Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Philip Warren & Son Ltd v Lidl Great Britain Ltd & Ors [2021] EWHC 2372 (Ch) (26 August 2021)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2021/2372.html

Cite as: [2021] Costs LR 1015, [2021] ETMR 58, [2021] FSR 35, [2021] EWHC 2372 (Ch)

[New search] [Printable PDF version] [Help]

Neutral Citation Number: [2021] EWHC 2372 (Ch)

Claim Number: IL-2019-000149

IN THE HIGH COURT OF JUSTICE

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INTELLECTUAL PROPERTY LIST (Ch.D)

SHORTER TRIAL SCHEME

As from: The Rolls Building

London EC4A 1NL

26 August 2021

MR DANIEL ALEXANDER QC

(Sitting as a Deputy Judge of the Chancery Division)

- - - - - - - - - - - - - - - - - - - - -

B E T W E E N: -

|

|

PHILIP WARREN & SON LIMITED |

Claimant |

|

|

- and –

|

|

|

|

(1) LIDL GREAT BRITAIN LTD (2) Lidl UK GmbH (3) LIDL STIFTUNG & CO KG |

Defendants |

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Nicholas Bacon QC (on costs) and Andrew Lomas

instructed by Stobbs IP for the Claimant

Benet Brandreth QC and Tristan Sherliker (of Bird & Bird) instructed by Bird & Bird for the Defendants

Hearing date: 1 June 2021 with further written submissions on 16 and 26 July 2021.

- - - - - - - - - - - - - - - - - - - - -

JUDGMENT APPROVED

COVID-19: This judgment was handed down remotely by circulation to the parties' representatives by email. It will also be released for publication on BAILII and other websites. The date and time for hand-down is deemed to be 10.00am on 26 August 2021.

MR DANIEL ALEXANDER QC

1. By a judgment dated 30 April 2021 ([2021] EWHC 1097 (Ch)) the court dismissed the claimant’s (“PWS’s”) claim and the defendants’ (“Lidl’s”) counterclaim for passing off. Three issues arose at the consequential hearing on 1 June 2020: (i) costs; (ii) whether a publicity order should be made in accordance with Samsung v. Apple and (iii) permission to appeal. This decision is long because of the multiple points raised on costs and issues of approach to a publicity order. It gives fuller background, which is part of the context for both issues.

Procedural history of this aspect of the case

2. This consequentials judgment has had an unusual procedural history. Following the hearing on 1 June 2021, the court provided a confidential draft judgment on 14 June 2021 for handing down on 18 June 2021. On 17 June 2021, the court received a note from counsel for Lidl inviting account to be taken of a number of points in the final judgment and for handing down to be postponed by 7 days, which was done. No submissions were received on behalf of PWS at that stage. However, in addressing Lidl’s points, I concluded that further brief submissions should be permitted, for a number of reasons, which I gave in a short summary. These included the fact the parties had not referred to all of the potentially relevant authorities (of which some were referred to in the draft judgment) and that argument on behalf of PWS specifically on the basis upon which costs should be awarded had been brief. I deal with some of the other points raised below. In the circumstances, it was desirable to give the parties an opportunity to advance any additional submissions and/or authorities in favour of or against PWS bearing Lidl’s costs on an indemnity basis, before the decision was finalised. I therefore adjourned hand-down, made an order for an interim payment for costs assessed on the standard basis, to be paid by 31 July 2021. I gave permission for the further submissions to be made in writing. However, PWS instructed additional specialist costs counsel and indicated that it may wish to have a hearing but I ruled that this would be disproportionate and instead gave permission to the parties to respond briefly to each other’s supplementary submissions by 26 July 2021. They did so and I am grateful to the parties for their submissions, which are now very comprehensive. In particular, Mr Nicholas Bacon QC, who had not been previously involved in the case, assisted with the extensive subsequent written submissions on costs on behalf of PWS. In the light of the overall decision I have reached, it has not been necessary to address all of the points made in these additional submissions but I have taken account of some of the points made in also adjusting the language to clarify certain points.

3. I indicated that Lidl’s application for a publicity order would be refused, with permission to re-apply by that date, for reasons to be given in a composite judgment, dealing with all of the issues. In the event, Lidl did not reapply for a publicity order. I had originally drafted the decision in a somewhat more colloquial style than is conventional, since Lidl had asked for an order publicizing the main decision in the popular press as well as linking to it and it seemed appropriate to try to make this decision as accessible as possible in case that was sought to be linked as well. Since that relief is not pursued, I have somewhat redrafted and shortened the text, particularly since parts of the decision relating to the publicity order are now largely of historical interest and chiefly only to the parties.

4. At the hearing on 1 June 2021, permission to appeal from the main judgment was granted on certain limited grounds set out in the draft Grounds of Appeal and an extension of time for the Notice of Appeal was ordered to 31 July 2021. This has since been extended further, in the light of the timetable for further submissions.

5. Part of the reason for devoting more attention than usual to this issue is that the case has some hallmarks of one which has been brought in what Lidl has described as a speculative investment in the hope that PWS and its lawyers will receive very large returns. Having considered the evidence at trial and what PWS’s lawyers previously said, by implication, about its likely value in justifying the particular damages-based agreement made to pursue the case, there is a significant likelihood that even if the claim had succeeded (or ultimately succeeds following an appeal and any further proceedings) the sum awarded would not be materially different from that offered by Lidl to settle the whole case in October 2020. I had originally thought that, partly because it was not possible to say definitively at this stage that the claim was exaggerated and that PWS was unreasonable to have refused Lidl’s offer to settle it, it would be wrong to award indemnity costs. I have not changed that view fundamentally, as a result of the further submissions for reasons explained more fully below, but have concluded that the better approach is to make a somewhat different order which will enable the court to address this issue and provide fuller compensation on costs, should it turn out that the preliminary view of the merits of the financial claim is correct. In that event, the entire proceedings, including the need to take steps to address the reporting of them (which are addressed in the publicity order aspect of this decision) would have not been a fruitful use of time and money since October 2020, in the light of a reasonable offer to settle the case made at that stage. Without that adjustment, Lidl would be at risk of both being significantly out of pocket in that event and insufficiently rewarded for having made a reasonable attempt to settle the case at an early stage. In principle, the making of early reasonable offers should be incentivized and refusing them should be a high risk strategy. If no opportunity to address this is given, PWS may ultimately be in a position in which it would not be liable to pay the full costs of having pursued a claim which should not have been pursued in the light of that offer. It, and its lawyers, would therefore have been able to take advantage of the chance of a potentially large (albeit unlikely) claim but without having to bear the full costs which doing so imposes on others if it fails. In my view that general approach is not mandated by but is broadly consistent with the case law cited by the parties since the hearing.

BACKGROUND

6. In order that this decision can be understood on its own, I first summarise some of the key substantive aspects of the case, highlighting those which matter most for this judgment.

7. PWS is an award-winning Launceston-based family butcher with a predominantly local retail business and a significant wholesale business, supplying, among others, well-known high-end restaurants in London and elsewhere. It has used various forms of branding, but most recently predominantly in the form

but also other branding, such as PHILIP WARREN AND SON.

8. In 2014, Lidl decided to rebrand its main fresh meat range to use the mark WARREN & SONS largely in this form.

9. On the evidence, Lidl did not choose the mark because of PWS or to imitate it and PWS did not contend that Lidl had done so. However, in replacing an earlier Lidl own brand, Lidl wanted an own-brand mark redolent of an English provincial butcher. WARREN & SONS was one choice out of several fictional ones and was not at the top of its list. Problems with other potential choices meant that Lidl adopted WARREN & SONS but, on the evidence, it appeared likely that there would have been a range of “traditional” sounding options. Lidl did find out about PWS’s existence before deciding to use the brand, but PWS did not have a registered trade mark and Lidl did not think PWS would have a right to object. Lidl registered a trade mark for WARREN & SONS without complaint and products bearing that mark started to be sold in June 2015.

