Freely Available British and Irish Public Legal Information

[Home] [Databases] [World Law] [Multidatabase Search] [Help] [Feedback]

England and Wales Family Court Decisions (other Judges)

You are here: BAILII >> Databases >> England and Wales Family Court Decisions (other Judges) >> MR v EF [2024] EWFC 144 (B) (20 June 2024)

URL: http://www.bailii.org/ew/cases/EWFC/OJ/2024/144.html

Cite as: [2024] EWFC 144 (B)

[New search] [Printable PDF version] [Help]

|

NOTICE This judgment was delivered in private. The judge has given leave for this version of the judgment to be published on condition that (irrespective of what is contained in the judgment) in any published version of the judgment the anonymity of any child and members of their family must be strictly preserved. All persons, including representatives of the media and legal bloggers, must ensure that this condition is strictly complied with. Unauthorised publication of the judgment will be a contempt of court. The names of the parties and any children must not be disclosed in public without the court’s permission |

|

This Transcript is Crown Copyright. It may not be reproduced in whole or in part other than in accordance with relevant licence or with the express consent of the Authority. All rights are reserved. |

Neutral Citation Number: [2024] EWFC 144 (B)

ZZ1D68500

IN THE FAMILY COURT AT GUILDFORD

The Law Courts

Mary Road

Guildford

GU1 4PS

BEFORE:

RECORDER RHYS TAYLOR

(In Private)

BETWEEN:

MR

Applicant

-and-

EF

Respondent

Mr Ben Wooldridge (Hopkin Murray Beskine Ltd) appeared for the applicant

Mr Douglas Allen (Bowles & Co Solicitors LLP) appeared for the respondent

Hearing dates 22 and 23 May 2024

This judgment was handed down remotely on 20 June 2024 at 10am by circulation to the parties or their legal representatives by email.

Contents

The issues I must determine. 20

1. This is the final determination of MR’s application for financial remedies dated 1 December 2021. I shall refer to the applicant as “the wife” in this judgment. The respondent is EF, whom I shall refer to as “the husband.”

2. The key issue in this case is the parties’ date of separation. The husband contends that it is 2014. The wife contends that it is 2021.

3. The husband contends that he should be entitled to retain capital which he says he has accrued since 2014. The husband says that there was an informal agreement in 2014 that the assets would be divided as at that date. The husband says that there would be no needs-based justification for invading his post-separation accrual.

4. The wife says that as the parties separated in 2021 this is a “full fat” sharing claim and that by my order, the parties’ assets should be divided 50/50.

5. The difference between the parties’ two positions, depending on how the assets are skinned and presented, amounts to in excess of £200,000.

6. For the reasons I shall give shortly, the husband has not persuaded me, on the balance of probabilities, that the date of separation was 2014.

7. On this basis the disposition which I provide for is on an equal sharing basis.

8. The wife was represented by Mr Ben Wooldridge, instructed by Hopkin Murray Beskine Ltd. The husband was represented by Mr Douglas Allen, instructed by Bowles & Co Solicitors LLP.

9. I am grateful to counsel for the manner in which this hearing was conducted and for their helpful opening and closing notes, agreed statement of issues and schedules. This is a factually knotty case. The burden on the court of unravelling what has happened here has been significantly lightened by all of the assistance I have been given.

10. It will come as cold comfort to the husband, but Mr Allen advanced his client’s case attractively and persuasively. Mr Allen could not have done anymore.

11. The husband is 64 and the wife is 59. They are both Italian nationals. They have each spent significant parts of their adult lives living in England, albeit they have retained property and familial interests in Italy.

12. This is a long marriage. The parties commenced cohabitation in about 1978 and married in 1980.

13. As I have already outlined, the parties have been unable to agree their date of separation. My finding, which I will explain shortly, is that the parties separated in 2021. Their union was in excess of 40 years.

14. There are two grown up and independent children. The parties’ daughter has a tangential appearance in some of the issues with which I have had to wrangle.

15. In or about 2015, the wife’s mother, who lived in Italy, required increasing care on account of being diagnosed with dementia. It is the wife’s case, which I accept, that the parties agreed that the wife would relocate to Italy to care for her mother. This was on the basis that the parties already had an Italian home and, says the wife, the parties respectively visited each other in England and Italy over the course of the time the wife’s mother required nursing care.

16. The parties purchased their final English matrimonial home in about 2010. This was long after the children had grown up. It is the wife’s case, which I accept, but only after a careful weighing of all the evidence, that by 2014 the parties wanted to move on. The husband is a builder. At around this time he had started to develop back issues and it was clear he could not go on as a builder forever. The parties had options. They had retained for many years an Italian home which they could locate to. However, the parties’ adult children and grandchildren were in England and so there would be attractions in staying in England, or at the very least having a pied à terre here.

17. On any option, the sale of the family home would release equity for the future. Whilst the parties have capital in the order of about £1.5M, they have little pension provision. It has been a notable feature of this case that the cost of property and living in Italy is enviably cheaper than here in England. The release of equity would provide some free capital on any option to assist with retirement provision in addition to any state pensions.

18. The wife’s mother died in the latter part of 2017 and the wife returned to England and resumed cohabitation in 2018.

19. Exhibited to the wife’s s.25 statement are some photographs. One photograph the wife dates as being on 28 April 2018, which was the date of a friend and neighbour’s wedding. The husband does not dispute the date. The photograph shows the wife in a black soft top F-Type Jaguar motor vehicle. The vehicle belonged to the wife. It appears (as I will explain later) that a BMW belonging to the wife was sold in about 2016. This would have the Jaguar being purchased after that date.

20. Surveying the wide canvass, as I must, on the balance of probabilities, it seems unlikely that the wife would have purchased such a luxury vehicle if she had moved to Italy permanently in 2014. The husband’s case is that the parties remained on “good terms” and that despite having separated in 2014, she later acquired this vehicle which the husband stored in the garage to the family home. He further asserts that he was insured on the vehicle and would drive it from time to time. I do not accept this account.

21. In or about 2018/2019 (the exact date is not material), the husband had a relationship with another woman. The husband said that the relationship lasted about 18 months. During this time, he told the wife he was going on a fishing trip to St Petersburg. In the hearing we did not explore the precise itinerary and detail of the trip, save to note that this woman accompanied the husband. The wife was speaking on the phone to the husband during the trip and she heard a woman’s voice in the background. When challenged he said that it was the television. Later in 2019, he admitted to the wife that he had been in a relationship. If the parties had not been in relationship since 2014, it seems unlikely that the wife would have been calling the husband when on holiday in 2019, and also challenging him about the sound of a woman’s voice in the background. It would have been none of her business. However, both parties accept that this exchange about the woman’s voice did take place.

22. Despite having placed the family home on the market in or about 2014/2015, it took until November 2018 to sell. At this point the wife returned to live in the parties’ Italian family home. The husband remained in England and went to live with the parties’ daughter. This was, in part, to assist her with renovations to her own home. However, at some point shortly thereafter the husband and his daughter fell out and he was no longer welcome to stay in her house. It seems, on the balance of probabilities, that the daughter had “taken the wife’s side” about the husband’s relationship with another woman. Had the relationship between the parties truly ended in 2014 then I doubt there would have been this kind of falling out between father and daughter.

23. In any event, the wife says that she was prepared to give the husband another chance accepting the husband’s apology and contrition. However, at some later point it became apparent to the wife that the husband’s relationship with the other woman had not been fully severed and she filed divorce proceedings.

