Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Chancery Division) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Chancery Division) Decisions >> London Capital & Finance Plc v Global Security Trustees Ltd [2019] EWHC 3339 (Ch) (10 December 2019)

URL: http://www.bailii.org/ew/cases/EWHC/Ch/2019/3339.html

Cite as: [2019] EWHC 3339 (Ch)

[New search] [Printable PDF version] [Help]

BUSINESS AND PROPERTY COURTS

OF ENGLAND AND WALES

PROPERTY TRUSTS AND PROBATE LIST

Fetter Lane, London EC4A 1NL |

||

B e f o r e :

____________________

| LONDON CAPITAL & FINANCE Plc (in Administration) |

Claimant |

|

| - and - |

||

| GLOBAL SECURITY TRUSTEES LIMITED |

Defendant |

____________________

James Pickering (instructed by Judge Sykes Frixou) for the Defendant

Hearing date: 19 November 2019

____________________

Crown Copyright ©

- The claimant ("LCF"), acting by its Administrators, seeks an order for the removal of the Defendant ("GST") as a trustee and for the replacement of GST by the Joint Administrators of LCF or by another trustee, or trustees, as the court may think fit.

- LCF operated on the basis of a stated business model of raising money from private investors for the purpose of making loans to SME's. Money was raised by issuing 'mini-bonds' to investors for periods of up to 5 years and at rates of interest that varied depending upon the terms of the bond and the bond issue. The mini-bonds proved to be popular and over a period of slightly in excess of two years, ending in December 2018, LCF raised over £237 million from more than 11,500 investors.

- LCF was regulated by the Financial Conduct Authority ("FCA") in respect of the promotion and sale of the mini-bonds but was not regulated in relation to their issue.

- The bonds were marketed as "secured bonds". In broad terms, security was provided by LCF executing a debenture in favour of GST with the latter acting as a 'Security Trustee'. In LCF's marketing material GST was described, alongside LCF's solicitors, accountants and others, as one of LCF's "Business Partners". It was also said that the GST management team had "over 120 years legal experience in business with a focus on Corporate and Security Bond Law". In fact, GST was only formed in October 2015 and its sole business appears to have been acting as the Security Trustee for LCF. GST also had very close connections with Buss Murton Law, one of the firms of solicitors which acted for LCF, and Buss Murton had professional connections with some individuals who benefited from loans made by LCF. One of the directors of GST was Robert Sedgwick, who was a consultant with Buss Murton. Mr Sedgwick was suspended by the Solicitors Disciplinary Tribunal on 14 September 2018.

- In April 2018, Mr Sedgwick resigned as a director of GST and another partner of Buss Murton, Mr Alexander Lee, was appointed in his place. On 31 March 2018, notification to Companies House was given that Oracle Ltd, a company incorporated in Malta, became a person of significant control of GST. Mr Jeremy Friedlander was appointed a director of GST in September 2018. By December 2018, Mr Lee and Mr Friedlander were the sole directors of GST and each held 50% of the issued share capital.

- On 10 December 2018, the FCA issued a First Supervisory Notice on the basis that LCF's promotional material was "misleading, unfair and unclear". LCF was required to cease its regulated business and not deal with or dispose of any of its assets. The following events then took place:

- The concerns raised by the Administrators in their report about transfers made to connected individuals are illustrated by the table below. Nearly £20 million of bondholders' money was transferred either directly or indirectly to the four individuals concerned.

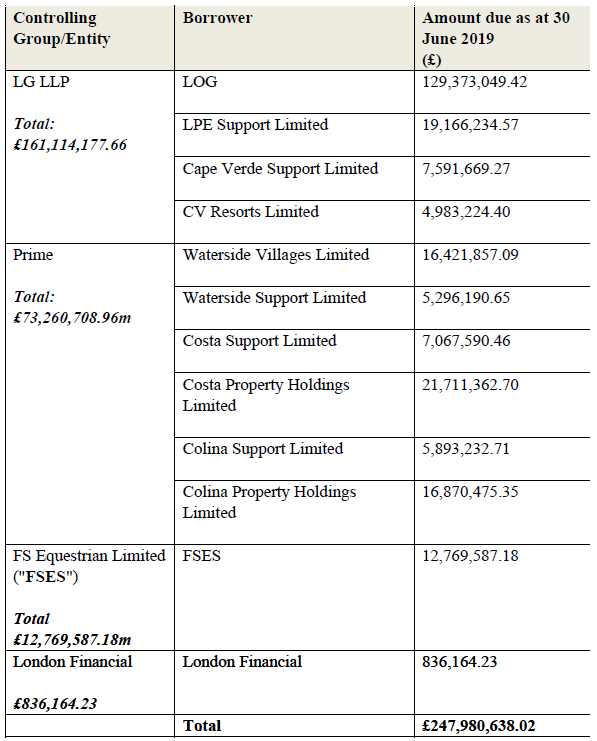

- The total amount that is outstanding on loans made by LCF as at 14 August 2019 was £247,980,638.02. Instead of lending to a broad spread of borrowers, as would have been prudent, LCF appears to have lent money to 12 companies that fall into four distinct groups. As the table below shows, the vast majority of the lending was made to companies in groups known as LG LLP and Prime. Mr Friedlander provided consultancy services to both LG LLP and Prime before his appointment as a director of GST.