10. From 2015 to 2020, when the WARREN & SONS brand was abandoned, hundreds of millions of packs of this brand were sold in the hundreds of Lidl stores around the country. Other than an isolated communication, no problems of possible confusion with PWS came to Lidl’s attention.

11. Lidl’s change of branding was known to PWS in late 2015 from a wrongly directed customer e-mail, which suggested some confusion. There were further occasional reports of confusion which caused annoyance and upset but were dealt with by PWS as they arose. The problem was not mentioned to Lidl at the time. PWS explained that this was because they did not know that they may have been able to do something about it until they met specialist solicitors, Stobbs. Having been informed that a claim might be possible in 2017, PWS did not raise the matter with Lidl right away. PWS and Stobbs spent considerable time making damages-based agreements for payment for legal services and obtaining insurance to enable a case to be brought inter alia for significant financial relief.

12. By the time PWS wrote to Lidl at the end of 2019 with a detailed letter before action indicating that large compensation would be sought, the WARREN & SONS brand was already on the way to being abandoned as a result of a decision taken independently by Lidl in 2018 to rebrand the whole range. Lidl told PWS this in early 2020 in response to the letter before action. The brand was phased out completely a few months later (although there was some Covid-related delay in finalizing this) and the registered trade mark was given up by Lidl in late 2020. This did not satisfy PWS and, as the correspondence at the form of order hearing has now made clear, the only reason the trial went ahead was that PWS is seeking a large sum in compensation. Instead of bringing the claim in IPEC, which is designed for SMEs and provides for a costs cap of £50,000, PWS and its lawyers decided to bring a case in the High Court where there is no cap on recovery.

13. The case was quite complex for a number of reasons, including PWS’s limited trading outside the Launceston area and in wholesale business at the relevant date for assessment of goodwill in 2015 and the different markets to which the respective businesses were directed. The case focused on three kinds of PWS’s customers/potential customers who might have been deceived by Lidl’s branding. First, those local to Launceston and region where there was some second-hand evidence that some thought (or more strictly, may have thought, since the evidence was not properly testable) that PWS’s products may have become available in Lidl. Second, those in the specialist high-end wholesale trade who, on the limited evidence as there was from those in this area, had not thought that there was a connection and who had not been troubled by Lidl’s continued use of WARREN & SONS, even though they may have been particularly sensitive to any perceived connection with Lidl. Third, mainly Lidl retail customers around the country who appeared to have found PWS on the internet after purchase of a WARREN & SONS product where a few had contacted PWS instead of Lidl by mistake or where they were not sure who to contact. There was a small number of these. Lidl’s evidence was that no confusion had come to light where they would have expected that to show up most readily, namely near Launceston.

14. The court therefore had to decide whether this was a solid enough evidential foundation to find Lidl liable for causing materially damaging (and operative) deception of the public into a connection with PWS such as to damage PWS’s goodwill. The judgment took the view that the evidence was not strong enough in the various domains where goodwill subsisted to say that there was significant operative misrepresentation causing material damage to PWS’s goodwill.

15. The law of passing off differs from registered trade mark law, which confers quasi-monopoly rights in a mark. It requires courts to focus on whether there is a misrepresentation as to trade origin, looking at the whole picture and requires distinctions to be made between misrepresentation and “mere confusion” in markets. Some case law distinguishes between situations where customers assume there is a connection between two brands and those where they only wonder whether there is. The law requires evaluation of whether any misrepresentation is likely to damage a claimant’s goodwill to a material extent. Reasonable people and courts differ as to where these lines are drawn. An allegation of passing off in a case of this kind requires proof that the defendant has misrepresented its products as being connected with a specific undertaking. It is not sufficient, in general, that a supermarket may have suggested that products come from (say) a local English butcher, thereby causing people to buy the brand because it carries a general sense of “high street authenticity” or because it is perceived not to be a supermarket brand. Some think such brands misleading but others like them, because they have a better “look” and appear less supermarkety, making them more acceptable to be taken to a barbecue, to adopt the words of one document.

16. Given that Lidl was stopping use of the WARREN & SONS brand before PWS wrote to complain and did so about a year before the trial, the case was ultimately focused on the claim for historic compensation. However, this stage of the case was about liability alone, because the parties adopted a conventional split trial with compensation to be evaluated later if the case was successful. Inevitably, because damage is an ingredient of the tort of passing off, it featured to some limited extent and the earlier judgment made some (non-binding) comments on the plausibility of the very large financial claim.

17. One matter relevant to the argument on costs is that assessing compensation for passing off is not easy. It is not even easy in cases of registered trade mark infringement. PWS did not allege that they had lost any sales as a result of Lidl’s actions and its business had never done better than during the years in which Lidl was alleged to have been damaging its goodwill. There is, however, case law indicating possible bases for compensation which may include profits made by a defendant or a reasonable royalty but it is not clear to what extent it applies in a case like the present. Quantification is more complicated in this case by the issue of whether any benefit obtained by Lidl, if there was passing off, was gained specifically at the expense of PWS, as opposed to other traders. Courts in other cases in the broad area have given indications that compensation should not be out of proportion to the actual benefit obtained by a defendant’s use of a mark or the loss suffered by a claimant as a result.

18. There is also a question of the relevance of delay on this issue. On PWS’s approach to compensation, the more and the longer the public was deceived by Lidl, the more PWS would gain. So too its lawyers who were acting pursuant to a damages based agreement (or DBA) which provides for lawyers to be able to share in up to 50% of compensation ordered or agreed. I should make it clear that this is not to suggest that raising the claim was delayed in order to increase the damages payable, merely that this is a paradoxical effect of delay in a case like this. It is unclear what the courts would do in a situation of this kind.

19. PWS’s claim was not successful and Lidl’s counterclaim was also not successful. The main judgment explains the reasoning more fully and it was far from a frivolous case. It is possible that the Court of Appeal would take a different view, if it progresses. However, at the consequentials hearing on 1 June 2021, rival Part 36 offers to settle were revealed. These offers, which related to financial relief, were put before the court without objection from either side, although quantum had not been determined or the case on this fully developed.

20. Despite denying liability, it appeared that in October 2020, Lidl had been amenable to resolution without the need for the trial, including paying compensation and offering essentially all the other relief PWS had been asking for. As well as abandoning the brand and surrendering the trade mark, Lidl offered PWS compensation of £230,000 and all PWS’s legal costs at that time in a total settlement package of about £1/2 million. This would have resulted in PWS and its lawyers being reasonably well compensated and would have avoided the significant costs of trial. It is possible that Lidl might have been prepared to pay somewhat more. The sum offered (it was only later explained) bore some relationship to profits from shops in the local Launceston area. Had terms been agreed along these lines, PWS would have received much more than nominal compensation for something PWS had not previously complained about and which had caused no loss of sales. It would have saved large costs. Few would have said that was fundamentally unfair.

21. However, PWS and its lawyers on its behalf clearly wanted - and thought they were entitled to - much more: PWS’s claim is (or was) for some £38 million although it made two Part 36 offers to accept less. PWS says that Lidl should have mediated the case and that there was a reasonable prospect of reaching a settlement which would have bridged the enormous gap. Lidl says that it was reasonable not to do so given the gulf between the parties’ positions, although it did not shut the door on settlement discussions. It says that it had made an offer with which PWS should have engaged more fully at the time and that it appeared that PWS and its lawyers appeared determined to hold out for huge sums, while threatening damage to Lidl’s reputation if a trial went ahead. So, Lidl say, it was reasonable not to deal with them on this basis. Whatever the rights and wrongs, it is regrettable that this case was not resolved earlier, as it could have been, relatively easily, if everything had been kept in proportion at the outset. That has consequences for the orders sought now and for the future.

