Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> Profile Partners Ltd, Re [2020] EWHC 1473 (Ch) (08 June 2020)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2020/1473.html

Cite as: [2020] EWHC 1473 (Ch)

[New search] [Printable PDF version] [Help]

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

COMPANIES COURT (ChD)

IN THE MATTER OF PROFILE PARTNERS LIMITED

AND IN THE MATTER OF THE COMPANIES ACT 2006

Rolls Building, Fetter Lane, London EC4A 1NL |

||

B e f o r e :

(sitting as a Deputy Judge of the Chancery Division)

____________________

| MR MICHAEL GOTT |

Applicant/Petitioner |

|

| - and - |

||

(1) MR RUNE HAUGE (2) MS LISA DAVEY (3) PROFILE SPORT AND MEDIA LIMITED (4) PROFILE HOLDINGS LIMITED (5) PROFILE PARTNERS LIMITED (a company incorporated in England and Wales) (6) PROFILE PARTNERS LIMITED (a company incorporated in Guernsey) (7) PROFILE PARTNERS GMBH & CO. KG (8) PROFILE PARTNERS VERWALTUNGSGESELLSCHAFT MBH (9) GUERNSEY RESOURCES GROUP LIMITED |

Respondents |

____________________

Kuldip Singh QC (instructed by Fieldfisher) for the Respondents

Hearing date: 19 May 2020

____________________

Crown Copyright ©

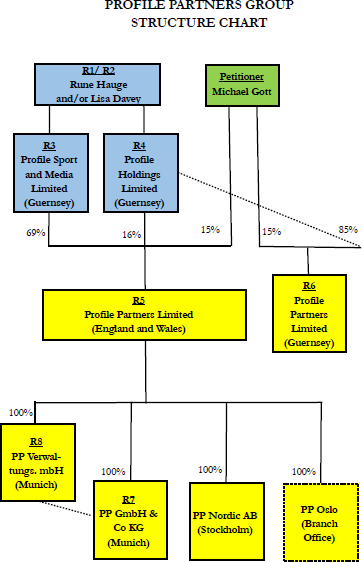

- This is an application for injunctive relief brought in the context of proceedings under s. 994 of the Companies Act 2006. The Petitioner ("Mr Gott") is a minority (15%) shareholder in the Fifth Respondent ("the Company"), a company incorporated in England and Wales and the holding company of a group of companies carrying on business as sports media rights consultants ("the PP Group"). The remainder of the shares in the Company (85%) are beneficially owned by the First Respondent ("Mr Hauge") and/or the Second Respondent ("Ms Davey").

- The other Respondents to the application are as follows:

- Mr Gott is seeking the following relief:

- Mr Hauge is Norwegian and resident for tax purposes in Guernsey. He was formerly a football agent. In about 1995 he established a business in the field of sports media rights. Mr Gott, who is German, was prior to 2005 the manager of a German sports marketing agency. According to the Petition, in 2005 he and Mr Hauge and others agreed to form a business, the purpose of which was to combine the expertise of Mr Gott and others in buying and selling media rights, particularly in Germany, with Mr Hauge's expertise in advising media rights owners, particularly in Scandinavia.

- Between 2005 and 2018 Mr Gott was the managing director of PP Munich GmbH and PP Munich KG and from 2008 the managing director of the Company. The business was conducted principally from Germany. According to the Petition, Mr Hauge is a de facto or shadow director of the Company. Ms Davey, who is Mr Hauge's life partner, is a director of a number of companies in the PP Group. Counsel for the Respondents informed me that, contrary to the assertion in the Petition that the Company is beneficially owned by Mr Hauge and/or Ms Davey, Mr Hauge beneficially owns 85% of the shares in the Company and Ms Davey owns none. This discrepancy does not matter for the purposes of the present application.

- The PP Group's clients are or have been principally national sports leagues (e.g. the Swedish Ice Hockey League and the Austrian Football League), sports associations (e.g. the Austrian Skiing Federation and the Swiss Ice Hockey Association) and sports clubs. The PP Group assists its clients with the marketing and sales of their media rights. According to the Petition, the PP Group has generated and was projected to generate substantial revenues. An investment bank report prepared in 2017 in connection with an anticipated sale of the business showed the PP Group's projected income for the period 2017 to 2027 to be in the order of €134.7 million.

- On 24 July 2018 and 16 August 2018, Ms Davey wrote to Mr Gott purporting to terminate his employment relationship with PP Munich KG and PP Munich GmbH and his office as managing director of PP Munich GmbH. On 10 September 2018, Ms Davey wrote again to Mr Gott stating that he was prohibited from acting on behalf of PP Munich GmbH or PP Munich KG or the Company. On 17 September 2018 a notice recording the termination of Mr Gott's appointment as a director of the Company was filed with the Registrar of Companies.

- Mr Gott's Petition was served in draft form on the Respondents on 19 February 2019. The covering letter enclosing the Petition sought undertakings from Mr Hauge and Ms Davey that the funds of the PP Group would not be used to defend the proposed proceedings and that no monies would be paid directly or indirectly from any bank account within the PP Group to or for the benefit of Mr Hauge or Ms Davey without Mr Gott's prior approval.

- Following correspondence between the parties, on 21 June 2019 Mr Hauge and Ms Davey entered into contractual undertakings set out in their solicitors' letter of 21 June 2019 ("the Contractual Undertakings"). The Contractual Undertakings included the following:

- Paragraph 9 of the letter provided for exceptions in relation to any "Regular Payment" including payments in respect of Mr Hauge's remuneration for services that he had provided and was providing pursuant to a consultancy agreement with an annual fee of €1 million. Paragraph 12 confirmed that the agreement was without admission as to the "validity or quantum of the Regular Payments". Paragraph 13 provided that Mr Hauge and Ms Davey confirmed that nothing in the letter would be construed as any admission, authorisation or ratification of any payment or use of funds.

