified), I can confirm that my timbers have not been shivered, and that although there is always room for criticism of the absence of one or more additional points that might have been made or expanded, the substance of the case as to the urgent need to preserve the assets of Metabay in the light of the claim made in the Ukrainian proceedings was fairly put.

- Disclosure. This is not a proprietary claim, and the disclosure that is and can be usually ordered is simply required to police the freezing order, not either to be of assistance in tracing, there being no proprietary remedy, nor of assistance in proving the facts of the underlying claim. In my judgment the order that was made by the Judge subject only to one clarification, which I made at the end of the hearing, is indeed limited to policing the freezing order. There can be no challenge to the words of clause 8(a), but the words of clause 8 (b) require some consideration. They read "Documents evidencing any commission and/or other payment paid by Farmaplant… under its Agency Agreement… and/or in respect of sales to [BCPP] in the period 1 January 2014 to present". Whereas I can see that in order to police the Order it is appropriate in the circumstances referred to in paragraph 15(ii) above as to the possible "missing" payments since 2016, which, if paid, might be somewhere to be found or, if unpaid, might amount to a debt owed to Metabay, to order some disclosure, but the precise wording may go beyond what is appropriate or necessary, in appearing to enquire into the relationship of Farmaplant and BCPP, rather than the monies payable or paid to Metabay. The Order has now been amended to make this clear. But Mr Sullivan's point is addressed to paragraph 70 of the affidavit of Mr Beale, in which, in explaining why the Claimant was seeking the disclosure order (set out in paragraph 71 in much the same terms as were contained in the accompanying draft order, which was granted) he gave what could be seen as a much wider explanation of the appropriateness and intention of the order, because he suggested that:

- For these reasons I dismiss the application to discharge and, subject to minor amendments, continue the Order till 7 days after judgment in the Ukrainian proceedings or further order

SIR MICHAEL BURTON GBE :

i) By paragraph 2.1.1 the respondents, who include Mother, Father and Iryna, are described as "officers of [BCPP] in the meaning of Article 2 of the Law of Ukraine On Joint Stock Companies" ("the Companies Law"). "Officers" are there defined as follows: "officers of the joint-stock company – individuals – the chairman and, members of the supervisory board, executive body, audit commission, auditor of the joint-stock company, as well as the chairman and members of another body of the company, if the formation of such a body is prescribed by the Articles of Association of the company".

ii) The complaint in the USC relates to the respondents having caused BCPP to purchase APIs from Farmaplant (described as a "suspicious supplier") at "extremely excessive" prices in comparison with market price, leading to (at paragraph 2.2.2(4)) "deliberate overstatement in supply agreements of the price for API to withdraw funds from [BCPP] through Farmaplant to the account of Metabay controlled by them", by way of a "deliberate arrangement for entering into the Agency Agreement between Metabay and Farmaplant, which agreement has no economically justifiable reason, to create a formal ground for the payment of a 30% "kickback" specifically to Metabay".

iii) "Hence" (paragraph 2.3) "the monetary funds lost by [BCPP] due to unlawful actions of its officers and which funds are the damages claimed in this case are kept on accounts of Metabay, whereas Metabay has no grounds to acquire the right of ownership to those funds."

iv) Although the case is thus pleaded in the USC on the basis that Iryna, like the other respondents, is an officer within the meaning of Article 2, the case put before me by the Defendant is that Iryna is not an officer of BCPP, indeed that such case is "hopeless". In evidence the Defendant asserted that there was no way in which Iryna would be able to extricate herself from the Ukrainian proceedings prior to trial, but it seems that she did then issue a strikeout application. Since the hearing before me, I have been informed that the Ukrainian Court has subsequently, at a hearing on 21 May, dismissed such application.

"1.4 Withdrawal to a UK company related to the Respondents of the amounts overpaid by [BCPP] for the supply of API

...

1.4.2. Respondent in this case [Iryna] is the beneficial owner of Metabay, which fact is confirmed by the excerpt issued by the UK Companies House...

According to information from public sources, Respondent [Iryna] also holds the position of Business Development Director of [BCPP] ....

Moreover, Respondent [Iryna] is a daughter of other Respondent in the case Mrs Liudmyla Bezpalko who held the position of General Director of [BCPP] in 1994-2018 and of Respondent in the case Mr Mykola Bezpalko who has been holding the position of Chairman of the Supervisory Board of [BCPP] at least from 2012. ...

1.4.3. .... the Bezpalko family [Respondents Mrs Liudmyla Bezpalko, Mr Mykola Bezpalko and their daughter [Iryna] actually control [BCPP] ... and withdraw profit from [BCPP] to an account opened with PKB … by Metabay, a UK company that is controlled by them.....