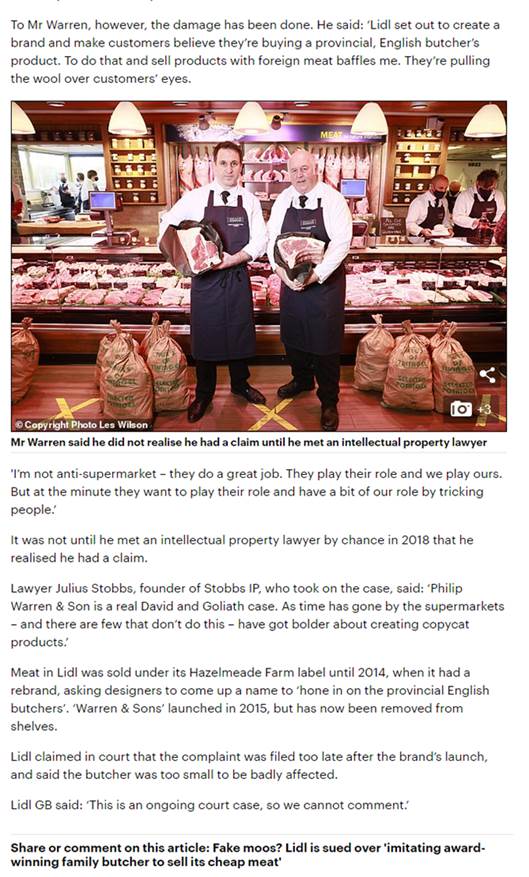

The Mail on Sunday/Mail Online and other articles following the trial

22. There is a further matter which has come to divide the parties. After trial, but before judgment, Mr Ian Warren of PWS and Mr Julius Stobbs of PWS’s solicitors assisted a journalist from the Mail on Sunday/Mail Online with an article of which a key part of the headline was “Fake Moos?”. It focused almost entirely on the case and was given nationwide publicity. The story was picked up by other papers, including in Cornwall. It did not paint a flattering picture of Lidl’s conduct, using material supplied by PWS and its lawyers, including the tendentious skeleton arguments deployed by PWS at trial. The overall message of the Mail on Sunday/Mail Online article (albeit less so others, as I explain in detail below) was that Lidl was being accused of deliberately taking the WARREN & SONS brand from PWS with a view to using PWS’s good name to sell poorer quality produce. It also portrayed Lidl as having had little of merit to say in their defence at the trial. The Mail Online article resulted in numerous adverse comments below the line (“BTL”) about Lidl, some of which were of a kind no retailer would want to see, including threatening not to shop there again. Some would describe it as a “BTL hammering”. PWS say that it was not their fault or Stobbs’ fault that the articles appeared in those terms, that the publications were not unfair as a whole and that Lidl could have countered them but declined to do so.

23. Again, whatever the origin and cause, the effect has been criticism of Lidl which neither side contends to have been based on a complete presentation of the situation and both sides agree went, in some key respects, too far or was so incomplete as to be misleading. The unfortunate effect is that, as regards branding of this kind Lidl was also portrayed as being worse than its competitors (who in some cases also have been reported as having adopted branding which has been criticized as inauthentic) when in fact, unlike others, it abandoned the brand complained of some time ago and had even offered to pay a substantial sum in compensation. The upshot is that it is likely that the manner in which the case has been given publicity may have resulted in Lidl’s reputation being damaged in a way which neither PWS nor its lawyers suggests is justified and for which it is not suggested there is any realistic or easy remedy.

24. I have set out the background at reasonable length partly to demonstrate that even an incomplete summary of the respective positions to try to give a picture of what has gone on takes multiple paragraphs. That is relevant to the decision I reached as to the publicity order as well as to the costs evaluation.

The applications

25. The applications were as follows:

26. As to costs, Lidl said that it should have its costs on an indemnity basis. PWS’s main point at the hearing was that there should be a substantial reduction to take account of various factors, including its partial success but of which the biggest was Lidl’s allegedly unreasonable failure to agree to mediation. It also said that the assessment of costs sought by Lidl, which it is accepted should be summary, was too high in various respects. PWS also argued (albeit that this was not really pressed with vigour at the hearing, recognizing that this was not realistic) that there should be no order as to costs, despite the fact that its claim had failed.

27. As to publicity order, Lidl said that the reporting of its conduct has been so unfair as a result of PWS and Stobbs’ communications to the press that it would be just for the result of the case and a link to it to be published at PWS’s expense in the same outlets to set the record straight. This was, to my mind the hardest issue at the time and required consideration of some case law and principles not cited by the parties.

28. There was also an application for permission to appeal which I granted in a more limited form than sought at the hearing.

29. There were also a few other more minor applications, addressed below.

A. COSTS

30. I deal with the respective costs claims in turn and have addressed the further post-hearing submissions in a separate section, so that the parties can see how the thinking has developed in the light of them.

(i) Lidl’s claim for indemnity costs

26. The main basis upon which indemnity costs were sought was that PWS had failed to beat a Part 36 offer made by Lidl in October 2020. There are also other points about PWS’s conduct said to justify such costs.

27. The recent decision of Fraser J in Beattie Passive Norse Ltd & Anor v Canham Consulting Ltd (No. 2 Costs) [2021] EWHC 1414 (TCC) at [11]-[24] conveniently summarises the principles by reference to which indemnity costs are awarded in a situation such as the present, from which the following is distilled:

General

28. First, CPR Rule 44.2, under the heading "Court's discretion as to costs" provides:

"(2) If the court decides to make an order about costs –

(a) the general rule is that the unsuccessful party will be ordered to pay the costs of the successful party; but

(b) the court may make a different order."

Rule 44.2(4) provides:

"(4) In deciding what order (if any) to make about costs, the court must have regard to all the circumstances, including –

(a) the conduct of all the parties;

(b) whether a party has succeeded on part of his case, even if that party has not been wholly successful; and

(c) any admissible offer to settle made by a party which is drawn to the court's attention, and which is not an offer to which costs consequences under Part 36 apply."

29. Second, CPR Part 36.17(1) makes clear that Part 36.17 applies where a claimant fails to obtain a judgment more advantageous than a Part 36 offer made by a defendant. (3) states:

"(3) Subject to paragraphs (7) and (8), where paragraph 1(a) applies, the court must, unless it considers it unjust to do so, order that the defendant is entitled to: -

(a) Costs (including any recoverable pre-action costs) from the date on which the relevant period expired; and

(b) Interest on those costs".

Indemnity costs where a Part 36 offer is not beaten

30. In Lejonvarn v Burgess [2020] EWCA Civ 114 , Coulson LJ said at [43]:

"…a defendant (such as the appellant in the present case) who beats his or her own Part 36 offer, is not automatically entitled to indemnity costs. But a defendant can seek an order for indemnity costs if he or she can show that, in all the circumstances of the case, the claimant's refusal to accept that offer was unreasonable such as to be "out of the norm". Moreover, if the claimant's refusal to accept the offer comes against the background of a speculative, weak, opportunistic or thin claim, then an order for indemnity costs may very well be made. That is what happened in Excelsior.”

He added:

"[80] When a defendant beats its own Part 36 offer, the court should always consider whether, in consequence, the claimant's conduct in refusing that offer took the case out of the norm. Sometimes it will; sometimes it won't. Mr Cohen articulated the question that had to be asked in these terms:

'At any stage from the date of the offer to the date of the outcome, was there a point when the reasonable claimant would have concluded that the offer represented a better outcome than the likely outcome at trial?'”