- LCF executed a debenture on 29 December 2015 in favour of GST. There were some immediate doubts about its enforceability and a further debenture was executed the following day in slightly revised terms. Nothing turns for present purposes on the differences between the two deeds. It is acknowledged by the Administrators that a valid debenture is in place. The following summary of the terms of the Debenture is taken from the 29 December 2015 version.

- Mr Pickering who appeared for GST particularly relies on the fact that insolvency was contemplated in clause 14.1(f) as an act of default that would trigger GST's right to take enforcement steps.

- The Security Trust Deed dated 5 November 2015 pre-dates the Debenture but nothing turns on that timing because the Security Trust Deed refers to the Debenture entered into "on and around the date of this Deed". Its principal terms provide:

- Clause 3 of the Security Trust Deed warrants being set out in full:

- The relationship between the Debenture and the Security Trust Deed is not entirely comfortable. Under the Debenture, GST had a right to demand payment of the Secured Liabilities, that is the sums due to bondholders and a discretion to enforce its security. Under the Security Trust Deed, GST had an obligation to enforce the security rights under the Debenture.

- Mr Collings QC who appeared for the claimant submitted that the Security Trust Deed set up what he described as a 'home made insolvency procedure' which mirrored, at least in part, the procedure that will be applied by the Administrators. One limb of his case involves a submission that the procedure under the Security Trust Deed is of no utility because it has been overtaken by the appointment of Administrators, a step to which GST consented. He did not, however, go as far as to say that, on a proper construction of the Security Trust Deed, its provisions ceased to have any effect on their appointment.

- Mr Collings QC contrasts the regime that was contemplated by the Security Trust Deed with the key provisions of Schedule B1 of the Insolvency Act 1986 including that:

- The court has power to appoint a new trustee under section 41(1) of the Trustee Act 1925 ("the Trustee Act") and also under its inherent jurisdiction. Mr Collings QC pursued the claim on the basis that he was seeking to invoke the court's inherent jurisdiction on the basis that the power under section 41(1) is limited by section 58(1) of the Trustee Act. Section 41(1) of the Trustee Act gives the court power to appoint a new trustee where it is expedient to do so "…either in substitution for or in addition to any existing trustee or trustees …". Section 58 of the Trustee Act provides that an application under section 41(1) may be made by a trustee or a beneficiary. LCF and/or the Administrators do not fall into either category.

- In Davidson and another v Seelig and others [2016] EWHC 549 (Ch) at [57] Henderson J (as he then was) accepted a submission from leading counsel for the fourth, fifth and sixth defendants that it is implicit in section 58(1) that nobody other than a trustee or beneficiary has standing to seek the appointment of new trustees under the Trustee Act. For the purposes of this judgment, neither party takes issue with that conclusion.

- It is common ground between counsel that the court has power under its inherent jurisdiction on an application by LCF to remove GST and to appoint the Administrators in its place or to appoint some other person or persons to act as trustee. There is a difference between counsel, however, about the circumstances in which the court should exercise this power. Mr Pickering submits that use of the power under the inherent jurisdiction is "exceptional" and it is necessary for LCF to show strong grounds for its use. Mr Collings QC submits that there is no basis for imposing a test that is more stringent than under section 41, which is that of expediency.

- Both counsel also agree that the test to be applied by the court when asked to remove a trustee starts with the decision of the Privy Council in Letterstedt v Broers (1884) 9 App Cas 371. The test is a simple one. The court considers the welfare of the beneficiaries. The applicable criteria, as they have been developed over the years, were summarised recently by me in Long v Rodman [2019] EWHC 753 (Ch) at [19] – [26] and in Schumacher v Clarke [2019] EWHC 1031 (Ch) at [18] to [21]. The principles to be applied are not controversial and it is unnecessary to cite those passages. I should mention, however, that Mr Pickering relies on the passage in Schumacher v Clarke at [20] where it is suggested it will rarely be sufficient for beneficiaries to say that they have fallen out with the trustee; and the court should be astute to prevent a trustee being held hostage by the beneficiaries.

- On the question of whether use of the inherent jurisdiction is exceptional, I was referred to Lewin on Trusts 19th ed. at 13-62 and 13-072A in the 4th supplement at 13-072A as well as Underhill and Hayton 19th ed at 70.1. There are two passages that are relied on by Mr Pickering to support his submissions.

- Lewin at 13-072A deals with the decision of Henderson J in Davidson v Seelig. Lewin summarises the effect of that decision to be: " … the court will not entertain an application by a protector for the removal of a trustee under the inherent jurisdiction save possibly in exceptional circumstances, such as where there is compelling evidence of misconduct by the trustees which might prejudice the interests of possible future beneficiaries." Davidson v Seelig concerns a late application by the second defendant to re-amend his defence and to add a counterclaim. The claimants, as beneficiaries under substantial trusts, sought to challenge the protectorial regime that had been set up. The first, second and third defendants were the protectors although the first defendant had resigned and been removed from that office.

