Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Lehman Brothers Holdings Plc, Re [2020] EWHC 3449 (Ch) (02 November 2020)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2020/3449.html

Cite as: [2020] EWHC 3449 (Ch)

[New search] [Printable PDF version] [Help]

THE BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INSOLVENCY AND COMPANIES LIST (ChD)

IN THE MATTER OF THE INSOLVENCY ACT 1986

7 Rolls Buildings London, EC4A 1NL |

||

B e f o r e :

____________________

| IN THE MATTER OF LEHMAN BROTHERS HOLDINGS PLC (IN ADMINISTRATION) | ||

| AND IN THE MATTER OF LEHMAN BROTHERS LIMITED (IN ADMINISTRATION) | ||

| AND IN THE MATTER OF LB HOLDINGS INTERMEDIATE 2 LIMITED | ||

| (IN ADMINISTRATION) | ||

| AND IN THE MATTER OF LB UK RE HOLDINGS LIMITED (IN ADMINISTRATION) | ||

| AND IN THE MATTER OF ELDON STREET HOLDINGS LIMITED (IN ADMINISTRATION) |

____________________

____________________

Crown Copyright ©

- This is a combined application in respect of five companies in administration in the Lehman group. As is now common knowledge, at least in the financial world and probably broader than that, the Lehman Group collapsed in September 2008, shaking the financial world and with repercussions which are still with us, including the continuation of a number of administrations of companies which went into administration on or around that date. In this case the five companies concerned are Lehman Brothers Holdings Plc ("LBH") which went into administration on 15 September 2008; LB Holdings Intermediate 2 Limited ("LBHI2") which went into administration on 14 January 2009; Lehman Brothers Limited ("LBL") which went into administration on 15 September 2008; Eldon Street Holdings Limited ("Eldon Street") which went into administration on 9 December 2008 and, finally, LB UK RE Holdings Limited ("LBUKRE") which went into administration in the first flush of the administrations on 15 September 2008.

- It can, thus, be seen that the relevant companies have been in administration for at least nigh on 12 years and three of them are entering their 13th year in that state. It follows also from that that it will be apparent that the court has on various occasions extended the administration, sometimes for long periods of time, since otherwise the administration lapses after one year in accordance with the statute. I do not think I need detail the various occasions on which the court has had to extend the administrations, since the really important point is that in the case of each of these companies the latest extension would expire on 30 November 2020 and it is important that a court decision be made well in time, since there are difficulties and probably insuperable difficulties in approving any extension ex post facto.

- The length of time which has been needed to complete the administrations of these companies may come as a surprise to some, but the complexities are very great indeed and in some senses largely flow from the success of the administration process, especially in the case of a company which is not presently requiring any extension which is Lehman Brothers International (Europe) ("LBIE"), which has realised very considerable amounts indeed in the course of an administration. The last I knew was that it was in the region of some £7 billion and that has in turn caused problems which very seldom arise as to how to deal with a massive surplus as between various creditors and their different claims for priority.

- In terms of the jurisdiction of the court I think it is clear, and the authorities confirm, that no specific constraint is imposed by statute on the court, although, of course, and as with any judicial decision, the discretion must be exercised judicially. The statutory limit of a term of one year unless extended by the court is readily understandable at an early stage when the question as to the viability of an administration as against other processes is very much on trial and the statutory purpose is demonstrated by the requirement that, if that which is hoped for within a year is not accomplished within a year, the court should review the matter if the process is to continue at all. However, different considerations apply in administration processes which have moved into the distributary mode. Although the permission of the court for an extension of the term of administration is still required, and the court will be concerned to be satisfied that there is good reason for any further extension, it will on the whole be positively inclined since the only alternative would be a liquidation process which would probably impede the distribution process and be more expensive for all concerned and, therefore, not the favoured route. That is not to say that the court will not be alive to any positive objections and, of course, will be concerned to ensure that in every case an administration is not unnecessarily prolonged.

- In the case of each of the companies concerned except one, the outlier being LBUKRE, the period of extension presently now sought is for two years from 30 November 2020. Mr Riddiford who appeared on behalf of the applicants in each case has made it clear that notwithstanding that fairly long extension, though not long in comparison to the maximum of five years which was granted in respect of three of the companies (LBIE, Lehman Brothers, LB UK RE, Storm Funding Limited, Mable Commercial Funding Limited) in 2011 and two of the companies (LBH and LBHI2) in 2015 it is by no means impossible and, indeed, may be likely from past experience that some further extension to ensure full completion of all the necessary things which must be accomplished in order to complete fully the processes may be required. The LBUKRE administrators seek an extension presently of only one year.

- I should say that in every case the administrators are well aware and in every case have confirmed in the witness statement of Mr Macnamara in support of all five applications that if they were able to accomplish what is necessary in an earlier period they would, of course, seek to do so. That is in accordance with their duties to the court and to the creditors, to ensure that the administrations do not take longer than is reasonably necessary for their completion.

- As I have said, the relatively long and in fact, in my experience, unparalleled time which it has taken to work through the administration process in the case of the Lehman companies has at least in part and, I should have thought in primary part, been the product of, first, a very great deal of interdependence between the various companies concerned within the Lehman Group with a complicated group structure and even more complex debt arrangements between them and, secondly, and equally important, the success of the administrators, at least of LBIE and in other companies, of recovering moneys serves to realise a surplus which, as I have indicated, has thrown up novel and probably wholly exceptional questions with regard, in particular to priorities between various classes of creditors, including other Lehman group companies.