General factors relevant to costs

31. The court is obliged to consider 'all the circumstances of the case' but these fall predominantly into the categories of:-

1. Conduct before and during the proceedings (Part 44.2(5)(a))

2. The reasonableness of the claimant's decision to pursue a particular allegation or issue (Part 44.2(5)(b))

3. The manner in which a claimant has pursued its case (Part 44.2(5)(c))

4. The extent to which a claimant has exaggerated its claim (Part 44.2(5)(d))

32. In Excelsior Commercial & Industrial Holdings Ltd v Salisbury Hammer Aspden & Johnson and another [2002] EWCA Civ 879 the Lord Chief Justice said:

"[31] … those paragraphs set out the need for there to be something more than merely a non-acceptance of a payment into court, or an offer of payment, by a defendant before it is appropriate to make an indemnity order for costs…However, I would point out the obvious fact that the circumstances with which the courts may be concerned where there is a payment into court may vary considerably. An indemnity order may be justified not only because of the conduct of the parties, but also because of other particular circumstances of the litigation. I give as an example a situation where a party is involved in proceedings as a test case although, so far as that party is concerned, he has no other interest than the issue that arises in that case, but is drawn into expensive litigation. If he is successful, a court may well say that an indemnity order was appropriate, although it could not be suggested that anyone's conduct in the case had been unreasonable. Equally there may be situations where the nature of the litigation means that the parties could not be expected to conduct the litigation in a proportionate manner. Again the conduct would not be unreasonable and it seems to me that the court would be entitled to take into account that sort of situation in deciding that an indemnity order was appropriate.

[32] I take those two examples only for the purpose of illustrating the fact that there is an infinite variety of situations which can come before the courts and which justify the making of an indemnity order…This court can do no more than draw attention to the width of the discretion of the trial judge and re-emphasise the point that has already been made that, before an indemnity order can be made, there must be some conduct or some circumstance which takes the case out of the norm. That is the critical requirement."

33. In Excalibur Ventures LLC v Texas Keystone Inc and others [2013] EWHC 4278 (Comm), Christopher Clarke LJ set out relevant factors which included where a party:

"(a) advances and aggressively pursues serious and wide-ranging allegations of dishonesty or impropriety over an extended period of time.

(b) advances and aggressively pursues such allegations despite the lack of any foundation in the documentary evidence for those allegations and maintains the allegations without apology to the bitter end.

(c) actively seeks to court publicity for its serious allegations both before and during the trial.

(d) turns a case into an unprecedented factual inquiry by the pursuit of an unjustified case.

(e) pursues a claim which is to put it most charitably thin, and in some respects far-fetched.

(f) pursues a claim which is irreconcilable with the contemporaneous documents.

(g) commences and pursues large scale and expensive litigation in circumstances calculated to exert commercial pressure on a defendant and during the course of the trial of the action the claimant resorts to advancing a constantly changing case in order to justify the allegations which it had made, only then to suffer a resounding defeat." (see also European Strategic Fund Limited v Skandinaviska Enskilda Banken AB [2012] EWHC 749 (Comm))

Lidl’s position and the background

34. Lidl relies primarily on the fact that it made a Part 36 offer to settle the case in October 2020, which would have given PWS more than the result it has achieved. Some background is relevant to whether it was unreasonable of PWS not to have accepted that offer and, because it is relevant to other aspects as well, I set it out more fully.

35. The claim was originally advanced by a lengthy letter before action, dated 22 November 2019, enclosing some 400 pages of documents. As to financial remedies, although not explicit, it said: “For present purposes, our client will be proceeding on the basis that the profit figure upon which an account of profits would be based will be in the region of £47 million”. This, and other aspects of the letter, suggested that PWS would be making a claim closely based on Lidl’s entire profits on the WARREN & SONS range over the whole period of sales. This letter had obviously been worked up over a considerable period.

36. Despite PWS not having mentioned the alleged problem at all over the previous 4 years, the letter demanded detailed undertakings, submission to an inquiry as to damages or an account of profits and a response in 14 days. Lidl answered (by its solicitors, Bird & Bird) on 6 December 2019 saying that time was needed to take instructions. The letter noted that PWS’s claim appeared to have been prepared over some 6 months and that the activity of which the letter complained had been ongoing for several years, with PWS’s knowledge and without objection. Lidl said they would respond by 10 January 2020. Despite this, without waiting for a substantive answer, PWS commenced proceedings straight away, which PWS says was appropriate. However, this initial exchange set something of the tone for the rest of the case which then developed and which, as the Part 36 correspondence has revealed, has heavily focused on a very large financial claim which was, in various ways, said by PWS to be all but inevitable.

PWS’s first Part 36 offer

37. ADR was suggested at various points by PWS’s solicitors (see further below) which looked to be something of a tactic to try to procure an early advantageous settlement. This was not taken up by Lidl but, on 31 July 2020, Lidl’s solicitors wrote to Stobbs indicating that they were assessing whether to make a settlement offer. This was Lidl being proactive in seeking information to try to resolve the case, as a reasonable defendant would be expected to do. They asked for confirmation of PWS’s costs. This was met a few weeks later with an unsolicited Valuation Report from Mr Robert Sharp of Valuation Consulting under cover of a letter from Stobbs on behalf of PWS. Stobbs wrote both on a without prejudice save as to costs and open basis to express confidence in PWS’s case and said that, on the basis of this Valuation Report, (which I have not considered but of which the detail does not matter for this purpose):

“…our client is confident that upon electing for an account of profits it will be awarded c. £38.3 million” and that in the unlikely event that Lidl succeed in persuading the court that PWS should be restricted to damages only (for which there is no arguable basis), then our client is confident that it will be awarded damages of £17.7 million.”

Stobbs said that this was the “minimum that our client can be expected to be awarded”.

It therefore made a Part 36 offer which had the following key terms:

(a) Payment by Lidl of the sum of £28,699,840 within 14 days;

(b) Lidl ceasing use of the mark WARREN & SONS for meat products from 30 September 2020;

(c) Lidl ceasing and desisting in the future from passing themselves or their goods off as those of PWS or as being in any way connected with PWS or its business and not causing, enabling or permitting others to do so;

(d) Surrendering the UK Trade Mark WARREN & SONS in class 29

(e) The offer took into account the counterclaim but the settlement sum did not include costs.

There were other terms concerning liability for costs and interest.

35. The letter said that the sum PWS was prepared to accept was a significant (25%) discount “on the total sum that our client has been advised that it will be entitled to receive at trial by way of an account of profits” and that it was “extremely generous in the circumstances”. This description of the proposed settlement terms was, to put the matter charitably, questionable since it contemplated payment by Lidl of a sum which vastly exceeded the profits made by PWS over the whole of its existence. It would also have involved payment of some £14 million to Stobbs/counsel (because of the DBA for compensation to PWS’s lawyers for their legal services). That, some may say, could fairly be described as “extremely generous”, inter alia, to PWS’s lawyers, given that they were also saying that this was a straightforward, short, case for which ordinary compensation for legal services in dealing with it would not approach that sum. It appeared to proceed on the basis that Lidl should disgorge to PWS the bulk (or at least a significant proportion) of its profits on the entirety of the WARREN & SONS range over the lifetime of the brand, regardless of whether a significant number (or any) consumers had bought the product on the basis of a perceived connection with PWS or had ever heard of them, in so doing. It was, in effect if not in terms, saying, that without knowing it, Lidl had spent the whole of 2015 to 2020 selling all its meat of this kind substantially (or at least in significant part) for the benefit of PWS and its lawyers who, on this basis should, instead of Lidl, profit from Lidl’s alleged deception of the public that this was a local butcher’s brand, to the tune of millions of pounds. Such a claim involved the underlying proposition that a brand owner could sit back, not mention that there was any potential problem, even after knowing that a claim would be advanced and hit a retailer which did not think it had done anything wrong with a vast profits/royalties claim which it and its lawyers could share out between them. In the event, Lidl clearly did not think that a claim of this kind was in the right ball-park.

