Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales High Court (Administrative Court) Decisions

You are here: BAILII >> Databases >> England and Wales High Court (Administrative Court) Decisions >> Elliott Associates LP & Anor, R (On the Application Of) v The London Metal Exchange & Anor [2023] EWHC 2969 (Admin) (29 November 2023)

URL: http://www.bailii.org/ew/cases/EWHC/Admin/2023/2969.html

Cite as: [2023] EWHC 2969 (Admin)

[New search] [Printable PDF version] [Help]

KING'S BENCH DIVISION

ADMINISTRATIVE COURT

DIVISIONAL COURT

Strand, London, WC2A 2LL |

||

B e f o r e :

MR JUSTICE BRIGHT

____________________

| THE KING on the application of (1) ELLIOTT ASSOCIATES L.P (2) ELLIOTT INTERNATIONAL L.P. |

Claimants |

|

- and - |

||

| THE KING on the application of JANE STREET GLOBAL TRADING, LLC |

Claimant |

|

- and - |

||

| (1) The London Metal Exchange (2) LME Clear Limited |

Defendants |

____________________

James Segan KC, George Molyneaux and Hollie Higgins (instructed by Quinn Emanuel Urquhart & Sullivan UK LLP) for the CO/2007/2022 Claimant

Jonathan Crow KC, James McClelland KC, Rebecca Loveridge, Emily Mackenzie and Alastair Richardson (instructed by Hogan Lovells International LLP) for the Defendants

Hearing dates: 20, 21, 22 June 2023

____________________

Crown Copyright ©

- The First Defendant ("the LME") is the world's main centre for the trading of industrial metals. The Second Defendant ("LME Clear") is the clearing house for trading on the LME. Much of the trading activity conducted via the LME and LME Clear concerns futures contracts and other derivatives.

- The metals traded via the LME include nickel in particular, nickel due for delivery in three months' time ("3M nickel"). In early March 2022, nickel prices rose very dramatically. There was a particularly pronounced spike early in the morning of 8 March 2022. At 08:15 on that day, the LME suspended nickel trading ("the Suspension"). At 12:05, the LME published a notice cancelling all nickel trades entered into on that day before the Suspension ("the Cancellation").

- The aggregate value of the cancelled trades was around US$12 billion. The parties affected included the Claimants in both the actions before us (respectively, "the Elliott Claimants" and "Jane Street"). The Elliott Claimants say that the Cancellation caused them to lose net profits totalling about US$456 million, which would otherwise have been made on the nickel trades agreed by them between 00:00 on 8 March 2022 and the Suspension at 08:15. Jane Street says that it has been caused to lose net profits totalling about US$15 million.

- The Elliott Claimants and Jane Street say that the decisions of the LME and/or LME Clear in relation to the Cancellation were unlawful. They seek declarations to this effect. They also seek damages to compensate them for their lost profits, on the basis that there has been a breach of their Convention rights under the Human Rights Act 1998 ("HRA 1998") specifically, their rights under Article 1 of the First Protocol ("A1P1").

- It is common ground that the LME and LME Clear undertake regulatory functions, that their decisions are amenable to judicial review and that they are "public authorities" for the purposes of the HRA 1998. However, it is also common ground that the LME and LME Clear are commercial entities. So too are the Elliott Claimants and Jane Street, as reflected by their claims for substantial damages which (we apprehend) are what really drives this litigation.

- After a case management hearing on 28 February 2023, directions were given for a split trial. Judicial review issues, including the A1P1 points, were to be heard first. There was then to be a separate hearing of remedies issues, notably the assessment of damages, as required. This judgment follows the judicial review hearing and is not concerned with the claims for damages. Nevertheless, the financial context, which permeates the case as a whole, is highly relevant to many of the judicial review issues. The public law issues are entwined with private law rights.

- Each party fielded an impressive array of legal talent, headed by Ms Monica Carss-Frisk KC for the Elliott Claimants, Mr James Segan KC for Jane Street and Mr Jonathan Crow KC for the Defendants. We are grateful to each of them, and to the other members of each team who contributed to the extremely thorough but succinct skeleton arguments, for all the assistance we have received.

- Each of the Elliott Claimants is an investment fund. They are experienced commodity traders, with substantial expertise in derivative contracts including nickel futures.

- Jane Street is an international trader, trading predominantly in financial products. Some of its business activities concern financial products associated with commodities such as nickel.

- The LME is a "recognised investment exchange" or "RIE" for the purposes of Part XVIII of the Financial Services and Markets Act 2000 ("FSMA 2000"). As an RIE, the LME has the regulatory functions set out in the Financial Services and Markets Act 2000 (Recognition Requirements for Investment Exchanges, Clearing Houses and Central Securities Depositories) Regulations 2001 (SI 2001/995) ("the Recognition Requirements Regulations").

- Trading on the LME is governed by the LME Rules and Regulations ("LME Rules"). The LME Rules include the Trading Regulations ("TRs") set out in Part 3 of the LME Rules. As discussed later, one of the key objectives identified in the Recognition Requirements Regulations, and acknowledged in the LME Rules, is to maintain a fair and orderly market.

- LME Clear is a "recognised central counterparty" for the purposes of Part XVIII of FSMA 2000 and an authorised "central counterparty" or "CCP" under the UK European Market Infrastructure Regulation ("UK EMIR", the Retained EU Law version of Regulation (EU) 648/2012). LME Clear's operations are governed by the LME Clear Limited Rules and Procedures ("LME Clear Rules").

- As a recognised clearing house and CCP, LME Clear is at the centre of every transaction concluded on the LME. It is the seller to every buyer and the buyer to every seller. It therefore is the effective guarantor of every contract concluded on the LME. In the event of a default, LME Clear will step in and manage the defaulting party's outstanding risk positions.

- Each of the Defendants is ultimately owned by Hong Kong Exchanges and Clearing Limited, via subsidiaries. They are 'for profit' entities. As well as having public law obligations as regulators, they (or, strictly, their respective boards) owe private law obligations to their shareholders.

- The CEO of the LME in March 2022 was Mr Matthew Chamberlain. The Chair of the LME was Ms Gay Huey Evans. The CEO of LME Clear was Mr Adrian Farnham. The COO of both the LME and LME Clear was Mr James Cressy (who was at the time of the hearing the acting CEO of LME Clear). The Chief Risk Officer of both the LME and LME Clear was Mr Christopher Jones. LME Clear's Head of Market Risk was Mr Paul Kirkwood. LME's Chief Regulatory and Compliance Officer was Ms Kirstina Combe. All of these individuals had a role in the events of 8 March 2022 and they all feature in this judgment.

- The LME and LME Clear have separate Boards of Directors, although a number of individuals (including, at the time of the hearing, Mr Chamberlain) are on both boards. Each Board has delegated its responsibility for overseeing all day-to-day business to the respective CEO.

- The LME and LME Clear each has an Executive Committee ("ExCom"). The role of each ExCom is to assist the CEO in decision-making.

- The LME and LME Clear each has a Default Management Committee ("DMC"). The responsibilities of each DMC include managing and resolving any default by a Clearing Member, including considering situations where a default may be likely to occur, for its respective entity. The Chair of the LME Default Management Committee was Mr Cressy. The Chair of the LME Clear Default Management Committee was Mr Farnham.

- The LME has a Special Committee, a sub-committee of the LME Board to which the Board has delegated specific powers which are set out in TR 17. As set out below, this applies in the event of the Special Committee having cause to suspect or anticipate a corner or undesirable situation or undesirable or improper trading practice likely to affect the market. In such event, the Special Committee is given the power to contain or rectify the situation by giving directions to Members, including directions to trade out positions or reduce their net positions or by the suspension or curtailment of trading.

- LME Clear has a Board Risk Committee. Its role is to consider matters relating to LME Clear's risk-management arrangements and in relation to developments impacting its risk management in emergency situations.

- Only LME Members can trade directly on the LME. Members have to satisfy the requirements for membership and submit to being bound by the LME Rules. This means (among other things) that Members submit to their trades being regulated by the LME, in accordance with the LME Rules.

