Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Rothesay Life Plc, Re [2020] EWHC 2185 (Ch) (07 August 2020)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2020/2185.html

Cite as: [2020] EWHC 2185 (Ch)

[New search] [Printable PDF version] [Help]

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

COMPANIES COURT (ChD)

Rolls Building Fetter lane, London, EC4A 1NL |

||

B e f o r e :

____________________

| IN THE MATTERS OF: |

||

| ROTHESAY LIFE PLC |

||

And |

||

| MONUMENT LIFE INSURANCE DAC |

||

AND IN THE MATTER OF |

|

|

| THE FINANCIAL SERVICES AND MARKETS ACT 2000 |

____________________

Hearing dates: 22 and 31 July 2020

____________________

Crown Copyright ©

- On Friday 31 July 2020 I made an order approving the transfer pursuant to Part VII of the Financial Services and Markets Act 2000 ("FSMA") of approximately 400 in-force life insurance policies (the "Transferring Policies") with a best estimate liabilities ("BEL") of £114 million as at 31 December 2019 from Rothesay Life plc ("Rothesay") to Monument Life Insurance DAC ("Monument Life"). I indicated that I would give my reasons for doing so in writing, which I now do.

- The Transferring Policies are individual annuities issued as a consequence of so-called "Buy Out" policies which were issued directly to beneficiaries of five Irish defined benefit pension schemes by MetLife Assurance Limited ("MetLife"). MetLife was an English subsidiary of a US group which had written the business in the Republic of Ireland on a freedom of services basis. After Rothesay had acquired MetLife in 2014, the Transferring Policies were transferred to Rothesay pursuant to a Part VII transfer scheme which was approved by Henderson J on 30 November 2015: see re Rothesay Assurance Limited [2016] EWHC 44 (Ch).

- The vast majority of the Transferring Policies are annuities now in payment: the remainder are deferred annuity policies. Some of the policies could therefore continue in existence for 30 years or more. The policies are currently administered by Mercer on behalf of Rothesay.

- Rothesay is an English insurer. All but three of the policyholders whose policies are to be transferred are resident in Ireland: two are resident in the UK and one in Australia. The rationale for the transfer is the desire to ensure continuity of service to the Transferring Policyholders once the freedoms of service and establishment ("passporting rights") under the recast EU Directive 2009/138/EC ("Solvency II") cease to be available to UK insurers such as Rothesay after the end of the "Implementation Period" on 31 December 2020 which follows the departure of the UK from the EU on 31 January 2020.

- In anticipation of the UK leaving the EU, the European Insurance and Occupational Pensions Authority ("EIOPA") published a number of opinions and recommendations between 2017 and 2019. EIOPA's earlier opinions called upon national authorities in the EU to ensure that contingency plans were in place to ensure service continuity for policyholders after the UK's withdrawal. EIOPA envisaged that the methods used to ensure service continuity might include the transfer of portfolios of cross-border insurance to an insurance undertaking established in the remaining EU member States (the "EU27") or the establishment of third-country branches in the EU27.

- Following EIOPA's guidance, commencing in late 2018, Rothesay conducted discussions with PRA, the FCA and the Central Bank of Ireland ("CBI") to address the risk that, in the event of a no-deal Brexit or an arrangement being reached between the UK and the EU which did not include passporting rights, Rothesay would be unable to service or make payments to the Transferring Policyholders in Ireland. As the size of the business comprising the Transferring Policies was a very small proportion of Rothesay's business, and Rothesay is focused on the UK and had no authorized subsidiaries or third country branches in any other EEA state, establishing a new branch in Ireland was considered by the board of Rothesay to be disproportionate in terms of cost and logistics. Accordingly, the directors chose to seek to transfer the relevant policies to another EEA insurer with the appropriate authorization to carry on the business after Brexit. Further, given that the Transferring Policies were originally written in Ireland, the residence of the overwhelming majority of the holders of the policies is in Ireland, and most of the policies are governed by Irish law, the directors of Rothesay determined to seek to transfer the relevant policies to an Irish regulated insurer.

- After seeking expressions of interest from third parties, Rothesay identified Monument Life as its preferred counterparty for the portfolio transfer. Monument Life is an Irish insurer which was formerly known as Laguna Life DAC and is a subsidiary of Monument Re Limited, a Bermudan reinsurance company ("Monument Re"). Monument Life writes a range of insurance business comprising term assurance, guaranteed and unit-linked savings contracts, annuities and protection business. It has the authorization to conduct the annuity business to be transferred to it and is regulated by the CBI.

- Rothesay selected Monument Life on the basis, among other things, that it was keen to take on the Irish annuity business as part of its growth strategy. One of Rothesay's other reasons for selecting Monument Life as its preferred transferee was because the group of which it is a member was able to execute a commercial deal (consisting of a reinsurance agreement to transfer the economic risk and an agreement to promote the Scheme) expeditiously so that the process for the portfolio transfer could be initiated prior to the end of March 2019 which was the date upon which the UK was due to leave the EU.

- In February 2019, and at a time when it was still uncertain whether there would be either an extension for the departure of the UK from the EU or any transitional arrangements, EIOPA issued a number of Recommendations which suggested that after the UK left the EU, national authorities in the EU27 should facilitate the orderly run-off of unauthorised business or require any UK insurer conducting such business to take steps to become authorised under EU law. As an alternative, the Recommendations suggested that the competent authorities in the EU27 should allow finalisation of portfolio transfers from UK insurers to EU27 insurers, provided that the process for such transfer had been initiated before the withdrawal date.

- In anticipation of the possibility that the United Kingdom might exit from the EU at the end of March 2019 without an agreement setting out the arrangements for such withdrawal, and in accordance with the EIOPA Recommendations, the process for approval of the portfolio transfer to Monument Life was initiated by Rothesay paying the regulatory transaction fee to the PRA on 14 March 2019 and receiving the PRA's approval to the appointment of an independent expert on 29 March 2019.

- On 17 March 2019 the Republic of Ireland enacted an Act dealing with the consequences for Ireland of the withdrawal of the UK from the EU (the "Irish Act"), the relevant sections of which could be commenced if the UK left the EU without a long-term trading arrangement. One of the provisions of the Irish Act would allow for a temporary run-off regime for up to three years for UK insurers during which existing insurance contracts could be serviced in Ireland with a view to running off liabilities or transferring the insurance contracts to an appropriate insurer. Such temporary run-off regime was not, however, brought into force due to the agreement for the Implementation Period and would not in any event cover the much longer period for which the Transferring Policies are expected to remain in existence.

- Taking these various factors into account, the board of Rothesay decided to proceed with the transfer of the Transferring Policies, and on 26 March 2019 Rothesay entered into a business transfer agreement with Monument Life and Monument Re. In effect, the business transfer agreement provided that the Transferring Policies and their associated records would (subject to the decision of this court) be transferred from Rothesay to Monument Life pursuant to a Part VII transfer scheme which they would propose.

- On the same day Rothesay and Monument Re also entered into a reinsurance agreement (the "Reinsurance Agreement") under which Monument Re agreed (subject to some limitations) to reinsure 100% of Rothesay's liabilities in respect of the Transferring Policies with effect from 1 January 2019, and also entered into various related security arrangements. The intended effect of the Reinsurance Agreement was to transfer the majority of the economic risk of the Transferring Policies from Rothesay to the Monument group with effect from 1 January 2019 in order to achieve certainty of price and commercial terms for the portfolio transfer.

- The Scheme itself is relatively straightforward. The Scheme does not make any change to the terms of the Transferring Policies. It simply transfers the legal obligations of Rothesay to pay the annuities and other liabilities in connection with the Transferring Polices to Monument Life. There is, however, an exception for liabilities for mis-selling or breaches of contract and related complaints and disciplinary action arising prior to the transfer date, which will not be transferred to Monument Life but will continue to be enforceable against Rothesay.