36. Further without prejudice save as to costs correspondence from Stobbs on 26 August 2020 indicated, inter alia, a preparedness to provide details of their costs only at a time when there were genuine prospects of settlement of the substantive claim being agreed but Stobbs confirmed that instructions would be taken in respect of any proposal for settlement of the claim. On 8 September 2020, Stobbs indicated that its costs to that date were a total of £228,600.

Lidl’s Part 36 offer

37. Although Lidl had not previously agreed to mediation, on 8 October 2020, following up on earlier correspondence, it made a Part 36 Offer to settle the whole claim. The letter said that PWS’s claim was being maintained out of opportunism but, given the potential costs, they proposed payment of £230,000 in full and final settlement. They also indicated that Lidl had already ceased use of the sign WARREN & SONS, were prepared to undertake not to resume selling products under the sign WARREN & SONS and had surrendered the registered trade mark.

38. Since it was a Part 36 offer, had it been accepted, PWS would have been entitled to its costs down to the relevant date. Stobbs sought clarification of the offer on 12 October 2020 and, in particular, as to whether the sum offered was a rounded up figure of costs and disbursements. Bird & Bird’s letter provided limited clarification on 14 October 2020, explaining that the similarity of the figures was co-incidental and that Lidl had arrived at the sum as being one which they considered would likely exceed the sum which would be awarded by way of an account of profits.

PWS’s second Part 36 offer

39. PWS did not accept this offer but they did again propose mediation, which again was not taken up by Lidl. PWS did not make a further Part 36 counter-offer until 29 January 2021, when they wrote again saying that they now had a “full picture against which to reassess their position on the merits of our client’s claim and your client’s liability”. This letter explained in some detail that PWS considered that it would be entitled to an account of profits but made an offer on the basis of user-principle damages (referring to a PCC/IPEC case National Guild of Removers [2011] FSR 9 and an Australian case, Winnebago Industries Inc. v. Knott Investments Pty Ltd (No.4) [2015] FCA 1327) and the Valuation Report. The letter contained a similar request for other relief as before, save that it said the sum PWS was prepared to accept to avoid a trial was now £15 million. That was said to amount to a c. 60% discount on the figure for an account of profits and a more modest (15%) discount on the valuation consultant’s figure for a notional royalty (of £17.7 million). Stobbs’ letter said that Lidl could not reasonably expect to achieve a more favourable outcome, given its “extremely weak” position on liability. The letter concluded with the following paragraph:

“In the circumstances, the Offer is extremely generous, and represents your clients’ final opportunity to dispose of our client’s claim without the cost and reputational harm that will inevitably result from the inevitably unfavourable outcome at trial.”

40. That reference to the “inevitably” unfavourable outcome at trial may have been at variance with the less certain chances of success given by Stobbs to its ATE insurers which appeared to have acknowledged that there was at least some chance of losing (in that the prospects of success were estimated as greater than 75%). This further “extremely generous” offer would also have left PWS receiving by way of damages more than it had made in its entire lifetime of existence from selling products (although half would have gone to its lawyers) and it would have provided that Stobbs/counsel share in compensation for their legal services a sum approximately 15 times greater than they have more recently asserted would be reasonable for the conduct of the case up to that point. As noted, the letter said that, unless Lidl paid PWS the £15 million requested within 14 days, pursuing the case to trial meant that damage to Lidl’s reputation was “inevitable”. Like other high street retailers, Lidl is sensitive to its reputation as the evidence on the applications showed. This letter therefore gives a flavour of the pressure, only indirectly related to the underlying merits of the claim, which PWS was seeking to put on Lidl to settle the case for a very large sum. It was of a piece with the tone of the previous correspondence. Lidl could reasonably have reached the conclusion that there was no point in having a mediation because PWS would never accept (or be advised by Stobbs or counsel to accept) sums of the order they may be prepared to pay. Lidl may well also have thought that, since Stobbs and counsel were to share half, it was unlikely that they would advise PWS to accept a much lower figure than £15 million especially since they had expressed such repeated confidence in their position. I emphasise that Mr Stobbs has said (and I accept) that this claim was pursued on clients’ instructions and I have not concluded that this claim was driven by lawyers wishing to obtain large sums. However, the parties remained nearly two orders of magnitude apart even in January 2021. That is relevant to PWS’s claim for a reduction in costs for failure to mediate, discussed below.

Part 36 and indemnity costs

41. Reverting to the indemnity costs point, with the benefit of hindsight, it is regrettable that PWS did not engage more seriously with Lidl’s earlier Part 36 offer of October 2020, but the question is whether this alone justifies indemnity costs.

42. I consider not. With some hesitation, I have reached the view that a reasonable claimant would not have concluded that Lidl’s offer at that stage represented a better outcome than the likely outcome at trial. I say so, with hesitation, because it was not an unreasonable offer in all the circumstances. However, PWS had obtained an independent expert valuation report which put the claim much higher. The references to a first instance case and an Australian case made the basis for a higher claim (sort of) arguable. Because of the uncertainties, including those relating to the approach to quantum in a passing off claim, I am not satisfied that PWS can be said to have been unreasonable in thinking that they at least might do better by pressing ahead and perhaps pushing Lidl up a bit before trial. Other aspects of Lidl’s correspondence had also hinted that any offer made may be at a higher level than approximately the level of costs, which this was not. So, prima facie, PWS’s failure to accept Lidl’s Part 36 offer does not justify an order for indemnity costs. My hesitation arises because this was (in my view) a reasonable offer and the making and acceptance of reasonable offers should, in principle, be incentivized (and refusing them strongly disincentivised), especially when the alternative is to continue expensive litigation which imposes significant costs on opposing parties.

43. It seems clear to me that Lidl’s Part 36 offer was at least in the right ball park. Two matters seem to support that conclusion. First, it seems to be in line with the kind of award and approach to it which the court considered appropriate in 32Red (see also below) albeit in a case where user damages were held to be appropriate. Second, Stobbs had said, to justify a 50% percentage on a DBA (the maximum permissible), that it was “conceivable” that the payment received by Stobbs “might” exceed the likely costs that would be charged pursuant to an ordinary retainer but there was a risk of Stobbs not being paid at all. That suggests that Stobbs may have recognised earlier on that a sum roughly of the order of legal costs as compensation would be appropriate, otherwise they would have found it harder to justify a 50% claim to damages under a DBA. So the fact that PWS might have been entitled to reject the Part 36 offer on the footing that they might have got a little more at trial does not involve saying that what they and Stobbs were proposing should be paid at a later stage was realistic. I return to this point below in considering the post-hearing submissions.