- The Petition was presented on 21 October 2019, The Petition includes the following principal allegations:

- The relief sought in the Petition includes an order for the purchase by the First to Fourth Respondents of the Petitioner's shares in the Company and an order for an account and/or inquiry, as between Mr Gott and Mr Hauge and/or his nominees, of the monies which they respectively have received from the PP Group.

- A Defence and Counterclaim was filed and served on behalf of all the Respondents on 7 February 2020. The Defence makes wide-ranging allegations of misconduct by Mr Gott. It alleges, amongst other things, that between at least 2006 and 2018 Mr Gott colluded together with Clemens Oehler, PP Munich KG's Chief Financial Officer and (from 2011) with Mark Deckelman, PP Munich KG's General Counsel, to cause damage to Mr Hauge, Ms Davey, the Company, PP Guernsey and PP Munich KG. The misconduct alleged against Mr Gott includes the following:

- The Counterclaim (which is 4 pages long as compared with the 100 page Defence) after repeating paragraphs 1 to 40 of the Defence states as follows:

- After adding a claim for repayment of a loan alleged to be due to Mr Hauge, the Counterclaim ends with a prayer for relief made by all the Respondents without differentiation. The relief claimed includes damages, indemnities, equitable compensation and delivery up of material of any property belonging to the Respondents.

- On 3 March 2020 the Respondents' solicitors (Fieldfisher LLP) wrote to inform Mr Gott's solicitors that the agreement made on 21 June 2019 "no longer applied" and nor did the undertakings given by the Respondents The letter continued as follows:

- The letter went on to say that, for the purposes of defending Mr Gott's claim, and/or for prosecuting their counterclaim, the relevant Respondents would need to spend monies from their funds on paying their legal costs in these proceedings.

- Fieldfisher enclosed with their letter a "Consultancy Services Deed" between PP Munich KG and Mr Hauge dated 2 March 2020 and two invoices from Mr Hauge also dated 2 March 2020. These claimed €1 million each on the basis of "Consultancy Services" purportedly provided for the period 1 January 2018 to 31 December 2018 and the period 1 January 2019 to 31 December 2019 respectively. Fieldfisher gave notice that the invoices would be paid within 14 days. This letter and a subsequent letter dated 5 March 2020, in which the Respondents refused to give undertakings sought on behalf of Mr Gott, triggered Mr Gott's application for injunctive relief. This was issued and served on the Respondents on 9 March 2020.

- On 13 March 2020 the application came before ICC Judge Burton. She handed down her reserved judgment on 11 May 2020 ([2020] EWHC 1152 (Ch)). She held, in summary, that as currently pleaded, the interests of the Fifth to Eighth Respondents were not sufficiently distinct to justify an exceptional departure from the general rule that the Company's money (here the money also of the Sixth to Eighth Respondents) should not be spent on disputes between shareholders. She therefore granted an injunction pending the return date restraining the Fifth to Eight Respondents from incurring any expenditure on legal or other professional services for the purposes of the Petition and/or the Respondents' counterclaims and/or any other aspect of the dispute between Mr Gott and the First to Fourth Respondents. This was in addition to undertakings given by the Respondents, pending the return date, not to act contrary to the Contractual Undertakings and not to pay the disputed invoices.

- On 9 March 2020, prior to the hearing before ICC Burton and unbeknown to Mr Gott, Ms Davey had authorised the commencement of further legal proceedings in Germany on behalf of PP Munich KG against Mr Gott, Mr Oehler and Mr Deckelman (the "German Claim"). The German Claim was commenced on 24 March 2020. Mr Gott was unaware of it until notified on 27 March 2020. The Plaintiff in the German Claim is PP Munich KG, represented by Ms Davey and Mr Salvatore Cuccu as its directors. The German claim is founded upon an allegation also made in the Defence and Counterclaim in these proceedings, namely that Mr Gott infringed his duties by concluding or accepting to the detriment of PP Munich KG agreements with Swiss sports associations and leagues which could be terminated at any time, thereby depriving PP Munich KG of the chance of prolonging them and so causing PP Munich KG to lose income.

- The Respondents did not mention the planned German claim in their evidence or at the hearing before ICC Judge Burton although the German claim was clearly germane to the relief sought by Mr Gott in his application.

- On 24 April 2020, Mr Gott applied to the Munich Labour Court for a declaration that, in accordance with the lis alibi pendens provisions of the Brussels (Recast) Regulation, it had no jurisdiction in respect of the claim against him. The outcome of that application is not yet known. The injunctive relief sought on this application has no bearing on that jurisdictional issue.

- It was submitted on behalf of Mr Gott as follows:

- It was submitted on behalf of the Respondents as follows:

- I agree with the observation of ICC Judge Burton that the purpose of the Contractual Undertakings appears to be to protect and preserve the assets of the Company pending the outcome of the s. 994 proceedings and to ensure that Mr Hauge and Ms Davey do not obtain an unfair advantage in the litigation via recourse to company funds.

- The Respondents' case, that the Contractual Undertakings do not bite on costs incurred by the Fifth to Respondents in defending the s. 994 proceedings and/or in prosecuting counterclaims, presupposes that it is possible to draw a distinction between, on the one hand, the costs incurred by the Fifth to Eighth Respondents in defending the s. 994 proceedings and in bringing their own counterclaims and, on the other, the costs of Mr Hauge and Ms Davey in defending the s. 994 proceedings. I am not, however, satisfied that there is any valid basis for that distinction, having regard to how the proceedings have been pursued by the Respondents.

- First, as a general point, the notion that the claims asserted by the Fifth to Eighth Respondents are claims that only the companies can advance is misconceived. It is commonplace in s. 994 petitions for a petitioner to rely, in support of the claim of unfair prejudice, on breaches of duty owed by the respondents to the company and for respondent shareholders similarly to rely, by way of defence, on breaches of duty owed by the petitioner to the company. It does not follow that the company has to take an active part in the proceedings.