- The transfer date upon which the policies are to be transferred under the Scheme is intended to be 7 September 2020. On transfer, and following the necessary migration activities, the administration of the transferred business will be undertaken by Equiniti on behalf of Monument Life.

- No investment assets are being transferred by Rothesay to Monument Life under the Scheme. That is because the assets covering the liabilities in respect of the Transferring Policies were transferred to Monument Re as the premium for the Reinsurance Agreement. As part of the Scheme, the rights and benefits of Rothesay under the Reinsurance Agreement and the associated collateral arrangements will pass to Monument Life.

- Although not a feature of the Scheme, Monument Life and Monument Re have entered into a deed to amend the Reinsurance Agreement and associated collateral arrangements. The changes will take effect after the Scheme takes effect in order to bring the Reinsurance Agreement into line with other existing reinsurance arrangements between the two companies. After amendment, Monument Re will (subject to limitations) reinsure only 90% of the risks under the Transferring Policies rather than 100%, and the reinsurance will be on a "funds withheld" basis. This essentially means that the reinsurance premium will remain a liability on Monument Life's balance sheet, and the assets covering reinsured liabilities will be placed into an account (the "Funds Withheld Account") with an independent custodian and will remain the legal property of Monument Life. In normal circumstances, the amount held in the Funds Withheld Account will be reassessed quarterly, with amounts being released to Monument Re as the reinsured liabilities run off. Monument Re will also be required by the amended Reinsurance Agreement to transfer assets into the Funds Withheld Account so that the Funds Withheld Account will normally contain sufficient assets to cover the BEL of the reinsured liabilities. There will also be restrictions on the type of assets that can transferred into the Funds Withheld Account to ensure the assets are of an appropriate type and quality.

- The terms of the amended Reinsurance Agreement allow Monument Life to terminate the reinsurance in a number of circumstances including if Monument Re defaults on its obligations or if Monument Re is unable to meet its regulatory capital requirements for a period of six months. Upon termination in such circumstances, Monument Life will be entitled to receive a termination payment expressed as a percentage of the BEL. For example, this is 105% if the termination is due to Monument Re defaulting and 100% if Monument Re fails to meet its regulatory capital requirement. If Monument Re is unable to pay the termination payment, Monument Life will, as a minimum, have recourse to the assets held in the Funds Withheld Account.

- The court has an unfettered discretion under Part VII FSMA 2000 whether to approve a transfer scheme such as the present. However, its approach to the exercise of that discretion is reasonably well established by authorities such as re London Life Association Ltd (unreported, Hoffmann J, 21 February 1989; re Axa Equity & Law Life Assurance Society plc [2001] 1 All ER (Comm) 1010 and (in the context of Brexit) re Royal London Mutual Insurance Society Limited [2019] EWHC 185 (Ch).

- In summary, the court will first be concerned to see whether a policyholder or group of policyholders (both transferring and non-transferring) will be adversely affected by the scheme. This involves a comparison between the contractual rights and reasonable expectations of policyholders before the scheme is promulgated and the likely result on those rights and reasonable expectations if the scheme is put into effect.

- So far as security of benefits is concerned, the court will pay close attention to (but is not bound to accept) the opinion of the independent expert (invariably an actuary) who is appointed under FSMA 2000, together with the views of the PRA. As regards reasonable expectations on matters such as service standards, management and governance, the court will also pay close attention to (but is not bound to accept) the views of the independent expert and the FCA. It has repeatedly been made clear that the court does not in any sense act as a rubber-stamp for the views of the independent expert, the FCA or the PRA.

- The fundamental question is then whether the scheme as a whole is fair to each of, and between, the different classes of persons affected. The fact that individual policyholders or groups of policyholders may be adversely affected in some respects does not mean that the scheme has to be rejected by the court. Nor is it for the court to insist upon some other, or in its view better, scheme than the one proposed.

- The last two points may be of particular importance where the scheme is a necessary response to some external circumstance, such as Brexit, which potentially affects the interests of policyholders, rather than being the result of a free commercial choice of the transferor. In the former situation, the court may be prepared to approve a scheme notwithstanding some elements of prejudice to policyholders in order to achieve a better result or avoid greater risks for them overall; whereas in the latter the court may well be unwilling to sanction a scheme which would impose greater risks or prejudice upon policyholders without any counterbalancing advantages being offered to them by the insurer.

- The transfer of policies under the Scheme in the instant case will have a number of consequences for Transferring Policyholders as a result of the change in their annuity provider from Rothesay to Monument Life, together with the change in their administrator from Mercer to Equiniti. It may also have indirect changes (primarily in terms of security of benefits) for the non-transferring policyholders of Rothesay and Monument Life.

- These effects of the Scheme have been examined in some detail by the independent expert, Mr. John Hoskin, who is a partner in Barnett Waddingham LLP and a Fellow of the Institute and Faculty of Actuaries. His overall conclusion is that the Scheme will not have a material adverse effect on the security of benefits, or on the reasonable expectations (including benefit expectations), service standards, management and governance, of any policyholder of Rothesay or Monument Life, whether or not they are holders of the policies to be transferred.

- The independent expert's reports and further letters dealing with points raised by me during the hearing of the Scheme, the communication programme with policyholders and the responses of policyholders have also been reviewed by the FCA and PRA who have each indicated that they have no objections to the Scheme.

- I turn to consider the main issues raised by those materials.

- Policyholders are currently protected by the Solvency II regime which applies to both Rothesay and Monument Life. Ireland will continue to operate under Solvency II, and at least immediately after the Implementation Period, the UK solvency regime for insurance companies will be essentially the same as Solvency II. Although thereafter there will be scope for divergence between the two countries, it is not expected that any divergence will be immediate or radical, not least because Solvency II was closely modelled on the previous UK regime.

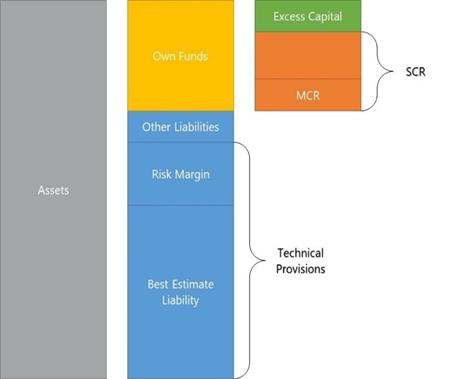

- Under Solvency II, the solvency requirements for an insurance company start with the quantification of BEL, which represents the present value of all future liabilities in connection with the policies for which it is the insurer on a realistic basis. To that amount is added the "risk margin" which is intended to reflect an additional amount which would have to be paid to another insurer to take over the policies and run them off. This is calculated on the basis of unhedgeable risks that a buyer would need to be compensated for to take on the business. The net result is referred to as the insurer's "Technical Provisions".

- The amount by which the assets of the insurer, measured in accordance with Solvency II, exceeds its Technical Provisions and other liabilities is known as the insurer's "Own Funds". An insurer is required to hold Own Funds at least equal in value to its "Solvency Capital Requirement" ("SCR"). This is the amount required to ensure that the firm's assets continue to exceed its Technical Provisions over a one-year time frame with a probability of 99.5%. The SCR is either calculated on the basis of a standard formula, or is calculated on the basis of a more bespoke internal model and depends upon the model chosen by the firm and approved by the relevant regulator. In either case, it is calculated by reference to the risks that firms generally run and that the firm itself is running. The SCR is underpinned by the "Minimum Capital Requirement" ("MCR") which is a prescribed lower amount of assets (currently €3.7 million) which all insurers must hold.