- The second defendant, by his proposed amendment, sought orders replacing the trustees of the settlement and the removal of his co-protector, the third defendant. Under the settlement, the second defendant had no standing qua protector to seek removal of the trustees acting on his own and, even acting together, the protectors had no power under the settlement to appoint new trustees. In addition, the protectors could not rely on section 41 of the Trustee Act. Henderson J went on to observe at [58] that the protectors had power acting jointly to remove trustees and could have surrendered the exercise of this power to the court or sought directions. However, neither of these options were available because the two protectors were not acting in harmony and, in any event, none of the beneficiaries were in favour of the trustees being removed. In this unusual context Henderson J went on to say at [59]:

- Having noted the absence of complaint about the trustees by the beneficiaries, it seems to me that Henderson J was saying no more than that there would need to be exceptional circumstances before the court would remove the trustees. He was, as it seems to me, doing no more than applying the Letterstedt v Broers test.

- The passage in Underhill and Hayton that is relied on states:

- To my mind the difference between the parties on this point is, in reality, minimal. The exercise of the court's inherent jurisdiction to remove a trustee is exceptional in the sense that it is not a jurisdiction that is commonly exercised, because the power under section 41 usually suffices. There is no basis, however, for adding a threshold test of exceptionality and the corollary that a strong case must be made out if the application is made under the inherent jurisdiction. This is because the jurisprudence dealing with the exercise of the power, whether exercised under section 41 or under the inherent jurisdiction, already has built within it adequate checks and balances. The court will never remove a trustee lightly. The court will always wish to consider the application in light of all the circumstances, with the welfare of the beneficiaries firmly in mind. If there has been misconduct by the trustees, it is likely that an order for removal will be made. On the other hand, the fact that the beneficiaries have fallen out with the trustees is likely to be insufficient on its own.

- I would only add that there is a puzzling sentence in paragraph 13-062 in Lewin where it is suggested that recourse may need to be made to the inherent jurisdiction because " … the statutory power under section 41 is not applicable or unsuitable because a dispute of fact is involved". [my emphasis] I do not agree that an application under section 41 is ruled out because there is a dispute of fact.

- The approach the court will take when considering the welfare of the beneficiaries is fact dependent. GST acts a 'Security Trustee'. Such a role has some features in common with a trustee of a special trust. The role of the Security Trustee is in some respects more extensive than that of a trustee of a special trust, such as taking steps to enforce the security; and it is more limited in others such as the absence of the need to invest. However, neither party suggested that different principles apply when the court is dealing with an application to remove a Security Trustee as opposed to the trustee of a special trust.

- It is necessary to acknowledge, however, that the court is not dealing in this case with circumstances that are conventional given (a) the scope of the role of the Security Trustee as it was envisaged by the express terms of the Deed (b) the very substantial shortfall that the bondholders face and (c) the very real concerns that exist about how LCF was operated. There can be no suggestion in these circumstances that the bondholders, by expressing support for the removal of GST as Security Trustee, are acting capriciously or are in some way holding the Security Trustee hostage. Their plight, having suffered a major loss on their investments, and the concerns about LCF's management, highlight the need for the scrupulous avoidance of conflicts of interest.

- Mr Collings QC points to the celebrated passage in the judgment of Millett LJ in Bristol and West Building Society v Mothew [1998] 1 Ch. 1 at [18] where the importance of single-minded loyalty and the necessity to avoid a position where the fiduciary's duty and interest may conflict. The bondholders are entitled to have complete confidence that the trustee will treat their interests as being paramount. Their wishes are inevitably affected by GST's close association with LCF.

- The claim has produced a great deal of evidence. LCF relies on statements from:

- GST relies on statements from:

- Happily, it is unnecessary to refer to this evidence in great detail. There are no material disputes of fact.

- At the time the claim was issued, Mr Stephens, who provides the Administrators' principal evidence, was right to say that GST suffered from irreconcilable conflicts of interest. GST was set up by those involved in the formation of LCF and it was at one time closely linked with LCF. GST had, and has, no business other than acting as Security Trustee for LCF and its ability to perform its role is entirely dependent upon the qualities of its directors and shareholders. There is no evidence to suggest that GST has any resources. Indeed, there is no clear evidence about how it is funding this litigation or how it would fund the performance of the role it says it could perform. All that Mr Pollard says is that the directors have sought and obtained external funding "… to enable us to continue to act for the bond holders in this matter, whilst these legal issues are resolved, given our disagreement with the Administrators, who have continued not to engage with us, and put us to task over covering their costs in at least part of this action."

- Mr Lee resigned on 18 April 2019. It is surprising that he did not reflect on his position some time previously. In view of his firm's involvement with LCF and its lenders, he could never have been a suitable candidate to act as a director of GST.

- Mr Friedlander explains in his first statement his connections with LOG, which owes about £137 million to LCF. He was introduced to LOG in 2016 and met Simon Hume-Kendall (to whom payments in excess of £8 million were made by LCF). Mr Friedlander acted as a consultant to LOG in the course of which he visited investment projects in the Dominican Republic and the Cape Verde Islands. LOG sold the projects to Prime in September 2017 after which he continued to have an involvement. He does not say when that involvement ended. For 12 months from May 2017 he was a director of International Resort Management ("IRM") although the links between IRM and other borrowers from LCF is not explained. He became a director of GST in April 2018 having been offered the role by Mr Thomson. That itself lends support to the concern that GST was thought of as one of LCF's 'business partners' instead of being an entity that was anxious to uphold the rights of bondholders and the security.