(ii) Other aspects of PWS’s conduct

44. Lidl relied on numerous other points in support of the claim for indemnity costs, with which I can deal relatively briefly because I was not persuaded that individually or collectively (or taken together with the refusal to accept the Part 36 offer) they came close to justifying indemnity costs. They were dealt with exhaustively at the hearing and in evidence from Bird & Bird and a helpful table from PWS’s counsel responding to this. I do not need to consider them at equal length here. Some points argued were swept up in the point on the Part 36 offers. The other main ones are as follows, with my assessment of them:

a. That the allegation of misrepresentation was based on no solid evidence or thin evidence. It is true that this is what the main judgment holds and I adhere to the view that, where a passing off claim is made for historical compensation of tens of millions of pounds and an allegation is made against a well-respected company that it has been deceiving the public to a material degree over a lengthy period during which this has not been noticed by it or mentioned to it, no loss of sales are suggested and the claimant’s business has never been stronger than during the period of alleged passing off, the claim should be based on sufficient solid evidence. The evidence at trial was, in my evaluation, not of that quality. However, I do not think that this suffices to take the case out of the norm. It is fairer, on the whole, to say that PWS did not win the case on its evidence rather than that Lidl won it convincingly.

b. That the allegation of damage was made in the face of PWS’s own evidence as to the lack of damage and that the claim for damages in the tens of millions was “implausible”. Again, while true that PWS did not claim loss of sales, the authorities on compensation for these kinds of cases are sufficiently equivocal that advancing such a case, while in my view implausible, was not improper. It is reasonably clear that it was done in an attempt to persuade Lidl to agree a higher sum in settlement and Lidl did not explain to PWS in correspondence exactly why, at that stage, in its view, the value PWS had placed on the claim was unreasonable, although it had explained its position somewhat briefly in response to the letter before action and Lidl’s arguments at trial made that considerably clearer. I remain of the view, for a range of reasons, that the claim for compensation is likely to be regarded as disproportionate, whatever the merits on liability but that does not mean that it was improper to advance it. Perhaps others will disagree if the case is fought to the bitter end, although I consider this unlikely. Lidl did not, in its response at that stage, reject the suggestion that a profits-based approach would have some merit in principle although it had made the general point elsewhere that such an approach was inappropriate. Where PWS may have gone wrong is not to step back and consider whether, in accordance with the general case law and the specific case law relevant to compensation in cases of this kind, its claim was proportionate to the loss suffered or the benefit obtained as a result of a misrepresentation of a connection specifically with PWS. But that is, in my view, no more than a failure to engage in realistic thinking on the part of PWS and its advisors, based on the case law as a whole, rather than isolated snippets from some. That is not something to take the case out of the norm. However, I consider the impact of my view that the claim is likely to be exaggerated in the light of the further submissions on costs below. The course I am now taking means that PWS might be obliged to compensate Lidl on a more generous basis in costs, if its evaluation of the quantum of the claim was erroneous.

c. That PWS alleged that Lidl had created a “fake” brand and sought to “imitate” PWS deliberately to deceive customers which was not sustained on the evidence. It is true that Lidl did not imitate specifically PWS deliberately to deceive customers but, equally, Lidl created a brand which was designed to appear as though the products were from a traditional English local butcher when they were in fact Lidl own brand, in some cases sourced from overseas. The distinction between imitation of a specific brand and choice of a fictional brand which is similar to an existing brand is a subtle - albeit important - one. The evidence showed that Lidl did not make it particularly easy to distinguish own brand from third party brands in store or on pack. PWS’s pursuit of the claim in this regard was not such as to take the case out of the norm.

d. The mismatch between the e-mails and the evidence under cross-examination and that cross-examination proceeded on the basis of PWS’s counsel’s opinion. In certain respects, PWS’s witnesses did not come up exactly to proof when their evidence was tested - but this was more a matter of nuance of their evidence. Some of the cross-examination missed the mark but that often happens in litigation. None of this rendered the case or its pursuit inappropriate or out of the norm. I do not consider that the fact that cross-examination was conducted on a given basis affects the position.

e. That PWS evinced absolute belief in the merits of its position. Again, there is nothing in this point. Lidl too said that they were going to win and valued the claim at zero. It often happens that lawyers write letters to each other expressing complete confidence in their respective positions. That is litigation life. Many such lawyers’ letters are taken with a pinch of salt by the recipient. Writing them does not take the case out of the norm.

f. That PWS tried to force a settlement by raising a threat of negative publicity as part of its argument including raising somewhat graphic material at a late stage. I was more troubled by this point, since PWS’s January 2021 Part 36 offer to settle for £15 million suggested that reputational damage would follow if it was not paid. However, I think it was only really a somewhat strong lawyers “please settle” letter (as many written on PWS’s behalf had been) pointing out that Lidl should pay because the trial would reveal Lidl’s conduct. It fell within the “rough and tumble” of litigation run, admittedly rather aggressively, on a no-win, no-fee basis and does not take the case out of the norm.

g. That PWS courted publicity for its serious allegations in the national and local media. I do not think PWS courted publicity (see below) but equally did not turn down the opportunity when it presented itself. None of this takes the litigation out of the norm. Lawyers and litigants often speak with the press about cases and, as the coverage shows, this case was of legitimate public interest. The problem with the publicity was, as I discuss below, the detail of what it said not the principle of giving publicity to the dispute.

h. That PWS’s lawyers made mountains out of molehills, overegging evidence and disclosure on admitted goodwill taking a bad point on a missed evidence deadline and repeatedly engaging in lengthy and combative correspondence. None of that takes the case out of the norm. As I read the correspondence, this was a hard fought case on both sides. I also think it was reasonable to include relevant documents on goodwill since they provided a more complete picture of the extent of PWS’s trading and were (in some respects) of assistance to evaluating the extent to which there was operative confusion.

i. PWS seeking to amend and then abandoning amendment of its case before trial after comments from the court; seeking to “ambush” Lidl late with more than 700 pages of new cross examination documents some of which were not what they at first appeared to be which had to be dealt with by Lidl and the court; and introducing certain other materials into the case at a late stage. While that took up some time and some of it was designed to be prejudicial, it was not much, the court was able to ignore the prejudice, and this does not take the case out of the norm.

j. PWS changing its evidence before the PTR. Again, although perhaps regrettable, this seems an aspect of the rough and tumble of hard-fought litigation. This material did reveal one point, namely that a reason why PWS brought proceedings in the High Court rather than IPEC was because PWS’s legal advisers wanted to be able to have the possibility of recovering a larger amount under the DBA than would have been the case in IPEC where the sum recoverable would have been limited (possibly, depending upon one’s view of the case, to only that which was reasonable and proportionate) but PWS’s costs liability would also have been limited to less than 1/10th of what it is now being asked to pay as a result of not being successful. So, what the lawyers and PWS would potentially gain would come at a price for PWS by way of exposure to costs liability. None of that, however, takes the case out of the norm.

k. There are several other points relied on including (a) a dispute over ownership of goodwill which was ultimately resolved but which required attention (b) PWS’s allegedly misconceived application to strike out the counterclaim which it says it did not make (c) the disclosure requests which the court rejected (d) putting Lidl and its solicitors to a substantial factual enquiry. Again, perhaps some of these were, with the benefit of hindsight, sub-optimal but they are all part of hard fought High Court litigation.

General points

45. The following further general points make an award of indemnity costs inappropriate.

46. First, it may have been better and possibly more productive of an early settlement had the litigation been conducted at lower intensity, including as to choice of court. However, that may be a characteristic of litigation which is conducted by a metaphorical “little person” against a “big corporation” where a claimant feels the need to shout to be heard. Second, until its October 2020 offer, Lidl had not undertaken not to use WARREN & SONS again and had not surrendered the registered trade mark. Third, to some extent, Lidl brought this case upon itself by its branding strategy which involved choosing a fictional brand to make its products more attractive and not troubling too much about whether it might affect the business of an undertaking with a similar name. There is nothing which required Lidl to take that approach to branding and the brand has now changed. Fourth, some (including me and perhaps even Lidl, since they were prepared to make a substantial offer to settle the case in October 2020) thought the case far from hopeless. Fifth, having heard from Mr Ian Warren, I am satisfied that PWS had reasonable motives for bringing the case.