...

1.4.4 .... In view of the above, [Iryna] as the Business Development Director of [BCPP] had an opportunity to arrange for entering into an agreement with Farmaplant without any intermediaries, therefore, the receipt by Metabay of the commission fee in the amount of 30% of the cost of supplies by [BCPP] for the supposed facilitation in entering into supply agreement(s) between Farmaplant and [BCPP] lacks any economic grounds.

This opinion is more obvious since [Iryna] herself is the beneficial owner of Metabay.

1.4.5. The arrangement for withdrawal of profit of [BCPP] to Metabay that is controlled by Respondent 8 looks as follows:

...

1.5.1.......It is obvious that .... failed attempts of the management of [BCPP] to deprive ... Darnitsa of its shareholder status were aimed at protecting the unlawful arrangement for withdrawal of profit of [BCPP] to Metabay controlled by Respondent 8.

The facts stated in Section I of this Statement of Claim prove that the Respondents artificially boost expenditures of [BCPP] thus resulting in decreased profit of the company and losses to the enterprise. At the same time, the overpaid funds are accumulated on accounts of Metabay controlled by Respondent 8.....

??. CAUSE OF ACTION

2.1. The Respondents are acting contrary to the interests of [BCPP] thus causing damages to the company.

2.1.1. The Respondents are officers of [BCPP] in the meaning of Article 2 of the [Companies Law]...

....

Thus, in view of the said provisions, the Respondents being officers of [BCPP] shall act in good faith, reasonably, and exclusively in the interests of the company. Non-compliance with the said requirements results in the imposition of joint and several obligations on the Respondents to reimburse the damages caused to [BCPP].

At the same time .... the Respondents as officers of [BCPP]act not in the interests of the said company, but in their own interests since they have created and maintain the operation of an arrangement for withdrawal of profit from [BCPP] to the account of Metabay, an offshore company, that, in addition, is controlled by them.

...

2.1.4. .... The said shows that the Respondents 4-7 who are members of the Supervisory Board of [BCPP] obviously colluding with Respondents 1-3 who held the position of General Director, in violation of Clause 5.1 of the Regulation on the Supervisory Board, fail to act in good faith thus causing damages to the said company.

In fact, members of the Supervisory Board of [BCPP] shelter unlawful actions of General Directors of the company who personally and/or through authorisation of other persons entered into supply agreements with Farmaplant and arranged for the performance of the agreements contrary to the interests of [BCPP] but for their own benefit in order to receive monetary funds to the account of Metabay - the company that is related to them.

...

2.2.2. The facts stated in Section I of this Statement of Claim convincingly show the existence of all elements of a civil violation in the actions of the Respondents, thus being the ground for reimbursement of damages caused to [BCPP], specifically, (i) damage, (ii) unlawful conduct, (iii) causal relationship, and (iv) fault of the officers as confirmed by the following:

...

(1) The damage caused by the Respondents to [BCPP] involves the fact that the said company, upon initiative and with the knowledge of the Respondents at least since 2014, has been purchasing pharmaceutical raw materials from Farmaplant at extremely excessive prices in comparison with the market ones....

(2) The unlawful conduct of the Respondents involves

(a) the entering into and approval by the General Directors of [BCPP] (in turn, Mrs Liudmyla Bezpalko, Ms Yulia Zdarevska, and Mr Mykhailo Pasichnyk) and subsequent arrangement by them for the performance by the company of agreements with Farmaplant for supply of API at excessive prices. ....

...

(c) default in duties by [Iryna]as the Business Development Director of [BCPP], which duties involve the facilitation of entering into the most profitable contracts with suppliers of pharmaceutical raw materials; instead, she acts in her own interests, through Metabay that is owned by her.

...

(4) The fault of the Respondents involves the availability of criminal intent in the Respondents' actions regarding (i) deliberate overstatement in supply agreements of the price for API to withdraw funds from [BCPP] through Farmaplant to the account of Metabay controlled by them, which account is opened with PKB ..; (ii) deliberate payment of the cost of API at excessive prices; (iii) deliberate arrangement for entering into the Agency Agreement between Metabay and Farmaplant, which agreement has no economically justifiable reason, to create a formal ground for the payment of a 30% "kickback" specifically to Metabay; (iv) deliberate failure by Respondents 4-7 to take control measures regarding the said actions, prevent, and put an end to damage being caused to [BCPP]. At the same time, the Respondents wished or at least knowingly admitted such damage was caused.

Thus, the damages in the amount of more than USD 4 million caused by deliberate unlawful actions of the Respondents acting contrary to the interests of [BCPP] shall be jointly and severally recovered from them for the benefit of the Claimant.

