Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Commercial Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Commercial Court) Decisions >> Deutsche Bank AG, London Branch v CIMB Bank Berhad [2017] EWHC 1264 (Comm) (25 May 2017)

URL: http://www.bailii.org/ew/cases/EWHC/Comm/2017/1264.html

Cite as: [2017] 2 CLC 155, [2017] EWHC 1264 (Comm), [2017] Bus LR 1671, [2017] WLR(D) 368

[New search] [Printable RTF version] [Buy ICLR report: [2017] Bus LR 1671] [View ICLR summary: [2017] WLR(D) 368] [Help]

QUEEN'S BENCH DIVISION

COMMERCIAL COURT

7 Rolls Buildings, Fetter Lane, London |

||

B e f o r e :

____________________

| Deutsche Bank AG, London Branch |

Claimant |

|

- and – |

||

| CIMB Bank Berhad |

Defendant |

____________________

Andrew Fletcher QC and Richard Hanke (instructed by Holman Fenwick Willan International LLP) for the Defendant

Hearing dates: 15 May 2017

____________________

Crown Copyright ©

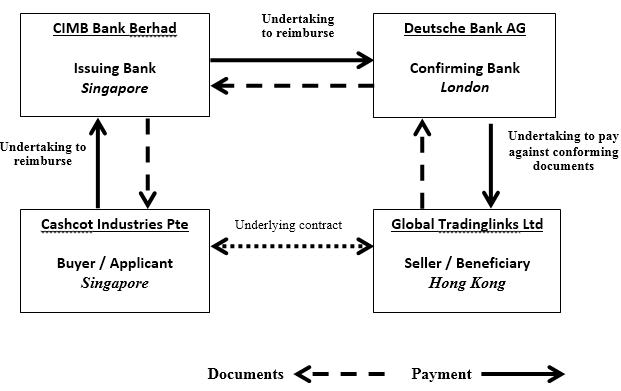

- This is a dispute under a series of ten letters of credit ("L/Cs") between the claimant, the confirming bank ("CB"), and the defendant, the issuing bank ("IB"). CB is the London branch of Deutsche Bank AG, a German bank. IB is the Singapore branch of CIMB Bank Berhad, a Malaysian bank.

- The dispute arises out of a formal request for further information ("RFI") made in these proceedings by IB as to CB's claim to have made payment under the L/Cs to the beneficiary, a customer of CB called Global Tradinglinks Ltd.

- In short, CB contends that IB has no right to this information. It contends that as a matter of principle, the issuing bank under a letter of credit must accept on its face the statement by a confirming bank that it has paid the beneficiary. It has no right to inquire further.

- IB, on the other hand, contends that the issuing bank cannot be obliged to make any reimbursement to the confirming bank if the latter has not in fact paid the beneficiary, and that since this is an essential element of the claim against it, it is entitled to the information which it seeks. I have to decide this as a question of principle.

- For present purposes, the facts can be stated shortly. The underlying contract concerned the sale of Indian cotton for shipment to China between the seller, Global Tradinglinks Ltd., and the buyer, Cashcot Industries Pte Ltd., which was IB's customer, and which has subsequently gone into liquidation, leaving the bank substantially uncovered. There were 23 presentations of documents in all. IB claims that the transactions were sham transactions entered into for the purpose of obtaining payment under the letters of credit. Fraud proceedings are ongoing in Singapore.

- In the English proceedings, CB seeks reimbursement of the sums it has paid under the L/Cs, being US$9,959,452.57. IB's challenge to the court's jurisdiction was rejected by Teare J on 25 January 2017 (see [2017] EWHC 81 (Comm)). On the pleadings, IB's defence is that the documents presented under the L/Cs were discrepant, presented late, and did not comply with the terms and conditions of the L/Cs. Payment by CB to the beneficiary is not admitted by IB.

- Expressed diagrammatically, the relationship between the parties is as follows.

- This case is concerned with the top two boxes, that is, the issuing bank's undertaking to reimburse the confirming bank.

- The L/Cs were set up as follows. On 25 September 2015, IB sent CB a Swift message MT 700 as to the issue of a documentary credit. The credit was stated to be irrevocable, and subject to "UCP latest version", which is UCP 600. The communications between the banks as to the other L/Cs used the same format.

- The L/Cs stipulated the documents to be presented. Those documents included the commercial invoice, the bills of lading and various certificates relating to the quantity and quality of the cotton.

- Field 47A(5) of the Swift messages dealt with reimbursement between banks providing that:

- There seems to be some dispute between the parties as to whether CB was the "negotiating bank" for these purposes. In my view, it was, or was in the position of, a negotiating bank within the meaning of Field 47A(5), though nothing turns on this.