- There are several categories of Members. Of particular significance for this case are Clearing Members, who are members of both the LME and of LME Clear and are entitled to contract as principals and deal with LME Clear. Clearing Members submit to be bound not only by the LME Rules but also by the LME Clear Rules, and thus submit to having their clearing activities regulated by LME Clear.

- Traders that are not Members can only trade on the LME indirectly, by dealing with LME Members as their "Clients" (this being the term used in the LME Rules and LME Clear Rules).

- Neither of the Elliott Claimants nor Jane Street is either a Member or a Clearing Member. To participate in transactions on the LME, they had to agree the commercial terms of a trade either (a) with a Clearing Member or (b) with a Member, i.e., as a Client. If a Client deals with someone other than its designated Clearing Member, that party does not contract as a principal but will "give up" the trade to a Clearing Member. Either way, therefore, it will be a Clearing Member that enters into the necessary contracts.

- All Members and Clearing Members are obliged under the LME Rules (specifically, TR 2.6) to ensure that all their contracts with non-Member clients such as the Claimants incorporate and are subject to the LME Rules. Thus, the Elliott Claimants and Jane Street could only do business via the LME by accepting the LME Rules. We understand that this was the case for all the transactions that we have to consider.

- In effect, the Elliott Claimants and Jane Street thereby agreed to be bound by the LME Rules, and by decisions made by the LME in accordance with those Rules, even though they are not Members and have no direct contractual nexus with the LME.

- The transactions that have given rise to these proceedings were predominantly sales. However, they could not be made by means of a contract of sale directly between buyer and seller. Because all LME transactions have to proceed via LME Clear as the CCP, and because non-Members cannot deal with LME Clear, a more complex contractual structure was required:

- The relevance of this is that the damages claims advanced by the Elliott Claimants and by Jane Street assert that they have been deprived of property consisting of their contractual rights in respect of the cancelled trades. Fundamentally, this means the right to make a profit by selling at high price. In effect, their claims are for the alleged lost profits.

- In each case, however, the contract that would have achieved such profit was not concluded merely by each Claimant agreeing commercial terms with its ultimate buyer. That agreement no doubt constituted a contract between those involved, but it was not a contract of sale. It was, rather, a contract imposing mutual obligations to take the steps necessary to ensure that contracts per the structure explained above would be put in place, via LME Clear.

- The contracts that would have generated profits for the Claimants would have been, rather, the contracts that the structure outlined above posits between each Claimant, as a Client, and the Clearing Member.

- The LME Rules and the LME Clear Rules differentiate between an "Agreed Trade", a "Cleared Contract" and a "Client Contract".

- When commercial terms have been agreed between Client and Member and/or Clearing Member (as the case may be), there is an "Agreed Trade" but this does not amount to a binding contractual agreement to trade under the LME Rules but (at most) a "Contingent Agreement to Trade". The relevant trade details are then entered into the LME system. When the LME and LME Clear have completed the relevant administrative processes and checks (notably, by confirming that the buy and sell orders match), the matching contracts between the Clearing Member and LME Clear become "Cleared Contracts". Following this but not beforehand the corresponding sale from the Client to Clearing Member becomes a "Client Contract".

- Thus:

- Precisely how these processes take place, and how rapidly, depends on which LME venue has been used. Some trades are concluded by open outcry on a physical trading floor; some on the LME electronic trading system, LMESelect; some occur in the inter-office market. These all have different features, and, no doubt, their own advantages and disadvantages. Our impression is that the time required to enter, check and clear all the relevant contracts is not great in any of them, but the process is likely to be quickest on the LMESelect electronic trading system.

- LME Clear's role as CCP means that it is exposed to the risk of default on both sides of the trade. Under the LME Clear Rules, on every trade the Clearing Member must deposit funds or provide equivalent collateral (known as "margin") to cover some (but not all) of LME Clear's estimated liabilities in the event of default. "Initial margin" is required when a Clearing Member enters into a futures contract and is adjusted daily; "variation margin" is required (sometimes intra-day) if price movements mean that LME Clear is no longer sufficiently protected.

- There is also an assessment at the end of each business day, when LME Clear uses closing prices to calculate further margin requirements, which are due for payment by 09:00 the next day. Intra-day margin calls must be paid within one hour (apart from the first intra-day margin call, which must be paid before 09:00). These calls reflect price movements and can affect all Clearing Members who have open positions in a given metal, not just those who have entered into trades that day.

- These margin assessments are not performed only on nickel trades. Each Member, and certainly each Clearing Member, trades on a regular basis in respect of many other metals. LME Clear must be collateralised on all such trades, and the assessment of margin therefore takes account of all the trading that has been done, by all Clearing Members, on all metals.

- The LME operates various pre-trade controls and volatility controls, including "price bands" which are monitored and adjusted by the LME's Trading Operations Team ("TOT"). If a Member seeks to book a trade outside the bands, it will not be accepted by the relevant trading platform, but will automatically be rejected. This is subject to those involved indicating that the trade reflects their actual intention. Our understanding is that they do this by simply contacting the TOT to confirm that the trade is genuine and not a mistake, and the trade is then booked as normal.

- The key provision from the LME Rules that the LME relied on as giving it the power to cancel trades was Trading Rule 22:

- The legal status of this is slightly unusual in the context of judicial review. As an RIE, the legislative regime that governs the LME imposes statutory obligations to ensure that the market that it manages complies with various requirements. This means, in turn, that the LME is obliged to ensure that the LME Rules give it the powers and obligations mandated by the overarching legislative regime.

- However, the LME Rules are not, themselves, pieces of legislation. In and of themselves, they have no legal effect over anyone. They have power over those who trade in the market only because those persons agree to be bound by the LME Rules, in contract. LME Members give that contractual agreement when they apply for and obtain membership. Their Clients (including the Elliott Claimants and Jane Street) give that agreement in contract, when they trade with any LME Member.

- It follows that the legal effect of the LME Rules, including TR 22.1, operates in the field of private law (specifically, the law of contract), not that of public law. However, the regulatory context makes it necessary to interpret the LME Rules and, in so far as relevant, the LME Clear Rules by reference to the overarching legislation. This regulatory context also informs the judicial review of the decisions made by the LME and LME Clear, pursuant to their respective Rules.

- The relevant legislation begins with Directive 2014/65/EU on markets in financial instruments ("MiFID II"). The submissions before us focussed primarily on Article 48(5), but we were also taken to Article 47(1)(d) and (f), and to Article 48(12).

- Article 47(1)(d) and (f) of MiFID II provide as follows:

- The specific source for TR 22.1 is in Article 48(5), but the submissions before us naturally explored the interplay between that provision and the others.

- MiFID II was implemented in the UK by Recognition Requirements Regulations. Paragraph 3A of Schedule 1 (headed "Market making agreements") in effect requires the existence of the LME Rules and that all Members should conduct business on the LME subject to the LME Rules.

- Paragraph 3B(1) and (2) of Schedule 1 to the Recognition Requirements Regulations provide as follows:

- We were also referred to paragraph 4(1) and paragraph 9ZB(1). Paragraph 4(1) provides as follows:

- Also relevant in implementing MiFID II are the Regulatory Technical Standards in Commission Delegated Regulation (EU) 2017/584 ("RTS 7"). RTS 7 is part of retained EU law, and to this end it was modified by the Technical Standards (Markets in Financial instruments Directive)(EU Exit)(No 1) Instrument 2019. RTS 7 is one of the ESMA standards anticipated by MiFID II Article 48(12) (see above, at paragraph 44).

- Article 18 of RTS 7 provides as follows:

- As well as TR 22, reference was made to TR 13 and TR 17, and we have noted TR 3. TR3 is the General TR and provides at 1.3 and 1.5 as follows:

- In relation to the LME Clear Rules, there was reference to the following provisions in the Clearing Procedures section. Clearing Procedure A6 is a Clearing Procedure provision setting out what pricing data LME Clear is to use when calculating margin requirements. It refers, in particular, to LME closing prices, and it was common ground that the LME closing prices for the various metals were, in fact, the primary metric used by LME Clear. However, within this provision, Clearing Procedure A6.10 provides as follows:

- On behalf of the Elliott Claimants, we were provided with witness statements made by Mr Christopher Leonard, an in-house lawyer with the Elliott group, and by Mr Thomas Houlbrook, a commodities trader who was involved in the Elliott Claimants' nickel trades. On behalf of Jane Street, we were provided with witness statements made by Mr Ariel Brown, a commodities trader and Global Co-Head of Commodities at Jane Street.