2.3. The damages must be recovered at the expense of the Respondents' property, including the monetary funds held on the account of Metabay opened with PKB.

...

... Darnitsa believes that the recovery of damages is such a remedy in this specific legal situation, including from accounts owned by Respondent 8, which funds, however, are actually kept on the account of Metabay owned by her, and which account is opened with PKB... This fact is confirmed by the following:

(1) The account of Metabay opened with PKB … has accumulated monetary funds received from [BCPP] through Farmaplant as a result of purchase by [BCPP] of API at excessive prices;

(2) Metabay conducts no independent business operations; the overstatement of prices for API purchased by [BCPP] is the only source of funds into the account of Metabay;

(3) The above overstatement of prices is a part of collusion between officers of [BCPP], Farmaplant, and [Iryna] who, at the same time, is a beneficial owner of Metabay, holds the position of Business Development Director of [BCPP], and is a daughter of the Chairman of the Supervisory Board of [BCPP] and former General Director of the company;

(4) There are no legal grounds for acquiring by Metabay of the right of ownership to the said funds since the Agency Agreement between Metabay and Farmaplant is null and void because its only objective is to create a formal ground for unlawful remittance of funds to the account opened with PKB .., which funds have been withdrawn by the Respondents from [BCPP], since:

a) Farmaplant did not need to engage Metabay as an agent to enter into supply agreements with [BCPP] since, as it was noted above, the manager of Farmaplant Mr Sergei Schlegel is acquainted with Respondent 8 [Iryna] who holds the position of Business Development Director of [BCPP]; at the same time, she is the beneficial owner of Metabay;

b) Metabay employs no personnel able to perform obligations of an agent under the Agency Agreement and it actually performed no obligations under the Agency Agreement - it performed no search of purchasers and took no actions aimed at the arrangement for entering into supply agreements with them (including [BCPP]) in the name of Farmaplant. The supply agreements for API with [BCPP] were not entered into with assistance of Metabay but through direct agreement of officers of [BCPP] with Farmaplant;

c) had it been not for extremely excessive prices for API supplied to [BCPP], Farmaplant was unlikely to agree to a 30% (obviously non-market) fee in accordance with the terms and conditions of the Agency Agreement;

(5) [Iryna] administers the funds on the account of Metabay opened with PKB .. in her own interests and, probably, in the interests of the other Respondents in the case, who in other circumstances [if there is no personal financial benefit] would not apparently have agreed to support and shelter the arrangement for withdrawal of funds from [BCPP], which arrangement has elements of a business crime in the meaning of the Criminal Code of Ukraine.

Hence, the monetary funds lost by [BCPP] due to unlawful actions of its officers and which funds are the damages claimed in this case are kept on accounts of Metabay, whereas Metabay has no grounds to acquire the right of ownership to those funds. Those funds are actually held, used, and administered by Respondent 8 [Iryna] in other words they are owned by her rather than Metabay. Hence, those funds may be recovered subject to the claims for recovery against Respondent 8."

i) they have a good arguable case that there has been a substantial fraud on BCPP (estimated at US$6.8m, but limited to the sum presently claimed in the USC of $4.263m – though amended since the hearing before me) and that Metabay is the recipient of the funds extracted by the 30% commission, which funds belong to Iryna and/or her family, the other respondents;

ii) there is a real and substantial risk of dissipation, by virtue of the concealed fraud, the use of Metabay as a vehicle, the wholly unexplained use of the Agency Agreement and the 30% commission, and the limbo in which Metabay is presently left.

i) a challenge to the arguability of the case;

ii) the absence of risk of dissipation;

iii) no full and frank disclosure.

i) that there has certainly been no delay by the Claimant, because it was unable to bring the derivative claim until its shareholding was confirmed by the Ukrainian Supreme Court in October 2020;

ii) it is far from clear that there is no risk of dissipation. The fact that there may be a substantial sum left in the PKB account is only a starting point. There must be a real question, on the Claimant's case, as to the explanation for the fact that there have been no commission payments apparently remitted by Farmaplant to the PKB account of Metabay since 2016, when the Agency Agreement has not been terminated and sales by Farmaplant to BCPP continued from 2016 until at least 2018.