47. Assuming even that PWS’s claim for financial relief was impossible rather than implausible (as to which I have not decided definitively, as opposed to indicating my preliminary view), I would have been slow to criticize PWS for pursuing it. There is an element of public interest in passing-off claims since they concern alleged deception of the public and upholding “truth in advertising/marketing”. Even if such claims are unsuccessful, there can be merit in having this issue aired. This claim also arises, as PWS counsel rightly submitted, in the context of concern about the inauthenticity of certain kinds of branding as well as legitimate debates about the need to protect smaller and especially rural businesses from perceived unfair practices by larger rivals. That said, it is important not to make too much of that in this case, given the fact that Lidl has abandoned the brand. There is here a difference between the justification for commencing the claim and the justification for continuing it in the face of a, prima facie, reasonable offer by Lidl to settle it. It is also subject to the points made below arising out of the further submissions. While there may be nothing reprehensible about pursuing prima facie unjustified sums, where a claim to such cannot be struck out, it seems to me that if a claim at a level which is prima facie implausible is pursued but fails, in the face of a reasonable offer to settle the claim, those responsible for the time and money wasted as a result should reasonably expect to pay the costs of that exercise in full.

48. For these reasons, I concluded that Lidl had not justified its claim for indemnity costs and I assessed costs down to trial on the standard basis. That decision did not affect the entitlement to interest, to which there is an entitlement where a Part 36 offer of this kind is beaten (see below as to how that is to be addressed).

Post-hearing submissions

49. As noted above, I gave permission to the parties to make further submissions on the issue of the appropriate basis for assessment of costs. My main reasons for doing so were that the draft decision had referred to some cases not referred to by the parties and that a question arose as to whether an award of indemnity costs may be appropriate if statements made in the course of justifying the DBA in question at a 50/50 share made it sufficiently clear that the claim subsequently advanced was exaggerated, for that to be taken into account and given significant weight, despite the fact that no determination of quantum had been made at this stage. I also had regard to the developing jurisprudence relating to litigation finance which has, in various ways, expressed some concern that increasing access to justice by the various means through which that has been done in recent years may come at a price of increasing the incentives to bring claims of a kind which should not be incentivized or creating unfairness in other respects by unfairly immunizing those bringing certain kinds of speculative claims from bearing the full costs and risks which they impose on others.

50. Lidl’s submissions largely followed its earlier points and submitted that both the facts and observations in Lejonvarn, to which it had not previously referred, supported its claim for indemnity costs. It also submitted, and I agree, that the mere fact that a substantial claim is pursued using a DBA could not justify costs being assessed on that basis. To that extent, whether or not there is a DBA, they submitted, was not relevant on the issue of indemnity costs. That is uncontroversaial and no-one had suggested otherwise.

51. However, Lidl also submitted that DBA and ATE funding was capable of creating or increasing incentives to pursue speculative or opportunistic litigation and that pursuit of litigation using a DBA and ATE insurance may create scenarios in which cases become harder to settle because one side was at “no risk of loss on damages while pursuing a claim with the chance of vast winnings”. Such litigation may become, in Lidl’s submission, “an investment vehicle” where, because there is no apparent downside to an insured claimant advancing a claim under a DBA, it may as well pursue the case to trial (and beyond), making what amounts to a “bet without any stake”. This potentially imposes unjustified costs both on an opposing party and the court, disincentivises the acceptance of reasonable offers and, if not adequately addressed in costs, enables a claimant to obtain the full benefit of its large claim if it succeeds but (on the assumption that it was not obliged to pay indemnity costs if it loses) may leave a successful defendant, or one which has made a reasonable offer to settle at an early stage, significantly out of pocket if the claimant fails to do better. The effect of such a claim would therefore be for a claimant to appropriate the fruits of success but externalize (to a large extent) the costs of failure, as well as reducing the incentive to a defendant to make reasonable offers to settle cases at the actual value of the claim at an early stage.

52. I think there is a further factor in play here, as the authorities cited by the parties suggest. Historically, it was regarded as contrary to public policy for lawyers to engage in what are kinds of joint venture to pursue claims, making payment for legal services contingent upon the outcome. However, with diminishing public financing for claims, the approach to financing litigation has liberalized considerably, first to enable cases to be brought using conditional fee agreements and, more recently, permitting certain DBAs. The litigation financing market has also developed, with undertakings using claims as (sort of) investment vehicles. Without getting into the myriad complexities of the justification for these approaches and the, often difficult, economic (including game theoretic) issues which these can raise, there are two broad reasons why that is desirable. First, it can enable access to justice, permitting cases to be brought which would otherwise not be maintainable because of the risks and costs involved. That can ensure that, in particular, smaller litigants which may be less able to bear the risks of uncertain litigation are placed on a more equal footing with larger undertakings. Second, it accords more with principles of freedom of contract.

53. However, as the authorities also show, that may have a price in some cases. Facilitating lower risk litigation, where remuneration for legal services is paid out of damages can also facilitate speculative investment claims. It can also encourage lawyers to make agreements in which they (in effect) contribute their labour and skill and litigants contribute the claim and their evidence in the hope of a large return. Again, I am not persuaded on the state of the authorities that this can be criticized as such and Lidl has made it clear, in agreement with PWS, that it does not do so. It can nonetheless be more problematic if such claims are pursued which impose large irrecoverable costs on a defendant to address, even if successful or if a defendant has made a reasonable offer to settle. A defendant’s irrecoverable costs represent a burden which the pursuit of the return by the claimant imposes on a defendant. It is not clear that, as a matter of principle, it is desirable for the court to support an approach to encouraging claims which do not have a high prospect of success (of winning or of beating reasonable offer) but which risk leaving a defendant with significant irrecoverable costs. While that is a consequence of litigation of this kind, regardless of whether it is pursued using a DBA, it may be anomalous for the court to take an approach to costs awards which facilitates claimants and their lawyers pursuing agreements which enable them both to appropriate large gains if the speculation pays off but to leave defendants with irrecoverable losses if the speculation fails. That, it seems to me, can risk allocating litigation risks and rewards in an unfair and unbalanced way and create a range of undesirable incentives - including to run litigation in a more expensive way to a defendant and refuse reasonable offers to settle. This thinking does not point to the court preventing arguable - even weak - claims: if arguable, they may properly be brought and pursued. However, it does point towards ensuring that, if such a claim fails and large costs have been incurred on the way, knowing that the claim is weak or speculative, those should be paid in full. That, in turn, suggests that, for failed claims of that kind, indemnity costs awards are more appropriate.

54. However, the question then arises as to whether the court is in a position reliably to determine that the claim in question is unjustifiable or whether an offer made to settle the case was a reasonable one, in circumstances where there is an order for a split trial. A claimant which has failed at the liability stage of such a claim can often say with justification (because quantum has not been determined and may be heavily contested) that it is impossible to tell sufficiently reliably whether the claim was excessive and thereby contend that an award of indemnity costs was inappropriate. However, that itself potentially imposes unfair costs on a defendant and somewhat skews any negotiating balance because a defendant will know at the outset that the best it may be left with, even if wholly successful on liability, is a potentially significant amount of irrecoverable costs. It also knows that if it loses on liability, it may have to pay significant costs which may never be recoverable even if it wins on quantum (say by exceeding a reasonable offer). This puts an effective “floor” on the rational settlement figure of approximately a sum lower than the probably irrecoverable costs. In substantial litigation, that can run to hundreds of thousands of pounds. So, if the court does not take steps to address that position, a claimant (and its lawyers) will know that the worst it can rationally get for them, give the uncertainties of litigation and the fact that litigation imposes large costs on a defendant in terms of management time (and sometimes reputation risks), is that a defendant will be incentivized to pay the claimant the difference, while preserving the upside of a potentially large speculative claim. So the litigation becomes in effect “no lose” in the sense that the rational expectation of recovery ranges from a reasonably substantial sum to a massive one, in which neither may bear a real relationship to the actual value of the claim. The consequence is that claimants and their lawyers can participate in a limited risk investment strategy but where the actual costs of that strategy are unlikely to be borne by them. It may also disincentivise making (or accepting) reasonable offers to settle.