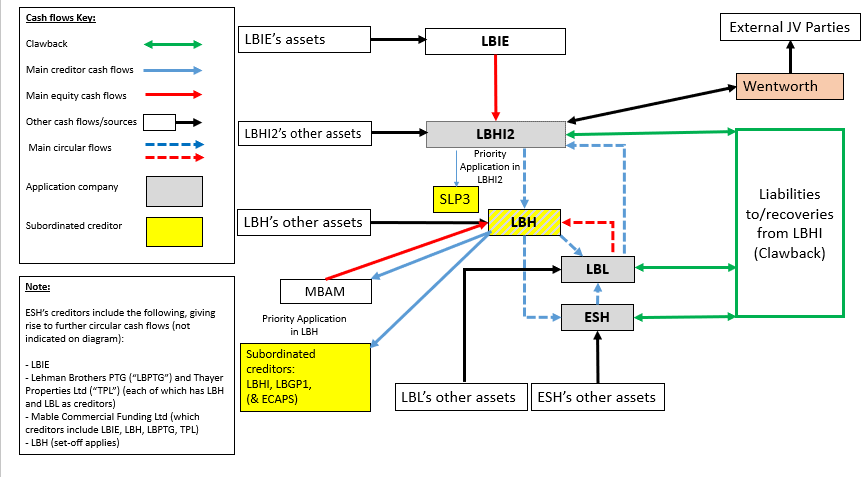

- The complexity of the arrangements between the companies concerned in these applications has been well illustrated in the diagram exhibited to Mr Macnamara's supporting witness statement, by reference to which Mr Riddiford made many of his introductory overall submissions (this diagram can be seen at Appendix 1). That diagram does very clearly illustrate quite how interdependent are the arrangements between the companies and how any difficulties in determining matters such as priorities or the levels of distributions affects each one in what in other circumstances more accurately might be called the waterfall. Broadly speaking, I think it is correct to describe the continuing matters outstanding in relation at least to the four companies other than LBUKRE as being in consequence of, first of all, the question as to distributions down from LBIE to LBHI2 and how LBHI2 is to deal with them; second and in connection with that, what priority there is as regards creditors of LBHI2 and in particular LBH and Lehman Brothers Scottish Holdings Inc ("SLP3"); and, thirdly, some proceedings known as the clawback proceedings which are taking place in the New York Bankruptcy Court which are due to be heard, at least at first instance, in January 2021. So those three; that is to say, distributions from LBIE and distributions on from LBHI2, claims against LBHI2 and their priority and, thirdly, the clawback proceedings are the three main headings for the complexities which require further time to unravel and complete.

- As regards the distributions from LBIE to LBHI2, the LBIE administrators made, quite recently, a successful application to the court for directions as to their ability to consent to the making by LBIE's directors of distributions to LBHI2. That was in what was called the LBIE distribution application. Now, the LBIE administrators are holding further cash which will or may in due course be distributed also down to LBHI2 or rather up to LBHI2, but that (and the quantum of that) will not be clear until other matters relating to the administration of the LBIE estate have been resolved. It appears likely, according to the administrators, that those matters may be resolved after 12 months, but not before then; and some period of time is required in that context.

- The second issue relates to the priority application which was heard before Marcus Smith J in November 2019. His judgment in July 2020 has resolved many issues in respect of LBHI2's subordinated debt position and as to the priority of sub debt holders, but the amounts are such and the complexities are also such that, as I understand it, Marcus Smith J has given permission to appeal in respect of major issues. Those who did not succeed before him have also sought permission to appeal in respect of other issues and the position will have to be finally determined on appeal, either to the Court of Appeal or, given the complexity of the matters and the very significant amounts involved, possibly even by the Supreme Court. That requires further time and the two years sought are in a sense the best hope with regard to the final conclusion of the priority issues which have arisen.

- The third matter is the clawback proceedings in the United States Bankruptcy Court for the Southern District of New York. As I have said, those are hoped to reach a first hearing or a hearing at first instance in January 2021, but the possibility of appeals is present there also and whilst I am not myself familiar with the exact route of appeal, I am told that there is every possibility of some further appeal which will also necessitate further time in the administrations concerned.

- The precise effect on each of the four companies I am presently dealing with; that is to say, LBHI2, LBH, LBL and Eldon Street, are very carefully set out in Mr Riddiford's extremely clear skeleton argument which has been conformed, as I understand it, with the witness statement of Mr Macnamara which is equally clear. I have both read these and been taken through the most relevant parts by Mr Riddiford. Rather than regurgitate the careful description given, the descriptions given in the skeleton argument have been included in an appendix to this judgment (Appendix 2), which can be cross referred from the description of each company there given and those who wish to see the further detail as to the repercussions of the three points that I have identified generally in terms of the precise position of each of the four companies can understand it readily.

- I have been told that the assessment of the administrators is that at least two years is necessary and that without it the administrations which have been successful so far cannot fully be completed. The alternative of liquidation has carefully been considered; but the assessment made is that that route would be likely to occasion additional expense without advantage. In this context, I queried why the alternative of a liquidation was not said to have any specific advantages lest that language suggest that there were more amorphous or debatable advantages of that alternative. I am rightly reminded that that was the wording that I used in describing the test in an earlier Lehman Brothers case reported at [2016] EWHC 3379 (Ch). Mr Riddiford, having taken instructions, confirmed to me that it was not intended by that use of words to suggest that there were any other advantages, simply that there were not positive advantages of liquidation, if any, which I must say I cannot see.

- The administrators have, as is essential, been careful to notify creditors interested in progress reports. In the case of all but one of the four companies they have expressly indicated the time period for the extension which is sought of two years. In the case of Eldon Street the progress report, though clear, is dated June 2020, now some time ago, and at that time it was not quite apparent how long would be required, but in a subsequent internet disclosure the fact of a two year extension has been made clear and the upshot of that notification process has been that so far as I am aware there has been no objection to the course which is contemplated.