- These witnesses all described the general structure of nickel trades placed by them on the LME, gave details of the specific trades relevant to this matter and noted that they were not consulted by the LME prior to either the Suspension or the Cancellation. These witnesses also all commented critically on the decisions made by the Defendants.

- On behalf of the Defendants, we were provided with witness statements made by Mr Chamberlain, Mr Farnham, Mr Cressy, Mr Jones, and Ms Combe. The Claimants criticised the evidence of these witnesses, saying that their statements were made long after the event, with the assistance of lawyers, and we should not rely on them. We were referred to the unanimous judgment of the Court of Appeal in R (United Trade Action Group Ltd) v Transport for London [2021] EWCA Civ 1197 at [125], where emphasis was placed on the caution that must be exercised in relation to evidence that has come into existence after the decision under review was made; and to R (Gardner) v Secretary of State for Health and Social Care [2022] EWHC 967 (Admin) at [259]. These authorities highlight the significance of contemporaneous documents and suggest that the Court should generally prefer the contemporaneous record of the decision-making. Indeed, a witness statement that is directly in conflict with the contemporaneous documents will not generally be admitted: R (United Trade Action Group) v Transport for London at [125(3)], citing R (Lanner Parish Council) v Cornwall Council [2013] EWCA Civ 1290. However, where the contemporaneous documents do not make matters clear, the decision-maker should explain them in evidence: Belize Alliance of Conservation Non-Governmental Organisations v Department of the Environment [2004] UKPC 6 at [86]. If the claimant wishes to challenge such evidence, he should apply to cross-examine, failing which the evidence will be accepted unless it "cannot be correct": R (Singh) v Secretary of State for the Home Department [2018] EWCA Civ 2861 at [16].

- Here, the relevant decisions were taken at relatively informal meetings, held remotely at short notice and reasonably early in the morning of 8 March 2022. No formal notes were taken. It was both sensible and necessary for Mr Chamberlain and the other main protagonists to state what they can recall of the discussions at the meetings, as well as the events leading up to them and their immediate aftermath. The Claimants did not apply to cross-examine them.

- Although there was no direct contemporary record, these witnesses were sometimes able to refer to emails or other contemporaneous materials that helped to anchor their evidence and seems likely to have refreshed their recollection in an entirely appropriate manner. There were no contemporaneous materials that the Claimants were able to point to as casting doubt on the witnesses' reliability. There are some passages where, to some extent, the statements contain evidence that has the flavour of an attempt to reconstruct what the witness thinks his or her thought-process must have been. This was less helpful to us. However, we did not find it difficult to sift the wheat from the chaff.

- The Claimants adduced expert evidence in the form of a report from Mr Andrew Dodsworth, who was the Head of Market Operations at the LME from April 2015 to March 2018. Mr Dodsworth's report covered the following areas:

- Mr Dodsworth's evidence was useful, in that it was a helpful way of explaining the Claimants' case. In some respects, their position emerged more clearly when set out by Mr Dodsworth, adopting the approach of someone with his industry background and in his own language, rather than as set out in the manner required by lawyers' pleadings. Furthermore, the result of this was that the Defendants' witnesses responded to Mr Dodsworth's evidence in a manner that we suspect would not otherwise have come about. All this was positively helpful, in that it meant that both sides had material in evidence that would not otherwise have been available, some of it very significant.

- However, while the end-result was to make us better informed, much of Mr Dodsworth's evidence really boiled down to criticising the merits of the decisions that were made, rather than shedding light on the lawfulness of those decisions.

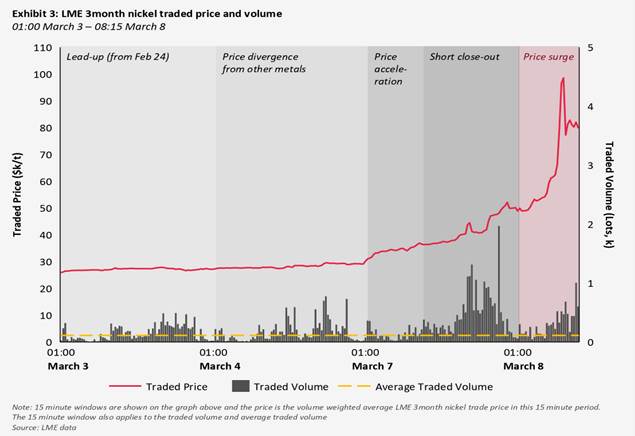

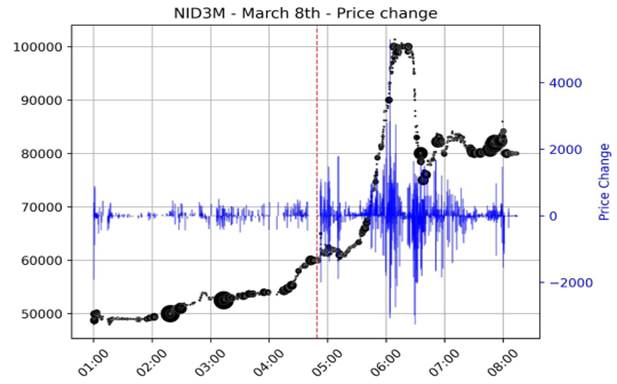

- While it is inevitable that this judgment must contain a narrative section, the heart of the story is apparent from the diagrams below.

- To put this in context, the OW Report says that the price rise on 7 March 2022, 69%, was "nearly five times greater than the next biggest move in nickel in the last twenty years." The spike that followed within the first few hours of 8 March 2022, until the Suspension, was considerably greater still: at the close of trading on 7 March 2022 the price was slightly below US$50,000; the peak of the spike was $101,365 (at 06:08), i.e., a rise of over 100% in about 5 hours. These prices are all in US$/tonne.

- The Russian invasion of Ukraine and the imposition of sanctions caused nickel prices to rise including 3M nickel. The first significant price rise in a single day was on 4 March 2022 (a Friday), when the market opened at US$27,080 and closed at US$28,919, an intra-day increase of 6.8%. Mr Chamberlain and the LME viewed this as explicable given the circumstances. However, it resulted in an unprecedented intra-day margin call imposed by LME Clear on the LME's market of approximately US$2.6 billion. This was 40% higher than the previous record.

- At 07:26 the price rise, even by that time, was considered remarkable, and Mr Chamberlain received an email from Mr Kirkwood drawing attention to it. This was a recurring topic throughout the day. By 09:24 a meeting of the Special Committee had been organized for later that day. It took place at 16:00. There was a discussion about whether the price increase reflected an underlying physical reality. The collective view was that the price rise was due to rational factors associated with the situation in Ukraine and reflected the market's fear of supply constraints arising from sanctions. On this basis, Mr Chamberlain considered the market was still orderly.

- The market peaked at about US$55,000 and fell back to slightly below US$50,000 at the close.

- As the day progressed, LME Clear imposed several margin calls, totalling approximately US$7.05 billion. The first margin call was due to be paid at 09:00. Three Clearing Members failed to pay on time. One remained in default until the end of the day and was sent a Notice of Default Event letter. The position of this Clearing Member was discussed by the Default Management Committees (which met jointly). Two Clearing Members said they were out of cash.

- The market opened below US$50,000. At around 04:49 approximately when the price had risen to US$60,000 the LME's TOT suspended the price bands.

- By 06:00 the price had risen above US$100,000. It peaked at 06:08, at US$101,365. It then fell back, but the price was consistently above US$80,000 from 07:00 until the Suspension.