24. The divorce petition was issued on 13 November 2021 complaining of the husband’s unreasonable behaviour, including his on-going relationship with the woman to whom I have already referred. A further particular alleged in the petition is that, “The Respondent used manipulative behaviour by promising he would retire to Italy with the Petitioner, but he never came. He would not respond to calls or engage fully in conversation to resolve marital disputes and would disappear for days on end without contact.”

25. Before falling out with one another, the husband advanced a £100,000 loan to assist his daughter’s partner with a business venture. The daughter has made plain in correspondence that she agrees that this money must be returned, but that she regards it as a loan from both of her parents. Each party indicated within the hearing that they would offer me an undertaking to share 50% of the loan with the other, depending on how the daughter decides to make the repayment.

26. More contentiously, the husband also says a further £47,000 is owed on account of the renovations to his daughter’s property. This is disputed by the daughter and given the rupture in the relationship, it may be more difficult to recover. Again, the parties can deal with this by way of like undertakings, should it ever be repaid.

27. The husband says that to avoid embarrassment within the family, the parties agreed in 2014 to present as a couple when required to “keep up appearances”. He says that the photographs of a smiling couple which the wife had produced were cynically taken for the purposes of placing on social media and the like, to further the plan to “keep up appearances”.

28. I am alive to the fact that there is sometimes a gap between how parties chose to present themselves on social media and the reality of a situation. I have weighed that carefully.

29. One photograph is of the parties on a plane together. The husband is nestled back into the wife’s chest taking a “selfie” photograph of the parties together. It is a warm and intimate photo. The parties look relaxed and happy together. The husband disputes the date which the wife asserts. The wife says it was taken on the way to a holiday together in Italy on or about 20 July 2018. The husband says that it was taken after the parties had sold their home in November 2018 when they took many of their possessions to their Italian family home. The wife is wearing a short-sleeved t-shirt. It is also “shoulder-less” in style. It is not in any way immodest, but it is “skimpy”. On the balance of probabilities, I do not think that this is the way someone would dress when boarding a plane in England in the winter months. The husband’s attempts to persuade me otherwise simply do not ring true.

30. As I have already commented, the Jaguar car in the April 2018 photograph poses real problems for the husband’s account that the wife left England in 2014. It is also not a “keeping up appearances” photograph. The wife is in the car alone.

31. Once the wife issued English divorce proceedings, the husband rejoined with Italian divorce proceedings. Whilst these were not ultimately pursued, they have added delay and expense to the English proceedings.

32. On 11 January 2022, the husband purchased an Italian life policy for €950,000. It took many months before it was finally established that this policy would allow for withdrawals prior to the maturity date which is some years hence. Putting it charitably to the husband, the timing of the purchase of the policy and the wife’s Form A dated

1 December 2021 looks unfortunate. Less charitably, it looks like the husband is choosing to be difficult.

33. The wife’s open offer is dated 20 May 2024 and seeks an equal sharing outcome. The mechanics include the wife taking as part of her settlement the Italian family home.

34. At the hearing, the wife suggested that the daughter’s loans and Italian premium bonds be divided equally, with other assets being retained by the parties who held them, subject to a balancing lump sum.

35. Whilst it has been impressed on me firmly that that wife’s primary objective is to receive the Italian family home as part of her disposition, in evidence it was clear that she does not feel that strongly about it, provided its value (more about that shortly) is properly factored into the settlement.

36. The husband’s open offer, before his present solicitors were instructed, is dated 16 February 2023. It was described by Mr Wooldridge, on behalf of the wife, as ill-judged in its terms. I tend to agree with that characterisation. It did not come anywhere near to meeting the wife’s claims, and I am not going to spend time measuring how or whether it would even meet the wife’s needs. The offer was made on the basis that the Italian proceedings would only remain suspended upon acceptance of the offer.

37. Shortly after this offer, the parties attended an FDR hearing before DDJ Don. The husband achieved that rare distinction at FDR of having a costs order made against him.

38. Mr Allen has titivated the husband’s offer in his opening note for the hearing. Mr Wooldridge has provided a detailed comparison with the offer dated 16 February 2023. I do not need to go into all that, as the outcome is not going to adopt the husband’s factual matrix. There is little point in my dwelling upon the details of an offer which is doomed not to get home.

Approach to determining primary facts

39. The burden of proof rests on the party seeking to assert a fact. I have to determine the case on the balance of probabilities. Is it more likely than not that an asserted fact is proved?

40. The decision on whether the facts in issue have been proved to the requisite standard must be based on all the available evidence. I take into account a wide range of matters including my assessment of credibility of the witnesses, documents and inferences which can be drawn from the evidence. I must consider each piece of evidence in the context of all of the other evidence.

41. Findings of fact must be based on evidence not speculation. Evidence-based findings of fact may include inferences that can be properly drawn from the evidence and not on suspicion or speculation: Re A (A Child) (Fact Finding Hearing: Speculation) [2011] EWCA Civ 12 [2011] 1FLR 1817. The decision on whether the facts in issue have been proved to the requisite standard must be based on all of the available evidence and should have regard to the wide context of social, emotional, ethical and moral factors.

42. In determining whether a party has discharged the burden upon it, the court looks at what has been described as “the broad canvas” of the evidence before it. The court takes account of a wide range of matters including its assessment of the credibility of the witnesses and inferences that can be properly drawn from the evidence. The role of the court is to consider the evidence in its totality and to make findings on the balance of probabilities accordingly. Within this context, the court must consider each piece of evidence in the context of all of the other evidence.

43. The evidence of the parties is of utmost importance. It is essential that I form a clear assessment of credibility and reliability. I am entitled to place weight on the evidence and impression that the parties have made upon me.

44. I remind myself that demeanour is an uncertain guide in assessing the reliability of evidence and that far more important is the substance of the evidence given, its internal consistency with contemporaneous documents and inherent probabilities. That said, the family court is still permitted to have regard to the demeanour of witnesses when there is little by way of other contemporaneous documents. I remind myself to guard against an assessment solely by virtue of the parties’ behaviour in the witness box.

45. This is a case where I also give myself a Lucas direction and remind myself that a witness may lie for many reasons, such as shame, misplaced loyalty, panic, fear and distress and the fact that a witness has lied about some matters does not mean that he or she has lied about everything. I have in mind the guidance provided most recently in Re A, B and C (Children) [2021] EWCA Civ 451, [2022] 1 FLR 329.

46. I accept entirely that just because a party has lied that does not necessarily prove the primary case against a party.

The statutory criteria

47. Once the court has determined the asset base it must go on to consider how the assets may be divided justly. I am required to do that fairly.

48. I must apply sections 25(1), (2) and s.25A of the Matrimonial Causes Act 1973.

49. s.25(1) provides:

“It shall be the duty of the court in deciding whether to exercise its powers under section 23, 24, 24A, 24B and 24E above and, if so, in what manner, to have regard to all of the circumstances of the case, first consideration being given to the welfare while a minor of any child of the family who has not attained the age of eighteen.”