- I should mention in that regard that a Mr Giacomino had indicated some interest, particularly in the LBL estate and more generally in the LBH estate and he had asked for had been provided with, the means to participate in this virtual hearing which, as I should have explained earlier, is taking place on the Skype platform, as has become common in light of the COVID pandemic restrictions. Though Mr Giacomino wished, and had every right, to be involved in the hearing (and, I understand, attended it in part), I have not understood him to be objecting on any particular basis.

- There being no objection, and in the circumstances that I have sought generally to describe, it seems to me clear that there is good reason for a two-year extension. In those circumstances, the interests of the creditors, the view of the administrators and the fact of no objection all point in the same direction of my giving the extension sought, as I do.

- That leaves only LBUKRE, which is in a rather different position. It is plain from the evidence and it is well described, again, in Mr Riddiford's skeleton argument that it had been rather hoped that it might be possible for that administration to be completed within the remaining time before 30 November 2020, but further complications have arisen, especially in relation to a deed of indemnity which was entered into during the course of the administration, which require time for their resolution. In particular, it is clear, the consent of the trustee Bank of New York Mellon which might have unlocked the position has not been available and that other arrangements which will ensure that the matters contemplated by the deed of indemnity will have to be dealt with in another way. These issues are well described in subpara.(4) of para.68 of Mr Riddiford's skeleton argument. Paragraphs 65 to 68 of Mr Riddiford's skeleton argument also be included in Appendix 2 to this judgment, so the more precise details which, again, Mr Riddiford carefully took me through and are well described also in Mr Macnamara's witness statement, can be seen.

- The upshot is an application on LBUKRE's behalf for a one year extension. That is supported by Lehman Brothers Holdings Inc. ("LBHI"), being LBUKRE's sole remaining creditor. In those circumstances, and given the necessity, as I see it, in order to fully accomplish the administration, I propose to grant that one year extension, noting in this context expressly, as I did more generally, that if the administrators are able, as presently they suppose they might be, subject to some delays with the Irish Revenue, to bring an end to the administration earlier then, of course, they have the ability to do so and that is what their intention would be.

- In conclusion, therefore, I grant each of the applications. The order proposed has been set out and included in tab 4 of the bundle provided to me. Subject to Mr Riddiford's confirmation that it is, as it appears to me to be, in a standard form which has been used in the past for the various extensions which have been required, I propose to initial that order in order that it may be sealed in good time so that these extensions are certainly granted with effect from a time before 30 November which avoids the difficulties to which I alluded earlier.

- LBHI2 is a holding company, the only material assets of which (other than tax losses and affiliate guarantee claims, as to which see further below) are its shareholding in LBIE and other affiliate debt. LBHI2 entered into administration on 14 January 2009. As is clear from the 23rd progress report for LBHI2 for the period 14 January to 13 July 2020 (see [3/23]), the Administrators have been seeking to achieve the purpose of the administration by realising the assets of LBHI2 and handling the claims of the company's creditors.

- Details in relation to LBHI2's recoveries to date are set out at Macnamara3, paragraph 57 to 62 [2/14-15].

- Future expected realisations from LBIE: As adumbrated above, LBIE is expected to make further significant distributions to LBHI2 (in the latter's capacity as sole owner of LBIE's preference shares). As set out above, there is currently approximately the pound sterling equivalent of the sum of £504 million in the LBIE estate, the majority of which is held as a conservative reserve against potential liabilities, future estimated costs and contingent expense claims of the LBIE administration. As noted above, it is anticipated that a significant proportion of the funds currently held by LBIE's administrators in reserves will ultimately be released, thus facilitating further distributions to LBHI2 as the shareholder of LBIE. As noted at paragraph 60 of Macnamara3 [2/15], certain contractual arrangements entered into by LBHI2 as part of the Wentworth joint venture mean that LBHI2 will be required to share a portion of any distributions it receives from LBIE with the other parties to that joint venture.

- Future expected realisations from LBL: LBHI2 expects further distributions from LBL in respect of the statutory interest on LBHI2's admitted claim of £257.2 million. Currently, it is not possible to estimate the final value of the distributions that LBHI2 can expect from LBL as they are contingent on the various circuitous cashflows from intercompany balances in several of the Lehman estates. In particular, payments from LBL to LHBI2 are dependent on LBL's recovery from its largest debtor, LBH. In turn, LBH's recoveries are contingent on the outcome of its recoveries from LBHI2, which (for the reasons explained above) are dependent on the final resolution of the Priority Application. In addition, for the reasons explained above, the amount of distributions that the Administrators of LBL are in due course able to make to LBL's creditors (including LBHI2) are contingent on the outcome of the Clawback Proceedings.

- Future expected distributions:

- In the circumstances, the Administrators consider that it is in LBHI2's creditors' best interests for LBHI2 to remain in administration until the above matters have been resolved, any further distributions have been made and the appropriate exit strategy has been implemented. It is the Administrators' view, for the reasons already given (see also Macnamara3, paragraph 71 [2/18]), that two years is the most realistic assessment of the minimum time it will take to resolve the outstanding matters in the LBHI2 estate. To the extent that it becomes possible to exit administration before the two-year term has expired, however, the Administrators would take steps to bring the administration to an end. The Administrators anticipate that they may need to apply for a further extension in the future, although an extension of two years now, as opposed to one year, would reduce the likelihood of that being required (see also Macnamara3, paragraph 71 [2/18]).