- Jane Street agreed various nickel trades between 01:37 and 08:14. They were executed on the LME electronic trading system, LMESelect. They were fully cleared and resulted in fully constituted Client Contracts between Jane Street and the relevant Clearing Member.

- The Elliott Claimants agreed various trades between 04:23 and 08:07, with several Members. They were executed on the inter-office market. They were not fully cleared and did not result in Client Contracts between the Elliott Claimants and any Clearing Member.

- Mr Chamberlain woke up at about 05:30. He immediately noted that the price of nickel had risen since the opening and watched it continue to rise. He did not know the precise cause of the price movements on 8 March 2022, but could not identify any relevant macroeconomic or geopolitical factors that would explain them. On this basis, by about 05:50, he concluded that the market had become disorderly.

- He made an approximate calculation of the likely increase in the intra-day margin requirement, his estimate being that it would be more than US$10 billion. He was concerned that some market participants would be unable to pay. From about 06:00 he started receiving calls and messages from several Members expressing concern about their likely margin calls.

- Mr Chamberlain was then in contact with other senior people within the LME and LME Clear. His view by this point was that there was a problem in the market which was not connected to the geopolitical or macroeconomic situation or the commonly understood reality in the global physical market supply chain for nickel. He thought that the price movements could not be explained by rational market forces, in that there was no connection with the value of the underlying commodity.

- At 07:24, Mr Kirkwood circulated a spreadsheet showing the margin call calculation based on a price as at 07:00 (i.e., approximately US$80,000), Members' current open positions and LME Clear's assessment of Members' creditworthiness ("First Risk Default Spreadsheet"). This showed that the additional margin required would total US$19.75 billion, which Members would be due to be paid by 09:00. This was considerably greater than the figure Mr Chamberlain had estimated.

- At least five Members were expected to default. Mr Chamberlain considered that four other Members would be at risk of default possibly more.

- Having concluded that the market was disorderly, Mr Chamberlain considered that trading should be suspended, and had a draft Notice prepared.

- At 07:30 Mr Chamberlain and other executives from the LME and LME Clear attended a remote meeting, held to discuss Mr Chamberlain's view that the market was disorderly, and the draft Notice. The meeting lasted for about 25 minutes. The decision to suspend nickel trading was confirmed.

- The LME issued Notice 22/052, as follows:

- At 09:00 there was another remote meeting, held to discuss what to do about the trades agreed prior to the Suspension, as outlined at point 9 of Notice 22/052 in particular, whether they should be subject to reversal or adjustment. The meeting was attended by Mr Chamberlain and at least 24 other executives from the LME and LME Clear, including Mr Farnham. It effectively superseded a meeting previously arranged for the joint ExComs of the LME and of LME Clear. The meeting lasted for about 52 minutes.

- A number of options were discussed:

- Any decision as to whether trades should stand or be cancelled was for the LME to make in the person of Mr Chamberlain as CEO. Any decision as to how margin requirements should be calculated was for LME Clear to make in the person of Mr Farnham. However, these issues were so interlinked that it would be impracticable to take a decision on one without a decision simultaneously being made on the other.

- Option 1A and Option 1B were discussed together. Option 1A was considered unacceptable by everyone who spoke, because those trades reflected a disorderly market and so were not meaningful. Mr Chamberlain and Mr Farnham also had in mind that Option 1A entailed the risk of multiple defaults by Members, in light of the First Risk Default Spreadsheet. Option 1A would not make the market orderly if anything, it risked causing a systemic disturbance to the nickel market.

- In relation to Option 1B, Mr Farnham said that it would not be acceptable to LME Clear for the trades to stand but margin to be calculated by reference to the 7 March 2022 closing price. He was concerned that this would leave LME Clear potentially under-collateralised. Others present expressed the view that it would be inconsistent to allow the trades to stand at their agreed prices while not using those prices for margin calculations on the basis that those prices were not meaningful. Mr Farnham also considered that Option 1B would still risk defaults by Members.

- Option 2 was rejected because it would not be fair to adjust prices, because the parties might well not have traded at the adjusted prices.

- This left the option of cancelling. There was some discussion as to which trades should be cancelled. No-one who spoke considered that it was possible to identify a point in time on 8 March 2022 when trading changed from being orderly to disorderly. Mr Chamberlain concluded that the last known good state had been the close of trading on 7 March 2022. On this basis he decided that trades up to that point should stand, and all trades on 8 March 2022 should be cancelled.

- At 09:47 (i.e., shortly before the 09:00 meeting ended), Mr Kirkwood circulated a further spreadsheet ("Second Default Risk Spreadsheet"). This was similar to the First Default Risk Spreadsheet, but it was prepared on the basis that the 8 March 2022 trades stood, but LME Clear calculated margin requirements on the basis of the 7 March 2022 closing price. It showed that the additional margin required would total US$750 million.

- Mr Farnham considered that the Second Default Risk Spreadsheet still indicated a risk that Members would default.

- Following the meeting, a draft Notice was prepared. It was circulated by email to the Special Committee, because some elements (delivery deferral) required the Special Committee's approval, which was duly obtained.

- At 12:05 on 8 March 2022, the LME published Notice 22/053, as follows:

- This Notice was sent out in the name of Mr Cressy because he was the COO of both the LME and LME Clear. However, the decision to cancel the trades was taken by Mr Chamberlain.

- The OW Report is the most authoritative guide to how the state of the nickel market on 8 March 2022 came about. Large short positions had been built up by a number of market participants. The Russian invasion of Ukraine caused a rise in prices across all metals. A price divergence between nickel and other metals began to develop from 4 March 2022, as traders began to cover their short positions, causing a short squeeze. The price accelerated, resulting in record margin calls on 4 and 7 March 2022. This took liquidity out of the market and placed further pressure on those holding exposed short positions. They were forced to buy rapidly, to close out their positions, exacerbating the price spiral.

- The OW Report also states that there was some awareness among market participants that there was pressure on large short positions. Not enough participants were willing to take opposite positions, i.e., to profit-take as the price rose. Eventually, the perception developed that some Members might not be sufficiently robust to withstand the events.

- The Claimants suggested to us that the major factor was the short positions built up by entities within the Tsingshan Holding Group Co. Ltd. ("Tsingshan"), a Chinese industrial user of nickel. Tsingshan's short activity was acquired not on the LME but on the over-the-counter ("OTC") market, making it less visible to the LME. However, a number of reports in the financial press in the days leading up to 8 March 2022 covered Tsingshan's short position.

- The OW Report indicates that the position was more complex than this.

- The Elliott Claimants and Jane Street each produced separate skeleton arguments, but the oral presentation of their case was in effect conducted jointly, the points being divided between Ms Carss-Frisk KC and Mr Segan KC. We are grateful for the efficiency with which they managed this.

- The Claimants did not criticise the Suspension but said that the LME and/or LME Clear acted unlawfully in relation to the Cancellation.

- First, they said that the Cancellation was ultra vires. The arguments here focussed on the interpretation of TR 22.1 in the light of other rules (notably TR 13) and the legislative materials (specifically, MiFID II, the Recognition Requirements Regulations and RTS 7). The Claimants also contended the decision was taken for an improper purpose. The Claimants also said that, in so far as the Cancellation was implemented to protect Members from the risk of default, this was not the purpose for the power under which TR 22.1 was conferred.

- Second, they said that the LME and/or LME Clear acted in a way that was procedurally unfair, because they failed to give the Claimants an opportunity to make representations, and/or engaged in a "one-sided consultation". The LME and LME Clear received information from Members facing the risk of default, but not from those who would be disadvantaged by cancelling. The Claimants said that they should have been consulted.

- Third, the Claimants said that the LME and/or LME Clear had an unlawful approach to disorderliness, in that Mr Chamberlain was wrong to focus on his view that the LME price had ceased to be rationally connected with the physical market, and he was wrong to have regard to the possible adverse consequences for some Members in terms of margin calls. The Claimants also complained that the LME and/or LME Clear had failed to take reasonable steps to inform themselves, failed to consider relevant factors and/or took irrelevant factors into account (i.e., a submission made by reference to the principles considered in Secretary of State for Education v Tameside MBC [1977] AC 1014). The Claimants said that Mr Chamberlain should have investigated the price movements leading up to the Cancellation, in which case he would have appreciated that they were explained by the short positions taken by traders such as Tsingshan, and made worse by the TOT's suspension of price bands.