- The insurer's eligible Own Funds divided by its SCR is known as the insurer's "SCR coverage ratio" and is usually expressed as a percentage number (so that an SCR coverage ratio of 100% would mean that the insurer's Own Funds equalled its SCR). It should be appreciated, however, that what might appear a material difference in SCR coverage ratio may not equate to a material difference in the likelihood of remaining solvent for a year. So, for example, an SCR coverage ratio of 100% equates to a likelihood of an insurer's assets being sufficient to cover its Technical Provisions in one year's time of 99.5%; an SCR coverage ratio of 130% would equate to a likelihood of the insurer's assets being sufficient to cover its Technical Provisions in one year's time of 99.96%; and an SCR coverage ratio of 150% would equate to a likelihood of its assets being sufficient to cover the insurer's Technical Provisions in one year's time of 99.994%.

- The net amount by which an insurer's Own Funds exceeds its SCR represents the "Excess Capital" of the insurer for Solvency II purposes. At least in theory, an insurer could seek to distribute any such excess, and it is for that reason that the court has on occasions been prepared to sanction a Part VII scheme notwithstanding that a transferee holds a lower proportion of Excess Capital than a transferor. The court has also indicated that there is nothing sacrosanct about any particular level of Excess Capital and there is no "right" level of Excess Capital for an insurer to hold: see e.g. re Rothesay Assurance Limited [2016] EWHC 44 (Ch) at [37]-[39].

- But that is not to say that the proportionate level of Excess Capital held by the transferee company when compared with the level held by the transferor is an irrelevant consideration. In reality, insurers invariably commit to retain a certain (target) level of Excess Capital in addition to the SCR. The target amount of such Excess Capital reflects the chosen "risk appetite" of the company and is determined by the insurer's capital management policy or "CMP". This additional level of capital is intended to provide comfort that even if a moderately severe event occurred, the insurer would still have sufficient capital to cover its SCR in full and to meet its obligations to policyholders. The capital management policy also operates as an early warning system to the directors of the insurer to enable them to take appropriate actions, such as changing asset mixes or hedging strategies, to mitigate the risk that the SCR might be breached.

- Thus, taken together (but recognizing that greater significance must be attached to the level of Technical Provisions and the SCR) the protection for policyholders by way of the level of assets an insurer has to hold to meet policyholders' claims is determined by a combination of the Technical Provisions, the SCR and the capital management policy.

- The independent expert's report in this case contained a helpful illustration of the various elements that I have just outlined.

- As at 30 June 2019 Rothesay had insured the pensions of 778,087 individuals and had issued 282,276 policies direct to individuals. Its BEL was £30.3 billion, its Own Funds £4.066 billion, and its SCR was £2.310 billion. Rothesay had Excess Capital over and above its SCR of £1.756 billion giving an SCR coverage ratio of 176%. As at 31 December 2019 that SCR coverage ratio was 201.2% and (assuming some recent actions to improve its solvency position had been completed) at 31 March 2020 it was 204%.

- The group to which Monument Life belongs is in the process of rationalization which is expected to complete later this year. If those transactions had completed on 30 June 2019 Monument Life would have had 252,084 policies issued with BEL of €558m. It would have had Own Funds of €33 million and its SCR would have been €14 million. Monument Life would have had excess capital over and above its SCR of £19 million, giving an SCR coverage ratio of 235.9%. As at 31 December 2019 that ratio would have fallen to 193.8% due a change in some of the assumptions used in the calculation of its Technical Provisions, and at 31 March 2020 it would have been 195.8%.

- Taking the proposed transfer from Rothesay into account, Monument Life's SCR coverage ratio as at 31 December 2019 would fall from 193.8% to 185.4%, and as at 31 March 2020 would fall from 195.8% to 186.3%. This would be the result of the additional risks taken on as a consequence of the Scheme, some transactional activity undertaken by Monument Life and the amendments to the Reinsurance Agreement. By comparison, Rothesay's SCR coverage ratio as at 31 December 2019 would be largely unchanged as a result of the transfer.

- Although expressed differently, the current capital management policies of Rothesay and Monument Life are reasonably similar. Rothesay targets an SCR coverage ratio of between 130% to 150%, and Monument Life targets an SCR coverage ratio of between 140% and 150%. Upon a deterioration, Rothesay considers an SCR coverage ratio of between 120% and 130% to be an "amber zone" requiring action over time with immediate action required at a lower level of 120%.

- Monument Life's capital management policy requires it to take action to restore its position if its SCR coverage ratio falls below 140%. In addition, and as part of its capital management policy, Monument Life recognises the potential consequences if the intra-group reinsurances with Monument Re were terminated. Monument Life therefore holds additional capital specifically in respect of its reinsurance exposure to Monument Re which is intended to be sufficient to allow it to terminate the reinsurance with Monument Re and still be able to cover its MCR (before any management actions are taken) and the SCR (after certain management actions are taken). At present Monument Life holds additional capital of €5.4 million in this respect, which gives it an SCR coverage ratio of about 175% to 185%.

- The independent expert considered the respective capital management policies of Rothesay and Monument Life, together with the range of management actions that each could take to improve their solvency position if their Excess Capital were to fall below the minimum target level set out in their respective capital management policies. He concluded that although it was difficult to make a direct comparison, the capital management policies and management actions available to each were similar and that changing to the Monument Life capital management policy from that of Rothesay would not have a material adverse effect on Transferring Policyholders' security of benefits.

- The independent expert also gave special consideration to the implications of the fact that Monument Life is significantly exposed to Monument Re because Monument Life has reinsurance for a major proportion of its business from Monument Re. He concluded that the structure of the reinsurance arrangements, the monitoring of Monument Re's financial condition and the additional €5.4 million that Monument Life holds against the risk of Monument Re defaulting on its obligations are appropriate ways for Monument Life to manage its reinsurance exposure to Monument Re.

- The independent expert concluded, having examined the effect of the Bermudan regulatory capital and Monument Re' s capital management and dividend policy, that the risk that Monument Re might default on its obligations was very low.

- That said, the independent expert also considered the effect upon Monument Life of a default by Monument Re. He observed that in reality the circumstances which might give rise to a default by Monument Re would be likely also to affect Monument Life's available capital, and that the value of the assets in the Funds Withheld Account might be lower than the BEL of the reinsured risks. In such a situation – which the independent expert stressed would be extreme – he could foresee the possibility of a small shortfall of assets against Monument Life's Technical Provisions. This would mean that policyholder benefits would have to be reduced, albeit by a very small percentage (2% on the example he gave). On the basis that this scenario was very unlikely to occur and would have a very small effect if it did, the independent expert did not consider that it represented a material risk to Transferring Policyholders.

- The independent expert summarised his conclusions on the effect of the Scheme on the security of benefits for Transferring Policyholders in the following way, noting also that his opinions were not dependent upon completion of the Monument group's internal reorganisation,

- both Rothesay and Monument Life are subject to the same regulatory solvency regime, meaning that the minimum amount of capital (assets in excess of their liabilities) that they must hold offers a similar level of security

- both Rothesay and Monument Life have similar targets in respect of excess capital (capital above the regulatory minimum capital requirement) such that the probability of either company being unable to meet its obligations to its policyholders, including the Transferring Policyholders, is remote

- as at 30 June 2019 both Rothesay and Monument Life held capital in excess of these target levels, and this remains the case based on the most recent information available as at 20 March 2020

- although the absolute amount of excess capital in Monument Life is lower compared to that in Rothesay under their respective capital targets, this is not detrimental to benefit security as the absolute amounts reflect the size of the respective risks

- the range of management actions identified by Monument Life as being available to restore its capital position if it breaches its capital targets are, in my opinion, credible and comparable to those identified by Rothesay in similar circumstances, which I also consider to be credible

- Monument Life's risk management framework and, in particular, its liquidity risk management approach which aims to ensure that assets are available to pay benefits as they fall due, is appropriate and comparable to that of Rothesay

- Monument Life has an appropriate framework in place to manage the additional risk exposures that arise from being part of a group of insurance companies (which do not apply to Rothesay) and, in particular, Monument Life's exposure to Monument Re, its most significant intra-group counterparty, does not result in a material risk to benefit security."