50. s.25(2) provides:

“As regards the exercise of the powers of the court under section 23(1)(a), (b) or (c), 24, 24A, 24B and 24E above in relation to a party to the marriage, the court shall in particular have regard to the following matters:

a) the income, earning capacity, property and other financial resources which each of the parties to the marriage has or is likely to have in the foreseeable future, including in the case of earning capacity any increase in that capacity which it would in the opinion of the court be reasonable to expect a party to the marriage to take steps to acquire;

b) the financial needs, obligations and responsibilities which each of the parties to the marriage has or is likely to have in the foreseeable future;

c) the standard of living enjoyed by the family before the breakdown of the marriage;

d) the age of each party to the marriage and the duration of the marriage;

e) any physical or mental disability of either of the parties to the marriage;

f) the contributions which each of the parties has made or is likely to make in the foreseeable future to the welfare of the family, including any contribution by looking after the home or caring for the family;

g) the conduct of each of the parties, if that conduct is such that it would in the opinion of the court be inequitable to disregard it;

h) in the case of proceedings for divorce or nullity of marriage, the value to each of the parties to the marriage of any benefit which, by reason of the dissolution or annulment of the marriage, that party will lose the chance of acquiring.”

51. s.25A(1) provides:

“Where on or after the making of a divorce or nullity of marriage order the court decides to exercise its power under s.23(1)(a), (b) or (c), 24, 24A, 24B or 24E above in favour of a party to the marriage, it shall be the duty of the court to consider whether it would be appropriate so as to exercise those powers that the financial obligations of each party towards the other will be terminated as soon after the making of the order as the court considers just and reasonable.”

52. A helpful summary of how to apply these sections is to be found in the judgment of Peel J in WC v HC (Financial Remedies) [2022] EWFC 22, [2022] 2 FLR 1110 at [21]

‘The general law which I apply is as follows:

(i) As a matter of practice, the court will usually embark on a two-stage exercise, (i) computation and (ii) distribution; Charman v Charman (No 4) [2007 EWCA Civ 503, [2007] 2 FLR 1246.

(ii) The objective of the court is to achieve an outcome which ought to be “as fair as is possible in all the circumstances”; per Lord Nicholls of Birkenhead in White v White [2001] 1 AC 596, [2000] 2 FLR 981, at 599 and 983H respectively.

(iii) There is no place for discrimination between husband and wife and their respective roles; White v White at [2001] 1 AC 596, [2000] 2 FLR 981, at 605 and 989C respectively.

(iv) In an evaluation of fairness, the court is required to have regard to the s 25 criteria, first consideration being given to any child of the family.

(v) Section 25A … is a powerful encouragement towards a clean break, as explained by Baroness Hale of Richmond in Miller v Miller; McFarlane v McFarlane [2006] 1 FLR 1186 at para [133].

(vi) The three essential principles at play are needs, compensation and sharing; Miller; McFarlane.

(vii) In practice, compensation is a very rare creature indeed. Since Miller; McFarlane it has only been applied in one first instance reported case at a final hearing of financial remedies, a decision of Moor J in RC v JC [2020] EWHC 466 (although there are one or two examples of its use on variation applications).

(viii) Where the result suggested by the needs principle is an award greater than the result suggested by the sharing principle, the former shall in principle prevail; Charman v Charman (No 4).

(ix) In the vast majority of cases the enquiry will begin and end with the parties’ needs. It is only in those cases where there is a surplus of assets over needs that the sharing principle is engaged.

(x) Pursuant to the sharing principle, (i) the parties ordinarily are entitled to an equal division of the marital assets and (ii) non-marital assets are ordinarily to be retained by the party to whom they belong absent good reason to the contrary; Scatliffe v Scatliffe [2017] 2 FLR 933 at [25]. In practice, needs will generally be the only justification for a spouse pursuing a claim against non-marital assets. As was famously pointed out by Wilson LJ in K v L [2011] 2 FLR 980 at [22] there was at that time no reported case in which the applicant had secured an award against non-matrimonial assets in excess of her needs. As far as I am aware, that holds true to this day.

(xi) The evaluation by the court of the demarcation between marital and non-martial assets is not always easy. It must be carried out with the degree of particularity or generality appropriate in each case; Hart v Hart [2017] EWCA Civ 1306, [2018] 1 FLR 1283. Usually, non-marital wealth has one or more of three origins, namely (i) property brought into the marriage by one or other party, (ii) property generated by one or other party after separation (for example by significant earnings) and/or (iii) inheritances or gifts received by one or other party. Difficult questions can arise as to whether and to what extent property which starts out as non-marital acquires a marital character requiring it to be divided under the sharing principle. It will all depend on the circumstances, and the court will look at when the property was acquired, how it has been used, whether it has been mingled with the family finances and what the parties intended.

(xii) Needs are an elastic concept. They cannot be looked at in isolation. In Charman v Charman (No 4) [2007] EWCA Civ 503, [2007] 1 FLR 1246, at para [70] the court said:

“The principle of need requires consideration of the financial needs, obligations and responsibilities of the parties (s.25(2)(b); of the standard of living enjoyed by the family before the breakdown of the marriage (s.25(2)(c); of the age of each party (half of s.25(2)(d); and of any physical or mental disability of either of them (s.25(2)(e)”.

(xiii) The Family Justice Council in its Guidance on Financial Needs on Divorce (April 2018) has stated that:

“27. In an appropriate case, typically a long marriage, and subject to sufficient financial resources being available, courts have taken the view that the lifestyle (i.e “standard of living”) the couple had together should be reflected, as far as possible, in the sort of level of income and housing each should have as a single person afterwards. So too it is generally accepted that it is not appropriate for the divorce to entail a sudden and dramatic disparity in the parties’ lifestyle.”

(xiv) In Miller/McFarlane [2006] 1 FLR 1186 Baroness Hale of Richmond referred to setting needs “at a level as close as possible to the standard of living which they enjoyed during the marriage”. A number of other cases have endorsed the utility of setting the standard of living as a benchmark which is relevant to the assessment of needs: for example, G v G (Financial Remedies: Short Marriage: Trust Assets) [2012] 2 FLR 48 and BD v FD (Financial Remedies: Needs) [2017] 1 FLR 1420.

(xv) That said, standard of living is not an immutable guide. Each case is fact-specific. As Mostyn J said in FF v KF [2017] EWHC 1093 at [18]:

“The main drivers in the discretionary exercise are the scale of the payer’s wealth, the length of the marriage, the applicant’s age and health, and the standard of living, although the latter factor cannot be allowed to dominate the exercise”.

(xvi) I would add that the source of the wealth is also relevant to needs. If it is substantially non-marital, then in my judgment it would be unfair not to weigh that factor in the balance. Mostyn J made a similar observation in N v F [2011] 2 FLR 533 at [17-19].’

The duration of the marriage

53. In IX v IY (Financial Remedies: Unmatched Contributions) [2018] EWHC 3053 (Fam), [2019] 2 FLR 449 Williams J had to consider when it might be said that a cohabiting relationship had commenced. This was in the context of assessing the length of “seamless cohabitation” for the purposes of assessing the length of a marriage.

54. At [68] Williams J stated:

“What the court must be looking to identify is a time at which the relationship had acquired sufficient mutuality of commitment to equate to marriage. Of course, in very many cases, possibly most cases, this will be very obviously marked by the parties’ cohabiting, possibly in conjunction with the purchase of a property. However, in other cases, and this may be one of them, it is not so easy to identify. The mere fact that parties begin to spend time in each other’s houses does not of itself, it seems to me, equate to marriage. In situations such as this the court must look at an accumulation of markers of marriage which eventually will take the relationship over the threshold into a quasi-marital relationship which may then either be added to the marriage to establish a longer marriage or becomes a weightier factor as one of the circumstances of the case.”