- Mr Friedlander does not accept that he is not a suitable director, although in his second witness statement he confirmed an offer to resign as a director of GST "if this will give comfort to the Administrators"; an offer that appears to have been made in somewhat grudging terms. However, he does not consider his resignation to be necessary and he points to the assistance he is able to provide in connection with attempts to recover the debt due from Prime. Curiously, he then says he has entered non-disclosure agreements with Prime which prevent him from providing more than the outline information contained in his statements.

- Mr Friedlander does not say in either statement anything about his background, qualifications and experience. Mr Pollard mentions that he is a lawyer without saying where or when he qualified.

- Mr Lee and Mr Friedlander remain the two shareholders of GST. This means that they are entitled to remove one or more of the current board of directors at any time. This concern was raised by the court during the hearing and after the short adjournment, Mr Pickering was able to convey three undertakings to the court.

- Mr Pollard became a director of GST after having been approached by Paul Sayers. He claims no professional qualifications but worked for HMRC for 33 years and in that capacity was involved in dealing with a great many insolvencies. He describes it as acting a 'professional creditor'. He undoubtedly has much experience in that field although that is not the business of GST. He claims no experience of acting as a trustee.

- Mr Pollard's initial suggestion, before the claim was issued, was that LCF should be placed into liquidation or that the current Administrators should be replaced, although those are not proposals he developed in his evidence. In his first statement he suggested that GST could help in two areas. First, he points to the low anticipated return for bondholders of 25% and says GST can play a valuable role in the administration process. Secondly, he considers that the board of GST is in a better position than the Creditors Committee who are lay individuals to keep the fees charged by the Administrators in check.

- He addresses conflicts of interest and says that neither he nor Mr Gill are conflicted. He then goes on to say:

- The passage I have emphasised strikes me as indicative of a failure to appreciate the importance in the context of a trusteeship of identifying potential conflicts of interest and, importantly, taking steps to deal with them. The suggestion Mr Pollard makes is that if the Administrators express concern about a conflict of interest no action need be taken, whereas if the same concern is raised by someone else it would be followed up. Such an approach overlooks the need to consider objectively whether a conflict of interest is present and the legitimate concerns of the bondholders.

- Mr Pollard developed his case about the role that GST could play in his second statement. He says:

- Mr Gill's qualifications and experience have not been provided. However, I accept for the purposes of this judgment that both he and Mr Pollard have substantial experience in dealing with insolvency and Mr Pollard has a good deal of experience of the type he sets out.

- The wishes of the bondholders can be seen from three sources:

- GST has taken some steps to address concerns about conflicts of interest. However, in my judgment, there has been a failure on the part of the directors of GST to appreciate the importance of ensuring that GST, and its directors, are not tainted by association with LCF, and its directors, companies who borrowed money from LCF and those who have received substantial sums personally from LCF. It need hardly be said that in the context of the very serious allegations that are made against Mr Thomson and his associates, the substantial deficit and the wider public concern about LCF, that anxious consideration should have been given to this subject on the appointment of Mr Pollard and Mr Gill to address this subject.

- As I have indicated, it should have been obvious to Mr Lee that he should not have acted as a director of GST in light of his professional involvement with LCF and its borrowers. Equally, it should have been obvious to board of GST that he should not remain a shareholder of GST in view of the control over GST the shareholding gave him, either by creating a deadlock or voting with the other shareholder.

- Similarly, the reasons for Mr Friedlander being appointed and remaining a director and shareholder show poor judgment on his part. His involvement in providing services to businesses that borrowed money from LCF does not provide a qualification for him to act as director of GST, as Mr Pollard suggests. Rather, it creates the clearest conflict of interest. Again, it should have been obvious to him, and to the board of GST however constituted, that his dealings with GST's debtors made him unsuitable. If there were any doubt on that subject, his inability to use knowledge he had acquired about Prime due to the non-disclosure agreements he has entered into ith Prime crystallises the position. As a director of GST, he would be possessed of knowledge that he was unable to use or reveal to his fellow directors. The board of GST also should have realised it was inappropriate for Mr Friedlander and Mr Lee to remain the two shareholders in GST.

- I would add that Mr Lee and Friedlander appear to have given little thought at an earlier stage, long before the Administrators were appointed, to their roles as directors of GST or the terms of the Security Trust Deed. Had they done so they would have realised that GST needed to hold details of all the bondholders in order to be in a position to comply with its obligation under clause 3 of the Security Deed to alert the bondholders of an event of default. This would have meant that GST should have received information about the bondholders on an ongoing basis or had access to a database that contained this information.

- It seems to me that the current board of GST has lacked an understanding of the need to be scrupulous to ensure that no conflicts existed. This highlights the lack of relevant experience on the part of Mr Pollard and Mr Gill for the role of trustee in the context of the collapse of LCF.

