Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> CGL Realisations Ltd, Re [2020] EWHC 1707 (Ch) (10 July 2020)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2020/1707.html

Cite as: [2020] EWHC 1707 (Ch)

[New search] [Printable PDF version] [Help]

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

INSOLVENCY AND COMPANIES LIST (Ch D)

IN THE MATTER OF CGL REALISATIONS LIMITED (FORMERLY COMET GROUP LIMITED) (IN LIQUIDATION)

AND IN THE MATTER OF THE INSOLVENCY ACT 1986

Royal Courts of Justice 7 The Rolls Building Fetter Lane London EC4A 1NL |

||

B e f o r e :

____________________

| GEOFFREY CARTON-KELLY AS LIQUIDATOR OF CGL REALISATIONS LIMITED (IN LIQUIDATION) |

Applicant |

|

And |

||

| DARTY HOLDINGS SAS (AS SUCCESSOR TO KESA INTERNATIONAL LIMITED) |

Respondent |

____________________

Mr Benjamin Strong QC and Mr Alex Barden (instructed by Sidley Austin LLP) on behalf of the Respondent

Hearing date: 18 May 2020

____________________

Crown Copyright ©

- I had before me two applications relating to essentially the same issues, namely whether at the relevant time for the purposes of section 240(1)(a) of the Insolvency Act 1986, CGL Realisations Ltd ('Comet') was connected to the Respondent, now Darty Holdings SAS, (as successor to the assets and liabilities of Kesa International Limited ('KIL')). Kesa Holdings Limited ('KHL'), which owned the entire shareholding in Comet, had entered into an agreement to sell the shares in Comet to Hailey Acquisitions Limited ('HAL'). Prior to the sale, Comet operated a revolving credit facility granted to it by KIL (the 'KIL RCF'). On 3 February 2012, being the date of the completion of the sale, Comet repaid £115.4 million owing under the KIL RCF. The question therefore is whether Comet was connected to KIL at the time of that repayment. The answer to this question depends upon my determination of three related sub questions:-

- I am grateful to all counsel in this case for dealing with their submissions before me in an expedient yet comprehensive way. In particular, I am grateful to Mr Gledhill QC on behalf of the Liquidator and Mr Strong QC on behalf of the KIL for the way they both dealt with my questions which has been of great assistance to me in being able to determine the issues raised in this case. The factual background relevant to the issues to be determined by me in this matter is agreed. There is also agreement that the issues raised can and should be dealt by me (unless I determine, on a consideration of the case, that there are issues of fact which would require determination). However, there is disagreement as to whether this matter should be determined by way of the strike out application issued by the Liquidator, or by way of a preliminary issue as applied for by the Respondent. Since there was no disagreement in relation to the issues which needed to be determined, I will waste little time dealing with this procedural issue. Mr Strong submits that the strike out would not really resolve the issue because he submits it is a mixed issue of law and fact and that even if the Liquidator is successful, the case would proceed to trial and there would not in essence be much of a saving. If it fails or succeeds, he submits the case continues. I disagree. In my judgment, as has in any event been made clear by Mr Gledhill, in so far as the strike out fails, the Liquidator would not be able to succeed because of my ruling that the parties were not connected at the relevant time. It is difficult to imagine how the Liquidator could continue his action with such a judgment against him on the connected point. The outcome of the preliminary issue would reach the same outcome in that if the preliminary issue was resolved in favour of the Respondent, then the Liquidator would not be able to continue his action by reason of the ruling.

- The effect of my decision upon the proceedings was certainly agreed between the parties. If I determine that either there was no connection at the relevant time, whether by reason of the issues raised in sub questions 1 or 2 or 3 above, then the Liquidator would be unable to proceed with his preference claim against KIL. This is because the alleged preference took place about 8 months from the time when Comet entered into an insolvency relevant event (here being the administration). Section 240(1)(a) states that the relevant 'look back' period in relation to a preference is 2 years only if the party is connected to the company in the relevant insolvency process. Otherwise, the relevant 'look back' period is six months (section 240(1)(b)). If I determined that KIL was connected at the relevant time, then this matter can proceed to trial. As there has been agreement between the parties as to the facts, in my judgment the issue raised does not require a determination of facts. Both parties are agreed that I can make a determination of the construction points relating to the documents without having to deal with any findings of fact relating to the surrounding circumstances. I agree. I am informed that there needs to be a CMC but this has been delayed pending the determination of the issues before me. The matter before me has been argued for a lengthy day (meaning sitting beyond 5 pm). Additionally, pre-reading time took over a day. Accordingly, the saving at trial is easily visible, in the event that the matter proceeds to trial.

- I will set out the relevant factual background but I do not propose to deal with procedural aspects of the current proceedings. References to particular parts of the pleadings will be made in so far as they are relevant to the issues I have to determine. Therefore, this is not and is not intended to be a comprehensive analysis of the preference claim. Equally, of course, this judgment does not consider the merits of the preference claim itself. The issue which requires determination by me is narrow. It will require that I consider carefully the ambit of section 239, that I consider the meaning of section 435(10) and additionally that I consider the relevant documents to determine the timing of the repayment by Comet to KIL of the KIL RCF. The relevant provisions of the Insolvency Act 1986 are set out in appendix 2 to this judgment. References to provisions in this judgment are to the provisions of the Insolvency Act 1986 save unless otherwise indicated.

- I have taken the relevant facts from the skeletons of both parties. Comet, a well known electrical retailer went into administration on 2 November 2012. On 3 October 2013, it was placed into liquidation. The Liquidator, also known as the additional liquidator, was appointed by order of this court on 7 June 2018. The preference claim made by the Liquidator against KIL arises from what the Liquidator asserts is an £83.1 million preference given to a connected party, KIL, on 3 February 2012 by reason of the repayment by Comet of the KIL RCF. The repayment of the KIL RCF arose out of the sale process entered into by KHL whereby it wished to sell the Comet Group.

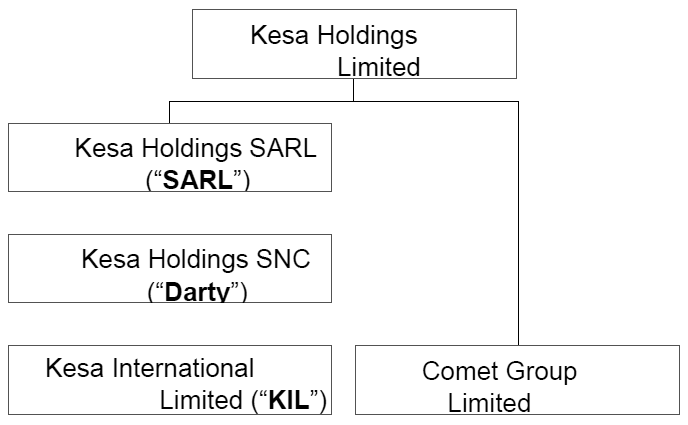

- After a sale process described in some detail in the witness statement of Mr Matthew Shankland, dated 12 May 2020, KHL decided to agree terms with OpCapita LLP. The acquisition vehicle was HAL. A detailed sale and purchase agreement ('SPA') was executed by KHL, Kesa Electricals PLC, Hailey Holdings Limited and HAL on 9 November 2011. The SPA related to the sale and purchase of the entire issued share capitals of Comet and Triptych Insurance NV. Although not relevant to the issues I have to determine, Kesa Electricals PLC was the parent company and Hailey Holdings Limited the 'topco' of HAL. At appendix 1 to this judgment is the agreed corporate structure. Besides the SPA, there is one further document entered into by various parties, namely the Completion Agreement ('the CA') dated 3 February 2012. The parties to the CA are as follows, Kesa Electricals PLC, KHL, KIL, Hailey Holdings Limited, HAL, Hailey 2 LP, Comet, Triptych Insurance NV and Macfarlanes LLP. As Mr Gledhill submitted, it is important to note that Comet was not a party to the SPA. Comet was a party to the CA and it is this document which is relied upon by Mr Gledhill. Mr Strong preferred to refer to the 'transaction', being the entire transaction whereby KHL sold its shares in Comet. Mr Strong made submissions and relied upon both the SPA and the CA. I will need to consider his submission in relation to both those documents.