- Second, the Respondent's submission that the Fifth to Eight Defendants are entitled to incur costs in defending the Petition in their own right assumes that the Fifth to Eighth Respondents have a separate interest to protect in the s. 994 proceedings. Mr Gott is not, however, claiming anything from the Fifth to Eighth Respondents other than an adjustment to reflect bonus payments payable by the Company and PP Munich GmbH which is in substance a claim directed at Ms Hauge and Ms Davey. The Fifth to Eighth Respondents are fairly described as "nominal Respondents". The only relevance of the allegations of breach of duty owed to the Fifth to Eighth Defendants, in the context of the Defence, must be to support the defence of Mr Hauge and Ms Davey. There is therefore no justification for the Fifth to Eight Respondents incurring costs in defending the Petition. Those costs should be borne by Mr Hauge and Ms Davey.

- Third, I accept that the Contractual Undertakings do not purport to restrict the Fifth to Eighth Respondents from incurring costs on their own counterclaims against Mr Gott. However, no attempt appears to have been made by the Respondents to distinguish in practice between, on the one hand, the costs attributable to the defence of the Petition and, on the other, the costs attributable to the counterclaims. No attempt has been made to apportion the defence costs to Mr Hauge and Ms Davey and the counterclaim costs to the relevant Respondents. Such apportionment might have enabled the Mr Hauge and Ms Davey to cause the Fifth to Eighth Respondents to pay the costs attributable to the counterclaims without breaching the Contractual Undertakings. The issue of the apportionment of costs was raised by Mr Gott's solicitors in correspondence and in the evidence in support of Mr Gott's application and referred to by ICC Judge Burton in her judgment, but no explanation has been provided as to whether or how costs might be apportioned. That gives rise to the concern that costs attributable to the defence might be borne by the Fifth to Eighth Respondents.

- The German claim is, as noted above, duplicative of one of the complaints raised in the Defence. There may therefore well be an overlap between the costs of the German claim and the costs of the relevant part of the Defence but again there is no indication that any apportionment of the costs has been carried out.

- Fourth, as ICC Judge Burton observed in her judgment, the positions of all the Respondents, as currently formulated in the Defence and Counterclaim, are inextricably linked and combined. There is no clear distinction drawn in the Defence and Counterclaim between any of the Respondents either when identifying the duties alleged or the losses allegedly suffered. For example, as noted in Mr Pickworth's second witness statement, in relation to the allegations concerning tax, it is said that Mr Hauge imposed a "requirement for tax-efficiency for him and his entities...and his interests" and that Mr Gott acted "contrary to [his] instructions from Mr Hauge and Ms Davey". It is not explained whether the alleged breach of duty was committed towards PP Munich KG (the relevant operating subsidiary), the Company, Mr Hauge personally (as an ultimate beneficial owner) or some other person. Likewise, it is unclear which of those persons are said to have suffered loss. As already noted, the Counterclaim concludes with a prayer for relief made by all the Respondents without differentiation.

- On 16 March 2020 Mr Gott served a draft amended Petition which includes a complaint that the Defence and Counterclaim failed to distinguish between the respective positions of the First to Fourth and Fifth to Eighth Respondents. It was submitted on behalf of the Respondents that no steps had been taken to amend the Defence and Counterclaim in response to the strike out application because of the injunction restraining expenditure. That does not explain why the First to Fourth Respondents could not have used their own funds to pay for any necessary amendments.

- For these reasons, I consider that Mr Gott has established a clear case that Mr Hauge and Ms Davey, despite their declared intention to abide by the Contractual Undertakings, may well breach the Contractual Undertakings by causing or permitting the Fifth to Eighth Respondents to use their funds to pay costs which are attributable to Mr Hauge's and Ms Davey's defence of the s. 994 petition. I consider that it is appropriate to apply the American Cyanamid criteria in deciding whether to grant an interim injunction. I address those criteria later in this judgment.

- In addition to the Contractual Undertakings, Mr Gott relies on the well-established principle of company law that a company's money should not be spent on disputes between shareholders; such a misuse of funds will be restrained as a misapplication of funds, and without reference to the principles in American Cyanamid: see Arrow Trading & Investments Est. 1920 & Anor v Edwardian Group Ltd & Ors [2003] EWHC 2863 (Ch) [2004] BCC 955, particularly per Sir Francis Ferris at [10]-[19].

- In response, it was submitted on behalf of the Respondents that the principle is irrelevant to the present case as it is not in substance a dispute between shareholders; the Fifth to Eighth Defendants have their own claims against Mr Gott which only they can bring and which they are entitled to pursue.

- Both sides relied on the cases of Jones v Jones [2002] EWCA Civ 961 and Pollard v Pollard (unreported 20 July 2007) which addressed the question whether a company's funds may be used to finance an action brought by the company against a petitioning shareholder in unfair prejudice proceedings.

- In Jones v Jones Edward was a 50% shareholder in the company with his brother William holding the other 50%. Edward started a competing business. He was dismissed as managing director. A Chancery action was commenced against Edward alleging breach of duty. Three days later, Edward commenced his s. 459 (now s. 994) proceedings. Edward then applied for an order prohibiting the holding of a board meeting to ratify the Chancery proceedings and to prevent any payment by the company of costs incurred in relation to the Chancery proceedings. Pumfrey J refused an injunction on the ground that the action could and should be brought by the company at its own expense. On appeal, Edward made two submissions. First, that the company (Incasep) should be regarded as deadlocked and it was a further act of unfair prejudice for any resolution to be passed ratifying the action brought in the name of the company and that damages were not an adequate remedy in that he (Edward) could not be compensated in money terms for the unfair advantage obtained by William using the resources of the company in the litigation. This submission was referred to as the "narrower submission" and was accepted by the Court of Appeal who granted the injunction. Applying American Cyanamid principles, there was a serious issue to be tried as to whether the passing of a resolution should have been passed and the balance of convenience favoured restraining Incasep from pursuing the Chancery action until after judgment in the s. 459 proceedings and from incurring further expenditure on legal or other professional services for the purposes of the Chancery action until further order.