- In overview, the independent expert concluded that Transferring Policyholders will move from one financially strong company to another financially strong company. He was of the view that it was the relative strength of the insurer which matters as opposed to the absolute size of excess capital that it holds, and in that respect he noted that Monument Life's SCR coverage ratio was broadly equivalent to that of Rothesay; that Monument Life would be expected to meet its capital management policy target post-Scheme; and that the options open to the management of Monument Life to deal with any failure to meet its target SCR coverage ratios were credible and comparable to Rothesay's.

- The independent expert is satisfied that the Scheme will have no material adverse effect on the security of the benefits of the non-transferring policyholders of either Rothesay or Monument Life. As regards Rothesay, the Transferring Policies represent a very small proportion of Rothesay's business with the result that the impact of the Scheme on Rothesay's financial position is not material.

- As regards Monument Life, the independent expert noted that the SCR coverage ratio of Monument Life (including the €5.4 million) would reduce as a result of the Scheme, from 193.8% to 185.4% as at 31 December 2019 and from 195.8% to 186.3% as at 31 March 2020. However, the independent expert was of the view that this reduction is modest and he pointed out Monument Life will continue to have capital in excess of its target level under its capital management policy. He also made the point that although Monument Life will, as a result of the Scheme, be exposed for the first time to material longevity risk, and hence a more diverse risk profile, this will be reflected in its capital requirements (in particular its SCR) and he considered that such additional risks can be managed within its existing risk management framework (including the revised Reinsurance Agreement with Monument Re).

- Subject to the points as regards COVID-19 which I consider below, having considered the reports and letters from the independent expert, together with the fact that the PRA does not dispute or doubt his analysis and findings, I am satisfied that his conclusions on the effect of the Scheme on security of benefits of policyholders are reasonable, and that they provide no reason for me to refuse to sanction the Scheme.

- There is no suggestion that the reasonable expectations and service standards for non-transferring policyholders of either company will be affected by the Scheme.

- As regards Transferring Policyholders, the independent expert noted that in relation to deferred annuities, there is scope for the application of discretion in relation to commutation, transfer out or amending retirement ages and that each company may use slightly different bases for calculating such benefits. Where the expert considered the approach proposed to be used by Monument Life could result in unfairness to Transferring Policyholders, he raised it with Monument Life who have agreed to change it. On that basis, the independent expert has been satisfied overall that the approach by Monument Life to discretionary benefits is fair and there will be no material adverse effect on the benefit expectations of Transferring Policyholders. The FCA does not disagree.

- The independent expert also considered service standards. Both Rothesay and Monument Life outsource their administration (to Mercer and Equiniti respectively), and the independent expert reviewed the likely service level to be provided by both and the process of migration from one to the other. In general terms the independent expert and the FCA were satisfied that although there will be minor changes in administration for Transferring Policyholders, they are not material.

- A significant number of Transferring Policyholders are eligible to refer complaints to the UK Financial Ombudsman Service ("FOS"). As indicated above, mis-selling and historic breach liabilities will be retained by Rothesay and in that regard access to the FOS will be unchanged for Transferring Policyholders. In addition, from the transfer date, Monument Life agrees under the Scheme to comply with the Disputes Resolution: Complaints ("DISP") section of the FCA Handbook (which contains the provisions as regards the FOS) as regards the Transferring Policies to the extent that DISP applied to those policies prior to transfer. The Scheme gives a direct right of enforcement to policyholders, as well as to the PRA and FCA in that respect.

- In addition, as regards post-transfer complaints, policyholders can avail themselves of the broadly similar scheme to the FOS in the Republic of Ireland, namely the Financial Services and Pension Ombudsman.

- Taking these views of the independent expert, and the comments on them by the FCA into account, I am satisfied that the Scheme ought not to have any material adverse effect upon the reasonable expectations and service standards for Transferring Policyholders.

- Seven policyholders (Messrs. Molony, Hartnett, Buckley, O'Connell, Bedder, Browne and Bannon) voiced objections to the Scheme in communications with the court or with Rothesay. I was taken by Mr. Moore QC to each of the objections. The points raised and the answers given to them by Rothesay were also considered by the independent expert and by the PRA and FCA. Although expressed in different ways, the main points made by the objectors are as set out below.

- A number of policyholders submitted that the court should not sanction the Scheme, but should wait to see if the UK and EU agree a deal covering the provision of financial services after 31 December 2020, or agree an extension to the Implementation Period which would enable Rothesay to continue to service the Transferring Policies. As an alternative, in the absence of any such agreement, it was suggested that the likelihood was that the Irish government would activate the relevant provisions of the Irish Act so as to put in place a temporary permissions regime for three years which would enable Rothesay to run-off its Irish business or find a transferee for the policies.

- The UK government has indicated that it will not seek an extension to the Implementation Period beyond 31 December 2020 and although negotiations are reported to be continuing between HM Government and the EU Commission as regards an agreement for a long-term trading relationship, it is unclear whether freedom of services for insurance business is under discussion or whether any such deal is likely to be struck before the end of the year.

- The PRA's Note to me in this respect summarises its views as follows,

- The view of the PRA that the risk that Rothesay will not be able to service the Transferring Policies after 31 December 2020 is "both real and material", together with its position that UK insurers should ensure that their EEA policies can lawfully be serviced after that date, strongly supports the conclusion that the decision of the board of Rothesay to promote the Scheme rather than delay taking action is entirely reasonable and in the best interests of policyholders.

- The independent expert was of a similar view which he expressed in the following way in his report,

- In addition, Mr. Moore QC submitted, and I accept, that deferring a Part VII transfer does not provide a solution because unless it was initiated before 31 December 2020, the jurisdiction under Part VII will effectively be limited to onshore UK transfers requiring an offshore transferee to have a UK branch. If the order sanctioning the transfer is not made before 31 December 2020, the mutual recognition required by Solvency II cannot be relied on, and the question of whether the CBI or an Irish court would recognise the order of this court would depend upon whether a regime similar to the Brussels Regulation exists or whether the Irish court would grant recognition on the basis of comity under Irish law. These would be novel questions of law which may take a considerable time to settle and it cannot be assumed that the circumstances in which an application for recognition might be made in the future would be any more favourable or less uncertain than they are now.

- Taking these points into account, provided always that the Scheme now proposed is in other respects fair and appropriate, I consider that there is no good reason for me to refuse to sanction it on the speculative basis that something better may come along. At best, reliance on an Irish transitional regime would, as Mr. Moore QC submitted, just be "kicking the can down the road" for a relatively short period of time in the context of the lifetime of the policies. The same problem of not being able to pay annuitants might well have to be confronted later on and in uncertain circumstances, and there can be no guarantee that any other insurer willing to accept a transfer would then be available. At worst, the result could be that policyholders in Ireland would be left being unable to be serviced or paid by Rothesay.