- The Security Trustee holds in trust the right to enforce LCF's obligations under the Debenture. It has three express obligations: (1) to alert the bondholders of an event of default; (2) to enforce the security and (3) to distribute the proceeds that are recovered. The first stage is of no practical utility any longer. Similarly, having consented to the appointment of Administrators, the entitlement to enforce the security has passed. Recovery of the loans made by LCF will now be dealt with by the Administrators by seeking to recover the loans under a conventional insolvency regime rather than the bespoke regime provided by the Security Trust Deed. An integral part of the Administrators' role will be to distribute the net recovery that is made to all the creditors; in this case the vast bulk of the creditors are the bondholders. It is unlikely to be of benefit to them for arrangements to be made for a distribution to be made through GST, a step that inevitably will duplicate expense. In any event, GST does not hold details of the bondholders and it would have to obtain their details from the Administrators. Although the point was not developed at the hearing, a direction from the court is likely to be required due to restrictions on the release of personal data under the GDPR.

- Mr Pickering points to:

- The first two obligations placed on GST cannot be performed by it, and the third obligation is of little value. Nevertheless, Mr Pollard says in his second statement, made just two weeks before the hearing, that he now sees GST's role as providing assistance to the Administrators in a manner that does not duplicate their role. Mr Pollard envisages that GST will consider the actions and costs of the Administrators with a view to ensuring that the bondholders receive the maximum return. A view about the assets of LCF is set out in a summary form in an exhibit to Mr Pollard's second statement. This comprises some brief notes expressing a view about the recoverability of the loans no doubt based in part on Mr Friedlander's knowledge. It does not, however, contain much, if any, information that is likely to be unknown to the Administrators and does not provide a plan for recovering the loans.

- No evidence has been provided on behalf of GST about whether advice has been obtained concerning the role it may be able to perform under the Debenture and the Security Trust Deed or the likely expense that it will incur.

- I would have expected GST to have applied to the court for guidance about the exercise of its function at the earliest opportunity. This possibility was raised in Mr Collings' opinion that was circulated. Whether the Security Trustee has a residual role, and if so what it may be, is a matter that would have benefited from a careful review in the context of such an application.

- There is powerful evidence that many of the bondholders do not wish GST to play any further part. The evidence strongly suggests that they are concerned about any person or entity that is tainted by association with the former management of LCF, or its borrowers, having any involvement whatever. This is an understandable position for them to adopt given the likely level of losses they will suffer. It seems to me that in this case it is not just actual conflicts of interest that are of concern but also a reasonably held perception of conflicted interests.

- I do not consider it is necessary to appoint Mr Considine as a representative bondholder. That step would only have been worthwhile had he been given an opportunity to be separately represented and to have provided the court with an alternative view at the hearing.

- The circumstances in which the application is made by the Administrators are unusual. The role of Security Trustee was clearly created in order to persuade bondholders that an investment in bonds offered by LCF offered limited risk. The function of the 'home grown' insolvency procedure contained in the Security Trust Deed has been largely overtaken by the appointment of Administrators, with the consent of GST. There remains some doubt, however, about whether the Security Trustee has any role to play. The Debenture secures the "Secured Liabilities", namely the liabilities of LCF owed to the bondholders. The Debenture remains in force such that the Security Trustee holds the rights it creates in trust for the bondholders.

- It seems to me the court should be careful not to conflate two matters which, although related, are in fact distinct. The first is whether GST should be removed as a trustee and the second is, if it is to be removed, should it be replaced and by whom.

- As I have already indicated, the jurisdiction to remove a trustee under the inherent jurisdiction does not have an initial threshold of exceptionality and there is no requirement, beyond that which is normal, for a strong case to be made out. It may be more common for the power under section 41 of the Trustee Act 1925 to be exercised but it does not follow, because it is less common to need to resort to the inherent jurisdiction, that anything other than the standard test should be applied. The welfare of the beneficiaries and what is in their best interests are infallible guides to both whether the power needs to be exercised and, if it does, how it is to be exercised.

- I am in no doubt that GST should be removed as the Security Trustee. My reasons for reaching this conclusion can be summarised in the following way:

- The more difficult question, to my mind, is whether the court should appoint the Administrators to act as Security Trustees or whether an independent professional trustee should be appointed.

- The Administrators' primary case is that in the unusual circumstances of this case, they can act as trustees in place of GST because its role is duplicative of their role. However, they recognised that this might be unattractive to the court and Mr Stephens referred in his first statement to an unnamed trust service provider which had indicated a willingness to act. He also said, without providing any details, that appointing the trust service provider "could entail quite large fees." During the course of the hearing, the service provider was named as Madison Pacific Trust Limited ("Madison Pacific"). The court was told that indicative fees were £20,000 for establishing the trusteeship and an annual charge of £15,000.

- At the request of the court, Mr Stephens made a further statement after the hearing to provide evidence of Madison Pacific's fitness to act. The statement also includes outline details of three possible alternatives, GLAS Trustees Limited, Trident Trust Company (UK) Limited and The Law Debenture Trust Corporation plc although they had been unable to confirm they could act in the limited time that was available. Mr Stephens suggests in his witness statement that the Administrators should pursue discussions, including proposals about fees, with each of the trust services providers only if the court determined that an independent trustee should be appointed.

- One of the difficulties for the court is that it has not had the benefit of an independent view about whether there is a residual role for the Security Trustee, other than if it were to be required, the distribution of sums due to the bondholders. GST explained in the evidence it provided it would like to perform that residual role but did not address the legal structure in doing so.