- Fourth, they said that the LME and/or LME Clear acted irrationally in their approach to Option 1B (and/or, Option 2). They also said that it was irrational to cancel all trades from 00:00 on 8 March 2022 at most, the cancellation should have been confined to those trades after the time when the market became disorderly, but Mr Chamberlain failed to ask himself that question or identify that time.

- Finally, the Claimants said that the Special Committee and/or the Board Risk Committee should have been consulted.

- The Defendants took issue with all these arguments. They also said that, even if the LME and/or LME Clear acted unlawfully, they would have made the same decision absent such unlawfulness, and relief should be denied pursuant to s. 31(2A) of the Senior Courts Act 1981.

- Both the Elliott Claimants and Jane Street proceeded from the outset on the basis that the decision that should be judicially reviewed was the decision to cancel the 8 March 2022 trades ("the Cancellation Decision"). They were not certain whether the party responsible for making this decision was the LME or LME Clear or a combination of both, hence there being two Defendants, but there was no uncertainty about the decision being challenged.

- As the case developed, the evidence (including the evidence of their expert, Mr Dodsworth) must have made it clear that the Cancellation Decision was taken by the LME, in the person of Mr Chamberlain.

- As set out above, a significant part of the Claimants' case on unlawful decision-making relates to Option 1B which would have involved allowing the 8 March 2022 trades to stand, but calculating margin requirements by reference to the 7 March 2022 closing price. However, any decision as to how margin requirements should be calculated was for LME Clear to make; and in the course of the 09:00 remote meeting, Mr Farnham said that it would not be acceptable to LME Clear for the trades to stand but margin to be calculated by reference to the 7 March 2022 closing price. This effectively excluded Option 1B.

- Thus, while the Cancellation Decision was made by the LME, the rejection of Option 1B was not (or, at least, not primarily) the result of a decision made by LME. It was the inevitable consequence of a separate and anterior decision, made by LME Clear in relation to how to conduct the margin assessment on 8 March 2022 ("the 8 March Margin Decision").

- We raised this with Mr Segan KC (who dealt with this part of the case for the Claimants in oral submissions). He confirmed that the Claimants wished also to challenge the 8 March Margin Decision. Mr Crow KC opposed the Claimants' being allowed to advance this un-pleaded case, but sensibly acknowledged that all the relevant materials were before the Court and it could be dealt with fairly. We decided that the Claimants should be allowed this latitude.

- Before we address the individual issues raised by the Claimants' case, it is convenient to address some of the features of the case that provide important context. Each of these matters affects all the issues, albeit in different ways and to varying degrees.

- The words "orderly" and "orderliness" appear in MiFID II, the Recognition Requirements Regulations and TR7. Although these words are not used in TR 22.1, they appear elsewhere in the LME Rules, and it was common ground that the concept of an orderly market was important to the proper exercise of the powers given to the LME under TR 22.1.

- None of these provisions defines what is meant by "orderly" or "orderly market" or "orderliness". While the significant and rapid price rise seen on 8 March 2022 was central to what happened, no-one suggested that price volatility was, in itself, enough to amount to disorderliness; and, certainly, no-one proposed a bright-line test such that a daily rise of x% was consistent with an orderly market but a rise of y% was not.

- In his evidence, Mr Chamberlain did not advance a specific definition of "orderly". His approach relied on the ordinary meaning of the word in the specific context. He did, however, make clear what led him to conclude that the market was not orderly: he did so in light of the unprecedented price levels reached, the speed of the price increase and the absence of any relevant macroeconomic, geopolitical or other factors relevant to the market for the underlying commodity which could explain those developments; i.e., a disconnect between the 3M nickel price and the value of physical nickel.

- The Defendants referred to guidance from the International Organization of Security Commissions ("IOSCO"):

- They also noted that NASDAQ has produced a definition of "disorderly market", as follows:

- The Claimants relied on the following evidence from Mr Dodsworth:

- We have set this passage out in full because of its significance to the Claimants' case. Their position (supported by Mr Dodsworth) was that the price rise on 8 March 2022 was explained by the short positions of some traders, notably Tsingshan. The Claimants said that the LME did not take this into account, because Mr Chamberlain did not consider or investigate this possibility; and they said that it was not indicative of disorderliness. All this was important both for their points on ultra vires and for their case that the Cancellation Decision was irrational.

- We do not accept Mr Dodsworth's evidence on this. The passage we have set out above begins with the words "In my experience ", but it was not apparent to us that Mr Dodsworth in fact has any experience of assessing whether a market is or is not orderly. He was the Head of Market Operations at the LME from April 2015 to March 2018, but he did not state in his report whether the orderliness of the market was questioned at any point during that period. His work since then has continued to focus on commodity markets as a consultant, but this has consisted of providing strategic and tactical advice, which we apprehend would not ordinarily involve assessing (on behalf of the RIE or otherwise) whether the relevant market was orderly. He gave no source for his averment that the four criteria that he identified in his paragraph 8.4 should be used to assess whether the market is orderly or disorderly, and that the process for doing so is as set out in his paragraphs 8.5 to 8.7. That is, he did not say (i) that this is how he has in fact gone about assessing orderliness on some specific occasion(s), (ii) that he knows that it is how someone else has in fact gone about assessing orderliness on some specific occasion(s) or (iii) that there is some published guidance to this effect. This leaves us with the impression that the criteria and methodology he proposes are of his own devising and have been produced, for the first time, in his report. This report was produced some months after the evidence of Mr Chamberlain, which was where the guidance from IOSCO and the NASDAQ definition were first highlighted. Those texts are public utterances by influential public bodies, which we would expect to be regarded as significant. Furthermore, they are flatly inconsistent with Mr Dodsworth's definition. However, he has not referred to them and has not given any reason for disagreeing with them. His failure to explain his taking a different view from IOSCO is particularly striking. Elsewhere in his report, when setting out his background experience, he highlighted the fact that he has worked as a consultant for IOSCO. Furthermore, his report relies on IOSCO guidance in a different context (the calculation of margin requirements).

- While the Claimants relied on Mr Dodsworth's definition, the Defendants (while citing IOSCO and NASDAQ) did not proffer or formulate a definition, instead submitting:

- This savours slightly of "you know it when you see it" often referred to as the "elephant test". This is an approach that sometimes makes lawyers uncomfortable: see Lucasfilm Ltd v Ainsworth [2011] UKSC 39, per Lord Walker and Lord Collins at [47] (with whom the other members of the Supreme Court all agreed on this point), expressing the view that judges ought to do better than this:

- We have this warning in mind. However, an RIE such as the LME, and an individual such as Mr Chamberlain who makes decisions on its behalf, is more akin to a zoologist than a judge. It/he is, or should be, capable of distinguishing between an orderly market and a disorderly one without needing evidence from others, let alone the assistance of an expert.

- The Claimants criticised Mr Chamberlain's qualifications as CEO of the LME, suggesting that he did not have expertise in the assessment of disorderliness. We found this surprising; given that by March 2022 he had been in senior roles at the LME for 10 years (including as CEO since 2017), any suggestion that Mr Chamberlain did not have sufficient expertise would apply twofold as against Mr Dodsworth. However, the main difference between them is that, in Mr Dodsworth's case, his expertise in making this kind of assessment has to be demonstrated to us; whereas, in Mr Chamberlain's case, his appointment as CEO means that he has been selected by the LME as the right person to make this assessment. The relevant RIE considered him to have the necessary expertise, and it would be difficult for us to gainsay this.

- Rather than falling back ourselves on the "elephant test", our approach is as follows. In circumstances where neither the legislation nor the LME Rules attempts a definition of "orderly" or "orderliness", there may be a number of different definitions or tests that a reasonable RIE could adopt. These include, but may not be limited to, the IOSCO guidance and the NASDAQ definition.