- The second, "wider submission" was that the allegations of misconduct against him would form an integral part of the defence to the petition brought by Edward, that the Chancery action was in essence part of the dispute between the shareholders and that it would drive a coach and horses through the general principle that the company's money should not be expended on disputes between the shareholders if the controlling shareholder were able to procure the company to commence and fund a separate action against the excluded quasi-partner for the misconduct alleged against him.

- After referring to this general principle, Arden LJ, as she then was, held as follows:

- In Pollard v Pollard George Pollard brought s. 459 proceedings against his two brothers Richard and Allan alleging that he had been wrongly excluded from the family company. Shortly after the presentation of the petition Richard and Alan indicated that they intended to launch a Chancery action alleging that he was in breach of fiduciary duties to the company. The judge (HHJ McCahill QC) granted an injunction to restrain company funds from being used to fund the Chancery action on American Cyanamid grounds as there was a serious issue to be tried as to whether or not the Chancery action had been validly authorised, given an alleged agreement that Richard and Alan would not exercise their votes as shareholders or directors in a way which went against the wishes of George.

- The judge went on to consider the decision in Jones v Jones and the question whether that the Chancery action was not bona fide and had been brought for a collateral purpose to achieve funding effectively for the defence of the petition in contravention of the principle that company funds should not be used for that purpose.

- The question which the judge said must be asked is whether the Chancery action was brought in response to the s. 459 proceedings. He considered that in answering that question the chronology was important. George was excluded from the company on the basis of breach of his fiduciary duty yet no action was taken by the company in that regard until four months after the petition was presented. Moreover there was a similarity of issues between the two sets of proceedings in that the defence to the petition had been "cut and pasted" into the Chancery action, making identical allegations of breach of fiduciary duty. Finally, there was the fact that, on the one hand, Richard and Alan wanted to have access to the company's funds to pursue the Chancery action and yet, on the other, they had denied dividends and bonuses to George in contrast to the pattern which had thitherto always applied. The judge concluded that there was a strong case that the Chancery action had been brought for improper purposes and therefore that on this additional ground the company should be restrained from using its funds to prosecute it.

- The following propositions may be derived from these two cases:

- Relying on the second, third and fourth of these propositions, Counsel for Mr Gott submitted that the fact that the Counterclaim did not emerge until almost a full year after receipt of the draft Petition suggested that it was brought in response to the s. 994 proceedings; the fact that the counterclaim and the German claim make identical allegations to those made in the Defence suggests that they are "part and parcel" of the dispute between the shareholders, as held by ICC Judge Burton; the withholding of an injunction would confer an unfair advantage on Mr Hauge and Ms Davey in the litigation, by granting them access to company funds, for which damages would not be an adequate remedy.

- Counsel for Mr Gott further submitted that the factors in favour of the grant of an injunction in this case are stronger than in Jones v Jones in three respects. First, whereas in Jones v Jones there was no question of creditors being prejudiced by the grant or withholding of an interim injunction, in the present case there is no information as to the financial position of the Fifth to Eighth Respondents. Second, in Jones v Jones, William had offered an undertaking to repay to the company its costs of the Chancery action and those payable to Edward if the court so ordered at the trial of the s. 459 petition. Mr Hauge and Ms Davey have not offered any such undertaking in this case. Third, in Jones v Jones, even though there were separate proceedings and separate junior counsel instructed for the respondents in relation to the Petition, it was held that the apportionment of costs was unsatisfactory because it was effected by the solicitors in such manner as they thought fit and there was no way of monitoring this. Here, the same solicitors and Counsel are acting in relation to both the Defence and Counterclaim.

- Counsel for the Respondents relied on the proposition that an overlap between the allegations made by way of defence to the s. 994 Petition and by way of a separate company claim does not necessarily mean that the company's claim is improper. With regard to the chronology, he submitted that ICC Judge Burton was wrong to infer that the counterclaims were only brought in response to the Petition. After the draft Petition was served in February 2019 there was a detailed response from the Respondents' solicitors alleging misconduct by Mr Gott which was followed by a mediation. A number of the matters about which complaint is made in the Defence and Counterclaim only emerged after Mr Gott had been dismissed.

- The Respondents further submitted that the present case is distinguishable from Jones and Pollard in that Mr Gott is not even a shareholder in the Seventh and Eighth Defendants. Neither Jones nor Pollard involved an attempt by a member of one company to prevent another company from using its funds to pay for legal proceedings.

- The Respondents also relied on Re Crossmore Electrical and Civil Engineering Ltd [1989] 5 BCC 37, Re Milgate Developments Ltd [1991] BCC 24, ex parte Johnson [1992] BCLC 24 and Re A Company [1994] BCLC 146 for the proposition that, even in a dispute between shareholders, a company may be able to show that it has a real interest independent of its shareholders in defending the petition.

- Mr Gott's case that the use the funds of the Fifth to Eighth Respondents to pay for the costs of defending the Petition and pursuing their counterclaims would be contrary to the company law principle referred to at paragraph 34 above raises similar issues to his case based on a threatened breach of the Contractual Undertakings. The principle does not necessarily prevent a company from pursuing a claim or counterclaim against a petitioning member but it does prevent a company from funding the controlling members' defence of a s. 994 petition. It is not sufficient for the Respondents to assert that this case is in substance a dispute between an employer and a disloyal employee rather than a shareholder dispute. Characterising the case in this way does not legitimise the use of company funds to pay for Mr Hauge's and Ms Davey's defence of the Petition. To the extent that allegations of breach by duty owed by Mr Gott to the Fifth to Eighth Respondents are relied on both by way of defence to the s.994 petition and in support of counterclaims, there would need to be a satisfactory apportionment of the costs for which there is no evidence.