55. In MB v EB (Preliminary Issues in Financial Remedy Proceedings) [2019] EWHC 1649 (Fam), [2019] 2 FLR 899 Cohen J had to consider when the marital partnership had come to an end. This was in circumstances where the parties had entered into a formal deed of separation.

56. Looking at matters from the other end of the relationship to Williams J above, the court determined that the approach in IX v IY can be applied to look at the date when a marital partnership is said to have come to an end.

57. At [52] Cohen J commented, “It is a truism that marriages come in all different shapes and sizes. What may be important to one couple may be trivial to another.”

58. Commenting upon the facts before him, Cohen J stated at [54]

“In some rare cases the definition of when parties separated can be extremely difficult. This is one such case. In most cases it is clear when one, if not both parties, to a marriage emotionally and physically disconnect from it. What is so unusual about this case is that the emotional, and to some extent the physical, connection endured long after 2004, the last time at which I can find that the parties lived together. They remained in an unusual relationship.”

59. Peel J was considering the cohabitation period in VV v VV [2022] EWFC 41, [2023] 1 FLR 170 and provides a useful summary of the cases between [40] and [46] which should be read into this judgment.

60. In particular, Peel J appears to advocate a subjective element to the analysis at [45] - [46]

“To the above jurisprudence I would add that the court should also look at the parties’ respective intentions when inquiring into cohabitation. Where one or both parties do not think they are in a quasi-marital arrangement, or are equivocal about it, that may weaken the cohabitation case. Where, by contrast, they both consider themselves to be in a quasi-marital arrangement, that is likely to strengthen the cohabitation case.

[46] In the end, it is a fact-specific inquiry. Human relationships are varied and complex; they do not lend themselves to pigeon holing. The essential inquiry is whether the pre-marital relationship is of such a nature as to be treated as akin to marriage.”

61. This subjective element is touched upon again by Sir Jonathan Cohen in DE v FE [2022] EWFC 71 at [20] where it was stated:

“I am not impressed by H’s argument that W’s answer to the question in her divorce petition of when they separated as being November 2017 is conclusive of the point. Whilst that date marks the physical separation it was not the date of their emotional separation nor the date when, as I find, either had concluded that the marriage was at an end. I suspect that as 2018 went on H became less optimistic for the future of the marriage whilst W remained more hopeful.”

62. The subjective element of gazing through the window, into the heart of a marriage, was deprecated by King LJ in Cazalet v Abu-Zalaf [2023] EWCA Civ 1065, [2024] 1 FLR 565 where one of the questions concerned whether the parties had reconciled during the course of proceedings, such that the decree nisi should be rescinded.

63. At [73(i)] King LJ commented that the judge’s evaluation was undermined by:

“The introduction of his own assessment of the quality of the relationship of the parties and his personal view as to the essential components of a marriage. The judge fell into this error notwithstanding that he had specifically reminded himself, by reference to his own decision in NB v MI (Capacity to Contract Marriage) [2021] EWHC 224 9Fam), [2021] 2 FLR 786, that ‘marriages come in all shapes and sizes’ and that a marriage ‘does not require the parties to love one another.’ In the present case, the judge instead went on at para [46] to say that ‘It does require, however, that the parties recognise that they enjoy a particular status and that they are in a formal union of mutual and reciprocal expectations of which the foremost is the sharing of each other’s society, comfort and assistance.”

64. It seems to me that there are conflicting cases about the applicability of the subjective element to determining whether parties consider themselves to be in a marital or quasi-marital relationship. This apparent conflict is made more difficult when the same question is being asked in slightly differing contexts. I do not consider that it falls to me to resolve these apparent conflicts.

65. For my purposes, I am going to apply the non-subjective approach of King LJ. I am looking at objective and external markers. Cazalet v Abu-Zalaf is the more recent and more authoritative statement. Even if I am wrong to do so, I am fortified in this case that there is a solid mass of objective evidence which allows me to make my determinations without having to subjectively try to peer into the parties’ souls.

The date for computing the assets

66. The date for determining the assets is the date of trial.

67. In DR v UG [2023] EWFC 68 Moor J stated at [51] - [53]

“[51] I further accept that it is possible to extend this concept to a company that has simply grown and prospered since the date of the separation. Mr Bishop refers me to the decision of Moylan J in SK v WL (Ancillary Relief: Post-Separation Accrual) [2010] EWHC 3768, [2011] 1 FLR 1471, where the award was 40% to reflect three years’ post-separation endeavour even though the business was the same business and merely grew conventionally. I do consider this to be somewhat of an outlier, particularly as it was a case where the husband had managed to lose a substantial portion of the proceeds of sale of the business. It is not binding upon me. Indeed, I am of the view that, twelve years later, it would not be decided in the same way. There has to be something that removes a case from the principle first espoused by the Court of Appeal in Cowan v Cowan [2001] EWCA Civ 679, [2001] 2 FLR 192 at [70] where Thorpe LJ said:-

“In this case, the reality is that the husband traded his wife’s unascertained share as well as his own between separation and trial, particularly committing those undivided shares to the investment in Baco. The wife’s share went on risk and she is plainly entitled to what in the event has proved to be a substantial profit.”

[52] Mr Marks postulates a number of circumstances where it will be possible to establish post-separation endeavour. He identifies cases where there is still more to do after the date of the trial to harvest the asset (eg Evans v Evans [2013] 2 FLR 999); cases where there has been a long and unjustified delay in bringing the application (eg S v S (Ancillary Relief after Lengthy Separation) [2006] EWHC 2339 (Fam), [2007] 1 FLR 2120); earn-outs or lock-ins (eg where the payer has to continue to work in the business in the future, despite the sale); truly new ventures, created, he submits, without the use of matrimonial assets; or where the payee has already been bought out, at a fair price, from the asset that has subsequently increased in value. I am certainly not prepared to accept that this is an exhaustive list but it does answer the point made by Mr Bishop that, to ignore post-separation endeavour, would fall foul of the requirement in section 25 to consider the parties’ respective contributions. I am further not convinced that the “truly new venture” needs to be created without the use of matrimonial assets. It will depend on the circumstances, although the assets used may be a relevant consideration as to whether the circumstance justifies departure from equality.

[53] My attention was drawn to a decision of my own, CO v YZ [2020] EWFC 62 where I said at [54]:-

“In general, post-separation endeavour is relied on to argue for a greater share of an increased value of the assets. I have always had real reservations as to the concept for the reason that, if the assets have fallen in value, it is difficult to see why the other party should not then argue that he or she should not have to share in that fall in value. Such difficulties are avoided if the concept is severely restricted in its operation. It is, of course, a very different matter if there has been a significant delay in bringing the application, such as in Wyatt v Vince, but that is not the case here. Just as the Husband has continued to run his businesses, so the Wife has continued her contribution in caring for the four children. Moreover, she can say with some force that he has been trading her undivided share. In this particular case, I will also have to consider the very significant losses that the Husband has incurred in other business ventures since separation that the Wife had no involvement in, or even, initially, knew about.”

68. Mostyn J held at [73] in E v L [2021] EWFC 60, absent undue delay, fairness will usually be found in taking the assets as at the date of trial and not separation:

“In my view there are already in this field too many uncertainties and subjective variables. The law needs to be transparent, accessible, readily comprehensible and should propound simple and straightforward principles. In my experience convention and tradition dictate that save in cases where there has been undue delay between the separation and the placing of the matter for trial before the court, the end date for the purposes of calculation of the acquest should be the date of trial. This rule of thumb should apply forcefully to assets in place at the point of separation which have shifted in value between then and trial. For new assets, such as earnings made during separation, I would apply the yardstick in Rossi v Rossi [2006] EWHC 1482 (Fam) at [24.4] where I stated: "I would not allow a post-separation bonus to be classed as non-matrimonial unless it related to a period which commenced at least 12 months after the separation".”