- Briefly, under the terms of the agreed sale, any net intercompany debt above a specified level would be capitalised (effectively written off) prior to the sale of the shares in Comet and its sister company, Triptych. Both of these companies were part of the Kesa group of companies. Triptych operated a profitable insurance business. Hailey Holdings Limited would provide Comet with a loan of up to £186.6m (the HAL RCF) which would replace the KIL RCF as well as being used in part to repay the KIL RCF. KIL would repay Triptych the £73.1m intercompany balance it owed. This would be lent by Triptych to HAL to part-fund the HAL RCF. The HAL RCF would also be funded by (i) OpCapita investing £35m (via the Hailey 2 LP and Hailey Holdings Limited), (ii) Kesa making a capital contribution of £50m, and (iii) payment by Kesa of Net Additional Amount calculated at £28.5m. Comet gave a debenture to HAL in respect of the HAL RCF. The creation of the debenture in respect of the HAL RCF meant that borrowing of Comet under the RCF which was previously unsecured would be thereafter secured borrowing after the transfer of the shares. The security issue does not really have a bearing on the issues I need to determine save that it is agreed that was the effect of the sale as agreed and executed. Mr Strong submitted that complaints of the Liquidator are really aimed at HAL, but again this really has no bearing on the issues I have to determine.

- The sale was effected under the terms of the CA. Thereafter, as I have set out above, Comet was placed into administration in November 2012 followed by liquidation in October 2013. The preference claim was issued on 26 October 2018 and amended on 13 December 2019 with the matter being dealt with by way of Particulars of Claim, Defence and Reply. The current application seeking a strike out was issued on 22 April 2020. I will have to consider terms in both the SPA and the CA in more detail below, but for present purposes, it is sufficient to set out that the actual execution and completion of the sale followed a detailed sequence of transactions and events under the terms of the CA. The Liquidator's case effectively relies upon the sequencing of events, being on 3 February 2012, the repayment of the KIL RCF at 14.30 and the transfer of the shares at 14.59. For present purposes, I need to consider whether the relevant parties, being KIL and Comet, were connected at the time of the repayment of the KIL RCF. The fact that the connection was broken by 14.59 does not in my judgment alter this. As I mentioned to the parties during the hearing, the point I have to determine is a narrow one. The artificiality of the exercise is perhaps a consequence of what I am invited to determine.

- The parties are agreed in relation to the association/connection which exists pursuant to section 435 in relation to the left hand side of the corporate structure at appendix 1. It is therefore agreed that in accordance with the provisions of section 435, KIL is associated to KHL through the intermediate companies. KIL will therefore be associated to Comet pursuant to section 435, in the event that KHL is associated to Comet at the relevant time. It is this issue which is the core of the case before me.

- Although I have effectively summarised above the issues relating to this current application, the matter is set out in the pleadings as follows, starting with the Particulars of Claim:-

- In the defence, the relevant paragraphs are as follows :-

- As can be seen from these extracts from the Particulars of Claim and the Defence, the issue between the parties does entail that in the event I refuse to strike out paragraph 25 (b) to (d) of the Defence on the basis that there was no connection at the relevant time, then the Liquidator will be effectively unable to proceed by reason of the date of the alleged preference. Mr Gledhill submitted that effectively by paragraph 19, the Defendant had admitted in its pleading that the parties remained connected prior to the completion of the sale. Before me, Mr Strong submitted, as is clear from the sub questions formulated above, that in effect the parties were not connected at the time of the repayment. He relied upon his construction point, being that upon a reading of both the SPA and the CA, the repayment of the KIL RCF occurred at the same time as the transfer of shares or after the completion of the transfer of the shares. He submitted this was also by reason of the conditionality of the obligation placed upon Macfarlanes not to action any of the letters of payment instruction held by them until it had all the letters. In fairness to Mr Gledhill, I accept that the defence as pleaded did not cover these points. They were also not covered in the replies given to the Part 18 request. However Mr Gledhill accepted that they were now before the Court and therefore I needed to deal with them.

- In order to be able to assess the respective submissions relating to the issues of (1) timing of the repayment of the KIL RCF and the (2) 'transaction as a whole', the terms of the documents need to be considered. Mr Gledhill submits that the documents, in particular the CA , demonstrate that the repayment occurred prior to the transfer of shares. Mr Strong submits that the documents demonstrate that everything occurred simultaneously or in fact that the repayment was after the transfer of the shares (the conditionality point).

- Before I consider the documents themselves, I should deal with a submission made by Mr Strong in his opening of his case to me which also appears in his skeleton and is as I understand one of the reasons that Mr Shankland filed a lengthy witness statement detailing the negotiations and the entire sale process. Mr Strong submits that the conclusion that he reaches on the documents, being either that the connection was severed at the same time as the transfer of shares or after the transfer of the shares, is not surprising and therefore I should bear this in mind. As he points out, it would indeed be surprising if a transaction negotiated and carried out between parties at arm's length would maintain the connection that the Liquidator asserts. That, he submits would be a surprising outcome bearing in mind the sale process, the arm's length position of the parties and the way that the sale was put together.

- With all those elements and discretions to be exercised by the Court, it is in my judgment simply not possible to derive, as Mr Strong invites me to do, any sort of 'sense check test' in relation to his construction and interpretation of the documents for the purposes of determining the connected and associated test. Mr Gledhill did not, when asked by me, shy away from his case being that there was a connection at the time of the repayment which was then severed about 20 minutes thereafter. That is his case. However, that does not mean that a finding in his favour on the point before me would be surprising. As I consider in the section relating to section 435 and its construction, this is an extremely wide and, in many respects, artificial test. It is designed to be extremely wide and as I deal with below, the Court of Appeal has recently confirmed the wide parameters of the provision. It is not however the only jurisdictional hurdle or element to a successful section 239 action. The Liquidator may or may not be able to meet the other requirements. That is not a matter for this judgment.

- The parties to the SPA dated 9 November 2011 are KHL, KESA Electricals PLC, Haley Holdings Ltd and HAL. It does not include Comet. The brief description of the SPA is that it relates to the sale and purchase of the entire share capital of Comet Group PLC and Triptych Insurance NV. The repayment of the KIL RCF is but one of a series of complex, but not unusual transactions which are set out in the SPA. The relevant clauses which need to be considered are set out below although of course the entire document has been read and considered by me.

- These provisions divide steps between those falling under pre-completion steps and those due to happen at Completion. 'Completion' is defined simply as being, 'completion of the sale and purchase of the Shares under this agreement'. As Mr Gledhill pointed out, the steps set out in clause 8 are to be carried out in a careful and deliberate order, each step states that it is to be taken, 'prior to completion'. The next step states that it is to be carried out after the immediately preceding step. The repayment of the KIL RCF therefore is to occur, according to this clause by the operation of three different tranches. Tranches A and C are settled by there being a sum of money in the client account of Macfarlanes (HAL's solicitors) and by a series of instructions letters, Macfarlanes hold the sums to the account of A, then B and so on. Tranche B effects a payment by way of a set off. All of the steps are the repayment. Clause 8.9 makes it clear that 'Prior to Completion but after the step set out in sub-clause 8.8, the Company shall draw down £35,000,000 under Tranche A of the Revolving Credit Facility'. Clause 8.10 requires the parent, KHL to procure that prior to completion but after the step set out in clause 8.9 (which will entail completion of all the steps up to clause 8.9 and therein is a reference to completion of the steps in clause 8.8 and so on) the company shall repay the amount of the KIL RCF. Mr Strong's submission is that this is only an agreement to repay, not the payment itself. I will deal with this below. Clause 8.10 also demonstrates the limitations upon the SPA because the relevant parent 'shall procure' in relation to the relevant member. So the SPA does not in my judgment create any obligation upon Comet itself to repay the KIL RCF. The relevant parent is the one under an obligation under the SPA rather than Comet itself.