- A number of policyholders were concerned about the relative characteristics of Rothesay and Monument Life. For example, Mr. Bannon and Mr. Hartnett referred to Rothesay being "large and [very] well-established" and Monument Life being "[relatively] small and recently formed". They both suggested that the trustees of their defined pension scheme had deliberately selected MetLife on the basis of its "financial assets and size", and the availability of protection from the UK's Financial Services Compensation Scheme ("FSCS") in the event that the provider of their annuities were to become insolvent. They also suggested that Rothesay had the possibility of "greater access to capital support [from its shareholders] should it be needed" than Monument Life.

- Another policyholder (Mr. Molony) also questioned why a more "well-established" financial institution was not selected by Rothesay for the transfer, whilst Mr. Buckley questioned Monument's reputation and asserted that it had no presence in Ireland, describing it as a "non-entity" and a "brass plate" company.

- In these respects, some of the policyholders drew attention to my decision in re Prudential Assurance Company Limited and Rothesay Life plc [2019] EWHC 2245 (Ch) ("Prudential") and suggested that similar factors were present in this case to those that caused me to refuse to sanction the transfer of annuities from Prudential to Rothesay in that case.

- Some of these points are factually incorrect. Rothesay is not more established than Monument Life. Monument Life has in fact been in existence for longer than Rothesay: it was incorporated in 2000 and Rothesay only in 2006. Monument Life also has a significantly greater physical presence in Ireland than Rothesay. Monument Life has the services of about 70 staff at offices in Dublin (the staff are employed by a services company in the Monument group as is frequently the case): whereas Rothesay is based in the UK and has no branch in Ireland.

- As regards size and resources, although it is true that Monument Life is far smaller in size than Rothesay in terms of assets and liabilities, as the independent expert has observed, the absolute size of a company or the absolute level of its Excess Capital are not, of themselves, a reliable guide to the security of benefits. It is primarily the proportionate size of assets compared to liabilities, and hence of Excess Capital, which is significant. In that respect, according to the independent expert, Monument Life is broadly equivalent to Rothesay. I shall consider that issue further below in relation to the potential effects of COVID-19, together with the availability of FSCS protection.

- I also consider that the Scheme is plainly distinguishable on the facts from the proposed transfer in the Prudential case. In that case, I heard from opposing policyholders that they had chosen the transferor company ("PAC") as their annuity provider because of the size and financial strength of the company and the larger Prudential group of which it formed an integral part, together with PAC's very long-established reputation over more than a century for organic growth and experience in successfully providing long-term financial products. Indeed, those attributes were the ones which PAC used in its marketing to policyholders, together with statements that fostered a reasonable assumption that PAC (and no other company) would be committed to providing annuitants with their income for life. Those characteristics contrasted sharply with Rothesay's much smaller size, the fact that it did not share a common name and business reputation with its shareholders (who might therefore not have the same commercial incentive to support it if the need arose), its relatively recent formation and rapid growth through acquisitions rather than building its business organically, and hence its lack of an equivalent long-term track-record in the business of providing annuities.

- In this case, the Transferring Policyholders (or their pension plan trustees) did not chose Rothesay to provide them with annuities: they chose MetLife and have only become holders of policies with Rothesay relatively recently by reason of a Part VII transfer scheme in late 2015. The Transferring Policyholders can therefore have no reasonable basis to insist that they should remain with Rothesay as opposed to any other insurer.

- As regards group structure and reputation, both Rothesay and Monument Life are relatively young companies, they each are owned by overseas shareholders, they each have sought actively to expand by (among other things) portfolio transfers of annuity policies, and neither has a long-established reputation for the provision of long-term products and services in the life insurance business.

- Further, and equally importantly, in Prudential, the scheme for the transfer of the annuity business was promoted for a particular commercial reason of PAC which did not derive from the conduct of the annuity business itself, but derived from PAC's desire to reduce its regulatory capital requirements in connection with a planned demerger of the Prudential group of which it was a significant member. The scheme conferred no benefit or advantage whatever upon the transferring policyholders, the transferring policyholders would no longer benefit from the likelihood that PAC would be supported, if the need arose, by the wider Prudential group, and PAC's commercial purpose of reducing its regulatory capital requirements had already been achieved by reinsurance with Rothesay which was not conditional upon sanction of the scheme. In such a situation, as I indicated in paragraph 23 above, there is a powerful argument that annuity policies should not simply be transferred to suit the unrelated commercial purpose of the insurer if the policyholders are thereby exposed to potential prejudice or additional risks without any counterbalancing advantage.

- In contrast, the Scheme in this case is the result of the external impact of Brexit which has forced Rothesay to take steps which are not of its own choosing to protect policyholders and avoid them suffering prejudice. Moreover, although the Reinsurance Agreement has served the purpose of fixing the price and providing certainty as between Rothesay and the Monument group, it does not solve the underlying problem of ensuring that the Transferring Policyholders can continue to be serviced and paid after the end of the Implementation Period on 31 December 2020.

- One policyholder (Mr. Hartnett) asserted that there are fundamental differences between regulation by the FCA and PRA in the UK and by the CBI in Ireland under the CBI's Consumer Protection Code ("CPC"). The policyholder cited, in particular, certain differences between the FCA's conduct regulation and the CBI's CPC as regards maintenance of financial resources, suitability of discretionary decisions and dealing openly and co-operatively with regulators. He also referred back to the collapse of the Irish banking sector and two earlier Irish insurance insolvencies as indicative of a failure of the Irish system of "self-regulation".

- Although expressed in different terms, as indicated above, the current regulatory regimes in the UK and Ireland are both based upon Solvency II. Although differing in form and wording, in essence they impose the same requirements on insurers and there is no reason to suppose that they will diverge to any material extent in the foreseeable future. Moreover, the examples of Irish insurance company failures to which the policyholder referred all pre-dated the introduction of Solvency II in Ireland; and there were similar failures in the UK. As such, both the independent expert and the PRA and FCA who reviewed his opinion were satisfied that there was no material prejudice to Transferring Policyholders from the change in regulatory regime from the UK to Ireland. I see no reason to disagree with that conclusion.

- The FSCS is a UK "fund of last resort" that compensates eligible customers in the event of the insolvency of a "Relevant Person". In this context, a Relevant Person is a financial services firm, including an insurer, authorised by the PRA or FCA. Eligible customers include private customers (i.e. those that are not businesses) holding policies written in the UK or in another EEA country by a UK insurer.

- For annuity contracts like the Transferring Policies, the FSCS will currently pay 100% of an eligible claim. This means that if an insurer within the scope of the FSCS were to become insolvent, any annuity benefits payable to its policyholders who are eligible customers should be paid by the FSCS to the extent that the benefits cannot be paid from the assets of the insolvent insurer.

- All Transferring Policyholders are believed to be currently eligible customers. As matters stand, therefore, the transferring policyholders would therefore be entitled to claim on the FSCS in the unlikely event of Rothesay becoming insolvent. If the Scheme is implemented, however, holders of Transferring Policies will become policyholders of Monument Life. There is no comparable compensation scheme for life insurance business, including annuity contracts in Ireland, or indeed in any other member state of the EU.

- As indicated above, a number of the policyholders who objected to the Scheme asserted that they (or their pension trustees on their behalf) specifically chose an insurer based in England when acquiring their policies because of the existence of the FSCS. Their complaint is that the potential loss of FSCS protection is a material disadvantage which ought to lead me to refuse to sanction the Scheme.

- I first note that Transferring Policyholders will not necessarily lose FSCS protection as a result of the Scheme. Under the current FSCS rules, Transferring Policyholders will remain eligible for FSCS protection if Monument Life is a Relevant Person at the time it becomes insolvent and unable to pay benefits.