69. In A v M [2021] EWFC 89, Mostyn J stated at [14]:

“For the purposes of my decision I shall calculate the marital acquest as at the date of trial. I note that Mr Justice Coleridge did so in B v B. In my opinion this should be the general rule unless there has been needless delay in bringing the case to trial. I gave my reasons for this view in my recent decision of E v L [2021] EWFC 60 at [71] - [73], which I do not repeat here. Shortly put, it is normally the right date because the economic features of the parties’ marital partnership will have remained alive and entangled up to that point. The fruits of the partnership will not have been divided and distributed. The share of one party in the partnership assets is likely to have been unilaterally traded with by the other. I accept that a different view might be taken in respect of a completely new asset brought into being during the interregnum between separation and trial. But that is not the case here. Here we are concerned with assets acquired pre-separation but worked on during the period up to trial.”

70. The parties provided me with a helpful agreed statement of issues at the commencement of the hearing.

71. A few of the points had boiled away by closing, leaving me to determine the following points:

Computation

71.1. The value of the former family home in Italy, given the husband does not accept the SJE valuation.

Matters of evaluation

71.2. The date of separation: 2014 (per the husband); 2021 (per the wife), or such other date as the court determines.

71.3. Was there any agreement between the parties in 2014 to divide a joint account equally (£50k each) and the English family home unequally upon sale in 2018? If so, what, if any, relevance does this have to the outcome of these proceedings?

71.4. Whether there is any post-separation accrual and, if so, whether such endeavour should sound in the outcome of these proceedings. Specifically, are sums held by the husband in an Italian life insurance policy non-matrimonial?

Matters of distribution/form of the order

71.5. Should the Italian family home be transferred to one of the parties or sold, with either party able to bid for its purchase?

71.6. Who should retain the contents of the Italian property?

71.7. Depending upon the court’s conclusions in respect of computation and evaluation, the quantum of the lump sum payable by the husband to the wife and whether the sum ordered reflects a needs or sharing assessment.

71.8. If the loan(s) to the parties’ daughter is/are repaid, should the benefit of the loan(s) be shared between the parties, or retained by the husband.

71.9. If, and, if so how, the costs incurred by the wife referrable to the Italian divorce proceedings should be taken into account.

The value of the Italian family home

72. In his Form E, the husband suggests that the Italian family home is worth €80,000, stating it was an “estimate pending valuation”.

73. In her Form E, the wife suggests that the Italian family home is worth €108,537. This figure is supported by a report in the bundle. This report was from an Italian surveyor and the report was obtained by the wife alone.

74. The parties were unable to agree a figure for the valuation of the Italian family home and so directions were provided for a SJE valuation. Through nobody’s fault, I am told, this was more difficult to obtain than the parties had first expected. When suitably qualified Italian experts knew it was for English matrimonial proceedings it appears there was a reluctance to become involved.

75. In the end a report was issued by a SJE on 18 May 2024. It was received by the parties on 20 May 2024. It provided for a valuation of €203,000.

76. Mr Allen notes this as being a “whopping” increase over the range of figures which the parties had each previously asserted.

77. Additionally, the figure was greater than the comparable property particulars in the bundle which the court had directed the parties provide to assist an understanding of the parties’ property needs.

78. The directions given by DDJ Don on 24 February 2023 had provided for conventional SJE directions in respect of the Italian property which allowed time for questions to be asked of the expert. Delays set in. The application was listed as a reserve hearing in November 2023 but then stood out to avoid brief fees being incurred. Following yet more delays, we arrived at the May 2024 final hearing with no time for written questions to be asked of the SJE.

79. This has troubled me. I can see that the SJE figure has come as a surprise. However, it is the only SJE evidence that I have.

80. Mr Wooldridge invites me to adopt the figure upon the basis that it is the only viable figure to work with. He also states that the husband did not ask for an adjournment for written questions to be put, nor was any attempt made to require the expert to attend via a remote link to be cross-examined.

81. Mr Allen says that through nobody’s fault there was no time for written questions and that I should simply ignore the expert report. He invites me to allow the market to find the price with an order for sale where the parties may each bid against the market over a period of about two months and that, if either matches the market bids, the property will go to the highest bidder as between the parties, with consequential provisions for a self-adjusting balancing lump sum.

82. When giving evidence about the SJE, the husband suggested for the first time, and without a flicker of any of this having been put to the wife by Mr Allen, that the wife had paid the SJE to “bump up the price”. He stated the SJE had been bribed. I have little doubt that if such an account had been given to Mr Allen, he would have put that allegation to the wife.

83. Whilst I accept that we were out of time for written questions, I was not told of any reason why the expert could not have been required to attend remotely. The court is well versed, willing and able to hear remote evidence where it is appropriate to do so. I do not consider that the obtaining of an Italian interpreter would have been an obstacle, even at short notice.

84. Had the bribery allegation been put to me as part of housekeeping in opening, I would have done everything within my power to allow that point to be properly tested, including by remote attendance and challenge of the SJE.

85. The fact that this issue simply arose in evidence suggests to me that the husband was willing to say just about anything to try to get his own way. Such a serious allegation would have been properly handled by Mr Allen, I have no doubt. The silence from Mr Allen speaks volumes about the husband’s evidence in this regard. I am afraid that I am driven to the conclusion that the husband was “making it up as he went along” in this regard.

86. Whilst the court is bound to be anxious about the inability to ask written questions having been timed out, we were not timed out for SJE remote attendance. This is especially so given the seriousness of the allegation the husband made in evidence and which the wife did not have an opportunity to reply to as she was not asked about it.

87. I am not attracted to testing the market. The English family home took years to sell and there were arguments about that (more on that in a moment). The husband has invited this court to accept a date of separation which I am not persuaded by. He commenced competing proceedings in Italy, causing delay and expense within these proceedings. He initially gave the appearance of having tied up a large part of the matrimonial assets in an Italian life policy, which took months to get to the bottom of. I have no confidence that testing the market will go well, given this unhappy background.

88. I also note that it is the wife’s case that she would like to keep the Italian family home and would pay the SJE price for it. As it happens, given that she appears to me less keen on it than the husband, I am content for the husband to retain it. However, I spy all kinds of opportunities for mischief with the husband in situ when a market price is being canvassed.

89. My approach therefore, without great enthusiasm, but on the basis that I have little other option and that “we are where we are”, is simply to adopt the unchallenged SJE figure of €203,000 which the husband shall have ascribed to his side of the schedule.

The date of separation. 2014 or 2021?

90. In summary, the husband says that there was an oral agreement in 2014.

91. Despite not having deposed to any detail at all in his statement, in reply to the court’s questions, the husband described that the parties had a conversation after work one day in the sitting room of the English family home. The parties had not been getting on well and so they agreed that they would separate. The husband then says that there was an agreement that nothing after 2014 would be shared between the parties.

92. I noted that this seemed a slightly tortuous way for the parties, then not attended upon by matrimonial lawyers steeped in the language of post-separation accrual. At the time of the alleged agreement, why would the parties be referencing assets which might have arisen post 2014? The husband then tacked in his evidence and said that the wife had said she would not claim for anything else in the future. I was left with the impression that the husband was unable to summon a clear recollection about this. However, he did not say this either. Without the benefit of anything being written down, it comes as little surprise to me that the details of a conversation in 2014 cannot be recalled. The attempt to provide conclusive detail, I am afraid, fell flat on its face.