- It was consistent with the IOSCO guidance and the NASDAQ definition for Mr Chamberlain to make his assessment on the basis that he explained i.e., in essence, whether there was a disconnect between the 3M nickel price and the value of physical nickel, which could not be explained by any relevant macroeconomic, geopolitical or other factors relevant to the market for the underlying commodity. The fact that Mr Chamberlain's understanding and approach was consistent with that of IOSCO and of NASDAQ must mean that it was reasonable and therefore, an approach that is legally permissible. It may be that some reasonable RIEs would prefer Mr Dodsworth's definition, but we do not have to decide this.

- Most of the authorities relevant to this occur in the context of rational decision-making and the margin of discretion to be allowed to the decision-maker. However, the general context in which the LME performs its role as RIE is also relevant to the ultra vires arguments, because it informs our approach to the interpretation of the legislation and the construction of the LME Rules. It is also the basis of our view that, unlike a judge, Mr Chamberlain can be counted on to know when he is looking at a metaphorical elephant.

- We were taken to R(ABS Financial Planning Ltd) v Financial Services Compensation Scheme Ltd [2011] EWHC 18 (Admin), per Beatson J at [61] to [62]:

- We were also taken to R(The Get Real Marketing Co. Ltd) v Culture Recovery Board [2022] EWHC 1137 (Admin), at 30(iii):

- The LME and LME Clear have specialist knowledge, experience and expertise in relation to complex and technical economic issues, arising in a niche area of commercial activity, that are beyond the knowledge, experience and expertise of this Court. This being so, it behoves a court to be cautious when reviewing any decisions made by the LME and LME Clear on grounds such as rationality or any Tameside-type failure to make proper inquiry, ask the correct question, or properly assess relevant considerations. The Court's approach to review must permit sensible latitude to decision-makers with specialist knowledge insofar as the decisions reviewed either rested on or were informed by such knowledge.

- Once again, most of the authorities here relate to rational decision-making and the margin of discretion to be allowed. However, urgency is also relevant to the ultra vires arguments, because the evidence and submissions that we have received suggest to us that decisions about the suspension and cancellation of trades, and about margin calls, are of their nature likely to be made in urgent situations and under conditions of great pressure. This must be borne in mind when interpreting the legislation and the LME Rules.

- Mr Crow KC submitted that the question whether the situation is or is not urgent (and, if so, how urgent) is, itself, a question for the decision-maker, which the Court should be slow to second-guess, especially when it arises in a complex, technical area. He cited no authority specific to this point, but it seems to us right that Mr Chamberlain and Mr Farnham were better equipped to assess the urgency of the situation in March 2022 than we are, even with the benefit of hindsight (which, naturally, we must eschew).

- That said, the situation does seem to us to have been urgent. The main point made by the Claimants in this regard was that, following the Suspension, there was no further trading in nickel, and the LME and LME Clear had an opportunity to reflect, investigate and consult, before making either the Cancellation Decision or the 8 March Margin Decision. However, this ignores the fact that, while trading in nickel had been suspended, trading in other metals continued.

- This meant that margin requirements still had to be assessed, and calls made, reflecting all the trades done by all Members and the potential exposure of LME Clear on those trades. It therefore was not possible to postpone LME Clear's margin requirements beyond the morning of 8 March 2022.

- Furthermore, if the relevant decisions had been postponed, this might have resulted in an outcome along the lines of Option 1A or Option 1B, but with this not being clear until sometime after 8 March 2022. This would not have eliminated the risk that Members would be pushed into default. It would simply have meant that this risk would not have eventuated until a later date. However, putting off the evil day in this manner would have created a fresh peril: that, in the meantime, those vulnerable Members would still have been free to trade in other metal markets. If the LME and LME Clear had allowed market participants to do business with Members who were at risk of being pushed into default by pending decisions on margin calls, this could have had very serious consequences.

- The reality was that everyone in the market, as well as the LME and LME Clear themselves, needed clarity as to whether the 8 March 2022 trades were to stand and, if so, at what prices. Postponement would have meant uncertainty, which in itself would have risked destabilising the market.

- Finally, it seems to us highly significant that the reason why TR 22 arises at all in relation to these Claimants is that they had agreed to contract on terms including TR 22, along with the other LME Rules.

- Most judicial review cases involve decisions made under powers that have been granted by the legislature, without any direct involvement on the part of the persons affected. Those persons generally come to be affected by those powers by mere happenstance.

- This case is very different. Here, each of the Elliott Claimants and Jane Street made a conscious decision to enter each trade, and to do so under the LME Rules. They did not have to do this. They could have conducted their nickel trades elsewhere (including the OTC market) or they could simply have abstained. They became subject to TR 22 through their deliberate free choice and consent.

- It is a general presumption that those who conclude contracts do so with a full understanding of the true meaning and effect of the contractual terms. Sometimes, this is a legal fiction that is at some remove from the practical reality. However, these Claimants are well-resourced entities with both internal and external lawyers at their disposal. They are also experienced and knowledgeable traders, who are familiar with the operation of RIEs and CCPs.

- They must be taken to have understood their rights and obligations, and the limits on those rights and obligations. They must also have understood properly the powers the LME Rules and LME Clear Rules granted to the LME and to LME Clear, and the limits on those powers. Furthermore, they must have formed the considered and informed view that the LME and LME Clear were suitable bodies to be trusted with those powers.

- All this is important, not only as context for some of the issues on lawfulness, but also for the A1P1 points.

- The Claimants contend that the LME lacked the power to cancel the trades. The LME relied (and relies) on TR 22 (see above at paragraph 39) and in particular the final sentence of TR 22:

- The Trading Rules pursue the objectives identified in Schedule 1 to the Recognition Requirements Regulations. TR 22 specifically reflects the requirement in paragraph 3B of Schedule 1 (see above, at paragraph 47). The Recognition Requirements Regulations are themselves an implementation of MiFID II. For present purposes, the material provision in MiFID II is article 48(5) (see above, at paragraph 44).

- The Claimants contend that, properly construed, the broadly-framed power in TR 22 is limited in a number of ways. The first submission is that the power given by TR 22 can be no wider than envisaged by paragraph 3B of Schedule 1 to the Recognition Requirements Regulations, so that the power to cancel " where [the LME] considers it appropriate" must be understood as a power to cancel transactions only "in exceptional circumstances". We accept this submission and did not understand the LME to dispute this point.

- The Claimants' second submission is that TR 22 must be read subject to TR 13 (see above, at paragraph 51) such that the TR 22 power can only be used to the extent permitted by "relevant procedures." The Claimants submit that since there were no such procedures pertinent to the circumstances prevailing on 8 March 2022, the TR 22 power was not available to the LME at that time. We do not accept this submission. First, there is no sufficient reason to read TR 22 as in some way subject to TR 13. The opening sentence of TR 22 makes clear the circumstances in which that power to cancel a trade arises. This sets TR 22 apart from TR 13. While the power at TR 13 does envisage the existence of "relevant procedures" which would, we assume, identify the "certain circumstances" in which the power to invalidate a transaction under that rule would arise, none of that says anything material to the power at TR 22 which is available on its own terms. Second, as formulated, TR 22 is consistent with the position anticipated by paragraph 3B of Schedule 1 to the Recognition Requirements Regulations. This is a further reason why TR 22 should not be read down by reference to TR 13.

- The Claimants' submission to the contrary relied on Article 47(1)(d) of MiFID II (above at paragraph 44). We do not think that provision takes the submission anywhere. Article 47 is a general provision that sets the context for the measures Member States are required to put in place for the operation of relevant regulated markets. The general provision in Article 47(1)(d) should not be read as a limitation on TR 22, not least because that would, for no sufficient reason, derogate from Article 48(5) which, as we have said, is the specific source for TR 22.

- The Claimants' third submission is that the TR 22 power is to be read as constrained by technical standards issued by the Commission pursuant to Article 48(12), specifically Article 18 of RTS 7 (see above, at paragraph 50). This submission links to the submission based on TR 13 since Article 18(2)(d) of RTS 7 provides that trading venues should be able to " cancel or revoke transactions in case of malfunction of mechanisms to manage volatility " and at Article 18(3)(f) requires trading venues to set out "policies and arrangements in respect of cancellation policy in relation to orders and transactions ".