- There are certainly doubts about whether the Security Trustee has any function to perform. However, the Security Trustee has the benefit of a covenant from LCF to pay the Secured Liabilities under the Debenture and is subject to a general obligation under the Security Trust Deed to enforce the Rights. There may be rights and duties that are to be implied in both contracts. Furthermore, the Security Trustee may be a creditor of LCF, depending on the determination of the court. If the Security Trustee is a creditor of LCF, it would be an obvious candidate for membership of the Creditors Committee and could provide assistance based upon commercial experience to assist the bondholders on the Creditors Committee.

- I am not in a position to determine in this claim that the Security Trustee has no role to perform or to determine, if there is a residual role, whether it is one that it is in the interests of the bondholders for the trustee to perform. In my judgment it would be wrong to, in effect, merge the role of Security Trustee with the role of Administrator until the issues I have highlighted have been resolved.

- I will therefore proceed in the following way:

- It will then be for the new trustee to decide what steps are to be taken. If the trustee has any doubts about its role, and its utility, it should apply to the court for directions.

Chief Master Marsh:

Background

(1) On 14 December 2018, Mr Lee and Mr Friedlander wrote on behalf of GST to Andy Thomson, the Chief Executive of LCF, to express their concern about the position and indicated the steps that might need to be taken to protect the interests of the bondholders, including GST taking over the running of LCF. The letter reserved GST's rights.

(2) On 3 January 2019, LCF sent a circular letter to bondholders concerning the intervention by the FCA. It was signed both by LCF and GST.

(3) On 17 January 2019, a Second Supervisory Notice was issued by the FCA.

(4) On 30 January 2019, LCF appointed Administrators[1]. GST, as a Qualifying Charge Holder, consented to the appointment.

(5) On 25 March 2019, the Administrators produced their first report. They estimated the likely return for bondholders on their investments to be as low as 20%, although the return was later revised to 25%. The Administrators said in their report:

"There are a number of highly suspicious transactions involving a small number of connected people which have led to large sums of the Bondholders' money ending up in their personal possession or control."

Mr Andrew Thomson, the managing director of LCF, is one of the connected persons to whom reference was made in the report, together with Simon Hume-Kendall, Elten Barker and Spencer Golding (and his related trusts and interests).

(6) On 10 April 2019 an opinion written by Mr Matthew Collings QC was provided to Mr Lee who remained a director of GST. Mr Collings QC advised the Administrators that it was inappropriate for GST to remain |Security Trustee in view of a conflict of interest.

(7) On 18 April 2019, Mr Lee resigned as a director or GST and Mr Mark Pollard and Mr Steven Gill were appointed directors. The issued share capital of GST remained held by Mr Lee and Mr Friedlander and Mr Friedlander remained a director.

(8) On 23 April 2019, Mr Lee sent, in his capacity of a partner in Buss Murton, an email to the Administrators with a form of proxy and revised proof of debt form. The email was sent on behalf of GST for the creditors meeting that was due to take place the following day. The proxy form provided voting instructions to vote against the establishment of a creditors' committee. The proof of debt form valued the debt due to GST at £237,207,497 of which £180,000,000 was valued for voting purposes as secured and £57,207,497 as unsecured.

(9) On 24 April 2019 GST's proof of debt was rejected by the Administrators on the basis that GST is not a creditor of LCF.

(10) On 15 May 2019, GST made an application to the court to reverse the Administrators' decision.

(11) On 31 May 2019 this claim was issued. GST's application to the court has been stayed by agreement pending the resolution of this claim.

Transfers outMr Barker /FONT> Mr Hume-

KendallMr Golding Mr Thomson/FONT> Charges Total out Date £ £ £ £ £ £ 22/06/2018 411,675.00 2,332,825.00 2,332,825.00 411,675.00 11,000.00 5,500,000.00 03/07/2018 150,448.50 709,827.50 709,827.50 351,296.00 3,850.50 1,925,250.00 23/07/2018 374,250.00 2,120,750.00 - 374,250.00 5,750.00 2,875,000.00 23/07/2018 - - - - - - 07/08/2018 - - 2,120,750.00 - 9,250.00 2,130,000.00 08/08/2018 187,125.00 1,060,375.00 1,060,375.00 187,125.00 - 2,495,000.00 17/08/2018 261,975.00 1,484,525.00 1,484,525.00 261,975.00 7,000.00 3,500,000.00 27/11/2018 112,309.93 - - - 225.07 112,535.00 27/11/2018 - - 636,225.00 - 1,275.00 637,500.00 27/11/2018 - 636,225.00 - - 1,275.00 637,500.00 27/11/2018 - - - 112,275.00 225.00 112,500.00 1,497,783.43 8,344,527.50 8,344,527.50 1,698,596.00 39,850.57 19,925,285.00

The Debenture

(1) LCF is described as the Borrower and GST as the Security Trustee.

(2) The deed recites that the Borrower has agreed to execute the Debenture as security for repayment of the Bonds and that the Security Trustee has agreed to hold the benefit of the rights and interests created by the Debenture on trust for the bondholders.

(3) Clause 2 contains a covenant by the Borrower that it shall "on demand pay to Security Trustee and discharge the Secured Liabilities when they become due."