- Clause 9 states the locality of completion and also refers to Schedule 2 (which is set out in this judgment at appendix 3) as setting out the steps which the Seller and the Purchaser must carry out at completion. In so far as completion is deferred pursuant to clause 9.4, there is a specific reference to the provisions of clause 8 applying to completion as so deferred. This lends to the submission of Mr Gledhill that there are two specific and distinct times, namely the steps which are required to be carried out pre-completion and those which form the basis of completion. Reference needs to be made to Schedule 2, which I have set out in appendix 3 of this judgment in its entirety. Turning to Schedule 2, the steps which are set out in clause 8, which include the repayment of the KIL RCF are not referred to. This in my judgment is because those steps have effectively been carried out at the pre-completion stage. Completion in accordance to what is set out in Schedule 2 includes the transfer of the shares and the registration of the same.

- Mr Gledhill submits that the SPA sets out the pre-completion steps in clause 8 and these include the repayment of the KIL RCF as one of those steps as covered in Tranches A, B and C. He submits that as is clear from the terms of the SPA, it is silent as to the timing of the various steps to be carried out and those matters are located in the CA. Mr Strong submits that what the parties are envisaging in the SPA and what is agreed will happen is that Comet will agree to repay at the pre-completion stage. He of course accepts that the obligations set out in the SPA are those agreed and imposed upon the relevant Parent company and not Comet itself because the latter is not a party to the SPA. He submits that Comet is not agreeing that a payment is going to be made pre-completion. Instead, the Parent is under the obligation to procure that Comet agrees to make the repayment at the pre-completion stage.

- One of the difficulties with this argument of Mr Strong is that, if he is correct, then one would expect to find in the SPA details of exactly when the matters which Comet has agreed to carry out according to his argument, are actually going to be executed. The SPA provides no details in relation to this point. In fact, as I have already stated above, the steps set out in clause 8 are not mentioned or referred to in the completion schedule (being schedule 2). Mr Strong also relied upon clauses 7.5 and 7.6. Clause 7.5 states that subject to clause 7.6, at Completion, the Purchasers will procure that there is paid by or on behalf of each relevant member of the Group to each relevant member of the Retained Group the amount of Group Debts which that member of the Group owes to that member of the Retained Group. Clause 7.5 (B) provides for the payment of Group Debt going effectively the other way, namely from the Seller. The definition of Group Debt is 'the aggregate of the amounts stated in lines 14-17 (Titled 'Group Debts') in the New Debt Statement, being the aggregate of all Inter-Company Balances which will be owed at the Effective Time by the Group to the Retained Group'. In essence clause 7.5 deals with the inter company liabilities. These are in my judgment not the same as the payments and other steps which are set out as being pre-completion steps in clause 8. This conclusion is fortified by a reading of clause 7.6 which sets out how the payments pursuant to clause 7.5 are to be satisfied and refers expressly to clauses 8.9, 8.10, 8.11 to 8.15, 8.16 to 8.21. All of these clauses are expressly to be performed in their numerical order which requires the steps set out in the preceding sub clause to be effected beforehand and which are to occur prior to completion. So even though there is at first sight some tension with the reference to 'at completion' at the start of clause 7.5, when that clause as well as clause 7.6 and the entirety of clause 8 is considered, in my judgement the steps in clause 8 are to take place before any further steps referred to in clauses 7.5 and 7.6.

- I have considered above the careful sequencing which requires the steps set out in clause 8 to occur one after the other and the reference to the same in clause 7.6 means that these steps in my judgment are agreed by the parties to occur before Completion. Despite the wording at the start of both clauses 7.5 and 7.6, I do not find that this provides real support to Mr Strong's submissions. This is because of the reference to the pre-completion steps in clause 8 as well as appearing in any event to relate to the repayment of certain intercompany liabilities rather than being related to the repayment of the KIL RCF which is expressly covered by Tranches A, B and C in clause 8. Even if Mr Strong is correct that what is set out in the SPA clause 8 is merely the 'agreement to pay' rather than payment itself, there is in my judgment no reference in the SPA as to when the payment itself was to occur.

- The Completion Schedule (see appendix 2 to this judgment) sets out what the purchaser's and the seller's obligations are 'at completion'. Clause 1(A) expressly states that the Seller must deliver a duly executed transfer in respect of the company shares in favour of Bidco (HAL). Sub Clause 8 states that the Seller must, '[at completion] procure the payment by way of telegraphic transfer (using the CHAPS system) of the cash amounts payable by any member of the Retained Group to any member of the Group, if any, pursuant to clauses 7(Completion Payments) and 8 (Pre-Completion Steps)'. The pre-completion steps relating to the repayment of the KIL RCF are set out in Tranches A, B and C. They do not operate as such to create 'cash payments' because they are to be carried out by payments, loans and set off which do not require an actual cash payment. Moreover, on the issue of timing, clauses 7 and 8 distinguish between the pre-completion steps set out in clause 8 and later steps. As such, in my judgment, I do not consider that this schedule assists in the construction sought by Mr Strong. Equally, for the reasons set out below with reference to the clauses in the CA, Mr Strong's submission relating to there being no more than 'an agreement to pay' until the moment of Completion does not accord with the terms of the CA. Even if the SPA set out only an agreement to pay, a consideration of the CA sets out when that payment is to be made.

- Submissions were made to me in relation to Schedule 12, entitled Payments Summary. This list is a schedule setting out the steps which are to be taken. Mr Strong relied upon this schedule with some force as supporting his argument that the SPA only related to an agreement to pay and not the payment itself happening at a pre-completion stage. The Schedule itself sets out the steps and identifies the agreement to repay the KIL RCF as step 3, pre-completion step, and refers to the payment of the same as part of the completion step, being step 6. The transfer of the shares is set out in step 6 as well but as a step higher up than the payment of the KIL RCF. In so far as this Schedule is relied upon as evidence that under the terms of the SPA, the agreement to pay was a pre-completion step but the payment itself was at the same time or after the transfer of shares, it does not actually accord with the terms of CA to which Comet was a party. Additionally, this schedule is a payments schedule and in my judgment it would be surprising to find the actual order of events in a payments summary rather than in the body of the document itself. The SPA is, as Mr Gledhill submitted, silent as to the actual timing of the order of events in relation to the execution of the SPA. That is to be found in the CA. The obligations relating to the payment of the KIL RCF appear in the CA because that is the agreement to which Comet is a party. Mr Strong did not seek to submit that the CA was not relevant, but asserted that by reason of the conditionality of the Macfarlanes payment instruction letters, all payments were made at the same time as the transfer of shares. I will deal with this conditionality argument when considering the CA. However for present purposes, I am not convinced that what is set out in Schedule 12 enables me to construe the SPA as setting out the payments as being made all at the same time. There is no substantial clause in the SPA which actually sets this out for the reasons Mr Gledhill submitted and with which I agree.

- Turning to the CA, which is relied upon by Mr Gledhill, this is the agreement to which Comet is a party and which sets out the timetable in relation to the steps which are to be carried out. Mr Strong submits that despite what is set out therein, the construction of this CA alongside the SPA supports his interpretation that all steps were to occur simultaneously or the transfer was to occur prior to the repayment of the KIL RCF.

- As Mr Gledhill pointed out the CA dated 3 February 2012 is between many parties including Macfarlanes, solicitors instructed by HAL, were required to hold certain payments made before releasing them under the terms of the CA. Comet was also a party to the CA. It is the CA which sets out the sequencing of events in relation to the completion of the agreement set out in the SPA. As such, Mr Gledhill submitted, it was this agreement which determines the sequence of events. He points to the definition of Pre-Completion Time which, 'means the time, prior to Completion, on the Completion Date (London time) at which the parties to this Agreement (acting in good faith) agree that the Completion Steps (other than the payments of the Kesa Final Amount and the OpCapita Final Amount) will occur.' This envisages certain events occurring prior to the Completion time itself. The definition of 'Completion' is said to have the meaning given to it in the SPA. The CA defines 'Completion Steps as having the meaning given in Recital A, which states, 'Pursuant to, and in accordance with the share purchase agreement between the Seller, the Parent and the Purchasers dated 9 November 2011 …relating to the acquisitions of the entire issued share capital of the Company [Comet] and Triptych by Bidco and Topco, respectively the Purchasers, the Parent and the Seller have each agreed to make certain payments (or procure that certain payments are made) prior to Completion or, as the case may be, at Completion (the 'Completion Steps').' This in my judgment accords with what Mr Gledhill has submitted, namely that there are pre-completion as well as completion steps. That is what has been agreed between the parties. This does not accord in my judgment to the agreement to pay being the pre-completion step and not the payment itself. However the entirety of the terms of the CA need to be considered.