- Field 47A(6) of the Swift messages provided:

- As expressly authorised, CB as advising bank added its confirmation to each of the L/Cs.

- In February 2016, CB sent Swift messages to IB in MT 754 format ("Adv of Payt/Acceptance/Nego") advising that "Principal Amt Paid/Accepted/Negd". Nothing turns on the distinction between payment, acceptance and negotiation, and it is common ground for present purposes that this message states that CB had paid the beneficiary under the L/Cs.

- The message goes on state to that the documents were en route to IB by courier, and claimed reimbursement from IB. The hard copy documents followed under a covering schedule.

- IB refused reimbursement on the basis of asserted discrepancies in the documents. No query was raised by IB at this stage about CB's payment arrangements with the beneficiary.

- These proceedings were begun in October 2016, and following its unsuccessful jurisdiction challenge, IB served its defence in March 2017. Payment of the beneficiary by CB is not admitted in the defence, and CB is "put to strict proof that it honoured … presentations by Global under the L/Cs …".

- CB then set out its case as regards payment in some detail in the reply. In summary, it pleads that pursuant to the beneficiary's financing agreement with it, CB advanced loans to the beneficiary. The obligation to repay those loans was discharged upon the compliant presentation of documents under the letters of credit. Such discharge "is to be treated as having made payment".

- IB served a relatively lengthy RFI in March 2017 asking for details of how CB says it made payment to the beneficiary. CB's response that the court should not order the information requested, because IB must accept CB's statement that it paid: it says that, "This is not a matter of the Court's case management discretion in relation to further information or disclosure: rather, it is a point of principle as to the operation of L/Cs". That is why I have had to decide it as a point of principle.

- CB's case in summary is as follows:

- IB's case in summary is as follows:

- It is common ground that payment could be made in the way that CB pleads in the reply. It is perfectly possible for payment to be made by a bank to the beneficiary of a letter of credit by way of set off against the beneficiary's obligations under an existing facility (as to the concept of "payment" see in a different context Charter Reinsurance v Fagan [1997] AC 313 at 384). This is not the present issue. The issue is whether the issuing bank can inquire at all as to whether the confirming bank has made payment, or whether it must simply take the confirming bank's word for it.

- As both parties recognise, the starting point is Art. 7 of UCP 600. Art. 7 deals with the issuing bank's undertaking to the nominated bank, here the confirming bank.

- Although CB submitted that Field 47A(5) of the Swift message MT 700 of 25 September 2015 gave rise to a parallel right to payment within 3 working days, it did not suggest that it could be read inconsistently with Art. 7, or lead to a different result. I agree with IB that it is concerned with the method and timing of payment, and does not affect the matter for decision.

- As regards the substance of the issuing bank's obligation, the relevant provision is Art. 7(c) which provides that:

- The relevant operative words in Art. 7(c) are that an "issuing bank undertakes to reimburse a nominated bank that has honoured … a complying presentation" (italics added). So far as relevant, the term "honour" is defined in Art. 2 to mean "pay at sight".

- CB seeks to read into Art. 7(c) the words, "states that" it has honoured. In treating the confirming bank's statement as conclusive, or at least conclusive in the absence of fraud, CB seeks to equate its reimbursement obligation to that arising under a first demand bond, where the issuer's obligation to the beneficiary arises on a compliant demand. (As the parties said in emails to the court after the hearing, such instruments are covered by ICC Uniform Rules for Demand Guarantees 758.)

- CB points to Art. 13 of UCP 600 in support. Art. 13 deals with the situation in which reimbursement is to be obtained by the claiming bank (here the confirming bank) from a party other than the issuing bank (described as the "reimbursing bank").

- That however is not the present situation. There is no third party bank of this kind concerned here. So whilst it is correct that Art. 13(b) provides that an issuing bank will be responsible for loss of interest and expenses incurred "if reimbursement is not provided on first demand by a reimbursing bank", it does not follow that the same applies as between issuing bank and confirming bank where no such bank is involved, and where the wording of the relevant provision of the UCP is different.

- It is also correct (as CB points out) that the case law draws a close comparison between letters of credit and first demand bonds in the context of the bank's liability to pay the beneficiary—this liability arises on presentation of conforming documents or a compliant demand independent of disputes between the buyer and the seller under the underlying contract (see Edward Owen Engineering Ltd v Barclays Bank International Ltd [1978] QB 159, at 170-1, cited in Wuhan Guoyu Logistics Group Co Ltd v Emporiki Bank of Greece SA [2012] EWCA 1629 at [27], and see a later decision in the Wuhan case, [2013] EWCA Civ 1679 at [21]).