- With regard to the propositions to be derived from Jones and Pollard, I accept the submission on behalf of Mr Gott that the timing of the counterclaims strongly suggests that they were brought in response to the Petition rather than bona fide in the interests of the Fifth to Eighth Respondents. The matters raised in the counterclaims go back as far as 2005. There has been no adequate explanation for the failure to bring proceedings sooner. Whilst some of the matters alleged may only have come to light after Mr Gott's dismissal in July 2018, whilst Mr Hauge may have been heavily engaged in a "rescue operation" to save the business of PP Munich KG in 2018/2019 and participated in a mediation after service of the draft Petition, this does not satisfactorily explain the delay in making the claims. ICC Judge Burton was in my view justified in finding that the fact the counterclaims were not brought until many years after the alleged causes of action and only in response to the Petition supports the conclusion that they are part and parcel of the dispute between the shareholders. The identical nature of the complaints made in the Defence and in the Counterclaim and German claim points to the same conclusion.

- The fact that Mr Hauge and Ms Davey are not shareholders of the Seventh and Eighth Respondents is immaterial. It would be a breach of duty for directors of a parent company to cause or permit a subsidiary to apply its funds to pay for the legal costs of the majority shareholders of the parent company in a shareholder dispute. Such conduct would also be capable of constituting unfairly prejudicial conduct. It is well established that the conduct of the affairs of the company, for the purposes of s. 994, is to be given a wide meaning, including, in appropriate circumstances, the affairs of subsidiaries.

- The cases cited by the Respondents do not support the proposition that the Fifth to Eighth Respondents are entitled to incur costs in defending the Petition. In Re Crossmore Electrical and Civil Engineering Ltd [1989] 5 BCC 37 the company sought relief under s. 127 of the Insolvency Act 1986 validating payments out of its bank account pending the hearing of two petitions, a creditor's winding-up petition and a s. 459 petition brought by the minority shareholder who was also the controlling director of the petitioning creditor. Hoffmann J granted the relief sought in relation to the creditor's petition – the fact that the petitioning creditor was controlled by a shareholder was an accidental circumstance – but made clear that the company's funds could not be used to pay the costs of the s. 459 petition. In Re Milgate Developments Ltd [1991] BCC 24 it was held that there was no justification for two companies, in relation to which s.459 petitions had been presented, from taking an independent part in litigating the shareholders' disputes, notwithstanding the fact that they might be affected by any share purchase order. In ex parte Johnson [1992] BCLC 701, the court observed that it might be proper for the company to incur costs on giving discovery or on making an application under s. 127 but held that it would be misfeasance for the directors to cause the company's money to be spent on opposing the s.459 petition. In Re A Company [1994] BCLC 146 the court held that there was a heavy onus on a company to justify active participation in a petition and advance approval would only likely be given upon proof by cogent evidence of the most compelling circumstances. These cases do not assist the Respondents. The injunctive relief sought in the present case should not prevent the Fifth to Eighth Respondents from incurring costs for the purpose of providing disclosure in the s. 994 proceedings if required.

- For these reasons, I consider that Mr Gott has established a clear case that that the Fifth to Eighth Respondents are in threatened breach of the principle that a company's money should not be spent on disputes between shareholders and that they should be restrained by injunction from incurring expenditure on legal or other professional services for the purposes of the Petition and/or the Respondents' counterclaims and/or any other aspect of the dispute between Mr Gott, Ms Davey and the Third and Fourth Respondents (including the German Claim). I consider that it is appropriate to apply the American Cyanamid criteria to the grant of the injunction, which I address later in this judgment.

- The Consultancy Deed enclosed with Fieldfisher's letter dated 3 March 2020 was drafted by Fieldfisher and executed by Mr Hauge, on his own behalf and by Ms Davey on behalf of PP Munich KG. It provides in Recital (C) as follows:

- The Consultancy Deed provides at clause 2 that PP Munich appointed Mr Hauge to perform the services until the termination of the deed and provides at clauses 4.1 to

- The invoices contain descriptions of the services allegedly performed by Mr Hauge in 2018 and 2019 (including the alleged travel destinations) expressed in almost identical terms in both invoices. They do not identify with any precision the services in fact performed for PP Munich KG. Certain of the services were stated to be performed "as a result of the damage and potential damage caused by Gott and others to the business" but with no explanation of the damage that Mr Gott was alleged to have caused.

- Mr Gott's case is that Mr Hauge did not provide any services to PP Munich KG, or any services which would justify the payment of the fees described in the Consultancy Deed. He alleges that Mr Hauge had not provided such services previously and that he would not do so in the future given that substantially all of PP Munich KG's clients apparently terminated their contracts in the first two months of 2019. He alleges that the Consultancy Deed did not represent an arm's length contract for services but was instead a means by which Mr Hauge and Ms Davey are seeking to extract funds from the PP Group for their own personal gain and/or to fund the costs of their shareholder dispute. He submits that looked at as a whole, the Consultancy Deed and the Invoices are implausible and suspicious and consistent with those documents being a pretext for depleting the resources of the PP Munich KG and the PP Group. He contends that there is at the very least a serious issue to be tried as to whether the threatened payment of the invoices would be in breach of duty and contrary to terms agreed with Mr Hauge.

- In response, the Respondents contend that there is no serious issue to be tried. They contend, first, that Mr Hauge is entitled to the fees charged. They refer to the evidence that Mr Hauge was employed as a consultant in the PP business by the Company from 2008 to 2017 and then by PP Munich from 2018, that his annual fee was originally a contractual rate of €1,000,000 and that, as from 2010, it was agreed on a case by case basis but Mr Gott, Ms Davey and Mr Hauge agreed that the appropriate annual fee should continue to be €1,000,000. Ms Davey's witness statement refers to the fact that the accounts of the Company for 2009, 2010, 2011, 2015 and 2016 made reference to the fees paid to Mr Hauge, PML or PP Guernsey and were signed by Mr Gott. The Respondents also refer to the fact that in the agreement of 21 June 2019 specific reference is made to Mr Hauge providing and having provided services "pursuant to a consultancy agreement with an annual fee of €1 million".