- Clause 4 of the CA sets out how the sums which are to be paid move around and additionally when such sums are paid.

- As set out in clause 4, the movement of funds is carried out by an irrevocable undertaking provided by the parties to instruct Macfarlanes and an agreement by Macfarlanes to action the relevant irrevocable 'payment instruction letters' in accordance with clauses 5,6,7 and 8 of the CA. Clause 5.1 sets out the obligations on the parties in relation to Tranche A. Sub Clause (D) states that in satisfaction of the provisions of, 'clause 8.10 of the SPA, notwithstanding the provisions of clause 7.6(B) of the SPA, the Company shall deliver the duly executed and completed Step 8.10 Payment Instruction to Macfarlanes' The form of Payment Instruction is at Schedule 1 of the CA. This irrevocably instructs Macfarlanes, with effect from the completion of the step set out in clause 5.1(c) of the CA, to cease holding the sum of £35,000,000 (being an amount equal to the Hailey 1 Funds) that Macfarlanes currently holds to the order of Comet and instead to hold the sum in the client account to the order of KIL. That payment Instruction therefore executes the obligation in clause 8.10 of the SPA. That, submits Mr Gledhill occurs before completion itself, even if this is on a notional (paper) basis. This in my judgment is an actual payment rather than as Mr Strong submits, an agreement by Comet to pay. So the question is when in accordance with the CA does this payment occur.

- Clause 8, which is titled 'Final Payments' states that, subject to clauses 4.1, 4.2, 4.3 and 4.4 of this Agreement, Macfarlanes shall, as soon as is reasonably practicable following completion of the steps set out in clause 7.2 of the Agreement, action the Kesa Final Amount Payment instruction and the OpCapita Final Amount payment Instruction. 'The steps in clause 7.2 relate to the execution of Tranche C which cannot be carried out until the steps necessary for Tranche B have been carried out which itself cannot be carried out until the steps in relation to Trance A have been carried out. This is what arises from clause 7.3. Clauses 4.1 to 4.4 relate to the movement of funds steps. In this way, the procedure sets out a clear sequence which ensures certain steps are carried out before others. This accords with the careful sequencing set out in the SPA as well.

- Clause 8 of the CA deals with what happens after the steps set out in the preceding clauses have been executed. It states, 'Subject to the clauses 4.1, 4.2, 4.3, and 4.4 above, Macfarlanes shall, as soon as reasonably practicable, following completion of the steps set out in 7.2 of the agreement, action the Kesa final payment instruction and the OpCapita final amount payment instruction'. As is set out in clause 4.1, there is a distinction made between Macfarlanes actioning all the payment Instruction Letters in accordance with clauses 5, 6, 7 and 8 of the CA 'on the Completion Date' and at the pre-completion time and timing of the Kesa Final Payment Instruction and the OpCapita Final Payment Instruction. These last two Payment Instructions are to occur, 'at completion' and not at the pre-completion time. That clause makes the clear distinction in my judgment between the completion date and a pre-completion time. This does not lend itself to have a simultaneous completion of all the carefully sequenced events set out in the pre-completion time.

- Mr Strong submits that the CA is consistent with his argument that there is simply an agreement to repay under the terms of the SPA and the payment itself is effected at completion and not before. He relies upon clauses 3.1 and 3.2 which he submits have the effect of Macfarlanes binding itself not to make payment or make any of the requisite movement of funds set out the Payment Instruction Letters until it has received all the Payment Instruction Letters. This is also covered in clause 4.2 set out above. This is Mr Strong's conditionality argument. He submits that by reason of Macfarlanes not being able to action the Payment Instruction Letters until it is in receipt of all them means that all the relevant steps occur at the same time, at completion.

- The relevant clauses are as follows :-

- Clause 3.1 stipulates that each completion party (this includes Comet and all the other parties to the CA save Macfarlanes) shall provide their respective duly executed and completed Payment Instruction letters as early as possible on the Completion date, but importantly as is set out in the last part of that clause, 'in any event before the Pre -Completion Time'. In my judgment, when clause 3.2 is considered, whereby all the completion parties instruct Macfarlanes not to action any of the Payment Instruction Letters unless it has received all of them, the receipt of those letters will, in accordance with clause 2.1, occur prior or at the commencement of the Pre-completion time. If not all the letters are received prior to, or at the Pre-Completion Time, then Macfarlanes do not action them through the various stages set out and during the Pre-completion Time. Equally Macfarlanes are not, pursuant to clause 3.2(A)(ii), to action the letters until the receipt of both the Hailey 1 Funds and the Kesa Funds. Pursuant to clause 2.2, the Kesa Funds are already paid over to Macfarlanes as at the date of the CA and are held by them in its client account. The Hailey 1 Funds are, pursuant to clause 2.1, to be paid over to Macfarlanes at or before Pre-Completion Time.

- In my judgment clauses 2 and 3 together make it clear that the irrevocable Payment Instruction letters are to be executed and delivered to Macfarlanes prior to or at Pre-completion Time. Equally the payment of Kesa funds as well as the Hailey 1 funds were also to be received by Macfarlanes before or at Pre-completion Time. This would therefore allow the movement of funds to occur in accordance with clause 4 and following the careful and detailed sequence set out in clauses 5, 6 and 7, during the Pre-completion time. Mr Strong's argument relating to Macfarlanes having to be in receipt of all the requisite letters before it could action them meaning that all these steps would take place at completion time is, in my judgment, inconsistent with the clear terms of the CA. The parties to the CA set out carefully the sequencing of the events with reference to the sequence of the events set out in the SPA. Clauses 5 – 7 of the CA set out the movement of funds, in their respective sequence. These clauses do not reflect any 'agreement to pay' but set out the actual payments. Moreover, as those clauses make clear, in my judgment, those payments occur during the Pre-completion Time. According to clause 3.2, the Pre-completion steps will only occur when Macfarlanes have all the letters before or at Pre-Completion Time and not at the later completion stage. Clause 3.2(C) requires Macfarlanes not to carry out the Pre-completion payments sequence in the event that the Completion takes place more than two business days after receipt by Macfarlanes of the Kesa Funds. This clause again does not assist Mr Strong because it simply requires Macfarlanes not to carry out the payments under the pre-completion steps if the completion date, preceded by the proposed Pre-Completion Time will be more than two business days after receipt by Macfarlanes of the Kesa Funds. The conditionality of the obligation upon Macfarlanes occurs prior or at Pre-Completion Time. This ensures that Macfarlanes is in receipt of all the letters before it commences the detailed sequence of payments under the terms of the CA and as mirrored in the SPA.

- In the event that I am wrong on the construction of the terms in the CA, Mr Gledhill counters the submission of Mr Strong relating to the conditionality by saying the element of conditionality does not alter the timing of the different steps in the agreement. The agreement contemplated and in fact set out the steps which were to occur by way of pre-completion and these steps were to occur before the completion itself. The agreement did not contemplate that all steps were to be treated as happening simultaneously. Mr Gledhill submits that the agreement does set out that Macfarlanes cannot make one payment without making all of them but also that the clause does not alter the other clauses of the agreement which set out a precise sequence of when each payment is made. Mr Gledhill submits that the 'all payments or none' clause does not affect the timing of the various payments. They are made on condition that in the event completion itself does not occur, then all payments are not 'made'. This only makes sense when one considers the notional and paperless payments being made under the various clauses by Macfarlanes. In so far as necessary, I accept this is correct. The timing of the payments to be made during Pre-completion would not be affected by a conditionality clause, in the event that the terms of the CA set out such a clause. For the reasons I set out above, the clauses relied upon by Mr Strong only create a condition relating to a period prior to or at the Pre-completion stage. This cannot be equated in some way to those payments being made instead at Completion Stage. In conclusion, Mr Strong's argument on construction fails for the reasons set out above. Accordingly in my judgment, under the terms of documents considered above, the repayment of the KIL RCF occurred before the transfer of the shares.