- As CB points out, Art 7(c) similarly recognises that "An issuing bank's undertaking to reimburse a nominated bank is independent of the issuing bank's undertaking to the beneficiary." However in my view this does not advance its argument. The present case does not concern the undertaking to the beneficiary. It concerns the relationship between the two banks, and specifically the question whether payment to the beneficiary by the confirming (i.e. nominated) bank is a prerequisite of the obligation of the issuing bank to reimburse the confirming bank.

- CB submits that its cause of action for reimbursement accrues when a conforming demand is made upon IB. But as IB said, this is essentially the same point—the question being whether the confirming bank must have paid the beneficiary to have the right to reimbursement, or whether a statement to that effect is enough. CB relied on Wuhan, supra, [2013] EWCA Civ 1679 at [22], but the court was there considering when the position crystallises as between beneficiary and bank.

- CB accepted that no authority or commentary has been found which directly supports its contention, though it submits that in general terms it is consistent with the cash principle (Solo Industries UK Ltd v Canara Bank [2001] EWCA Civ 1041 at [31]), and upholding it would avoid the possibility of abusive inquiries into the confirming bank's payment arrangements intended to cause delay.

- There are however statements in the authorities which directly support IB's contentions:

- Further, as has been noted, the relevant operative words in Art. 7(c) of UCP 600 are that an "issuing bank undertakes to reimburse a nominated bank that has honoured … a complying presentation" (italics added). This supports the finding in Fortis Bank (supra) that "What matters is the fact of honouring or negotiating a complying presentation."

- CB seeks to read into Art. 7(c) the words, "states that" it has honoured. But as was said by Thomas LJ on appeal in the Fortis Bank case, "… a court must recognise the international nature of the UCP and approach its construction in that spirit" ([2011] EWCA Civ 58 at [29]). Though not expressing a concluded view, he said at [55] that "there would be real difficulties in using a rule of national law as to the implication of terms (if distinct from a method of construction) to write an obligation into the UCP".

- Similarly in the present case, I do not think it is right in principle to construe Art. 7(c) of UCP 600 by writing in words that materially change its sense. The UCP is revised periodically, and that is the occasion for introducing changes if thought desirable. In my view, by Art. 7(c), read with the definition of "honour" in Art. 2, an issuing bank's undertaking to reimburse the confirming bank arises where the confirming bank has honoured a complying presentation by making payment under the credit. To repeat what is said above, "payment" is not of course limited to making a cash credit to the beneficiary's account.

- It follows that I accept IB's contentions on this point. There is in my view no basis on which to equate the reimbursement obligation owed by the issuing bank to the confirming bank under Art. 7(c) UCP 600 to that arising under a first demand bond. There was some reference in submissions to the position if a bank has negotiated documents within the meaning of Art, 7(c), but this does not arise on these facts.

- This conclusion is consonant with the position on the pleadings in the present case. I set this out above. In summary, in the defence IB does not admit payment by CB which is put to proof that it honoured presentations by the beneficiary under the L/Cs. In the reply, CB meets that by pleading a detailed case as regards payment. It is that pleading which is the subject of IB's RFI asking for details of how CB says it made payment to the beneficiary. In my view, the claimant having made assertions as to payment, the defendant is entitled to ask for further information in the usual way.

- However, there is a significant qualification. The width of the RFI served by IB in some respects has the air of a fishing expedition. It is important that the RFI vehicle is not used to replicate the old "Requests for Further and Better Particulars" which were all too often an excuse for tactical time wasting. In the present context, the court should not entertain requests seeking unduly to investigate the confirming bank's payment arrangements in the hope that something by way of a defence will turn up.

- In that regard, paragraph D15.1(c) of the Admiralty & Commercial Court Guide explains that, "The court will only order further information to be provided if satisfied that the information requested is strictly necessary to understand another party's case" (emphasis added). This was an issue explored in oral argument. The parties should be able to agree the order.

- The issues at trial will be limited to the conforming documents issue and the payment issue (if pursued). As regards further directions, I understand the parties to be in agreement that the case will be transferred into the Shorter Trials Scheme (except that there is no need for a designated judge). There is no need for a disclosure order, because the RFI already contains a request for relevant documents relating to payment. The legitimate scope of what should be produced was also explored in oral argument, and again the parties should be able to agree the order.

- I am grateful to the parties for their assistance.