- Second, they submit that an injunction should be withheld in the Court's discretion because Mr Gott does not have "clean hands". This is on the basis that Mr Gott has admitted paying invoices submitted by Mr Hauge even though there was no contractual entitlement to the large sums invoiced.

- Third, the Respondents submit that Mr Gott has no legal right or standing to apply for an injunction to prohibit PP Munich KG from making the invoiced payment on the basis that any right violated belonged to PP Munich KG, of which Mr Gott is not even a director or shareholder.

- In reply, Mr Gott submits that the agreements relied on by Mr Hauge and the fact that the payments were tolerated in the past does not entitle Mr Hauge to the invoiced payments. The agreement of 21 June 2019 specifically recorded that the agreement was without admission as to the "validity or quantum of the Regular Payments" and included a confirmation by Mr Hauge and Ms Davey that nothing in the letter would be construed as any admission, authorisation or ratification of any payment or use of funds. The requirement to give 14 days' prior notice to Mr Gott was to allow for an application to restrain any such payment to Mr Hauge.

- Second, Mr Gott submits that it was open to he and Mr Hauge, as the ultimate beneficial owners of the Company, to permit the Company to recognise invoices issued by Profile Media Limited. Therefore no question of "clean hands" arises.

- Third, Mr Gott submits that he clearly has standing to apply for an injunction, as a minority shareholder in the Company, PP Munich KG's parent, to restrain the payments to Mr Hauge on the basis that causing or permitting the payments to be made would amount to unfairly prejudicial conduct on the part of Mr Hauge and/or Ms Davey.

- I am satisfied that, on the grounds advanced on behalf of Mr Gott set out above, there is at least a serious issue to be tried as to whether the Fifth to Eighth Respondents are entitled to pay the invoices dated 2 March 2020 from Mr Hauge addressed to PP Munich KG or otherwise to make any payment pursuant to the purported Consultancy Services Deed dated 2 March 2020 or any similar arrangement.

- The American Cyanamid principles applicable to the grant of interim injunction are, in summary, as follows:

- So far as concerns the application of those principles to s. 994 petitions, Harman J noted (obiter) in Re a Company [1985] BCLC 80 (at 82-83) that, as a general rule, it is desirable to preserve the status quo in the case of a petition on the unfair prejudice ground. The petitioner in a s. 994 petition is entitled to seek that the assets of the company itself are properly dealt with and to obtain relief which prevents its assets being dissipated pending trial: Palmer v Loveland (unreported, 16 August 2017)

- For reasons given earlier in this judgment, I am satisfied that there is a serious question to be tried as to Mr Gott's entitlement to the three heads of injunctive relief sought.

- I consider that, on the evidence before me, damages would not be an adequate remedy for Mr Gott if successful at the trial of the Petition. This is for two main reasons. First, if Mr Hauge and Ms Davey are not restrained from causing or permitting the Fifth to Eighth Respondents from incurring costs in the defence of the Petition and the pursuit of the counterclaims conduct, they may obtain an unfair financial advantage in the litigation, as was the case in Jones v Jones.

- Second, the use of the resources of the PP Group may prejudice the ability of the First to Fourth Respondents or the Company to meet any buy-out order. Mr Gott's claims are estimated to be worth €22 million without interest and costs. The financial position of the PP Group, from which a buyout of Mr Gott's shares might be funded, is unclear. Despite the fact that Mr Gott put the financial position of the Respondents in issue (as was recognised in ICC Judge Burton's Judgment), the Respondents have not provided the Court with any real details of the PP Group's financial position such as up-to-date financial statements, forecasts or projections. ICC Judge Burton noted that "the Petitioner has scant information regarding the extent of the Respondents' assets".

- There is no reliable evidence as to Mr Hauge's own means. I accept that Mr Hauge has in the past been in receipt of substantial payments from the PP Group but it is not clear what has happened to those payments. Counsel for the Respondents took me to what was said to be evidence of the Respondents' assets. This comprised a list of bank balances in the name of various corporate entities (not the Respondents) as at 16 December 2014. I was also taken to a list of assets of what I was told were Mr Hauge's assets but which appeared on its face to be a list of properties belonging to two companies, La Maison d'Aval Limited and Vale Property Holdings Limited as at 20 October 2011.

- ICC Judge Burton also held in her judgment that there was no evidence of any damage that would be caused to the Respondents prior to the return date which could not be financially compensated by Mr Gott. There has been no fresh evidence or subsequent change in circumstances to suggest that I should reach a different conclusion. The Respondents have not provided cogent evidence of damage that they would suffer if the injunctions were granted, still less any damage that could not be met by Mr Gott's cross-undertaking. The Respondents submit that, if an injunction is granted prohibiting the Fifth to Eighth Respondents from incurring legal costs, their defence and counterclaims will be lost. There is, however, no evidence to establish that the First to Fourth Respondents would have any difficulties in funding the Counterclaim, the German Claim, or any other proceedings against Mr Gott. Nor is there any evidence, as opposed to assertion, of any prejudice that would be suffered by an order which restrains the dissipation of the assets of PP Munich KG. Mr Hauge asserts that "The damage to the PP business if I do not continue in my work as a consultant will be obvious" but does not identify what that the business is currently doing or what Mr Hauge is doing to support it.

- In summary, I consider that the inadequacy of an award of damages for Mr Gott, if successful at trial, and the adequacy of an award of damages to the Respondents, if successful at trial, point clearly in favour of the grant of an injunctive relief.

- If it were necessary to consider the balance of convenience, the preservation of the status quo is a particularly important factor in the context of a s.994 petition, as held by Harman J in Re a Company, in that the status quo affects the remedies that are available. Here, the status quo would be maintained by the grant of injunctive relief to prevent the assets of the Fifth to Eighth Respondents from being used to pay the costs of the s. 994 petition, as held by ICC Judge Burton, and from being withdrawn for the benefit of Mr Hauge and Ms Davey.