- Monument Life was a Relevant Person for the purposes of the FSCS rules while the UK was a member of the EU and, under the terms of the Withdrawal Agreement between the UK and the EU, it will continue to be a Relevant Person until the expiry of the Implementation Period on 31 December 2020.

- In November 2018, the UK government passed the EEA Passport Rights (Amendment, etc., and Transitional Provisions) (EU Exit) Regulations 2018 (SI 1149/2018). It provided for a three-year temporary permissions regime (the "UK TPR") transitional period from the date of the UK's departure from the EU without a withdrawal deal in place for EEA firms operating in the UK before that date. The UK TPR will allow non-UK EEA insurers to continue to operate in the UK over a further transitional period of up to three-years starting from the end of the Implementation Period.

- Monument Life has applied to enter the UK TPR, and its status as a Relevant Person for the purposes of the FSCS rules will continue while it remains in the UK TPR. In addition, and importantly, however, Monument Life has indicated in the evidence to me that it intends to submit an application to allow it to establish a so-called "third country" branch in the UK within the transitional period covered by the UK TPR. Mr. Moore QC submitted that Monument Life has a commercial imperative to apply to the UK authorities to enable it to establish such a branch office in the UK, since about 95% of all of its policyholders (excluding the Transferring Policyholders) are resident in the UK and it needs to continue to be able to service and pay those policyholders. If such a branch is established, Monument will remain a Relevant Person and the Transferring Policyholders would, at least for so long as the current FSCS rules continue, benefit from the possible rights of compensation under the FSCS.

- There is a further UK regime, the Financial Services Contracts Regime (the "FSCR"), which applies from the end of the Implementation Period to allow non-UK EEA insurers to run off policies that are already in force. This applies to a firm which has entered the UK TPR, but which leaves that regime without obtaining a UK authorisation for a third country branch. The FSCR applies to a firm in these circumstances for 15 years from the date on which the firm left the UK TPR, although the regulations provide for its possible extension by HM Treasury. As such, if Monument Life is not successful in its application to establish a branch in the UK, upon leaving the UK TPR, it will fall within the FSCR and will be a Relevant Person for as long as it continues to do so up to 15 years. After that time, however, the Transferring Policyholders would lose FSCS protection.

- Against this background, the independent expert's conclusions on the issue of possible loss of FSCS protection for Transferring Policyholders are as follows,

- The FCA also considered this issue. After paraphrasing the independent expert's view and noting that even where the risk of insolvency of the transferee is remote it is appropriate to consider "possible mitigations", the FCA "acknowledges that other options to provide security to the Transferring Policyholders have been considered but none are considered proportionate". The FCA report then stated,

- I confess that I do not find the FCA's views easy to follow, not least its suggestion that in other circumstances, policyholders could be given the option of those policies being cancelled and there could be a "return of pro-rated premiums for the remainder of the duration of the policy". I find it difficult to understand that suggestion in the context of annuity policies in payment. Nonetheless, in spite of the obscurity of expression, the view of the FCA seems to be clear, namely that the mitigation offered by Monument Life of applying for branch authorisation in the UK so as to maintain FSCS protection is considered by the FCA to be sufficient protection for Transferring Policyholders in circumstances in which there is an overall net benefit of providing certainty of continued service to policyholders based in Ireland.

- In considering this issue it is, in my view, first necessary to appreciate that prejudice to Transferring Policyholders as a result of loss of FSCS protection is a very remote possibility, for a number of reasons. First, because the evidence is that the risk of insolvency of Monument Life is itself very low for reasons that I have explained. Secondly, because Monument Life is intending to establish a branch in the UK which will provide continued access to FSCS protection for Transferring Policyholders. Whilst there can be no assurance in this respect, neither the independent expert nor the PRA or FCA have suggested any reason why authorisation for such a branch is unlikely to be given. Thirdly, because even in the absence of a branch in the UK, on the basis of current UK law it would seem the Transferring Policyholders will continue to have access to the FSCS for at least 15 years (although I accept that this point is not as strong as the other two given that some of the Transferring Policies could remain in existence for far longer).

- Further, although the Transferring Policyholders resident in Ireland (or the pension scheme trustees on their behalf) may have had the existence of the FSCS in mind when they chose a UK-based insurer (MetLife) for their annuity policies, they doubtless did so on the much more important assumption that it was, and would remain, lawful for that insurer to be able to continue to be able to service and pay the annuity policies in Ireland. In that respect, the problem faced by the Transferring Policyholders of Rothesay losing its ability to service and pay their policies in Ireland after the end of the Implementation Period is a far greater and more immediate problem than the possible loss of FSCS protection should it be needed at some point in the future.

- In that regard, it is, of course, unfortunate that Rothesay does not have a branch in Ireland, but the court does not have the power (under Part VII FSMA or otherwise) to require it to establish such a branch. Nor, for reasons that they have given, do the UK regulators consider it appropriate to require Rothesay to apply to the CBI to establish such a branch rather than to promote the Scheme. Further, the court also has no power to require Rothesay to find another UK insurer with a branch in Ireland as a potential transferee, and I have no evidence that one would be available.

- In this respect, reference can be made to the decision of Hoffmann J in London Life Association Limited (supra) in which the judge rejected a suggestion by opposing policyholders that the board of London Life should, instead of proposing the scheme for the policyholders to be transferred to the Australian Mutual Provident Society (AMP), have made investigated the Japanese insurance market or made arrangements for them to transfer to Equitable Life (which was, at the time, thought to be a particularly sound institution). Hoffmann J stated,

- For my part I entirely accept the views of the UK regulators and the independent expert that the benefits of ensuring continuity of service for Transferring Policyholders far outweigh the very remote risk that the situation will arise in which, first, Monument Life were to fail, and secondly that FSCS protection would not then be available. There has also been no concrete suggestion, still less any assurance, that any other scheme or other outcome which would guarantee continued FSCS protection would be attainable in the time available before 31 December 2020. In those circumstances, it would be quite wrong for me to deprive Transferring Policyholders of the certain benefits that the Scheme offers in the hope that some better result might be found in terms of FSCS protection.

- A number of policyholders expressed concern that Rothesay was proceeding with the Scheme at a time of heightened uncertainty given the COVID-19 pandemic. In that regard, the question is whether Transferring Policyholders are more or less likely to be protected from the future adverse effects of the pandemic if they remain with Rothesay or are transferred to Monument Life. Or as Mr. Moore QC put it in argument, COVID-19 is an external shock in addition to Brexit which has had financial and operational impacts on the parties irrespective of the Scheme, "but the critical question is whether those impacts are [or may be] asymmetric as between Monument Life and Rothesay".

- Against that background, the independent expert sought to investigate whether any group of policyholders are likely to be materially disadvantaged as a result of the COVID-19 pandemic if Transferring Policyholders are transferred to Monument Life rather than remaining with Rothesay.

- As regards security of benefits, the independent expert expressed the view in the summary of his Supplemental Report dated 8 July 2020 that the on-going COVID-19 pandemic had not caused him to change the view expressed in his original report that the Scheme had no material adverse effect upon the security of benefits of Transferring Policyholders. He expressed this view on the basis, among other things, that the financial positions of both Rothesay and Monument Life have been resilient up to now in spite of the challenging economic conditions, and that both companies have maintained adequate liquidity. The independent expert also indicated that stress and scenario tests performed by both companies estimating the impact of severe adverse events that might arise due to the future development of the COVID-19 pandemic show that both companies would continue to meet their SCR requirements.