- As is set out above, what I need to consider here is whether at the time of the repayment, Comet remained connected to KHL. The answer to this question effectively answers the issue identified in the sub question here, because there is no dispute that KHL was connected to KIL and therefore if KHL is also connected to Comet, then KIL is connected to Comet under the provisions of section 435. Mr Gledhill submits that Comet was connected to KHL as at the time of repayment because KHL was still the owner of the shares and entitled to exercise one third of more of the voting power at any general meeting of the company. This is the first limb of section 435 (10)(b). The second limb of section 435(10)(b), was not completely conceded by Mr Gledhill, but sensibly he devoted his submissions to the first limb of 'entitled to exercise' rather than 'control the exercise of'. As only one or the other is necessary, I will consider the first limb and only if I am satisfied that it is not met, I will proceed to consider the second limb. Mr Gledhill's submission is that whatever restriction KHL had agreed to by entering into a SPA, being a contract, at all times until the transfer of the shares it held in Comet, it has remained entitled to exercise its voting power at a general meeting. It is irrelevant whether it has elected not to exercise that vote because it has restricted its ability by reason of the SPA. The provision considers 'an entitlement to exercise a voting power'. That is wide enough to cover the position of KHL. So the issue is whether KHL would have been entitled to exercise the voting power.

- Mr Strong submits that by reason of the entry into the SPA, KHL was not free to exercise any vote at a general meeting and that therefore the connection had been severed. He relies upon the terms of the SPA as creating a restriction upon the ability of KHL to vote freely. He says there is a restriction on the way that KHL can vote and accordingly KHL is not entitled to exercise its vote at a general meeting. He submits that after the entry into the SPA, KHL is not entitled as against the company, Comet, to prevent the repayment of the KIL RCF as it had been agreed as part of the SPA. As Mr Strong submitted, it would have no choice but to approve the repayment of the KIL RCF.

- As both Counsel agree, the two cases which I need to consider in this area are Re Kilnoore Ltd, Unidare plc v Cohen [2005] EWHC 1410 (Ch) and Granada UK Rental & Retail Ltd v the Pensions Regulator [2019] EWCA Civ 1032 (also known as Box Clever). Unidare is a decision of Mr Justice Lewison (as he then was) in relation to whether shares in Kilnoore Limited (the company) which were held on an express bare trust fell within the first limb of section 435(10)(b). The case concerned a share purchase agreement dated 31 January 2002 which provided for completion to take place immediately after the execution of the agreement. However, the share transfer itself was not perfected until August 2002. The parties had agreed as part of the SPA that, in the intervening period as between exchange and completion and actual perfection by registration in the company's books, the purchaser's rights were protected by an irrevocable power of attorney. The irrevocable power of attorney which was to be executed by Unidare ( the vendor) appointing Kozo Limited ( the purchaser ) as Unidare's attorney in respect of shares, pending stamping and registration of the transfers. Pursuant to clause 2 of the SPA, Holdings undertook not to exercise any right, power, privilege attaching to the shares without Kozo's consent. As held by the Judge, 'the trust thus declared was, in my judgment, a bare trust'. Therefore, during the period between the execution of the agreement and the perfection of the transfer of shares, Unidare, as the vendor of the shares was a pure nominee of the buyer.

- The Judge went on to consider whether the legal owner of the shares was still entitled to exercise or control the exercise of one third or more of the voting power. After considering various cases in relation to tax and whether directors had a controlling interest in shares held by them beneficially. At paragraph 54 the Judge set out his conclusions from the cases,

- Of course the discussion in Unidare related to the position of an entity which held the shares as a bare trustee. As Mr Gledhill submitted, a bare trusteeship is the extreme case whereby the beneficiary can seek to collapse the trust ( see so far as necessary Saunders v. Vautier (1841) 41 ER 482). It is the bare trustee position which occupied the Judge as is clear from the following paragraphs :-

- Mr Strong does not seek to argue that the position of KHL is that of a bare trustee. He also accepts that there was no irrevocable power of attorney. He does submit that by reason of the execution of the SPA, the purchaser acquired a beneficial interest in the shares. Further he submits that Unidare enables him to argue that KHL is not entitled to exercise voting power by reason of the restrictions imposed on it under the SPA. This is not to say that there is an express term in the SPA relating to voting its shares, but Mr Strong submits this follows from the SPA. I disagree. In paragraph 54 (i) and (ii), Mr Justice Lewison dealt with the principles which cover a party in KHL's position. Firstly, a determination of a person's entitlement to exercise its voting rights is resolved by looking at the register of members. In the case of KHL, this means it remained up to the transfer itself, the registered member. Secondly, it is not permissible to look outside these materials and to inquire whether there are contractual or fiduciary restraints, as between the registered shareholder and others, which inhibit him from exercising those rights. This is exactly, in my judgment, the position before me. Mr Strong's argument invites me to go behind the list of members. This, in my judgment, does not accord with what is set out in Unidare or indeed accord with considering the actual words of the provisions. The provision (section 435(10(b)) simply asks, who is entitled to exercise the voting power? It does not ask who can actually effectively and in reality exercise the voting power. It is a hypothetical question. Those who control the voting power are caught by the second limb of section 435(10)(b), but the provision also catches those who are quite simply entitled to exercise the voting power. This demonstrates the width of section 435.

- As I observed to Mr Strong during the hearing, the entirety of section 435 is drafted deliberately widely. I gave the example of former husbands and wives remaining associated (section 435(2) and (8)) despite my observation that in many cases, there can be little logic in the notion that that former husbands and wives would act in some way in their common interests. This confirms in my judgment the hypothetical approach of the entire provision. The only exception was in relation to the extreme case of a bare trusteeship. Even this exception has now been disapproved and rejected in the more recent Court of Appeal case of Box Clever, which I now turn to.

- Even if I am incorrect about the position of KHL based on the judgment of Mr Justice Lewison in Unidare, in my judgment, the case of Box Clever places the matter beyond doubt. This was a case concerning the exercise by the Pensions Regulator of one of its moral hazard powers, section 43 of the Pensions Act 2004. That provision entitles the Regulator to impose a financial support direction (FSD) on those who are connected and associated at the relevant time with the company which is the employer in relation to the relevant occupational pension scheme. The connected and associated test is one of the hurdles which the Regulator needs to meet in order to be in a position to seek the relevant FSD. In many ways, similar to the operation of the connected and associated test in relation to insolvency provisions, the connected and insolvency test in this pensions legislation also operates as one of the jurisdictional hurdles. Again, similar to the insolvency provisions, meeting this jurisdictional hurdle does not in itself create a liability for the FSD. There are many other hurdles as well as a general requirement of reasonableness to be exercised before an FSD is imposed. The pensions legislation has adopted the definition of sections 249 and 435 of the Insolvency Act 1986 for the pursues of its connected and associated test.

- The Box Clever case was heard by way of a referral from the Determinations Panel of the Pensions Regulator in the Upper Tribunal which held, alongside many other issues, that at the relevant time, the 'Targets' being the Appellants, were connected to the scheme because under the terms of the debenture (which had secured the borrowing obtained for the joint venture to acquire the business) the right of the three employer companies' parent, BxC Holdings, to exercise the voting of the shares in the three companies, had not ceased on the occurrence of the declared default under the terms of the debenture. Under the terms of the debenture, BxC Holdings would cease to be able to direct the votes if notice had been given to that effect after the occurrence of a declared default. The Targets had a 50 % interest in the parent, BxC Holdings. As no notice had been given, BxC Holdings remained entitled to vote and the Targets remained connected for the purposes of section 435(10)(b).

- In relation to the fourth participating employer company, TUK, it was argued on the appeal that its immediate parent, THSP did not have control of TUK because THSP was in administrative receivership from 2003 and therefore on 31 December 2009, it was not 'in control' of the voting power by reason of the administrative receivership. The argument failed. The Court of Appeal held that the administrative receivership made no difference to the exercise of voting power. The receivers were agents of the company. As between THSP as owner of the shares and the company itself, pursuant to section 435(10)(b), THSP was entitled to exercise more than one third of the voting power. The Court of Appeal stated that it made no difference that it would be the administrative receivers who would decide how to vote in the event of any general meeting. It was still THSP exercising its entitlement to utilise its voting power in relation to the company, TUK.