- As noted above, the Administrators' intention to make the present application, seeking an extension to their term of office in relation to LBHI2 in the specific length of two years, was made clear in LBHI2's most recent progress report [3/8-23]. Moreover, in that progress report the Administrators provided an estimate for their future costs (noting that the Administrators' remuneration is reported in LBHI2's progress reports on a six-monthly basis in any case), which assumes (on a cautious basis) that they will need to remain in office for a further 36 months [3/22]. Finally, as noted above, on 28 October 2020 an update was uploaded on to the LBHI2 website, specifying the date and time of the forthcoming hearing and offering to make available the application documents (and precise details of the forthcoming hearing) to those who wished to consider these and/or to attend the hearing.

- The principal activity of LBH was to hold investments in a range of assets, the majority of which were held through subsidiaries or joint ventures, although it had some proprietary investments of its own. LBH entered into administration on 15 September 2008. As is clear from the most recent progress report for LBH (for the period 15 March 2020 to 14 September 2020) [3/24-52], the Administrators have been seeking to achieve the purpose of the administration by realising the assets of LBH and of its subsidiaries, including realising book debts and handling the claims of the company's creditors.

- Details in relation to LBHI2's recoveries to date are set out at Macnamara3, paragraphs 75 to 77 [2/19-20].

- Future expected realisations (equity positions): The key shareholdings that remain to be dealt with are in MBAM and LBL. The current status of these investments is as follows (Macnamara3, paragraph 78 [3/20]):

- Future expected realisations (debt positions):

- Future expected distributions:

- In the circumstances, the Administrators consider that it is in LBH's creditors' best interests for LBH to remain in administration until the above matters have been resolved, any further distributions have been made and the appropriate exit strategy has been identified. That may, in the Administrators' view, take at least a further two years. Accordingly, the Administrators request that their appointment in respect of LBH be extended so as to run until 30 November 2022. The Administrators anticipate that they may need to apply for a further extension in the future, although an extension of two years now, as opposed to one year, would reduce the likelihood of that being required (see Macnamara3, paragraph 86 [2/22-23]).

- As noted above, the Administrators' intention to make the present application, seeking an extension to their term of office in relation to LBH in the specific length of two years, was made clear in LBH's most recent progress report [3/35]. Moreover, in that progress report the Administrators provided an estimate for their future costs (noting that the Administrators' remuneration is reported in LBH's progress reports on a six-monthly basis in any case), which assumes (on a cautious basis) that they will need to remain in office for a further 36 months [3/40]. Finally, as noted above, on 28 October 2020 an update was uploaded on to the LBH website, specifying the date and time of the forthcoming hearing and offering to make available the application documents (and precise details of the forthcoming hearing) to those who wished to consider these and/or to attend the hearing.

- LBL entered into administration on 15 September 2008. Prior to its entry into administration, LBL's sole activity was as a service company providing administrative and infrastructure services to fellow companies within the Lehman Group in the UK and Europe, being reimbursed on a recharge basis for costs incurred in the provision of services. These services included the provision of property, employees and support services (including IT, operational, accounting and legal services). As a result of LBL's role as a service company within the Lehman Group, substantially all of its debtors are affiliates. In addition, some affiliates are creditors of LBL as a result of intercompany dependencies. As is clear from the most recent progress report for LBL (for the period 15 March 2020 to 14 September 2020) [3/53-73], the Administrators have been seeking to achieve the purpose of the administration by realising the assets of LBL, adjudicating on the claims of the company's creditors, seeking to resolve the ongoing Clawback Proceedings and certain other claims, and making distributions to creditors, including by way of statutory interest.

- Details in relation to LBL's recoveries to date are set out at Macnamara3, paragraphs 91 to 93 [2/23-24].

- Future expected realisations:

- Future expected distributions:

- It is the Administrators' view that two years is the most realistic assessment of the minimum time it will take to resolve the outstanding matters in the LBL estate. To the extent that it becomes possible to exit administration before the two-year term has expired, however, the Administrators would take steps to bring the administration to an end. The Administrators anticipate that they may need to apply for a further extension in the future, although an extension of two years now, as opposed to one year, would significantly reduce the likelihood of that being required (see Macnamara3, paragraph 105 [2/26]).

- As noted above, the Administrators' intention to make the present application, seeking an extension to their term of office in relation to LBL in the specific length of two years, was made clear in LBL's most recent progress report [3/57]. LBL's creditors have been advised that, owing to uncertainties regarding future asset realisations and outcomes of the various litigation, the future costs in the LBL administration are uncertain (but, in the usual way, the Administrators' remuneration shall continue to be reported to the committee for approval on a six-monthly basis). See Macnamara3 fn.8, [2/26]. Finally, as noted above, on 28 October 2020 an update was uploaded on to the LBL website, specifying the date and time of the forthcoming hearing and offering to make available the application documents (and precise details of the forthcoming hearing) to those who wished to consider these and/or to attend the hearing.

- Prior to the collapse of the Lehman Group, Eldon Street was the holding company for a number of the Lehman Group's real estate investments. It held investments in subsidiaries, as well as receivables from many of them. Eldon Street entered into administration on 9 December 2008. As is clear from the most recent progress report for Eldon Street (for the period 9 December 2019 to 8 June 2020) [3/74-93], the Administrators continue to work towards achieving the purpose of the administration by protecting Eldon Streets' assets and disposing of such assets and winding down its subsidiaries in a controlled manner, to limit the detrimental effects on realisations that could arise if the assets were sold prematurely.

- Details in relation to Eldon Street's recoveries to date are set out at Macnamara3, paragraphs 110 to 114 [2/27-28].