- We do not consider that Article 18 has any bearing on the exercise of the TR 22 power in circumstances such as those existing on 8 March 2022. While the scope for regulatory technical standards under Article 48(12) of MiFID II is widely cast, we consider it to be clear that the premise for RTS 7 was Article 48(12)(g) i.e., "the requirements to ensure appropriate testing of algorithms so as to ensure that algorithmic trading systems cannot create or contribute to disorderly trading conditions on the market." Delegated Regulation (EU) 2017/584 is, therefore, directed to algorithmic trading. The first recital to the Regulation provides:

- By Article 1, "algorithmic trading" has the definition at regulation 2 of the Financial Services and Markets Act 2000 (Markets in Financial Instruments) Regulations 2017:

- The final matter relied on for the purposes of the vires submission was Clearing Procedure A6.10 within the LME Clear Rules (see above, at paragraph 52). The Claimants submitted that LME Clear's ability under this provision to "amend any prices that it considers do not accurately reflect the current market price" was the power directly applicable in the factual situation that arose on 7 and 8 March 2022, such that resort to any other power (including TR 22) was unlawful.

- If this point is seen in this way (which is, we think, the substance of the point), it collapses into the Claimants' later submission on Option 1B. We consider that submission below at Section L, and do not need to add to those reasons here: we do not consider the failure to follow Option 1B (the course that would have rested on resort to Clearing Procedure A6.10) was unlawful.

- The vires-related point is that the possibility that resort could have been had to Clearing Procedure A6.10 means that any option to use the power at TR 22 either disappeared or did not arise. We do not consider it is appropriate either to construe these two provisions as being mutually exclusive, or to read the existence of the power at TR 22 as in some way contingent, whether that be contingent on the unavailability of the power at Clearing Procedure A6.10 or on a lawful decision by LME Clear not to exercise its power under Clearing Procedure A6.10. In circumstances such as those on 7 and 8 March 2022, that is not a helpful approach. The better approach is to consider the two powers as existing independently of each other and providing different options.

- Both Claimants' submissions on ultra vires also contended that the LME had exercised its power to cancel for an improper purpose. They said that the LME's permitted functions do not extend to protecting market participants from the consequences of bad trading decisions or to averting perceived systemic risk; particularly where the effect would be to protect some market participants at the expense of others.

- On the facts of this case, however, the 'proper purpose' argument comprises no more than a different way of putting the submissions (a) that irrelevant matters were considered when the decision was taken; and (b) that no proper regard was had to other options available to the LME on 8 March 2022. We consider those matters below, in Sections K and L, respectively. For the reasons set out there, in particular at paragraphs 181 183 and 197 210, the submission that the LME acted for an improper purpose also fails.

- The case law on procedural fairness is legion. We mention below only the cases that received particular attention in submissions.

- First, our attention was drawn to R v Secretary of State for the Home Department, Ex p Doody [1994] 1 AC 531, per Lord Mustill at p. 560:

- Next, we were taken to Bank Mellat v HM Treasury (No. 2) [2014] AC 700 and referred to two passages. The first was per Lord Sumption at [31]. Having cited the passage set out above from Lord Mustill's speech in R v Secretary of State for the Home Department, ex parte Doody, Lord Sumption said:

- The Claimants preferred the passage per Lord Neuberger at [179], while the Defendants preferred the passage per Lord Sumption at [31]. We are not convinced that either passage differs from the other; not, at any rate, in a respect that could affect the outcome in this case. Both acknowledge the significance of the context of the particular case, which had been emphasised by Lord Mustill in ex parte Doody.

- We were then taken to a number of further authorities, which shed light on how context may shape the requirements of procedural fairness and provide practical examples:

- The Claimants emphasised their position as persons who would be directly affected, highlighting their case as to their A1P1 property rights. They said this put them into the first category noted in Kebbell, i.e., persons whose legally protected interests might be adversely affected. They also noted that Mr Chamberlain's evidence was that no consideration was given to the possibility of consulting with market participants.

- The Defendants emphasised that no duty of consultation is imposed either under MiFID II or the other legislative instruments; above all, there is no such duty under the LME Rules or the LME Clear Rules. They referred (in particular) to Plantagenet Alliance at [98(6)].

- In Plantagenet Alliance, the Divisional Court expressed the relevant point in terms of a democratically elected body. Judicial deference to a decision by a rule-maker not to impose a duty of consultation must, no doubt, be at its highest where the rule-maker has been democratically elected. However, as noted in Section G above, it seems to us significant that in this case the Claimants consented to TR 22.1, and they must be taken to have appreciated that its terms do not require prior consultation.

- The Defendants also said that the urgency of the situation precluded consultation with the Claimants or (more broadly) the general class of persons who had agreed trades on 8 March 2022, relying in this regard on evidence from Mr Chamberlain (as well as various other witnesses) to this effect.

- For the reasons we have already given, we accept that the situation was urgent. Above all, we accept that the situation was regarded as urgent by Mr Chamberlain and Mr Farnham (along with others) and we consider that they were entitled to come to that view.

- Furthermore, it strikes us as important that neither the Elliott Claimants nor Jane Street is a Member of the LME, let alone a Clearing Member, and they accordingly had no direct relationship to the LME or to LME Clear, still less a contractual nexus in respect of the trades in question. This not only impacts on the legal proximity of the relationship between the Claimants and the Defendants, it also would have affected the practicality of either the LME or LME Clear first identifying the market participants potentially affected by the relevant decisions, then contacting them, then carrying out any consultation.

- Finally, Mr Chamberlain stated in his evidence that his view was, and is, that any consultation would not have provided any useful information because the views expressed would simply have reflected the respective interests of the consultees. It was already obvious to him (and others) that there would be winner and losers. This is a part of Mr Chamberlain's evidence where we are slightly sceptical that he was setting out a thought-process that he actually carried out at the time, rather than stating what he thinks he would have thought if he had asked himself the question on 8 March 2022. Nevertheless, we accept the basic logic of Mr Chamberlain's evidence here: namely, that consultation would not have told him or Mr Farnham anything that was not already obvious to them. Based on the various accounts given about the two remote meetings, it seems obvious to us that everyone involved was aware both that the Suspension and Cancellation decisions were momentous, and of the likely effects on all market participants including those in the position of the Claimants.

- Mr Chamberlain did in fact hear from some Clearing Members who were concerned about the consequences for them, in terms of margin calls, if the 8 March 2022 trades were to stand. We do not accept that this made the decisions unfairly one-sided. Those parties, too, were not saying anything that was not already obvious to Mr Chamberlain and Mr Farnham: namely, that a margin call of US$19.75 billion would cause some Members to default.

- Accordingly, we reject the Claimants' case in relation to procedural fairness and the failure to consult. Consultation was not expressly required under the LME Rules or the LME Clear Rules. It was for the LME and LME Clear to decide whether, whom and how to consult, and they are entitled to a wide margin of discretion. In these circumstances, especially the urgent context, there was no duty to consult the Claimants.

- In any event, even if a consultation had taken place, we consider it very unlikely that it would have made any difference, so this is a part of the case where section 31(2A) of the Senior Courts Act 1981 would have been relevant had we found either the Cancellation Decision or the 8 March Margin Decision to have been unlawful on this ground, which we have not.

- The Claimants had several criticisms of the LME's approach to disorderliness, raising various aspects of the general duty summarised in Tameside (above), per Lord Diplock at p. 1065 that decision-makers must ask the right questions and must take reasonable steps to acquaint themselves with the relevant information to enable them to answer those questions correctly.