93. I am also troubled by the husband’s suggestion that the parties were able to agree to separate and divide their finances in principle all in one conversation after work one day. As any matrimonial lawyer knows, conversations about separation can be painful and drawn-out affairs. The husband’s clinical wrap up in one session does not ring true to me.

94. In the husband’s favour, however, he cites the following facts:

94.1. He registered as the sole occupier in the English family home on 10 June 2014, for the purposes of a single person’s Council Tax discount.

94.2. The English family home was placed on the market in 2014, it having only been purchased in or about 2010.

94.3. The wife opened an English Santander account in her sole and maiden name in June 2014.

94.4. When the family home was sold in 2018, the proceeds were not paid into a joint account but were paid in broadly equal amounts, save that the husband had an additional £50,000. He says this was because the wife wanted a quick sale in 2018 and was prepared to take a figure lower than he was prepared to wait for.

94.5. He had a relationship with another woman in 2018/2019 which makes plain that all was not well in the parties’ relationship.

94.6. The husband went to live in bedsit-style accommodation after he had fallen out with the parties’ daughter. He says, why would he do this if he expected the wife to come home to him?

95. The wife cites the following in support of the fact that the parties did not separate in 2014:

95.1. The husband has attested to a variety of different dates over the course of the last couple of years:

95.1.1. In his Italian divorce petition, he cites the date of separation as being January 2018;

95.1.2. In a letter from his previous solicitor dated 12 February 2022, the husband states that the date of separation was 2015. The 2015 date is repeated in a D11 application and his Form E;

95.1.3. In his section 25 statement he states the date was 2014.

95.2. The parties agreed in or about 2015 that the wife would relocate to Italy to care for her ill mother.

95.3. The wife says that her siblings would provide respite care from time to time and that she would come back to visit the husband during these times. The husband does not gainsay that the wife was back in the English family home on the following dates.

95.3.1. 11 February 2016 to 8 June 2016

95.3.2. 13 October 2016 to 7 November 2016

95.3.3. 23 March 2017 to 21 April 2017

95.3.4. 29 June 2017 to 5 July 2017

95.3.5. 15 September 2017 to 22 September 2017

95.4. The husband would visit the wife in Italy.

95.5. The wife had a BMW and, if it was sold by the husband on or about 11 July 2016 in the sum of £25,000, why did he keep the money (more on this shortly)? The husband rejoins that if the £25,000 is for the sale of her BMW car, then he would have retained the money on account of the fact that she had had access to funds held on his account by, I think, his sister in Italy. This has the appearance of accounting for finances during the subsistence of a relationship. How else would the wife gain access to the account held by the sister, even if she remained on good terms with her?

95.6. Why did the wife purchase, after 2016, a luxury F Type Jaguar vehicle (from an inheritance) and choose to store it in the garage of the English family home, and also let the husband drive it?

95.7. Why are there references to transfers to the husband’s savings account referenced “husband”?

95.8. If the parties had separated in 2014, whey did the husband’s Italian divorce petition only follow the wife’s English petition issued in 2021?

95.9. Why did the husband’s section in the ES1 for the first appointment say, “This is a long marriage and, for English law purposes, the date of separation is irrelevant other than considering what might be post-matrimonial property (there is none)”.

96. Each side has made points of substance which I have had to weigh carefully. Ultimately, I prefer the evidence of the wife, however.

97. The wife’s absence from the home from 2015 is explicable on the basis of the care which she was providing for her mother in Italy. I do not know why the husband obtained a single person’s Council Tax discount from June 2014. There may be some confusion about the exact date of the wife’s departure here. The wife had no part in the application for the discount. I am satisfied that the wife was not in the English family home between 2015 and late 2017 and the principal explanation was her mother’s illness, necessitating the wife’s attendance upon her mother in Italy. In those circumstances, the husband was entitled to claim a discount and it does not, in and of itself, point to a foundering marriage.

98. The marketing of the English family home was, in my judgment, pursuant to the parties’ planning for their next stage of life. Given the husband’s health, it was plain that he would not be able go on as a builder forever. Whilst the English family home had only been purchased in 2010, the parties had reached a stage in life when illness and parental care had caused them to reflect upon future options.

99. The bedsit-style accommodation does not assist the husband as much as he would wish in circumstances where the parties already have another family home in Italy.

100. The wife’s Santander account in her maiden name might, at first blush, appear a strong piece of evidence in the husband’s favour. Upon closer inspection it is not. The husband accepted that in Italy it is commonplace for women to use their maiden names on bank accounts and the like. The wife stated that her mother had previously lived in England and had come “unstuck” at one point by not having an English bank account in her sole name. The wife was making arrangements pursuant to a change in her life, namely an unspecified time relocating to Italy, and she wanted an English account. I accept that she was just “being Italian” in putting it in her maiden name and that this is not an indicator of a foundering marriage.

101. The appearance of another lady in 2018/2019 does not assist the husband. The wife wanted to know about the woman’s voice on the fishing trip to St Petersburg and this appears to have precipitated a falling out with his daughter.

102. The unequal division of the proceeds of sale of the English property is explained by the wife on the basis that they were each going to hold money so that they each benefitted from the bank account guarantee scheme (currently at £85,000). The wife is unable to explain the fact that the husband got £50,000 more than her. She denies it was due to her wanting a “quick sale”. The wife says she just signed the papers. This is a ragged edge to the case to which I cannot smooth over. All I can say is that the preponderance of the husband’s assertions do not persuade me. When balanced against the forceful points which the wife makes, or has in her favour (e.g. holiday photo date, Jaguar photo, husband “making it up as he goes along” with the SJE evidence), I am left, on the balance of probabilities, unpersuaded that the separation occurred in 2014.

103. Finally, the wife spoke of being comforted by the husband at her mother’s home from time to time when she was caring for her. This did not denote sexual intimacy but “being held” and cuddled when she was upset at the state of her mother’s health. This had a ring of truth to it. I believe the wife that this happened. The fact that the husband did not stay over at the mother’s home does not detract from this. The wife and her mother were sleeping downstairs in what sounds like makeshift beds to accommodate the mother’s frailty. The parties had a family home in Italy at their disposal.

2014 agreement re finances?

104. Having been unpersuaded that there was a 2014 separation, I am equally unpersuaded that there was an agreement in respect of finances, or for the wife to take £50,000 at that time. As I have already observed, one articulation of the husband’s alleged oral agreement sounded rather odd and formal for a couple who have just agreed to end their marriage of some thirty years.

105. If the wife did take money with her to Italy, this was not part of any separation and merely making provision for whilst she was away. The husband has provided no evidence that £50,000 was ever paid to the wife. His case is that this would have been paid from the daughter’s account as she was holding £100,000 on their behalf. There is no documentary evidence to support this.

Proof of post separation accrual

106. Even if I am wrong about the date of separation, and I do not consider that I am, the husband also fails on the issue of actually proving a post-separation accrual.

107. Mr Allen set out an extremely helpful table at paragraph [46] of his note. It encapsulates the husband’s case as to post-separation accrual at a glance. Mr Allen has drawn a number of figures from the husband’s bank account. One can see a balance in the account in 2014 at £51,126, rising each year to show a figure of £277,454 which the husband says are the fruits of his post-separation endeavours. The yearly savings (excluding the receipt of the husband’s share of the net proceeds of sale of the English family home) range between £17,000 and about £50,000.