- Future expected realisations: Further distributions by LBH to Eldon Street in respect of statutory interest depend on LBH's recoveries, which in turn depend to a significant degree on the recoveries that LBH is able to make from its admitted subordinated claim against LBHI2 and its equity investment in LBL. The extent to which LBH can make a recovery from its subordinated debt claims in LBHI2 and LBL, and the timing of any such recovery, is currently uncertain. There are three factors which currently contribute to this (see Macnamara3, paragraph 116 [2/28]):

- Future expected distributions:

- It is the Administrators' view that two years is the minimum realistic assessment of the time it will take to resolve the outstanding matters in the Eldon Street estate. To the extent that it becomes possible to exit administration before the two-year term has expired, however, the Administrators would take steps to bring the administration to an end. The Administrators anticipate that they may need to apply for a further extension in the future, although an extension of two years would reduce the likelihood of that being required. See Macnamara3, paragraph 123 [2/30].

- As noted above, the Administrators' intention to make the present application, seeking an extension to their term of office in relation to Eldon Street, was made clear in Eldon Street's most recent progress report [3/81][1]. Moreover, in that progress report the Administrators provided an estimate for their future costs (noting that the Administrators' remuneration is reported in Eldon Street's progress report on a six-monthly basis in any case), which assumes (on a cautious basis) that they will need to remain in office for a further 36 months [3/92]. Finally, as noted above, on 28 October 2020 an update was uploaded on to the Eldon Street website, specifying the date and time of the forthcoming hearing (as well as the exact length of extension to be sought) and offering to make available the application documents (and precise details of the forthcoming hearing) to those who wished to consider these and/or to attend the hearing.

- As noted above, the Administrators seek a one-year extension to their appointment in relation to LBUKRE. The facts and matters underpinning the Administrators' application in relation to LBUKRE are substantially different from those underpinning the application in relation to the other four Companies.

- This Court most recently extended the Administrators' terms of office on 26 November 2019 for a period of one year, up to 30 November 2020 (which is when their appointment is currently due to expire) (see the 26 November 2019 Order at [3/6-7]). In the evidence filed in support of the applications that led to the making of these various Orders, the Administrators indicated that it might, in due course, be necessary for them to apply for further extensions of their appointments in respect of LBUKRE[2].

- LBUKRE entered into administration on 15 September 2008. As is clear from the Administrators' most recent progress report to LBUKRE's creditors [3/94-103], the Administrators have been seeking to achieve the purpose of the administration by protecting, managing and realising LBUKRE's assets and investments. LBUKRE's principal assets as at the time of administration consisted of portfolios of sub-performing, non-performing and performing loans ("SNPL"), real estate assets and other investments and shareholdings in companies and hedge funds, affiliate receivables, receivables in relation to derivative instruments and claims against third party debtors. The Administrators have made significant progress with the administration of LBUKRE, with the aim of achieving a better result for creditors than would be likely if LBUKRE was wound up without first being in administration, details of which are set out in the most recent progress report [3/94-103]. See also Macnamara3, paragraphs 124 to 126 [2/30].

- Details in relation to the Administrators' realisations to date on behalf of LBUKRE are set out at paragraphs 127 to 129 of Macnamara3 [2/31].

- As to the Administrators' distributions to creditors (see Macnamara3, paragraphs 131 to 134 [2/31-32]):

- Outstanding issues: Notwithstanding the progress made since the administration was most recently extended last November, there remain certain issues which need to be completed before the administration can be concluded. In particular (see Macnamara3, paragraphs 136 to 141 [2/32-34]):

- LBHI's position: As noted above, LBHI has become and remains LBUKRE's sole creditor. As to LBHI's position on the present Application:

- As noted above, it is the Administrators' current expectation that the remaining arrangements in respect of the Florian securitisation will have been completed by 30 April 2021, at which point the contractual indemnity and contingent liability will fall away upon dissolution of LBUKRE automatically, i.e. in accordance with the terms of the Deed of Release. The remaining reserves being maintained by the Administrators in respect of the Florian securitisation at that stage can therefore be released immediately prior to LBUKRE's dissolution, and there ought to be no substantive bar to the conclusion of the administration and the dissolution of LBUKRE.

- As noted above, LBHI (being LBUKRE's sole remaining creditor) is aware of and supports the Administrators' application for a one-year extension.

MR JUSTICE HILDYARD:

Company-specific points

(i) LBHI2

(1) In September 2017 and September 2018, the Administrators of LBHI2 declared distributions of £940.9 million and £240.6 million respectively to its unsubordinated creditors. Those distributions settled in full the unsubordinated creditors' principal claims. The Administrators also paid statutory interest on those claims.

(2) LBHI2 has two outstanding subordinated debt claims from LBH and SLP3, totalling c.£5.8bn. As noted above, the order in which distributions should be made to LBH and SLP3 in respect of the LBHI2 Sub Debt and the LBHI2 Sub Notes is the subject of the Priority Application.

(3) The Administrators of LBHI2 have been able to make distributions totalling £204.7 million to LBH on account of the LBHI2 Sub Debt claim. They were able to make these distributions, despite the uncertainty of the ranking of the subordinated claims, because the Administrators agreed a structure whereby the other subordinated creditor, SLP3, agreed to waive any entitlement to a share in these distributions, whilst reserving any right it may have to receive a catch up dividend at a later stage, to the extent that LBHI2 has sufficient funds.

(4) As intimated above, any further distributions from LBHI2 are also contingent on its outcome in the Clawback Proceedings. LBHI2 had direct and guarantee claims against LBHI which were admitted in 2011 in the amounts of USD 2.7 million and USD 302 million respectively. LBHI2 sold its direct claim against LBHI in December 2017. Its sole remaining claim against LBHI is the guarantee claim. To date, LBHI2 has received cumulative dividends from LBHI in respect of the guarantee claim of USD 105.6 million. LBHI is seeking to reclaim the USD 105.6 million it has paid to LBHI2 in relation to the guarantee claim, along with pre-judgment interest. To date, LBHI has withheld payments to LBHI2 totalling approximately USD 3.6 million in respect of declared distributions.