- In the body of his Supplemental Report, where the independent expert discussed this issue, he indicated that he was not at liberty to disclose details of the COVID-19 stress and scenario tests conducted by Rothesay and Monument Life publicly, but he described the results of the Monument Life tests as follows,

- Surprisingly, however, the independent expert did not give any similar information as regards the impact of the stress and scenario tests carried out by Rothesay. As a result I was unable to make any comparison to assess whether COVID-19 might have an asymmetric effect as between Rothesay and Monument Life. In other words, it was not clear from the independent expert's two reports whether his view was that Rothesay would be better placed to withstand the future effects of the COVID-19 pandemic than Monument Life. Equally surprisingly, especially given that the effect of COVID-19 was one of the issues expressly raised by policyholders, neither the FCA nor the PRA picked up or addressed this point in their second reports.

- After I had pressed this point at the hearing of the application, the independent expert produced further evidence by way of a letter to the court dated 24 July 2020. In that letter, the independent expert first confirmed that the extreme scenarios used in the stress testing had been selected by each company based upon their own internal risk management policies, and that he considered that they were appropriate to their respective risk profiles. It was also emphasised to me that such extreme scenarios were not predictions of anticipated outcomes.

- The independent expert then commented that both companies had assessed the possible effect of the pandemic on their liabilities. Although it was not possible to be certain, Rothesay took the view that the likely effect of the pandemic would be that its liabilities to annuitants would decrease, but Monument Life considered that its liabilities in respect of policies covering sickness and unemployment might rise.

- As a precursor to his further analysis, the independent expert reiterated that both companies have similar capital management policies, but that as at 31 March 2020 Rothesay's SCR coverage ratio was 183%, which was significantly higher than its target range, whilst that of Monument Life was 152% plus the €5.4 million, which was only just over the top of its target range.

- The independent expert then stated that on the basis of Rothesay's actual SCR coverage ratio as at 31 March 2020,

- However, in an earlier paragraph in his letter, the independent expert had explained why he considered that the appropriate comparison is not between the outcome of the stress testing scenarios on the actual level of Excess Capital held by Rothesay and Monument Life, but should be between those outcomes on the basis that both companies were starting from a position with Excess Capital at or just above the target levels in their respective capital management policies. In that regard, he said,

- On that basis, the independent expert stated as follows,

- The independent expert then expressed his conclusions on the effect of the COVID-19 scenario stress testing as follows,

- The further question which arose as a result of this analysis was whether the independent expert's view that reliance should not be placed on Rothesay retaining its current higher level of Excess Capital was based upon a theoretical possibility that such Excess Capital might be lost, used to support new business ventures or be distributed; or whether there was a real possibility that Rothesay would lose, use or distribute that higher level of Excess Capital in the foreseeable future notwithstanding the COVID-19 pandemic. I therefore requested further input from the independent expert in this regard.

- In an additional letter to the court dated 30 July 2020 the independent expert expressed the opinion that,

- The stated reasons for that opinion were that Rothesay does not intend to maintain the buffer over its target Excess Capital because of uncertainty over COVID-19, or intend to strengthen its capital management policy because of COVID-19. Rothesay told the independent expert that it is unlikely that it would look to pay a dividend or repay capital to its shareholders before the middle of next year, but that it is actively seeking new business which would result in the deployment of Excess Capital. Under Rothesay's business model, that new business may comprise bulk annuity purchases from pension schemes, transfers of business into Rothesay under Part VII (or an overseas equivalent) and/or the acquisition of other annuity providers.

- To put this into context, Rothesay wrote new annuity business of £13 billion in 2018 and £16 billion in 2019, and the independent expert took the view that it would be reasonable to envisage that it might be successful in winning new business of an additional £6 billion in the next six to twelve months. Depending upon the level of reinsurance obtained, the independent expert was of the opinion that this that might more or less eliminate Rothesay's Excess Capital over and above its target range.

- The independent expert also stated that Rothesay had told him that it is altering the asset mix of investments backing its recently acquired business to meet its long-term investment strategy. Rothesay has been switching assets during the first half of 2020 and anticipates switching the remainder over the next twelve months. Given the long duration of assets, Rothesay has estimated that the impact of asset switching on SCR coverage could be a reduction of up to ten percentage points, depending on the precise asset mix.

- Pulling these threads together, the independent expert summarised his views in this way,

- The PRA's comments on the additional materials from the independent expert were to reiterate that it does not place reliance upon capital held in excess of that required to meet an insurer's capital management policy and risk appetite, and that such Excess Capital is not assumed to be permanent. It observed that the PRA's review includes, but is not limited to, Solvency II capital metrics. The PRA then stated,

- As regards Rothesay's approach to dividends and writing new business, the PRA simply drew my attention to a letter which it had sent to insurers on 31 March 2020 which reminded firms,

- The net result of these additional materials was although some Transferring Policyholders might think that they would be better off staying with Rothesay because it currently has a stronger capital position due to holding greater levels of Excess Capital over and above the target range in its capital management policy, and hence that Rothesay could better withstand the problems which might be caused by the COVID-19 pandemic than Monument Life, that was not the view of the independent expert. He took the view that Rothesay's plans for expansion of its business over the next year mean that its current level of Excess Capital provides no greater protection against the effects of the COVID-19 pandemic than Monument Life's current level of Excess Capital, and hence that policyholders would not be materially adversely affected by being transferred to Monument Life.

- That view did not appear to be disputed by the PRA, which as indicated, generally places no reliance on levels of Excess Capital, and has simply relied upon the CBI, as an EEA regulator operating under Solvency II, satisfying itself of Monument Life's ability to meet its SCR after the Scheme becomes effective.

- In the end, I was persuaded by the additional material from the independent expert. This showed that the result of Rothesay's business model of active expansion will likely be to reduce Rothesay's Excess Capital to the top of its target range over the next six to twelve months, which is approximately where Monument Life is already. The independent expert also took the view that both companies are equally likely to remain able to satisfy their capital management policies notwithstanding the COVID-19 pandemic. However, if some of the extreme scenarios relating to COVID-19 used in their respective internal stress testing were to occur, he also stated that the outcomes for both companies would also be similar, in that both companies would fail to meet their respective Excess Capital targets, but would still have sufficient assets to cover their respective SCRs.

- As such, and to return to Mr. Moore QC's test, it would seem to me that the effects of COVID-19 are not likely to be asymmetric as between Rothesay and Monument Life. Transferring Policyholders can have no greater assurance that the security of their benefits will be unaffected by COVID-19 if they were to stay with Rothesay than if they were to be transferred to Monument Life.

- I therefore did not think that the possible impact of the COVID-19 pandemic gave me any reason to refuse to sanction the Scheme and thereby deprive Transferring Policyholders of the benefit of certainty as regards the servicing of their policies in Ireland after the end of the Implementation Period on 31 December 2020.

- I was satisfied that all of the necessary steps had been taken under the relevant regulations made pursuant to section 108(1) FSMA and that in accordance with section 111(2) that the appropriate certificates under Schedule 12 FSMA had been obtained. These included, in particular, a certificate from the CBI confirming that Monument Life will, taking the proposed transfer into account, possess the necessary margin of solvency and has the necessary authorisation to carry on the business to be transferred to it; and a certificate from the PRA under paragraph 3A of Schedule 12 as to consultation with, and consent (or deemed consent) from, EEA regulators.

- For the reasons that I have given above, I considered that the Scheme would not put any affected policyholders in a materially worse position than if the Scheme was not implemented, and it served the valuable purpose of ensuring that the policies of the Transferring Policyholders will be able to be serviced and paid after 31 December 2020 whatever the outcome of the Brexit negotiations between the UK and the EU. I therefore considered that I should exercise my discretion to sanction the Scheme.

MR JUSTICE SNOWDEN

Background

The Scheme

The Law

The effects of the Scheme

Security of benefits

Regulatory capital

The effect of the Scheme on the capital position of the parties

The effect upon Transferring Policyholders

"I am satisfied that implementation of the Scheme will have no material adverse effect on the benefit security provided to the Transferring Policyholders.