- Counsel on behalf of the Targets relied upon the decision of Unidare as in some way supporting the analysis of the Targets. Counsel submitted that as the Targets had no influence at all over matters relating to TUK once the administrative receivers were appointed, this meant that the Targets should no longer be considered as being entitled to exercise the voting power. In rejecting this argument, the Court of Appeal gave detailed consideration to the judgment in Unidare and after considering the various tax cases (the controlling interest argument) which had been discussed and considered by the Judge in Unidare, the Court of Appeal (the judgment being given by Lord Justice Patten) stated as follows:-

- Mr Strong invited me to consider that the passages above are in reality obiter because effectively, the decision relating to the administrative receivers being entitled to exercise the vote did not arise in Unidare (referred to in the Court of Appeal as Kilnoore). Moreover, he submitted that this part of the judgment was also obiter by reason of the decision in relation to the other three employer companies in relation to the terms of the debenture. In my judgment, the Court of Appeal gave a clear and reasoned judgment which included consideration of the decision in Unidare. In so far as it took a different view from that taken by Mr Justice Lewison in Unidare, this was in relation to those who hold as bare trustees. As I have already set out above, KHL is not a bare trustee and does not argue before me that it is in the same exceptional and extreme case of a bare trustee. What the decision in Box Clever does, is conclude that even a bare trustee is caught under section 435(10)(b). In my judgment as I have already set out above, Mr Strong's reliance upon Unidare fails because KHL's position was not one of a bare trustee and the passages of Mr Justice Lewison relating to those in KHL's position, having contractual or fiduciary restraints apply. However, the Court of Appeal in Box Clever makes it clear that the provision is actually wider than Mr Justice Lewison considered because even bare trusteeships are caught as being entitled to exercise a voting power. In those circumstances, I cannot see how KHL is able to assert that it is not connected pursuant to section 435(10) (b). Regardless as to whether the passages I have set out above can be said to be obiter, Mr Strong's argument fails both in relation to his reliance on Unidare and any 'last gasp' in his argument fails under Box Clever. I am not prepared to ignore the passages I have set out above from Box Clever but even if I were so minded, as I have made clear above, the argument based on Unidare fails in any event.

- Section 239 defines a preference as being for the purposes of this case, 'the company does anything or suffers anything to be done which (in either case) has the effect of putting that person in a position which, in the event of the company going into insolvent liquidation, will be better than the position it would have been in if that thing had not been done' ( s239(4)(b)). The Liquidator's pleaded case in this respect is that Comet repaid the KIL RCF. Mr Gledhill submits that is the act relied upon. Mr Strong submits that the repayment of the KIL RCF was 'part and parcel' of the transfer of ownership of the Comet Group out of the hands of Kesa and the repayment of the KIL RCF was not and should not, he submits, be viewed as a separate transaction. If he is correct, then he submits this means that in viewing the entire transaction, Comet was not connected with KIL at the relevant time. He supports this submission of considering the 'entire transaction' by reference to three cases, being Agricultural Mortgage Corporation PLC v Woodward [1995] 1 BCLC 1, Philips and another v Brewer Dolphin Bell Lawrie Ltd [2001] UKHL 2, and Damon v Widney PLC (unreported (ChD ) 28/11/01, 2500/2001). The case of Damon v Widney PLC is, it appears, an extempore decision of Mr Justice Neuberger (as he then was).

- The general principles which derive from Woodward and Brewer Dolphin are well known, but they merit scrutiny because neither of them in my judgment actually assist Mr Strong in his submission. In Woodward, the transaction which was being considered was between the husband and wife, pursuant to section 423 of the Insolvency Act 1986. The husband knew that the Bank was pursing him and granted his wife a tenancy in relation to the farm property which decreased the value of the property and essentially prevented the Bank from pursing the entirety of its debt. The wife argued that the tenancy agreement was for full value and therefore there was no transaction at an undervalue. In the Court of Appeal, Sir Christopher Slade stated, 'In applying section 423(1)(c) to the facts of the present case, one must look at the transaction as a whole. The tenancy agreement cannot be considered in blinkers'. This therefore enabled the Court of Appeal to consider the benefits obtained by the wife by reason of the transaction as a whole rather than just the actual tenancy agreement. The consideration was therefore not limited to just the value of the tenancy agreement, but included her ability to secure her home, exploit the property on an agricultural basis as well as placing her in a valuable 'ransom' position vis a vis the Bank. Accordingly, the consideration of 'the transaction' was not restricted to what was to be paid by the wife under the terms of the tenancy. However the 'entire transaction' in this case enabled the Court of Appeal to consider as between the parties the benefits and value of the consideration given and received.

- In the House of Lords case of Philips and another v Brewer Dolphin Bell Lawrie Ltd, the Court of Appeal carefully analysed the transaction considered for the purposes of section 238 of the Insolvency Act 1986. It held that only the consideration which flowed from that transaction between the parties would be taken into account for the purposes of assessing the consideration provided and received between the parties. This accords with the wording of section 238(4)(b), which states, 'the company entered into a transaction with that person for a consideration the value of which, in money or money's worth, is significantly less than the value, in money or money's worth, of the consideration provided by the company'. At paragraph 20 of the judgment, the House of Lords did not detract from what the Court of Appeal stated was the transaction for the purposes of section 238(4)(b), but stated that the approach to be followed was to consider the issue of consideration. According to the House of Lords, section 238(4)(b), that subsection did not stipulate by what person the consideration is to be provided. On this basis, the House of Lords considered the collateral agreement which had been entered into by the same parties. The House of Lords therefore determined that it was not just a question of identification of the transaction but identification of the consideration provided and received. So in my judgment this also does not assist Mr Strong because on a careful reading, the case does not provide authority for his entire transaction submission. The issue of consideration is key in relation to both section 238 claims and section 423 claims. Consideration is not relevant for a preference claim. The case before me relates to a preference, which is not necessarily involved with a transaction but with an act.

- Damon v Widney is a section 239 case. It was the hearing of an application to strike out the Liquidator's originating application which relied upon section 238. Lifeplan Ltd ('Lifeplan') was a wholly owned subsidiary of Widney PLC. Lifeplan had unsecured borrowings of about £2.7 million from its parent. It had other substantial trade creditors, debtors and assets. It was also the respondent in arbitration proceedings which had been stated against it by Euro Atlas. Widney and the Lifeplan took advice from solicitors and accountants to develop a scheme whereby 'Newco' would be created to acquire all the assets of Lifeplan alongside take responsibilities for some of its liabilities. The scheme involved Lifeplan being left with two liabilities, the large liability owed by it to Widney and the potential liability to EuroAtlas which might arise under the ongoing arbitration proceedings. As observed by the Judge, the scheme which was carried out was effectively a book entry device. The purchase price to be paid by Newco to Lifeplan would be used by Lifeplan to repay the loan to Widney. Widney would use the repaid loan to advance to Newco a new loan in the same amount to Newco. Newco would then use the funds it received from Widney to pay the purchase price for the assets and liabilities to Lifeplan. Once this transaction was carried out, the Lifeplan would be left with no assets capable of meeting an eventual Euro Atlas lability. In fact, such a liability emerged at the arbitration hearing which was not paid by Lifeplan. The award against Lifeplan was in the sum of £480,000. Unsurprisingly, Euro Atlas pursued Lifeplan and Lifeplan was wound up by order of the court.

- The Liquidator's case brought against Widney sought relief pursuant to section 239. The Liquidator claimed that Widney received the sum of £2.7 million from Lifeplan after that company had been denuded of all its assets with the exception of the liability to Widney and its liability to Euro Atlas. Accordingly, Widney received a preference in the sense that it was paid in full whereas Euro Atlas was paid nothing. The Judge considered the competing submissions as between the parties. Counsel on behalf of Widney argued that the transaction had to be looked at as a whole. However even when considered as a whole, in so far as a case could be made out against Widney pursuant to section 239 and 241, that case related to Widney being on one day a creditor of Lifeplan in the sum of £2.7 million and the next day being a creditor of Newco in the sum of £2.7 million with the benefit being that Widney did not need to share pro rata with the remaining creditor of Lifeplan, Euro Atlas. Counsel accepted that there may be a case relating to the position of Widney even if the whole transaction was viewed, but that this would not amount to the entirety of the loan.