(4) The term Secured Liabilities is widely defined to include all present and future monies and liabilities owed by LCF to the bondholders under the Bonds.

(5) The Bonds are defined as "… the secured bonds issued by …" LCF.

(6) Clause 13.7 permits the Security Trustee to appoint an Administrator pursuant to Paragraph 14 of Schedule B1 of the Insolvency Act 1986.

(7) Clause 14.1 provides that the security becomes enforceable on the happening of an Event of Default which includes under clause 14.1(a) a failure to pay any amount due under the Bonds[2] within 30 days and under clause 14.1(f) the commencement of any "insolvency proceedings".

(8) Clause 14.2 gives the Security Trustee a discretion to enforce all or part of the security as it thinks fit after the security becomes enforceable.

(9) Clause 15 contains provisions for the enforcement by GST of the security and clause 16 permits GST to appoint a receiver.

The Security Trust Deed

(1) Under clause 2 the Security Trustee is to hold the Trust Property on trust for the Beneficiaries on the terms of the deed.

(2) The Trust Property is defined as being a combination of the Rights and the Proceeds.

(3) The holders of the bonds issued by LCF are the Beneficiaries.

(4) The Rights are defined as including the security rights vested in the Security Trustee under the Debenture and other associated rights.

(5) The Proceeds are defined as all receipts or recoveries by the Security Trustee pursuant to or upon enforcement of any of the Rights after deducting certain specified items.

(6) Clause 4 sets out further provisions dealing with the application of the Proceeds. The Security Trustee is required to set up a Proceeds Account and clause 4.2 (which is mirrored in clause 19.1 of the Debenture) specifies the priority in which payments are to be made. First, the Security Trustee is required to discharge all costs and charges and, secondly, payments are made to the Beneficiaries pro rata the amounts owed to them.

"3 ENFORCEMENT EVENT PROCEDURE

3.1 If an Enforcement Event occurs, the Security Trustee shall as soon as reasonably practicable after becoming aware of the same, notify the Beneficiaries of such occurrence.

3.2 The Security Trustee shall at any time after the occurrence of an Enforcement Event be obliged to enforce the Rights."

(1) An Administrator is an officer of the court (paragraph 5).

(2) There is power to establish a creditors' committee. The committee is entitled to require the Administrator to attend on the committee and to provide information about the exercise of the Administrator's functions (paragraph 57).

(3) The entitlement of a creditor to challenge the Administrator's conduct (paragraph 74).

(4) The court may remove an administrator from office (paragraph 88).

Removal of a trustee

"The position might conceivably be different if there were compelling evidence which suggested that the Trustees were guilty of misconduct which might jeopardise the interest of possible future beneficiaries, or of charity (which is one of the objects of the Trustees' overriding powers of appointment). But in my judgment the existing evidence comes nowhere near satisfying a test of this nature."

"(2) A trustee may be removed from his office:

…

(d) by the court appointing a new trustee in his place (or, exceptionally, under its inherent jurisdiction by simply removing the trustee without replacing him if sufficient trustees remain), at the instance of any trustee or beneficiary, where he has behaved improperly, or is incapable of acting properly, or from faults of temper or want of tact is in a permanent condition of hostility with his co-trustees and beneficiaries, or has been convicted of an offence involving dishonesty or is a recent bankrupt, … or where any other good reason exists:" [my emphasis]

The evidence

(1) Mr Adam Stephens, who is one of the Joint Administrators. He has made four statements.

(2) Michael Stubbs, who is a solicitor with Mishcon de Reya LLP.

(3) Mr Alan Considine who is one of the bondholders and therefore a beneficiary. He is willing to be joined as a representative party if the court considers that is needed.

(1) Mr Mark Pollard who is one of the directors of LCF. He has made two statements.

(2) Mr Jeremy Friedlander who is also a director of LCF. He too has made two statements.

(3) Mr Steven Gill who is also a director of LCF.

(1) Mr Friedlander would resign as a director if required to do so.

(2) Mr Friedlander and Mr Lee would transfer their shares to Mr Pollard and Mr Gill.

(3) Mr Pollard and Mr Gill would accept the transfers.

"58. We have already addressed any potential conflicts in respect of what may previously have happened in this case, and have undertakings from both Mr Lee and Mr Friedlander that they will withdraw as shareholders, directors (for Mr Friedlander alone) or even advisors to us, should anyone other than the incumbent administrator [sic] raise any issues with their involvement going forwards in this matter. We have also ensured that no actions can be taken by GST without our involvement and agreement, via the changes to the GST rules requiring at least one of Mr Gill or Myself to form one of the two directors to make a quorum, and hence be able to make decisions on behalf of GST." [My emphasis]

"5. The Directors of GST are not Administrators, we do not intend to duplicate their work or comment on it. GST's role is to ensure that the Administrators act in an appropriate and proportionate fashion, giving due regard to the assets of [LCF]. GST is uniquely placed to assist in this regard for three reasons, all linked to the knowledge base of the three current directors. Mr Gill has worked in the insolvency industry for a considerable period of time and has extensive experience of both insolvency processes and investigation. Mr Friedlander has first hand knowledge of a number of the assets of LCF and I understand he will address this in a second witness statement.