(5) Accordingly, the timing and quantum of any future distributions by LBHI2 is therefore subject to the final outcomes of the Priority Application and Clawback Proceedings.

(ii) LBH

(1) MBAM is a solvent company and, subject to the outcome of the Clawback Proceedings, LBH may make a small, final recovery from MBAM in due course.

(2) Dependent on the outcome of the Priority Application and the Clawback Proceedings, and the quantum of further distributions by LBIE, in due course LBL may be able to make further payments of statutory interest to its creditors (including LBH, as a consequence of the assignment of LBEL's claim in LBL to LBH). Thereafter, LBL may potentially pay an equity distribution to LBH as its sole shareholder.

(1) LBH continues to hold a subordinated claim of USD 2,249.6 million against LBHI2, of which some USD 204.7 million has been paid to date. As explained above, the distributions that LBH can expect from LBHI2 in respect of the LBHI2 Sub Debt are dependent on the outcome of the Priority Application. Given the judgment of the High Court that the LBHI2 Sub Debt ranks ahead of the LHBI2 Sub Notes, LBH should receive distributions in priority to SLP3. As above, certain of the Priority Application rulings are subject to appeal (if brought) and the Administrators do not expect a final determination of these issues until 2022 or thereafter.

(2) Further, the LBH Administrators have been investigating whether LBHI2 is indebted to LBH for an additional, subordinated amount of approximately USD 961 million. The Administrators remain in discussions with the LBHI2 administrators in relation to this possible additional claim. Any distributions in relation to this possible claim would also be dependent on the outcome of the Priority Application. Until these and other key issues have been determined, the amount of any potential future recoveries remains uncertain.

(1) The admitted, unsubordinated claims of creditors (totalling £1,074.8 million) have been paid in full, together with an aggregate of £27.1 million of statutory interest, of which £1.2 million was paid to HM Revenue & Customs ("HMRC") in relation to UK withholding tax.

(2) The Administrators anticipate that LBH will be in a position to make further distributions of statutory interest to its unsecured unsubordinated creditors in due course. The quantum of further distributions remains uncertain, being contingent mostly on the level of any further recoveries made by LBH from its subordinated claim against LBHI2, as well as (indirectly) the outcome of the Clawback Proceedings. The order in which LBH is able to make distributions to its subordinated debt is also dependent on the outcome of the Priority Application. As noted above, the ranking of the LBH Sub Debt and the LBH Sub Notes is a matter in dispute in the Priority Application. The High Court's ruling was that these two subordinated debts rank pari passu, however the Court has granted the parties permission to appeal on this issue and the Administrators anticipate that an appeal will be lodged in due course. The High Court also considered in the Priority Application certain other issues which arose in the LBH Administrator's application, in particular relating to LBHI's claim against LBH regarding the LBH Sub-Debt. The High Court's ruling on these issues is described in further detail above.

(3) Further, LBH is one of the Administration Companies which has realised value by surrendering surplus tax losses to other Lehman Group companies. This was achieved pursuant to a tax loss agreement entered into with several Lehman Administration Companies and Lehman Brothers Bankhaus AG. For the tax year ending in September 2019, LBH paid £10.2 million to another Lehman entity for group relief claimed in respect of the year ended 14 September 2017. If LBH entered into liquidation, it may not be able to claim losses from or surrender losses to other Lehman Administration Companies or its subsidiaries. This could result in tax being paid unnecessarily or in LBH not receiving any further benefit from sales of tax losses (if available).

(iii) LBL

(1) LBL has made significant realisations in respect of various intercompany claims. It expects to make further realisations from various intercompany creditors, although the exact quantum and timing of future realisations is not clear. Approximately 13 other Lehman Group balances continue to be monitored and progressed where there remains a reasonable prospect of future realisations. See Macnamara3, paragraph 94 [2/24].

(2) In particular, LBL anticipates that it may receive further distributions from LBH in respect of statutory interest. The timing and quantum of any payments by LBH are uncertain and ultimately dependent upon the outcome of the Priority Application, as described in further detail above. The timing and quantum of any payments are also indirectly dependent upon the outcome of the Clawback Proceedings. To the extent, LBH is able to make further payments of statutory interest, this will enable LBL to pay further statutory interest and then make further payments towards its remaining subordinated claims, together with statutory interest (and may also enable a return of funds to its shareholder). See Macnamara3, paragraph 95 [2/24].

(1) LBL has 1709 admitted creditor claims totalling £711.7 million, there are currently three claims remaining to be finally adjudicated totalling £8.9 million, which have been fully reserved for. Overall, the Administrators have declared and paid the following dividends to ordinary unsecured creditors and subordinated creditors whose claims have been admitted: (i) a dividend of 100 pence in the pound to former employees on admitted preferential claims (comprising unpaid wages and holiday pay); (ii) two dividends totalling 100 pence in the pound on admitted ordinary unsecured claims; and (iii) two dividends totalling 100 pence in the pound on admitted subordinated claims ranking ahead of statutory interest. In addition to making the above distributions, LBL has made an interim distribution to preferential, unsecured and subordinated creditors and paid £160.7 million by way of statutory interest. See Macnamara3, paragraphs 99 to 100 [2/25].