- For these reasons, which are essentially the same as those underlying the judgment of ICC Judge Burton, my decision is that Mr Gott is entitled to the injunctive relief claimed.

- I will hear the parties on the wording of the order, directions and costs if these cannot be agreed.

Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties' representatives by email and release to Bailii. The date and time for hand-down is deemed to be 14.00 am on 8 June 2020.

Andrew Lenon QC:

The Application

2.1 the Third Respondent ("PML") and Fourth Respondent ("PP Guernsey"), Guernsey companies which act as nominees for Mr Hauge and/or Ms Davey;

2.2 the Sixth Respondent, another Guernsey company, the shares in which are held in the same proportions as those in the Company but which is not formally a parent or subsidiary, and

2.3 the Seventh and Eighth Respondents (respectively, a German limited partnership and a German private limited company, "PP Munich KG" and "PP Munich GmbH") which are wholly owned subsidiaries of the Company carrying on the PP Group's business in Germany, Switzerland and Austria.

A group structure chart is attached to this judgment.

3.1 An injunction to restrain Mr Hauge and Ms Davey from committing what are alleged to be threatened breaches of contractual undertakings given by them not to use funds belonging to the Fifth to Eighth Respondents to defend on their own behalves the Petition and not, without giving at least 35 days' written notice to Mr Gott, to cause to be paid monies from accounts used by companies in the PP Group to any account used by the Mr Hauge or Ms Davey;

3.2 An injunction to restrain the Fifth to Eighth Respondents from incurring any expenditure on legal or other professional services for the purposes of the Petition and/or the Respondents' counterclaims and/or any other aspect of the dispute between Mr Gott and the First to Fourth Respondents;

3.3 An injunction to restrain the Fifth to Eighth Respondents from paying two invoices dated 2 March 2020 from Mr Hauge until final judgment;

3.4 An injunction to restrain the First to Fourth Respondents from causing or permitting the Fifth to Eight Respondents from taking directly or indirectly the actions set out in paragraphs 3.2 or 3.3 above.

Background

"... Subject to the matters below. .. the Individual Respondents (and each of them) hereby contractually undertake to Mr Gott as follows, pending the resolution of the current dispute between the parties as set out in the letter before action: -

8.1 that they shall not use funds belonging to the PP Companies [defined to include each of the Fifth to Eighth Respondents, amongst others] or any of them to defend on their own behalves any petition presented and served on them in the same or substantially the same form ... as that sent in draft under cover of a letter dated 19 February 2019 from Mishcon de Reya LLP;and

8.2 that they shall not, without giving at least 35 days' written notice to Mr Gott ... cause to be paid to any bank account used by or on behalf of any Individual Respondent any monies directly or indirectly: (i) from a bank account used by any of the PP Companies; or (ii) from a debtor of a PP Company on terms that such payment shall discharge any part of the debtor's liabilities to the relevant PP Company."

11.1 The Company was established as a quasi-partnership between Mr Gott and Mr Hauge.

11.2 Mr Hauge caused a breakdown in trust and confidence and acted in breach of the agreement/understandings between him and Mr Gott by insisting on significant withdrawals from the PP Group, depleting its tax and liquidity reserves, and by causing purported invoices to be submitted which put Mr Gott in an impossible position.

11.3 Until 20 December 2016, Mr Gott tolerated these on the basis of a "withdrawal agreement" pursuant to which an account of withdrawals would be kept (ensuring that Mr Gott received his proportional entitlement). Mr Gott did not consent to any withdrawals between 20 December 2016 and 8 March 2017 and only to €75k per month from 9 March 2017 to 30 July 2018 and to none from 31 July 2018 onwards. A number of withdrawals were therefore made without Mr Gott's consent and, as such, were made in breach of duty. In any event, Mr Hauge has refused to settle the account of their withdrawals.

11.4 Since 24 July 2018 Mr Gott has been wrongfully excluded from the business in breach of his contractual or equitable rights and in breach of duty. Since his exclusion there has been further misconduct and mismanagement on the part of Mr Hauge and/or Ms Davey.

13.1 ignoring Mr Hauge's instructions and tax advice from tax experts about taking steps lawfully to minimise tax payable, causing damage to (amongst other) PP Munich KG which had a larger tax bill than should have been the case;

13.2 deceiving Mr Hauge and Ms Davey as to the true financial position concerning withdrawals by Mr Hauge and payments to Mr Gott;

13.3 making false representations to Mr Hauge as a result of which he decided that he had to sell the business and then subverting and manipulating the sale process to Mr Gott's own improper ends;

13.4 deliberately undermining the PP business by having PP Munich KG enter into sports media contracts which did not protect its position in that clients were able to terminate their contracts before the expiry of the agreed term, and failing to ensure appropriate legal advice was taken about such contracts;

13.5 destroying or attempting to destroy material/information, including incriminating information held at PP Munich KG's offices on its computer systems, and wrongly taking property belonging to PP Munich KG;

13.6 acting in breach of duty towards PP London, PP Guernsey and PP Munich KG, including acting in breach of statutory duty, contractual duty, common law duty and duty in equity.

"By reason of those matters pleaded above, the Respondents, and in particular Mr Hauge, Ms Davey, PSML, Profile Holdings, PP London, PP Guernsey, PP Munich, and PP Munich, have suffered loss and damage."

"In summary, there has been a sea-change in the factual and legal position in this case, not least because, as can be seen from our clients' Points of Defence and Points of Counterclaim filed and served on 7 February 2020 (the "Defence and Counterclaim"), seven of them (all corporate entities), who were made parties to these proceedings by Mr Gott, are not only defending such proceedings, but also at least some (including Respondents 4-8) are prosecuting a counterclaim against Mr Gott, and seeking (amongst other things) damages and for equitable compensation. The agreement of 21 June 2019 was based on the assumption (erroneous, as it transpires) that none of the PP Companies referred to in It, nor for that matter any of the Respondent entities not referred to in it, would need to take part, nor would take any part, as a party, or an active party, in the proposed proceedings to be brought by Mr Gott, and therefore would not have to spend any money on legal costs."