I am satisfied that there is a real risk of dissipation, particularly in the light of the total absence of explanation by the Defendant as to the Agency Agreement and the commission arrangements. In any event the very limbo in which Metabay was placed, with no directors and seemingly no formal shareholding, makes it essential to secure its assets.

i) Mr Sullivan suggests that the case was not put to HH Judge Pelling entirely clearly as to the Ukrainian position of 'officer', and any problems that there might be in that regard. In his judgment he referred to the fact that "father and daughter are respectively the equivalent of Chairman of the Board of Directors and Director of Business Development of that company". That is of course factually correct. The USC describes them both as officers. It is the Claimant's case that they are both officers. In my judgment this was not deficient, as suggested:

ii) Mr Sullivan complains that it was left as an inference to be drawn that the Bezpalkos opposed an audit of BCPP because they had something to hide, when in reality the two companies were competitors and BCPP was anxious to protect its confidential information. Mr Harrison submits that the judge knew that the two companies were both pharmaceutical companies, except that it was not specifically said that they were competitors, but nevertheless contends that it was and is a proper inference to draw, not least because the USC carries that inference (at paragraph 1.5.1) and because the Bezpalkos'opposition to the audit did in fact turn up the existence of the 30% commission arrangement and in due course the Agency Agreement.

iii) Mr Beale in his affidavit on the ex parte application disclosed an issue as to the provenance of documents, in the context of making full and frank disclosure that the Agency Agreement and the Metabay bank statements had been obtained during the German criminal proceedings, and that "It may be that Metabay will allege that these documents are obtained by Darnitsa in breach of a law or obligation of confidentiality. However neither I nor Darnitsa are aware that such a breach occurred". Judge Pelling referred to this evidence by saying "Mr Beale's evidence is that the material has not been obtained in such a way". The fact that the Judge in an extempore judgment misconstrued the evidence of Mr Beale on a relatively minor point is not, in my judgment, a matter for criticism of the Claimant.

iv) The Judge in the course of his extempore judgment expressed views as to a possible ground that the Metabay funds were "the traceable proceeds of the fraud or funds held on constructive trust for the Ukrainian company that on the Claimant's case has been the victim of the fraud". This is not a way in which the Claimant put, or at Ukrainian law could put, its case. Mr Sullivan submits that Mr Harrison should have more clearly addressed the question of proper law or explained that the claim in the Ukraine did not include a claim for the imposition of a remedial proprietary interest on the basis of receipt of a secret commission. I am satisfied that this was a matter raised by the Judge of his own motion in his extempore judgment, and did not in any way spring from any submission of Mr Harrison, who had no obligation to rule out any cause of action upon which he was not relying.

v) The Claimant did not give the Judge details of the prices paid by Darnitsa for the products for which he claims BCPP overpaid Farmaplant. It still has not done so, and, in my judgment, has no need to do so in order to set out the case by reference to the Ukrainian proceedings. On the basis of the reports and evidence before me the "extremely excessive prices" referred to in the USC were between 97% and 144% higher in respect of thirteen of the APIs than market price.

vi) Mr Sullivan complains that Mr Harrison did not draw the Judge's attention to the case of Holyoake. Judge Pelling is an extremely experienced commercial judge, dealing on a regular basis with ex parte applications for freezing orders. There is in my judgment no need for a raft of authorities on the exercise of his discretion to be brought to his attention.

vii) Mr Sullivan complains about the order made for disclosure (and the basis of application for it). I shall deal with that as a separate matter, but do not consider that it goes to the question of full and frank disclosure. Similarly, there is a complaint, which is in my judgment justified, that the normal undertaking as to there being no collateral use of the documents was deleted or omitted. The undertaking is implied in any event, and has not been breached. It should have been included and should now be added, but again I do not see this as a matter of a failure to give full and frank disclosure.

"Ancillary disclosure is therefore needed pursuant to the WFO in the interest of justice to enable and ensure:

70.1 Darnitsa to identify what commissions the family have obtained in respect of sales to be CPP and what has happened to those commissions:

70.2 The exact amounts of money each of the Ukrainian Defendants extracted for their own profit from BCPP and clearly identify the roles of each of the Ukrainian Defendants, Metabay and Farmaplant in the Scheme".

Clearly in an application which is simply intended to police the order, such disclosure would not be appropriate and would go beyond what was correct. It seems that by Article 81 of the Ukrainian Civil Procedure Code there could be an application for such evidence made against a Defendant, a third-party or even a non-party, but now is not the time for that to occur. However, whatever may have been the intention and desire of Mr Beale (and in fact it seems that in any event this may not have been a part of his affidavit which the learned Judge was invited to read), the order which the Judge in fact made did not (save in the minor respect dealt with above) go beyond the ordinary requirements of policing an injunction, which was what Mr Harrison told Judge Pelling was sought and was contained in the draft order. Mr Sullivan submits that what was intended, as expressly stated in Mr Beale's affidavit, should infect and falsify the result. Inadvisable as the passages in Mr Beale's affidavit may have been, I am satisfied that they had no deleterious impact on the Order which was in the event sought and made.