(2) Similar to LBH, LBL is one of the Administration Companies which has realised value by surrendering surplus tax losses in pre-appointment tax accounting periods to other Lehman Group companies and has also paid other Lehman Group entities for group relief claimed in respect of recent tax years. If LBL entered into liquidation, it may not be able to claim losses from or surrender losses to other Lehman Administration Companies. This could result in tax being paid unnecessarily or in LBL not receiving any further benefit from sales of tax losses (if available), depending on various factors including future distributions and interest rates. See Macnamara3, paragraph 101 [2/25].

(3) The Administrators anticipate that further payments of statutory interest will be paid in due course, but the timing and quantum are materially dependent upon (i) LBL's outcome in the Clawback Proceedings; and (ii) distributions it receives from LBH, which are in turn dependent on LBH's outcome in the Priority Application, and (indirectly) the Clawback Proceedings. The Administrators continue to review and adjudicate outstanding unsecured claims, and to pay catch up dividends on claims once agreed. See Macnamara3, paragraph 102 [2/26].

(4) As to the Clawback Proceedings (see Macnamara3, paragraphs 103 to 104 [2/26]):

a) LBHI is seeking to reclaim approximately USD 128 million from LBL in relation to payments it made to LBL under the Settlement Agreement, and pre-judgment interest of 9% per annum.

b) LBL has filed a counterclaim against LBHI in the Clawback Proceedings, seeking payment by LBHI of further distributions in respect of the guarantee claims. LBL is seeking to recover sums in respect of further distributions which it believes have been wrongfully withheld by LBHI. To date, LBHI has withheld payments totalling approximately USD 2.1 million in respect of declared distributions.

(iv) Eldon Street

(1) Firstly, any such recoveries are dependent on the quantum and timing of LBHI2's recovery from its equity interest in LBIE, and therefore on the eventual, final outcome of the LBIE estate;

(2) Secondly, any such recoveries are dependent on the outcome of the Priority Application, described in further detail above. The final outcome of the Priority Application will directly impact the quantum of total distributions which LBHI2 is able to make to LBH, and in turn LBH is able to pay to Eldon Street; and

(3) Thirdly, any such recoveries are dependent on the final outcome of the Clawback Proceedings, described in further detail above. The outcome of the Clawback Proceedings will directly impact the quantum of total distributions which LBHI2 and LBL are able to make to LBH, and in turn LBH is able to pay to Eldon Street.

(4) In short, LBH will not be in a position to make further payments of statutory interest to Eldon Street, until these issues have been finally resolved.

(1) To date, a total of approximately £208 million has been distributed, equating to a cumulative dividend of approximately 46.72 pence in the pound. The Administrators anticipate that further distributions will be paid in due course, however, their quantum and timing are uncertain. See Macnamara3, paragraphs 118 to 119 [2/28-29].

(2) Eldon Street is itself a party to the Clawback Proceedings in the NY Bankruptcy Court. In relation to Eldon Street, LBHI is seeking to reclaim USD 10.2 million it has paid to Eldon Street under the Settlement Agreement in respect of the guarantee claim (plus pre-judgment interest). Eldon Street has issued a counterclaim in which it seeks payment by LBHI of further distributions in respect of the guarantee claim. To date, LBHI has withheld payments to Eldon Street totalling approximately £0.2 million in respect of declared distributions. The timing and quantum of any final distributions to be made by Eldon Street are therefore dependent upon the final outcome of the Clawback Proceedings. See Macnamara3, paragraph 120 [2/29].

(3) Eldon Street is a material debtor of LBPTG, such that LBPTG will receive dividends from Eldon Street after Eldon Street receives dividends from its debtors and investments in the future. It will likely also be necessary for the Administrators to make an application for the extension of the administration of LBPTG, which is currently due to expire in November 2021, in line with the Eldon Street administration. See Macnamara3, paragraph 121 [2/29].

(4) In any case, since moving Eldon Street into liquidation at this stage would not carry with it any specific advantages to the creditors which are not available in administration, the Administrators respectfully suggest that the outstanding matters detailed above justify the proposed extension to their term of office. In particular, the fact that the Administrators will continue to make distributions to Eldon Street's unsecured creditors and may (subject to the outcome of Clawback Proceedings) collect dividends in respect of Eldon Street's admitted claims against LBH and LBHI, suggest that a further extension to their term of their office would be appropriate. See Macnamara3, paragraph 122 [2/29-30].

C. LBUKRE

(1) On 27 September 2012, the Administrators declared the first dividend to unsecured creditors of 30 pence in the pound to all unsecured creditors whose claims had been admitted for dividend purposes. On 2 September 2013, the Administrators declared and paid a second interim dividend of 10 pence in the pound. On 13 March 2014, the Administrators declared and paid a third interim dividend of 3.2 pence in the pound. On 27 August 2014, the Administrators declared and paid a fourth interim dividend of 8.5 pence in the pound. On 30 July 2015, the Administrators declared a final dividend equating to 8.9 pence in the pound to all remaining unsecured creditors whose claims had been admitted for dividend purposes.

(2) Given the residual assets of LBUKRE could not be readily or advantageously sold, the Administrators, LBHI and certain other unsecured creditors controlled by LBHI (the "LBHI-Controlled Creditors", being (along with LBHI) the only remaining creditors of LBUKRE), entered into a residual assets transfer agreement (the "RATA") in July 2015, whereby the parties agreed the terms pursuant to which ownership of such residual assets were to be transferred to LBHI and the LBHI-Controlled Creditors by distributions in specie in accordance with rule 2.71 of the Insolvency Rules 1986 (a similar rule is now contained in rule 14.13 of the Insolvency (England and Wales) Rules 2016). LBHI and the LBHI-Controlled Creditors were content to receive their final distributions, valued at approximately 8.9 pence in the pound, on this basis. The claims held by the LBHI-Controlled Creditors have since been transferred to LBHI, leaving LBHI as the sole remaining creditor of LBUKRE.