108. This table is best read alongside Mr Wooldridge’s equally helpful summary of net taxable profit derived from the husband’s earnings as a builder. The net taxable profit amount ranges from about £25,000 to just over £33,000 between 2019 and 2022. I assume we do not have accounts that go back further. It was not suggested by the husband that these are outlier figures and that he used to earn money on an altogether different scale. I would be surprised if he had, being a self-employed builder.

109. The husband told me that he never worked for cash in hand. Even after moving into bedsit-style accommodation, the husband would have had rent to pay. He claimed that much of his work as a builder was with restaurants and so he was able to have free food whilst on the job.

110. It will be immediately apparent that it is hard to square how savings of, say, £50,000 can be made in a year when average gross earnings are £30,000.

111. I was treated to an in-depth cross-examination on the husband’s savings account. He was unable to assist in many material respects.

112. There was a deposit of £25,000 on 11 July 2016 with the entry [redacted]”. I was surprised that the husband was unable to tell me what this sum related to. It amounted, in one deposit in 2016, to nearly a year’s worth of earnings. I pressed him and suggested that in the scale of his personal economy he should be able to recall what such a figure related to. Eventually, the husband suggested that the figure may relate to the sale of the wife’s BMW motor vehicle.

113. If it was the sale of a motor vehicle, it poses further questions which the husband could not really answer. Why was the money not paid to the wife? I have already noted above that the reply to this relates to a complex description of accounting as between husband and wife, whereby the husband was permitted to keep the money on account of the wife having accessed some funds in Italy held on his account, albeit in his sister’s name. The character of the Italian funds were not explored. I am left slightly baffled about all of this, but doubting, if indeed the £25,000 on 11 July 2016 does relate to a car sale belonging to the wife, that this is the husband’s post-separation endeavour which he is entitled to keep.

114. There are a series of monthly payments made in the sum of £666, referenced “AA”. This was said to be a monthly repayment to the husband for works which he did for a garage-owning friend in 2015. Rather than pay the £40,000 up front, there appears to have been some kind of agreement, based upon the husband’s good friendship with the owner of AA, that he would receive monthly repayments and a small commission on each MOT which was undertaken until the £40,000 was repaid. All of the works having been undertaken in 2015, the later receipts were not “endeavour” but simply receipts for work done at an earlier date, much more proximate, even on the husband’s case, to a time when the marriage was subsisting.

115. I was further taken to a series of payments of £20,000, £20,000, £15,000, £20,000 and £15,000 (total £90,000). The husband was unable to tell me what these relate to, despite their scale when set against the size of his economy. I think there may have been a suggestion that one was a cash payment from a premium bond, but the husband did not give me chapter and verse as to the character of the premium bond so that I could understand whether it was non-matrimonial in character. Given the size of the husband’s earnings, I doubt it.

116. So, in three significant domains I am left with more questions than answers, the £25,000, the AA payments and the £90,000.

117. If the husband wishes to advance a post-separation accrual argument, the burden is upon him to demonstrate, on the balance of probabilities, that he has made this out by fresh endeavour, post-separation. Mr Allen can only make bricks from evidential straw. The husband has not made out his case.

118. Further, during this period the parties have remained, until 2018, joint owners of an English property and, to date, joint owners of an Italian property. The husband accepted that each has made contributions to the upkeep and maintenance of the properties, even if that amounts to the wife cleaning the properties when she is resident in them.

119. The combination of English proceeds and the further monies in the husband’s Saver account went to purchase the Italian Life insurance policy. Whilst this cost €950,000, the sum has now been reduced to €801,194 with the husband making withdrawals in part to pay his legal costs of all of these proceedings.

120. Having made the foregoing findings, the assets available for sharing equally amounts to about £1.5M. The wife retains her share of an Italian property she owns with her siblings, as does the husband with his.

121. I am invited to simply remove the chattels from the asset schedule. There is, however, quite a disparity between the cars which they each own. The husband’s car is asserted by the wife to be worth £33,000, albeit if included the husband will say it has depreciated from that figure. He also owns a Fiat van with a nominal value. In total his vehicles come to £35,500 (subject to possible deprecation) plays the wife’s Astra at £3,000.

122. The wife also has two pensions with gross values of about £27,039, albeit after receipt of the tax-free lump sum there will be tax to pay, making the net value of the pensions less.

123. Standing back and wielding the broad brush, I am simply going to exclude all cars and pensions. It may be slightly rough justice, but the figures will be broadly similar and fairer than simply removing the cars on their own.

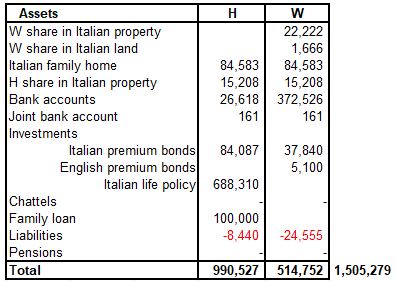

124. The computational table below converts all figures into GBP:

125. Having determined that this is a “full fat” sharing claim, my task is simple.

126. I agree that housing needs should be measured at the value of the Italian family home and, upon that basis, the parties will each have a comfortable amount of free capital with which to live off for the rest of their lives, supplemented by state pensions.

127. Neither has significant outgoings, in part a measure of their personal economy and in part due to the cost of living in Italy.

128. I agree with Mr Wooldridge that the daughter’s loan and Italian premium bonds should be dealt with in specie.

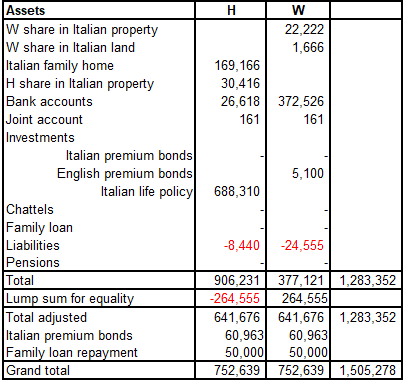

129. I have set out in a table below how I consider the Italian premium bonds will fall out, on the figures as we understand them now. The total Italian premium bonds are £121,927. Half of that figure is £60,963. The wife already holds £37,840 and so if the in specie division was conducted today, that would result in a further sum of £23,124 being paid to the wife. I shall leave to counsel whether there is a division of the bonds now, or whether some deferred provision is provided for. The principle of equal division is clear.

130. As I have already indicated, whilst the wife’s primary case was for the Italian family home, the parties’ evidence left me with the clear impression that the husband was more anxious to retain that asset. It has been his home for some time now in any event. On that basis I am going to allow the husband to retain the Italian property.

131. Drawing the threads together, this means that the husband is going to need to pay a lump sum of £264,666 in order to effect equality. My calculations are set out in the table below:

132. So far as the contents of the Italian family home are concerned, the parties will, I hope, be able to resolve outstanding issues without reference back to me. Items of personal significance should be returned or retained by the person to whom they are personally special. There may have to be a pragmatic divvy up of anything else. The costs of coming back to court are likely to be disproportionate.

133. The wife’s English solicitor’s costs of dealing with the Italian proceedings are set out in an N260 and they amount to £9,055.45. Save to increase costs, stress and delay, the husband’s manoeuvring on this front has achieved nothing. On an equal sharing basis, why should the wife have to pay for this?