55. Cases such as Excalibur Ventures LLC v Texas Keystone Inc [2016] EWCA Civ 1144, [2017] 1 WLR 2221, although an extreme example of this, illustrate some of the undesirable features of certain large claims advanced using complex litigation finance which it would be a stretch to describe as “facilitating access to justice”. They are high-risk litigation investments pursued at great cost to others. As the Court of Appeal pointed out there, some modern funding arrangements facilitate access to justice, but others do not have that aim at heart. They are really speculative investment vehicles in which those involved in litigation seek to share the profits from a potentially substantial claim. The Court of Appeal pointed out that facilitation of access to justice was an “incidental by-product of commercial funding, but that is not the essential motivation of the commercial funder. The commercial funder is an investor who hopes to make a return on his investment. For that reason, justice will usually require that, if the funded proceedings fail, the funder or funders must pay the successful party's costs…” There is nothing in the judgments in that case which suggests that, where such claims fail, it is desirable to leave defendants with significant losses by way of unrecoverable costs. To the contrary, the message I take from the decisions taken as a whole is that where a case appears to be one which is not really an “access to justice” case but a commercial investment (as to which the boundary may admittedly not always be easy to determine) there is a greater justification for ensuring that others are not left to bear the costs of the claimant’s investment strategy which they have had imposed on them. In some cases, that can best be done (as it was in Excalibur) by ensuring that the potential beneficiaries of the failed investment (in that case, the litigation funders) share the costs burden, if appropriate, on an indemnity basis. This approach is fair in that it ensures that those who stand to gain from the investment do not leave others taking unjustified losses.

56. That general approach is also consistent with the concerns expressed in other recent cases (again not directly on point for the present case) such as Paccar v Road Haulage Association [2021] EWCA Civ 299 in which the Court of Appeal drew attention to the potential for abuse to which the regime for collective proceedings could lead. The court referred at [17] to the judgment of Lord Sales and Lord Leggatt in the Supreme Court, Merricks v MasterCard Inc [2020] UKSC 51 at [98], [2021] Bus LR 25, which made similar points about the potential for class actions to be used oppressively or unfairly and the opportunities provided for profit for litigation funders.

57. The trend discernable from the developing case law is that, while creative forms of litigation financing enabling claims to be pursued will be permitted and in some cases actively encouraged, the courts should take account of the possibilities for such to lead to abuse and unfairness and seek to address that so far as possible. Lidl drew attention to two aspects of litigation funding regimes which mitigate against the risks of such. First, in the context of collective proceedings, the Group Litigation provisions of CPR19, including requiring a group litigation order to proceed. Those are not relevant here. Second, the observations by the Court of Appeal in Excalibur at [31] to the effect that “on-going review of the progress of litigation through the medium of lawyers independent of those conducting the litigation, a fortiori those conducting it on a conditional fee agreement, seems to me not just prudent but often essential in order to reduce the risk of orders for indemnity costs being made against the unsuccessful funded party.” In my view, the rationale underlying this observation applies with no less force to cases conducted pursuant to a DBA, and may be more important where the sums in question sought by lawyers is, by any standards, very large and, in particular, is very large compared with what those lawyers themselves suggested would be the right order of magnitude when making the DBA arrangements in the first place. In such cases, it seems to me incumbent on lawyers to undertake a particularly dispassionate review of whether the claim being advanced and from which they allege they should stand to benefit on a large scale is really justifiable on the authorities and on the facts. That is no more than encouraging what might be described as responsible DBA litigation. I do not exclude the possibility that lawyers may conclude with their clients that, even if a claim is speculative, the risk is worth taking. It is not for the court to police the risk appetite of litigants and lawyers, which may well be higher than that which the court may consider prudent. However, if the claim at that level is not ultimately justified, it seems to me, in principle, right that the costs of that should not fall on the party which has been forced to incur them to demonstrate that fact. More specifically, there is a public interest in the court making litigants face up to the real costs that rejection of a reasonable offer may impose on others.

58. There is a further factor in play here. One of the problems with this kind of high risk/high reward litigation particularly in which multiple undertakings have a stake is that such cases can become harder to settle. The more undertakings involved, the greater the risk of conflicts arising. Not even litigants and their own lawyers may share the same risk appetite, which can in any event, diverge during proceedings especially if it appears that the likely return is not as great as may have been thought. It is one thing for costs risks in the millions to be taken if a claim is worth tens of millions. It is quite another if it is worth two orders of magnitude less. Moreover, partly because the nature of litigation funding for cases of this kind, successful claimants may have to bear direct and immediate financial costs. Sometimes, as Lidl points out, victory can even be more expensive than defeat. An example of this comes from a case to which Lidl drew attention in the context of intellectual property litigation, Global Energy Horizons Corp v Winros Partnership (Formerly Rosenblatt Solicitors) [2020] 8 WLUK 247. That case was mainly focused on testing the validity of a funding arrangement between a party and its solicitors. Global Energy Horizons (‘GEHC’) was the claimant in patent action in which damages were estimated by their (former) solicitors in the hundreds of millions. Several conditional fee agreements were agreed and there was a funding arrangement in respect of other costs. The claimant won on liability but damages were then estimated by an expert as being only up to $15 Million. The upshot of the various complex funding arrangements was that, if the valuation of the claim really was only $15 million or thereabouts, it was likely that nothing would be left once legal costs had been accounted for and the investors who had funded the case so far would be unlikely to recover their costs outlay, let alone any compensation for supporting GEHC. This created an intolerable conflict which ultimately led to a lengthy and itself costly dispute between GEHC and its solicitors. The main action became, effectively, impossible to settle. Because the fee arrangements had been affected by the over-estimate of recoverable damages, a claimant in such a situation could be better off having lost (and thereby incurring no costs), than it would have been in accepting a settlement offer even of the full $15 Million (with the possible consequence of being liable to solicitors for their legal costs-plus-success fee, which may exceed the damages, leaving “nothing left”, in the words of the Court of Appeal).

59. While the present case is very different on the facts, it is a matter of common knowledge that (for example) ATE insurance premiums can become payable on victory. Unless a claimant recovers more in compensation than the total payments which it is required to make under the various funding arrangements, it can find itself no better off winning than losing. That is all the more so because it seems to me that if such a case is pursued to the bitter end and a damages award is made at a lower level, a claimant may become liable for large costs to a defendant, especially in the face of a reasonable Part 36 offer made at a much earlier stage of the proceedings. So victory may, as a case develops, become almost as risky for a claimant as defeat, sometimes more so.

60. In this case, I accept PWS’s submission that, because it is impossible at this stage to tell precisely what the right level of quantum would be and the case has not been developed, it is not possible properly to say definitively whether the claim advanced is excessive and whether it was unreasonable to refuse the Part 36 offer in the sense required by the case law. That does not mean the court should say nothing about it. First, this is a case in which a claim for an account of profits at the level sought faces numerous hurdles and it is well known that accounts of profits in intellectual property cases are problematic generally and specifically where (as would inevitably be the case here) there are numerous reasons why profits may be made as a result of a product bearing a given mark being sold in a supermarket, most of which would have nothing to do with the precise branding or any connection it signalled. There was, moreover, no evidence that any customer had bought any of the WARREN & SONS products on the strength of any perceived connection with PWS. As regards the claim for user based damages, apart from the difficult legal question as to whether such damages would be appropriate at all in a case of this kind (and if so to what extent), on the facts, this is a case in which (as in the well-known case of 32Red) Lidl would have had numerous alternative marks, some redolent of high street butchers, from which to choose which would have significantly affected what a reasonable licence fee would have been. The justification for a comparatively modest figure would have been increased by the fact that, on the evidence, PWS were insufficiently troubled by Lidl’s WARREN & SONS brand to raise the matter in correspondence until a long time after they knew they might have a right to complain. There are numerous other factors which mean that this is not a case which has the hallmarks of a very large claim, on the basis of the existing case law.