- Counsel for the Liquidator submitted that in considering the words used in section 239(4)(b), it was not an issue of considering the entire transaction between the parties but the act being relied on, namely the repayment of the loan. Although the Judge agreed that considering the transaction in a 'realistic and commercial way' was appropriate, the Judge did not prevent the Liquidator from being able to pursue its claim. Section 239(3) requires the Court to make such an order as it thinks fit for restoring the position to what it would have been if the company had not given that preference. The Judge directed declaratory relief in relation to the quantum, acknowledging that in considering section 239(3), the sum involved in the case was how Widney, as a creditor had improved its position. With this restriction, the claim was allowed to proceed in its entirety to trial.

- In my judgment the difficulty in seeking to rely upon this case is that although the Judge had before him the arguments relating to a 'narrow' and a wider construction of section 239(4)(b), the Judge did not rule upon the matter. The Judge stated at page 9 of the judgment, 'It may be therefore that the wording of section 239(4)(b) requires one to concentrate on the position of the person vis a vis the Company, and the Company vis a vis the person, and not to cast one's eyes wider. Even if that is so, I do not think it affects the ultimate outcome of this case.' The 'entire transaction' in this case related to all the steps identified by the scheme described above, where it appears from the judgment that the company was a party thereto.

- In my judgment the cases above do not assist KIL in seeking to rely upon the entire transaction being effectively the 'act' in section 239(4)(b). Two of the cases relied upon are of course transactions at an undervalue cases, one under section 238 and the other under section 423. The case of Widney is a section 239 case and I have set out more detail of the facts therein. I am not persuaded that on an analysis of whether a party is connected to another, I should attempt to rewrite the 'act' being relied upon by the Liquidator. Such a strike out application failed in Widney. Additionally, in any event the entire transaction which Mr Strong invites me to interpret as being what needs to be considered in relation to the preference is not an entire transaction as between all the same parties. Comet is not a party to the SPA. In Widney it appears that the company, Lifeplan was a party to the scheme.

- In any event even if Mr Strong is correct about his 'entire transaction' argument, in my judgment, this does not prevent Comet being connected to KHL at the relevant time. I have held above that the entire transaction argument does not necessarily operate when the company in question, namely Comet, is not a party to the 'agreement' which Mr Strong sough to rely upon, namely the SPA. Even if he were able to rely upon the SPA, I am not persuaded this would allow him to assert that all the events set out in the SPA and the CA occurred at the same time. The effect of the transaction was to enable the shares of Comet to be acquired by another party. In order to succeed, Mr Strong would have to persuade me that the act identified and relied upon by the Liquidator needs to be amended to be effectively the entire transaction and that additionally, that entire transaction occurred all at the same time such that the repayment of the KIL RCF took place at exactly the same time as the transfer of shares. This goes against what is set out in the CA. As I have set out above, the issues before me relate to the connected and associated issue as identified by both parties in their pleadings. What this point being made now really goes to is whether KIL is entitled effectively to seek to strike out the act relied upon by the Liquidator as being the preference. That was the case before the Judge in the Widney case. In the case before me, the issue relates to connected and associated. I reject Mr Strong's submissions that the preference identified needs to be the entire transaction and that if he was correct in that, this would mean all the steps occurred at the same time.

- I have reached the conclusion that the Liquidator's application succeeds for the reasons set out above. In summary, the relevant documents do not demonstrate that the repayment of the KIL RCF occurred at the same time or later than the transfer of shares. The provisions of the Insolvency Act 1986 do not require me to seek to rewrite the act relied upon by the Liquidator to be the entire transaction rather than the act of repayment of the KIL RCF as relied upon and pleaded by the Liquidator. Moreover, as I have dealt with above, for the reasons set out in the section of this judgment dealing with the construction of the documents, it is clear that in relation to timing, the repayment of the KIL RCF occurred prior to the transfer of the shares. This is what the parties intended and went into some great detail to achieve under the terms of the documents. Finally, KHL was entitled to exercise its voting power which exceeded 30% at a general meeting of Comet pursuant to section 435(10)(b) of the Insolvency Act 1986. This period when KHL could have exercised its voting power is a very short period of time. However Box Clever makes it clear that section 435 is to be construed widely. The Court of Appeal stated that the provision is not about who controls the voting in practical terms. That must apply even if the period of time between the act which forms the basis of the preference and the severance of the connection is as short as in this case. Accordingly, those parts of the defence which seek to argue that there was no connection at the relevant time are to be struck out. In relation to the application brought by KIL by way of a preliminary issue, this is answered by me by declaring that KIL was a person connected with the Comet in relation to the alleged preferential payment, in so far as this is necessary. I invite the parties to seek to agree an appropriate form of order. If the issue of costs can also be agreed, then that should be incorporated in any draft order.

- After I had circulated my judgement in draft, at the same time as receiving the required return, I received an email from Junior Counsel, Mr Alex Barden, on behalf of the Respondent inviting me to consider points which he submitted I had not covered in my judgement relating to the submissions made. In relation to the first point made in that email, which related to paragraph 14 above, I have slightly altered the word used there. Nothing turns on this amendment by me as it is simply a question of more appropriate language.

- The second point raised in the email is said to be a failure by me to deal with one of the submissions relating to the conditionality point raised by Mr Strong. I have dealt at paragraphs 34 to 36 with the issue relating to the timing of the receipt of the Payment Instruction Letters and the funds, being the Kesa Funds and the Hailey 1 Funds. In particular, I noted that all of these matters had to be complied with at or prior to the Pre-Completion Time. So the conditionality of the obligations imposed upon Macfarlanes to make those payments occurred at the latest at Pre-Completion Time. However what Mr Barden asserts is that the Respondent's submissions also included the submission that Macfarlanes were obliged by virtue of clause 3.2(B) either to make all the Payments or none. The submission is that therefore Macfarlanes were obliged to make the Final Amount Payment Instalments which were required by clause 4.1(B) and 4.3. These payments were to occur later than at Pre-Completion Time. Therefore, by reason of clause 3.2(B), all the payments were therefore made at the later time being at the time that those

- In my judgment, clause 3.2(B) needs to be placed carefully into the complex and interlinking arrangements made in the CA both in relation to obligations upon the parties and timing. Whilst as I have analysed above, until the moment of just before or at Pre-Completion Time, Macfarlanes was not obliged to act upon the Payment Instruction Letters until it had received all of them as well as the Kesa Funds and Hailey 1 Funds. These are the conditions stipulated in clause 3.2. However, in my judgment clause 3.2(B) does not create on its own some further conditionality such that it is capable of being construed as altering the timing of the payments to be made under the terms of the CA.

- The Respondent's submission would in my judgement effectively elevate clause 3.2(B) to meaning that despite the fact that Macfarlanes are in receipt of all the Payment Instruction Letters as well as the Kesa and Hailey 1 Funds, the payments are all to be construed as happening at the same time by reason of clause 3.2(B). In my judgment, clause 3.2(B) ensures that all the payments must be made or none of them. It does not in itself alter the timing of the payments which are carefully set out in the CA itself and to which I have referred to in my judgment in some detail. This construction would effectively run counter to the distinction between Pre Completion Time and Completion Time set out in the CA as well as the careful sequencing set out therein. Unlike the conditionality which arises from having to receive all the Payment Instruction Letters as well as being in receipt of the Kesa and Hailey 1 Funds, clause 3.2(B) does not require anything more than Macfarlanes being obliged to make all the payments. Macfarlanes are in any event required to carry out all the obligations imposed upon it by the terms of the CA which would include making all the payments. That follows in any event from the terms of the CA itself which requires Macfarlanes to make the payments, by actioning the Payment Instruction Letters in accordance with clauses 4, 5, 6, 7, and 8 as well as making the final payments. So Macfarlanes are obliged to comply with all the clauses of the CA. Clause 3.2(B) does not alter the timing of the steps to be taken at Pre-Completion Time and those to take place at Completion. Accordingly, I reject as a construction that clause 3.2(B) means that all payments must be timed as occurring at the timing of the last payments made, being at Completion. That is not what these carefully sequenced and detailed provisions stipulate as I have set out in these addendum paragraphs as well as above in the judgment itself.