134. I am not actually dealing with a formal costs’ application here. Rather I am being invited to make a modest adjustment to the equal division to reflect this issue. It is rare that an N260 survives completely unscathed. Once again, wielding the family law broad brush, I am going to take 70% of those costs which is £6,338.81 and the husband should make a payment of £3,000 to the wife. This will be in addition to the provision I have made above. This will spare her the burden of financing what turned out to be a wholly unnecessary step in the life of this separation.

135. I would ask that counsel provide me with a draft order.

136. This is my judgment.

Costs

137. Mr Wooldridge invites me to make an order as to costs.

138. The wife’s first open offer was made on the 28 February 2024. I am asked to award costs from this date, which amount in an N260 to £39,541.49. VAT is not payable on these fees as the wife now resides out of the jurisdiction.

139. Mr Wooldridge submits that the 28 February 2024 offer was on the basis that this case involved a long marriage and there should be equal sharing of the assets, albeit the wife also contended for the parties’ Italian home as part of her settlement sum. Mr Wooldridge submits that this offer amounted, in effect, to £246,245 which was a lump sum of £200,000 plus £46,245 being 50% of the value of the Italian property as it was then understood by the wife to be.

140. The 20 May 2024 offer included her modestly valued non-matrimonial assets. In closing Mr Wooldridge submitted that the wife was entitled to £267,208 if the wife’s approach was endorsed, save that the husband retained the parties’ Italian home.

141. With the inclusion of 50% of the Italian divorce costs (which I made plain was not a costs order but part of the court’s substantive award) the final lump sum figure ordered was £267,555.

142. Mr Wooldridge submits that the wife’s open position since February has largely been vindicated save that she did not retain the parties’ Italian home as part of her settlement. Further, he submits that the wife’s position was on the money as the wife’s closing offer was £347 less than the final sum awarded, or £21,310 more than what the wife would have settled for in February.

143. Mr Wooldridge says that open offers should have consequences. I am taken to FPR r 28.3(1) and (5) which enunciates the starting point of no order as to costs in financial remedy proceedings. However, the court may depart from this by reference to r 28.3(6) and the factors listed in 28.3(7) which the court “must have regard to.” I have all the factors in mind.

144. My particular attention is drawn to r 28.3(7)(b) which makes open offers a relevant factor to take into account. This is supplemented by PD28A paragraph 4.4 which provides that “…The court will take a broad view of conduct for the purposes of this rule and will generally conclude that to refuse to openly negotiate reasonably and responsibly will amount to conduct in respect of which the court will consider making an order for costs. This includes a ‘needs’ case where the applicant litigates unreasonably resulting in the costs incurred by each party becoming disproportionate to the award made by the court.”

145. In OG v AG [2020] EWFC 52 Mostyn J stated, “[31] It is important that I enunciate this principle loud and clear: if, once the financial landscape is clear, you do not openly negotiate reasonably, then you will likely suffer a penalty in costs. This applies whether the case is big or small, or whether it is being decided by reference to needs or sharing.” In VV v VV [2022] EWFC 46 Peel J stated, “Sensible attempts to settle the case, or unreasonable failure to make such attempts, will ordinarily be a powerful factor one way or the other when considering costs….” Mr Wooldridge submits that by my findings at paragraphs [36] and [38] above I have categorised the husband’s open proposals as being unreasonable. I accept that submission.

146. Mr Wooldridge also invites me to consider r 28(7)(c) and whether it was reasonable to contest a particular issue. He submits the husband has comprehensively lost, having failed to establish his contended date of separation and having failed to evidence his post separation accrual.

147. Mr Wooldridge also references r 28(7)(e) and “other aspects of the husband’s conduct” including his unheralded bribery allegation and the court’s findings at paragraphs [32] and [87] concerning the complications created by the purchase of the Italian life policy.

148. Mr Allen says I should not make a costs order. He says that although the husband has lost in the final analysis, he was not frivolous in pursuing these points. He submits that there where there is a legitimate dispute over material facts that should not necessarily result in a costs’ penalty for the losing party.

149. Mr Allen also analyses the wife’s offer dated 28 February 2024 and points out that she was not quite asserting a 50/50 split and that the precise terms of the offer resulted in a capital offset in her favour, as the assets were understood at that point, as to her 54.7%. He says that 20 May 2024 offer is too late to have any costs’ potency. Further, the wife did not win on her getting the Italian family home in settlement. Mr Allen says that the wife is not the clear winner in that respect.

150. Mr Allen also says that the Italian life policy issue and the bribery issue should not sound in costs. He says the husband’s conduct did not cause disproportionate costs to be incurred by the wife and that I should be slow to penalise the husband in the overall context of this case.

151. The wife’s open offer was much closer to the outcome than the husband’s. It was a reasonable attempt at settlement. Although I do bear in mind that the wife did not get it all her own way in the final analysis, as the husband kept the Italian family home. I am afraid to say that the husband’s open offer was unreasonable.

152. At paragraph [96] the court found that each party had points of substance to make. Ultimately the wife’s case prevailed. I do not consider that this was an unreasonable case to contest by the husband. Whilst the Italian life policy was a hinderance, this taken alone would not persuade me to make a substantive costs’ order. The bribery allegation did not add to costs.

153. Reasonable and/or unreasonable open offers may well have costs consequences. There is little point in having rules, practice directions and stern proclamations from the higher courts if they are not followed through with. Whilst the husband was free to contest the issues which he did, the law is plain that if his open offer was unreasonable, he faced a costs’ peril. It would have been open to him, for example, to contest these issues but make some kind of open compromise offer which hedged his position, factoring in some litigation risk he may lose.

154. Accordingly, I am persuaded that by reason of the interplay of the parties’ respective open offers, the court’s findings about them and the ultimate order which I have made, which is much closer to the wife’s position, I should make an order for costs.

155. As to quantum I am going to say £20,000 should be paid. The reduction from the amount requested takes into account a broad assessment of the reasonableness and proportionality of costs and also factors into account that on one issue, the wife’s offer was not adopted. I am satisfied that such an order will not have undue financial implications on the husband.

Publication

156. I am invited by the wife to publish this decision on The National Archives’ website on an anonymous basis. Mr Wooldridge reminds me that the judiciary at all levels are encouraged to publish decisions to help foster an understanding as to what goes on in the Family Court. He says that the Re S balancing exercise would favour publication, albeit in an anonymised form.

157. The husband says that this is an invasion of his Article 8 rights, as those close to the parties may be able to recognise this judgment, even in an anonymised form. He says that there is little of interest in this judgment which would warrant publication.

158. I agree that with the particular configuration of facts, this case may be identifiable by a very small cohort of individuals known to the parties. Whilst I bear this in mind, I think that this is likely to have only a slight impact on private and family life and such impact must be weighed against countervailing factors in favour of publication. No particular harm has been asserted to flow from any identification, although I accept there may be some embarrassment. I bear in mind that it is the usual practice of many other courts to publish their decisions without anonymisation in any event.

159. The husband’s Article 8 rights are not absolute and may be interfered with where it is necessary and proportionate to do so. Anonymisation in itself is an Article 10 interference, although I accept here, a proportionate one.

160. There is a public interest in the public being able to see how decisions are made in the Family Court. I have to balance the competing factors. The public interest in better understanding the work of the Family Court carries the day in this instance and I will provide for an anonymised version of this decision to be published on the National Archives’ website.

RECORDER RHYS TAYLOR

20 JUNE 2024