The Contractual Undertakings The parties' submissions

23.1 The Contractual Undertakings restrict (i) the use of funds belonging to the Fifth to Eighth Respondents in the defence of the unfair prejudice proceedings and (ii) the payment of funds from the Fifth to Eighth Respondents to Mr Hauge and Ms Davey.

23.2 As held by ICC Judge Burton, the Contractual Undertakings "were entered into for the purpose of protecting and preserving the assets of the Fifth Respondent pending the outcome of the s.994 proceedings and to ensure that the First and Second Respondents did not obtain an unfair advantage in the litigation via recourse to company funds."

23.3 The Respondents' assertion that the Contractual Undertakings "no longer apply" is clear evidence that Mr Hauge and/or Ms Davey intend to breach the Contractual Undertakings. Mr Hauge and Ms Davey have made clear that they intend to use company funds both in defending the claim and in relation to the Counterclaim even though the Counterclaim has no life of its own.

23.4 This is a clear threatened breach of contract and/or a simple point of construction. Mr Gott is accordingly entitled to an injunction restraining the breach as of right and without reference to balance of convenience: SDI Retail Services Ltd v The Rangers Football Club [2018] EWHC 2772 (Comm). Alternatively, Mr Gott is entitled to interim relief on the grounds that he has a triable issue of a breach of the Contractual Undertakings for which damages would not be an adequate remedy. Unless restrained, Mr Hauge and Ms Davey would obtain an unfair advantage in the litigation.

24.1 Mr Gott's assertion that Mr Hauge and Ms Davey are threatening to breach the Contractual Undertakings is misconceived. Mr Hauge and Ms Davey have made clear that they intend to comply with the Contractual Undertakings. They have no intention of using company funds for their own defence,

24.2 Following the service of the Defence and Counterclaim there has, however, been a "sea change" in the sense that the Contractual Undertakings did not envisage the bringing of counterclaims by the corporate Respondents. The Contractual Undertakings do not prevent the Fifth to Eighth Respondents, who are not parties to and not bound by the Contractual Undertakings, from spending their own funds on defending the Petition in so far as it relates to them, or from prosecuting their counterclaims. Some of the claims in the Defence and Counterclaim are claims which only the relevant corporate Respondent can bring, for example the claim concerning destruction of material on PP Munich's computer system or the claim concerning Mr Gott's failure to follow tax advice which caused loss to PP Munich.

Discussion

(2) Misuse of corporate funds The parties' submissions

"That principle clearly applies to participation by a company in s.459 proceedings brought by a member. However, there is no case where it has been applied in a duly authorised corporate action. As Mr Kosmin submitted, it is difficult to see how it can apply to such an action unless it is said that the action was brought under the authority of directors who were motivated not by the company's interests but by a desire to further the interests of shareholders.

Circumstances of that kind may well, however, be very rare. In the present case Mr Hollington has not, in my judgment, shown that the Chancery action is in substance part and parcel of the shareholders' dispute. There is almost total overlap in the factual material but separate relief is claimed in favour of lncasep on the grounds of breach of duty to it. There is no suggestion that (but for the narrower submission) the action was one which could not be, or was not being, properly brought by Incasep. The fact that the same relief could have been claimed by William and Susan on a petition brought by them under s.459 does not mean that relief had to be sought in that way. The situation might have been very different if the Chancery action had clearly been brought in response to s.459 proceedings."

43.1 Whether or not a company may spend money on an action against a member petitioning for relief in s. 994 proceedings depends on whether the company's action is brought for a proper purpose in the interests of the company rather than in furtherance of the interests of the controlling members as part of the shareholder dispute.

43.2 The fact that the company's action appears to have been brought in response to the s. 994 proceedings may well indicate that it is being brought in the interest of the controlling members rather than in the interests of the company. The chronology may be important here. A failure by the company to take action in respect of an alleged breach of duty by the petitioning member until after s. 994 proceedings are in prospect or have started may well indicate that the company's action is not bona fide and is in essence part of the shareholder dispute.

43.3 The fact that the same allegations of breach of duty are relied on by the company in an action against the petitioning member and by the controlling members in their defence of the unfair prejudice proceedings does not necessarily mean that the action has been brought for the improper purpose of obtaining company funding for the members' defence but it may do so.

43.4 If no injunction is granted to restrain the use of the company's funds to pay for the company's action, damages may not adequately compensate the petitioning member for the consequential advantage conferred on the controlling members in the shareholders dispute.

Discussion

The Consultancy Deed and invoices

"The parties hereby acknowledge and agree that [Mr Hauge] provided relevant consultancy services to the Client from 2005 onwards, and in particular during the periods 1 January 2018 – 31 December 2018 and 1 January 2019 – 31 December 2019, that [Mr Hauge] is owed fees for such services which have already been provided and in relation to which no payment has yet been made, and that this Deed shall apply to such services".

4.5 for the payment of fees of €1 million per annum plus VAT together with interest. The services to be provided by Mr Hague are described in generic terms and do not stipulate the number of hours which Mr Hauge was required to work or had worked previously.

Adequacy of damages and balance of convenience

65.1 Is there a serious issue to be tried?

65.2 Would the applicant for the injunction be adequately compensated by an award of damages if successful at the trial and would the respondent be able to pay them? If so, no injunction should be granted,

65.3 If damages would not be an adequate remedy for the applicant, would the applicant's cross-undertaking in damages provide adequate protection for the respondent if the court were to grant interim injunctive relief which, following trial, proves to have been wrongly granted? If not, that points against the grant of interim relief.

65.4 If there is doubt as to the adequacy of the respective remedies in damages available to either party or to both, the court must consider the balance of convenience.

65.5 Where other factors appear to be evenly balanced the Court should preserve the status quo.