(3) The RATA contemplates that the residual assets are to be transferred to LBUKRE's creditors on an ongoing basis, subject in certain cases to consents or approvals being obtained from third parties or certain administrative matters being dealt with. In addition to assets, a total of £56.5 million, in cash, has also been transferred to LBHI to date under the terms of the RATA.

(4) The transfer of assets to LBHI pursuant to the terms of the RATA is ongoing, but almost complete. Since the 2019 Order was granted, the Administrators and LBHI have continued to work closely to determine the most appropriate transfer, closure or realisation strategy for each of the remaining assets. The Administrators have been finalising asset positions and making payments to LBHI on an ongoing basis.

(1) The primary outstanding issue, and the principal reason why the Administrators have been compelled to seek a further extension to their appointments, is the fact that LBUKRE is continuing to work with LBHI to complete the remaining steps required to facilitate its exit from arrangements made in connection with the Florian securitisation structure (in which LBUKRE participated prior to entering administration).

(2) As the Court may recall, the Administrators have faced difficulties because of the contractual indemnity LBUKRE provided to the Bank of New York Mellon (as security trustee) (the "Trustee") during the course of the administration. In August 2011, LBUKRE issued an instruction letter to the Trustee and agreed, by way of a deed (the "Deed of Indemnity"), to provide the Trustee with an indemnity for actions taken or not taken by the Trustee pursuant to the instruction letter. The indemnity is capped at EUR 1 million, however as a condition of the indemnity LBUKRE agreed to deposit the sum of EUR 200,000 with the Trustee. While the indemnity is a contingent liability, it would rank as an expense of the administration if it were to materialise. LBUKRE is therefore holding EUR 800,000 in reserve to meet this expense, if it were to materialise. Accordingly, the Administrators are unable to distribute these remaining sums to its creditor (i.e. LBHI), unless it obtains a discharge from the indemnity.

(3) It is the Administrators' view that the prospects of the Trustee calling on the indemnity are very remote. However, the Trustee has indicated that it is unwilling to unconditionally release LBUKRE from the indemnity (and it has no incentive to do so).

(4) In November 2019, LBUKRE entered into a set of agreements with LBHI, Florian Investments No.1 Designated Activity Company, Florian Grundstücks-GmbH and the Trustee, in the context of unwinding the Florian securitisation structure. One of the documents signed in November 2019 was a Deed of Release entered into by LBUKRE and the Trustee. Pursuant to the Deed of Release, the Trustee irrevocably and unconditionally agreed that LBUKRE shall be released and discharged from its obligations arising under the Deed of Indemnity, such release to be effective upon the latest to occur of:

a) receipt by the issuer (i.e. Florian Investments No.1 DAC) of the Consideration Payment;

b) the cancellation by the issuer of the notes;

c) completion of the liquidation of the issuer; and

d) The dissolution of LBUKRE.

(5) The Administrators understand that the consideration payment under (a) has been made and the cancellation by the issuer of the notes under (b) has also occurred. LBHI has informed the Administrators that the liquidation of Florian Investments No. 1 DAC commenced on 26 May 2020 and that the liquidator of Florian Investments No. 1 DAC has indicated that, unless tax clearance from the Irish Revenue takes longer than expected, it is anticipated that the Final Meeting of Florian Investments No. 1 DAC will occur by early January 2021 and that Florian Investments No. 1 DAC will be dissolved by 30 April 2021. At that point condition c) will be fulfilled, leaving only the dissolution of LBUKRE (condition d)) to be concluded before the discharge will become effective.

(6) Given the anticipated timing for completing the liquidation of Florian Investments No.1 DAC (i.e. by 30 April 2021), the Administrators will not be in a position to dissolve LBUKRE by the date on which the administration is currently due to end, being 30 November 2020. However, once the liquidation of Florian Investments No.1 DAC has concluded it should be possible to bring the administration to a close in relatively short order (subject to the handful of other outstanding issues identified at paragraph 146 of Macnamara3 [2/36]).

(1) Noting that the issue regarding the Deed of Indemnity is the main factor blocking the conclusion of LBUKRE's administration, the Administrators have explored whether, in order to obtain a release for LBUKRE in the interim, they could novate the indemnity obligation to LBHI (a step which would require the consent of both LBHI and the Trustee). The Administrators have discussed this option with LBHI, who have confirmed in writing that they would prefer not to enter into such negotiations with the Trustee. See Macnamara3, paragraph 142 [2/34].

(2) By email dated 1 October 2020, a member of the Administrators' team contacted LBHI in order to seek written confirmation of LBHI's views in relation to the possibility of the novation of the indemnity obligations to LBHI, concluding that, in the absence of such a novation the Administrators consider that they need to seek an extension of their appointments and believe it would be prudent to seek a further 12-months in office, remarking that the Administrators "understand that LBHI is supportive of such an application" and indeed "prefers that course to the opening up of discussions with BNY Mellon Corporate Trustee Services Limited about the possible novation of the Deed of Indemnity" [3/435-437].

(3) LBHI's representative responded to this email in the affirmative: "I agree with your assessment, and understand this means you will seek to extend the administration of LBUKRE" [3/434-435].

| Transcribed by Opus 2 International Limited Official Court Reporters and Audio Transcribers 5 New Street Square, London, EC4A 3BF Tel: 020 7831 5627 Fax: 020 7831 7737 civil@opus2.digital |

Note 1 See the point made at footnote 5 above regarding the length of extension sought in relation to Eldon Street; why this was not specifically flagged in the June 2020 progress report; and the fact that this specific point has now been brought to Eldon Street’s creditors’ attention by way of the website update on 28 October 2020. [Back]