I have formed this opinion taking into account, amongst other things, that:

The effect of the Scheme on non-transferring policyholders

Conclusion on security of benefits

Policyholders' reasonable expectations and consumer protection

Conclusion on reasonable expectations and service standards

Policyholder objections

Brexit

"[The] PRA notes that this Part VII transfer is Rothesay's preferred plan to avoid the risk that the Irish government will not permit it to lawfully service EEA policies over their lifetime after the end of the transition period (expected to be 31 December 2020) following the UK's withdrawal from the European Union. The risk that Rothesay will not be able to service these policies after the transition period is a standalone risk that has the potential to manifest regardless of the firms' capital positions and it is one that the PRA considers to be both real and material to UK insurers with outstanding EEA policies. This is because there is uncertainty at the moment as to what temporary regimes will be in place in the various EEA states to permit run off of UK insurers' business following the transition period and what will be the length of temporary regimes in those EEA states that will adopt them. The PRA recently wrote to UK insurers with EEA business in relation to their contingency plans to ensure that their EEA policies can be lawfully serviced in EEA states after the transition period. In the present case, the transferring policies are annuity policies with long tail liabilities and there is therefore a risk that even if a post-transition period temporary regime is adopted in Ireland, the duration of the regime may not be sufficient to cover the transferring policies over their lifetime."

(my emphasis)

The letter to insurers to which the PRA refers made it clear that the PRA expected insurers to have contingency plans in place to ensure service continuity and to have addressed the possibility of a "no-deal, no transition" scenario.

"Having considered the point raised by the policyholder, in my opinion, there is no appropriate reason to delay implementation of the Scheme. There is a very real risk that Rothesay will be unable to lawfully service the Transferring Policies at some stage in the future. To defer taking action simply adds additional uncertainty to the process. In my opinion, it is important for Transferring Policyholders that the transfer is completed as soon as practicable to ensure that there is no interruption to the payment of benefits under their policies and to provide certainty for all parties."

The choice of Monument Life as transferee

Differences in regulation between the UK and Ireland

Possible loss of FSCS protection

"I consider that the value lost by Transferring Policyholders from any possible loss of FSCS protection after the Financial Services Contracts Regime period is outweighed by the benefit of having certainty that the insurer responsible for paying benefits to policyholders is lawfully able to do so regardless of the outcome of negotiations concerning the longer-term trading relationship between the UK and the EU. The potential loss of EU freedom of services rights following the end of the Implementation Period represents a material risk to the ongoing servicing and benefit payments on the Transferring Policies and so it is necessary and appropriate for Rothesay to take action. I have reviewed the alternative solutions that were considered by Rothesay to ensure continuity of service and benefit payment and I am satisfied that a transfer to an Irish insurer is an appropriate solution in light of the available options.

The possible loss of FSCS protection after the FSCR period is an unavoidable risk of transferring to an Irish insurer in circumstances where that Irish insurer's future status under the FSCS rules after the FCSR period depends on it obtaining authorisation from the UK regulatory bodies and where that authorisation cannot be certain."

"If the transfer had been motivated by purely commercial factors, the FCA would likely have wanted to see some further mitigation for the affected policyholders. For example, an offer by the firm to cancel the policy or any policyholder for whom loss of FSCS would be an issue, and return pro-rated premiums for the remainder of the duration of the policy. However, as the purpose of the Scheme is to avoid any uncertainty of the UK losing its passporting rights. [sic] Therefore the transfer seeks to improve the certainty around the Transferor's ability to service certain existing EEA-based policyholders which we consider to be a net benefit that can be taken into account when considering any loss of protection.

Monument Life will seek to take the steps [to apply for authorisation to establish a branch in the UK] in order to maintain FSCS coverage for Transferring Policyholders. The FCA does not currently consider it appropriate to object to the proposals for lack of any further mitigation proposals, in order to achieve a higher degree of protection."

"The court does not have to be satisfied that no better scheme could have been devised. A board might have a choice of several possible schemes, none of which, taken as a whole, could be regarded as unfair. Some policyholders might prefer one such scheme and some might think they would be better off with another. But the choice is in my judgment a matter for the board. Of course one could imagine an extreme case in which the choice made by the board was so irrational that a court could only conclude that it had been actuated by some improper motive and had therefore abused its fiduciary powers (Howard Smith v Ampol [1974] AC 821). In such a case a member would be entitled to restrain the board from proceeding. But that would be an exercise of the court's ordinary jurisdiction to restrain breaches of fiduciary duty; not an exercise of the statutory jurisdiction under [the predecessor of Part VII FSMA]."

The possible impact of COVID-19

"In some circumstances, these extreme scenarios result in Monument Life being unable to meet the target level of capital set out in its capital management policy. However, in all scenarios, its capital is expected to remain above the regulatory requirement of the SCR.

In such circumstances, which I stress are extreme, Monument Life has a number of actions available to it to restore its capital position, including seeking a capital injection from its parent. While I cannot guarantee that such an injection would be forthcoming, information shared with me demonstrates that, with its current level of capital, Monument Re is expected to be able to withstand similarly extreme scenarios and continue to hold capital above its target levels such that it is likely it would have resources to provide support to Monument Life.

Under these extreme scenarios, even if Monument Life is unable to restore its capital position to meet its target level, it should be able to pay policyholder benefits in full, as holding capital above the level of its SCR will provide a buffer against further adverse experience."

"Although not stated explicitly in my Supplementary Report, I can confirm that, given this starting position to assess the impact of the scenarios considered, Rothesay's capital would be sufficient to meet its internal target level of Excess Capital in all of the scenarios that it has shared with me."

"In my view, Excess Capital held by a company that is above the target set in its capital management policy should not be relied upon. This is because … subject to certain logistical and governance hurdles, current Excess Capital above the internal target level could, in principle, be transferred out of a company through dividends or the repayment of capital. It could also be eliminated through future adverse experience or used to support additional risk-taking in the company, such as writing new business, acquisitions or other business activities, which would increase the SCR and thereby reduce the level of Excess Capital. It is therefore more instructive, when considering security of policyholder benefits, to consider the target rather than current Excess Capital."

"… if the impact of the scenarios were to be assessed on the basis of Rothesay holding Excess Capital equal to the top of its internal target range [an SCR coverage ratio of 150%], rather than on the materially higher actual position, it would fail to meet its Excess Capital target under some of the scenarios considered.

Therefore, if the starting position were similar for both companies in terms of holding Excess Capital at the top end of their internal targets, the outcomes of applying the scenario stresses referred to above would be similar in that, while both companies would under some of the stresses fail to meet their respective internal capital targets, they would still have sufficient assets to cover their respective SCRs."

"Given its current level of capital, which is significantly above its internal target, Rothesay will be able to withstand the adverse experience considered under its stress scenarios and still maintain its target Excess Capital. As explained above, I cannot rely on Rothesay maintaining this current level of capital. If Rothesay were to apply its stress scenarios from a starting point of holding capital at the top end of its internal target level of Excess Capital it would, in some of the scenarios, fail to cover its target Excess Capital after the stress and would be in a similar position to that of Monument Life.

… if possible extreme outcomes associated with the COVID-19 pandemic do occur, there would be very limited impact on the ability of Monument Life to pay policyholder benefits as they fall due. I would expect Monument Life to continue to meet its SCR and to be able to pay policyholder benefits in full. Consequently, in my opinion, if the Scheme is implemented, the impact of the ongoing Covid-19 pandemic is not likely to lead to a materially worse outcome for Transferring Policyholders …"