Mr Justice Blair:

"TT reimbursement is allowed, in which case, negotiating bank is required to send an authenticated swift to issuing bank certifying that documents have complied with all L/C terms and conditions, and that documents have been despatched to issuing bank by courier service, indicating L/C number, amount claimed name of courier, air waybill number and date of despatch. We shall cover the negotiating bank as requested value 3 (three) working days after date of receipt of claim."

"L/C advising bank is authorised to add its confirmation to the L/C at beneficiary's request and cost. Upon confirmation the credit becomes available by payment and draft to be drawn on advising bank."

The parties' cases

i) The principle is that an issuing bank under an L/C must accept on its face the statement by a nominated bank (here the confirming bank) that it has paid the beneficiary.

ii) It follows that:

a) when a nominated bank forwards complying documents to an issuing bank and states that it has paid the beneficiary then the issuing bank must, without more, fulfil its undertaking under UCP 600 Art. 7(c) to reimburse the nominated bank;

b) if an issuing bank fails to reimburse the nominated bank then the nominated bank can sue upon the undertaking;

c) to obtain judgment on such a claim, the nominated bank need only show that the issuing bank was obliged at the time and on the basis of the information and documents then available to the issuing bank to reimburse the nominated bank.

iii) UCP 600 Art. 7(c) must therefore be construed as an undertaking "to reimburse a nominated bank that states it has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank". The reading-in to Art. 7(c) of the two underlined words reflects the inexorable logic of the L/C machinery and the "cash principle".

iv) By contrast, the effect of IB's argument is that the undertaking is to "reimburse a nominated bank that satisfies the issuing bank or a competent court it has honoured or negotiated…". This is uncommercial, unworkable and plainly not what the parties must be taken to have intended.

i) The honouring of the presentations made by the beneficiary is a fundamental element of these proceedings since CB claims reimbursement from IB of payments that it allegedly made to the beneficiary.

ii) IB cannot be obliged to make any reimbursement to CB if CB has not in fact honoured the presentations made to it by the beneficiary.

iii) CB seeks to treat its statement as to payment as conclusive, but conclusive evidence provisions are to be strictly construed.

iv) There is no warrant for reading words into UCP 600 article 7(c), and if the drafters of this provision had wished to achieve this effect they could simply and easily have done so.

v) Challenging the question of payment does not infringe the autonomy principle, which has to do with the autonomy of the credit from the sale or other contract on which it may be based.

vi) Field 47A(5) of the Swift messages does not seek to re-write the nature of the issuing bank's reimbursement obligation, but is concerned merely with the method and timing of payment.

vii) The spectre that the requirement a bank prove that it has honoured a presentation would create chaos is fanciful.

Discussion and conclusions

"An issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank. Reimbursement for the amount of a complying presentation under a credit available by acceptance or deferred payment is due at maturity, whether or not the nominated bank prepaid or purchased before maturity. An issuing bank's undertaking to reimburse a nominated bank is independent of the issuing bank's undertaking to the beneficiary."

i) In United City Merchants v Royal Bank of Canada [1983] 1 AC 168, a leading authority in this field, it was held at p.183 in analysing the various contractual relationships that, "If payment is to be made through a confirming bank, the contract between the issuing bank and the confirming bank authorising and requiring the latter to make such payments and to remit the stipulated documents to the issuing bank when they are received, the issuing bank in turn agreeing to reimburse the confirming bank for payments made under the credit."

ii) In Credit Agricole Indosuez v Generale Bank [1999] 2 All ER (Comm) 1009 it was held that once an authorised payment had been made under a letter of credit, the paying bank was entitled to the reimbursement promised by the issuing bank. I agree with IB that Rix J's judgment proceeds on the assumption that the question whether the presentation of documents has been honoured by payment is a relevant matter for investigation: see especially p. 1012-1013.

iii) In Fortis Bank v Indian Overseas Bank [2009] EWHC 2303 (Comm) at [64], Hamblen J said that, "Under the UCP the obligation to reimburse the nominated bank arises if it honours or negotiates a complying presentation and forwards the documents to the issuing bank. In the present case Fortis did negotiate what on their case was a complying presentation and did forward the documents to IOB. What matters is the fact of honouring or negotiating a complying presentation." (This point did not arise on appeal.)

iv) The textbooks are consistent with this view:

a) Jack, Documentary Credits, 4th edn, (2009) at 9.54 ("if the bank pays in accordance with the terms of the credit, then it is entitled to reimbursement ….");

b) Brindle and Cox, The Law of Bank Payments, 4th edn at 8-051 ("if the nominated bank honours the credit or negotiates drafts and/or documents that strictly comply with the terms of the credit, it will be entitled to reimbursement from the issuing banker.");

c) Encyclopaedia of Banking Law at F[303] ("An issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank.").