6. Personally, I worked for HMRC, effectively as a professional creditor. I cannot provide details, being a signatory to the Official Secrets Act, but I can confirm the following:

(i) I have acted on several cases where over a billion pounds of tax has been claimed.

(ii) I have worked on cases that have been to the European Court of Justice.

(iii) I have acted on a number of multinational insolvencies.

[There is no paragraph (iv)]

(v) I have acted on a number of household name insolvencies.

(vi) In addition, I have assisted HMRC on several hundred investment fraud cases, including Ponzi Schemes and land banking, working in conjunction with branches of the Police, many of which resulted in criminal prosecutions. This has included the SCO, the FCA and NCA. There are few people who can offer this level of expertise, a role which I am able to undertake. [sic]

7. Given my experience as referred to above, I am well placed to consider the actions and costs of the administrators of LCF, to ensure that best value is received for creditors. To that end I attach GST's view on the assets of LCF, which can be contrasted with [the table at 8 above] …

8. I am of the view that the administration of LCF requires a third party with such experience to act as security trustee due to the unique nature of the dual role of the administrators. [After referring to LOG having entered administration and the overlap between LCF's and LOG's Administrators] the costs position will need to be reviewed carefully and impartially. Given the knowledge held by Mr Friedlander and my background as referred to above, I am of the view that we are best placed to serve the bondholders in this role."

(1) The Creditors Committee passed a resolution supporting the commencement of these proceedings.

(2) Mr Considine who is on the Creditors Committee confirms that it is the wish of members of the Committee for GST to be removed and from his dealings with other bond holders he is aware that this is a widely held view.

(3) Mr Stubbs has taken part in four 'roadshows' in Birmingham, Manchester, Bristol and Glasgow. He says all the bondholders he spoke to indicated that they did not wish GST to have anything to do with LCF's assets.

Grounds for removal

Ground (1) – Conflicts of interest

Ground (2) - Utility

(1) Clause 14(f) of the Debenture which provides that the security becomes enforceable if any insolvency proceedings are commenced against LCF. He submits that the Debenture and therefore the Security Trust Deed contemplated an insolvency event and, therefore, GST has a role to play in the events that have occurred. True it is that the commencement of some form of insolvency proceedings was contemplated as a trigger for enforcement. However, it does not follow that in light of GST's consent to the appointment of Administrators, its role is necessarily preserved.

(2) GST's case that it is a creditor of LCF. This is disputed by the Administrators who have rejected GST's proof of debt. A challenge to that rejection has been made but stayed pending the outcome of this claim. It would not be right for me to determine in this claim an issue that is before the court in separate proceedings . The point would of course become academic if the Administrators are appointed to replace GST as the Security Trustee.

(3) The need for the court to be slow to override the contractual separation that was created between the roles of LCF and GST.

Ground 3 – The wishes of the bondholders

Conclusions

(1) The current board has been slow to appreciate the importance of conflicts of interest. Even two weeks before the hearing, Mr Friedlander was put forward as being a suitable director, in effect, because he held information about Prime, albeit he was hampered by a non-disclosure agreement.

(2) Similarly, the board should have realised a long time ago that the shares in GST should be held by persons other than Mr Lee and Mr Friedlander.

(3) The undertakings that were offered at the hearing came much too late. It was incumbent on the board of GST and its shareholders to take all necessary steps to enable it to act as a trustee immediately on the appointment of Mr Pollard and Mr Gill.

(4) In light of these observations, I have reservations about whether Mr Pollard and Mr Gill are suitable persons to form the board of GST in the current context. They have no experience of the role of a trustee. Furthermore, despite their knowledge of insolvency, they have not put forward a clear basis upon which the Security Trustee has a role to play under the provisions of the Deed, what it will cost and how its work will be funded. An experienced trustee would have realised immediately upon appointment that it would be unwise to proceed without guidance being obtained from the court about the role GST might perform.

(5) The role for GST that was articulated in Mr Pollard's second statement has not been linked to the provisions of the Security Trust Deed or the Debenture.

(6) The wishes of the bondholders weigh heavily in the balance. It is of course right that the wishes of the beneficiaries are but one factor for the court in many cases. Here, the circumstances which led to LCF's administration give rise to very grave concern and it is important that the confidence of the bondholders in the regime that is in place to recover their losses is maintained, as far as possible. The taint of GST's connections with LCF, Mr Thomson and LCF's advisers is hard to remove if GST remains the trustee, even with Mr Pollard and Mr Gill as GST's sole directors and shareholders.

(1) I will make an order removing GST as a trustee. I propose that this will take immediate effect, but I will hear counsel when this judgment is handed down about whether there may be difficulties, for example in relation to the dispute about the proof of debt, if there is an interregnum between GST's removal and the appointment of a new trustee.

(2) The Administrators will be ordered to lodge further evidence about the four candidates for the role of Security Trustee they have identified, including an indication of the likely cost that will be incurred.

(3) I will appoint a new Security Trustee after considering that evidence. It may be possible to deal with that step without a hearing.

Note 1 Finbarr O’Connell, Adam Stephens, Henry Shinners and Colin Hardman of Smith & Williamson. [Back] Note 2 Bond (singular) is used in 14.1(a) but this must be a typographical error. [Back]