- The further issue raised by Mr Barden in his email relates to paragraph 22 which deals with consideration by me of clauses 7.5 and 7.6. These matters are adequately dealt with in paragraphs 19 – 25 and reference is made to all those paragraphs. However, even if I am incorrect in my construction of clauses 7.5 and 7.6 of the SPA, this in my judgment does not assist the Respondent. This is because clause 8 of the SPA is where the repayment of the KIL RCF is set out ( Tranches A, B and C ). The steps set out in clause 8 are stated to occur as pre-completion steps and are a detailed set of steps which are to occur sequentially before any of steps outside of clause 8. Even if in some way clause 8 is transformed as being steps occurring 'at completion', the Respondent still fails in my judgment on its submission relating to the construction of the CA. It is that agreement which sets out the precise timing of the steps and it was executed by all the parties. I have dealt with this extensively in my judgment.

Deputy Insolvency and Companies Court Judge Agnello QC:

Introduction and identification of issues

(1) whether on the basis of the relevant documents, the transfer of the shares in Comet from KHL to HAL occurred (a) after the repayment of the KIL RCF, (b) at the same time as the repayment of the KIL RCF, or (c) occurred before the repayment of the KIL RCF;

(2) on the assumption that the repayment of the KIL RCF occurred prior to transfer of the shares from KHL to HAL, whether at the time of the repayment of the KIL RCF, Comet was connected to KIL pursuant to section 435 of the Insolvency Act 1986;

(3) whether the preference identified by the Liquidator, being the repayment of the KIL RCF can be, for the purposes of section 239 of the Insolvency Act 1986, viewed in separation from the entire transaction carried out under the SPA and the Completion Agreement. If to be viewed as the entire transaction, then this raises the argument as to whether the repayment could be viewed as being made prior to the transfer of the shares.

Factual Background

The pleadings

'8. On 3 February 2012, and in contemplation of the sale of the Company to HAL, the Company and HAL concluded:

8.1 A revolving credit facility (the "HAL RCF"), under which, HAL agreed to lend up to £186.6m to the Company, subject to the approval of subsequent drawdown requests by its (HAL's) ultimate parent, Hailey 2 LP. And:

8.2 A Security Agreement, securing (so far as material) the Company's liabilities to HAL under the HAL RCF by means of fixed and floating charges over the Company's assets and undertaking.

9. Also prior to, and in contemplation of, completion of the sale:

9.1 £13,586,452 of the amount owing by the Company to KIL under the KIL RCF was capitalised pursuant to clause 8.4 of the SPA, in exchange for the allotment to KIL of 100,000 ordinary shares in the Company. And:

9.2 Repayment of the balance of £115,415,524 owing under the KIL RCF was demanded by KIL, and the same was paid by the Company in three tranches pursuant to clauses 8.6-8.21 of the SPA, as further provided for in a separate Completion Agreement, also executed on 3 February 2012.

10. The repayment of the KIL RCF, some 9 months before the Company went into administration, was a preference of KIL (being a creditor of the Company), in that it put KIL into a position which, in the event of the Company going into insolvent liquidation, was better than the position it would have been in, had that repayment not been made.

Specifically:

10.1 Following the partial debt capitalisation pleaded in subparagraph 9.1 above, KIL received 100p/£ in respect of the unsecured balance of £ 115,415,524 owed to it under the KIL RCF, whereas:

10.2 Had the Company gone into insolvent liquidation on 3 February 2012, KIL would have received a dividend of 28.04p/£ ( the "Counterfactual Dividend") in respect of that unsecured balance, equating to £32,361,510 (i.e. £ I 15.4m x 0.2804) in aggregate.'

Also paragraph 11:-

'11. At the date of that preference, KIL was a wholly-owned subsidiary of the respondent (at that date, called Kesa Holdings SNC), which was a wholly-owned subsidiary of Kesa Holdings SARL, which was in turn a wholly-owned subsidiary of KHL. In the premises:

11.1 KIL was an associate of the Company within the meaning of s.435 of the Insolvency Act 1986 ("IA86"), and (consequently) connected with the Company, within the meaning of IA86 s.249.

11.2 In making the preferential payment, the Company is presumed by IA86 s.239(6) to have been influenced in deciding to make it by the desire mentioned in IA86 s.239(5), unless and until it shows the contrary, in these proceedings. And:

11.3 The preferential payment was made at an IA86 s.239(2) relevant time, by reason of IA86 s.240( 1 )(a).'

'19. Paragraphs 8 and 9 are admitted. KIL will rely on the full terms of the sale transaction, including the following features:

(a) The HAL RCF was entered into pursuant to clause 8.8 of the SPA.

(b) The capitalisation pursuant to the SPA of £13,586,452 owed to KIL under the KIL RCF was in exchange for shares in the Company which were immediately sold to HAL within the price of £1. The capitalisation was in practical terms a write-off of approximately £13.6m.

(c) KIL paid a capital contribution of £50m plus a Net Additional Amount of

£28,460,000 to Hailey 2 LP. Those sums were used to fund (in part) the HAL RCF.

(d) A "Locked Box" mechanism under which KIL bore the risk that net debt within the Comet Group would be greater than £32.75m at 31 January 2012. In the event, the net debt was £29,341,167 so no adjustment was required.

(e) Kesa assumed the entirety of the Company's liability for its defined benefit pension scheme. KEP became the new principal employer, while in order to satisfy the requirements of the Pensions Trustee and Pensions Regulator, KIL and KHL guaranteed payment obligations under the Scheme for ten years (capped at £23m). The scheme was estimated to be in deficit on an ongoing basis in the amount of £76.2m as at 30 September 2011. Kesa agreed to increase annual deficit contributions to the pension scheme from £6.1m pa to £10m pa.

(f) KHL sold 100% of the issued share capital of Triptych, to HHL for £1.

(g) KIL repaid Triptych £73,136,412 of inter-company debt, which amount Triptych was to lend to the buyer's group to fund the Company.

(h) The existing directors (other than Mr Darke) stepped down, and John Clare and Carl Cowling were appointed as directors nominated by HAL to form the 3-man Post-Sale Board.

(i) As set out in paragraph 8.1, HAL granted the HAL RCF. HAL was provided with the £186.6m commitment of the HAL RCF by each of the following being invested (via HHL where appropriate) in HAL: (i) KIL's capital contribution to Hailey 2 LP of £50m, (ii) KIL's Net Additional Amount paid to Hailey 2 LP of £28.5m, (iii) £73.1m lent by Triptych to HHL (which it was only in a position to lend because KIL's repayment to it of an equivalent amount) and (iv) OpCapita's investment of £35min Hailey 2 LLP.

(j) Part of the HAL RCF was used to repay KIL the amount due and owing to it under the KIL RCF. The balance of the monies referred to above was held by HAL at Completion to enable it to fulfil its commitment to the Company under the HAL RCF.

(k) HAL granted, and the Company agreed to take, the HAL RCF on terms which included (i) the giving of the HAL Debenture, (ii) an interest rate of 7.5% above base rate, and (iii) certain fees. No Kesa company was party to that agreement, and the SPA did not require that the HAL Debenture be entered into.

(l) HAL procured the provision by Retail Finance IV LLC of an asset-backed finance facility ("the RF4 Facility") in the amount of up to £40m.'

And,

'20. Paragraph 10 is denied. KIL did not receive a preference for the reasons set out in paragraphs 21 to 24 below'…'

Alleged connection with the Company

25. As regards paragraphs 11 and 11.1:

(a) It is admitted that, on 3 February 2012, KIL was an indirect wholly owned subsidiary of KHL and that, until the transfer of the shares in the Company from KHL to HAL took effect, the Company was a wholly owned subsidiary of KHL.

(b) However, by the SPA, KHL agreed to sell the entire issued share capital of the company to HAL. KHL was not free to exercise the voting power at any general meeting of the Company in any way which would be inconsistent with the SPA. Accordingly, KHL is not to be taken as having control of the Company for the purposes of IA86 s.435. Further or alternatively, the repayment of the KIL RCF was made as an essential component of the transfer of the Company out of the ownership of KHL.

(c) On that basis, it is denied that, when the repayment of the KIL RCF was made, KIL was an associate of, or accordingly connected with, the Company.

(d) Save as set out above, paragraphs 11 and 11.1 are denied. As pleaded at paragraph 34 below, it follows that the repayment of the KIL RCF was not made at a relevant time and the Applicant's claim fails entirely.'