- The general legal principles in this area are apparent from two relatively recent cases which refer to and summarise some of the other well-known authorities. The first is R (Friends of the Earth Ltd) v Secretary of State for Transport [2020] UKSC 52. The Supreme Court gave guidance on how a court should review and identify the considerations that the decision-maker should have in mind and, therefore, the considerations in respect of which it should inform itself at [116] to [121]:

- The second case was R (Pantellerisco) v Secretary of State for Work and Pensions [2021] EWCA Civ 1454. Underhill LJ (with whom the other members of the Court of Appeal agreed) summarised the irrationality test, as well as the law as to the degree of intensity with which the Court will review a public law decision, and the importance of context, at [54] to [57]:

- So far as concerns the decision-maker's duty to obtain information, we were taken to the following extract from the judgment of the Court of Appeal in R (Campaign Against Arms Trade) v Secretary of State for International Trade [2019] EWCA Civ 1020, at [58] to [59]:

- One common thread running through these authorities is the importance of context. It affects both the intensity and the scope of review notably, what considerations should the decision-maker have regard to, what should he not have regard to, and what steps should he take to obtain information in relation to them. We have outlined our assessment of the salient contextual features in Section G above. They inform our application of the principles set out above in several significant respects.

- First, the fact that the LME and LME Clear are specialist decision-makers, operating in a complex, technical area, is highly relevant to the intensity of our review of their decisions, for the reasons given by Lord Mance JSC in Kennedy and summarised in Pantellerisco at [56] to [57].

- Second, we note that the passage from Underhill LJ's judgment at [57] cites R (SC) v Secretary of State for Work and Pensions (Equality and Human Rights Commission intervening) to highlight, in this context, the separation of powers between the judiciary and elected branches of government. As we have already said in the context of procedural unfairness, the LME and LME Clear are not elected bodies, but it seems to us significant that the Claimants consented to subject themselves to their decision-making, by contracting on terms providing for the LME Rules.

- Third, TR 22.1 does not specify what considerations the LME must have in mind when exercising the powers granted under that Rule; nor does it specify any matters to be excluded from consideration. However, the regulatory and legislative context in which TR 22.1 sits makes it apparent that the orderliness or disorderliness of the market, and the LME's overarching obligation to ensure orderly trading, are certainly considerations that the LME must have regard to.

- Fourth, the LME is to be allowed a margin of discretion in respect of its approach to the matters to be considered when assessing orderliness: Friends of the Earth at [117] to [119]; and in respect of its approach to the weight they should be given: Friends of the Earth at [121].

- Fifth, for the reasons already given in Section G, as well as in the light of the point noted in the last paragraph, we accept that it was legitimate for Mr Chamberlain to assess orderliness as he did by considering whether there was a disconnect between the 3M nickel price and the value of physical nickel, which could not be explained by any relevant macroeconomic, geopolitical or other factor relevant to the market for the underlying commodity.

- Sixth, the margin properly to be allowed for the discretion of the decision-maker must, once again, reflect the specialist, technical context, and the fact of the Claimants' express, informed consent to the LME's role as decision-maker.

- Seventh, it was for the LME to decide what investigations were appropriate, subject to a Wednesbury challenge: Campaign Against Arms Trade at [58], and the second and third points in the passage from Balajigari, cited at [59].

- Eighth, the urgency of the situation is also relevant when considering what investigations should have been made and the margin of discretion to be afforded to the LME and LME Clear.

- This relates to the Claimants' criticisms of Mr Chamberlain's understanding of and approach to orderliness, and their preference for Mr Dodsworth's definition. These criticisms were central to many of their other points. However, we have already explained our conclusion that Mr Chamberlain's understanding and approach was reasonable.

- The Claimants also criticised Mr Chamberlain for taking account of the possible adverse consequences for some Members in terms of margin calls. They said that this was an irrelevant consideration, which amounted to favouring some Members above others.

- This criticism mischaracterises Mr Chamberlain's concerns. The fear that he had, along with Mr Farnham and most if not all those present at the remote meetings, was not merely that some Members might lose money. It was that some Members, including Clearing Members, might default. This would mean that they could not trade on the LME until the default was cleared whether in nickel or any other metal. Ultimately, it might mean that they would go out of business. This would not merely be a problem for the Members in question. It would also cause a general loss of confidence among LME Members and their Clients. It is difficult to think of anything more likely to make the nickel market disorderly. Further, it would not only have affected the nickel market; the failure of an LME Member, let alone a Clearing Member, would have had a serious impact on the global commodities market more broadly.

- Mr Chamberlain was very clear in his evidence that such thoughts were actively in his mind when he made the Suspension Decision and when he made the Cancellation Decision. So too was Mr Farnham. They both considered that allowing the 8 March 2022 trades to stand entailed the risk of multiple defaults by Members, causing a systemic disturbance to the market. We do not see how an RIE charged with ensuring an orderly market could not properly be entitled to take these considerations into account.

- The Claimants criticised Mr Chamberlain for failing to investigate the causes of the price movements leading up to and on 8 March 2022.

- Mr Chamberlain reached the conclusion that the nickel market was disorderly fairly rapidly within about 20 minutes from waking up in the morning of 8 March 2022. He did so without speaking to or consulting anyone, on the basis of some internet research on his mobile phone and his own familiarity with the market, including the events of the previous few days. His conclusion was then tested and confirmed in the course of the two remote meetings that followed at 07:30 and 09:00. However, his conclusion was not based on any real investigation. He was not aware of the fact that there were several market participants with significant short positions despite the fact that there had been some press reports in relation to Tsingshan. He therefore did not appreciate that the immediate cause of the sharp rise in prices was the short squeeze which Tsingshan and the other relevant short traders were experiencing.

- The Claimants said there was, therefore, an economically rational explanation for the price rise, which Mr Chamberlain was not aware of, but could and should have made himself aware of, by investigating the causes of the price movements.

- We cannot accept this criticism for several reasons. First and foremost, it was fundamentally dependent on Mr Dodsworth's preferred definition of orderliness. Once it is accepted that Mr Chamberlain was entitled to understand and assess orderliness in the way that he did, it follows that all he needed to know was whether the disconnect between the 3M nickel price and the value of physical nickel could be explained by any relevant macroeconomic, geopolitical or other factor relevant to the market for the underlying commodity. The short squeeze explained in the OW Report was not such a factor. In short, Mr Chamberlain did not need to establish why prices had moved as they did, in order to conclude that the market was disorderly. He was entitled to identify the relevant question as one related to the value of physical nickel, and to satisfy himself that he knew the answer to that question.

- Second, the situation was urgent. It would not have been possible for Mr Chamberlain to find out why the price had moved as it did, within the timescale that he and Mr Farnham considered necessary for the decisions they had to make. It is worth noting that the OW Report took several months to be produced.

- Third, it is fair to say that, in the limited time available, it would have been possible for Mr Chamberlain to find out at least something about the involvement of a short squeeze affecting some market participants, notably Tsingshan. This is because of the press reports shortly before and on 8 March 2022, referring to Tsingshan's exposed short position.

- However, if (contrary to our view) the decisions facing the LME and/or LME Clear could only properly be made having established the causes of the price movements, we do not consider that these press reports would have provided a very satisfactory basis. It is apparent from the OW Report that the true position was much more complex than the contemporary press reports suggested, and that the scale of the short squeeze was much more significant (and not confined to Tsingshan). It would not have been useful for Mr Chamberlain to spend time and energy seeking information that would inevitably have been incomplete and unreliable.

- It is apparent from his evidence that Mr Chamberlain did not know that the TOT had suspended the price bands for nickel at around 04:49 on 8 March 2022. By this time the price had risen from US$49,208 when the market opened to about US$60,000. As is apparent from the diagrams in Section E above, it then rose particularly steeply in the period up to about 06:00.

- The Claimants said that Mr Chamberlain should have known that the price bands had been suspended. They also said that this development was significant to the way the price rose after 04:49.

- We agree that it seems odd that Mr Chamberlain does not appear to have learnt that the TOT had suspended the price bands, at any time before the Cancellation Decision. We would have thought this would be the kind of information the CEO would like to have, if only as an indicator of the way the market was behaving. However, on the evidence we have received, we do not accept that the suspension of price bands was in any way causative of the price rises that followed. On the contrary, our understanding is that the suspension was caused by the fact that the price was rising, not the other way around.